Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Lyft Stock Leaps Forward, Carrying Uber, as Ride-Sharing Makes Comeback

By: TheStreet | November 3, 2021

• Lyft stock leaps after reporting third-quarter earnings that handily beat analysts’ forecasts, raising expectations that rival Uber also will report strong results.

Lyft (LYFT) stock leapt forward on Wednesday, gaining more than 15% in premarket trading, after the ride-sharing company reported third-quarter earnings that handily beat analysts’ forecasts and said it is seeing a post-pandemic return of passengers and drivers to the roads.

Shares of rival Uber (UBER) also gained as investors recalibrated their expectations for its third-quarter earnings, due out on Thursday.

Lyft stock was up 15.95% at $52.55 in premarket trading after the company reported third-quarter revenue of $864 million, slightly ahead of estimates. It posted per-share earnings of 5 cents vs. analyst estimates of a 3-cent-a-share loss.

"We had a great quarter,” Lyft CEO Logan Green said in a statement accompanying the earnings announcement. “Driver supply materially improved in Q3, up nearly 45% versus last year, reflecting strong new driver trends."

The company said it anticipates improved service and pricing in the fourth quarter. "Given our success onboarding new drivers and expected supply tailwinds, we anticipate our service levels will naturally improve in Q4 and lead to lower prices," CFO Brian Roberts said in the statement.

Ride-sharing rival Uber also saw its shares rise following the earnings release and into premarket trading on Wednesday. At last check, Uber shares were up 6.09% at $45.50 in premarket trading.

Uber is expected to post its latest financial results on Thursday. Analysts surveyed by FactSet expect the company to report a loss of 33 cents a share on sales of $4.42 billion.

Ride-sharing companies suffered badly during the peak of the COVID-19 shutdowns, as travel fell sharply, and drivers chose to stay home to avoid exposure. Uber saw some benefit from its food delivery operations that cushioned part of the blow.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft says drivers are coming back, but disappoints on active riders

By: CNBC | November 2, 2021

Lyft reported third-quarter earnings on Tuesday after the bell. Shares rose around 4% after it beat on revenue and said drivers are coming back, though it missed active riders estimates.

Here are the key numbers:

• Earnings per share: 5 cents adjusted vs loss of 3 cents per share expected in a Refinitiv survey of analysts

• Revenue: $864.4 million vs $862.7 million expected by Refinitiv

• Active riders: 18.9 million vs 19.7 million expected, per StreetAccount

• Revenue per active rider: $45.63 vs $43.89 expected, according to StreetAccount

Lyft reported a net loss for the quarter of $71.5 million versus a net loss of $459.5 million in the same period of 2020. The company said its net loss includes $203.3 million of stock-based compensation and related payroll tax expenses.

Lyft again posted an adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) profit of $67.3 million. It’s a large jump compared to the prior quarter when Lyft posted its first quarterly adjusted EBITDA profit of $23.8 million. The company said in August it expected to maintain that milestone, which it met a quarter earlier than expected and before competitor Uber.

Lyft’s revenue grew 13% quarter-over-quarter to $864.4 million. That’s up 73% year-over-year thanks to easy comparables due to the Covid-19 pandemic. It also recorded record revenue per active rider at $45.63, which is up 14% year-over-year.

The company missed Wall Street expectations on active riders. Lyft reported 18.94 million active riders this quarter, compared to the expected 19.69 million, per StreetAccount.

The company has struggled with driver supply and demand imbalances throughout the pandemic, leading to higher costs or long wait times. Investors have been attuned to the imbalance, especially as the company has invested millions in incentives to bring drivers back to the platform.

Lyft CEO Logan Green said driver supply materially improved in the third quarter, up nearly 45% year-over-year.

“Given our success onboarding new drivers and expected supply tailwinds, we anticipate our service levels will naturally improve in Q4 and lead to lower prices,” CFO Brian Roberts said in a release.

Read Full Story »»»

DiscoverGold

DiscoverGold

Q3 2021 EPS Estimates for Lyft, Inc. Lowered by Piper Sandler (NASDAQ:LYFT)

By: MarketBeat | October 20, 2021

Lyft, Inc. (NASDAQ:LYFT) - Piper Sandler dropped their Q3 2021 earnings per share estimates for Lyft in a research report issued to clients and investors on Sunday, October 17th. Piper Sandler analyst A. Potter now anticipates that the ride-sharing company will post earnings of ($0.71) per share for the quarter, down from their previous estimate of ($0.42). Piper Sandler has a "Overweight" rating and a $84.00 price objective on the stock. Piper Sandler also issued estimates for Lyft's Q4 2021 earnings at ($0.35) EPS, FY2021 earnings at ($2.27) EPS, Q1 2022 earnings at ($0.26) EPS, Q2 2022 earnings at ($0.13) EPS, Q4 2022 earnings at ($0.02) EPS, FY2022 earnings at ($0.48) EPS and FY2023 earnings at $0.36 EPS. Lyft (NASDAQ:LYFT) last issued its quarterly earnings results on Tuesday, August 3rd. The ride-sharing company reported ($0.68) earnings per share (EPS) for the quarter, topping the Zacks' consensus estimate of ($0.70) by $0.02. Lyft had a negative return on equity of 79.27% and a negative net margin of 65.35%. The firm had revenue of $765.03 million during the quarter, compared to analyst estimates of $701.24 million...

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft built a brand on being the nice gig work app clad in pink

By: Washington Post | September 21, 2021

• SAN FRANCISCO - Ray Givaudan has driven for Lyft, Uber and even briefly Instacart to supplement his retirement over the last few years.

At first, the 55-year-old was loyal to Lyft. But then Uber introduced a long pickup fee to pay more if he goes out of his way to pick up a passenger. In addition, he could see what a customer paid for a trip, helping him understand if he was getting a fair share. Instacart provided more opportunities for work during the pandemic.

"The first couple of years with Lyft, you seemed to be a decent company and transparent," the Roanoke-based driver recently wrote in a letter to Lyft co-founders Logan Green and John Zimmer. "The last couple of years, not so much." He cited the disappearance of surge-priced pay, lagging driver rewards and the removal of helpful features such as a live phone help line for drivers.

Lyft has spent years trying to win over drivers and passengers with fun branding, an emphasis on social justice and charitable causes, and in-app tipping. The perks gave it a reputational edge in a marketplace where rival Uber was criticized for its treatment of drivers and corporate scandals, and where food and grocery delivery was a budding and uncertain sector of the gig economy, often with lower pay.

But the pandemic and related labor shortage has dramatically shifted that landscape over the past couple years. At Lyft, which remained focused on ride hailing, ridership was down by as much as 75 percent last year.

Drivers aren't bound to one company, and can easily switch between apps. In the interim, many drivers chose to work for rival food delivery services, which experienced a boom in deliveries and offered additional transparency into earnings, along with advantages like negating the risk of interacting with passengers. Companies like DoorDash and Shipt added driver incentives, such as cash bonuses last winter in an effort to meet surging demand.

And while Uber experienced similar ridership declines to Lyft at the height of the pandemic, it doubled down with its Eats food delivery business.

Now demand for rides is returning, fueling a driver shortage. And as other companies have offered steadier work and more transparency, some drivers say they are frustrated with Lyft.

Lyft has fallen behind the gig work market in several areas, more than a half-dozen drivers, analysts and researchers say. Lyft's take-home pay also tends to be lower than its biggest rival, Uber, owing to a combination of stiff competition and algorithms less sensitive to surges in demand.

"I think Lyft is floundering," Givaudan said.

Lyft spokeswoman Julie Wood said the company places a priority on the driver experience. She said quoted wait times for riders on Lyft were lower than on Uber in 24 of the 30 largest markets over a recent period, according to company data points and visualizations that were shared with The Washington Post. That meant there was little indication drivers were choosing Uber over Lyft. And drivers in some cities were earning more than $35 an hour, well beyond what they would typically collect, the company said recently.

"We continue to invest in making the Lyft experience a great one for drivers," Wood said in a statement. "We know we're making progress because of the increased number of drivers on the platform, and the fact that they're earning more than ever before."

But the lack of transparency can lead some drivers to feel they're not receiving a fair share. One driver shared screenshots with The Post showing a passenger paid more than $43 for a trip from Northwest Washington to Reagan National Airport, but he took home just over $16. The driver, a music instructor who spoke on the condition of anonymity because he did not want his students to know he was driving for Lyft, had to ask the passenger to see how much they paid for the ride.

Wood said many of the features mentioned in this story are available on the Lyft app, either through pilot programs or unlockable driver rewards. Lyft has a long pickup bonus in six markets, for example. And drivers can earn the ability to see passenger destinations through their driver rewards, she said. Lyft is also experimenting with upfront pay in two markets, allowing drivers to see the earnings and trip details on the screen before accepting a ride.

Uber spokesman Matthew Wing acknowledged the company has had to make improvements in the face of outside pressure and calls for change.

"Being the market leader comes with more scrutiny, as it should," Wing said. "Drivers have a lot of choices and actions, not branding, are what you need to earn their trust."

Instacart spokeswoman Natalia Montalvo said the firm met a March 2020 goal to add 300,000 shoppers, and there are stable numbers of shoppers across North America.

DoorDash declined to comment. Amazon and Shipt did not immediately return requests for comment. (Amazon founder Jeff Bezos owns The Washington Post.)

Drivers say they've watched a shift at Lyft from its beginnings, when it was the first ride-hailing app to implement a default tipping feature and has allowed customers to tip since its debut nearly a decade ago. Lyft also was first to let drivers pocket their earnings right away through a feature called "Express Pay," with instant deposits for a transfer fee, it said.

In California, estimated to be the largest U.S. market for gig work with more than 1 million workers, a 2019 law that mandated companies treat gig workers as employees helped drive some changes in driver treatment. Some companies - particularly Uber - added a number of perks for drivers, including more control over fares and transparency into earnings even before a driver took on a ride. The initiatives tried to prove drivers were independent.

Lyft didn't adopt new features, as it pursued a different legal strategy. Analysts said that company likely benefited from the fact that Uber drivers were turning down trips, and the changes Uber made to its app were costly from a research, development and operational standpoint.

A judge last month ruled that a ballot proposition called Prop 22 that usurped that law's requirement for gig workers was unconstitutional. Although it faces a promised appeal, the ruling has once again put drivers' issues in the spotlight - particularly as gig work companies try to replicate Prop 22 with new legislation across the country.

Still, some of Uber's changes were short lived. It uncoupled driver earnings from passenger fares earlier this year as it no longer needed to prove drivers were independent operators in a supply-and-demand-based marketplace, sparking outrage among some drivers.

That led to cases where passengers found themselves paying astronomical fares while drivers collected meager bonuses. Meanwhile, some riders trying to take a Lyft were shown reasonable prices, but there weren't drivers to accept the fares.

Ride-hailing apps are highly dependent on their matching algorithms to pair customers with nearby drivers for a reasonable fare, at a rate that ensures gig workers are willing to make the trip.

Lyft's algorithm is less sensitive, analysts said, meaning prices don't spike as easily and driver bonuses can be lower and less frequent. Wood pointed to the wait time data as evidence that there is an ample supply of drivers, however.

But the differing algorithms can lead to headaches. For example, when customers pouring from an event are all demanding rides at once, they might find the price of an Uber has spiked while Lyft is comparably cheaper. In that case, Uber's algorithm has detected a surge in demand and raises the price accordingly so customers can secure a ride with the limited supply of drivers.

Changing an algorithm in an app can cost tens or millions of dollars, said Brad Erickson, an equity analyst with RBC Capital Markets. "That is not a trivial change, product-wise," he added.

While gig companies are known for luring drivers with high earnings potential and slowly whittling it away, there has been something of a mini perk war among those duking it out for drivers.

DoorDash provides all drivers a guaranteed rate of pay upfront, and visibility into how far drivers' trips will take them, critical insights for drivers determining whether deliveries are worth their while. Instacart, meanwhile, began letting drivers connect with a company agent by phone in under two minutes, chat directly within the app or schedule a call with an agent.

Delivery service Shipt offered surprise "recognition" bonuses for shoppers following the busy holiday season, awarding between $50 and $500 to workers who took on a range of order amounts.

At the ride-hailing companies, bonuses constitute a large chunk of driver earnings, as Uber drivers pursue "Quest" goals that pay out hundreds of dollars for hitting certain milestones, such as 60 or 70 trips over a weekend. Lyft drivers operate under a similar system, though experienced drivers who spoke with The Post said the bonuses are fewer and farther between for all but the newest contractors.

"Lyft historically is known to have less drastic surge pricing and price fluctuation," said Ippei Takahashi, founder of RideGuru, a website that provides fare comparisons for the ride-hailing apps. "Many historical [studies] have stated that Lyft takes a larger portion of each ride - at least in aggregate," he added.

It's a phenomenon gig driver Timothy Bullock experienced directly during an East Coast snowstorm in February. Bullock shared screenshots of the surge map - a map of all bonuses available to drivers - for both apps taken one minute apart.

"Uber was offering surge rewards to drivers in excess of $40 a ride, yet Lyft was offering nothing," Bullock said. "The result was that there were no available drivers, even though a standard Lyft ride was significantly cheaper."

Lower customer fares and longer wait times are possible amid the driver shortage, but they follow a pattern that typically benefits drivers, said Lyft spokeswoman Wood.

"When rider prices are lower, that generally helps to stimulate rider demand. More rider demand means more rides for drivers," she said. "Drivers understand that the busier they are, the more they make."

Lyft continues to promote its brand of social appeal, extending it to drivers. Just this month, Lyft announced it would cover drivers' legal costs under Texas's restrictive abortion law, which bans abortions as early as six weeks and lets anyone file a lawsuit against another person who has helped someone obtain an abortion.

Ben Valdez, a Los Angeles-based volunteer organizer with the group Rideshare Drivers United who drives for both companies, said a friend recently called him to ask for a ride because he had been waiting more than an hour on the ride-hailing apps. He'd been promised a $60 Lyft, after finding the comparable Uber ride would have cost $100.

"Uber was surging during bar rush; they wanted $100 for a 15-mile ride," Valdez said. The friend instead embarked on an extended wait for a Lyft.

With Lyft, Valdez said, "It's literally, 'You get what you pay for.' "

Read Full Story »»»

DiscoverGold

DiscoverGold

Uber Drivers Are Employees, Not Contractors, Dutch Court Says

By: TheStreet | September 13, 2021

• Uber's 4,000 drivers in Amsterdam deserve the benefits that coincide with taxi sector employees, a Dutch court said Monday.

Shares of Uber Technologies (UBER) were rising Monday morning after a Dutch court ruled that the company's drivers are employees and not contractors.

The ruling means that Uber drivers are entitled to greater workers' rights under local labor laws, which could be a setback for the U.S. company's operations in Europe.

An Amsterdam district court ruled in favor of the Federation of Dutch Trade Unions, which argued that Uber's nearly 4,000 drivers in the Dutch capital should be granted benefits in line with taxi sector employees, Reuters reported.

Uber said it will appeal the decision and that it "has no plans to employ drivers in the Netherlands."

"We are disappointed with this decision because we know that the overwhelming majority of drivers wish to remain independent," said Maurits Schönfeld, Uber's general manager for northern Europe, said in a statement. "Drivers don’t want to give up their freedom to choose if, when and where to work."

The business model for Uber, and other ride hailing services like Lyft, has been challenged in court's across the world.

Last month, a California court invalidated a gig worker ballot initiative that had been championed by Uber and Lyft.

Alameda County Superior Court Judge Frank Roesch said late Friday that the 2020 decision known as Proposition 22-- which received 58% voter support -- was unconstitutional as it "limits the power of a future legislature to define app-based drivers as workers subject to workers' compensation law."

Uber shares Monday rose 2.6% to $40.95 at last check.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft and Uber will cover legal fees of drivers sued under Texas abortion law

By: Engadget | September 3, 2021

• Lyft is also donating $1 million to Planned Parenthood.

Lyft will cover the legal fees of drivers sued under the state of Texas’ recently enacted SB8 abortion law, the company announced on Friday. The law prohibits women from terminating a pregnancy after six weeks. That’s a time frame before most even know they’re pregnant. Critically, SB8 also allows private citizens to sue anyone who assists a pregnant woman trying to skirt the ban, including rideshare drivers who face the prospect of $10,000 fines.

“This law is incompatible with people’s basic rights to privacy, our community guidelines, the spirit of rideshare and our values as a company,” Lyft said in a blog post. In response to SB8, the company is establishing a legal defense fund it says will cover 100 percent of the legal fees incurred by its drivers. It’s also donating $1 million to Planned Parenthood.

“This is an attack on women’s access to healthcare and on their right to choose,” Lyft CEO and co-founder Logan Green said on Twitter in which he also called other companies to offer the same support. Uber CEO Dara Khosrowshahi responded some 30 minutes later, announcing Uber would follow suit. “Team Uber is in too and will cover legal fees in the same way,” Khosrowshahi said. “Thanks for the push.” The move comes after the US Supreme Court formally denied a request earlier in the week from abortion clinics in the state to freeze the law.

Read Full Story »»»

DiscoverGold

DiscoverGold

Companies-backed Massachusetts gig worker ballot measure clears key hurdle

By: Reuters | September 1, 2021

BOSTON (Reuters) - Massachusetts' attorney general on Wednesday gave backers of a proposed ballot measure that would define drivers for app-based companies like Uber Technologies (NYSE:UBER) Inc and Lyft Inc (NASDAQ:LYFT) as independent contractors rather than employees the green light to collect the signatures needed to put it before voters.

Massachusetts Attorney General Maura Healey certified the measure met constitutional requirements, clearing the way for a coalition of app-based service providers backing the initiative to begin collecting the 80,239 signatures needed to get the proposal onto the November 2022 ballot.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft Stock: No Lift Back to Past Prices

By: Tip Ranks | August 29, 2021

Investors may be shrugging off recent regulatory headwinds when it comes to Lyft (NASDAQ:LYFT) stock. Shares in the rideshare app operator initially dipped on news of an August 20 California state court decision that could mean an end to gig workers being classified as independent contractors in that U.S. state.

Yet, as more investors and analysts became bullish that the company, and its rivals such as Uber (NYSE:UBER) seemed poised to win on appeal, shares began bounce back. The stock went from under $45 per share, to briefly back above $50 per share, before closing out the week ending August 27 at around $48.39 per share.

This market reaction makes sense, as the rideshare industry has so far been successful combating the backlash over its labor practices. Investors might be correct at believing regulatory risks are overblown. On the other hand, various factors at play could result in Lyft making more moves lower in the months ahead.

Between the U.S. labor crunch, its profitability challenges, and a rich valuation, there’s still more in play to send it lower than to send it higher from here. This author is bearish on the stock. (See Lyft Stock Analysis on TipRanks)

LYFT Stock and The Overturning of Proposition 22

The U.S. federal government has yet to put in place changes to how gig workers are classified. Instead, in recent years, the battle’s been playing out on the state level. U.S. states like California have attempted to change labor practices believed by critics to be unfair.

Back in 2019, California passed a bill known as AB5. This bill would have made it so that gig worker platforms would be required to classify workers as employees rather than as independent contractors.

A change in classification means higher labor costs. As employees rather than an contractors, gig platforms would have to adhere to employment law, and pay unemployment insurance taxes. Yet, well-connected and well-financed, the gig platform industry fought back and won. Its financial backing of Proposition 22 helped the proposition to be passed by voters in November 2020.

Prop 22 exempted app-based transportation and delivery companies, such as DoorDash (DASH), from the provisions of AB5. Yet last week's court decision, mentioned above, overturned this exemption. Chances are, though, that nothing much is set to change, in practice. Why? The gig platform industry still has options to fight back.

Three Other Issues Still Weighing Down on Shares

Likely to appeal the decision, major gig platform operators may not be immediately under threat by this recent court decision. Yet that doesn’t guarantee LYFT stock will continue to trend higher. Three factors that have pushed it down from its 52-week high, of $68.28 per share, to today’s prices, could remain in effect.

First, the U.S. labor shortage. The COVID-19 “reopening” has helped to bring back demand for its platform. However, said reopening has also reduced the supply of drivers. Many former and would-be drivers have found better gigs/jobs elsewhere. As a result, the company had to pay up in the form of driver incentives. Wedbush analyst Daniel Ives has recently said that this will affect the company's near-term results.

Second, Lyft's continued issues with becoming profitable. Analysts project the company will finally get out of the red in 2022. Yet if challenges like the labor shortage remain an issue going into next year, it may be unable to hit these projections.

Third, valuation. “Taper talk” notwithstanding, the Federal Reserve’s aggressive monetary policy remains in place. This has helped to sustain the rich valuations of fast-growing tech names like this one. All the same, if we see these policies change from dovish to hawkish sooner than anticipated, LYFT stock could see further multiple compression.

What Analysts are Saying About LYFT Stock

According to TipRanks, LYFT stock has a consensus rating of Moderate Buy. Out of 22 analyst ratings, 14 rate it a Buy, 8 analysts rate it a Hold, and 0 analysts rate it a Sell.

As for price targets, the average Lyft price target is $74.74 per share, implying around 54.45% in upside from today’s prices. Analyst price targets range from a low of $59 per share, to a high of $88 per share.

Don’t Expect Lyft to Get a Lift Back to Prior Highs

The recent California court decision may not be the end of the world for Lyft. The gig app industry appears well-positioned to fight off the push to have its workers reclassified.

That alone likely won’t translate into LYFT stock getting a lift back to its 52-week high. Instead, the three other factors mentioned above will likely apply more downward pressure.

Read Full Story »»»

DiscoverGold

DiscoverGold

3 Reasons to Ride Lyft Stock

By: MarketBeat | August 27, 2021

• After two and a half years as a public company, Lyft (NASDAQ: LYFT) has still yet to deliver any profits for early shareholders. Its stock is trading more than 40% below its IPO level—and this is good news for long-term growth investors.

With economic activity starting to pick up, the San Francisco-based ridesharing company may be finally hitting its stride. And while Lyft is still not profitable, improvements in its cost structure and the launch of complimentary services point to a strong 2022 and beyond.

When Will Lyft Be Profitable?

In 2020, the Covid-19 pandemic wreaked havoc on the ride-hailing industry as it did to many others. With restaurants, bars, and entertainment venues closed, demand was minimal. Although Lyft performed better than analysts feared, it still lost a whopping $2.66 per share.

Lyft’s bottom-line performance in the first quarter of this year was actually worse than in 2020 amid increased spending but still tepid demand. Things looked significantly better in the second quarter. The company posted a narrower than expected loss of $0.05 as it was able to rein in costs and benefit from higher rider volumes.

Last quarter’s result was significant because it marked the first time Lyft reached EBITDA profitability—and because it did so six months ahead of schedule. The first period of positive EPS could come as early as the current quarter. We’ll learn in early November if Lyft is able to beat the consensus forecast of a $0.03 per share loss and turn its first real profit.

The first full year of profitability is expected to be 2022. Analysts are forecasting Lyft will swing to a profit of $0.69 per share. Of course, much will depend on how things develop on the pandemic front. But as things are shaping up, Lyft should finally be profitable in its 15th year in business.

People are getting more comfortable with contactless everything these days. That goes for Lyft’s cash-free ride-hailing service which is now available in more than 600 U.S. cities and in Canada. There’s no doubt the Lyft app is resonating with customers and especially Millennials. It just needs a healthy economic environment and the riders that come with it. As restrictions on dining and leisure activities continue to be lifted, the company’s core business is positioned to thrive.

Beyond car ridesharing, Lyft also operates a fleet of bikes and scooters designed for short-distance travel in urban settings. It is this expansion into other transportation modes that will also be a key growth contributor over the next three to five years.

It is likely that both Uber and Lyft can find success in the post-pandemic world as people embrace the perceived safety and cleanliness of ride-hailing services over taxis. A key difference between the two though, is that Uber has entered the food delivery business whereas Lyft has not.

