Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

It hurts when they dilute but remember last 2x the PPS rebounded immediately. Hoping it does again. Selling in Norway now double production capacity, introducing more models. Future is bright temporary pain

Good strategy, I am long.

Fantastic for sure lol. What a great short this was from 41.40 it just took one day to watch this fall 8%. locked in the profits with some options now lets see what happens. Either way we just made 8% in hours if it goes up we make the money on the calls and if it goes down further we clean up on the hedge. This was easy money and Wall street doesnt give gifts this easy lol. Have a great day..$$$$$$$$$$$$$$$$$$$$ most wont post their trades real time but I did and learn from it.

I understand that. I sold half of my shares between 46 and 49. I have 1500 sh left and wont sell again till a min of $60. My ave was $4 now my shares are free. If it does fall to $32 level i will probably buy a few back. I dont look at anything as long term. I take profits from everything i own when available

If we see sub 35 I have to add more. These are fantastic opportunities. This company is going to grow and the share price will run. My cost basis is in the twenties but I am still tempted to add.

In December it ran after offering. Who knows it is clown world after all.

Premarket is down a buck. No big deal. Probably end green. Cause the Money raise is for growing and the lotus deal is huge which involves Volvo and Europe. Go back and read the news. This deal is worth Buko bucks and will put nio shares value in the hundreds soon.

Do your research. This will be the stock to watch.

Good luck and buy any dips. As nio will pull ahead of Tesla

I wont be surprised to see 32 to 35. The dilution killed them in jan and its going to hurt again

Wow even more dilution. We build it,you pay for it.Hong Kong, Mainland China listing comming soon.What the heck?

Wow NIO I didnt know it would be this easy Perfect timing on the shorts today. Let see how fast we can see 37.00???

Nio shares fall after $2 billion stock offering announced

By: StreetInsider | September 7, 2021

NIO Inc. (NYSE: NIO) (“NIO” or the “Company”), a pioneer and a leading company in the premium smart electric vehicle market in China, today announced that it has filed a prospectus supplement to sell up to an aggregate of US$2,000,000,000 of its American depositary shares (“ADSs”), each representing one Class A ordinary share of the Company, through an at-the-market equity offering program (the “At-The-Market Offering”).

The ADSs will be offered through Credit Suisse Securities (USA) LLC, Morgan Stanley & Co. LLC, Goldman Sachs (Asia) L.L.C., China International Capital Corporation Hong Kong Securities Limited, Nomura Securities International, Inc. and Guotai Junan Securities (Hong Kong) Limited as sales agents. Some of the sales agents are expected to make offers and sales both inside and outside the United States through their respective selling agents.

The Company has entered into an equity distribution agreement with the sales agents relating to the At-The-Market Offering. Sales, if any, of the ADSs under the At-The-Market Offering will be made from time to time, at the Company’s discretion, by means of ordinary broker transactions on or through the New York Stock Exchange (the “NYSE”) or other markets for its ADSs, sales made to or through a market maker other than on an exchange, or otherwise in negotiated transactions, or as otherwise agreed with the sales agents. Sales may be made at market prices prevailing at the time of sale or at negotiated prices. As a result, sales prices may vary.

The Company currently plans to use the net proceeds from the At-The-Market Offering to further strengthen its balance sheet, as well as for general corporate purposes.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio files to sell up to $2B worth of shares in at-the-market equity offering...

Nio (NYSE:NIO) says it filed to sell up to $2B worth of ADSs through an at-the-market equity offering program.

The electric vehicle company entered into an equity distribution agreement with the sales agents relating to the at-the-market offering. Sales of the ADSs under the at-the-market offering will be made from time to time or not at all, at Nio's discretion. Sales may be made at market prices prevailing at the time of sale or at negotiated prices.

Nio plans to use the proceeds from the at-the-market offering to further strengthen its balance sheet, as well as for general corporate purposes.

Shares of Nio are down 2.88% in AH trading to $39.43.

There are about 1.64B shares outstanding on Nio (NIO). The public owned about 51% of Nio before the ATM offering.

I was afraid of more dilution in nio. Looks like i was right. Ive mentioned it a couple of times

Nio gets another huge upgrade. Look for the Nio / Lotus partnership formally announced soon This will mean huge upside. Even Volvo is in bed with nio now. Stay tuned.

We got some great shorts off today near the highs. Looking for a downgrade coming for NIO. We are looking for 37.00 short term and then we will decide either to cover or short more if the news is bad. The gap was filled and now its going to get drilled. Dont be surprised to see NIO in the low 30's on a downgrade.

Nio Earnings Surge despite Crackdown on Big Tech

By: Tip Ranks | September 5, 2021

Established in 2014, Nio (NYSE:NIO) has come a long way to become one of the leading EV manufacturers in China. The company has seen a steady rise in demand for its luxury SUVs in 2021. Additionally, Nio has witnessed a doubling of its car sales in 2020 and is focusing on developing its battery technology and introducing newer EV models.

The company does not manufacture electric cars. Rather, it has partnered with a state-owned car manufacturer. This has provided Nio with an asset-light business model, allowing Nio to focus on technological development and design, much the same way as other high-profile companies such was Apple (NASDAQ:AAPL).

This extraordinary business model has resulted in otherwise stellar earnings. Nio's recent Q2 results highlighted how successful this Chinese EV player has been. The company updated its forward revenue guidance, and announced plans to battle the rising competition from domestic and foreign rivals such as U.S giant Tesla (NASDAQ:TSLA).

Nio's stock fell after China’s Communist Party’s Central Committee declared a 5-year plan for increased regulation. Indeed, all Chinese growth stocks fell on this news. While the CCP had earlier imposed a series of regulatory curbs on its tech start-ups, investors are increasingly trying to decide how the future regulatory environment may look for Chinese stocks in this environment.

Accordingly, Nio is an intriguing stock to assess today. This author is bullish on the stock. Let's dive into whether this is a worthwhile stock for investors consider a long-term growth investment today. (See Nio stock charts on TipRanks)

Nio Earnings in Q2

Starting with the top line, things are looking up for EV player Nio. The company reported a massive year-over-year revenue jump of 145% in the second quarter. Experts believe that the Chinese EV sector may not be as affected by the recent regulations as much as the other sectors. If true, this implies more upside for NIO stock relative to other high-profile Chinese tech companies.

On the bottom line, Nio also outperformed. The company posted a loss of $0.09 per share, relative to a $0.17 loss during the previous quarter last year. While still losing money, Nio appears to be trending in the right direction, and could head into the black shortly.

Nio's deliveries ended up coming in near the higher-end of the company's previously-estimated range of 21,000-22,000 vehicles. The company reported deliveries of 21,896 units of its luxury electric vehicles this past quarter. These delivery numbers were stronger than many expected, given difficult headwinds caused by a global chip shortage and increased competition.

Nio has stated that its July sales in the current year have more than doubled in comparison to last year. Accordingly, the company aims to sell 23,000 to 25,000 EVs during the next quarter, which would be 88%- 105% more as opposed to last year.

These numbers are very strong, and represent the kind of growth investors expect from a company with this sort of valuation.

Nio Aims to Expand in Norway

Chinese EV manufacturers have already started to make inroads into Norway. Why Norway? Well, it is a major EV market in Europe, with much higher adoption rates than other sub-regions in Europe. EV makers like Nio, BYD Auto (BYDDF (OTC:BYDDF)), Li Auto (LI), and others are planning to enter the Norwegian EV market, which is otherwise dominated by Tesla.

Nio has already shipped its first batch of its ES8 luxury electric SUVs to Norway. Nio’s expansion to foreign markets is a bullish sign for investors looking past China. Though China is a massive, fast-growing market, Nio is clearly making a move to become a global leader in the EV race. Long-term investors ought to like this move.

Nio to Launch a Series of New Models

Currently, Nio manufactures a lineup of luxury electric SUVs, including its ES6, EC6, and ES8 models. Founder and CEO William Li has announced that the company would be introducing its first electric sedan ET7 next year. The EV maker plans to launch three new models in the upcoming year, including its ET7 sedan.

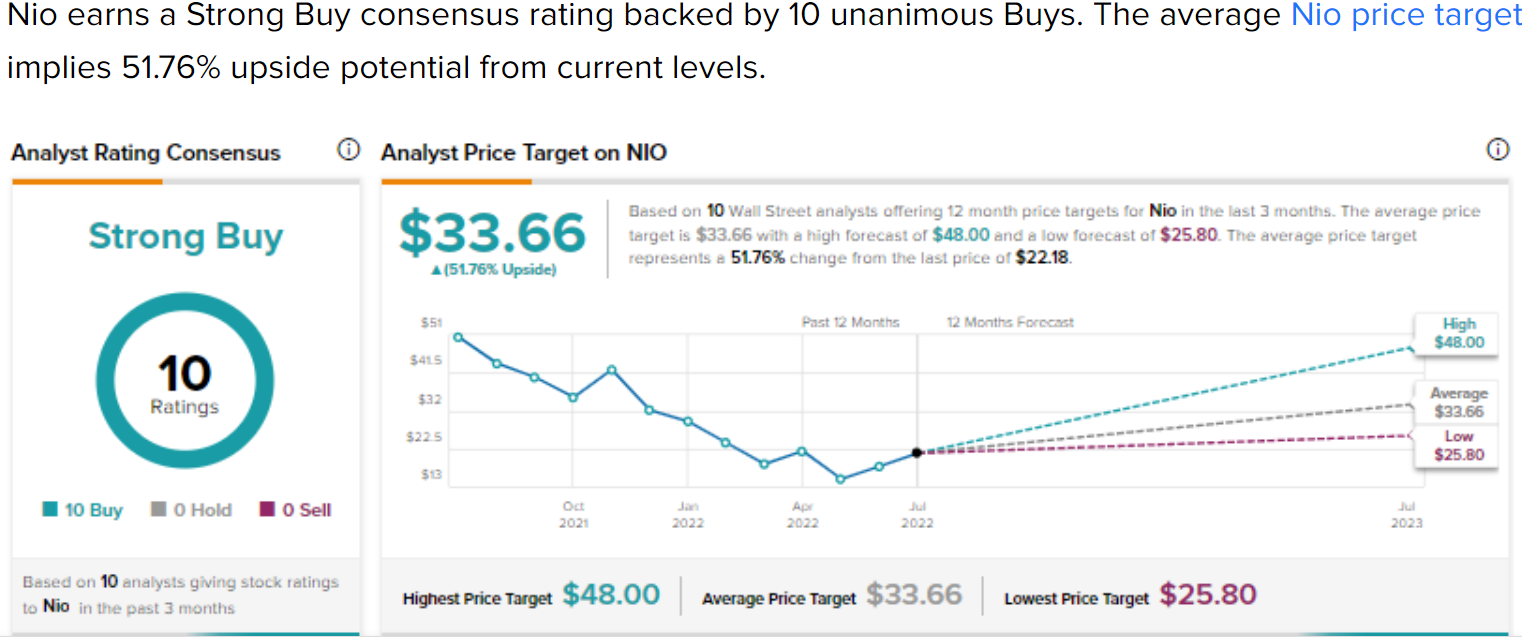

What are the Analysts Saying about NIO Stock?

According to TipRanks analyst rating consensus, NIO stock is a Strong Buy. Out of 7 analyst ratings, there are 7 Buy recommendations.

The average analyst Nio price target is $66.01, implying an upside of 63.6%. The analyst price targets range from a low of $57 for each share to a high of $72 per share.

Bottom Line

Nio has constantly been trying to develop new battery technologies to get an edge over its competitors. Moreover, it is also working on creating a new battery swapping service that would allow users to swap exhausted batteries with a fully-charged one.

With newer EV models, overseas market expansion, and key innovations, Nio is poised to grow. This is a top growth stock every long-term investor should at least look at today.

Disclosure: At the time of publication, Chris MacDonald did not have a position in any of the securities mentioned in this article

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio $NIO Having some difficulty in-between the volume gap

By: TrendSpider | September 4, 2021

• $NIO Having some difficulty in-between the volume gap.

Read Full Story »»»

DiscoverGold

DiscoverGold

Green in the last 10 minutes lol... enjoy the weekend!

Expecting big numbers for the rest of 2021 with the nice amount of orders that were placed but delayed delivery because of chip shortage. Don’t be surprised when this stock reaches ATH sooner than later...

Nio (NIO) Having trouble facing these heatmaps

By: TrendSpider | September 2, 2021

• $NIO Having trouble facing these heatmaps.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Charts Suggest Caution After Disappointing Deliveries

By: TheStreet | September 2, 2021

• Nio stock is trading lower after the Chinese EV producer issued a disappointing update on deliveries. Here's how to trade the stock from here.

It didn’t look like it was going to be a very good day for Nio (NIO) on Wednesday.

The shares were trading lower by 5% in the premarket, as investors were disappointed by the Chinese electric-vehicle producer's delivery update.

Nio reduced its third-quarter delivery expectations and now expects to deliver 22,500 to 23,500 vehicles in the quarter. That’s down from the prior range of 23,000 to 25,000 vehicles.

That said, Nio stock is now flat on the day after an impressive rebound.

It also comes at a time where other EV stocks -- except for Tesla (TSLA) are struggling. Tesla is hitting its highest level since April.

Despite Nio trading below all of its daily moving averages, this rally from negative territory on bad news is pretty impressive. Let’s look at the chart to see what could be next.

Trading Nio Stock

Daily chart of Nio stock.

Chart courtesy of TrendSpider.com

Nio rode into 2021 with some impressive momentum. Unlike most growth stocks, though, this name topped well before the February high. That doesn’t mean, though, that it was spared from the ensuing bear market in growth stocks.

Nio was knocked lower just like its peers. In early May, the stock took out its February low, bottomed at $30.71 and quickly rebounded higher. Since being rejected near the $54 level and the 61.8% retracement, Nio stock has been struggling for upside traction.

Today’s action is impressive -- yet I am still a bit cautious on Nio stock.

The shares remain below the key $39 to $40 area, as the July low is currently acting as resistance. Before the struggle with this area, it looked like we had a rather typical “ABC” correction down to the weekly VWAP measure.

Now with Nio struggling, though, it sets us up for a potentially larger pullback — something like an “ABCDE” correction, a five-wave dip.

Aggressive bulls may consider being long with a stop below the August low (at $36.24). But I’d rather have a better entry.

That either comes from a deeper correction -- potentially to the weekly VWAP measure or possibly even deeper -- or on a rotation higher.

For the latter, a close above $40 and the 21-day moving average would be attractive. Not only would that give us a weekly-up rotation but it would also put the 50-week and 200-day moving averages in play.

Nio is a tricky one. Its chart still suggests caution, but Tuesday’s action had some promise. Let’s keep an eye on this one.

Read Full Story »»»

DiscoverGold

DiscoverGold

the good news is the quarterly guidance on deliveries is barely changed which means the next month should be approx 9,000 vehicles. That should give us a boost.

Nio Shares Fall After EV Maker Cuts Deliveries Estimate

By: TheStreet | September 1, 2021

• NIO expects to deliver 22,500 to 23,500 vehicles in the third quarter, down from the previous estimate of 23,000 to 25,000.

Nio NIO shares fell on Wednesday after the Chinese electric vehicle maker trimmed its forecast for third-quarter deliveries.

“In light of the continued uncertainty and volatility of semiconductor supply, the company prudently adjusts vehicle production and expects to deliver approximately 22,500 to 23,500 vehicles in the third quarter, revised from the previous outlook of 23,000 to 25,000 vehicles,” Nio said in a statement.

The Shanghai company's stock recently traded at $37.29, down 5%. It had dropped 14% in the six months through Tuesday amid concern about valuation.

NIO delivered 5,880 vehicles in August, representing 48% year-over-year growth.

“While the company’s new order reached an all-time high in August, driven by increasing demand, vehicle production, especially the manufacturing of the ES6 and EC6, was materially disrupted by supply chain constraints resulting from COVID-19 in China and Malaysia.”

Earlier this month, Nio shares fell after a Chinese executive reportedly died in an accident while driving one of the Chinese electric-vehicle maker's model ES8 SUVs.

He died after activating the autopilot navigation system in his SUV, according to reports from several Chinese media outlets.

The Nio ES8 is equipped with several driver-assistance functions, including features enabled by Intel (INTC) division Mobileye, that enable some forms of autonomous driving, Barron's reported.

Also this month, Nio posted better-than-expected second-quarter earnings, reporting a jump in revenue and raised its guidance.

It registered an adjusted loss of 3 cents a share. The FactSet analyst consensus called for a loss of 9 cents. Revenue totaled $1.31 billion, more than double (up 127%) the year-earlier figure.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Inc - (NIO) Receives Average Recommendation of "Buy" from Brokerages

By: MarketBeat | August 24, 2021

• Nio Inc - (NYSE:NIO) has earned a consensus rating of "Buy" from the eighteen brokerages that are currently covering the company, MarketBeat reports. Five research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company. The average 12 month price target among brokers that have issued a report on the stock in the last year is $60.35...

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Holding tight to support on the weekly

By: TrendSpider | August 28, 2021

• $NIO Holding tight to support on the weekly.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO has been a great short for us. We covered the other day and are looking to put new shorts out again. Ca CHING ring the cash register again

China’s securities regulator signals willingness to work with US over audit inspections https://www.asianewsday.com/chinas-securities-regulator-signals-willingness-to-work-with-us-over-audit-inspections/

Millions of electric car batteries will retire in the next decade. What happens to them?

By: XiaoZhi Lim | August 20, 2021

A tsunami of electric vehicles is expected in rich countries, as car companies and governments pledge to ramp up their numbers – there are predicted be 145m on the roads by 2030. But while electric vehicles can play an important role in reducing emissions, they also contain a potential environmental timebomb: their batteries.

By one estimate, more than 12m tons of lithium-ion batteries are expected to retire between now and 2030.

Not only do these batteries require large amounts of raw materials, including lithium, nickel and cobalt – mining for which has climate, environmental and human rights impacts – they also threaten to leave a mountain of electronic waste as they reach the end of their lives.

As the automotive industry starts to transform, experts say now is the time to plan for what happens to batteries at the end of their lives, to reduce reliance on mining and keep materials in circulation.

A second life

Hundreds of millions of dollars are flowing into recycling startups and research centers to figure out how to disassemble dead batteries and extract valuable metals at scale.

But if we want to do more with the materials that we have, recycling shouldn’t be the first solution, said James Pennington, who leads the World Economic Forum’s circular economy program. “The best thing to do at first is to keep things in use for longer,” he said.

“There is a lot of [battery] capacity left at the end of first use in electric vehicles,” said Jessika Richter, who researches environmental policy at Lund University. These batteries may no longer be able run vehicles but they could have second lives storing excess power generated by solar or windfarms.

Several companies are running trials. The energy company Enel Group is using 90 batteries retired from Nissan Leaf cars in an energy storage facility in Melilla, Spain, which is isolated from the Spanish national grid. In the UK, the energy company Powervault partnered with Renault to outfit home energy storage systems with retired batteries.

Establishing the flow of lithium-ion batteries from a first life in electric vehicles to a second life in stationary energy storage would have another bonus: displacing toxic lead-acid batteries.

Only about 60% of lead-acid batteries are used in cars, said Richard Fuller, who leads the non-profit Pure Earth, another 20% are used for storing excess solar power, particularly in African countries.

Lead-acid batteries typically last only about two years in warmer climates, said Fuller, as heat causes them to degrade more quickly, meaning they need to be recycled frequently. However, there are few facilities that can safely do this in Africa.

Instead, these batteries are often cracked open and melted down in back yards. The process exposes the recyclers and their surroundings to lead, a potent neurotoxin that has no known safe level and can damage brain development in children.

Lithium-ion batteries could offer a less toxic and longer-lasting alternative for energy storage, Fuller said.

The race to recycle

“When a battery really is at the end of its use, then it’s time to recycle it,” Pennington said.

There is big momentum behind lithium-ion battery recycling. In its impact report, published in August, Tesla announced that it had started building recycling capabilities at its Gigafactory in Nevada to process waste batteries.

Nearby Redwood Materials, founded by the former Tesla chief technology officer JB Straubel, which operates out of Carson City, Nevada, raised more than $700m in July and plans to expand operations. The factory takes in dead batteries, extracts valuable materials such as copper and cobalt, then sends the refined metals back into the battery supply chain.

Yet, as recycling becomes more mainstream, big technical challenges remain.

One of which is the complex designs that recyclers must navigate to get to the valuable components. Lithium-ion batteries are rarely designed with recyclability in mind, said Carlton Cummins, co-founder of Aceleron, a UK battery manufacturing startup. “This is why the recycler struggles. They want to do the job, but they only get introduced to the product when it reaches their door.”

Cummins and co-founder Amrit Chandan have targeted one design flaw: the way components are connected. Most components are welded together, which is good for electrical connection, but bad for recycling, Cummins said.

Aceleron’s batteries join components with fasteners that compress the metal contacts together. These connections can be decompressed and the fasteners removed, allowing for complete disassembly or for the removal and replacement of individual faulty components.

Easier disassembly could also help mitigate safety hazards. Lithium-ion batteries that are not properly handled could pose fire and explosion risks. “If we pick it down to bits, I guarantee you, it’s not going to hurt anyone,” Cummins said.

Changing the system

Success isn’t guaranteed even if the technical challenges are cracked. History shows how hard it can be to create well-functioning recycling industries.

Lead-acid batteries, for example, enjoy high rates of recycling in part due to legal requirements – as much as 99% of lead in automobile batteries is recycled. But they have a toxic cost when they end up at improper recycling facilities. Spent batteries often end up with backyard recyclers because they can pay more for them than formal recyclers, who have to cover higher operating costs.

Lithium-ion batteries may be less toxic but they will still need to end up at operations that can safely recycle them. “Products tend to flow through the path of least resistance, so you want to make the path which goes through formal channels less resistant,” Pennington said.

Legislation could help. While the US has yet to implement federal policies mandating lithium-ion battery recycling, the EU and China already require battery manufacturers to pay for setting up collection and recycling systems. These funds could help subsidize formal recyclers to make them more competitive, Pennington said.

Last December, the EU also proposed sweeping changes to its battery regulations, most of which target lithium-ion batteries. These include target rates of 70% for battery collection, recovery rates of 95% for cobalt, copper, lead and nickel and 70% for lithium, and mandatory minimum levels of recycled content in new batteries by 2030 – to ensure there are markets for recyclers and buffer them from volatile commodity prices or changing battery chemistries.

“They aren’t in final form yet, but the proposals that are out there are ambitious,” Richter said.

Data could also help. The EU and the Global Battery Alliance (GBA), a public-private collaboration, are both working on versions of a digital “passport” – an electronic record for a battery that would contain information about its whole life cycle.

“We are thinking about a QR code or a [radio frequency identification] detection device,” says Torsten Freund, who leads the GBA’s battery passport initiative. It could report a battery’s health and remaining capacity, helping vehicle manufacturers direct it for reuse or to recycling facilities. Data about materials could help recyclers navigate the myriad chemistries of lithium-ion batteries. And once recycling becomes more widespread, the passport could also indicate the amount of recycled content in new batteries.

As the automobile industry starts to transform, now is the time to tackle these problems, said Maya Ben Dror, urban mobility lead at the World Economic Forum. The money pouring into the sector offers an “opportunity to ensure that these investments are going to be in sustainable new ecosystems and not just in a new type of car”, she said.

It’s also worth noting that sustainable transport goes beyond electric cars, said Richter. Walking, biking or taking public transportation should not be overlooked, she said. “It’s important to remember that we can have a sustainable product situated within an unsustainable system.”

Read Full Story »»»

DiscoverGold

DiscoverGold

I bailed out could not take anymore losses

You right most times it goes back to $45

Getting ready for a good buy!!!! Thanks

$NIO could bounce from here

Why Nio Stock Rebounded Today

By: Motley Fool | August 18, 2021

Key Points

• Many Chinese stocks have fallen on risks related to the Communist Party, but there can be another side to that, too.

What happened

Shares of Nio (NYSE:NIO) have been on a steady decline over the past seven trading days. There are several reasons the stock dropped about 15% in that time period, but it rebounded today, rising as much as 2.4% before settling to a gain of 2% as of noon EDT.

So what

Nio reported its quarterly financial results last week, and some investors weren't adequately impressed. The automaker has also been caught in a net of U.S.-listed Chinese names that have taken hits due to Chinese government regulators who have taken aim at certain technology industries. But the latest word from China's leadership could turn into a tailwind for the electric vehicle (EV) industry.

Now what

Chinese state media said that President Xi Jinping recently spoke at an economic meeting discussing how the country would aim to spread wealth to more citizens, and curb "excessive incomes," CNBC said. The report included a translation from the meeting that said the plan is for "reasonable adjustment of excessive incomes and encouraging high income groups and businesses to return more to society."

It's impossible to know exactly what China's president and Communist government have in mind. But if it results in more of the population of the largest automotive market in the world having additional discretionary income, it could bode well for EV sellers there.

Nio sells three SUV models, and plans to launch a luxury sedan early next year. The company also said it will announce another two new products in 2022. If more Chinese citizens are able to become customers, investors may be thinking it could be another future tailwind for Nio and other EV makers.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Blue Doji showing a little hesitancy breaking below that support line

By: TrendSpider | August 18, 2021

• $NIO Blue Doji showing a little hesitancy breaking below that support line.

Read Full Story »»»

DiscoverGold

DiscoverGold

Xpev just over took nio in share price. What's up with that? I just added some nio. This is ridiculous. GL.

Scooped up my final add today. Might drop a little more. Great opp.

Nio (NIO) Stock Drops After Report EV With Self-Driving Feature Crashed

By: TheStreet | August 16, 2021

• NIO drops after reports said one of its all-electric SUVs with its self-driving feature activated was involved in a fatal crash.

U.S.-listed shares of Nio (NIO) fell on Monday after a Chinese executive reportedly died in an accident while driving one of the Chinese electric-vehicle maker's model ES8 SUVs.

Shares of the Shanghai company at last check fell 5.8% to $38.66.

Lin Wenqin, founder of the brand-management firm Meiyihao, died last Thursday in an accident after activating the autopilot navigation system in his NIO SUV, according to news reports by several Chinese media outlets.

The NIO ES8 is equipped with several driver-assistance functions, including features enabled by Intel (INTC) division Mobileye, that enable some forms of autonomous driving, Barron's reported.

NIO’s driver-assistance functions are called NIO Pilot and employ cameras as the so-called eyes of the car.

In July, a NIO SUV, the model EC6, reportedly caught fire when it hit a stone pier in Shanghai, according to another Chinese media news report. The driver was killed.

NIO reported a narrower-than-expected second-quarter loss on a recovery in car-buyer demand, and said it’s working with semiconductor suppliers to mitigate the impact on production from a global chip shortage, Bloomberg reported last week.

Separately, U.S. authorities have opened a formal probe into electric-vehicle maker Tesla's (TSLA) autopilot system, after they identified 31 accidents connected to the use of the system over the past three and a half years.

The National Highway Traffic Safety Administration said it would look at the autopilot system in around 765,000 Tesla Model X and Model Y SUVs and Model S and Model 3 sedans made between 2014 and 2021.

Read Full Story »»»

DiscoverGold

DiscoverGold

Apparently a self driving nio was in a fatal collision in china

If it doesnt hold here the next stop i see is around 34 to 35

oldmusky

You are absolutely correct!

A sound thrashing over the past two days. Nothing but good news for the company. lots of opportunity to get in here.

$NIO Looking at a potential move down to support. Analysts' estimates mainly bullish with 12 "Buy," 5 "Hold," and 0 "Sell" in the past year

By: TrendSpider | August 16, 2021

• $NIO Looking at a potential move down to support. Analysts' estimates mainly bullish with 12 "Buy," 5 "Hold," and 0 "Sell" in the past year.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |