Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

NCPCF: effective Aug. 19,2024 a one for 100 reverse split:

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

I've been following this company for over a year and waited patiently to buy at under a nickel per share. Today it finally happened. I will continue to buy as I believe in the management.

NCPCF - WAY OFF THE $1.25 DOLLAR PRICE OF THE RECENT PAST- NICKEL IS THE NEW SILVER/ GOLD - PEOPLE

Well, reportedly Eric Sprott likes them and/or is in them and their market cap's around 55 million Canadian - I dunno.

https://ceo.ca/ncp

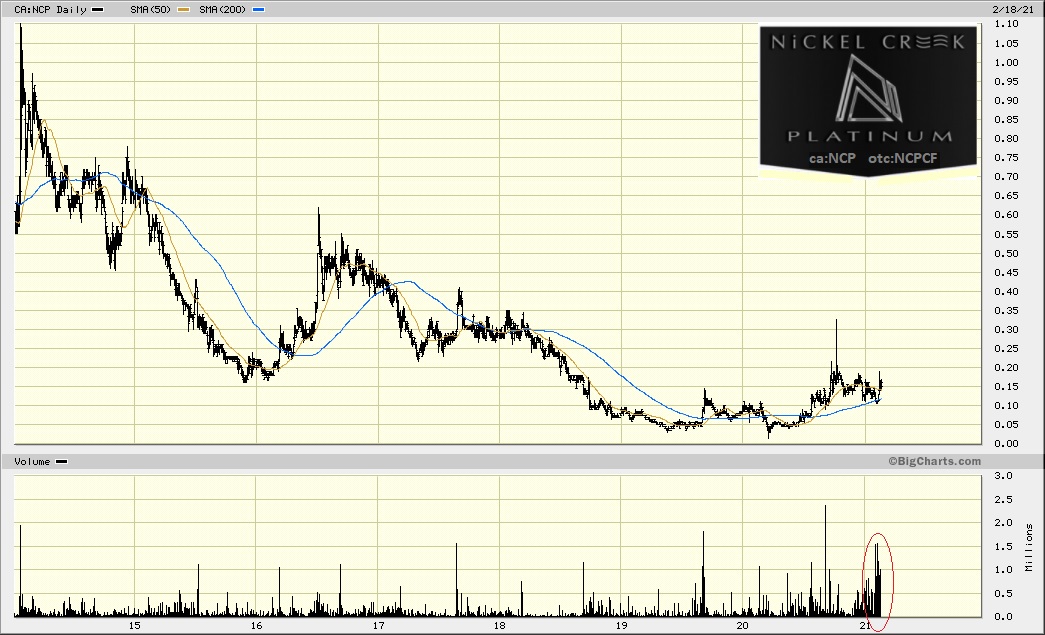

Does seem rather odd that it's so off the radar.....I like the recent volume tho and last summers' Golden Cross.

Capital structure of Nickel Creek?

My caution with this company is that even if we get good news and they are heading into production, how will the capital structure be? Reverse splits? Issuing of more shares? Warrants? Expiring options, etc. Pump and dump marketing companies, etc.

I’m looking to reengage this post for Nickel Creek to get more comments. The company just put out a new sales deck.

My analogy with this company is like a script for a movie that a screenwriter is trying to get a major studio to buy.

Is his a chicken and an egg with Nickel prices not going up until the large demand for EV?

I wonder what the price of Nickel has to go to to make this more attractive to get funding?

I’m surprised the price of the stock isn’t in the middle of the last year instead of dead at the bottom?

How much money does his company need to get started?

Thanks for the opinions.

Wellgreen Platinum Ltd., WGPLF, changed to Nickel Creek Platinum Corp., NCPCF:

http://otce.finra.org/DLSymbolNameChanges

Wellgreen Platinum CEO buys another 233,000 shares for a total of 800,000 this week. Canadian Insider.com

Wellgreen Platinum CEO Diane Garrett buys 567,000 shares of common stock on the open market. Canadian Insider. com

Hey saw your post. Anyone still in this Platinum stock? If not are there any you suggest. I think we are at a bottom in Platinum and want to throw in. Do you know any leveraged Platinum stock? Thanks

JJeeddoo7, I was just wondering if you were still here,I used to see your posts on the yahoo board. I've been in wellgreen for 3 years, any thoughts on new Ceo, management changes, catalysts for upside s/p appreciation in the near to mid term. Thanks

http://www.wellgreenplatinum.com/

Wellgreen Platinum is a Canadian mining exploration and development company focused on the active advancement of its 100% owned Wellgreen platinum group metal (PGM) and nickel project. Located in the Yukon Territory, Canada, a 2015 Preliminary Economic Assessment (the “2015 PEA”) demonstrated that the Wellgreen PGM and nickel project has the potential to become a large, low cost open pit producer of platinum, palladium, gold, nickel, and copper. The Wellgreen property is accessible from the paved Alaska Highway, which leads to year-round deep sea ports in southern Alaska.

The Company is led by a management team with a track record of successful large scale project discovery, development, financing and operation. Our vision is to create value for our shareholders through development of the Wellgreen deposit into a leading North American PGM and nickel producer.

http://www.otcmarkets.com/stock/WGPLF/profile

The Wellgreen deposit occurs within, and along the lower margin of, an Upper Triassic ultramafic-mafic body, within the Quill Creek Complex. This assemblage of mafic-ultramafic rocks is 20 kilometres long and closely intrudes along the contact between the Station Creek and Hasen Creek formations. The main mass of the Quill Creek Complex, the Wellgreen and Quill intrusions, is 4.7 kilometres long and up to 1,000 metres wide.

Mineralization on the Property occurs within the Quill Creek Complex, a layered intrusion which gradationally transitions from Dunite to Peridotite to Pyroxenite to Clinopyroxenite to Gabbro with a corresponding increasing sulphide content through this sequence toward contact with the Paleozoic sedimentary country rocks. Mineralization within the main Wellgreen deposit has been delineated into six zones of massive and disseminated mineralization known respectively as the Far East Zone, East Zone, Central Zone, West Zone, Far West Zone, and North Arm Zone. The mineralization at Wellgreen is similar to gabbro-associated nickel deposits such as those found in Noril’sk, Russia; Stillwater, Montana; and Sudbury, Ontario, though it is unusual in comparison with the width of continuous disseminated mineralization and total platinum group metals (PGMs) content.

Exploration drilling has defined a mineralized zone over a 2.8 kilometre East-West trend. The deposit averages 100 to 200 metres in thickness at surface in the Far West Zone, expands to 500 metres in thickness in the Central Zone and to nearly a kilometre wide in the Far East Zone where the deposit remains open down dip and along trend.

The main sulphide minerals associated with potentially economic mineralization at Wellgreen include pentlandite for nickel, chalcopyrite for copper, with the PGMs platinum, palladium, rhodium, iridium, ruthenium, and osmium, as well as, gold included in sperrylite, merenskyite, sudburyite, and other lesser known minerals that are often associated with magnetite, pyrrhotite, chalcopyrite, and pentlandite, along with cobaltite for cobalt.

http://www.wellgreenplatinum.com/projects/wellgreen/location-geology

I put 50.00 on stocks like this one, looks very nice.

$WGPLF Couldn't ask for a better leader, Diane Garrett...http://people.equilar.com/bio/diane-garrett-romarco-minerals/salary/703937#.V3aLFyMpBoM

http://hailegoldmine.com/home/videos/

Wellgreen Platinum Ltd...

http://www.wellgreenplatinum.com/

$WGPLF recent news/filings

bullish 0.226

## source: finance.yahoo.com

$WGPLF charts

basic chart ## source: stockcharts.com

basic chart ## source: stockscores.com

big daily chart ## source: stockcharts.com

big weekly chart ## source: stockcharts.com

$WGPLF company information

## source: otcmarkets.com

Link: http://www.otcmarkets.com/stock/WGPLF/company-info

Ticker: $WGPLF

OTC Market Place: OTCQX International

CIK code: 0001510604

Company name: Wellgreen Platinum Ltd.

Company website: http://www.wellgreenplatinum.com

Incorporated In: British Columbia, Canada

Business Description: Wellgreen Platinum is a Canadian mining exploration and development company focused on the active advancement of its 100% owned Wellgreen platinum group metals (PGM) and nickel project. Located in the Yukon Territory of Canada, the 2015 Preliminary Economic Assessment demonstrated that the Wellgreen PGM and nickel project has the potential to become a large, low cost, open pit producer of platinum, palladium, gold, nickel, and copper. The Wellgreen property is accessible from the paved Alaska Highway, which leads to year-round deep sea ports in southern Alaska.The Company is led by a management team with a track record of successful large-scale project discovery, development, financing and operation. Our vision is to create value for our shareholders through development of the Wellgreen deposit into a leading North American PGM and nickel producer.Wellgreen shares trade on the US OTCQX market under the symbol WGPLF and on the Toronto Stock Exchange under the symbol WG.Less >>

$WGPLF share structure

## source: otcmarkets.com

Market Value: $25,092,412 a/o Mar 10, 2016

Shares Outstanding: 125,462,061 a/o Nov 10, 2015

Float: 25,971,984 a/o Jun 29, 2011

Authorized Shares: Unlimited a/o Jan 31, 2011

Par Value: No Par Value

$WGPLF extra dd links

Company name: Wellgreen Platinum Ltd.

Company website: http://www.wellgreenplatinum.com

## STOCK DETAILS ##

After Hours Quote (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/after-hours

Option Chain (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/option-chain

Historical Prices (yahoo.com): http://finance.yahoo.com/q/hp?s=WGPLF+Historical+Prices

Company Profile (yahoo.com): http://finance.yahoo.com/q/pr?s=WGPLF+Profile

Industry (yahoo.com): http://finance.yahoo.com/q/in?s=WGPLF+Industry

## COMPANY NEWS ##

Market Stream (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/stream

Latest news (otcmarkets.com): http://www.otcmarkets.com/stock/WGPLF/news - http://finance.yahoo.com/q/h?s=WGPLF+Headlines

## STOCK ANALYSIS ##

Analyst Research (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/analyst-research

Guru Analysis (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/guru-analysis

Stock Report (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/stock-report

Competitors (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/competitors

Stock Consultant (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/stock-consultant

Stock Comparison (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/stock-comparison

Investopedia (investopedia.com): http://www.investopedia.com/markets/stocks/WGPLF/?wa=0

Research Reports (otcmarkets.com): http://www.otcmarkets.com/stock/WGPLF/research

Basic Tech. Analysis (yahoo.com): http://finance.yahoo.com/q/ta?s=WGPLF+Basic+Tech.+Analysis

Barchart (barchart.com): http://www.barchart.com/quotes/stocks/WGPLF

DTCC (dtcc.com): http://search2.dtcc.com/?q=Wellgreen+Platinum+Ltd.&x=10&y=8&sp_p=all&sp_f=ISO-8859-1

Spoke company information (spoke.com): http://www.spoke.com/search?utf8=%E2%9C%93&q=Wellgreen+Platinum+Ltd.

Corporation WIKI (corporationwiki.com): http://www.corporationwiki.com/search/results?term=Wellgreen+Platinum+Ltd.&x=0&y=0

WHOIS (domaintools.com): http://whois.domaintools.com/http://www.wellgreenplatinum.com

Alexa (alexa.com): http://www.alexa.com/siteinfo/http://www.wellgreenplatinum.com#

Corporate website internet archive (archive.org): http://web.archive.org/web/*/http://www.wellgreenplatinum.com

## FUNDAMENTALS ##

Call Transcripts (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/call-transcripts

Annual Report (companyspotlight.com): http://www.companyspotlight.com/library/companies/keyword/WGPLF

Income Statement (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/financials?query=income-statement

Revenue/EPS (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/revenue-eps

SEC Filings (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/sec-filings

Edgar filings (sec.gov): http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001510604&owner=exclude&count=40

Latest filings (otcmarkets.com): http://www.otcmarkets.com/stock/WGPLF/filings

Latest financials (otcmarkets.com): http://www.otcmarkets.com/stock/WGPLF/financials

Short Interest (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/short-interest

Dividend History (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/dividend-history

RegSho (regsho.com): http://www.regsho.com/tools/symbol_stats.php?sym=WGPLF&search=search

OTC Short Report (otcshortreport.com): http://otcshortreport.com/index.php?index=WGPLF

Short Sales (otcmarkets.com): http://www.otcmarkets.com/stock/WGPLF/short-sales

Key Statistics (yahoo.com): http://finance.yahoo.com/q/ks?s=WGPLF+Key+Statistics

Insider Roster (yahoo.com): http://finance.yahoo.com/q/ir?s=WGPLF+Insider+Roster

Income Statement (yahoo.com): http://finance.yahoo.com/q/is?s=WGPLF

Balance Sheet (yahoo.com): http://finance.yahoo.com/q/bs?s=WGPLF

Cash Flow (yahoo.com): http://finance.yahoo.com/q/cf?s=WGPLF+Cash+Flow&annual

## HOLDINGS ##

Major holdings (cnbc.com): http://data.cnbc.com/quotes/WGPLF/tab/8.1

Insider transactions (yahoo.com): http://finance.yahoo.com/q/it?s=WGPLF+Insider+Transactions

Insider transactions (secform4.com): http://www.secform4.com/insider-trading/WGPLF.htm

Insider transactions (insidercrow.com): http://www.insidercow.com/history/company.jsp?company=WGPLF

Ownership Summary (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/ownership-summary

Institutional Holdings (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/institutional-holdings

Insiders (SEC Form 4) (nasdaq.com): http://www.nasdaq.com/symbol/WGPLF/insider-trades

Insider Disclosure (otcmarkets.com): http://www.otcmarkets.com/stock/WGPLF/insider-transactions

## SOCIAL MEDIA AND OTHER VARIOUS SOURCES ##

PST (pennystocktweets.com): http://www.pennystocktweets.com/stocks/profile/WGPLF

Market Watch (marketwatch.com): http://www.marketwatch.com/investing/stock/WGPLF

Bloomberg (bloomberg.com): http://www.bloomberg.com/quote/WGPLF:US

Morningstar (morningstar.com): http://quotes.morningstar.com/stock/s?t=WGPLF

Bussinessweek (businessweek.com): http://investing.businessweek.com/research/stocks/snapshot/snapshot_article.asp?ticker=WGPLF

$WGPLF DD Notes ~ http://www.ddnotesmaker.com/WGPLF

Is there the intention to mined it on there own, or to sell after the mapping of the poject?

Does anyone know the life of this mine? I have not found it. Probably my error.

latest news out

http://www.wellgreenplatinum.com/news_2014_sept_08_wellgreen_platinum_announces_filing_of_updated_mineral_resource_estimate_for_its_wellgreen_project_and_upcoming_precious_metals_summit_webcast_presentation.php

http://www.wellgreenplatinum.com/news_2014_sept_03_wellgreen_platinum_reports_updated_and_increased_metallurgical_recoveries_at_the_wellgreen_pgm-ni-cu_project_in_the_southwestern_yukon_territory.php

2014-09-09 19:39 ET - In the News

Lawrence Roulston, in the Aug. 26, 2014, edition of Resource Opportunities, tells readers why to buy Wellgreen Platinum Ltd., recently 70 cents. Mr. Roulston said buy on July 27, 2011, at $2.90 and on Nov. 29, 2013, at 54 cents. A $1,000 investment for each buy is now worth $1,536. Wellgreen is updating its preliminary economic assessment (PEA) of its Wellgreen platinum group metal (PGM) project in the Yukon, with results expected in September. This work follows an updated resource estimate. The Wellgreen project contains measured and indicated resources of 5.5 million ounces of platinum plus palladium plus gold (3E), with a further 13.8 million ounces of 3E inferred. As well, it hosts 1.9 billion pounds of nickel and one billion pounds of copper indicated, with another 4.4 billion pounds of nickel and 2.6 billion pounds of copper inferred. These figures make the project one of the largest PGM deposits outside South Africa or Russia. Wellgreen's next steps are to complete the updated PEA, start a prefeasibility study right after that and start a full feasibility study next year. Mr. Roulston concludes that the company is "almost certain to rise in the near term" as investors start to appreciate its "world-class" project.

From their June 24 2014 news release:

"All Officers and Directors of the Company participated in the financing, subscribing for an aggregate of 535,769 Units. "

and that's at a price of $0.65 CDN, today's current value.

From WGPLF's website:

"Wellgreen Platinum Ltd. is a Canadian mining exploration & development company focused on the acquisition and development of platinum group metals (PGM) projects in politically stable, mining-friendly jurisdictions. The Company is led by a highly-experienced management team with a track record of successful large scale project discovery, development, operation and financing.

One of the few significant undeveloped PGM deposits outside southern Africa or Russia, our 100% owned flagship Wellgreen project in Canada's mining-friendly Yukon Territory is just 14km by all-weather road from the paved Alaska highway leading to deep sea ports in Haines and Skagway, Alaska.

To achieve our vision of developing into a significant global PGM producer, our primary strategy is to continue to advance the Wellgreen project towards production."

I agree! Bought 10k shares today. I think there will be a steady increase in the share price as the PEA on the Wellgreen project inches nearer.

new analyst coverage

H. C. Wainwright & Co., LLC is an investment bank dedicated to providing corporate finance, strategic advisory and related services to public and private growth companies across multiple sectors and regions.

The H. C. Wainwright team has been the leader in the PIPE (private investment in public equity) and RD (registered direct offering) transaction markets.

According to Sagient Research Systems, the team has been ranked the #1 Placement Agent in terms of the aggregate number of PIPE and RD transactions cumulatively since 1998.

H. C. Wainwright was established in 1868 and is headquartered in New York City.

At Surface and Out of Africa: CEO Greg Johnson on Wellgreen Platinum’s Yukon Project

Wednesday July 2, 2014, 3:30pm PDT

By Teresa Matich+ - Exclusive to Platinum Investing News

Share on email EmailShare on print Print

At Surface and Out of Africa: CEO Greg Johnson on Wellgreen Platinum's Yukon ProjectSouth Africa, long known as a platinum and palladium powerhouse, saw an end to a protracted miners’ strike last week. However, the white metals are still rallying, and South African mines will take time to ramp up production again. In light of those factors, investors and analysts may be interested in looking at companies that operate outside that country.

One such company is Wellgreen Platinum (TSXV:WG), which holds the Wellgreen deposit, a large PGM-nickel-copper deposit in Canada’s Yukon. It features mineralization that begins at surface rather than deep underground, making it noteworthy for miners and investors alike.

To find out more about the company, Platinum Investing News (PIN) spoke with Wellgreen’s president and CEO, Greg Johnson. In the interview below, the CEO discusses the unique characteristics of the Wellgreen deposit, the importance of PGM projects in mining-friendly jurisdictions and what’s next for Wellgreen Platinum.

Get the latest Platinum Investing News articles delivered to your email inbox. Learn more

Email Sign up

PIN: Just to start off with, I don’t think we’ve covered Wellgreen extensively on our network before, so could you tell our readers a bit about your company?

GJ: Wellgreen is a PGM-focused exploration and development company, and our primary asset is the Wellgreen project, which is located in the Yukon territory. It’s one of the largest undeveloped platinum and palladium resources in the world at about 10 million ounces, and it’s an open-pittable type deposit. This is quite unique in that most of the world’s platinum and palladium is concentrated in Southern Africa and Russia, so a large deposit in general is quite rare, and one that’s located in Canada in an open-pittable type configuration is even more scarce, so we’re seeing strong investor interest in the company. We just recently completed a $6.9-million financing that’s going to allow the company to move seamlessly into the prefeasibility level of activity this field season.

PIN: How does the Wellgreen deposit compare to others around the world?

GJ: Wellgreen is one of the largest undeveloped projects of its kind in the world, and has the potential to be a very significant producer. Most of the world’s platinum and palladium production is coming from deep, underground mines that are quite costly to operate, very labor intensive and don’t have the ability to really scale up the way you can with an open pit.

Our project is quite unique in that its very wide widths of mineralization start right at surface and are typically between 100 and up to 700 meters wide. So in many ways our project would look more like a porphyry copper-gold type deposit, except that our metals are PGM and nickel. This is a project that was historically developed back in the 1970s by HudBay Minerals (TSX:HBM) as a high-grade underground operation, but since the late 90s, the focus has been on looking at it as a bulk mineable deposit, and that has been the focus of Wellgreen Platinum’s activities as well.

PIN: Interesting. I’ve seen a few comparisons between platinum deposits; for example, Ivanhoe Mines’ (TSX:IVN) Flatreef deposit in South Africa vs. the Bushveld Complex. How does Wellgreen compare to that deposit?

GJ: In terms of comparison, what makes the Ivanhoe and Platinum Group Metals (TSX:PTM,NYSEMKT:PLG) deposits stand out from the others in South Africa is that even though they’re mostly underground, they have much greater widths of mineralization than is typical of the area. I believe with Platinum Group Metals it’s around 25 meters width and I think for Ivanhoe it’s up to 90 meters in width.

Our mineralization on the western end of the Wellgreen deposit, where it’s the narrowest, is about 100 to 200 meters in width, and it widens out to over 500 meters at surface in the central part of the deposit; it then expands to almost a kilometer wide at the eastern end of the deposit where it’s open. So it’s a very large system, and we’re also fortunate with the geometry, since mineralization starts right at surface as opposed to being a kilometer deep or more, which is more typical in South Africa and Russia. And that’s just really the result of the particular geologic setting that we have at Wellgreen, which means that it happens to be exposed right at the surface. That allows us to look at far wider zones of mineralization with a slightly overall lower grade because it’s open-pit mining cost as opposed to underground mining cost.

PIN: How unusual is it to have an open-pittable platinum deposit?

GJ: It’s quite unusual, around 95 percent of the world’s platinum production is from underground mines. There are a handful of projects in the first world that are open pit and those tend to be the lowest-cost producers. I think much like we’ve seen in the gold and the silver business over time we’re going to see a migration towards the lower-cost, higher-scale, open-pit type operations. The challenge is you have to have the right kinds of geology, the right rocks to host these deposits, and the ultramafic rocks that host ours are exceedingly rare; they only occur in a few places globally.

PIN: And you said there was historic mining in the area?

GJ: Yes, the historic infrastructure is still in place and available. We are right now updating our preliminary economic assessment on the project and targeting this summer for release. It will update the overall resource estimate on the project, as well address the major objective of converting a significant portion of the inferred ounces into measured and indicated.

Importantly, it will also update the overall approach to the mining of the project. The new approach that’s being developed is looking at a smaller-scale operation that has lower capital investment up front, but is focused on higher-grade material, so we think that should enhance the economics. Then, later in the mine plan, the project gets naturally wider as we start mining deeper and towards the east the project; at that point, we would likely scale up to a higher throughput level with the geometry of the deposit changing. And that could result in the project being one of the largest first-world PGM producers.

PIN: What does your timeline look like in terms of getting to commercial production?

GJ: Right now we are looking to start prefeasibility activities in the second half of this year. That would likely allow us to start feasibility activities in 2015, so potentially we could be looking at a construction decision in 2017, which would allow for first production in 2018 or perhaps 2019. For a development-stage project, it has the opportunity to move quite rapidly, and because the Yukon is one of the best jurisdictions for mining in Canada, there’s a very straightforward permitting and regulatory process to move the project forward to production.

PIN: Your website highlights the importance of your project being outside of South Africa and Russia, which have been problematic jurisdictions in the past, but are the world’s largest PGM producers. What is the importance of platinum and palladium projects outside of these jurisdictions?

GJ: Starting on the demand side in general, the fundamentals for platinum and palladium are quite different than what we see today in gold and silver. Platinum and palladium are also precious metals, but the single largest use for both is catalytic converters in automobiles. So we’ve basically seen nearly continuous demand growth since the mid-1980s for platinum and palladium, particularly for catalytic converters. As higher emissions standards are implemented in the first world and in the developing world, we’re seeing that growth continue.

That demand growth was matched up until the mid-2000s, with new mine supply of platinum and palladium as one might expect, but because of the challenges of mining deep underground in South Africa and in Russia, we’ve seen falling mine supplies since 2006 for platinum and since 2004 for palladium. The main decrease in supply on the platinum side was due to a decrease in production supply from South Africa, while the main decrease in supply of palladium came from decreasing supply out of Russia. So the opportunity to have a project located in Canada that has an open-pittable and very saleable configuration that could add to the source of supply outside of Southern Africa or Russia has real strategic value.

PIN: Given the current situations in Russia and South Africa, what do you think the future holds for PGM producers in North America?

GJ: Well, the trend was in motion well before the strike in terms of declining supply out of South Africa and Russia, so most analysts continue to project deficits in terms of mined supply vs. total demand for the metals. That’s obviously very bullish for projects that are in areas that don’t have the same kind of political and operating risks that we see today in South Africa and Russia. We would not expect that the removal of the strike would significantly change the overall fundamentals, and in fact, you’ve taken about a million ounces of platinum off the market this year from the strikes, so potentially with that lack of production taking away additional sources of supply for the market, I think analysts are expecting looking to see continued price increases looking forward to at least 2020.

June 24, 2014 – Vancouver, B.C. – Wellgreen Platinum Ltd. (TSX-V: WG, OTC-QX: WGPLF) is pleased to announce that it has completed its previously announced bought deal financing (the “Offering”) led by Dundee Securities Ltd., along with Edgecrest Capital Corporation, Haywood Securities Inc. and Mackie Research Capital Ltd. (collectively, the “Underwriters”), along with H.C. Wainwright & Co., LLC as U.S. Placement Agent. Pursuant to the Offering, 10,615,650 units of the Company (the “Units”) were issued, at a price of C$0.65 per Unit, for total gross proceeds of C$6,900,172, representing the base offering size of 9,231,000 Units and the exercise in full of the over-allotment option for an additional 1,384,650 Units.

The Company will use the net proceeds of the Offering toward initiation of Pre-feasibility studies on its flagship Wellgreen PGM-Nickel-Copper project, to further exploration and development of its properties and for general corporate purposes.

Each Unit consists of one common share (“Share”) of the Company and one common share purchase warrant (“Warrant”). Each Warrant entitles the holder thereof to acquire one Share at a price of $0.90 for a period of 24 months following today’s date. In the event that the Company’s shares trade at a closing price of greater than $1.35 per share for a period of 10 consecutive trading days, the Company may accelerate the expiry date of the Warrants by giving notice to the holders thereof and, in such case, the Warrants will expire on the 30th day after the date on which such notice is given by the Company.

Greg Johnson, Wellgreen President & CEO, states, “The Company appreciates the high level of participation from our existing shareholders and the strong level of interest from new investors in this offering. These funds will facilitate the continued advancement of our flagship Wellgreen project and will enable us to take full advantage of the field season to initiate Pre-feasibility-level work, while we finalize engineering on the updated Preliminary Economic Assessment.”

All Officers and Directors of the Company participated in the financing, subscribing for an aggregate of 535,769 Units. Pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions

And at this point do you have as an investor any major mining corporations or large mineral funds that will sort of provide the role of lead order in that financing? Greg Johnson: Yeah, we’ve got — a number of our existing shareholders have invested in each round of financing, including, putting in lead orders. We’ve got a number of new funds that are looking at the company in terms of new investment. These are names that are also invested in other platinum names and are groups that are putting capital to work today. In addition, we are already discussing the project and potential investment from a number of more strategic type investment groups. These could be groups that are affiliated with smelting groups, or some of the producers. I think we’ve got a number of irons in the fire that we’re pursuing. It is still fairly early days at Wellgreen, but there are so few assets of scale in the platinum space, particularly that would likely have an open pit mining cost structure and scalability, and I think as we get out this next set of studies on the resource and on the engineering, and as we’re advancing that we’re likely to see a lot of attention from those groups over the next couple of quarters and years.

Here is the latest...

CEO Greg Johnson provides an overview of Wellgreen’s renewed focus on bringing its flagship platinum-nickel-gold project into production with a revised (and smaller) capex approach, and the moves the company has made to strengthen both its management team and its share structure. Transcript: Greg Johnson: Well, it’s been a fairly busy period for the company. Our new management team all joined about 15 months ago, in late 2012 and at that point the Board brought in a new technically focused management group. We undertook a couple of important things over the last year plus. One was to comprehensively go back and compile all of the existing information on the project back to the 1950s to bring all that into a single database and systematize it and allow our geologists and team to really dive in, engage some of the leading experts in PGMs who helped us to be able to understand the Wellgreen system in context with other world class systems like Norilsk in Russia, the Bushveld down in South Africa. So our work with the new drilling, we have got almost 40,000 meters of new drill information that’s gone into the program since the 2011 resource estimate has really built our confidence in terms of understanding of the system. The early work in 2011 demonstrated that we had a very large system, mostly inferred, and the work that we’re doing now is really reinforcing the scale of the system, in fact, it’s demonstrating that we’ve got what’s effectively becoming a porphyry scale PGM System here, that’s open-pitable. In addition, there were some pretty important structural changes at the corporate level. We had a controlling shareholder that was around a 30% position that we placed entirely in 2013, in new hands, and that restructuring of the company resulted in new Board of Directors and effectively taking that over-hang from those stock sales from that financially distressed investor out of the way so that we would be in a position to be able to take the story out. James West: Okay, was that a Prophecy Coal you are referencing there? Greg Johnson: Prophecy Coal was the original control and shareholder in Wellgreen and they are now effectively completely out of the shares. James West: Okay. So what’s been happening since your new team has taken over? Greg Johnson: Well, in addition to the drilling, the development of the new geologic model, we have been undertaking as well, engineering and metallurgical test work. We’ve got a couple of major milestones here in the second quarter. We are looking to deliver an updated concept on the engineering and production for the project. We are looking at a smaller capital project focused on higher grade material, potentially an open-pit and underground combination operation, and we’re targeting an operation that could be the largest producer of PGMs in the first world, potentially larger than Stillwater; as our target for this project, and clearly the resource that’s coming together is demonstrating that this is a system that could be a very large producer for a very long period of time. In addition, we are getting set up to look at pre-feasibility activities, they are going to get kicked off in the second half of this year and we are targeting to be able to move into feasibility in 2015. James West: Hey, well that’s interesting. Have you been drilling all through the winter this year? Greg Johnson: We drilled up in through November and we’ve been releasing the results of a combination program, it was about 5000 metres of new drilling, including one of the widest intercepts ever hit on the property, 756 meters at almost 2 grams per ton, platinum equivalent. In addition, we had the benefit of being able to go back into historic drilling. Particularly drilling that was done in the 1980s, and we were able to re-log and resample many of it for the very first time, about 20,000 meters of historic drilling. So our combined program was about 25,000 meter program. And all of that is going to go into this new resource estimate that’s going to be coming out in the second quarter and the new preliminary economic assessment. James West: I see! Okay, so then — I had actually visited the Wellgreen project back in 2011 and at the time there was some discussion about a 16-17 kilometer strike length for the whole Wellgreen project. Is that still something that you feel comfortable sort of putting out there? Greg Johnson: Yeah, our property is about 18 kilometers long that we control a 100%. The main focus — we’ve got almost 800 drill-holes in the Wellgreen deposit proper, and that’s about a ten million ounce platinum equivalent resource for platinum, palladium and gold. Along trend of that, we have got a series of other deposits that are also associated with these ultramatic systems. (00:05:12) Most of the work on those was done in the 1980s. There really hasn’t been much more modern work done since that time. But we undertook some surveys on project, both of magnetics as well as surface sampling and we have identified two very high priorities areas. One that is the continuation of the Wellgreen to the East called Quill and that’s about a two-and-a-half kilometer long anomaly combination of soils and magnetics. And then the second is the Burwash area which historically was actually a separate property that was optioned by INCO and others looking for high grade massive sulfide deposits. And that deposit has a very strong signature similar in scale to Wellgreen itself, with historic drilling shallow holes, but some interesting results in some of that historic work. And with the new surveys that we have, we’ve got some very large targets that we’re hoping to be able to test this year. All of this is on the road. So all of this, if we can develop additional open-pitable resources could be processed through a centralized facility and all of it could be looked at as kind of a single coherent district James West: I see! Interesting! So those discrete deposits to the East that you mentioned in Burwash and Quill, are those — you don’t think those are contiguous possibly connected to the main Wellgreen deposit? Greg Johnson: Well, the geology is mapped as continuous. But we don’t have a lot of information on there yet. A lot of that is based on outcrop mapping and magnetics in particular. The Ultramatic Host Rocks for the deposits do have a high degree of magnetic minerals in them. So magnetics can be a very good tool, but until we actually have a series of drill-holes across those, it’s hard to say whether or not this is going to be continuous. Certainly when you look at Quill, and you look at the strength of the magnetic signature at Wellgreen, and the fact, that that runs unbroken into the Quill target, one could argue that there is a strong probability that there is continuation of Wellgreen into Quill. Burwash, it almost appears that there is a — the area that our main access road comes in and the Quill creek drains out of — it looks like there may be some kind of important structure; geologic structure that goes through there. And sometimes in geology and ore deposits, big structures can be important. So it looks like we may have a little different geometry as we get across into Burwash. And we don’t know what level we’re looking at in the system, we could be looking deeper than we are at Wellgreen. So we’re pretty excited to take a look at that and see what comes out of it. James West: Sure! Okay, so what is the drilling budget for 2014 in terms of dollars and metrage? Greg Johnson: So we’re basically looking to start a pre-feasibility level program in the second half of the year. So that’s probably going to kick off sometime in June. We are talking of $5-$10 million program, and actually that’s likely to be something that’s going to be in the 5,000-10,000 meter program combination, probably of reverse circulation and core drilling. We haven’t finalized, right now we’re going through and developing our priority target list, and I can tell you that our target list is probably going to be longer than what we’re going to be able to go after, so you know we’ll clearly be prioritizing within our priority list. But there are some very exciting targets. Some of the very best holes at Wellgreen have not had the natural step-out adjacent to them, and so, were going to want to test some of these targets at Quill and Burwash look like, very promising targets. So I think we would want to test some of those. So it’s going to be a combination of both, infill confirmatory work, as well as step out and expansion work and testing some of these new targets. James West: And I assume that’s all in support of an updated revised resource calculation? Greg Johnson: Yeah, so we’ll have an updated resource out this second quarter along with the updated economic approach looking at this smaller capital, higher grade start-up concept. And then, we would look to put out a pre-feasibility update to that probably early in 2015 and then begin the feasibility work in the remainder of 2015, with potentially permits could be completed by late 2016 on the projects. (00:10:03) So, we do have the opportunity that this thing can move quite rapidly, particularly mining is the industry in the Yukon, as you know. So they’ve got a good process in terms of going through environmental assessment, The Kluane First Nations are strong supporters of the project and we see the project being able to move fairly quickly through that process. James West: Sure! Okay, so in terms of financing a $10 million drill program in 2014, does Wellgreen have that capital in the bank? Greg Johnson: We are going to need to raise some money, and so we’re basically going to be looking to raise, probably something in the $5-$10 million range. It’s depending on the outcome of that investment round, that’s going to kind of set the plans in terms of how much work will be done in the summer or into the fall. But that work would be specifically targeted towards that next major milestone of the completion of the pre-feasibility studies. James West: I see. And at this point do you have as an investor any major mining corporations or large mineral funds that will sort of provide the role of lead order in that financing? Greg Johnson: Yeah, we’ve got — a number of our existing shareholders have invested in each round of financing, including, putting in lead orders. We’ve got a number of new funds that are looking at the company in terms of new investment. These are names that are also invested in other platinum names and are groups that are putting capital to work today. In addition, we are already discussing the project and potential investment from a number of more strategic type investment groups. These could be groups that are affiliated with smelting groups, or some of the producers. I think we’ve got a number of irons in the fire that we’re pursuing. It is still fairly early days at Wellgreen, but there are so few assets of scale in the platinum space, particularly that would likely have an open pit mining cost structure and scalability, and I think as we get out this next set of studies on the resource and on the engineering, and as we’re advancing that we’re likely to see a lot of attention from those groups over the next couple of quarters and years. James West: Sure! Okay, now what about infrastructure? It seems to me that there were some challenges there in terms of energy, electricity etcetera. Has there been any progress on that front since 2011? Greg Johnson: I mean the Yukon energy is one of the main issues for all projects. Now fortunately, we’ve got the highway that goes past the project and we’ve got our year round access road and the two ports. The one at Skagway and the one at Haines are already in place with capacity to be able to handle our concentrates. So really when we talk infrastructure, for our project, it mostly is about energy with the access roads and things already there. The Yukon has about 20 MW of capacity on the grid. There is a high capacity line near Haines junction which is a about 100 kilometers from the project down the highway. LNG is definitely coming to the Yukon; there is a couple of initiatives that are underway now. The State of Alaska’s Industrial Development Bank is putting in place an LNG facility in Fairbanks, Alaska. They’ve completed their feasibility and they’ve gone to tender for the groups that’s going to construct that, and that’s supposed to be up and running by late 2015. So that’s a possible source for us, and in fact, we are in discussions with the Alaska Industrial Development and Export Authority right now about a potential MoU on that source of LNG. In addition, about 95% of the Yukon grid is hydroelectric, about 5% of their power comes from diesel and they are upgrading those sets to become LNG and are actually in the construction phase on their first LNG plant that would be tied into the grid now in Watson Lake. So the Yukon Energy Corporation is going to be bringing LNG to the territory for that. So we are going to be looking for this next study, the PEA that was done in 2012, we used diesel as its assumed power source. We are likely to be looking at an LNG-base case, which could be a significant reduction in the cost assumptions for power and it looks like we’ve got two or three different potential sources along with investigating whether or not it may make sense to extend the power line from the main Yukon Energy Corporation Grid. James West: Oh well, great! So it sounds like you’ve got options there. That sounds great Greg! Thanks for taking the time. We’ll catch up with you in the next couple of quarters and see how you are making out. Greg Johnson: I really appreciate your time and look forward to providing you further updates. James West: Thanks very much Greg!

June is it...

CEO stated on Jay Taylor that approxomately 90% of inferred will go to M&I

Wellgreen mineral resource & grades from Wellgreen Project Preliminary Economic Assessment, Yukon, CA, effective Aug. 1, 2012 (Wellgreen PEA)

447Mt@ 0.87g/t PGM+Au, 0.31%Ni, 0.25%Cu

(Inferred Resource) at a 0.2% Ni Eq. cut-off

400MT (ish)

_________

_________

add in RE's

the picture is coming clearer every day...most will "get it" around June

______________________________________________________

Then they will figure out what negative cash costs are

nickel and copper pay for miining and PGM's are "free"

CEO Interview 4/8/14

http://jaytaylormedia.com/audio/

First Nations, industry plot a new way forward

Eva Holland Friday March 28, 2014

Ian Stewart/Yukon News

p3Alatini.jpg

Kluane First Nation Chief Math'ieya Alatini says she's found the ingredients for a healthier relationship between Yukon First Nations and the mining industry.

At the fifth annual Yukon First Nations Resource Conference in Whitehorse this week, the emphasis was on partnerships and communication.

The two-day conference, which took place Wednesday and Thursday, featured panel sessions with titles like “Working Together to Explore for More,” “Project Certainty through Respectful, Honest and Trusting Relations,” and “Mining: An Economic Opportunity for First Nations.”

Set against the backdrop of ongoing First Nations lawsuits against the Yukon government over mining-related issues, the pitch was clear: engaging respectfully with First Nations can be a net good for the industry, and mining can also be a boon for those First Nations that embrace it.

The final session of the conference, “Advancing Projects and Partnerships,” featured Chief Math’ieya Alatini of the Kluane First Nation as well as representatives from Kaminak Gold Corp. and Wellgreen Platinum.

Allison Rippin Armstrong, director of lands and environment for Kaminak, spoke from an industry perspective about the hows and whys of engaging with First Nations. She argued that exploration companies should not just inform First Nations about their projects and plans, but also listen and ask questions - about wildlife movements, culturally significant sites, and other sensitive areas that can derail a project.

She suggested that open communication, environmental monitoring, cultural significance studies and even reclamation studies should begin before the project begins to have any impact on the land - not after.

By working closely with First Nations and local communities from the outset, she said, “you improve the likelihood of successful and timely permitting. You have a true partnership going into the construction of your project.”

Chief Alatini spoke next, explaining that her drive to engage actively with the industry was a result of her election in 2010, in the midst of an enormous staking rush. The activity, she said, was overwhelming - so the KFN responded by gathering industry and First Nations experts and sitting down to analyze the First Nation’s capacity to provide services to industry, as well as its needs and how industry might be able to help meet them.

The KFN revived its then-defunct Kluane Development Corporation and also created a second institution, the Kluane Community Development Corporation - while the former would focus on wealth generation through tools like limited partnerships and investments, the latter would provide support to local businesses and help to create support services for industry.

The most notable project on KFN land right now is Wellgreen Platinum, which is touted as one of the world’s largest undeveloped deposits of platinum and its related group of metals. Located just off the Alaska Highway north of Burwash Landing, the Wellgreen deposit was mined briefly in the 1970s. If it’s revived as a working mine it has the potential to be the third-largest producer of platinum in North America.

The project is noteworthy not only because it’s a deposit of rare and in-demand platinum, but because when Chief Alatini signed an impact benefit agreement with then-owner Prophecy Platinum in August 2012, the Kluane First Nation received an unspecified number of shares alongside the usual education and employment incentives. Wellgreen was just the third mining project in the North to offer shares to a First Nation - two others, Brewery Creek and the N.W.T.‘s Nechalacho rare earths project, signed similar agreements in July 2012.

Chief Alatini has ambitious plans for her First Nation’s involvement in the potential mine. “If the mine site goes ahead, we want to be ready for it,” she told the conference attendees. The KFN wants its citizens to get the training necessary not just for unskilled positions - “we want geologists, engineers,” she said. “We want to see highly skilled individuals with the ability to establish long careers.”

The First Nation is looking into ways to provide an array of services to the mine site, from haulage and camp services to employee housing and roadwork. It’s even contemplating the possibility of building its own LNG power plant, to power the mine and to reduce the community’s reliance on diesel.

The KFN is also involved in the planning for the mine, with quarterly meetings to discuss environmental stewardship, reclamation plans, and other issues. They’re planning for “seven generations,” Alatini said. “It’s a very collaborative approach and it’s working for us.”

After the panel, Chief Alatini spoke to the News about her approach to dealing with industry. “We didn’t want to just be reactive, we wanted to be pro-active,” she said. “I think the way we’ve engaged all the industry players that have been in our area, we’ve developed really good working relationships with them.”

She isn’t afraid to say no to industry when necessary, she said. “We’re able to do that in a respectful manner that doesn’t have to be in the media and doesn’t have to be in the courts. We’re able to sit down and say ‘This is not going to work for us.’”

Her advice for First Nations looking to work directly with the mining industry: “Know what your parameters are. Know what you definitely don’t want. Know your limits. And then get informed about the industry so that you’re making informed decisions.”

As for the industry, she says that reaching out to local First Nations is the first step. “Call, number one. Create awareness about your project and your intent.” The second step? “Be prepared to answer some questions but also to ask questions. Are there concerns?”

“Those are the ingredients,” she said, for a healthier relationship between Yukon First Nations and industry.

Wellgreen Platinum Announces Warrant Exercises for Approximately $1 Million

Print Friendly Version of this pagePrint Get a PDF version of this webpagePDF

March 28, 2014, Vancouver, B.C., Wellgreen Platinum Ltd. (TSX-V: WG, OTC-QX: WGPLF) announces that, over the course of the past few weeks, 903,636 warrants were exercised at $0.80 and 300,000 warrants were exercised at $0.90 resulting in a total of 1,203,636 common shares of the Company being issued from treasury for total proceeds to the Company of approximately $1.0 million.

In addition, the Company has applied to the TSX Venture Exchange (the “Exchange”) to amend the expiry date of 2,533,604 warrants that were granted by the Company on July 31, 2012 with an expiry date of July 31, 2014, and 1,250,000 warrants that were granted by the Company August 29, 2012 with an expiry date of August 29, 2014 (together, the “Warrants”). Subject to Exchange approval, the term of the Warrants will be extended to September 29, 2016, in accordance with the policies of the Exchange. All other terms of the Warrants, including but not limited to the exercise price of $2.00 and the “accelerator” clause whereby Wellgreen Platinum can require that all Warrants be exercised within a 30 day period in the event that the closing price of the Company’s common shares on the Exchange exceeds $2.80 for ten consecutive trading days, shall remain unchanged.

The Company has amended the maturity date from March 31 to December 31, 2014 for loans aggregating $0.9 million that the Company advanced to its senior management team in order to assist them in participating in the $5.9 million equity financing of the Company that closed on June 20, 2013 (the “Placement”). All other terms of the loans remain unchanged, including that the Company holds as collateral for the loans, all shares and warrants subscribed for by the loan recipients under the Placement, and the amended loan agreements will be available under Wellgreen Platinum’s SEDAR profile at www.sedar.com.

About Wellgreen Platinum

Based in Vancouver, Canada, Wellgreen Platinum Ltd. is a platinum group metals focused exploration and development company with advanced Canadian projects in the Yukon Territory and Ontario. Our 100% owned Wellgreen PGM-Ni-Cu project, located in the Yukon, is one of the world’s largest undeveloped PGM deposits and one of the few significant PGM deposits outside of southern Africa or Russia. Our Shakespeare PGM-Ni-Cu project is a fully-permitted, production-ready brownfield mine located in the well-established Sudbury mining district of Ontario.

Our experienced management team has an extensive track record of successful, large-scale project discovery, development, permitting, operations and financing combined with an entrepreneurial approach to sustainability and collaboration with First Nations and communities.

SA

Sprott's Thoughts on Platinum in SA

Sprott's Thoughts

March 28, 2014

South Africa: Platinum, Gold Miners and Workers Are Stuck – Nick Holland, Gold Fields By Henry Bonner (hbonner@sprottglobal.com) Read online Nick Holland, CEO of major gold miner Gold Fields Inc., has become well-known for his approach to reconciling state and workers’ demands with the drive to maximize shareholder earnings. He helped propose the current sliding tax system in Peru – where tax rates depend on metals prices. The deal helps miners maintain their production during tough times, while government enjoy a higher take when miners are most profitable. On a call to his offices in South Africa, I asked Mr. Holland to comment on the situation unraveling on the ground there. An eight-week strike by the South African Association of Mineworkers and Construction Union (AMCU) mining union has blocked operations at platinum producers Anglo American Platinum Ltd. (Amplats), Lonmin Plc., and Impala Platinum Holdings Ltd. (Implats). As of March 21st, losses to these companies’ revenues were 9.4 Billion South African Rand, or around $865 million, because of the strikes2. “Unfortunately, I believe the miners will not be able to get what they want from the big mining companies,” said Mr. Holland. “The real issue in South Africa is that there is a very big gap in incomes,” he continued. “You have a situation where unions are now becoming much more aggressive in terms of what they want as base wages. “This comes against a backdrop in the platinum industry where the price of platinum has come down and costs are escalating rapidly. Producers are not in a position to give more – otherwise, they will roll over.” It’s not simply that mining companies pay too many taxes to be profitable, he adds: “I don’t think that the taxes we pay here are out of line with worldwide taxes. I think that taxes are reasonably competitive and fair. “ “I think that there is probably a big political undertone in the actions of the new dominant union – the AMCU – which is leading the strikes. They are trying to score points in the political arena – independent of the economic viability of their demands.” Is there any resolution in sight? Can mining companies meet the workers’ terms? “Well, it seems like there is not much room for compromise. Miners cannot pay more because productivity has declined as the mines have gotten deeper, and as the ore bodies grow further away from the surface. The costs of mining have thus gone up, but productivity has not matched it. “Meanwhile, the industry is simply carrying too many people. Mechanization of mines – which requires less labor – is severely lagging the rest of the world. Over the past 40 years, Australia and Canada have gone through the mechanization revolution, but South Africa has stuck with the old labor-intensive mining methods. “The platinum and gold industries carry about 280,000 employees. With the kind of increases that these workers want, you will need gold and platinum prices substantially higher than where they are today – assuming costs do not rise as well. “Because of strikes and political action, wages have actually risen faster than inflation over the past, while productivity has decreased. I am afraid that there is no easy solution at the moment. “In fact, you will notice that we have decreased our exposure in South Africa over the years. Our only remaining mine in South Africa is mechanized and employs only around 4,000 people. We have chosen to replace our production with mines in new jurisdictions, including Peru, Ghana, and Australia.” Nicholas Holland was appointed an executive director of Gold Fields in 1997 and became CEO on 1 May 2008. Prior to that, he was the Company’s CFO. Mr. Holland has more than 31 years’ experience in financial management, of which 23 years were in the mining industry. Prior to joining Gold Fields, he was Financial Director and Senior Manager of Corporate Finance at Gencor

Spoke too soon. WTO says China violated International Trade law when it limited Rare Earth exports.

updated corp presentation

there is a few newer items...really looking at the plat and pall side of this mine

also gives timelines from here to mine open

and...Shakespeare info...

Assuming OPEX reduction and stabilized metals prices, minimal capital required for potential

2014 restart as direct shipping operation

Significant Production & Near Term Cash Flow Potential

• Average annual production of 25,000 oz PGMs+Au, 8M lbs Ni and 10M lbs Cu over the life of

the mine plan

• Potential for significant near-term cash flow generation

http://www.wellgreenplatinum.com/pdf/Wellgreen_Platinum_Corporate_Presentation.pdf

Updated Resource Estimate and PEA targeted in Q2-2014

• Pre-Feasibility studies targeted to begin H2 - 2014

Resampling of over 8,136m of core from over 16,000m of historic drill holes that were previously only

selectively assayed in narrow, massive sulphide intercepts

• 4E (platinum, palladium, rhodium + gold), Ni, Cu, Co analysis in progress with quality control measures

in place to ensure compliance with NI 43-101

• Data from across deposit will be available for inclusion in 2014 updated Mineral Resource Estimate

http://www.kitco.com/news/2014-03-21/Palladium-Hits-800Oz-On-News-Of-ETFs-On-Top-Of-Supply-Issues.html?sitetype=fullsite

Maybe Russia gets this moving, like China did to the Rare Earth Elements (Molycorp). Palladium highest since August 2011.

TGR: Do you have any picks in the platinum space?

LR: Within the precious metal realm, platinum has very favorable economics, even better than gold. Platinum is primarily an industrial metal and its fundamentals are very positive. There are not a lot of platinum companies to choose from. I particularly like Wellgreen Platinum Ltd. (WG:TSX.V; WGPLF:OTCPK;). The company's new management team has re-evaluated what was previously seen as a large, low-grade nickel-copper deposit. Now, that type of deposit often has platinum associated to it. Wellgreen re-thought its geological approach and re-assayed a lot of the old drill core. Then, it drilled new holes and confirmed its new geological interpretation: It is now looking at one of the most attractive, undeveloped platinum deposits on the planet.

base metal streaming.

TGR: Please explain the nature of this streaming.

LR: Most investors in the precious metals sector are familiar with Silver Wheaton Corp. (SLW:TSX; SLW:NYSE) and its silver streaming strategy. Streaming is fronting the cash to buy the right to the output of a particular metal over the life of a mine. Silver Wheaton has put up billions of dollars to assist a large number of companies to bring their mines into production or to expand existing operations.

This private equity group is doing it from a different perspective: It looks to stream only the byproduct—the base metals production—of a precious metal company. The company gets access to capital and is able to keep control of its precious metal production. The public companies in this space get a higher multiple on income from precious metals than they do on income from base metals. Streaming is basically a value creating mechanism.

TGR: Who else does this?

LR: A number of private equity groups are looking at doing it. But we have not seen any other transactions of the type that we did with Western Pacific Resources—streaming a byproduct from a precious metal-dominant mine. Sandstorm Metals & Energy Ltd. (SND:TSX.V) streams, but its deals access the dominant base metal stream.

TGR: Any final thoughts about gold today?

LR: The message for the non-crybabies is that the resource market is notoriously cyclical and it makes a whole lot of sense to come in at the bottom of the cycle. Evidence is mounting that we are close enough to the bottom of the gold cycle and the resource market cycle that this is a good time to acquire shares in the best quality junior companies.

TGR: Have a good day, Lawrence.

LR: Thank you.

Lawrence Roulston is an expert in the identification and evaluation of exploration and development companies in the mining industry. He is a geologist, with engineering and business training, and more than 30 years of experience in the resource industry. He has generated an impressive track record forResource Opportunities, a subscriber-supported investment newsletter. Roulston has launched an investment fund, the Metallica Development Fund, to take advantage of severely oversold positions in high-quality resource companies. The focus of the fund is on companies with production and/or advanced-stage exploration and development projects—companies with potential for near-term recovery in value that also have potential for longer-term growth.

New results from shallow drilling in the Central Zone have also confirmed the presence of areas with higher grade mineralization beginning from surface. Hole 222 intercepted 163.0 metres grading 2.20 g/t Pt Eq. or 0.53% Ni Eq. from surface, including a 24.0 metre section grading 5.22 g/t Pt Eq. or 1.26% Ni Eq. Hole 138, approximately 56 metres West of hole 222, intercepted 74.9 metres at 2.72 g/t Pt. Eq or 0.65% Ni Eq., including 26.8 metres at 5.10 g/t Pt. Eq. or 1.22% Ni Eq. Future drilling and metallurgical testing will evaluate the potential extraction of these mineralized areas as near surface starter pits designed to provide higher grade mill feed early in the life of the mine.

Greg Johnson, Wellgreen Platinum's President and CEO, stated, "The identification of this band of higher grade mineralization in the Central Zone is very significant. This material is located just 50 metres from the existing underground workings, which could make this area amenable to low cost development. The updated preliminary economic assessment planned for Q2 will evaluate a combination of open pit mining and selective bulk underground mining of higher grade material at a reduced capital spending level. One of our key goals over the past year has been to develop a high confidence, predictive geologic model for Wellgreen to identify the controls to, and location of, higher grade mineralization in the deposit. The work on the model over the past year has significantly advanced our understanding and confidence in the geologic model and supports the upcoming resource update that will be the basis for the new engineering approach to the project. This new model shows that PGM-Ni-Cu mineralization occurs both within the often very high grade contact related zones that were the focus of historic mining and exploration as well as in the broad bands of higher grade mineralization up to 500 metres thick in the core of the ultramafic bodies that have been intercepted over one kilometre of strike length from the Far East Zone to the Central Zone."

Investors should note that Wellgreen is a polymetallic deposit with mineralization that includes the platinum group metals (PGMs) platinum, palladium, rhodium and other rare PGM metals along with gold, nickel, copper and cobalt. At current metal prices using anticipated metallurgical recoveries and proportionally allocated costs for each of the metals, the net economic contribution is anticipated to be largest for platinum, palladium and gold (3E elements), followed by nickel and then by copper and cobalt.

http://media3.marketwire.com/docs/303wg_figure1.jpg

http://media3.marketwire.com/docs/303wg_figure2.jpg

These bands of higher grade mineralization are open to expansion to depth and further along trend towards the west. The Company continues to receive and interpret final assay results from additional holes drilled in the last program, as well as results from the re-logged and re-sampled historical drill holes. Results from the West and Far West Zones in the Wellgreen deposit are currently being integrated into the model and additional results are anticipated to follow in future updates.

March 3rd news release...

Metallurgical and Engineering Update

Metallurgical optimization test work continues on representative samples from disseminated mineralization at Wellgreen. Testing has focused on optimizing the process flow sheet, grind size and reagent selection for the mineralized samples. Current work has been advanced using a conventional copper flotation process followed by magnetic separation to increase recoveries of PGMs prior to nickel flotation. Batch sample test work continues and includes optimization of the magnetic separation process, grinding requirements and evaluation of the extraction of the rare PGMs (rhodium, iridium, osmium and ruthenium) in addition to platinum, palladium and gold. Upon completion of the batch sample test work, the metallurgy team will commence locked cycle tests on composite samples. The results from this metallurgical test work will be used to generate recovery and concentrate grade assumptions for the Preliminary Economic Assessment (PEA) update in Q2-2014.

Engineering studies are also under way to look at optimizing the project using a staged production approach that will review a series of lower capex throughput with higher grade extraction concepts as compared with the 2012 PEA. In addition scenarios will also be evaluated to assess the optimal larger-scale production level that fully attains the economic potential of the resource to which the project may ultimately expand. Studies are also being completed to select optimal locations for mine infrastructure, which includes the camp, mill, water treatment plant and the tailings storage facility.

and...

SA

Wellgreen Platinum: A Gem Amongst The Rubble - Genuine '10-Bagger' Upside

Jan. 21, 2014 3:00 PM ET | About: WGPLF

This article is now exclusive for PRO subscribers.

Editor's notes: New management is among a series of positive catalysts and events that could drive WG.V higher. The platinum miner may make a mint for investors as an acquisition target.

(Editors' Note: Wellgreen Platinum trades under the symbol WG.V on the TSXV with average daily volume of ~$40,000 CAD)

Wellgreen Platinum: (OTCQX:WGPLF) (WG.V) Our 5-month investigation concludes that Wellgreen has the best Risk vs. Reward within the Platinum/Palladium sector:

Platinum/palladium supply remains at a significant deficit. ETF demand doubled in 2013.

Wellgreen Platinum holds one of the largest PGM deposits in the world; the Canadian location is ideally situated for off-take shipment to Asian smelters.

93% of global Platinum supply (83% of Palladium) comes from Russia, South Africa or Zimbabwe. High risk of supply shock. Labor unrest growing.

Recent Indonesia action banning export of unprocessed minerals will lead to an estimated 234,000 tonnes of unused capacity,

Only subscribers can access this article, which is part of the PRO research library covering 3,536 different stocks.

Growing numbers of fund managers and other investment professionals subscribe to Seeking Alpha PRO for equity research that is unavailable elsewhere, so they can:

Research new investment ideas

Reduce risk

What is possible PRICE TARGET

for this stock, let's say for the next 1-3 years from now ?

10 Pulsations

1) Looking at the Ashburn Ventures and the Caribou King properties and the activity in monies spend in the very recent past, they are willing to bet on the Kluane Ultramafic Belt, and located next to our Wellgreen Platinum project.

2) The addition of Greg Johnson as our CEO and the team he has assemilated, he does not get involved in project unless they are Big.

3) The ore body keeps growing will every assay and drilled hole, we are open at depth and width still, never thought I would love the far east area as much as I do to date! Drill, baby, drill.

4) We know we will at least double the size, if not triple, with the new 43-101 coming Q2.

5) Also having an updated PEA with the targeted higher grade starter pit and proper CAPEX in place, ensures the market to understand the complexity of deep evaluation of multiple metals like we have here at Wellgreen, also around end of Q2

6) The well seasoned government in the Yukon that truely understands their role of actually helping a company thru the permiting process to establish a mine.

7) The local First Nation involvement in this project and their willingness to partner along side.

(do not underestimate these last two)

8) Open pitable mine, nearly scratching the surface, with a mine life extending beyand the 37 years stated in the past PEA, as the ore body increases in size.

9) Transportation, deep sea ports, LNG, possible hydro, new met testing with higher % of recovery very possible, etc

10) ahh, ten, the fact that there are signed confidentiality agreements with possible joint venture partners AND producers at this time.

considerations: A) Do we prefer a joint venture? what terms?

B) Do we want a buyout? when? $$$?

C) Do you like pina coladas?

toss out your opinion

amazing the ore width and depth

and open ended...please understand this massive deposit...or find someone that can comprehend the drilling and assay results

AND that they have multiple companies that have signed confidentiality agreements...these are serious buyers looking at the documentation details of the company!!

we will be bought out.

Prophecy Platinum Corp., PNIKF changed to Wellgreen Platinum Ltd., WGPLF:

http://www.otcbb.com/asp/dailylist_detail.asp?d=12/18/2013&mkt_ctg=NON-OTCBB

|

Followers

|

17

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

78

|

|

Created

|

07/25/11

|

Type

|

Free

|

| Moderators | |||

The 100% owned Wellgreen project hosts a large PGM-Ni-Cu deposit located just off the Alaska Highway in the southwest of Canada’s mining-friendly Yukon Territory. A 2012 Preliminary Economic Assessment (“PEA”) on Wellgreen estimated open pit production potential of 7 million ounces of PGM + gold, 2 billion pounds of nickel and 2 billion pounds of copper over a 37 year mine life (please refer to footnote disclosure on the PEA below)1. The Wellgreen property features excellent access and transportation infrastructure and the deposit is just 15 kilometres by all-weather road from the paved Alaska Highway, a major all-season trucking route leading to deep sea ports at Haines and Skagway, Alaska. Ranked in the top 20 mining jurisdictions globally in the 2013/2014 Fraser Institute Survey of Mining Companies, the Yukon has a rich mining heritage that dates back to the Klondike gold rush of the late 1800s.

Wellgreen Platinum is focused on the advancement of the Wellgreen project toward production, with current efforts underway designed to further define the mineral resource, evaluate overall project economics, simplify project financing requirements and complete environmental permit applications.

The Company expects to release the results from an updated PEA by the end of Q2 2014.

The Company anticipates releasing the results of an updated PEA on the Wellgreen project in Q2 2014 and associated engineering studies on pit designs, the location and general arrangements of the mill, tailings pond, waste piles, water treatment system, accommodations, and water (domestic, potable and process) are in progress. The updated PEA will consider Liquefied Natural Gas (LNG) as a primary power source rather than higher cost diesel, which was the primary power source in the 2012 PEA. The project team is investigating a staged capex approach with a lower production rate than the 2012 PEA during the initial years of operation with the goal of decreasing pre-production capital expenditures. The Company will also evaluate the economics of larger production scenarios in the PEA update.

The Company has continued environmental baseline studies and First Nations consultation in order to begin the environmental assessment process in 2015.

Mineralization at Wellgreen has been defined over a strike length of approximately 2.5 km and is open in most directions. Drilling conducted since 2012 has identified a nearly continuous zone of disseminated PGM, nickel and copper mineralization in ultramafic intrusive rocks, starting from surface and continuing down to 200-500 metres, with a higher grade package of ultramafics lower in the section of up to 150-300 metres with substantially higher PGM grades.

An updated geologic model for the project that integrates all existing geologic information is being developed as part of work to provide an updated resource estimate for the PEA update and which allows for the development of priority targets for future testing.

The 2013 Project Activities are summarized as follows:

The Company has conducted a thorough technical review of the Wellgreen project, including a comprehensive assessment of exploration results back to the 1950’s. With the historic focus on high grade massive sulphide occurrences amenable to narrow seem underground mining many of the historic drill holes were only selectively assayed for high grade mineralization. With a focus on the bulk mining potential of the deposit the Company has re-logged and completed continuous assays where possible sampling all of the material within the mineralized ultramafic host rocks.

On July 17, 2013, the Company announced the commencement of the 2013 exploration field program. Metallurgical test work and engineering initiatives had also commenced at that time. Comprehensive re-logging and cataloging as well as re-sampling of historic drill holes has now been completed and is being integrated and interpreted. The total re-logging and re-testing program completed to date is 18, 377m.

RE-ASSAYING PLAN VIEW

A targeted surface exploration drilling program, designed to upgrade a portion of the Inferred resource as well as test potential higher grade zones also commenced in July 2013. This drill program was completed near the end of November 2013. The program included deeper holes from surface designed to pursue higher grade PGM mineral resources as well as a number of shorter holes designed to increase confidence in the model and upgrade portions of the resource to Measured & Indicated resources from Inferred.

All of the historical exploration data that was re-evaluated along with most recent drilling programs will be utilized in an updated deposit model that is projected to be completed by Q2 2014 and will be part of a PEA update. The above image shows the locations of the historic holes that were re-logged and assayed in 2013 and early 2014.

As noted above, extensive work conducted on the geologic modeling of Wellgreen revealed some exciting new potential developments. The modeling work started in the center of the deposit with the most concentrated drill information and moved out from there to both the easternmost and westernmost ends where less information was available. This work has been aimed at increasing confidence in the resource model, defining new bulk mineable zones of mineralization that have not been previously recognized as well as better defining the geometry and distribution of higher grade material in the resource.

2.5Km Strike: Open East / West and at Depth

Work to date has allowed the Company to identify three promising target areas with wide intervals of higher grades:

Market conditions in the resource sector have led major institutional investors to focus on projects with lower pre-production capital requirements over those with large scale high initial capex expenditures. To address this, the Company is analyzing first-stage operations targeting a lower production rate and a significantly reduced capex scenario as compared to the 2012 PEA1. The full text of the 2012 Wellgreen PEA is available here and under the Company’s SEDAR profile at www.sedar.com.

The metallurgical test work upon which the 2012 PEA was based was preliminary in nature and attained the initial objective of demonstrating the material would report to a conventional sulfide flotation circuit bulk concentrate. Subsequent metallurgical testing has supports the potential of using conventional sulphide flotation methods to produce separate nickel and copper concentrates (click here to view the 2012 metallurgy report). The metallurgical testing also indicated opportunities to optimize recoveries, improve concentrate quality, and pursue recovery of rhodium, ruthenium, osmium and iridium.

Mr. Mason began his career and traditional training with Deloitte LLP as a Chartered Accountant, followed by Homestake Mining Company (merged with Barrick Gold Corporation) in mineral exploration, construction and operations reporting.

COMPANY WEBSITE

http://www.wellgreenplatinum.com/

4/14 JAMES WEST INTERVIEW