Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Thank you for some insight and perspective..I agree…and factual statement

All EV shares are garbage at this time, NIO Car is excellent.

just for education purposes:

In last month:

LCID down 43%

FSR down 50%

NkLA down 45%

Rivian down 35%

Xpev down 30%

Nio down 26%

Li down 16%

Tesla down 16%

Beat down is sector…not Nio specific

Moonboy1 isn't totally wrong, tho. This stock has done nothing but plummet over the past 3 plus years. This was thriving around the end of 2020 at ~$45.00 / share. It's frustrating to watch this stock climb for a few days then fall further a few days later. This stock literally is sitting at $6.11 / share but was @ $9.00 a month ago.

U should sell..enjoy the 60 min charging stations lolll.

Dude stop..ur embarrassing

Check out the last month for EV:

Li

Tesla

Rivian

Xpev

NkLA

FSR

LCID

NKLA

All battered..same shit..most worse than nio..facts are facts

So this supposed to be a luxury car brand. Not a brand that competes with Tesla for the masses. So Tesla's price lowering should have no effect in this stock unless this company is actually run like dog sh-- and if has issues which are now obvious. I'm tired of losing money in POS companies like this one.

You must like to lose money. Glad you have it to lose. This is a POS company and always has been. Any company that screws their investors is a POS. Bottom line. Still tanking. Now in the $6.20s. Heading to 1$ fast in my opinion

Probably dumbest post of 2024…u know nothing about nio tech..ur embarrassing.

Soooooo the dudes 2billion dollar investment at $7.50 is…. Toast 🤦♂️

Well the one thing we all now for sure is the "ain't " no Tesla killer or anywhere close. This company is obviously no where near the capabilities of Tesla and it's reflected in this POS stock price

NIO My God! Change Of Plans 2 Sub Brands This Year $NIO 🚀📈

I said what I said. This stock is just nose diving. Goes up for two days than falls for the next four. It's the same trend for the past three years.

This is bottom, hold for $15-14 1 month.

I guess I'm done with this company. Been too long of nothing here. Time to move on to better stocks. This never holds any gains since it's first run several years ago

NIO Inc. Delivered 18,012 EVs in December, 50,045 in Q4

By: Investing | January 2, 2024

NIO Inc. (NIO) today announced its December, fourth quarter and full year 2023 delivery results.

NIO delivered 18,012 vehicles in December 2023, increasing by 13.9% year-over-year. The deliveries consisted of 12,048 premium smart electric SUVs, and 5,964 premium smart electric sedans. NIO delivered 50,045 vehicles in the fourth quarter of 2023, representing an increase of 25.0% year-over-year. For the year of 2023, NIO delivered a total of 160,038 vehicles, showing a year-over-year increase of 30.7%. Cumulative deliveries of NIO vehicles reached 449,594 as of December 31, 2023.

At NIO Day 2023, NIO launched the ET9, a smart electric executive flagship. The ET9 embodies NIO’s latest advancements in technological research and development, presenting a combination of flagship-style exterior, innovative executive space, leading driving and riding experience, intelligent technologies, efficient power solutions, and comprehensive safety standards. The ET9 is an epitome of NIO’s innovative technologies, setting a new technological benchmark for smart electric vehicles executive flagship. Deliveries of the ET9 is expected to start in the first quarter of 2025.

Read Full Story »»»

DiscoverGold

DiscoverGold

Just added $8.13. what's up with NIO? More Dilution?

NIO Getting Closer to the Loading Zone $7.75-$8.25

$NIO Be honest, could you handle it?

By: TrendSpider | January 2, 2024

• $NIO Be honest, could you handle it?

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Saving Customers $14,090 Sales Exploded!

no. 8 tomorrow

$9.51 all in……..![]() jk

jk

NIO share price Double Top Breakout today, on 26-Dec-2023. Happy New Year 2024, GLTA.

Why Options Traders Are Targeting This EV Stock Nio Inc (NIO)

By: Schaeffer's Investment Research | December 26, 2023

• Options traders are targeting the stock at three times the usual intraday volume

• Nio unveiled a new luxury sedan

China-based electric vehicle (EV) manufacturer Nio Inc (NYSE:NIO) is one of the best performing stocks on the New York Stock Exchange (NYSE) today. At last check, NIO is 9.4% higher at $9.21, following the unveiling of its newest four-set ET9 EV, a flagship sedan that is planned to rival the likes of Porsche and Mercedes-Benz with an estimated starting price of $112,000.

Options traders are taking notice of the Tesla (TSLA) competitor's announcement. Already today, 351,000 calls and 57,000 puts have crossed the tape, which is three times the average intraday amount. New positions are being bought-to-open at the top three most popular contracts, led by the weekly 12/9 9.50-strike call.

Calls were already the popular choice of late, per Nio stock's 50-day call/put volume ratio of 5.13 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). This ratio stands higher than 100% of readings from the past year, suggesting calls are being picked up at their fastest clip compared to the last 12 months.

These traders picked an opportune time to speculate on NIO with options, as premiums can be had for a bargain at the moment. The equity's Schaeffer's Volatility Index (SVI) of 67% is higher than just 17% of readings from the last 12 months, indicating that the options market is pricing in relatively low volatility expectations right now.

On the charts, the security recently bounced back above its 80-day moving average that stood overhead since early September. Nio stock is still trading well below its Aug. 4 annual high of $16.18, however, as it looks to overcome a 5.2% year-to-date deficit before the year closes out at the end of the week.

Read Full Story »»»

DiscoverGold

DiscoverGold

CYVN investors, I dont think would invest 2billion if they know it was going down or to nowhere..

This stock has hardly reached $12 in like two years.

Right about what, exactly? Stock is still TRASH!

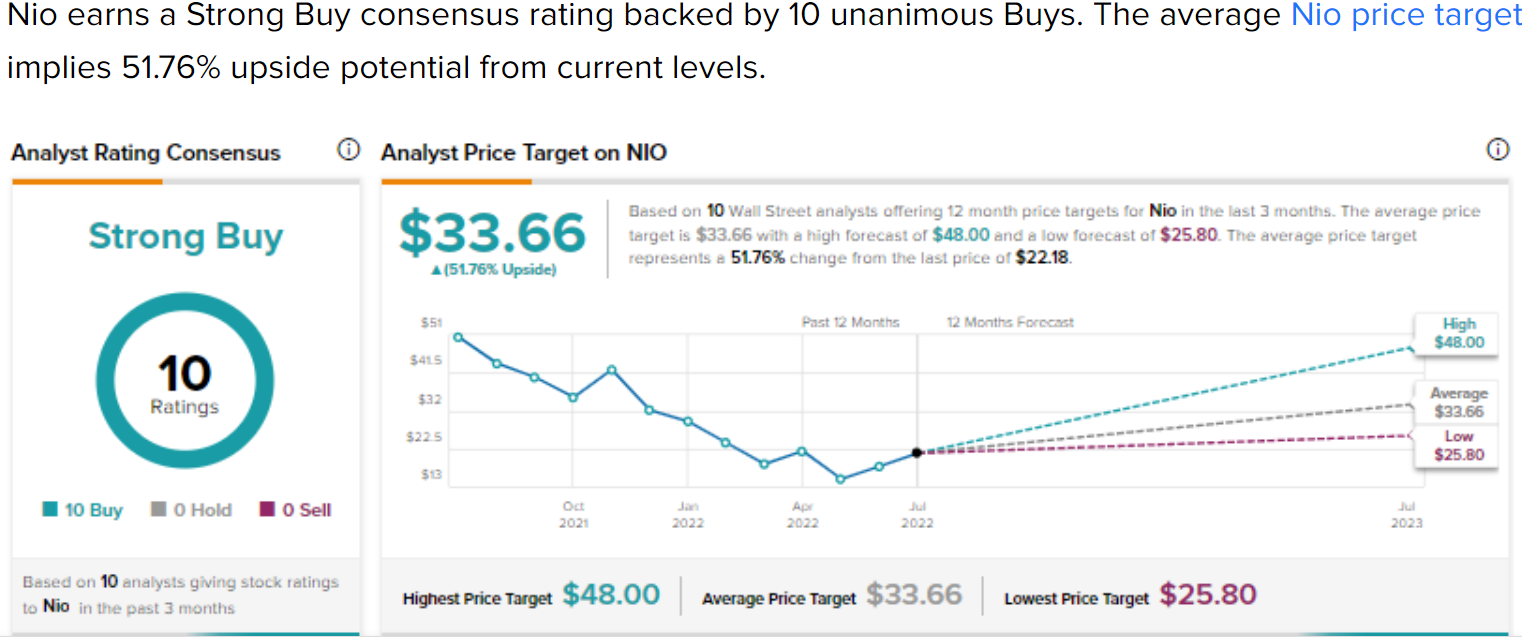

Any price targets here with Nio….

$15

$NIO made the video tonight which is nice to see

China's Nio to get $2.2 billion investment from Abu Dhabi's CYVN

By: Investing | December 18, 2023

SHANGHAI (Reuters) -Electric vehicle maker Nio (NYSE:NIO) has signed a pact for an investment of $2.2 billion from CYVN Holdings, an investment vehicle based in Abu Dhabi, the Chinese company said on Monday.

The investment comes as Nio, with its EV sales and profitability under pressure in a price war started by Tesla (NASDAQ:TSLA), has sought to boost efficiency by cutting a tenth of the workforce and deferring non-core projects.

The deal, expected to close in the final week of December, would take CYVN's shareholding to 20.1% of Nio's total issued and outstanding shares, following an investment of $1 billion in July, Nio said in a statement on its website.

That would make CYVN the largest single shareholder of Nio, although founder and chief executive William Li retains the most voting power, with his ownership of Class 'C' ordinary shares.

CYVN, which will subscribe to 294,000,000 newly issued Class A ordinary shares priced at $7.50 each, will also be entitled to nominate two directors to Nio's board, the company said.

The company, whose Nio-branded EVs compete with premium brands such as Mercedes-Benz (OTC:MBGAF) and BMW (ETR:BMWG) in China, has been developing two new brands for mass markets that it aims to bring them to Europe from 2025, its executives have said.

In its drive to become more efficient, Nio is considering a spin-off of its battery production unit while continuing to develop technologies for key components on its own, Reuters has reported previously.

Read Full Story »»»

DiscoverGold

DiscoverGold

My God NIO 2.2 Billion. We Were Right! 💸

NIO is the leader in the premium luxury EV space in China.

NIO Shanghai To Europe Firefly! 🚀

NIO to launch Firefly brand in Europe in 2025

Good video featuring NIO as the FEATURED Stock

My God NIO More Spin-Off! Edison Yu, Thank you

Bears Bet Against EV Manufacturer Nio (NIO) But Could It Backfire?

By: Barchart | December 12, 2023

Ranking among the stars of the equities market during the post-pandemic surge, Chinese electric vehicle manufacturer Nio (NIO) looks set to print a sizable loss this year. Down more than 20% since the January opener, NIO stock happened to suffer a 50% haircut since the close of the Aug. 3 session.

Not necessarily helping to comprehensively assuage concerns was the company’s third-quarter earnings print. To be sure, Nio rang up sales of $2.6 billion, representing a 47% year-over-year lift. Also, deliveries jumped 75% YOY and gained 136% against the prior quarter sequentially. That was huge because deliveries had started to fade in recent quarters.

Still, the vehicle margin of 11% – while improved from 6% in Q2 – was down from 16.4% in the year-ago quarter. Further, gross margin sat at 8% in the most recent quarter, down conspicuously from the 13.3% recorded in Q3 2022. Fundamentally, these metrics suggest that wider economic pressures, along with the EV sector price war, have taken their toll on Nio.

Indeed, the Barchart Technical Opinion indicator rates NIO stock a 72% strong sell. And while the analyst consensus view comes in as a moderate buy, the assessment itself is rather split: four strong buys, one moderate buy and six holds. A couple more pensive ratings and NIO won’t look that appealing from an expert standpoint.

Still, it’s difficult to discount the EV manufacturer given its popularity among retail investors. Based on public forums, NIO stock remains one of the most heavily discussed ideas. Interestingly, on Monday, shares gained slightly over 4%. While it’s too early to call, we might be looking at a near-term speculative rally.

Contrarian Bulls Look to Penalize NIO Stock Pessimists

Curiously, when looking at Barchart’s screener for unusual stock options volume, NIO stock represented one of Monday’s highlights – that is, for generating overall volume lower than normal. However, this stat alone obscures the fact that there are individual contracts within the NIO options chain worth watching closely.

One in particular stands out, the Feb 16 ’24 8.00 Call. On Dec. 7, Fintel’s options flow data – which exclusively filters for big block transactions likely made by institutions – showed a heavy concentration of sold (written) contracts of this call option. At the end of that session, volume totaled 11,017 contracts, a hefty wager.

For those unfamiliar with the lexicon, at face value (assuming no integration of complex multi-tiered strategies), traders placing this bet are assuming that by the expiration date of Feb. 16 of next year, NIO stock will not materially rise above the $8 strike price. If NIO fails to exceed this level, then the call seller (writer) will collect maximum premium, which in total amounted to $128,000.

On the other side of the transaction, those who believe that NIO stock can hit $8 before expiration collectively paid the $128,000 premium. It’s a test of will and conviction. However, for the risk underwriter, an added concern exists about covering the bearish bet. If the position is naked – that is, the call writer wrote the calls without owning the underlying security – it exposes the bear to unlimited liability.

Understanding this, NIO stock pessimists who underwrote the risk will be sweating until the February expiration date. In fact, the delta of the target call option sat at 48% on Dec. 7, then slipped to 45.8% the next day. That’s good for the call writer as it indicates that the underlying stock is moving away from the strike price.

However, with the big move up on Monday, delta for the call jumped to 51%. That’s great news for call holders but not so much for call writers. To add another wrinkle to the narrative, open interest for this option now stands at 26,126 contracts, leaving a huge vulnerability for pessimists if NIO stock soars past $8.

A Warning Sign Against Excessive Bearish Speculation

Truth be told, I’m neutral on NIO stock over the intermediate to long term. While the company brings many positives to the table, including leadership in EV technology and a focus on the user experience, the upstart also suffers from fierce competition. And that competition will almost certainly apply pressure to the margins, which already is a questionable topic.

However, I simultaneously lack the conviction to place excessively bearish wagers against NIO stock. For anyone who happens to be bearish on the Chinese EV maker, it’s more sensible to purchase put options. With buying options, your risk is limited only to what you put into the derivatives.

Selling options, especially selling call options, opens a can of worms. These folks are obligated to fulfill the terms of the contract upon exercise. For call writers, that means selling the underlying security at the listed strike price. However, if you don’t own the security in question, you may find yourself forced to buy back the stock at increasingly higher prices, only to sell shares at the (lower) strike price.

What’s worse, savvy contrarians may be aware of your bearish bets through data points like options flow. Therefore, NIO stock could be interesting for bullish speculators until Feb. 16.

Read Full Story »»»

DiscoverGold

DiscoverGold

My God! NIO Robo Taxi Soon. Power to 300,000 Homes. ✨📈

NIO Inc. reports robust Q3 results, plans expansion

By: Investing | December 8, 2023

NIO Incorporated (NYSE: NIO), a leader in China's premium smart electric vehicle market, delivered a robust performance in the third quarter of 2023, with vehicle deliveries soaring by 75.4% year-over-year to 55,432 units. The company's market share in China's EV segment surpassed 45%, maintaining its top position. The launch of the All-New EC6 in September bolstered its product lineup, and the company anticipates Q4 deliveries to range between 47,000 to 49,000 vehicles. Financially, NIO reported total revenues of RMB19.1 billion, marking a 46.6% increase year-over-year. Despite a challenging macroeconomic environment, the company has maintained a strong cash position with RMB45.2 billion in cash and cash equivalents.

Key Takeaways

NIO's Q3 vehicle deliveries hit 55,432, a 75.4% increase year-over-year.

The company holds over 45% market share in China's EV segment.

Q3 revenues reached RMB19.1 billion, up 46.6% year-over-year.

Vehicle margin stood at 11% in Q3; a decrease from 16.4% in the same period last year.

NIO ended Q3 with RMB45.2 billion in cash and cash equivalents.

Company Outlook

NIO's management expressed confidence in their long-term competitiveness within the Smart EV industry, emphasizing the introduction of advanced technology capabilities and the first vehicle operating system with LiDAR SoC in China. Plans to expand the battery swap network and open it to the industry were compared to cloud infrastructure, showcasing the company's strategic vision for infrastructure development.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Inc considers further job cuts amid financial strain

By: Investing | December 7, 2023

SHANGHAI - Chinese electric vehicle (EV) maker Nio Inc (NYSE:NIO) may be planning for additional workforce reductions, reports Bloomberg. This follows an earlier 10% cut, as the company faces financial challenges, including a significant third-quarter net loss.

On Tuesday, Nio revealed a third-quarter loss per share of 2.67 yuan, which surprisingly beat analyst expectations. The loss comes in a landscape marked by Tesla (NASDAQ:TSLA)'s aggressive pricing strategies and cautious spending by Chinese consumers. Nio's revenue for the quarter reached nearly $2.7 billion (19.1 billion yuan), marking a 47% increase year-over-year but still falling short of estimates. The company's gross margin retreated to 8%.

Despite the revenue growth, Nio's vehicle margin stands at only 11%, which is an improvement from the previous quarter but a decline compared to last year's figures. In response to these financial headwinds, Nio is focusing on cost-efficiency measures, including workforce reductions and the suspension or termination of non-profitable projects over the next three years.

Additionally, Nio is in the process of acquiring assets from JAC Motors for RMB 3.16 billion and is considering divesting its battery business segment. These strategic moves are aimed at bolstering the company's position against competitors like Tesla and BYD (SZ:002594), which currently enjoys higher gross margins and threatens to challenge Tesla's EV market dominance.

For the fourth quarter, Nio expects revenues to range between 16.1 billion yuan and 16.7 billion yuan with vehicle delivery targets set between 47,000 to 49,000 units.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio (NIO) jumps in pre-market following narrow 3Q losses

By: Investing | December 5, 2023

Shares of Chinese electric automaker, Nio Inc. (NYSE:NIO) jumped 4% in pre-market trading after the company released their 3Q earnings report showing narrowing losses.

Nio announced revenue of 19.07 billion yuan in the quarter, coming in behind the consensus estimate of 19.4 billion. Revenue rose 47% year-on-year.

The automaker reported an adjusted EPS loss of 2.67 yuan, missing an expected loss of 2.53 yuan.

Investors are directing their attention towards the Chinese electric carmaker's capacity to exhibit greater fiscal discipline while navigating its path towards profitability.

Nio's CEO, William Li, reaffirmed the company's commitment to enhanced efficiency as a fundamental focus.

“We have identified opportunities to optimize our organization, reduce costs and enhance efficiency,” Li said.

Several of these initiatives have begun to show positive results. In the third quarter, Nio reported a net loss of 4.6 billion yuan, marking a 24.8% decrease from the second quarter of 2023. However, it remained higher than the corresponding period in 2022.

Additionally, the company recently downsized its workforce by 10% last month, attributing the decision to "fierce competition."

The electric vehicle landscape in China is fiercely competitive, with Nio contending with pressure from emerging startups like Xpeng (NYSE:XPEV) and Li Auto (NASDAQ:LI), as well as established giants such as Tesla (NASDAQ:TSLA) and BYD.

Adding to the challenge, Chinese consumers are exhibiting caution in their spending habits, potentially impacting Nio's strategy aimed at capturing the premium segment within the local EV market.

Nio's projected fourth-quarter revenue is estimated to fall between 16.1 billion yuan and 16.7 billion yuan. This forecast represents a year-on-year increase ranging from 0.1% to 4.0%. However, analysts had initially anticipated a higher forecast of 22.4 billion yuan for the December quarter.

Nio expects to distribute between 47,000 and 49,000 vehicles in the fourth quarter. This projection signifies a notable increase of approximately 17.3% to 22.3% compared to the same period last year.

Shares of NIO are up 1.5% in afternoon trading on Tuesday.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |