Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$GBHL Funding/JV Partner-News expected on their WeedWeb Professional Cannabis Network application:

http://www.global-gbhl.com/

Bullish Chart:

EPAZ Weed Companies Are Embracing Blockchain https://www.rollingstone.com/culture/culture-features/weed-companies-blockchain-cryptocurrencies-760151/

$KNHBF The company recently announced that it has commenced construction of its Colombian Cannabis Centre of Excellence. https://dailytrendingstocks.com/knhbf-next-wave-growth-story-cannabis-space/

$MFST BIG NEWSSSSSSSS IS OUT! https://finance.yahoo.com/news/medifirst-solutions-announces-division-cbd-183903229.html

New play; CANN GLOBAL to be listed soon - now it`s time to get in to the action. WEED will be the new GOLD next year - now it`s time to position yourself for the huge changes that are taking place right now.

https://www.queenslandbauxite.com / to be CANN GLOBAL within weeks.

Do your own DD.

$CIIX The market of CBD

Cannabidiol is one of the fastest growing market categories in the U.S. hemp and legal marijuana industries with a compound annual growth rate of 59%. In 2015, the CBD industry grew from a nearly invisible market a few years ago to $202 million in consumer sales, and it is further expected to grow to $2.1 billion in consumer sales by 2020 with $450 million of those sales coming from hemp based sources.

http://chineseinvestors.com/opportunities-in-cbd/

$CIIX CIIX a hemp and CBD company that we have discovered and from a revenue standpoint is crushing lots of its competition. CIIX reported $1.7M in revenues in their last quarterly filing, there are $100M market cap companies out there with far less revenues if any at all. If you are just discovering CIIX for the first time, start your own research immediately, the company is under the radar, and could attract significant attention from the street at any time. CIIX has a hemp and CBD products retail store just outside of Los Angeles, Ca., and is looking to expand into mainland China. Those that find CIIX before it's expansion could be in store for a great ride.

China, Canada & USA Firm with CBD Hemp Cannabis @ $CIIX || Global legal marijuana spending is forecast to reach $32 billion by 2022, according to a joint Arcview Group and BDS Analytics report. Additionally, analysts from the Cowen Group predict that legal marijuana will generate $75 billion over the next decade or so. As the sector presents favorable prospects, it’s no wonder why numerous marijuana stocks are moving higher.

$CRON updated corporate presentation for Oct 2018. lots of updates for what the co has been up to and revamped format. looking good @CronosGroupMJN now if the cdn. government could just get out of industry's way...but I digress.

https://t.co/NT8bHihzK1

#MARIJUANA #WEED #CANNABIS

https://t.co/nfAKuIIyhW

$CIIX What is CBD?

Hemp CBD is a non-toxic and non-addictive natural concentrate extracted from the Cannabis plant. It is capable of positively impacting nearly every organ system in the human body and has a balancing effect on both the body and the mind. CBD can be refined into CBD oil health products, which are available in sprays, capsules, concentrates, balms, drops and vape liquid, and can be made into a variety of flavors and concentrations to suit consumers? preferences.

http://chineseinvestors.com/opportunities-in-cbd/

$CIIX Announces Upcoming Launch of CBD Hemp Wine https://smallcapvoice.com/blog/chineseinvestors-com-inc-announces-upcoming-launch-of-cbd-hemp-wine/

$NEPT Neptune Receives Confirmation of Readiness Letter from Health Canada

Neptune Wellnes $CGC is a Very undervalued "Weed" stock that investors should get before Oct. 17th and licenses get approved.

PRESENTATION https://t.co/Nrb0LnZMQT

https://t.co/kgXBM86J3x

https://t.co/D4HyN9sISY

Marijuana $TRTC insiders The last TRTC insider buy occurred when NAHASS MICHAEL purchased a total of 10,000 shares on July 10, 2018. In the last 4 years insiders have on average purchased 465,000 shares each year.

$HEMP #Hemp Monster News coming

You currently can get Bob Marley's sons company for under a quarter and Willie Nelson's for under a dime? how much longer

Bob Marley's sons company for under a quarter and Willie Nelson's for under a dime? how much longer

$NEPT Neptune Announces Multi-year Agreement w Canopy Growth to Provide Extracted Cannabis Products

https://t.co/f1NIA3JsBj

$NEPT A BUYOUT TARGET BY Canopy

$STZ $CGC

$PHOT STORE IN CANADA IS KILLING IT RIGHT NOW. LEGALIZATION IS OCTOBER 17TH

GrowLife Canada - Calgary

Suite 113-2323 32nd Ave NE

Calgary, Alberta

403.452.9990

Hours: Mon-Thu 10:00 - 6:00pm | Fri 10:00 - 6:00pm | Sat 10:00- 6:00pm | Closed: Sunday

http://growlifeinc.com/stores/

GrowLife, Inc. Launches Canadian E-Commerce Platform to Meet Increasing Demand for Cultivation Equipment in Expanding Legalized Market

KIRKLAND, Wash., May 24, 2018 (GLOBE NEWSWIRE) -- GrowLife, Inc. (OTCQB:PHOT), one of the nation’s most recognized indoor cultivation product and service providers, today announced that it has launched a new online e-commerce platform designed to service both consumer and commercial customers throughout the country of Canada.

The new platform is available at GrowLifeHydro.ca and features thousands of products designed to support cost-effective and efficacious indoor plant cultivation for growers of all sizes. The addition of this platform reflects GrowLife’s expansion efforts throughout Canada as the company continues to strategically position itself within Canada’s rapidly evolving legislative landscape.

“As GrowLife’s consumer division experiences increased momentum in its U.S. growth, the addition of this e-commerce sales channel and distribution network will allow us to better service all of North America with our entire product offering,” said Lauren Schmitt, Vice President and head of GrowLife’s consumer division. “We have identified a tremendous opportunity for our services and products in Canada and as a result prioritized getting this platform user ready ahead of legalization occurring in the coming months. GrowLifeHydro.ca allows us to further strategically expand our footprint in the rapidly evolving multibillion-dollar cannabis market by reaching a new demographic-focused clientele.”

GrowLife CEO Marco Hegyi said: “Our investment in the consumer division, led by Lauren, is critical to capturing market share in the burgeoning Canadian market where we have already made significant strides, including our strong retail presence in Calgary. Having personally met with industry professionals and investors in Canada, I am encouraged by the excitement that is building around our company and we understand that the opportunity has never been greater for us to become a leading resource for the many operators and home growers throughout Canada.”

Canada is expected to fully legalize adult use cannabis by summer of this year, which will allow for large-scale producers to enter the market as well as home cultivators aged 21 and up to grow up to four cannabis plants. Canada’s new adult use market presents a lucrative expansion opportunity for GrowLife, which through its new e-commerce site is one of the first leading indoor cultivation companies offering a country-specific product distribution platform catering specifically to the cannabis marketplace.

GrowLife recently announced the opening of a Canadian retail location that is well-positioned to meet the growing market demand for indoor cultivation equipment in the emerging legal Canadian marketplace. Deloitte estimates the legal Canadian cannabis marketplace has a retail base value of between $4.9 billion-$8.7 billion.

For more information about GrowLife, including the CEO’s most recent video statement, please visit the company’s website. Products can be purchased at ShopGrowLife.com.

About GrowLife, Inc.

GrowLife, Inc. (PHOT) aims to become the nation’s largest cultivation service provider for cultivating organics, herbs and greens and plant-based medicines. Our mission is to help make our customers successful. Through a network of local representatives covering the United States and Canada, regional centers and its e-Commerce team, GrowLife provides essential goods and services including media, industry-leading hydroponics and soil, plant nutrients, and thousands more products to specialty grow operations. GrowLife is headquartered in Kirkland, Washington and was founded in 2012.

Public Relations Contact:

CMW Media

Cassandra Dowell, 858-264-6600

cassandra@cmwmedia.com

www.cmwmedia.com

Investor Relations Contact:

info@growlifinc.com

https://globenewswire.com/news-release/2018/05/24/1511626/0/en/GrowLife-Inc-Launches-Canadian-E-Commerce-Platform-to-Meet-Increasing-Demand-for-Cultivation-Equipment-in-Expanding-Legalized-Market.html

$ACAN 8K Filing. PR likely to follow.

https://t.co/mVbvYSh1ED

1 MIL SQ FT of Cannabis #MEDICAL #MARIJUANA Cultivation and will be the most technologically advanced cultivation facilities in the country.

https://t.co/mavno5LjcR

https://t.co/plzNyOw3UX

https://t.co/3GrVvDomoC

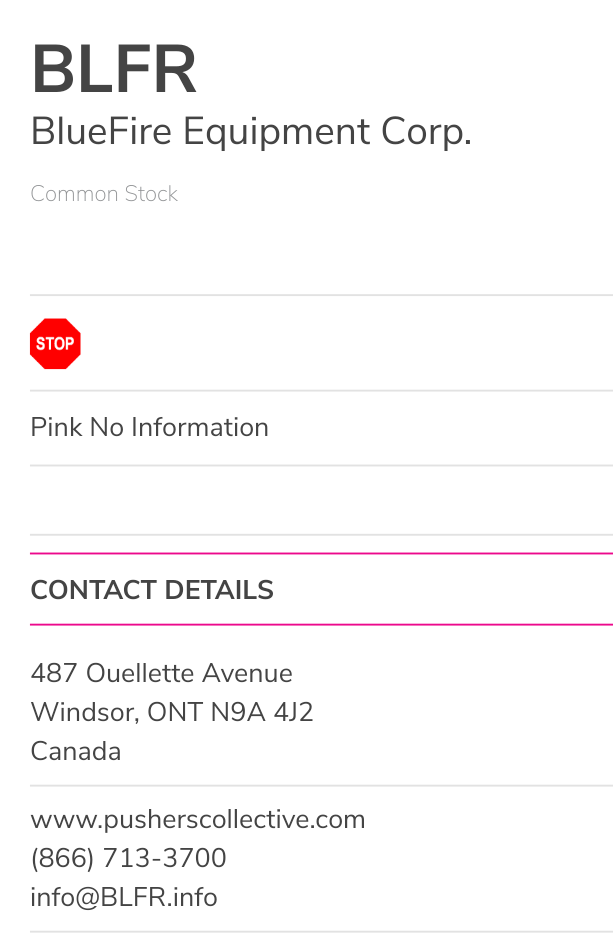

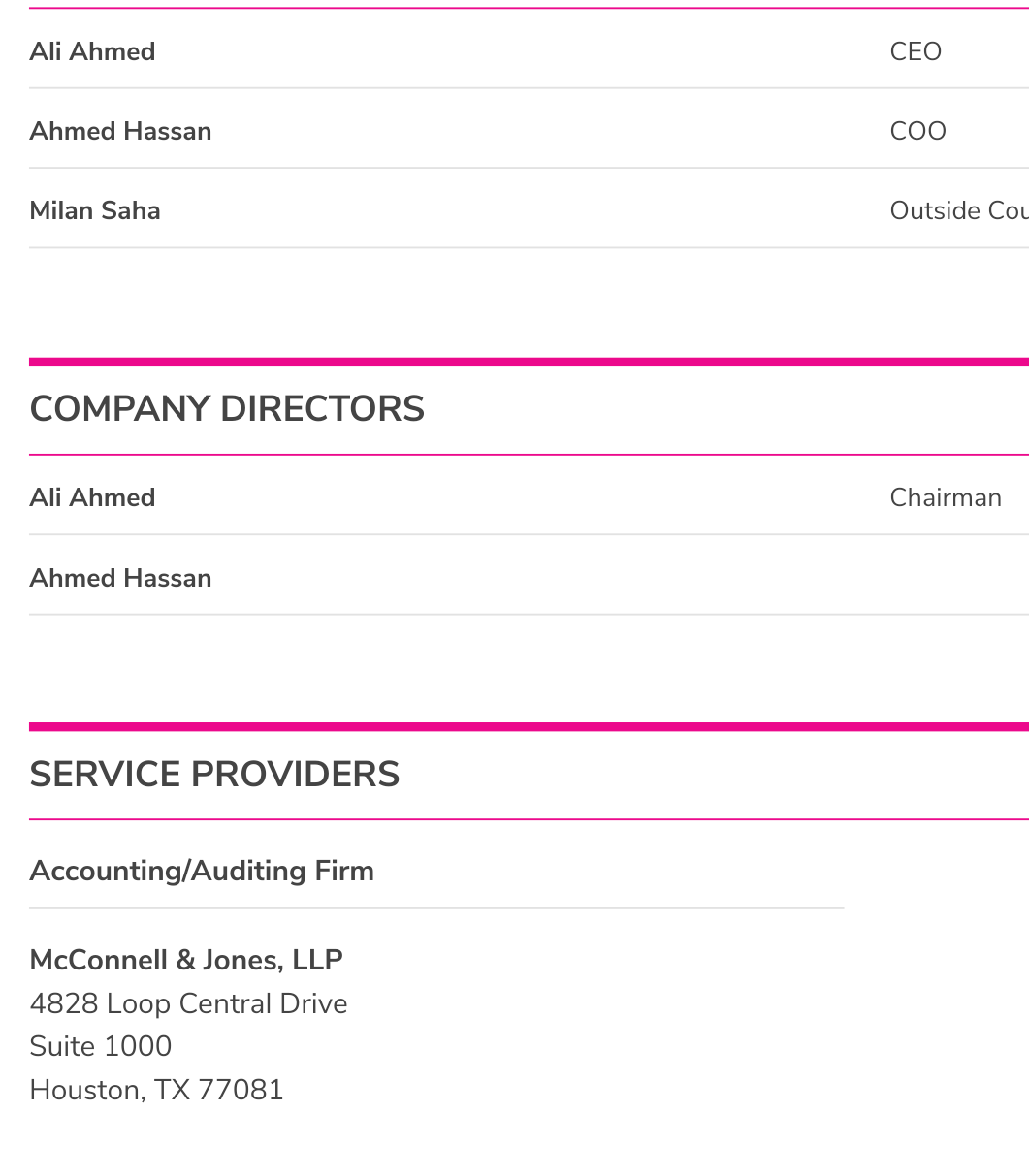

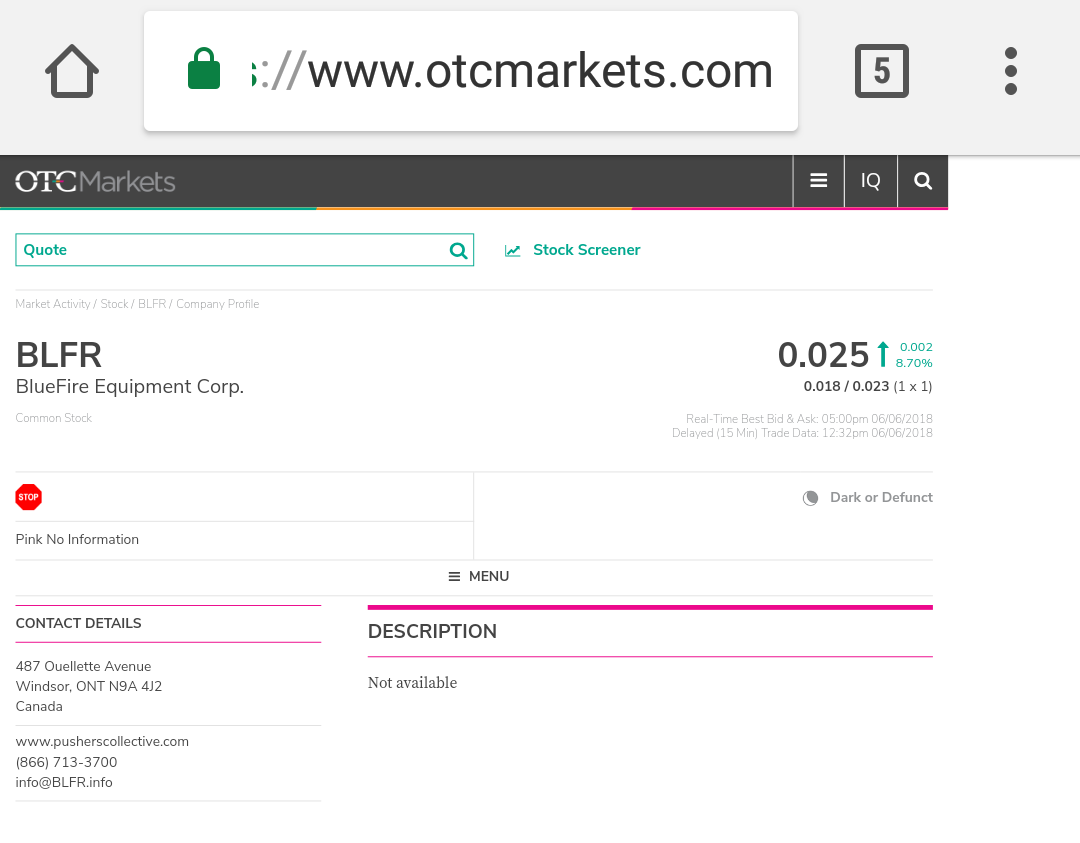

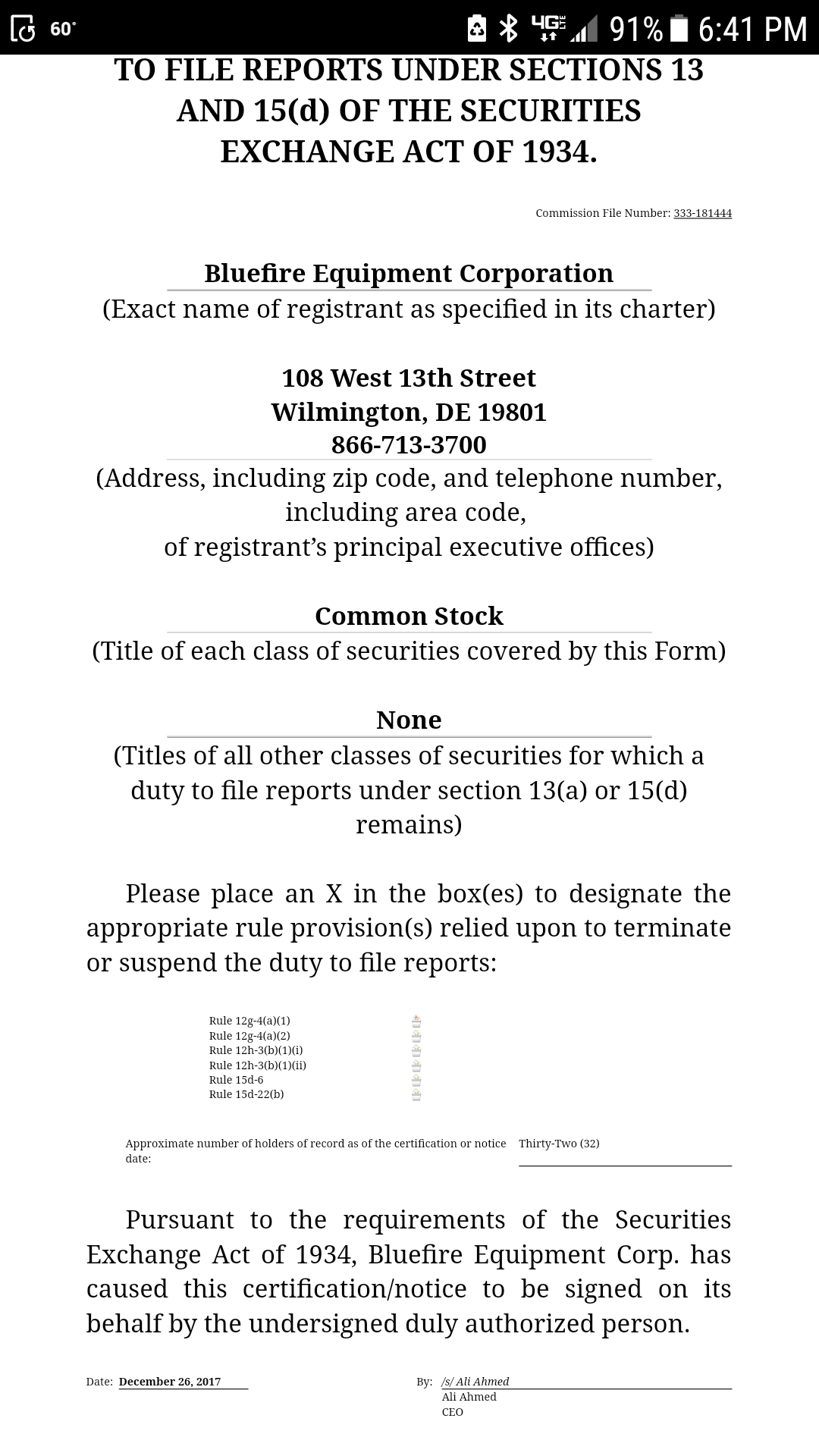

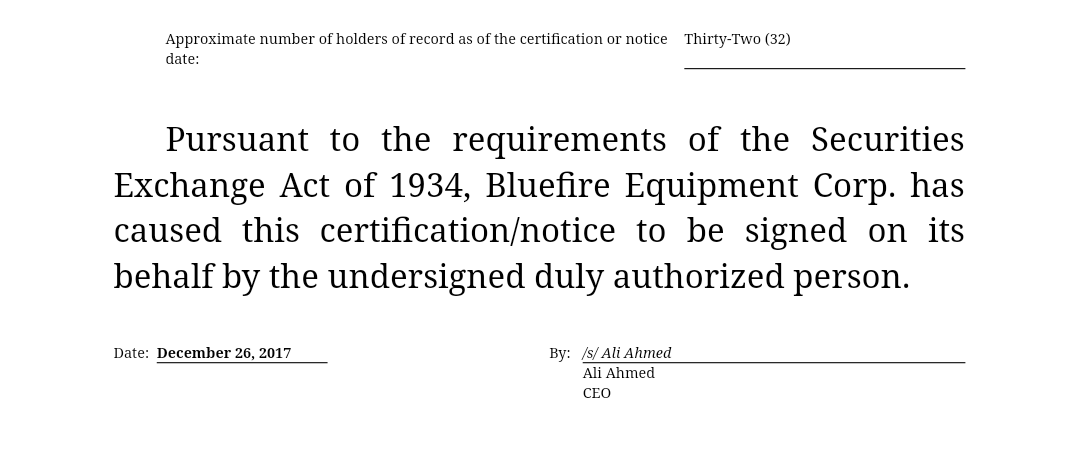

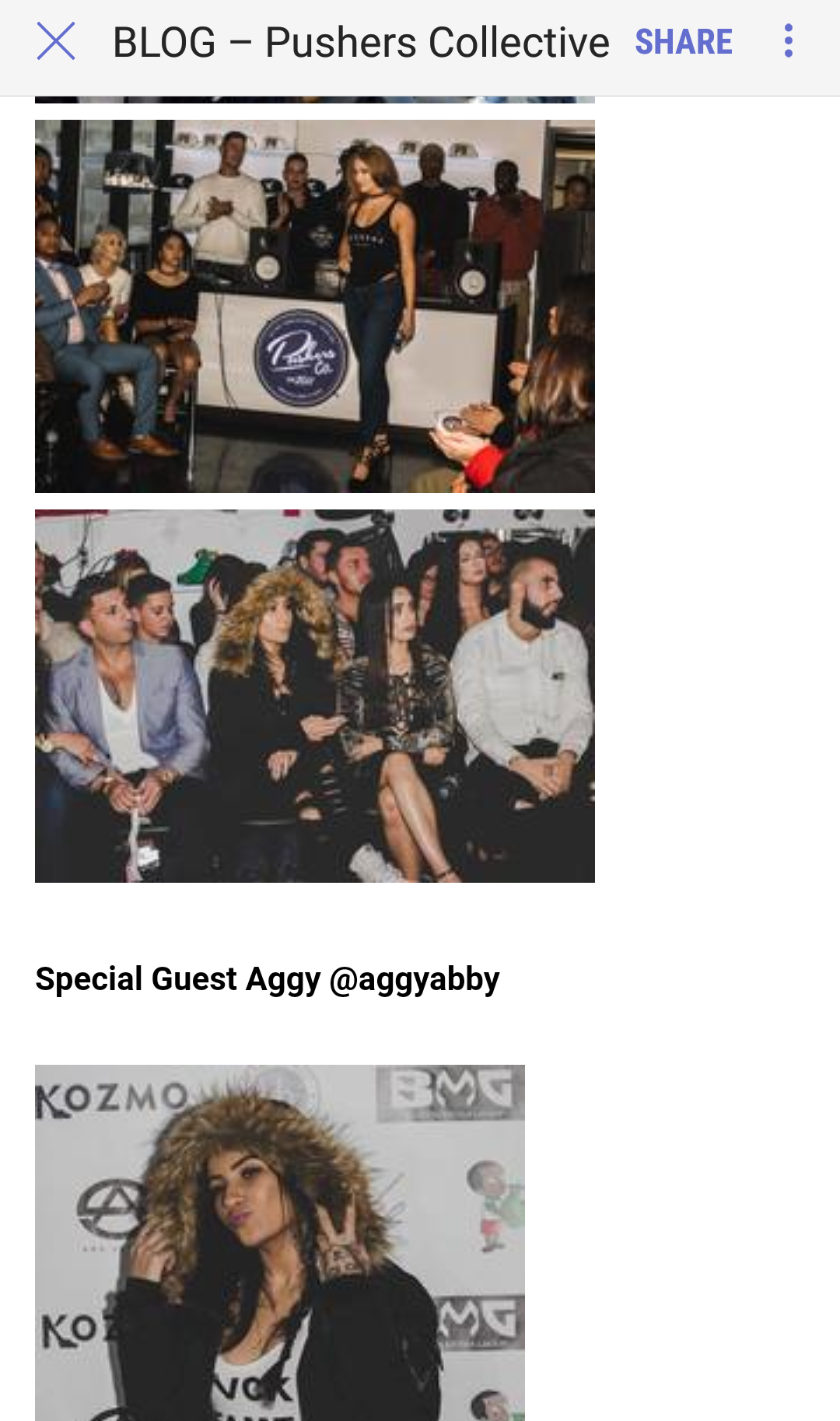

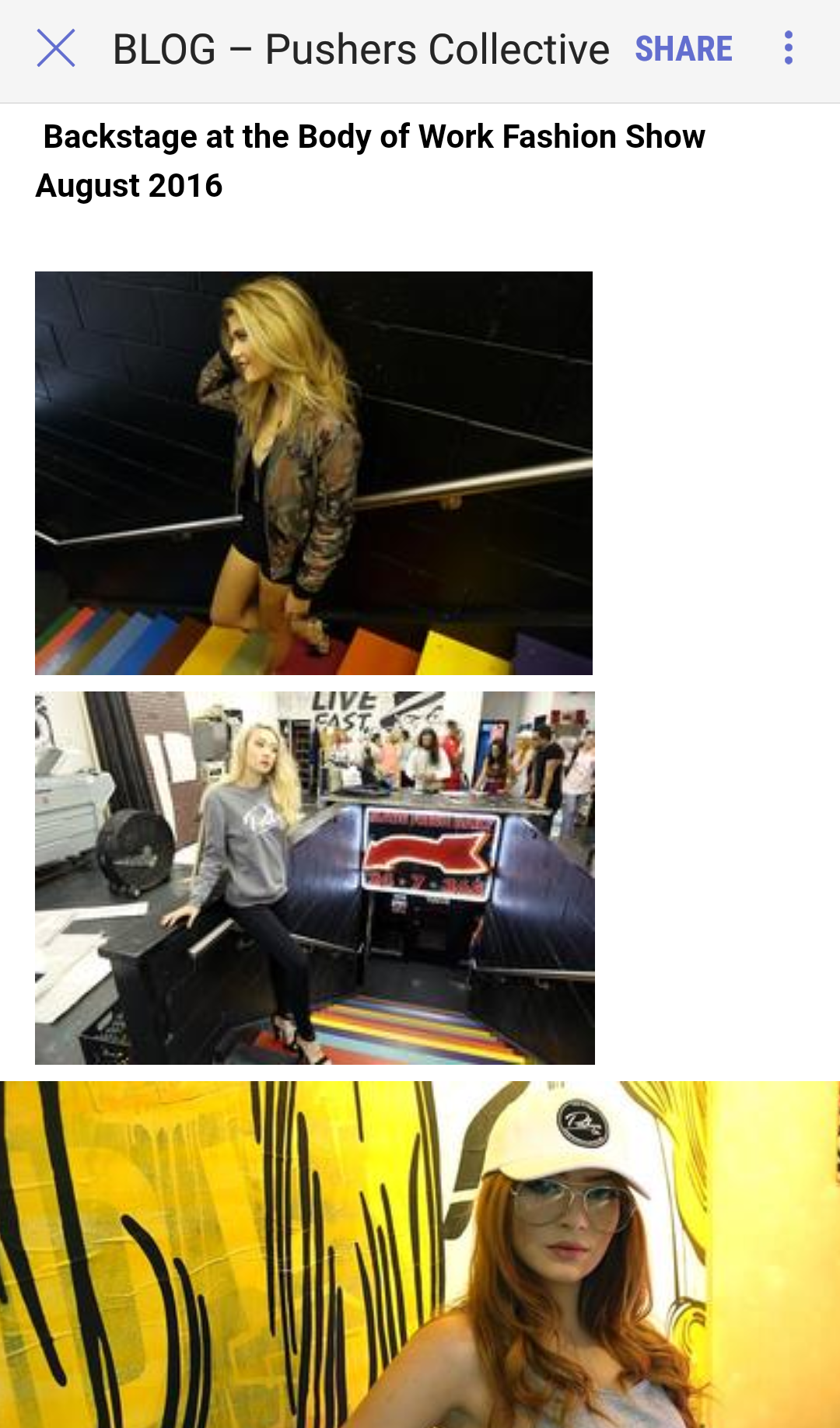

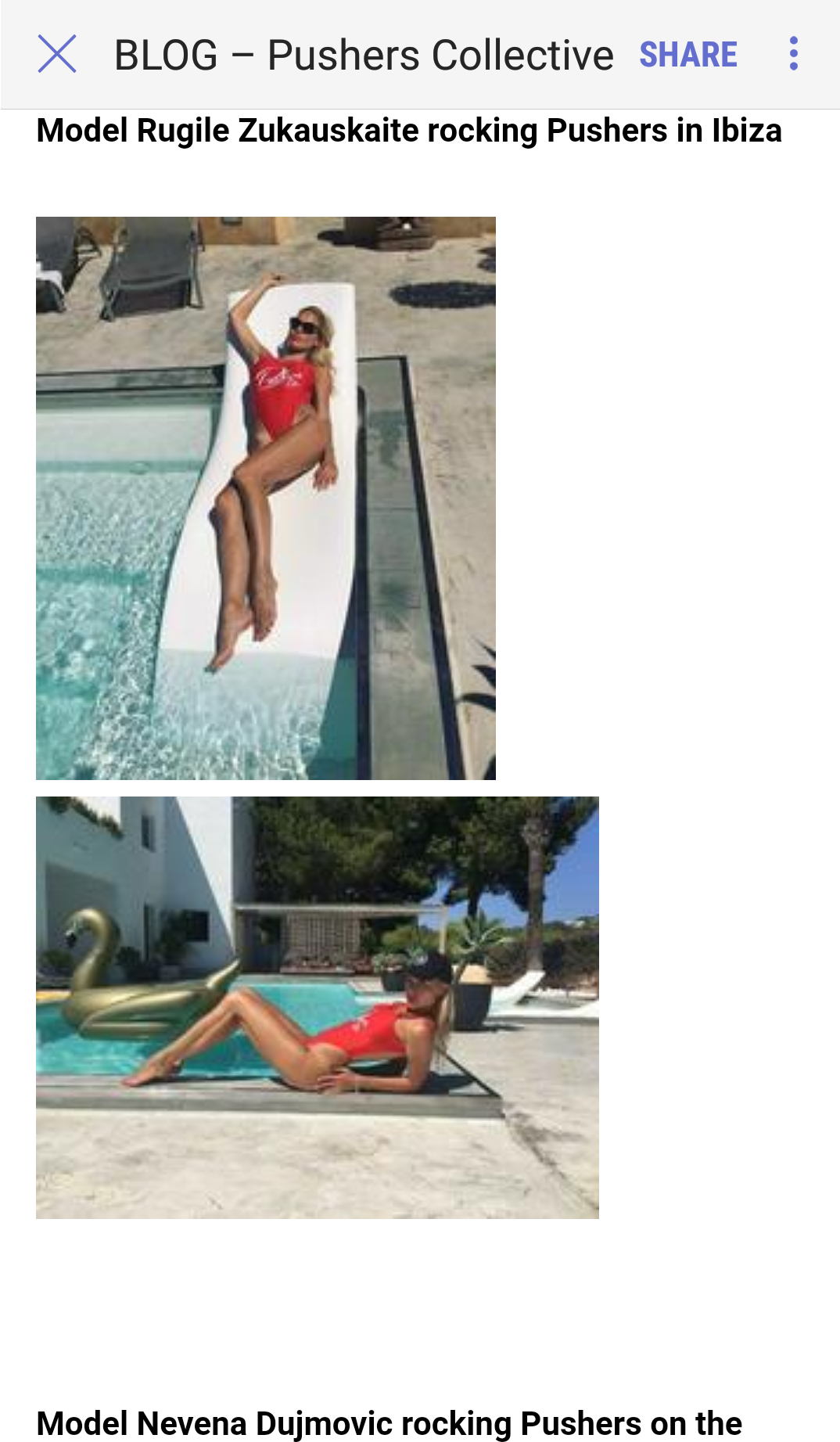

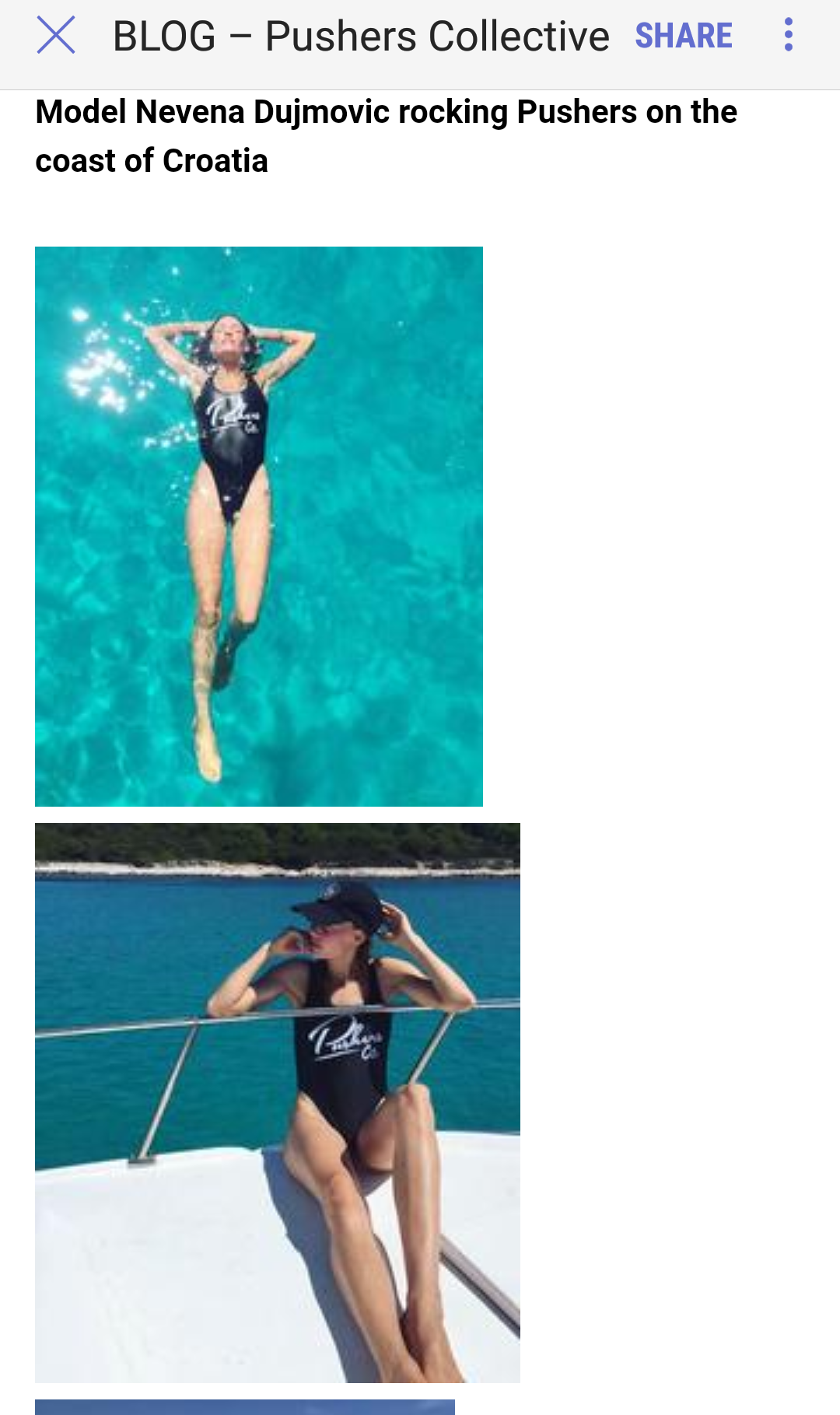

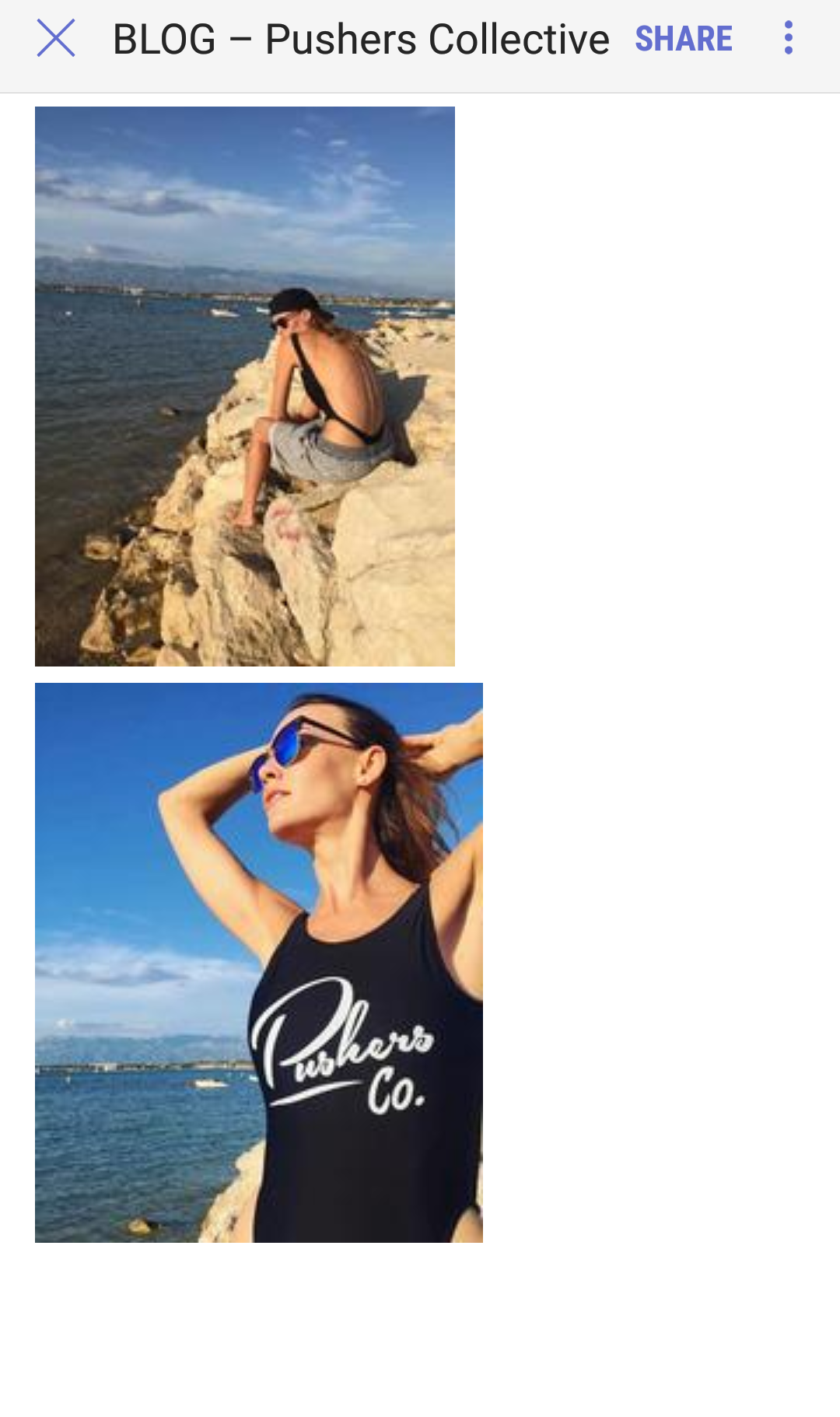

$BLFR VERIFIED DUE DILIGENCE CONFIRMING REVERSE MERGER OF PUSHERS COLLECTIVE CEO ALI AHMED

.50+ POSSIBLE

CEO IS NOW ALI AHMED AS SEEN ON THE FILING DATED JANUARY 2ND 2018

$BLFR OTC MARKETS PROFILE Just updated $BLFR W New CEO COO NEW CO #REVERSEMERGER INTO SHELL

1.7 Million Followers

Pushers Co. (@PushersTM)

https://twitter.com/PushersTM?s=03

DONT TALK ABOUT IT PUSH ABOUT IT

Pushers Collective (@PushersCo)

https://twitter.com/PushersCo?s=09

Idea Shop | Production Company | Record Label Info@pushers.co 519-915-1111

CEO TWITTER PAGE PUSHERS GAMRINI (@GAMRINI)

https://twitter.com/GAMRINI?s=09

? CEO & Founder of @PushersTM | @PushersCo | http://t.co/fz4hSIiVTt

$BLFR TWITTER PAGE

BlueFire Equipment (@BlueFireEquip)

https://twitter.com/BlueFireEquip?s=03

https://t.co/Uwi7gEL83R

LINK

https://ih.advfn.com/p.php?pid=nmona&article=76392381

Ali Ahmed, owner and CEO of Pushers Collective, inside the store at 487 Ouellette Ave

http://windsorstar.com/life/fashion-beauty/downtown-windsor-streetwear-shop-celebrates-one-year-of-pushing-gear/attachment/pushers-10

LINKEDIN PROFILE

https://www.linkedin.com/company/pushers-collective

https://pusherscollective.com/

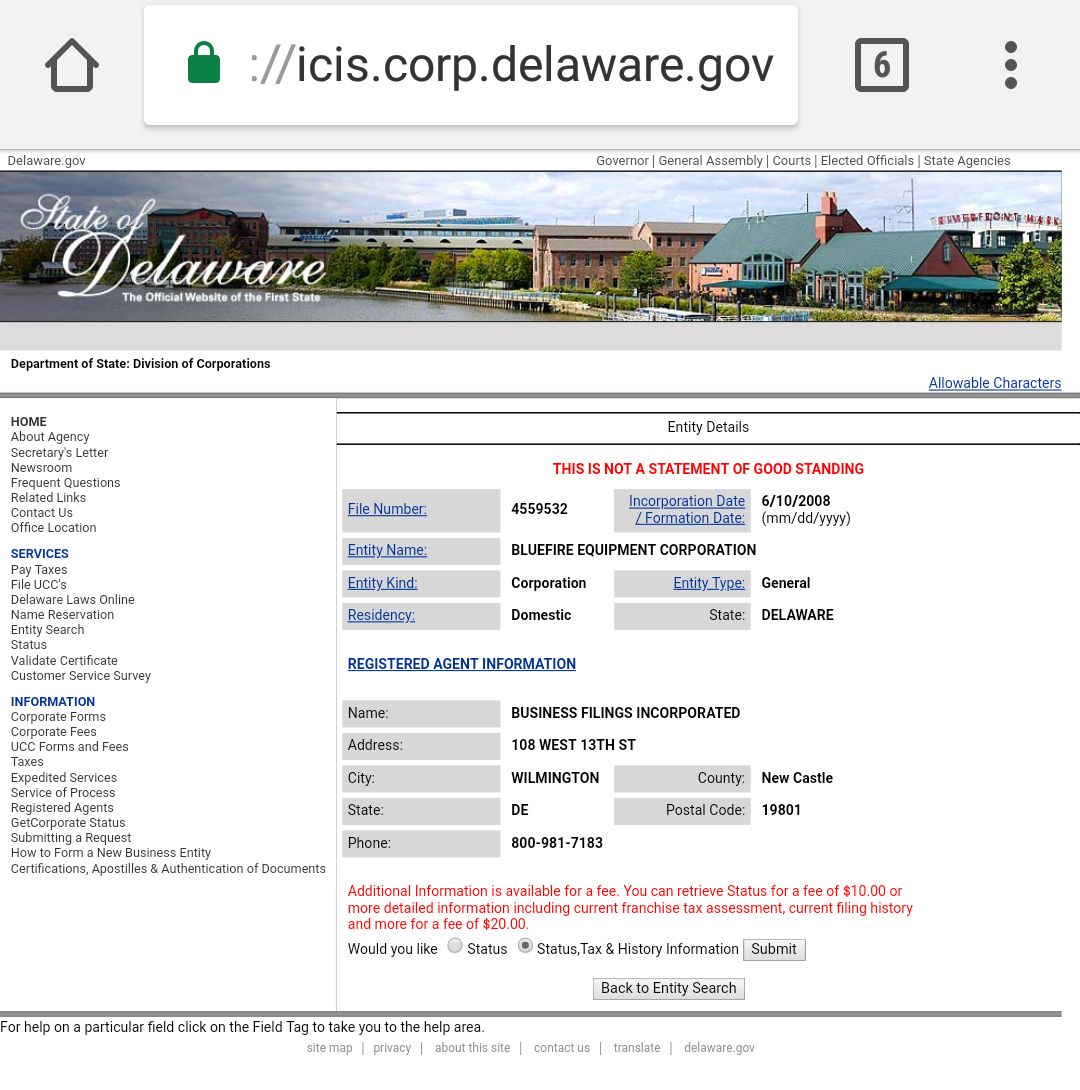

Incorporated in State Of Delaware

https://icis.corp.delaware.gov/Ecorp/EntitySearch/NameSearch.aspx

PUSHERS COLLECTIVE

Find exclusive street wear brands and sneakers from a variety of designers found no where else in the region. Created and run internationally out of Windsor, Pushers Clothing has been distributing clothing throughout the world to inspire those who are struggling to push through. Pushers Collective features its in-house brand including shirts, hats, Letterman jackets, socks and skateboard decks. Through connections with the hip-hop industry Pushers Collective designs have been worn by rappers such as Big Sean and Soulja boy and many professional athletes. The brand is built on ‘pushers’ the people who made something out of nothing and came out on top. As well as selling street wear the store features a barber shop, recording studio and print shop.

—

Ali Ahmed: community activist

http://eyesonwindsor.com/event/pushers-collective-fashion-show/ ;

https://bizxmagazine.com/pushers-collective-santa-joining-forces/ ;

https://pusherscollectiveblog.wordpress.com/ ;

http://www.alphakor.com/community-involvement/sitting-on-a-panel-for-west-of-windsor/ ;

https://www.cbc.ca/amp/1.4254097 ;

https://issuu.com/bizxmagazine/docs/biz_x_magazine_march_2017/20 ;

https://windsor.snapd.com/events/view/1066625 ;

https://criskambouris.com/yqg-is-talking-and-im-listening/ ;

https://www.eventbrite.ca/e/yqg-talks-making-an-impact-tickets-34876159532

(Medical Cannabis/Hemp) QBL.AX Queensland Bauxite Ltd.

Fellow Investors, some more info to clearify; the QBL has more then one application of there cannabis products.

Here is another one; https://docs.wixstatic.com/ugd/1943b6_c007317...2f50ca.pdf

The time will tell how they will market them; as equals in the marketplace or different approach to them depending who is the targeted customer.

Some more news; https://www.queenslandbauxite.com/single-post...Production

The other Product; Queensland Bauxite to bring ‘game changing’ medical cannabis pill to market

January 9, 2018

https://smallcaps.com.au/queensland-bauxite-g...ll-market/

$VAPE Green Rush RUNNER...@.0082 and totally undervalued

https://investorshub.advfn.com/Vape-Holdings-Inc-VAPE-19648/

VAPE is a California based Marijuana Co. and massively on fire! California Legalization 2018 imminent...Vape Holdings, Inc. (OTCPK:VAPE) is a holding company primarily owning and operating a manufacturer and distributor of cannabis consumption products for both torched concentrates and electronic vaporization.

http://hiveceramics.com/

20265 Ventura Blvd a

Woodland Hills, CA 91364

USA

Products sales in 1000+ stores

Authorized Stores: http://www.hiveceramics.com/authorized-shops

Ihub

https://investorshub.advfn.com/Vape-Holdings-Inc-VAPE-19648/

Patent License: 14 Year Term License For Distribution

FDA Approval: Hive Ceramics Dab Nail 2017

http://pdfpiw.uspto.gov/.piw?PageNum=0&docid=D0752727&IDKey=1DB6C6FD79D2%0D%0A&HomeUrl=http%3A%2F%2Fpatft.uspto.gov%2Fnetacgi%2Fnph-Parser%3FSect1%3DPTO1%2526Sect2%3DHITOFF%2526d%3DPALL%2526p%3D1%2526u%3D%25252Fnetahtml%25252FPTO%25252Fsrchnum.htm%2526r%3D1%2526f%3DG%2526l%3D50%2526s1%3DD752727.PN.%2526OS%3DPN%2FD752727%2526RS%3DPN%2FD752727

(INMG) Innovativ Media Group

Share Structure

Market Value $3,760,331 a/o Dec 29, 2017

Authorized Shares 500,000,000 a/o Jun 28, 2017

Outstanding Shares 291,724,670 a/o Dec 11, 2017

-Restricted Not Available

-Unrestricted Not Available

Held at DTC Not Available

Float 172,611,602 a/o Dec 11, 2017

Par Value Not Available

https://www.otcmarkets.com/stock/INMG/profile

INMG from the latest Quarterly: (Q3)

Total Assets: $2,700,000

Total Current Liabilities: $90,000

Q3 Revenue: $58,000

Total Operating Expenses: $70,000

Net Loss for the Q3: $12,000

C.E.O. TOM COLEMAN OWNS 92 MILLION SHARES - See link Page 6

https://www.otcmarkets.com/financialReportViewer?symbol=INMG&id=182194

LOS ANGELES, CA--(Marketwired - Nov 28, 2017) - Innovativ Media Group, Inc. (OTC PINK: INMG) ("Company") today announced that CannaNet.TV http://www.cannanet.tv/, its online, ad supported channel, streaming entertainment, informational and educational content related to the cannabis and CBD culture and industry, will be 'live' as of 8:30 am EST this morning.

The platform will launch with an eclectic, on-demand mix of movies, videos and music titles, the CannaNet Radio Network, the Cannabis 101 Talk 'potcast,' a selection of cannabis related apps and a wide assortment of news, tutorials, videos and other features in its 'World Wide Weed' section. CannaNet.TV http://www.cannanet.tv/ offers a state of the art video and display ad serving platform powered by Admaximizer. This feature rich, single tag solution consists of a RTB (real-time bidding), fully mobile compatible ad network with hundreds of local, national and international brands.

Tom Coleman, CEO of Innovativ Media, said: "We have built a sophisticated platform and are pleased to now make it available to the community and public. We expect to be continually on boarding new, relevant content to the channel and we will be collecting and analyzing user data in the coming weeks to help us customize and enhance audience experience."

http://www.otcmarkets.com/stock/INMG/news/Innovativ-Media--INMG--Launches-CannaNet-TV?id=176425&b=y

Innovativ Media (INMG) Redeems Series B Preferred Shares

LOS ANGELES, CA--(Marketwired - Oct 11, 2017) - Innovativ Media Group, Inc. (OTC PINK: INMG) ("Company"), a multi-media content producer and distributor, today announced that it has redeemed all of the Series B Preferred Stock held by an original Company investor in exchange for a Promissory Note for $110,000. The Company also reported that it had secured an investment from a private equity source for $52,000 in the form of a 6% Note, which is convertible into restricted shares of the Company's common stock at a fixed conversion price of $.0261 per share. The Company has no other debt on its balance sheet and has no obligation to register any of the shares.

Tom Coleman, CEO of Innovativ Media said: "The Company decided it was an appropriate time to exercise the option it had under a lock-up agreement to redeem the shares and remove any uncertainty regarding long term dilution. We are committed to scaling CannaNet.TV http://www.cannanet.tv/ rapidly and the funds provided by the Note will help us accelerate growth and capitalize on some developing opportunities."

http://www.otcmarkets.com/stock/INMG/news/Innovativ-Media--INMG--Redeems-Series-B-Preferred-Shares?id=172123&b=y

The PREFERRED B SERIES shares he used on October 18, 2017 were for 25 million shares. The 10 Preferred B shares that were exercised at market caused the dip (10 SERIES B x 2.5 million = 25 million shares).

THAT CANNOT HAPPEN AGAIN BECAUSE THEY ARE NO LONGER AVAILABLE. THEY WERE EXTINGUISHED AS PER PRESS RELEASE DATED OCTOBER 11, 2017.

http://www.otcmarkets.com/stock/INMG/news/Innovativ-Media--INMG--Redeems-Series-B-Preferred-Shares?id=172123&b=y

This has been the dilution component for the owner of those shares since the inception of the ticker.

HE CUT A DEAL with a lender for a restricted note that CANNOT be exercised for 1 year, and it has a strike price of $0.0261. This was done to protect the future prospects of growth for the company, and to protect the shareholders and HIMSELF.

TOM COLEMAN OWNS 92 MILLION COMMON SHARES.

The first potential round of dilution would be June 25th, 2018. That's exactly one year from when the restricted shares used to purchase a minority stake in Night Flight were issued. From the PR:

The Company’s equity interest in Night Flight, Inc. was purchased with a combination of cash and through the issuance of restricted common shares of the Company’s stock and was completed on June 25, 2017.

BECAUSE OF RULE 144, THE NOTE HOLDER CANNOT SELL THEM UNTIL OCTOBER 2018, THEREFORE, WE WILL REMAIN WITH A FLOAT OF 172,611,602 SHARES UNTIL JUNE 25, 2018 AT THE EARLIEST!!!

https://www.sec.gov/reportspubs/investor-publications/investorpubsrule144htm.html

------------------------------------------------------------------------------------------------------------------------------------

(INMG) ***A FEW FACTS TO KEEP IN MIND***

1. INMG is almost PROFITABLE ALREADY....There was only a $12,000 loss in Q3 (Rev - Operating expenses). HOW MANY OTC COMPANIES ARE PROFITABLE? THE ANSWER: VERY FEW TO NONE!!!

2. INMG has VERY LITTLE DEBT/LIABILITIES and a small locked FLOAT until mid 2018. HOW MANY OTC companies can say that? NONE except for INMG

3. WITH THE LOW OVERHEAD TO MAINTAIN THE NETWORK (meaning most of it is outsourced), it doesn't take much money to operate it. Tom expects the CASH flow alone from advertising to cover it, and I have NO DOUBT that it will quickly. It should take no later than Q1 2018 at the latest become VERY PROFITABLE.

4. They earned $58,000 in revenues last quarter, and Cannanet.Tv wast not even up yet. It was mostly from Live Stream Sales & Lux DIgiital Library.

The Operating Expenses were only $70,000 which was mostly due to LIVE STREAM COSTS. Even then, the company was ALREADY ALMOST PROFITABLE.

There was only a $12,000 LOSS for the quarter. COMPARE THAT TO THE MJ STOCKS WITH $50-100M Market caps. They have HUGE LOSSES, and NO REVENUES.

5. The market cap of INMG is $3M which is a JOKE. It should be much higher, and IT WILL GET THERE!

A PPS of 0.40 would support a market cap of 50 Million, which would be in line with the sector.

The stock may not be worth 0.40 currently, but it's surely worth more than where it is now!!

Further DD can be found by clicking the link to OwnTheFloat.com

http://ownthefloat.com/index.php/2017/11/22/inmg-cannanet-tv-to-make-historic-network-launch-in-the-cannabis-space/

Micro Cap Update on Viaderma Inc ($VDRM)

Micro Cap Update on Viaderma Inc (OTCMKTS: $VDRM)

By Gene Daniel - May 7, 2017

Viaderma Inc (OTCMKTS:VDRM) has been one of the more active micro caps in recent months. Advertising around MSD (Male Sexual Dysfunction) drugs like Cialis and Viagra dominate sports programming, so the taboo nature of the discussion has subsided over the years. But it is still surprising when you see a stock like Viaderma Inc (OTCMKTS:VDRM) take off, but some digging showed that this falls into the cannabis sector and the share price move is related to the theme of replacing pharma with CBD’s. But this should not surprise those who follow the Erectile Dysfunction (ED) market which is dominated by Cialis and Viagra. But this stock is based on the sales of the topical market for ED, and the growth of medical cannabis.

A look at the price action is a different story, it has been a story of peaks and valleys as investors get their hands around how these shares fit in the cannabis sector. But look at the yearly chart, and you will see this reflected in the price and volume, and the volatility that comes with new hot sectors. Those who are in the stock know it is up 500% for the year and were as high as +2000% at it’s peak. Volatility in new markets will stay with cannabis for many years so get used to it – it is the toll you pay – to invest and achieve these outsized returns.

Viaderma Inc (OTCMKTS:VDRM) is a specialty pharmaceutical company devoted to bringing new products to market, recently announced that the Company has filed with the (FDA) Food and Drug Administration for a new over the counter or OTC version of its “Premature Ejaculation Drug”. The new “OTC Drug” should have FDA registration approval in approximately 8 weeks and the Company’s name of the new drug will portray prolonged endurance. The Company says it’s recent testing of the drug has proved to be successful in retarding the onset of ejaculation during sexual intercourse.

The market for male sexual dysfunction is dominated by #Viagra and #Cialis both are taken orally for Erectile Dysfunction (ED). The Company’s alternative is a topical solution that does not have to be ingested and processed through the digestive system. The Company believes there is a vast market for this type of non-orally ingested new product and should generate significant Company revenues starting in 2017.

Subscribe below and we’ll keep you on top of what’s happening before $VDRM stock makes its next move.

$VDRM 10-Day Chart Below: Premature ejaculation (PE) is the most common male sexual disorder, and it may have a profound negative impact on a man and his partner’s lives. Premature ejaculation sprays became available in the UK in last year in November, but men wishing to use it would have to visit their Doctor, who would then order the spray from a pharmaceutical company.

In the US, topical sprays that treat PE are available OTC. In reported testing these types of products work on 9 out of 10 men and can have them last twice as long during sexual intercourse. Research reports have found the premature ejaculation treatment segment of the sexual dysfunction market has been estimated to be $1.3 Billion dollars for 2017. Also, reported, the market for these types of products could become larger than the tablet or oral (ED) market.

ViaDerma, Inc. (OTCMKTS: $VDRM) is a publicly traded specialty pharmaceutical company committed to bringing new products to market and licensing its innovative technology to current leaders in the pharmaceutical industry in a wide variety of therapeutic areas. ViaDerma’s lead product, Viabecline, uses an innovative transdermal delivery method that allows for application of active ingredients in a topical form. This patent-pending dual carrier transdermal technology may be applied in products within the medical and cosmetic markets. Also, a patent application using the combination of CBD’s and THC with the delivery system was filed in 2014. The use of CBD’s is for the reduction of inflammation and for the treatment of several diseases, such as, nicotine addiction, fibromyalgia, Cohn’s disease, schizophrenia, migraine headaches, pain management for cancer and Multiple Sclerosis.

This is an innovative story with a Cannabis twist that replaces synthetics with a natural drug, which has been a positive theme in all small company trades occurring in 2017. It is worth watching how this plays out in this niche market. Shares have been much higher than they are now, but recent bounces may show the company is getting some traction.

We like these natural replacement drugs where a synthetic drug is being replaced by a CBD, and investors like investing in these stocks as they emerge. Investors are beginning to understand, through recent price action, that pharmaceutical companies as we know them are changing forever and for always.

http://oracledispatch.com/2017/05/07/micro-cap-update-viaderma-inc-otcmktsvdrm/ via @Oracle Dispatch

$VDRM Here's Something Viaderma Inc $VDRM Shareholders Should See

By Chris Sandburg / in Biotech, Momentum & Growth, Momentum Stocks, Stocks / on Wednesday, 10 May 2017 10:58 AM / 0

https://www.insiderfinancial.com/viaderma-inc-otcmktsvdrm-a-bit-of-due-diligence-on-the-patent-claims/122577/

Viaderma Inc (OTCMKTS:VDRM) took a bit of a hit recently based on the surfacing of some litigation related to the delivery method associated with its lead asset. Over the last few days, however, the company has recovered much of the lost ground, trading up to the tune of around 20% on the Monday open at current prices (midsession on Wednesday) and up close to 10% for the day so far.

With the potential for an FDA green light for its lead registration asset just around the corner, and the company fresh off the back of what was reported as being a successful conference presentation by its CEO relating to the lead target indication – diabetic foot ulcer therapy – it looks as though we could be in for some strength. The litigation dampens sentiment somewhat, however, right now, but a little bit of digging reveals that sentiment need not be impeded by what’s going on.

Here is why.

By way of a bit of background, Viaderma has developed a topical antibacterial formulation of an already FDA registered drug, which it has been able to prove in trials has the potential to treat diabetic foot ulcers successfully in more than 90% of applications. This category of condition is crying out for fresh therapy options right now, and a number of companies have failed in their attempts to bring said options to market just recently. We covered this company not long ago, requesting that management put out some degree of insight (by way of a press release or otherwise) as to how the above-mentioned presentation went. To put it bluntly, we felt that the claims made as to the 90% success rate in this indication were too good to be true, and wanted to see how the scientific community responded to said claims.

Shortly after our coverage, we got exactly what were looking for, with this release.

The product is in final testing for manufacturing, and based on the available evidence, should be a shoo-in for a quick transition toward standard of care therapy in this sector. So what’s holding the company back? Well, as mentioned, there is a claim against the technology that underpins the product.

Specifically, one of the guys who worked on a product (a patent lawyer) with the current CEO and the technology’s initial inventor (a scientist) claims to have ownership rights. If this is the case, it’s potentially terminal for the program. However, it doesn’t take too much digging to prove that the claim is essentially baseless.

Head over to this site.

Insert the following into the field as an application number: 13/729776.

This is the application number for the patent that the guy we’re talking about is trying to challenge – his name is Steven Keough and he’s listed as an inventor on the patent, along with D. Howard Phillips.

Check the status of the patent:

” Abandoned — Failure to Respond to an Office Action”

So first of all, the patent isn’t even a patent – it’s an application.

More important that that, however, it has been abandoned. When a patent application gets abandoned it’s as if nothing has ever been filed. Even if an individual is listed as an inventor on the application, his or her rights to any return based on future commercial application of the technology covered by the initial application are non-existent.

This is all based on a bit of research in a murky area – we aren’t patent lawyers and we don’t work at the USPTO. We may be misinterpreting something (although we’re pretty certain we aren’t), so we’re going to say that it’s important for anyone thinking about acting on our coverage to do a bit of due diligence before doing so.

All said, however, this just looks like a bit of opportunism from Keough.

If that’s the case, then, our bull thesis remains firm, and our attention returns to the science (and the therapeutic application) as near term value inputs.

We will be updating our subscribers as soon as we know more. For the latest updates on VDRM, sign up below!

Sign up for next microcap runner ahead of the crowd.

Submit

Disclosure: We have no position in VDRM and have not been compensated for this article

NNSR low Float. no dilution. Merger news & filings this week]

Brand New Company in Formation. w/product(s) and a go big plan.

Reverse Merger nearly official... otc filings in end of last week.

+ company news pending..

"We signed an NDA w/ CannaBrand yesterday. Excited for their help in getting our products out to consumers." http://cannabrand.co

patent pending thc cap - fully owned subsidiary of Perspective Technologies. http://www.thecannacap.com

https://twitter.com/perspectivetch

@perspectivetch Jun 21

"We have identified several revenue producing acquisition candidates in bitcoin, spatial tech, and alternative medicine. Discussions ongoing.."

News Alert for ViaDerma Inc ($VDRM)

ViaDerma, Inc. Begins Consumer Testing on its Topical Antibiotic in the Philippines Due to Country Wide Interest from Distributors as it Eyes Huge Market for Several New Follow-on Products with Registration Numbers from the FDA Soon to Follow

Take a look at VAPI Vapir.com. Awesome vaporizers. Super high quality product. High quality company, current on all their filings. Low float (Insider holds approx. 80%), low o/s, only down here due to CDEL shorting it because no eyes on the stock. This will skyrocket if any volume comes in it. See company website, really nice quality site. Nice MJ play with room to run.

All my opinion, please do your own DD.

$VDRM Here's Something Viaderma Inc $VDRM Shareholders Should See

By Chris Sandburg / in Biotech, Momentum & Growth, Momentum Stocks, Stocks / on Wednesday, 10 May 2017 10:58 AM / 0

https://www.insiderfinancial.com/viaderma-inc-otcmktsvdrm-a-bit-of-due-diligence-on-the-patent-claims/122577/

Viaderma Inc (OTCMKTS:VDRM) took a bit of a hit recently based on the surfacing of some litigation related to the delivery method associated with its lead asset. Over the last few days, however, the company has recovered much of the lost ground, trading up to the tune of around 20% on the Monday open at current prices (midsession on Wednesday) and up close to 10% for the day so far.

With the potential for an FDA green light for its lead registration asset just around the corner, and the company fresh off the back of what was reported as being a successful conference presentation by its CEO relating to the lead target indication – diabetic foot ulcer therapy – it looks as though we could be in for some strength. The litigation dampens sentiment somewhat, however, right now, but a little bit of digging reveals that sentiment need not be impeded by what’s going on.

Here is why.

By way of a bit of background, Viaderma has developed a topical antibacterial formulation of an already FDA registered drug, which it has been able to prove in trials has the potential to treat diabetic foot ulcers successfully in more than 90% of applications. This category of condition is crying out for fresh therapy options right now, and a number of companies have failed in their attempts to bring said options to market just recently. We covered this company not long ago, requesting that management put out some degree of insight (by way of a press release or otherwise) as to how the above-mentioned presentation went. To put it bluntly, we felt that the claims made as to the 90% success rate in this indication were too good to be true, and wanted to see how the scientific community responded to said claims.

Shortly after our coverage, we got exactly what were looking for, with this release.

The product is in final testing for manufacturing, and based on the available evidence, should be a shoo-in for a quick transition toward standard of care therapy in this sector. So what’s holding the company back? Well, as mentioned, there is a claim against the technology that underpins the product.

Specifically, one of the guys who worked on a product (a patent lawyer) with the current CEO and the technology’s initial inventor (a scientist) claims to have ownership rights. If this is the case, it’s potentially terminal for the program. However, it doesn’t take too much digging to prove that the claim is essentially baseless.

Head over to this site.

Insert the following into the field as an application number: 13/729776.

This is the application number for the patent that the guy we’re talking about is trying to challenge – his name is Steven Keough and he’s listed as an inventor on the patent, along with D. Howard Phillips.

Check the status of the patent:

” Abandoned — Failure to Respond to an Office Action”

So first of all, the patent isn’t even a patent – it’s an application.

More important that that, however, it has been abandoned. When a patent application gets abandoned it’s as if nothing has ever been filed. Even if an individual is listed as an inventor on the application, his or her rights to any return based on future commercial application of the technology covered by the initial application are non-existent.

This is all based on a bit of research in a murky area – we aren’t patent lawyers and we don’t work at the USPTO. We may be misinterpreting something (although we’re pretty certain we aren’t), so we’re going to say that it’s important for anyone thinking about acting on our coverage to do a bit of due diligence before doing so.

All said, however, this just looks like a bit of opportunism from Keough.

If that’s the case, then, our bull thesis remains firm, and our attention returns to the science (and the therapeutic application) as near term value inputs.

We will be updating our subscribers as soon as we know more. For the latest updates on VDRM, sign up below!

Sign up for next microcap runner ahead of the crowd.

Submit

Disclosure: We have no position in VDRM and have not been compensated for this article

$VDRM Confirmed with management that there will be ZERO DILUTION from today until September 2017. CONFIRMED !

FACTS ARE BELOW!

PER IR " In the last month there were 10 million shares issued as a result of a convertible note. There are no more issuance is expected until another note comes due beginning in either September or October and it will be staggered for a couple months. So no more issuance of shares until the fall"

And another direct response

"To date not one single Insider has sold a share"

INVESTOR RELATIONS RICHARD INZA 1-954-251-0616 or 1-310-734-6111!!

FDA APPROVAL REGISTRATION NEWS, DUE OUT ANYDAY NOW!! !

Viaderma Inc VDRM Moves to Phase II Testing on Cannabis Tech

https://streetregister.com/2017/05/15/viaderma-inc-otcmktsvdrm-moves-to-phase-ii-testing-on-cannabis-tech/ ;

Viaderma Inc (OTCMKTS:VDRM) Moves to Phase II Testing on Cannabis Tech

By Michael Luke -

May 15, 2017

382

The last time we touched upon Viaderma Inc (OTCMKTS:VDRM) was earlier this spring, when the stock had shot up over 800% after it received provisional patent numbers for FDA-registered Viabecline and Cannabis Technologies.

This week, we wanted to circle back around to VDRM after the company reported positive results from Phase I testing on those technologies, as well as the commencement of Phase II testing.

Viaderma Inc (OTCMKTS: VDRM) aims at developing an approved method for delivering medical and recreational cannabinoids to the body. The testing was performed in British Columbia, Canada with THC and has proven very successful.

The Company plans to conduct medical research and clinical trials to develop Cannabinoids-based pharmaceuticals and treatments for conditions including, but not limited to, psoriasis, fibromyalgia, PTSD, Depression, Anxiety and migraines. The Company will also be pursuing the “Recreational Market” in Canada with expansion plans into the USA once the proper legal standards are addressed.

“THC, CBD, and CDN are more commonly known Cannabinoids found in the Cannabis and Hemp plants but there are over 100 known Cannabinoids that our technology can be used for. As pharmaceutical companies develop different cannabinoids for treating various medical conditions our delivery system, we believe, will be the premiere way of dosing and delivering the medication transdermally,” said CEO Dr. Chris Otiko.

ViaDerma will be begin developing unique delivery systems for the effective delivery and dosage of recreational and medical cannabinoids and plans to start a grass roots product for both THC and non-THC Cannabinoids, both in a patch form, roll on and spray. The plans include distribution in every dispensary across Canada to start with, and add a website for global distribution.

The Company’s success of its first round of testing is compelling and the company plans to start continued Clinical Trials to ensure that the delivery system meets medical standards. The idea is to continue and expand testing to include pure Cannabinoid isolates, including pure THC oil, to ensure that developed products will be accepted by the medical community to treat illness as well as providing the recreational market with a more favorable alternative to smoking or ingesting.

Otiko said, “We are very excited our initial tests absorbed THC into the body using our proprietary patent pending delivery system for Cannabinoids by applying the medication onto the skin in an ointment based topical solution. Plans are, in addition to our own products, eventually license the technology to global Pharmaceutical Licensed Producers of Cannabinoids

for their medical and recreational products as well as smaller companies that produce the Home-Grown Hand Crafted Strains of medical and recreational products.”

Earlier this year the Company signed a Licensing Agreement with a Canadian group with expertise in logistics and development that includes distribution for the new and anticipated products. The Management Company is developing the trial protocols, products, and eventually the sales for the new patent pending products to countries that have accepted “Medical Marijuana” and “Recreational Use” of cannabis products and technologies for the delivery of Cannabinoids. The management company will also target countries that allow the “Clinical Studies” for medical testing such as the United Kingdom and other Asian countries. (Source: Marketwired)

We like VDRM’s approach to the recreational market in Canada, which is certainly further along in the march toward full legalization than its American counterpart. While the US is dealing with an administration that has all but reversed that momentum, Canada plans to move ahead with nationwide legalization in 2018. It’s one more aspect that draws us to continue to keep an eye on VDRM.

Disclosure: No one at Street Register has been compensated in any way for the publishing of this article, nor do we hold any position in VDRM stock, short or long.

$VDRM UPDATED DUE DILIGENCE/ RESEARCH

Christopher Otiko CEO, DPM

http://www.neurogenx.com/testimonial/christopher-otiko-dpm-ceo-executive-medical-director/

$VDRM This Technology and The Company Are As Real as it gets!

The Federal Law will validate everything Dr Otiko has stated, leading to a much higher valuation on the stock in my opinion

Two new items in the May 3rd press release Worth Highlighting!

The Company has filed provisional patents on several products, and their pending status has already gone through a screening process by the USPTO.

The Company is moving ahead with its aggressive growth plans and plans to complete its initial production of Viabecline topical antibiotic by the end of Q2."

VDRM VIADERMA NEWS

https://finance.yahoo.com/news/viaderma-inc-vigorously-defend-companys-120000945.html

https://www.otcmarkets.com/stock/VDRM/news

What Is The Buzz Surrounding With Viaderma Inc $VDRM

www.mmjobserver.com/what-is-the-buzz-surrounding-with-viaderma-inc-otcmktsvdrm/28597/

ViaDerma, Inc. (VDRM: OTC Pink Limited) | Attorney Letter with Respect to Current Information

http://www.otcmarkets.com/financialReportViewer?symbol=VDRM&id=171208

The problem Steven Keogh has, is the fact that he has done nothing to "Revive" the abandoned patent in a reasonable time and failed to respond to the US PATENT TRADE OFFICE! He has ZERO rights to any technology related to the patent / intellectual property referred to in the lawsuit.

https://www.uspto.gov/web/offices/pac/mpep/s711.html ;

Therefore, this patent application is deemed "dead". First to file does not apply on abandoned patent applications.

http://patentassociate.com/patentblog/2016/09/21/reviving-abandoned-patents/ ;

Case will be dismissed in my opinion!

VDRM will have the right to countersue based on defamation, financial damages and false allegations!!!

$VDRM CHECK THIS OUT! SCREEN SHOTS OF THE PATENTS KEOUGH ABANDONED! Case will be dismissed in my opinion based on my conversations with legal professionals, including a patent attorney.

SCREEN SHOTS DIRECTLY FROM THE US PATENT TRADE OFFICE

https://twitter.com/MOMOSTOCKTRADES/status/856568132646948864

Additional INFORMATION

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=130754240

VDRM / CHART is A Beauty!

http://stockcharts.com/c-sc/sc?s=VDRM&p=D&b=5&g=0&i=t12669425044&r=1491246424508

$VDRMhttps://www.barchart.com/stocks/quotes/VDRM ;

Per INVESTOR RELATIONS "News due out very soon. I inquired about FDA approval for the cream / spray and was advised it should be 6 to 8 weeks from April 5th, putting us at a target date sometime during the last 2 weeks in May!

Product will begin rolling out in 45 to 60 days. "

Based on the previous press releases:

Expecting the following:

Drugs in pipeline - Updates

Product Rollouts

Lawsuit update

Company response to lawsuit

Company clarification to lawsuit details

Additional intellectual property/ Patent Filings

Initial Product Manufacturing and Launch

FDA Product Registration / Approvals

Partnerships

Additional Conferences/ Meetings

Additional Data for Products in pipeline

Etc.

With that being said, there is a SHORTSQUEEZE IMMINENT !

THERE IS HEAVY SHORTING THROUGH CITADEL, MARKET MAKER CDEL.

HERE'S A REPORT DIRECTLY FROM FINRA.

http://otcshortreport.com/?index=VDRM&action=view

$VDRM UPDATED SUPPLY VS DEMAND /

SHORT SELLERS ARE CLEARLY LOSING CONTROL AND THIS IS ON THE VERGE OF EXPLODING HIGHER. FACTS ARE BELOW!

#SHORTSQUEEZE IMMINENT

ALL READ THE FOLLOWING!

<<<<SEE NEW SHORT INTEREST FIGURES BELOW>>>

The SHORT Reports are Reported Directly From Finra!

There's ZERO BS. IT'S FACTS, and extremely telling!

Anyone thinking about selling INTO this RALLY, really needs to think twice!

There's a reason why the PERCENTAGE of Volume SOLD SHORT per day has increased so dramatically!!!

The Short SELLERS got pegged against the wall and are trying to stop the UPWARD MOMENTUM, with there fake walls.

Nobody who's half intelligent would place a large block of shares for sale on the ask. The blocks are put there to place a psychological block, to deter people from buying. When you buy into the block, you put FEAR into the short SELLERS and they quickly pullback from there SHORT Attack!

The higher the price goes, the more they lose control!

As the stock climbs, it gains momentum which will lead to a larger climb, creating a short squeeze and "A PANIC BUYING" SITUATION.

VDRM Days Volume 7,985,191 NEW RECORD # Shorted for one day = 5/11/17 = 5,035,769 63.06% of Volume http://otcshortreport.com/?index=VDRM&action=view

VDRM Days Volume 5,462,889 NEW RECORD # Shorted for one day = 5/10/17 = 2,830,328 51.81% of Volume http://otcshortreport.com/?index=VDRM&action=view

>>>>>>> VDRM NEW RECORD SHORT Volume for One Day! <<<<<<<<

THIS WILL SQUEEZE HARD!!!

VDRM Days Volume 8,163,772 NEW RECORD # Shorted for one day = 5/9/17 = 6,131,400 75% of Volume http://otcshortreport.com/?index=VDRM&action=view

VDRM Volume 10,880,426 # of Shares Shorted 5/8/17 =7,123,809 65.47% of THE Days Total Volume

http://otcshortreport.com/?index=VDRM&action=view

$VDRM MAY 5Th 2017 Volume 4,849,891 # of Shares Shorted WAS 1,987,459 Representing 40.98% of May 5ths Total Volume

http://otcshortreport.com/?index=VDRM&action=view

MAY 4th 2017

FACT! NEW RECORD SHORT INTEREST FOR 1 DAY! $VDRM Volume 5,397,797 # of Shares Shorted Today 3,154,634 Representing 58.44% of May 4ths Total Volume

http://otcshortreport.com/?index=VDRM&action=view

$VDRM May 3rd 2017 Volume 9,834,653 # of Shares Shorted of which 5,636,599 Representing 57.31% of Total Volume for the day was shares SOLD Short

http://otcshortreport.com/?index=VDRM&action=view

Now let's put this into perspective, shall we!!

This stock is being artificially held down. The volume is at record lows for four straight business days. The majority of the shares being sold, are from short sellers.

There is practically no more shares available at this level.

So what you see taking place, is trading from one short seller to another.

They artificially dropped the share price down by selling back and forth between there accounts, using the same shares.

THE minute any volume comes in to buy, that is not a short seller, the stock instantaneously rises on the bid and ask at the same time.

Most shareholders are holding, as 90% of the weak hands have sold.

So there continuously shaking the tree by creating artificial volume at a deflated stock price, hoping to create fear. (Based on the volume, they have already lost!)

But what actually has taken place is, the entire floats been locked up by stronger hands, creating added pressure on short SELLERS. (Now they are forced to try and figure out ways to create fear, hence misleading posts, rumors, confusion etc.)

This is a coiled spring and will explode higher in a matter of days just like it has done over and over, during the past 4 months.

Be strong and don't fall for these games! Place a bid in , good til canceled and take away the remainder of the shares from short SELLERS. .

http://otcshortreport.com/?index=VDRM&action=view

There is a HIGH LIKELYHOOD OF a SHORT SQUEEZE < You can't short millions of SHARES everyday, forever!!!

The next major news will ignite a massive rally in my opinion.

Note, if you buy at the ask, the large blocks that appear to be on the sell side, quickly vanish.

If you buy at the ask, short SELLERS quickly hit the bid with a small amount to make it appear like there's selling pressure.

This one's ready! Do not fall for the short SELLERS tactics.

Recommend reading the following information:

http://counterfeitingstock.com/CS2.0/CS16ConfessionsOfAPaidStockBasher.html

_____________________________________

Also confirmed with Management that there will be ZERO DILUTION from today until September 2017. CONFIRMED !

_______________________________________

PER IR " In the last month there were 10 million shares issued as a result of a convertible note. There are no more issuance is expected until another note comes due beginning in either September or October and it will be staggered for a couple months. So no more issuance of shares until the fall"

"To date not one single Insider has sold any shares"

"Dr Otiko owns over 40 million shares and has not SOLD any shares" directly from IR

INVESTOR RELATIONS

RICHARD INZA 1-954-251-0616 or 1-310-734-6111

info@viadermalicensing.com

____________________________________

$VDRM DUE DILIGENCE

The CEO of VDRM was involved with Phillips on inventing a transdermal delivery system that changes drugs into an ointment for better absorption .

Steven Keogh was the patent attorney several years back. The guys trying to say he had rights to the patent. Which is freakin ridiculous. He's known to be a corrupt attorney who trys to steal intellectual property. So he recently filed a suit against VDRM over the patent. It's a Frivolous suit in my view. Hence the reason the stock dipped.

Steven Keogh is a piece of doodoo patent attorney , trying to extort money from company.

Read this article

http://patrickpretty.com/2010/03/26/inetglobal-accuses-former-ceo-of-extortion-bid-says-company-is-solvent-accuses-government-of-leaking-search-warrant-affidavit-to-press/

Keoughs patent expired!

It was abandoned which means that it was never issued because he abandoned it before seeing through the entire process.

Once it's abandoned its fair game anybody can claim it.

But either way the patent that we have is different than the abandoned patent.

We're not even fighting over the same technology as far as I am aware.

Dr Christopher Otiko made changes and improved upon the original technology. He greatly advanced it and filed provisional patents for the new technology.

I did verify the original patent (Referenced by Stephen Keough) was abandoned via us patent trade office.

This is FACTUAL, NOT SPECULATION.

HERE IT IS, DIRECTLY FROM THE US PATENT ORGANIZATIONS WEBSITE!

13/729,776 TOPICAL DRUG DELIVERY SYSTEM WITH DUAL CARRIERS

Status: Abandoned -- Failure to Respond to an Office Action

Status Date: 11-16-2015

First Named Inventor: D. Howard Phillips , Millerton, OK

First Named Applicant: PHARMACLINE, LLC , Minneapolis, MN

Patent info from DR Otiko took 20 mins for response...

The original patent filed by Steve Keough was abandoned. Keough the patent attorney for Dr. Phillips who invented the technology with my assistance. I was responsible for 90% of the data that led to the patent, HOWEVER Keough put himself on as an inventor, which wasnt true. The patent was abandoned because Keough and Dr. Phillips had a falling out. I filed a provisional patent to protect the IP.

Hope this helps clarify things.

Dr. Chris Ayo Otiko,

President & CEO

ViaDerma, Inc

Corporate Headquarters

4640 Admiralty Way Suite 500, Marina Del Rey, CA 90292

Phone: (310) 496-5744

Fax: (310) 943-1457

viadermalicensing.com/

People are missing this KEY section.

Directly from the Annual Report

"Furthermore,

the predecessor transdermal technology, which is the subject of dispute by Mr. Keough, is not even

currently used by the Company and any protections related to its provisional patents are believed to have

expired. All new products being developed and sold by the Company are based on a newer transdermal

technology created directly by the Company or its management team. "

RECENT THIRD PARTY DUE DILIGENCE

$VDRM Here's Something Viaderma Inc $VDRM Shareholders Should See

By Chris Sandburg / in Biotech, Momentum & Growth, Momentum Stocks, Stocks / on Wednesday, 10 May 2017 10:58 AM / 0

https://www.insiderfinancial.com/viaderma-inc-otcmktsvdrm-a-bit-of-due-diligence-on-the-patent-claims/122577/

Viaderma Inc (OTCMKTS:VDRM) took a bit of a hit recently based on the surfacing of some litigation related to the delivery method associated with its lead asset. Over the last few days, however, the company has recovered much of the lost ground, trading up to the tune of around 20% on the Monday open at current prices (midsession on Wednesday) and up close to 10% for the day so far.

With the potential for an FDA green light for its lead registration asset just around the corner, and the company fresh off the back of what was reported as being a successful conference presentation by its CEO relating to the lead target indication – diabetic foot ulcer therapy – it looks as though we could be in for some strength. The litigation dampens sentiment somewhat, however, right now, but a little bit of digging reveals that sentiment need not be impeded by what’s going on.

Here is why.

By way of a bit of background, Viaderma has developed a topical antibacterial formulation of an already FDA registered drug, which it has been able to prove in trials has the potential to treat diabetic foot ulcers successfully in more than 90% of applications. This category of condition is crying out for fresh therapy options right now, and a number of companies have failed in their attempts to bring said options to market just recently. We covered this company not long ago, requesting that management put out some degree of insight (by way of a press release or otherwise) as to how the above-mentioned presentation went. To put it bluntly, we felt that the claims made as to the 90% success rate in this indication were too good to be true, and wanted to see how the scientific community responded to said claims.

Shortly after our coverage, we got exactly what were looking for, with this release.

The product is in final testing for manufacturing, and based on the available evidence, should be a shoo-in for a quick transition toward standard of care therapy in this sector. So what’s holding the company back? Well, as mentioned, there is a claim against the technology that underpins the product.

Specifically, one of the guys who worked on a product (a patent lawyer) with the current CEO and the technology’s initial inventor (a scientist) claims to have ownership rights. If this is the case, it’s potentially terminal for the program. However, it doesn’t take too much digging to prove that the claim is essentially baseless.

Head over to this site.

Insert the following into the field as an application number: 13/729776.

This is the application number for the patent that the guy we’re talking about is trying to challenge – his name is Steven Keough and he’s listed as an inventor on the patent, along with D. Howard Phillips.

Check the status of the patent:

” Abandoned — Failure to Respond to an Office Action”

So first of all, the patent isn’t even a patent – it’s an application.

More important that that, however, it has been abandoned. When a patent application gets abandoned it’s as if nothing has ever been filed. Even if an individual is listed as an inventor on the application, his or her rights to any return based on future commercial application of the technology covered by the initial application are non-existent.

This is all based on a bit of research in a murky area – we aren’t patent lawyers and we don’t work at the USPTO. We may be misinterpreting something (although we’re pretty certain we aren’t), so we’re going to say that it’s important for anyone thinking about acting on our coverage to do a bit of due diligence before doing so.

All said, however, this just looks like a bit of opportunism from Keough.

If that’s the case, then, our bull thesis remains firm, and our attention returns to the science (and the therapeutic application) as near term value inputs.

We will be updating our subscribers as soon as we know more. For the latest updates on VDRM, sign up below!

Sign up for next microcap runner ahead of the crowd.

I bought. If the lawsuit gets dismissed it will skyrocket in my opinion as the lawsuit basically VALIDATES there's significant value on the patent not currently priced in!

Good luck to all!

$VDRM HUGE DRUG NEWS THAT HASN'T BEEN PR^D YET!

$VDRM Viabecline DRUG News

LOAD UP BEFORE THIS IS PRESS RELEASED BY THE CO

https://www.accuriallc.com/product-information/

CONDITIONS TREATED

https://www.accuriallc.com/conditions-treated/

Why Choose Viabecline?

Viabecline is registered with the FDA as first aid to help prevent skin infection in minor cuts, scrapes, and burns.

Evolution is how bacteria develop resistance to the effects of all antibiotics. Papers and articles on antibiotic resistance evolution of bacteria have concentrated almost entirely on CHEMICAL threats to the bacteria. The mechanism of action of all known antibiotics is chemical in nature. Chemical (biochemical) processes previously have been the primary focus when combating bacteria drug resistance. Drug developers believe it takes much longer for bacteria to develop drug resistance to a physical kill mechanism. This is because it is relatively easy for bacteria to change their response to a chemical threat, but it takes numerous generations for bacteria to grow a new kind of cell wall structure to respond to a physical threat. This is why Viabecline is able to kill all bacteria it has been tested on, and is also the reason why antibiotic resistance will be very difficult.

The patent-pending transdermal delivery system allows the active ingredient (tetracycline) to be carried in higher concentrations, more quickly, to and through the cell walls, where the tetracycline can become more effective than other antibiotics. Most other antibiotics require more time (usually prescribed for 5 to 7 days for best results), whereas our product usually produce desirable results in 24 hours (or less).

Viabecline contains Vitamin D3 in the form of cholecalciferol. This is an essential component of skin healing. More benefits of Vitamin D3 can be found in the product benefits section. Viabecline not only helps prevention or treat infection, it also helps heal the skin from damage caused by the infection.

Viabecline contains Vitamin C in the form of ascorbic acid. This is an essential component of skin healing. More benefits of Vitamin D3 can be found in the product benefits section. Viabecline not only helps prevention or treat infection, it also helps heal the skin from damage caused by the infection because it contains Vitamin C and D3.

https://www.accuriallc.com/why-choose-viabecline/

Viabecline

At Accuria, we like to refer to Viabecline as a “super-drug”. We believe it is one of the world’s strongest topical antibiotics. Viabecline kills all harmful Gram positive and Gram negative bacteria that have been available for testing We have put this amazing antibiotic in the hands of people without the need of a prescription needed. We use both a physical and a chemical mechanism of kill to fight pathogens.

All known antibiotics (other than ours) primarily use only a chemical mechanism of kill. The physical mechanism of kill is a key feature of Viabecline’s strength.

PRODUCT INGREDIENTS

Active Ingredient (in each gram): Tetracycline Hydrochloride 30mg

Inactive Ingredient: Acetic Acid, Ascorbic Acid, chlorhexidine gluconate, cholecalciferol, dimethyl sulfoxide, dipropylene glycol, glucono delta lactone, glycerin, histidine, hydroxethyl-cellulose, magnesium stearate, methylparaben, sodium hydroxide, sorbic acid, steric acid, water.

Viabecline contains Vitamin D which has the following benefits for the skin:

Minimize acne, boost elasticity, stimulate collagen production, enhance radiance, lessen lines and the appearance of dark spots. Vitamin D Cream or supplements can be effective for treatment of psoriasis. Vitamin D also repairs skin damage prevents infections that might be caused due to skin injuries and rejuvenate the skin. One of the most well-known uses for Vitamin D in terms of skin is its treatment of psoriasis. Psoriasis symptoms include itchy and flaky skin, which can heal by the topical application of Vitamin D cream or by having prescribed Vitamin D supplements.

Vitamin D3 contains strong anti-inflammatory properties which make it effective for treating burns, skin injuries, skin damage and stretch marks. Thus vitamin D is added to Viabecline for its anti-inflammatory properties.

Vitamin D also helps to treat eczema and is a potential saviour of rosacea sufferers. Enzymes in the skin of rosacea sufferers can cause them to produce antimicrobial peptides in an abnormal form

Viabecline also contains Vitamin C (ascorbic acid). The antioxidant properties of vitamin C and its role in collagen synthesis make vitamin C a vital molecule for skin health. Topical ascorbic acid has the following beneficial effects on skin cells.

Production of Collagen: Vitamin C is a required component for the production of hydroxyproline and hydroxylysine, both of which are needed to bind the molecules that produce collagen. This, in turn, firms and tones the skin. Collagen deficiency makes the skin dull and lifeless. Collagen rejuvenates the skin from the roots and reduces wrinkles and symptoms of aging.

Heals Wounds: The body uses Vitamin C to replace the damaged tissue and helps to heal the wound at a faster pace. Wounds that heal slowly indicate Vitamin C deficiency. Vitamin C improves the skin elasticity and helps to create scar tissue and ligaments for quick recovery.

Protects Against Skin Discoloration: Vitamin C protects DNA from photochemical reactions that can lead to tumor, skin discoloration and several kinds of skin cancer. It also inhibits the production of Pyrimidine dimers that are the primary cause of melanomas in humans.

It lightens dark discoloration like skin freckles and age spots and helps to get a younger and smoother skin.

Improves Skin Texture: Collagen also provides the structure for the blood vessels. The tiny blood vessels under the skin carry oxygen and nutrients that keep the skin healthy. Without enough nutrients, the skin will become rough and dry. Creams containing Vitamin C improve the appearance and texture of the skin.

Vitamin C increases the formation of elastin which thickens, protects and heals the skin cells. The thickening effect helps retain moisture, increases the skin circulation and plumps up the skin surface.

BENEFITS

Infection Protection. It works by killing sensitive bacteria on the skin or in wounds. So far it has killed 99% of all bacteria it has been tested on. Prevention of wound infection following minor surgical or cosmetic procedures. Relieves symptoms associated with secondarily infected eczematous dermatitis. Relieves symptoms associated with secondarily infected acne. Relieves symptoms associated secondarily infected psoriasis. Soothes Painful Cuts, Scrapes, and Burns. Rapid Absorption.

POSSIBLE REACTIONS/COUNTER INDICATORS

Anyone allergic to tetracycline should not use. Do not use if allergic to any ingredient listed on this label.

Warnings For external use use only.

May be harmful is swallowed.

Do not use in eyes.

Do not use longer than 1 week unless directed by doctor.

Ask a doctor before use if you have deep or puncture wounds animal bites serious trauma. Stop use and ask a doctor if condition persists or gets worse.

Keep out of reach of children.

If swallowed, get medical help or contact a Poison control Center right away.

PACKAGING SIZES:5 ml bottle15 ml bottle28 ml spray bottle

OTHER INFORMATION:Keep product refrigerated to preserve its effectiveness and color, stop use if product is misused. This product is an OTC antibiotic for human use. Contains no alcohol, no animal ingredients. Blended for typical skin color. May stain cloth

No claims regarding stem cell healing are implied for this product.

Found an abstract from last year on Dave Pozek of Accuria on linkedin.

Author is Dr Otiko

https://www.linkedin.com/pulse/healing-diabetic-ulcers-dave-pozek-1 ;

$UAMM NEWS ALERT ON A SATURDAY! - JUST POSTED MARIJUANA BUSINESS UPDATE NEWS ON ITS FACEBOOK PAGE. LOAD BEFORE THEY PUT OUT AN OFFICIAL PR, IN MY OPINION. RUNS SUPER FAST!

IBRC huge news - retiring 4.5 bill, per interview at close:

$NMUS FULL CEO Interview A Sit Down With Nemus Bioscience; Cannabinoids In Focus - Nemus Bioscience, Inc. (OTCMKTS:NMUS) | Seeking Alpha

A Sit Down With Nemus Bioscience; Cannabinoids In Focus

Feb. 1, 2017 11:06 AM ET Nemus Bioscience, Inc. (NMUS)

Summary

Cannabinoids are fast becoming an interesting market with proven efficacy for a host of disease and illness.

Separating cannabinoid companies from marijuana stocks is a critically important aspect of investing in the sector.

NMUS is well connected with educational institutions, has some strong license agreements and may capitalize from increased interest in cannabinoid based therapy.

I have received enough questions from followers about Nemus Bioscience (OTCQB:NMUS) that my curiosity was finally piqued to the point of action. While Seeking Alpha has certainly presented a fair share of information and analysis about NMUS, the time is probably ripe for management to provide a detailed update as to the current state of NMUS, as well as to provide guidance on its near term ambitions.

Being that as it may, I went straight to the source, and NMUS management was more than receptive to providing some current data and to provide investors with a fresh take on what NMUS is working to accomplish.

From my point of view, NMUS is growing and is charting a course for growth in the near term. From managements perspective, they are already well on their way.

Q. In looking at NEMUS' portfolio of cannabinoid product candidates and the unique relationship with The University of Mississippi, can you provide us with an overview of the pipeline and patent portfolio?

The University of Mississippi has held the only contract to cultivate cannabis for research purposes on behalf of the Federal Government since 1968. By virtue of the University's 49-year experience with the Cannabis plant, Nemus benefits tremendously from the University's knowledge. Nemus is the sole developmental and commercialization partner with the University and has exclusive, global licenses to intellectual property related to these molecules.

Those licenses include access to intellectual property for both a prodrug of tetrahydrocannabinol (THC) and an analogue of cannabidiol (CBD). The THC-prodrug is being developed as a therapeutic agent for glaucoma and chemotherapy-induced nausea and vomiting (CINV). The analogue of CBD is being explored as a possible therapeutic for chemotherapy-induced peripheral neuropathy (CIPN) and other pain syndromes. Lastly, Nemus is developing cannabinoid-based platforms for use as anti-infectives, especially for use against bacteria and viruses that have developed resistance to established therapies.

Q. Often times investors confuse pharmaceutical-based cannabinoids with plant derived products. Can you give a layman's overview of the difference and significance from a regulatory standpoint?

The Cannabis plant is known to have more than 100 different cannabinoid molecules. These molecules can possess diverse activity at the cellular level in multiple organs in the body. Plant-derived molecules are very hydrophobic or not that soluble in water. The lack of significant water solubility makes these molecules difficult to administer into the body, especially by oral ingestion. Nemus' cannabinoid molecules have been re-engineered to make them chemically more hydrophilic or water soluble, so they can traverse cellular membranes easier with the goal that they can be absorbed in a more predictable and safer way. Patents have been issued for compounds licensed by Nemus that have intellectual property claims related to composition of matter, methods of synthesis, and methods of use.

Nemus cannabinoid molecules are being chemically synthesized to meet purity and scale-up criteria for eventual commercialization. The synthetic manufacturing process must meet DEA and FDA specifications for cannabinoid-based drug product. Furthermore, Nemus plans to conduct the necessary pre-clinical and clinical studies so these molecules meet the specifications to be an approvable drug product.

Q. In terms of competition in the space with GW Pharma, Zynerba, and Insys, how do you feel NEMUS should be compared?

Nemus is an early-stage developmental company compared to the listed cannabinoid-market incumbents. We aspire to be a second-generation market disruptor.

a) Nemus does not rely on plant extraction for its drug product candidates and in fact, by virtue of biosynthetic manufacturing, can potentially develop high-purity active pharmaceutical ingredients (APIs) with associated shorter manufacturing times.

b) Nemus's portfolio consists of re-engineered cannabinoids, a prodrug of THC and an analogue of CBD. These drug product candidates are designed to have multiple routes of administration specific to the disease indication that could potentially give Nemus a competitive advantage on issues of bio-distribution, bioavailability, and pharmacokinetics.

c) Unlike companies that use traditional plant cannabinoids, Nemus' licensed bio-engineered molecules have been issued patents for composition of matter as well as methods of use. Consequently, Nemus may not have to rely on orphan indications for market exclusivity but could approach entire therapeutic areas globally. These markets, namely glaucoma, pain, methicillin-resistant Staphylococcus aureus (MRSA) and CINV, are all multi-billion dollar global opportunities with an urgent medical need for newer, safe and effective therapies.

d) Nemus currently holds some market distinctions, including, to our knowledge, being the only cannabinoid company developing a portfolio of drug candidates for use in ophthalmology, with a leading indication being glaucoma; the only cannabinoid company developing an anti-infective platform against multiple infectious agents; the only cannabinoid company utilizing biosynthetic manufacturing; and the only cannabinoid company with prodrug and analogue capability with multiple potential routes of administration including ocular, trans-mucosal/buccal, transdermal, and transmembranous delivery that avoids first-pass metabolism by the liver.

Q. With GW Pharma being the most advanced in the clinic with a market cap of almost $3 Billion, how do you see NEMUS moving forward with GW having the first mover advantage?

With a pipeline bio-engineered with the goal of better target-organ access, we believe Nemus can be a classical second-mover to capitalize on unmet medical needs of first-in-class drugs. Those needs include: more rapid onset of action, predictable bioavailability and pharmacokinetics, routes of administration that avoid first-pass liver metabolism, versatility in dosing mechanisms, and efficient API manufacturing. We believe Nemus will be able to enter large therapeutic areas versus having to focus on orphan indications.

Q. From a regulatory standpoint at the federal level and some of the laws that have been passed, do you believe the current administration will loosen plant-based cannabinoids versus pharmaceutical, and how would that impact your business model?

Time will tell what the new administration's position will be. For pharmaceutical developers, the pathway to drug approval is carefully delineated and all drugs must meet the criteria set by the regulatory agencies. If marijuana is re-scheduled as a Schedule II drug, pharmaceutical developers will be required to conduct clinical trials and have scientifically rigorous data to make claims about and promote the medicinal benefits of the Cannibas plant as was done with other Schedule II medications like oxycontin. Nemus plans to conduct research and development in accordance with FDA standards so the proper regulatory filings can be made to reach drug approval.

Q. Looking forward at how you advance your portfolio, should investors be looking at structures such as co-development or licensing agreements, and are there examples of such in the cannabinoid industry?

It will come as no surprise to anyone that drug development is time consuming and expensive, especially on a global scale. Nemus has access to patents and compounds that have shown activity in both in vitro and animal testing. To maximize shareholder value, Nemus is open to explore strategic collaborations with partners that can help expedite our goals to commercialize our pipeline. That collaboration could possibly take the form of a co-development deal, an in-licensing of our products, or an outright acquisition of a promising platform, especially one that requires resources that an early-stage biotechnology company may not have.

Mature companies in the cannabinoid sector like GW Pharma have also partnered with larger firms, especially those that can provide development capital and provide sales capabilities in overseas territories. We anticipate that this will be more the rule than the exception as breakthrough companies in the pharmaceuticalized cannabinoid space expand their capabilities.

Q. In closing, given all of the developments that have occurred both in NEMUS and the cannabinoid sector over the past year, what should investors focus on in 2017?

I believe investors will see strides in the cannabinoid sector beyond pain and epilepsy as companies like Nemus advance other cannabinoid molecules for newer indications. I feel the cannabinoid sector is a hyper-competitive space and there will be greater emphasis to expand treatment options utilizing different routes of administration to enhance safety and the clinical response. Nemus has licenses from the University of Mississippi that allow the company to develop unique methods to administer our novel forms of cannabinoids and we look forward to introducing these approaches into the development pipeline in 2017.

End interview

While technically not a marijuana stock, NMUS will most likely rise and fall with the sector, at least until the market fully understands the differentiating features of the company. NMUS is certainly a stock to keep an eye on in the near term, as cannabinoids are becoming increasingly popular in clinical trials and are demonstrating significant therapeutic benefit for a host of disease and illness.

Thanks to Brian Murphy and the rest of the management team at NMUS for taking the time to update shareholders. While all small caps have risk, the ones that have a clear plan of action hold the most promise of making it out of penny land alive. For NMUS, as long as management can stay focused to their tasks at hand and remain steadfast to their corporate responsibilities, they may fare well in the next 12-24 months.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

http://seekingalpha.com/article/4041487-sit-nemus-bioscience-cannabinoids-focus

$NMUS February 16, 2017 NEW Investor Presentation Posted to Website

Impressive Presentation

http://s2.q4cdn.com/753474459/files/doc_presentations/2017/Nemus-Public-Deck_Feb-2017_FINAL.pdf

http://www.nemusbioscience.com/investor-relations/events-and-presentations/presentations/default.aspx

At $15/share for LCTC, the entire float, in theory, could be locked up for less than $3 million. Lifeloc produces three times that in revenue and has more than that in available cash ($3.3 million). I can almost promise there is no other stock in the entire US publicly traded market where the entire float could be owned for less then 1/3rd the annual revenues. I'm not really sure how this information will help anyone with trading it, but it does show you how easily someone could own the float for less than what the company produces in annual revenues. Time for this company to put out some news (we could really use an update on progress being made with the marijuana breathalyzer) and get this thing moving higher.

aviation and marijuana ventures - G Y O G - low floater

https://www.otcmarkets.com/stock/GYOG/profile

Website: http://www.greenenergyent.com/

Phone: 904-207-6503

Email: Donnell@greenenergyent.com

Business Description:

Green Energy Enterprises, Inc. is in the aviation industry and operates flight training, aircraft rental and air tours operations. Green Energy is a certified FAA & FCC Computer Assisted Testing Service (CATS) and Comira facility. Green Energy is a service provider to the Legal and Medical Marijuana Industry with a retail Hydroponic Grow Store and ECommerce site. Green Energy is in opening an Insurance division that will service the Cannabis Industry more to come on this new venture.