Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Why Nio and Chinese Tech Stocks Jumped Today

By: Motley Fool | April 27, 2022

• Today's move comes after sharp declines over the last several weeks.

What happened

U.S.- listed Chinese stocks have been taking a beating in recent months. The reasons behind the downtrend include political and regulatory fears, supply chain and raw material cost headwinds, and lockdowns in several cities to try to slow a new COVID-19 outbreak.

That sentiment reversed today, however. Chinese stocks including EV makers Nio (NIO 3.45%) and XPeng (XPEV 5.20%), as well as trucking technology platform Full Truck Alliance (YMM 3.11%), were all higher as of 11:34 a.m. ET:

• Nio was up 2.4%.

• XPeng was up 5.5%.

• Full Truck Alliance was up 4.4%.

So what

The jumps in these international stocks are in line with the broader Chinese market today. The Shanghai Composite index soared 2.5% today. And the moves come with Nio shares down 25% over the last three months. In that same period, XPeng and Full Truck Alliance shares have dropped 35%. Today's jump is more a response to macro issues than company-specific news.

Now what

But Nio did announce a milestone for its business yesterday. The company marked the production of its 200,000th electric vehicle since it began operations in 2018. It's notable that almost half that total was produced just last year. Vehicle production has accelerated for both Nio and XPeng as demand remains strong in China. XPeng also delivered nearly 100,000 vehicles in 2021, an increase of 263% over 2020 levels. Nio's deliveries rose 109% year over year in 2021.

While not an EV manufacturer, Full Truck Alliance is a supplier to the Chinese transportation and freight industry. In its recent fourth-quarter and full-year 2021 conference call, founder and CEO Hui Zhang called the company a "low carbon logistics service provider," signaling its focus on the EV sector.

In the short term, shares of these names can move based on macro events. Those swings can go in both directions, as today's market action is showing. Ultimately, though, these companies will only prove themselves as worthy investments if the underlying businesses succeed, and there looks to be a long runway ahead for China's EV industry.

Read Full Story »»»

DiscoverGold

DiscoverGold

I dont see myself ever investing in China again. They ran this stock into the ground with their big mouths and policies.

2 Reasons to Be Bullish on NIO Stock

By: InvestorPlace | April 24, 2022

Electric Vehicle makers in China are having trouble due to the fresh Covid-19 lockdown. Having recently announced a forced halt in EV production, Nio (NYSE:NIO) stock has suffered. The stock tumbled after the announcement since investors assumed that the company will miss production targets. NIO stock went from $23 to $19 over the past two weeks. Once the impact of the pandemic subsides, Nio will have a massive market to cater to since the demand for EVs is only going to expand in the coming years.

I think the market is overreacting to this move and has a misunderstanding that Nio has completely suspended production. However, this is not the case. Let’s dig deeper into the two reasons you should be bullish on NIO stock.

The Production Halt Was Temporary

The situation is not as bad as it is feared and I think that it is only temporary. Nio was only taking a short production halt and not closing production completely. However, we might see a dip in the delivery numbers, but it could only be for a month and not a consistent dip. According to the management, Nio will still be running but on a limited scale, and the halt is limited to the weekends only. Nio has already resumed production.

Let’s not miss out on the big picture. Nio could be up and running in the next few weeks at its full capacity since it has not suspended production completely. This is not reason enough for investors to give up on NIO stock. Interestingly, the company reported solid deliveries for March and met the quarterly delivery target. This is reason enough to have faith in Nio’s production abilities.

Nio Is Not the Only One Considering a Price Hike

One thing to keep in mind is that whenever the price of raw material increases, manufacturers will consider a price hike. In this case, the price of lithium is skyrocketing and it has impacted all EV makers. However, Nio is not the only one raising the price of its cars. Tesla (NASDAQ:TSLA) has increased prices several times in the past. Since China is still grappling with the pandemic, Nio will have to pay a higher price for the raw materials and this will have an impact on the cost of production. Nio doesn’t have much choice except to raise the price of its cars.

Even Lucid (NASDAQ:LCID) is considering a price hike to meet the supply chain and inflation concerns. The automakers who haven’t announced a price hike yet may have to do so in the coming months. Sustaining demand in the competitive EV industry is the key to success and as long as Nio manages to produce and deliver the projected number of cars, it will be able to keep growing.

Bottom Line on Nio Stock

Nio is suffering more than it should and it is because of temporary reasons. The stock was once trading as high as $55 and is finding it difficult to hit $25 now. However, I believe the stock has solid potential to grow and reap returns in the long term. NIO stock is a long-term play and not a stock to sell when the market is down. Keep holding on to the stock for better returns in the second half of the year.

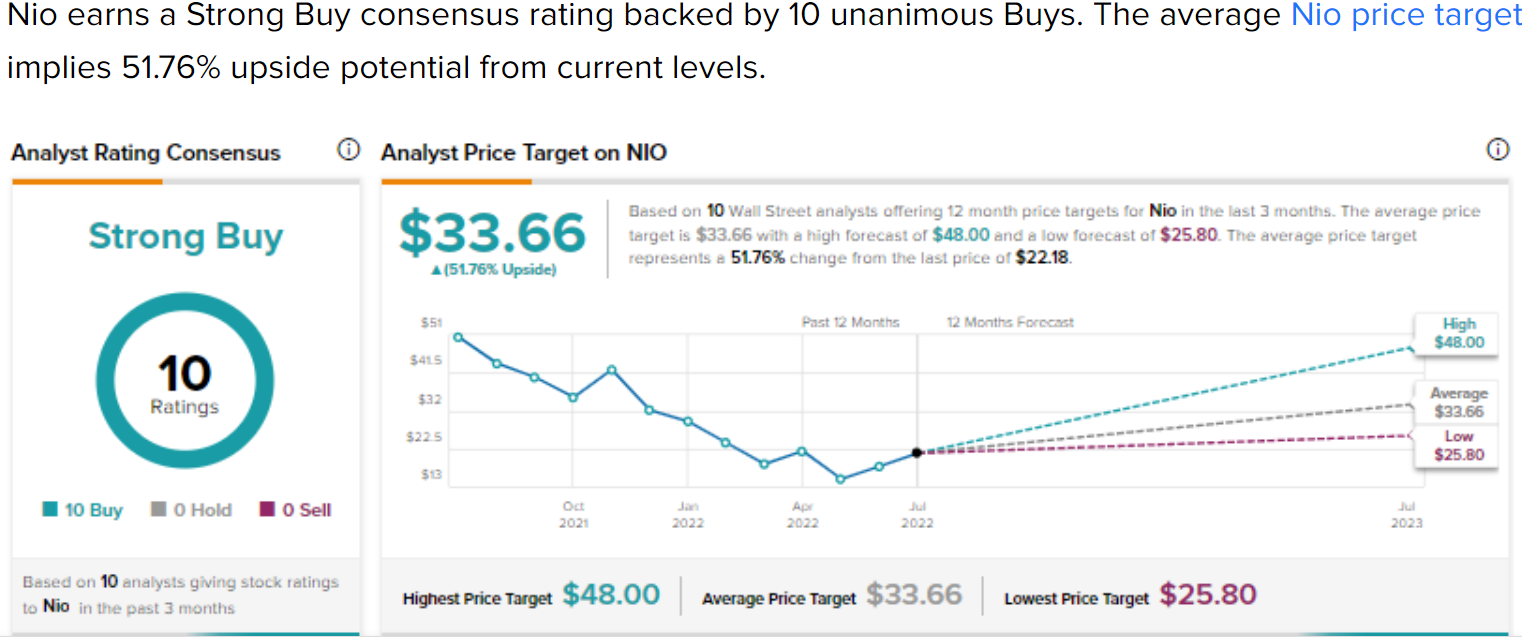

UBS analyst Paul Gong has a buy rating for the stock with a price target of $32. The analyst thinks that the time to strike is now and the shares look undervalued at the current level. Further, Martin Heung, a Nomura analyst has a buy rating with a price target of $51.50 on NIO shares. At a price target of $51.50, the analyst gives a massive upside potential. Do not underestimate the potential of the stock to rebound and that will be your chance to make the most of NIO stock.

Read Full Story »»»

DiscoverGold

DiscoverGold

Beijing races to contain ‘urgent and grim’ Covid outbreak as Shanghai lockdown continues

https://www.cnn.com/2022/04/24/china/beijing-covid-outbreak-lockdown-fears-intl-hnk/index.html $NIO

$NIO China EV names all struggling w/ lockdowns

By: Options Mike | April 23, 2022

• $NIO China EV names all struggling w/ lockdowns. That gap to 15 might be filled.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO 5 million share #darkpool print at $17.18

By: Money Flow Mel | April 22, 2022

• $NIO 5 million share #darkpool print at $17.18.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio and WWF Enter Clean Parks Strategic Cooperation

By: Michael Elkins | April 22, 2022

Electric vehicle startup Nio (NYSE:NIO) has entered into a Clean Parks strategic cooperation with World Wide Fund for Nature (WWF), becoming the co-sponsor initiating Clean Parks. NIO announced Clean Parks, an ecological co-construction initiative, in December 2021.

Clean Parks is a global ecological co-construction plan initiated by NIO to implement the Blue Sky Coming vision. It is the world's first open platform started by an automobile company to support the construction of national parks and nature reserves.

According to the agreement, WWF will join hands with NIO in establishing a clean and low-carbon energy circulation system in national parks and nature reserves, driving clean mobility and sustainable development, launching demonstrative projects, and protecting authenticity and integrity of ecosystems.

"Since China started the pilot project on national parks in 2015, WWF has been actively participating in establishing the nature reserve system with national parks as the main body and facilitating the high-quality development of national parks," said Lunyan Lu, Chief Representative of WWF China. "Clean Parks starts with co-construction, with which NIO and WWF will leverage our respective resources and technological advantages to provide solutions to and share practices on the protection of national parks, nature reserves and their surrounding communities."

"It's a great honor to have WWF co-initiate Clean Parks with NIO, to jointly build a clean and low-carbon energy circulation system in nature reserves in China and even around the world, and to move towards a greener and more sustainable future. We also look forward to jointly popularizing clean mobility and biodiversity conservation to further raise the public's awareness of environmental protection, contributing to building a community of all life on Earth, and shaping a clean and beautiful world with blue skies," said William Li, founder, chairman and CEO of NIO.

Read Full Story »»»

DiscoverGold

DiscoverGold

Well if your looking to get in under 20. It’s at $18.25 now. I will get it at $8.25

I don't know if we will see single digits at NIO but if we get anywhere near $13 again, I intend to avg down. That's for sure. My avg cost PPS is $30.13. Sure, like to get it under $20 if I can. GLTA

These lock downs in China will bring the share price down to the single digits. Watch the news.

$NIO These huge province lockdowns are going to hit the EV makers hard next Q... Careful here

By: Options Mike | April 17, 2022

• $NIO These huge province lockdowns are going to hit the EV makers hard next Q... Careful here.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Resumes Production Following COVID Halt

By: Michael Elkins | April 14, 2022

Nio Inc. (NYSE:NIO) announced Thursday that the company would be resuming production at its facility west of Shanghai following a temporary halt due to supply chain issues related to a Covid outbreak. Nio had suspended operations Saturday after Covid restrictions in Changchun and Hebei halted production at suppliers' factories.

Now that supply chain issues have begun to recover, the production base is gradually resuming. Vehicle production at NIO has been down for less than one week. Production at the Tesla (NASDAQ:TSLA) manufacturing plant in Shanghai, for comparison, has been offline since late March.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO EV Production Halt Not as Bad as Initially Feared - Nomura

By: Investing.com | April 13, 2022

Nio (NYSE:NIO) announced a few days ago that it has been forced to halt EV production in China amid fresh COVID-19 lockdowns.

As a result, NIO stock price tumbled on fears that the halt will push the company to miss production and delivery targets.

However, Nomura analyst Martin Heung argues that the overall situation is not as bad as initially feared.

“The market has widely believed that NIO is undertaking a complete production halt. However, according to NIO management, the halt is limited to weekends only, and production lines will still be running on weekdays, albeit on a limited scale. According to management, the affected suppliers are responsible for exterior body parts of vehicles (from Jilin) and engineering components (from Shanghai) that are essential for automotive electrification,” Heung said in a client note.

The analyst added that Nio’s management is hopeful of restarting EV production in the coming days with the normal level of functionality expected to be achieved in 2-3 weeks.

“On the completion and initial production run of the second manufacturing plant in NeoPark, NIO reiterates these remain on schedule (in 3Q22) so long as the pandemic does not spread beyond Shanghai, which is only 470km from Hefei,” Heung added.

The analyst has a Buy rating and a $51.50 per share price target on Nio.

Read Full Story »»»

DiscoverGold

DiscoverGold

NIO - NIO Inc. Outside of $TSLA the EV plays are very weak. This one back under all the MA's now

By: Options Mike | April 10, 2022

• $NIO Outside of $TSLA the EV plays are very weak. This one back under all the MA's now. Some support @ 18.

Read Full Story »»»

DiscoverGold

DiscoverGold

China EV maker Nio suspends production due to supply chain disruptions

https://finance.yahoo.com/news/china-ev-maker-nio-suspends-090803756.html

$NIO Unusual VERY LARGE #darkpool ~ 4 Million Shares at $20.36

By: Money Flow Mel | April 7, 2022

• $NIO Unusual VERY LARGE #darkpool ~ 4 mil shares at $20.36.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO SIZE - 4.78 million share #darkpool prints at $21.68

By: Money Flow Mel | April 6, 2022

• $NIO SIZE - 4.78 million share #darkpool prints at $21.68.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Climbs on UBS Upgrade to ‘Buy’, Price Target Cut

By: Investing.com | April 4, 2022

Nio ADRs (NYSE:NIO) traded 8% higher Monday after UBS analyst Paul Gong upgraded it to ‘buy’ with a target of $32, still 34% higher after the surge.

The analyst had a target of $46 for the ADRs with a ‘neutral’ rating, according to StreetInsider.

Nio began delivering its ET7 mid/large sedan late last month and should launch the ET5 medium sedan in September and the mid/large ES7 SUV in late 2022.

“These products offer stronger powertrains, a better digital experience and more advanced autonomous driving than its four-year-old platform,” Gong wrote in his note.

The analyst expects ET5 to become a major volume model, with more than 10,000 unit sales likely per month, as it has a similar powertrain and intelligence specifications as ET7 but is cheaper by RMB 100,000 ($15,723).

A recent survey by UBS showed that Nio’s brand recognition is on the up. Nio’s consumer mindshare is now better than BMW, Audi, or Mercedes, according to Gong.

Nio sold 9,985 vehicles in March, up about 38%. The company said it plans to unveil the NIO ES8, ES6, and EC6 SUVs in May.

Read Full Story »»»

DiscoverGold

DiscoverGold

Why the Rally in Alibaba, NIO and Other Chinese Stocks May Be Short-Lived

By: Barron's | April 4, 2022

U.S.-listed Chinese stocks like Alibaba , NIO , and JD.com were soaring Monday after Chinese authorities moved to cooperate with U.S. regulators and signaled concessions on an issue that has created significant uncertainty for this group of companies.

The China Securities Regulatory Commission (CSRC), in a joint statement with other regulators, said Saturday that it would loosen its auditing rules. This includes removing the legal requirement that on-site inspections be mainly conducted by Chinese authorities or rely on their inspection results, according to a summary of the changes published in Chinese, translated by Barron’s with Google translate software.

Chinese companies listed in the U.S. have faced intense pressure from regulatory concerns over the past year. Headwinds have picked up in recent months as Washington has renewed the prospect that Chinese companies may be forced to delist in the U.S. if they don’t meet accounting transparency rules. If China moves to satisfy the demands over accounting transparency from Washington, and Washington agrees, it would lift a cloud of uncertainty from this group of stocks.

“Requests made by overseas regulators to conduct investigations, including collecting evidence for investigation purpose, and inspections in the Chinese mainland shall be carried out through cross-border regulatory cooperation mechanisms,” the CSRC said in an English-language statement. It “will lay an institutional foundation for secure, efficient cross-border regulatory cooperation,” the regulator said.

Alibaba (ticker: BABA) jumped 4% in U.S. premarket trading on Monday, with NIO (NIO) nearly 6% higher and JD.com (JD) gaining more than 5%. The news that broke over the weekend confirmed a report last week that the move was coming, which sent these stocks higher on Friday.

But analysts warned that the rally driven by regulatory news may be short-lived.

“It still depends on how the U.S respond on this,” Danny Law, an analyst at Guotai Junan Securities, one of China’s biggest investment banks, told Barron’s. “There is still high uncertainty for getting a consensus from the U.S.”

Law also highlighted that regulations still include protections for data that the Chinese government deems sensitive and a security — a definition that U.S. regulators may not agree with.

“Tech companies in China are still required to comply with such regulations, particularly with [highly] sensitive data,” the analyst said. “It is quite difficult for tech companies in China to strive for a balance between China’s regulations and overseas regulations.”

Other analysts were more upbeat.

“Now that China has shown it’s ready to compromise, it is the U.S. regulator’s turn to respond,” Bo Pei, an analyst at broker U.S. Tiger Securities, told Barron’s. “While I think there will still be some back and forth, I believe the overall direction is positive.”

Greater cooperation with the U.S. over some of China’s largest companies, listed in the U.S., has been in the works for weeks. In March, the Chinese government said it would work to boost economic growth and support the stock market, as well as clear up a punishing regulatory environment, including concerns around U.S. delistings.

While Alibaba and its peers were rallying for a second session, Law cautioned that the moves represented only changes in short-term market sentiment.

“We expect market sentiment will only support the short-term valuation,” the analyst said. “For the longer term, [the market] will follow the Company’s fundamentals.”

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Delivery numbers gave it a nice gap up, see if it holds

By: Options Mike | April 3, 2022

• $NIO Delivery numbers gave it a nice gap up, see if it holds.

Read Full Story »»»

DiscoverGold

DiscoverGold

Closed my new position at $23.00 haha. Nice little flip today.

Started a new position here again this morning. Just going to add shares every couple days for a while. GL. $NIO

Started a new position here again this morning. Just going to add shares every couple days for a while. GL. $NIO

I bought at 4 and sold at 3.80..... lol horrible investor, it ran to 60+ after that

I initially bought for 1.98 a share. Should of sold in thirties. Hoping to get to 60s

Nio (NIO) Given New $60.00 Price Target at Mizuho

By: MarketBeat | March 28, 2022

• NIO (NYSE:NIO - Get Rating) had its target price reduced by investment analysts at Mizuho from $65.00 to $60.00 in a note issued to investors on Monday, The Fly reports. Mizuho's price objective indicates a potential upside of 201.36% from the company's current price...

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO Starting to explode!

By: TrendSpider | March 30, 2022

• $NIO Starting to explode!

Read Full Story »»»

DiscoverGold

DiscoverGold

Go NIO go! Would love to see $40-50 by summer.

I just saw where I sold 11 shares of NIO on March 14th for $13.93 each. Maybe I should find a new hobby.

$NIO Potential inverse H&S forming outside of resistance

By: TrendSpider | March 28, 2022

• $NIO Potential inverse H&S forming outside of resistance.

Read Full Story »»»

DiscoverGold

DiscoverGold

Nio Jumps as Smart Electric Flagship Sedan ET7 Rolls Out

By: Investing.com | March 28, 2022

Nio ADRs (NYSE:NIO) traded 5.8% higher Monday after the EV-maker delivered the first batch of its smart electric flagship sedan ET7 to users.

The automaker has claimed a driving range of up to 621 miles from a 150 kWh battery pack for the ET7, a feature most users worry about - the distance an electric vehicle will run on a single charge.

This compares with Lucid Air’s 520 miles for the 19-inch wheel, the longest-range EV rated by the Environmental Protection Agency (EPA) so far.

Nio's first model on the second-generation technology platform NT2.0 comes standard with over 100 configurations and is equipped with a brand-new software system called Banyan. According to reports, the vehicle’s specifications are not yet certified by the regulator Environmental Protection Agency.

The company rolled out the first batch of vehicles at its plant in Hefei. This will be followed by exports to Norway, Germany and then the rest of Europe.

The company is currently offering two variants of ET7, the regular model and the first edition, with pre-subsidy prices of RMB 448,000 ($70,400) and RMB 526,000 ($82,500), respectively. Customers who choose the battery rental service will see the starting price slashed by at least RMB 70,000, according to InsideEVs.

Read Full Story »»»

DiscoverGold

DiscoverGold

Barclays Remains Bullish on EV Maker Nio Stock, Urges Investors to 'Ignore Near-term Noise'

By: Investing.com | March 28, 2022

Barclays analyst Jiong Shao reiterated an Overweight rating and a $34.00 per share price target on Nio (NYSE:NIO) stock following the quarterly earnings report released last week.

The analyst praised the early performance of NIOs ET7 & ET5 sedans, saying the bank expects the two models to become best-sellers after deliveries start.

Shao said NIOs planned capacity expansion in 2022 and the rollout of two new sedans are expected to boost deliveries and revenue in the second half of the year, even though the current chip shortage and tighter coronavirus restriction measures could weigh on the near-term demand.

The analyst listed several things he liked in the earnings report, including solid delivery performance and vehicle gross margins; pre-orders of new models, the ET7 and ET5, are ahead of managements prior expectations; new factory on track to be in production in September; continued strong demand for existing models; and high market share in targeted vehicle class.

Nio stock price is up nearly 2% in pre-open Monday.

Read Full Story »»»

DiscoverGold

DiscoverGold

$NIO They didn't like the report. gap down, gap below..

By: Options Mike | March 27, 2022

• $NIO They didn't like the report. gap down, gap below.. no clue.

But hey Cathie bought a bunch...

Read Full Story »»»

DiscoverGold

DiscoverGold

Is NIO The Buy Of The Year?

By: MarketBeat | March 25, 2022

• This might not be a question you were expecting to hear with regards to NIO (NYSE: NIO), whose shares are down almost 70% from last year’s all-time high, but it’s one worth asking. Because if one thing’s for sure, the Shanghai headquartered electric vehicle (EV) maker knows how to keep investors on their toes. Their shares rallied close to 3,000% in the months after the COVID pandemic started, with many analysts calling them the next Tesla (NASDAQ: TSLA).

Comparisons like this are always going to be made with any up-and-coming EV company, but NIO stock’s seemingly unlimited resistance to gravity initially made it all the more pertinent. So too, it could be said, has the stock’s subsequent fall from the highs, and it will surely be nailed down once and for all if it can recover in the coming weeks. There’s plenty afoot with NIO that suggests its shares might be about to kick off a much-needed rally.

Mixed Earnings

Their Q4 earnings, released last night, gave investors and Wall Street a glimpse into the engine. Revenue for the quarter was ahead of analyst expectations and up 52% year on year, which helped to offset the slight miss on EPS. Delivery of vehicles for the fourth quarter of 2021 was up 44% compared to the same quarter the previous year, with total deliveries for 2021 up 109% compared to 2020. These are good numbers and suggest NIO’s revenue engine is building significant momentum. The timing is perfect too, with the effects of the Russian - Ukraine war on oil and gas prices causing many to think about switching permanently to an EV...

Read Full Story »»»

DiscoverGold

DiscoverGold

Cathie Wood & Ark Invest's Buys 420,057 Shares of Nio Inc. (NIO)

By: Ark Invest Daily | March 25, 2022

• Cathie Wood & Ark Invest's trade activity from today 3/25

Read Full Story »»»

DiscoverGold

DiscoverGold

Can Nio Throw a Punch at Tesla?

By: TheStreet | March 25, 2022

• Nio has strong growth ambitions both in China and internationally, but the supply chain could stand in its way.

Fiscal 2021 was a rough year for Chinese electric vehicle maker Nio (NIO).

The pandemic led to supply chain issues that hobbled the entire auto industry, but the environment was particularly toxic for Nio, a company that is just getting off the ground.

Nio was able to deliver 91,429 vehicles in 2021, representing a 109% year over year increase. In the fourth quarter the company delivered 25,034 vehicles, topping analyst estimates of 24,945.

But Nio has a ton of work to do to catch up with Tesla and BYD for the luxury EV lead in China.

Demand for electric vehicles is growing in China with retail penetration growing from 5.9% in January 2021 to 18.6% in December, according to the China Passenger Car Association.

The Tesla Model Y and Model 3 were the third and fourth highest selling electric vehicles in China last year, according to the CPCA. BYD's Quin was the second highest selling EV.

The top spot went to the Hongguan Mini, which is a more affordable EV, unlike Tesla (TSLA), BYD and Nio's luxury models.

None of Nio's vehicles made the top 15 in 2021, so if Nio wants to make its mark it has some work to do. But the company's fourth quarter earnings release calls into question its ability to take advantage of a hot EV market in the far East.

Nio's ET7 Could Face Supply Chain Headwinds

Nio is hoping its ET7 luxury sedan can do for it the same thing Tesla's Model 3 did for that company.

In China, while SUVs are growing in popularity, the Model Y was the only large vehicle in the top-5 best sellers from 2021. So there is definitely an appetite for electric sedans.

But the question is whether Nio can actually deliver them.

"On the side of supply chain, we are still faced with challenges of growing chip supply, volatility, raw material cost increase, COVID, and the changing international situation," the company said Friday.

"Although the user demand and order momentum remains strong, the production and delivery have been affected by the COVID and the volatility of supply chain, production capacity."

The company announced that the first batch of the EV sedans have officially come off its assembly line and deliveries to reservation holders beginning March 28 remain on track.

But still, the company expects first quarter 2022 deliveries to range between 25,000 and 26,000. While this puts it on pace for deliveries ahead of last year's totals, it may not be enough for investors.

Nio is forecasting first quarter revenue between $1.51 billion and $1.57 billion, which is short of Wall Street's consensus of $1.66 billion.

Nio's Has International Growth Plans

If Nio wants to catch Tesla, which delivered nearly 1 million vehicles in 2021 or about 10 times more than Nio, it will have to grow internationally too.

The company recently chose Norway as the first market it wanted to expand to outside of China and the company has posted job openings in Germany and the Netherlands as it searches for fertile EV markets.

Nio said that it will enter Germany, Netherlands, Denmark, and Sweden in 2022, and reach 25 countries by 2025, at its annual Nio Day event.

Nio has also posted nearly 50 job openings on LinkedIn based in the U.S., which could mean it has plans to bring the fight to Tesla's home turf.

Back in China, to help push adoption, Nio says it has been accelerating the deployment of its power network. As of January 31, the Shanghai-based company has built 836 power swap stations, 3,766 power chargers, and 3,656 destination chargers.

Read Full Story »»»

DiscoverGold

DiscoverGold

Why NIO Stock Is Down By 9% Today

By: Vladimir Zernov | March 25, 2022

• The stock is trying to settle below the $20 level.

NIO Stock Falls As Guidance Disappoints

Shares of NIO gained strong downside momentum after the company released its quarterly results. NIO reported revenue of $1.55 billion and an adjusted loss of $0.16 per share, beating analyst estimates on revenue and missing them on earnings.

In the fourth-quarter of 2021, the company delivered 25,034 vehicles, up from 24,439 in the third quarter. Vehicle margin improved from 18.0% in the third quarter of 2021 to 20.9% in the fourth quarter of 2021, while gross margin was 17.2% in Q4.

As usual, the market focused on the company’s guidance for the first quarter of 2022. NIO expects that deliveries will be between 25,000 and 26,000 vehicles. Total revenues are expected to be between $1.51 billion and $1.57 billion.

What’s Next For NIO Stock?

NIO expects no revenue growth in the first quarter, so the market’s reaction to the report is not surprising. Treasury yields continue to move higher as traders prepare for aggressive moves from the Fed, so shares of tech companies have become even more sensitive to financial guidance.

Analysts expect that NIO will report a loss of $0.23 per share in 2022, so the company is not expected to become profitable in the near term. The recent developments in commodity markets should push costs higher, which will be bearish for NIO.

In addition, traders remain worried about the future of Chinese stocks’ listing in the U.S., which also serves as a bearish catalyst for NIO.

While NIO stock has recently enjoyed a strong rebound from lows, it will need additional upside catalysts to continue the upside move.

Read Full Story »»»

DiscoverGold

DiscoverGold

Yes, the MM are having a ball with NIO. Shorting....then buying huge amounts.

Keep your eye on the long term....this stock will jump soon and keep going.

Tesla went thru the same in the early days.

NIO rolls first batch of ET7 sedans off assembly line ahead of deliveries next week

By: Electrek | March 24, 2022

NIO moves ever-closer to delivering its ET7 luxury sedan. The company announced the first batch of EVs has officially rolled off its assembly line in Hefei, China. ET7 deliveries remain on schedule to arrive to NIO reservation holders in China beginning March 28.

NIO ($NIO) is a publicly-traded EV automaker founded in China in 2014. Since then, it has quickly established itself as one of the leading electrified brands, beginning with its ES8, ES6, and EC6 SUVs.

During its “NIO Day” presentation in January of 2021, the automaker unveiled the ET7, its flagship electric sedan. By May, NIO had announced plans to expand to markets outside of China, beginning in Norway. Germany was soon announced as the next country to receive NIO EVs, and the first outside of China to see ET7 deliveries.

A few weeks ago, we shared news that NIO had begun offering test drives of the ET7 in China, starting with 300 rides a day before expanding to about 1,000. These rides first began at the NIO House at the NIO-JAC manufacturing base in Hefei, Anhui province, where the ET7s are being built.

At the time, deliveries were slotted to begin on March 28 and, according to NIO’s latest status update, that timeline remains on track despite COVID-19 lockdowns in the country.

NIO remains on track for ET7 deliveries next week.

In a recent post to its official Weibo page, NIO shared an image of the first batch of ET7 sedans rolling off its assembly line in Hefei.

NIO continues to tout the 1,000 km (621 miles) cruising range of the ET7, garnered from its 150 kWh battery pack. However, when we configure our own model through NIO’s WeChat, only the 100 kWh battery is available, offering 675 km (419 miles) range. Both ranges are impressive, although they are not EPA certified.

Either way, the ET7 will be the first to arrive on NIO’s NT2.0 platform and is certain to turn some heads – at least in China to start. German orders are supposed to commence later this year ahead of deliveries in Q4. Whether other European countries will also see deliveries of the new sedan remains to be seen.

NIO has already shared plans for a second sedan called the ET5 – a smaller version of the ET7 unveiled during NIO Day 2021 this past December. The ET5 began the validation prototype phase in January and should follow its sedan sibling into the Chinese and EU markets in 2022.

Read Full Story »»»

DiscoverGold

DiscoverGold

This is acting crazy in the aftermarket...all over the place.

NIO Inc. Reports Unaudited Fourth Quarter and Full Year 2021 Financial Results

By: GlobeNewswire Inc. | March 24, 2022

NIO Inc. (“NIO” or the “Company”) (NYSE: NIO; HKEX: 9866), a pioneer and a leading company in the premium smart electric vehicle market, today announced its unaudited financial results for the fourth quarter and full year ended December 31, 2021.

Operating Highlights for the Fourth Quarter and Full Year of 2021

• Deliveries of vehicles were 25,034 in the fourth quarter of 2021, including 5,683 ES8s, 12,180 ES6s and 7,171 EC6s, representing an increase of 44.3% from the fourth quarter of 2020 and an increase of 2.4% from the third quarter of 2021.

• Deliveries of vehicles were 91,429 in 2021, representing an increase of 109.1% from 2020.

Key Operating Results

2021 Q4 2021 Q3 2021 Q2 2021 Q1

Deliveries 25,034 24,439 21,896 20,060

2020 Q4 2020 Q3 2020 Q2 2020 Q1

Deliveries 17,353 12,206 10,331 3,838

Financial Highlights for the Fourth Quarter of 2021

• Vehicle sales were RMB9,215.4 million (US$1,446.1 million) in the fourth quarter of 2021, representing an increase of 49.3% from the fourth quarter of 2020 and an increase of 6.7% from the third quarter of 2021.

• Vehicle marginii was 20.9% in the fourth quarter of 2021, compared with 17.2% in the fourth quarter of 2020 and 18.0% in the third quarter of 2021.

• Total revenues were RMB9,900.7 million (US$1,553.6 million) in the fourth quarter of 2021, representing an increase of 49.1% from the fourth quarter of 2020 and an increase of 1.0% from the third quarter of 2021.

• Gross profit was RMB1,699.5 million (US$266.7 million) in the fourth quarter of 2021, representing an increase of 48.8% from the fourth quarter of 2020 and a decrease of 14.7% from the third quarter of 2021.

• Gross margin was 17.2% in the fourth quarter of 2021, compared with 17.2% in the fourth quarter of 2020 and 20.3% in the third quarter of 2021. The decrease of gross margin from the third quarter of 2021 was mainly resulted from the sales of automotive regulatory credits in the third quarter of 2021 which contributed a higher gross margin.

• Loss from operations was RMB2,445.1 million (US$383.7 million) in the fourth quarter of 2021, representing an increase of 162.5% from the fourth quarter of 2020 and an increase of 146.5% from the third quarter of 2021. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB2,048.4 million (US$321.4 million) in the fourth quarter of 2021, representing an increase of 135.1% from the fourth quarter of 2020 and an increase of 182.0% from the third quarter of 2021.

• Net loss was RMB2,143.4 million (US$336.4 million) in the fourth quarter of 2021, representing an increase of 54.4% from the fourth quarter of 2020 and an increase of 156.6% from the third quarter of 2021. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB1,746.7 million (US$274.1 million) in the fourth quarter of 2021, representing an increase of 31.5% from the fourth quarter of 2020 and an increase of 206.6% from the third quarter of 2021.

• Net loss attributable to NIO’s ordinary shareholders was RMB2,179.2 million (US$342.0 million) in the fourth quarter of 2021, representing an increase of 46.0% from the fourth quarter of 2020 and a decrease of 23.8% from the third quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB1,715.7 million (US$269.2 million).

• Basic and diluted net loss per American Depositary Share (ADS)iii were both RMB1.36 (US$0.21) in the fourth quarter of 2021. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per ADS (non-GAAP) were both RMB1.07 (US$0.16).

• Cash and cash equivalents, restricted cash and short-term investment were RMB55.4 billion (US$8.7 billion) as of December 31, 2021...

Read Full Story »»»

DiscoverGold

DiscoverGold

The first batch of mass produced ET7s, a highly autonomous electric sedan, rolled off the production line in Hefei Thursday, according to CnEVPost.com. Deliveries are set to begin on March 28.

China EV Stock Could More Than Double: Analyst

The "tide may finally be turning" for Nio stock, Deutsche Bank analyst Edison Yu wrote March 20.

"While volumes have stagnated over the past few quarters due to operational bottlenecks, we think deliveries are on track to increase from 10,000 per month to 25,000 exiting the year, which will shift the narrative away from supply constraints to product cycle," he said.

Yu tied his expectations to the launch of several new electric vehicles.

"We expect three new models to begin deliveries this year starting with the ET7 next week, which, based on local media reports, has garnered very favorable early reviews," Yu said. He rates Nio stock a buy with a 12-month price target of 50.

Nio's an emerging rival to Tesla in China. Nio CEO William Li sees the luxury, highly autonomous ET7 electric sedan as a rival to the Model S.

I'm not sure, might wait till after hours. Tomorrow this stock will take huge leaps! $$$$$$$$$$$$$$$

I predict the stock will jump up and down all day today....until shorts start covering. News will be positive no doubt......supply shortage will have minimal affect on NIO....since all parts are made in China.

Chinese suppliers will ALWAYS take care of their own first.

Shares of Electric Vehicle Maker Nio Inc Stall Out Before Earnings

By: Schaeffer's Investment Research | March 23, 2022

• The electric vehicle maker reports earnings after the close tomorrow, March 24

• The stock hasn't fared too well after earnings in the past two years

The shares of Nio Inc (NYSE:NIO) are down 0.6% today, last seen trading at $21.62 as the Tesla (TLSA) competitor gets ready to step into the earnings confessional. Nio is set to report fourth-quarter financial results after the close tomorrow, March 24, and analysts are anticipating a loss of -2.97 Chinese Yuan, or around 47 cents.

A look back at Nio stock's post-earnings history during the past two years shows a overwhelmingly dismal response, with only one of the last eight next-day sessions ending higher -- a 2.2% rise last April. NIO has averaged a large post-earnings swing of 7.2%, regardless of direction. This time around, the options market is pricing in a much larger move of 13%.

The equity has steadily trended lower over the last six months, culminating in a 19-month low of $13.01 on March 15. Pressure from the 60-day moving average remains firmly overhead, and in the last 12 months Nio stock has shed more than 46%.

The options pits have been pessimistic, with puts popular over the last 10 weeks. Over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), Nio stock sports a 50-day put/call volume ratio that sits higher than 99% of annual readings. This suggests long puts are getting picked up at a much quicker-than-usual pace.

Short sellers have been piling on NIO of late. Specifically, short interest added 16.5% in the last two reporting periods, and the 78.11 million shares sold short make up 6% of the stock's available float, or just over one day worth of pent-up buying power.

Read Full Story »»»

DiscoverGold

DiscoverGold

Support is coming! Hold on for the ride.

NIO Power is a mobile internet-based power solution with extensive networks for battery charging and battery swap facilities. Enhanced by Power Cloud, it offers a power service

the system with chargeable, swappable, and upgradable batteries to provide users with power services catering to all scenarios.

NIO News

NIO's Game-changer: Unveiling the 1,000 KM Range Electric Vehicle Battery | New Era in EV Technology! | |

NIO featured on CNN NIO featured on CNN |

Company Contact Information:

NIO. Inc. (China) P:862169083306

No. 56 Antuo Road Investor

Jiading Shanghai 201804 Relations

Website: www.nio.com

Twitter twitter.com/NIOGlobal

Instagram www.instagram.com/nioglobal

Facebook www.facebook.com/NIOGlobal

News www.nio.com/news

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |