Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Yup, those are some butt ugly financials

Did you see the first quarter revenue????

LMFAO….

They basically sold ONE (1) Class 1 vehicle in the first quarter.

Yes …O.N.E.

What a farce.

The 10Q is another unmitigated disaster.

The coming dilution is going to tank the stock.

They sold Jack shit in the first quarter….LMAO

C, some of us on this board aren't here to bash or take pot-shots at anyone who thinks possitively of Mullen. We've seen these $MULN games before from DM. One well-known member on this board lost over $100K last year. My unsolicited advise is that you should not try to invest (if that's what you're doing), but swing trade the crap out of this thing. If not for the $50M convertable note reported in Dec'23 that matured last month and has been dumping, this thing may have been at the $10 you mentioned. Dilution has been killing this stock since I got in almost 3 years ago and WILL continue to. The OS will triple in short order. Good luck to you, brother!

Hopefully folks on this board understand now why they saw all the PRs that they did in the past 2 weeks. DM is a master at manipulation through timely press releases and reshaping/spining bad news and horrible business moves into perceived good news! We endured years of this after being trapped in $MULN while him and the BoD made $Millions through compensation packages that were only approved by controlling the vote!!! FACTS!

Who remembers that Series AA share that represented a 1.3M voting value that he threatened to us if the vote for the first of 3 RS (1:25) May '23 wasn't 'YES?'

https://www.otcmarkets.com/filing/conv_pdf?id=16349331&guid=MrQ-kpVcRXrPB3h

As of May 9, 2024, a total of 11,412,596 shares of Registrant's common stock, par vaue $.001 per share, were issued and outstanding.

$MULN---how long will the @SECGov and @DOJCrimDiv and @Nasdaq allow this EV hustle from career con artist crooks continue?

— otcinvestorfrombrooklyn (@mikeycolombia33) May 14, 2024

AULT and MISERY should be in prisonhttps://t.co/RBu6bs5T7a@HindenburgRes @NateHindenburg @GaryGensler @cvpayne @CNN @SenWarren

The first $250 million tanked the stock price 99.99%. The next $150 million should be at least 99.9%.

At some point he will have to disclose the conversion terms.

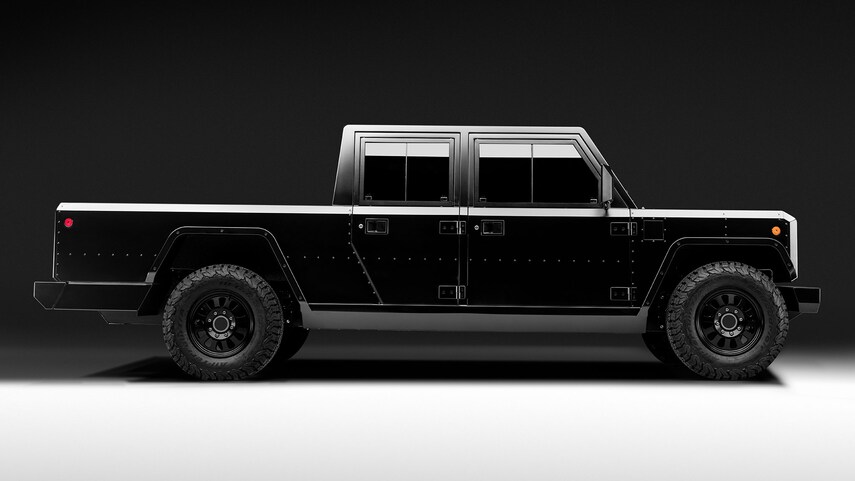

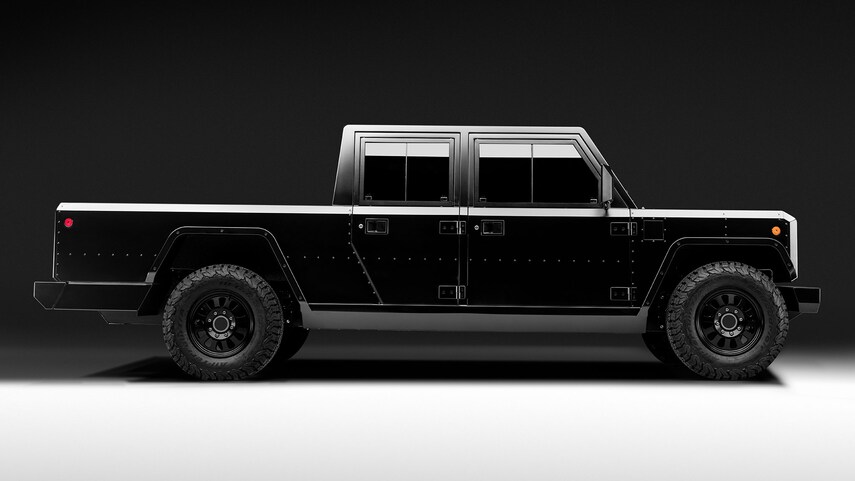

This is the Mullen if you are so excited about GM post on that board.

But the news today is played as Michery has been pumping loans for years.

From Michery - "Results from a comprehensive 6-month EV market exploration study and conceptual benchmark test indicate that the Mullen FIVE is conceptually highly competitive with the Tesla Model Y and Ford Mach-E. Results will support Mullen’s U.S. Department of Energy’s ATVM Loan Application for $450M."

That didn't workout very well.

But there is more:

"In January 2024, Mullen Automotive, Inc. (MULN) requested a $50 million loan from the U.S. Department of Energy's Advanced Technology Vehicles Manufacturing (ATVM) loan program to support its expansion into domestic battery manufacturing. The company also submitted a concept paper to the Department of Energy for $50 million in grant funding for its battery initiatives. The grant would support capital investment for plant equipment and tooling."

So Mullen has applied to the DOE for loans totaling $550 Million and received nothing.

Tesla received $457 Million in loans from the DOE under the ATVM program.

Michery issued a press release about - "an additional $50 million of senior secured convertible notes" - and there isn't any details on the terms of the conversion.

IG

2 career crooks yet the SEC and NASDAQ sleep

Once again a pumping press release void of any details about the terms of the loan agreement - the financials must really suck because of the Michery pumping.

Odd that Michery didn't file an 8-K but he can provide the details in the 10-Q - so we shall see.

Michery and the insiders manipulate the price after a pumping press release - doing wash trades and spoofing.

The shorts have made a fortune and moved on.

Post your proof of a short attack.

IG

...and has sold up to an additional $50 million of senior secured convertible notes to family offices and high net worth investors.

On December 18, 2023, Mullen Automotive, Inc. (the “Company”) agreed to issue a non-convertible secured promissory note (the “Note”) that does

not include any stock, warrants or other securities (the “Debt Agreement”). The Note, which does not include any conversion rights, will provide additional

capital for the Company’s manufacturing operations. Pursuant to the Debt Agreement, the Company will issue a Note that will have an aggregate principal

amount of $50,000,000, for a total purchase price of $32,000,000, or an original issue discount of $18,000,000. The issuance of the non-convertible Note

contemplated by the Debt Agreement will occur on the later of: (i) January 1, 2024 or (ii) the first day on which the Nasdaq Stock Market is open for trading on which all conditions to closing of both parties under the Debt Agreement have been satisfied. The Debt Agreement contains customary representations,

warranties and covenants.

The Note will bear interest at a rate of 10% per annum (which interest rate is increased to 18% per annum immediately after the occurrence and

continuance of an Event of Default (as defined in the Note) and it will have a maturity date set as the date that is three months from its date of issuance. The Company's repayment obligations under the Note may be accelerated, at the holder’s election, upon the occurrence of certain customary events of default. In the event of a default and acceleration of the Company's obligations, the Company would be required to pay the principal amount of the Note, plus all accrued and unpaid interest, plus all other amounts, costs, or expenses due under the Note.

the scam is on its deathbed

WOOHOOO! More toxic financing!!!

Oh, poor short… $10 in play

Mullen Announces $150 Million Financing Commitment

Who cares about MULN when GM@ Is going crazy, lol

From Michery - "Results from a comprehensive 6-month EV market exploration study and conceptual benchmark test indicate that the Mullen FIVE is conceptually highly competitive with the Tesla Model Y and Ford Mach-E. Results will support Mullen’s U.S. Department of Energy’s ATVM Loan Application for $450M."

That didn't workout very well.

But there is more:

"In January 2024, Mullen Automotive, Inc. (MULN) requested a $50 million loan from the U.S. Department of Energy's Advanced Technology Vehicles Manufacturing (ATVM) loan program to support its expansion into domestic battery manufacturing. The company also submitted a concept paper to the Department of Energy for $50 million in grant funding for its battery initiatives. The grant would support capital investment for plant equipment and tooling."

So Mullen has applied to the DOE for loans totaling $550 Million and received nothing.

IG

If you are going to throw out numbers without any facts you might as well have said $100.

"Will we hit 10$ next week? I think there is a good chance."

What is your reason for posting the pumping nonsense.

Michery issued a deluge of pumping press releases. Before the next Q is due on Wednesday 05/15/2024.

We will see the revenue then.

IG

Silver

You may be right that’s 5 cents a share pre split and FSRN is below that the question is are they both naked shorts

You're not very good at predicting, genius.

6.20 tomorrow...5.50 by Friday close

4.98 next week till next pumpathon

Will we hit 10$ next week? I think there is a good chance.

nice!! $muln is a scam...being manipulated as float is low after 3 reverse splits into oblivion.....still under pps of last R/S

More than likely the only way this thing stays above $6 by next Wednesday is if they announce some sort of purchase agreement. Those of us who have been here for a while have all shot that 'hopeium' of selling vehicles in our veins at some point in the past 2+ years and had a hell of a time in rehab after several lies and failures. Look at all the agreements to buy hundreds of Mullen vehicles that had us saying: "oh, it'll be different this time!" and NEVER happened. How are investors supposed to feel about that?

Mullen is just like Workhorse! When insiders finally decide to form a sustainable company after enriching themselves for years, it's too late. DM will use that same playbook for proping this thing up with share offerings, RS's and potential government subsidies but, like Workhorse, it will cost twice as much just to produce vehicles (which Mullen has yet to do), let alone sell them. Lordstown (RIDE) had a slow death! Workhorse (WKHS) is having a slow death. That scumbag of a CEO is no different!!! $MULN

Hopeium (colloquial, derogatory) - A clinging to unreasonable or unfounded hopes.

You apparently don’t know when you are being played.

But when the Q1 financials come out in a couple of weeks you will see that they didn’t book $33 million in revenue in the quarter let alone January. I would be surprised if it was over $750K…and not surprised if it was less than $500K.

You apparently haven’t been paying attention the last few weeks.

What “sales”? LMAO.

They can make ‘em…they just can’t sell ‘em.

They didn’t have $33.5 million in sales in January. I think the poster is referring to the “invoiced” or production quality.

The problem is they aren’t selling…there is no sales. They are sitting on RM storage lots.

$33.5 million in sales in January alone

Pretty sure most of us "doom and gloomers" have been here for over 2 years, or when the stock was at the current equivalent of $22,000 and change, per share....

That isn't true - Michery has a well established record as a failure as a CEO.

$33.5 million? Huh? Where on earth are you getting that number?

They haven’t announced any sales. Only channel stuffing activity.

Could be 21st. No set date.

$33.5 million in sales in January alone, no announcements of sales since then. Been doing some dd. looks very interesting. earnings is expected next week for the first quarter correct?

That isn't my opinion - it is a fact. Obviously you haven't read the financials. It clearly shows that Mullen is shipping to RMA and only being paid when a sale is made.

Odd that RandyMarionMullen.com which was redirected to randymarion.worktrucksolutions.com.

Now there isn't any Mullen Vans or trucks on randymarion.worktrucksolutions.com.

IG

Notice how there was little talk when this was going up yesterday from the doom and gloom team

and today since it's dropped, they are out in full force? I am here regardless of up and down.

They can't say the same.

That isn't true - Michery has a well established record as a failure as a CEO.

"Mullen’s Founder, Chairman and CEO, David Michery led 5 failed penny stock companies prior to Mullen. Two had their securities registrations revoked by the SEC, two terminated their securities registrations, and the last one merged with a speculative gold mining company.

Michery merged one of his prior entities as part of a 3-way deal with an individual who was later charged with criminal securities fraud and sentenced to 30 years in prison. Prosecutors alleged that the merger deal involving Michery’s prior company was part of the scheme."

Using AI I found a total of 10 companies associated with Michery that have failed.

David Michery, an entrepreneur and businessperson, has been at the helm of 10 different companies. Let’s delve into his notable positions and ventures:

Mullen Automotive, Inc.:

Chairman, President & Chief Executive Officer

Mullen Automotive, Inc. specializes in advanced electric vehicle & battery production, with its main product being the Dragonfly K501.

Founded by David Michery, this company has been making strides in the EV industry.

Mullen Technologies, Inc.:

Chairman & Chief Executive Officer

Mullen Technologies, Inc. is a subsidiary of Mullen Automotive, Inc.

It focuses on motor vehicles and consumer durables, particularly electric vehicles.

Primco Management, Inc.:

President & Chief Executive Officer

David Michery has been leading this company since February 6, 2013.

Seven Arts Music, Inc.:

Chief Executive Officer

A company in the entertainment sector, Seven Arts Music, Inc., has benefited from Michery’s leadership.

Former Positions:

iFinix Corp.: Chairman & Chief Executive Officer

Petro America Corp.: President & Chief Executive Officer

GL Energy & Exploration, Inc.: President & Chief Executive Officer

American Southwest Music Distribution, Inc.: President & Chief Executive Officer (both are subsidiaries of Petro America Corp.)

Shades Holdings, Inc.: President & Director

MNRK Music Group LP / Death Row Records brand: President

All American Communications, Inc.: Head-Urban Music.

Those that don't learn from history are doomed to repeat it.

IG

I understand it quite well. That is your opinion. I have heard differently.

And that opinion has worked out for me so far.

You don't seem to understand that Mullen has the worst agreement with RMA that isn't sustainable - Mullen rebrand the Chinese Vans and Trucks and delivers them to Mullen - but RMA doesn't pay Mullen until they make a sale - and 2 weeks ago RMA hadn't made any sells.

That is a recipe for Bankruptcy.

IG

Past does not determine present or future results.

The present does not look good for shorts.

Those shorting have made about 70% profit since the last reverse split.

Michery is in desperation mode as he is a pumping press release machine.

Another meaningless PR today.

Most shareholders have been crushed by the combined 1:22,500 reverse split.

Anyone shorting Mullen has done much better than any long.

IG

No sales news yet, but today's news is good for cash flow.

U.S. Department of Commerce Approves Mullen’s Tunica, Miss., Facility as Foreign Trade Zone

|

Followers

|

539

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

72985

|

|

Created

|

11/05/21

|

Type

|

Free

|

| Moderators Wayne R m$teamworkotc Huggy Bear Dragon Lady SmellMyFinger | |||

I.P.O.'D @ $13/ BIG TIME STORY/ #muln #stock #mullen $MULN NEW TRADING/MULN Stock:

The Biggest Short Squeeze in HISTORY or SELL it ALL? ??

1,111 viewsFeb 28, 2022

https://www.youtube.com/watch?v=73n0UiGxvDE&ab_channel=MoonMarket

E.V. PLATFORM;

| MULN [NASD] |

| Mullen Automotive, Inc. |

| Consumer Cyclical | Auto Manufacturers | USA |

https://www.mullenusa.com/

| Index | - | P/E | - | EPS (ttm) | -10.64 | Insider Own | 28.60% | Shs Outstand | 17.47M | Perf Week | -11.55% |

| Market Cap | 21.60M | Forward P/E | 0.92 | EPS next Y | 0.75 | Insider Trans | -0.33% | Shs Float | - | Perf Month | -78.36% |

| Income | -80.70M | PEG | - | EPS next Q | 0.16 | Inst Own | 3.30% | Short Float | - | Perf Quarter | -92.19% |

| Sales | - | P/S | - | EPS this Y | -536.60% | Inst Trans | 46.73% | Short Ratio | 0.16 | Perf Half Y | -93.52% |

| Book/sh | -0.60 | P/B | - | EPS next Y | 294.70% | ROA | -265.40% | Target Price | 23.00 | Perf Year | -93.31% |

| Cash/sh | 0.00 | P/C | - | EPS next 5Y | - | ROE | 532.00% | 52W Range | 0.52 - 15.90 | Perf YTD | -86.85% |

| Dividend | - | P/FCF | - | EPS past 5Y | 3.70% | ROI | - | 52W High | -88.42% | Beta | 2.55 |

| Dividend % | - | Quick Ratio | 0.50 | Sales past 5Y | - | Gross Margin | - | 52W Low | 253.96% | ATR | 0.28 |

| Employees | 44 | Current Ratio | 0.50 | Sales Q/Q | - | Oper. Margin | - | RSI (14) | 46.64 | Volatility | 27.83% 20.24% |

| Optionable | Yes | Debt/Eq | - | EPS Q/Q | -431.40% | Profit Margin | - | Rel Volume | 88.85 | Prev Close | 0.69 |

| Shortable | Yes | LT Debt/Eq | - | Earnings | - | Payout | - | Avg Volume | 6.99M | Price | 1.84 |

| Recom | - | SMA20 | 7.64% | SMA50 | -47.36% | SMA200 | -78.15% | Volume | 492,790,936 | Change | 167.53% |

02-07-2021

PER IHUB MGMT

DISCLAIMER: ONLY FOR MICK

https://investorshub.advfn.com/boards/profilea.aspx?user=1012

*The Board Monitor and herewithin , are not licensed brokers and assume NO responsibility for actions,

investments,decisions, or messages posted on this forum.

CONTENT ON THIS FORUM SHOULD NOT BE CONSIDERED ADVISORY NOR SOLICITATION

AUTHORS MAY HAVE BUYS OR SELLS WITH THE COMPANIES MENTIONED IN TRADING POSTERS SHOULD DUE DILIGENT BUYING OR SELLING.

ALL POSTING SHOULD BE CONSIDERED FOR INFORMATION ONLY. WE DO NOT RECOMMEND ANYONE BUY OR SELL ANY SECURITIES POSTED HEREWITHIN.

ANY trade entered into risks the possibility of losing the funds invested.

• There are no guarantees when buying or selling any security.Any

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |