Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

mik - Andy will cease being CEO the day Plug closes for good in a year or two.

(See Hyzon.)

Andy should give the shareholders an idea of how much longer he will be the ceo...

Will Fuel Cell Electric Vehicles Boom or Bust in the Next 20 years?

https://www.electricvehiclesresearch.com/articles/32824/will-fuel-cell-electric-vehicles-boom-or-bust-in-the-next-20-years

Energy Week: Hydrogen Innovation in Kern County

https://www.kget.com/studio17live/energy-week-hydrogen-innovation-in-kern-county/

The role of hydrogen fuel cells in clean transportation worldwide

https://urbantransportnews.com/article/the-role-of-hydrogen-fuel-cells-in-clean-transportation-worldwide

PLUG's DEATH SPIRAL :

PLUG needs more capital . The DOE Loan if it shows up, helps with CAPEX, but that doesn't keep the lights on.

Even after "Project Quantum Leap" , Plug will need at least $500+ million OPEX. So this week's raise is not nearly enough.

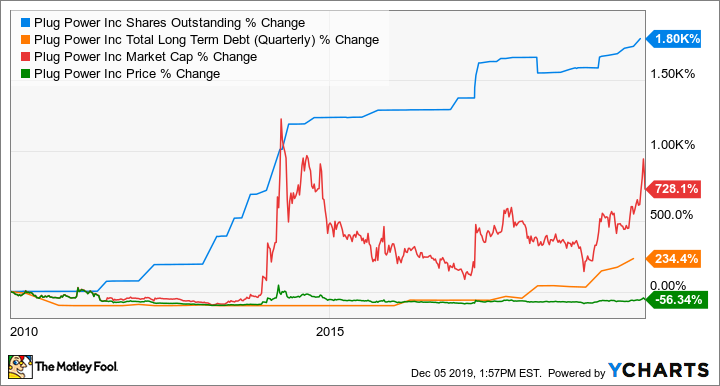

Once upon a time, Plug could raise capital by selling shares for $65.00; BUT ... Today Plug will need to sell 40 TIMES more shares to reach $65.

This means Plug will need to DILUTE by about 500 million more shares in 2025.

What will that kind of Dilution (50%), do to Plug's share price.

https://cleantechnica.com/2025/02/26/plug-power-has-lost-3-12-billion-since-2010-never-turned-a-profit-stock-collapsing/

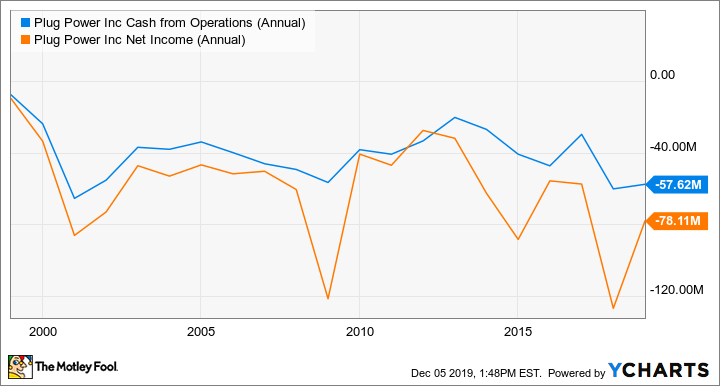

This is the year that the hydrogen bubble pops, especially for transportation, but increasingly for all hydrogen for energy plays. One of the firms on my hydrogen death watch is Plug Power, which has managed to lose $3.12 billion of other people’s money since 2010, about $200 million a year on average, and has never turned a profit in its 28 years of existence.

Largest Hydrogen Deal Cancelled because Hydrogen is too Expensive !

https://www.hydrogeninsight.com/industrial/exclusive-thyssenkrupp-has-put-hydrogen-tender-for-3bn-green-steel-plant-on-hold-due-to-significantly-higher-prices-than-expected/2-1-1795894

sounds like another TRU opportunity ![]()

Who remembers them...

It probably will not matter as financial data will come out on the economy and tank the market big time next week is my guess. That may get the Feds attention, but who knows they usually wait too long, and we go into a 'transition' or for Republicans a horrible RECESSION!!! Whatever, we are weaning off a government lead to a freer market economy. With regulations cut and more jobs coming to replace nonproductive government jobs we will take off, but it will take time. Patients is needed. Any Plug long knows about that.

Next week, the media will finally realize that hydrogen is part of the 'all-of-the-above' energy policy.

In the coming weeks and months, we can expect more hydrogen-related news from the DOE.

https://www.energy.gov/search?keywords=hydrogen&page=0&sort_by=date

Only great weekends from now on!

At the cost of a prototype? It wouldn't make sense. Get the production costs down and put hundreds of thousands (around the US), or millions (around the world) and it makes financial sense.

Edit

Probably, similar to the first cooled soda vending machines.

Hydrogen, included in Trump's 'all-of-the-above' energy policy, will support Plug stock in the coming days.

rick - Business 101 - Do you know how many cans of Coke you need to sell to make a positive ROI on a hydrogen fuel cell dispenser ?

Reality says, this is just another MULAG.

Maybe, or just use lithium iron phosphate batteries, a solar charge controller, and a solar panel on the roof. I guess it depends on what the weather is like.

I think you are missing the potential. These machines can go where there isn't any power. They can be set in the middle of a park, at the beach, or the bottom of the Grand Canyon ( or maybe just in the nearest parking lot).

Nothing, except another possible market for hydrogen.

What does Plug have to do with this deal? Seems it will be in 2025 in Japan for 50 units.

SECURING AMERICA’S ENERGY FUTURE

A Project Success: Wabash Valley Resources in West Terre Haute, Indiana

...

March 2025

U.S. DEPARTMENT of ENERGY | Fossil Energy and Carbon Management

https://www.energy.gov/sites/default/files/2025-03/Wabash%20Valley%20Resources%20Project%20Success%20Infographic.pdf

I think HYDROGEN is included in Trump's 'all-of-the-above' energy policy.

Finally, the first NEW article about hydrogen on the DOE website since January 20. For months, the DOE has been posting OLD articles about hydrogen and other renewable energy topics.

Infographic: A Project Success: Wabash Valley Resources in West Terre Haute, Indiana

The Wabash Valley Resources project in West Terre Haute, Indiana is transforming a coal gasification site into a world-class, low carbon hydrogen and ammonia facility.

March 21, 2025

https://www.energy.gov/fecm/articles/infographic-project-success-wabash-valley-resources-west-terre-haute-indiana

rick - A one-off demo costing 5 Times more than a standard vending machine.

They mistimed to PR. It should have been released on April Fools Day/.

Coca-Cola’s new hydrogen-powered vending machine doesn’t need a power outlet

https://www.theverge.com/news/633779/coca-cola-fuji-electric-vending-machine-hydrogen-power

Coca-Cola hasn’t shared specifics on how long the vending machines can be powered before their hydrogen cartridges need to be replaced. Cutting the power cord potentially allows these new machines to be installed almost anywhere, but the company will still need relatively easy access for regular maintenance. Even if the hydrogen fuel cell lasts for weeks, the vending machine’s stock of Coca-Cola and other drinks may not.

CORRECT :

RECENTLY I POSTED :

PLUG's Death Spiral

PLUG needs more capital . The DOE Loan if it shows up, helps with CAPEX, but that doesn't keep the lights on.

Even after "Project Quantum Leap" , Plug will need at least $500+ million OPEX.

Once upon a time, Plug could raise capital by selling shares for $65.00; BUT ... Today Plug will need to sell 40 TIMES more shares to reach $65.

This means Plug will need to DILUTE by about 500 million more shares in 2025. What will that kind of Dilution (50%), do to Plug's share price.

Yes, and more dilution to us shareholders. When the stock was in the $60's this was not bad, but under $2 it is a killer.

Don’t worry I talked to Trump you’ve been pardoned your good to go 😊

B_B - You promised that you would never Post here again .

Repealing the Inflation Reduction Act could wipe $160 billion off US GDP

Mizy Clifton Mar 20, 2025

A full repeal of the Inflation Reduction Act this year could cause significant damage to the US economy, triggering nearly 790,000 job losses in 2030 and reducing GDP by more than $160 billion, modeling published Thursday suggested.

https://www.semafor.com/article/03/20/2025/repealing-the-inflation-reduction-act-could-wipe-160-billion-off-us-gdp

Green Investors Are Finding Bargains in Trump’s Big Oil Era

William Mathis and Petra Sorge Fri, March 21, 2025

(Bloomberg) -- Private infrastructure investors are snatching up green bargains in what’s emerged as a buyer’s market for wind, solar and battery projects.

...

“We think the fundamentals of renewable power are as strong as they’ve ever been,” said Ignacio Paz-Ares, managing partner and deputy chief investment officer in the renewable power and transition group at Brookfield Asset Management. “Whenever we see a dislocation between what the market noise is and the fundamentals, that creates a very good opportunity for us to make acquisitions at very attractive entry prices.”

...

“Stock prices haven’t done well over last few years, but in the real economy clean is booming,” said Aniket Shah, head of sustainability and transition strategy at Jefferies. “When sentiment around something is low, it’s a good time to be a buyer.”

Vincent Policard, co-head of European infrastructure at KKR & Co., which is looking to raise up to $7 billion for its first Global Climate fund, said the geopolitical factors putting pressure on valuations is “creating a compelling opportunity for long-term investors like us to lean in and support the energy transition.”

...

Despite the challenging political situation in the US, “we continue to be bullish on the energy transition,” Bianca Ziccarelli, managing director of Canada Pension Plan Investments, said on a panel at the Infrastructure Investor Global Summit in Berlin on Thursday. “We have been quite busy and we continue to find good opportunities in renewables.”

https://finance.yahoo.com/news/green-investors-finding-bargains-trump-050000128.html

I think a press release will be issued today regarding the offering.

Each share of common stock will be sold in combination with an accompanying warrant to purchase 46,500,000 shares of our common stock.

The combined offering price for each share of common stock and accompany warrants is $1.51.

46,500,000 shares + 46,500,000 warrants for $70,215,000 (46,500,000 x $1.51).

The exercise price for the warrant is $2.00 (exercisable from six-month to three year).

Also offering 138,930,464 pre-funded warrants for $1.51.

138,930,464 warrants for $209,785,000 (138,930,464 x $1.51).

The exercise price for the warrant is $2.00 (exercisable immediately upon issuance to three year).

$70,215,000 + $209,785,000 = $280,000,000 (net $267,966,975)

If the warrants and pre-funded warrants are exercised in full, Plug will receive additional gross proceeds of $371.0 million, or $651.0 million in the aggregate (net $638 million).

All warrants: 46,500,000 + 138,930,464 = 185,430,464

185,430,464 x $2 (exercise price) = $370,860,928

$280,000,000 + $370,860,928 = $650,860,928 (net $638 million).

The ‘Single Investor’ will pay $2.806 per share (if all warrants are exercised in full)

$650,860,928 for 231,930,464 (46,500,000 + 46,500,000 + 138,930,464) shares

(page 1/69)

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001093691/29b704dd-8a73-4319-a361-eb84e6865ff5.pdf

Probably an error in the SEC filing March 19,2025.

Common stock to be outstanding immediately following this offering should be 971,68,954 shares

925,178,088 + 46,500,000 = 971,678,088

Outstanding shares in the annual report was 925,178,088 shares, not 913,896,854 shares.

Common stock to be outstanding immediately following this offering 960,396,954 shares, assuming no exercise of the warrants or pre-funded warrants included in this offering.

(page 9/69)

The number of shares of our common stock to be outstanding after this offering is based on 913,896,854 shares of common stock outstanding as of December 31, 2024

(page 10/69)

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001093691/29b704dd-8a73-4319-a361-eb84e6865ff5.pdf

As of February 26, 2025, 925,178,088 shares of the registrant’s common stock were issued and outstanding.

(page 1/302)

March 03, 2025 Form10-K Annual Report

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001093691/090b50e6-c6df-4f9b-9d5a-92e6cb9c2415.pdf

Albanese Government to power Australian industry with reliable renewables, as WA hydrogen project receives green light

https://www.nationaltribune.com.au/albanese-government-to-power-australian-industry-with-reliable-renewables-as-wa-hydrogen-project-receives-green-light/

Canada’s deal to export hydrogen to Germany awaits more federal funding decisions

https://www.winnipegfreepress.com/business/2025/03/20/canadas-deal-to-export-hydrogen-to-germany-awaits-more-federal-funding-decisions

The project also requires a competitive auction process to allow Canadian firms to bid for the right to supply Europe with clean hydrogen. That hydrogen would then be auctioned off to buyers — a model that’s meant to drive down the cost of hydrogen.

Current prices for hydrogen are too high to compete with other forms of energy, so Canada and Germany agreed to a process to help bring the price down.

Hydrogen Infrastructure Market to Reach USD 12.76 Billion by 2032, CAGR 10.05% | NEL Hydrogen, Linde, Siemens Energy

https://www.globenewswire.com/news-release/2025/03/20/3046112/0/en/Hydrogen-Infrastructure-Market-to-Reach-USD-12-76-Billion-by-2032-CAGR-10-05-NEL-Hydrogen-Linde-Siemens-Energy.html

Sorry!

correction: 185430464 x $2 = $371 M

Toyota Announces New Hydrogen Fuel Cell System With More Range And Durability

https://www.msn.com/en-us/autos/news/toyota-announces-new-hydrogen-fuel-cell-system-with-more-range-and-durability/ar-AA1zpYFp?ocid=feedsansarticle

Toyota says the new system is smaller and lighter than its predecessor, in addition to a host of other improvements

The automaker states the new fuel cell system is twice as durable as its predecessor, with a maintenance-free design thanks to its use of hydrogen as fuel.

Toyota also highlighted the improvements in fuel efficiency. While the automaker will use the hydrogen propulsion system in a variety of vehicles, Toyota did say a passenger car fitted with its third-gen hydrogen system could travel 20-percent further than before. Hypothetically, that would mean a current Toyota Mirai fitted with its latest hydrogen tech would be approaching 500 miles in drivable range.

NOT GOOD NEWS !

Citi Reaffirms Their Sell Rating on Plug Power (PLUG)

In a report released today, Vikram Bagri from Citi maintained a Sell rating on Plug Power (PLUG – Research Report).

stck.pro/news/PLUG/102378260/

The sale of stocks and warrants will net Plug $260 M. When all the warrants are exercised, Plug will receive an additional $371 M (138,930,464 x $2), bringing the total to $631 M. These warrants are almost like call options.

We estimate that the net proceeds to us from the sale of the shares of common stock and accompanying warrants in this offering will be approximately $267.0 million, after deducting the underwriting discounts and estimated offering expenses payable by us and excluding the proceeds, if any, from the exercise of the warrants sold in this offering. If all of the warrants and pre-funded warrants sold in this offering were to be exercised in cash at their exercise price, we would receive additional gross proceeds of approximately $371.0 million.

(page 15/69)

https://d18rn0p25nwr6d.cloudfront.net/CIK-0001093691/29b704dd-8a73-4319-a361-eb84e6865ff5.pdf

Not bad news!

The more China advances, the faster the hydrogen economy evolves and the new administration can't afford to ignore it.

New Chinese hydrogen electrolyser 'can slash installation and maintenance costs by 60%'

CPU Hydrogen installed the first commercial 5MW unit of its ‘ultra-low load’ machine this week in just eight hours

Leigh Collins 19 March 2025

https://www.hydrogeninsight.com/electrolysers/new-chinese-hydrogen-electrolyser-can-slash-installation-and-maintenance-costs-by-60-/2-1-1794777

First green hydrogen produced in southern Africa — using Chinese electrolysers

HyIron’s Oshivela plant is expected to initially produce 15,000 tonnes a year of green iron using H2

Polly Martin 20 March 2025

https://www.hydrogeninsight.com/production/first-green-hydrogen-produced-in-southern-africa-using-chinese-electrolysers/2-1-1794839

API has publicly released a five-point energy plan for Trump and Congress to follow that includes permit reform, boosting offshore oil leasing, protecting tax credits for carbon capture and hydrogen production and rolling back subsidies for electric vehicles.

Trump pushes energy dominance agenda in meeting with US oil executives

Reuters 20-03- 2025

U.S. President Donald Trump hosted top oil executives at the White House on Wednesday as he charted plans to boost domestic energy production in the midst of falling crude prices and looming trade wars.

...

The meeting included members of the American Petroleum Institute's executive committee, the source said.

Hess Corp CEO John Hess, ExxonMobil CEO Darren Woods, Chevron CEO Mike Wirth, ConocoPhillips CEO Ryan Lance, Phillips 66 CEO Mark Lashier and Marathon Petroleum CEO Maryann Mannen are among the leaders on the trade group's executive committee, according to public biographies.

...

API has publicly released a five-point energy plan for Trump and Congress to follow that includes permit reform, boosting offshore oil leasing, protecting tax credits for carbon capture and hydrogen production and rolling back subsidies for electric vehicles.

https://thesun.my/world-news/trump-pushes-energy-dominance-agenda-in-meeting-with-us-oil-executives-GI13824332#google_vignette

Amid a slowdown in the US driven by uncertainty, China is accelerating its hydrogen economy to take the lead, with Germany, Japan, and South Korea following suit. The need for proven hydrogen technologies will intensify.

Other catalysts for Plug Power:

- Louisiana plant operational

- H2 Energy/Morgen Energy 1GW

- Fertiglobe Egypt 100MW

- Update on the Galp project

- Unfreezing of 45V

- Q1’25: margin improvement and revenue beat >140M

- AccionaPlug Valley H2V Navarra plant operational

- New Fortress Energy ZeroParks Texas 100MW

- Update/expansion on Carreras Grupo Logístico hydrogen ecosystem

- Unfreezing the DOE loan

A beautiful day today! This is the light at the end of the tunnel.

$PLUG Total Cash (mrq) $205.69M

hydrogen fuel cell vehicles is heating up. https://investorshub.advfn.com/boards/read_msg.aspx?message_id=175951325 $PLUG

Plug CEO, Andy Marsh, Reinforces Commitment to Company Mission by Taking 50% of Compensation in PLUG Stock for 2025

https://markets.businessinsider.com/news/stocks/plug-ceo-andy-marsh-reinforces-commitment-to-company-mission-by-taking-50-of-compensation-in-plug-stock-for-2025-1034496593

|

Followers

|

748

|

Posters

|

|

|

Posts (Today)

|

11

|

Posts (Total)

|

59804

|

|

Created

|

03/01/05

|

Type

|

Free

|

| Moderators uksausage WeTheMarket Jack_Bolander JOHNNY-VEGAS | |||

Page is currently being updated - watch for more information about their recent acquisitions and competitors

Welcome to Plug Power

http://www.plugpower.com/Home.aspx

Plug Power is the leading provider of clean hydrogen and zero-emission fuel cell solutions that are both cost-effective and reliable.

In 2020/21 Plug Power cemented two major partnerships

https://www.plugpower.com/plug-power-and-sk-group-partnership/

https://www.ir.plugpower.com/Press-Releases/Press-Release-Details/2021/Groupe-Renault--Plug-Power-Join-Forces-to-Become-Leader-in-Hydrogen-LCV/default.aspx

The architect of modern hydrogen and fuel cell technology, Plug Power is the innovator that has taken hydrogen and fuel cell technology from concept to commercialization. Plug Power has revolutionized the material handling industry with its full-service GenKey solution, which is designed to increase productivity, lower operating costs and reduce carbon footprints in a reliable, cost-effective way. The Company’s GenKey solution couples together all the necessary elements to power, fuel and serve a customer. With proven hydrogen and fuel cell products, Plug Power replaces lead-acid batteries to power electric industrial vehicles, such as the lift trucks customers use in their distribution centers.

Extending its reach into the on-road electric vehicle market, Plug Power’s ProGen platform of modular fuel cell engines empowers OEMs and system integrators to rapidly adopt hydrogen fuel cell technology. ProGen engines are proven today, with thousands in service, supporting some of the most rugged operations in the world. Plug Power is the partner that customers trust to take their businesses into the future.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |