Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Thanks for the up-date NYBob,

Been in VATE for awhile...

chevy56

GLTA

Central Shaft sinking at Blanket mine expected to be finished in a matter

of weeks!

Update from @CaledoniaMining following its quarterly results.

Mark Learmonth, CFO, speaks to Charlie Gibson on the Bw Business News via

@CoreFinanceTV ??

http://ow.ly/27dy50ufNYG #gold #mining

Bw Business News – Mark Learmonth, CFO – Caledonia Mining

Core Finance

Published on 17 May 2019

Chevy56 Great News: Caledonia lauds Govt on gold price -

16 May, 2019 - 00:05

Tawanda Musarurwa

Toronto Stock Exchange-listed and Zimbabwe-focused mining firm,

Caledonia Mining Corporation says it is encouraged by efforts

being made by the Government in improving the country’s business

environment including the recent setting of a new gold support

price.

Last week, Fidelity Printers and Refiners (a subsidiary of the

Reserve Bank of Zimbabwe) announced that it had raised the price

it pays for gold to US$44 000 per kilogram or

US$1 368,55 an ounce.

The new price is a premium of approximately $86 per ounce to the

spot price in London.

“Notwithstanding the challenges experienced in the quarter,

we remain encouraged by the overall direction of policy

development which we believe will result in improved operating

conditions and a better investment climate in Zimbabwe.

https://www.herald.co.zw/caledonia-lauds-govt-on-gold-price/

Tower of Hanoi' welcome to 'Caledonia Mining Corporation (CMCL

following mark #5 to you -

In GOD We Trust -

image: https://www.kitconet.com/images/live/au0001wb.gif

image: https://www.kitconet.com/images/live/ag0001wb.gif

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

glad to get rid of this low cost , low divided, bush-fever swine hunt

Newmont's Buyout Offer Cleared by Goldcorp's Shareholders

Newmont Mining Corporation’s NEM proposed merger with Goldcorp Inc GG has been approved by the shareholders of the latter. Goldcorp’s shareholders have voted in favor of the plan of arrangement for the proposed merger at a special meeting held on Apr 4.

Goldcorp’s move was welcomed by Newmont as the companies are a step closer to form a leading gold business in terms of assets, prospects and resources. Notably, the transaction was approved by more than 97% of the votes that were cast by Goldcorp's shareholders either in person or by proxy at the meeting.

Newmont will arrange a special shareholder meeting on Apr 11, 2019, where its shareholders will be asked to vote on the issuance of Newmont common shares related to the proposed transaction with Goldcorp. The companies expect the deal to close in second-quarter 2019, which is subject to approval by Newmont’s shareholders along with satisfaction of customary closing conditions and regulatory approvals.

Post merger, the newly-formed entity will be known as Newmont Goldcorp. It is expected to deliver a total of $365 million in annual pre-tax synergies, supply chain efficiencies and full-potential improvements. This represents the opportunity to create $4.4 billion pre-tax net present value.

Moreover, the company will be able to leverage its combined scale, targeting a profitable gold production in the range of 6-7 million ounces over the long term. The deal offers an investment-grade balance sheet and financial flexibility to pursue promising projects that are capable of generating a targeted IRR of minimum 15%. It will have the largest gold reserves and resources in the industry, including on a per share basis.

Newmont’s shares have lost 5.4% in the past year, against the industry’s 4.5% rise.

Zacks Rank & Key Picks

Newmont currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Kirkland Lake Gold Ltd. KL and Ingevity Corporation NGVT, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kirkland has an expected earnings growth rate of 8.8% for 2019. The company’s shares have surged 104.4% in the past year.

Ingevity has an expected earnings growth rate of 17.9% for the current year. The company’s shares have rallied 53.7% in a year’s time.

Is Your Investment Advisor Fumbling Your Financial Future?

See how you can more effectively safeguard your retirement with a new Special Report, “4 Warning Signs Your Investment Advisor Might Be Sabotaging Your Financial Future.”

Click to get it free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

QuoteMedia logo

So they got it done. That is a big merger.

Goldcorp Announces Shareholder Approval for Combination with Newmont

APR 04, 2019

https://www.goldcorp.com/English/investors/news-releases/default.aspx#2019#Goldcorp-Announces-Shareholder-Approval-for-Combination-with-Newmont

Dr. Jim Willie PhD URGENT ?? Central Banks Buying Gold!!! GLOBAL Monetary Reset in Apr 2019

321 views

Special Reports 2019

Published on Apr 6, 2019

Goldcorp: 'Anything but my Payment' -

Goldcorp Inc. (G:TSX; GG:NYSE, US$11.52) looks set to be acquired by Newmont, but not without continuing controversy, particularly over chairman Ian Telfer's egregious "retirement allowance" payment, almost tripled after the acquisition announcement. After my comments last bulletin, I was invited onto BNN/Bloomberg to discuss the merger. See TV interview here. The response was overwhelming, and positive.

Following the noisy opposition, Newmont and Goldcorp announced that Telfer would not be continuing as vice chairman of the combined company. But Telfer keeps his payment.

A few Newmont shareholders weighed in, saying Goldcorp should not benefit from the recent Newmont/Barrick Nevada joint venture, and opposing the large payment to Goldcorp's chairman. Goldcorp agreed for current Newmont shareholders to receive an extra cash dividend. But Telfer keeps his payment.

Shareholders are down by about two-thirds since Telfer became chairman. But Telfer keeps his payment.

We are holding the shares for now. We have voted our shares against

the merger, opposing both the payment but also

the sale of the company close at barely one-third the share price

when Telfer took over in 2006. Confucius he say:

"To receive a salary when you have lost the Way, that is shameful."

chevy56 welcome, I agree with; What’s new: Paulson & Co wants the terms

of the Newmont-Goldcorp deal re-cut and wants Newmont

to offer 0.254 shares of Newmont stock

for each share of Goldcorp (plus 2 cents of cash per Goldcorp share).

I think the offer bid for Goldcorp shares are WAY TO LOW -

Goldcorp has >60 mil. ounces in reserve and is very undervalued, imo!

I voting against the offer!

Newmont’s Goldcorp Deal Faces Opposition. Here’s What It Means for Gold Miners.

By Al Root

March 22, 2019 1:08 p.m. ET

Newmont’s Goldcorp Deal Faces Opposition. Here’s What It Means for Gold Miners.

Photograph by Romeo Gacad/AFP/Getty Images

Text size

Hedge fund and prominent gold investor Paulson & Co. is opposing Newmont Mining ’s proposed merger with Goldcorp .

“The $1.5 billion premium to Goldcorp (ticker: GG) shareholders is unjustified given Goldcorp’s poor performance,” wrote John Paulson and Marcelo Kim in a letter sent to Newmont (NEM) CEO Gary Goldberg.

https://www.barrons.com/articles/newmonts-goldcorp-deal-faces-opposition-heres-what-it-means-for-gold-miners-51553274512?mod=hp_LATEST

The suggestion that Goldcorp has struggled isn’t controversial. Its shares have returned negative 15% a year on average for the past five years. While combining a top operator with an underperforming asset can generate shareholder value, which may be true for Newmont-Goldcorp, the deal has implications for other gold miners as well.

The back story: Goldcorp stock has struggled—and more than other gold miners. The VanEck Vectors Gold Miners ETF (GDX) has returned negative 1.7% a year on average over the last five years. Still an annual loss, but better than Goldcorp stock’s performance. Newmont shares, by contrast, have fared much better returning 7.7% a year on average over the same span.

The wide spread in stock performance may be driving M&A activity. 2019 started off with a bang in the sector when Newmont announced its $13 billion bid for Goldcorp. About a month later Barrick Gold (GOLD) announced a hostile bid for Newmont saying a combination between Barrick and Newmont was superior to the company Newmont wants to form with Goldcorp.

Newmont and Barrick eventually agreed to a joint venture—combining assets in Nevada to capture synergies that benefit both companies. The end of Barrick’s hostile bid left the Goldcorp deal active.

What’s new: Paulson & Co wants the terms of the Newmont-Goldcorp deal re-cut and wants Newmont to offer 0.254 shares of Newmont stock for each share of Goldcorp (plus 2 cents of cash per Goldcorp share). The new ratio values Goldcorp at $8.73 per share, below the $9.69 Goldcorp was trading at before the Newmont deal was announced.

Goldcorp shares were at $10.64 in Friday afternoon trading—more than 20% above Paulson’s suggested price. Based on that reaction, the market doesn’t think a large adjustment to the exchange ratio is likely yet.

Paulson & Co. referred Barron’s to its letter when asked about the deal, and Newmont didn’t immediately respond to questions about the price it’s paying for Goldcorp.

Looking ahead: It seems that most everyone involved agrees with the premise of the Newmont-Goldcorp transaction—that Goldcorp could benefit from Newmont’s operational acumen. Barron’slikes the Newmont-Goldcorp deal as well, in part, for the same reason. Paulson’s suggested exchange ratio may be its opening gambit with Newmont in an effort to recapture some of the deal value, but it would be surprising to see the entire deal derailed.

And Newmont’s approach could have implications for other gold miners. Companies like Kinross Gold (KGC) and Eldorado Gold (EGO) have lower returns than peers of similar size. Perhaps larger miners with better operational histories could adopt the Newmont approach in an attempt to create value through better operational execution.

Write to Al Root at allen.root@barrons.com

https://www.barrons.com/articles/newmonts-goldcorp-deal-faces-opposition-heres-what-it-means-for-gold-miners-51553274512?mod=hp_LATEST

God Bless

I`m in...

chevy56

GLTUS

GOLD the reason for its popularity is its rarity -

Gold is a finite commodity -

There is only so much of the golden metal available, and

it can’t be manufactured.

Some experts, including Goldcorp’s chairman, Ian Telfer, are predicting

that the amount of future gold to be mined is already on the decline.

The fact that gold mining is on the decline is nothing new.

That has happened before.

What is worrying some investors is that

the world may be running out of physical gold.

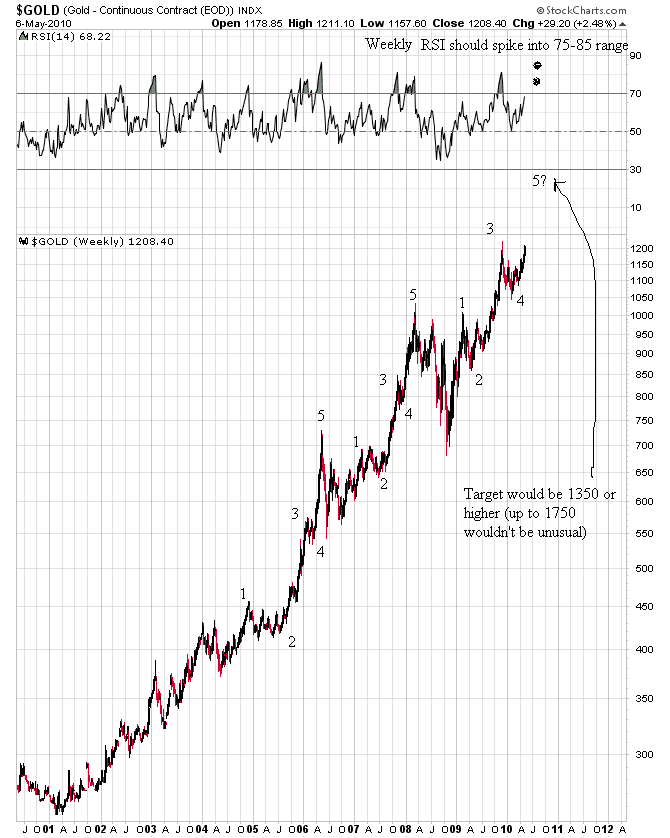

Well we got it in time, ex....the futures LT;

long term trend normal moves since >500yrs cycles >

7yrs up and 7yrs down > if not

manipulated and if manipulated >

it fly much higher or fall off the cliff -

Worldwide Major Central Banks are Accumulating Their Gold Holdings

Gary Wagner Gary Wagner

Friday March 22, 2019 18:20

Note, bottom line....

There is an old adage that you buy when the big boys buy, and

sell when the big boys sell.

If this adage holds any weight we could be looking for gold

pricing to continue to rise in value.

https://www.kitco.com/commentaries/2019-03-22/Worldwide-Major-Central-Banks-are-Accumulating-Their-Gold-Holdings.html

The Operative Word for Gold and Silver? Patience - Weekly Wrap-Up (March 22, 2019)

https://www.sprottmoney.com/Blog/the-operative-word-for-gold-and-silver-patience-weekly-wrap-up-march-22-2019.html

Gold Could Fly If US Fed Keeps Or Cuts Interest Rates

By Lisa Smith -

March 20, 201910

https://www.iexpats.com/gold-could-fly-if-us-fed-keeps-or-cuts-interest-rates/

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Newmont’s Goldcorp Deal Faces Opposition. Here’s What It Means for Gold Miners.

By Al Root

March 22, 2019 1:08 p.m. ET

Newmont’s Goldcorp Deal Faces Opposition. Here’s What It Means for Gold Miners.

Photograph by Romeo Gacad/AFP/Getty Images

Text size

Hedge fund and prominent gold investor Paulson & Co. is opposing Newmont Mining ’s proposed merger with Goldcorp .

“The $1.5 billion premium to Goldcorp (ticker: GG) shareholders is unjustified given Goldcorp’s poor performance,” wrote John Paulson and Marcelo Kim in a letter sent to Newmont (NEM) CEO Gary Goldberg.

https://www.barrons.com/articles/newmonts-goldcorp-deal-faces-opposition-heres-what-it-means-for-gold-miners-51553274512?mod=hp_LATEST

The suggestion that Goldcorp has struggled isn’t controversial. Its shares have returned negative 15% a year on average for the past five years. While combining a top operator with an underperforming asset can generate shareholder value, which may be true for Newmont-Goldcorp, the deal has implications for other gold miners as well.

The back story: Goldcorp stock has struggled—and more than other gold miners. The VanEck Vectors Gold Miners ETF (GDX) has returned negative 1.7% a year on average over the last five years. Still an annual loss, but better than Goldcorp stock’s performance. Newmont shares, by contrast, have fared much better returning 7.7% a year on average over the same span.

The wide spread in stock performance may be driving M&A activity. 2019 started off with a bang in the sector when Newmont announced its $13 billion bid for Goldcorp. About a month later Barrick Gold (GOLD) announced a hostile bid for Newmont saying a combination between Barrick and Newmont was superior to the company Newmont wants to form with Goldcorp.

Newmont and Barrick eventually agreed to a joint venture—combining assets in Nevada to capture synergies that benefit both companies. The end of Barrick’s hostile bid left the Goldcorp deal active.

What’s new: Paulson & Co wants the terms of the Newmont-Goldcorp deal re-cut and wants Newmont to offer 0.254 shares of Newmont stock for each share of Goldcorp (plus 2 cents of cash per Goldcorp share). The new ratio values Goldcorp at $8.73 per share, below the $9.69 Goldcorp was trading at before the Newmont deal was announced.

Goldcorp shares were at $10.64 in Friday afternoon trading—more than 20% above Paulson’s suggested price. Based on that reaction, the market doesn’t think a large adjustment to the exchange ratio is likely yet.

Paulson & Co. referred Barron’s to its letter when asked about the deal, and Newmont didn’t immediately respond to questions about the price it’s paying for Goldcorp.

Looking ahead: It seems that most everyone involved agrees with the premise of the Newmont-Goldcorp transaction—that Goldcorp could benefit from Newmont’s operational acumen. Barron’slikes the Newmont-Goldcorp deal as well, in part, for the same reason. Paulson’s suggested exchange ratio may be its opening gambit with Newmont in an effort to recapture some of the deal value, but it would be surprising to see the entire deal derailed.

And Newmont’s approach could have implications for other gold miners. Companies like Kinross Gold (KGC) and Eldorado Gold (EGO) have lower returns than peers of similar size. Perhaps larger miners with better operational histories could adopt the Newmont approach in an attempt to create value through better operational execution.

Write to Al Root at allen.root@barrons.com

https://www.barrons.com/articles/newmonts-goldcorp-deal-faces-opposition-heres-what-it-means-for-gold-miners-51553274512?mod=hp_LATEST

God Bless

Great discussion on gold and monetary expansion

I really liked the last line.

King World News note: The last chart says it all in terms of the gold price.

Gold is now at one of the most undervalued points in history. The same

could be said of the mining shares.

This well worth a review.

https://kingworldnews.com/european-analyst-warns-day-of-reckoning-approaching-for-central-banks-as-gold-price-set-to-surge/

God Bless

Federal Reserve Interest-Rate Decision—Live Analysis

Last Updated Mar 20, 2019 at 1:44 pm ET

Federal Reserve officials are on track to leave interest rates unchanged

at their two-day meeting ending today and could indicate at 2 p.m. EDT

they are comfortable holding them steady for a while.

We'll have all the details plus video of Fed Chairman Jerome

Powell's press conference at 2:30 p.m. EDT.

https://www.wsj.com/livecoverage/federal-reserve-march-meeting-2019

Gold Could Fly If US Fed Keeps Or Cuts Interest Rates

By Lisa Smith -

March 20, 201910

https://www.iexpats.com/gold-could-fly-if-us-fed-keeps-or-cuts-interest-rates/

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

It's funny how some things change. I remember the days when gold was a hedge against inflation and everytime they raised rates gold would go up.

Gold Could Fly If US Fed Keeps Or Cuts Interest Rates

By Lisa Smith -

March 20, 201910

https://www.iexpats.com/gold-could-fly-if-us-fed-keeps-or-cuts-interest-rates/

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Germany wants its gold back and Mnuchin's visit to Fort Knox, weird things are happening.

2,169 views

TheStreet: Investing Strategies

Published on Sep 2, 2017

Did Germany ever get their gold being held at Ft. Not. ?

They wanted it but there was some snafu??? Anyone here about how that turned out?

Found this gem being pumped on a number of sites hence bringing me here. What is the deal with this one? Seems like day traders are running it up to dump imo. Any info??

very nice pump for that dog Levon..that I lost a lot of money on...nuff said

Goldcorp Announces Support for Barrick and Newmont Nevada Joint Venture

T.G |

Canada NewsWire

VANCOUVER, March 11, 2019 /CNW/ -

GOLDCORP INC. (TSX: G, NYSE: GG) ("Goldcorp" or the "Company")

announced today that it has consented to and fully supports the

announced Nevada Joint Venture between Barrick Gold Corporation

("Barrick") (NYSE:GOLD) (TSX:ABX) and Newmont Mining Corporation

("Newmont") (NYSE: NEM). More information on the Nevada Joint

Venture is available at

http://www.newmont.com

Goldcorp's board of directors continues to recommend that Goldcorp shareholders vote FOR the proposed plan of arrangement with Newmont, as previously announced on January 14, 2019. More information on the proposed plan of arrangement with Newmont and the special meeting of Goldcorp shareholders on April 4, 2019 is available at www.goldcorp.com.

Goldcorp also welcomes the announcement that Barrick has agreed to

withdraw its proposal to acquire Newmont.

About Goldcorp

http://www.goldcorp.com

Goldcorp is a senior gold producer focused on responsible mining practices with safe, low-cost production from a high-quality portfolio of mines.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within

Read more at https://stockhouse.com/news/press-releases/2019/03/11/goldcorp-announces-support-for-barrick-and-newmont-nevada-joint-venture#yTdZKQHIUkV15jwE.99

Levon Resources buy-out target 2019. This is intresting, just read about Goldcorp is in talk with Levon for a takeover. I can see the value, Levon has a gigantic silver deposit, no debt and well funded.

Newmont CEO holds 10% of the shares.

https://levon.com/

To be continued, M and A is the trend now.

Have you read this article.https://www.zerohedge.com/news/2019-03-07/gold-soar-central-banks-try-play-god-again-david-brady

chevy56

GLTUS

Goldcorp (GG) /Keep & Stack Gold\ Sell Less Gold -

Russia China Gold Standard Means Death Of US/NWO fiat$Dollar -

It Was Very Good for Goldcorp when Robert McEwen Stacked

the Gold and Sold Less ![]() )

)

It has become more and more nations who want their gold back -

Turkey was the last country to ask for gold, and withdrew 220 tonnes of

gold from the US Federal Reserve on 19 April 2018.

The country's 220 tonnes of gold are valued at $25.3 billion.

Turkey has followed countries such as

Germany,

the Netherlands,

Austria,

Belgium,

Russia and

China which have already started to repatriate their gold stocks.

There is a real lack of confidence in the U.S. Treasury which

currently holds 261,000,000 ounces of gold mainly at Fort Knox,

according to GOLD TELEGRAPH.

Furthermore, the official gold reserves have never been thoroughly

independently verified.

Why Romania Wanting Its Gold Back May Mean More Than You Think

Mar 06, 2019

Guest(s): Jeffrey Christian Managing Partner, CPM Group

https://www.kitco.com/news/video/show/PDAC-2019/2309/2019-03-06/Why-Romania-Wanting-Its-Gold-Back-May-Mean-More-Than-You-Think#_48_INSTANCE_puYLh9Vd66QY_=https%3A%2F%2Fwww.kitco.com%2Fnews%2Fvideo%2Flatest%3Fshow%3DPDAC-2019

The repatriation of gold from central banks has less to do with gold

and more to do with the rise of nationalism, said Jeffrey Christian,

managing partner of CPM Group.

“The more important thing has nothing to do with gold and it has

everything to do with the rise of nationalism,” Christian told Kitco

News on the sidelines of the PDAC 2019.

“What you’re really seeing is a rising nationalist trend, not only in

Europe, but also in other countries.”

Italy’s gold reserves belong to central bank – BoI’s Visco

Posted on March 6, 2019 by News

Reuters/Stefano Bernabei/3-4-2019

“Bank of Italy’s Governor Ignazio Visco said on Monday the country’s

reserves of gold belonged to the central bank and could not be used to

fund government spending.”

Note: Here we are again witnessing an argument among principal players

over the sovereign nature of a barbarous relic

that has no relevance in

the modern monetary system [sigh. . . to NWO fiat$fed counter paper fits]

Modern Monetary Theory is smoke and mirrors nonsense

Posted on March 6, 2019 by Opinion

MarketWatch/Kenneth Rogoff/3-5-3019

“Just as the Federal Reserve seems to have beaten back blistering

tweets from President Donald Trump, the next battle for central-bank

independence is already unfolding.

And this one could potentially destabilize the entire global

financial system.

A number of leading U.S. progressives, who may well be in power after

the 2020 elections, advocate using the Fed’s balance sheet as a cash

cow to fund expansive new social programs, especially in view of

current low inflation and interest rates.”

The Fed is moving to take even more control of debt markets and interest rates

Posted on March 6, 2019 by Opinion

Mises Institute/Thorsten Polleit/3-4-2019

“In the second scenario, in the light of an actual or expected rise in

inflation, people lose their confidence in the value of the currency.

They try to rid themselves of their money balances, withdraw bank

deposits and divest their bond holdings. To prevent this from raising

market interest rates, the central bank has purchase more debt and

issue more money.

This causes confidence in the value of money to decline further.

The debt market sell-off continues, and more money is issued,

so that eventually price inflation accelerates.”

https://mises.org/wire/fed-seizing-even-more-marketplace

xxxx xxxx

God Bless America

chevy56 thank you, Goldcorp (GG) /Keep & Stack Gold\ Sell Less Gold -

Russia China Gold Standard Means Death Of US/NWO fiat$Dollar -

It Was Very Good for Goldcorp when Robert McEwen Stacked

the Gold and Sold Less ![]() )

)

It has become more and more nations who want their gold back -

China, Russia and India All Prepare To DUMP the DOLLAR in Global Trade!

53,722 views

The Money GPS

Published on Oct 31, 2018

Ex....

Goldcorp (GG) /Keep & Stack Gold\ Sell Less Gold -

Russia China Gold Standard Means Death Of US/NWO fiat$Dollar -

It Was Very Good for Goldcorp when Robert McEwen Stacked

the Gold and Sold Less ![]() )

)

It has become more and more nations who want their gold back -

China, Russia and India All Prepare To DUMP the DOLLAR in Global Trade!

53,722 views

The Money GPS

Published on Oct 31, 2018

Ex....

FT. Knox and Why You Should Stack Silver Not Gold -

32,173 views

SilverTorch66

Published on Feb 25, 2019

All Fiat currency goes to zero -

Parliament leaders want Romanian gold reserves brought home

Submitted by cpowell on 11:50PM ET Thursday, February 28, 2019. Section:

Daily Dispatches

By Ioana Erdei

Business Review, Bucharest, Romania

Wednesday, February 27, 2019

BUCHAREST, Romania -- Chamber of Deputies President Liviu Dragnea and

Socia Democratic Party Sen. Serban Nicolae have proposed a bill to

force the National Bank to store 95 percent of Romania's gold reserves

in the country.

The bill is meant to change the law that establishes the National's Bank

statute. According to the document, the reason for this demand is that

gold stored abroad produces only additional costs with storage.

The bill also wants to eliminate the word "international" from the

terminology used by the National Bank in "international gold reserves."

Romania's gold reserves, 103.7 tons, are stored in three countries,

according to the National Bank officials.

Three years ago, the institution announced that 60 percent of the gold

reserves were stored abroad.

The situation has not changed -- 61 tons of the gold are stored at the

Bank of England, more than 40 tons are kept at the Bank of Romania in

Bucharest, and fewer than five tons are stored at the Bank for

International Settlements in Basel, Switzerland. ...

... For the remainder of the report:

http://business-review.eu/news/liviu-dragnea-demands-the-national-bank-to-bring-back-the-gold-reserves-stored-abroad-197298

* * *

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

GATA Chairman Murphy, TF Metals Report's Hemke interviewed on palladium, silver

Submitted by cpowell on 01:16AM ET Friday, March 1, 2019.

Section: Daily Dispatches

8:17p ET Thursday, February 28, 2018

Dear Friend of GATA and Gold:

Craig Hemke of the TF Metals Report and GATA Chairman Bill Murphy

were interviewed this week by Phil Kennedy of Kennedy Financial,

discussing the recent explosion in palladium and whether failure

of naked shorting of futures contracts in that metal could cause

failure of the futures markets in gold and silver.

They also discuss JPMorganChase's domination of the silver market.

The interview is 36 minutes long and can be viewed at You Tube here:

Barrick Is Throwing “Smoke Bombs” In Aim To Distract Says Pierre Lassonde

Feb 25, 2019

https://www.kitco.com/news/video/show/BMO-Conference-2019/2285/2019-02-25/Barrick-Is-Throwing-Smoke-Bombs-In-Aim-To-Distract-Says-Pierre-Lassonde#_48_INSTANCE_puYLh9Vd66QY_=https%3A%2F%2Fwww.kitco.com%2Fnews%2Fvideo%2Flatest%3Fshow%3DBMO-Conference-2019

Pierre Lassonde Chairman, Franco-Nevada

Barrick Gold may just be trying to lower Newmont MIning's share price

enough in order to do a proper bid, said Pierre Lassonde, chairman of

Franco-Nevada.

"What's happening has never been seen in history.

Frankly, it's the first time I've ever seen a hostile [takeover]

at a discount to the stock price," Lassonde told Kitco News at

the BMO Global Metals & Mining Conference.

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Good for Goldcorp. McEwen

Rob McEwen Talks Newmont-Barrick And Future Of Gold -

Feb 27, 2019

https://www.kitco.com/news/video/show/BMO-Conference-2019/2291/2019-02-27/Rob-McEwen-Talks-Newmont-Barrick-And-Future-Of-Gold#_48_INSTANCE_puYLh9Vd66QY_=https%3A%2F%2Fwww.kitco.com%2Fnews%2Fvideo%2Flatest%3Fshow%3DBMO-Conference-2019

Guest(s): Rob McEwen

Mining mogul Rob McEwen said that more consolidation on the mega-cap

level without premiums would ultimately mean

shareholders benefit in the long-term.

“Over the last five years, you’ve heard a growing voice from

shareholders saying ‘hey, look after our interests first.’

And by going in and doing an at-market or discount to market

where you can see real synergies occurring, say in Nevada,

maybe more companies would start looking at that,”

McEwen told Kitco News on the sidelines of the

BMO Global Metals and Mining Conference.

McEwen said that it may be more beneficial to both parties

to merge without a large premium to begin with.

“It’s a good trend. I think if we could see more of

that happening, you’d see consolidation happening in

the industry and the shareholders would be treated better,”

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

opinion appreciated

TIA

Hostile takeover?

Newmont Says Rival Miner Barrick Gold Has Bought a Small Stake

Barrick proposes to make it easier for Newmont stock owners to call a

meeting, a move that comes ahead of a potential hostile bid

The Merian gold mine, owned and operated by the Newmont Suriname mining company in Suriname in 2016.

https://www.wsj.com/articles/newmont-says-rival-miner-barrick-gold-has-bought-a-small-stake-11551050912

The Merian gold mine, owned and operated by the Newmont Suriname mining company in Suriname in 2016. PHOTO: RANU ABHELAKH/REUTERS

2 COMMENTS

By Alistair MacDonald

Updated Feb. 24, 2019 7:33 p.m. ET

Newmont Mining Corp. NEM 3.02% said Sunday that rival miner Barrick Gold Corp. GOLD -2.10% has taken a small stake in the company and proposed to make it easier for Newmont stock owners to call a shareholder meeting, a move that comes ahead of a potential hostile bid by the Canadian company.

A spokesman for Denver-based Newmont said Barrick had bought 1,000 shares in the company, which has 535 million shares outstanding.

Barrick, with a market value of almost $23 billion, said Friday it is considering an all-stock, no-premium transaction to merge with Newmont, which is valued at about $19 billion.

Buying a small stake allowed Barrick to make two shareholder proposals for consideration at Newmont’s next annual shareholders meeting.

One proposal would be to amend Newmont’s bylaws to lower the share-ownership threshold necessary to requisition shareholder meetings to 15% from the current 25%, Newmont said.

Barrick also proposed to repeal all bylaw amendments implemented since Oct. 24, 2018. Newmont said there have been no bylaw amendments since then.

Though uncommon, Barrick’s move has the potential to turn into a possible proxy fight for control of Newmont’s board to force a deal. By seeking to make it easier for shareholders to force Newmont to call a shareholder vote, Barrick is laying the groundwork to put forth a slate of directors who might be more amenable to a merger if Barrick pursues a tie-up and Newmont’s current management and board oppose the idea.

A spokesman for Barrick declined to comment.

Newmont agreed earlier this year to buy miner Goldcorp Inc. of Vancouver, Canada, in a stock deal valued at $10 billion.

The pending deal would make Newmont the biggest gold miner by production, passing longtime rival Barrick, whose output has been declining.

The Newmont spokesman said the Goldcorp tie-up “will create an unmatched portfolio of world-class operations, projects, reserves, exploration opportunities and talent.”

He said the company won’t speculate on Barrick’s motivation for announcing it is considering making a hostile bid. Newmont said it hasn’t yet received an approach from Barrick.

Goldcorp shareholders are set to vote on Newmont’s offer April 4.

Barrick has long considered merging with Newmont to pair up their large gold-mining operations in Nevada and create an industry giant that would dwarf its nearest competitor. The last serious attempt at a deal faltered in 2014.

—Ben Dummett contributed to this article.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

Appeared in the February 25, 2019, print edition as 'Newmont Rival Buys Stake.'

https://www.wsj.com/articles/newmont-says-rival-miner-barrick-gold-has-bought-a-small-stake-11551050912

Barrick’s Thornton puts Newmont in check in gold takeover game

By DANIELLE BOCHOVEBloomberg

Fri., Feb. 22, 2019

https://www.thestar.com/business/2019/02/22/barricks-thornton-puts-newmont-in-check-in-gold-takeover-game.html

Barrick eyes hostile bid for Newmont, Toronto Globe and Mail says

Submitted by cpowell on 02:17PM ET Friday, February 22, 2019. Section:

Daily Dispatches

By Niall McGee and Rachelle Younglai

The Globe and Mail, Toronto

Thursday, February 21, 2019

Barrick Gold Corp. is mulling a takeover bid for Newmont Mining Corp.,

a transaction that would represent one of the largest mining deals ever

and solidify the Toronto-based companys position as

the world's largest gold producer.

Barrick is working on a plan for a two-step deal that would see it

take over Colorado-based Newmont for about US$19 billion in stock,

then flip some of Newmont's assets to Australia's Newcrest Mining,

according to industry sources familiar with the situation.

... Dispatch continues below ...

The sources, who were granted anonymity by The Globe because they were

not authorized by their employers to speak publicly, cautioned that

there are still a number of hurdles.

One of those obstacles is winning support from shareholders of Newmont.

The company is attempting to close its own US$10 billion acquisition of

Vancouver miner Goldcorp Inc., which was announced only last month.

Under the potential terms of the deal, Barrick would keep

Newmonts Nevada and African mines, while Newcrest would take over its

Australian operations, which are worth billions. ...

... For the remainder of the report:

https://www.theglobeandmail.com/business/article-barrick-eyes-hostile-bi...

https://www.theglobeandmail.com/business/article-barrick-eyes-hostile-bid-as-newmont-set-to-become-no-1-gold-producer/

* * *

Hostile Bid, yeah saw this earlier. Gold Stocks are heating up.

chevy56

GLTUS

Barrick eyes hostile bid for Newmont, Toronto Globe and Mail says

Submitted by cpowell on 02:17PM ET Friday, February 22, 2019. Section:

Daily Dispatches

By Niall McGee and Rachelle Younglai

The Globe and Mail, Toronto

Thursday, February 21, 2019

Barrick Gold Corp. is mulling a takeover bid for Newmont Mining Corp.,

a transaction that would represent one of the largest mining deals ever

and solidify the Toronto-based companys position as

the world's largest gold producer.

Barrick is working on a plan for a two-step deal that would see it

take over Colorado-based Newmont for about US$19 billion in stock,

then flip some of Newmont's assets to Australia's Newcrest Mining,

according to industry sources familiar with the situation.

... Dispatch continues below ...

The sources, who were granted anonymity by The Globe because they were

not authorized by their employers to speak publicly, cautioned that

there are still a number of hurdles.

One of those obstacles is winning support from shareholders of Newmont.

The company is attempting to close its own US$10 billion acquisition of

Vancouver miner Goldcorp Inc., which was announced only last month.

Under the potential terms of the deal, Barrick would keep

Newmonts Nevada and African mines, while Newcrest would take over its

Australian operations, which are worth billions. ...

... For the remainder of the report:

https://www.theglobeandmail.com/business/article-barrick-eyes-hostile-bi...

https://www.theglobeandmail.com/business/article-barrick-eyes-hostile-bid-as-newmont-set-to-become-no-1-gold-producer/

* * *

This is as bullish I think I have ever heard Hemke -

Bear Market in Gold & Silver is Over – Craig Hemke

USA Watchdog, Released on 2/19/19

U.S. stocks were mixed as investors awaited further details from the fiat - fraud Federal Open Market Cabal’s latest mafia meeting -

https://finance.yahoo.com/news/stock-market-news-february-20-2019-134719869.html

xxxx xxxx

God Bless America

Salvini Calls For Elimination Of Italy's Central Bank, "Prison Time For Fraudsters"

Profile picture for user Tyler Durden

by Tyler Durden

Sun, 02/10/2019 - 19:56

https://www.zerohedge.com/news/2019-02-10/salvini-calls-elimination-italys-central-bank-prison-time-fraudsters

On Friday, in a moment of predictive insight, Bank of America correctly warned that the greatest threat to EPS - i.e., markets - in the next 3 years "is an acceleration of global populism via taxation, regulation & government intervention." Just one day later, this warning to the financial establishment was starkly manifest in that ground zero for Europe's populist revolt, Italy, where the country's coalition government hinted at where the global populist wave is headed next when he slammed the country’s central bank leadership and stock market regulator, escalating its attacks on establishment figures ahead of the European parliamentary vote in May.

Matteo Salvini, the outspoken head of the anti-immigrant League party, said the Bank of Italy and Consob, the country’s stock market regulator, should be "reduced to zero, more than changing one or two people, reduced to zero", or in other words eliminated, and that “fraudsters” who inflicted losses on Italian savers should "end up in prison for a long time."

As the FT notes, this latest broadside against Italy’s financial establishment comes as the two parties which are increasingly at odds with each other amid speculation Salvini may hold elections to become the sole leader of Italy, prepare to run against each other in the European parliamentary elections in May, a contest widely seen as a proxy for national polls. Meanwhile, both leaders have also increased their attacks against targets including the EU and French president Emmanuel Macron.

God Bless America

Newmont CEO On Why The World’s Largest Gold Merger Happened

3,474 views

Kitco NEWS

Published on Jan 30, 2019

Does anyone have any Golden Eagle 1700-1800 gold coins 1-50$ ea they want to sell ??

ps BOB---Relax--Gold stock is the only green thing showing today---hence the word green-back-ups

RE:GG sold for peanuts

This is what i said in an earlier post. The guidance was on track but the company failed to report this because the deal was done way before the annoucement. The share price would have moved up and Newmont did not agree to anymore than 10billion.THIS IS A RIP OFF PEOPLE BUY THE CEO AND IT'S BOARD>>>>>> VOTE NO!

Hopefully they will be SUED by big institutional investors and stop this corruption. We deserve a better deal and NEWMONT needs to up it's price for goldcorp.

Read more at http://www.stockhouse.com/companies/bullboard#KHx3RR1GkmG3R4qY.99

This is what i said in an earlier post. The guidance was on track but the company failed to report this because the deal was done way before the annoucement. The share price would have moved up and...read more

VOTE NO

posted January 17, 2019 10:28 am by stockfart

2 stars

image: http://www.stockhouse.com/CMSModules/Avatars/CMSPages/GetAvatar.aspx?maxsidesize=38&avatarguid=42f9d97e-b0c8-43a2-8a35-62dfec5ae64a

User avatar

mentor2018

image: http://www.stockhouse.com/Stockhouse/images/stars-mask.png

1.5 stars

User Actions January 17, 2019 - 07:05 AM 74 Reads

Post# 29244004

GG sold for peanuts

It is absolutely clear that GG's management only worked for themselves and failed to maximize shareholder value. At least they should have waited 1-2 years if the promised better performance was in the cards. They did not even wait to show the better 4Q production numbers first. This probably was already enough to bring the shares back to $10-11 without NEM. NEM takes almost no risk by paying with their relatively highly valued shares. They called it a premium of 17% which already disappeared because of the collapse of their stock. The whole thing is just not right for the GG shareholder who is ripped off. Clearly GG's management committed a crime not to defend their shareholders.

Read more at http://www.stockhouse.com/companies/bullboard#8YskE3VD6R4LU6QL.99

Gold bull McEwen sticks with his $5,000 call as pot stocks peak

By DANIELLE BOCHOVE Bloomberg

Thu., Jan. 17, 2019

Gold mining veteran Rob McEwen is nothing if not optimistic.

The founder of Goldcorp Inc. is sticking with his bold prediction that the

precious metal will soar almost fourfold to $5,000 an ounce (U.S.),

bolstered by a weaker dollar and waning demand for trendy assets like pot

stocks.

https://images.thestar.com/fMBEg9KUwU-dvY3mVcyxEmMMq-I=/1086x610/smart/filters:cb(1547748018139)/https://www.thestar.com/content/dam/thestar/business/2019/01/17/gold-bull-mcewen-sticks-with-his-5000-call-as-pot-stocks-peak/rob_mcewan.jpg

Gold mining veteran Rob McEwen is sticking with his bold prediction that

the precious metal will soar almost fourfold to $5,000 an ounce (U.S.),

bolstered by a weaker dollar and waning demand for trendy assets like pot stocks. (MICHAEL NAGLE / BLOOMBERG)

“Once people get over buying cryptos and biotech and cannabis stocks

they’re going to start looking at gold again,” the chief executive

officer of McEwen Mining Inc. said in an interview Thursday in Toronto

with Bloomberg Television.

Asked about his price target, McEwen said: “I’ve always liked $2,000

and beyond that $5,000.”

McEwen has been wrong before. In 2017, he predicted a “tsunami” of

liquidity seeking safe haven would push gold above $5,000 an ounce.

In 2016, he predicted prices of $1,700 to $1,900 by the end of the

year. The metal ended below $1,200 an ounce, and trades only slightly

higher now at about $1,290.

(the Fed NWO banksters mafia cabals have been making counterfit fiat

fraud currency for more than 100yrs. and manipulated the gold market

as long, imo! ex....

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=146133115

A loss of confidence in the dollar, a peak in the broader stock market

and fears of inflation will feed the impending spike in gold prices,

he said.

“The gold bull market started in January of 2016,” he said.

“People haven’t seen it yet but we’re about a third of the way

through.”

McEwen, 68, is a fixture in Canada’s tight-knit gold mining community.

The founder of Goldcorp is a noted philanthropist, having donated

tens of millions of dollars to healthcare, business education, and

other causes. He also remains the country’s most famously unabashed

gold bull.

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

Ps.

the more the Fed 666 banksters mafia manipulate the legal tender of

gold and silver, the higher it will FLY in the end ![]() )

)

Ps.

opinion appreciated

TIA

great info. My great grandfather panned the rivers in California in the mid 1800's and had $10,000 worth minted into gold coins in New Orleans. Still some family still search with metal detectors on the old home place they received from the Republic of Texas for his dad fighting in the Alamo.

Just think where our nation would be had we stayed with the gold standard and had Wilson not sold out by going along with the banksters creating the Fed. and the revenuers.

How California stayed with gold when the rest of the U.S. adopted fiat money -J.P. Koning:

Submitted by cpowell on 02:15AM ET Thursday, January 17, 2019.

Section: Daily Dispatches

9:15p ET Wednesday, January 16, 2019

Dear Friend of GATA and Gold:

Bullion Star's J.P. Koning tonight reviews early California's attachment

to gold as money and its rejection of the U.S. national government's

fiat currency "greenbacks" during the Civil War.

Koning concludes that the primary determinant of currency use is

whatever most people are using, even if the majority's currency is

steadily devaluing.

Koning's analysis is headlined "How California Stayed with Gold

When the Rest of the U.S. Adopted Fiat Money" and it's posted

at Bullion Star here:

https://www.bullionstar.com/blogs/jp-koning/how-california-stayed-with-gold-when-the-rest-of-the-u-s-adopted-fiat-money/

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

Goldcorp Achieves 2018 Production and Cost Guidance

JAN 14, 2019

VANCOUVER, Jan. 14, 2019 /CNW/ -

GOLDCORP INC. (TSX: G, NYSE: GG) ("Goldcorp" or the "Company") is

pleased to report gold production for the fourth quarter of

630,000 ounces, which was a 25% increase from the third quarter of 2018

and exceeded previously stated guidance.

Production for the year ended 2018 was 2,294,000 ounces.

All-in sustaining costs for the full year are expected to be at

the revised guidance of $850 per ounce.

Goldcorp's complete 2018 financial results will be released on

February 13, 2019.

In addition, the Pyrite Leach Project at Peñasquito achieved commercial

production during December 2018.

The project was completed under budget and ahead of schedule and was

one the first major projects completed using Goldcorp's Investment

Framework.

Due to the announcement of the proposed merger with Newmont,

Goldcorp will be cancelling its Investor Day, originally scheduled for

January 18, 2019.

About Goldcorp

http://www.goldcorp.com

Goldcorp is a senior gold producer focused on responsible mining

practices with safe, low-cost production from a high-quality portfolio

of mines.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" within the

meaning of Section 27A of the United States Securities Act of

1933, as amended, ---------"might" or "will", "occur" or

"be achieved" or the negative connotation thereof.

Forward-looking statements are necessarily based upon a number of

factors and assumptions that, if untrue, could cause the actual

results, --------differ materially from those described in forward-

looking statements, there may be other factors that cause actions,

events or results not to be as anticipated, estimated or intended.

Forward-looking statements are subject to known and unknown risks,

uncertainties and other important factors that may cause the actual

results,--------forward-looking statements that are included in this

document, whether as a result of new information, future events or

otherwise, except in accordance with applicable securities laws.

For further information please contact:

INVESTOR CONTACT

MEDIA CONTACT

Shawn Campbell

Director, Investor Relations

Telephone: (800) 567-6223

E-mail: info@goldcorp.com

Christine Marks

Director, Corporate Communications

Telephone: (604) 696-3050

E-mail: media@goldcorp.com

http://www.goldcorp.com

https://www.goldcorp.com/English/investors/news-releases/default.aspx#2019#Goldcorp-Achieves-2018-Production-and-Cost-Guidance

Cision View original content:

http://www.prnewswire.com/news-releases/goldcorp-achieves-2018-production-and-cost-guidance-300777440.html

SOURCE Goldcorp Inc.

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

https://investorshub.advfn.com/Goldcorp-GG-1997/

God Bless America

User avatar on stockhouse.com - (giving a bit more following info...

BSdetector2016

image: http://www.stockhouse.com/Stockhouse/images/stars-mask.png

2 stars

User Actions January 15, 2019 - 10:40 AM 125 Reads

Post# 29233139

Shareholders of both companies must approve the transaction

Goldcorp shareholders can still put an end to this giveaway to a US company.

FROM THE NR: The transaction is expected to close in the second quarter of 2019. Closing of the transaction is subject to approval by the shareholders of both companies; regulatory approvals in a number of jurisdictions including the European Union, Canada, South Korea and Mexico; and other customary closing conditions.

Read more at http://www.stockhouse.com/companies/bullboard#FoyhB6kr3AdXLomd.99

RE:RE:RE:RE:Wonder if shareholders can stop this takeover now!

as Gold goes to $1500 then $100,000 an oz this USA take over is BS!

Read more at http://www.stockhouse.com/companies/bullboard#fvatMpXhfR6QHFVg.99

Asked google about lawsuite against Goldcorp and following info

came up.... ??? that's all info I got....so far....mosty old or maybe outdated???

Shareholder Class Action Filed Against Goldcorp, Inc. | New Cases...

www.ktmc.com/new-cases/goldcorp-inc

Notice is hereby given that a class action lawsuit has been filed on behalf of those who purchased or otherwise acquired shares of Goldcorp, Inc. (NYSE: GG ...

SHAREHOLDER ALERT: Class Action Lawsuit Filed Against Goldcorp,...

finance.yahoo.com/news/shareholder-alert-class-action...

RADNOR, PA / ACCESSWIRE / September 6, 2016 / The law firm of Kessler Topaz Meltzer & Check, LLP reminds Goldcorp, Inc. (GG) (TSX:G.TO) ("Goldcorp" or the "Company") shareholders that a class ...

Shareholder Class Action Filed Against Goldcorp, Inc. - GG

www.prnewswire.com/news-releases/shareholder-class-action...

RADNOR, Pa., Aug. 31, 2016 /PRNewswire/ -- The law firm of Kessler Topaz Meltzer & Check, LLP announces that a shareholder class action lawsuit has been filed...

Appreciate more info ???

Thanks in advance -

God Bless

|

Followers

|

62

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

2867

|

|

Created

|

09/27/03

|

Type

|

Free

|

| Moderators | |||

Goldcorp Inc., NYSE: GG

Goldccorp Since 1910, over 19.5 million ounces of gold

have been recovered from the Hollinger Mine -

while about 10.8 million ounces were recovered from

the McIntyre Mine -

along with 67,000 tons of copper....

more info....

http://www.porcupinegoldmines.ca/en/ouroperations/hollinger.asp

http://www.goldcorp.com/operations/porcupine/

http://www.goldcorp.com

http://www.goldcorp.com/company/

Suite 3400-666 Burrard Street

Park Place

Vancouver, BC V6C 2X8

(604) 696-3000 begin_of_the_skype_highlighting (604) 696-3000 end_of_the_skype_highlighting

(604) 696-3001 begin_of_the_skype_highlighting (604) 696-3001 end_of_the_skype_highlighting

info@goldcorp.com

http://www.goldcorp.com

www.ivarkreuger.com/metalcharts.htm

www.ivarkreuger.com/metalcharts.htm

Goldcorp GG in yellow Daily Chart 10 year compared to Barrick Gold ABX in black and Newmont NEM in blue -

Goldcorp dividends -

http://www.goldcorp.com/investors/financials/

http://www.goldcorp.com/investors/presentations/

www.ivarkreuger.com/metalcharts.htm

www.ivarkreuger.com/metalcharts.htm

Rothschild World Part 3 "All Enemies both Foreign and Domestic"

Daily One-Year Charts

RED LAKE |

|

| The Red Lake Gold Mine is composed of two operating complexes: the Red Lake Complex and the Campbell Complex. Red Lake Gold mine is Canada's largest gold mine, and in 2007 produced 700,600 ounces. It is also one of the world's richest gold mines and lowest cost producers. The Campbell Complex has been in continuous operations since 1949, producing over 11 million ounces. |

www.goldcorp.com/operations/red_lake_mine/

Weekly Five-Year Charts

Gold Daily

Gold Weekly

Inflation Calculator

data.bls.gov/cgi-bin/cpicalc.pl

Gold $2,400.- per ounce - 500years ago - add inflation - it is a long hike back UP to fair market value - compare to any fiat paper -

The three historical comparisons above (and see chart below) would put gold anywhere from $6,000 to $10,000 and this is without inflation, or more likely hyperinflation. In a hyperinflationary environment, the price gold will go to is really irrelevant since it depends on how much money is printed. In the Weimar Republic for example gold went to DM 100 trillion. What is more important is that gold is likely to go up at least 5 times from today without inflation and with hyperinflation gold will protect investors against the total destruction of paper money and many other assets.

http://www.goldcorp.com

TIA

God Bless

WELCOME ~

This board is for fundamental and technical discussion about Goldcorp Inc., GG ~ Gold Mining enjoy it ~

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |