Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

TOKYO, May 10 (Reuters) - Japan's Panasonic Holdings Corp on Wednesday said it expects net profit to rise to a record high this year on robust auto battery sales and a hefty tax credit in the United States.

The industrial conglomerate, which supplies batteries to U.S. electric vehicle (EV) leader Tesla Inc, is expanding its energy business just as persistently high inflation rates worldwide dampen consumer sentiment.

Panasonic Holdings Corporation (PCRFY)View quote details

Other OTC - Delayed Quote (USD)

9.76+0.10(1.04%)

At close:3:59PM EDT

Add to watchlist

1D5D1M6MYTD1Y5YMaxFull screen

Panasonic predicts net profit will grow 32% from a year earlier to a record 350 billion yen ($2.59 billion) as it expects a tax credit for EV battery operations under the U.S. Inflation Reduction Act to boost its bottom line by 100 billion yen.

The net profit outlook would be up 23% from the prior record for net profit of 284.1 billion yen, set in the year ending in March 2019.

The company sees operating profit of 430 billion yen for the year through March 2024, versus 288.6 billion yen a year earlier. That beats the 383.96 billion yen average of 20 analyst estimates compiled by Refinitiv.

For the fourth quarter of the year ended March 31, Panasonic posted operating profit of 54.4 billion yen. That compared with 83.4 billion yen a year prior and the 59.49 billion yen average of 12 analyst estimates.

(Reporting by Kiyoshi Takenaka; Editing by Christopher Cushing, Muralikumar Anantharaman and Sharon Singleton)

Makes sense, I too have been here for a couple of years, currently underwater but hopeful for the long term.

I do not like the reports that suggest the company "might or could" build a battery factory in the US, they either are or not. I am sure we can all handle the truth.

Its a weekly chart. This is a long term hold for me. Not getting there today, just pointing out some levels. Needs to close above that $9.57 first.

Why aren't message boards productive anymore?

Why would that be? I do not see any earthquake news.

We should be getting a huge increase with the new battery solutions.

Ford is a Major buyer of Panasonic Batteries.

$PCRFY

$MNXXF Close Prices Last 3 Months Price/volumes not adjusted for restructures

Date Ex Sym Open High Low Close Chg Vol #Tr Bid Ask

2022-03-08 Q MNXXF 0.221 0.2358 0.221 0.2347 0.0137 28,771 16 0.221 0.24

2022-03-07 Q MNXXF 0.2231 0.22545 0.221 0.221 -0.01 76,409 24 0.2007 0.24

2022-03-04 Q MNXXF 0.22845 0.2345 0.2255 0.231 -0.009 35,186 11 0.2231 0.24

2022-03-03 Q MNXXF 0.234 0.24 0.22 0.24 0.0052 165,911 35 0.20 0.2694

2022-03-02 Q MNXXF 0.23 0.23615 0.2269 0.2348 0.00505 22,337 15 0.20 0.2449

2022-03-01 Q MNXXF 0.24645 0.2499 0.225 0.22975 0.00175 97,300 25 0.20 0.2695

2022-02-28 Q MNXXF 0.25 0.25 0.22235 0.228 -0.004 36,968 16 0.229 0.245

2022-02-25 Q MNXXF 0.224 0.2364 0.224 0.232 0.0032 10,505 9 0.23 0.2541

2022-02-24 Q MNXXF 0.2251 0.231108 0.215 0.2288 0.0056 102,846 39 0.20 0.231

2022-02-23 Q MNXXF 0.2215 0.23255 0.2215 0.2232 -0.0043 13,138 9 0.22 0.2664

2022-02-22 Q MNXXF 0.22 0.24362 0.22 0.2275 -0.005808 95,107 29 0.2163 0.241

2022-02-21 Q MNXXF 0.2432 0.2446 0.230824 0.233308 -0.007892 0 0

2022-02-18 Q MNXXF 0.2432 0.2446 0.230824 0.233308 -0.007892 54,350 17 0.221 0.27

2022-02-17 Q MNXXF 0.2481 0.2489 0.24 0.2412 -0.0048 19,001 11 0.221 0.2699

2022-02-16 Q MNXXF 0.2398 0.24656 0.2355 0.246 0.0065 190,813 50 0.235 0.27

2022-02-15 Q MNXXF 0.2427 0.2481 0.23355 0.2395 -0.0093 76,500 32 0.23 0.27

2022-02-14 Q MNXXF 0.2422 0.25 0.24 0.2488 0.0007 74,950 21 0.22 0.27

2022-02-11 Q MNXXF 0.2512 0.25819 0.24329 0.2481 -0.0114 30,687 16 0.24 0.27

2022-02-10 Q MNXXF 0.26879 0.26879 0.2592 0.2595 11,130 14 0.2544 0.27

2022-02-09 Q MNXXF 0.245 0.2689 0.245 0.2595 0.0047 43,400 15 0.255 0.27

2022-02-08 Q MNXXF 0.25 0.264025 0.24277 0.2548 0.0048 43,758 12 0.255 0.27

2022-02-07 Q MNXXF 0.245 0.2532 0.2436 0.25 -0.00462 93,314 18 0.24 0.27

2022-02-04 Q MNXXF 0.2496 0.257088 0.2468 0.25462 0.00042 47,180 17 0.245 0.264

2022-02-03 Q MNXXF 0.2556 0.2602 0.24885 0.2542 -0.00784 69,891 24 0.235 0.27

2022-02-02 Q MNXXF 0.27 0.27 0.2593 0.26204 -0.00696 84,915 21 0.255 0.27

2022-02-01 Q MNXXF 0.2543 0.269 0.245 0.269 0.0284 91,506 38 0.2528 0.27

2022-01-31 Q MNXXF 0.2459 0.2459 0.232368 0.2406 0.0006 56,150 19 0.236 0.2476

2022-01-28 Q MNXXF 0.2261 0.245 0.2253 0.24 0.0131 93,394 58 0.22 0.2459

2022-01-27 Q MNXXF 0.25 0.26 0.2269 0.2269 -0.0231 228,122 41 0.2246 0.2496

2022-01-26 Q MNXXF 0.244 0.30 0.244 0.25 0.0328 546,043 57 0.2452 0.27

2022-01-25 Q MNXXF 0.20265 0.22775 0.20265 0.2172 0.0174 51,807 31 0.2019 0.25

2022-01-24 Q MNXXF 0.20 0.2145 0.1896 0.1998 -0.0112 710,276 147 0.197 0.215

2022-01-21 Q MNXXF 0.2153 0.2243 0.2056 0.211 -0.014 115,154 43 0.2048 0.2244

2022-01-20 Q MNXXF 0.22519 0.226568 0.2235 0.225 -0.002 18,170 13 0.223 0.2295

2022-01-19 Q MNXXF 0.213 0.254 0.213 0.227 -0.00576 86,778 32 0.223 0.2394

2022-01-18 Q MNXXF 0.2422 0.2422 0.2265 0.23276 0.00636 175,076 59 0.221 0.2481

2022-01-17 Q MNXXF 0.22095 0.229 0.22095 0.2264 -0.0064 0 0

2022-01-14 Q MNXXF 0.22095 0.229 0.22095 0.2264 -0.0064 23,341 19 0.211 0.2314

2022-01-13 Q MNXXF 0.2338 0.2346 0.227 0.2328 0.0003 43,719 14 0.227 0.2519

2022-01-12 Q MNXXF 0.2337 0.2368 0.218475 0.2325 0.0025 62,670 42 0.2099 0.236

2022-01-11 Q MNXXF 0.23

See the Full Article

Click Here and Get Ready!

Panasonic is one of Fords Go to for EV Batteries.

$PCRFY

Panasonic to begin production of 4680 Li-ion cells for EVs in FY 2023

01 March 2022

Panasonic to begin production of 4680 Li-ion cells for EVs in FY 2023

Panasonic Corporation announced that its Energy Company will establish a production facility at its Wakayama Factory in western Japan to manufacture new, large 4680 (46 millimeters wide and 80 millimeters tall) cylindrical lithium-ion batteries for electric vehicles (EVs).

Tesla unveiled a 4680-format prototype cell in 2020. This next-generation cell features a cylinder more than twice the diameter of the 2170—and a capacity about five times as large. (Earlier post.) Since then, battery makers have been working been working on production versions of a 4680-format cell (e.g.earlier post).

Panasonic unveiled its 4680 cell last October.

$PCRFY!

I'm going to pick up some more tomorrow.

GLTA

$PCRFY

Battery Orders on the Way!

$PCRFY

Panasonic is quietly going to sky rocket, and has held it own in this recent market correction.

$PCRFY

From the information that I have gathered.

It appears that $PCRFY will be supplying EV batteries to Ford.

$PCRFY

If the EV sector continues to build $PCRFY will stay with it.

$PCRFY

This will be a 2022 and beyond Stock to have.

$PCRFY

Ford Uses $PCRFY for one of their EV Battery Suppliers.

All types of Lithium iON Batteries are going to be on the radar this year, as many people are going off the grid and changing their vehicles in for EV.

$PCRFY

Yes we will get there!

$PCRFY

Someday it will break $16 and goes beyond

Panasonic is as steady as they go.

$PCRFY

Nice Steady Price Climb.

New Products are going to be explosive!

$PCRFY

Imagine stopping in at an EV charging station and have your car's batteries charged in the time it would take to fill it with gas. Thats a big reason why I bought. And freezer technology for vaccines as they hold the exclusive contract for providing those for all of Japan. Thinks look very bright soon for Panasonic.

Looking forward to news on Panasonic's Quantum Glass Battery. Hard to find information on it. This would be disruptive and a great money maker if it actually performs to it's touted capabilities.

Holding strong!

$PCRFY

We did it again!

Panasonic Rockin'

$PCRFY

Not bad up 3% the day I bought it!

GO $PCRFY

Looks Like we got a bit of a spike as soon as I purchased some shares.

$PCRFY!

Gonna Get Some Panasonic Tomorrow!

$PCRFY

Ride Ride Ride Would you let it Ride!

Get On the Panasonic Wild Train Ride and let it Ride!

$PCRFY

Panasonic Stock is about to go Parabolic

With The EV Battery Sales!

$PCRFY

$PCRFY : Upswing at $10.61.... GigaFactory turns profit

https://www.teslarati.com/tesla-tsla-700-panasonic-battery-update-wall-st-upgrade/

GO $PCRFY

And I know Tesla has been getting fewer batteries from them, but still the price is slaughtered. The company gots a lot more then batteries though.

I understand this is probably not going to get answered legitimately. But any reason this has been going down since last March? Price looks historically low that doesn't mean they are low though! Wall street feels like it is always my best answer.

Thanks for reply . . . maybe Pan keeps the NV Gig factory relationship going for now as way to keep a foot in USA market?

I spent hours deciding what to do with Pan and I stayed in . . . LT as I am in near the present stock price range.

PAN could get bot out or broke up . . . either way its the type of company (like GE and F) that is not planing to die just yet. Its no Sears or Pennys. Lets see if Japanese government throws them some contracts to keep their workers employed.

Power, Looks like you should have bailed yester-

yesterday (Thurs).

Panasonic is semi-pulling the plug

at the Nevada, USA gigafactory. Not

gonna pump another $2Billion into

albatross Tesla.

That should have pumped the stock up.

But instead have today's disaster.

I spent hours today trying to decide if I should stay in Pan Sonic . . .

I decided to for now.

The very recently PR wherein Pan and TOY have joined forces to find a way forward in new tech/business projects like battery tech, IOT, home robot companions, and new tech homes in Japan (as a start); means they have read the surviving going forward 'handwriting on the wall'.

Smooth Move by PS . . . as TOY partner is on The White List of foreign companies allowed to sell battery tech in China.

Along with ERIC, PS is experimenting in Colo USA to test a highway/road system that can communicate and pick up vehicle data that is two-way useful for auto safety AND relays travel quality info that is salable to governments and businesses via the Deep Learning AI Cloud.

PS has (I believe that's correct) the right at the NV Giga Factory site to produce and sell excess battery production therein, to anyone in USA it choses to? That little factor means it can still chose to increase battery production in USA, any time anyone else decides to use its battery cells for other EV uses (and still provide Tesla Power Walls battery cell units) also. Not bad Options for PS to hold on to, state-side?

Is PS still going to produce solar cells back in Eastern USA with Tesla? Based on the above . . . I do not see PS going out of business, but rather able to function efficiently as a world class business.

TA wise, is PS bottoming pattern displaying?

How Tariff Wars affect all this . . . who can tell.

Other comments on whether one thinks PS can use NA battery cell plant to sell to all the Americas would be appreciated.

One deciding factor herein could be how the USA economy holds up in coming quarters. Or . . . what better way to get business in Li southern Americas raw materials business . . . but to also offer to produce PS battery power cells therein domestically?

Such a little trick could easily be offered to pull away from

China and NK strategic materials sourcing 'problems'.

Food-for-thought about how to brighten up Free World rare metals supply issues and jointly help our southern neighbors economies.

This is a great company and batteries (rechargeable are a big thing).

That said . . . Ultra Caps are also a focus of Pan Sonic and robotics.

Pan could buy out Tesla Wall business plant and go its own way in USA based business. Its an open question if Tesla will be in EV USA market

unless they build their EVs in China and ship to USA . . . lets see how the battery business goes. Japan and India are forming strong ties and

why would India develop its own batteries, when Pan has superior ready to go batts?

I don't think batteries are that huge a deal.....and neither does the Market :

You're fooling yourself if you think that they are....(a huge deal) . . . .

You'd be better off purchasing just a whole bunch of pencils.

x

x

x

Last time I posted on this board it was at $12.oo

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=143109842

Sorry Volle Kraft

Ok so why aren't share prices reflecting your world full of nothing but "positive facts" ?....LoL

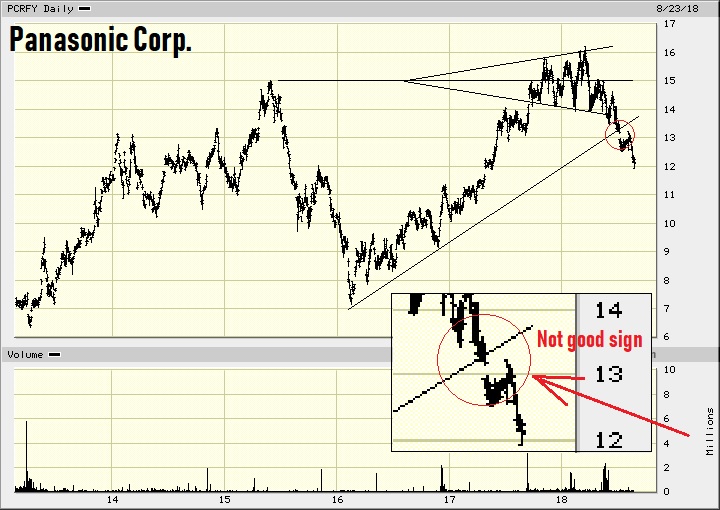

I've been negative now on this stock for about 8 months, warning of the $15 dollar resistance level and of the (bearish) Broadening Top

That down-gap was pointing to further declines - Same as Orocobre's gap was

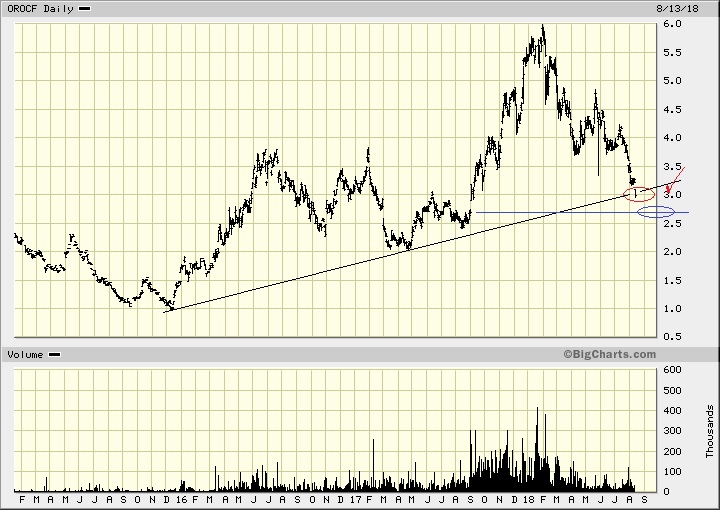

This is Orocobre 10 days ago (it's on its' way to my 2.75 Target).....It just down-gapped thru a line as well ! . . . . ha

And you bought 3 weeks ago up at 3.50 ? ....Ha ! You should learn how to read CHARTS billyboy !

Learn how to listen to what the markets are saying.....instead of listening to what all the various media sources are "pumping out".

Screw that Joe Lowry man - He don't know squat

Neither of you listen to what the markets are saying...

https://twitter.com/globallithium

That's all simply old-fluffy-bubble-pop gum

!

.....

Has nothing to do with the facts (ie share price)

|

Followers

|

12

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

402

|

|

Created

|

04/10/11

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |