Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Never mind I see they did change the ticker and wow great job. CUDOS to you!

The ticker it is LSTA get on etrade market castor that is what I am on

Did they change the ticker?tia

It going through the roof right now I left 5000 on the table who knew it was going over 9.00 wow volume at over 627000 now premarket

It shows 615000 premarket on etrade market castor and it over 9.00 a share now wow

But the stock shows 0 trades pre mkt???

Clbs my second best play this week wow!! When everyone was saying it was tanking big time sold this morning for a nice Gain

Wow I got up this morning and it was over 7.50 I called etrade and they put my sell order through I just made 2400.00 profit when everyone even moonmarket said it was a bad trade for him ,I bought at .40 yesterday 7.50is like selling it for .60 at the old share structure

You're absolutely correct. I will keep this on watch.

lately everything is a pnd, they push it up too high and short it back

with some exceptions, that have a few day run

I have been reading all about it on OTC site and stock twits I put a bid in for .385 just for the fun of it

Merger news this morning mixed with the r/s is why I bought. Took loss and keeping it on radar for reversal

YOU BOUGHT AT .63 IT WAS JUST AT .385

Yea, nothing surprises me

Looks like a group wacked out to chase another ticker

I didn't get the memo. lol

Maybe someone didn't get the memo that r/s plays are hot right now haha

Snagged 63s

This is a very unusual year with all the R/S working out! Scratching my bald head!

post RS plays are HOT **CLBS* +Merger

adtx nrbo

Yep double whammy r/s and merger. Surprised this isn't getting more attention

Merger in progress

R/s after the close. Could be another big runner

Dawson James - Caladrius (CLBS) - Delays, Delays & delays + Burning Cash

Caladrius has fallen to $0.90 from $1.61 (2.15.21) when we wrote "Dam the Shareholders Full Speed Ahead", commenting on the highly dilutive capital raise. Revisiting the story, we see little progress. Caladrius reported 3Q21 results spending $7M in the quarter, steadily whittling down its $100M in cash balance but to what end? We note multiple delays across previously promoted programs such as CLI in Japan, now suspended.

Click here for the full report

HONDERA (CLBS12) – Suspended for CLI in Japan –This was planned as a small Phase 2 study, an interventional, open-label, proof-of-concept (POC) trial planned for two centers, but the company had problems finding patients, blaming COVID. Caladrius now says the program is suspended until a Japanese partner is identified. We remain skeptical and see this program as "dead."

XOWNA (CLBS16) – Enrollment has Slowed: The product is currently being evaluated in a P2b study in patients with CMD and without obstructive coronary artery disease. Patient enrollment is behind schedule, so the company has been expanding the number of sites and modifying the study protocol. These protocol amendments were implemented in the latter part of the quarter. We see these as "red flags."

Management was Pushing the CD34+ cells as a COVID Play – This appears to have fizzled out. Is anyone surprised? What's the Problem? On just about every level, we find management's explanations across multiple programs as lacking. Management seems to lack an understanding of 1. the competitive environment. Multiple off-the-shelf, allogeneic companies are already treating COVID patients but on ventilators and potentially earlier, and recent failures of other cell therapies in COVID due to improved standard of care. 2. For example, in COVID, using cells to ameliorate the after-effects of ventilator therapy for COVID patients is a great idea, BUT a) harvesting cells from these patients is not ideal; b) how do you measure how effective your treatment is? For NORDA, we see a POC trial as a $65M and multi-year investment. What size trial is needed to measure the effect versus standard of care? 3. Caladrius's autologous therapy is very late in the field.

Valuation. For Caladrius, we previously lowered our rating to Neutral from Buy (March 2020) and removed our price target. Our model uses our highest discount rate of 30% in our free cash flow to the Firm (FCFF), discounted EPS, and Sum of the Parts (SOP) models. Our models go out to 2029 and have been updated for the recent dilution. The company now has a negative enterprise value, but we believe that won't last as its likely management will now be on a spending spree. Spending on clinical trials that we feel go nowhere and or looking to make an acquisition. Our bottom-line concern is that Caladrius has, in our opinion, missed the window. Allogenic competitors are advancing now in heart failure, back pain, stroke, CLI, GvHD, and three companies are today treating COVID patients for ARDS

Risks to our thesis include the following: (1) commercial; (2) regulatory; (3) clinical; (4) manufacturing; (5) financial; (6) liability; and (7) intellectual property.

SI as of 2/12/21

2/12/2021 1,450,000 shares

1/29/2021 2,930,000 shares

1/15/2021 127,600 shares

12/31/2020 130,000 shares

12/15/2020 130,000 shares

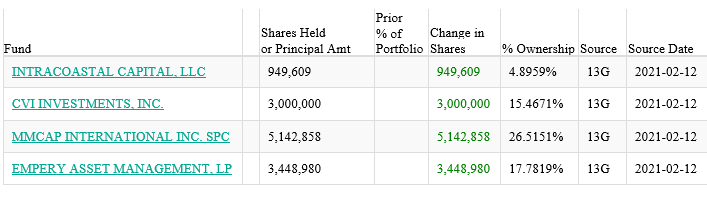

Four funds have new positions as of 2/12/21: https://whalewisdom.com/stock/nbs-2

this stock is hot. they have a 9 a share 1st year target we will get there soon

Opened a cr*p-load of April Calls in the AM.

C'mon 7!

* * $CLBS Video Chart 01-20-2021 * *

Link to Video - click here to watch the technical chart video

Out as well. Pulled a profit so all good. Gltu

$CLBS out core $4.05 will revisit..patience + DD forever

Caladrius Biosciences Treats First Patient in the Phase 2b FREEDOM Trial of CLBS16 for the Treatment of Coronary Microvascular Dysfunction

https://www.biospace.com/article/releases/caladrius-biosciences-treats-first-patient-in-the-phase-2b-freedom-trial-of-clbs16-for-the-treatment-of-coronary-microvascular-dysfunction/#:~:text=(Nasdaq%3A%20CLBS)%20(%E2%80%9C,dysfunction%20(%E2%80%9CCMD%E2%80%9D)%20at

$CLBS is squeezing the shorts out of their positions following an announcement of a patient treated in a Phase 2b trial. https://cnafinance.com/clbs-stock-caladrius-biosciences-squeezes-shorts/

Figured you were long out. Now this bomb confirms it.

Have you sold and moved on. Very quiet around here.

Falling apart here. Are we do any updates anytime soon?

How much patience does one need. We are going sideways and it’s not too much fun.

Bought a few more cheapies today. Just have to be patient with this one.

Unfortunately not looking so hot for us who bought in much higher.

|

Followers

|

83

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

3109

|

|

Created

|

03/08/07

|

Type

|

Free

|

| Moderators | |||

Caladrius Biosciences, Inc. is a clinical-stage biopharmaceutical company dedicated to the development of cellular therapies designed to reverse, not manage, disease. We are developing a first- in-class cell therapy product that is based on the notion that our body contains finely tuned mechanisms for self-repair. Our technology leverages and enables these mechanisms in the form of specific cells, using formulations and modes of delivery unique to each medical indication.

The Company’s current product candidates include CLBS119, a CD34+ cell therapy product candidate for the repair of lung damage found in patients with severe COVID-19 infection who experienced respiratory failure, for which the Company plans to initiate a clinical trial in the coming months as well as three developmental treatments for ischemic diseases based on its CD34+ cell therapy platform: CLBS12, recipient of SAKIGAKE designation and eligible for early conditional approval in Japan for the treatment of critical limb ischemia (“CLI”) based on the results of an ongoing clinical trial; CLBS16, the subject of a recently completed positive Phase 2 clinical trial in the U.S. for the treatment of coronary microvascular dysfunction (“CMD”); and CLBS14, a Regenerative Medicine Advanced Therapy (“RMAT”) designated therapy for which the Company has finalized with the U.S. Food and Drug Administration (the “FDA”) a protocol for a Phase 3 confirmatory trial in subjects with no-option refractory disabling angina (“NORDA”).

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |