Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

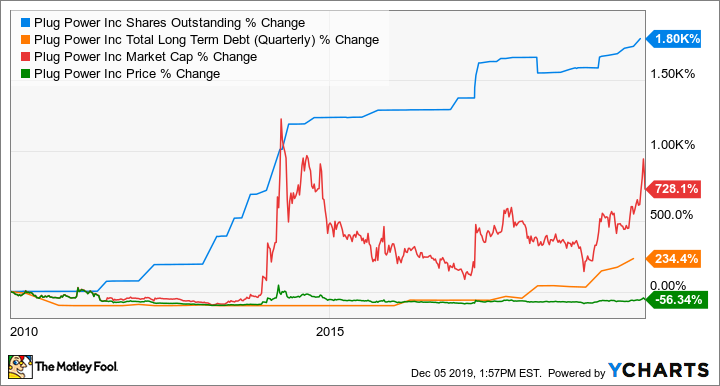

B_B - Looks like more PLUG Dilution.

A Reverse Split Next ?

PLUG has to get the share price up before the Next Secondary.

Just like FCEL.

I wasn't aware of this "Hydrogen in Advanced Semiconductors."

"Semiconductor manufacturing is an intensive process which uses large volumes of industrial gases. For this reason, semiconductor fabricators need a reliable supply of high purity nitrogen and hydrogen." Source https://www.azom.com/article.aspx?ArticleID=16974

Mission Hydrogen webinar “HYDROGEN IN TAIWAN” tomorrow August 21, 4 am ET.

When: Wednesday, August 21, 2024, 01:00 am Pacific | 04:00 am Eastern | 10:00 CEST | 01:30 pm IST | 04:00 pm AWST

Speakers: Dr. Harry Kuo and Dr. Yujen Lin, CTCI Foundation

Registration: www.mission-hydrogen.com

Price: free

Background

With more than 50% of the worldwide production, Taiwan is the most important producer of semiconductors. And to make the best semiconductors, guess what is needed: Hydrogen. Large amounts of hydrogen.

At the same time, Taiwan has significant challenges in their energy system due to the fact that they are an island with relatively little own resources and a high industrialization. And guess what they think could help to both decarbonize the energy system and make them more resilient: Hydrogen.

That being said, we believe that the webinar “HYDROGEN IN TAIWAN” will be a very interesting one.

CTCI Foundation is Taiwan’s key R&D institution since 1959. They have played a critical role in establishing Taiwan as one of the world leading technology and industrial countries by doing cutting edge research on petrochemicals, energy, catalysts and other technologies. A second important role of CTCI Foundation is policy and strategy consulting for the government and for companies.

Dr. Harry Kuo and Dr. Yujen Lin are the leading researchers of CTCI in the field of hydrogen, fuel cells, battery electric vehicles, solar and wind. Harry has 30+ years of experience in material science and holds a Ph.D. in composite technology. Prior to working for CTCI, Harry held various positions in the composite industry and solar industry.

In the webinar, they will cover the following topics:

- Taiwan’s Net zero Emission Roadmap

- Taiwan’s technology investment and development roadmap

- Hydrogen in the semiconductor industry

- Hydrogen as a fuel in turbines

- Hydrogen powered drones (Current demonstration project)

- AEM Electrolyzer development

- Shalun Hydrogen Energy Technology Demonstration Site

- Type IV hydrogen storage systems development

- Hydrogen refueling stations in Taiwan

- Hydrogen bus demonstration project

That being said: This webinar is for everyone interested in hydrogen. Taiwan is investing in every part of the value chain, and they are serious about it.

another way to look at it is without the r/s they recently did, the pps would be 24 pennies...

one of the reasons companies in dire straits like to do a r/s is so that they can reduce the mountain of outstanding shares they created and make them appear quite small again...then they can start diluting all over again at a higher pps...

American Airlines

American is helping to catalyze the development of hydrogen-electric propulsion technology - through which hydrogen is used in fuel cells - as well as the future of hydrogen distribution logistics for aviation. We have made two strategic investments in ZeroAvia, a pioneer in hydrogen-electric aviation powertrains.

still hyping up nkla?...why?...lol

"Nikola Corporation (NKLA -10.64%) stock tumbled 10% in early trading Monday before recovering a bit. The fuel cell-powered truckmaker filed a form S-3 with the Securities and Exchange Commission (SEC) this morning, describing its plan to raise $500 million through issuances of new debt, convertible debt, and shares in the company."

the stock is down over 10%...on heavy volume...well, heavy volume for them...

Good Post. Glty

Thank you UKSAUSAGE for the reply. Your opinion is as good or much better than the old style stock brokers. I'm so old, I can remember walking into the W.E. Hutton Brokerage Office in Mansfield, OH when I was a teenager with my Dad. I would sit in the row of chairs and watch the symbols go across the electronic NYSE and I think OTC boards. The teletype ticker would be making racket in the corner and old men would be smoking cigars. The secretary would walk through once in a while and she was always nice to look at for a teenage boy. Back to PLUG: you guys have called me out on this one! I fell in love with this stock when customers Walmart and then Amazon joined up. I have held stocks for up to 20 years and yea, they finally fought through the scale and cost saving process and did well. I believe PLUG will too, No one will agree with me, but I think Paul Middleton already had the cost saving/turnaround process under control. I don't think they really needed Dean Fullerton. You could hear it in Paul's voice, giving his 2nd Qtr. call presentation. I think Sanjay got excited and covered them up with inventory, but they will work through it. Thank again UK.

America facing largest hydrogen deployment in history: 14 GW, 24 states and billions of dollars

by D. García 08/19/2024

https://www.ecoticias.com/en/america-largest-hydrogen-deployment-history/5519/

PLUG Stock PLUG POWER EARNINGS CALL Is it time to BUY? Martyn Lucas Investor

Martyn Lucas Investor

32.2K subscribers

Premiered Aug 8, 2024

Plug Power CEO Expects Softening of U.S. Treasury Guidance on Clean Hydrogen

Green Stocks Research

Posted Aug 9, 2024

Plug Power CEO Andy Marsh expects a softening of the US Treasury's proposed guidelines on clean #hydrogen production after the democratic convention.

He expects 'gigawatt scale' projects will then need another 12-18 months to get to FID.

Nikola Update: Is the Electric Truck Maker Back on Track?

FreightWaves

30K subscribers

Posted Aug 14, 2024

FreightWaves Now dives deep into the latest developments at Nikola with CEO Steve Gursky. After facing numerous challenges, Nikola is now delivering fuel cell trucks and expanding its hydrogen infrastructure. In this episode, we discuss the company's progress, financial outlook, and the potential for future partnerships. Join us as we analyze whether Nikola is finally turning the corner.

Timestamps:

00:00:00 - Introduction

00:01:30 - Nikola's progress and current state

00:03:00 - Challenges and obstacles faced by Nikola

00:04:30 - Financial outlook and future plans

00:06:00 - Potential partnerships and industry impact

Report: Transparency, standards needed for U.S. clean hydrogen to take off

A new report from Troutman Pepper law firm says transparency on tax credits and standards for hydrogen certification are needed to unlock clean hydrogen’s ceiling.

8.6.2024

https://www.power-eng.com/hydrogen/report-transparency-standards-needed-for-u-s-clean-hydrogen-to-take-off/

In order to make clean hydrogen viable for the U.S. energy mix, greater clarity on tax credits and a commitment to rules and standards on certification are needed, according to a new industry report from U.S. law firm Troutman Pepper.

The report, Fueling Up: How to Make U.S. Clean Hydrogen Projects Happen, draws upon the views and expertise of a range of sector specialists to explore what steps could be taken to realize clean hydrogen’s potential.

The report argues that the U.S. should boost exports to provide additional routes to market, bolster domestic manufacturing for hydrogen technologies, and prioritize ‘backbone’ infrastructure to reduce project risk.

The report says the Inflation Reduction Act and Bipartisan Infrastructure Law have generated commercial interest in American clean hydrogen projects. But the legislation, and implementation of those regulations, come with complexities and caveats that require navigation.

One issue is tax credits. Designed as incentives to encourage companies to produce clean hydrogen, helping them transition from early-stage development and planning to construction, the arrival of proposed IRS regulations on Section 45V in December 2023 have been considered too stringent by many, offering up more questions than answers, the report said.

For hydrogen to be considered ‘clean’ and eligible for credits it must meet three criteria: additionality, time matching, and deliverability. These criteria require that hydrogen facilities cannot draw power from a source more than three years older than the hydrogen project, electricity-producing hydrogen must be generated within the same hour as the hydrogen, and the electricity source and hydrogen facility must be in the same geographical area, as defined by the DOE’s transmission needs analysis.

Troutman Pepper says that as a result, many concerned developers and utilities are halting progress, warning that it will drive up costs and make it harder to get projects funded and constructed in this nascent sector, as they await further clarity from the IRS on its finalized rules.

Meanwhile, off-takers are asking for improved clean hydrogen certification standards to offer transparent reassurance that they are getting the product they think they are. To stimulate demand, the Biden Administration made $7 billion available to support seven regional clean hydrogen production hubs across the country.

However, businesses inclined to follow this route, such as chemical and metal producers, oil refineries, and transportation and utility companies, are feeling uneasy about the potentially ambiguous nature of hydrogen classifications, the report said. Faced with directives to reduce their environmental impact, businesses are struggling with a lack of visibility, guidance, and uniform certification to verify how green any available fuel actually is.

The report notes that more states could encourage greater uptake of clean hydrogen, similar to what numerous states previously did with regard to renewable portfolio targets. For instance, only California, Oregon, and Washington have introduced low-carbon fuel standards thus far. State-led commitments along these lines could provide clean hydrogen users with greater confidence to support the development of a robust domestic clean hydrogen market, the report said.

Beyond the domestic market, some commentators within the report argue there is an opportunity to establish the U.S. as a clean hydrogen exporter, particularly to Europe and Asia, including in the form of ammonia. Industries globally are under regulatory pressure to decarbonize. Many countries outside the U.S. face greater challenges in relation to their regional energy transition policies, making U.S. hydrogen a potentially attractive proposition, bringing in capital and off-take certainty from around the world, while developing a spot market for clean hydrogen and related products.

On U.S. soil, report commentators have encouraged the building out of U.S. manufacturing facilities for hydrogen technologies, while prioritizing nationwide ‘backbone’ infrastructure to reduce project risk. Bloomberg New Energy Finance recently reported that 68% of global electrolyzer manufacturing is in China. In the short-term, this represents a reassuring level of access to equipment, but in the longer-term, the federal government has committed to growing domestic production to counteract that reliance.

Equally, interviewees argued that the government needs to unlock investments to support infrastructure, helping producers store and move their product more efficiently and economically. The DOE recognized this challenge in its June 2023 National Clean Hydrogen Strategy & Roadmap, where it reported that between $2 billion and $3 billion of investment annually is needed in hydrogen infrastructure projects between 2023 and 2030 to enable the U.S. to achieve annual production of 10 million metric tons by 2030.

“When compiling this report, we found that most commentators and sector specialists agreed about the vast potential of clean hydrogen to become a highly useful non-fossil component of America’s energy mix,” said Mindy McGrath, a regulatory and finance Partner in the energy practice group at Troutman Pepper. “And it’s been encouraging to see government incentives and financial support acknowledging that potential in an effort to drive both production and demand.

“What is less clear at present is how these mechanisms and stimuli will play out in the real world. Regulators are justifiably concerned about doing things the right way. That said, if the rules surrounding the sector are too onerous or ambiguous it is going to stifle progress. Major energy businesses – developers, producers, utilities, and investors – are rightly wary of this uncertainty. In this report we look at why there needs to be a concerted effort to demystify complex regulatory matters, and why clear guidance is needed to create a cohesive framework of strategies to properly advance the sector.”

the third reason hes so fixated is that he wants to justify the extreme arrogance he used when recommending that everyone buy the stock from the 20's all the way down...he expressed how CERTAIN he was that the stock would go to $100 per share and how ignorant and unintelligent you would have to be not to see it...

now the stock is 50 cents and of course he now says that he knew all along that $29 would never hold because it got there with nothing but hope, smoke and mirrors...he now says he always knew the stock would drop?....

i dont know...hes all over the place...

UK, Hoghead7 being so fixated on FCEL, in my opinion arises from the enormous amount of Due Diligence, time and effort he has put on FCEL over many years. I've seen the same thing happen to others for other stocks. After a while they become oblivious to the negatives, see only the positives, and become very defensive if others say anything negative about the company. It's what some people describe as falling in love with the stock.

Personally, I understand it, and it doesn't bother ne. In fact, I take it as a learning experience, and try my best not to make the same mistake.

“ I am puzzled why he is so fixated on FCEL”

It’s a combination of mom and pop investing where your stock becomes more of a team that you cheer on whether they win or lose…but it’s also the gamblers thing where you are sure it’s a one in a million stock that will make you rich…and you just can’t stop betting on it…no matter how far or how long it drops…

Jack

WTM wasn't reposting hoghead7’s opinions just links that may be relevant to PLUG that Hoghead7's scanner had found

I wasn't aware of his background and it doesn't really matter to me anyway as everything posted here has to be taken with a grain of salt.

I am puzzled why he is so fixated on FCEL as you need to be spread around the hydrogen market not in just one stock. (crossing the chasm 101)

HI Studer,

Happy to give an opinion but it is just that. I am an amateur chart reader and mostly an investor not trader (hence I didn't sell at $50+ apart from buying a car)

I dont see the longer term down trend breaking at the moment. When the chart is in a n up slope like now it still falls back

I would need to see some higher lows being formed (This years are roughly $3.00 $2.30 $2.27, $1.90)

I am sure some shorts are covering as they can probably get better returns elsewhere not from fear of being burned by a price rise here.

In some respects I hope your $1.88 order doesn't fill as that may indicate it isnt going any lower, but the next low needs to be above the $2.30 to be a “higher low”. The chart and history suggest otherwise.

When the DOE loan or other financing is announced then we may well see a real reversal but it will be very slow until they can show better financial management

mik - NOT TRUE .

Just because you didn't, does not make that a universal rule.

You are not the universal standard.

You may instead be the exception which proves the rule.

Which would make you WRONG.

Wrong jack...ive had dogs for 50 yrs and no fleas!!

WTM - When you associate with Dogs, you are gonna get fleas.

JB, that's an unjustified personal attack, in my opinion.

Not really interesting.. Russ is biased we know that!

"I would recommend you watch the video before commenting on it."

yea, i dont think so...i value my time and have no need to listen to a failed executive...

"They need partners but ones sharing the same vision and urgency for decarbonizing the transportation sector."

their problem isnt really about a sense of urgency to decarbonize the transportation sector....the urgency is a need to sell trucks so they can keep their head above water without diluting the crap out of the stock...or they will go BK...pretending its about "decarbonizing the transportation sector" is a nice way to distract from the real issue which is that nkla has one foot in BK and the other on a banana peel...

a prior ceo and founder of nkla went to prison for fraud after he lied about how nkla was progressing...this current ceo was the chairman of the board in 2020...the pps was about $1500...a year ago he was made the ceo when the pps was about $60...the pps is now $8...

i dont think hes the savior of nkla...at least he isnt showing that to be the case...

"Certainly not a team that are panicking but certainly one that cannot have delays to their execution plan."

hmmm...maybe its time to panic?...

WTM - Did you know that Hoghead is a failed used car dealer and roofing estimator ? He has been flogging hydrogen for years and is currently down more than 90%.

The only people I respect LESS than Hoghead are those who quote him without disclosing his background and track record.

Here's an interesting Read :

https://www.yahoo.com/news/drivers-hydrogen-cars-annoyed-california-100052443.html

Repost from FCEL board, courtesy of Hoghead7.

Everyone knows I'm not fluent or nearly as optimistic about Plug as FCEL. However, this suggests to me, PLUG DOE finding will follow shortly!

https://www.h2-view.com/story/celadyne-secures-doe-funding-for-fuel-cell-expansion/2113763.article/

UK, I value and study everything you post. I have a question for you : If you don't want to respond, it's ok, but I would like to know what you think. We placed a buy limit order Friday for 20,000 shares of PLUG at $1.88. I see catalysts coming up which will drive the price north of the Friday $2.21 close; such as the clarification announcement for "Credits" and the PLUG DOE loan. The past week seemed to be some covering from shorts, but the volumes were mediocre. How much lower, if any, from Friday's close do you see PLUG going?

I would recommend you watch the video before commenting on it.

To some extent he is in a position of strength as they are first mover by along way for hydrogen trucking. They need partners but ones sharing the same vision and urgency for decarbonizing the transportation sector.

There is demand for the trucks (c 400 HVIP vouchers in California for starters) and they have the management team in place to execute the strategy they have been executing for over a year.

Find me one bad review for the FCEV.

Managing the supply chain and reducing the costs of the supply chain (newer tech, local suppliers, volume etc) will bring gross margins (losses) down while H2 sales will keep rising. They have been very open about their need for capital and go to the market once a quarter to get it, let the share price rise with the sales numbers and dilution is less.

Certainly not a team that are panicking but certainly one that cannot have delays to their execution plan.

"I did not hear panic."

me either because i did not listen to the video...all i did was read the short quote that was posted...thats all i needed...

"if they're late by a year, no one in their company cares, if we're late by a year we're out of business. We go to work every day like our life depends upon it, because it does, this is all we do"

panic and desperation...

"and we need to find Partners who feel the same way."

big talk from a 28 cent company...but hes got to pretend...hes gotta act like hes coming from a position of strength...which he clearly is not...and everyone knows it...

he must have gone to the bathroom after that and threw up....lol

I did not hear panic. I think he has a clear head on the situation and what they need to do. I wish Andy was as direct. He told you they will need to dilute more, and they need scale.

no...they dont...and the word is SHILL...

Not really! Everyone sounds like a shrill at times!

there is little difference to the oil companies bewteen oil and hydrogen...except the cost to make hydrogen as big as oil...

if the Gov spends the trillions of dollars it will take to build the infrastructure and hands out tax credit like candy at halloween, big oil will gladly be all in...they will be in control of hydrogen just like they were oil...they will periodically raise the price of hydrogen to the consumer insuring that they will ALWAYS have tens or hundreds of billions in profit...and if the consumers complain, well its just the cost of having a clean environment!...you do want a clean environment...right?.....for your children and all the puppies?...lol

but if the Gov doesnt sent out wefare checks to big oil, then they will gladly keep things just as they are...pretending to struggle mightily in discovering new ways to combat all that nasty carbon problem...but only if they can profit hugely from it...if they actually discover a way to do it cheaply, it will never see the light of day...

if NKLA had not done that recent 1-30 reverse split, their share price would be 28 cents today...what you are hearing and seeing from NKLA's ceo is near panic and desperation...he knows hes very close to being the ceo that sends NKLA into bankruptcy...which will mean the end of his career and be his legacy...

oh well...stuff happens...

I think in H2'24 the suppression of hydrogen will stop and the fossil fuel companies/countries will rush to hydrogen.

Only a quarter of Saudi Arabia's $1 trillion capex plan will go into oil

August 14, 2024

...

But the oil industry is likely to receive a smaller portion of this than previously forecast.

Roughly 73% of the investment funds will go to non-oil sectors, ... An earlier forecast pegged non-oil investment at 66%.

Clean energy is expected to get $235 billion in funding, up from a previous forecast of $148 billion, with the increase driven mainly by renewables as Saudi Arabia more than doubles its 2030 capacity target.

...

https://www.goldmansachs.com/insights/articles/only-a-quarter-of-saudi-arabias-1-trillion-capex-plan-will-go-into-oil

Next week: Democratic National Convention August 19 - 22

Andrew Marsh

“I think it's really clear that the regulations on the three pillars are going to become much looser. We won't be surprised if there's some announcement after the Democratic Convention and a further announcement after the election.”

Plug Power Inc. (PLUG) Q2 2024 Earnings Call Transcript

https://finance.yahoo.com/news/plug-power-plug-q2-2024-214513853.html

No, not related to Plug.

Just correcting the misleading, negative text about green hydrogen.

Ørsted is negative about e-fuel and positive about green hydrogen.

From what I recall Nikola and Hyundai had both had off take from Georgia when it was just the gaseous not liquid plant. Always puzzled me what client of Nikola would want Green H2 from Georgia when they are focused on CA and Canada.

Hyundai we know has Georgia manufacturing so I suspect is taking some all the time. Could JB Hunt or someone have an onsite H2 dispensing capability and be trialling the Nikola FCEV in Georgia? Possibly, the warehousing business there is incredible - look at PLUGs MH customers (HD, BMW, Amazon Walmart Nike etc) so the trucking business is huge as well

PLUG priority though is its own use as that impacts their bottom line most. If they have surplus in Georgia (which when LA comes on line they may do) then why not let NKLAs customer buy it.

Steve, an interesting quote for me was the following one at minute 6-7 into the interview. This quote reminds me of a point BB has been making for some time now, that is that Big Oil Companies, in a sneaky diabolical way, may be pretending to be supporting the hydrogen economy, but are in fact trying to disrupt it, or at a minimum trying to delay it. I believe in a very diplomatic way, Nikola CEO, Steve Girsky, is saying that he doesn't trust Big Oil Companies as partners, good for him.

Minute 6:06

"Disrupting that market, we're trying it on the truck side we're trying it on the fuel side and and we encourage partners on the fuel side also. But let's be honest Allan we need like-minded Partners we're trying to build a coalition of a purpose-built coalition a coalition of the Willing people who are like-minded we have since we put trucks on the road. We are getting more interest from potential Partners than we ever have but if we have Big Oil Company come over and say we want to partner with you on stations that's great because they have money, we're Capital constrained, but there's one problem we move faster than they do ,and the second problem is, if they're late by a year, no one in their company cares, if we're late by a year we're out of business. We go to work every day like our life depends upon it, because it does, this is all we do, and we need to find Partners who feel the same way."

Is this ongoing project related to Plug?

Two years after making a final investment decision, Danish renewables developer Orsted has scapped a planned green hydrogen to methanol plant called FlagshipONE.

Ørsted cans FlagshipONE e-fuel project in favour of green hydrogen

Pamela Largue Aug 16, 2024

Danish energy firm Ørsted has decided to cancel FlagshipONE, the company’s first commercial-scale Power-to-X project, and is opting to prioritise the development of renewable hydrogen.

The news was announced in Ørsted’s interim report for H1 2024. The report explains that the decision was taken due to the slow growth of Europe’s nascent e-fuel market.

Mads Nipper, group president and CEO of Ørsted, commented on the decision: “The liquid e-fuel market in Europe is developing slower than expected, and we have taken the strategic decision to de-prioritise our efforts within the market and cease the development of FlagshipONE.

“We will continue our focus and development efforts within renewable hydrogen, which is essential for decarbonising key industries in Europe and closer to our core business."

...

https://www.powerengineeringint.com/finance-investment/orsted-cans-flagshipone-e-fuel-project-in-favour-of-green-hydrogen/

Noticed around 26-27 minutes he said they would be getting green H2 from Plug Power later this year from Ga. I had not heard that and wonder why they are waiting and not getting it now? I thought that we were to double the Ga. plant, but assumed it stopped with everything else except Olin in La.

From another board :

Two years after making a final investment decision, Danish renewables developer Orsted has scapped a planned green hydrogen to methanol plant called FlagshipONE.

Meanwhile, in Hannover, a proposed green hydrogen plant called "Sewage Plant H" has been scrapped due to cost overruns and a lack of offtake agreements.

The failed project has left the city with bills over 10million Euro..

That sure sounds like a Shill to me.

i listened to him and heard him quite clear...

"step right up folks and listen to what i am about to say!...you say you want clean air?...you say you want zero emissions?...well ive got the elixer for a sick world that you are looking for right here!...its a miracle fuel called hydrogen...GREEN hydrogen to be exact...CLEAN hydrogen...whats it going to cost you ask?...why, next to nothing!...all its gonna take is a few trillion Fed dollars to build out the infrastructure and huge tax credits from now until the rapture...and all it will cost you personally is twice what you pay now for gas....now is that too much to ask for a clean environment for your children and little puppies?....I THINK NOT!...

Not really...if you listen and realize what he is saying.

And not a very good one…

But he casted his line and has certainly hooked WTM who never ceases to post that guys ranting on and on about the hydrogen/ snake oil he’s selling…

|

Followers

|

736

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

58528

|

|

Created

|

03/01/05

|

Type

|

Free

|

| Moderators uksausage WeTheMarket Jack_Bolander | |||

Page is currently being updated - watch for more information about their recent acquisitions and competitors

Welcome to Plug Power

http://www.plugpower.com/Home.aspx

Plug Power is the leading provider of clean hydrogen and zero-emission fuel cell solutions that are both cost-effective and reliable.

In 2020/21 Plug Power cemented two major partnerships

https://www.plugpower.com/plug-power-and-sk-group-partnership/

https://www.ir.plugpower.com/Press-Releases/Press-Release-Details/2021/Groupe-Renault--Plug-Power-Join-Forces-to-Become-Leader-in-Hydrogen-LCV/default.aspx

The architect of modern hydrogen and fuel cell technology, Plug Power is the innovator that has taken hydrogen and fuel cell technology from concept to commercialization. Plug Power has revolutionized the material handling industry with its full-service GenKey solution, which is designed to increase productivity, lower operating costs and reduce carbon footprints in a reliable, cost-effective way. The Company’s GenKey solution couples together all the necessary elements to power, fuel and serve a customer. With proven hydrogen and fuel cell products, Plug Power replaces lead-acid batteries to power electric industrial vehicles, such as the lift trucks customers use in their distribution centers.

Extending its reach into the on-road electric vehicle market, Plug Power’s ProGen platform of modular fuel cell engines empowers OEMs and system integrators to rapidly adopt hydrogen fuel cell technology. ProGen engines are proven today, with thousands in service, supporting some of the most rugged operations in the world. Plug Power is the partner that customers trust to take their businesses into the future.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |