Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

could the kitty do a better job than riss ?

The response you received is irrelevant, just more BS!! If I remember correctly, NetCapital made a bundle off pvsp, so sure they are pals, lolololol!!!!!!

Riss is the CCO at Netcapital

He has done all their financials and got them listed on Nasdaq, been pals for many years.

where's the connection...if any?

He turned Here to Serve into a garage door sales and service...(small local SoCal)

Now he's a gold miner in Canada...

and...

Riss is setting up NetCapital for Broker-Dealer License !!!!!

Sure would be nice to have a friendly Broker - Dealer for small cap issuers, like Paul Riss Tweeted

Paul Riss

@PaulRiss

$NCPL expanding its ecosystem. Wouldn't it be nice to do 15c2-11 filings for small cap issuers?

https://twitter.com/PaulRiss

Yep, and others like it.zen

I posted this several months ago…

Flippers be flipping, not expecting a run until record date announcement of the spinoff…

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173785221

So unless there’s news in the meantime that would dramatically affect the stock price to jump, I don’t see much happening while we wait…

Wow, we are getting hotter now....$225.00 total trading for a Monday.... Geez this Is Sad.... Nice Wall though...22Million on the ask... .0005. Cheap but very little market interest at the moment... Hope things can Change for the Positive...

$PVSP

In answer to some mail concerning PVSP...I've been sidetracked by the new puppy for one thing...the other thing is fishy...as in 3 day old fishy...I see who started it now and it explains a lot...I can't send private messages and am not about to give IH another 12 bucks a month! post it or suck it...one of the two?

I think NOLs come in play and we have mllions of those

Reclassifying Marijuana Could Unlock Billions in Tax Savings for Cannabis Companies

Wall Street Journal

Proposed change could lift income-tax burden that wipes out most licensed marijuana retailers’ earnings

By

Jennifer Maloney

May 5, 2024 9:00 am ET

Cannabis businesses are currently barred from claiming deductions on many basic business expenses.

Many U.S. cannabis businesses could become profitable for the first time if the Biden administration follows through on its plan to reclassify marijuana as a less dangerous drug.

That is because the change could lift a heavy income-tax burden: Section 280E of the federal tax code currently bars cannabis businesses from claiming deductions on many basic business expenses. That rule often results in an effective tax rate of 70% or more, wiping out most licensed marijuana retailers’ earnings.

“It’s an absolute game-changer,” said Boris Jordan, executive chairman of Curaleaf Holdings, which operates 145 dispensaries and 19 cultivation sites across the U.S. “It’s something we’ve been waiting for, for the better part of 10 years.”

The proposed rule could take months to complete and could be further stalled by lawsuits. The public, including state regulators and marijuana companies, would have a chance to comment and the White House would have to sign off on a final version of the rule before it could go into effect.

Marijuana is legal in some form in 40 states and the District of Columbia, but is illegal under federal law—and would remain so even if the Drug Enforcement Administration moved marijuana from Schedule I to the less-restrictive Schedule III, equivalent to prescription medications such as anabolic steroids and some combinations of acetaminophen and codeine.

Cannabis businesses would still have to contend with limited access to banking services and financing. They still wouldn’t be allowed to transport marijuana across state lines. And companies that sell marijuana in the U.S. still couldn’t be traded on U.S. stock exchanges. (Several Canadian operators are listed on U.S. exchanges while U.S. operators are listed on Canadian exchanges.)

Current tax rules allow cannabis businesses to deduct their cost of goods sold, so growers that put most of their resources into production don’t get hit hard.

A national survey conducted in 2022 by Whitney Economics, a cannabis industry research firm, found that fewer than 25% of cannabis businesses were profitable. Licensed U.S. cannabis companies this year are expected to make $31.4 billion in sales and pay $2.3 billion more in federal taxes than they would under normal business tax rules, according to Whitney Economics forecasts.

For companies that have been hanging on in hope of one day making it into the black, the policy change could be transformative. Business leaders said they could use the cash to invest more in marketing, offer better benefits to employees and expand into newly opened markets such as Ohio. Industry leaders said they are also optimistic that the policy shift could reduce the stigma around cannabis, bring more investors into the sector and make federal lawmakers more open to legalizing marijuana.

Congress created Section 280E of the tax code in 1982, when Sen. Bill Armstrong (R., Colo.) tucked the provision into a larger bill as the federal War on Drugs was ramping up.

Cresco Labs CEO Charlie Bachtell, center, said the company has paid millions more in U.S. federal taxes than it would have under normal business conditions. PHOTO: DANIEL ACKER/BLOOMBERG NEWS

The law denies many ordinary deductions and tax credits to businesses that are “trafficking in controlled substances” listed under Schedule I and II.

When marijuana was illegal at the federal and state levels, that deduction limit had a relatively small impact, and it mostly gave U.S. authorities an additional tool to go after drug dealers and impose taxes on top of criminal prosecutions. But state legalization combined with Section 280E created an odd hybrid. The cannabis industry looked like regular businesses in many respects—except for the income-tax bills.

“Draconian, I think, is putting it lightly,” said Charlie Bachtell, chief executive of Cresco Labs, which has dispensaries and production facilities across eight U.S. states. For each of the past two years, Cresco has paid between $70 million and $80 million more in U.S. federal taxes than it would have under normal business conditions, he said. Despite the hefty tax bill, Cresco in the last quarter of 2023 became free cash-flow positive for the first time since it went public in 2018.

The cannabis industry has “really been kind of stumbling its way forward because of the economic burdens of 280E,” said Brian Vicente, a cannabis lawyer in Denver.

The current tax rules allow cannabis businesses to deduct their cost of goods sold, so growers that put most of their resources into production don’t get hit hard. Businesses closer to the consumer get hammered by Section 280E. For instance, a retailer selling clothes or food can deduct rent, marketing and wages when calculating taxable income. But a cannabis retailer typically can’t take any of those deductions.

“It’s impossible to make those numbers work,” said Wanda James, CEO and co-founder of Simply Pure Brands, which has a dispensary in Colorado and a new branch about to open in New Jersey. “It’s just a question of how long is your runway.”

James, a former Navy officer, restaurateur and political organizer, was among the first Black cannabis licensees in Colorado. She said the tax change could lower the barriers to entry for women, people of color and veterans, many of whom have struggled to keep their cannabis businesses afloat after winning state lotteries for social-equity licenses.

The tax change could also shrink the gap in profitability between legal and illegal cannabis businesses, helping licensed businesses that have struggled to compete with the black market. Unlicensed operations can sell marijuana at lower prices and pay fewer administrative and regulatory costs.

More broadly, moving cannabis to Schedule III could create an unusual tax regime. Businesses would still face significant state taxes and high costs for banking and other services. But cannabis would actually have more favorable federal tax treatment than alcohol and tobacco, which are subject to federal excise taxes on top of income taxes.

You may have not seen this from the GERS board…

The alternative path to liquidity will likely take the form of a distribution or other transaction under which the Company’s common shareholders of record are issued shares in another publicly-traded company at a premium to the Company’s current market price, subject to fulfillment of the required conditions and the blessings of counsel for all applicable parties. That transaction is likely to involve a pre-existing equity interest in Artizen Corporation.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=165779947

Slashnuts

01/29/24 12:04 PM

Post #52,823

PVSP Get's 15% Of Artizen GERS Get's 16.15%...

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=171002918

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=171691384

[color=red][/color]

The change in ownership was a guesstimate ( thinking out loud )

Oldrogue.

A dreamer poster who thinks Gers is getting Artizen shares and controls pvsp.

Change in ownership!?

T+1...I heard that.

"Slashnuts"?...GERS...I will look...I would not put it past them to say "grab your ankles"!...

Do not like; Jonathan D. Leinwand...at all!

Refresh my memory...who's Slashnuts?

Thanks....

Over a billion accumulated…getting ready for something? Changing ownership?

I do know at the end of May 2024 most markets if not all go to a T+1 settlement date.

Slashnuts mentioned GERS stock holders would possibly get shares in PVSP. It’s just a wait and see?

Oldrogue.

100milly to UR...

Held at DTC Shares Updated:

🔴 2,944,228,659 (2024-03-28)

🟢 4,019,170,696 (2024-04-26)

Difference: +36.5% (+1.1B)

was done a week ago but just posted or no?

TIA...

Senators Schumer, Wyden and Booker reintroduce Cannabis legislation!!!

Good video of them announcing they are reintroducing the Cannabis Administration and Opportunity Act and striking while the iron is hot. They feel they have the wind at their backs on Cannabis legislation and are going full steam ahead!!!

We may have broken the log jamb and things are going to happen very quickly now on the way to legalization of cannabis.

May 1, 2024

On Wednesday, Majority Leader Chuck Schumer (D-NY), Sen. Ron Wyden (D-OR), and Sen. Cory Booker (D-NJ) held a press conference about the Cannabis Administration and Opportunity Act.

Ok Thanks Shaker777!!

Feel better now!! LOL

Thanks to everyone posting!! Hahah

Whenever I visit this board, I ignore all posts by BJones

I know they are irrelevant pumping posts, mostly a copy&paste of irrelevant interviews with the vampire.

But it was interesting today to see someone writes Thanks BJones

As it triggered a question: How many aliases BJones created to admire his deserted posts?

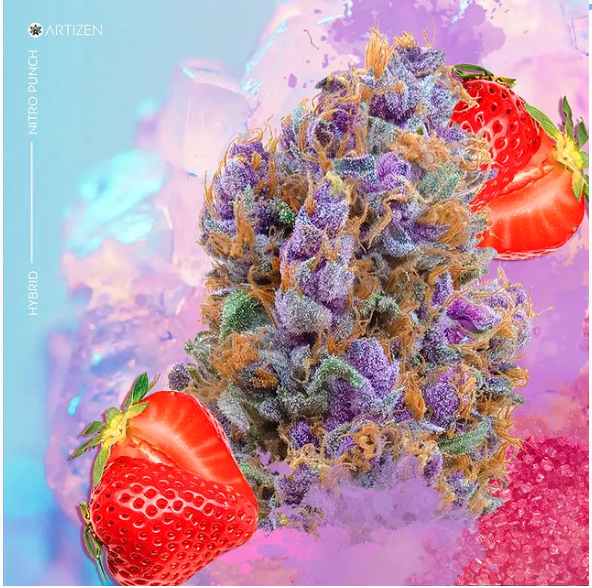

How about those New Artizen Hoodies & Tees !!

Look pretty Cool!

https://www.artizencannabis.com/shop

Pricella Ray has a bog on the New Site some good information on Cannabis.

https://www.artizencannabis.com/blogs

Majority Of Americans Say Marijuana Banking Bill Would Promote Public Safety And Help Underserved Communities,

Financial Association Poll Finds

Published on May 2, 2024By Kyle Jaeger

A strong majority of Americans agree that passing a marijuana banking bill would improve public safety, according to a new poll commissioned by Independent Community Bankers of America (ICBA).

The survey, conducted by Morning Consult, found that 64 percent of Americans feel the provisions of the Secure and Fair Enforcement Regulation (SAFER) Banking Act to allow cannabis businesses to access the banking system will “help improve public safety.”

A second question in the poll noted that some cannabis-related businesses are owned and led by people of color, women and members of the LGBTQ community, asking respondents whether “opening the banking system to cannabis-related businesses would help these underserved communities.” Fifty-four percent agreed.

CBD Can Help Treat Pain, Cancer, Schizophrenia, COVID And Other Conditions

As Senate leadership works to advance the legislation, which cleared committee last September, the ICBA poll that was released last week underscores that the proposal enjoys sizable public support.

ICBA has long advocated for the bipartisan cannabis banking legislation and commissioned several polls consistently demonstrating its popularity. The association’s president, Rebeca Romero Rainey, said in a press release that this latest survey featuring questions on cannabis banking and other policies of concern for the association shows that “Americans from coast to coast support our views on key policy issues.”

“With polling conducted by Morning Consult showing Americans understand the importance of these issues in ensuring continued access to locally based banking, ICBA is proud to continue helping community banks advocate in Washington and power the potential of local communities nationwide,” she said.

The polling is consistent with findings from a separate American Bankers Association (ABA) survey released last month that found 63 percent of Americans back cannabis businesses banking access, compared to just 17 percent who are opposed.

A prior ABA survey, in 2022, found 66 percent of people either strongly (37 percent) or somewhat (29 percent) supported marijuana banking reform, while 16 percent either strongly (8 percent) or somewhat (8 percent) opposed it. Nineteen percent of respondents last year said they didn’t know or didn’t have an opinion.

A separate ABA poll earlier in 2022 found that 68 percent of respondents felt Capitol Hill should act.

ICBA, meanwhile, also hosted a summit in Washington, D.C. this week, where House Financial Services Committee Chairman Vice Chair French Hill (R-AR) discussed ongoing bipartisan collaboration on a cryptocurrency regulations bill that certain lawmakers, including Senate Majority Leader Chuck Schumer (D-NY), hope will be merged with the SAFER Banking Act.

Hill said last week that he’d support a hybrid marijuana banking and cryptocurrency bill, saying “our country will benefit” if both reforms are enacted.

There have also been talks about attaching both measures to a must-pass Federal Aviation Administration (FAA) reauthorization bill. But those plans are meeting some opposition, with a Senate aide telling Marijuana Moment on Monday that Republican leadership is proactively opposing that possibility.

A spokesperson for Senate Minority Leader Mitch McConnell (R-KY) separately told Marijuana Moment that the senator, who is considered a legislative gatekeeper in the GOP caucus, “continues to oppose marijuana banking.” House Speaker Mike Johnson (R-LA) is also reportedly against the move to attach cannabis banking to the aviation legislation.

U.S. Senators Introduce Bill To Legalize Marijuana

A.J. Herrington

Contributor

I cover cannabis and hemp news, business, and culture.

May 2, 2024,09:33am EDT

A group of 18 Democratic Senators this week reintroduced a bill to legalize marijuana nationwide, only a day after news reports revealed that the U.S. government would reclassify cannabis under federal law. The legislation, known as the Cannabis Administration and Opportunity Act, was introduced in the Senate on Wednesday by Sen. Cory Booker of New Jersey, Senate Majority Chuck Schumer and Oregon’s Sen. Ron Wyden, with co-sponsorship by an additional 15 lawmakers in the upper chamber of Congress.

“It’s past time for the federal government to catch up to the attitudes of the American people when it comes to cannabis,” Schumer said in a statement about the bill. “That’s why we’re reintroducing the Cannabis Administration and Opportunity Act, legislation that would finally end the federal prohibition on cannabis while prioritizing safety, research, workers’ rights and restorative justice. We have more work to do to address decades of over-criminalization, particularly in communities of color, but today’s reintroduction shows the movement is growing, and I will keep working until we achieve meaningful change.”

The comprehensive legislation goes further that the Biden administration’s proposal to reclassify marijuana under the CSA that was advanced by the Department of Health and Human services last year. If approved by the White House Office of Management and Budget, the proposal would remove cannabis from Schedule I, the strictest classification that includes heroin and LSD, and instead place it under Schedule III, a group of drugs such as Tylenol with codeine and testosterone. I

n January, the U.S. Food and Drug Administration (FDA) determined that marijuana was eligible for reclassification after a review of relevant scientific data. On Tuesday, the Associated Press reported that the Drug Enforcement Administration had approved the bid to reschedule marijuana and ease restrictions on the drug under federal law.

“Our comprehensive Cannabis Administration and Opportunity Act doesn’t tell states what to do—but it provides them with the tools to effectively implement the laws their voters and legislators choose,” said Wyden. “Public health, public safety, opportunity and social justice must be at the core of any cannabis reform proposal, and it’s crucial stakeholders continue to have a seat at the table. I look forward to working with my colleagues and advocates across the country to make these priorities a reality.”

The comprehensive legislation goes further that the Biden administration’s proposal to reclassify marijuana under the CSA that was advanced by the Department of Health and Human services last year. If approved by the White House Office of Management and Budget, the proposal would remove cannabis from Schedule I, the strictest classification that includes heroin and LSD, and instead place it under Schedule III, a group of drugs such as Tylenol with codeine and testosterone. In January, the U.S. Food and Drug Administration (FDA) determined that marijuana was eligible for reclassification after a review of relevant scientific data. On Tuesday, the Associated Press reported that the Drug Enforcement Administration had approved the bid to reschedule marijuana and ease restrictions on the drug under federal law.

Looks like we have a NEW Website for Artizen?

Spin off must be getting close, new headquarters location and a New Website.

https://www.artizencannabis.com/

Well almost G ;)

$PVSP Everything is falling in place! 😉

$PVSP Everything is falling in place! 😉https://t.co/QYYMUed2z7

— Pervasip Corp (@PervasipC) May 1, 2024

PVSP on X - "Everything is Falling into Place" !!!

Pervasip Corp

@PervasipC

·

$PVSP Everything is falling into place

https://twitter.com/search?q=%24PVSP&src=cashtag_click

Today the MJ Sector got Great Long Awaited News and Many Companies Enjoyed a Great Day in the Market. $PVSP traded less than 2,900.00$ Can Management Bring this Back to Life... .0004 is Rough...2 Billion Share Reduction would Help?? U Approved it 07/2022... @PervasipC https://t.co/I2N2vk9s9L pic.twitter.com/aubTq0s4zg

— Urocka (@UrockaLife) May 1, 2024

Pot Stocks Surge on Report DEA Is Moving to Reclassify Marijuana

Carmen Reinicke, Bloomberg News

(Bloomberg) -- Shares of cannabis-related companies jumped Tuesday after the US Drug Enforcement Administration moved to reclassify marijuana to a less dangerous drug category in what would be a historic shift for the industry.

Tilray Brands Inc. jumped 40%, while Canopy Growth Corp. gained 79%. The MJ PurePlay 100 Index, which tracks the industry globally, rose 22%, the most since October 2022. Meanwhile, the AdvisorShares Pure US Cannabis ETF surged 25% and was halted for volatility in intraday trading.

Investors have been long awaiting DEA action on the reclassification of marijuana, which has been grouped with drugs such as LSD and heroin. Moving the substance to a different group would remove additional taxes that cannabis companies have to pay — a major overhang for the industry. The agency has been reviewing the classification for marijuana since September after a nudge from the Biden administration.

“There’s been a lot of rumors coming out in the last few days but this looks official,” said Dan Ahrens, managing director of Advisorshares Investments LLC, adding that this move from the DEA could start a domino effect. “I think it makes it easier for the House and Senate to act on SAFER Banking.”

The SAFER Banking Act would make banking and financial services more accessible for the industry.

Cannabis industry stocks have risen this year and even outperformed the S&P 500 Index as investors bought back into the beaten down names in anticipation of the DEA action. Still, pot stocks are trading at steep discounts to the highs hit a few years ago at the start of the cannabis boom.

Read more: WEED, MJ Beating S&P 500 as Cannabis-Reform Hopes Mount

In addition to removing extra taxes cannabis companies have to pay and therefore boosting cash flow, changing the classification could also help bring institutional investment to the industry, Jefferies analyst Owen Bennett wrote in a Tuesday note.

“The major reason current multiples are depressed is lack of institutional ownership,” Bennett wrote, adding that this is due to a combination of factors including major exchanges not listing cannabis stocks.

Reclassification could also prompt more states in the US to legalize marijuana, help destigmatize use and make it easier for the substance to be studied, according to the Jefferies note.

The move “would hugely improve the prospects of full federal legalization within the next 5 years, with a critical piece of this move making it easier to study cannabis and thereby fill in the data gaps where there may be concerns around its widespread use among the population,” said Bennett.

Of course, it’s not clear when the final word on the change could come from the DEA. In his note, Bennett said a rule could be published this week, while Needham analyst Matthew McGinley expects a scheduling announcement in the coming months, he wrote in a note.

“If enacted, rescheduling would be a significant federal reform and the most substantial incremental policy change regarding cannabis at the federal level in a century,” said McGinley.

The government is shifting Cannabis from Schedule I to Schedule III

Attorney general moves to reclassify marijuana as lower-risk drug, officials say

By Michael Scherer, Tyler Pager, Dan Diamond and David Ovalle

Updated April 30, 2024 at 2:45 p.m. EDT|Published April 30, 2024 at 1:55 p.m. EDT

The White House Office of Management and Budget must review the proposal from the Drug Enforcement Administration to reclassify marijuana. (Arin Yoon/for The Washington Post)

Attorney General Merrick Garland on Tuesday will recommend loosening restrictions on marijuana in what would be a historic shift in federal drug policy, according to multiple people familiar with the matter.

The measure, if enacted, would not instantly legalize marijuana at the federal level but could broaden access to the drug for medicinal use and boost cannabis industries in states where it is legal. The move may also prove to be a political win for President Biden, who is campaigning for reelection and has sought to ameliorate racial and criminal justice inequities wrought by the nation’s long war on drugs.

The Justice Department was scheduled to submit the formal recommendation to the White House on Tuesday. It follows the Drug Enforcement Administration’s approval of the Department of Health and Human Services recommendation that marijuana be reclassified.

The White House Office of Management and Budget must review the measure, according to the people familiar with the matter, who spoke on the condition of anonymity to discuss internal administrative matters. The measure, if accepted, would not go into effect for months until the public has a chance to comment.

The DEA’s approval was first reported Tuesday by the Associated Press. The DEA, the Justice Department and the White House declined to comment.

For more than five decades, marijuana has been classified as a Schedule I controlled substance with a high potential for abuse and no accepted medical use. Under the DEA’s proposed change, marijuana would go to the less-risky Schedule III — in the same tier as prescription drugs such as ketamine, anabolic steroids and testosterone.

The historic policy shift comes as marijuana is easier than ever to obtain and has become an industry worth billions in the United States. Thirty-eight states and D.C. have legalized medical marijuana programs, and 24 have approved recreational marijuana.

Biden administration plans to reclassify marijuana, easing restrictions nationwide

Cannabis is currently classified along with drugs like heroin and LSD. The DEA is expected to reschedule it into a category that includes Tylenol and steroids.

Since 1971, marijuana has been in the same category as heroin, methamphetamines and LSD.

April 30, 2024, 1:30 PM EDT / Updated April 30, 2024, 2:05 PM EDT

By Julie Tsirkin and Monica Alba

WASHINGTON — The Biden administration will take a historic step toward easing federal restrictions on cannabis, with plans to announce an interim rule soon reclassifying the drug for the first time since the Controlled Substances Act was enacted more than 50 years ago, four sources with knowledge of the decision tell NBC News.

The Drug Enforcement Administration is expected to approve an opinion by the Department of Health and Human Services that marijuana should be reclassified from the most strict Schedule I to the less stringent Schedule III, marking the first time that the U.S. government would acknowledge its potential medical benefits and begin studying them in earnest.

The Justice Department "continues to work on this rule," a Biden administration official said. "We have no further comment at this time."

What rescheduling means

Since 1971, marijuana has been in the same category as heroin, methamphetamines and LSD. Each substance under the Schedule I classification is defined as a drug with no accepted medical use and a high potential for abuse. Schedule III substances include Tylenol with codeine, steroids and testosterone.

By rescheduling cannabis, the drug would now be studied and researched to identify concrete medical benefits, opening the door for pharmaceutical companies to get involved with the sale and distribution of medical marijuana in states where it is legal.

For the $34 billion cannabis industry, the move would also eliminate significant tax burdens for businesses in states where the drug is legal, notably getting rid of the Internal Revenue Services code Section 280E which currently prohibits legal cannabis companies from deducting what would otherwise be ordinary business expenses.

The Department of Justice’s rescheduling decision could also help shrink the black market which has thrived despite legalization in states like New York and California and has undercut legal markets that are fiercely regulated and highly taxed.

Years in the making

President Joe Biden directed the Department of Health and Human Services in October of 2022 to review marijuana’s classification. Federal scientists concluded that there is credible evidence that cannabis provides medical benefits and that it poses lower health risks than other controlled substances.

Recommended

2024 ELECTION

Illinois governor's pro-abortion rights group sinks money into Florida ballot question

2024 ELECTION

Trump on political violence in 2024: 'If we don't win, you know, it depends'

Biden even made history at the State of the Union address this spring, for the first time referencing marijuana from the dais in the House chamber and making note of the federal review process. “No one should be jailed for using or possessing marijuana,” the president said during the speech.

When Biden served as Vice President in former President Barack Obama’s administration, the White House was opposed to any legalization of marijuana because it would “pose significant health and safety risks to all Americans.”

Jim Cole, who served as deputy attorney general in the Obama administration authored the now infamous Cole Memo in 2013 which paved the way for the modern marijuana market. The memo scaled back federal intervention in states that legalized marijuana, as long as they implemented “strong and effective regulatory and enforcement systems to control the cultivation, distribution, sale and possession of marijuana.”

Cole, who is now a member of the National Cannabis Roundtable, told NBC News in an interview this week that reclassifying marijuana to Schedule III would “open up the ability to actually test it and put it in a laboratory without all of the restrictive measures” of a Schedule I drug.

Kevin Sabet, president and CEO of Smart Approaches to Marijuana and a former Obama Administration advisor, said that the decision to reclassify marijuana is "the result of a politicized process," arguing that it "will be devastating for America’s kids, who will be bombarded with attractive advertising and promotion of kid-friendly pot products."

"The only winner here is the marijuana industry, who will receive a new tax break and thus widen their profit margins," said Sabet. “Reclassifying marijuana as a Schedule III drug sends the message that marijuana is less addictive and dangerous now than ever before. In reality, today’s highly potent, super strength marijuana is more addictive and linked with psychosis and other mental illnesses, IQ loss, and other problems.”

Researchers have raised concerns about high-potency marijuana and cannabis-induced psychiatric disorders, particularly young men.

Some challenges ahead

Once the DEA formally makes its announcement, the marijuana industry will see immediate benefit. But with the DEA’s proposed rule change comes a public review period that could lead to a challenge, and perhaps even a change, to the rescheduling proposal.

Once that public comment period has concluded and the Office of Management and Budget reviews the decision, Congress would be also able to overturn the rule under the Congressional Review Act, which gives the legislative branch the power to weigh in on rules issued by federal agencies. Democrats control the Senate with a 51-seat majority and for a CRA to be successful, two-thirds of the House and Senate would be needed to support it, meaning the marijuana rescheduling would likely survive.

Though cannabis remains a divisive topic on Capitol Hill, there has been growing support on a bipartisan basis for marijuana reforms, largely driven by the electorate. Nearly six in ten Americans say that marijuana should be legal for medical and recreational purposes, according to a Pew Research poll last month. Cannabis is legal in 24 states for recreational use.

Congress is considering its own bills

Congress is considering its own measures that would make it easier for legal marijuana businesses to thrive and would allow for more small and minority-owned shops to flood the marketplace.

The SAFER Banking Act, for example, would grant legal marijuana businesses access to traditional banking and financial services and could pass both chambers by the end of the year.

Lawmakers are also considering the HOPE Act, another bipartisan bill that would provide states and local governments resources to automatically expunge criminal records for petty, non-violent cannabis offenses.

There is also a Democratic-only effort to remove cannabis entirely from the Controlled Substances Act, empowering states to create their own cannabis laws and prioritize restorative and economic justice for those impacted by the War on Drugs.

But there is weariness among lawmakers who remember the last time Congress made law surrounding the drug.

The Republican-led Senate legalized hemp production in the 2018 Farm Bill, a decision that led to synthetic and exotic cannabinoids being sold over the counter, oftentimes without regulation, particularly in states where marijuana is not legal.

It’s a gray area that has earned pushback from both sides of the aisle, most recently with the rise of Delta-8: a synthetic THC product that uses chemicals — some of them harmful — to convert hemp-derived CBD into Delta-8 tetrahydrocannabinol.

Stick to talking about PVSP, those two you mentioned don’t belong here since this is a stock specific board, not a general Mary Jane board…

Wrong board? I hold a substantial amount of shares here, guess I have the right to be disappointed?

Some of the Marijuana stocks have been halted.

Complaints of trades not being made!

Oldrogue.

We may see an accelerated Artizen spin out?

Oldrogue.

https://www.marijuanamoment.net/

Finally!

Oldrogue

Rescheduling would eliminate Code 280E, allowing for credits or deductions!!

Were DEA to accept FDA’s current recommendation, it would have significant implications for state-legal cannabis businesses, though the rescheduling would not change the ultimate conflict between state and federal law with respect to the sale and distribution of cannabis and its derivatives.

For example, though rescheduling would not federally legalize these businesses, it would eliminate the burden of Internal Revenue Code 280E (IRC 280E), allowing state-legal cannabis businesses to take credits or deductions other than those for costs of goods sold. Currently, cannabis businesses cannot make these deductions because they are prohibited for businesses that are “trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act).”

DEA Cannabis Scheduling announcement as early as Today!!!!!

Officials with the nation’s top marijuana prohibitionist advocacy group say they are hearing that the results of the Drug Enforcement Administration’s (DEA) cannabis scheduling review will be announced “very soon,” possibly as soon as “today or tomorrow.”

Marijuana Rescheduling Announcement Coming ‘Very Soon,’ As Early As This Week, Opposition Group Says

Published on April 29, 2024By Kyle Jaeger

Officials with the nation’s top marijuana prohibitionist advocacy group say they are hearing that the results of the Drug Enforcement Administration’s (DEA) cannabis scheduling review will be announced “very soon,” possibly as soon as “today or tomorrow.”

DEA has spent the last eight months considering a U.S. Department of Health and Human Services (HHS) recommendation to move cannabis from Schedule I to Schedule III of the Controlled Substances Act (CSA). Now leaders of the organization Smart Approaches to Marijuana (SAM) say they’re seeing indications that DEA’s review is complete and will be revealed imminently.

“We’re hearing a lot of chatter—even as we’re having this podcast, I’m hearing from some sources that pro-marijuana Democratic senators are saying it’s very soon, as in today or tomorrow,” SAM President Kevin Sabet said during an interview on the organization’s “The Drug Report” podcast on Monday. “So it could be wishful thinking or not. I don’t know whether it will be coming as we as we talk. So, again, we’ll see.”

Rumors about the timing of a rescheduling decision have been swirling for months. But the sources of those rumors have been consistently pro-reform, making it all the more notable that this time it’s coming from a prohibitionist group that has advocated for keeping marijuana in Schedule I.

“We are hearing it’s going to come soon. It very well could happen this week,” Sabet said. “But it also could happen in three weeks. It could happen in three months. We don’t know.”

The SAM executive also reiterated his skepticism about the revised Food and Drug Administration (FDA) drug scheduling review process—a talking point that’s also been picked up by certain GOP lawmakers.

“One thing I have to say: Obviously sort of a glass half full-glass half empty way to look at this. Obviously, I don’t like [rescheduling] for many reasons, and we completely oppose it,” Sabet said. “But the glass half full, if you’re going to look at it that way—and I always think you’ve got to sometimes look at it that way, even if it’s overall not good, you don’t want it, you wanted a full glass of water—but if you have a half and you look at it that way, the goalposts have changed.”

Sabet said earlier in the interview that SAM has “some pretty decent intel that [the scheduling review is] moving through the process. There’s no doubt about it.”

He pointed out that past scheduling petitions have taken years to complete, only to have the government deny the asks to reclassify marijuana under the CSA. In this case, however, the scheduling review was directed by President Joe Biden. A DEA official also recently said it sometimes takes up to six months for the agency to complete its analysis of health officials’ recommendations—which is now less than how long it has now been since the agency began its current cannabis assessment.

SAM has long opposed even incremental marijuana reform, and it’s coordinated messaging with GOP lawmakers to discourage DEA from rescheduling marijuana. It’s also encouraged supporters to reach out to their congressional representatives to oppose rescheduling, marijuana banking reform and legalization proposals.

Last week, a coalition of 21 congressional lawmakers told DEA to “promptly remove marijuana from Schedule I,” while recognizing that the agency may be “navigating internal disagreement” on the issue.

That point references reporting in The Wall Street Journal that said DEA officials are “at odds” with the Biden administration over the scheduling review.

Marijuana Moment reached out to DEA about the status of its review multiple times in recent weeks, but representatives have not provided on-the-record comment. The White House has also so far declined to comment about the rumored timeline.

Meanwhile, the head of the Food and Drug Administration (FDA) says there’s “no reason” for DEA to “delay” making a marijuana scheduling decision.

Last month, HHS Secretary Xavier Becerra defended his agency’s rescheduling recommendation during a Senate committee hearing and also told cannabis lobbyist Don Murphy that he should pay DEA a visit and “knock on their door” for answers about the timing of their decision.

You who is waiting to collect the butter from the ant's belly...

You will never fry your eggs 🤣

Many thanks bj ... and also for the news you provide. Keep it coming!

oldroque: yes you’re correct on 3Q, thanks

PVSP fiscal year ends in November, 3 quarter is June, July and August. Check it if you would.

Oldrogue.

|

Followers

|

855

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

183865

|

|

Created

|

10/04/08

|

Type

|

Free

|

| Moderators jobynimble DSherman allenc | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |