Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

NIO Saving Customers $14,090 Sales Exploded!

no. 8 tomorrow

$9.51 all in……..![]() jk

jk

NIO share price Double Top Breakout today, on 26-Dec-2023. Happy New Year 2024, GLTA.

Why Options Traders Are Targeting This EV Stock Nio Inc (NIO)

By: Schaeffer's Investment Research | December 26, 2023

• Options traders are targeting the stock at three times the usual intraday volume

• Nio unveiled a new luxury sedan

China-based electric vehicle (EV) manufacturer Nio Inc (NYSE:NIO) is one of the best performing stocks on the New York Stock Exchange (NYSE) today. At last check, NIO is 9.4% higher at $9.21, following the unveiling of its newest four-set ET9 EV, a flagship sedan that is planned to rival the likes of Porsche and Mercedes-Benz with an estimated starting price of $112,000.

Options traders are taking notice of the Tesla (TSLA) competitor's announcement. Already today, 351,000 calls and 57,000 puts have crossed the tape, which is three times the average intraday amount. New positions are being bought-to-open at the top three most popular contracts, led by the weekly 12/9 9.50-strike call.

Calls were already the popular choice of late, per Nio stock's 50-day call/put volume ratio of 5.13 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio stands higher than 100% of readings from the past year, suggesting calls are being picked up at their fastest clip compared to the last 12 months.

These traders picked an opportune time to speculate on NIO with options, as premiums can be had for a bargain at the moment. The equity's Schaeffer's Volatility Index (SVI) of 67% is higher than just 17% of readings from the last 12 months, indicating that the options market is pricing in relatively low volatility expectations right now.

On the charts, the security recently bounced back above its 80-day moving average that stood overhead since early September. Nio stock is still trading well below its Aug. 4 annual high of $16.18, however, as it looks to overcome a 5.2% year-to-date deficit before the year closes out at the end of the week.

Read Full Story »»»

DiscoverGold

DiscoverGold

CYVN investors, I dont think would invest 2billion if they know it was going down or to nowhere..

This stock has hardly reached $12 in like two years.

Right about what, exactly? Stock is still TRASH!

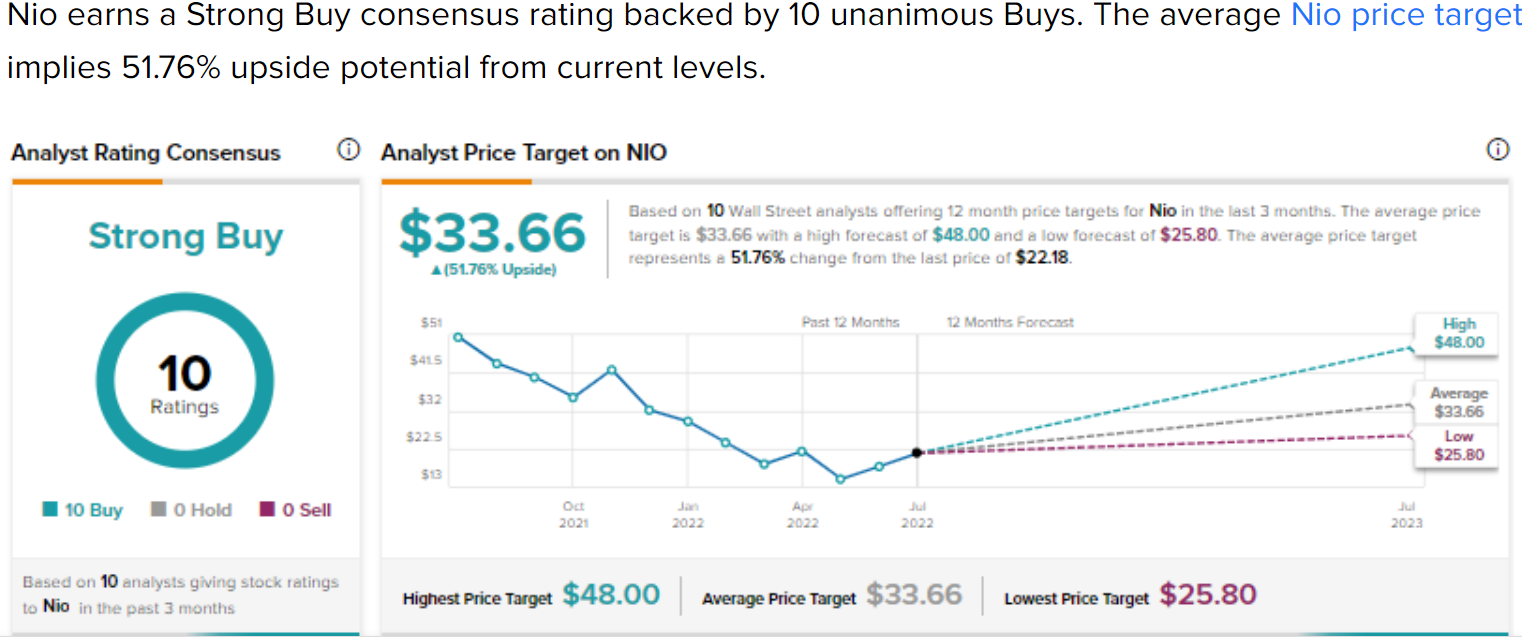

Any price targets here with Nio….

$15

$NIO made the video tonight which is nice to see

China's Nio to get $2.2 billion investment from Abu Dhabi's CYVN

By: Investing | December 18, 2023

SHANGHAI (Reuters) -Electric vehicle maker Nio (NYSE:NIO) has signed a pact for an investment of $2.2 billion from CYVN Holdings, an investment vehicle based in Abu Dhabi, the Chinese company said on Monday.

The investment comes as Nio, with its EV sales and profitability under pressure in a price war started by Tesla (NASDAQ:TSLA), has sought to boost efficiency by cutting a tenth of the workforce and deferring non-core projects.

The deal, expected to close in the final week of December, would take CYVN's shareholding to 20.1% of Nio's total issued and outstanding shares, following an investment of $1 billion in July, Nio said in a statement on its website.

That would make CYVN the largest single shareholder of Nio, although founder and chief executive William Li retains the most voting power, with his ownership of Class 'C' ordinary shares.

CYVN, which will subscribe to 294,000,000 newly issued Class A ordinary shares priced at $7.50 each, will also be entitled to nominate two directors to Nio's board, the company said.

The company, whose Nio-branded EVs compete with premium brands such as Mercedes-Benz (OTC:MBGAF) and BMW (ETR:BMWG) in China, has been developing two new brands for mass markets that it aims to bring them to Europe from 2025, its executives have said.

In its drive to become more efficient, Nio is considering a spin-off of its battery production unit while continuing to develop technologies for key components on its own, Reuters has reported previously.

Read Full Story »»»

DiscoverGold

DiscoverGold

My God NIO 2.2 Billion. We Were Right! 💸

NIO is the leader in the premium luxury EV space in China.

NIO Shanghai To Europe Firefly! 🚀

NIO to launch Firefly brand in Europe in 2025

Good video featuring NIO as the FEATURED Stock

My God NIO More Spin-Off! Edison Yu, Thank you

Bears Bet Against EV Manufacturer Nio (NIO) But Could It Backfire?

By: Barchart | December 12, 2023

Ranking among the stars of the equities market during the post-pandemic surge, Chinese electric vehicle manufacturer Nio (NIO) looks set to print a sizable loss this year. Down more than 20% since the January opener, NIO stock happened to suffer a 50% haircut since the close of the Aug. 3 session.

Not necessarily helping to comprehensively assuage concerns was the company’s third-quarter earnings print. To be sure, Nio rang up sales of $2.6 billion, representing a 47% year-over-year lift. Also, deliveries jumped 75% YOY and gained 136% against the prior quarter sequentially. That was huge because deliveries had started to fade in recent quarters.

Still, the vehicle margin of 11% – while improved from 6% in Q2 – was down from 16.4% in the year-ago quarter. Further, gross margin sat at 8% in the most recent quarter, down conspicuously from the 13.3% recorded in Q3 2022. Fundamentally, these metrics suggest that wider economic pressures, along with the EV sector price war, have taken their toll on Nio.

Indeed, the Barchart Technical Opinion indicator rates NIO stock a 72% strong sell. And while the analyst consensus view comes in as a moderate buy, the assessment itself is rather split: four strong buys, one moderate buy and six holds. A couple more pensive ratings and NIO won’t look that appealing from an expert standpoint.

Still, it’s difficult to discount the EV manufacturer given its popularity among retail investors. Based on public forums, NIO stock remains one of the most heavily discussed ideas. Interestingly, on Monday, shares gained slightly over 4%. While it’s too early to call, we might be looking at a near-term speculative rally.

Contrarian Bulls Look to Penalize NIO Stock Pessimists

Curiously, when looking at Barchart’s screener for unusual stock options volume, NIO stock represented one of Monday’s highlights – that is, for generating overall volume lower than normal. However, this stat alone obscures the fact that there are individual contracts within the NIO options chain worth watching closely.

One in particular stands out, the Feb 16 ’24 8.00 Call. On Dec. 7, Fintel’s options flow data – which exclusively filters for big block transactions likely made by institutions – showed a heavy concentration of sold (written) contracts of this call option. At the end of that session, volume totaled 11,017 contracts, a hefty wager.

For those unfamiliar with the lexicon, at face value (assuming no integration of complex multi-tiered strategies), traders placing this bet are assuming that by the expiration date of Feb. 16 of next year, NIO stock will not materially rise above the $8 strike price. If NIO fails to exceed this level, then the call seller (writer) will collect maximum premium, which in total amounted to $128,000.

On the other side of the transaction, those who believe that NIO stock can hit $8 before expiration collectively paid the $128,000 premium. It’s a test of will and conviction. However, for the risk underwriter, an added concern exists about covering the bearish bet. If the position is naked – that is, the call writer wrote the calls without owning the underlying security – it exposes the bear to unlimited liability.

Understanding this, NIO stock pessimists who underwrote the risk will be sweating until the February expiration date. In fact, the delta of the target call option sat at 48% on Dec. 7, then slipped to 45.8% the next day. That’s good for the call writer as it indicates that the underlying stock is moving away from the strike price.

However, with the big move up on Monday, delta for the call jumped to 51%. That’s great news for call holders but not so much for call writers. To add another wrinkle to the narrative, open interest for this option now stands at 26,126 contracts, leaving a huge vulnerability for pessimists if NIO stock soars past $8.

A Warning Sign Against Excessive Bearish Speculation

Truth be told, I’m neutral on NIO stock over the intermediate to long term. While the company brings many positives to the table, including leadership in EV technology and a focus on the user experience, the upstart also suffers from fierce competition. And that competition will almost certainly apply pressure to the margins, which already is a questionable topic.

However, I simultaneously lack the conviction to place excessively bearish wagers against NIO stock. For anyone who happens to be bearish on the Chinese EV maker, it’s more sensible to purchase put options. With buying options, your risk is limited only to what you put into the derivatives.

Selling options, especially selling call options, opens a can of worms. These folks are obligated to fulfill the terms of the contract upon exercise. For call writers, that means selling the underlying security at the listed strike price. However, if you don’t own the security in question, you may find yourself forced to buy back the stock at increasingly higher prices, only to sell shares at the (lower) strike price.

What’s worse, savvy contrarians may be aware of your bearish bets through data points like options flow. Therefore, NIO stock could be interesting for bullish speculators until Feb. 16.

Read Full Story »»»

DiscoverGold

DiscoverGold

My God! NIO Robo Taxi Soon. Power to 300,000 Homes. ✨📈

NIO Inc. reports robust Q3 results, plans expansion

By: Investing | December 8, 2023

NIO Incorporated (NYSE: NIO), a leader in China's premium smart electric vehicle market, delivered a robust performance in the third quarter of 2023, with vehicle deliveries soaring by 75.4% year-over-year to 55,432 units. The company's market share in China's EV segment surpassed 45%, maintaining its top position. The launch of the All-New EC6 in September bolstered its product lineup, and the company anticipates Q4 deliveries to range between 47,000 to 49,000 vehicles. Financially, NIO reported total revenues of RMB19.1 billion, marking a 46.6% increase year-over-year. Despite a challenging macroeconomic environment, the company has maintained a strong cash position with RMB45.2 billion in cash and cash equivalents.

Key Takeaways

NIO's Q3 vehicle deliveries hit 55,432, a 75.4% increase year-over-year.

The company holds over 45% market share in China's EV segment.

Q3 revenues reached RMB19.1 billion, up 46.6% year-over-year.

Vehicle margin stood at 11% in Q3; a decrease from 16.4% in the same period last year.

NIO ended Q3 with RMB45.2 billion in cash and cash equivalents.

Company Outlook

NIO's management expressed confidence in their long-term competitiveness within the Smart EV industry, emphasizing the introduction of advanced technology capabilities and the first vehicle operating system with LiDAR SoC in China. Plans to expand the battery swap network and open it to the industry were compared to cloud infrastructure, showcasing the company's strategic vision for infrastructure development.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Inc considers further job cuts amid financial strain

By: Investing | December 7, 2023

SHANGHAI - Chinese electric vehicle (EV) maker Nio Inc (NYSE:NIO) may be planning for additional workforce reductions, reports Bloomberg. This follows an earlier 10% cut, as the company faces financial challenges, including a significant third-quarter net loss.

On Tuesday, Nio revealed a third-quarter loss per share of 2.67 yuan, which surprisingly beat analyst expectations. The loss comes in a landscape marked by Tesla (NASDAQ:TSLA)'s aggressive pricing strategies and cautious spending by Chinese consumers. Nio's revenue for the quarter reached nearly $2.7 billion (19.1 billion yuan), marking a 47% increase year-over-year but still falling short of estimates. The company's gross margin retreated to 8%.

Despite the revenue growth, Nio's vehicle margin stands at only 11%, which is an improvement from the previous quarter but a decline compared to last year's figures. In response to these financial headwinds, Nio is focusing on cost-efficiency measures, including workforce reductions and the suspension or termination of non-profitable projects over the next three years.

Additionally, Nio is in the process of acquiring assets from JAC Motors for RMB 3.16 billion and is considering divesting its battery business segment. These strategic moves are aimed at bolstering the company's position against competitors like Tesla and BYD (SZ:002594), which currently enjoys higher gross margins and threatens to challenge Tesla's EV market dominance.

For the fourth quarter, Nio expects revenues to range between 16.1 billion yuan and 16.7 billion yuan with vehicle delivery targets set between 47,000 to 49,000 units.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio (NIO) jumps in pre-market following narrow 3Q losses

By: Investing | December 5, 2023

Shares of Chinese electric automaker, Nio Inc. (NYSE:NIO) jumped 4% in pre-market trading after the company released their 3Q earnings report showing narrowing losses.

Nio announced revenue of 19.07 billion yuan in the quarter, coming in behind the consensus estimate of 19.4 billion. Revenue rose 47% year-on-year.

The automaker reported an adjusted EPS loss of 2.67 yuan, missing an expected loss of 2.53 yuan.

Investors are directing their attention towards the Chinese electric carmaker's capacity to exhibit greater fiscal discipline while navigating its path towards profitability.

Nio's CEO, William Li, reaffirmed the company's commitment to enhanced efficiency as a fundamental focus.

“We have identified opportunities to optimize our organization, reduce costs and enhance efficiency,” Li said.

Several of these initiatives have begun to show positive results. In the third quarter, Nio reported a net loss of 4.6 billion yuan, marking a 24.8% decrease from the second quarter of 2023. However, it remained higher than the corresponding period in 2022.

Additionally, the company recently downsized its workforce by 10% last month, attributing the decision to "fierce competition."

The electric vehicle landscape in China is fiercely competitive, with Nio contending with pressure from emerging startups like Xpeng (NYSE:XPEV) and Li Auto (NASDAQ:LI), as well as established giants such as Tesla (NASDAQ:TSLA) and BYD.

Adding to the challenge, Chinese consumers are exhibiting caution in their spending habits, potentially impacting Nio's strategy aimed at capturing the premium segment within the local EV market.

Nio's projected fourth-quarter revenue is estimated to fall between 16.1 billion yuan and 16.7 billion yuan. This forecast represents a year-on-year increase ranging from 0.1% to 4.0%. However, analysts had initially anticipated a higher forecast of 22.4 billion yuan for the December quarter.

Nio expects to distribute between 47,000 and 49,000 vehicles in the fourth quarter. This projection signifies a notable increase of approximately 17.3% to 22.3% compared to the same period last year.

Shares of NIO are up 1.5% in afternoon trading on Tuesday.

Read Full Story »»»

DiscoverGold

DiscoverGold

i assume thats good? NIO

BREAKING: NIO buys plant assets sold by JAC for $442 million

Nio said it will acquire the manufacturing equipment and assets of the F1 and F2 plants from JAC for a total consideration of about RMB 3.16 billion.

Nio (NIO) Stock Price Prediction in 2030: Bull, Base & Bear Forecasts

By: 24/7 Wall St. | December 4, 2023

Shanghai-based EV maker Nio Inc. (NYSE: NIO) raised $1 billion in its September 2018 IPO, selling 160 million American Depositary Receipts (ADRs) at $6.26 per ADR. The company initially expected to raise $2 to $3 billion at a valuation sharply higher than the $6.4 billion it settled for.

Thirteen months later, the stock had dropped 75%, setting an all-time low of around $1.20. Then, in June 2020, the stock price began a meteoric rise that didn’t end until it reached an all-time high of around $63.00. Increased deliveries led to positive gross margins and positive cash flow. An extension to the government’s incentives to buyers of EVs added more push.

Again, though, Nio couldn’t hold on. The COVID-19 pandemic and the Chinese government’s mandatory lockdowns crippled production and snarled supply chains. A $740 million share issuance in June drew a line under Nio’s problems. Three months later, a $1 billion convertible debt offering slashed 17% off the share price. Shareholders responded by heading for the exit.

The company has posted big losses in both 2021 and 2022 and analysts expect big losses again in 2023 despite rising sales. In the June quarter of this year, Nio lost $35,000 for every car it sold. That’s even worse than U.S. EV maker Rivian Automotive Inc. (NASDAQ: RIVN). ADD LINK TO RIVIAN BULL-BEAR STORY

Heavy spending on R&D and an EV price war in China compound the problem. So does Nio’s limited global presence. The company sells its cars in a mere handful of European markets and does not plan to enter the U.S. market until sometime in 2025.

Because the company uses a China-based contract manufacturer, Nio’s cars will not qualify for U.S. incentives available to automakers with U.S. manufacturing operations...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO STOCK UPDATE | TESLA VALIDATES NIO’S ENTIRE BUSINESS MODEL 🚀🚀🚀

$NIO Massive Total Cash $27.85 Billions

$NIO Massive Debt Total Debt (mrq) $28.43 Billions $.0001 coming

$NIO Next Big Step with Mercedes in Energy Innovation! - NIO stock.

Watch Nio EL7 Instantly Swap Its Battery In POV Video

$NIO Total Debt (mrq) $28.43B bankrupt soon

NIO Stock Forecast 2030: How High Can the 'Tesla of China' Rise?

By: Barchart | November 24, 2023

While many retail investors and a section of sell-side analysts have been bullish on Chinese electric vehicle (EV) company NIO (NIO), it has failed to live up to expectations. After closing in the red in 2021 and 2022, it has lost almost a fifth of its market cap in 2023 as well, and looks on track for its third consecutive year of losses.

The “Tesla of China,” as NIO was once hailed, is now struggling to justify that title, even as China-based BYD (BYDDY) looks set to snatch the crown of largest EV seller from Tesla (TSLA) – after having already surpassed the Elon Musk-run company in terms of total deliveries, after accounting for plug-in hybrid vehicles (PHEVs).

Some NIO bulls expect the stock to rise to $100 over the long term, while a tiny fraction is even speculating the stock can reach $1,000. Here’s the 2030 forecast for NIO, and why the probability of it reaching $100 by 2030 looks remote.

www.barchart.com

NIO’s Business Model

EV players tend to have one of two business models. The first is self-manufacturing, which players like Tesla, Rivian (RIVN), and Lucid Motors (LCID) have adopted. While the strategy is capital-intensive, it also underscores the importance that these companies have put on manufacturing - which many would argue has historically been the core business of automotive companies.

The second strategy is contract manufacturing, which NIO and some others, like Fisker (FSR), have adopted. Proponents of this business model believe that just like smartphone companies, automotive companies can also outsource manufacturing to third parties while focusing on design and software. Incidentally, Foxconn - which produces most of Apple's (AAPL) products - has entered into automotive contract manufacturing, and has formed a joint venture with Saudi Arabia to manufacture EVs in the oil-rich kingdom.

Both strategies have their own pros and cons, and while self-manufacturing gives a lot more control over the production process and supply chain, third-party manufacturing brings manufacturing prowess to the table – something startup EV companies lack.

Currently, China’s state-owned JAC Motors produces cars for NIO. However, there are reports that NIO is considering buying the facility from the company to gain independence in manufacturing. Morgan Stanley believes that buying the plants from JAC would make “strategic sense” for NIO.

NIO has also built a network of battery-swapping stations in China. It also provides the battery on subscription, which lets it offer lower car prices to buyers while generating recurring revenues through subscription fees. In order to reduce its cash burn rate, NIO has also stopped providing free battery swaps for new buyers.

NIO Is Not Going Out Of Business

In Q1 2020, there were fears that NIO might not survive and go bankrupt. However, it managed to raise cash from strategic investors, and the Chinese government also pooled money to bail out the struggling company.

NIO has since raised capital multiple times through different instruments – including a $740 million strategic investment by CYVN Holdings, which is majority-owned by the Abu Dhabi government. It held $4.3 billion as cash and cash equivalents on its balance sheet at the end of June, and has shown the ability to raise cash from multiple investors. The importance of a strong balance sheet can't be overstated amid the current EV industry slump, as it provides financial viability amid the macro turmoil.

www.barchart.com

NIO’s President and co-founder, Lihong Qin, tried to allay fears about its survival and said at this year’s Guangzhou Auto Show that "Nio will not go out of business, and there is absolutely no possibility of it going out of business.” That said, the company has gone slow on expansion, and has fired 10% of its workforce as its growth hasn’t been as high as expected.

NIO Stock 2030 Forecast

While many of the current startup EV companies might not be around by 2030, we can be reasonably sure that NIO should be able to survive the current slump. However, its long-term forecast will depend on the success of its upcoming models, sustainable profitability and free cash flows, as well as the planned international expansion - which is now looking a lot more complicated than a few quarters back.

For instance, while NIO plans to enter the U.S. market by 2025, the company might find itself at a disadvantage in the world’s most lucrative automotive market due to the tax credit rules, which won’t apply to its cars imported from China. With EV buyers increasingly price-conscious, the absence of a $7,500 EV tax credit could hurt NIO’s prospects in the U.S. market.

Also, while the company has started shipping cars to Europe, in October the European Commission opened a formal anti-subsidy investigation into imports of battery electric vehicles from China. Almost every country is trying to create a domestic ecosystem of electric car manufacturing – which is at odds with NIO’s current business model of producing the cars in China and then shipping them globally.

Will NIO Stock Reach $100 By 2030?

At present, NIO stock trades under $8, with a market cap of just around $12.8 billion. At its peak in Feb. 2021, NIO’s market cap was a tad short of $100 billion - but those were different times, and for loss-making EV names, almost a different epoch altogether.

To reach $100 by 2030, NIO stock would need to rise at a CAGR of more than 40% and jump 13.4x from these levels, which would mean a market cap of $180 billion. Realistically speaking, I don’t expect NIO stock to reach $100 by 2030 even as at the current depressed valuations, it looks like an EV stock worth considering.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO STOCK NEWS! NIO Signs Battery Swap Deal with Chang An Motors 🚀

Nio Inc. (NIO) still 'debating' North America entry by 2025, seeks partnerships

By: Investing | November 10, 2023

Ganesh Iyer, the CEO of Chinese electric automaker Nio Inc. (NYSE:NIO), attended the Reuters Events Automotive USA 2023 conference this week where the CEO revealed that his company is still “debating” a 2025 entry into North America.

NIO continues to be a leading force in EV innovation in China, and its influence has grown to reach European markets and beyond. Apart from producing popular EVs, NIO is also a pioneer in battery swap stations and has ventured into related technologies, such as mobile phones.

Ganesh Iyer discussed NIO's potential entry into the North American market, mentioning that the company is still debating a 2025 debut. Previous reports suggest that NIO plans to manufacture its electric vehicles in China and then import them into various markets, with the United States being a potential destination in the future.

Iyer stated that NIO is open to potential partners in North America to facilitate its market entry, expressing to reporters that the company is actively exploring "any kind of partnerships" on the continent.

Shares of NIO are down 2.66% in afternoon trading on Friday.

Read Full Story »»»

DiscoverGold

DiscoverGold

China's Ghost Cities: The Truth Behind The Empty Megacities

NIO Stock Explosive SUB - BRAND NEWS 🚀🚀🚀

NIO has done a double bottom at $7-7.20. This is going back to test $16

China is Throwing Away Fields of Electric Cars - Letting them Rot!

Total cash on the Balance Sheet...$27.85 billion

$NIO Total Debt (mrq) $28.43B

China's EV Revolution Has Arrived In Mexico. Is The US Next?

China has spent years and billions of dollars ramping up its homegrown EV industry, to the point where Western and other Asian brands (including even Tesla) are losing ground to players like BYD, NIO, Li Auto, Xpeng and others. That's terrible news for the other automakers' bottom lines; they banked on a rising China to be an almost permanent growth engine for new car sales.

https://insideevs.com/news/691889/china-evs-mexico-motor-trend/

$NIO Bankruptcy soon. Total Debt (mrq) $28.43B

The strong selling has calmed down. The price might go up to test higher levels and fill the gap around $9.60-$10.22.

But be careful; after that, the price could suddenly drop, causing short-sellers to lose money and new buyers to get stuck. It could even drop to a new low below $7.00 soon.

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |