Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

More Bad News :

Austrian Railway scraps hydrogen plans.

The Zillertal railway has scrapped its hydrogen plans after a independent study found that a electric approach using batteries, overhead lines, or a hybrid version would be much less expensive and lead to faster decarbonization. The Vienna University of Technology analysed 6 different drivetrains while the state of Tyrol has outlawed the use of overhead lines on the entire route. Batteries and partial overhead line use were found to be more cost effective than hydrogen.

Last year, Stadler, admitted that hydrogen will almost always be more expensive than battery trains due to the replacement costs of the stacks(3yr) and maintenance on the high pressure storage tanks. Those comments came after the first hydrogen railway in lower Saxony announced they would only buy battery trains due to the operating costs of their hydrogen trains.

The primary reason batteries cost less than hydrogen in Central Europe is that railways there are rarely less than 80km from a station with an overhead charging line, which can be used to charge the battery with 15,000 volts — 15 minutes of which is enough to power the train for a further 50-150km.

Poor Hydrogen Economics ! UH, OH.

Banger - If you ever want to see $10.00 again, this is what needs to be done.

- A new CEO

- A new CFO

- A new COO

- A new HQ in Texas

- $1.0 + Billion in Fresh Capital

________________________________

And to answer you :

"well it would give them a better chance of being successful and the market would like it reflecting in a better SP." $10.00+ increase in the share price just on the changes.

"But the current team may make it, their chances reflected in current SP." The current team is incompetent and not credible. Current share price will continue to fall as long as they are running things in Backwater, NY

Had it not been for the 2 year delay in NY and 12 months in Georgia (plus 6 more for he final testing set up) they wouldn’t be in he cash strapped position they are now. These were external delays but should have been in their plans (Sanjay too overconfident). We might them be saying we have a wonderful C Suite...?????

"Where is the board of directors though they should be addressing this. Is George too weak or too much the status quo guy? " PLUG's Board needs to wake up and ACT.

well it would give them a better chance of being successful and the market would like it reflecting in a better SP.

But the current team may make it, their chances reflected in current SP.

Had it not been for the 2 year delay in NY and 12 months in Georgia (plus 6 more for he final testing set up) they wouldn’t be in he cash strapped position they are now. These were external delays but should have been in their plans (Sanjay too overconfident). We might them be saying we have a wonderful C Suite...

Where is the board of directors though they should be addressing this. Is George too weak or too much the status quo guy?

Banger - So, in order to be successful going forward, PLUG Needs :

- A new CEO

- A new CFO

- A new COO

- A new HQ in Texas

- $1.0 + Billion in Fresh Capital

Other than that, everything is just Ducky.

Did I miss anything ?

I agree, except Andy needs to be there just not as CEO - he is the visionary but hasn't had the team to deliver a realistic plan to get there and stand up to Andy to tell him it would be 24 months late.

A proper CFO would help compensate for weakness in other positions along with a COO from energy market.

They need executives experienced in an energy company not a fork lift parts supplier as you always like o refer to them as.

Surprised Andy isnt moving back to Texas where he came from. Having their headquarters there would be much better.

C'mon, Half of the pump posts on this board have nothing to do with PLUG.

What is bad for one part of the sector, negatively affects the other sectors.

is this related to PLUG?

not really news either as passenger cars will be a 2028 thing currently suffering from the rip off prices for gray hydrogen…. need more supply

Banger - You have exposed another issue with PLUG.

LEADERSHIP !

Who is going to run this MESS ? Andy is a proven failure and has destroyed PLUG's credibility and Shareholder value.

Paul is just more of the same.

Sanjay and Jose Luis are over their heads. Ole, who had my vote, is gone (a Big Loss).

PLUG needs to bring in a Professional . A real deal.

But good luck getting a top-tier leader to move to Slingerlands.

on this we agree!

Sanjays strategy badly played out so he was demoted (lost the control of H2 production) after he under estimated the permitting and other pre-construction tasks leading to 6-12 month delay on Georgia, Texas and NY before the cash crunch.

he still runs the Electrolyser manufacturing business which involves supplying many non-PLUG projects and our JVs which Ole was better qualified to do

Part of PLUGs ROI formula was to not pay APD or LIN $10+ /kg for gray hydrogen but make green/blue for $5

But once that is covered (OLIN may provide their daily needs) it does get harder to justify.

Big question for the board. If you win the Powerball would you approach Andy to finance NY Stamp and lease it back - or something similar?

Honeywell wins contract to develop hydrogen fuel cell power system for U.S Army soldiers

posted by AJOT | Apr 03 2024

Honeywell has won a contract from General Technical Services for the development of a hydrogen fuel cell system that will power a multitude of electronic devices carried by soldiers. Weighing roughly half as much as commonly used batteries, the system will deliver the same power foot soldiers need.

.....

https://www.ajot.com/news/honeywell-wins-contract-to-develop-hydrogen-fuel-cell-power-system-for-u.s-army-soldiers

Apple won their Third Granted Patent Regarding Future Devices Powered by Fuel Cell Energy

Sep 29, 2020

The U.S. Patent and Trademark Office officially published a series of 63 newly granted patents for Apple Inc. today. In this particular report we cover Apple's third granted patent regarding systems that use fuel cells to provide electrical power. More specifically, the patent relates to a fuel cell system which is designed to provide electrical power to a portable computing device via an external connection such as USB-C.

.....

https://www.patentlyapple.com/2020/09/apple-won-their-third-granted-patent-regarding-future-devices-powered-by-fuel-cell-energy.html

FreightWaves

@FreightWaves

VIDEO -

"An Inside Look

At GM’s Fuel Cell Lab"

| Truck Tech

3:00 PM · April 3, 2024

An Inside Look At GM’s Fuel Cell Lab | Truck Tech https://t.co/KNZWxTCXHX

— FreightWaves (@FreightWaves) April 3, 2024

Yes, all talk no action!

I think he was partly responsible for the delays.

April 04, 2023

Sanjay K. Shrestha, the General Manager, Energy Solutions, Chief Strategy Officer, and Executive Vice President of the Company, in addition to his current responsibilities, will take over the responsibilities of Mr. Hoefelmann.

https://www.marketscreener.com/quote/stock/PLUG-POWER-INC-10490/news/Plug-Power-Inc-Announces-Resignation-of-Dirk-Ole-Hoefelmann-as-Executive-Vice-President-43432261/

B_B - That would be a huge mistake.

Sanjay is all talk.

I think Sanjay Shrestha wants the CEO chair.

B_B - Rearranging the Deck Chairs ?

Plug Power moving headquarters to Slingerlands

Meredith Savitt by Meredith Savitt April 3, 2024

https://spotlightnews.com/news/2024/04/03/plug-power-moving-headquarters-to-slingerlands/

Steve - A DOE Loan and 45v will definitely give PLUG a Bump.

Will it be enough to Reverse the Trend ? I don't think so.

Maybe, Andy does not care being an idealist and spending OPM. As long he gets his and in his mind is working to save the planet by any means necessary maybe his motto. After all these years his ego and idealism has lost shareholders millions. I'm hoping either or both the 45V and or DOE pass and give us a bump. Maybe at that point I make a change.

Steve - It's not the technology. We know that hydrogen works.

It's the economics. A key metric in FID is ROI. In today's world it is pretty difficult to produce a major capital project for Hydrogen that has a positive ROI or a payback in less than 10 years.

Smart companies like Exxon, Woodside, APD and Linde have all run their financial models and the economics look pretty discouraging.

What concerns me is that PLUG doesn't seem to worry about RAROCE or ROI.

Yep, everyone waiting. Why? Is there something else out there coming soon that will be a paradigm shift, and no one wants to commit? If they wait that long nothing may happen at all.

Delays in Australia, Delays in EU, Delays in North America.

I'm beginning to see a New Trend in Hydrogen.

And that trend is Negative.

EXCLUSIVE | Uniper delays major offshore-wind green hydrogen project to 2030, hands back EU subsidies

The German energy firm tells Hydrogen Insight that it plans to bring full 500MW electrolyser capacity on line by the end of the decade

3 April 2024 By Polly Martin

https://www.hydrogeninsight.com/production/exclusive-uniper-delays-major-offshore-wind-green-hydrogen-project-to-2030-hands-back-eu-subsidies/2-1-1620287

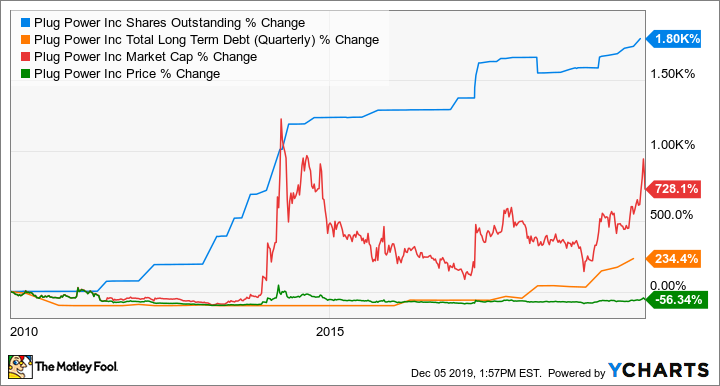

Will PLUG be selling ATM shares below $3.00 ?

I have to believe that PLUG is contributing to this Free Fall at the Shareholder's expense.

“Maybe a few will, but not enough to cause the pps to skyrocket…”

Time will tell.

“I personally won’t buy anything with margin…ever…”

Me too, I only buy what I can afford.

I have never borrowed money for a car or leased one.

“I’m not aware of any special sec rules that apply to a $4 stock as opposed to a $5 stock that are particularly detrimental…”

It was mentioned in this article:

https://moneyandmarkets.com/why-large-investors-obey-the-5-stock-rule/

“If the stock price stays above $5, small and large investors will jump in and buy more shares (with borrowed money).”

Maybe a few will, but not enough to cause the pps to skyrocket…

I personally won’t buy anything with margin…ever…

“because the SEC applies special rules to stocks under $5.”

I’m not aware of any special sec rules that apply to a $4 stock as opposed to a $5 stock that are particularly detrimental…

The only exception would be in the case of shorting a stock…there are certain rules that apply to penny stocks in cases of short selling…

Sadly, I don't foresee anything that gets us to $10. Even if 45v and the DOE loan comes through soon in our favor it would be tough to hit $10 and hold it. Plug will have to show it can make a profit and I'm sorry at this point I just do not have faith they can as they have not proven they can as of now. This would take a disciplined management that had their act together. We need consecutive quarters of improving margins and decreasing losses. We need proof and soon. No more empty promises.

If the stock price stays above $5, small and large investors will jump in and buy more shares (with borrowed money).

The stock price will skyrocket.

Penny stocks, which are stocks that generally trade per share for under $5 are not allowed to be purchased on margin at a particular brokerage or financial institution. They must be fully funded by the investor's cash.

Many firms instruct portfolio managers to avoid low-priced stocks because the SEC applies special rules to stocks under $5.

I still want to sell my shares for $50 this year.

New Texas Fuel Cell Gigafactory Pours More Cold Water On Clean Power Foes

23 hours ago

https://cleantechnica.com/2024/04/01/new-texas-fuel-cell-gigafactory-pours-more-cold-water-on-clean-power-foes/

I wonder if this new manufacturing approach by Tesla, would also work for fuel cell manufacturing.

Tesla’s $25,000 Car Means Tossing Out the 100-Year-Old Assembly Line

Mar 28, 2024

https://www.bnnbloomberg.ca/tesla-s-25-000-car-means-tossing-out-the-100-year-old-assembly-line-1.2052740

Relevant excerpts:

"The company is moving to what it calls an “unboxed” approach, which is more like building Legos than a traditional production line. Instead of a large, rectangular car moving along a linear conveyer belt, parts are assembled simultaneously in dedicated areas and then all put together at the end. Tesla says the change could reduce manufacturing footprints by more than 40%, allowing the carmaker to build future plants far faster and at less expense."

"If the new assembly process is successful, Tesla says it can slash production costs in half."

The pps would have to reach at least $10 before the company could attract a buyout price of $14….

And if the pps were to rebound to $10 that would mean their prospects had greatly improved…so why sell the company at that point?…

Companies are sold for decent money when they are doing well and a much larger company wants what they have and can expand them bigger and faster…

Companies that get sold while struggling, are sold at bargain basement prices…

And the ceo will always strike a deal where he is well compensated…usually by becoming a overpriced consultant for the buying company for 3 or 5 year contract where he is expected to sit around, look pretty and not get in the way…

Money for nothing and the chicks for free…

If they sell out at a price just above the stock strike that would surely look suspect and screw us that paid $40 plus and under water 90%. Not saying they would not do this as they work in their own self-interest and could give a rat's ass about shareholders like me.

Historical data shows Dow Jones gains 1.3% in early April, influenced by tax season liquidity

…..

Historical April Stock Performance

Over the past seven decades, the U.S. stock market has shown a tendency to perform well during the first two weeks of April. This pattern, attributed to increased liquidity in the financial system around the U.S. tax payment deadline on April 15, has been observed since the tax-filing deadline was established on this date in 1955. The Dow Jones Industrial Average (DJIA) has, on average, produced a gain of 1.3% in the first half of April, compared to an average gain of 0.3% in the first half of other months. This difference in performance is statistically significant at the 90% level, suggesting a notable trend, though it falls short of the 95% confidence level often relied upon by statisticians.

Tax Season Dynamics

As the federal tax deadline approaches, the U.S. Treasury typically experiences a substantial surplus in April, contrasting with other months where government spending exceeds tax revenue collection. This influx of funds to the IRS, due to tax payments, is believed to influence the Federal Reserve's open-market operations, potentially increasing liquidity in the financial system to accommodate these payments. While the specific actions of the Federal Reserve are not publicly disclosed, the correlation between tax season and increased market liquidity leading to stock market strength is plausible.

.....

https://super.news/en/articles/2024/03/26/april-tax-season-trends-dow-jones-historical-gains-and-taxpayer-engagement

They will either sell out and leave with fat pockets of cash at some stupidly low price to a bigger company…..

…..Paul said we had loads of options

The 2021 performance-based stock options end this year (September 2024).

$9.84 one-third (1/3) of the shares

$11.81 an additional one-third (1/3) of the shares

$13.77 the remaining one-third (1/3) of the shares

If the stock price stays below $9.84 until September, they will not get any shares this year.

I hope Paul is referring to a M&A deal, to receive the maximum shares, the offer price should be above $13.77.

May 31, 2023 Statement of Changes in Beneficial Ownership

https://www.ir.plugpower.com/financials/sec-filings/default.aspx

TAXES are Due .

Do you sell a good stock or a DOG Stock to pay your Taxes?

PLUG might have a tough couple of weeks in front of them.

No parachute for me, thanks!

I'm afraid of heights, so I keep my feet on the ground 🤣

If Andy is not stressed, I am not stressed 😁

I think his meds are working because he either knows something huge is near term or living in an altered reality to everyone else. When it comes to things like this, I always say follow the money. I ask myself, what would normal human nature have him do? Sure, he and others would be buying shares hand over fist. Sadly, even at this, what would seem, bargain price, none are. I think he and Paul already know the future. They will either sell out and leave with fat pockets of cash at some stupidly low price to a bigger company looking to add green H2 sites and sell off the other businesses or they have already reconciled the will run out the ATM, and (assuming the DOE money comes) and then reverse split and do another huge offering for the next phase of expansion with far fewer shares. To them it is no big deal. They can reprice their shares, yet again, but we get screwed either way. The offering should take them to 2028 or maybe 2030 assuming they are better stewards this time. I believe this is also why the shorts have yet again dug in with more shares. They always have better information than us longs it seems. Another sign is the B. Riley deal. Paul said we had loads of options and yet they work with a death spiral type little firm akin to a loans shark for the desperate penny companies. Neither Andy nor Paul is credible. You have to look at their actions and not their words.

B_B - Sure..... Why Not ?

PLUG is crashing and Andy has a Parachute.

Do you ?

Andy looked relaxed, healthy and no longer stressed, much better than before.

Fortescue tight lipped over why it now has a hat-trick of FID delays for the Gibson Island project

Adrian Rauso Tue, 2 April 2024

For the third time in just over three months Andrew Forrest’s Fortescue has missed the deadline to give its Gibson Island green hydrogen and ammonia project in Queensland the investment green light.

…..

https://thewest.com.au/business/energy/fortescue-tight-lipped-over-why-it-now-has-a-hat-trick-of-fid-delays-for-the-gibson-island-project-c-14157957

Hold it! How can he say we can sell everything we have in electrolysers when we have a billion dollars of inventory?

yada, yada, yada. Nothing worthwhile here. Just the same positive about everything and not reality based as to what is going on with the business. Why no news for ages about much of anything. How about moving out the inventory!

Sadly, I do not think these fools have any idea on the impact to the consumers with increased inflation or just don't care. Lower paid, middle class and retirees will suffer with lower standards of living. When you force technology that does not lower cost on people you create all sorts of problems.

Australia, US See Low Cost Green Hydrogen On Horizon

2 days ago

https://cleantechnica.com/2024/03/29/australia-us-see-low-cost-green-hydrogen-on-horizon/

Treasury hearing told to incentivise nuclear for hydrogen under IRA rules

By Charlie Currie

on Mar 27, 2024

https://www.h2-view.com/story/treasury-hearing-told-to-incentive-nuclear-for-hydrogen-under-ira-rules/2108026.article/

You should concentrate on YH board.

It´s a better place for your kind of postings!

|

Followers

|

739

|

Posters

|

|

|

Posts (Today)

|

6

|

Posts (Total)

|

58742

|

|

Created

|

03/01/05

|

Type

|

Free

|

| Moderators uksausage WeTheMarket Jack_Bolander | |||

Page is currently being updated - watch for more information about their recent acquisitions and competitors

Welcome to Plug Power

http://www.plugpower.com/Home.aspx

Plug Power is the leading provider of clean hydrogen and zero-emission fuel cell solutions that are both cost-effective and reliable.

In 2020/21 Plug Power cemented two major partnerships

https://www.plugpower.com/plug-power-and-sk-group-partnership/

https://www.ir.plugpower.com/Press-Releases/Press-Release-Details/2021/Groupe-Renault--Plug-Power-Join-Forces-to-Become-Leader-in-Hydrogen-LCV/default.aspx

The architect of modern hydrogen and fuel cell technology, Plug Power is the innovator that has taken hydrogen and fuel cell technology from concept to commercialization. Plug Power has revolutionized the material handling industry with its full-service GenKey solution, which is designed to increase productivity, lower operating costs and reduce carbon footprints in a reliable, cost-effective way. The Company’s GenKey solution couples together all the necessary elements to power, fuel and serve a customer. With proven hydrogen and fuel cell products, Plug Power replaces lead-acid batteries to power electric industrial vehicles, such as the lift trucks customers use in their distribution centers.

Extending its reach into the on-road electric vehicle market, Plug Power’s ProGen platform of modular fuel cell engines empowers OEMs and system integrators to rapidly adopt hydrogen fuel cell technology. ProGen engines are proven today, with thousands in service, supporting some of the most rugged operations in the world. Plug Power is the partner that customers trust to take their businesses into the future.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |