Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Look at those whales sucking up the shares like a giant vacuum cleaner. Amazing manipulation this morning to tank the stock. Whales were but hurt they missed the boat last week

NIO Falls As Margins Decline

By: Vladimir Zernov | June 9, 2022

Key Insights

• NIO released its first-quarter report, beating analyst estimates on both earnings and revenue.

• Traders focused on falling margins and deliveries guidance for the next quarter.

• The market remains worried about China’s zero-COVID policy which increases risks of lockdowns in Shanghai.

NIO Retreats After Q1 2022 Report

Shares of NIO found themselves under strong pressure after the company released its first-quarter results.

The company reported revenue of $1.56 billion and an adjusted loss of $0.13 per share, beating analyst estimates on both earnings and revenue.

In the first quarter, NIO delivered 25,768 vehicles compared to 25,034 vehicles in Q4 2021. Vehicle margin declined from 20.9% in Q4 2021 to 18.1% in Q1 2022. Gross margin has also declined from 17.2% to 14.6%.

In the second quarter of this year, NIO expects to deliver between 23,000 and 25,000 vehicels. Total revenues are expected to be in the $1.47 billion – $1.59 billion range.

The market focused on falling margins and modest guidance, which was bearish for NIO stock. In addition, it looks that traders remain worried about the possibility of more lockdowns in Shanghai.

What’s Next For NIO Stock?

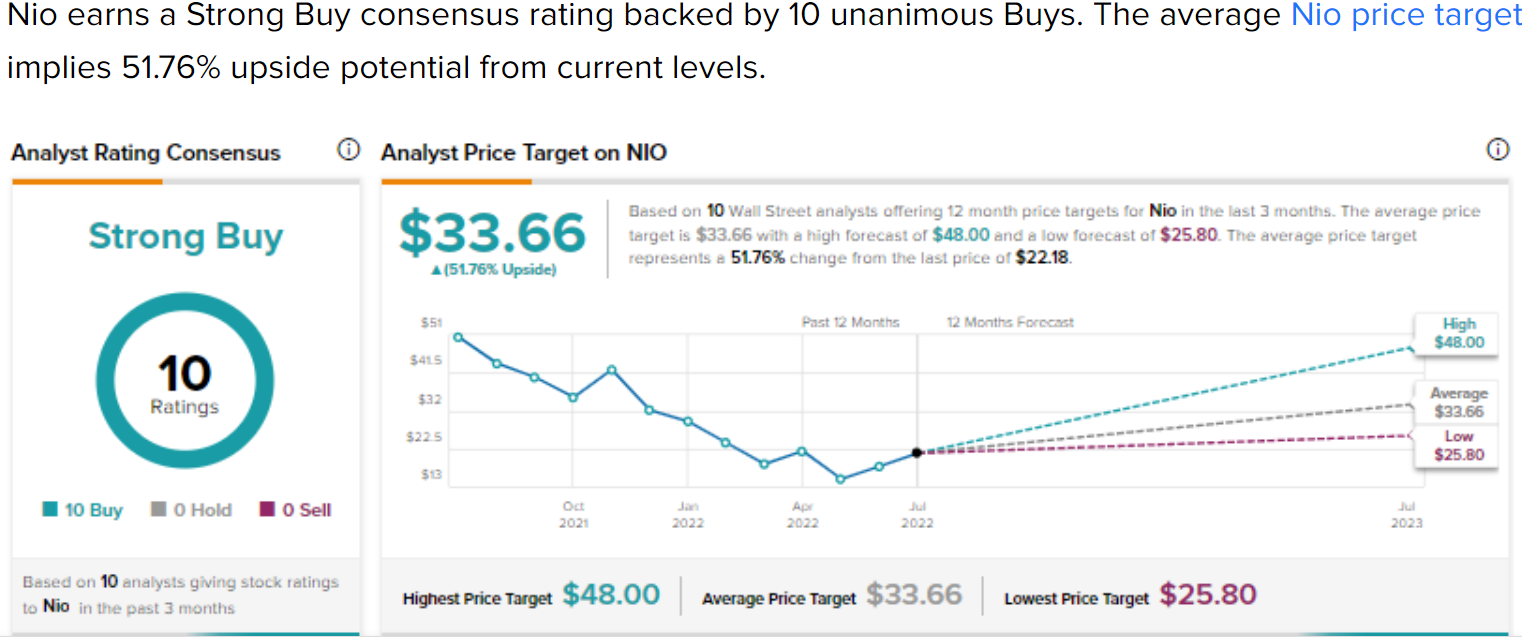

Analysts expect that NIO will report a loss of $0.54 per share in the current year and a loss of $0.11 per share in the next year. Analyst estimates have been moving lower in recent months, which is not surprising given the negative impact of lockdowns in China.

In recent weeks, NIO stock managed to move away from yearly lows amid a broad rebound in Chinese stocks. It should be noted that NIO stock is down by more than 70% from the highs that were reached back in 2021, so some speculative traders may see this major pullback as a buying opportunity.

In the near term, NIO stock will remain sensitive to news about the situation with coronavirus in China. The company’s second-quarter guidance already looks bleak, and another lockdown will further hurt margins and deliveries.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Q1 Deliveries up +28.5% YoY but forward guidance weighs

By: TrendSpider | June 9, 2022

• $NIO Q1 Deliveries up +28.5% YoY but forward guidance weighs.

Read Full Story »»»

DiscoverGold

DiscoverGold

So many lies and manipulation in articles related to Nio. One day they Rock the next they suck.

"Covid shutdowns hampered Nio’s production in the first five months of 2022."

https://www.cnbc.com/2022/06/09/nio-q1-2022-earnings-reveal-wider-loss.html?__source=sharebar|twitter&par=sharebar

"Nio lost $281.2 million in the first quarter, wider than the $68.8 million it lost a year ago."

https://www.cnbc.com/2022/06/09/nio-q1-2022-earnings-reveal-wider-loss.html?__source=sharebar|twitter&par=sharebar

Bearish: earnings are priced in.

NIO GoNoGo Trend now firmly bullish

By: TrendSpider | June 8, 2022

• $NIO GoNoGo Trend now firmly bullish.

Read Full Story »»»

DiscoverGold

DiscoverGold

So everything is perfect again in China? Nio stock soaring. Just last week it was over for China. Haha. Gotta love the stock manipulation by the talking heads on TV.

Earnings Preview: Nio Inc. (NYSE: NIO)

By: 24/7 Wall St. | June 7, 2022

• Here is a look at four companies scheduled to release quarterly results late Wednesday or early Thursday.

Nio

China-based electric vehicle maker (EV) Nio Inc. (NYSE: NIO) has dropped about 54% from its share price over the past 12 months. Since dipping to a 52-week low in mid-May, the stock has added 46%. Nio is expected to report results before markets open on Thursday.

Barron’s reported three reasons for the recent share price increase: first, the company is reportedly looking to hire U.S. talent and that could lead to sales and perhaps production in this country. Second, China’s government has instituted a tax break for people who buy new cars by the end of the year. Third, Shanghai will subsidize EV purchases to the tune of $1,500 until the end of the year.

There are 26 analyst ratings on Nio’s stock, and all but two are Buy or Strong Buy ratings. At a share price of around $19.20, the upside potential based on a median price target of $32.53 is about 69%. At the high target of $83.23, the upside potential is 333%.

For the first quarter of fiscal 2022, the consensus estimates call for revenue of $1.48 billion, down 5.1% sequentially but 21.3% higher year over year. Nio is expected to post an adjusted loss per share of $0.16, better than the $0.17 per-share loss in the prior quarter and worse than the year-ago loss of $0.03 per share. For the full year, the company is expected to report a per-share loss of $0.50, worse than the $0.30 loss in 2021, on sales of $9.41 billion, up about 65.5%.

Analysts estimate that Nio will trade at 84.7 times earnings in 2024. Until then, it is not expected to post a profit. The enterprise value-to-sales multiple is expected to be 2.9 in 2022 and 1.7 in 2023. The stock’s 52-week range is $11.67 to $55.13. The company does not pay a dividend, and the total shareholder return for the past year is negative 54.3%.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO (NIO) to Release Quarterly Earnings on Thursday

By: MarketBeat | June 2, 2022

• NIO (NYSE:NIO - Get Rating) will release its earnings data before the market opens on Thursday, June 9th. NIO has set its Q1 2022 guidance at EPS.Investors that are interested in registering for the company's conference call can do so using this link...

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO 3.62 Million Share at $18.85 #darkpool print

By: Money Flow Mel | June 2, 2022

• $NIO 3.62 million share #darkpool print at $18.85.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Stock Surges Amid Easing Covid-19 Restrictions

By: Schaeffer's Investment Research | May 31, 2022

• As a result, Morgan Stanley called the electric vehicle maker a research tactical idea

• Year-over-year, NIO remains down roughly 55%

Chinese electric vehicle (EV) maker Nio Inc (NYSE:NIO) is up 3.1% to trade $17.09 this morning, as Shanghai looks to reopen its economy after Covid-19 curbs with a stimulus package that will encourage developments in cloud computing, artificial intelligence (AI), and blockchain technologies. As a result, Morgan Stanley called NIO a research tactical idea, predicting a rebound for the equity as it benefits from such stimulus programs and resumes sales.

Analysts are bullish towards Nio stock, with seven of the eight in question calling it a "buy" or better, while the 12-month consensus target price of $41.55 is a lofty 137.8% premium to current levels. Meanwhile, the 78.40 million shares sold short make up 5.1% of the equity's available float.

Short-term options traders are also optimistic. This is per NIO's Schaeffer's put/call open interest ratio (SOIR) of 0.54, which sits higher than only 2% of readings from the past 12 months. In simpler terms, these traders have rarely been more call-biased.

Nio stock has struggled so far in 2022, but the equity is today pacing for a second-straight close above its 30-day moving average, and fourth consecutive daily win. What's more, the shares are testing resistance at the $18 region, which has been capping the security since April. Year-over-year, NIO remains down 54.9%.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Squeezing above the trendline in pre market trading!

By: TrendSpider | May 31, 2022

• $NIO Squeezing above the trendline in pre market trading!

Read Full Story »»»

DiscoverGold

DiscoverGold

The Shanghai municipal government on May 29 unveiled (in Chinese) 50 stimulus measures, which included giving out 40,000 new car plates and handing out cash incentives for gas car owners trading in for EVs.

Consumers will also receive rebates of RMB 10,000 ($1,503) per car for any trade-in of gasoline vehicles for new electric vehicles (EVs) for the rest of the year, as stated on the notice of the municipal government’s official WeChat account.

Cui Dongshu, Secretary General of the China Passenger Car Association, on Monday told Jiemian News (in Chinese) that he expects Shanghai’s stimulus package to increase sales of passenger vehicles by around 150,000 units, of which two-thirds could be new energy vehicles, which includes all-electric vehicles and plug-in hybrids.

On Monday, a Nio spokesperson told Chinese media The Paper on Monday that the company expects the stimulus measures to accelerate EV adoption, adding that orders for its models in the city have increased “significantly” in May (our translation).

A number of local authorities also released similar cash subsidies for people to buy cars. Shenzhen on Thursday announced (in Chinese) plans to lift its limits on the number of new vehicles allowed on the city’s roads by allocating 20,000 new license plates to quotas and providing incentives of up to RMB 20,000 for new car purchases.

Both the central Chinese city of Zhengzhou and Shenyang, the capital city of the northeastern Liaoning province, announced new voucher programs of RMB 100 million to boost vehicle buying earlier this month. Meanwhile, car buyers in the central city of Wuhan could receive a subsidy of RMB 8,000 or RMB 3,000 for each trade-in of new energy vehicles or combustion engine vehicles, respectively.

Context: China’s central government has pledged to strengthen the current state subsidy to EV makers to encourage auto sales, as the latest wave of Covid-19 cases has disrupted auto parts supply chains and forced carmakers to drop their outlooks for the year.

During a State Council executive meeting on May 23, Beijing unveiled dozens of new stimulus measures, including cutting car purchase taxes by RMB 60 billion, in the hope of helping the industry withstand the impact of the pandemic, SCMP reported.

China’s auto sales dropped by nearly half to 1.18 million units in April compared to the same time a year earlier, according to official figures. Major automakers such as Tesla were hit hard by supply-chain constraints and a month-long production shutdown.

Local EV upstarts Xpeng and Li Auto earlier this month issued a gloomy outlook for the second quarter of this year, after reporting record declines in vehicle deliveries for April.

$NIO going to be tough on China EV names until lockdowns stop

By: Options Mike | May 30, 2022

• $NIO going to be tough on China EV names until lockdowns stop.

Off the lows, 50D @ 18 would be the next target.

Read Full Story »»»

DiscoverGold

DiscoverGold

Rumors have been floating around for months that Nio is looking to set up a manufacturing location in the United States, but today is not the day we get official confirmation. We instead came across some information that indirectly confirms it, this time straight from China, claiming that Nio is already hiring people for manufacturing-related jobs in the US, even though it has not officially announced building the facility.

According to Yicai, Nio (known in China by its company name, Wei Lai) is not only hiring people for manufacturing-related jobs, but is also looking to build a factory in the United States. We don’t yet know if it will purchase an already existing plant and repurpose it or build one from scratch in a new location.

$NIO pushing off the trendline and 8/21 EMA cloud on Friday

By: TrendSpider | May 21, 2022

• $NIO pushing off the trendline and 8/21 EMA cloud on Friday.

Read Full Story »»»

DiscoverGold

DiscoverGold

I'll be taking profits at 9am pre market. GL. Fundamentals not good in China. Singapore listing is just theatrics.

Warren Buffett owns BYD and soon NIO I hope.

https://www.fool.co.uk/2022/02/17/should-i-listen-to-warren-buffett-and-buy-nio-stock/

$NIO On breakout watch

By: TrendSpider | May 17, 2022

• $NIO On breakout watch.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Profit taking here

NIO Shares Pop After BofA Upgrade to Buy on 'Attractive' Valuation

By: Investing.com | May 16, 2022

Shares of Nio (NYSE:NIO) are trading 4% higher today after Bank of America analyst Ming Hsun Lee upgraded to Buy from Neutral with a $26.00 per share price target, up from $25.00.

Improving sales, better margins expected in the second half of the year, and attractive valuations are the 3 key reasons that pushed Lee to upgrade Nio shares to Buy.

“ET7 shipment began in March; ES7 is expected to launch in June and start delivery in Aug (slightly ahead of our previous expectation); ET5 is scheduled to be delivered in Sep; facelifts of ES6, ES8 and EC6 will be available in 2H22. ES8/ES6/EC6 waiting time is 10 weeks and ET7 6 months, showing ample orders on hand,” Lee said in a client note.

On valuation, the analyst notes that NIO is trading at 1.7x 1-year forward EV/sales, which is below its historical average.

“This seems attractive given the improving outlook – NIO traded at a similar valuation only during 2H19-1Q20 when it faced sales slowdown, product recalls and financing challenges, while its current fundamental is stronger in terms of brand equity, sales growth, R&D capability, and improved cash flow. Factoring in the latest model schedule and production recovery pace, we lift 2022/23E sales volume by 3%/8%,” Lee concluded.

Read Full Story »»»

DiscoverGold

DiscoverGold

Not a Single Car Was Sold in Shanghai Last Month

Posted On : 16 May 2022 Published By : Tom Whipple

For evidence of just how tight Shanghai’s lockdown has been, consider this: not a single car was sold in the city last month. The majority of the city’s 25 million residents were mostly confined to their homes or residential compounds in April as part of a sweeping lockdown to stamp out the nation’s worst Covid outbreak since the virus emerged in Wuhan more than two years ago. Almost all dealerships in the city were closed during the month, the Shanghai Automobile Sales Association said in a statement Monday, when it highlighted the zero sales figure. In April last year, 26,311 vehicles were sold in the city, according to the association, which represents about 300 companies. Nationwide, car sales fell the most in two years in April, down almost 36 % from a year earlier

$NIO Lockdowns need to stop for me to have any interest in China EV plays

By: Options Mike | May 15, 2022

• $NIO had a 11 print this week, compete round trip. Lockdowns need to stop for me to have any interest in China EV plays.

Read Full Story »»»

DiscoverGold

DiscoverGold

Add these. Just found this article from today about the best EV Auto Investments. They really slam some.

https://evautoinsider.com/ev-auto-investments-the-good-terrible-and-amazing/ ;

If Chinese on Covid lockdowns who is buying cars? Not looking good here anytime soon

Yes I have I have been in and out of Nio for over a year. But I think it’s more likely this will hit $5 before it hits $70.

Have you looked onto the battery replacement system they have in the works? Supposedly, if you pay a premium of 10k I think, instead of waiting to charge at a power spot, they will have like a carwash area where you pull in and some fancy little robots change your battery in under 5 mins for a full one. That's what has me interested

I bought in at $4 and sold at 3.80, shortly after it went to around $70 lol. Have a starter average of $19 and learning DCA

I will be buying this pos at $5 or under.

Earnings Previews: Nio Inc. (NYSE: NIO)

By: 24/7 Wall St. | May 11, 2022

• Here is a look at three more companies set to report results after Thursday’s close.

Nio

Shares of China-based electric vehicle maker Nio Inc. (NYSE: NIO) have plunged by nearly 64% over the past 12 months. From a 52-week high posted in late June, the stock is down by 75%. The company delivered nearly 26,000 vehicles in the first quarter.

Nio also has been identified as one of more than 80 China-based companies that may be kicked off U.S. stock exchanges for failing to meet recently enacted federal accounting requirements. The company completed a secondary listing in Singapore on Tuesday. The company has until May 25 to dispute the federal listing that could get the stock delisted.

There are 25 analyst ratings on Nio’s stock, and 22 of those are Buy or Strong Buy ratings. At a share price of around $13.50, the upside potential based on a median price target of $32.16 is about 138%. At the high target of $82.29, the upside potential is 510%.

For the first quarter of fiscal 2022, the consensus estimates call for revenue of $1.46 billion, down 6% sequentially and up 19.7% year over year. Nio is expected to post an adjusted loss per share of $0.17, flat sequentially, and worse than the year-ago loss of $0.04 per share. For the full year, the company is expected to report a per-share loss of $0.50, worse than the $0.30 loss last year, on sales of $9.37 billion, up about 65%.

Analysts estimate that Nio will trade at 59.8 times earnings in 2024. Until then, the company is not expected to post a profit. The enterprise value-to-sales multiple is expected to be 1.9 in 2022 and 1.1 in 2023. The stock’s 52-week range is $12.86 to $55.13, and the low was posted Tuesday. The company does not pay a dividend. Total shareholder return for the past year is negative 60.9%.

Read Full Story »»»

DiscoverGold

DiscoverGold

When you say "skyrocket" can you explain that?

I have a feeling that $NIO is going to skyrocket this week with the announcement of their 100,000 production vehicle. STAY TUNED

$NIO Finally filled that gap

By: Options Mike | May 7, 2022

• $NIO Finally filled that gap on news added to SEC delisting list. That is a year away, but they are going to have to take action sooner than later. 13 in play.

Read Full Story »»»

DiscoverGold

DiscoverGold

what a useless article. There is no information worth printing in it.

Electric Vehicles $NIO vs $MULN

https://tickeron.com/compare/MULN-vs-NIO/

$NIO 3.30 at $14.93 Million Share #darkpool print

By: Money Flow Mel | May 6, 2022

• $NIO 3.30 million share #darkpool print at $14.93.

Read Full Story »»»

DiscoverGold

DiscoverGold

EV Week In Review: Musk's $8.5 Tesla Stock Sale, Nikola Tre Semitruck Launches, Nio's ET5 Updates, Ford Lightning Strikes And More

https://benzinga.com/news/22/04/26917872/ev-week-in-review-musks-8-5-tesla-stock-sale-nikola-tre-semitruck-launches-nios-et5-updates-ford-lig $NIO $NKLA

JPMorgan Reflects on Nio's Decision to List Shares in Singapore

By: Investing.com | May 6, 2022

Chinese electric vehicle (EV) company Nio (NYSE:NIO) announced this morning that it is planning for a secondary listing in Singapore, two months after listing its shares in Hong Kong.

This way, Singapore will become the third exchange that offers Nio’s shares, after New York and Hong Kong. The move didn’t surprise investors given that US-listed Chinese companies are facing potential delisting from US exchanges.

JPMorgan analyst Nick Lai expects a “limited fundamental impact on Nio’s operations in the near term” from the company’s decision.

“This, in our view, in a similar move to that in March when Nio had a secondary offering on the HKSE and the shares trading on the HKSE are fully fungible with ADRs in the US. The move to list in Singapore provides an alternative venue for future capital raising if needed in our view. Strategically, as Nio gradually expands its footprint to international markets (thus far, Europe), the company believes Singapore will also be an important regional hub considering its robust international financial system,” Lai told clients in a note.

The analyst reiterated his stance of preferring OEMs with vertically integrated business models, like BYD (OTC:BYDDY)) and Guangzhou Auto (HK:2238).

Read Full Story »»»

DiscoverGold

DiscoverGold

I took 1000 shares after hours for a quick buck or two!

Last time i owned this stock i was in at an ave of $4. Sold at an ave of $40. Its beginning to look like i may get a chance to do that again. As of today i will be keeping a close eye on it

NIO Provides Update on Status under Holding Foreign Companies Accountable Act

By: NIO Inc. | May 4, 2022

• JSHANGHAI, May 05, 2022 (GLOBE NEWSWIRE) -- NIO Inc. (“NIO” or the “Company”) (NYSE: NIO; HKEX: 9866), a pioneer and a leading company in the premium smart electric vehicle market, today provides an update on its status under the Holding Foreign Companies Accountable Act (the “HFCAA”).

NIO is aware that the Company has been provisionally identified by the SEC under the HFCAA on May 4, 2022 U.S. Eastern Time. The Company understands such identification may result from its filing of the annual report on Form 20-F for the fiscal year ended December 31, 2021.

NIO understands the SEC made such identification pursuant to the HFCAA and its implementation rules issued thereunder, and this indicates that the SEC determines that the Company used an auditor whose working paper cannot be inspected or investigated completely by the PCAOB, to issue the audit opinion for its financial statements for the fiscal year ended December 31, 2021.

In accordance with the HFCAA, if the SEC determines that the Company filed an annual report containing an audit report issued by a registered public accounting firm that has not been subject to inspection for the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit the shares or American depositary shares of the Company from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

NIO has been actively exploring possible solutions to protect the interest of its stakeholders. On March 10, 2022, the Company completed a secondary listing of its Class A ordinary shares on the Main Board of the Hong Kong Stock Exchange (the “HKEX”) under the stock code “9866.” The Class A ordinary shares listed on the HKEX are fully fungible with the ADSs listed on the NYSE.

NIO will continue to comply with applicable laws and regulations in both China and the United States, and strive to maintain its listing status on both the NYSE and the HKEX in compliance with applicable listing rules.

About NIO Inc.

NIO Inc. is a pioneer and a leading company in the premium smart electric vehicle market. Founded in November 2014, NIO’s mission is to shape a joyful lifestyle. NIO aims to build a community starting with smart electric vehicles to share joy and grow together with users. NIO designs, develops, jointly manufactures and sells premium smart electric vehicles, driving innovations in next-generation technologies in autonomous driving, digital technologies, electric powertrains and batteries. NIO differentiates itself through its continuous technological breakthroughs and innovations, such as its industry-leading battery swapping technologies, Battery as a Service, or BaaS, as well as its proprietary autonomous driving technologies and Autonomous Driving as a Service, or ADaaS. NIO launched the ES8, a seven-seater flagship premium smart electric SUV in December 2017, and began deliveries of the ES8 in June 2018 and its variant, the six-seater ES8, in March 2019. NIO launched the ES6, a five-seater high-performance premium smart electric SUV, in December 2018, and began deliveries of the ES6 in June 2019. NIO launched the EC6, a five-seater premium smart electric coupe SUV, in December 2019, and began deliveries of the EC6 in September 2020. NIO launched the ET7, a flagship premium smart electric sedan, in January 2021, and began deliveries of the ET7 in March 2022. NIO launched the ET5, a mid-size premium smart electric sedan, in December 2021.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO daily @ trendline

By: Nick | May 5, 2022

• $NIO daily @ trendline.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO, XPeng, Li Auto Deliveries Hit by Lockdown-Related Supply Chain Issues

By: Investing.com | May 2, 2022

Chinese electric vehicle companies NIO, XPeng, and Li Auto said that supply chain issues resulting from the ongoing COVID situation in the country impacted deliveries in April.

Nio Inc.'s (NYSE:NIO) April deliveries took a significant hit after production was briefly halted during the month due to COVID lockdowns in China. NIO delivered 5,074 vehicles in April 2022, down almost 50% from the 9,985 delivered in March and decreasing from the 7,102 cars in April 2021.

NIO stated: "Vehicle production and delivery have been impacted by the supply chain volatilities and other constraints caused by a new wave of the COVID-19 outbreaks in certain regions in China. The vehicle production has been recovering gradually."

NIO stock rose 2% in early Monday trading...

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |