Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Peak Oil Review: 11 March 2019

By Tom Whipple, originally published by Peak-Oil.org

https://www.resilience.org/stories/2019-03-11/peak-oil-review-11-march-2019/

GRAPHIC OF THE WEEK

Quote of the Week

“All the climate arguments are real, urgent and important.” Spencer Dale, group chief economist at supermajor BP, told the Washington Post.

1. Oil and the Global Economy

The struggle between declining economic growth and falling oil supplies continued to affect oil prices last week. The failure of a significant portion of Venezuela’s electricity grid has already been a significant blow to the country’s roughly 1 million b/d of oil production, and the situation seems likely to get worse. However, part of this decline could be offset by the return to production of Libya’s 300,000 b/d Sharara oilfield after being offline for three months.

There was mixed economic news last week. The US jobs report does not bode well for the future, and China’s exports were some 20 percent lower last month than in 2018. This news was offset by talk of a settlement to the US-China trade dispute later this month. These factors balanced each other off resulting in London futures falling about 1 percent to $65.74 and New York futures climbing by a similar amount to close the week at $56.07.

The major domestic news for the week was the announcement by Chevron that it plans to increase its production from the Permian Basin by 900,000 b/d in the next five years and a similar statement by Exxon that it will expand its Permian output by 1 million b/d. These announcements came in response to a Wall Street Journal story that US shale oil production is starting to falter due to wells being drilled too close together.

For the next few weeks, the course of the Venezuelan power outage and the US-China trade talks could impact oil supplies and prices. Should Venezuela’s multiple problems lead to the loss of a major part of the country’s exports, then oil prices will likely move higher. Coupled with the OPEC+ production cuts, signs that the rapid growth of US shale oil production may be about to slow, and even the furor over Brexit, we may be on the verge of geopolitical changes that will affect the oil markets before the year is out.

The OPEC Production Cut: Russia plans to speed up oil output cuts this month, and by the end of the month it will bring its oil production cut to 228,000 b/d from the October level. Energy Minister Novak told reporters on Monday “We have an understanding that in March there will be higher compliance rate than in previous months.” Moscow maintains that the extreme cold in which most of its oil is produced prevents it from cutting production in the winter without damaging its equipment and oil fields.

US Shale Oil Production: Last week began with a report in the Wall Street Journal that the “shale companies’ strategy to increase oil and gas production by drilling thousands of new wells more closely together is turning out to be a bust.” Not only is less oil than expected coming from wells being drilled too close to an older well, but the production from older wells in the vicinity of the new ones is “threatening the US oil boom and forcing the maturing industry to rethink its future.” The practice of bunching wells in close proximity to other wells has been going on for some time, but now we have the prestigious Wall Street Journal, which is read carefully by lenders to shale drillers, alleging that the practice has become so widespread that it threatens the industry.

The Journal, which has verified the problem by examining production reports for thousands of recently drilled wells, says that engineers are warning that the new “child” wells could produce as much as 50 percent less oil than more widely spaced wells. These “child” wells, however, cost the same to drill and frack as more isolated wells, raising the issue of whether the capital cost of “child” wells will turn out to be more than the value of the oil that they will ever produce. Most of the wells planned for the next decade will be “child” wells.

One driller who was planning to drill 32 wells in each drilling block of roughly two square miles is now planning to drill 16 to 24. A recent study by the Society of Petroleum Engineers found child wells could produce between 15 and 50 percent less oil, depending on how close the wells are packed. Another study by Rystad Energy found that the first “parent” wells will produce 10 to 12 percent less oil and gas on average when a “child” well is drilled nearby. Much lower production from “child” wells becomes important as over 50 percent of the wells in the Permian Basin are now “child” wells.

Drillers have finite acreage from which to produce oil, so it’s not always possible to stretch out the same number of planned wells over a larger area. Companies will have to drill fewer wells than they had anticipated, which means that we are likely facing “an industry-wide write-down” if drillers are forced to downsize the estimates of wells they can drill and soon will have trouble coming up with enough new production to offset the notoriously rapid depletion of shale oil wells.

The story brought an immediate reaction from Chevron and Exxon who are heavily invested in the Permian and are counting on production from the basin for much of their profitability in the coming decade. These companies have deep pockets, so they are not dependent on a constant infusion of new capital and bring with them more technical expertise than the smaller drillers. Both companies are expecting a Permian basin oil boom in the next five years.

Chevron says it expects to double its production to 900,000 b/d in the Permian and Exxon expects to be producing 1 million b/d by 2024. Chevron says it does not have the problem of lower production from child wells that is plaguing the smaller drillers as it is using “sophisticated machine learning technology” to plan where and how to drill and frack its wells. Chevron is becoming increasingly dependent on shale oil production and says its Permian resources of 16.2 billion barrels are about a quarter of its total reserves.

Exxon says its Permian reserves are now about 10 billion barrels out of global reserves of 100 billion. The company claims it is so good at producing shale oil from the Permian that it can be profitable even if prices fall to $35 a barrel. However, last year the Australian mining giant BHP pulled out of the US shale oil business after writing off roughly $20 billion saying they had better opportunities for making money than producing shale oil. Perhaps Chevron and Exxon will be better managers of shale oil properties and will be able to extract oil at a profit where others have failed. It will be an interesting decade ahead.

Last week US oil drillers cut the number of operating oil rigs for a third week in a row to the lowest level in 10 months as the smaller producers cut spending even though oil majors plan to spend more. Drillers cut nine oil rigs in the week to March 8, bringing the total rig count down to 834, the lowest since May.

2. The Middle East & North Africa

Iraq: Iraq maintained near-record levels of oil exports in February, with overall sales averaging 3.996 million b/d. The export total includes 3.621 million b/d by the federal government and 375,000 b/d by the autonomous Kurdistan Regional Government.

At least six paramilitary fighters died in an insurgent ambush on in Iraq’s disputed northern territories, which remain fertile ground for Islamic State militants to continue the insurgency. This is the region which had been controlled by the Kurds until they were forced out by government troops last year.

Saudi Arabia: The kingdom produced 10.1 million b/d of crude in February, well below its quota under the OPEC+ supply quota 10.31 million b/d. A government official told S&P Global Platts that “March will be lower.” Saudi Energy Minister al-Falih said last month that March production would fall to 9.8 million b/d, with exports at 6.9 million b/d.

Large volumes of natural gas have been found in the Red Sea, according to the Energy Minister al-Falih. Aramco also is considering opportunities for acquisitions of liquefied natural gas projects in the United States. Earlier this year, Aramco’s chief executive Amin Nasser told Reuters that the company was looking to spend billions of dollars on natural gas acquisitions in the US as part of a strategy to bolster its gas business.

The listing of Saudi Arabia’s Aramco is on track to take place in 2021 according to Energy Minister al-Falih. In January, Al-Falih said the company would issue an international bond in the second quarter of this year, mostly to fund the acquisition of a majority stake in petrochemicals major Sabic, valued at $70 billion, but also to tap “multiple sources of capital.” Given Aramco’s reluctance to make its accounts public, as befits a company preparing for a listing, many are skeptical that the bond issue will ever take place since international bond investors are just as interested in a company’s financial health as stock investors.

Libya: The country’s biggest oil field resumed production last week, adding another complication to OPEC’s effort to trim a global supply glut. Sharara is expected to produce 80,000 b/d immediately, and the regular output of 300,000 b/d will be restored now that the site has been secured. The first export cargos of Sharara crude since the lifting of force majeure will be loaded this weekend, according to trading sources and shipping reports.

The field, which was shut down in December after guards seized it while demanding more money, was taken over last month by forces loyal to eastern militia leader Khalifa Haftar. The National Oil Company “has received assurances that site security has been restored, verified by our inspection team, enabling staff to return to work,” Chairman Mustafa Sanalla said in the statement. The shutdown led to $1.8 billion in lost production.

In a new development, forces from eastern Libya loyal to Haftar have now reinforced a base in the center of the country and signaled to Tripoli that they might move to take over the capital. The UN is attempting to mediate between Haftar and Tripoli’s internationally-recognized government led by Prime Minister al-Serraj, Western diplomats say. They fear it may be the last UN attempt to unify the rival administrations and end the chaos that followed the overthrow of Muammar Gaddafi in 2011.

Haftar, a 75-year-old former general, is increasingly taking the situation into his own hands, backed by the United Arab Emirates and Egypt who see him as the man to restore order to Libya. For many, especially in the east, the general is the only one who can end fighting by numerous small militia groups with ever-changing names. His enemies in western cities see him as the new Gaddafi.

3. China

China lowered its economic growth target this year to between 6 and 6.5 percent, acknowledging a deepening slowdown. A paper published last Thursday by the Brookings Institution reinforced longstanding skepticism about the government’s statistics. According to the paper, China’s economy is about 12 percent smaller than official figures indicate, and its real growth has been overstated by about 2 percent annually in recent years suggesting that Beijing’s economy currently is growing at around 4 percent.

Beijing reported its steepest year-on-year decline in exports in three years on Friday, the latest sign that a global slowdown and the trade dispute with the US are hurting its economy. Exports sank 20.7 percent last month compared with February 2018, the biggest monthly fall since February and four times steeper than the 4.8 percent decline forecast in a Reuters poll of economists. Imports fell 5.2 percent, compared with a forecast drop of 1.4 percent, leaving China with the smallest trade surplus in 11 months.

China’s CNPC plans to increase its oil and gas exploration budget five-fold over last year as the country’s dependence on foreign-sourced energy commodities deepens to nearly 70 percent for oil and over 45 percent for natural gas. CNPC will spend $740 million (5 billion yuan) on exploration to pursue the goal of reducing import dependence.

US-based LNG exporter Cheniere Energy is in talks with China’s state-run Sinopec about a long-term LNG supply agreement, with the parties awaiting further instructions from government authorities. The Wall Street Journal reported that Cheniere is expected to sign an $18 billion supply agreement with Sinopec that might be announced as part of a broader US-China trade deal at a summit between President Trump and Chinese President Xi Jinping at the end of March.

The supply of domestic coal is expected to tighten further as authorities in China’s northwestern province had ordered open-pit mines to shut down. According to a document released by local authorities in Shenmu and Fugu, counties in Shaanxi’s Yulin city, all open-pit coal mines will have to be shut by the end of this year.

China’s coal imports in February fell sharply from January due to uncertainty over Beijing’s policies, while the week-long lunar new year holiday also cut into business. Coal arrivals were nearly halved in February to only 17.6 million tons, down from 33.50 million tons in January.

4. Russia

Russian exports of oil and oil products to the United States surged in the last week of February to their highest level since 2011, with Russia taking advantage of the Venezuelan collapse. At least nine tankers delivered 3.19 million barrels of oil and oil products of Russian origin to US ports in the week February 23 to March 1.

5. Venezuela

On Thursday evening the San Geronimo B substation in the center of the country, which supplies electricity to four out of five Venezuelans from the massive Guri hydropower plant, went down. The San Geronimo B substation connects eight out of ten Venezuela’s largest cities to the Guri hydropower plant via one of the longest high-voltage lines in the world.

So far, the government has said nothing about the cause of the blackout, except to blame it on Washington and the opposition. Venezuela gets about two-thirds of its power from four hydro dams along the Caroni river including the Guri dam which is one of the largest in the world. The nearby San Geronimo A backup substation, which transmits current from the smaller Matagua hydropower plant, operated intermittently on Sunday. Supplies from Matagua and few unreliable thermoelectric plants allowed the government to send sporadic power to parts of Caracas throughout the weekend.

Unless repairs to the to the substation can be made quickly, which seems increasingly unlikely, due to the lack of spare parts, the country is facing a humanitarian crisis on a scale not seen since World War II. Food is spoiling due to the lack of refrigeration and there no way to pump or transport fuel so that food supplies can be maintained. Much of the oil industry has come to a halt due to the lack of power for pumps.

In other news, opposition leader Juan Guaido had returned to the country despite threats to arrest him. The US is considering imposing more sanctions and is discussing emergency economic aid. The World Bank says that Venezuela must pay ConocoPhillips more than $8 billion to compensate Conoco for assists expropriated by Hugo Chavez back in 2007.

In recent years, PDVSA’s fleet of 15 oil tankers has been operated by a German ship-management company that supplied the crews and operated the ships. This worked well until Caracas stopped paying the German firm and the various port charges that tankers accrue during normal operations. The German firm has already abandoned several oil tankers that have been detained in foreign ports for non-payment of local bills. The Germans say they will return ten tankers to Venezuela and remove their crews, but there are no crews in Venezuela immediately available to operate the giant ships. Unless a solution is found, Venezuela will soon be out of the tanker business.

As the political and economic situation deteriorates to unimaginable levels, Moscow has reaffirmed its support of the Maduro government. This support includes threatening the US against military intervention and facilitating payments for Venezuelan oil that skirt the US sanctions. In recent years, Russia has invested billions of dollars in supporting the Maduro regime and fears it will lose its money and its influence in the country should the government fall. Over the weekend, however, there were signs that Moscow is backing off on its support for the Maduro government as the power shortage makes its situation ever more hopeless.

6. Mexico

Standard & Poor’s cut the credit rating for Mexico’s national oil company, Pemex, last week. The move reflects concerns that the government’s plan to clean up Pemex’s finances is insufficient, and that the company will continue to be subjected to political decisions that conflict with its financial objectives. Newly elected Mexican President Obrador has said he will inject $3.9 billion into the company which is currently $106 billion in debt. S&P says this is not enough and that it will take at least $20 billion in government aid to revive Pemex.

Despite the efforts of the new Mexican government to reduce the country’s dependence on US natural gas, a new report says this will be impossible in the foreseeable future. Mexico now imports over 50 percent of its natural gas requirement from the US, and this seems likely to increase. Mexico does not have the capital to develop sufficient gas production to reduce that being piped in from the US.

7. The Briefs (selections from the press – date of article in Peak Oil News is in parentheses – see more here: news.peak-oil.org)

BP on oil’s future: Despite the forecast that peak oil demand could come in the 2030s, BP noted that under all scenarios oil will continue to play a significant role in the global energy system by 2040. Moreover, BP wrote that significant levels of investment are required for there to be sufficient supplies of oil to meet demand in 2040, adding that in all scenarios, trillions of dollars of investment in oil is needed. (3/6)

Norway’s $1 trillion sovereign-wealth fund took a major step toward selling off some of its substantial holdings in oil-and-gas companies, a move to shield the oil-rich nation from the risk of permanently lower crude prices. The Norwegian finance ministry proposed that the fund remove energy-exploration and -production companies from its portfolio, following a 2017 recommendation made by the central bank, which uses the fund to invest the proceeds of the country’s oil industry. (3/9)

Russia’s Gazprom Export said Thursday it had made its first ever sale of gas to a western European company priced in rubles, as the company continues to use its Electronic Sales Platform as a tool for diversifying its European gas sales. (3/8)

The US oil rig count decreased by nine to 834, the lowest since last May and the third straight weekly decline, according to GE’s Baker Hughes. Gas rigs declined by two to 193. (3/9)

Exports growing: The US is poised to export more oil and liquids than Saudi Arabia by year-end, according to Rystad Energy. The shift, Rystad explains, comes from continued rising production from US shale plays and increased oil export capacity from the US Gulf Coast. (3/8)

Offshore brouhaha? The Trump administration is set to unleash its offshore, five-year oil drilling plan within weeks, making it perfectly clear that it would like to open more acreage to drillers along the coast of the country. That has drawn opposition from both Democratic and Republican leaders in the coastal states. (3/8)

South Dakota’s governor, Kristi Noem, has proposed legislation seeking to uncover where out-of-state funds for pipeline protests come from and “cut them off at the source;” Republican Noem also said she would set up a fund for extraordinary costs for law enforcement that usually accompany pipeline protests. (3/6)

Colorado is overhauling the laws governing how the oil and gas industry operates in the state. The legislation seeks to put more protections on public health, safety and the environment as it relates to oil and gas development. (3/7)

Oil busting: The Colorado State Senate Transportation & Energy Committee has passed a bill which the American Petroleum Institute (API) says “threatens hundreds of thousands of jobs.” In an organization statement posted on its website, the API said bill SB19-181 would “at the very least hinder, if not prohibit” energy development in Colorado. (3/8)

Sage grouse habitat issue: The US government received bids for about 70 percent of the land it offered at a large oil and gas lease sale in Wyoming last week, held over the protests of conservationists who argued the area was critical habitat for wildlife, including a threatened bird. (3/4)

Alaska’s dream of building a massive liquefied natural gas (LNG) export terminal could be coming to an end. For years, former Alaska Gov. Bill Walker pushed the massive $44 billion capex intensive project as a way to offset decades of dwindling oil production in the country’s largest state. To date, some $260 million has been spent by the AGDC on the Alaska LNG project. New governor Michael Dunleavy, who took office in December, is taking a different approach. (3/6)

Alaska Gas Line Development Corp said on Wednesday it received the last major federal permit needed before it can decide on its proposed $10 billion Alaska Stand Alone Pipeline to supply natural gas to in-state consumers. (3/7)

The first US floating liquefied natural gas (LNG) project continues to plan future steps in its progress despite the U.S.-China trade war, a top manager at one of the project’s partners told Reuters on Thursday. The first US floating LNG project, Delfin LNG, is planned to be located nearly 50 miles off the Louisiana coast in the US Gulf of Mexico. (3/8)

EV supercharging: Tesla announced that it is introducing V3 Supercharging, which will support peak rates of up to 250 kW per car. V3 represents a new architecture for Supercharging. A new 1MW power cabinet with a similar design to Tesla utility-scale products supports the peak rates of up to 250kW per car. At this rate, a Model 3 Long Range operating at peak efficiency can recover up to 75 miles of charge in 5 minutes. (3/8)

VW and EVs: One of the world’s largest carmakers, Germany’s Volkswagen AG, is betting big on electric vehicles and e-mobility with a war chest of around US$50 billion to challenge Tesla, which, for the time being seems unfazed by the increasingly crowded EV market. (3/7)

UK wind: The UK has announced a new target to source a third of its electricity from offshore wind by 2030 but faces criticism for not setting more ambitious goals to reduce carbon emissions. The agreement is the first sector deal for renewable energy and follows a period of rapid growth of wind power, which accounted for 17 per cent of the country’s electricity generation last year. (3/7)

Germany’s RE: Combined wind and solar generation in Germany is forecast to reach a record high this week after Monday’s total narrowly missed the country’s daily all-time high. Wind power covered 64 percent of German power demand on Monday and has been Germany’s single biggest source of electricity year to date. The surge in renewables is expected to push average German weekly spot power prices down to levels seen last spring. Widening the view, across Europe wind power covered 24 percent of electricity demand Monday. (3/6)

Efficiency backsliding: LED light bulbs are already on the shelf, work great, last longer, use one-sixth of the power of an incandescent bulb, and are gaining sales dramatically. Efficiency advocates worry that the Trump administration could slow the pace of this lighting revolution by pushing back some supportive rules established during the Obama administration. (3/9)

Greenland’s 660,000-square mile ice sheet contains enough fresh water to flood coastal cities around the world. Warm air over the sheet is causing it to melt, but new work reveals that rainfall is also causing more melting than previously thought. (3/9)

BP climate strategy: BP said that it would support a call from a group of institutional investors to expand its carbon emissions reporting and to describe how BP’s strategy is consistent with the goals of the Paris Agreement in yet another pledge by Big Oil to start taking investor demands on climate action seriously. (3/6)

Peak Oil Review 4 March 2019

By Tom Whipple, Steve Andrews, originally published by Peak-Oil.org

https://www.resilience.org/stories/2019-03-04/peak-oil-review-4-march-2019/

Quote of the Week

“The once-powerful partnership between fracking companies and Wall Street is fraying as the industry struggles to attract investors after nearly a decade of losing money. Frequent infusions of Wall Street capital have sustained the US shale boom. But that largess is running out. New bond and equity deals have dwindled to the lowest level since 2007. Companies raised about $22 billion from equity and debt financing in 2018, less than half the total in 2016 and almost one-third of what they raised in 2012.

Bradley Olson and Rebecca Elliott, Wall Street Journal, 2/24/19

Graphics of the Week

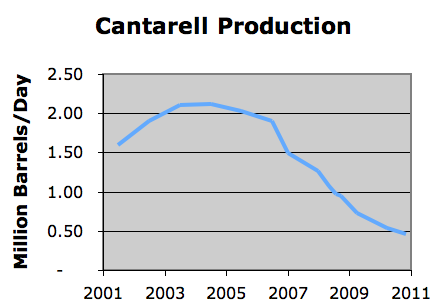

From Ron Patterson’s web site Peak Oil Barrel

1. Oil and the Global Economy

The struggle between lower crude output and the prospects for a global economic setback that could reduce the demand for oil continued last week. Prices rose on bullish news early in the week and then fell to close only slightly higher for the week at $55.80 in New York and $65.07 in London. Most analysts are predicting that oil prices will continue to rise as the case for lower production later this year seems stronger than the case for lower demand.

For some time now analysts have been noting that for the last few years, global oil production outside of the US has been generally stagnant. (Note the trailing average in the graphic above) While oil prices have varied during this period, they have not spiked due to the spectacular increase in US shale oil production. In recent years the demand for oil has been increasing at about 1.5 million b/d each year which has been satisfied by US production. Unless there is a global economic recession or a substantial increase in oil prices, demand for oil seems destined to continue increasing for the foreseeable future despite growing concerns about carbon emissions.

Currently, there is no evidence that a spectacular jump in global oil production is in the offing and new oil discoveries remain well below the world’s annual oil consumption of some 36 billion barrels per year.

Leaving aside the concerns about carbon emissions, the heart of the global oil availability issue in the immediate future seems to center on whether US shale oil production can keep growing. The government and the oil industry say that it can; qualified outside observers say it is highly unlikely that it will. We are likely to be entering a period of considerable uncertainty and volatility of oil prices.

The OPEC Production Cut: The cartel’s production fell to 30.68 million b/d in February, a four-year low, as Saudi Arabia and its Gulf allies over-delivered on the group’s supply agreement while Venezuelan output continued to decline, and 300,000 b/d remain offline in Libya. The drop came despite criticism from President Trump, who on Monday tweeted a call for the group to ease its efforts to boost prices, saying they were “getting too high.” These figures are from a Reuters survey as OPEC will not release its official data for February production until March 14th.

The most significant drop in supply came from Saudi Arabia, which pumped 130,000 b/d less than in January. Saudi supplies had hit a record 11 million b/d in November after Trump demanded more oil be pumped to curb rising prices and make up for losses from Iran. OPEC and the kingdom then changed course as prices slid on the prospect of oversupply in 2019.

The Saudis have already signaled that they plan to cut production further to around 9.8 million b/d in March, some 500,000 b/d below its commitment in the OPEC+ deal. Energy Minister al-Falih said last month that Saudi Arabia also would be cutting its crude oil exports to near 6.9 million b/d this month, down from 8.2 million just three months ago.

Al-Falih’s comments suggest that OPEC will not back down in the face of pressure from Washington. The standoff with the Saudis is coming at a time when the US Congress is pushing forward on the “NOPEC” legislation, which would open up OPEC members to antitrust regulation by the US Justice Department. A confluence of events has come together in favor of the bill, including a President who used to beat up on OPEC.

However, US Energy Secretary Perry said Thursday that anti-OPEC legislation under consideration in Congress could lead to an oil price spike by preventing the world’s producers from managing supply. Perry essentially defended OPEC’s role of balancing oil supplies and delivered a critique of the proposed bill for which President Trump has repeatedly expressed support, although not since taking office.

US Shale Oil Production: America’s crude oil production will keep setting annual records until 2027 and will remain higher than 14 million b/d through 2040, thanks to continuously growing shale production, according to the EIA’s Annual Energy Outlook 2019. This projection is very optimistic and does not square with what outside observers are saying about the long-term prospects for shale oil production.

US crude production edged lower in December to 11.85 million b/d, posting its first official decline since May, according to the EIA’s monthly report issued on Thursday. Production fell 56,000 b/d from a record 11.91 million in November. While output rose by 53,000 b/d in Texas and North Dakota, the gains were offset by a production decline of 125,000 b/d in the Gulf of Mexico. Production numbers from the EIA’s monthly report,which are delayed by two months, are considered to be more accurate than the EIA’s weekly estimates.

The EIA’s weekly production estimates, however, continue to express optimism with the latest release saying that US crude oil production rose 100,000 b/d the week before last to a record 12.1 million b/d. This forecast comes despite a harsh winter in North Dakota’s Bakken oilfield which is likely to see a decline in production during the winter due to the extreme cold. Some analysts are saying that while total US shale oil production is still snowballing, it could well flatten out by mid-year.

The US oil rig count has been dropping of late due to decisions made several months ago. The US rig count is already in decline. Total oil rigs are stood at 853 for the week ending on February 22, down from a peak of 888 in November. In particular, the Permian –on which most of the hope for the shale oil industry rests – has seen the rig count decline to a nine-month low.

Moreover, the industry is awash in stories of cutbacks in capital spending due to the need to show bankers and investors a real profit rather than just deficit-financed production gains. Several firms, however, are saying that they will be able to increase production despite less capital spending this year due to “efficiencies.” Some observers are skeptical, as most of the technical “efficiencies” gained from longer laterals and the use of more fracking sand have already been realized. One “efficiency” that seems to be real is the squeezing of the oil service companies by drillers.

One unknown in the future of shale oil production is the increasing share of output that is coming from the major oil companies, particularly in the Permian Basin.

Companies such as Exxon and Chevron do not need to make a profit on every well drilled and can finance their drilling from the profits of conventional production. These companies can profit from the scale of their operations, refining, transporting, and marketing any shale oil they produce and are not dependent on selling crude at market rates. Chevron, which increased its Permian production to 377,000 b/d in the fourth quarter, is expressing much optimism about the future of shale oil and says it will be profitable in 2020 – implying that it will lose money this year.

A recent study found that a group of 32 mid-sized drillers spent nearly $1 billion more on drilling and related capital expenditures during the third quarter of 2018 than they generated in sales. This is notable because selling prices were higher last summer than currently. As few small and mid-sized drillers have ever made any money from drilling operations, it will be interesting to see how the large oil companies do in the next few years. The future of global oil production may hang on this question for if the shale oil boom fizzles from the lack of profitability, global oil production may peak soon thereafter.

2. The Middle East & North Africa

Iran: Asia’s crude oil imports from Iran slipped in January to the lowest in two months after China and India slowed purchases and as Japan recorded zero imports for a third month. However, in February, Japanese buyers were back in the market to buy as much Iranian crude as they can before the US sanction waivers close in May. Cosmo Oil has ordered a cargo of 900,000 barrels of Iranian heavy crude for March delivery and this will likely be the last cargo of Iranian crude to be shipped to Japan. Asia’s top four buyers of Iranian oil – China, India, Japan, and South Korea – imported a total 710,699 b/d of Iranian crude in January, 49 percent lower than the same month in 2018.

Two days after saying he intended to step down, Iran’s foreign minister, Mohammad Zarif, returned to his post after President Rouhani rejected the resignation. Zarif has been Iran’s public face and brokered the deal curtailing Iran’s nuclear program. After President Trump withdrew from the nuclear deal last year Zarif lost standing with Iran’s leadership, and he was relegated to the sidelines. Given his good relationship with most of the world’s leaders, the government likely realizes that they may need his skills to help negotiate the hard times ahead.

Iraq: Last week the Kurds resumed trading crude and fuels across the border with Iran. This trade was halted at Washington’s request as part of the sanctions on Iran. After receiving a new order from the KRG Ministry of Natural Resources on Feb. 20, border officials at the three main crossing points between Iraqi Kurdistan and Iran began letting tanker trucks through.

The Bashiqa exploration block – which straddles the line between the autonomous Kurdistan region and the rest of Iraq –is fraught with political and geological problems. ExxonMobil sold half of its stake in the project in 2017, and now, Norway’s DNO has taken over as operator, under a contract with the Kurds. This action will likely set off another round of problems with Baghdad.

Saudi Arabia: Energy Minister Khalid al-Falih said on Wednesday that he was leaning toward an extension of the OPEC+ production cuts after June, although he noted that the producer group would take a measured approach not to tighten the oil market too much. President Trump tweeted last Monday his latest criticism of OPEC’s cuts aimed at rebalancing the market and lifting prices. The tweet sent oil prices tumbling by more than 2 percent on Monday, but a surprise draw in crude oil inventory of 4.2 million barrels as reported by the API lifted prices again.

Saudi Arabia’s crude oil exports to the US are falling sharply, with shipments in February at just 1.6 million barrels versus 5.75 million barrels a year ago. For January, Saudi Arabia exported just 2.69 million barrels of crude to the United States. The decline follows Saudi Arabia’s decision to cut its crude oil production—primarily heavy grades of oil —by more than it agreed to at the December OPEC+ meeting as it seeks higher oil prices.

Aramco aims to export as much as 3 billion cubic feet of gas per day by 2030, Amin Nasser, the company’s CEO, said on Tuesday. Aramco will solely develop the kingdom’s conventional and unconventional gas reserves and will control exports via pipelines and LNG tankers.

Last week, in a speech at the International Petroleum Week in London, Nasser rebuked all those who predict the demise of the oil industry in the near future, saying that those claiming that the world will soon run on anything but oil “are not based on logic and facts, and are formed mostly in response to pressure and hype.” “While most forecasts see peak oil demand at some point in the 2030s, the oil industry still sees itself as being relevant for decades to come.”

Libya: Workers at Libya’s El Sharara oilfield are ready to resume production with an initial output of 80,000 b/d but are still waiting for approval from the state oil firm, a field engineer and trader said on Wednesday. “There is no technical obstacle to the restart of production. The issue is security,” a NOC spokesman said.

At least 19 people were killed during the fighting in southern Libya, according to a member of parliament, as forces loyal to strongman Khalifa Haftar fought for control of oilfields in the region. Haftar’s Libyan National Army (LNA) killed civilians, including children, and set fire to more than 30 houses in the southern city of Murzuq. The member of parliament from the region claims that farms were also destroyed, and more than 100 cars were stolen. The battle for Murzuq, a city 900km south of the Libyan capital, Tripoli, was the first battle for a city fought by the LNA since it started a campaign to take control of oilfields in the south a month ago.

If these claims of extensive fighting are true, it would explain why it is taking so long to resume production from the 300,000 b/d oilfield. Libya’s state-run National Oil Corp announced last week that its chairman, Mustafa Sanalla, traveled to the United Arab Emirates to meet with a number of Libyan and international parties to discuss the Sharara oilfield crisis.

3. China

The Xinhua news agency reports that China has found “massive” shale oil reserves in the northern Tianjin municipality. Two wells at a field have been flowing for more than 260 days, according to Dagang Oilfield, a subsidiary of state-owned China National Petroleum Corporation (CNPC). According to the state company, the newly found shale reserves will help boost China’s national energy security and economic development. As part of a government push to expand domestic energy supply, CNPC and Sinopec are raising investments to increase local oil and gas production and are increasing drilling at tight oil and gas formations in western China. The Chinese have been looking for shale oil and gas fields similar to those that have revolutionized US oil and gas production for the last ten years – with little success. After years of exploring for commercial tight oil deposits, it seems doubtful that any on the scale found in the US or possibly Argentina will be found in China.

China’s leader, Xi Jinping recently told a national gathering of senior party officials that the country faces significant risks on all fronts. Whether dealing with foreign policy, trade, unemployment, or property prices, he declared, officials would be held responsible if they slipped up and let dangers spiral into real threats. The speech, which was one of Mr. Xi’s starkest warnings since he came to power in 2012, underscores how slowing growth and China’s grinding trade fight with the United States have magnified the party leadership’s deep-seated fears of social unrest.

China imported 9.8 million tons of natural gas in January, up 6.2 percent from December, and 26.8 percent year on year, according to the General Administration of Customs. China imported 6.58 million tons of LNG in January, up 4.6% month on month, and increased 27.8 percent year on year, and 3.23 million tons of natural gas via pipeline in January, up 9.7 percent month on month and 24.8 percent year on year. Australia was the biggest supplier of natural gas to China in January at 2.34 million tons, followed by Turkmenistan at 2.25 million tons and Qatar at 1.40 million tons.

China is about to announce the creation of a state-held oil and gas pipeline company combining the assets of national firms. Such a firm would allow energy companies to focus on boosting exploration and production rather than worrying about distribution. China’s National Development and Reform Commission —the economic planning body—has already approved the plan, while the State Council has yet to issue final approval. A national pipeline firm would be the most significant energy ‘reform’ in China since 1998 when the country restructured its oil and gas sector.

China’s coal consumption rose for the second year in a row in 2018, but coal’s share of total energy consumption fell below 60 percent for the first time as cleaner energy sources gained ground. The world’s biggest coal consumer used 1 percent more coal in absolute terms last year than in 2017, China’s National Bureau of Statistics said in an annual communique. Coal consumption had risen for the first time in four years in 2017. This increase is not good news for efforts to control carbon emissions which all projections show rising in future years despite the UN agreements to cut carbon emissions.

An oil tanker carrying US crude oil is offloading its cargo at a Chinese port on Friday, marking China’s first import from the United States since late November, according to trade sources and Refinitiv data. Trade tensions between the United States and China cut US oil exports to Asia to a trickle in the second half of last year. No US crude volumes were recorded going into China during October, December, and January, according to China customs. President Trump asked China in a tweet on Friday to lift all of its tariffs on American agricultural products, pointing to his decision to delay the second round of tariffs and to improving trade relations with China.

4. Russia

Russian oil output was 11.34 million b/d in February, down some 75,000 from the October level, its baseline for the OPEC+ production cut. This production level was down from 11.38 million bpd in January. All the Russian majors reduced their output. Russia’s largest oil producer Rosneft and No.2 Russian oil company, Lukoil, cut their output by 0.6 percent and 0.5 percent month-on-month, respectively. Production at Gazprom Neft, the oil arm of gas giant Gazprom, was down by 1.9 percent.

Russia’s energy ministry met with domestic oil companies on March 1 to discuss the deal between OPEC and other leading global oil producers to reduce production. A Gulf OPEC source said that OPEC and its allies would stick with their agreement to cut oil supply, pushing for more adherence despite a demand by US President Donald Trump that the producer group eases its efforts to boost crude prices.

5. Nigeria

Nigerian President Muhammadu Buhari won a second term as the chief executive of Africa’s largest economy and top oil producer. However, the former general now faces a dizzying array of challenges including a divided population, moribund economy and a rejuvenated Islamist insurgency. Nigeria’s electoral commission reported that Buhari beat his opponent, Atiku Abubakar by a margin of four million votes, 15.2 million vs. 11.3 million, in an election marred by delays, ballot manipulations, and violence that left 39 people dead. However, no independent observer has reported electoral fraud. Turnout was a record low at just 35.6 percent. Atiku Abubakar criticized what he called a “sham election” and has vowed to go to court.

In an effort to help out its fiscal situation in a time of low oil prices, Nigeria is seeking nearly $20 billion from international oil majors in back taxes. The government has asked Shell, Chevron, ExxonMobil, Total, Eni, and Equinor to pay from $2 billion to $5 billion each. So far Shell has said that the country’s tax claims lacked merit and could see the Final Investment Decision on Bonga South West 200,000 b/d oil project slip into 2020 from 2019 while the claim is disputed. Underpayment of taxes and theft of oil through accounting fraud by the international oil companies is a frequent theme in Nigerian political discourse.

For example, a recent report claims that Nigeria’s oil and gas sector is responsible for 92.9 percent of illicit financial flows out of the country of over $217.7 billion between 1970 and 2008. Illegal money sometimes flows into Nigeria. Shell is facing prosecution from the Dutch authorities over its acquisition of an offshore oil and gas block in Nigeria a few years ago. The Anglo-Dutch firm is already a defendant in a trial for the same deal in Italy. The 2011 acquisition of block OPL 245 in Nigeria by Shell and Eni, according to Italian and Nigerian prosecutors, involved a transfer of money to personal accounts held by the Nigerian oil minister at the time. The official, Dan Etete, was later convicted of money laundering by a French court in a separate, unrelated case.

Nigeria does not seem to be taking its OPEC production cut pledge very seriously. The national oil company announced last week that production from the recently started Egina deepwater field would remain outside Nigeria’s commitment to OPEC’s production cuts. Nigeria, which currently produces around 1.8 million b/d of crude oil and another 400,000 b/d of condensate, is due to cut by about 40,000 b/d at the same time it is increasing production from its new 200,000 b/d field. It seems as if the only way Nigeria will be adhering to its share of the production cut will come if the Nigeria Delta Avengers stick to their pledge to start blowing up oil facilities in the Delta.

There may be yet another gasoline shortage soon. The National Petroleum Corporation says that Nigerians consume an average of 333,000 b/d of gasoline daily. Only one tanker carrying gasoline is due into Nigeria in the next two weeks.

6. Venezuela

It was relatively peaceful in Venezuela last week as the fighting over allowing food supplies building up at the borders is on hold. Moscow announced that it is helping Venezuela with shipments of wheat as the government is not letting other humanitarian aid into the country. The United States announced new sanctions against Venezuelan government officials last week as tensions in the country continue to escalate. The latest sanctions, against four governors close to President Nicolas Maduro, came after clashes at the border prevented humanitarian aid from entering Venezuela. Vice President Mike Pence had called on the Lima Group—a group of governments trying to resolve the Venezuelan crisis peacefully—to increase pressure on the Maduro government by seizing PDVSA assets as well as other government-owned assets of Venezuela and transfer the ownership to Juan Guaido’s interim government from the Venezuelan opposition.

Citgo is formally cutting ties with its parent company PDVSA, to avoid running afoul of US sanctions on PDVSA and to keep Citgo’s refineries and pipeline systems in operation.

Venezuela has shifted some of its crude exports from American refiners to India and Europe, according to the country’s oil minister and ship-tracking firms. However, it will difficult for the Maduro government to generate a profit from these sales. Since late January, the regime’s oil exports have come under US restrictions aimed at redirecting crude revenue to opposition leader Juan Guaidó, whom the US recognizes as the country’s legitimate president. China’s crude imports from Venezuela surged 50.7 percent month on month to 411,000 b/d in January, posting the fifth month in a row of increases after hitting a four-year low last September. In the past, shipments to China did not generate any revenue as they were going to pay off past loans. It is likely that China is suspending loan payoff as without some revenue from this oil Caracas would have little with which to pay for food imports.

7. Mexico

State oil company Pemex said last week that its losses narrowed in 2018, helped by currency exchange gains as crude production and refining rates continued to decline. Mexico’s largest company still reported a loss of $7.6 billion in 2018, down by nearly half from losses of about $14.3 billion the previous year, according to a filing with the Mexican stock exchange. The company posted a $6.4 billion loss in the fourth quarter and is facing mounting scrutiny from investors after its credit rating was cut by Fitch Ratings in late January to one notch above junk status.

Mexico’s central bank on Wednesday cut its economic growth forecasts for this year and next, pointing to the risk of rating downgrades to the country and state-run oil firm Pemex. In a quarterly report, the bank lowered its Mexican growth forecast to between 1.1 percent and 2.1 percent for 2019 and between 1.7 percent and 2.7 percent for 2020, echoing increasing skepticism among private-sector economists on the outlook.

Auctions scheduled later this year to pick joint venture partners for Pemex will proceed, an official at the national oil regulator said on Thursday, despite the president’s apparent cancellation of the tie-ups.

The equivalent of 1,145 truckloads of oil is stolen in Mexico per day from Pemex. That’s $7.4 billion in lost revenue since 2016 – a significant hit for a country where 3.8 percent of GDP comes from oil exports.

8. The Briefs (selections from the press – date of article in Peak Oil News is in parentheses – see more here: news.peak-oil.org)

BP on US oil market: The US shale industry responds only to oil price signals and is like “a market without a brain,” BP’s chief executive Bob Dudley said on Tuesday. He stated that unlike Saudi Arabia and Russia, which adjust their output in response to gluts or shortages in oil supplies, the US shale market responds purely to oil prices. (2/27)

Global oil and gas companies are increasingly facing an uphill battle as global warming policies are taking their toll. Most analysts and market watchers are focusing on peak oil demand scenarios, but the reality could be much darker. International oil companies are likely to face a Black Swan scenario, which could end up being a boon for state-owned oil companies. Increased shareholder activism, combined with global warming policies of institutional investors and NGOs, are pushing IOCs in a corner, constricting financing options for oil companies. (2/25)

Exxon’s climate pushback: Exxon is trying to block an investor initiative seeking to force the supermajor to commit to a reduction in harmful emissions, especially carbon emissions. Exxon calls the investor initiative misleading and saying it was trying to “micro-manage” the business. The investors are the endowment fund of the Church of England and the New York State pension fund. (2/26)

Global liquefied natural gas trade will rise 11 percent to 354 million tons this year as new facilities increase supplies to Europe and Asia, Royal Dutch Shell said in an annual LNG report on Monday. Shell, the largest buyer and seller of LNG in the world, said trade rose by 27 million tons last year, with Chinese demand growth accounting for 16 million tons of those volumes. (2/25)

Offshore Cyprus, ExxonMobil added another giant gas discovery to the east Mediterranean region after finding a gas-bearing reservoir, but infrastructure bottlenecks and geopolitical disputes mean output from the field could be far off. (3/1)

Indian refiners processed 21.94 million mt, or an average 5.2 million b/d, of crude oil in January, down 3.6% year on year. (2/27)

Thailand’s natural gas depletion problems are causing the southeast Asian country to make significant changes to its energy mix. The capacity of non-hydro renewables in Thailand—mostly driven by the biomass and solar sectors—may expand to 21 percent of the country‘s total power capacity mix at 14,858 MW by 2028. (2/27)

In Mozambique, militants have attacked Anadarko’s LNG project in what is the first attack on the oil and gas industry in the African country. More than a dozen masked, armed men—suspected to be members of an Islamic militant group—attacked a convoy near the project, which is still under construction, and injured four people. (2/26)

In Nigeria, Shell is facing prosecution from the Dutch authorities over its acquisition of an offshore oil and gas block a few years ago. (3/2)

The US oil rig count declined by 10 to 843 while the number of active gas rigs grew by 1 to 185, according to GE’s Baker Hughes. The oil and gas rig count is now 57 up from this time last year, 43 of which is in oil rigs. (3/2)

Heavy crude okay: A tight market for heavy sour crude, exacerbated by US sanctions on Venezuela, has yet to negatively impact operations at Saudi Aramco’s Port Arthur refinery on the Gulf Coast. The 630,000 b/d Port Arthur facility in Texas, operated by Aramco subsidiary Motiva, is the US’ largest refinery. (3/1)

Exxon Mobil Corp said it added 4.5 billion oil-equivalent barrels of proved oil and gas reserves in 2018, driven mainly by increases in its holdings in the US Permian Basin, Guyana, and Brazil. The oil major said its proved reserves totaled 24.3 billion oil-equivalent barrels at the end of 2018, with liquids accounting for 64 percent, up from 57 percent in 2017. (3/1)

Digital oilfield: In the post-2014 world, digital technology and Big Oil have teamed up to bring in the era of the digital oilfield, which just a couple of decades ago must have sounded like science fiction. Earlier this month, Schlumberger announced it had struck a partnership with Rockwell Automation, a company specializing in automation solutions for industrial applications. (2/28)

SPR sale: The US Energy Department said it is offering up to six million barrels of sweet crude oil from the national emergency reserve in a sale mandated by a previous law to raise funds to modernize the facility. (3/1)

Three new natural gas-to-methanol plants are expected to start up in the US in 2019 and 2020—two in the Gulf Coast and one in West Virginia. The higher methanol production capacity will boost the US production of the fuel which can be used as an alternative transportation fuel or blended into gasoline to increase engine efficiency and cut air pollution; the higher capacity will also increase the industrial use of natural gas. (2/26)

WV pipeline moving forward: TransCanada said on Friday that the US Federal Energy Regulatory Commission approved the full in-service of the Mountaineer XPress natural gas pipeline project, which will help link the Appalachian basin’s natural gas supplies and growing markets in the US and beyond. The Mountaineer XPress project includes a 170-mile natural gas pipeline in West Virginia that will increase natural gas capacity by 2.7 billion cubic feet per day and together with related infrastructure—new compressor stations and modifications to existing compressor stations—represents a total investment of US$3.2 billion. (3/2)

Alaska gas pipeline plan fading: The new CEO of Alaska’s state gas corporation told legislators Thursday he is prepared to shut down the project and return unused funds to the state treasury if customers or investors do not appear in the next few months. (3/1)

Electricity evolution is slow: A study conducted by a team led by Robert Gross of Imperial College London and published in December 2018, concluded that, on average, the adoption time of the last four major power-generation technologies was 43 years. And by the end of that time, these technologies were well established, but not yet in a dominant position. (2/28)

The contribution of nuclear power to the global power mix in mature markets is set for a significant decline under current policy frameworks, as there are limited investments in new plant construction, the IEA said. China and India are responsible for more than 90 percent of net growth to 2040. However, outside of Japan, nuclear power generation in mature economies is seen dropping by 20 percent by 2040. (2/28)

Global EV growth: In 2018, 4.28 million BEVs, PHEVs, and HEVs were sold globally—an increase of 28.6% over the year prior—amounting to 5.2% of total global passenger vehicle sales, according to Adamas Intelligence. Not only is the EV market growing rapidly, the modern EV itself is also undergoing rapid technological evolution, from model to battery pack to cell and cell chemistry, Adamas says. (2/26)

The EV battery race intensified this week with the announcement that a startup financially supported by the US Department of Energy had released a lithium-ion battery that stores more energy than the 250 Wh EV industry benchmark. The company, 24M, said its semi-solid-state nickel-manganese-cobalt battery had achieved an energy density of 280 Wh and that its approach to battery building would allow it to hit a target of 350 Wh by the end of the year. (3/1)

Record cold: Temperatures as much as 30 to 50 degrees below normal are entering the Northern Plains as we close out the workweek. Through the weekend, brutal conditions you might expect in a frigid January overtake the central portion of the country, from the Mexican to the Canadian borders. Heading into the first full week of March, Arctic air takes up residence in the East as well. When it’s all done, most of the contiguous US will endure a punishing blow of frigid air from this Arctic blast. Records for cold are likely. (3/2)

Peak Oil Review 25 February 2019

By Tom Whipple, originally published by Peak-Oil.org

https://www.resilience.org/stories/2019-02-25/peak-oil-review-25-february-2019/

Quote of the Week

“While Exxon invested $12.5 billion on international upstream capital expenditures (CAPEX) to produce 1.7 million barrels a day of total liquid oil production in 2018, it spent a staggering $7.7 billion in US upstream CAPEX to supply only 551,000 b/d of oil. Thus, Exxon spent nearly double the amount of CAPEX for each barrel of US oil production versus its international oil supply… ExxonMobil’s US oil and gas sector is heading toward a financial disaster. It’s US oil and gas CAPEX spending will choke the living hell out of its profits. While some may think I am fermenting hype, the financial results shown above point to a pretty clear trend… and it ain’t good. If one of the world’s largest oil companies can’t make money producing US shale, then what does that say for the rest of the industry?” Steve St. Angelo, independent precious metals and energy researcher

Graphic of the Week

1. Oil and the Global Economy

Brent crude futures briefly touched $67.73 a barrel on Friday, their 2019 high. The London contract then fell 5 cents to settle at $67.12 a barrel while US futures US gained 30 cents to settle at $57.26 per barrel, after hitting $57.81 earlier in the day. Despite forecasts that US shale oil production will continue to increase rapidly next month, supply disruptions in Venezuela and Libya, the 1.8 million-barrel OPEC+ production cut, and hopes that the US-China trade dispute may be settled soon, were enough to push prices higher last week. Prices have now gained about $5 a barrel since mid-February but are still some $20 a barrel below the recent highs set last October.

Fears of a global economic slowdown appear to have waned for the minute in hopes that a settlement of the US-China trade dispute will result in a period of faster global economic growth. While European oil consumption has been flat a long time, demand has declined year-on-year in the past few months, which suggests a slowdown is underway in the European economy. While China seems to be settling into a planned growth of around 6.5 percent, many observers note that in China, economic growth, and the statistics to back it up, is more a political target than a reflection of the actual state of the economy. For years, Chinese officials at all levels of government cooked statistics to meet those political objectives. For now, China’s economy seems to be perking along, but many are warning of problems ahead.

The OPEC+ Production Cut: The monitoring committee for the OPEC+ supply reduction deal on Wednesday found compliance with the cuts at 83 percent. Just what they are measuring remains to be seen. Libyan production is down about 300,000 b/d due to unrest at its largest oilfield, and Venezuelan production is likely down hundreds of thousands of barrels a day due to the US sanctions. While Caracas’ production is likely to fall in the foreseeable future, Libyan could pop back to around 1 million b/d at any time.

The Saudis are undertaking the bulk of the production cut on behalf of OPEC and have pledged to cut production further in March. In contrast to the Saudis, Moscow is saying it is impossible to reduce output during the frigid Russian winter months and that they will be in full compliance with their pledge by May.

The lack of enthusiasm for the cuts, coupled with reports that a major Russian oil firm is saying that the cuts are unnecessary, is raising questions as to whether the alliance between the Saudis and Moscow will hold. Reports that the relationship will be formalized by a treaty are being denied in Moscow as unnecessary. A complete collapse of the Venezuelan oil industry would produce much the same results as the OECP+ production freeze.

According to President Muhammadu Buhari, Nigeria could start reducing its crude oil production in line with the output cut. This time the country was not exempted from the cuts and was assigned a reduction of about 40,000 b/d. However, instead of reducing its production, Nigeria boosted it with the start of production at the giant Egina offshore field, operated by French Total.

US Shale Oil Production: The EIA’s February Drilling Productivity Report, which was released last week, has spawned a raft of analysis and commentary as to just where US shale oil production is headed and at what costs. The EIA expects US shale production will grow by 84,000 b/d in March 2019. The gains are forecast to be led by the Permian (+43,000 b/d), followed by smaller contributions from the Niobrara (+16,000 b/d), the Bakken (+13,000 b/d), the Eagle Ford (+9,000 b/d) and Appalachia (+3,000 b/d).

There are some interesting numbers showing up in the EIA’s Drilling Productivity Report. The report says that new-well production by rig is around 1,400 b/d in the older Bakken and Eagle Ford shale oil deposits, while only about 600 b/d in the Permian shale oil deposits. This discrepancy seems to imply that it takes more than twice as many wells in the Permian to end up with the same amount of oil at the end of the first month. The large difference in initial productivity needs some explanation if we are to accept that the Permian Basin is to drive the US increase in oil production in the coming years.

While still impressive, the growth of US shale oil production is slowing. EIA forecasts US crude oil production will average 12.4 million b/d in 2019 and 13.2 million b/d in 2020, with most of the growth coming from the Permian region of Texas and New Mexico. The EIA currently projects February Permian growth at 23,000 b/d and March at 43,000 b/d. By contrast, a year ago, EIA forecasted February 2018 basin growth at 76,000 b/d and March 2018 increase at 75,000 b/d, so there is quite a decline in expectations.

Expenditures in the shale oil industry are starting to contract as investors put increased pressure on drillers to make money and not just increase money-losing production. The rig count for February fell by nine. That was the first-time drillers removed rigs for three months in a row since October 2017. The rig count declined by two in December and 23 in January. Financial services firm Cowen & Co said last week that early indications from the exploration and production companies it tracks point to a 6 percent decline in capital expenditures for drilling and completions in 2019.

Whether the industry will live up to the EIA’s projections remains to be seen. Many firms are saying they will be producing more oil this year with fewer resources. Frigid weather in the Bakken this winter is likely to slow production considerably.

The problem of moving the associated natural gas from the Permian to market may become a limiting factor in the next year to two. The startup of Plains All American Pipeline’s 350,000 b/d Sunrise expansion at the end of 2018 marked the start of a period that should bring higher prices and more takeaway capacity for Permian crude and problems of what to do with the associated gas. According to Platts Analytics, about 3 million b/d is expected online in the next 18 months, bringing total takeaway capacity from the Permian to market to approximately 6 million b/d by 2020.

According to Platts Analytics, Permian gas production becomes fully constrained around 9.4 billion cf/d, considering that effective takeaway capacity on pipelines exiting the basin is about 8.7 billion cf/d, with local demand capable of absorbing another 700 million cf/d. Until Kinder Morgan’s 2 billion cf/d Gulf Coast Express expansion comes online in October, price volatility is likely to increase as the available capacity for production growth remains limited.

2. The Middle East & North Africa

Iran: Iranian crude exports in January were higher than expected, while February shipments may be even higher. According to tanker-tracking data from Refinitiv Eikon, Iran’s exports in February have averaged 1.25 million b/d so far, while the January exports were between 1.1 million b/d and 1.3 million b/d. These are considerably higher than the 1-million-b/d level, which was seen in December. Higher Iranian shipments would weigh on oil prices and work against the effort to cut supply in 2019 led by the OPEC+ alliance. Much of the recent increase may be due to the US waivers to the most important of Iran’s customers. These waivers are due to expire at the end of March.

Oil Minister Bijan Zangeneh said last week that Iran had completed the third phase of the new Persian Gulf Star Refinery, making the country self-sufficient in gasoline production. Tehran has been importing gasoline for its domestic needs for years. Under the previous Western sanctions, Tehran couldn’t buy spare parts for refinery maintenance, and had reduced gasoline production capacity in the wake of the Iran/Iraq war. Most of Iran’s fuel imports have been coming from refiners in India, Southeast Asia, and North Asia. According to the minister, Tehran could export some of the gasoline, but it will not do so as it wants to boost its domestic stockpiles.

Tehran is holding its annual naval drill in the Strait of Hormuz. The three-day exercise with maneuvers extending as far as the Sea of Oman and the Indian Ocean began last Friday with warships, submarines, helicopters, and surveillance aircraft taking part.

Iraq: Negotiations between Kurdistan’s two leading political parties have broken down in their efforts to form a new government in Erbil and elect a new governor of Kirkuk. The setback further extends a period of political uncertainty and lame-duck administration of the semi-autonomous region, although officials from both the ruling KDP and the PUK expressed hope that they can regenerate some forward momentum.

Saudi Arabia: Saudi Arabia’s crude oil exports fell by nearly 550,000 b/d to 7.687 million b/d in December, as the Kingdom started to limit supply after the US granted waivers to eight Iranian customers. Saudi oil production also dropped in December to 10.6 million b/d from an all-time high of 11.09 million b/d the month before. During November, Saudi Arabia’s crude oil exports had jumped by 534,000 b/d month on month to 8.24 million bpd—the highest level in two years as the Kingdom moved to offset supply losses from Iran with the return of the US sanctions.

Saudi Arabia’s Energy Minister Khalid al-Falih told CNBC in January that Moscow had moved “slower than I’d like. In response, Russian Energy Minister Alexander Novak said Russia was “completely fulfilling its obligations in line with earlier announced plans to gradually cut production by May this year.” However, the numbers say Russia is not shouldering its part of the new deal. The OPEC+ members agreed to cut supply by 1.2 million barrels per day.

Saudi Arabia agreed to make up for most of the cut among OPEC members and has also said it will drop its crude oil production by a further 400,000 b/d to 9.8 million in March. If that output cut is reached, it would mean that since December (one month before implementation of the deal), Saudi Arabia has become responsible for 70 percent of the total OPEC+ target.

State-owned Saudi Aramco has signed an agreement to form a joint venture with Chinese conglomerate Norinco to develop a refining and petrochemical complex in Panjin city, saying the project is worth more than $10 billion. Aramco and Norinco, along with Panjin Sincen, will form a new company called Huajin Aramco Petrochemical Co as part of a project that will include a 300,000 barrels per day refinery with a 1.5 million metric tons per annum ethylene cracker, Aramco said on Friday.

Over the weekend Saudi Arabia appointed Princess Reema bint Bandar as ambassador to the US, making her the first woman envoy in the country’s history. The kingdom seems to be trying to repair its image in the US media and Congress.

Libya: There was no news last week as to whether the 300,000 b/d Sharara oilfield has reopened after General Haftar’s Libyan National Army took control of the region two weeks ago.

3. China

After months of concerns that the global economy and oil demand would suffer from a US-China trade war, renewed hopes that an agreement could be reached buoyed optimism last week. China’s Vice Premier Liu He was in Washington last week and if progress is made these discussions might be followed by a Trump/Xi meeting in March. US officials note that there are still significant issues outstanding. In the meantime, the US has eased off the plan to impose tariffs on Chinese imports beginning on March 1st.

PetroChina achieved production rate of 733 b/d, from the Jimsar oil field in the western Xinjiang province, which suggests that shale drilling could finally have commercial potential in China, according to Morgan Stanley. China has been attempting to find commercial shale oil and gas deposits for the past ten years will little result. Much of China’s oil has been found in geology that is not conducive to forming shale oil deposits.

Saudi Crown Prince Mohammed bin Salman concluded a $10 billion deal for a refining and petrochemical complex in China on Friday while meeting Chinese President Xi Jinping. The Saudi delegation, including top executives from Saudi Aramco, arrived on Thursday on an Asia tour that has already seen the kingdom pledged to invest $20 billion in Pakistan and seek to make additional investments in India’s refining industry. Saudi Arabia signed 35 economic cooperation agreements with China worth a total of $28 billion at a joint investment forum during the visit. The Saudis are looking for or trying to buy, new friends in the wake of the Khashoggi murder which has soured relations with the US, Europe, and other countries.

4. Nigeria

The country, which now has a population of 191 million, voted for president over the weekend. Organizing for an election where 73 million are supposed to vote in an underdeveloped nation is some undertaking and the election was delayed for a week as officials got their act together. The ruling party, represented by Muhammadu Buhari, a 76-year-old former army general, whose health is not good, is likely to win as the incumbent rarely loses in Nigeria. Buhari has a reasonably good reputation in a country noted for corruption while his opponent Atiku Abubakar has a long history of involvement in crime even in the US where he has been the subject of FBI investigations.

Both candidates are from the northern part of the country and are disliked in the oil-producing south. The Delta Avengers, who did a respectable job of shutting down several hundred b/d of Nigeria’s oil production a few years back are talking about renewing attacks on the oil infrastructure if Buhari is re-elected. Whoever wins will have many problems, including the Boko Haram insurgency, which is reported to be killing more people each year than the wars in Yemen or Afghanistan.

The government is trying to develop a new source of revenue from suing international oil and financial companies that have been working in Nigeria for decades. Last week, a High Court in London granted Nigeria’s plea to allow it to proceed with the trial of JPMorgan Chase. The bank is alleged to have enabled the misappropriation of state funds totaling $875 million during the procurement of an oil drilling license.

Even more lucrative could be a new government effort to collect “back taxes” from the oil companies doing business in Nigeria, including Royal Dutch Shell, Chevron, Exxon Mobil, Eni, Total and Equinor. Each of the firms has been ordered to pay the government between $2.5 billion and $5 billion for a total of around $20 billion. Sending out tax bills is a lot easier than suppressing insurgencies to maintain oil production.

Nigeria is currently producing about 1.8 million b/d. Production has been going up recently due to the opening of a new offshore oilfield, which is a lot less vulnerable than oil coming from the Niger Delta. The country is supposed to cut 40,000 b/d as part of the OPEC+ production agreement, but so far seems to be increasing production despite occasional claims that it plans to comply with the deal.

5. Venezuela

Troops loyal to President Maduro violently drove back foreign aid convoys from Venezuela’s border on Saturday, killing at least two protesters and prompting opposition leader Juan Guaido to propose that Washington consider “all options” to oust him. Trucks carrying US food and medicine that was not torched by Venezuelan troops returned to warehouses in Colombia after opposition supporters failed to break through lines of soldiers.

The opposition had hoped Venezuelan soldiers would balk at turning back supplies desperately needed in the country, where a growing number of its 30 million people suffer from malnutrition and treatable diseases. But while some 60 members of the security forces defected on Saturday, the lines of National Guard soldiers at the frontier crossings held firm. During the confrontation, President Maduro addressed thousands of his supporters in Caracas warning that any US effort to use military force against his government would result in another Vietnam.

The state of Venezuela’s oil production is mired in confusion. Oil production in January was around 1.1 million b/d but has declined rapidly in the last three weeks. PDVSA is partnered with several international oil companies in heavy crude projects in the Orinoco, ranging from the US’ Chevron to Russia’s Rosneft and China National Petroleum Corp. Together, those joint ventures produced just over half of Venezuela’s total oil output. A decline of as much as 400,000 b/d due to the US embargo on diluent exports to PDVSA is currently underway. PDVSA oil production, in conventional assets outside the Orinoco, is likely to drop to minimal levels, if not shut down completely, as US sanctions take hold.

Some are saying that Caracas’s production could be as low as 500,000 b/d by the end of the year. If there is a total collapse of Venezuela’s economy, it could be close to zero. The withdrawal of foreign oil workers from the country would likely hasten the collapse. As Venezuelan refineries are barely working, widespread fuel shortages are emerging. Moscow and Europe continue to sell fuels to Caracas but at very high prices.

The long-term prospects for Venezuela’s oil industry are not good. Most of Venezuela’s future oil production will likely come from the Orinoco tar sands. This crude is extremely heavy and requires considerable processing and diluting with imported hydrocarbon liquids before it can be shipped. Most Orinoco operations are in partnership with foreign operators who can do little if diluents are not available in quantity.

Given the country’s current economic, political, and humanitarian state, it is doubtful that international oil companies will want to invest much money in Venezuela for a while. There are better opportunities elsewhere and given concerns about climate change and dirty oil, there may not be much of a future for Oronoco oil. Should a new anti – “socialist” government emerge in Caracas, it may not be interested in paying off the billions of dollars that Moscow and Beijing have loaned their fellow “socialist” country in recent years. Reviving the Venezuelan oil industry after the current troubles may find few friends.

6. Mexico

Pemex produced 1.62 million b/d in January, less than any month in almost three decades, the state-owned oil company said on Friday. The company’s crude output for the month was the lowest since at least 1990, when Pemex’s publicly available records begin. The company’s crude oil exports also fell in January to total 1.07 million bpd, down nearly 10 percent from 2018.

President Lopez Obrador, who took office in December and ran on a promise of strengthening the ailing company, said he will grow its output to around 2.5 million b/d by the end of his six-year term in 2024. Lopez Obrador has yet to fully outline how Pemex alone would be able to reverse the long-standing slide, but he did push through a larger budget for the company this year, in addition to a fresh capital injection from the government and a lower tax bill.

Pemex burned through $665 million at its fertilizer unit, ignored consultants and made high-risk investments with no discernible business strategy, according to a government audit of its 2017 operations. The report, published on Wednesday, offers insight into how Pemex ended up creaking under $106 billion of debt during the six-year term of former President Enrique Pena Nieto.

In addition to its oil production, Mexico is looking for ways to reduce its dependency on US natural gas imports, which currently satisfy over 50 percent of its demand. This is the highest foreign gas dependency rate in the world. That’s especially true because Mexico uses natural gas for over 60 percent of its power generation: a much higher portion than other gas import-dependent countries.