Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

.20 to .01 in less than 2 months is pretty amazing. I will give Capt Neil and the crappy bunch that!

Not worth selling now lol. It’s darn near worthless. Equal to trading at .01 pre split

They are making changes to the share structure in otc com

Well, if m holding out then. Good things come to those that wait

Had a great history until this one. Never had done anything like this. Never a split to this extent either.

So we have had a reverse split and no word? Does this custodian have a bad history? Thanks

Neil and his cronies dumped what they could in all of us then split.

Doesn’t appear so

So are we not getting a new company in here or not? Thanks

No Shit. neil reithinger is a total POS.......His company also:

https://eventusag.com/team/neil-reithinger/

Z

This Neil has to be one of the biggest pieces of shit I’ve had to deal with investment wise. Guys complete garbage

It's Bad..........

Z

No, it doesn't sound good....

That good or bad? Doesn’t sound good

$PKPH just filed a Form 15.....no longer reporting to the SEC........fwifw.......

Z

The "D" drops after 30 days. But who cares, we're up 12,505%. I wish, really.

Not surprising to have a Shell Risk, no real business operations atm.

At least not a STOP sign....or worse.

what's going on? "D" dropped? shell risk added?

Maybe they WILL merge with a super company......would have to be pretty good to support the stock price.......especially when they start issuing more shares..........

Z

Fair enough, all good points! (Unfortunately)

AND LAST, $PKPHD $PKPH WILL be issuing a shitton of new shares, which will drive the price down......Even with a GREAT merger, it's gonna drop.......cause right now the OS is:

150,000 shares.......lolololo...........

Z

And with a 38M OS, the stock could have gone to $4 (where it is now) easily: ORGANICALLY

Z

Why do I say that?.......Ahhhh......Cause that asshole neil reithinger KILLED all his shareholders. That's why.

And by doing that he basically killed all his credibility, AND created immense animosity towards peak pharma..... $PKPHD $PKPH.

The guy has shit for brains.

He absolutely RUINED the STRONG shareholder base, which was doing a great job giving support to the company/stock.

He also put a big black mark on his company eventus: https://eventusag.com/team/neil-reithinger/

If I had a company, I would avoid those assholes like the plague.

Z

Why do you say that? Just curious?

Peak Pharmaceuticals $PKPHD $PKPH is a f**ked company now.......all due to their CEO Neil Reithinger who is a scum bag.....probably Eventus where he's the CEO is a scam also

https://eventusag.com/team/neil-reithinger/

Z

Looks like this CEO of $PKPHD $PKPH Neil Reithinger is a real asshole:

https://eventusag.com/team/neil-reithinger/

Z

New quarterly filing. I didn't see anything that stuck out I guess, but i'm not good at reading them

https://www.otcmarkets.com/otcapi/company/financial-report/361079/content

$HNRC is putting out some Spacs.......fwiw

Z

Doesn’t make much sense. Pretty much the reason I have been out of the pinky market for well over a year. Options and a few SPAC plays.

Nobody expected a 1-200 RS on a 38M OS.......nobody

Z

Glad I didn’t touch this POS. Received a bunch of PM’s about it. Seemed fishy from day one.

Seems like he just wanted to wipe the slate clean and now can issue shares to some new corp or group of insiders whenever a merger happens?

What we don't know, we don't know. Impossible to answer that question since we really don't know what they have going. However, we can speculate....going back to the original DD and the reason most are here, it coulld be in anticipation of merger/uplist.

If it would have been a 20:1, it would probably support the speculation of spinoff/merger and uplist. However, the real quesiton, which no one can make sense of, why the 200:1 RS when the SS was decent to start. the 200:1 RS is what caught everyone off guard.

Absolutely no idea...

What was the point of the RS at this time?

He is finished f@cking the shareholders yet.....

Still here…seeing how it plays out.

I hope not. I own most of the float. Hehe. Not really.

Just add to me carryover losses on day I suppose.

Yep hope so too. or at the very least get some comment in the next filing. But i think the timeline he gave a while ago is probably still accurate. Like I said i'm down far enough I might as well hold

|

Followers

|

64

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

968

|

|

Created

|

09/26/12

|

Type

|

Free

|

| Moderators | |||

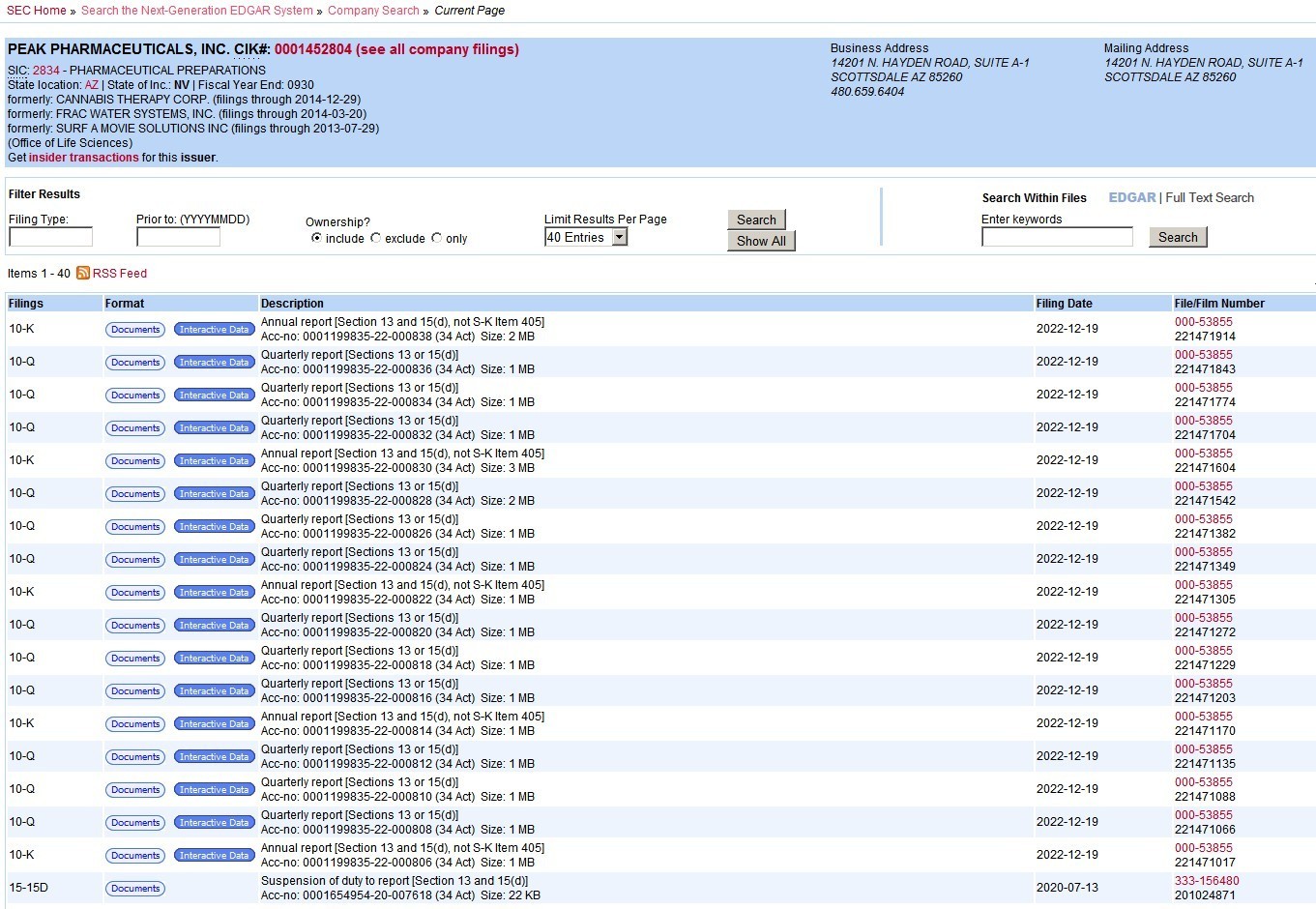

This company is a Shell, and recently got Current with the SEC/EDGAR, with 17 Filings.

These filings needed to be audited, and that's very expensive.

We're guessing they spent upwards of $500K.

The CEO is also involved with a Nasdaq Stock ( $ORGS ) that is currentl doing a Spin-Off.

This Spin-Off got $110M in Funding. (See 8K excerpt below)

So that Spin-Off will likely move into the $PKPH Shell, and thereby become a Nasdaq Stock.

Share Structure: AS: 300M, OS: 78M, Float: 36M

https://www.sec.gov/ix?doc=/Archives/edgar/data/1460602/000149315222030824/form8-k.htm

On November 4, 2022, Orgenesis Inc. (“Orgenesis”), Morgenesis LLC (“Morgenesis”), a recently formed subsidiary of Orgenesis holding all the assets of Orgenesis’ point of care services business for treating patients (“POCare Services”), and MM OS Holdings, L.P. (“MM”), an affiliate of Metalmark Capital Partners(“Metalmark Capital”), entered into a series of definitive agreements intended to finance, strengthen and expand Orgenesis’ POCare Services business. Morgenesis will use the investment to develop and expand its POCare Services business globally, but with an initial focus on the United States. This includes the development of additional POCare Centers, as well as the Orgenesis Mobile Processing Units and Labs (“OMPULs”). OMPULs will allow Orgenesis to provide biotech companies and hospital systems with global cGMP supply for their cell and gene therapy products at the point of care, with the ability to rapidly grow and scale cell and gene treatments to keep up with ever increasing demand. Metalmark Capital is a leading private equity firm that seeks to build long-term value through active and collaborative partnerships with business owners, founders and executives, with a focus on healthcare, agribusiness, and industrials.

https://www.sec.gov/ix?doc=/Archives/edgar/data/1460602/000149315222030824/form8-k.htm

At any time until the consummation of a Company IPO or Change of Control (in each case, as defined in the LLC Agreement), MM may, in its sole discretion, elect to invest up to an additional $60,000,000 in Morgenesis (any such investment, an “Optional Investment”) in exchange for certain Class C Preferred Units of Morgenesis (the “Class C Units” and, together with the Class A Units and the Class B Units, the “Preferred Units”). $10,000,000 of such Optional Investment shall be to purchase Class C-1 Preferred Units based on an enterprise value of $125,000,000, with such enterprise value adjusted by any net debt as of such time; $25,000,000 of Optional Investment shall be to purchase Class C-2 Preferred Units based on an enterprise value of $156,250,000, with such enterprise value adjusted by any net debt as of such time; and $25,000,000 of Optional Investment shall be to purchase Class C-3 Preferred Units based on an enterprise value of $250,000,000, with such enterprise value adjusted by any net debt as of such time.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |