Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

gm, lol !!! and here i thought i'd be hearing about more great buying opportunities!!! viva la nlst !!!

mho no it should bounce from here or maybe a little lower $1.33 would be a double bottom.

unless the delay does have an effect on share price then i guess it could. so to put all that I just said in prespective I have no idea lol

robcobb

5m

$NLST I am disappointed about another delay in the Samsung 293 case as I know everyone else is,because my golf game is not that good right now and I am ready to be in the courtroom and see the Samsung lawyers get it handed to them again by Jason!I am convinced that Judge Gilstrap has Nlst interest at heart in getting to the finish line without Samsung being able to win an appeal!(Judge Gilstrap knows all of Samsungs tricks as he has them in his courtroom so often!) I have faith that his decisions even though it is taking longer than I would like ,is the right path to get Nlst justice in the end.Don’t forget about Micron,important decisions could happen at anytime also. I am glad the Samsung trial is finally set in stone (Sept.9)so I can start planning my week for the trial!Good luck to the true longs ,and don’t worry about the SP as a drop in price always occurs with delays ! Nlst justice is coming sooner than later ! (IMO)Sept 9 will be here soon!

do you think we get down to 1.25 ?

Stokd has a theory on everything lol Heres mine, shorts covering to it to $1.48 and today they walk it back down on low volune to do it all over again. Its been happening all yr.

Stokd

3m

$NLST The sell off into the close today started 2 hours prior, which is 3 hours after the order delaying trial by only 3 weeks dropped.

IMO, the sell off had nothing to do with it, just more manipulation we're familiar with.

Food for thought: We are aware there are "insiders" that are privy to filings/orders before the public/retail—as witnessed in the past by price action that is well ahead, regardless if it's positive or negative news.

The Continuance order is dated July 4th, but did not publicly drop till today. The day after the July 4 holiday was Friday July 5th, when all of a sudden for no reason mid day we popped 8%. And today, we dropped exactly to the pre Friday pop price.

I'm guessing it was a set up starting Friday, whose goal was to exhaust sentiment and induce frustration towards the court system and Gilstrap....by the reactions it seems to be mission accomplished.

Don't underestimate manipulative forces here, as some said....price action/T&S was indeed strange all day.

https://stocktwits.com/Stokd/message/578827846

Screenshots from PTAB's Decision Granting Institution of claim 16/912 IPR—linked below....pgs 23-26 for full substance and context.

https://ptacts.uspto.gov/ptacts/public-informations/petitions/1549198/download-documents?artifactId=EilvW218s-TEP3Cxywp3Nw2xYkkSFVPM1Dd_xLsW18EKXNmHwumEGmQ

https://sih-st-charts.stocktwits-cdn.com/production/original_578802133.png

Stok $NLST Let the point I was trying to make over the weekend sink in: That Samsung’s position and PTAB Board’s conclusion in the claim 16/912 IPR, are essentially based on the idea that the USPTO examiner during the previous lengthy 912 examination and reexamination, erred in their findings allowing claim 16.

So it’s the PTAB & Samsung versus a USPTO examiner, who did a more thorough job analyzing/examining the claim, and allowed it despite the "supposed" pressure/influence from Google at the time—what we've come to believe about the PTAB and their APJs.

Now, don’t you think the examiner had their reasons, with all the implications and the number of claims that were cancelled or Netlist had to rewrite….claim 16 survived. I’m going with the initial examiner in how the CAFC will see it.

My points have nothing to do with whether the Director Review is granted, my focus is on the CAFC, in front of who I believe the PTAB has a weak position/case here—that the USPTO examiner erred.

read thread https://stocktwits.com/Stokd/message/578796151

this will be our largest jury award to date. other than that for all the bs it would be nice to see gilstrap treble it!!!

Stokd $NLST There will be no more delays or continuance — "The Court recognizes the importance of having lead counsel participate in both the pretrial conference and trial given the scope and complexity of the case. However, the Court is not persuaded that it should impose multiple lengthy continuances given that this case has already been continued for more than four months from its original setting in April 15, 2024. The Court finds that a modest adjustment of the schedule is appropriate to accommodate the schedules of the parties’ lead counsel."

And further in the order stating---

"Accordingly, given the parties’ representations, there are no existing conflicts with the Court’s proposed dates for the pretrial conference and trial."

https://sih-st-charts.stocktwits-cdn.com/production/original_578776099.png

SilviaJ $NLST DR ALBERT: “They blacked out this -- the other prong of the fork, to claim that there is now a -- a fork in the road here. But the figures themselves describe this fork-in-the-road concept; the patent specifically describes this fork-in-the-road concept.

THE COURT: Mr. Albert, can you go back to your slide with figure 5 from the patent; not the modified version, but the actual version? The fork in the road that you're describing is the place where path A and path B split off at the top of figure 5 there. Is that right?

DR ALBERT: That's exactly right, Your Honor.

THE COURT: Do you contend that you cannot drive a signal along path A without disabling path B? In other words, are you taking the position that it's not electrically possible to do that?

DR ALBERT: Well, that's -- the patent doesn't describe a dual operation of both path A and path B.

THE COURT: I know. My question is different. Do you contend that you cannot drive a signal along path A without disabling path B?

DR ALBERT: Not with this circuit as disclosed in the '339. Now --

THE COURT: I don't know what that means.

DR ALBERT: Engineers are very bright, and you can certainly create a different circuit with a different disclosure that could drive different pins at the same time

THE COURT: All right. And my question is do you contend that you cannot drive a signal along path A of this circuit without disabling path B.

DR ALBERT: Your Honor--I don't mean to duck your question

Gilstrap doing his job to make sure no appeals go through. Only problem is he never closes out cases for infringers to even begin the appeals process. LOL. We should definitely win. But it's the WHEN that's highly in question. My grandkids (if I ever have some), may thank me for HODLing.

Case 2:22-cv-00293-JRG Document 724 Filed 07/04/24

Case #00293 continuance granted!

The Court recognizes the importance of having lead counsel participate in both the pretrial conference and trial given the scope and complexity of the case. However, the Court is not persuaded that it should impose multiple lengthy continuances given that this case has already been continued for more than four months from its original setting in April 15, 2024. The Court finds that a modest adjustment of the schedule is appropriate to accommodate the schedules of the parties’ lead counsel.

The Court finds that Samsung’s Motion (Dkt. No. 712) should be and hereby is

GRANTED AS MODIFIED. Accordingly, it is ORDERED that the pretrial conference in the above-captioned case is reset for Friday, August 23, 2024 at 9:00 AM and Monday, August 26, 2024 at 9:00 AM. It is further ORDERED that the trial in the above captioned case is specially set to begin with jury selection Monday, September 9, 2024 at 9:00 AM. The Court intends that this case go first in the order of trials for the trial term beginning September 9, 2024. Except as expressly granted herein, all other dates in the Court’s Seventh Amended Docket Control Order remain in effect.

the court is asking the questions and the jury is the party responding. its the 294 micron case for the $445million........

here is the thread..... https://stocktwits.com/microby/message/578713182

big numbers deserve big pps !!! easier said than done, not too mention the wait............

who are these two question being ask? who is answering them?

sounds a bit over done to me but thats just mho

DDR4 gen, million 🔥 rdimm memory modules 😉

https://sih-st-charts.stocktwits-cdn.com/production/original_578713182.png

https://stocktwits.com/microby/message/578713182

like i said, i dont think he was hired by nlst, but i sure like his pps projections !!!

The Sales Potential of Netlist Inc.'s (NLST) Patented Memory Products. Article Discusses What Stock Price Potential Could Be...A Must Read!

Netlist Inc. (OTCQB: NLST) is an industry leader in advanced memory solutions, underpinned by a robust portfolio of patents. These patents are fundamental to high-performance computing, data centers, and enterprise applications. As the demand for these technologies grows, understanding the sales potential of Netlist's patented products is crucial for investors and industry analysts alike. This article explores Netlist's current market landscape, key legal developments, potential licensing revenues, and projected stock price.

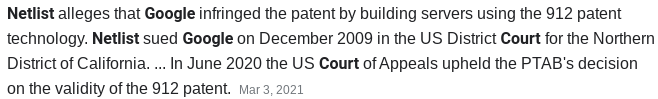

### Overview of Netlist Inc.'s Patented Memory Products

Netlist's technology portfolio includes several cutting-edge memory products:

1. HyperCloud: Enhances performance by providing higher memory density and reduced latency.

2. NVvault: Combines DRAM and NAND flash to provide non-volatile memory solutions, ensuring data retention during power loss.

3. NVDIMM: Non-volatile memory modules offering high-speed data access and retention, vital for enterprise-level computing and server applications.

These products are increasingly critical as data centers and enterprises demand higher performance and reliability.

### Current Market Performance of Major Memory Manufacturers

To assess Netlist's licensing potential, it's essential to examine the annual sales of major memory manufacturers like Micron Technology, Samsung Electronics, and SK Hynix for memory products related to Netlist's patents.

1. Micron Technology (MU):

- 2023 Revenue from applicable memory products: $12 billion

- Major contributions from DRAM and NVDIMM products.

2. Samsung Electronics (SSNLF):

- 2023 Revenue from applicable memory products: $25 billion

- Significant revenue from DRAM and NVMe SSD products.

3. SK Hynix (000660.KS):

- 2023 Revenue from applicable memory products: $10 billion

- Predominantly from DRAM and NVDIMM products.

### Existing Licensing Agreement with SK Hynix

In 2021, SK Hynix paid Netlist $40 million for a licensing agreement, reflecting the value of Netlist's intellectual property. This agreement is up for renewal in 2026, which could provide a substantial revenue boost for Netlist if renegotiated favorably.

### Ongoing Litigation with Google

Netlist is currently involved in significant litigation against Google, with the trial expected to begin in early 2025. The lawsuit could potentially result in a judgment or settlement worth billions of dollars, significantly impacting Netlist's financial outlook and stock price.

### Potential Licensing Agreements with Major Players

If Micron Technology, Samsung Electronics, and SK Hynix enter into licensing agreements with Netlist, we can estimate the potential licensing fees based on a conservative licensing fee rate of 3%.

1. Micron Technology:

- Revenue from applicable memory products: $12 billion

- Licensing fee at 3%: $360 million annually

2. Samsung Electronics:

- Revenue from applicable memory products: $25 billion

- Licensing fee at 3%: $750 million annually

3. SK Hynix:

- Revenue from applicable memory products: $10 billion

- Licensing fee at 3%: $300 million annually

### Total Annual Licensing Fees for Netlist Inc.

If all three companies enter into licensing agreements, Netlist could potentially generate:

- Micron: $360 million

- Samsung: $750 million

- SK Hynix: $300 million

Total Annual Licensing Revenue: $1.41 billion

### Projecting Future Licensing Fees

The market for these specific memory products is projected to grow at a compound annual growth rate (CAGR) of 40% to 60% over the next five years. Using a midpoint growth rate of 50% for our projections:

#### Yearly Licensing Fee Projections:

1. Year 1: $1.41 billion

2. Year 2: $2.12 billion ($1.41 billion * 1.5)

3. Year 3: $3.18 billion ($2.12 billion * 1.5)

4. Year 4: $4.77 billion ($3.18 billion * 1.5)

5. Year 5: $7.16 billion ($4.77 billion * 1.5)

### High Profit Margin Potential

Given that the profit margin for licensing fees is estimated to be around 95%, the net annual profit from licensing fees would be substantial.

1. Year 1: $1.41 billion * 95% = $1.3395 billion

2. Year 2: $2.12 billion * 95% = $2.014 billion

3. Year 3: $3.18 billion * 95% = $3.021 billion

4. Year 4: $4.77 billion * 95% = $4.5315 billion

5. Year 5: $7.16 billion * 95% = $6.802 billion

### Estimating Netlist Inc.'s Stock Price

Assuming a price-to-earnings (P/E) ratio of 15, which is a conservative figure for the tech industry, we can estimate the potential market capitalization and stock price:

1. Year 1: $1.3395 billion * 15 = $20.0925 billion

2. Year 2: $2.014 billion * 15 = $30.21 billion

3. Year 3: $3.021 billion * 15 = $45.315 billion

4. Year 4: $4.5315 billion * 15 = $67.9725 billion

5. Year 5: $6.802 billion * 15 = $102.03 billion

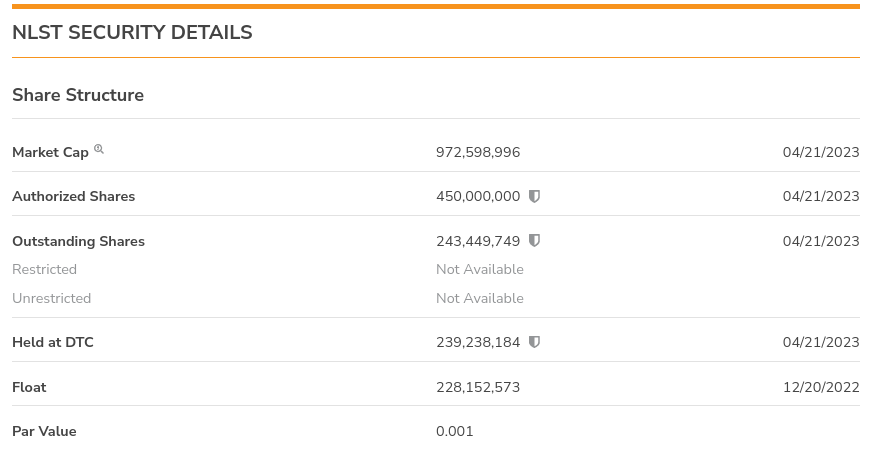

With approximately 250 million shares outstanding, the estimated stock prices would be:

1. Year 1: $20.0925 billion / 250 million shares = $80.37 per share

2. Year 2: $30.21 billion / 250 million shares = $120.84 per share

3. Year 3: $45.315 billion / 250 million shares = $181.26 per share

4. Year 4: $67.9725 billion / 250 million shares = $271.89 per share

5. Year 5: $102.03 billion / 250 million shares = $408.12 per share

### Impact of Google Lawsuit

The potential outcome of the Google lawsuit could add billions to Netlist's earnings. If we assume a favorable judgment or settlement of $2 billion in 2025, this would significantly impact Netlist’s stock price.

Projected impact:

1. Year 3 (2025): $3.021 billion + $2 billion (settlement) = $5.021 billion

2. Market capitalization: $5.021 billion * 15 = $75.315 billion

3. Estimated stock price: $75.315 billion / 250 million shares = $301.26 per share

### Supreme Court Chevron Decision and Upcoming Litigation

A recent Supreme Court decision regarding the Chevron doctrine strengthens Netlist's position in its legal battles and licensing negotiations. This legal precedent may make it easier for Netlist to enforce its patents and secure favorable licensing terms.

Additionally, Netlist is scheduled for another court appearance on August 18, 2024, against Samsung for patent infringement of patent 912. A favorable jury verdict could award Netlist hundreds of millions of dollars, further boosting its financial standing and stock price.

### Financial and Stock Purchasing Disclaimer

The projections and estimates provided in this article are based on current market data and assumptions about future growth and profitability. These estimates are for informational purposes only and should not be construed as financial advice. Investing in stocks involves risks, and it's essential to conduct thorough research and consult with a financial advisor before making investment decisions. Past performance is not indicative of future results.

### Conclusion

Netlist Inc.'s patented memory products hold significant sales potential, and the company's future licensing agreements with major industry players could substantially increase its revenue and stock valuation. Additionally, the ongoing litigation with Google presents an opportunity for a significant financial windfall that could further enhance Netlist's market position and stock value. However, these projections are subject to various market dynamics and legal outcomes that may affect actual results. With a strong portfolio of innovative memory technologies and strategic licensing agreements, Netlist is well-positioned to capitalize on the growing demand for high-performance computing solutions in the coming years.

In conclusion, while the sales potential and financial projections for Netlist Inc. appear promising, it is important for investors to remain cautious and stay informed about market conditions and company developments. As always, thorough research and consultation with financial advisors are recommended before making any investment decisions.

https://www.linkedin.com/pulse/sales-potential-netlist-incs-nlst-patented-memory-products-wallach-vnjwe

$NLST PART-3

May as well include Netlist's Director Review Request, to tie it all up with context.

From Netlist’s/Warrick’s Director Review Request — INTRODUCTION: “The Board’s final written decision presents important issues of law and policy related to the recognition of priority dates for patents challenged in inter partes review. Director Review is necessary to clarify that the Board must consider evidence of how skilled artisans would understand priority-document disclosures, as well as to clarify evidentiary burdens in priority disputes."

"This error fatally undermines the Board’s obviousness determination, which rests solely on a subsequently filed, published, and abandoned patent application reference (Ellsberry). There is no dispute that if claim 16 is entitled to the July 15, 2004 priority date of the ’244 provisional,” Ellsberry does not qualify as prior art to claim 16 of the ’912 patent.

Wow, didn't notice how late it is...😂🙏🏼🍻

Link below—

https://ptacts.uspto.gov/ptacts/public-informations/petitions/1549198/download-documents?artifactId=uV6DO5I97Y5iWz4torZzU9bK97Cqfj4vczPSz2R790-TdCGKelIzyyw

https://sih-st-charts.stocktwits-cdn.com/production/original_578703766.png

https://stocktwits.com/Stokd/message/578703766

NLST PART-2

I as Netlist, don’t think the Examiner erred, and believe the petitioner and the Board are incorrect….by erring in their decision to institute IPR, shifting the burden of production to Netlist, and invalidating claim 16 in IPR FWD. Which are exactly the basis for Netlist’s arguments in Dir Review and will be on appeal at the CAFC.

Read pgs 23—26 of Paper 20 on Advanced Bionics--linked in my PART 1. It’s crucial to understand the substance and therefore Netlist’s claims/arguments against the Board. Folks, educate yourself and dive in when needed, everything is not as grey as it seems. There are substantive and legitimate arguments made by Netlist, but you have to be aware of and understand the opposition and what they asserted and why, in order to grasp the strength of Netlist’s claims on appeal. Which again, I vehemently stand behind.

Continued in comments are the relevant quotes from screenshots used as the basis of my post.

https://sih-st-charts.stocktwits-cdn.com/production/original_578703585.png

“Consequently, we find that Petitioner carried its initial burden to show that Ellsberry is prior art. The burden of production thus shifts to Patent Owner to show that the subject matter of claim 16 of the ’912 patent is supported by its priority applications such that Ellsberry is not prior art.” — “Petitioner has shown sufficiently that the Examiner erred in a manner material to the patentability of the challenged claims under the second part of the Advanced Bionics framework. The Examiner assumed that Ellsberry was not prior art based on the ’912 patent’s earliest priority date without considering whether the features claimed in the ’912 patent were supported by the earlier priority applications.” — and we know how this IPR concluded.

https://stocktwits.com/Stokd/message/578703585

$NLST PART-1

PTAB did not ignore it….if you've read docs in claim 16/912 IPR, you would understand why. It also leads where substance can be found….last line of your pic—"Paper 20 at 23".

Paper 20 is the Institution Decision, where pg 23 explains that although part 1 of Advanced Bionics framework lead the Board to consider and then acknowledge Ellsberry was presented and considered during previous 912 examination and reexamination, which concluded it was not prior art to 912.

Part 2 of the same framework led the Board to conclude that petitioner’s claims—““the Examiner clearly erred in allowing claim 16” because the Examiner assumed that Ellsberry was not prior art to the ’912 patent based on its earliest effective filing date.” were adequate to carry the initial burden, and shifted the burden of production to Netlist to show otherwise.

Continued in 2 comments are relevant quotes from pics used as basis of my post. Link to Institution Decision (Paper 20) below.

https://ptacts.uspto.gov/ptacts/public-informations/petitions/1549198/download-documents?artifactId=EilvW218s-TEP3Cxywp3Nw2xYkkSFVPM1Dd_xLsW18EKXNmHwumEGmQ

https://sih-st-charts.stocktwits-cdn.com/production/original_578703557.png

https://stocktwits.com/Stokd/message/578703557

NLST This is so unbelievable; how could the PTAB ignore this.

https://sih-st-charts.stocktwits-cdn.com/production/original_578702413.jpeg

https://stocktwits.com/SilviaJ/message/578702413

we're going to win.

I believe that Stokd neglected to mention that we are still waiting on Gilstrap to give a ruling on Samsung’s request for a new trial in the 00463 case.

Once Gilstrap denies that motion (I can’t imagine he won’t), then there’s not much doubt that 29 days or so later, we’ll see Samsungs appeal of that case.

That will start the clock on THAT 18 -24 month wait!

july 6th updated litigation chart..........

https://sih-st-charts.stocktwits-cdn.com/production/original_578689410.png

Stokd $NLST Though not much has changed, it's been a while since last post/version of the litigation chart & timeline to CAFC finality chart.

Here’s what we’ve been immediately waiting on that’s significant—among other known developments.

- Trial date of Samsung 293/912 ptnt case, whether Samsung’s trial continuance was denied.

- Final Judgment in Micron 294 case.

- Rulings on post trial motions in Samsung 463 case.

- Claim 16/912 Director Review Request—if denied, the CAFC appeal is next.

Litigation chart below and CAFC timeline chart in comments.

https://sih-st-charts.stocktwits-cdn.com/production/original_578688575.png

Timeline to CAFC finality chart.

https://sih-st-charts.stocktwits-cdn.com/production/original_578688658.png

$NLST Competition for people and skills in the HBM space.

Samsung, SK compete to secure semiconductor experts

Samsung Electronics and SK hynix started their respective recruitment procedures this week to hire massive numbers of semiconductor experts, amid a fierce competition for leadership in the rapidly growing artificial intelligence (AI) chip market, according to industry officials, Thursday.

This is unusual for the two largest chipmakers in Korea to post job openings in July.

Their recent move has been interpreted as part of efforts to lead the market for high-bandwidth memory (HBM), which has enjoyed rising global demand following the rapid growth of AI technologies https://www.msn.com/en-us/money/companies/samsung-sk-compete-to-secure-semiconductor-experts/ar-BB1po453

$NLST Potential Impact on USPTO Regulations of Supreme Court Unraveling the Chevron Deference https://www.jdsupra.com/legalnews/potential-impact-on-uspto-regulations-7287717/

NLST With the recent SCOTUS judgement (striking down the Chevron doctrine and curtailing power of federal agencies such as EPA, FDA, USPTP/PTAB,…) the „race to first judgement“ may become even more important.

How could the CAFC give more weight to the PTAB when a jury and real judge have already given their verdict (?) We will need to see the effects of that recent SCOTUS judgement, but if it has an effect on Netlist’s litigations then rather favourable.

https://www.scotusblog.com/2024/06/supreme-court-strikes-down-chevron-curtailing-power-of-federal-agencies/

JERRY ALSTON NLST.............

https://investors.netlist.com/websites/netlist/English/4050/leadership.html

STRAPS ON THE JOB LOL !!!

https://sih-st-charts.stocktwits-cdn.com/production/original_578668124.jpg

Let's go Judge Gilstrap, finish these issues up. Onward to the Appellant Court where 91% of appeals from your court are denied. https://sih-st-charts.stocktwits-cdn.com/production/original_578660578.jpeg

SilviaJ $NLST So Samsung calls out NLST to the judge saying that Netlist is trying to game the system, get their judgement in first. And what was Judge Gilstrap's reply?

Sorry, but no.....it would wrongly signal that the judicial branch is subservient to the executive branch; denied!

Judge Gilstrap knows there is a "Race to Final Judgement"

And Samsung called out Netlist in the last court document. All that is remaining to wrap things up is for the "Court's ruling on the few post-trial issues".

https://sih-st-charts.stocktwits-cdn.com/production/original_578660059.jpeg

Stokd $NLST In our 215 & 417 IPRs—whose decisions (FWD) are due by Aug 2—there was an Order today.

At first glance of the title—PANEL CHANGE ORDER—I though...what kind of BS is this, "due to unavailability"...which makes no sense and is irrelevant being briefs are complete and so was oral argument.

So of course given all the bias/corrupt nonsense we've witnessed and experienced, the first thought in my mind is PTAB or Director is stacking the panel and making changes to usher the decision they prefer/want. It's not the first time in our IPRs there was a panel change, although earlier in the proceeding.

But after reading the doc and getting to who is being replaced, I felt better. Leaving is Galligan...."what is DRAM" guy who was the most nefarious towards Netlist/Sheasby during previous oral arguments. Still smells a bit, we'll see.

"Due to unavailability, Administrative Patent Judge Kevin C. Trock replaces Administrative Patent Judge Daniel J. Galligan on the panel."

https://ptacts.uspto.gov/ptacts/public-informations/petitions/1550898/download-documents?artifactId=2Rwuwb_oUb1AvwwJ4Y2q2aXxa5g9md1yF68ocqmB5v176UJqEhumZ1Y

my 02.......i dont think he was hired. i see his posts from time to time. hes either the same guy or just reposting the updates as opinions.

LinkedIn postings on ST

Is it possible that the poster on ST who continues to link to the LinkedIn stories on Nlst has been hired by NLST to promote the company? If so he needs to post outside of the NLST thread on ST because there he is just preaching to the choir.

your absolutely correct, i was jumping the gun. i had to re read that filing again. it will be hong as it has to be. i thought the accounting firm Macias Gini & O’Connell LLP were getting on board. see what happens when you get excited!!!

lol !!! yes, if it wasnt for the swamp we'd have a lot less information on this board. God bless them all!!!

bobbeach

9:13 AM

$NLST I have been patient as heck but this current line of info has put even me in a negative mode. For years I have believed and backed nlst with great belief in our Legal system, but I am slowly realizing this may go on until I die. I'm an Officer from Special Forces with bullet holes for this country but I am losing my belief in my Country's fairness to the small investors!!! Most of us aren't as sophisticated as Robcob, Stoked or Silvia, et al, and this thread is a slow realization that this may never end. For the first time I am losing my faith in the fairness of my own country!!! We need to destroy these foreign bastards like Samshit, Googlie, and the lawyers who condone and suck up to them. Stil slightly bullish!!!

Bullish

thx, yeah just speaking off the top of my head there. its just that it made me think of it being a cue to go when he started bringing it up. time span is another story, the pps is any ones guess. but we'll deal with it when it happens.

I think you are jumping too far ahead Striper. Every corporation has to have directors, and therefore Hong is our one and only director. The BOD required for NAZ has to include outside directors. Otherwise, you are usually right on target and I appreciate your postings bring the stuff from the swamp at ST over here where it is much easier to read. Keep it up please.

i got the meaning of both you guys conversation and would like to add. a few years ago it hit me that when hong starts mentioning bod hes got nazdaq on the mind. because he only needs bod for the nasdaq uplisting, nothing else. thats why he got rid of them and went otc to save his company without any of there red tape.

so now we got a vote coming on a member for the bod. it might mean nothing, but he is mentioning bod which is needed to up list, its only getting started no where enough members but it is a start. thats why i liked this guys post. we're gonna crush the 912 in texas and have google on the hook in february for a lot more than all our combined jury awards to date.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174704789

maybe i'm premature on the naz thing, but those jury verdicts on the 912 will go are way for a monetary amount before or if they go to cafc.

NLST Received a response from Senator Tillis’s office a couple days ago. Went something like:

Hi Mr. xxxx my name is Caleb calling from senator Tom Tillis’s office. Wanted to give you a call, I know you had sent senator Tillis, a message regarding Netlist, and some of the challenges they’re having with regards to their intellectual property. Certainly understand your concern there, and just more generally about things that have gone on with the PTAB. I wanted to mention that senator Tillis has joined the piece of legislation, along with Senator Chris Coons together they are the chairman and ranking member of the senate judiciary committee sub committee on intellectual property. They have a couple of bills they worked on together. One of them is the prevail act. Essentially, this would attempt to make some changes to the PTAB, restore it to what it was intended Less gamesmanship, room for gamesmanship going on there. It certainly sounds like this would tie into the issues cont…

You’re talking about. So I wanted to mention that more broadly, we understand the concern and I will certainly be sure to raise it with our team and senator Tillis as well. But just wanted to touch base and let you know we got your email. We certainly understand the concern, and would welcome any further input on topics of concern you might have weather is specifically related to this or any others. You’re welcome to email just as you did or give our office a call at 202 224 6346 OK have a good rest of your day. Thank you

https://stocktwits.com/bluesuit55/message/578595221

I realize that but they can negotiate a buyout/merger sometimes you need deeper pockets to get to the end goal! Sometimes you can’t let your pride stand in your way! Remember all public traded companies are supposed to have their shareholders in mind! Can NetList make it alone maybe and maybe not. Will definitely have to issue more shares but time will tell.

|

Followers

|

307

|

Posters

|

|

|

Posts (Today)

|

9

|

Posts (Total)

|

26020

|

|

Created

|

05/14/07

|

Type

|

Free

|

| Moderators papaphilip gdog 100lbStriper Jetmek_03052 eyeownu Redoocs | |||

IN HONG WE TRUST....

Created by Sub-Teacher:

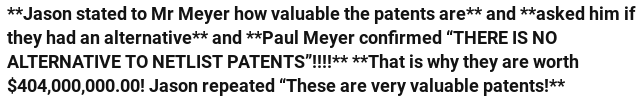

Samsung's Expert WItness Quote:

https://netlist.com/

brings over two decades of high-tech management experience to Netlist. He most recently served as President of Infinilink, a DSL equipment manufacturer, and as executive vice president of Viking Components, Inc. Prior to that, he spent 15 years with LG where he held various senior management positions in the U.S and Korea. Mr. Hong holds an MS in technology management from Pepperdine University and a BS in economics from Virginia Commonwealth University.

brings over two decades of high-tech management experience to Netlist. He most recently served as President of Infinilink, a DSL equipment manufacturer, and as executive vice president of Viking Components, Inc. Prior to that, he spent 15 years with LG where he held various senior management positions in the U.S and Korea. Mr. Hong holds an MS in technology management from Pepperdine University and a BS in economics from Virginia Commonwealth University.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |