Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I'm not sure, might wait till after hours. Tomorrow this stock will take huge leaps! $$$$$$$$$$$$$$$

I predict the stock will jump up and down all day today....until shorts start covering. News will be positive no doubt......supply shortage will have minimal affect on NIO....since all parts are made in China.

Chinese suppliers will ALWAYS take care of their own first.

Shares of Electric Vehicle Maker Nio Inc Stall Out Before Earnings

By: Schaeffer's Investment Research | March 23, 2022

• The electric vehicle maker reports earnings after the close tomorrow, March 24

• The stock hasn't fared too well after earnings in the past two years

The shares of Nio Inc (NYSE:NIO) are down 0.6% today, last seen trading at $21.62 as the Tesla (TLSA) competitor gets ready to step into the earnings confessional. Nio is set to report fourth-quarter financial results after the close tomorrow, March 24, and analysts are anticipating a loss of -2.97 Chinese Yuan, or around 47 cents.

A look back at Nio stock's post-earnings history during the past two years shows a overwhelmingly dismal response, with only one of the last eight next-day sessions ending higher -- a 2.2% rise last April. NIO has averaged a large post-earnings swing of 7.2%, regardless of direction. This time around, the options market is pricing in a much larger move of 13%.

The equity has steadily trended lower over the last six months, culminating in a 19-month low of $13.01 on March 15. Pressure from the 60-day moving average remains firmly overhead, and in the last 12 months Nio stock has shed more than 46%.

The options pits have been pessimistic, with puts popular over the last 10 weeks. Over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Nio stock sports a 50-day put/call volume ratio that sits higher than 99% of annual readings. This suggests long puts are getting picked up at a much quicker-than-usual pace.

Short sellers have been piling on NIO of late. Specifically, short interest added 16.5% in the last two reporting periods, and the 78.11 million shares sold short make up 6% of the stock's available float, or just over one day worth of pent-up buying power.

Read Full Story »»»

DiscoverGold

DiscoverGold

Support is coming! Hold on for the ride.

Sold all my RIVN stock....buying all NIO today!

If the rumors are true this stock will jump after earnings call.

NIO Slides Despite Positive Deutsche Bank Comments

By: Investing.com | March 21, 2022

Shares of Chinese electric vehicle company Nio Inc (NYSE:NIO) fell over 3% Monday ahead of its earnings release later this week.

The company, which has seen its share price decline 35% in 2022, is set to report earnings after the bell Thursday.

Meanwhile, Deutsche Bank analyst Edison Yu cut the firm's price target on NIO to $50 from $70, despite providing positive commentary on the company in a note to investors.

Yu explained in a research note that NIO has "cultivated an aspirational premium brand, underpinned by a leading service infrastructure that no domestic automaker has been able to match."

The analyst pointed to operational bottlenecks stagnating the company's volumes in the last few quarters but added that NIO's deliveries are on track to increase from 10,000 per month to 25,000 at the end of the year.

Yu said NIO's ET7 and ET5 models will be the most desired cars in China this year.

Read Full Story »»»

DiscoverGold

DiscoverGold

If $NIO was a US company it would be easily a $200 billion company! the good news is that China wants this company to succeed and they made it clear to work with the US and not be delisted.

$NIO Monthly Chart. #NIO month isn't over yet, but beginning to form a monthly hammer candlestick

By: ReciKnows | March 19, 2022

• $NIO Monthly. #NIO month isn't over yet, but beginning to form a monthly hammer candlestick.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Earnings Preview: Here’s What You Need to Know

By: TipRanks | March 18, 2022

Chinese electric vehicle (EV) maker NIO Inc. (NIO) is on a massive expansion drive in 2022. The company is scheduled to release its fourth-quarter and full-year 2021 earnings results on March 24, 2022, after the market close, and investors eagerly wait to see if the upcoming financial data update justifies bullish ratings on NIO stock.

NIO's Record High Deliveries to Lift Q4 Revenue

The EV maker remains committed to providing monthly updates on vehicle deliveries. Vehicle deliveries during the fourth quarter amounted to 25,034 vehicles - a new record-high quarterly delivery in the company's history. Fourth-quarter deliveries represented a 44.3% year-over-year increase. Deliveries reached 24,439 vehicles during the third quarter.

NIO delivered 91,429 vehicles during the year 2021, a strong deliveries growth rate of 109.1% year-over-year. Fourth-quarter vehicle deliveries were well within management guidance range, well upper range, a sign that the company will likely report revenue within the anticipated range. Revenue should surge as deliveries grow.

Revenue Estimates for NIO Show Sequential Decline

Back in November, management at NIO provided fourth-quarter revenue guidance for between $1.48 billion and $1.60 billion, representing an increase of 41.2% to 52.2% year-over-year and either a sequential decline of 4.4% or an increase of 3.1% from the previous quarter.

Wall Street analysts currently project RMB 9,75 billion ($1.53 billion) revenue for NIO's fourth quarter. Revenue for the third quarter was RMB 9.8 billion. Analyst estimates imply a sequentially softer revenue performance during the fourth quarter, despite higher deliveries.

Perhaps market watchers see sequentially lower "Other" revenue from charging, battery swaps, and sales of regulatory credits. The company's "Other" revenue segment was the fastest-growing after a 118% sequential sales growth to $181.4 million (12% of quarterly revenue) during the third quarter.

Analysts expect -$0.14 per diluted share for the fourth quarter, which could show an improvement from the previous year's $1.05 loss per share.

Importantly, NIO has beaten analysts' EPS forecasts over the last two consecutive quarters.

Key Revenue Drivers for NIO in 2022

Product portfolio growth, geographical expansion, and the global chip supply situation may drive the company's revenue performance in 2022.

NIO's vehicle sales accounted for 88% of total revenue during the third quarter of 2021. Since releasing its first EV model in 2016, the EP9, NIO has grown its product portfolio to three current models, the ES8, the ES6, and the EC6.

The company unveiled a mid-sized smart EV sedan in December last year, the ET5, which will be available to the Chinese market in September 2022. Investors expect three new model launches this year.

Order confirmations for a new flagship model, the ET7 have already started, and deliveries will commence on March 28, 2022. The company unveiled the ET7 in January last year.

Unlike its immediate competitor Li Auto (LI), which is a bit reserved about launching new models, NIO is taking an aggressive growth stance. It's launching new models at varying price points to capture a larger diversified driver base.

The company will continue to expand its charging and battery swapping network in 2022. It plans to launch sales in Germany, the Netherlands, Sweden, and Denmark this year. By 2025, NIO expects to have a presence in over 25 countries and regions worldwide.

Product portfolio growth and geographical expansions will unlock new growth potential for NIO this year. Improved chip supplies could boost productivity across the whole EV manufacturing industry globally.

The Future Looks More Derisked

Until recently, NIO stock was listed only on the New York Stock Exchange. The risk of Chinese stocks being delisted from U.S. exchanges was uniquely significant to it. This is no longer the case.

NIO finally listed its shares on the Stock Exchange of Hong Kong (SEHK) on March 9, 2022. Hong Kong-listed shares are fully fungible with the American depositary shares (ADSs) listed on the NYSE.

Investors have another venue to continue trading in NIO stock if Chinese shares leave American markets.

Wall Street's Take

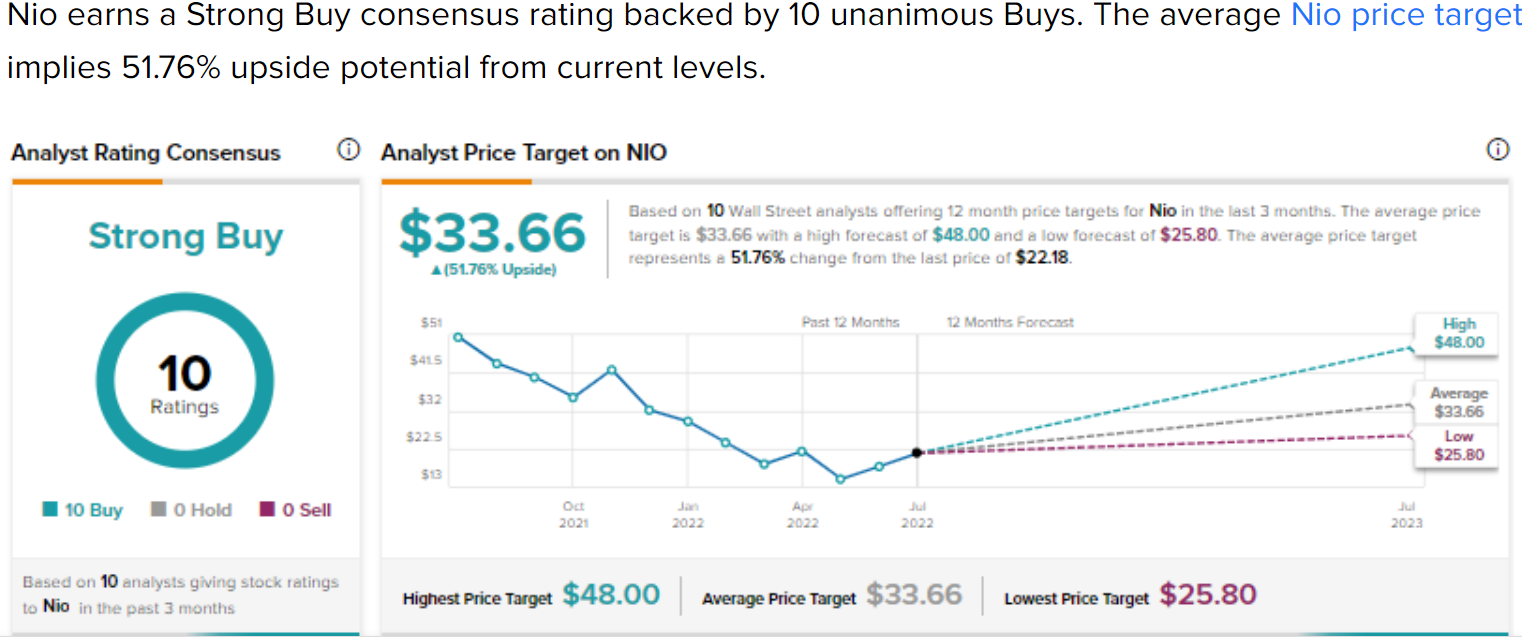

Turning to Wall Street, NIO earns a Strong Buy consensus rating from Wall Street analysts based on 10 Buys vs. 2 Holds. At the time of writing, the average NIO stock price target of $51.14 represents 176.4% upside potential over the next 12 months.

Investor Takeaway

NIO's future looks brighter as the company increases its production footprint, expands its product portfolio, and widens its geographic reach. More so as the world increasingly embraces electric vehicles as it fights the harsh realities of global climate change.

That said, NIO is still a Chinese company that faces unique equity risks not shared with U.S. and European EV stocks. Geopolitical tensions may potentially suppress its valuation for longer.

However, shares could rally should there be any breakthroughs on the U.S. and Chinese regulatory impasse regarding outstanding audit-related issues.

A listing on the Hong Kong market acts as a hedge should the worst happen.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO From retesting IPOs to breaking out on the daily!

By: TrendSpider | March 18, 2022

• $NIO From retesting IPOs to breaking out on the daily!

Read Full Story »»»

DiscoverGold

DiscoverGold

I believe a lot of consolidation is going to happen buyouts and mergers with this chip shortage it has to happen anybody believe that besides me?

NIO (NIO) to Release Earnings on Thursday

By: MarketBeat | March 17, 2022

• NIO (NYSE:NIO - Get Rating) will post its quarterly earnings results after the market closes on Thursday, March 24th. Individual that wish to register for the company's earnings conference call can do so using this link...

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO (NYSE:NIO) Coverage Initiated by Analysts at Citigroup

By: MarketBeat | March 16, 2022

• Investment analysts at Citigroup began coverage on shares of NIO (NYSE:NIO - Get Rating) in a report released on Wednesday, Briefing.com reports. The firm set a "buy" rating on the stock...

Read Full Story »»»

DiscoverGold

DiscoverGold

[color=darkblue][Update] $NIO Daily Chart. Huge bounce off prior weekly support. Wait for pullback to play the bounce [/color]

By: ReciKnows | March 17, 2022

• [Update] $NIO Daily. Huge bounce off prior weekly support. Wait for pullback to play the bounce.

Read Full Story »»»

DiscoverGold

DiscoverGold

The start of a new trend? Bought 1,000 more around $15… glad I did!

Back to 50.... Taiwan invasion put off

Definitely. Let’s roll.

A lot of gamesmanship going on with this one. Political seems to be the theme.

LOL...it sure took a pretty leap this morning at premarket open...hopefully it will sustain.

Debt in yen maybe, in dollars its 2.6 billion usd…

https://finance.yahoo.com/news/nio-inc-nyse-nio-just-071321638.html

$NIO Turning red to green as price finds some support off the IPO previous highs

By: TrendSpider | March 15, 2022

• $NIO Turning red to green as price finds some support off the IPO previous highs.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Total Debt $19.2 Billion

7 to 9 imho...ziggy

Yea...that is what peeps have been thinking on the retrace down to the $40s from $50...eventually it will be true....it will be a buy of a lifetime...like around $5 perhaps.

Buying opportunity of a lifetime… buy buy buy

This could end up in the single digits.

Wow worst investments just prior to all this mess. I bought all these chinese ev stocks, thinking i was buying a discount after the tech sector fell.

Looks like I might have thrown all that money away.

China's daily cases of symptomatic COVID more than triple

https://www.reuters.com/business/healthcare-pharmaceuticals/china-daily-local-symptomatic-covid-cases-more-than-triple-2022-03-13/ $NIO

$NIO Weekly Chart. Between fears of US delisting, Ukraine/Russia war, COVID, and inflation China names are getting hit big time

By: ReciKnows | March 13, 2022

• $NIO Weekly. Between fears of US delisting, Ukraine/Russia war, COVID, and inflation China names are getting hit big time.

Wouldn't be surprised to see #NIO in single digits soon.

Read Full Story »»»

DiscoverGold

DiscoverGold

Well this has quickly become one of the worst investments I made. Its my own fault for investing in a chinese company. EV market has been popping and this turd just floats around the bowl.

All good things come to an end thanks to our gov. "IMO" they will accelerate it.

SEC Chair: Roughly 250 Chinese companies could be delisted 'as early as 2024'

https://www.uscc.gov/sites/default/files/2021-05/Chinese_Companies_on_US_Stock_Exchanges_5-2021.pdf

https://finance.yahoo.com/news/sec-chair-roughly-250-chinese-companies-could-be-delisted-as-early-as-2024-122037497.html

what basis do you have to make that claim?

But honestly the chip shortage is still real. And so is Chinese delisting. No Catalyst in the making. This will drift down to single digits

Buying opportunity of a lifetime… buy buy buy

$NIO, one of the bubble stocks of 2020 is approaching its next weekly cycle low, next week or the following

By: CyclesFan | March 11, 2022

• $NIO, one of the bubble stocks of 2020 is approaching its next weekly cycle low, next week or the following. One thing is certain, the gap at 9.40 will be filled later this year or by early 2023. It's likely to have a 85-90% haircut from the 2021 high.

Read Full Story »»»

DiscoverGold

DiscoverGold

It is starting to look like NIO is going to get delisted

$NIO Breaking down after failing to cross the 8/21 MA Cloud

By: TrendSpider | March 10, 2022

• $NIO Breaking down after failing to cross the 8/21 MA Cloud.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Shares of Chinese companies are trading lower amid multiple possible catalysts including overall market weakness following the collapse of Russia-Ukraine ceasefire talks as well as weakness in JD.com following Q4 earnings. Additionally, recent US media reports have questioned the neutrality of Chinese media coverage of the Russia-Ukraine conflict.

Why NIO Stock Is Down By 13% Today

By: Vladimir Zernov | March 10, 2022

• The stock is trying to settle below the $18 level.

NIO Stock Retreats As The Company’s Shares Start Trading In Hong Kong

Shares of the Chinese electric vehicle maker NIO gained additional downside momentum after the company’s stock began to trade in Hong Kong.

The stock reached highs near the $67 level back at the beginning of 2021 but moved below the $20 level in 2022 on fears about the ongoing crackdown on tech companies in China and the risks of delisting due to worsening U.S. – China relations.

The listing in Hong Kong has clearly ignited fears of delisting from U.S. markets. Such risks have been recently highlighted by the trading action in U.S.- listed Russian stocks, which have been effectively frozen when the relations between Russia and the West hit new lows.

The current situation in commodity markets raises concerns about future profit margins of electric vehicle markets so many EV stocks, including Tesla, have been trending lower in recent weeks.

What’s Next For NIO Stock?

Analysts expect that NIO will report a loss of $0.24 per share in 2022, so the company is projected to remain unprofitable in the near term.

Analyst estimates have been mostly stable in recent weeks but they will likely start to trend lower due to recent developments in commodity markets.

The stock is hit by multiple risks, including caution towards unprofitable companies, delisting fears and the rally in commodity markets.

The company has already lost more than 40% of its market capitalization since the beginning of this year but it remains to be seen whether speculative traders will rush to buy NIO stock.

At this point, it looks that traders will wait for an upside trend in the market leader Tesla before buying other EV stocks.

Read Full Story »»»

DiscoverGold

DiscoverGold

Apparently Hong Kong didn’t help

Nice day yesterday, lets see of it was a mirage. This stock is so oversold.

All the analysts have it as a strong buy with 12 month projections near $60. Triple where we are now in just a year.

NIO one of the champ within the EV market, let’s go!!!

$NIO Hanging on by a thread, descending triangle getting ready to push lower

By: Theta Warrior | March 7, 2022

• $NIO Hanging on by a thread, descending triangle getting ready to push lower.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Weekly Chart Breaking Down After Failing to Reclaim the Wedge/Triangle

By: Theta Warrior | March 6, 2022

• $NIO Weekly breaking down after failing to reclaim the wedge/triangle.

Read Full Story »»»

DiscoverGold

DiscoverGold

SEC Chair: Roughly 250 Chinese companies could be delisted 'as early as 2024'

https://www.uscc.gov/sites/default/files/2021-05/Chinese_Companies_on_US_Stock_Exchanges_5-2021.pdf

https://finance.yahoo.com/news/sec-chair-roughly-250-chinese-companies-could-be-delisted-as-early-as-2024-122037497.html

Other than no shares will be added nothing. Just stay away from China stocks for now, monitor NIO and by at a low point. This may drop further since China seems to side with Putin. I think they made a poor decision, since they want less hostility with the U.S.

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |