Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

LOL...it sure took a pretty leap this morning at premarket open...hopefully it will sustain.

Debt in yen maybe, in dollars its 2.6 billion usd…

https://finance.yahoo.com/news/nio-inc-nyse-nio-just-071321638.html

$NIO Turning red to green as price finds some support off the IPO previous highs

By: TrendSpider | March 15, 2022

• $NIO Turning red to green as price finds some support off the IPO previous highs.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Total Debt $19.2 Billion

7 to 9 imho...ziggy

Yea...that is what peeps have been thinking on the retrace down to the $40s from $50...eventually it will be true....it will be a buy of a lifetime...like around $5 perhaps.

Buying opportunity of a lifetime… buy buy buy

This could end up in the single digits.

Wow worst investments just prior to all this mess. I bought all these chinese ev stocks, thinking i was buying a discount after the tech sector fell.

Looks like I might have thrown all that money away.

China's daily cases of symptomatic COVID more than triple

https://www.reuters.com/business/healthcare-pharmaceuticals/china-daily-local-symptomatic-covid-cases-more-than-triple-2022-03-13/ $NIO

$NIO Weekly Chart. Between fears of US delisting, Ukraine/Russia war, COVID, and inflation China names are getting hit big time

By: ReciKnows | March 13, 2022

• $NIO Weekly. Between fears of US delisting, Ukraine/Russia war, COVID, and inflation China names are getting hit big time.

Wouldn't be surprised to see #NIO in single digits soon.

Read Full Story »»»

DiscoverGold

DiscoverGold

Well this has quickly become one of the worst investments I made. Its my own fault for investing in a chinese company. EV market has been popping and this turd just floats around the bowl.

All good things come to an end thanks to our gov. "IMO" they will accelerate it.

SEC Chair: Roughly 250 Chinese companies could be delisted 'as early as 2024'

https://www.uscc.gov/sites/default/files/2021-05/Chinese_Companies_on_US_Stock_Exchanges_5-2021.pdf

https://finance.yahoo.com/news/sec-chair-roughly-250-chinese-companies-could-be-delisted-as-early-as-2024-122037497.html

what basis do you have to make that claim?

But honestly the chip shortage is still real. And so is Chinese delisting. No Catalyst in the making. This will drift down to single digits

Buying opportunity of a lifetime… buy buy buy

$NIO, one of the bubble stocks of 2020 is approaching its next weekly cycle low, next week or the following

By: CyclesFan | March 11, 2022

• $NIO, one of the bubble stocks of 2020 is approaching its next weekly cycle low, next week or the following. One thing is certain, the gap at 9.40 will be filled later this year or by early 2023. It's likely to have a 85-90% haircut from the 2021 high.

Read Full Story »»»

DiscoverGold

DiscoverGold

It is starting to look like NIO is going to get delisted

$NIO Breaking down after failing to cross the 8/21 MA Cloud

By: TrendSpider | March 10, 2022

• $NIO Breaking down after failing to cross the 8/21 MA Cloud.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Shares of Chinese companies are trading lower amid multiple possible catalysts including overall market weakness following the collapse of Russia-Ukraine ceasefire talks as well as weakness in JD.com following Q4 earnings. Additionally, recent US media reports have questioned the neutrality of Chinese media coverage of the Russia-Ukraine conflict.

Why NIO Stock Is Down By 13% Today

By: Vladimir Zernov | March 10, 2022

• The stock is trying to settle below the $18 level.

NIO Stock Retreats As The Company’s Shares Start Trading In Hong Kong

Shares of the Chinese electric vehicle maker NIO gained additional downside momentum after the company’s stock began to trade in Hong Kong.

The stock reached highs near the $67 level back at the beginning of 2021 but moved below the $20 level in 2022 on fears about the ongoing crackdown on tech companies in China and the risks of delisting due to worsening U.S. – China relations.

The listing in Hong Kong has clearly ignited fears of delisting from U.S. markets. Such risks have been recently highlighted by the trading action in U.S.- listed Russian stocks, which have been effectively frozen when the relations between Russia and the West hit new lows.

The current situation in commodity markets raises concerns about future profit margins of electric vehicle markets so many EV stocks, including Tesla, have been trending lower in recent weeks.

What’s Next For NIO Stock?

Analysts expect that NIO will report a loss of $0.24 per share in 2022, so the company is projected to remain unprofitable in the near term.

Analyst estimates have been mostly stable in recent weeks but they will likely start to trend lower due to recent developments in commodity markets.

The stock is hit by multiple risks, including caution towards unprofitable companies, delisting fears and the rally in commodity markets.

The company has already lost more than 40% of its market capitalization since the beginning of this year but it remains to be seen whether speculative traders will rush to buy NIO stock.

At this point, it looks that traders will wait for an upside trend in the market leader Tesla before buying other EV stocks.

Read Full Story »»»

DiscoverGold

DiscoverGold

Apparently Hong Kong didn’t help

Nice day yesterday, lets see of it was a mirage. This stock is so oversold.

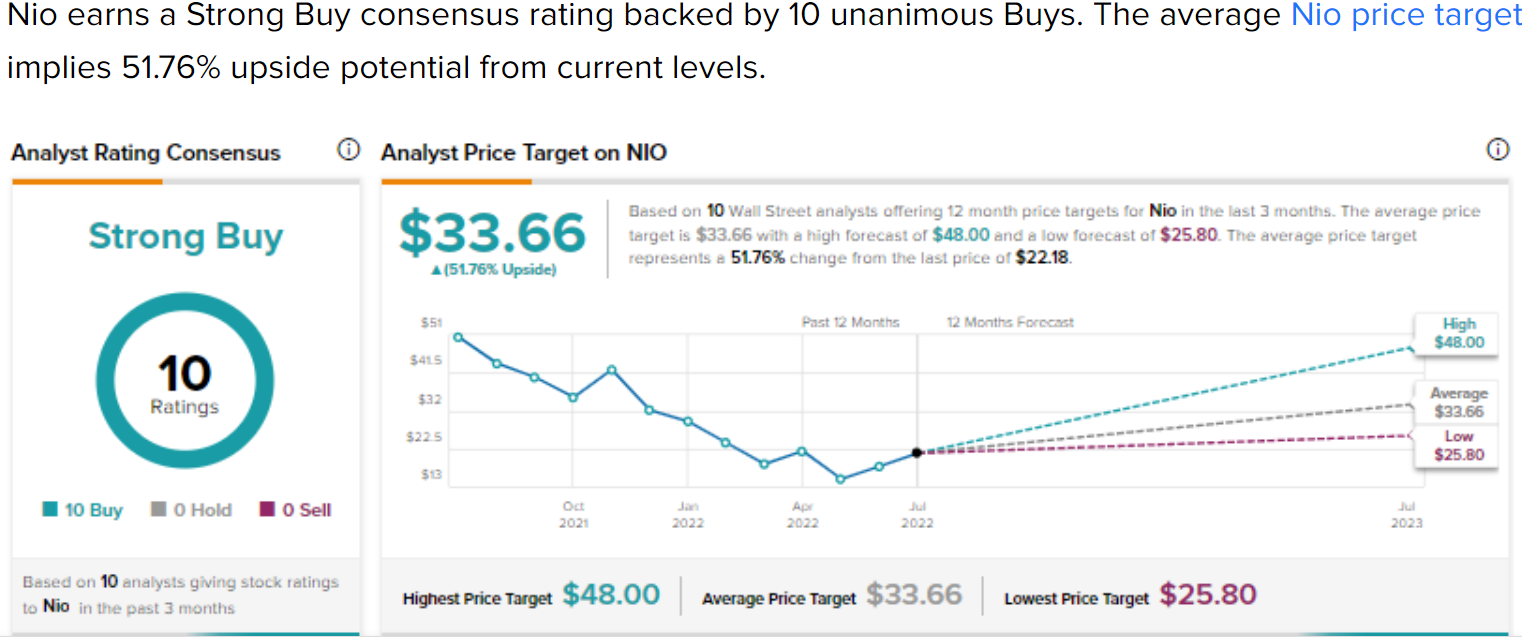

All the analysts have it as a strong buy with 12 month projections near $60. Triple where we are now in just a year.

NIO one of the champ within the EV market, let’s go!!!

$NIO Hanging on by a thread, descending triangle getting ready to push lower

By: Theta Warrior | March 7, 2022

• $NIO Hanging on by a thread, descending triangle getting ready to push lower.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Weekly Chart Breaking Down After Failing to Reclaim the Wedge/Triangle

By: Theta Warrior | March 6, 2022

• $NIO Weekly breaking down after failing to reclaim the wedge/triangle.

Read Full Story »»»

DiscoverGold

DiscoverGold

SEC Chair: Roughly 250 Chinese companies could be delisted 'as early as 2024'

https://www.uscc.gov/sites/default/files/2021-05/Chinese_Companies_on_US_Stock_Exchanges_5-2021.pdf

https://finance.yahoo.com/news/sec-chair-roughly-250-chinese-companies-could-be-delisted-as-early-as-2024-122037497.html

Other than no shares will be added nothing. Just stay away from China stocks for now, monitor NIO and by at a low point. This may drop further since China seems to side with Putin. I think they made a poor decision, since they want less hostility with the U.S.

Nio Inc $NIO Bear flag breakdown as price gets rejected by the previous swing low VWAP

By: TrendSpider | March 2, 2022

• $NIO Bear flag breakdown as price gets rejected by the previous swing low VWAP.

Read Full Story »»»

DiscoverGold

DiscoverGold

Anyone have an opinion on what the Hong Kong Phooey listing means to NIOs stock price? I have seen no op eds it.

$NIO Potential Bear flag forming with price continuing to be rejected by the previous swing low VWAP

By: TrendSpider | March 1, 2022

• $NIO Potential Bear flag forming with price continuing to be rejected by the previous swing low VWAP.

Read Full Story »»»

DiscoverGold

DiscoverGold

Just a small downside because of low February deliveries due to holiday/plant closures. But:

1) earnings release March 7th

2) Nio on Hong Kong exchange March 10th.

3) ET5 production release March 30th

4) NeoPlant opening in March.

Nio Inc $NIO Price looking to break the previous low VWAP as the MACD makes quite the curl

By: TrendSpider | March 1, 2022

• $NIO Price looking to break the previous low VWAP as the MACD makes quite the curl.

Read Full Story »»»

DiscoverGold

DiscoverGold

The trend is your friend...nio to hit $30 by end of march...ziggy

https://cnevpost.com/2022/03/01/nio-delivers-6131-vehicles-in-feb-up-9-9-year-on-year/amp/

$NIO Continuing lower lows as price struggles to regain the previous swing low VWAP

By: TrendSpider | February 28, 2022

• $NIO Continuing lower lows as price struggles to regain the previous swing low VWAP.

Read Full Story »»»

DiscoverGold

DiscoverGold

Earnings Previews: Nio Inc. (NYSE: NIO)

By: 24/7 Wall St. | February 28, 2022

• Here is a look at five companies scheduled to report quarterly results after markets close on Tuesday.

Nio

China-based EV maker Nio Inc. (NYSE: NIO) has dropped nearly 60% from its share price over the past 12 months. The stock’s only foray above the break-even line occurred on June 30. After sorting through some issues over the company’s structure, Nio expects to begin trading on the Hong Kong stock exchange on March 10. The automaker is not raising any cash from the listing, unlike competitors Xpeng and Li Auto, which raised about $2 billion and $1.7 billion, respectively, when they completed their secondary listings in Hong Kong.

There are 25 analyst ratings on Nio’s stock, and 21 of those are Buy or Strong Buy. At a share price of around $20.95, the upside potential based on a median price target of $53.70 is about 156%. At the high target of $88.01, the upside potential is 320%.

For the fourth quarter, the consensus estimates call for revenue of $1.547 billion, up 1.5% sequentially and 51% year over year. Nio is expected to post an adjusted loss per share of $0.12, worse than the $0.06 per-share loss in the prior quarter but better than the year-ago loss of $0.14 per share. For the full year, the company is expected to report a per-share loss of $0.30, better than the $0.66 loss last year, on sales of $5.67 billion, up about 128%.

Analysts estimate that Nio will trade at a multiple of 91.4 times earnings in 2023. Until then, it is not expected to post a profit. The enterprise value-to-sales multiple is expected to be 5.3 in 2021 and 3.0 in 2022. The stock’s 52-week range is $18.47 to $55.13. The company does not pay a dividend. Total shareholder return for the past year is negative 54.3%.

Read Full Story »»»

DiscoverGold

DiscoverGold

Chinese EV maker Nio pursues Hong Kong secondary listing

By: Reuters | February 27, 2022

Chinese electric vehicle (EV) maker Nio (NYSE:NIO) Inc will carry out a secondary listing in Hong Kong by way of introduction, according to stock exchange filings on Monday.

The New York-listed firm said it had received preliminary approval from the Hong Kong Stock Exchange to trade its shares in the city.

Nio said the Class A shares are due to start trading on March 10 under the code 9866 once it receives final approval from the stock exchange. Its primary listing will remain in New York, the company said.

Unlike a typical initial public offering (IPO) or secondary listing, companies listing stock by introduction in Hong Kong raise no capital and issue no new shares.

The mechanism was popular among companies in the past looking to build a brand in Hong Kong and the rest of Greater China.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Daily Chart. Needs to hold 18.04 pivot for bullish divergence to be valid, falling wedge into prior weekly support

By: ReciKnows | February 25, 2022

• $NIO Daily. Needs to hold 18.04 pivot for bullish divergence to be valid, falling wedge into prior weekly support.

Read Full Story »»»

DiscoverGold

DiscoverGold

BIGGEST B******* RATING EVER, this stock should be 60 at ease end of year.

they are selling cars per 10 thousand...

I like your post. NIO is going places and interested in the PPS by the end of this year. It's all positive news about NIO. I do need to avg down though but not too worried about NIO. GLTA

Agreed, and it is not a bull right now seeing as it has been trending downward but this is the time to buy, not wait til it becomes a bull. This is where charting falls on its face.

People get rich by buying when others are running scared. That doesn;t always work because sometimes there are good reasons to run scared. But this company plans to be in 25 countries in 3 years. They're doubling their manufacturing capability. And they have the best EVs in the world hands down.

Charts vs Fundamentals. I am a fundamental guy. So charts mean nothing. Either a company is too expensive or too cheap. This is a buy now and hold through 2023(Minimum play)

$NIO Really hard for me to see the bull thesis on this one with this recent pennant breakdown and the gaps below

By: Jake Wujastyk | February 19, 2022

• $NIO #NIO Really hard for me to see the bull thesis on this one with this recent pennant breakdown and the gaps below.

Read Full Story »»»

DiscoverGold

DiscoverGold

Second-Largest U.S. Pension Bought Up EV Stocks NIO...

By: Barron's | February 20, 2022

The second-largest U.S. pension by assets bought up shares of four electric-vehicle makers as 2021 was coming to a close. Unfortunately, they all have slumped so far in 2022.

The California State Teachers’ Retirement System more than tripled holdings in three Chinese EV makers— NIO (ticker: NIO ), XPeng ( XPEV ), and Li Auto ( LI )—and bought shares of U.S. electric-truck maker Rivian Automotive ( RIVN ), which had an initial public offering in November. Calstrs, as the pension is known, disclosed the trades, among others, in a form it filed with the Securities and Exchange Commission.

Calstrs didn’t offer a comment on the investment changes. It managed assets of $327.6 billion as of Dec. 31.

The pension bought 210,763 more American depositary shares of NIO to end the fourth quarter with 305,036 ADRs. Calstrs also bought 90,011 more ADRs of XPeng and 124,171 additional ADRs of Li Auto to lift its respective holdings to 123,957 ADRs and 172,163 ADRs.

NIO ADRs tumbled 35% in 2021, compared with a 27% rise in the S&P 500 index. Interestingly, NIO’s peers ended 2021 with gains, although short of what the index marked: ADRs for XPeng and Li Auto rose 18% and 11%, respectively. But so far this year, the ADRs of all three are down: NIO with a 27% drop, XPeng is down 25%, and Li Auto with a relatively moderate drop of 11%, while the index has slipped 9%.

Early this year, bullish calls were made for the Chinese EV makers, but the wheels came off the story when EV deliveries by the three all fell in January. Also, NIO, XPeng, and Li Auto ADRs currently have two major overhangs: an uncertain Chinese regulatory environment, and an investor bias favoring value stocks over growth as higher interest rates loom.

Rivian stock came public just in time to get caught up in the latter. Shares ended 2021 with a gain of 33% from the $78 IPO price, but shares have dropped 36% so far in 2022. Rivian is now a so-called broken IPO, as shares, which closed at $66.37 on Friday, are under the IPO price.

Calstrs bought 282,772 Rivian shares in the fourth quarter.

The surge in Rivian stock late last year provided a boost to Amazon.com (AMZN) earnings, as the retail and cloud giant was an early investor. With the drop in Rivian shares, however, we pointed out that Amazon is now sitting on a substantial paper loss. This month, George Soros’ family office disclosed it bought 20 million Rivian shares in the fourth quarter.

Read Full Story »»»

DiscoverGold

DiscoverGold

Who cares about price targets right now? The important thing is the become profitable next year as planned and then stick a nice PE on that, and the stock will be much higher.

Nio Inc (NIO) Price Target Lowered to $35.00 at CLSA

By: MarketBeat | February 16, 2022

• NIO (NYSE:NIO) had its price target decreased by CLSA from $60.00 to $35.00 in a research note issued on Wednesday, The Fly reports. CLSA's price target suggests a potential upside of 35.71% from the stock's current price...

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |