Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$NIO pushing off the trendline and 8/21 EMA cloud on Friday

By: TrendSpider | May 21, 2022

• $NIO pushing off the trendline and 8/21 EMA cloud on Friday.

Read Full Story »»»

DiscoverGold

DiscoverGold

I'll be taking profits at 9am pre market. GL. Fundamentals not good in China. Singapore listing is just theatrics.

Warren Buffett owns BYD and soon NIO I hope.

https://www.fool.co.uk/2022/02/17/should-i-listen-to-warren-buffett-and-buy-nio-stock/

$NIO On breakout watch

By: TrendSpider | May 17, 2022

• $NIO On breakout watch.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Profit taking here

NIO Shares Pop After BofA Upgrade to Buy on 'Attractive' Valuation

By: Investing.com | May 16, 2022

Shares of Nio (NYSE:NIO) are trading 4% higher today after Bank of America analyst Ming Hsun Lee upgraded to Buy from Neutral with a $26.00 per share price target, up from $25.00.

Improving sales, better margins expected in the second half of the year, and attractive valuations are the 3 key reasons that pushed Lee to upgrade Nio shares to Buy.

“ET7 shipment began in March; ES7 is expected to launch in June and start delivery in Aug (slightly ahead of our previous expectation); ET5 is scheduled to be delivered in Sep; facelifts of ES6, ES8 and EC6 will be available in 2H22. ES8/ES6/EC6 waiting time is 10 weeks and ET7 6 months, showing ample orders on hand,” Lee said in a client note.

On valuation, the analyst notes that NIO is trading at 1.7x 1-year forward EV/sales, which is below its historical average.

“This seems attractive given the improving outlook – NIO traded at a similar valuation only during 2H19-1Q20 when it faced sales slowdown, product recalls and financing challenges, while its current fundamental is stronger in terms of brand equity, sales growth, R&D capability, and improved cash flow. Factoring in the latest model schedule and production recovery pace, we lift 2022/23E sales volume by 3%/8%,” Lee concluded.

Read Full Story »»»

DiscoverGold

DiscoverGold

Not a Single Car Was Sold in Shanghai Last Month

Posted On : 16 May 2022 Published By : Tom Whipple

For evidence of just how tight Shanghai’s lockdown has been, consider this: not a single car was sold in the city last month. The majority of the city’s 25 million residents were mostly confined to their homes or residential compounds in April as part of a sweeping lockdown to stamp out the nation’s worst Covid outbreak since the virus emerged in Wuhan more than two years ago. Almost all dealerships in the city were closed during the month, the Shanghai Automobile Sales Association said in a statement Monday, when it highlighted the zero sales figure. In April last year, 26,311 vehicles were sold in the city, according to the association, which represents about 300 companies. Nationwide, car sales fell the most in two years in April, down almost 36 % from a year earlier

$NIO Lockdowns need to stop for me to have any interest in China EV plays

By: Options Mike | May 15, 2022

• $NIO had a 11 print this week, compete round trip. Lockdowns need to stop for me to have any interest in China EV plays.

Read Full Story »»»

DiscoverGold

DiscoverGold

Add these. Just found this article from today about the best EV Auto Investments. They really slam some.

https://evautoinsider.com/ev-auto-investments-the-good-terrible-and-amazing/ ;

If Chinese on Covid lockdowns who is buying cars? Not looking good here anytime soon

Yes I have I have been in and out of Nio for over a year. But I think it’s more likely this will hit $5 before it hits $70.

Have you looked onto the battery replacement system they have in the works? Supposedly, if you pay a premium of 10k I think, instead of waiting to charge at a power spot, they will have like a carwash area where you pull in and some fancy little robots change your battery in under 5 mins for a full one. That's what has me interested

I bought in at $4 and sold at 3.80, shortly after it went to around $70 lol. Have a starter average of $19 and learning DCA

I will be buying this pos at $5 or under.

Earnings Previews: Nio Inc. (NYSE: NIO)

By: 24/7 Wall St. | May 11, 2022

• Here is a look at three more companies set to report results after Thursday’s close.

Nio

Shares of China-based electric vehicle maker Nio Inc. (NYSE: NIO) have plunged by nearly 64% over the past 12 months. From a 52-week high posted in late June, the stock is down by 75%. The company delivered nearly 26,000 vehicles in the first quarter.

Nio also has been identified as one of more than 80 China-based companies that may be kicked off U.S. stock exchanges for failing to meet recently enacted federal accounting requirements. The company completed a secondary listing in Singapore on Tuesday. The company has until May 25 to dispute the federal listing that could get the stock delisted.

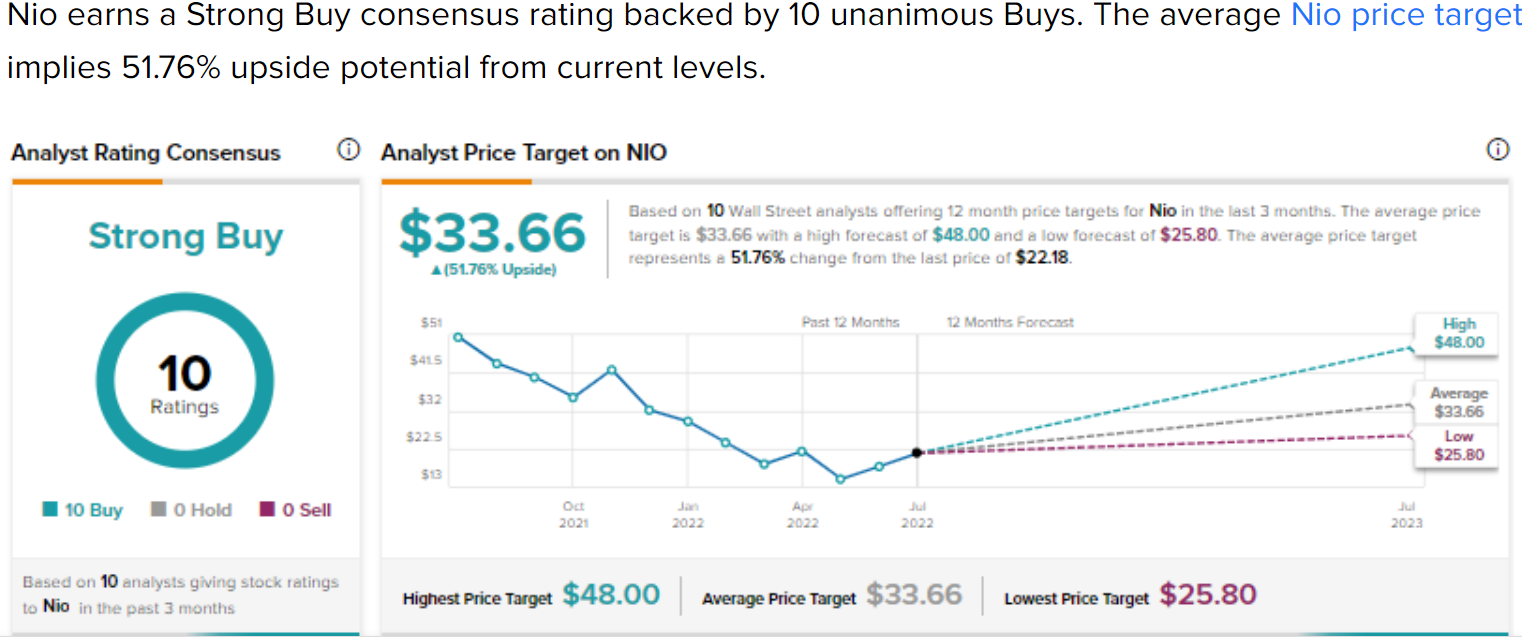

There are 25 analyst ratings on Nio’s stock, and 22 of those are Buy or Strong Buy ratings. At a share price of around $13.50, the upside potential based on a median price target of $32.16 is about 138%. At the high target of $82.29, the upside potential is 510%.

For the first quarter of fiscal 2022, the consensus estimates call for revenue of $1.46 billion, down 6% sequentially and up 19.7% year over year. Nio is expected to post an adjusted loss per share of $0.17, flat sequentially, and worse than the year-ago loss of $0.04 per share. For the full year, the company is expected to report a per-share loss of $0.50, worse than the $0.30 loss last year, on sales of $9.37 billion, up about 65%.

Analysts estimate that Nio will trade at 59.8 times earnings in 2024. Until then, the company is not expected to post a profit. The enterprise value-to-sales multiple is expected to be 1.9 in 2022 and 1.1 in 2023. The stock’s 52-week range is $12.86 to $55.13, and the low was posted Tuesday. The company does not pay a dividend. Total shareholder return for the past year is negative 60.9%.

Read Full Story »»»

DiscoverGold

DiscoverGold

When you say "skyrocket" can you explain that?

I have a feeling that $NIO is going to skyrocket this week with the announcement of their 100,000 production vehicle. STAY TUNED

$NIO Finally filled that gap

By: Options Mike | May 7, 2022

• $NIO Finally filled that gap on news added to SEC delisting list. That is a year away, but they are going to have to take action sooner than later. 13 in play.

Read Full Story »»»

DiscoverGold

DiscoverGold

what a useless article. There is no information worth printing in it.

Electric Vehicles $NIO vs $MULN

https://tickeron.com/compare/MULN-vs-NIO/

$NIO 3.30 at $14.93 Million Share #darkpool print

By: Money Flow Mel | May 6, 2022

• $NIO 3.30 million share #darkpool print at $14.93.

Read Full Story »»»

DiscoverGold

DiscoverGold

EV Week In Review: Musk's $8.5 Tesla Stock Sale, Nikola Tre Semitruck Launches, Nio's ET5 Updates, Ford Lightning Strikes And More

https://benzinga.com/news/22/04/26917872/ev-week-in-review-musks-8-5-tesla-stock-sale-nikola-tre-semitruck-launches-nios-et5-updates-ford-lig $NIO $NKLA

JPMorgan Reflects on Nio's Decision to List Shares in Singapore

By: Investing.com | May 6, 2022

Chinese electric vehicle (EV) company Nio (NYSE:NIO) announced this morning that it is planning for a secondary listing in Singapore, two months after listing its shares in Hong Kong.

This way, Singapore will become the third exchange that offers Nio’s shares, after New York and Hong Kong. The move didn’t surprise investors given that US-listed Chinese companies are facing potential delisting from US exchanges.

JPMorgan analyst Nick Lai expects a “limited fundamental impact on Nio’s operations in the near term” from the company’s decision.

“This, in our view, in a similar move to that in March when Nio had a secondary offering on the HKSE and the shares trading on the HKSE are fully fungible with ADRs in the US. The move to list in Singapore provides an alternative venue for future capital raising if needed in our view. Strategically, as Nio gradually expands its footprint to international markets (thus far, Europe), the company believes Singapore will also be an important regional hub considering its robust international financial system,” Lai told clients in a note.

The analyst reiterated his stance of preferring OEMs with vertically integrated business models, like BYD (OTC:BYDDY)) and Guangzhou Auto (HK:2238).

Read Full Story »»»

DiscoverGold

DiscoverGold

I took 1000 shares after hours for a quick buck or two!

Last time i owned this stock i was in at an ave of $4. Sold at an ave of $40. Its beginning to look like i may get a chance to do that again. As of today i will be keeping a close eye on it

NIO Provides Update on Status under Holding Foreign Companies Accountable Act

By: NIO Inc. | May 4, 2022

• JSHANGHAI, May 05, 2022 (GLOBE NEWSWIRE) -- NIO Inc. (“NIO” or the “Company”) (NYSE: NIO; HKEX: 9866), a pioneer and a leading company in the premium smart electric vehicle market, today provides an update on its status under the Holding Foreign Companies Accountable Act (the “HFCAA”).

NIO is aware that the Company has been provisionally identified by the SEC under the HFCAA on May 4, 2022 U.S. Eastern Time. The Company understands such identification may result from its filing of the annual report on Form 20-F for the fiscal year ended December 31, 2021.

NIO understands the SEC made such identification pursuant to the HFCAA and its implementation rules issued thereunder, and this indicates that the SEC determines that the Company used an auditor whose working paper cannot be inspected or investigated completely by the PCAOB, to issue the audit opinion for its financial statements for the fiscal year ended December 31, 2021.

In accordance with the HFCAA, if the SEC determines that the Company filed an annual report containing an audit report issued by a registered public accounting firm that has not been subject to inspection for the PCAOB for three consecutive years beginning in 2021, the SEC shall prohibit the shares or American depositary shares of the Company from being traded on a national securities exchange or in the over-the-counter trading market in the United States.

NIO has been actively exploring possible solutions to protect the interest of its stakeholders. On March 10, 2022, the Company completed a secondary listing of its Class A ordinary shares on the Main Board of the Hong Kong Stock Exchange (the “HKEX”) under the stock code “9866.” The Class A ordinary shares listed on the HKEX are fully fungible with the ADSs listed on the NYSE.

NIO will continue to comply with applicable laws and regulations in both China and the United States, and strive to maintain its listing status on both the NYSE and the HKEX in compliance with applicable listing rules.

About NIO Inc.

NIO Inc. is a pioneer and a leading company in the premium smart electric vehicle market. Founded in November 2014, NIO’s mission is to shape a joyful lifestyle. NIO aims to build a community starting with smart electric vehicles to share joy and grow together with users. NIO designs, develops, jointly manufactures and sells premium smart electric vehicles, driving innovations in next-generation technologies in autonomous driving, digital technologies, electric powertrains and batteries. NIO differentiates itself through its continuous technological breakthroughs and innovations, such as its industry-leading battery swapping technologies, Battery as a Service, or BaaS, as well as its proprietary autonomous driving technologies and Autonomous Driving as a Service, or ADaaS. NIO launched the ES8, a seven-seater flagship premium smart electric SUV in December 2017, and began deliveries of the ES8 in June 2018 and its variant, the six-seater ES8, in March 2019. NIO launched the ES6, a five-seater high-performance premium smart electric SUV, in December 2018, and began deliveries of the ES6 in June 2019. NIO launched the EC6, a five-seater premium smart electric coupe SUV, in December 2019, and began deliveries of the EC6 in September 2020. NIO launched the ET7, a flagship premium smart electric sedan, in January 2021, and began deliveries of the ET7 in March 2022. NIO launched the ET5, a mid-size premium smart electric sedan, in December 2021.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO daily @ trendline

By: Nick | May 5, 2022

• $NIO daily @ trendline.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO, XPeng, Li Auto Deliveries Hit by Lockdown-Related Supply Chain Issues

By: Investing.com | May 2, 2022

Chinese electric vehicle companies NIO, XPeng, and Li Auto said that supply chain issues resulting from the ongoing COVID situation in the country impacted deliveries in April.

Nio Inc.'s (NYSE:NIO) April deliveries took a significant hit after production was briefly halted during the month due to COVID lockdowns in China. NIO delivered 5,074 vehicles in April 2022, down almost 50% from the 9,985 delivered in March and decreasing from the 7,102 cars in April 2021.

NIO stated: "Vehicle production and delivery have been impacted by the supply chain volatilities and other constraints caused by a new wave of the COVID-19 outbreaks in certain regions in China. The vehicle production has been recovering gradually."

NIO stock rose 2% in early Monday trading...

Read Full Story »»»

DiscoverGold

DiscoverGold

5,074 vehicles delivered in April.......more than I had expected.

https://www.globenewswire.com/news-release/2022/05/01/2433057/0/en/NIO-Inc-Provides-April-2022-Delivery-Update.html

NIO Inc. Provides April 2022 Delivery Update

May 01, 2022 04:30 ET | Source: NIO Inc.

NIO delivered 5,074 vehicles in April 2022

NIO delivered 30,842 vehicles year-to-date in 2022, increasing by 13.5% year-over-year

Cumulative deliveries of vehicles as of April 30, 2022 reached 197,912

SHANGHAI, China, May 01, 2022 (GLOBE NEWSWIRE) -- NIO Inc. (“NIO” or the “Company”) (NYSE: NIO; HKEX: 9866), a pioneer and a leading company in the premium smart electric vehicle market, today announced its April 2022 delivery results.

NIO delivered 5,074 vehicles in April 2022. The deliveries consisted of 4,381 premium smart electric SUVs, including 1,251 ES8s, 1,878 ES6s and 1,252 EC6s, and 693 ET7s, the Company’s flagship premium smart electric sedan. As of April 30, 2022, cumulative deliveries reached 197,912 vehicles.

In late March and April 2022, the Company’s vehicle production and delivery have been impacted by the supply chain volatilities and other constraints caused by a new wave of the COVID-19 outbreaks in certain regions in China. The vehicle production has been recovering gradually. The Company will closely monitor the situation and its impact to the Company’s business and financial conditions, and continue to work with its supply chain partners to accelerate the recovery of production to its full capacity.

On April 29, 2022, the first batch of tooling trial builds of the ET5 rolled off the production line at the new manufacturing plant at NeoPark in Hefei. The Company expects to start delivery of the ET5 in September 2022.

NIO is committed to environmental protection and sustainability. In April 2022, the Company joined hands with the World Wide Fund for Nature in Clean Parks, an ecosystem co-construction initiative launched by NIO in 2021. The two parties will jointly establish a clean and low-carbon energy circulation system in national parks and nature reserves.

About NIO Inc.

NIO Inc. is a pioneer and a leading company in the premium smart electric vehicle market. Founded in November 2014, NIO’s mission is to shape a joyful lifestyle. NIO aims to build a community starting with smart electric vehicles to share joy and grow together with users. NIO designs, develops, jointly manufactures and sells premium smart electric vehicles, driving innovations in next-generation technologies in autonomous driving, digital technologies, electric powertrains and batteries. NIO differentiates itself through its continuous technological breakthroughs and innovations, such as its industry-leading battery swapping technologies, Battery as a Service, or BaaS, as well as its proprietary autonomous driving technologies and Autonomous Driving as a Service, or ADaaS. NIO launched the ES8, a seven-seater flagship premium smart electric SUV in December 2017, and began deliveries of the ES8 in June 2018 and its variant, the six-seater ES8, in March 2019. NIO launched the ES6, a five-seater high-performance premium smart electric SUV, in December 2018, and began deliveries of the ES6 in June 2019. NIO launched the EC6, a five-seater premium smart electric coupe SUV, in December 2019, and began deliveries of the EC6 in September 2020. NIO launched the ET7, a flagship premium smart electric sedan, in January 2021, and began deliveries of the ET7 in March 2022. NIO launched the ET5, a mid-size premium smart electric sedan, in December 2021.

$NIO Not sure what is holding it up. Delivery numbers tomorrow w/ many of their suppliers locked down..

By: Options Mike | May 1, 2022

• $NIO Not sure what is holding it up. Delivery numbers tomorrow w/ many of their suppliers locked down..

I don't expect good China delivery numbers from any of the EV plays this month.

Read Full Story »»»

DiscoverGold

DiscoverGold

This will be a time of consolidation there are a lot of buyouts and mergers coming nio will be bought out or merger it’s just a matter of time imho

Does anyone know went NIO earnings are due out Thank you

Why Nio and Chinese Tech Stocks Jumped Today

By: Motley Fool | April 27, 2022

• Today's move comes after sharp declines over the last several weeks.

What happened

U.S.- listed Chinese stocks have been taking a beating in recent months. The reasons behind the downtrend include political and regulatory fears, supply chain and raw material cost headwinds, and lockdowns in several cities to try to slow a new COVID-19 outbreak.

That sentiment reversed today, however. Chinese stocks including EV makers Nio (NIO 3.45%) and XPeng (XPEV 5.20%), as well as trucking technology platform Full Truck Alliance (YMM 3.11%), were all higher as of 11:34 a.m. ET:

• Nio was up 2.4%.

• XPeng was up 5.5%.

• Full Truck Alliance was up 4.4%.

So what

The jumps in these international stocks are in line with the broader Chinese market today. The Shanghai Composite index soared 2.5% today. And the moves come with Nio shares down 25% over the last three months. In that same period, XPeng and Full Truck Alliance shares have dropped 35%. Today's jump is more a response to macro issues than company-specific news.

Now what

But Nio did announce a milestone for its business yesterday. The company marked the production of its 200,000th electric vehicle since it began operations in 2018. It's notable that almost half that total was produced just last year. Vehicle production has accelerated for both Nio and XPeng as demand remains strong in China. XPeng also delivered nearly 100,000 vehicles in 2021, an increase of 263% over 2020 levels. Nio's deliveries rose 109% year over year in 2021.

While not an EV manufacturer, Full Truck Alliance is a supplier to the Chinese transportation and freight industry. In its recent fourth-quarter and full-year 2021 conference call, founder and CEO Hui Zhang called the company a "low carbon logistics service provider," signaling its focus on the EV sector.

In the short term, shares of these names can move based on macro events. Those swings can go in both directions, as today's market action is showing. Ultimately, though, these companies will only prove themselves as worthy investments if the underlying businesses succeed, and there looks to be a long runway ahead for China's EV industry.

Read Full Story »»»

DiscoverGold

DiscoverGold

I dont see myself ever investing in China again. They ran this stock into the ground with their big mouths and policies.

2 Reasons to Be Bullish on NIO Stock

By: InvestorPlace | April 24, 2022

Electric Vehicle makers in China are having trouble due to the fresh Covid-19 lockdown. Having recently announced a forced halt in EV production, Nio (NYSE:NIO) stock has suffered. The stock tumbled after the announcement since investors assumed that the company will miss production targets. NIO stock went from $23 to $19 over the past two weeks. Once the impact of the pandemic subsides, Nio will have a massive market to cater to since the demand for EVs is only going to expand in the coming years.

I think the market is overreacting to this move and has a misunderstanding that Nio has completely suspended production. However, this is not the case. Let’s dig deeper into the two reasons you should be bullish on NIO stock.

The Production Halt Was Temporary

The situation is not as bad as it is feared and I think that it is only temporary. Nio was only taking a short production halt and not closing production completely. However, we might see a dip in the delivery numbers, but it could only be for a month and not a consistent dip. According to the management, Nio will still be running but on a limited scale, and the halt is limited to the weekends only. Nio has already resumed production.

Let’s not miss out on the big picture. Nio could be up and running in the next few weeks at its full capacity since it has not suspended production completely. This is not reason enough for investors to give up on NIO stock. Interestingly, the company reported solid deliveries for March and met the quarterly delivery target. This is reason enough to have faith in Nio’s production abilities.

Nio Is Not the Only One Considering a Price Hike

One thing to keep in mind is that whenever the price of raw material increases, manufacturers will consider a price hike. In this case, the price of lithium is skyrocketing and it has impacted all EV makers. However, Nio is not the only one raising the price of its cars. Tesla (NASDAQ:TSLA) has increased prices several times in the past. Since China is still grappling with the pandemic, Nio will have to pay a higher price for the raw materials and this will have an impact on the cost of production. Nio doesn’t have much choice except to raise the price of its cars.

Even Lucid (NASDAQ:LCID) is considering a price hike to meet the supply chain and inflation concerns. The automakers who haven’t announced a price hike yet may have to do so in the coming months. Sustaining demand in the competitive EV industry is the key to success and as long as Nio manages to produce and deliver the projected number of cars, it will be able to keep growing.

Bottom Line on Nio Stock

Nio is suffering more than it should and it is because of temporary reasons. The stock was once trading as high as $55 and is finding it difficult to hit $25 now. However, I believe the stock has solid potential to grow and reap returns in the long term. NIO stock is a long-term play and not a stock to sell when the market is down. Keep holding on to the stock for better returns in the second half of the year.

UBS analyst Paul Gong has a buy rating for the stock with a price target of $32. The analyst thinks that the time to strike is now and the shares look undervalued at the current level. Further, Martin Heung, a Nomura analyst has a buy rating with a price target of $51.50 on NIO shares. At a price target of $51.50, the analyst gives a massive upside potential. Do not underestimate the potential of the stock to rebound and that will be your chance to make the most of NIO stock.

Read Full Story »»»

DiscoverGold

DiscoverGold

Beijing races to contain ‘urgent and grim’ Covid outbreak as Shanghai lockdown continues

https://www.cnn.com/2022/04/24/china/beijing-covid-outbreak-lockdown-fears-intl-hnk/index.html $NIO

$NIO China EV names all struggling w/ lockdowns

By: Options Mike | April 23, 2022

• $NIO China EV names all struggling w/ lockdowns. That gap to 15 might be filled.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO 5 million share #darkpool print at $17.18

By: Money Flow Mel | April 22, 2022

• $NIO 5 million share #darkpool print at $17.18.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio and WWF Enter Clean Parks Strategic Cooperation

By: Michael Elkins | April 22, 2022

Electric vehicle startup Nio (NYSE:NIO) has entered into a Clean Parks strategic cooperation with World Wide Fund for Nature (WWF), becoming the co-sponsor initiating Clean Parks. NIO announced Clean Parks, an ecological co-construction initiative, in December 2021.

Clean Parks is a global ecological co-construction plan initiated by NIO to implement the Blue Sky Coming vision. It is the world's first open platform started by an automobile company to support the construction of national parks and nature reserves.

According to the agreement, WWF will join hands with NIO in establishing a clean and low-carbon energy circulation system in national parks and nature reserves, driving clean mobility and sustainable development, launching demonstrative projects, and protecting authenticity and integrity of ecosystems.

"Since China started the pilot project on national parks in 2015, WWF has been actively participating in establishing the nature reserve system with national parks as the main body and facilitating the high-quality development of national parks," said Lunyan Lu, Chief Representative of WWF China. "Clean Parks starts with co-construction, with which NIO and WWF will leverage our respective resources and technological advantages to provide solutions to and share practices on the protection of national parks, nature reserves and their surrounding communities."

"It's a great honor to have WWF co-initiate Clean Parks with NIO, to jointly build a clean and low-carbon energy circulation system in nature reserves in China and even around the world, and to move towards a greener and more sustainable future. We also look forward to jointly popularizing clean mobility and biodiversity conservation to further raise the public's awareness of environmental protection, contributing to building a community of all life on Earth, and shaping a clean and beautiful world with blue skies," said William Li, founder, chairman and CEO of NIO.

Read Full Story »»»

DiscoverGold

DiscoverGold

Well if your looking to get in under 20. It’s at $18.25 now. I will get it at $8.25

I don't know if we will see single digits at NIO but if we get anywhere near $13 again, I intend to avg down. That's for sure. My avg cost PPS is $30.13. Sure, like to get it under $20 if I can. GLTA

These lock downs in China will bring the share price down to the single digits. Watch the news.

$NIO These huge province lockdowns are going to hit the EV makers hard next Q... Careful here

By: Options Mike | April 17, 2022

• $NIO These huge province lockdowns are going to hit the EV makers hard next Q... Careful here.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Resumes Production Following COVID Halt

By: Michael Elkins | April 14, 2022

Nio Inc. (NYSE:NIO) announced Thursday that the company would be resuming production at its facility west of Shanghai following a temporary halt due to supply chain issues related to a Covid outbreak. Nio had suspended operations Saturday after Covid restrictions in Changchun and Hebei halted production at suppliers' factories.

Now that supply chain issues have begun to recover, the production base is gradually resuming. Vehicle production at NIO has been down for less than one week. Production at the Tesla (NASDAQ:TSLA) manufacturing plant in Shanghai, for comparison, has been offline since late March.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO EV Production Halt Not as Bad as Initially Feared - Nomura

By: Investing.com | April 13, 2022

Nio (NYSE:NIO) announced a few days ago that it has been forced to halt EV production in China amid fresh COVID-19 lockdowns.

As a result, NIO stock price tumbled on fears that the halt will push the company to miss production and delivery targets.

However, Nomura analyst Martin Heung argues that the overall situation is not as bad as initially feared.

“The market has widely believed that NIO is undertaking a complete production halt. However, according to NIO management, the halt is limited to weekends only, and production lines will still be running on weekdays, albeit on a limited scale. According to management, the affected suppliers are responsible for exterior body parts of vehicles (from Jilin) and engineering components (from Shanghai) that are essential for automotive electrification,” Heung said in a client note.

The analyst added that Nio’s management is hopeful of restarting EV production in the coming days with the normal level of functionality expected to be achieved in 2-3 weeks.

“On the completion and initial production run of the second manufacturing plant in NeoPark, NIO reiterates these remain on schedule (in 3Q22) so long as the pandemic does not spread beyond Shanghai, which is only 470km from Hefei,” Heung added.

The analyst has a Buy rating and a $51.50 per share price target on Nio.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO - NIO Inc. Outside of $TSLA the EV plays are very weak. This one back under all the MA's now

By: Options Mike | April 10, 2022

• $NIO Outside of $TSLA the EV plays are very weak. This one back under all the MA's now. Some support @ 18.

Read Full Story »»»

DiscoverGold

DiscoverGold

China EV maker Nio suspends production due to supply chain disruptions

https://finance.yahoo.com/news/china-ev-maker-nio-suspends-090803756.html

$NIO Unusual VERY LARGE #darkpool ~ 4 Million Shares at $20.36

By: Money Flow Mel | April 7, 2022

• $NIO Unusual VERY LARGE #darkpool ~ 4 mil shares at $20.36.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |