Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

This turd was already hit with a "Promotional Flag" last year.

Real companies don't do this. lol

Policy on Stock Promotion

The promotion flag remains on the security for 15 days after the last promotional material is distributed. Promoted with “Stock Promotion” Designation We publicly identify securities that are the subject of stock promotion by placing a “stock promotion” flag This promotion flag is designed to provide an alert regarding the potential risks associated with trading the security and enhance broker-dealer compliance OTC Markets Group monitors for potential promotional activity relating to securities trading on our markets. Misleading promotional materials often employ false or baseless claims, omit material information, exaggerate an issuer’s future potential, or predict ....

Not a scam, been in business for many yrs

Real assets, google their address see warehouse with their subsidiary name on it, sheesh do a little dd

Website, apply for a job there

$MGUY - Scam??

Share price suggests it. down ~90% from 52-week high >

Excellent

Thank You

Q out Profitable and zero dilution last 6 months

A little nibble today More volume also

That 4.2 m loss is a killer No excuses for that

Probably correct. That's why MGUY price sits below $.01.

Hard to believe an OTC company with revenues over $50M has a share price so low.

But that's the OTC for you. Can't count on anything! LOL

Doesn't look very likely that uplisting plans are going anywhere

MGUY files Annual Report. Remains as PINK CURRENT.

https://www.otcmarkets.com/otcapi/company/financial-report/396357/content

Dumping continuing. Now ~3.9M sold down to $.0063

~1.1M shares sold this morning down to $.0064

Fairly significant "dump" by likely one person who threw in the towel (probably).

Something up? First peek above $.01 since Dec.

Well, I'll be doggone. I was also able to place a buy order after the market closed today. Also GTC.

Strange that during regular market hours my buy order was NOT accepted.

Anyway, thanks for the info.

I just bought with fidelity. Put my order in after market closed. And gtc. That 10 share was me on fidelity. Same with ni$h and gmz$...

We have dilution! OS data from Q2/Q3 reports.

Outstanding Shares

428,547,203 as of June 30, 2023;

508,547,203 as of date: September 30, 2023.

80M new MGUY shares issued past 3 months.

https://www.otcmarkets.com/otcapi/company/financial-report/384841/content

https://www.otcmarkets.com/otcapi/company/financial-report/385880/content

Check out Pinkies PFIE and CRAWA - real companies making real profits.

Check out Pinkies PFIE and CRAWA - real companies making real profits.

Super frustrating! Thanks for keeping up with this one.

Guess all the PRs were BS. Fidelity not accepting buy orders for this ticker for the past 3-4 weeks.

Only sell orders accepted online.

Promotion Flag now OFF MGUY OTCM* website.

https://www.otcmarkets.com/stock/MGUY/overview

* OTCM = OTC Markets Group, Inc.

My guess is there will be a strong move UP in share price once the "promo flag" is removed from their OTCMarket webpage.

Don't know exactly when this flag will be removed, but again I'm guessing that it will come off next week. Most likely by Monday or Tuesday.

Have a nice weekend everyone. Next week things could be getting interesting again.

Maybe setting up. Looks can be deceiving though...

Looks like some figured out the promo flag will be coming off "soon".

OTCMarkets leaves the flag up for 15 days after the promo ends. According to my calculation that means the promo flag for MGUY should come off either tomorrow or Friday. As far as I can tell, the promo ended Oct. 18.

Start shouting when it hits a buck LOL

I was WRONG again. LOL

Gonna keep my mouth shut here until I see Q3 numbers.

Not soaring yet. But pointed in right direction.

jmho

Here's what OTCMarkets says about Promotional Flags.

This promotion flag is designed to provide an alert regarding the potential risks associated with trading the security and enhance broker-dealer compliance processes. The promotion flag remains on the security for 15 days after the last promotional material is distributed.

Agree. Great time to re-load. Won't get much cheaper than now.

If even HALF of what Koubi said in his promo article comes true, MGUY could be the bargain of a lifetime at current prices.

Hope that those who sold come back in a year or so to see where MGUY is then! lol

PS. I still see promo flag. Should come off by Monday.

https://www.otcmarkets.com/stock/MGUY/overview

Promo flag is off and looks like all the trash bags are gone. I'm gonna start reloading soon .

To me, "uplist" conjures up the words "reverse split".

Perhaps this is what is driving down MGUY share price? "Reverse split" is the worst thought in most OTC trader's minds. Especially in the current OTC environment. Also note that MGUY has recently been flagged by OTCMarkets for "Stock Promotion".

https://www.otcmarkets.com/stock/MGUY/overview

Well, until proven otherwise, I'm going to trust Koubi's revenue guidelines for 2025 of ~$185M.

Even better would be positive earnings in 2024.

Nice bounce off the bottom today. Up ~90% from bottom.

Still down ~26% at the close. But the EOD bounce eased some of the sting.

Hopefully in the coming week we'll see some stability in MGUY trading.

Is there no end to the selling today?? WTF

MGUY low $.0222, worse than where it closed last Friday ($.0225).

Guess traders either didn't believe the forward-looking news this week or didn't care. They took their profits and moved on.

Awful trading today. Looks like MGUY could fall all the way back to where it started from on Monday ($.0248).

YUCK!

Good week overall

My current view of MGUY chart.

Lots of volatility past 3 days. Trading range today (so far) much less volatile.

Accumulation rising again after the big dip on Tuesday. However, RSI still showing extremely overbought conditions with RSI jumping to over 80% yesterday (85.5%).

Based on these technical indicators, I'm expecting MGUY chart to level off in the current range. However, be aware that this is the OTC after all and sometimes charts and technical indicators can be completely thrown out the window. This is especially true if buying volume remains strong.

Be wary of this kind of promotional article.

Here's an example of an OTC company that got slapped on the wrist for this.

https://finance.yahoo.com/news/pontus-protein-ltd-responds-otc-203400485.html

The link you posted was from the same promotional company, Awareness Consulting Network LLC. , mentioned in the article above.

Quote below was in the disclaimer section of the article you linked.

CapitalGainsReport (CGR) is owned by RazorPitch Inc. and has been retained by Awareness Consulting Network to assist in the production and distribution of content related to MGUY.

|

Followers

|

30

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1530

|

|

Created

|

03/05/08

|

Type

|

Free

|

| Moderators | |||

Reverse Merger Play with 7M Float and 40M O/S registered in Delaware

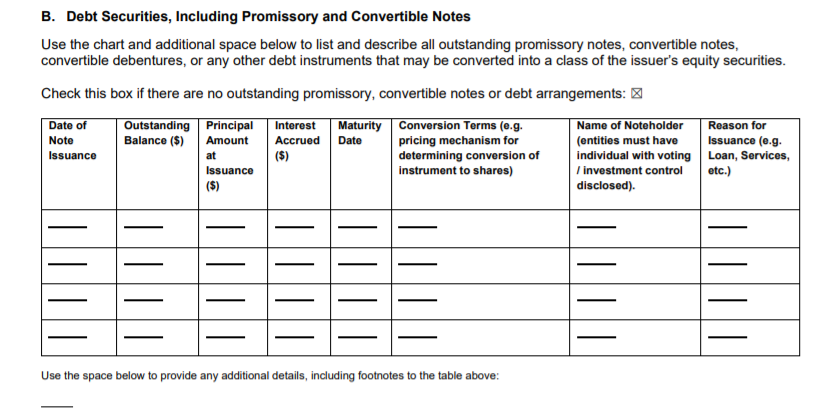

No Debt

Clean Balance Sheet

UPDATED SHARE STRUCTURE INFO (From OTC Markets webpage)

http://www.stockta.com/cgi-bin/analysis.pl?symb=MGUY&num1=1&cobrand=&mode=stock

http://www.stockscores.com/quickreport.asp?ticker=MGUY&rtype=small ------ with Dover Petroleum Corp (DVPC)

http://stockcharts.com/c-sc/sc?s=mguy

http://www.barchart.com/quotes/stocks/MGUY

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |