Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Anyone have an opinion on what the Hong Kong Phooey listing means to NIOs stock price? I have seen no op eds it.

$NIO Potential Bear flag forming with price continuing to be rejected by the previous swing low VWAP

By: TrendSpider | March 1, 2022

• $NIO Potential Bear flag forming with price continuing to be rejected by the previous swing low VWAP.

Read Full Story »»»

DiscoverGold

DiscoverGold

Just a small downside because of low February deliveries due to holiday/plant closures. But:

1) earnings release March 7th

2) Nio on Hong Kong exchange March 10th.

3) ET5 production release March 30th

4) NeoPlant opening in March.

Nio Inc $NIO Price looking to break the previous low VWAP as the MACD makes quite the curl

By: TrendSpider | March 1, 2022

• $NIO Price looking to break the previous low VWAP as the MACD makes quite the curl.

Read Full Story »»»

DiscoverGold

DiscoverGold

The trend is your friend...nio to hit $30 by end of march...ziggy

https://cnevpost.com/2022/03/01/nio-delivers-6131-vehicles-in-feb-up-9-9-year-on-year/amp/

$NIO Continuing lower lows as price struggles to regain the previous swing low VWAP

By: TrendSpider | February 28, 2022

• $NIO Continuing lower lows as price struggles to regain the previous swing low VWAP.

Read Full Story »»»

DiscoverGold

DiscoverGold

Earnings Previews: Nio Inc. (NYSE: NIO)

By: 24/7 Wall St. | February 28, 2022

• Here is a look at five companies scheduled to report quarterly results after markets close on Tuesday.

Nio

China-based EV maker Nio Inc. (NYSE: NIO) has dropped nearly 60% from its share price over the past 12 months. The stock’s only foray above the break-even line occurred on June 30. After sorting through some issues over the company’s structure, Nio expects to begin trading on the Hong Kong stock exchange on March 10. The automaker is not raising any cash from the listing, unlike competitors Xpeng and Li Auto, which raised about $2 billion and $1.7 billion, respectively, when they completed their secondary listings in Hong Kong.

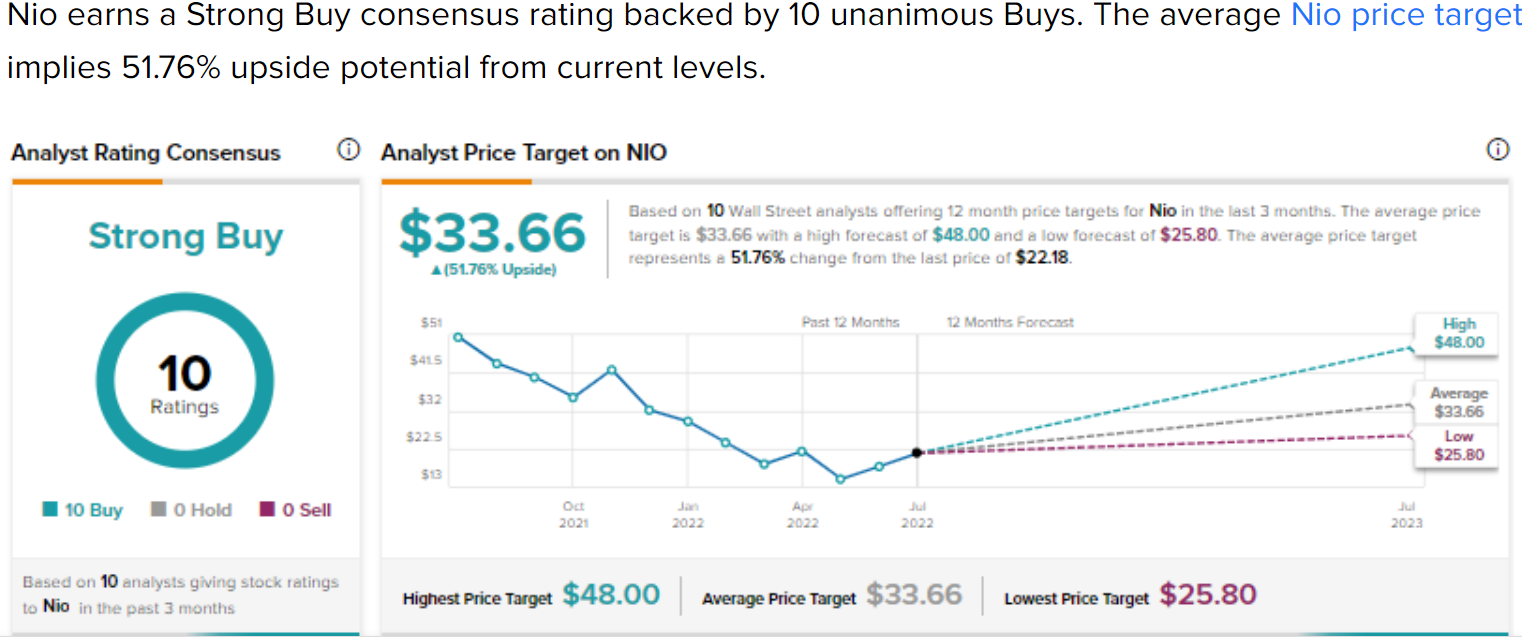

There are 25 analyst ratings on Nio’s stock, and 21 of those are Buy or Strong Buy. At a share price of around $20.95, the upside potential based on a median price target of $53.70 is about 156%. At the high target of $88.01, the upside potential is 320%.

For the fourth quarter, the consensus estimates call for revenue of $1.547 billion, up 1.5% sequentially and 51% year over year. Nio is expected to post an adjusted loss per share of $0.12, worse than the $0.06 per-share loss in the prior quarter but better than the year-ago loss of $0.14 per share. For the full year, the company is expected to report a per-share loss of $0.30, better than the $0.66 loss last year, on sales of $5.67 billion, up about 128%.

Analysts estimate that Nio will trade at a multiple of 91.4 times earnings in 2023. Until then, it is not expected to post a profit. The enterprise value-to-sales multiple is expected to be 5.3 in 2021 and 3.0 in 2022. The stock’s 52-week range is $18.47 to $55.13. The company does not pay a dividend. Total shareholder return for the past year is negative 54.3%.

Read Full Story »»»

DiscoverGold

DiscoverGold

Chinese EV maker Nio pursues Hong Kong secondary listing

By: Reuters | February 27, 2022

Chinese electric vehicle (EV) maker Nio (NYSE:NIO) Inc will carry out a secondary listing in Hong Kong by way of introduction, according to stock exchange filings on Monday.

The New York-listed firm said it had received preliminary approval from the Hong Kong Stock Exchange to trade its shares in the city.

Nio said the Class A shares are due to start trading on March 10 under the code 9866 once it receives final approval from the stock exchange. Its primary listing will remain in New York, the company said.

Unlike a typical initial public offering (IPO) or secondary listing, companies listing stock by introduction in Hong Kong raise no capital and issue no new shares.

The mechanism was popular among companies in the past looking to build a brand in Hong Kong and the rest of Greater China.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Daily Chart. Needs to hold 18.04 pivot for bullish divergence to be valid, falling wedge into prior weekly support

By: ReciKnows | February 25, 2022

• $NIO Daily. Needs to hold 18.04 pivot for bullish divergence to be valid, falling wedge into prior weekly support.

Read Full Story »»»

DiscoverGold

DiscoverGold

BIGGEST B******* RATING EVER, this stock should be 60 at ease end of year.

they are selling cars per 10 thousand...

I like your post. NIO is going places and interested in the PPS by the end of this year. It's all positive news about NIO. I do need to avg down though but not too worried about NIO. GLTA

Agreed, and it is not a bull right now seeing as it has been trending downward but this is the time to buy, not wait til it becomes a bull. This is where charting falls on its face.

People get rich by buying when others are running scared. That doesn;t always work because sometimes there are good reasons to run scared. But this company plans to be in 25 countries in 3 years. They're doubling their manufacturing capability. And they have the best EVs in the world hands down.

Charts vs Fundamentals. I am a fundamental guy. So charts mean nothing. Either a company is too expensive or too cheap. This is a buy now and hold through 2023(Minimum play)

$NIO Really hard for me to see the bull thesis on this one with this recent pennant breakdown and the gaps below

By: Jake Wujastyk | February 19, 2022

• $NIO #NIO Really hard for me to see the bull thesis on this one with this recent pennant breakdown and the gaps below.

Read Full Story »»»

DiscoverGold

DiscoverGold

Second-Largest U.S. Pension Bought Up EV Stocks NIO...

By: Barron's | February 20, 2022

The second-largest U.S. pension by assets bought up shares of four electric-vehicle makers as 2021 was coming to a close. Unfortunately, they all have slumped so far in 2022.

The California State Teachers’ Retirement System more than tripled holdings in three Chinese EV makers— NIO (ticker: NIO ), XPeng ( XPEV ), and Li Auto ( LI )—and bought shares of U.S. electric-truck maker Rivian Automotive ( RIVN ), which had an initial public offering in November. Calstrs, as the pension is known, disclosed the trades, among others, in a form it filed with the Securities and Exchange Commission.

Calstrs didn’t offer a comment on the investment changes. It managed assets of $327.6 billion as of Dec. 31.

The pension bought 210,763 more American depositary shares of NIO to end the fourth quarter with 305,036 ADRs. Calstrs also bought 90,011 more ADRs of XPeng and 124,171 additional ADRs of Li Auto to lift its respective holdings to 123,957 ADRs and 172,163 ADRs.

NIO ADRs tumbled 35% in 2021, compared with a 27% rise in the S&P 500 index. Interestingly, NIO’s peers ended 2021 with gains, although short of what the index marked: ADRs for XPeng and Li Auto rose 18% and 11%, respectively. But so far this year, the ADRs of all three are down: NIO with a 27% drop, XPeng is down 25%, and Li Auto with a relatively moderate drop of 11%, while the index has slipped 9%.

Early this year, bullish calls were made for the Chinese EV makers, but the wheels came off the story when EV deliveries by the three all fell in January. Also, NIO, XPeng, and Li Auto ADRs currently have two major overhangs: an uncertain Chinese regulatory environment, and an investor bias favoring value stocks over growth as higher interest rates loom.

Rivian stock came public just in time to get caught up in the latter. Shares ended 2021 with a gain of 33% from the $78 IPO price, but shares have dropped 36% so far in 2022. Rivian is now a so-called broken IPO, as shares, which closed at $66.37 on Friday, are under the IPO price.

Calstrs bought 282,772 Rivian shares in the fourth quarter.

The surge in Rivian stock late last year provided a boost to Amazon.com (AMZN) earnings, as the retail and cloud giant was an early investor. With the drop in Rivian shares, however, we pointed out that Amazon is now sitting on a substantial paper loss. This month, George Soros’ family office disclosed it bought 20 million Rivian shares in the fourth quarter.

Read Full Story »»»

DiscoverGold

DiscoverGold

Who cares about price targets right now? The important thing is the become profitable next year as planned and then stick a nice PE on that, and the stock will be much higher.

Nio Inc (NIO) Price Target Lowered to $35.00 at CLSA

By: MarketBeat | February 16, 2022

• NIO (NYSE:NIO) had its price target decreased by CLSA from $60.00 to $35.00 in a research note issued on Wednesday, The Fly reports. CLSA's price target suggests a potential upside of 35.71% from the stock's current price...

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Inc - (NIO) Given Consensus Recommendation of "Buy" by Brokerages

By: MarketBeat | February 15, 2022

• Shares of Nio Inc - (NYSE:NIO) have been assigned a consensus rating of "Buy" from the thirteen analysts that are presently covering the stock, Marketbeat.com reports. One investment analyst has rated the stock with a sell recommendation, one has issued a hold recommendation and ten have given a buy recommendation to the company. The average twelve-month target price among analysts that have issued a report on the stock in the last year is $54.83...

Read Full Story »»»

DiscoverGold

DiscoverGold

Great day! Good news around the world!

$NIO Swing low VWAP holds as support as price looks to head into resistance and the gap fill

By: TrendSpider | February 15, 2022

• $NIO Swing low VWAP holds as support as price looks to head into resistance and the gap fill.

Read Full Story »»»

DiscoverGold

DiscoverGold

Why NIO Stock Is Up By 5% Today

By: Vladimir Zernov | February 15, 2022

• The stock is trying to settle above the $25 level.

NIO Stock Gains Ground As EV Stocks Rebound

Shares of NIO gained strong upside momentum amid increased demand for electric vehicle stocks during a rebound led by Tesla.

The beginning of this year has been challenging for EV stocks as traders moved out of high-PE names while Treasury yields moved higher.

According to a recent report, NIO has launched the development of a sub-brand model. The model would have an annual production capacity of 60,000 units. It should be noted that this report had a limited impact on the dynamics of NIO stock as traders focused on general market sentiment towards EV stocks.

What’s Next For NIO Stock?

Analysts expect that NIO will report a loss of $0.22 per share in 2022, but the company is expected to be profitable in 2023.

NIO stock touched highs near the $67 level back at the beginning of 2021, and it has already lost more than 60% of its value during a year-long pullback. In NIO’s case, the general bearish sentiment towards Chinese stocks has clearly added to the pressure.

Shares of NIO will likely remain sensitive to the fluctuations of market sentiment towards EV stocks at a time when the Fed is ready to raise rates. On the one hand, NIO stock has already suffered a major pullback so it may attract speculative traders who want to bet on the future of the EV industry and do not want to limit their portfolio to Tesla stock. On the other hand, rising rates and skepticism towards Chinese stocks may continue to put pressure on NIO shares.

In the longer term, traders will stay focused on earnings forecasts as a move from the loss-making status to the profitable status often provides a major boost to a company’s stock. If the market sees that the path to profitability is clear, NIO stock may gain significant upside momentum.

Read Full Story »»»

DiscoverGold

DiscoverGold

BREAKING: NIO confirms new model ES7 to be unveiled in April, delivery expected within the year

By: CnEVPost | February 15, 2022

After many rumors, NIO finally confirmed today that the new SUV ES7 will be announced soon.

NIO will unveil the new model ES7 in April, which is positioned as a big five-seat pure electric SUV, between the ES6 and ES8, said Qin Lihong, co-founder and president of NIO.

The model will be built on the NIO NT2.0 platform with the same level of intelligence as the ET5 and ET7 sedans, Qin said at a media event today, adding that the model will be delivered during this year.

"Our delivery target for this year is up to the supply chain, and we will increase our capacity this year and deliver as many as we can," Qin said.

The ES7 is the rumored model codenamed Gemini, which was previously misunderstood to be a new brand, but is actually a new model, according to Qin.

The model is aimed at competing with the BMW X5L, which will be released this year, according to Qin.

Except for three SUVs based on the first-generation platform - ES8, ES6 and EC6 - NIO had no new models for delivery throughout last year.

In contrast, its local counterpart XPeng began deliveries of a facelifted G3 SUV, the G3i, last year, and Li Auto began deliveries of a facelifted Li ONE.

NIO said last year that it would deliver three models based on the NT2.0 platform in 2022, including the ET7 sedan, which was announced early last year.

The company announced the ET5, the second model on the platform, late last year, and the third model has been a mystery.

Late last year, automotive website Xchuxing posted several spy photos of a model closely included in the camouflage, saying it was the NIO ES7, the first SUV on the EV maker's NT2.0 platform.

These spy photos do not show the NIO logo, but the roof lidar and camera setup is identical to the NIO ET7 and ET5 sedans.

According to Qin today, the ES7 is expected to be equipped with the same smart driving hardware as the ET5, which is used in the ET7 model.

NIO will adopt a monthly subscription model for its autonomous driving technology NAD (NIO Autonomous Driving), or ADaaS (AD as a Service), starting with the ET7.

Current indications are that the company appears to be carrying unified autonomous driving hardware in future models so that users can choose whether to subscribe to the service.

NIO delivered 9,652 vehicles in January, up 33.6 percent from 7,225 in the same month last year and down 8 percent from 10,489 in December, data released by the company earlier this month showed.

Deliveries of the NIO ET7 will begin on March 28, and deliveries of the ET5 are expected to begin in September. With the addition of the ES7, NIO's deliveries this year are expected to see a significant boost in the second half of the year if supply chain issues improve.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Short-term breakdown getting caught on the swing low VWAP

By: TrendSpider | February 14, 2022

• $NIO Short-term breakdown getting caught on the swing low VWAP.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Finding some bounce off the swing low VWAP

By: TrendSpider | February 12, 2022

• $NIO Finding some bounce off the swing low VWAP.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO | KXIN "It’s also clear that the EV sector is moving beyond providing luxury sedans and SUVs to wealthy consumers to fill the growing demand caused by companies implementing sustainability in their shipping operations."

https://finance.yahoo.com/news/kxin-stock-alert-10-000-163014170.html

$NIO 2.80 million share #darkpool print at $25.35

By: Money Flow Mel | February 10, 2022

• $NIO 2.80 million share #darkpool print at $25.35

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO said to have launched development of sub-brand model with planned annual capacity of 60,000 units

By: CnEVPost | February 10, 2022

• NIO has launched the development of a mass-market sub-brand model in Hefei, which will be positioned below NIO's existing SUV and sedan models, according to local media.

NIO has launched the development of a sub-brand model for the mass market in Hefei, central China's Anhui province, according to a report by local media Auto-time on Wednesday.

The model will be positioned below NIO's existing SUV and sedan models and is slated for an annual production capacity of 60,000 units, the report said, without citing any sources.

The report focused on describing the novelty expressed by people in China's smaller cities and rural areas when they see electric cars driven back from big cities during the Chinese New Year holiday.

Residents of small counties in China, where new energy vehicles are rarely owned, expressed envy at the sight of such vehicles, according to the report.

The report did not provide more information about NIO's sub-brand, but said the company's sales channel is now penetrating third- and fourth-tier cities in regions including remote Inner Mongolia and Heilongjiang.

Last year, there were a lot of rumors about the NIO sub-brand, especially when JAC started a tender for the construction of a production line for JAC-NIO's 60,000-unit-per-year model codenamed "Gemini" at the end of April, and the topic was hotly discussed.

Autohome reported in late May last year that the car was positioned below the current NIO models and that "Gemini" might be a model code or project name, not the name of the final model to be launched.

Because of its positioning, the "Gemini" may be placed under the new brand, the report said.

However, in early June, NIO co-founder and president Qin Lihong said that "Gemini" is the code name for a new NIO product to be launched in 2022, without giving further details.

Last August 12, in a conference call after the announcement of the second-quarter earnings report, William Li, NIO's founder, chairman and CEO, finally confirmed that the company would launch a sub-brand.

NIO will enter the mass market through the new brand, and preparations for this have been accelerated and a core team has been established, Li said at the time.

The relationship between the NIO brand and the new brand is similar to that between Lexus and Toyota, Audi and Volkswagen, he said, adding that the brand is lower in price than Tesla, but the experience will surpass the latter.

NIO is currently the only local carmaker in China to have a firm foothold in the premium market, and deliveries are already holding steady at around 10,000 two per month.

Many now have high hopes for NIO's ET5 model, which will begin deliveries in September, as well as for a lower-priced sub-brand, expecting them to bring a strong new growth engine to the company.

While NIO’s initial focus on the higher-end segment of the market gave the company a head start, since higher-end consumers in China were indeed among the earliest adopters of EVs, it is critical for the company to launch mass-market offerings in the next two years, Barclays analyst Jiong Shao said in a research note sent to investors on Tuesday.

Should NIO stay at the upper end of the market, inevitably it won’t have as much data as competitors with a mass-market focus, and as a result far more cars on the road than NIO, according to the note.

"Indeed, NIO plans to launch several new models in the next 24 months and we believe most of these will be geared towards mass-market customers," the analyst said.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nice volume...nio should run soon!!!!

Ziggy

$NIO Not giving that VWAP up without a fight!

By: TrendSpider | February 9, 2022

• $NIO Not giving that VWAP up without a fight! Price recaptures the IPO anchored VWAP on the weekly!

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Weekly. #NIO inside week with a small gap above, would like to see 21.60 hold for a decent bounce to test overhead resistance

By: ReciKnows | February 6, 2022

• $NIO Weekly. #NIO inside week with a small gap above, would like to see 21.60 hold for a decent bounce to test overhead resistance

Read Full Story »»»

DiscoverGold

DiscoverGold

Are you looking to buy or trade EV stocks?

LCID RIVN NIO

YouTube Link:

$NIO 15 min chart with historical #darkpool activity

By: Money Flow Mel | February 2, 2022

• $NIO 15 min chart with historical #darkpool activity

Price action holding & closing above most recent larger levels.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Steps Up Its 2022 Deliveries, Still Well Behind Tesla (But Ahead of Lucid)

By: TheStreet | February 1, 2022

• The electric vehicle (EV) said that it is accelerating the deployment of its power network as it looks to increase adoption.

Nio (NIO) - Get NIO Inc. (China) Report, a Chinese electric vehicle (EV) maker, struggles in a way that all but one electric vehicle (EV) companies do. It's not Tesla TSLA and that means that it has a long way to go to meet expectations even if it has a high market cap (about $39 billion as of the morning of Feb. 1).

Tesla has set a high bar. It's an innovative company that has backed up its bravado (or at least CEO Elon Musk's bravado) with actual vehicle sales. The EV leader has hit roughly one million vehicles delivered per year pace and that puts Nio well behind its rival.

That's not an easy number to reach, but Nio's latest production numbers at least show progress.

How Many Vehicles DId Nio Make in January?

Nio delivered 9,652 vehicles in January, marking a 33.6% year-over-year increase led by the company's ES6 five-seater high-performance smart electric SUV.

The majority of sales in the month came from the ES6 and the company's EC6 electric coup SUV, which saw 2,874 deliveries.

To help push adoption, Nio says it has been accelerating the deployment of its power network. As of January 31, the Shanghai-based company has built 836 power swap stations, 3,766 power chargers, and 3,656 destination chargers.

Nio is gearing up to make a run at the U.S. market and is reportedly hiring a local team of experts in the country, a media report said.

The news came a few weeks after the Shanghai-based company said it plans to enter Germany, Netherlands, Denmark, and Sweden in 2022, and reach 25 countries by 2025, at its annual Nio Day event.

Nio Coming for Tesla's Spot

Tesla, as noted above, delivered nearly 1 million vehicles in 2021 on the way to solidifying its spot as the global market share leader in electric vehicles.

However, the company's market share is falling as competition ramp up in the battery-powered vehicle sector. Analyst firm IHS Markit predicts Tesla's share of the U.S. EV market was 56% at the end of 2021, down from 79% a year prior, according to CarExpert. (Those numbers are relative as the overall market has grown).

Nio said that it will enter Germany, Netherlands, Denmark, and Sweden in 2022, and reach 25 countries by 2025, at its annual Nio Day event.

Nio delivered 24,439 vehicles in the third quarter of 2021. That roughly doubled its total from the previous year. The company closed the year with over $7 billion on its balance sheet. It expects to deliver between "23,500 and 25,500 vehicles, representing an increase of approximately 35.4% to 46.9% from the same quarter of 2020," the company said in its Q3 earnings report.

Nio Has Ground to Cover in the U.S.

If Nio has ambitions to enter the U.S., the world's second-largest EV market, it will have to play catch up to Tesla and Ford (F) - Get Ford Motor Company Report.

Ford (F) became number two for electric vehicle sales in 2021, led by its Mustang Mach-E, which sold 27,140 vehicles in 2021, making it the nation's second-best-selling full-electric SUV behind Tesla's Model Y.

General Motors (GM) currently only sells two electric vehicles in the U.S., the Chevrolet Bolt and Bolt EUV.

Earlier this month, the GM introduced an electric Chevrolet Silverado pickup truck.

In addition to legacy carmakers looking to transform their gas-powered fleets into an electric model, the U.S. EV market also has startups looking to topple Tesla.

Lucid (LCID) has managed to garner a $70 billion market cap despite having only begun to deliver cars in the dozens in October.

Lucid CEO Peter Rawlinson says he expects to produce about half as many vehicles as Tesla did in 2021 about eight years from now.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Heck of a MACD curl following the gap fill

By: TrendSpider | January 31, 2022

• $NIO Heck of a MACD curl following the gap fill

Read Full Story »»»

DiscoverGold

DiscoverGold

So, can't wait till tonight when January delivery numbers come out. I have to think they beat out December. Earnings at end of the month.

Nio Inc (NIO) Stock Surges on Repurchase Right Offer Completion

By: Schaeffer's Investment Research | January 31, 2022

• NIO completed the repurchase right offer for its 4.50% convertible senior notes

• Analysts are overwhelmingly bullish towards NIO

Chinese electric vehicle (EV) concern Nio Inc (NYSE:NIO) is surging today, last seen up 17.3% to trade at $24.51, after the company said it completed the repurchase right offer for its 4.50% convertible senior notes, due in 2024. The last time we checked on the security, it had just popped up on a list of names attracting the highest weekly options volume.

Options traders have remained much more call-biased than usual. This is per the stock's Schaeffer's put/call open interest ratio (SOIR) of 0.74, which sits higher than just 15% of readings from the past year.

The brokerage bunch echoes that optimism, with all but one of the seven analysts in coverage calling NIO a "strong buy." Plus, the security's 12-month consensus target price of $57.17 is a 133.3% premium to current levels.

Digging deeper, NIO is looking to recover from a Jan. 28, two-year low of $19.91, after breaching recent support at the $28 level. The 40-day moving average has kept a tight lid on the stock since early December, though, and quarter-to-date shares are down 22.7%.

Read Full Story »»»

DiscoverGold

DiscoverGold

DiscoverGold, Thank you for that update! This company should do well.

NIO rolls first ET5 validation prototypes off assembly line, makes moves to enter Danish market in 2022

By: electrek.co | January 31, 2022

Chinese EV automaker NIO, recently shared images of production line verification prototypes of its upcoming ET5 sedan that recently rolled out at its facility in Hefei. The ET5 will arrive this fall beginning in China, although it should eventually see other markets as well. One of those markets could be Denmark, which sits as one of several new countries NIO intends to sell its EVs in, beginning in 2022.

The ET5 EV is the second sedan from NIO, following the ET7, which just opened for Chinese orders in January. The ET5 was officially unveiled this past December during the automaker’s annual NIO Day event.

According to NIO at the time, the ET5 was designed with autonomous driving in mind, starting with its silhouette based on the ET7 while integrating autonomous driving sensors into its body lines.

NIO’s ET5 can accelerate from 0 to 100 km/h (0-62 mph) in 4.3 seconds, and its CLTC range is 550+ km (342 mi) with the 75 kWh Standard Range Battery, 700 km (435 mi) with the 100 kWh Long Range Battery, and over 1,000 km (620 mi) with the 150 kWh Ultra-long Range Battery.

In addition to unveiling the ET5 and its specs on NIO Day, the automaker shared news for global expansion. NIO first entered the European market in 2021 beginning in Norway with its ES8 SUV. It later shared news that it would also be entering the German market, and both countries will eventually see the ET7 when it begins deliveries.

Furthermore, NIO shared plans to enter 25 countries and regions by 2025, revealing additional intentions to sell EVs in The Netherlands, Sweden, and Denmark in 2022.

With its latest update, NIO is on track with ET5 production and is preparing to allow for sales in Denmark later this year.

NIO provides ET5 production and European sales updates

NIO shared news on its ET5 production progress via its Weibo page, alongside two images of the EVs on their assembly line. According to the Chinese automaker, ET5 production is, “progressing in an orderly manner.”

Right now, we know that the NIO ET5 is scheduled to deliver to customers in China in September, but delivery to European markets remains less clear at this time. With the ET7 confirmed for Norway and Germany, it would make sense for the smaller, more affordable ET5 to follow suit, but that has not been confirmed yet.

Speaking of European markets, NIO will soon be selling its EVs in Denmark, whether it includes the ET5 or not. According to a recent news release from De Danske Bilimportører, aka The Danish Car Importers Association, NIO has officially become a member. The Association represents all automakers whose vehicles and their respective technologies are procured in Denmark.

NIO’s new entry as a member is further evidence of its expansion into the Danish market later this year. Which EV models arrive in Denmark, Sweden, and The Netherlands has not yet been revealed by NIO, but the automaker is taking the necessary steps to fulfill its expansion goals throughout Europe...

* * *

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Weekly. #NIO entering prior weekly support

By: ReciKnows | January 30, 2022

• $NIO Weekly. #NIO entering prior weekly support.

Read Full Story »»»

DiscoverGold

DiscoverGold

Honestly, tesla has catchup to do....

batteryswap car for 40k, 1000km range, and a lot nicer than the tesla medel 3...

Well like I said when NIO was 42.00 it is a great short and we made a killing on this it got cut in half. We covered our shorts and now we are flat on the position. With what we made we could probably by 4 or 5 of their vehicles. Good luck to all it might be a buy here but there are many other places to put good money to work. Have a great weekend

Price Levels to Watch - 2-Minute Stock Breakdown of Ticker NIO

#NIO $NIO #EVstocks

YouTube Link:

Nio $NIO Looking for a lifeline as price continues down into no-mans lands...

By: TrendSpider | January 27, 2022

• $NIO Looking for a lifeline as price continues down into no-mans lands...

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Shares of electric and clean energy vehicle companies are trading lower possible in sympathy with Tesla, which fell following Q4 earnings after the company reported supply chain issues.

Trading Levels for EV Stock NIO $NIO

YouTube Shorts Link:

What does what mean?

Right on. What does that even mean? Lol

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |