Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Sector News:

Russia’s Buyout of Uranium One Positive Signal for Uranium Market

Thursday, January 31, 2013 At 06:37PM

http://www.uranium-stocks.net/home/russias-buyout-of-uranium-one-positive-signal-for-uranium-ma.html

Atomredmetzoloto’s (ARMZ) recent buyout of Uranium One (TSX:UUU) is the latest strategic move in Russia’s quest to dominate the world’senergy markets. The world’s largest producer of crude oil and second-largest producer of natural gas, Russia also holds demi-god status in the nuclear power industry and has aggressively been staking out a position in the uranium industry.

In 2010, ARMZ acquired a 51.4-percent majority stake in the Canada-based producer, which holds projects in Kazakhstan, Australia and the US. Earlier this month, the Russian company offered $1.3 billion to buy up the remaining shares; it plans to take the uranium miner private.

Investors have been hitting the message boards to share their thoughts on the deal, with many decrying what they view as too low a price at a time when most feel that the uranium market is at the precipice of an upswing. For others, the deal is yet another positive signal that industry heavies like Russia’s ARMZ know we’re at a bottom and the time is ripe for picking up assets at bargain prices.

“The whole sector is currently undervalued, and the timing by ARMZ is exceptional as they are buying assets at the bottom of the market,” Marin Katusa, chief energy investment strategist at Casey Research, explained to Uranium Investing News in an interview.

“It’s a smart move by the Russians in my view,” Mark Lackey, executive vice president of CHF Investor Relations, told Uranium Investing News. “They’ve determined by looking at the market conditions that uranium prices will go higher and right now is a very good time for acquiring assets.”

Parts of the sector are jumping... let's go!!!

Pricing news...

Uranium Price Gap Widens

http://uraniuminvestingnews.com/11849/uranium-price-gap-widens.html

Tuesday July 3, 2012, 1:09pm PDT IBTimes reported June was a slow month in uranium as the yellowcake remained largely untraded and the gap between buyers and sellers widened.

As quoted in the market news:

“Spot prices barely budged on the 15 transactions reported in June by industry consultant TradeTech, with sellers unwilling to drop their prices and buyers not willing to pay more.

With traders comprising the vast majority of both buyers and sellers in the bulk of the transactions reported over the past several months, TradeTech notes the spot uranium price remains stuck between the lack of committed buyers and what are fairly unmotivated sellers at current levels.

U308 related: Another Sign That A Nuclear Renaissance Is Inevitable - Oil Prices Rose 19% In 2011

January 3, 2012

http://seekingalpha.com/article/317065-oil-prices-rose-19-in-2011-another-sign-that-a-nuclear-renaissance-is-inevitable

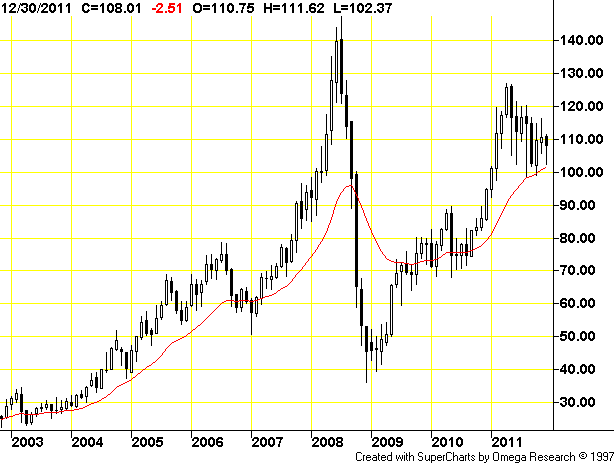

Oil prices rose 19% over the course of 2011, the third consecutive year marked by a rise in the price of oil. Below is the monthly chart of Brent Crude Oil that illustrates the clear uptrend.

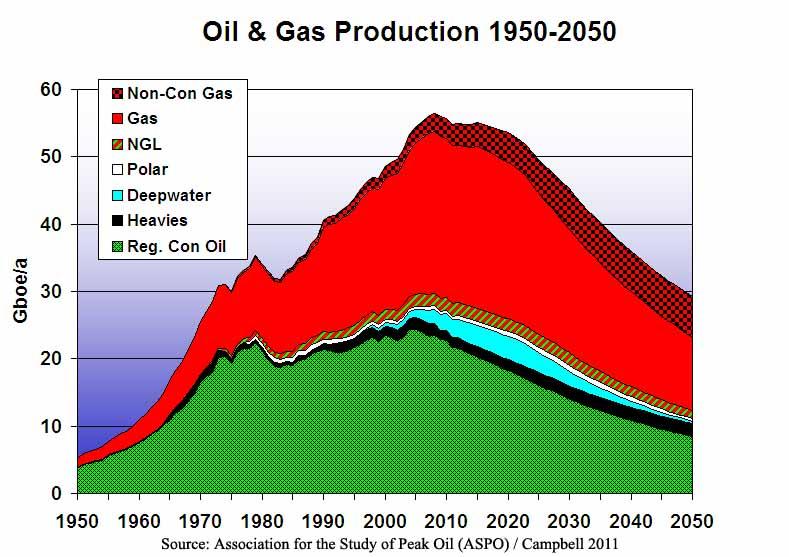

While currency devaluation, geopolitical tensions, and speculators are all forces that may be contributing to rising oil prices and greater market volatility, a growing factor that suggests the price rise will continue is the supply/demand imbalance in the oil market. In other words: demand for oil and other fossil fuels is only growing, but the supply of them is diminishing. The chart below illustrates.

While I believe the world will likely be using fossil fuels as a primary source of energy for some time, we are clearly at a point where a new source of energy is needed. I believe nuclear energy is the primary candidate destined to grow, for the following reasons:

1. It can provide "baseload" - meaning always on - energy

2. It is emission-free

3. It has high power density, which means it does not require an inordinate amount of land and thus is conducive to powering cities

4. It is inexpensive

No other source can really make these same claims. Wind and solar are much more expensive and cannot effectively provide baseload energy, which is precisely why they remain insignificant sources of power on a global basis. Technological breakthroughs may change this, though I don't see this on the horizon, and believe renewables will have limited roles in the global energy market until this changes.

And so, the rise of nuclear energy is virtually inevitable -- the world will demand it for survival. Accordingly, China already has 25 nuclear power plants under construction, and realizes that nuclear will be a key part of how its nation is powered as it increasingly urbanizes. Investors can recognize China as the "smart money" -- the force driving the market's demand and sending prices higher -- in the nuclear energy market.

Of course, this transition will not occur overnight - nuclear power plants take a long time to build - and so oil, coal, and natural gas will continue to play an important role in providing energy to the world. Investors will need to be patient, as this market may take up to a decade to really get going. The value network is still developing and much depends on how government participates and regulates the market, as well as what innovations entrepreneurs will develop as the market grows.

For now, the investment opportunity is simple: uranium. Nuclear power is most easily obtained through processing of uranium, and so uranium mining firms are the buy and hold opportunity for patient investors looking to participate in the nuclear renaissance. Uranium ETFs like URA as well as mining companies like Uranerz (URZ), Uranium Energy Corporation (UEC), and Cameco (CCJ) are plays that make sense from this perspective, with UEC being my favorite due to the adept leadership of its Amir Adnani - its founder and CEO with a background as a serial entrepreneur with a marketing focus - as well as the firm's focus on ISR mining which I regard as an enabling technology that will allow UEC to experience lower mining costs than traditional open pit mines.

As compelling as the uranium story is, I cannot overemphasize the need for patience. Nuclear energy is still not appreciated and the entire energy market is poorly understood. This represents a great opportunity for the educated investor, provided they have patience and conviction, and understand the economics of nuclear is really the only option barring some type of technological breakthrough that currently is nowhere in sight. As always, investors will find it to their advantage to focus on the actions of the smart money - which in this case is China - while ignoring short-term sentiment factors like the concerns about nuclear energy stemming from the Fukushima crisis.

While uranium remains the mineral to invest in and focus on, investors should also keep an eye out to see how Thorium develops. Thorium is a potential substitute for uranium in the production of nuclear power, and possesses less of a radiation risk - a common criticism of uranium. However, the value network for thorium is a bit undeveloped at the moment, and it does not appear that there is yet a "smart money" faction that can push prices higher. Thorium is also more a more expensive way of generating nuclear power, an obstacle I suspect will need to be overcome if thorium is to become a serious opportunity for investors looking to invest in the nuclear renaissance.

So get ready for a whole new energy paradigm as we move away from oil. Understand, though, the process will take time, and that the science and economics suggest the opportunity is nuclear energy unless there is some type of a big technological breakthrough. And of course, patience is your friend; while the economics will, as always, ultimately dictate what happens, the process can be slow. China is the one to watch, and so long as they are committed to the market, any sell-offs in opportunities to invest in nuclear energy, namely via uranium mining firms, constitute an opportunity to buy the dip.

Disclosure: I am long UEC, CCJ.

Pancontinental Uranium Corporation: Assay Results From Core Drilling Program; Buchanan Prospect, Chilling Project, NT

Press Release: Pancontinental Uranium Corporation – 18 hours ago

http://finance.yahoo.com/news/pancontinental-uranium-corporation-assay-results-184200198.html

U308 news: Canada reaches uranium trade deal with China

Thu Feb 9, 2012 10:16am EST

* Pact allows more Canadian uranium into China

* China fastest growing nuclear market in world

* Uranium to be used for civilian nuclear program

http://www.reuters.com/article/2012/02/09/canada-china-uranium-idUSL2E8D94O520120209

BEIJING, Feb 9 (Reuters) - Canada has reached a deal with China that will make it easier for Cameco Corp and other Canadian uranium producers to sell nuclear fuel into the fastest-growing market for atomic power.

The trade deal, announced on Thursday during Prime Minister Stephen Harper's visit to China, allows Cameco - the largest publicly listed producer - to sell uranium from its Canadian projects into China. Details of the agreement were not provided.

"This agreement will help Canadian uranium companies to substantially increase exports to China, the world's fastest growing market for these products," Harper's office said in a statement.

China currently operates some 13 nuclear reactors, with a total nuclear power output of about 11 gigawatts. The Asian country, which has 27 reactors under construction, plans to boost output to 80 gigawatts by 2020.

By contrast, the United States has 104 nuclear reactors.

Construction of reactors in China is expected to outweigh the decommissioning of plants in Japan, where reactors were taken offline in the wake of the Fukushima disaster last March, and in Germany, where the Japanese disaster led to a policy shift away from nuclear power.

In 2010, Cameco signed two deals with China to provide the country more than 50 million pounds of uranium over 15 years. Cameco has major uranium projects in Canada, the United States, Kazakhstan and Australia.

"We couldn't deliver Canadian uranium here until this agreement was signed so it opened the door for us to do that," said Chief Executive Tim Gitzel, who is part of a trade delegation visiting China this week with the Canadian prime minister.

Canada and China are working to finalize the text of the agreement and expect it to be completed within the next few months, according to the release.

Saskatoon, Saskatchewan-based Cameco, which will report its fourth-quarter earnings after market close on Thursday, plans to boost its uranium production to 40 million pounds a year by 2018.

Scoreboard for the week: +23.08%

Sector comps... they seem to be swimming in quicksand:

http://stockcharts.com/freecharts/candleglance.html?USU,URRE,URG,URZ,PUC.V,ATURF,DNN,UEC,URPTF,MGAFF,lbsr,sxrzf|B|H14,3

Buying the dip here. I've watched this stock for over a year waiting for a buying opportunity. We'll see how it goes.

And now turning north with the rest of the sector... comparables link:

http://stockcharts.com/freecharts/candleglance.html?USU,URRE,URG,URZ,PUC.V,ATURF,DNN,UEC,URPTF,MGAFF|B|H14,3

Spoke way too soon... the bottom here is a new 52 week low!

Good deal! Two things to look forward to!

Pancon/Crossland Announce Commencement of Drilling at Chilling Project, NT, Australia

Press Release Source: Pancontinental Uranium Corporation On Wednesday September 7, 2011, 6:30 am EDT

http://finance.yahoo.com/news/Pancon-Crossland-Announce-iw-1133582811.html?x=0

VANCOUVER, BRITISH COLUMBIA--(Marketwire -09/07/11)- Pancontinental Uranium Corporation (TSX-V: PUC.V - News) ("Pancon") and its 50:50 Joint Venture partner, Crossland Uranium Mines Limited (ASX: CUX.AX - News) ("Crossland") are pleased to announce a drilling program, consisting of approximately 100 RAB holes, has commenced in the Buchanan Window prospect at the Chilling Project in Australia. These RAB holes will be followed by 12 diamond drilling core holes at Buchanan commencing around mid-September. The total drilling is expected to be approximately 2,500 RAB metres and 2,400 metres of rotary/core drilling.

To view accompanying Figure 1, visit the following link: http://media3.marketwire.com/docs/PanconFigure1.jpg

The Buchanan Window is a key target area for mineral deposits of the Rum Jungle style. Rum Jungle has produced uranium and copper from unconformity style deposits, as well as base metals from strata-bound and remobilised deposits such as Woodcutters. The geological setting at Buchanan is also analogous to the Alligator Rivers uranium province that hosts the well-known Ranger, Jabiluka, Koongarra and Nabarlek uranium deposits. Pancon/Crossland's work at Buchanan over the past two years has disclosed good geological, geochemical and geophysical responses for these target types.

Drill targets have been defined by a combination of intensive stream geochemical sampling, geological mapping and detailed, ground-based spectrometer surveys completed during the previous two field seasons. Crossland has been successful in securing a grant of $100,000 from the NT Government under its Bringing Forward Discovery Initiative to assist with the core drilling program at Buchanan.

The drill program is expected to take approximately one month. Results should be available during the 4th quarter.

Pancon/Crossland will also be issuing an initial resource Rare Earth Elements (REE) estimate for the Charley Creek Project before the end of September.

All technical information in this release has been reviewed by Geoff Eupene, Qualified Person for Crossland and Pancon.

About Pancontinental Uranium Corporation

Pancontinental Uranium Corporation ("Pancon") is a Canadian-based company focused on uranium and REE discovery and development. Through a 50:50 joint venture with Crossland Uranium Mines Limited ("Crossland") of Australia, Pancon has established one of the strongest management teams in the uranium industry. This management and operating team has unparalleled experience from exploration, through development to operations, and includes people who were instrumental in the discovery of two of the largest uranium deposits in the world. Pancon and Crossland hold an impressive uranium and REE exploration portfolio with projects in prolific, mining friendly districts.

Active exploration is ongoing at three Australian projects which include Chilling, Charley Creek, and Kalabity. The Chilling project has the potential to host a mirror image of a portion of the renowned Alligator Rivers Uranium Field containing the large Jabiluka, Ranger and Koongarra deposits. Charley Creek has the potential for large, lower-grade, Rossing-type, granite-hosted uranium deposits and REE. The Kalabity project lies in a district of historic uranium/radium mining that contains a variety of known uranium deposit styles.

Pancon has earned a 50% interest in this significant uranium and REE project portfolio with Crossland through the expenditure of A$8 million. Pancon and Crossland are also pursuing exploration beyond Australia through an international subsidiary company, Crosscontinental Uranium Limited, and plans include formulating an exploration program in Burkina Faso.

ON BEHALF OF THE BOARD OF DIRECTORS

Rick Mark, President & CEO

For additional information, please visit our website at http://www.PanconU.com.

Cautionary Language and Forward Looking Statements

This press release may contain "forward-looking statements", which are subject to various risks and uncertainties that could cause actual results and future events to differ materially from those expressed or implied by such statements. Investors are cautioned that such statements are not guarantees of future performance and results. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure documents filed from time to time with the Canadian securities authorities.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contact:

Contacts:Pancontinental Uranium CorporationRichard MarkPresident and CEO604-986-2020 or 1-866-816-0118Pancontinental Uranium CorporationKeith PateyDirector of Communications604-986-2020 or 1-866-816-0118604-986-2021 (FAX)www.panconu.com

a big plus-moving in the right direction.particularly with drop in oil prices

It actually closed strongly at .195 UP on the Canadian exchange. That is .025 higher than the previus close!

down to .17 today-not bad considering the beating the markets have taken

Pancontinental Uranium UP 4 Cents Today. Closes at .23 on 44,400 shares traded today. I'm hoping Pancon will start its next big share price increase higher than .19 (the price it was at the day before its first big increase). If its higher, than maybe the close of its next big push will be higher too. :)

maybe it eliminates some internal conflict (that only some are aware of) so that now the company moves forward on something.

time will tell

Crossland Directors Resign from Pancontinental Uranium Board

At first I was suprised by this development. However, I noticed the Market was reacting favorably to it (price of PUC stock going up as of 12:16 P.M. EST). Nice day for a drum solo.

True, as well, there is a lot of activity in the background so news is just a matter of time.

volume is low-company needs some news

Sumi, glad you're still on board PUC.V. Hopefully the company will produce some exciting 43-101 resource numbers for the Charley Creek REE property and we can see another November 1,2010 huge price rise occur. :) Thanks for the compliment on my stock-picking. I'm looking at silver stocks but haven't found any that have any quality. They are either way over-priced or active in some part of the world that I wouldn't want to risk my money in.

EG, still in Pancontinental Uranium for the rare earth metals. But I was in the garden too much and did not post to remain as a moderator here.

Any investment with FuturesJackal as moderator should be considered a good sign for the stock. He will make the iBox into an elaborate, informative tool. It may take time, as he moderates so many boards.

Good luck to all of us in Pancontinental. You're correct, it is an Australian investment via a Canadian company. PLUS, even though the Japanese tragedy occurred, uranium will be needed as an alternative to Peak Oil and Global Climate Change.

Watch out for falling trees and look for great investments. You pick good ones.

Know of any cheap silver stocks?

sumi

thank you. I will watch this one

Welcome FuturesJackal! You're the moderator? What happened to mr. sumisu? He had been the moderator on this board.

Welcome stockguy1234 to the Pancon board! :) The main reasons I bought PUC.V was it gives me a foothold in Australia via Canada, very few shares outstanding (high leverage potential), and PUC's big REE discovery at Charley Creek!

Panco has a lot going on... watching closely!

Oversold chart makes me think a bounce may occur.

Very small share structure here.

It has only just begun!!!

Pancontinental Uranium completes $2 million financing today.

Dear Pancon Followers, I'm delighted to introduce to you, for the first time and by video interview, our Australian JV partner's Chairman, Mr. Bob Cleary. Bob is the former CEO of the Ranger Uranium Mine, still the second largest Uranium mine in the world. He was instrumental in putting together the Joint Venture that has resulted in Pancontinental owning 50% of the fast developing REE/U project at Charley Creek in NT, Australia, and 50% of the large and prospective advanced U project, Chilling, across the Alligator River Valley from the Ranger Mine, also in NT. The video interview, conducted by George Tsiolis of Agoracom, is about 15 minutes. That is a long "sit" these days, so I will try to make it a little easier for you by highlighting content that may interest you within the interview. You can move to segments as you wish, or settle in to spend 15 minutes with Bob and George. Here is a breakdown of the interview into segments, if you wish to go at your own pace. Open to 2:30 Introduction and the nature of the Heavy REE concentrate potential at Charley Creek. (Heavy REEs are in great demand worldwide). 2:30 to 3:45. Defining an alluvial REE deposit. (We are pursuing two at Charley Creek). 3:45 to 6:00 The short time frame to production possible at Charley Creek and the specifics of the three separate deposit types we are chasing there. 6:00 to 7:30 The challenge of focusing on three very large targets and details on the bedrock drilling at Cattle Creek and the size of the project. 7:30 to 9:45 Bob, as chemical engineer, discusses the opportunity to "get to a saleable product" quickly and looks at the logistical advantages these three deposit types offer investors. 9:45 to 11:25 George and Bob discuss the experience and expertise in the Pancon/Crossland JV management. 11:25 to 13:15 Bob discusses new metallurgical processes that will make us low cost and fast to market. 13:15 Quick summary of U projects and wrap up. I have said for the last four years that this management team is among the very best in the business. I'm pleased to have you meet the guiding hand behind the scenes, Crossland Chairman, Bob Cleary. And thanks to George at Agoracom for making it happen. We look forward to your feedback. You can access the video by visiting this link: http://www.smallcapepicenter.com/executive/AGORACOMPancontinentalUraniumSmallCapSkype-3May2011/ Best regards, Rick Mark President & CEO Pancontinental Uranium Corporation

Pancontinental Uranium Corporation: Crossland Recommences Drilling at Charley Creek, NT, Australia Testing REE Targets

Press Release Source: Pancontinental Uranium Corporation On Tuesday April 5, 2011, 6:30 am EDT

http://finance.yahoo.com/news/Pancontinental-Uranium-iw-451980356.html?x=0&.v=1

VANCOUVER, BRITISH COLUMBIA--(Marketwire - 04/05/11) - Pancontinental Uranium Corporation (TSX-V:PUC - News) ("Pancon") and its joint venture partner, Crossland Uranium Mines Limited (ASX:CUX - News) ("Crossland"), are pleased to update shareholders on the recommencement of drilling at Charley Creek, NT, Australia.

"Collaring the first drill hole at Cattle Creek"

Drilling at the REE Project at Charley Creek began March 31 near the site of the bedrock REE discovery announced March 9, 2011. The prospect has been named Cattle Creek.

The drill program, contracted by Crossland to specialist air-core operators, Budd Drilling Pty Ltd, will extend for six weeks. It is anticipated that over 8,500 metres of drilling will be completed in 250 to 300 holes, depending on depths to hard rock. The first 50 holes will be drilled to scope the area immediately around the REE discovery hole.

As of April 4, 2011, the first 25 holes of the program have been drilled. The first 271 samples were submitted to the laboratory on April 4. The turnaround on results is about four weeks.

The Cattle Creek Prospect was revealed by the re-assaying for REE of samples collected in a 2008 Crossland exploration program for uranium. Five metres of REE mineralization, which averaged 1.03% Total Rare Earth Oxides (not including Yttrium) from 37 metres, was identified in hole CCA121. Extensive stream sediment sampling results seem to suggest that the area warranting further testing covers approximately 40 square kilometres.

Following completion of the scoping drilling at Cattle Creek, the rig will move to the Cockroach Dam Prospect, where sampling of an alluvial resource will be advanced. The rig will collect samples from deeper alluvium than could be sampled using auger drills used earlier in the program. This drilling should finalize the field work required to produce an initial resource estimate from the Cockroach Dam Alluvial deposits.

The rig will then move to test a selection of the large areas of alluvial fans that drain north from the MacDonnell Ranges, where the Joint Venture hopes to define viable volumes and grades of REE to support a long term sand mining operation producing heavy minerals containing REE and zircon.

It is expected that by the time these three programs of drilling are completed, the results of the scoping drilling at Cattle Creek announced today will have been received, After those results are received, the rig will return to Cattle Creek for more scoping drilling.

REE markets and Charley Creek's potential

In Crossland's recent PowerPoint presentation to brokers and analysts in Australia, they were able to access current research from the US Department of Energy specifying the REE's that are in critically short supply around the globe in the short and medium term.

In the short term, they are Europium, Indium, Neodymium, Terbium, Yttrium and Dysprosium. In the medium term, they are Yttrium, Europium, Terbium, Neodymium, and Dysprosium.

The initial results at Charley Creek suggest that the REEs tend towards the heavy REEs which make up the shortfall lists from the USDoE.

To view the March 28 Crossland PowerPoint featuring current research on the REE market and detailed maps and images of the Charley Creek REE project go to http://panconu.com/Investors/Crosslandpresentationmarch2011/default.aspx.

All technical information in this release has been reviewed by Geoff Eupene, Qualified Person for Crossland and Pancon.

About Pancontinental Uranium Corporation

Pancontinental Uranium Corporation ("Pancon") is a Canadian-based company focused on uranium and REE discovery and development. Through a 50:50 joint venture with Crossland Uranium Mines Limited ("Crossland") of Australia, Pancon has established one of the strongest management teams in the uranium industry. This management and operating team has unparalleled experience from exploration, through development to operations, and includes people who were instrumental in the discovery of two of the largest uranium deposits in the world. Pancon and Crossland hold an impressive uranium exploration portfolio with projects in prolific, mining friendly districts.

Active exploration is ongoing at three Australian projects which include Chilling, Charley Creek, and Kalabity. The Chilling project has the potential to host a mirror image of a portion of the renowned Alligator Rivers Uranium Field containing the large Jabiluka, Ranger and Koongarra deposits. Charley Creek has the potential for large, lower-grade, Rossing-type, granite-hosted uranium deposits and REE. The Kalabity project lies in a district of historic uranium/radium mining that contains a variety of known uranium deposit styles.

Pancon has earned a 50% interest in this significant uranium and REE project portfolio through the joint venture with Crossland through the expenditure of A$8 million. Pancon and Crossland are also pursuing exploration beyond Australia through an international subsidiary company, Crosscontinental Uranium Limited, and immediate plans include formulating an exploration program in Burkina Faso.

ON BEHALF OF THE BOARD OF DIRECTORS

Rick Mark, President & CEO

For additional information, please visit our website at www.PanconU.com.

Cautionary Language and Forward Looking Statements

This press release may contain "forward-looking statements", which are subject to various risks and uncertainties that could cause actual results and future events to differ materially from those expressed or implied by such statements. Investors are cautioned that such statements are not guarantees of future performance and results. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure documents filed from time to time with the Canadian securities authorities.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Contact:

Contacts:Pancontinental Uranium CorporationRichard MarkPresident and CEO604-986-2020 or Toll Free: 1-866-816-0118Pancontinental Uranium CorporationKeith PateyDirector of Communications604-986-2020 or Toll Free: 1-866-816-0118604-986-2021 (FAX)www.panconu.com

Dear Pancon Followers,

Today, we sent out a news release to provide investors an opportunity to hear Geoff Eupene speak directly to our REE discoveries at Charley Creek. The link to the 6 minute interview with Australian Boardroom radio is below.

Our REE story is complicated and it is very, very big.

As you read in last week's release, the area we are exploring at Charley Creek is huge. That is fantastic regarding potential, but challenging to quantify at this early stage. We thought hearing Geoff's comments might clarify what we have already discovered and what is coming next. To add to that, in today's release we summarized Geoff's interview highlights in less technical language than was used in last weeks' release.

As you will hear and read, there is much news to come on the REE front in the very near future. The early results of the 700 auger drilling samples are expected shortly.

The markets closed well up off their lows today, so we are hopeful we are done with the plunge we all faced the last two days across the markets and particularly in U related stocks, like PUC. I was pleased to see the New York Times headline today that India and China will not be altering their nuclear power plans. And, today, I saw at least one analyst telling investors to look for buys in our space.

Our "game" is never easy. So many variables can come into play at any time and dramatic changes ensue.

Our corporate focus remains: Discovery at Charley Creek and Chilling in NT, Australia.

As always, I look forward to your comments.

Best regards,

Rick Mark

President & CEO

Pancontinental Uranium Corp.

Crossland CEO, Geoff Eupene, Interviewed on REE Results and Discovery Announcement

?

?Vancouver, B.C., March 15, 2011. Pancontinental Uranium Corporation (TSX-V: PUC) ("Pancon") is pleased to advise that Mr. Geoff Eupene, CEO of its joint venture (JV) partner, Crossland Uranium Mines Ltd. (ASX: CUX) ("Crossland"), and a Director of Pancon, was interviewed on Australian radio following last week's press release (March 9) describing the latest results of the JV's Rare Earth Elements (REE) alluvial sampling program and bedrock REE discovery. In the interview Mr. Eupene discussed the importance and significance of these results. The interview can be found at:

Boardroom Radio Australia (6 min) -? http://www.brr.com.au/event/preview/wfkoq3zp1q/77569

Pancontinental Uranium Corporation: High Value Rare Earth Elements ("REE") Stream Sediment Results and New REE Hard Rock Drill Intersection at Charley Creek Project

Release Source: Pancontinental Uranium Corporation On Wednesday March 9, 2011, 2:06 pm EST

VANCOUVER, BRITISH COLUMBIA--(Marketwire - 03/09/11) - Pancontinental Uranium Corporation (TSX-V:PUC - News) ("Pancon") and its joint venture partner Crossland Uranium Mines Limited ("Crossland") (ASX:CUX - News) are pleased to provide the following update on the latest results from their expanding (REE) exploration program at their Charley Creek project, 100 kilometres North West of Alice Springs, in the Northern Territory, Australia.

As well as continuing high value returns from stream sediment sampling at the project, Crossland, the operator, has discovered a new promising REE drill intersection in unweathered bedrock. The hard rock drill intersection points to a total area of over 40 square kilometres prospective for REE deposits.

The outstanding assay results to date from the stream sediment sampling, along with awaited auger drill results, have the companies on track to complete a resource evaluation later this year on an initial alluvial volume.

Pancon and Crossland believe that these results present opportunities for low cost production of a heavy mineral concentrate with high REE values from the large volumes of alluvial sediment deposits at Charley Creek.

Highlights:

http://finance.yahoo.com/news/Pancontinental-Uranium-iw-3514580986.html?x=0&.v=1

Japan asks Australia for rare earth supply

Published 2:28 PM, 11 Feb 2011 Japan looked to Australia on Friday for stable supplies of rare earths after China, the world's largest producer, temporarily banned exports to its neighbour after a territorial row.

China produces 97 per cent of the world's rare earth metals, used in high-tech electronics, magnets and batteries. Last year, it heavily cut export quotas, including a de-facto ban on shipments to Japan, and is raising taxes on overseas sales.

Japanese Trade Minister Banri Kaieda made it clear after talks with his Australian counterpart in Sydney that he wanted Australia to become a reliable, long-term alternative supplier.

"From my side, I have requested stable supplies of rare earths," Mr Kaieda told reporters. He did not elaborate, but Australian Trade Minister Craig Emerson added to reporters: "Our reputation as a stable and reliable supplier of minerals extends to rare earths."

China denies claims that it cut rare earths exports to Japan because of a spat that erupted in September over disputed islands in the East China Sea. Instead, Beijing says it needs to conserve more of its production to meet booming domestic demand. Exports to Japan were effectively suspended between late September and late November, but they rebounded in December.

The brief de-facto ban left Tokyo intent of securing other supplies.

Australia has an estimated 1.6 million tonnes of rare-earths reserves, according to the US Geological Survey, but the industry is still largely in the exploration phase.

China has half the world's known reserves, with 55 million tonnes, followed by the former Soviet Union with 19 million tonnes and the United States with 13 million tonnes.

Thanks for your continued updates, Energy Guy. I have been posting and reading less during my incredible winter of snow.

Things look great here though.

sumi

Pancon Issues More Info About 2011 Plans

The company issued a general overview and specific information on the Chilling Property namely that they intend to drill at least 11 holes this year based on all the preliminary work they have done on Chilling in 2010 and January 2011. If you wish to read the announcement in its entirety, please click this website link: http://www.panconu.com

PUC/CUX Boards To Meet In Sydney Australia Dear Pancon Followers, Today, I'm sending along excerpts from a fine analytical piece looking at Uranium today. As I'm sure you are aware, uranium is ascending again and the trend appears to be very much in our favour in 2011. I selected six pages from Australian based BGF Equities report on the uranium sector. I'd like to thank them for allowing us to use their information. (see link below) I think it is clear that the addition of our REE discovery at Charley Creek (see news release dated November 1, 2010 http://panconu.com/Newsroom/NewsReleaseDetails/2010/Pancon-Reports-Rare-Earth-Heavy-Mineral-Concentrate-Results-From-Charley-Creek-Northern-Territory1123042/default.aspx) provides shareholders a second commodity target that is also very much in favour with investors and with a real demand growth curve for 2011, and beyond. Next week, for the first time, the Boards of Pancontinental Uranium and Crossland Mines will meet in Sydney to plan 2011 and our future. We have now earned our 50% of the Charley Creek, Chilling and Kalabity projects in Australia and our relationship is now as full Joint Venture partners. We will meet to determine how best to execute, fund and promote the development of these very large and very prospective property packages. We are all looking forward to a productive meeting; I expect it will be very beneficial to us all. Our Australian partners have remarkable backgrounds in the uranium industry. Our properties are just beginning to be tested. I'm confident Pancon will emerge as a bigger, stronger player in these two ascending markets in 2011. Best regards, Rick Mark President & CEO Pancontinental Uranium Corporation To access BGF Equities Uranium Sector Analysis click here: http://panconu.com/Theme/Pancontinental/files/doc_downloads/Uranium_Report.pdf

Pancon's Board Of Directors Going To Sydney Australia To Meet With JV Partner Crossland's Board. (Lucky people!) :) Purpose? To plan best ways to maxamize shareholder value for all of 2011. They have a major REE discovery and substantial/prospective uranium lands to consider.

The Squeeze In Rare Earths What Happened: Germany's Economic Minister Rainer Bruederle urged visiting Chinese Vice Premier Li Keqiang to reconsider China's decision to further restrict exports of its rare earth metals. What It Means: Germany, along with other countries that rely on these metals for their high-tech manufacturing, is feeling the pinch as dwindling supplies drive up rare-earth prices. Why It Matters: Rare earth metals are an increasingly vital part of high-tech gadgets, from cell phones to microwaves to hybrid cars. China is sitting in the driver's seat with 97% of the world's supply, and knows it has a very valuable asset. China has been cutting back on exports for a few years now, so don't expect it to budge on its policy. This means the price of these metals is only going to go higher. Guess what Reader? PUCCF is in a truly great position because it has heavy rare earths (the most desirable), its deposits are shallow to on service, the rare earths are bound in phosphates which can be easily inexpensively separated, the deposit is wide spread on PUCCF's propery and the weather conditions are certainly better than Canada's frozen North. All these important factors will make Pancontinental Uranium the best REE explorer/soon to be producer in the whole world!

China cuts rare earth export quotas, U.S. concerned

A worker shovels cast-off tailings out of a channel underneath a pipeline that transports crushed mineral ore containing rare earths to a disposal dam near Xinguang Village, located on the outskirts of the city of Baotou in China's Inner Mongolia Autonomous Region in this October 31, 2010 picture.

Credit: Reuters/David Gray

BEIJING | Tue Dec 28, 2010 6:07pm EST

http://www.reuters.com/article/idUSTRE6BR0KX20101228?feedType=RSS&feedName=GCA-GreenBusiness&rpc=43

BEIJING (Reuters) - China said on Tuesday it will cut its export quotas for rare earth minerals by more than 11 percent in the first half of 2011, further shrinking supplies of metals needed to make a range of high-tech products.

China produces about 97 percent of rare earth minerals, used worldwide in high-technology, clean energy and other products that exploit their special properties for magnetism, luminescence and strength.

The rare earth issue could further strain U.S.-China ties, which have been battered this year by arguments over human rights, Tibet, Taiwan, the value of the Chinese currency and North Korean military attacks on South Korea.

Chinese President Hu Jintao is due to visit the United States next month for talks with President Barack Obama that both sides hope can stabilize the vital relationship.

Beijing says its curbs are for environmental reasons and to guarantee supplies to Chinese clean energy firms it is trying to promote internationally. But it has also said its dominance as a producer should give it more control over global prices.

China's Commerce Ministry allotted 14,446 tons of quotas to 31 companies, which was 11.4 percent less than the 16,304 tons it allocated to 22 companies in the first half of 2010 quotas a year ago.

China slashed the export quota by 40 percent in 2010. The export restraints on rare earths has inflamed trade ties with the United States, European Union and Japan in particular.

In Washington, the U.S. Trade Representative's office expressed concern over the latest announcement.

"We are very concerned about China's export restraints on rare earth materials. We have raised our concerns with China and we are continuing to work closely on the issue with stakeholders," a USTR spokeswoman said.

Last week, the trade representative's office said China had refused U.S. requests to end export restraints on rare earths, and the United States could complain to the World Trade Organization, which judges international trade disputes.

TURBINES AND HYBRIDS

Wind turbines and hybrid cars are among the biggest users of rare earth minerals, which analysts say are facing a global supply crunch as demand swells. The minerals are also used in some weapons systems.

This little-known class of 17 related elements is also used for a vast array of electronic devices ranging from Apple's iPhone to flat-screen TVs, all of which are competing for the 120,000 tons of annual global supply.

While industrial users of rare earths in industrialized countries face tighter supplies and higher prices, China's export curbs have created opportunities to open mines or revive dormant production in Canada, Australia and the United States.

After China's announcement, shares of Molycorp Inc, the Colorado-based company that owns a rare earth mine in California, rose as much as 11.6 percent.

But the headline-driven surge in a firm whose value has tripled since July proved only temporary, in part reflecting the fact that Molycorp's rare-earth mine in Mountain Pass, California, is due to come back online only late next year.

Canada alone has at least 26 publicly traded companies, including Great Western Minerals Group and Rare Element Resources, that have rare earth projects in some stage of exploration.

Jack Lifton of Technology Metals Research, a Chicago-based consultancy, said Molycorp and Australia's Lynas Corporation Ltd can eventually offset shortfalls from Chinese cuts in supply and refining capacity -- but not before early 2013.

"Until one of them can produce commercial quantities of high-purity rare earths on a regular basis, the market will belong to the Chinese entirely," he said.

In a short statement on its website (www.mofcom.gov.cn), the Chinese Commerce Ministry said it had added more producer companies to the quota list but cut volumes allocated to trading companies.

CLEAN UP, CONSOLIDATION IN CHINA

Japan has been hard hit by the export curbs. Japanese imports of rare earths shrank further in November, reflecting the impact from China's de-facto ban on shipments of the minerals that was lifted late last month.

The European Union has also expressed concern over China's limiting of rare earth exports, though the bloc's trade commissioner said earlier this month China had reiterated that rare earth supplies would be sustained.

With more than 100 mines and some 40 refineries, "the Chinese seem to be quite serious about cleaning up the sector environmentally and consolidating it," said Lifton.

Beijing has been trying hard to impose discipline on its chaotic rare earth sector and is expected to establish a rare earth industry association by next May, said Wang Caifeng, an official with the Ministry of Industry and Information Technology, speaking at a conference on Tuesday.

Tougher environmental regulations for the rare earth sector are also expected to be unveiled next year, the China Business News reported on Tuesday.

(Reporting by Niu Shuping, David Stanway and Michael Martina in Beijing; and Roberta Rampton and Paul Eckert in Washington; Editing by Vicki Allen, Will Dunham and Todd Eastham)

Sumi, your "Roar Metals" post is most excellent and timely! :)

Roar Earths

Submitted by Ryan Puplava CMT on Tue, 28 Dec 2010

http://www.financialsense.com/contributors/ryan-puplava/roar-earths

Rare earth metal miners were roaring this morning with many of the Market Vectors Rare Earth ETF component holdings up double-digit percentage points. On my daily volume breakout screen, 5 of the top 16 volume breakouts were in rare earth/strategic metals miners, including: China GengSheng Minerals Inc (CHGS), Avalon Rare Metals Inc (AVL), General Moly Inc (GMO), Rare Element Resources Ltd (REE), and REMX (the Market Vectors Rare Earth ETF itself). Those are just a few of the top volume breakouts across the U.S. markets. Here’s a list of holdings within the REMX ETF as per Bloomberg and their performance today:

Shares of many rare earth and strategic metals flew on Monday and Tuesday this week based on an announced rare earth mineral export quota cut from China, the largest producer of rare earth metals in the world. So what are the implications should the largest producer in the world restrict supply? Prices go up. It’s the same idea behind the oil cartels. Control the supply of a resource with inelastic demand and you have the setup to make substantial profits.

“China’s Commerce Ministry allotted 14,446 tonnes of quotas to 31 companies, which was 11.4 percent less than the 16,304 tonnes it allocated to 22 companies in the first batch of 2010 quotas a year ago.” (Source: Reuters)

Are Rare Earth Metals in a bubble?

On October 21st, Mark Smith, the CEO of Molycorp, was caught in a faux pas by calling the product his company produces, a bubble. “They (prices) are really spiked right now and there may be a bubble occurring because of all of the news and the frenzy.” He was referring to a short-term spike in prices last October in an interview with Fast Money on CNBC. He believes the long-term fundamentals will remain strong as China has made it clear they will continue to restrict supply; however, he believes that “when you see prices that are increasing by 600 or 700 percent in a 30-day period, you have to be very careful and make sure that you’re not making future business plans on those types of price increases.” This is the kind of prudent planning you see in the majority of resource company CEOs – it’s normal.

Short-term price spikes aren’t bubbles. They’re merely blow off excesses in speculation that drive up prices as supply gives way to the stronger of the two forces. Eventually, supply steps back in and you get a consolidation or reversal if demand has dried up. I think Mark Smith realized his mistake as his November 9th and December 21st interviews on Fast Money suggest he has reversed his comments, that there “isn’t a bubble in rare earth prices.”

The definition of a bubble, as defined in David Scott’s Investment Terms for Today’s Investor, is “a price level that is much higher than warranted by the fundamentals. Bubbles occur when prices continue to rise simply because enough investors believe investments bought at the current price can subsequently be sold at even higher prices. They can occur in virtually any commodity including stocks, real estate, and even tulips.”

All it takes to identify a bubble is common sense. Even though it’s clear to me that bonds are in a bubble based on net inflows into bond funds, the 30-year chart on interest rates, the debt levels of the United States, and inflationary expectations, it’s not clear when a bubble should or has burst until it has already happened. What I’m saying is, bubbles, trends, and bull markets can surprise to the upside and last as long as there’s somebody willing to pick up the tab at the end of trading. When the last dummy says, wait a second here, and a bid fails to appear, that’s when the game unravels.

Is there a bubble in rare earth metals? Well, the fundamentals are there. Everybody knows the story: China, producing 97% of the world’s production, is cutting that production and keeping it. What happens if China says, “Just kidding”? Well, then the game unravels, but until then…like Mark Smith said…China has made it clear they will continue to restrict supply; however, I hope you see just what the bull market in rare earth hinders on. If that fundamental story is gone, then the game unravels.

High rare earth prices are attracting investment outside of China. Supply will come on stream to meet demand. Capitalism demands it. China has a monopoly on production of rare earth metals, not the resource itself. World production was 124,000 metric tons in 2009. Molycorp said they’re currently producing 3,000 tons a year on existing stockpiles, but will ramp up when new ore from operations comes online in 2012. They are aiming for annual production of 20,000 tons by the end of 2012. Lynas Corporation is predicting it will plan 11,000 tons a year, but with further investment, they’re looking to double that production by the end of 2012. Unless China has plans to expand its production, while restricting it at the same time, China’s 97% market share on world production of rare earth elements will fall. Do you see the conundrum that rare earth bulls will be facing in a year or so?

Source: www.Nikkei.com

Do I believe that rare earth metals are in a bubble? The answer is yes as price is artificially being lifted by China’s control of the resource. For now, the fundamentals are pointing towards higher prices until market forces increase world supply to match China’s cuts. Because unless China stops cutting production as other production sights go online, they will lose market share and control.

The story behind buying rare earths at today’s price, is you believe China will make an announcement tomorrow, or the day after (metaphorically speaking), they’re going to cut supply again or demand will increase. Efficient market theory tells us that yesterday’s cut is already priced into the market today. It’s likely that China will continue to cut production over the next year. They will continue to have a monopoly for a while longer; however, capitalistic forces are clearly at work as Molycorp’s IPO in addition to Sumitomo’s investment nearly financed all of Molycorp’s plans to bring the Mountain Pass project back online. Lynas Corporation, about the same market cap as Molycorp, has plans to increase production as well. If supply increases faster than demand increases, price falls. It’s simple economics.

Rare earth mining is an area I’m invested in. The rare earth story has been out for a while since China announced plans to cut production of rare earth elements in April of 2009. So I’m not talking out of a bearish bias, having missed the run - on the contrary. I’m invested now, but eventually, I plan to get out when capitalist forces create enough supply to satiate demand. Natural gas at $11.88—uranium at $138—oil at $147; eventually, price demands supply. Just ask the Japanese steel industry how much rare earth gets smuggled out of China each year in their steel beams. Price always gets what it wants.

EG, thanks for the info!

sumi

Dear Pancon followers, Today's release from Australia summarizes our progress in developing the REE opportunity at Charley Creek. Geoff Eupene has provided a detailed statement of the status of the program to date and also describes the processes he is using to analyze and develop this REE discovery. The REE discovery is at surface and the timeline to understanding what we have is very short. As you will read, an REE production scenario is part of the 2011 business being contemplated. You can expect a thorough update on the Chilling Project, including 2011 plans and results from the U drilling at Charley Creek, in January. Best Regards, Rick Mark CEO Pancontinental Uranium Corp. RARE EARTH ALLUVIAL SAMPLING PROGRAM AT CHARLEY CREEK, NT, PROGRESSING WELL; OVER 200 SAMPLES COLLECTED Vancouver, B.C., December 21, 2010. Pancontinental Uranium Corporation (TSX-V: PUC) ("Pancon") and joint venture partner Crossland Uranium Mines Ltd. (ASX:CUX) ("Crossland") are pleased to update shareholders on the rare earth alluvial sampling program from the Charley Creek Project, Northern Territory, Australia. Highlights The accelerated two-part, Phase One Rare Earth Elements (REE) alluvial sampling program is progressing on schedule; over 200 samples collected to date. Results of the Phase One program on the REE program are expected early in 2011. Assuming these results prove positive, an evaluation leading to Resource definition is planned to commence immediately, with the aim of being completed by late in 2011 on an initial alluvial volume. Background On November 1, 2010, Pancon and Crossland announced that extensive alluvial deposits have been identified in their Charley Creek Project, and that these deposits contained heavy minerals with rare earth elements (REE). These REE are present in phosphate minerals that should be readily processible using available REE extraction technology. The heavy mineral concentrate produced from the initial Charley Creek tests weighed approximately 2kg and contained grades and proportions of individual REE as indicated in the following table. The concentrate was produced from panning approximately 400kg of alluvium, followed by removal of the magnetic minerals from the sample and a TBE heavy liquid separation.

|

Followers

|

4

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

85

|

|

Created

|

04/20/10

|

Type

|

Free

|

| Moderators | |||

Pancontinental Uranium Corporation ("Pancon") is a Canadian-based company focused on uranium discovery and development.Through a 50:50 joint venture with Crossland Uranium Mines Limited of Australia, Pancon has established one of the strongest teams in the uranium industry. The joint venture is led by a management and operating team with unparalleled experience from exploration, through development to operations, and includes people who were instrumental in the discovery of two of the largest uranium deposits in the world.

Fact Sheet - September 2010 & Crossland Presentation - March 2011 |

If you found this i-Message/i-Box to be helpful, please leave a Followmark/Boardmark... Thanks!!! |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |