Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Gitbox

Acoustically I presume...

What part of buy and hold forever is escaping you? Looking for the bottom of a dip to drop a chunk is ALWAYS on everyone's mind. However, you sound more like a trader than an investor. This is not a trading stock. This is a reap dividends stock. I like to think of it as a competitive annuity where you get to keep your capital.

Regards

The closer we get to Dec end(peeps sale that bought above this $55 as she heads south), plus Fed is gonna hike the tax rate in dec, thus the PPS stands to fall more on fear if not below t

$52 then it will be tested again before northbound comes. Imo

When do you think we will see the end of year sell off from capital losses? That would be the ideal time to buy.

even at this PPS for me too looks appealing, but i'd have to take a loss that's about turn gain, so now i'm looking to scramble on funds on O and then it drop, not rdy for that ouch, to some this is a buyying opp as the overall market looks good in the long!!! IMO

Would be nice to get some around support area and the divy yield would be much more appealing

I'm thinking 44.55 could be bottom with a slight chance of $42.33ish but if the PPS goes under $44.55 the closing price the day when it happens no telling where bottom will lye. I knew the 52(key is also if we break below the 52 resistance to get lower prices) was possible months ago, but lower only a good Q will save it and with the drama in RE that has been going all year long I give it a 50/50. usally most election craziness peels off by the 21stish of Nov, I need to look when the Q comes out again here, but recent buyers will look at it in the weeks to come and most likely sell on a loss to capitalize on tax loss season, thus pending fins I don't see northward momentum lasting until after Jan 1 2017!

Waiting for 4's that would be my confort zone

if you are looking to add cheapies, I think we will get one more chance as this is rallying the real estate market is under attack from fear of the fed increasing tax rates and my cheat sheet here still has em at a sell

https://www.barchart.com/stocks/quotes/o/opinion

$52s again are easy but will $42s be a thing, i think a short-lived possibility!

anywhere from current prices to 42 looks to be a spot good for reentry or adding here!

I'm thinking now until the 21st which is historically good time to add after an election under$55, but charts are suggesting my guess with the fed increasing the interest rate stealing our profits, that $42ish and possible below is possible.

Air are you a long holder and or what do you think we should expect on the Q? I'm looking to buy but at the right price in this down market!

Post-election market correction, on fears of new Pres, tax loss, etc that stand to allow us to test as low as $45.45ish (i called the $52 months ago here) by the 21st I'd expected a turnaround if not sooner. Great time to add with dummies/sheeple selling on fear!

96% sell https://www.barchart.com/stocks/quotes/o/opinion

Looked at it finally I guess I was thinking .6 a quarter even though I knew this was a monthly play, I cannot remember but I thought morning star had Em at three stars.

http://www.morningstar.com/stocks/XNYS/O/quote.html

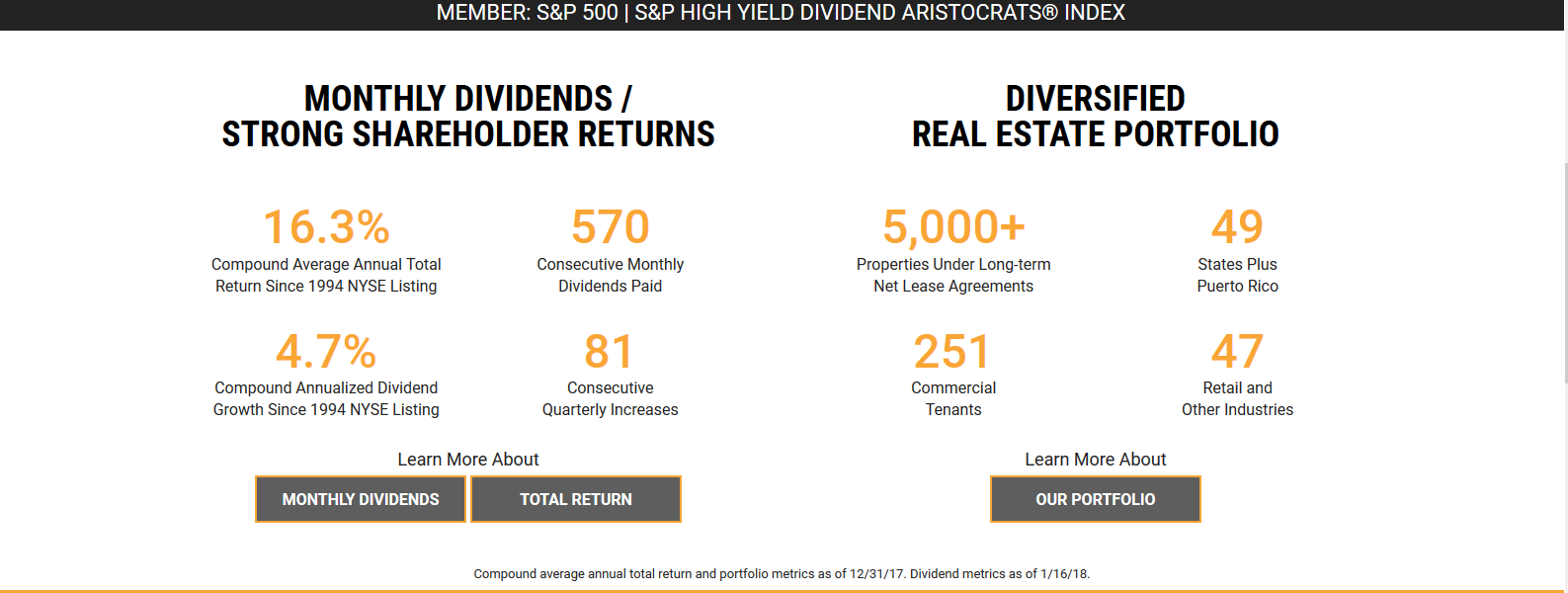

Nasdaq says .20 a share per month

last two i think where like .60 a share monthly I'd imagine they'd have to drop it but to my knowledge O never drops will have to do more research, none the less it is severely undervalued IMO at these prices, but we may be on the verge of the next bubble thus get ready to buy em cheaper and I wouldn't expect lower than $52 but the analysis reports I've seen thru USAA doesn't look pretty and technicals to me suggests a potential 42ish bottom but if we fall there will she go lower? I dunno, I'd like to think post nov 21 and after this fed and election crap is over and whenever the fins come back out there will be sideways trading into late Feb then back up and heading toward $80 but might take a year or two to recoup it. If all lucky smooth sailing for the next few years following the housing trends but still setting a benchmark

What's the dividend yield in case it drops that low?

agree, this election is wreaking havoc on blue chips, I had this one forecasted to $55 in Nov, with a chance of $52, but after recent news and opinions this could get lower and as long as you are a long then this is a great time to avg down or up with $42 a PPS potential in range.

96% strong sell ouch

https://www.barchart.com/stocks/quotes/O/opinion

I'm looking to make a buy in as I feel once this craziness is over O will resume its trek up and over $80 in the long but don't think we will see that until after March! Thus buying the dip

That's the play I'm making as well, Doc. Traditional IRA for me though. Already at $163/mo dividends with 100% DRIP and continuing to add. Turning 38 this month. Hoping to have a nice percentage of my retirement income from O in about 15-20yrs to supplement my portfolio.

I hope the pps stays at a low and slow climb for DRIP purposes. Monthly ATM, baby.

it's scary how good I am, expect an easy $52 in attempt to go to $42, but I think $52/ 100day MA on the weekly will hold pre-Nov 21st, then she will start heading north as Dec fins come out and come mar I'd bet money $80 PPS and climbing north. this is my O forecast I may be off on the timing, but most of the time I'll get my PPS. GLTA

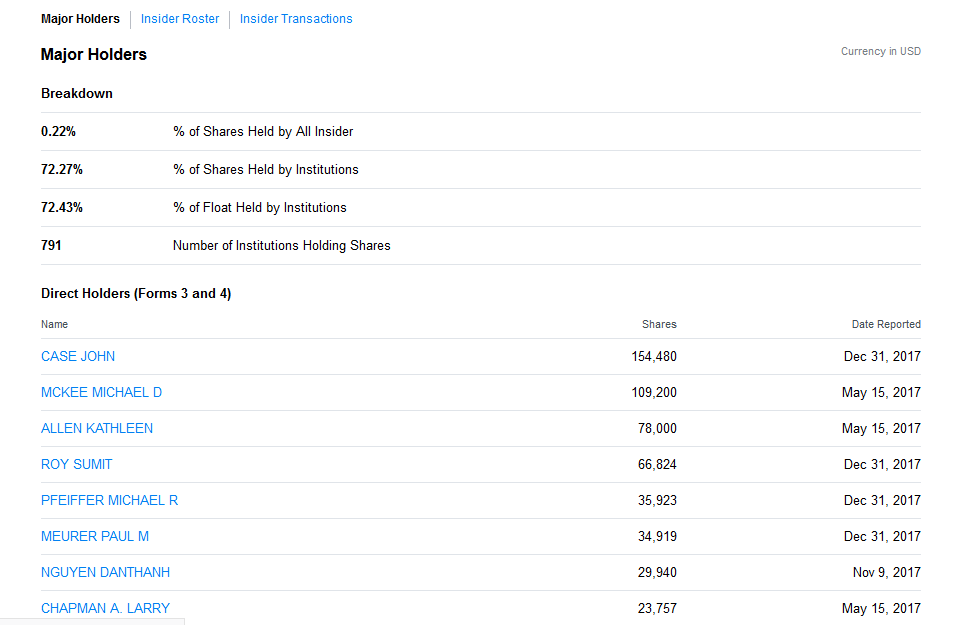

Agreed, just saying given these troubling times and w insiders selling this is a buying opp to add shares for no lower than 55ish, but given their track record no worries. I'b bet money(and have) on two things right now currently this is a market correction on the way down, and in a week or two some BS federal news on housing will push this down on fear.

I am holding thisin my Roth and will hold forever. I am less concerned about short term pps but I do like the lower PPS right before I get my dividend to reinvest as it gets me more shares for the long term.

currently this is a buying opp IMO, but i think giving the current moves since friday about every two days were down $1.25, and i believe this is gonna last till, Gap at $61 is filled, Bond issues in the market are rectified, Nov pres election is over, Insider activity cools, and investor sentiment/fears are improved. This might get as nasty at $55 a share.... but one hobbyist technical analyst can only dream right.

Buy more and avg down if it happens unless ur shorting, my rule is find something to be long and try to beat the avg. You can't lose unless you sell on a loss! And with O it is a win win to me either way, minus a crappy put option I did this week I'm prolly gonna lose $40, but I am testing the waters

Thanks for the well thought out reply.

I bought at the top of the gap so I'm of course unhappy. The election year effect has me nervous!!

You asked why the down? There are several catalyst for that and the main one is election year blue chips will drop from here till Dec, two not a good year for real estate, three mega gap up on the chart suggested $58.5ish IS Coming. If your long your ok! It'll hit 80 one day, but for now I'm gonna put my money to add at 58.5

Another green day. I think the bottom is in.

Why the downtrend???

This stock has cooled off big time. The price per share has fallen almost every day for a month straight. Anyone have any thoughts as to why?

It is a great long term company. Pays a good divided MONTHLY.

I'm in! This stock is on fire!!!

Awesome company. Just buy a bunch in your IRA and forget about it.

nice! ,I found this @ a little higher price, ..love the divvy's.

I originally picked this up when it was under $30 and I get a nice monthly dividend which I automatically reinvest.

This is one of the best stocks to buy a chunk in your ira and forget it.

I think she will move on up!

Buying opportunity?

I knew $O was interest rate sensitive .... but wow down 5% on MAYBE there will be a rate hike next month.

Chris

great divvy though

41 not looking good

might try for 41,good entry

i agree its all bout the o

Perhaps. I'm reinvesting my dividends. This is a long term hold for me. I haven't looked at the chart in a while, so I would suggest doing some DD before loading the current PPS. I believe the PPS has room to grow at the current level however.

Is this the indication to load up at this pps?

Nice. I expect $O to make new highs soon. Realty Income Group is the Marshawn Lynch of REITs, if not monthly dividend paying stocks.

|

Followers

|

41

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

219

|

|

Created

|

02/09/12

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |