Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Same crap, different day...Still no news and late filing again.

Yep..still SHIT here…..including management!

lmao- 38 TOTAL shares traded today, what a piece of SHIT!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Third bench shitty cabinet making skills, probably won’t even last one month!

Just a dilution ATM for Fair here, no benefits for shareholders, still hope they rot in hell!!!

OTCN on the bid/ask during the day…some large dilution blocks went off at .0003 .

Oh it wont help, SEC probably wont even look into it and this assclown Fair isnt concerned with anything we have to say, as I said,,not even why this POS shitstorm even trades.....dilution ATM for them I suppose.

Maybe that will give them the kick in the ass they need to put out some news!

Filed 2 different SEC complaint, one against $THBD, the other against David Fair!!! May not help but Im addressing this moron and hope SEC goes after him hard!!

There is a form on their site to do so:

To file a complaint with the SEC, you can visit their official website and complete an online form or print out a complaint form and mail it to the appropriate address.

Give us all the link on how to do that.

SEC complaint filed on these bastards, it probably won’t help but I did my part!! Hate the day I ever bought this shit scam!! Total loss!

Company SuCKS and been silent for years!!

Good question. No-one knows what the hell is going on with this turd. They don't put out news!

Does David SCAM Fair still own this POS shit for brains company??

Enquiring minds want to know if this is still a cup and handle. LOL

Well, I see this is STILL garbage!

THBD .0004

Beginning of new month should see some Canouse dilution trades…been like clockwork for last couple of years.

It’s already tanked to shit years ago….

As long as the company is making their filings on time and paying the fees they will not be delisted. Canouse has too much debt left to convert to let that happen.

Should have been already! Its a total waste and we lost all our money here with these crooks!

I think this thing is really close to being delisted

management here = DOO DOO!!!!!

OS increased to 292,509,230 6/20/2024

This stock and management team continue to be a smothering pile of shit!!!!💩💩💩💩

Still not sure why this still even trades…..biggest POS on the OTC along with $BLDV

Turd town. Next to circle-the-drain-ville.

Check the history of this turd, it says it all.

Please elaborate. I would be happy to assist in reporting these scammers to the proper authorities here in NM.

Why are these scam artist NOT in Jail already????

Ouch.....Shitshow really tanking now......

What a turd pile. 2's on the bid, and the bid is thin.

WHY does this JUNK still trade???

It is the beginning of the month so you know what that means. Like clockwork. Should get an updated share count within a week.

For real, 2 years of patience now and its still dilutive SHIT!!!!!!!!!!!!!!!!!

Patience? How much patience can one have with 7 years of NECA and 2 years of THBD? lol. Patience. Every pumper says, "patience" and "soon"

LOL!!!!! For 2 years now??? Only been tanking in that time with unlimited dilution!! LMAO!!!

Needs patience!

$THBD= DONKEY SHIT STILL!!!!

They could have put out news on the settlement of the Federal EEOC lawsuit, but it must not have gone well for the company.

This remains Trash just like the management team of it! Sewer trash scum crooks!!!

|

Followers

|

684

|

Posters

|

|

|

Posts (Today)

|

1

|

Posts (Total)

|

84413

|

|

Created

|

10/31/11

|

Type

|

Free

|

| Moderators bri123 BearRickPunch | |||

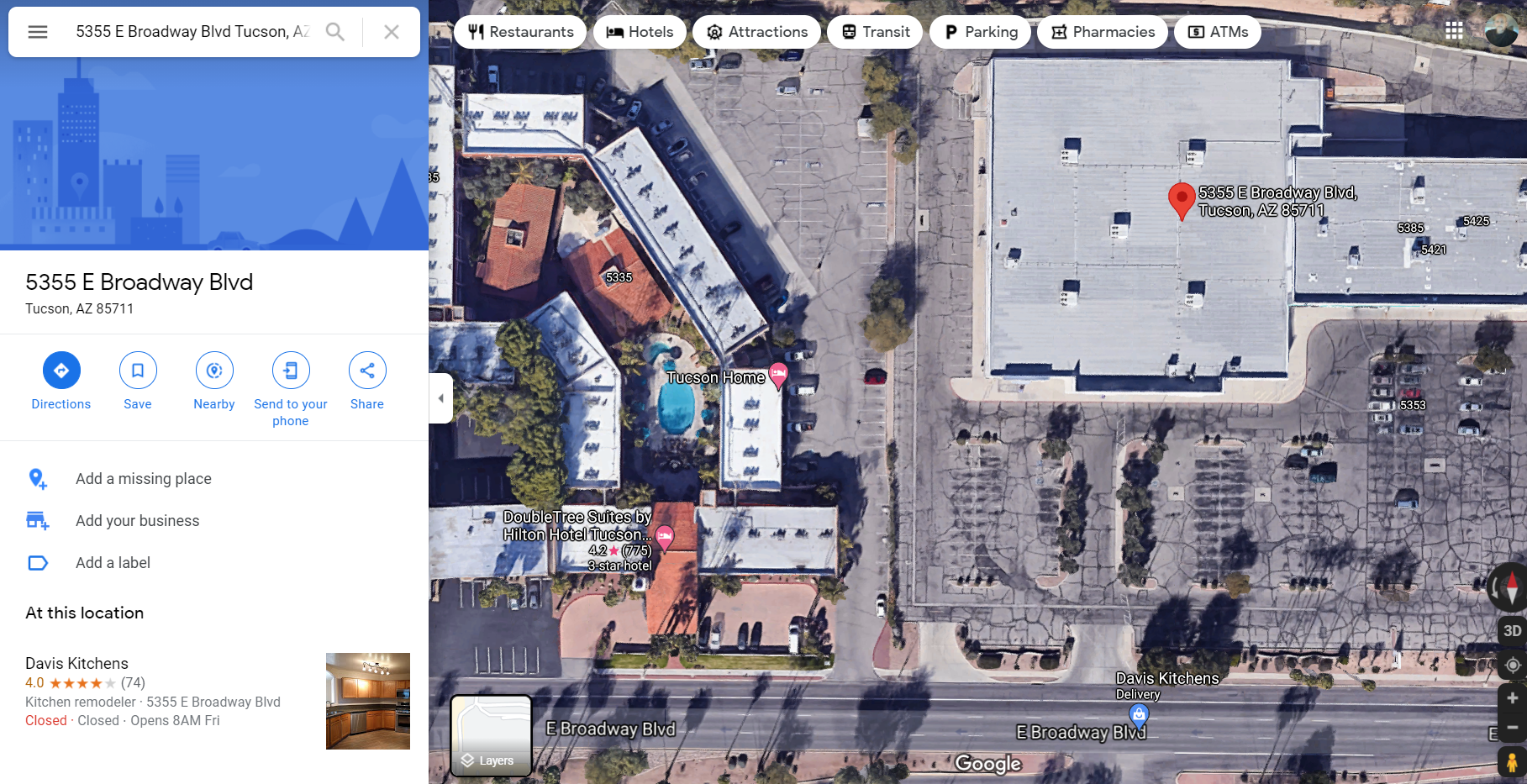

Since 1975, Davis Kitchens has offered striking design, quality cabinetry,professional installation and first-class service. Davis Kitchens is Southern Arizona’s leader in cabinetry. We are a major Tucson, Arizona cabinet distributor for remodeling and new construction alike. We provide professional cabinet designs and installation for your kitchen remodeling, bathroom remodels, room addition, or new home construction.

Watch Video Here

Visit Website Here

DAVID FAIR

FOUNDING PARTNER & CHIEF EXECUTIVE OFFICER

David Fair Named in 2021 Wood Industry 40 Under 40

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |