Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Some positive PRs starting to move the needle. I’m excited for this company!

Marietta’s MiMedx moving past recent woes

By Andy Peters, The Atlanta Journal-Constitution

High hopes for a new arthritis drug

Marietta skin graft maker MiMedx hopes a treatment it is developing for osteoarthritis, tendonitis and plantar fasciitis will help it bounce back from a scandal that saw its former CEO go to prison for securities fraud last year.

The company plans to start late-stage trials by December of its injection therapy for musculoskeletal conditions. If federal regulators approve the drug, MiMedx could begin selling it as soon as the second half of 2026 and help return the company to its high-flying days.

“It’s a huge, huge market,” CEO Tim Wright said during a recent interview at MiMedx headquarters. “At least 240 million patients suffer from knee and hip osteoarthritis worldwide.”

Ramakanth Swayampakula, an analyst for investment bank H.C. Wainwright & Co., wrote in a November report that MiMedx, with its revamped management, a multiyear commercialization plan and a late-stage research and development pipeline, should see significant sales growth in the coming years.

The new treatment is made from placental tissue that has been ground into a powder, added to a liquid solution and injected at the source of osteoarthritis. The anti-inflammatory and healing properties of the mixture promote rapid regeneration of vital cells.

The chemical makeup of placental tissue can’t be replicated synthetically. MiMedx obtains the tissue from women who have recently given birth through cesarean section and have donated their placentas.

Other pharmaceutical companies are testing similar injection treatments, though none has obtained U.S. Food and Drug Administration approval.

In the meantime, MiMedx will continue to rely on its line of skin substitutes made from placental tissue that are used to treat diabetic foot ulcers, burn unit patients and other severe wounds. The skin grafts, which are produced in sheets, keep wounds sterile and promote healing.

Its sales of wound-care products rose 15% in 2021 to $240 million, compared to 2020. But that is lower than the company’s 2018 peak of $359 million, according to regulatory filings.

Wright, who joined MiMedx as CEO in May 2019 after a stint at Teva Pharmaceuticals, said the company wants to expand wound-care product sales to surgical recovery units and launch sales in Japan.

The global wound-care market is huge, with market research firm DelveInsight estimating its value could grow 80% from its 2020 figure of $9.5 billion to $17 billion in 2026.

Wright said he expects Veterans Administration hospitals to provide a major sales boost for MiMedx, as its wound-care products are “tailor-made for our active military members and our veterans.” MiMedx recently won a $67 million contract with the U.S. Department of Veterans Affairs.

MiMedx’s sales to the VA hospital system were at the center of a years-long criminal investigation. In 2020, the company paid $6.5 million to settle a federal probe into overcharging the VA.

As part of that probe, former CEO Pete Petit was accused of masterminding a scheme aimed at inflating revenues at the company. He was convicted of securities fraud in February 2021, sentenced to one year in prison and ordered to pay a $1 million fine. The 82-year-old Petit is scheduled to be released from a federal prison in October. His appeal of the conviction remains pending in federal court in New York.

MiMedx has faced other legal challenges, from former employees who alleged they were fired for flagging Petit’s fraud to a challenge last spring from an investor group. Prescience Point Capital Management put up three of its own nominees for the company board. The group withdrew its slate of candidates in May 2021 after MiMedx made changes to its corporate governance.

All major lawsuits and investigations have now been resolved, and Wright said MiMedx has put that era behind it.

“The integrity of the company had been challenged significantly, and many, many people here got hurt,” Wright said. “Our values today are around character and integrity. We’re in this for the long term.”

https://www.ajc.com/news/business/mariettas-mimedx-moving-past-recent-woes/MHQQVYRULRDO3MBAIJNRKOSI3I/

looks like an opportunity to buy some MDXG dips...

Catching fire. Thanks for article, I'd think that is part of this buying, but this seems more than speculative buying. More like successful trial or business picking up, or all of it!

01-Apr-21 09:35 ET

MDXG

MiMedx Group mentioned positively again by Prescience Point (10.48 +0.18)

Prescience Point says "FDA's likely rejection of Pfizer $PFE & Eli Lilly's $LLY new drug for knee OA is extremely bullish for @MiMedx and we believe will lead to multiple buyout offers for $MDXG from Big Pharma after its phase 2B knee OA trial results are published this summer."

Something seems to be happening now... About time for quarterly too

MDXG can't get no luv from the Market...I would think today's 8k is positive news...maybe we need to wait a couple more day's to see some upward movement.

GLTA

Had a decent move on 14 Dec 2020: But could be that company that make a big move in 2021...Merry Christmas All

BATON ROUGE, La., Dec. 16, 2020 /PRNewswire/ -- Prescience Point Capital Management, a research-focused, catalyst-driven investment firm, today announced it has issued new research on MiMedx Group Inc. (Nasdaq: MDXG), raising the price target on the leading advanced wound care and therapeutic biologics company to $31 per share. Prescience Point is one of the company's largest shareholders, owning 9 million or approximately 6.5% of the fully-diluted common stock of MiMedx.

Over the past six months, Prescience Point has conducted an in-depth analysis of MiMedx's Amniofix injectable product, which is currently in Phase 2b trials for knee osteoarthritis ("knee OA"), as well as Phase 3 trials for plantar fasciitis and Achillles tendonitis. Following the extensive analysis, which included a comprehensive review of the knee OA and osteoarthritis market, an analysis of clinical data, an analysis of competing treatment options, and conversations with dozens of physicians and patients who have used and been treated with the product, Prescience Point has concluded that Amniofix will be a game-changing treatment for knee OA and other musculoskeletal ailments, which will generate billions of dollars in annual sales for MiMedx.

Prescience Point's research indicates that Amniofix is a far superior treatment for knee OA than the few FDA approved treatments now available for the 20 million people in the U.S. who suffer from this chronic and debilitating condition. Prescience Point's research also indicates that Amniofix is a highly effective treatment for a variety of other musculoskeletal ailments including plantar fasciitis, shoulder osteoarthritis, and ankle osteoarthritis.

Based on the findings of its research, Prescience Point believes that the FDA will approve Amniofix for knee OA and multiple other indications beyond knee OA. Prescience Point also believes that the RMAT designation that the FDA granted to Amniofix could open the door for MiMedx to receive early approval after its Phase 2b knee OA trial, as the FDA can and often does approve fast track treatments following a successful Phase 2 trial.

"Although MiMedx's share price has increased by more than 200% since we published our initial report in January 2019, its shares are still trading at just a fraction of their fair value." said Eiad Asbahi, Founder and Managing Partner of Prescience Point. "We believe that MiMedx's wound care business by itself is worth at least $8 per share. This means that investors who purchase MiMedx shares today are buying the wound care business at a substantial discount and, on top of this, are receiving Amniofix, an asset that we believe is worth multi-billions of dollars, essentially for free."

* * $MDXG Video Chart 12-16-2020 * *

Link to Video - click here to watch the technical chart video

MDXG moved to the Nasdaq from the OTC:

https://otce.finra.org/otce/dailyList?viewType=Deletions

Today it’s over with OTC trading...

Back to Nasdaq, great opportunities, no

further SP dumps here !!!!

shareholder letter we were approved for listing on nasdaq 11/4 - finally !

I don`t believe a word they say. Who are they, and where can I find what they said? Thanks

There’s a lot of short manipulation going on.

I don’t believe a word they say.

please show link or source--thank you

.... It will be uploaded to the Nasdaq Exchange on Mon Sept 28th in the premarket

Shitty OTC terminated, MM included

again nice call--is cc conference call?

Upcoming CC may have an announcement on up-listing. Could be nice increase in share price.

I mean, you were off by 36 hours or more... I see no news, but can't wait to see more to come.

What a good call--holding 13,000 shares

No particular reason except mdxg said they would have 2019 10k done in early 2020 and they have not met a time goal yet. June 15 is about as late in early 2020 that quickly came to mind. The new management leaves

a lot to be desired. I think they are in over their heads and are

milking the company for everything that they can get. Except for a little creative accounting, Pete was doing a much better job communicating and growing the company.

your post 260, refers to June 15, 2020, why this date? holding 13,000 shares.

Noles:

Smith &Nephew acquisition of Osiris implies what value to MDXG?

Lost 1/2 million in last week on RLMD but not selling, Rockefellers paid $30 in December

FSU’72 so long ago we called it ‘half ass U’ lived it what became known as the Burt Reynolds athletic dorm Stadium apartments, so many VWs in the pool they cemented it in

Pop w financials coming... back to 16 b4 2021. Just a prediction ??

Thanks for link, nice to hear and were my thoughts on this company too.

Another month or so for Finances and maybe 3 months to relisting. Can't wait to updates on trials/pipeline/future!

Trials ending June 2018 or later:

Jun 2018-DHACM in Robotic Assisted Laparoscopic Prostatectomy (RALP)

Jun 2018-Amniotic Membrane in Decompressive Craniectomy to Reduce Scarring

Sep 2018-Dehydrated Human Umbilical Cord Allograft in the Management of Diabetic Foot Ulcers

Oct 2018-A Case Series: Safety and Efficacy of Weekly Application of Dehydrated Human Amnion/Chorion Membrane in the Treatment of Pressure Ulcers

Dec 2018-Dehydrated Human Amnion Chorion Membrane (dHACM) vs. Control in the Treatment of Partial Thickness Burns.

Dec 2018-Use of Human Dehydrated Amnion Chorion Allograft in Closed Hemorroidectomy

Jan 2019-Use of Human Dehydrated UmbiliUse of dHACM in the Treatment of Venous Leg Ulcerscal Cord Allograft in Supraspinatus Tendon Repair

Feb 2019-Use of Human Dehydrated Amnion/Chorion (DHACM) Allograft in Partial Nephrectomy

Jul 2019-Use of Human Dehydrated Amnion Chorion Allograft in Laryngectomy/Pharyngectomy

Dec 2019-Micronized dHACM vs. Saline in the Treatment of Osteoarthritis of the Knee, Phase 2B

Dec 2019-Micronized dHACM Injectable for the Treatment of Achille Tendonitis, Phase 3

Aug 2020-Micronized dHACM Injectable for the Treatment of Plantar Fasciitis Phase 3

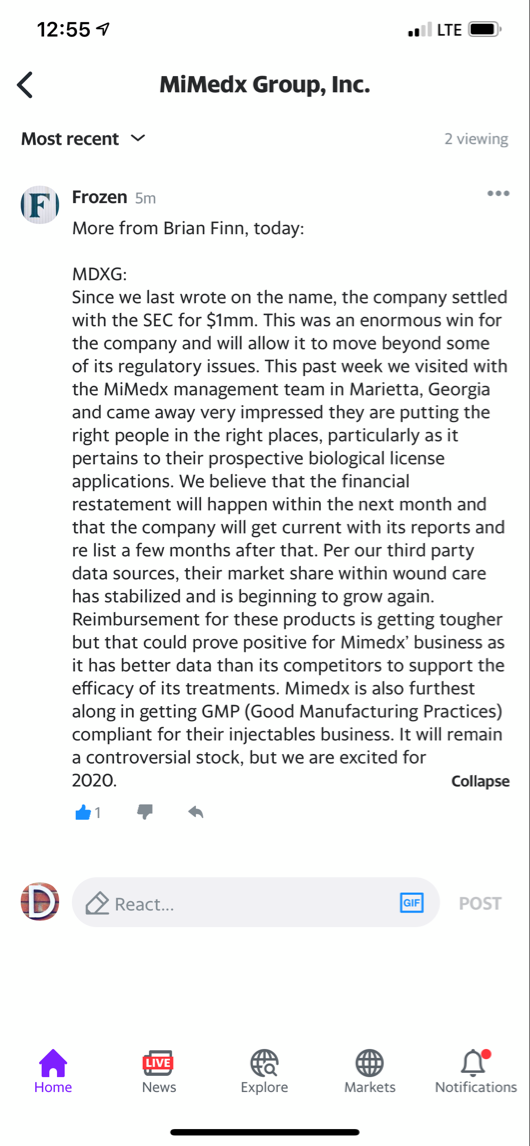

OK. Here is a recent podcast from Brian Finn of FIN Capital on the MDXG saga. Def worth a listen and then an update from their visit with MiMedx saying finances should be out within a month.

https://anchor.fm/avery-pagan/episodes/Brian-Finn-FIN-Capital-on-Behavioral-Bias-in-the-Stock-Market-ea380b

...someone does know something...read my last msg and it explains the downturn last 2 weeks. Should get back to $7.50 quick and resume slow rise. Finances could be out within the month. I'll post some good info...gotta upload a pic.

Restatement must be coming out soon. Rising price indicates somebody knows something, or something positive is happening behind the scenes. Current s/p move is a significant change in character of this chart. But there is no news anywhere on the web. Remain alert for public notice. It could be a time ahead to add to position quickly if numbers look good. Checking this one multiple times a day now.

Recent downtrend is because a large option holder has been exercising $5 option calls and dumping them because he doesn't have the millions to buy them all. He was also selling the calls at market. A million shares sold the past 2 weeks was all from him and his options.

It will be over today...good time to add this afternoon.

Updated financials early 2020. I've waited this long, next quarter is fine by me. Get this thing rolling!!

Hope everyone hangs in there next 3 days. MDXG said on Nov 12th they are still on target for 12/16 in their NT 10-Q. Doubt they would have put that in there with the Hialeah deadline to inform 'it would be late' already passed. "the Company is working diligently to complete its audited financial statements and has agreed to work in good faith to endeavor to file its audited financial statements for the year ended December 31, 2018 by December 16, 2019." They have an out, but let's hope it doesn't come to that.

I'm guessing 2018 and 2019 revenue will be around $290-$310 million each...about the same as when the valuation was $15. $400-$430 in 2020 minimum. Anyone else?

I hope they get the Super K out by Monday...no reason to give the shorts a cheap way out. GL

Current MiMedx AmnioFix Trials:

ongoing NCT03485157 A Phase 2B, Prospective, Double-blinded, Randomized Controlled Trial of the Micronized Dehydrated Human Amnion Chorion Membrane Injection as Compared to Saline Placebo Injection in the Treatment of Osteoarthritis of the Knee 2019-12-31

https://clinicaltrials.gov/ct2/show/NCT03485157

ongoing NCT03414255 A Phase 3, Prospective, Double-Blinded, Randomized Controlled Trial Of The Micronized dHACM Injection As Compared To Saline Placebo Injection In The Treatment Of Achilles Tendonitis 2019-12-31

https://clinicaltrials.gov/ct2/show/study/NCT03414255

ongoing NCT03414268 A Phase 3, Prospective, Double-Blinded, Randomized Controlled Trial of the Micronized dHACM Injection As Compared To Saline Placebo Injection In The Treatment Of Plantar Fasciitis 2020-08-31

https://clinicaltrials.gov/ct2/show/NCT03414268

I wonder if and when they will do a conference call. They may wait until the 2019 10-K. Not sure...it's been very quiet. Can't wait!

|

Followers

|

29

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

303

|

|

Created

|

10/27/08

|

Type

|

Free

|

| Moderators | |||

MiMedx® has built a management team with highly experienced healthcare executives with track records of leading large healthcare organizations in generating growth, producing profitability, and increasing shareholder value. Our management team draws on guidance from an insightful board of directors and medical advisory board. Collectively, they are committed to achieving success, accomplishing our corporate goals and growing the company. The management team at MiMedx® includes:

Mr. Wright was appointed Chief Executive Officer effective May 13, 2019. Previously, Mr. Wright served as a Partner at Signal Hill Advisors, LLC, a consulting practice, since February 2011.

Mr. Borkowski, was appointed Interim Chief Financial Officer on June 6, 2018. He previously served as Executive Vice President of MiMedx since April 19, 2018.

Mr. Graves joined MiMedx in July 2018 and brings more than 20 years of pharmaceutical and biotech industry experience to the Company, ranging from compliance and sales management to government affairs.

Mr. Hulse joined MiMedx in December 2019, and brings to MiMedx more than twenty years’ experience in large law firms and life sciences organizations, with significant legal, risk management, compliance and operational expertise.

Dr. Mason was named the Company’s Chief Medical Officer in December 2018. He joined MiMedx in June 2014, in the position of Vice President of Medical Affairs for Clinical Programs. Dr. Mason is a Board Certified Internist, board eligible in Rheumatology and Infectious Diseases, whose experience includes a 27-year pharmaceutical and medical device industry career, with increasing levels of responsibility.

Dr. Koob is the Chief Scientific Officer of MiMedx. He is the senior executive responsible for the overall research direction and oversight of the Company’s product and tissue offerings.

Mr. Harris was named Senior Vice President, Marketing and Business Development in December 2018. He joined MiMedx as Senior Vice President, International in June 2018, bringing to the Company 20+ years of experience in the regenerative medicine, medical device and cell therapy fields. In this role, Mr. Harris is responsible for corporate and product marketing, partnerships and joint ventures, as well as international sales and operations.

Scott Turner, has served as Senior Vice President, Operations and Procurement since April 2017. Mr. Turner oversees supply chain from donor recovery services through distribution as well as procurement, engineering, and facilities.

Dr. Brown joined SpineMedica LLC, an early-stage predecessor company to MiMedx, in 2005. She initially served as the Director of Project Management and Senior Engineer for SpineMedica, and later served as its Director of Research and Development and as Vice President of Operations.

Mr. Burrows joined MiMedx Group in April 2011 as Vice President of Wound Care to lead the marketing of the Company’s wound care offerings and other exciting products and tissues. He assumed the role Of Vice President of Global Marketing in August 2011 to focus on expanding the Company’s presence in the regenerative tissue market.

Mr. Spencer is the co-founder of Surgical Biologics, a leading processor of amnion tissue for use in a variety of surgical implants. Since the founding of Surgical Biologics in 2006, he led the development of the proprietary PURION® Process,

About MiMedx

MiMedx® is an industry leader in advanced wound care and an emerging therapeutic biologics company developing and distributing human placental tissue allografts with patent-protected processes for multiple sectors of healthcare. The Company processes the human placental tissue utilizing its proprietary PURION® process methodology, among other processes, to produce allografts by employing aseptic processing techniques in addition to terminal sterilization. MiMedx has supplied over 1.5 million allografts to date.

Hilary Dixon

Corporate & Investor Communications

770.651.9066

investorrelations@mimedx.com

Estimated Market Cap : $783.0M as of Dec 11, 2019

Outstanding Shares : 110.8M as of December 11, 2018

$1.5M Settlement Recognizes Company's Cooperation & Remediation Efforts

MARIETTA, Ga., Nov. 26, 2019 /PRNewswire/ -- MiMedx Group, Inc. (OTC PINK: MDXG) ("MiMedx" or the "Company"), an industry leader in advanced wound care and an emerging therapeutic biologics company, today announced that it has finalized a settlement with the Securities and Exchange Commission (the "SEC"), resolving a previously disclosed investigation into the Company's financial accounting practices.

The Company has agreed to settle with the SEC, without admitting or denying the SEC's allegations, by consenting to the entry of a final judgment, subject to court approval, that permanently restrains and enjoins the Company from violating certain provisions of the federal securities laws. As part of the resolution, the Company also agreed to pay a civil penalty in the amount of $1.5 million. The settlement, if approved by the court, will conclude, as to the Company, the matters alleged by the SEC in its complaint.

Dr. M. Kathleen Behrens served as a member of the board of directors of each of Sarepta Therapeutics, Inc. (SRPT), a multi-billion dollar medical research and drug development company focused on the discovery and development of unique RNA-targeted therapeutics for the treatment of rare neuromuscular diseases, since March 2009

Mr. Wright was appointed Chief Executive Officer effective May 13, 2019. Previously, Mr. Wright served as a Partner at Signal Hill Advisors, LLC, a consulting practice, since February 2011.

Mr. Barry has served as a director of Elcelyx Therapeutics, Inc., a private pharmaceutical company, since February 2013 and has served as a Managing Member of GSM Fund, LLC, a fund established for the sole purpose of investing in Elcelyx Therapeutics, since February 2013.

Mr. Bierman served as President and Chief Executive Officer of Owens & Minor, Inc., a Fortune 500 company and a leading distributor of medical and surgical supplies, from September 2014 to June 2015.

Mr. Dewberry is a private investor with significant experience at both the management and board levels in the healthcare industry.

Mr. Evans has over 40 years of experience in the healthcare industry. He is currently President of the International Health Services Group, an organization he founded to support health services development in underserved areas of the world.

Mr. Koob joined the law firm of Simpson Thacher & Bartlett, LLP in 1970 and became a partner in 1977.

Mr. Newton has, since 2014, served as Chief Executive Officer and a member of the board of directors of Apollo Endosurgery, Inc. (APEN), a leader in the field of gastrointestinal therapeutic endoscopy.

Dr. Yeston is the Past President of the New England Surgical Society and currently serves as Active Senior Staff, Department of Surgery at Hartford Hospital.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |