Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

"Did you speak to Dan recently?"

Yes. If I hadn't, I'd be as frustrated as anybody here.

Email Dan. Ask whatever is on your mind. He's happy to talk with anyone.

Getting Otto more involved should move things along.

m2m

Looking forward to updates from Dan.

m2m

Post four times to become a mod

m2m

Alot of crap on the SRSRboard at I-hub . . . .

did you speak to Dan recently ?

I trust Dan and Otto because they also invested alot in SRSR but we want some news, something, anything, give us something Dan.

I'm fairly confident IGEX will become NBTC soon. I smell more news on the way too. Of course this will be dismissed by some as rumor, but good things are happening behind the scenes.

It is pretty quiet here but that is much better than what we have on the SRSR board. Looking forward to hearing from many of you.

Thanks for the replies guys. Contacted my broker, biggest in UK, and they won't trade SRSR. Something about settlements... Will have to wait for the new ticker and try that.

If the IGEX/SRSR transaction goes through, SRSR is a better buy than IGEX. Here's why:

If you are contemplating an igex post split position, you have three options:

(1)you could just buy igex after the split at whatever price it trades

or (2) buy igex shares now at the ask (.0001)..every 1,250,000 share purchase will cost $125 plus commissions and net you 1000 shares after the split,

or better (3)buy srsr shares at the ask (.004) every 31,250 share purchase will cost $125 plus commissions and net you 1,562 shares after completion of the split and sale.

The $125 amount is just for illustrative purposes to reflect the relative values.

The nemo property is real and your risk/reward is pretty awesome IF management delivers.

m2m

Yeah I'd say pick up as much SRSR as possible right now. Or, wait to start trading IGEX after the restructure.

Only uncertainty is whether IGEX dips after restructure or goes up immediately. Sounds like Dan has more PRs to release post-FINRA approval and share distribution.

Once we become NBTC and start trading without all the past baggage, I expect serious appreciation in value. The Niobium market is strong and we have a better property than our closest competitor.

Read the Ibox for IGEX it will give you the details of the merge. If you want to buy before the merge you would want to look into SRSR.

Stupid question. Which ticker is this stock if I want to buy now ahead of planned merger (effectively) of igex and srsr? Q to Srsr investors: what are your thoughts on the asset/management? Followed igex previously and it was a bit of a shambles. Can see this taking off big if igex anything to go by, even if it's a bit of a trading stock as opposed to a buy and hold. Still figuring this one out. Thanks.

Welcome REE.

Back to .004 in honor of your arrival.

m2m

Hate those bastards!

We aren't sure if this will become the new board or iHub will switch the IGEX board. Fingers crossed it's this one and we can ditch some of the swamp monsters.

So this is the secrete spot! You guys are hiding out over here eh? Lot less swampy. Who's the jackass that threw 100 shares at the bid to knock us down 40%, sucka!!

Latest from Dan in reply to my inquiry:

Yes it has been a while and entirely too long. However we are pushing as hard as we can to get everything done.

FINRA was delayed on our end by the 251g restructuring for IGEX which protects us new shareholders from any past liabilities. It was then further delayed by the holidays.

Once FINRA has seen all in the paperwork and supporting documents in mid January, they have indicated approval would come for the requested corporate actions once we have our 10K and 10Q filed with the SEC which are presently delinquent.

The documents required for the 10K and 10Q come from the audited financial statements of our independent auditor. We have been working back and forth with the auditor trying to finish them as we speak. We have little control of how particular the auditor can be about things but it's moving forward and I think we are close.

Remember these are the finances of IGEX at this point. So we are somewhat reliant on their past management.

I just reviewed the first draft of the 10K and 10Q this morning. I am hoping the auditor is done early next week and everything can be filed shortly there after. Once filed We expect FINRA to act.

I understand investors are frustrated and feel there is something wrong that I am not sharing. That couldn't be further from the truth. If that was the case I wouldn't still be here working for free nor would anyone have just paid a 5 figure sum to the auditor like we recently did.

I and a select few of our fellow shareholders who recently put a substantial amount of their hard earned capital into the company continue to be very optimistic about our future.

Hopefully not too much longer.

Dan

After the ticker change is approved we will.

It would be nice to see some intrest here.

I will put in an application to do so. IGEX is up and coming to NBTC.

Just like before I would be glad to mod here.

Likely a done deal

What happened to the other mods on this board? There were six now only 3. Same deal happened on igex board. Come back guys before the bad guys appoint themselves.

m2m

*** CONTACT

If you've recently tried to reach out to Dan using the old IR@niostar.com email, it is down. Please resubmit your email to ir@niotechcorp.com. That address should also be used for any future communications.

I believe so. Then within 90 days to approve the share dividend.

FINRA could approve the IGEX reverse split any day now. It's already been 2 weeks and, according to Dan, the process only used to take 10 days...

So the ticker change should take less than a month?

Never hurts to take a profit. I've been in and out of that one a few times. Currently, back in.

m2m

Ugh. I just had a small position in one of them. Got out at .04 then watched it go to over .20

Looking forward to NBTC taking off in a similar way.

Yep. They're heavy into cannabis stocks right now and that kind of action happens on a regular if not daily basis.

m2m

You can be sure his penny crew will be keeping an eye on SRSR / NBTC after the restructure. If they pour back in, even temporarily, we'll see a soar in the pps.

I follow his board daily. No mention of srsr. I think his assistants occasionally check the board.

m2m

Not sure. He has mentioned SRSR on his own board in the past but hasn't posted on the SRSR board in a long long time.

Thanks a lot for the information

There's only one spot sill open. You need to make 4 posts then click "add me as moderator." If you don't get approved within an hour or so, PM an admin.

Some more #s (all approximate):

Based on the 1 share of the new igex for each 20 srsr share dividend, srsr shareholders would receive approx. 45.5 million shares of the new igex. If this is in fact 95% of the new igex shares, igex will have approx. 48 million shares outstanding.

If management delivers and brings this forward to development, the share price will respond accordingly. I can only guess at what the valuation would be, but just a $250 million capitalization would be $5.20 per new igex share ($.26 per current srsr share).

Webpence posted a resource estimate (based on SRSR share structure) a long while back which I can't find. Web, can you re-post in the ibox? I can update based on the 48 million igex shares (unless you want to).

Of course, if management fails...well, you know.

m2m

If you or any igex shareholder is contemplating increasing your igex post split position, you have three options:

(1)you could just buy more igex after the split at whatever price it trades

(2) buy more igex shares at the ask (.0001)..every 1,250,000 share purchase will cost $125 plus commissions and net you 100 shares after the split,

or better (3)buy srsr shares at the ask (.085) every 2,000 share purchase will cost $17 plus commissions and net you 100 shares after completion of the slit and sale. You could pay as much as $.06 per share for srsr and still do better than buying igex pre-split. For another 100 bucks at current prices, you could buy approx. 11,500 shares of srsr which would net you approx. 575 igex post-split shares and you'd have a total of approx. 583 igex shares. Your cost per share would drop from $12.50 each for the 8 shares to approx. $.35 for the 583 shares.

The nemo property is real and your risk/reward is pretty awesome if management delivers.

m2m

Send a message to Admin Dan.

It the moment 24 hrs. later I have gotten no response from ihub other than the original 'we will take it under consideration'. So I reapplied fust now and this is the new response. 'It has been less than 30 days since your last application to moderate this board, or the date your last request was closed.

You will be eligible to re-apply on 11/16/2016 09:15:12 PM.

I guess I was rejected. SAML

Welcome aboard.

m2m

I am certainly interested in a moderator position on this message board, NBTC is the future of niobium.

Niobium is a metal in the forefront of technology. Hope to see many interested investors come here. A great future with dedicated leaders in the company.

NBTC has been on my watchlist for many years.

I expect to see very interesting developments here.

|

Followers

|

5

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

98

|

|

Created

|

10/13/16

|

Type

|

Free

|

| Moderators | |||

Specialty metals and Rare Earth elements are the building blocks of a modern society and, while we may not realize it, many of them feature prominently in our lives. Niobium is no exception. The United States and most developed countries have included Niobium in the list of critical metals as the play an important role in national security. Niobium is used in gas pipelines, building construction, bridge construction, automotive manufacturing, aerospace and ever-growing uses in the electronics we use every day.

Just $9 of Niobium used in the construction of a car can reduce its weight by 100kg, a savings which can reduce fuel consumption by 5% which reduces emissions. **Source: World Steel Association

In August 2016, researchers at the University of Texas developed a new process which uses niobium oxide to turn ordinary windows into “smart windows,” glass which can change properties (e.g. transparent to opaque) at the touch of a button. In the coming years, such uses for Niobium are undoubtedly going to increase, and that means demand for this specialty metal is going to continue to increase. **Source: University of Texas at Austin, August 22, 2016

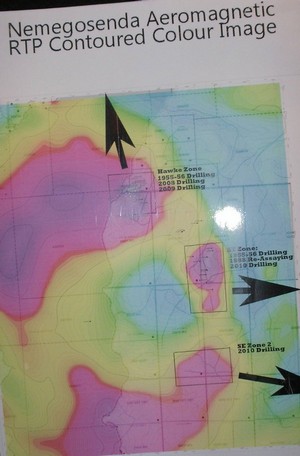

During the 1950s and 1960s, the USGS flew over North America and used airborne magnetometers to find anomalies in the Earth's magnetic field that could signify big rare earth deposits. Since then, mining companies have taken it upon themselves to confirm the presence of these deposits. Nio Tech Corp’s wholly-owned Nemegosenda property is one of these rare earth deposits. Consequently, Nio Tech Corp is positioned to enter the marketplace as the first additional supplier of Niobium in over 40 years.Nio Tech Corp is an early stage mining development company based in the United States with the ultimate goal of becoming one of the few strategic suppliers of Niobium. It has been formed by the following event:

The Nemegosenda Property (map) was identified in the mid-nineteen fifties through aeromagnetic surveys conducted by Gulf Minerals Canada Limited. Subsequent exploration and testing, as summarized in the Ontario Geological Survey study 34 by R.P Sage (click to read the full report) in 1987, highlighted a number of "higher grade niobium zones." Of particular note, Zone D indicated "20,000,000 tons of 0.47 percent Nb2O5 material in a block 600 by 800 feet in size and to depths up to 600 feet," based on Gulf's drilling and a 580 foot adit which penetrated 235 feet into the zone. Based on this historic (non-NI-43-101-compliant) data (Pg 34), this indicates the potential for approximately 9.4 pounds of Nb2O5 per ton of ore in situ.

of Nb2O5 per ton of ore in situ.

Other zones within the property have also indicated smaller, but meaningful niobium mineralization. Another area of mineralization of Niobium and rare earths called the 'South-East' Area was previously outlined on the property. It occurs 1500 metres south east of the Hawke zone (formerly called 'D' Zone). From the 1955 and 1956 drilling program by Dominion Gulf, plus re-assaying of nine drill holes by Musto Explorations in 1988 which covered this area, a historical resource of Niobium mineralization was indicated to exist within an area of some 700m x 250m to a depth of 200m having a weighted average from the assays of all drill holes of 0.35% Nb2O5.

It should be noted that the drilling program successfully confirmed both the mineralized zone data historically reported, and that the mineralization continues below what had previously been identified as the depth of the mineralized zone. It has also demonstrated that the mineralized zone increases in grade and depth towards the eastern portion of the zone.

The three drill holes on the eastern end of the current drill sections returned:DDH-09-73 at 344,525E 5,320,425N includes 194m to 239m = 45m @ 0.77% Nb2O5

DDH-09-74 at 344,550E 5,320,475N includes 167m to 179m = 12m @ 0.71% Nb2O5

Note: DDH-9-74 was stopped at 197m.

DDH-09-77 at 344,575E 5,320,525N includes 131m to 260m = 129m @ 0.56% Nb2O5

2008-2009 Drill Program 2nd Phase This program involved further diamond drilling to continue to expand on the mineralized niobium resource in the Hawke (D) Zone. It was targeted to test the eastern extension, and is conducted under the guidance of Hillar Pintson M.Sc., P.Geo. In addition the Company has opened up 4 trenches in the SE Zone. Scintillomoter readings taken within the trenching area have provided significant readings. The trenching program was conducted initially under the supervision of the late Alan Hawke, and followed up on by geologist Hillar Pintson. It was conducted in the middle of the SE Zone, where forty-nine 2.5 metre continuous channel samples were collected along the northern side of trench 09-5A and submitted for assaying. The average grade over the full 122.5 metre length of the trench was 0.35% Nb2O5. In the 49 samples submitted for assay, highlights included 2 samples of greater than 1% Nb2O5 and 10 samples greater than 0.5% Nb2O5. As well as the significant Nb2O5 results, the samples returned anomalous values of tantalum and uranium, along with 2 samples of greater than ten thousand ppm total rare earth elements.

Of additional significance is that this trenching program was carried out in an area of the SE Zone that had not previously been drilled, so continues to expand the area of potential mineralization in this area. A follow-up drilling program has been initiated to test the areas underneath the zone exposed during the trenching program.

Exploration History

Dominion Gulf Co. completed a magnetic survey and several drill holes on the property. The company’s initial focus was on the drilling of magnetic anomalies in the SE-Zone, most

likely caused by the pyrochlore-magnetite rich pyroxenites. By the fall of 1956, 68 holes had been completed totaling 35,306 feet (~10,760 m) of diamond drilling on the property. Approximately 33 of these holes were drilled in the D-Zone, majority of which occurred on a cross-sectional drilling pattern. In 1958, an adit was driven 580 feet (~177 m) into the main D-Zone to obtain a bulk sample, and $1,000,000 was spent to investigate and develop a process of metallurgical extraction at the time.

This work resulted in a historic, non 43-101 compliant resource estimate of approximately 18 – 20 short tons grading 0.47 % Nb2O5. This resource estimate used a block model that

extended from surface to approximately 180 – 200 meters depth. More information on the historic resource estimate is presented in the NI 43-101 compliant technical report completed by P. Chance (2010), which is available through SEDAR.

Musto Exploration Ltd. continued exploration in the late 1980s. Their predominant focus was on developing the REE potential in the SE-Zone. They completed an airborne magnetic and EM survey of the property, trenching work, and re-assayed some historic Gulf Dominion core for REEs.

Current Exploration Work

Sarissa began exploration again in 2008, and drilled 11 holes in the D-Zone. This work mainly looked at expanding and improving drill hole coverage on the cross-sectional pattern drilled by Dominion Gulf Co. Two holes were drilled in the SE-Zone, with DDH-10-81 showing elevated REE concentrations, and expanding the known extents of niobium mineralization. Currently, a new drill program aims at duplicating historic Gulf Dominion holes in the D-Zone to validate and confirm historic data, to enable the possible use of this data in an updated, comprehensive resource estimate for the D-Zone. This work follows on recommendations by P. Chance in the 2010 NI 43-101 compliant technical report.

Metallurgical Testing: A further aspect of this program will entail beginning metallurgical studies. SGS Lakefield Research Ltd. has been retained to conduct a Proof of concept program, which will focus on the recovery of niobium compounds. The multi-disciplinary approach will fully characterize the ore, investigate if physical ore upgrading is feasible by standard ore beneficiation processes, and develop a hydrometallurgical method for the extraction and selective recovery of (initially) the Nb phase. The investigation should be considered as a scoping or pre-feasibility study to establish a baseline flowsheet for targeted product recovery.

So far the first phase of metallurgical testing has been completed and no barriers to extraction have been identified. This correlates well with the previous $1,000,000 of metallurgical research conducted by Dominion Gulf Company in conjunction with the Colorado School of Mines Research Foundation in 1959-1960. The next stage metallurgical testing will focus on a more detailed mineralogical study.

Sarissa's recent drilling program has increased the confidence level in the historic exploration and subsequent evaluation to the point that an indicated resource may now be calculated for the D Zone. Drill hole intersections, with a weighted average grade of 0.43%, are located within a surface area of some 76,250 square metres and to a depth of at least 200m. In 1958 an adit was driven 580 feet into the D Zone where historic sampling indicated that the average grade contains a weighted average of 0.57% Nb2O5.

NI 43-101 Technical Reports for Nemegosenda

Oakville, ON, July 27, 2009 - Sarissa Resources Inc., ("Sarissa" or the "Company") (OTCPinksheets: SRSR - News), is pleased to announce the completion of an independent technical report on its 100% owned niobium property in northern Ontario. The report was prepared by John C. Archibald, P.Geo.of Billiken Management Services Inc. of Toronto, and was prepared to standards as outlined by National Instrument 43-101 Standards and Disclosures for Mineral Projects ("NI 43-101.")

This 43-101 was later retracted until

Oakville, ON, October 5, 2010 - Sarissa Resources Inc. ("Sarissa" or the "Company") (OTCPinksheets: SRSR - News)is pleased to report that it has filed a technical report under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") prepared by Patrick Chance, P.Eng., dated 23 September 2010 and entitled "Nemegosenda Lake Niobium Property, Chewett, Collins and McGee Townships, Porcupine Mining Division, Ontario, Canada - a NI 43-101 Compliant Technical Report" (the "2010 Report").

https://docs.google.com/viewer?a=v&pid=explorer&chrome=true&srcid=0B7qjX5srbuoQZThmY2MwYzUtODM2Yi00NzJjLTlhYTktODE5NjM5ODk2YWZh&hl=en

**this document is also available on http://www.sedar.com.

In April 2015 Patrick Chance updated the Technical Report.

Recommendations in the current report focus on readying the project for an initial mineral resource estimate and on developing exploration drill targets to expand the resource.

https://drive.google.com/file/d/0Bymgrtz5WdnHU0Vybkg3cEd4eWM/view?usp=sharing

**this document can also be downloaded from Sarissa's profile page on SEDAR.

Daniel Byrnes | President, Interim Chief Financial Officer and Director

Daniel Byrnes | President, Interim Chief Financial Officer and DirectorMr. Byrnes has over 25 years of senior management and investment experience primarily in alternative investments, specifically, quantitative modeling, risk management and trading of global markets including: commodities, stock indices, currencies, precious and base metals as well as energy. In addition, Mr. Byrnes has provided business consulting services to a wide range of companies and industries, from small start-ups to established business as well as Government Agencies. Mr. Byrnes was the President and a founding partner of Fort Orange Capital Management an alternative investment asset management company from 1996-2010. Prior to Fort Orange, Mr. Byrnes was vice-president and head trader of CCA Capital Management, an alternative investment asset management company from 1987-1996 Mr. Byrnes was named Futures Magazine, “Top Traders” in 2005 and 2006. Mr. Byrnes received his BA in Economics from the University of Colorado at Boulder in 1987.

John O’Shea has 25 years of knowledge and experience in Business Development; including a convincing personal history in sales and the sales cycles for small to large organisations. His significant strength in lead generation, prospecting and coordination of new market developments, including new verticals and geographic expansions. He has an intuitive knowledge of recognizing concepts and opportunities that have commercial application while managing them through to operation.

Mr. Pichler has more than 35 years of hands on experience; 16 years in senior management roles (Managing Director, Chief Operating Officer and Chief Executive Officer) for several global companies with annual revenues up to US$700 Million Dollars. Mr. Pichler holds a degree in chemical engineering and has managed infrastructure projects with capital expenditure of up to US$450 Million Dollars.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |