Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Alive in the form of two r/s until they thin out the bloated s/s ROFL

I sure hope so. I was very disappointed to see RBNW go dark.

THIS WILL COME ALIVE, A LOT OF FUNDS INVESTED HERE

Ain't that the truth! Time for conman hustler to bring RBNW back to life!

I'l take a r/s at this point anything that get me out of this garbage been holding the bag for years now

Many of us still had hair when we took a starter on this ticker ROFL

RBNW

Why does it show a trade now and then even though the bid and ask are at zero?

Sorry about yer loss buddy and train

Come on Husstler - bring RBNW back to life!

Yes, a share is worth (count the 0's) .000001

I personally believe it will. You can't keep a conman down, so I think he'll be back with another scam at some point. It looks like he's still involved with BOMO, so he doesn't appear to be out of the game. I don't know the intricacies of the OTC though. All just my opinion.

Something going on here? I am up some today with this stock.

Such a husstler! I would think he'll be back to do something with this pig though - he'll need to sell more shares eventually. I sure hope so… I'd really like to get my money out of here one day.

LAST PR AND THE ATTACHED WEBSITE:

RBNW

Renewable Energy & Power, Inc.

Common Stock

Overview

Quote

Company Profile

Security Details

News

Financials

Disclosure

Research

OTC DISCLOSURE & NEWS SERVICE

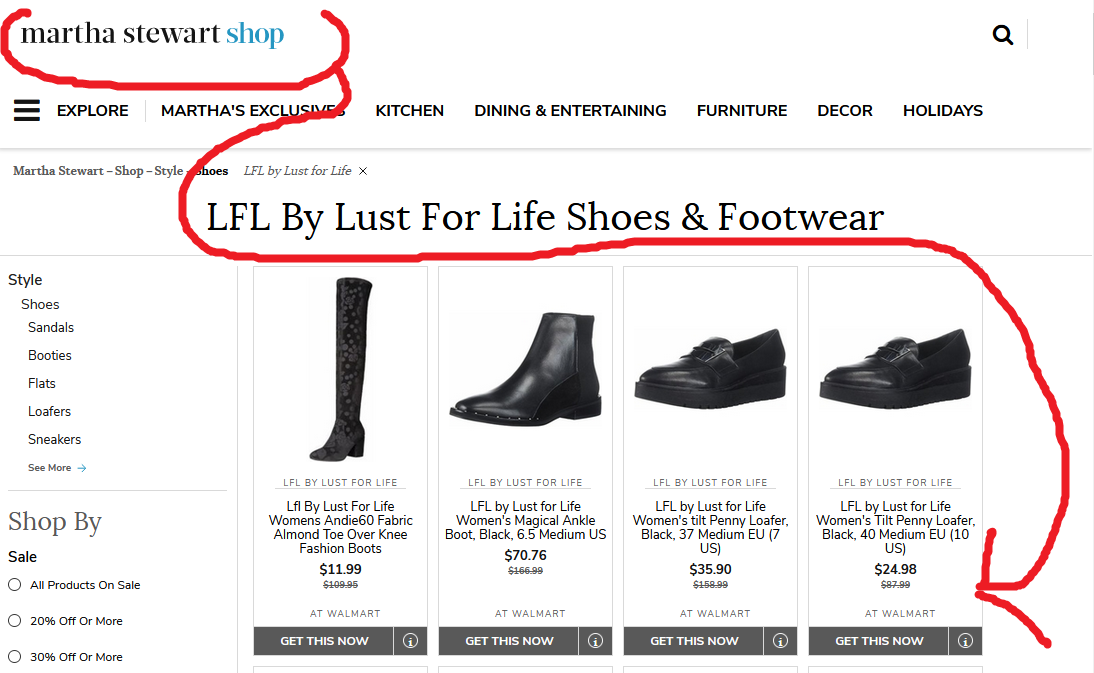

Lust for Life Footwear Meeting Strong Consumer Demand for Early Fall Boots Currently Receiving New Orders for Spring/Summer Season

Press Release | 02/23/2022

NEW YORK, NY / ACCESSWIRE / February 23, 2022 / Lust for Life Footwear LLC (the "Company"), the main subsidiary of Renewable Energy & Power, Inc. (OTC PINK:RBNW), is turning its attention to Fall Footwear and is excited to announce an initial order for $600,000 in fashionable boots. As Lust for Life recently announced, our success in streamlining our manufacturing and shipping has enabled us to begin delivering these early core boots in June rather than what was historically the months of August and September.

Lust for Life will also be introducing wide calf boots into its collection to appeal to a larger demographic and increase revenue. The continuing manufacturing of boots will then proceed into August and September with new fashion trends. This will give the Fall Footwear a projected boost in sales of 50 percent.

Lust for Life Footwear announced a powerful relationship with Brazil in the last press release as well as the short lead time for manufacturing and shipping. Lust for Life has been currently receiving orders for season Spring/ Summer 2022. The ability to utilize Brazil for in-season and quick turnaround is now benefiting both the consumer and our customers.

About Renewable Energy & Power, Inc.:

Renewable Energy & Power, Inc. (OTC PINK:RBNW) is the parent company to Lust for Life Group. RBNW is a holding company for apparel lines with both direct to consumer and wholesale sales to national retail chains. Previously, RBNW was focused on renewable energy projects, however in August 2019, with the acquisition of Blind Faith Concepts, Inc., which holds 100% of Lust for Life, LLC, RBNW's management determined to shift operations to focus on apparel. For more information on RBNW, visit www.lustforlifeshoes.com.

Safe Harbor and Forward-Looking Statements:

Yup - Huss likely starting a new SCAM again. No lust for life anywhere.

https://www.lustforlifeshoes.com/

RBNW now posts itself as a private company on its website:

http://reappower.weebly.com/about.html

Are you trying to start a rumor ROFL

#$RBNW THANKS DRUG DOC ,,,,THATS RIGHT IF YOU HAVE A SHOES THAT WOMEN LOVE YOU CAN MAKE SOME BIG MONEY BUT $RBNW DEVOLVED INTO SELLING SHARES AND LIES IT HAPPENS WAY TOO MUCH IN THE $OTC

Back when this appeared to be a real thing, there was good distribution of the Lust for Life brand, both in brick and mortar stores and online.

I can only imagine the shenanigans that went on with the stock.... That eventually caused Karen to throw in the towel...

its way far easier to sell shares then it is to sell women's shoes

$50 FOR ***RBNW***** DANCING STEPS COMMENCES IMMEDIATELY** FOR REAL

TMC will be supplying massive amounts of critical metals to the renewable industry. Check out the last month’s price movement. No headwind in site. Really good news must be on the way. I would assume so because there has been a ton of front loading prior to any news. Good luck and see you at $50.00

It was a shoe company, but it ended up a SCAM. It's OVER!

$RBNW IM GONNA DANCE OUT BACK AT MIDNIGHT AT THE FULL MOON HOPING TO PUT SOME LIFE IN THS DEAD STOCK

This sad man look at all this bagholders staring at RBNW like some sort of electrocardiogram machine in hopes that its vitals comes back to life lol

HOPEFULLY OUR MONEY IS PUT INTO GOOD USE. WE ARE STILL WAITING. GL TO RBNW

Nope all lotto plays moved to expert market rofl

ITS THE OTC YOU NEVER KNOW ???????????????

YES, STILL CHECKING AND VERY VERY VERY VERY OPTIMISTIC. WE SHALL CHECK BACK ANOTHER TIME

$RBNW ANYBODY STILL HERE ??????????????????

It's OVER! Warning! This security is eligible for Unsolicited Quotes Only

https://www.otcmarkets.com/stock/RBNW/overview

This stock is not eligible for proprietary broker-dealer quotations. All quotes in this stock reflect unsolicited customer orders. Unsolicited-Only stocks have a higher risk of wider spreads, increased volatility, and price dislocations. Investors may have difficulty selling this stock. An initial review by a broker-dealer under SEC Rule15c2-11 is required for brokers to publish competing quotes and provide continuous market making.

Warning! This security is traded on the Expert Market

The Expert MarketSM serves broker-dealer pricing and investor best execution needs. Quotations in Expert Market securities are restricted from public viewing. OTC Markets Group may designate securities for quoting on the Expert Market when it is not able to confirm that the company is making current information publicly available under SEC Rule 15c2-11, or when the security is otherwise restricted from public quoting. See additional information about the Expert Market here.

Looks like this train ride is ending! 15 day grace period? LMAO

Unfortunately, those loading the .0001's can only sell for .000001 now, if they can figure out how to do that anyway to get the 99.99% loss... Oh well, it's a tax write off..

https://www.otcmarkets.com/stock/RBNW/overview

This security has entered a Grace Period, where it can be publicly quoted for 15 days before moving to the Expert Market for unsolicited quoting only. Securities enter the Grace Period when OTC Markets Group is no longer able to confirm that the issuer’s disclosure is current and publicly available as required under Rule 15c2-11.

$RBNW WELL IM HOPING SOMEONE TAKE OVER ???ANYBODY >>??????

Even the websites on the stickies are dead.

$RBNW GOT A BAG FULL HERE JUST WAITING ON SOMETHING ???? ANY THING ????

Did you see that block of 47M at 0001! That was a blue whale lol

RBNW

Ah, no. As much as I understand your sentiment toward RBNW, it does say that over 50M of those shares traded at .0001. That's what makes it interesting.

LMAO $57 dump of 57,000,000 shares at .000001>>> count the 0's...

Someone just bought a good number of shares. Come on RBNW!

Bit of volume coming in here for RBNW. Let's hope something finally happens with this pig in 2023!

|

Followers

|

410

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

46082

|

|

Created

|

09/23/15

|

Type

|

Free

|

| Moderators | |||

| PER IHUB MGMT |

02-07-2021

DISCLAIMER: ONLY FOR MICK

https://investorshub.advfn.com/boards/profilea.aspx?user=1012

*The Board Monitor and herewithin , are not licensed brokers and assume NO responsibility for actions,

investments,decisions, or messages posted on this forum.

CONTENT ON THIS FORUM SHOULD NOT BE CONSIDERED ADVISORY NOR SOLICITATION

AUTHORS MAY HAVE BUYS OR SELLS WITH THE COMPANIES MENTIONED IN TRADING POSTERS SHOULD DUE DILIGENT BUYING OR SELLING.

ALL POSTING SHOULD BE CONSIDERED FOR INFORMATION ONLY. WE DO NOT RECOMMEND ANYONE BUY OR SELL ANY SECURITIES POSTED HEREWITHIN.

ANY trade entered into risks the possibility of losing the funds invested.

• There are no guarantees when buying or selling any security.Any

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |