Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Gold May Advance With Industrial Metals; Silver Is Near a 2 1/2-Year High

http://www.bloomberg.com/news/2010-09-06/gold-may-climb-as-dollar-near-two-week-low-spurs-alternative-asset-demand.html

By Nicholas Larkin and Sungwoo Park - Sep 6, 2010 11:46 AM ET

Five of the six main industrial metals on the London Metal Exchange rose, led by zinc, after a report last week showed U.S. employers added more jobs than estimated. The dollar dropped to a two-week low against the euro before rebounding. Gold, which usually moves inversely to the greenback, is trading 1.2 percent below a record.

Stronger prices for other metals are “spilling over into gold,” Peter Fertig, owner of Quantitative Commodity Research Ltd. in Hainburg, Germany, said today by phone. “A weaker dollar is usually a supportive factor for gold. It’s expected to be a quieter day for gold” because of a U.S. holiday, he said.

Immediate-delivery bullion added $2.80, or 0.2 percent, to $1,249.55 an ounce at 4:32 p.m. in London. Prices gained 0.7 percent last week. Gold for December delivery was little changed at $1,251.20 in electronic trading on the Comex in New York. Comex floor trading is closed today for the Labor Day holiday.

The metal was little changed at $1,249 an ounce in the afternoon “fixing” in London, used by some mining companies to sell output, from $1,249.50 at today’s morning fixing. Spot prices climbed the past five weeks, the longest winning streak since September last year.

Bullion has advanced 14 percent this year, reaching a record $1,265.30 an ounce on June 21. The price is set for a 10th annual gain as investors seek to protect their wealth against financial turmoil in Europe and the prospect of slowing economic growth.

‘Sentiment Remains Bullish’

U.S. private payrolls climbed 67,000 in August after a revised 107,000 increase in July, Labor Department figures showed Sept. 3. The median forecast of economists in a Bloomberg News survey was for 40,000 more positions. Gold’s losses were limited on Sept. 3 after a U.S. report showed service industries expanded in August at the weakest pace in seven months.

“Gold will continue trying to break the record,” said Hwang Il Doo, a senior trader at Korea Exchange Bank Futures Co. in Seoul. “Once it breaks it, bullion will shoot up. Sentiment remains bullish.”

An index measuring sentiment in the 16-nation euro region slid to 7.6 in September from 8.5 in August, according to a report from the Sentix research institute. Economists in a Bloomberg survey had forecast an increase to 9.0.

Assets in the SPDR Gold Trust, the biggest exchange-traded product backed by bullion, were little changed at 1,294.44 metric tons on Sept. 3, figures on the company’s website showed. Holdings touched a record 1,320.44 tons in June.

Jewelry Demand

“An anticipated pickup in gold demand for jewelry use in September and expectations for inflation may support” prices, Lee Suk Jin, a commodities analyst at Seoul-based Tong Yang Securities Inc., wrote in a report today. Households in India, the biggest gold user, typically increase jewelry purchases in the year’s final months to mark festivals and weddings.

Silver for immediate delivery in London was little changed at $19.9063 an ounce. The metal reached $19.9225 on Sept. 3, the highest price since March 2008. Platinum gained as much as 0.7 percent to $1,566.75 an ounce, the highest price since Aug. 9, and was last at $1,560.80. Palladium was little changed at $529.50 an ounce after rising as much as 0.7 percent to $533.25, the highest level since May 14.

Silver, platinum and palladium “reflect both an urge to own insurance and an urge to hedge in favor of further global economic growth,” said Dennis Gartman, an economist and the editor of the Suffolk, Virginia-based Gartman Letter.

To contact the reporters on this story: Sungwoo Park in Seoul at spark47@bloomberg.net ; Nicholas Larkin in London at nlarkin1@bloomberg.net .

Big Autumn Silver Rally 2

By Adam Hamilton

Aug 20 2010 1:00PM

http://www.ZealLLC.com

http://www.kitco.com/ind/hamilton/aug202010.html

Silver has been drifting in a rather lackluster summer. Ever since surging to $19.50 in mid-May, this often-popular white metal has been grinding sideways to lower. By late July it had fallen over 10% to about $17.50. But despite silver’s recent excitement-bereft sojourn, it actually has excellent potential for a big autumn rally in the coming months.

The primary reason is gold. Since the early 1970s, silver has closely followed and sometimes amplified the price moves of the granddaddy of precious metals. Over the vast majority of this decades-long span, silver has been nearly perfectly statistically correlated with gold. When gold is strong, traders flock to silver. And when gold is weak, they abandon its smaller cousin. In hard technical price-chart terms, there is no doubt at all that silver is a derivative play on gold.

Of course autumn is typically an excellent time of the year for gold, and therefore for the whole precious-metals complex. Big seasonal factors converge which tend to seriously ramp up global gold demand and hence gold prices. These include income-cycle drivers like Asian harvest, after which farmers invest some of their year’s surplus income in gold. They also include cultural drivers, like Indian wedding season where brides are adorned with intricate and expensive gold-jewelry dowries.

While the usual autumn gold rally is very bullish for silver, it certainly isn’t the only thing silver has going for it right now. This essay will explore those other factors, including silver technicals coiled like a spring and ready to launch as well as silver’s continuing undervaluation relative to gold. Even if gold somehow managed to languish flatlined this autumn, silver’s own intrinsic merits are exceptionally bullish today.

This first chart looks at silver’s impressive technicals. Silver and its key moving averages are tied to the right axis, while Relative Silver is rendered in red on the left. Relativity is a measure of oversoldness and overboughtness, helping traders understand when prices are exceptionally low (the time to buy) or exceptionally high (the time to sell). rSilver is computed by dividing the close in silver by its 200-day moving average. The result charted over time creates a horizontal constant-percentage trading range.

.............................................

In order to understand why silver looks exceptionally bullish emerging out of this year’s typical summer doldrums, we need some technical perspective. Back in the summer of 2008, silver was consolidating high after a massive rally in late 2007 (which started in autumn) and early 2008. Then the brutal stock panic hit like an F5 tornado, destroying the global appetite for all risky assets including silver. In just 4 months, this metal plummeted a sickening 53%!

Ever since that epic panic anomaly, silver has been relentlessly recovering. This recovery provides the critical strategic lens through which all recent price action must be considered. Silver had already stubbornly returned to its pre-panic price levels last autumn. It averaged $18.07 in July 2008 before the panic, and $17.90 in November 2009 after last year’s autumn rally. Since then, it has generally consolidated sideways.

Provocatively, this high consolidation over most of the past year occurred within the old pre-panic high-consolidation range. Silver did fall out of this range once, when it plunged 20% in 3 weeks in late January and early February 2010 in response to sharp gold and stock-market retreats. But that correction was quickly erased, silver rapidly climbed back up into this high-consolidation trend less than a month later.

High consolidations are basing events, very important technically. After any fast rally to new price levels not yet seen in a bull, traders are nervous about whether those seemingly-stellar prices are sustainable. Some traders, looking for a correction, sell. Meanwhile other traders, excited because the price has rallied so far, buy to ride the momentum. The net result is a high consolidation, prices grind sideways not far off their new highs while traders digest their implications.

The longer a high consolidation lasts, the more comfortable traders get with those new price levels. Back in early 2008, $18 silver seemed pretty high and overbought. While the silver-to-the-moon zealots loved it, more prudent traders were concerned since silver often plunges even faster than it rallies. Yet today, since we’ve seen $18 silver on and off for a few years now, it seems perfectly normal. Silver doesn’t feel overbought at all at $18, we’ve been conditioned to accept this level.

This base has been established over a long time, either since late 2009 or early 2008 depending on your perspective. The longer that a particular price level bases in a fundamentally-driven secular bull, the more powerful the inevitable rally out of that base. Since the stock panic was an ultra-rare once-in-a-century anomaly, silver’s base extends back to 2008 in my book. But if you want to be more conservative and consider it only relevant since late 2009, that is still a long basing period.

Remember, silver follows gold. Back in February 2008 when silver pierced $18 initially in this bull, gold averaged $926. Last month (July 2010) when silver averaged $18, gold averaged $1192 (29% higher). So as I’ll discuss after the next chart, silver’s high basing in the face of strong gold prices makes it look even cheaper today. This high base is the perfect springboard for a major silver rally.

There are some other bullish technical developments beyond this long high consolidation to note. First, silver’s key support zones are converging today. Its recent recovery-support line since the panic has just hit its old pre-panic high-consolidation support line. For technically-oriented traders who pay attention to these things, and most silver-futures traders do, a convergence of major support lines is a powerful incentive to buy. Right in time for the autumn rally!

More importantly, check out rSilver’s position in its horizontal range. Considered as a multiple of its 200dma, over the past 6 years or so silver has tended to run between 0.96x its 200dma when it is oversold and 1.40x when it is overbought. The last time rSilver traveled in the upper half of its long trading range was way back last autumn. Languishing at an average under 1.04x so far this month, silver is low in its range and near-oversold today. It’s been a long time since silver has seen any excitement.

The best time to buy anything is when traders aren’t excited about it, when it is low relative to its 200dma. And thanks to this year’s summer doldrums, rSilver has been grinding ever lower on balance since spring. To see silver mired in bearish sentiment, and hence low technically, right before the usual strong autumn seasonal factors kick in is exceptionally bullish. If silver was overbought instead, stretched well above its 200dma, too much greed could lead to a correction fighting against autumn seasonals.

But this isn’t the case today. As we exit the summer doldrums and head into gold’s strong autumn, rSilver is near the oversold end of its secular trading range and traders aren’t excited at all about this metal. Meanwhile silver has been consolidating high for at least a year and building a strong base from which to launch its next big rally to new bull highs. On top of all this, the recovery support line has converged with silver’s high-consolidation support. Together these facts create a great environment to be long silver.

Way back in the heart of the stock panic, we bought silver stocks aggressively and encouraged our subscribers to do the same. Why? Silver was radically undervalued relative to gold. Since then, I’ve advanced this argument several times using the Silver/Gold Ratio. Prior to the panic silver traded in a definite range relative to gold. The panic anomaly blew that apart as risky silver plummeted much faster than much-safer gold. But ever since that panic, silver has been gradually recovering relative to gold.

This next chart highlights the state of the Silver/Gold Ratio today, another powerfully-bullish driver for silver this autumn. Since the silver price divided by the gold price yields a difficult-to-parse small decimal, I prefer dividing gold by silver and then inverting the axis to get an easier-to-understand proxy for the SGR. This SGR is rendered in blue on the right axis, while the raw silver price is slaved to the left in red.

..............................................

For years prior to that stock-panic anomaly, the SGR was actually climbing higher in a secular uptrend. And this makes sense. Strong gold prices get traders interested in leveraging the precious-metals bull in silver. So the longer a gold bull persists, and the higher it runs, the more traders want silver exposure. And the more traders bidding silver higher, the faster its price rises. Since silver is such a tiny market compared to gold, as a gold bull matures silver gradually gains ground relative to the gold price.

Between January 2005 and August 2008, the time of normalcy before all the wild dislocations the panic spawned, the SGR averaged 54.9x. An ounce of silver traded for about 1/55th the price of an ounce of gold. In addition, silver had a correlation r-square with gold of 95% over this span! In other words, 95% of the daily price action in silver was directly explainable statistically by gold’s own price action. This was the normal precious-metals secular-bull environment.

But when highly-speculative silver plunged far faster than gold during the panic, this relationship was blown apart. Between September and December 2008 when the extreme the-sky-is-falling panic psychology reigned, the SGR averaged a dismal 75.8x. At worst at the panic’s nadir, it easily hit its lowest point of the entire secular bull (1/84th the price of gold!). And in correlation terms silver started following the US stock markets rather than gold, its r-square with the yellow metal fell to an unbelievable 53%.

Now if you’ve studied silver’s historical relationship with gold, even in the bowels of the panic it was crystal-clear this anomaly couldn’t be sustained. It was the best opportunity of this entire secular bull to buy silver stocks, so we and our subscribers did aggressively. And time has vindicated our hardcore contrarian stance then, as silver has indeed been recovering relative to gold since.

From January 2009 to today, the SGR has regained a 66.4x average. And silver’s correlation r-square with gold is back up to 89%, nicely returning towards historic norms. But I don’t believe this post-panic recovery is over yet. Remember that silver is highly-speculative, and thus exceptionally sensitive to prevailing sentiment in the financial markets. And ever since the panic, widespread fear and anxiety have continued to dominate. This ugly environment has slowed silver’s recovery relative to gold, but not stopped it.

Depending on where you want to measure it from, silver’s undervaluation relative to gold today runs somewhere from substantial to enormous. Ever since this post-panic recovery got underway in earnest in early 2009, the SGR has been recovering in the uptrend rendered above. Today the SGR is down low near its support, silver is unloved thanks to the summer doldrums. But if the SGR merely climbs back up to resistance, we are looking at an SGR of 58x or so.

At $1200 gold, this yields a silver price of $20.70. But gold tends to rally in the autumn, and is set up beautifully this year (low in its relative trading range, near its 200dma). At $1300 gold, a 58x SGR yields a silver price approaching $22.50. But for a variety of reasons, I think merely using this SGR recovery uptrend’s resistance line is far too conservative. Ever since the panic, I’ve argued that silver ought to at least regain its old secular pre-panic average SGR near 55x.

At $1200 and $1300 gold, this yields “fairly-valued” silver prices around $21.75 and $23.50. Of course these are well into new-bull-high territory, as silver achieved its best level of this secular bull ($20.77) back in March 2008. And you better believe that as soon as silver surges to new bull highs, interest in buying silver stocks is going to soar. Probabilities are high that we’ll see new bull highs in silver this autumn.

For me, a return to the old pre-panic average SGR is plenty bullish enough. But for some investors, silver is a religion. They hold nothing but physical silver and silver stocks, and their whole financial future revolves around a silver moonshot. While not being diversified is extremely risky, this all-or-nothing bet on silver is common enough to throw out some optimistic projections for these silver zealots.

Check out the SGR’s old pre-panic secular uptrend rendered above. Today its support extends to 46x and its resistance to 35x. Remember the longer a precious-metals bull persists, the more traders get interested in silver and the higher it is bid relative to the gold price. So it is probable at some point, though almost certainly not this autumn, that the SGR will re-enter this pre-panic trend. If you plug a 46x or 35x SGR into a reasonable gold price in the coming years, you get some silver-price projections that will make even the raging bulls smile.

Back to a more reasonable 55x in the near term, $1200 and $1300 gold projections are conservative. On average seasonally, gold rallies about 5% between mid-August and late September and then another 12% between late October and late February. Together these rallies average around 14% in the autumn and winter buying season. If gold rallies 14% this year from its recent late-July low, we’d be looking at $1325 before next spring.

Heck in last year’s autumn rally, which was admittedly quite exceptional, gold soared 31% between late July and early December. A similar rally this year, which I’m not betting on since its odds aren’t great, would push gold up above $1500! Even at the pre-panic average 55x SGR, this would yield a silver price around $27.25. And even if we don’t see this until autumn 2011, the appreciation potential of silver stocks is vast thanks to silver’s continuing post-panic recovery relative to gold.

So while gold and hence silver seasonals are always bullish in autumn, this year looks like it has greater potential than normal. Silver has been basing for a long time getting traders comfortable with $18ish levels. It looks cheap technically trading near its 200dma and sentiment, while not exactly rotten, is certainly still totally bereft of any greed or excitement. On top of all this, silver remains very undervalued relative to gold, and is even trading near support in its post-panic-recovery SGR uptrend. What an explosive setup heading into autumn!

The bottom line is silver looks very bullish heading into autumn 2010. Big seasonal gold-demand spikes are approaching, and rising gold prices get traders excited about silver. After consolidating high and forming a strong base for at least a year, silver has the perfect springboard from which to launch to new bull highs. Couple this with converging major support lines, near-oversold technicals, and little enthusiasm today, and silver is perfectly positioned for a fast ride higher in the coming months.

Overarching all these bullish silver technicals is this metal’s continuing panic-driven undervaluation relative to gold. Until this valuation gap is fully closed, silver has a lot of ground to regain and thus should rally faster on balance to catch up. Thanks to all these bullish influences, this year’s big autumn silver rally certainly has the potential to surprise on the upside. And silver stocks will naturally soar if all this comes to pass, creating a great opportunity for traders today.

Adam Hamilton, CPA

August 20, 2010

I think we are building that base right now...

Ya probably slipping with the overall markets right now. Where to you think we might form a base support again?

Cheers,

D

Canadian Zinc Corp. (Toronto: CZN) (OTCBB: CZICF)

Price: $0.37

www.canadianzinc.com

Our new stock suggestion is Canadian Zinc Corp. currently on the Toronto exchange at $0.37 and on the OTCBB exchange at $0.358.

When the Hunt brothers attempted to corner the silver market in 1980, driving the price of silver up to $50 per ounce, they were quietly getting ready to open their own silver mine. The mine the Hunt brothers were getting ready to open is called Prairie Creek. It was explored, developed and brought almost to completion, but never operated. After Federal Reserve Chairman Paul Volcker raised interest rates to 20% and saved America from the inflationary crisis it was about to experience, the price of silver collapsed. The Hunt brothers were forced to file for bankruptcy and Prairie Creek was placed into receivership.

CZN now owns the rights to the Prairie Creek Silver, Lead & Zinc mine in Canada. CZN’s long-term aim is to bring the 100%-owned Prairie Creek Mine in the Mackenzie Mountains of the Northwest Territories into production at the earliest possible date. The mine, which has a fascinating 25 year history, is a silver and base metals property already in the advanced stages of development, with substantial resources of high-grade silver, zinc, and lead.

The Prairie Creek Mine is partially developed with an existing 1,000 tonne per day mill and related infrastructure. There are still fresh paint signs on the walls from the Hunt brothers in the 1980s. In fact, in one of the bathrooms, you can see where the tile people suddenly stopped working and left all the tools behind when the Hunt brothers were forced to abandon the project.

In 2006 and 2007, CZN carried out major programs at Prairie Creek including driving a new internal decline approximately 600 metres long which enabled a significant underground exploration and infill drilling program to occur. A total of $18.7 million was invested in Prairie Creek in 2006 and 2007.

A Technical Report dated October 12, 2007 indicates that the Prairie Creek Property hosts Measured and Indicated Resources of 5,840,329 tonnes grading 10.71% zinc, 9.90% lead, 161.12 grams silver per tonne and 0.326% copper. In addition, the report confirms a large Inferred Resource of 5,541,576 tonnes grading 13.53% zinc, 11.43% lead, 215 grams per tonne silver and 0.514% copper and additional exploration potential.

The Measured and Indicated Resource is now capable of supporting a mine life of at least 20 years at the planned 600 - 1,200 tonnes per day production rate. Although CZN holds permits for the exploration and development of the Prairie Creek Property, CZN does not have all the permits necessary to operate the mine. Recently, CZN applied to the Mackenzie Valley Land and Water Board for permits that will allow the operation of the mine.

Having a mill that is 90% complete and machinery that is still in good working condition gives CZN a tremendous advantage in getting this mine up and running. It would cost well over $100 million in today's dollars to build what they already have! The main thing holding CZN back from taking this property into production is the environmental impact board which should have a decision made by March 2011.

CZN also holds a 17% interest in Vatukoula Gold Mines plc. The Vatukoula Gold Mine located in Fiji recovered 38,402 ounces of gold during the nine months ended May 31, 2010. Vatukoula trades on the London Stock Exchange under ticker symbol VGM. CZN's shares in VGM are currently worth $18.2 million Canadian dollars.

CZN has 125,150,563 million shares outstanding giving it a market cap at $0.37 of $46.3 million Canadian dollars making it a truly undervalued situation. As of March 31, 2010, CZN had cash of $4.956 million, short term investments of $1.687 million, and no debt. On July 1, 2010, it was announced that CZN raised $2.5 million in a private placement at $0.40 per share.

If we combine CZN's cash and short-term investments with the recent private placement and estimate that CZN has burned around $1 million since the end of the 1Q, CZN probably has a cash position right now of somewhere around $8.1 million.

If we take CZN's current market cap of $46.3 million and subtract an estimated cash position of $8.1 million and the value of their 17% stake in VGM of $18.2 million, CZN’s Prairie Creek Property is currently being valued at only $20 million!

Remember, Prairie Creek already has about $100 million in infrastructure in place from the Hunt brothers' efforts and CZN has already spent another $18.7 million on exploration.

CZN plans to mine not only silver but also zinc. Because of recent gains in zinc prices, the U.S. government is now looking for ways to make coins without zinc. Congressman Ron Paul recently said, "We could not maintain the gold standard nor the silver standard. We could not maintain the copper standard, and now we cannot even maintain the zinc standard, paper money inevitably breeds inflation and destroys the value of currency.”

Sprott Asset Management is a major investor in CZN. As of December 31, 2009, they reported shared voting power of 17,652,033 shares. Sprott, just like CZN, is also a major shareholder in VGM.

NIA considers CZN to be a once in a lifetime opportunity to prosper during the upcoming hyperinflationary crisis.

Our legal disclaimer: http://inflation.us/legaldisclaimer.html

For the week, down ~4%... hmmmm...

We have had a good litttle correction but the MA50/100 are doing their respective supportive jobs right now!!!

Vatukoula Gold Mines plc (VGM-AIM)

Invitation to the Vatukoula Gold Mines plc PDAC booth number 3350

Vatukoula Gold Mines plc is a mining company quoted on the Alternative Investment Market of the London Stock Exchange, which owns and operates the Vatukoula Gold Mine in Fiji (annual target production at 100,000 oz Au per year). The Mine has a NI 43-101 Proven & Probable Resource of 680,000 oz Au at a grade of 10.9 g/t and 4.3 m oz Au in the Measured, Indicated and Inferred categories. The mine is a shallow underground mine, with a maximum depth of 880 meters. In addition, the company has the exploration licence on 40 km2 of land surrounding the mine.

The company’s market cap is approximately US$140 million. Vatukoula Gold Mines plc intends to seek a listing on a North American exchange later this year.

The Company’s largest shareholders are Canadian Zinc Corporation (CZN-T) and Sprott Asset Management.

We will be exhibiting at the PDAC International Convention, Metro Toronto Convention Centre, March 7 to 10 in booth #3350. We cordially invite those attending the show to stop by our booth. The Right Honourable Fijian Minister of Lands and Natural Resources, accompanied by his team from the Ministry of Mines, will be available at our booth on Tuesday the 9th March 2010 between 11:00 and 13:00, should you wish to enquire about the Vatukoula Operations or any other issues regarding minerals explorations on the islands of Fiji.

We look forward to seeing you there.

If you have no interest in receiving further information on Vatukoula please reply to Sue Lim on suelim@vgmplc.com

2/1/2010 CANADIAN ZINC FILES AMENDED AND RESTATED QUARTERLY FINANCIAL STATEMENTS

http://www.canadianzinc.com/docs/NR020110.pdf

The Vatukoula mine is producing more gold now, and

share price is up considerably from where

CZN bought into it.

See website:

http://www.vatukoulagoldmines.com/index.asp

Jim Rogers- Except for Gold Commodities Still Depressed - CNBC 01/18/2010 -

http://eclipptv.com/viewVideo.php?video_id=9562

What a massive candle today... NICE!!!

Well done good job keep it UP and John keep improving -

the web site also ![]()

time for Hunt brothers dream silver mine to ![]()

open up the gem treasure chest ![]()

http://www.canadianzinc.com/content/gallery/video/

John is also doing a great improvement at CQR Alexander property -

beside Goldcorp's world richest goldmines and Au lowest cost -

at Red Lake ![]()

http://www.conquestresources.net/pdfs/CQR_Fact_Sheet.pdf

John F. Kearney, Chairman and Director -

http://www.investmentpitch.com/media/514/Conquest_Resources_Ltd.__TSXV_CQR/

The CZN and CQR's management are great and holding large share

position themself it makes me to trust them to do a great

work for all shareholders ex..

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=44314286

God Bless

How's that for a flashy new i-Box?

CANADIAN ZINC REPORTS THIRD QUARTER 2009 RESULTS

Vancouver, British Columbia, November 16, 2009 - Canadian Zinc Corporation (TSX: CZN; OTCBB: CZICF) (the "Company" or "Canadian Zinc") announces its financial results for the quarter ended September 30, 2009. This press release should be read in conjunction with the unaudited financial statements and notes thereto for the period ended September 30, 2009, and management's discussion & analysis ("MD&A") for the period ended September 30, 2009 available on SEDAR at www.sedar.com.

As at September 30, 2009, the Company had cash and cash equivalents of $6.711 million, short term investments of $4.891 million and marketable securities of $525,000 (for a total of $12.127 million). The Company also had a positive working capital balance of $11.762 million.

For the quarter ended September 30, 2009, the Company reported a net loss of $2.416 million compared to a loss of $1.672 million for the three months ended September 30, 2008. For the nine months ended September 30, 2009, the Company reported a net loss of $3.435 million compared to $3.153 million in the equivalent 2008 period. The increased loss in 2009 was primarily attributable to expenses related to the American Eagle Tuvatu Gold Project in Fiji, which expenses were not incurred in 2008.

Prairie Creek Operations Update

Canadian Zinc's primary focus for 2009 has been to move forward in the permitting process for the operating permits for the Prairie Creek Mine.

The Prairie Creek site re-opened in mid May 2009 and the main focus of summer work has been an ongoing program of rehabilitating the winter road which connects the Prairie Creek Mine site to the Liard Highway. This program involved drilling and blasting to widen the road in the proximity of Prairie Creek. In addition, the Company continued to carry out studies as part of the ongoing Environmental Assessment process and performed a number of projects at Prairie Creek that will be included in the Developer's Assessment Report to be filed with the Mackenzie Valley Environmental Impact Review Board ("MVEIRB" or "Review Board"). These studies/programs have included mine site water management, groundwater analysis, air-monitoring, rare plant/wildlife analysis, archaeological surveys, geotechnical assessments, road analysis and terrain assessments.

In addition, there has been follow-up with local communities on the previously signed Memoranda of Understanding which included preliminary discussions regarding Impact Benefits Agreements.

In May 2008, the Company applied to the Mackenzie Valley Land and Water Board ("MVLWB") for a Type "A" Water Licence and three Type "A" Land Use Permits ("LUPs"); one for the operation of the Prairie Creek Mine and the other two for Transfer Facilities along the road. A detailed Project Description Report ("PDR") was filed with the MVLWB as part of the permit applications. In September 2008, the MVLWB referred the applications to the Review Board for Environmental Assessment ("EA").

An EA is the next stage in the regulatory process following preliminary screening by the MVLWB. The initial phase of the EA consisted of community scoping sessions and written hearings, submissions and rulings to determine the scope of the Terms of Reference for the EA. The Review Board issued the Draft Terms of Reference and a Draft Work Plan in May 2009 and the final Terms of Reference and Work Plan were issued by the Review Board on June 26, 2009.

The Company is in the process of preparing the Developer's Assessment Report to be submitted to the Review Board later this year. The Review Board has indicated that it anticipates concluding its Report of Environmental Assessment by October 2010.

Vatukoula Gold Mines Plc

Canadian Zinc now holds a total of 628,669,022 ordinary shares, or approximately 17% of the issued share capital of Vatukoula Gold Mines plc ("VGM"). VGM is a UK company, listed on the AIM Market of the London Stock Exchange, which currently owns and operates the Vatukoula Gold Mine located in Fiji. Two nominees of Canadian Zinc have been appointed to the Board of VGM.

The Vatukoula Gold Mine has an operational history of over 70 years during which time it is reported to have produced some seven million ounces of gold and over two million ounces of silver from the treatment of around 22.5 million tonnes of ore. Production at the mine was suspended by the previous owners in 2006. VGM acquired the mine in April 2008 and since then has restarted operations.

Current planning is to restore mine operations to a rate of 110,000 ounces per year. VGM has reported that the Mine has a Proven and Probable Reserve of 858,000 ounces of gold and a Measured, Indicated and Inferred resource of 5.15 million ounces of gold. (These reserve and resource figures were prepared in March 2008 in accordance with the JORC reporting standards and are not in compliance with National Instrument 43-101).

For the quarter ended August 31, 2009 VGM reported that underground mine production at its Vatukoula Gold Mine was 43,705 tonnes compared to 54,618 tonnes in the previous quarter. Gold production for the quarter was 6,722 ounces compared to 8,711 ounces in the previous quarter.

Underground ore production for the quarter decreased to 43,705 tonnes, with an average mine grade of 7.49 grams of gold per tonne. This decrease can be attributed to delayed delivery of underground mining equipment which subsequently constrained the underground development rates and access to the ore.

The Vatukoula Treatment Plant continued to operate satisfactorily, with current gold recoveries at 84%, which is consistent with historic gold recoveries at Vatukoula. The tonnage milled has decreased as a result of the lower feed from the mining operations. The oxide circuit started production in July 2009 and has operated at a rate of 650 tonnes per day. The average grade of material delivered has averaged 1.79 grams gold per tonne with recoveries of 86% in the Mill.

On October 22, 2009 VGM completed a financing of approximately £9 million before expenses through the placing of 750,000,000 ordinary shares at a price of 1.2p per share. Canadian Zinc subscribed for 125,000,000 shares at a cost of £1.5 million (Cdn$2.553 million).

The net placing proceeds of £8.65 million will be used to assist VGM in increasing its pro rata gold production to an annual rate of 100,000 ounces by the beginning of the 2011 calendar year. This is expected to be achieved via an increased underground capital development program, allowing access to increased mining faces, increasing both the capacity of tonnage delivered from underground and an increase in delivered grade to the mill.

Subject to the delivery of underground mobile equipment, VGM believes that it has the resources available to achieve a targeted rate of in excess of 100,000 ounces of gold per annum by the beginning of the calendar year 2011.

The development program requires general capital expenditure both underground, at the power generating facility and at the mill. The primary expense is on 13 pieces of underground haulage equipment of which 12 have now been ordered and five have been delivered. The capital development program will also be supplemented by an underground surface drilling program which will allow the development program to focus on higher grade ore bodies and optimize mine planning and mining techniques.

Detailed mine planning has budgeted for the build up of gold production over this coming year, which, when supplemented with oxide production, results in a targeted production of 60,000 ounces of gold for the year ending August 2010.

While VGM is confident of reaching its stated objectives there can be no guarantee that they will be achieved.

For further information on VGM see the company's website: www.vatukoulagoldmines.com

Risks and Uncertainties:

This press release should be read in conjunction with the unaudited financial statements and notes thereto and management's discussion & analysis ("MD&A") for the period ended September 30, 2009, available on SEDAR at www.sedar.com.

The Company's business and results of operations are subject to numerous risks and uncertainties, many of which are beyond its ability to control or predict. Because of these risks and uncertainties, actual results may differ materially from those expressed or implied by forward-looking statements, and investors are cautioned not to place undue reliance on such statements, which speak only as of the date hereof.

Investors are urged to review the discussion of risk factors associated with the Company's business set out in the Company's Annual Information Form for the year ended December 31, 2008, which has been filed with the Canadian Securities Regulators on SEDAR (www.sedar.com). The risks and uncertainties, as summarized in the Company's MD&A and in other Canadian and U.S. filings, are not the only risks facing the Company. Additional risks and uncertainties not currently known to the Company, or that are currently deemed to be immaterial, also may materially adversely affect the Company's business, financial condition and/or operating results.

Alan Taylor, P.Geo., Chief Operating Officer, Vice President Exploration and a Director of Canadian Zinc Corporation, is responsible for the Company's exploration program, and is a Qualified Person for the purposes of National Instrument 43-101 and has approved this press release.

Cautionary Statement - Forward Looking Information

This press release contains certain forward-looking information, including, among other things, estimates relating to production volumes at the Vatukoula Gold Mine and the advancement of mineral exploration and development properties. This forward looking information includes, or may be based upon, estimates, forecasts, and statements as to management's expectations with respect to, among other things, future production at the Vatukoula Gold Mine, the timing and availability of capital equipment, the issue of permits, the size and quality of the company's mineral resources, future trends for the company, progress in development of mineral properties, future production and sales volumes, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining charges, the outcome of legal proceedings, the timing of exploration, development and mining activities and the financial results of the company. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. The Company does not currently hold a permit for the operation of the Prairie Creek Mine. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be converted into mineral reserves.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission ("SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this press release, such as "measured," "indicated," and "inferred" "resources," which the SEC guidelines prohibit U.S. registered companies from including in their filings with the SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F which may be secured from us, or from the SEC's website at http://www.sec.gov/edgar.shtml.

For further information contact:

John F. Kearney

Chairman

(416) 362- 6686

Suite 1002, 111 Richmond Street West

Toronto, Ontario M5H 2G4

Alan Taylor

Vice President Exploration & Chief Operating Officer

(604) 688- 2001

Suite 1710 - 650 West Georgia Street ,

Vancouver, BC V6B 4N9

Tel: (604) 688-2001

Fax: (604) 688-2043

Tollfree:1-866-688-2001

A more extensive description of the Company's activities is available on the Company's web site at

http://www.canadianzinc.com

E-mail: invest@canadianzinc.com Website: www.canadianzinc.com

Zinc market showing signs of recovery - Nyrstar

Demand is being driven from China, Europe and the US

Author: Antonia van de Velde (Reuters)

Posted: Wednesday , 28 Oct 2009

http://www.mineweb.com/mineweb/view/mineweb/en/page36?oid=91543&sn=Detail

Nyrstar (NYR.BR), the world's biggest zinc producer, said on Wednesday the zinc market was showing recovery signs driven by higher demand in the Chinese, European and U.S. steel industry, and was on track to cut costs.

Nyrstar said its zinc market metal production rose 6% in the third quarter to 207,000 tonnes from the previous three months, but was down 26% year on year for the first nine months of the year.

Led by China, the world economy was emerging from its deepest downturn in decades as a result of fiscal and monetary policies and as the destocking that occurred in late 2008 and first half of 2009 came to an end, Nyrstar said in a statement.

Zinc is mainly used to galvanise steel to protect against corrosion, and the recovery in the steel industry had been important for zinc demand, with galvanised steel accounting for over half of total zinc consumption, according to the International Lead Zinc Study Group.

World crude steel output was 0.5% higher month-on-month in September 2009 after a gain of 2.5% in August, according to data from the World Steel Association.

The company had seen some improvement in demand for its galvanising and speciality alloys, but premiums remained under pressure.

Nyrstar shares opened higher but by 1140 GMT, the stock was down 3.7% at 8 euros, in line with a 4.2% drop for the DJ Stoxx European basic resources index .SXPP.

"We believe the cost savings are sustainable in 2010 and will enable Nyrstar to fully benefit from the higher zinc price," Royal Bank of Scotland analyst Pieter Zwinkels said in a note to clients.

Zinc futures MZN3 are trading at around $2,300 per tonne, against about $1,500 per tonne in mid-July and around $1,200 per tonne a year ago.

The group benefited from the rally in zinc prices in the third quarter, but it said sulphuric acid prices remained under pressure. Sulphuric acid is a by-product of the zinc-making process, which Nyrstar also sells.

"Whilst in the short term markets are likely to remain volatile, we continue to believe that the outlook for zinc and other resources in the medium to long term is positive and will provide further opportunities for growth," Chief Executive Roland Junck said.

The group was on track to cut annual costs by 75 million euros ($112 million) by the end of 2010, it said.

Nyrstar said it would change its dividend policy from a fixed payout ratio to a recommendation by the board. It added that the new dividend policy would maintain adequate cash flows to carry out a new strategy to expand into mining to complement its smelting operations, which it outlined in June. ($1=.6718 euro) (Reporting by Antonia van de Velde, editing by Dale Hudson and Jon Loades-Carter)

© Thomson Reuters 2009 All rights reserved

Canadian Zinc Cor (USBB:CZICF)fiat(USD) $ 0.349 UP $0.044 (+14.43% ![]()

Bid 0.31

Ask 0.35

Volume 263,552

Day's Range 0.305 - 0.349

Last Trade 2:40:03 PM EDT

Click for Detailed Quote Page

Cdn Zinc Corp Com (TSE:CZN)(CAD) $ 0.34 UP $0.025 (+7.94% ![]()

Bid 0.325

Ask 0.34

Volume 180,902

Day's Range 0.31 - 0.35

Last Trade 3:51:56 PM EDT

Click for Detailed Quote Page

SILVER $49.-/oz in 1980 has the same buying power as

$128.35/oz in 2009

http://data.bls.gov/cgi-bin/cpicalc.pl

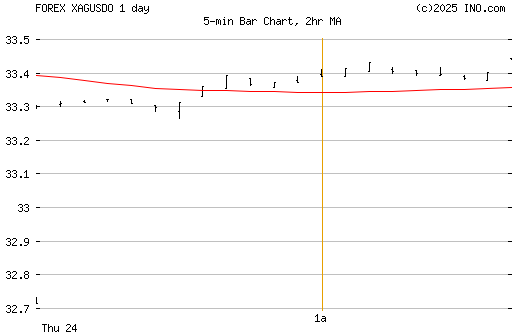

Silver Spot (FOREX:XAGUSDO)fiat$ 17.90/oz

Last trade 17.90 Change -0.06 (-0.33%)

Open 17.96 Previous Close 17.96

High 18.09 Low 17.68

Bid 17.90 Ask 17.94

2009-10-14 20:11:05, 0 min delay

http://www.canadianzinc.com/

http://investorshub.advfn.com/boards/board.aspx?board_id=14899

Canadian Zinc Participates in Vatukoula Financings-Vatukoula Gold Mine Operational Update-Tuvatu Option Cancelled

http://finance.yahoo.com/news/Canadian-Zinc-Participates-in-iw-1240384562.html?x=0&.v=1

* Press Release

* Source: Canadian Zinc Corporation

* On Tuesday September 29, 2009, 9:23 am EDT

*

Companies:

o CANADIAN ZINC CORP

o CDN ZINC CORP COM NPV

VANCOUVER, BRITISH COLUMBIA--(Marketwire - 09/29/09) - Canadian Zinc Corporation (TSX:CZN - News)(OTC.BB:CZICF - News) reports that it has conditionally agreed to subscribe for 125 million new shares in Vatukoula Gold Mines plc ("VGM") for an investment of Pounds Sterling 1.5 million (1.2 pence per share).

Canadian Zinc's subscription is part of a share placement by VGM to raise approximately Pounds Sterling 9 million (Cdn $15.75 million). Sprott Asset Management Inc., a substantial shareholder of both VGM and CZN has also subscribed for 124.5 million shares of VGM for an investment of Pounds Sterling 1.5 million.

Canadian Zinc also reports that Viso Gero Global Inc. has exercised its previously announced call option and has purchased from Canadian Zinc 200 million shares of VGM for Pounds Sterling 2 million.

In a separate transaction, Canadian Zinc has exercised its right, upon exercise of the Viso Gero call option, to acquire further shares of VGM and has agreed with VGM to subscribe Pounds Sterling 2 million for 156 million new shares (1.28 pence per share).

Following completion of the VGM financing and CZN's separate subscription, Canadian Zinc will hold 628 million shares of VGM representing approximately 17.2% of VGM's then outstanding shares.

The net placing proceeds will be used by VGM to assist in increasing its' pro rata annual production to in excess of 100,000 ounces by the beginning of the 2011 calendar year. This is expected to be achieved via an increased underground capital development program, allowing access to increased mining faces, increasing both the capacity of tonnage delivered from underground and an increase in delivered grade to the mill. While VGM is confident of reaching its stated objectives there can be no guarantee that they will be achieved.

Vatukoula Gold Mines plc is a UK company, listed on the AIM Market of the London Stock Exchange, which currently owns and operates the Vatukoula Gold Mine located in Fiji.

Tuvatu Option cancelled

Canadian Zinc also reports that it has agreed to cancel its option on the Tuvatu Gold Project in Fiji. Tuvatu is a high grade gold deposit on the island of Viti Levu, Fiji, and located approximately 37 kilometres to the southwest of the Vatukoula Gold Mine.

The Tuvatu Project is currently owned by American Eagle Resources Inc. ("American Eagle"), through its 100% owned Fijian subsidiary Lion One Limited. Under an Option Agreement entered into in May 2009, Canadian Zinc had the option, exercisable at any time until October 31, 2009, to acquire Tuvatu, via amalgamation of American Eagle with a wholly-owned subsidiary of Canadian Zinc under which 16,250,000 shares of Canadian Zinc would have been issued to the shareholders of American Eagle.

Canadian Zinc has now agreed to cancel its option to acquire American Eagle in consideration of the issue to Canadian Zinc of warrants entitling Canadian Zinc to acquire up to 1,250,000 shares (approximately 10%) of American Eagle, at an exercise price of the lesser of $2.00 per share or 25% above the price per share of the initial public offering of American Eagle. The warrants are exercisable until October 31, 2010.

Vatukoula Operations Update(a)

Vatukoula has announced that gold production from the Vatukoula mine for the quarter ending 31 August 2009 was 6,722 ounces.

�

----------------------------------------------------------------------------

4th 3rd 2nd 1st 12

quarter quarter quarter quarter Months

Ending ending ending ending Ending

August May February November August

2009 2009 2009 2008 2009

----------------------------------------------------------------------------

Mined tonnes (Underground Ore) 43,705 54,618 47,113 67,100 212,536

----------------------------------------------------------------------------

Mined grade -grams Au / tonne

(Underground Ore) 7.49 7.46 7.37 7.84 7.59

----------------------------------------------------------------------------

Mined tonnes (Surface Ore) 35,770 - - - -

----------------------------------------------------------------------------

Mined grade -grams Au / tonne

(Surface Ore) 1.79 - - - -

----------------------------------------------------------------------------

Gold produced -ounces (Oz) 6,722 8,711 7,471 10,522 33,426

----------------------------------------------------------------------------

Average gold sale price -US$ /

Oz 941 920 884 792 877

----------------------------------------------------------------------------

Cash Cost -US$/ Oz 1,041 680 915 778 837

----------------------------------------------------------------------------

Mine Net Profit (Loss) Pounds

Sterling, 000 (un-audited) (1) (982) 875 (195) (117) (419)

----------------------------------------------------------------------------

(1) The Mined Net Profit (Loss) has been re-stated for the first, second and

third quarter as a result of year end adjustments.

All figures in the table and in this update relating to the twelve months ending 31 August 2009 are provisional and unaudited.

(a) Information pertaining to the Vatukoula Operations Update has been derived from the VGM news release dated September 25, 2009, available on the VGM website at: www.vatukoulagoldmines.com.

Underground Operations

During the quarter ended August 31, 2009, VGM instigated an accelerated underground development program, which while resulting in lower production figures in the shorter term, should increase the mine's flexibility and allow VGM to realize its longer term production targets. In addition to the accelerated underground development program, the underground drill exploration program has been increased to assist with long term planning.

Underground ore production for the quarter decreased to 43,705 tonnes, with an average mine grade of 7.49 grams of gold per tonne. This can be attributed to delayed delivery of underground mining equipment which subsequently constrained the underground development rates and access to the ore. Five of the eight ordered pieces of underground equipment have been delivered to site. A further two pieces are due to be commissioned and delivered within the calendar year. VGM is currently in the process of sourcing an additional five pieces of underground equipment.

The capital development program will also be supplemented by an underground and surface drilling program which will allow the development program to focus on higher grade ore bodies, optimize mine planning and mining techniques.

Milling Operations

The Vatukoula Treatment Plant continues to operate satisfactorily, with current gold recoveries at 84% of the head grade delivered to the mill, which is consistent with historic gold recoveries at the mine. The ore milled from underground has decreased as a result of the lower feed from the mining operations.

Oxide Operations

The new oxide circuit has performed well and is operating at a rate of 650 tonnes per day. The average grade of material delivered from the low-grade stockpile has averaged 1.79 grams gold / tonne with recoveries of 86% of the head grade delivered to the mill.

VGM Outlook

Subject to the delivery of underground mobile equipment, VGM believes that it has the resources available to achieve a targeted rate of in excess of 100,000 ounces of gold per annum by the beginning of the calendar year 2011. This rate of production should lower the cash costs per ounce (assuming an oil price of $80 / barrel) to less than US$ 600 / ounce. Detailed mine planning has budgeted for the build up of gold production over this coming year, which, when supplemented with the VGM's oxide production, results in a targeted production of 60,000 ounces of gold for the year ending August 2010.

About Vatukoula Gold Mines plc:

Vatukoula Gold Mines plc is a UK company, listed on the AIM Market of the London Stock Exchange, which currently owns and operates the Vatukoula Gold Mine located in Fiji.

The Vatukoula Gold Mine has an operational history of over 70 years during which time it is reported to have produced some seven million ounces of gold and over two million ounces of silver from the treatment of around 22,500,000 tonnes of ore. Production at the mine was suspended by the previous owners in 2006.

VGM acquired the Vatukoula Gold Mine in April 2008 and has since then re-established gold mining operations. Current planning is to restore mine operations at a rate of 110,000 ounces per year. VGM has reported that the Mine has a Proven and Probable Reserve of 858,000 ounces of gold and a Measured, Indicated and Inferred resource of 5.15 million ounces of gold. (These reserve and resource figures have been prepared in accordance with the JORC reporting standards and are not in compliance with National Instrument 43-101). VGM has no forward gold sales and no bank debt.

For further information: www.vatukoulagoldmines.com

About Canadian Zinc:

The Company's principal focus is its efforts to advance the Prairie Creek Mine, a zinc/lead/silver property located in the Northwest Territories of Canada, towards production. The Prairie Creek Mine is partially developed with an existing 1,000 tonne per day mill and related infrastructure.

In April 2009 CZN acquired approximately 348,000,000 shares of Vatukoula Gold Mines plc for Pounds Sterling 2.54 million ($4.56 million) and subsequently, in June 2009, CZN subscribed for a further 200,000,000 shares of VGM for Pounds Sterling 1.20 million ($2.16 million). Following completion of the VGM financing and CZN's separate subscription, Canadian Zinc will hold 628 million shares of VGM representing approximately 17.2% of VGM's then outstanding shares.

Cautionary Statement - Forward Looking Information

This press release contains certain forward-looking information, including, among other things, estimates relating to production volumes and related costs of production at the Vatukoula Gold Mine. This forward looking information includes, or may be based upon, estimates, forecasts, and statements as to management's expectations with respect to, among other things, future production and sales volumes at the Vatukoula Gold Mine, the timing and availability of capital equipment, the size and quality of mineral resources, future trends for the company, progress in development of mineral properties, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining charges, the outcome of legal proceedings, the timing of exploration, development and mining activities, acquisition of shares in other companies and the financial results of the company. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. The Company does not currently hold a permit for the operation of the Prairie Creek Mine. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be converted into mineral reserves.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission ("SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this press release, such as "measured," "indicated," and "inferred" "resources," which the SEC guidelines prohibit U.S. registered companies from including in their filings with the SEC.

Contact:

Contacts:

Canadian Zinc Corporation

John F. Kearney

Chairman

(416) 362-6686

(416) 368-5344 (FAX)

Canadian Zinc Corporation

Alan B. Taylor

VP Exploration & Chief Operating Officer

(604) 688-2001 or Toll Free: 1-866-688-2001

(604) 688-2043 (FAX)

invest@canadianzinc.com

http://www.canadianzinc.com

http://investorshub.advfn.com/boards/board.aspx?board_id=14899

Canadian Zinc Cor (USBB:CZICF)fiat(USD)$0.32 UP $0.037 (+13.07% ![]()

Bid 0.30

Ask 0.34

Volume 434,150

Day's Range 0.285 - 0.329

Last Trade 7:59:37 AM EDT

Click for Detailed Quote Page

- The China Factor -

Now, this is rockin'!!!!

Cdn Zinc Corp Com (TSE:CZN)fiat(CAD)$0.34 UP $0.04 (+13.33% ![]()

Bid 0.33

Ask 0.34

Volume 125,000

Day's Range 0.30 - 0.34

Last Trade 12:28:54 PM EDT

Click for Detailed Quote Page

Canadian Zinc Commences Diamond Drill Exploration Program on Tuvatu Gold Project, Fiji -

http://finance.yahoo.com/news/Canadian-Zinc-Commences-iw-52599028.html?x=0&.v=1

welcome to Hunt brother's silver dream mine ![]()

http://investorshub.advfn.com/boards/board.aspx?board_id=14899

Cdn Zinc Corp Com (TSE:CZN)fiat(CAD)$0.24 UP $0.005 (+2.13% ![]()

Bid 0.24

Ask 0.25

Volume 16,283

Day's Range 0.24 - 0.245

Last Trade 3:52:24 PM EDT

Click for Detailed Quote Page

Canadian Zinc Reports Second Quarter 2009 Results

- PRAIRIE CREEK EXCLUDED FROM EXPANSION OF NAHANNI NATIONAL PARK RESERVE ![]()

- TERMS OF REFERENCE ISSUED FOR ENVIRONMENTAL ASSESSMENT OF PERMITS ![]()

- UPDATE ON VATUKOULA GOLD MINES AND TUVATU GOLD PROJECT ![]()

http://www.marketwire.com/press-release/Canadian-Zinc-Corporation-TSX-CZN-1031091.html

http://www.canadianzinc.com/ ![]()

Still looking great over here...

VATUKOULA REPORTS INCREASE IN GOLD PRODUCTION

Vancouver, British Columbia, June 23, 2009 -

http://finance.yahoo.com/news/Canadian-Zinc-Corporation-iw-2314035232.html?x=0&.v=1

Canadian Zinc Corporation -

(TSX: CZN; OTCBB: CZICF) reports that Vatukoula Gold Mines plc ("VGM"), which is 20% owned by Canadian Zinc, has reported an increase in gold production for its third quarter ended May 31, 2009.

VGM reported that underground mine production at its Vatukoula Gold Mine in Fiji increased to 54,618 tonnes for the quarter ended May 31, 2009, compared to 47,113 tonnes in the previous quarter. As a result of the increase in underground mine production and higher mining grades, gold production for the quarter increased by approximately 17% to 8,711 ounces from 7,470 ounces in the previous quarter.

3rd quarter ending

May

2009

2nd quarter ending February 2009

1st quarter ending November 2008

9 Months

ending

May

2009

Mined tonnes

54,618

47,113

67,100

168,831

Mined grade - grams gold / tonne

7.46

7.37

7.84

7.59

Gold produced - ounces (troy)

8,711

7,471

10,522

26,704

Average gold sale price-US$ / ounce

920

884

792

861

Cash Cost - US$/ ounce

680

915

778

739

The increased gold production reduced the cash cost per ounce to US$680/ounce for the third quarter from US$915/ounce in the second quarter.

Underground production for the period increased by 16% to 54,618 tonnes, with an average mined grade of 7.46 grams of gold per tonne. The underground mining operations remain adversely affected by the availability of underground haulage equipment which has limited the amount of ore the Mine is able to transport to the shaft ore-pass complex.

Following completion of its recent financing activities, part of which was subscribed by Canadian Zinc, VGM began sourcing and ordering refurbished underground mobile equipment required to achieve targeted production levels. VGM has upgraded its underground pumping capacity with additional pumps and continues with the scheduled refurbishment program of the diesel power generators.

The Vatukoula Treatment Plant continues to operate satisfactorily, with current gold recoveries at 90%, which is consistent with historic gold recoveries at Vatukoula. The ore milled has increased as a result of the higher feed from the mining operations.

During the quarter VGM commenced construction of an "oxide circuit" allowing a second feed option to the Mill. This will allow the Vatukoula Treatment Plant to treat surface oxide ore separately from the underground sulphide ore. Pre-crushed material will be delivered from various sources and the gold will be recovered using a carbon-in-pulp recovery process. The oxide circuit is nearing completion and VGM expects commissioning and production starting in July 2009.

The identification of oxide material on surface close to the current milling operations has given the mine an opportunity to enhance gold production while underground operations are constrained. The oxide circuit will provide additional mineral processing capacity which will augment the mine's gold production. This in turn will allow underground development to be carried out so as to generate sufficient underground working faces to achieve full production in 2010.

Subject to the ongoing refurbishment program and delivery of mobile equipment arriving on schedule, VGM believes that it will be able to achieve a pro-rata production rate of 110,000 ounces of gold during the first half of 2010. VGM believes that this rate of production should lower the Mine's cash costs per ounce (assuming an oil price of US$70/barrel) to between US$520/ounce and US$580/ounce.

On June 10, 2009 VGM announced that it had entered into a Memorandum of Understanding with the Fijian Sugar Corporation ("FSC") to enter into an agreement to purchase the electrical power generated from the planned Rarawai Mill Bagasse project. The FSC is committed to the Bagasse power project as a means to reduce their overall cost of production from the utilization of a waste product. The VGM gold mine has historically operated on diesel generated power, which can represent approximately 40% (dependent on usage and oil price) of the cash costs.

VGM also announced on June 10, 2009 that the Ministry of Finance and National Planning of Fiji granted VGM additional duty concessions on the import of mobile equipment, and reduced the rate of duty for all other imports, for a period of three years.

About Vatukoula Gold Mines plc:

Vatukoula Gold Mines plc is a UK company, listed on the Alternative Investment Market ("AIM") of the London Stock Exchange, which currently owns and operates the Vatukoula Gold Mine located in Fiji.

The Vatukoula Gold Mine has an operational history of over 70 years during which time it is reported to have produced some seven million ounces of gold and over two million ounces of silver from the treatment of around 22,500,000 tonnes of ore. Production at the mine was suspended by the previous owners in 2006.

VGM acquired the Vatukoula Gold Mine in April 2008 and has since then re-established gold mining operations. Current planning is to restore mine operations at a rate of 110,000 ounces per year. VGM has reported that the Mine has a Proven and Probable Reserve of 858,000 ounces of gold and a Measured, Indicated and Inferred resource of 5.15 million ounces of gold. (These reserve and resource figures have been prepared in accordance with the JORC reporting standards and are not in compliance with NI 43-101). VGM has no forward gold sales and has no bank debt.

For further information: www.vatukoulagoldmines.com

About Canadian Zinc:

The Company's principal focus is its efforts to advance the Prairie Creek Mine, a zinc/lead/silver property located in the Northwest Territories of Canada, towards production. The Prairie Creek Mine is partially developed with an existing 1,000 tonne per day mill and related infrastructure.

In April 2009 CZN acquired approximately 348,000,000 shares of Vatukoula Gold Mines plc for £2.54 million ($4.56 million) and subsequently, in June 2009, CZN subscribed for a further 200,000,000 shares of VGM for £1.20 million ($2.16 million). CZN now holds approximately 548,000,000 shares, or 20% of the issued shares of VGM. (See Canadian Zinc Press Release dated June 10, 2009)

Cautionary Statement - Forward Looking Information

This press release contains certain forward-looking information, including, among other things, estimates relating to production volumes and related costs of production at the Vatukoula Gold Mine. This forward looking information includes, or may be based upon, estimates, forecasts, and statements as to management's expectations with respect to, among other things, future production and sales volumes at the Vatukoula Gold Mine, the timing and availability of capital equipment, the size and quality of mineral resources, future trends for the company, progress in development of mineral properties, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining charges, the outcome of legal proceedings, the timing of exploration, development and mining activities, acquisition of shares in other companies and the financial results of the company. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. The Company does not currently hold a permit for the operation of the Prairie Creek Mine. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be converted into mineral reserves.

Cautionary Note to United States Investors

The United States Securities and Exchange Commission ("SEC") permits U.S. mining companies, in their filings with the SEC, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this press release, such as "measured," "indicated," and "inferred" "resources," which the SEC guidelines prohibit U.S. registered companies from including in their filings with the SEC.

For further information contact:

John F. Kearney

Chairman

(416) 362- 6686

Suite 700, 220 Bay Street

Toronto, Ontario M5J 2W4

Alan Taylor

Vice President Exploration & Chief Operating Officer

(604) 688- 2001

Suite 1710 - 650 West Georgia Street , Vancouver, BC V6B 4N9

Tel: (604) 688-2001 Fax: (604) 688-2043

Tollfree:1-866-688-2001

A more extensive description of the Company's activities is available on the Company's web site at www.canadianzinc.com

E-mail: invest@canadianzinc.com

Website: http://www.canadianzinc.com

Seemingly, CZN just can't be stopped.

Canadian Zinc Corp (USBB:CZICF)fiat(USD)$0.25 UP $0.028 (+12.61% ![]()

Bid 0.222

Ask 0.249

Volume 1,000

Day's Range 0.25 - 0.25

Click for Detailed Quote Page

Last Trade:7:57:21 EDT Jun-23-09

Cdn Zinc Corp (TSE:CZN)fiat(CAD)$0.27 UP $0.01 (+3.85% ![]()

Bid 0.265

Ask 0.27

Volume 75,700

Day's Range 0.26 - 0.27

Click for Detailed Quote Page

Last Trade:10:32:31 EDT Jun-23-09

CZN is a strategic bargain ![]()

http://investorshub.advfn.com/boards/board.aspx?board_id=14899

sumisu thanks great NEWS - Vatukoula Shareholders Approve Investment by Canadian Zinc -

http://finance.yahoo.com/news/Vatukoula-Shareholders-ccn-15497539.html?.v=1

CZN chart TA TI alert strong buy ![]()

http://quote.barchart.com/texpert.asp?sym=CZN.TO

Short Term Indicators

7 Day Average Directional Indicator Buy

10 - 8 Day Moving Average Hilo Channel Buy

20 Day Moving Average vs Price Buy

20 - 50 Day MACD Oscillator Buy

20 Day Bollinger Bands Hold

Short Term Indicators Average: 80% - Buy

20-Day Average Volume - 203173

Medium Term Indicators

40 Day Commodity Channel Index Buy

50 Day Moving Average vs Price Buy

20 - 100 Day MACD Oscillator Buy

50 Day Parabolic Time/Price Buy

Medium Term Indicators Average: 100% - Buy

50-Day Average Volume - 143657

Long Term Indicators

60 Day Commodity Channel Index Buy

100 Day Moving Average vs Price Buy

50 - 100 Day MACD Oscillator Buy

Long Term Indicators Average: 100% - Buy

100-Day Average Volume - 115388

Overall Average: 96% - Buy ![]()

Photovoltaics boosts silver demand which is expected to soar to 24 MM troy ounces by 2016.

http://www.commodityonline.com/news/Silver-s-new-boost-comes-from-rising-solar-industry-18265-3-1.html

June 1, 2009

Silver’s new boost comes from rising solar industry

Commodity Online

VIRGINIA: At present solar industry may not be the largest consumer of silver, but trends are changing. The high prices of fossil fuels, their environmental impact due to carbon emissions is already leading to world-wide growth in investments in solar and alternative technologies for energy.

Photo-voltaics is the fastest growing application for silver in the past five years due to the above mentioned factors. A NanoMarket’s research suggests that the volume of silver used for photovoltaics will reach over 24 million troy ounces in 2016. The report titled “Silver Markets for Photovoltaics” pointed out that the market dynamics of the silver and PV market are changing. As thin-film and organic PV begin to take a larger share of the overall PV market the use of silver will shift from that of a simple coating used to fabricate the top electrodes in crystalline silicon PV to that of a key determinant in boosting efficiencies and materials performance. NanoMarkets believes that thin-film PV and organic PV both will account for 27 percent of silver used by PV in 2016.

Trade commodities or equities from across the globe. Join Now

While the overall markets for silver are dominated mainly by its established, "conventional" uses, there are a number of emerging technologies that also use silver, and these rapidly growing technologies will account for a disproportionate amount of the growth in the silver market.

Key Findings:

-PV is the fastest growing application for silver; NanoMarkets' research suggests that the volume of silver used for photovoltaics will reach over 24 million troy ounces in 2016.

-NanoMarkets also believes that silver reflective coatings could prove of immense importance in getting organic PV (OPV) to performance levels that would make its satisfactory for its biggest area of opportunity; building integrated photovoltaics (BIPV).

-While PV silver will continue to be dominated by simple silver pastes, the need for higher performance will create demand for pastes manufactured from nanomaterials which have higher degrees of conductivity than regular pastes.

-

-Another new opportunity can be found in transparent composite materials in which indium tin oxide (ITO) or conductive polymers are mixed with silver to create new materials for high performance top electrodes. These composites are being tried out first in OPV, but NanoMarkets believes that they will have applications throughout the industry.

The use of silver is, of course, partially linked to the price of silver. The price of silver has been fairly volatile over the past several years, ranging as high as $20 per ounce in mid-2008 and back down to about $10 per ounce in early 2009. Much of the recent decline in silver prices is due to the ongoing worldwide recession, which has reduced demand for most industrial silver, including for products made with silver inks. This volatility does introduce a level of uncertainty into the use of silver inks, but generally where an ink is the preferred form of a conductor, silver inks' benefits far outweigh the relative cost, even at high silver prices. Price is only one factor in the market for silver conductive inks, and such inks generally contribute only a relatively small portion of the cost of the products that use them., NanoMarkets report said. (Courtesy: PRNewswire)

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=38602655

Canadian Zinc Corp (USBB:CZICF)fiat(USD)$0.297 UP $0.004 (+1.37% ![]()

Bid 0.28

Ask 0.315

Volume 193,000

Day's Range 0.22 - 0.32

Click for Detailed Quote Page

Last Trade:9:10:14 EDT Jun-11-09

Vatukoula Shareholders Approve Investment by Canadian Zinc ![]()

Thursday June 11, 2009, 6:00 am EDT

http://finance.yahoo.com/news/Vatukoula-Shareholders-ccn-15497539.html?.v=1

by sumisu thanks for the inf ![]()

Hi, NYBob. Sorry, but I haven't been following CZN lately.

Sold it last year.

Anyway, I just looked at the chart, and it looks "toppy" to me. I think these levels might be the highs for a while, unless they come out with fantastic news.

Just my opinion.

Vatukoula Shareholders Approve Investment by Canadian Zinc

On Thursday June 11, 2009, 6:00 am EDT

http://finance.yahoo.com/news/Vatukoula-Shareholders-ccn-15497539.html?.v=1

VANCOUVER, BRITISH COLUMBIA--(Marketwire - June 11, 2009) - Canadian Zinc Corporation (TSX:CZN - News; OTCBB:CZICF - News) is pleased to announce that at the extraordinary general meeting of Vatukoula Gold Mines plc ("VGM") held in London on June 10th shareholders approved the necessary resolutions for the issue to Canadian Zinc of 200,000,000 ordinary shares of VGM for an investment of Pounds Sterling 1,200,000 (Pounds Sterling 0.006 per share), or approximately Cdn$2,160,000.

The Share Subscription has been completed and Canadian Zinc now holds a total of 547,669,022 ordinary shares, or approximately 20.01% of the issued share capital of VGM.

Under the Subscription Agreement VGM has undertaken that in the event of any future financing by VGM within the next twelve months, Canadian Zinc will be invited to participate on the same terms in such financing pro rata to its holding so as to maintain its equity position in VGM immediately prior to the completion of such equity financing.

In addition, under the Subscription Agreement, Canadian Zinc will be entitled to subscribe for up to 250,000,000 additional VGM shares in the event that Viso Gero Global, Inc. exercises a call option granted to Viso Gero by Canadian Zinc on 200,000,000 of its VGM shares, so that the total percentage, shareholding held by CZN in VGM remains at 20.01%. (See Canadian Zinc press release dated May 7, 2009).

Canadian Zinc has agreed that for a period of nine months it will not dispose of any of the Subscription Shares without the prior consent of the Board of VGM, except in certain defined circumstances.

The shares of VGM are being acquired for investment purposes. Depending on the performance of the Vatukoula mine and on market and other conditions, Canadian Zinc may from time to time in the future increase or decrease its ownership, control or direction over the shares of VGM, through market transactions, private agreements or otherwise.

About Vatukoula Gold Mines plc:

Vatukoula Gold Mines plc is a UK company, listed on the Alternative Investment Market ("AIM") of the London Stock Exchange, which currently owns and operates the Vatukoula Gold Mine located in Fiji.

The Vatukoula Gold Mine has an operational history of over 70 years during which time it is reported to have produced some seven million ounces of gold and over two million ounces of silver from the treatment of around 22,500,000 tonnes of ore. Production at the mine was suspended by the previous owners in 2006, following which VGM acquired the mine and restarted operations in April 2008.

VGM recently reported that mine production for the six months ended February 28, 2009 totaled some 17,990 ounces of gold. (See VGM Press Release May 29, 2009 at www.vatukoulagoldmines.com)

About Canadian Zinc:

The Company's principal focus is its efforts to advance the Prairie Creek Mine, a zinc/lead/silver property located in the Northwest Territories of Canada, towards production. The Prairie Creek Mine is partially developed with an existing 1,000 tonne per day mill and related infrastructure.

Cautionary Statement - Forward Looking Information