Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Silver laid bare..

Michael J. Ballanger

Friday, April 1, 2022

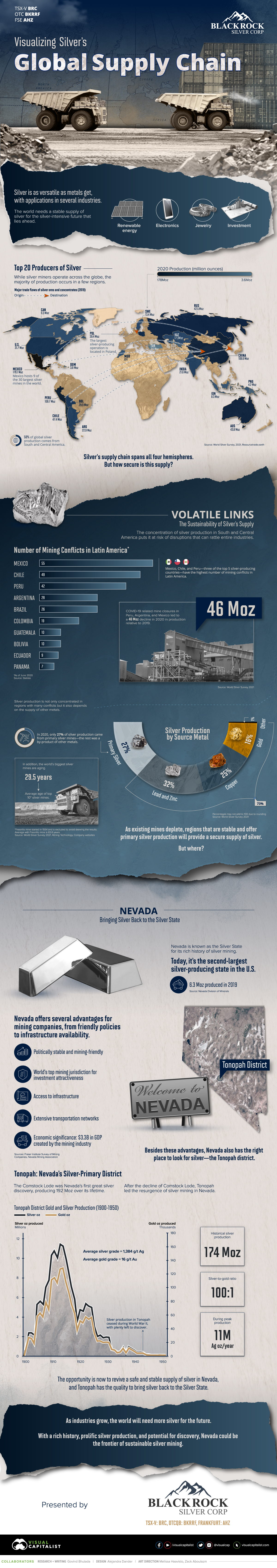

If you take the time to read through all of the commentary on silver that is freely accessible via the myriad of social media outlets and popularized content providers, you come away totally bewildered by the vast array of opinions, arguments and theories covering silver’s role in the world monetary kingdom as well as its applications in the electrification movement and technology in general. As a commentator, I am astounded at the lack of actual research applied by many of my colleagues to the actual economics of silver and while newcomers to the world of investing have gravitated to the (mis)use of the phrase “due diligence”, the evidence abounds that they have no real understanding of the phrase and what it actually entails.

I read an article this week that had the author hyperventilating through an overheated keyboard over the assumption that all of this currency debasement was going to exacerbate the “current global shortage situation” (in silver). As I vainly attempted to avoid choking on the mouthful of Cabernet-Sauvignon I was “sipping”, I thought to myself “What publications could this chap be reading and in what decade were they penned?”.

I had just finished reading a fascinating article on “Kupferschiefer-style” mineralization which occurs in the region near the Germany-Poland border which carries approximately ten-parts copper for every one-part silver but based upon the sheer volume of this style of mineralization, it has been determined that it constitutes the largest historical silver resource on the planet. The significance of this lies in the fact that these deposits are primarily copper deposits carrying silver credits along with them so while we are commonly shown what are deemed be “stand-alone” silver deposits as part of a junior’s marketing pitch, the silver supply is dominated by base metal operations.

I recall back in 2013 while attending the Prospector and Developers’ Convention in Toronto speaking to a Glencore executive about a 30-million-ounce silver deposit in Peru and just at the point where I was about to deliver my “knockout punch”, he held up both hands and proceeded to tell me that Glencore’s zinc operation in Peru had slag heaps (waste dumps) with ten times that amount of silver that were viewed as “unremarkable” at best. I skulked away to the Royal York Hotel’s famous “Library Bar” to drown my embarrassment immediately thereafter.

In the history of global mining, there has never been a “global silver shortage”. Unlike gold, where most of the metal ever mined now resides in vaults controlled by the central banks, silver enjoys no such controls so every ounce produced has to find either a monetary or industrial buyer.

So, when a new player to the world of silver starts tripping the light fantastic in a celebratory jig about the outlook for silver prices, I look for remarks about supply as a queue to proceed with the article. Furthermore, if the word “shortage” appears in the first two paragraphs, I move along.

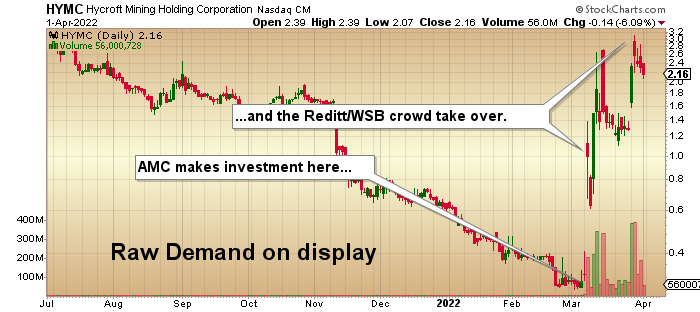

Now that I have cloud-seeded the first part of this missive with what might be construed as a “bearish” tilt toward the silver market, it is the other side of the equation that has my attention (and what prompted me to buy a few silver contracts this week) was the implications for pricing that could develop in upcoming weeks and months by the arrival of unanticipated demand. What steered me in the direction of the possible resurgence of such demand was a development which has left me totally aghast - the performance of a heretofore uninteresting junior gold developer called Hycroft Mining Holding Corporation (NCN) (HYMC:US)(USD $2.12).

For those unfamiliar with the details, a company historically involved in movie theatres, (AMC Entertainment, AMC:US) caught the attention of the Reddit/WSB crowd and ramped the stock from under $2 in early 2021 to over $70/share for absolutely no fundamental reason but in doing so raised a mountain of fresh capital in its wake. I applaud the decision to use the pump as a funding conduit but that is where my adulation goes off a cliff. On the giddiness of a fat treasury after years of “subsistence farming”, AMC decided to foray into the perilous halls of the junior mining menu but with all of the asset-rich, valuation-challenged junior miners all scrambling for attention, AMC opted to take a material chunk of Hycroft (formerly bankrupted disaster stock Allied Nevada Corporation).

Now, publications with far greater sway and influence than the GGM Advisory have already lined up the AMC/Hycroft deal in their crosshairs and have roasted the deal and the Hycroft Mine with total acidity and malice of intent. That mine is unquestionably “challenged” in terms of both metallurgy and optics – AND – if we are to believe the armchair mining analysts that decided to assail the deal – it will undoubtedly crush anyone that takes a position. That was all at around USD $1.30 per share and even I was tempted to inquire of the loan post at the firm I use if I could borrow a few hundred thousand shares in order to profit from the impending crash in the stock – and then it hit me. The same group that ramped AMC for $2 to $70 on gaseous vapours of hopium are now being hand-delivered on a silver platter the singular most promotable, ramp-able, moon-rocket-of-a-stock owned by mining legend and billionaire Eric Sprott in the form of HYMC and because they know nothing about mineral economics, they are free to trust only in the power of their investor community which, after the AMC ride, allows the court of investment judgement to be determined only by price and volume.

On March 27th, HYMC traded at USD $3.10 and closed out the week at $2.16. That is up 138% or 66% from the price when the Doomberg group (amomgst others) issued the death sentence.

What that tells me is that silver needs no supply-demand equilibrium in order to make money. Silver need nothing in the form of “fundamentals” nor does it require investors to conduct anything that might come close to resembling “due diligence”. With all of the cash sloshing around the system from incredible market moves like AMC and Gamestop and Telsa, based purely on momentum and FOMO, all that is required are the steely nerves of the novice crap shooter, because silver’s future lies in the randomness of the riverboat casino or the back-alley dice game. Why should we not take a position in silver, where the key to performance lies in the sudden unexpected appearance of monstrous, unbridled demand?

Given that skyrocketing base metals prices are encouraging the mobilization of formerly sub-economic supply, will the arrival of this possible new supply also stimulate the accompaniment of the silver bi-product? Who cares? Fundamentals do not matter. I think not. If the old adage of “safety in numbers” can be applied to gang warfare, it is of even greater significance in the stock pump game and if there us one thing that HYMC and AMC have demonstrated to the investment world with the utmost of emphasis and strength of purpose, it is that size matters. If your investor group decides that as a collective, they are going to revalue a worthless corporate issuer to a level considered borderline fraudulent, then let free market capitalism live on and reward the believers.

For this reason, I think silver is going to hit USD $50 per ounce in the next move because a bunch of video-game-trained Millennials figured out how to vanquish the “bosses” in the form of traditional Wall Street power brokers known as bullion banks. In late February of 2021, the SilverSqueeze movement went into a gunfight armed with machetes and got taken out behind the proverbial woodshed. However, they have recently regrouped and reinforced their ranks with profits taken in the rise to all-time highs in many if the “meme stocks”. The ascendancy of Hycroft Mining to a market cap of absolute absurdity represents the sounding of the clarion call of the advancing armies being called to service and it is with great irony that that I declare that there is absolutely no reason from either an economic or event-driven perspective that this move will occur.

I cannot provide time frames or price objectives with any real clarity or certainty but at the end of the day, this is what happens when citizens the world over lose all respect for the integrity of their home currency. When the fear of losing money – i.e. the recognition of risk – vacates the market place, it is because money has lost its scarcity value. When central banks are allowed to create currency and credit with little or no controls or limitations, that scarcity value evaporates and bubbles – one after the other – come rushing in.

My greatest fear is the point in time when people lose all interest in earning a living because government eliminates the requirement for the “earning” part. What history has shown regarding all financial crises since the Crash of ’87 is that it is the responsibility of government to protect investors from any and all risks, be they subprime banking fraud or health issues such as the 2020-2022 pandemic. Now, with inflation raging at nearly 8%, they are considering stimulus cheques designed to offset the impact of rampaging fuel and food prices proving once again that these legislators have never taken and certainly never passed any courses in economics.

I know that there are many gifted analysts out there that can provide relevant statistical reasons for owning silver and I recognize that my disillusionment with traditional fundamental analysis may come across as a blasphemy of sorts, but until the sanctity of money and respect for savings have been restored by a return to the principles of sound money and prudent fiscal behaviour, I will no longer attempt to provide logical rationale for ownership.

Instead, I will simply remember the immortal words of the croupier when the right number shows up in that wonderful carpet of green felt – “Winner, winner, chicken dinner!”.

MJB

https://lemetropolecafe.com/chien_du_cafe.cfm?pid=17598 ( sub. req.)

$GREAT PANTHER MINING LTD BIG BUYING OPPORTUNITY | GPL STOCK ANALYSIS | GPL STOCK UPDATE | GPL TARGET

240 viewsFeb 3, 2022

$stockwrestler Great Panther Reports Fiscal Year 2021 Financial Results and Reiterates Positive Outlook for 2022

Production of 105,006 gold equivalent ounces with $185.7 million in revenues; 2022 outlook includes return to steady-state production and underground mine portal development in H2

(All dollar amounts expressed in US dollars unless otherwise noted)

TSX: GPR | NYSE American: GPL

https://www.greatpanther.com/news-media/news/great-panther-reports-fiscal-year-2021-financial-results-and-reiterates-positive-outlook-for-2022

$TM Thanks; Great Panther Announces Coricancha Mine Complex Exploration Results

March 01 2022 - 05:02PM

PR Newswire (US)

Results from the 2021 drill program extend mineralization and

indicate good continuity at high grades, confirming the importance of

the recently discovered Escondida vein.

https://www.greatpanther.com/news-media/news/great-panther-announces-coricancha-mine-complex-exploration-results

This news release constitutes a "designated news release" for the

purposes of the Company's prospectus supplement dated October 15, 2021,

to its short form base shelf prospectus dated September 10, 2021.

TSX: GPR | NYSE American: GPL

VANCOUVER, BC, March 1, 2022 /PRNewswire/ -

Great Panther Mining Limited (TSX: GPR) (NYSE-A: GPL) ("Great

Panther" or the "Company"), a growth-oriented precious metals producer

focused on the Americas, reports drill results from

the Coricancha Mine Complex ("Coricancha"), located in

the central Andes of Peru, approximately 90 kilometres

east of Lima. A total of 22 holes were completed over approximately

5,219 metres.

Exploration Highlights:

https://ih.advfn.com/stock-market/AMEX/great-panther-mining-GPL/stock-news/87428352/great-panther-announces-coricancha-mine-complex-ex

https://www.greatpanther.com

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/quotes_7a.gif?1493417496003

http://www.kitconet.com/images/live/au0001wb.gif

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

https://www.usdebtclock.org/

God Bless

Aurcana Silver Provides Operations Update

Vancouver, BC – March 8, 2022 – Aurcana SILVER Corporation ("Aurcana" or the "Company") (TSXV: AUN; OTCQF: AUNFF) provides the following update on operations at its wholly owned Revenue-Virginius Mine located in Ouray, Colorado, USA.

Mining and development operations have continued to focus on the completion of the #1 Alimak raise hoist / elevator system (the “#1 Raise Hoist”) throughout January and most of February. As a result of extreme winter weather conditions at the mine site during the second half of February, the site has been periodically inaccessible. Due to the high cost of maintaining the Company’s labor on standby and the higher cost of winter operations in general, the Company has temporarily suspended mining operations in order to ensure the efficient use of the Company’s resources and to conserve cash during the immediate term.

Based on the progress at site to date, the Company’s anticipated plans for resumption of work, the completion of the #1 Raise Hoist remains targeted for the second quarter of 2022. Completion of the #1 Raise Hoist is essential to reducing underground travel time for mine workers and for safe and sustainable access to the upper levels of the Virginius Vein. The Company believes that this hoisting system will have an immediate and long-term positive impact on mining productivity, as well as on subsequent mine development and production and mill production. The improved access to the upper levels of the Virginius and other veins is also expected to enhance future exploration and development activities at the mine.

Operations are anticipated to resume as soon as it is practical and cost effective to do so, with an initial priority focus on activities associated with completion of the #1 Raise Hoist. The Company then anticipates that operations at the mine will ramp to full production as quickly as possible thereafter following the completion of the #1 Raise Hoist.

Qualified Person Statement

The scientific and technical content of this news release was reviewed and approved by Michael Gross, P. Geo, a “qualified person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

ABOUT AURCANA SILVER CORPORATION

Aurcana Silver Corporation owns the Revenue-Virginius Mine, in Colorado, and the Shafter-Presidio Silver Project in Texas, US. The primary resource at Shafter and Revenue-Virginius is silver. Both are fully permitted for production.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURCANA SILVER CORPORATION

“Kevin Drover”

President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Silver Corporation

850 – 789 West Pender Street

Vancouver, BC V6C 1H2

Phone: (604) 331-9333

https://www.aurcana.com/news/2022/index.php?content_id=494

$Pro-Life Thanks; Great Panther Announces Coricancha Mine Complex Exploration Results

March 01 2022 - 05:02PM

PR Newswire (US)

Results from the 2021 drill program extend mineralization and

indicate good continuity at high grades, confirming the importance of

the recently discovered Escondida vein.

https://www.greatpanther.com/news-media/news/great-panther-announces-coricancha-mine-complex-exploration-results

This news release constitutes a "designated news release" for the

purposes of the Company's prospectus supplement dated October 15, 2021,

to its short form base shelf prospectus dated September 10, 2021.

TSX: GPR | NYSE American: GPL

VANCOUVER, BC, March 1, 2022 /PRNewswire/ -

Great Panther Mining Limited (TSX: GPR) (NYSE-A: GPL) ("Great

Panther" or the "Company"), a growth-oriented precious metals producer

focused on the Americas, reports drill results from

the Coricancha Mine Complex ("Coricancha"), located in

the central Andes of Peru, approximately 90 kilometres

east of Lima. A total of 22 holes were completed over approximately

5,219 metres.

Exploration Highlights:

https://ih.advfn.com/stock-market/AMEX/great-panther-mining-GPL/stock-news/87428352/great-panther-announces-coricancha-mine-complex-ex

https://www.greatpanther.com

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

https://www.kitconet.com/images/quotes_7a.gif?1493417496003

http://www.kitconet.com/images/live/au0001wb.gif

https://www.kitco.com/images/live/silver.gif?0.8344882022363285

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

https://www.usdebtclock.org/

God Bless

Silver has never failed to reach it's ALL-TIME highs after gold does it first. So, it's not a questions of IF... but WHEN? Previous ranges were from 5-40 months... We are at month 21. Tic Toc."

"Silver has never failed to reach it's ALL-TIME highs after gold does it first.

— Patrick Karim (@badcharts1) March 8, 2022

So, it's not a questions of IF... but WHEN?

Previous ranges were from 5-40 months.

W̷e̷ ̷a̷r̷e̷ ̷a̷t̷ ̷m̷o̷n̷t̷h̷ ̷9̷.̷ We are at month 21.

Tic Toc."#xagusd #xauusd #silver #gold pic.twitter.com/IWyPV9neGI

Kootenay Silver - Red Cloud 2022 Pre-PDAC Mining Showcase

Jim Rogers: Silver Will Protect You - Mar 6, 2022

https://www.youtube.com/watch?v=19lZ2HmdaZY

Nobody is searching for $gold or $silver yet in Google trends. I take that as good news.

8:16 PM · Mar 5, 2022

Nobody is searching for $gold or $silver yet in Google trends. I take that as good news.

— Jonathan West (@JWest0926) March 6, 2022

KOOTENAY SILVER REPORTS AZTEC – KOOTENAY JV DRILLS BEST HOLE YET INTERSECTS 3.42 GPT AU OVER 51.7 M WITHIN 1.49 GPT AU OVER 136.8 M FROM CALIFORNIA ZONE AT CERVANTES PROJECT IN SONORA, MEXICO

March 2, 2022

*CAL22-05 represents the best gold mineralized intersection drilled to date at the Cervantes project

*Initial gold results from 15 additional drill holes are expected over the coming weeks

Kootenay Silver Inc. (TSXV: KTN, OTC: KOOYF) (the “Company” or “Kootenay”) is pleased to announce project partner and operator Aztec Minerals has reported on 3 more holes from the Cervantes project in Sonora, Mexico.

California Zone Drill Highlights

* CAL22-005

-1.486 gpt Au over 136.8 m, including 51.7 metres of 3.424 gpt Au at the southern edge of the central part of the mineralized zone some 50 meters from hole CAL22-004 that previously reported 1.0 gpt Au over 167 meters with 24.4 meters of 4.25 gpt Au.

*CAL22-006

-0.75 gpt Au over 100.3 m including 3.087 gpt Au. Over 9.1 meters at the northern edge of the central portion of the mineralized zone

*CAL22-007

-0.422 gpt Au over 63.8 m located at the northern edge of the central portion of the mineralized zone

To-date, every hole drilled at California has intersected near surface, oxidized gold mineralization with minor copper oxides. There are 13 more holes pending from the California zone with one pending from each of the Jasper and California North targets.

View drill section here:

Link to section view holes CAL22-004 and CAL22-005 https://bit.ly/3IFS4xU

Link to section view hole CAL22-005 https://bit.ly/3HwShlO

Link to section view hole CAL22-006 https://bit.ly/3vxGpgW

Link to section view hole CAL22-007 https://bit.ly/3MutH95

Reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures and veinlets within quartz-feldspar porphyry, feldspar porphyry stocks and related hydrothermal breccias.

California 2022 RC Drill Program Plan Map https://bit.ly/3K9auHV

Holes CAL22-005, 006 and 007 intersected extensive gold mineralization, see table below, extending the known mineralized zone at depth and to the north and to the south and covers an area now measuring approximately 900 metres long by 250 to 500 metres wide, with demonstrated, continuous mineralization up to 265 metres depth vertically. The porphyry gold-copper mineralization is still open in all directions.

Click on link below to view mining table

Drill samples cuttings are collected every 5 feet (1.52m) from all drill holes. The samples are analyzed by Bureau Veritas for gold with a 30-gram sample size using the method FA430 followed by MA300. Over limits, when present, are analyzed by AR404 or FA550. All holes contain certified blanks, standards, and duplicates as part of the quality control program. The QA/QC has delivered excellent results to date good data integrity. The samples are shipped to and received by Bureau Veritas Minerals laboratory for the gold and multielement geochemical analysis and additional gold results will be received and reported in the next several weeks. Final multielement ICP results are expected to follow the release of the preliminary gold assays and are expected to be received during the second quarter 2022.

Cervantes Property Overview

Cervantes is a highly prospective porphyry gold-copper property located in southeastern Sonora state, Mexico. The project lies 160 km east of Hermosillo, Sonora, Mexico within the prolific Laramide porphyry copper belt approximately 265 km southeast of the Cananea porphyry copper-molybdenum mine (Grupo Mexico). Cervantes also lies along an east-west trending gold belt 60 km west of the Mulatos epithermal gold mine (Alamos Gold), 35 km northeast of the Osisko San Antonio gold mine, 45 km west of the La India mine (Agnico Eagle), and 40 km northwest of Santana gold deposit (Minera Alamos). View: Cervantes Project Location Map

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Chihuahua, State and Sonora, State , Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-silver-reports-aztec-kootenay-jv-drills-best-hole-yet-intersects-342-gpt-au-over-517-m-within-149-gpt-au-over-1368-m-from-california-zone-at-cervantes-project-in-sonora-mexico

Aurcana Announces Closing of Second Tranche of Non-Brokered Private Placement for Aggregate of $5,972,725

Vancouver, BC – February 28, 2022 – Aurcana SILVER Corporation ("Aurcana" or the "Company") (TSXV: AUN; OTCQF: AUNFF) is pleased to announce it has closed the second and final tranche of the non-brokered private placement offering (the “Private Placement”) announced on February 1, 2022, subject to the approval of the TSX Venture Exchange. The second tranche consists of 1,926,857 Units at a price of C$0.35 per Unit, for a total of $674,399.95. The first and second tranches combined consist of a total of 17,064,928 units for a total of $5,972,724.80 raised.

Each Unit consists of one common share of the Company and one full common share purchase warrant (“Warrant”), with each Warrant entitling the holder thereof to purchase one common share at a price of C$0.525 for a period of 36 months following the closing of the Private Placement, subject to adjustment upon certain customary events.

The net proceeds of the Private Placement will provide contingency funding for the restart of the Company’s wholly owned Revenue Virginius (RV) Mine as well as funding for growth of the resource base at the RV Mine which may enable the Company to grow future production volumes. Net proceeds will also be used for working capital and general and administrative expenses including potential opportunities to advance its wholly owned Shafter Project in light of the current silver price.

The Units have been issued on a private placement basis pursuant to applicable exemptions from prospectus requirements under applicable securities laws. The common shares and Warrants (and any common shares issued pursuant to the Warrants, as applicable) are subject to a statutory hold period of four months and one day from the date of issuance of the Units. The hold period for the first tranche expires on June 2, 2022 and the hold period for the second tranche expires on June 29, 2022.

The Company paid an aggregate of C$243,558 in finder’s fees and issued an aggregate of 695,880 agent’s warrants, (“Agent’s Warrants”) with each Agent’s Warrant entitling the holder thereof to purchase one Common Share at a price of C$0.525 for a period of 36 months from the date of issuance.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy the securities in the United States nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or any state securities laws and may not be offered or sold in the United States unless registered under the 1933 Act and any applicable securities laws of any state of the United States or an applicable exemption from the registration requirements is available.

ABOUT AURCANA CORPORATION

Aurcana Corporation owns the Revenue-Virginius Mine, in Colorado, and the Shafter-Presidio Silver Project in Texas, US. The primary resource at Shafter and Revenue-Viriginius is silver. Both are fully permitted for production.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURCANA CORPORATION

“Kevin Drover”

President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Corporation

850 – 789 West Pender Street

Vancouver, BC V6C 1H2

Phone: (604) 331-9333

https://www.aurcana.com/news/2022/index.php?content_id=493

This chart clearly shows how undervalued $SILVER is relative to the US #moneysupply. And since $SILVER is a hedge against currency debasement together with $GOLD, and since #inflation is caused by an increase in the money supply, this chart has a very, very long way to go.

This chart clearly shows how undervalued $SILVER is relative to the US #moneysupply. And since $SILVER is a hedge against currency debasement together with $GOLD, and since #inflation is caused by an increase in the money supply, this chart has a very, very long way to go. pic.twitter.com/LvuqlElYuW

— Graddhy - Commodities TA+Cycles (@graddhybpc) February 23, 2022

KOOTENAY SILVER REPORTS AZTEC – KOOTENAY JV DRILLS 4.2 GPT GOLD OVER 24.4 METERS WITHIN 167 METERS OF 1.0 GPT GOLD AT THE CERVANTES PROJECT, SONORA, MEXICO

February 23, 2022

Kootenay Silver Inc. (TSXV: KTN, OTC: KOOYF) (the “Company” or “Kootenay”) is pleased to announce that its joint venture (“JV”) partner and JV operator, Aztec Minerals Corp. (“Aztec”) continues to intersect broad, high-grade, gold mineralization during the 2022 RC drill program at the California target on the Cervantes property located in Sonora, Mexico.

The best of three drill holes reported in this news release is CAL22-004 which intercepted:

*167.2 meters grading 1.002 gpt gold including 24.4 meters grading 4.247 gpt gold.

Two fences of drilling have now been completed on each side of the previously drilled fence of holes on the California shallow oxide gold target with the objective of expanding the size of the zone identified in 2017-2018 drilling. This has been successful so far with a foot print now measuring 250 to 500 meters wide and 900 meters long with mineralization continuous vertically to at least 245 meters.

California Zone Drill Highlights

* 1.002 gpt gold over 167.2 meters in mineralized quartz feldspar porphyry, including 24.4 meters of 4.247 gpt gold in CAL22-004, located in the central part of the mineralized zone

* 0.374 gpt gold over 99.1 meters in mineralized porphyries and hydrothermal breccias in CAL22-002 located at the west end of the mineralized zone

* 0.451 gpt gold over 45.7 meters in mineralized porphyries in CAL22-003, including 13.7 meters of 0.868 gpt gold located at the south end of the mineralized zone

View drill section here:

Link to section view hole CAL22-002: https://bit.ly/3seIHzA

Link to section view hole CAL22-003: https://bit.ly/3ImRPIg

Link to section view hole CAL22-004: https://bit.ly/3sdnHJx

Reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures and veinlets within quartz-feldspar porphyry, feldspar porphyry stocks and related hydrothermal breccias.

California 2022 RC Drill Program Plan Map: https://bit.ly/3vckYSo

Holes CAL22-002 and 003 intersected extensive gold mineralization, see table below, extending the known mineralized zone at depth and to the north, west, and CAL22-004 to the south. The porphyry gold-copper mineralization is still open in all directions.

Detailed Drill Results – CAL-22-001 to CAL-22-004

Click on link below to view Drill Results table

The Aztec-Kootenay JV has now completed its Phase 2 Reverse circulation (RC) program of 26 holes, totaling 4,649 meters at the Cervantes Property. Four holes drilled into the Purisma target have been previously reported. The single drill holes at Jasper and California North found mineralized quartz feldspar porphyry with results pending.

The Aztec-Kootenay JV will now carry out channel sampling and geologic mapping of the new drill roads at California, California Norte and Jasper, as well as to expand surface sampling and mapping on the property in general to continue the 2021 phase 1 surface program.

Drill samples cuttings are collected every 5 feet (1.52 meters) from all drill holes. The samples are analyzed by Bureau Veritas for gold with a 30-gram sample size using the method FA430 followed by MA300. Over limits, when present, are analyzed by AR404 or FA550. All holes contain certified blanks, standards, and duplicates as part of the quality control program. The QA/QC has delivered excellent results to date good data integrity. The samples are shipped to and received by Bureau Veritas Minerals laboratory for the gold and multielement geochemical analysis and additional gold results will be received and reported in the next several weeks. Final multielement ICP results are expected to follow the release of the preliminary gold assays and are expected to be received during the second quarter 2022.

Cervantes Property Highlights

View: Cervantes Project Location Map: https://bit.ly/353s9ld

*Large well-located property (3,649 hectares) with good infrastructure, road access, local town, all private land, water wells on property, grid power nearby

*Seven prospective mineralized zones related to high level porphyries and breccias along an 7.0km east-northeast corridor with multiple intersecting northwest structures

*Distinct geophysical anomalies California target marked by high magnetic and low resistivity anomalies, high radiometric and chargeability anomalies responding to pervasive alteration

*Extensive gold mineralization at California zone 118 soil samples average 0.44 gpt gold over 900 m by 600 m area, trench rock-channel samples up to 0.47 gpt gold over 222m

*Already drilled the first discovery hole at the California zone, intersected gold oxide cap to a classic gold-copper porphyry deposit, drill results up to 0.77 gpt gold over 160 m

*Excellent gold recoveries from preliminary metallurgical tests on drill core from California zone; oxide gold recoveries in bottle roll tests range from 75% to 87%

*California geophysical anomaly wide open laterally and at depth, IP chargeability strengthens and broadens to >500m depth over an area 1100 m by 1200 m

*Three-Dimensional IP Survey conducted in 2019 extends strong chargeability anomalies to the southwest covering Estrella, Purisima East, and Purisima West, coinciding well with alteration and Au-Cu-Mo soil geochemical anomalies, all undrilled.

Cervantes Property Overview

Cervantes is a highly prospective porphyry gold-copper property located in southeastern Sonora State, Mexico located 160 km east of Hermosillo, Sonora, Mexico within the prolific Laramide porphyry copper belt approximately 265 km southeast of the Cananea porphyry copper-molybdenum mine (Grupo Mexico). Cervantes also lies along a northeast-southwest transverse trending gold belt that includes the Mulatos epithermal gold mine (Alamos Gold) 60 km to the east, 35 km northeast of the Osisko San Antonio gold mine, 45 km west of the La India mine (Agnico Eagle), and 40 km northwest of Santana gold deposit (Minera Alamos). The property was acquired by Kootenay Silver by prospecting and staking and later optioned to Aztec Minerals who earned a 65% interest under the agreement. The property is now a 65/35 JV operated by Aztec with Kootenay holding a 35% interest and both parties contributing their pro rata interests to the project.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-reports-aztec-kootenay-jv-drills-42-gpt-gold-over-244-meters-within-167-meters-of-10-gpt-gold-at-the-cervantes-project-sonora-mexico

Be Ready: $600 Silver is Possible After This HAPPENS! - Lynette Zang | Silver Price Prediction - Feb 22, 2022

https://www.youtube.com/watch?v=k3kGozXQNxU

Kootenay Silver announces Aztec – Kootenay JV Intersects 2.8 gpt Au over 24.4 meters within 1.1 gpt Au over 88.4 meters at the Cervantes property in Sonora, Mexico.

February 16, 2022

Kootenay Silver (KTNV: KTN; OTC: KOOYF) is pleased to announce JV operator Aztec Minerals Corp. has reported a broad, high grade, gold intercept in the first RC drill hole on the California target on the Cervantes property located in Sonora, Mexico.

California Zone Drill Highlights

* 1.1 gpt Au over 88.41 m in mineralized quartz feldspar porphyry

- Including 1.56 gpt Au over 54.9 m with 2.8 gpt Au over 24.4 meters

View drill section here: Link to section view hole CAL22-001 https://bit.ly/3rYcxIk

This is the first hole in the California target in the current program and represents a significant step out from a previous fence of holes that established a broad area of shallow oxide gold mineralization. The best hole from which graded a drill length of 160 meters of 0.77 gpt Au, 0.13% copper and 3.4 gpt silver.

The Phase 2 RC drill program at Cervantes is focussed on expanding previously drilled California zone by completing two drill hole fences parallel to and on either side of the 2017-18 Phase 1 drill hole fence. To-date, every hole drilled at California has intersected near surface, oxidized gold mineralization with minor copper oxides.

Reported lengths are apparent widths, not true widths, and the observed gold mineralization appears to be widely distributed in disseminations, fractures and veinlets within a quartz-feldspar porphyry stock and related hydrothermal breccias.

James McDonald President and CEO of Kootenay Silver says “The current drill program on the Cervantes project is off to a great start with the best hole drilled to date. We are looking forward to the remainder of the drill holes results.”

The Cervantes project is a 65/35 joint venture with Kootenay holding a 35% participating interest.

California 2022 RC Drill Program Plan Map https://bit.ly/34JoXLI

Hole CAL22-001 intersected extensive gold mineralization extending the known mineralized zone at depth and to the north. The area currently being drilled measures approximately 800 metres long by 300 metres wide, with demonstrated, continuous mineralization of up to 170 metres depth. The porphyry gold-copper mineralization is still open in all directions.

The Aztec-Kootenay JV has completed 22 holes of a 25 hole, 5000 meter RC program. The first four RC holes tested the previously undrilled Purisima East target, where high grade gold mineralization was sampled in a glory hole. Preliminary gold assays in these four holes exhibit anomalous but sub-economic gold grades.

The main objective of the 2021 – 2022 exploration program is to further test the open pit, heap leach gold potential of the porphyry oxide cap at California and evaluate the potential for deeper copper-gold porphyry sulfide mineralization underlying the oxide cap.

Drill samples cuttings are collected every 5 feet (1.52m) from all drill holes. The samples are analyzed by Bureau Veritas for gold with a 30-gram sample size using the method FA430 followed by MA300. Over limits, when present, are analyzed by AR404 or FA550. All holes contain certified blanks, standards, and duplicates as part of the quality control program. The QA/QC has delivered excellent results to date good data integrity. The samples are shipped to and received by Bureau Veritas Minerals laboratory for the gold and multielement geochemical analysis and additional gold results will be received and reported in the next several weeks. Final multielement ICP results are expected to follow the release of the preliminary gold assays and are expected to be received during the second quarter 2022.

Qualified Persons

The Kootenay technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (Standards of Disclosure for Mineral Projects) and reviewed and approved on behalf of Kootenay by James McDonald, P.Geo, President, CEO & Director for Kootenay, a Qualified Person.

About Kootenay Silver Inc.

Kootenay Silver Inc. is an exploration company actively engaged in the discovery and development of mineral projects in the Sierra Madre Region of Mexico and in British Columbia, Canada. Supported by one of the largest junior portfolios of silver assets in Mexico, Kootenay continues to provide its shareholders with significant leverage to silver prices. The Company remains focused on the expansion of its current silver resources, new discoveries and the near-term economic development of its priority silver projects located in prolific mining districts in Sonora, State and Chihuahua, State, Mexico, respectively.

For additional information, please contact:

James McDonald, CEO and President at 403-880-6016

Ken Berry, Chairman at 604-601-5652; 1-888-601-5650

or visit: www.kootenaysilver.com

https://www.kootenaysilver.com/news/kootenay/2022/kootenay-silver-announces-aztec-kootenay-jv-intersects-28-gpt-au-over-244-meters-within-11-gpt-au-over-884-metres-at-the-cervantes-property-in-sonora-mexico

Rick Rule: Banks Secret Plan To Crash The Stock Market, Seize Your Money (& Cause A Food Shortage?) - Feb 20, 2022

https://www.youtube.com/watch?v=fLp4LfyRXwM

97% Will LOSE Money With Silver If They Don't Realise This - Lynette Zang | Silver Price Prediction - Feb 19, 2022

https://www.youtube.com/watch?v=nL3RKpfMFAM

Silver themed videos on YT are numerous... keep stackin'!!!

$Great Panther Files NI 43-101 Technical Report for the Topia Mine

VANCOUVER, BC, Feb. 11, 2022 /CNW/ -

Great Panther Mining Limited (TSX: GPR) (NYSE: GPL) ("Great Panther" or the "Company"), a growth-oriented precious metals producer focused on the Americas, reports the filing of the "NI 43-101 Technical Report on the Topia Mine Mineral Resource Estimates as of March 31, 2021" (the "Technical Report"). The Technical Report has an effective date of March 31, 2021.

The Technical Report has been filed on SEDAR at www.sedar.com and on the Company's website at www.greatpanther.com , and will be filed on EDGAR as soon as practicable at www.sec.gov. The Technical Report supports the information regarding mineral resource estimates at the Topia Mine presented in a news release dated February 11, 2022, which is also available on SEDAR, EDGAR and the Company's website.

ABOUT GREAT PANTHER

Great Panther is a growth-oriented precious metals producer focused on the Americas. The Company owns a diversified portfolio of assets in Brazil, Mexico and Peru that includes three gold and silver mines, an advanced development project, and a large land package with district-scale potential. Great Panther is focused on creating long-term stakeholder value through safe and sustainable production, reinvesting into exploration and pursuing acquisition opportunities to complement its existing portfolio. Great Panther trades on the Toronto Stock Exchange trading under the symbol GPR and on the NYSE American under the symbol GPL.

SOURCE Great Panther Mining Limited

For further information: Fiona Grant Leydier, Vice President, Investor Relations, T : +1 604 638 8956, TF : 1 888 355 1766, E : fgrant@greatpanther.com, W :

http://www.greatpanther.com

$TM Great Panther Announces Mineral Resource Estimates for the Topia

Mine and Guanajuato Mine Complex in Mexico

This news release constitutes a "designated news release" for the

purposes of the Company's prospectus supplement dated

October 15, 2021 , to its short form base shelf prospectus dated

September 10, 2021 .

TSX: GPR | NYSE American: GPL

https://www.greatpanther.com/news-media/news/great-panther-announces-mineral-resource-estimates-for-the-topia-mine-and-guanajuato-mine-complex-in-mexico

VANCOUVER, BC , Feb. 11, 2022 /CNW/ -

Great Panther Mining Limited (TSX: GPR) (NYSE-A: GPL) ("Great Panther" or the "Company"), a growth-oriented precious metals producer focused on the Americas, reports Mineral Resource Estimates ("MRE") for the Company's 100%-owned Topia Mine ("Topia") and Guanajuato Mine Complex ("GMC") in Mexico . The estimates were prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

The Company will file a technical report in respect of each of Topia and GMC, prepared in each case in accordance with NI 43-101, on SEDAR and EDGAR within 45 days of this news release.

Topia Highlights

Measured and Indicated ("M&I") Mineral Resource grade increased 8% to 1,041 silver equivalent grams per ton ("Ag eq g/t"), when compared with the 2018 MRE for Topia .

M&I Mineral Resources decreased 25% to 11.1 million silver equivalent ounces ("Ag eq oz"), when compared with the 2018 MRE.

GMC Highlights

M&I Mineral Resource grade increased 2% to 391 grams Ag eq g/t when compared with the 2020 MRE for GMC.

M&I Mineral Resources decreased 36% to 7.7 million Ag eq oz when compared with the 2020 MRE.

Topia Mineral Resource Estimate Update

Topia lies northwest of Durango and is a silver ("Ag"), gold ("Au"), lead ("Pb"), zinc ("Zn") district with a central concentrator plant capable of processing 260 tonnes per day ("tpd"), supporting multiple mine headings on precious and base metal veins. Topia has been in the Great Panther portfolio since 2005 and has cumulatively produced 9.5 million silver equivalent ounces (comprised of silver and gold) plus 17,574 tonnes of lead and 23,592 tonnes of zinc.

The MRE for Topia has an effective date of March 31, 2021 . Compared to the previous MRE with an effective date of July 31, 2018 , grades have significantly increased with M&I grades increasing 32% for silver, 37% for gold, 14% for lead and 11% for zinc. The higher-grade ore, however, is associated with an overall decrease of 30% in tonnes and 25% in silver equivalent ounces. Key factors that varied during the three-year period since the last MRE were the increase in mining costs, metal price variations and mine depletion, which totalled 3.7 million Ag eq oz.

Measured and Indicated Mineral Resources are estimated to contain 331,800 tonnes at 609 g/t Ag, 1.84 g/t Au, 4.40% Pb, and 4.50% Zn and Inferred Mineral Resources are estimated to contain 274,600 tonnes at 592 g/t Ag, 1.44 g/t Au, 3.35% Pb, and 3.63% Zn. The MRE for Topia is summarized below in Table 1.

https://www.greatpanther.com/news-media/news/great-panther-announces-mineral-resource-estimates-for-the-topia-mine-and-guanajuato-mine-complex-in-mexico

SPROTT: This Is Why Gold Will Break Out To Higher Levels

February 08, 2022

https://kingworldnews.com/sprott-this-is-why-gold-will-break-out-to-higher-levels/

80% OF All US Dollars In Existence Have Been Printed In Just The Past Two Years

January 20, 2022

https://thewashingtonstandard.com/80-of-all-us-dollars-in-existence-have-been-printed-in-just-the-past-two-years/

$THE END OF THE DOLLAR IS JUST ONE ANNOUNCEMENT AWAY

WATCH

https://www.bitchute.com/video/QFBR0FGbAzi2/

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

$Great Panther Announces Mineral Resource Estimates for the Topia

Mine and Guanajuato Mine Complex in Mexico

This news release constitutes a "designated news release" for the

purposes of the Company's prospectus supplement dated

October 15, 2021 , to its short form base shelf prospectus dated

September 10, 2021 .

TSX: GPR | NYSE American: GPL

https://www.greatpanther.com/news-media/news/great-panther-announces-mineral-resource-estimates-for-the-topia-mine-and-guanajuato-mine-complex-in-mexico

VANCOUVER, BC , Feb. 11, 2022 /CNW/ -

Great Panther Mining Limited (TSX: GPR) (NYSE-A: GPL) ("Great Panther" or the "Company"), a growth-oriented precious metals producer focused on the Americas, reports Mineral Resource Estimates ("MRE") for the Company's 100%-owned Topia Mine ("Topia") and Guanajuato Mine Complex ("GMC") in Mexico . The estimates were prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

The Company will file a technical report in respect of each of Topia and GMC, prepared in each case in accordance with NI 43-101, on SEDAR and EDGAR within 45 days of this news release.

Topia Highlights

Measured and Indicated ("M&I") Mineral Resource grade increased 8% to 1,041 silver equivalent grams per ton ("Ag eq g/t"), when compared with the 2018 MRE for Topia .

M&I Mineral Resources decreased 25% to 11.1 million silver equivalent ounces ("Ag eq oz"), when compared with the 2018 MRE.

GMC Highlights

M&I Mineral Resource grade increased 2% to 391 grams Ag eq g/t when compared with the 2020 MRE for GMC.

M&I Mineral Resources decreased 36% to 7.7 million Ag eq oz when compared with the 2020 MRE.

Topia Mineral Resource Estimate Update

Topia lies northwest of Durango and is a silver ("Ag"), gold ("Au"), lead ("Pb"), zinc ("Zn") district with a central concentrator plant capable of processing 260 tonnes per day ("tpd"), supporting multiple mine headings on precious and base metal veins. Topia has been in the Great Panther portfolio since 2005 and has cumulatively produced 9.5 million silver equivalent ounces (comprised of silver and gold) plus 17,574 tonnes of lead and 23,592 tonnes of zinc.

The MRE for Topia has an effective date of March 31, 2021 . Compared to the previous MRE with an effective date of July 31, 2018 , grades have significantly increased with M&I grades increasing 32% for silver, 37% for gold, 14% for lead and 11% for zinc. The higher-grade ore, however, is associated with an overall decrease of 30% in tonnes and 25% in silver equivalent ounces. Key factors that varied during the three-year period since the last MRE were the increase in mining costs, metal price variations and mine depletion, which totalled 3.7 million Ag eq oz.

Measured and Indicated Mineral Resources are estimated to contain 331,800 tonnes at 609 g/t Ag, 1.84 g/t Au, 4.40% Pb, and 4.50% Zn and Inferred Mineral Resources are estimated to contain 274,600 tonnes at 592 g/t Ag, 1.44 g/t Au, 3.35% Pb, and 3.63% Zn. The MRE for Topia is summarized below in Table 1.

https://www.greatpanther.com/news-media/news/great-panther-announces-mineral-resource-estimates-for-the-topia-mine-and-guanajuato-mine-complex-in-mexico

SPROTT: This Is Why Gold Will Break Out To Higher Levels

February 08, 2022

https://kingworldnews.com/sprott-this-is-why-gold-will-break-out-to-higher-levels/

80% OF All US Dollars In Existence Have Been Printed In Just The Past Two Years

January 20, 2022

https://thewashingtonstandard.com/80-of-all-us-dollars-in-existence-have-been-printed-in-just-the-past-two-years/

$THE END OF THE DOLLAR IS JUST ONE ANNOUNCEMENT AWAY

WATCH

https://www.bitchute.com/video/QFBR0FGbAzi2/

$In GOD We Trust - Real Money - AU Safety 6000yrs ![]() )

)

$GOLD & SILVER SHORT SQUEEZE: Mining Stocks Explode Higher As Short Squeeze Underway!

January 19, 2022

https://kingworldnews.com/gold-silver-short-squeeze-mining-stocks-explode-higher-as-short-squeeze-underway/

$GREAT PANTHER REPORTS FULL YEAR 2021 PRODUCTION OF 105,006 GOLD EQUIVALENT OUNCES AND PROVIDES 2022 GUIDANCE

January 19 2022 - 07:27AM

PR Newswire (Canada)

https://ih.advfn.com/stock-market/AMEX/great-panther-mining-GPL/stock-news/87051233/great-panther-reports-full-year-2021-production-of

Is 2022 The Year For Gold & Silver? If The Central Banks & Private Citizens Keep Buying, It Will Be!

699 views Dec 8, 2021

Silver options trading, SILJ, SilverFest II, Hunt brothers history, (Chris Marcus, Rob Kientz)

Aurcana Silver Provides Operations Updates

Vancouver, BC – January, 10, 2022 – Aurcana SILVER Corporation ("Aurcana" or the "Company") (TSXV: AUN; OTCQF: AUNFF) is pleased to provide an update on current operations at its wholly owned Revenue-Virginius Mine located in Ouray, Colorado, USA.

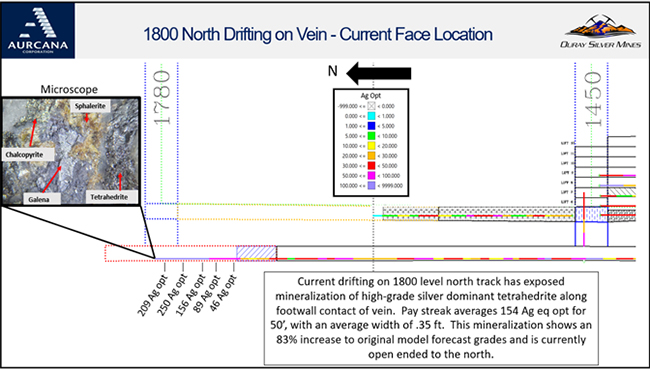

Operations are continuing to focus on the completion of the #1 Alimak raise hoist / elevator system which will enable efficient movement of men and materials between the 2000 level and the four levels being developed above 2000. Operations also continue stoping on the 1800 level of the Virginius Vein, and making ongoing improvements to the process plant.

It is anticipated that the mill will resume operations in mid-January and will run as stope ore is available. Significant improvement in concentrate quality was realized in the most recent mill run in December and is expected to continue once the mill is back in operation.

Completion of the #1 Alimak raise hoist / elevator project remains targeted for May 2022. The #1 Raise Hoist is the key to safe, efficient, and sustainable travel for men and materials to the upper levels of the Virginius mine. This hoisting system will have an immediate positive impact on mining productivities and subsequent mine development & production and mill production. The improved access to the upper levels of the Virginius and other veins is expected to also enhance future exploration and development activities at the mine.

Mining operations have continued to focus on the optimization of 1800 level stope mining. Stope ore has been stockpiled underground in anticipation of the resumption of milling. Currently, the mine has two stopes available on the 1800 level to supply the mill with high grade silver ore with a third stope partially completed.

Assays taken from on vein development openings continue to demonstrate strong mineralization in support of the geologic model. The figure below depicts a graphical representation of the grades encountered while drifting north on the Virginius Vein on the 1800 level.

Figure 1

“We are very pleased with the grades we are encountering, and the fact these grades are significantly higher (83%) when compared to the geologic model; this gives us great confidence in our ore body.”, said Kevin Drover, President and CEO of Aurcana.

Qualified Person Statement

The scientific and technical content of this news release was reviewed and approved by Michael Gross, P. Geo, a “qualified person” within the meaning of NI 43-101

ABOUT AURCANA SILVER CORPORATION

Aurcana Silver Corporation owns the Revenue-Virginius Mine, in Colorado, and the Shafter-Presidio Silver Project in Texas, US. The primary resource at Shafter and Revenue-Virginius is silver. Both are fully permitted for production.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURCANA SILVER CORPORATION

“Kevin Drover”

President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Silver Corporation

850 – 789 West Pender Street

Vancouver, BC V6C 1H2

Phone: (604) 331-9333

Gary Lindsey, Corporate Communications

Phone: (720)-273-6224

Email: gary@strata-star.com

https://www.aurcana.com/news/2022/index.php?content_id=491

Silver price drops 2.5% as COMEX drain accelerates

The silver price is down 2.5% this morning, which seems a little counter-intuitive based on what’s going on in the world.

Especially since in addition to the Federal Reserve escalating its hyperinflation campaign, the drain on the silver stockpile on the COMEX actually started accelerating again in the last 2 days of 2021.

While it’s still a bit early to tell for sure, if this trend continues over the next few days, we could well be nearing the break-point.

So to find out what’s going on before we finally see one of the most spectacular moves in financial history, click to watch this video now!

$GPL GOLD TARGET $3,100-$7,600: Last Time Gold Had This Setup It Surged 330%!

December 16, 2021

https://kingworldnews.com/gold-target-3100-7600-last-time-gold-had-this-setup-it-surged-330/

Gold Surges Above $1,800 But This Will Trigger $30 Silver And $2,100 Gold

December 17, 2021

https://kingworldnews.com/gold-surges-above-1800-but-this-will-trigger-30-silver-and-2100-gold/

Is 2022 The Year For Gold & Silver? If The Central Banks & Private Citizens Keep Buying, It Will Be!

699 views Dec 8, 2021

Aurcana Silver Corp Ships First Concentrate Production and Announces Management Change

Mr. Kevin Drover reports:

VANCOUVER, British Columbia, Dec. 23, 2021 (GLOBE NEWSWIRE) -- AURCANA SILVER CORPORATION ("Aurcana" or the "Company") (TSXV: AUN; OTCQF: AUNFF) is pleased to announce that it has shipped its first concentrate production from its wholly owned Revenue-Virginius Mine, located in Ouray, Colorado, USA.

The Company continues to mine high-grade ore during this time of reduced underground capacity. The processing system’s capability has been demonstrated through the mill operating at design capacity and the ability to produce shippable concentrate. However, the lack of consistent ore feed from the mine has been a bottleneck to optimizing processing performance.

Going forward, the near term operating plan is to continue to mine the two available stopes on the 1800 level and create a stockpile that will help ensure a longer period of sustained processing run-time. It is expected enough ore will be stockpiled to enable the processing plant to restart again during the first week of January.

Although the delays in specific underground development projects has meant the mine has been slower to get to full production than originally planned, a number of very important milestones have been achieved for the Revenue-Virginius Mine restart. First, the grade on the 1800 level based on assay results from samples taken from development advance shows the grade is as expected or better when compared against the geological model. The Company expects to be incorporating these assay results into future resource work. Second, the mine has proved the resue mining method works well for this ore-body in both dilution and geotechnical control features. And third, the processing facility has demonstrated that it can perform when given suitable ore feed to run at design rates and make sellable concentrates.

The Company continues to evaluate its development plan and timeline and will update shareholders in the new year. The #1 Raise Hoist remains the main bottleneck to achieving target mining productivities and its completion is a key to the success of the overall operation. Work on the #1 Raise Hoist continues and is the number one priority in the mine. Completion is now scheduled for May of 2022.

Aurcana also announces the resignation of Brian Briggs from the position of Chief Operating Officer of Aurcana Silver Corp and from the position of Chief Executive Officer of Ouray Silver Mining Inc (“OSMI”). The responsibilities and duties of these positions will be shared among existing managers and officers of the Company and OSMI.

Qualified Person Statement

The scientific and technical content of this news release was reviewed and approved by Michael Gross, P. Geo, a “qualified person” within the meaning of NI 43-101

ABOUT AURCANA SILVER CORPORATION

Aurcana Corporation owns the Revenue-Virginius Mine, in Colorado, and the Shafter-Presidio Silver Project in Texas, US. The primary resource at Shafter and Revenue-Virginius is silver. Both are fully permitted for production.

ON BEHALF OF THE BOARD OF DIRECTORS OF AURCANA SILVER CORPORATION

“Kevin Drover”

President & CEO

For further information, visit the website at www.aurcana.com or contact:

Aurcana Silver Corporation

850 – 789 West Pender Street

Vancouver, BC V6C 1H2

Phone: (604) 331-9333

Gary Lindsey, Corporate Communications

Phone: (720)-273-6224

Email: gary@strata-star.com

https://www.juniorminingnetwork.com/junior-miner-news/press-releases/525-tsx-venture/aun/113051-aurcana-silver-corp-ships-first-concentrate-production-and-announces-management-change.html

Inflation Expectations and the Metals

By Steven Saville

December 20, 2021

[This blog post is an excerpt from a commentary published at TSI last week]

Popular measures of inflation such as the CPI and the PPI are backward looking, but the financial markets are always trying to look forward. To be more specific, current prices in the financial markets are determined by what’s expected to happen in the future as opposed to what happened in the past. An implication is that prices in the financial markets are influenced to a far greater degree by changes in the expected future CPI (inflation expectations) than changes in the reported CPI.

The expected CPI is indicated by the TIPS (Treasury Inflation Protected Securities) market. For example, the following chart shows the expected CPI factored into the price of the 5-year TIPS. According to this measure, the market’s inflation expectations peaked in mid-November and made a 2-month low during the first half of this week.

Contrary to the opinions of many commentators on the financial markets, gold tends to underperform the industrial metals when inflation expectations are rising and outperform the industrial metals when inflation expectations are falling. Therefore, if inflation expectations have peaked then the Industrial Metals Index (GYX) should have peaked relative to gold.

The following chart comparison of the GYX/gold ratio and the Inflation Expectations ETF (RINF) shows that GYX peaked relative to gold in mid-October, meaning that the downward reversal in the GYX/gold ratio led the downward reversal in the expected CPI by about one month.

The sustainability of the recent downward reversal in inflation expectations is yet to be determined, but our guess is that it has marked the start of a trend that will continue for 6-12 months or longer. An implication is that it is time to start favouring gold over industrial metals.

https://tsi-blog.com/2021/12/inflation-expectations-and-the-metals/

$Stockwrestler thanks; GOLD TARGET $3,100-$7,600: Last Time Gold Had This Setup It Surged 330%!

December 16, 2021

https://kingworldnews.com/gold-target-3100-7600-last-time-gold-had-this-setup-it-surged-330/

$Gold Surges Above $1,800 But This Will Trigger $30 Silver And $2,100 Gold

December 17, 2021

https://kingworldnews.com/gold-surges-above-1800-but-this-will-trigger-30-silver-and-2100-gold/

$Is 2022 The Year For Gold & Silver? If The Central Banks & Private Citizens Keep Buying, It Will Be!

699 views Dec 8, 2021

KOOTENAY SILVER INTERCEPTS 1,050 GPT SILVER OVER 2.0 METERS WITHIN 667 GPT SILVER OVER 7.05 METERS WITH FINAL 2021 DRILL HOLES ON COLUMBA HIGH-GRADE SILVER PROJECT (TSXV: KTN; OTC: KOOYF)

December 16, 2021

James McDonald Kootenay's President and CEO states, "The B Vein is continuing to yield impressive grades and widths. These results are amongst the best on the Property and as such we view the B Vein as having excellent potential for the discovery of large, mineralized zones within the vein."

Gustavo Gallego, Kootenay's Chief Geologic Engineer commented, "The B vein system is very promising, like all the targets drilled to date in Columba, drilling has returned excellent values with very interesting widths. We have tested a little more than 200 meters in length of this system and up to 200 meters in depth with drilling. On the surface we did not find high values of silver, however important grades begin approximately 100 meters deep, which gives us confidence that almost the entire epithermal system is preserved from erosion. With the 1:500 scale mapping program we have managed to extend this area by up to 600 meters on strike with vein widths of up to 1 meter on the surface. We look forward to the phase 4 program to begin drilling to expand this entire zone."

Continued at:

https://www.kootenaysilver.com/news/kootenay/2021/kootenay-silver-intercepts-1050-gpt-silver-over-20-meters-within-667-gpt-silver-over-705-meters-with-final-2021-drill-holes-on-columba-high-grade-silver-project

$SW2 Thanks; Ep.56 LFTV: Basel III - The Elephant in the Room - Unprecedented Impact

for GPL Gold and Silver

5,311 views Dec 10, 2021

Chris Marcus: CFTC suppresses silver manipulation evidence again

Earlier this year, acting CFTC chairman Rustin Benham confirmed that his agency took steps to cap the price of #silver. which is certainly an unusual comment for a regulator to make.

However, in following up with the agency to get clarity, I was able to contact the public media director, and in tonight's video you’ll find out what happened.

So if you want to know the truth about silver manipulation and the CFTC, click to watch the interview now!

KOOTENAY SILVER ANNOUNCES DRILL RESULTS FROM COPALITO SILVER-GOLD PROJECT. HIGHLIGHTS INCLUDE 276 GPT SILVER EQ. OVER 23 METERS AND 642 GPT SILVER EQ. OVER 5 METERS (TSXV: KTN; OTC: KOOYF)

December 2, 2021

https://www.kootenaysilver.com/news/kootenay/2021/kootenay-silver-announces-drill-results-from-copalito-silver-gold-project-highlights-include-276-gpt-silver-eq-over-23-meters-and-642-gpt-silver-eq-over-5-meters

Peru communities resolute on mine shutdowns despite government shift - 26TH NOVEMBER 2021

https://www.miningweekly.com/article/peru-communities-resolute-on-mine-shutdowns-despite-government-shift-2021-11-26/rep_id:3650

Jim McDonald, CEO of Kootenay Silver (TSXV:KTN; OTC:KOOYF) at The 2021 StockPulse Silver Symposium

BOTTOM FEEDERS ALERT:

Great Panther Mining Limited (GPL)

is a precious metals mining and exploration company. The company operates three mines including the Tucano Gold Mine in Amapa State, Brazil, and two primary silver mines in Mexico...

Silver demand to surpass 1 billion ounces this year, hitting a 6-year high – Silver Institute

By Neils Christensen

Wednesday November 17, 2021 11:25

The global silver market will see demand reach 1.29 billion ounces this year, the first time it has breached 1 billion since 2015, according to the latest report from the Silver Institute.

Wednesday, in its interim market report, the Silver Institute said that silver demand had seen broad-based growth through 2021, with industrial demand leading the way.

"The recovery in silver industrial demand from the pandemic will see this segment achieve a new high of 524 million ounces (Moz). In terms of some of the key segments, we estimate that photovoltaic demand will rise by 13% to over 110 Moz, a new high and highlighting silver's key role in the green economy," said analysts at Metals Focus, who conducted the latest research on behalf of the Silver Institute.

The report also noted robust investment demand with interest in physical bullion expected to increase 34% or by 64 million ounces to 263 million ounces, representing a six-year high.

"Growth began with the social media buying frenzy before spreading to more traditional silver investors. Indian demand reflects improved sentiment towards the silver price and a recovering economy. Overall, physical investment in India is forecast to surge almost three-fold this year, having collapsed in 2020," the analysts said.

Paper demand for silver is also expected to increase in 2021. Holdings in silver-backed exchange-traded funds are projected to rise by 150 million ounces.

"During 2021 and through to November 10, holdings rose by 83 Moz, taking the global total to 1.15 billion ounces, close to its record high of 1.21 billion ounces which occurred on February 2, at the height of the social media storm," the analysts said.

The report said that silver jewelry and silverware fabrication is expected to see partial recoveries from the 2020 depressed levels, growing by 18% and 25%, respectively.

"Both markets will benefit from a marked upturn in all key countries, especially in India as the economy and consumer sentiment have bounced back more quickly than expected, and as restrictions ended in time for the all-important wedding and festive season," the analysts said.

Looking at the supply side, Metals Focus said that mine production is forecasted to increase by 6% to 829 million ounces.

"This recovery is largely the result of most mines being able to operate at full production rates throughout the year following enforced stoppages in 2020 due to the pandemic. Those countries where output was most heavily impacted last year, such as Peru, Mexico and Bolivia, will have the biggest increases," the analysts said.

Looking at the market's supply/demand fundamentals, Metals Focus looks for silver to see a modest supply deficit of 7 million ounces. "This will mark the first deficit since 2015," the report said.

The optimistic demand outlook comes as silver prices see a renewed uptrend. December silver prices last traded at $25.215 an ounce, up 1% on the day. Economists have noted that precious metals have seen new bullish momentum after consumer inflation rose to its highest level in 31 years.

One billion ounces is just the start - Hecla CEO

Phillip Baker, CEO of Hecla Mining, said in a telephone interview with Kitco News that he expects silver prices to remain in a strong uptrend as investors look for inflation hedges.

"Right now, we are seeing the consequences of trying to smooth out our economic system and avoid crisis," he said. "The result is higher inflation and it is doesn't seem to be very transitory."

Tuesday, Hecla, which represents 40% of all silver mined in the U.S., rang the closing bell on the New York Stock Exchange. This year the company is also celebrating its 130th anniversary.

Baker added that he expects silver demand to continue to grow and sees the potential of a 2-billion ounce market in the next 30 years.

"There's no doubt that with the desire to have clean energy, the demand for silver is going to continue to increase and increase probably at a much faster rate than what we've seen in the past," he said. "With all that demand, silver is more expensive."

To put the demand growth into perspective, Baker said that the world would need to see seven to ten new mines the equivalent size of its Green Creek in Southeast Alaska. The mine is forecasted to produce about 10 million ounces of silver this year. It is one of the largest primary silver producers in the world.

https://www.kitco.com/news/2021-11-17/Silver-demand-to-surpass-1-billion-ounces-this-year-hitting-a-6-year-high-Silver-Institute.html

Daybreak in the Land of Precious Metals

Michael J. Ballanger

Friday, November 12, 2021

There have been many times in my sexagenarian journey through four and a half decades of inflationary, disinflationary, and deflationary cycles when the spinning plates above my head suspended upon poles of flawed data and errant central bank policy appear on the verge of a massive chaotic accident. There are, however, other times when all is right with the world in which the precious metals investor resides and this past week was just one of those.

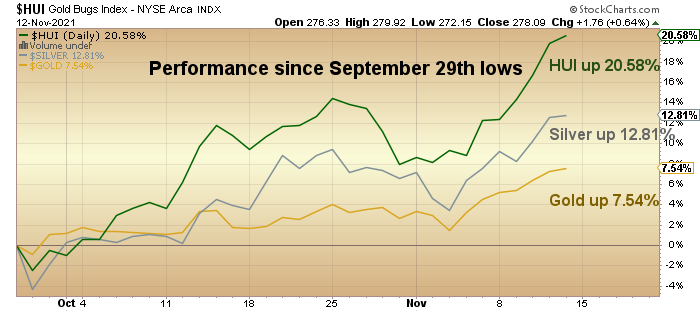

From a technical perspective, I could not ask for a more enviable confluence of conditions and events. Firstly, the precious metals bucked the trend of yielding to U.S. dollar strength so to the degree that this decoupling marks a new paradigm of gold and silver drivers, it was a watershed week. Secondly, as you all have been reading for as long as I have been allowed to perch upon the soapbox of blogosphere scrutiny, that repetitive drone resembling the bespectacled high school English teacher blathering on about conjugations with fifteen minutes left in an early summer school day, it was that silver outperformed gold and that the HUI outperformed both metals while the mightily-gilded TSX Venture Exchange surpassed 1,000, symbolizing the return of “animal spirits” to the world of precious metals.

To coin the Longfellowian phrase, it was as if the world of the hard asset disciple rolled into light; it was daybreak everywhere; and it was long overdue.

I have been arguing the bullish case for gold and silver since the middle of August, having stepped away from the senior and junior miner ETF’s back in August of 2020, when suddenly every blogger on the planet were reciting quotes from the “Gold Bug’s Almanac” while quoting Von Mises and Keynes and Peter Schiff chapter and verse in their rebirth into gold and silver idolatry. Flash forward to late September 2021 when I seized upon silver’s phony false breakdown below $22/ounce (so obviously orchestrated by the bullion bank silver shorts) and designed to spook speculative longs into a final cathartic capitulation. I contend that the late September reversal was the precise moment that the precious metals gods finally held up both hands and pronounced “Enough!” putting an end to the ever-ignored shenanigans that have plagued the paper markets for what seems like an eternity.

The star performer was gold for much the early move but now it appears that the freckle-faced, red-haired hellion – silver – has put a clamp on the leadership torch wrenching it away from gold and about to pass it over happily to the mining shares, where the GDX and GDXJ have been absolute beasts since the late September reversal.

Outside of the RSI levels for the HUI, GDX, and GDXJ all closing out the week solidly above 70 (overbought), history has proven that they can stay overbought for weeks and especially when gold has moved away from “correction” mode and into “resumed uptrend” mode in which I believe we are now immersed and in a highly-convincing manner.

This chart marks the performance of the three precious metal classes and it is textbook. Shares are outperforming metal and silver is outperforming gold; this is a classic trademark of a confirmed bull market and while it will most certainly not be a straight line to all-time highs, my only conundrum is whether gold gets there by New Year’s Day.

We all read the same commentators and listen to all the same podcasts but to whom I pay particular attention are those highly-successful investors that have rarely, if ever, owned precious metals that are now on the record as owning gold and looking for significantly higher prices. A few weeks ago, I listened to an interview with Sam Zell, one of the greatest horse-traders in the history of modern finance, in which he basically called out the policymakers for trashing the American balance sheet while citing gold as an appropriate place to park one’s wealth. It is those massive pools of capital that are now sloshing around the bond and equity arenas that are going to be eventually forced to assets that have no counterparty risk and when that occurs, it will be elephantine demand meeting rodent-ine supply resulting in an unfathomable price reaction in everything vaguely even associated with gold or silver.

I have told this story before but it bears repeating. In the late 1970’s while working as a clueless trainee for a large Canadian brokerage firm, one of the senior salesmen (not “wealth advisor”) told me about a junior gold explorer called “Mattachewan Consolidated Mines” at about CAD $.08 per shares so, having never bought a stock before in my life, I took my life savings at the time and bought 20,000 shares worth CAD $1,600 and then promptly forgot about it. A few months later, I was handing out the bond quote sheets (there were no quote terminals for bonds back then) when I ran into the senior salesman who asked while sporting a broad smile how I liked the move in Mattachewan. I asked him what it was doing, sluffing off my ignorance due to being “too busy” counting Canada Savings Bonds and licking stamps. “Why,” he said “it just traded at $1.80 and it’s going to $3!” Having earlier learned my “times tables”, I quickly did the math and realized (while hyperventilating madly) that I had just won a lottery with my $1,600 now worth $36k and possibly on its way to $60k! “Well,” I said puffing out my chest and trying to look scholarly, “I need to do some research on this. Can you tell me where they have their gold and how much of it they own?” The senior salesman began laughing hysterically after which he responded while wiping tears from his ruddy cheeks, “son, this is a gold bull market and there is no bull market like a gold bull market. The only gold Mattachewan has is the letters G-O-L-D in their name.” He then embarked on another howling round of laughter and I skulked off to the cloakroom.”

The point I make is that the vast majority of Millennials and Genexers have never seen a) a bear market or b) a bull market in precious metals miners. They know crypto and they know technology but their eyes glaze over when you describe the move in Consolidated Stikine in 1989 or Diamondfields in 1996. Just as fortunes have been made in this cycle in worthless EV companies or counterfeiting schemes like certain crypto deal, fortunes are about to made in the junior developers and explorers. The TSX Venture Exchange is the Canadian version of the junior NASDAQ so like its U.S. counterpart, it is a great barometer for speculative sentiment. While the tech-laden COMPQ hit record highs last week, it is important to remember that the high for the TSXV was in May 2007 when it traded over 3,350; it has been that long since the junior mining markets have received anything resembling “love” on a par with technology or crypto. The bottom line is that like silver, which has yet to see record highs, the junior resource sector has a great deal of upside if we are to believe that the Great Currency Debasement exercise around the world is going to reprice all assets to new highs. We have seen it everywhere in the industrial and soft commodities and should expect to see it in uranium, silver, and the TSXV before the cycle gets terminated by either policy errors or global war, both of which are possible but impossible to either time or predict.