Lyft does, however, have a partnership with Grubhub whereby Lyft Pink members get access to the Grubhub+ service go along with the program’s other perks such as 15% off rides. Still, less than a year old, Lyft’s Grubhub+ connection versus Uber Eats will be a key battleground to watch.

Another disruptive force in consumer transportation is self-driving vehicles. Lyft sold its Level 5 autonomous driving division earlier this year but is staying in the game. Instead of developing the technology on its own, it plans to form partnerships with self-driving technology groups to have exposure to this potentially huge long-run growth driver.

Lyft is getting ready for the future of transportation by further investing in the transportation-as-a-service, or TaaS model. Management is making a big bet that over time consumers will shift from the hassle and expense of vehicle ownership to more service-based transportation modes. If it’s right, it could gain access to a larger chunk of the industry as people rely further on ride sharing.

Is Lyft Stock a Buy?

In terms of the technical indicators, Lyft looks to be on the upswing. After dipping below the lower Bollinger band earlier this month, the stock has broken back into the band’s mid-section in decent volume. If it can maintain support at the $49 level, a near-term run to $56 to $57 looks plausible.

Looking beyond the near-term, there’s reason to believe Lyft can return to its days as an $80-plus stock. There is not an analyst on the Street that currently calls Lyft a ‘sell’ which suggests the downside is limited. Since the company reported second-quarter results, twelve sell-side firms have issued ‘buy’ ratings with price targets ranging from $65 to $88. Even the most cautious post-earnings stance (Nomura’s ‘hold’ rating and $59 target) still represents 21% upside from present levels.

As far as valuation, Lyft isn’t cheap at more than 70x fiscal 2022 earnings. Nor are shares of Uber which is not expected to be profitable for some time. But buying Lyft here still makes sense if you are a long-term growth investor because the industry is still in the early stages of a multiyear growth trajectory.

More than just a ride-hailing business, Lyft will have multiple growth levers at its disposal as transportation becomes more tech-forward. Look for more investors to hop on board as the company rings up profits in the quarters ahead.

SHOULD YOU INVEST $1,000 IN LYFT RIGHT NOW?

Before you consider Lyft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lyft wasn't on the list.

While Lyft currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

Read Full Story »»»

DiscoverGold

DiscoverGold

Did Lyft and Uber Stocks Just Bottom on Bad News?

By: TheStreet | August 23, 2021

• Uber and Lyft are both rallying on bad news. That has investors wondering whether these two stocks have bottomed.

Lyft (LYFT) and Uber (UBER) were in the headlines over the weekend, which set the stocks up for an early selloff on Monday.

At the lows, Lyft and Uber were down about 4% and 3%, respectively. In premarket trading, the losses were a bit larger.

The dip came after a “judge in California invalidated a 2020 ballot initiative that allowed the ride-sharing groups to classify workers as independent contractors.”

However, both stocks were in positive territory by midday Monday.

Both companies reported earnings in early August and the stocks tried to shake off the selling pressure. However, that endeavor has been unsuccessful thus far.

With Monday's rally off the lows, it’s got investors wondering if the bottom is in.

Trading Lyft Stock

Daily chart of Lyft stock.

Chart courtesy of TrendSpider.com

Lyft has been trending lower since topping out in March.

After reporting earnings earlier this month, shares broke below the 200-day moving average. While this mark was quickly reclaimed, the stock wasn’t able to hold up over it.

Last week, the stock broke its post-earnings low, while Monday’s early action had it dangerously close to the 21-month moving average and the 2021 low at $42.94.

On a rebound, bulls need to see Lyft reclaim the 10-day moving average and $50. Above the latter will put the stock back above the post-earnings low and last week’s resistance.

Below Monday’s low leaves the 2021 low in play. Below $40 and bears may look to flush this one lower.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft (LYFT) PT Raised to $88.00 at Citigroup

By: MarketBeat | August 4, 2021

Lyft (NASDAQ:LYFT) had its target price lifted by investment analysts at Citigroup from $80.00 to $88.00 in a research report issued to clients and investors on Thursday, The Fly reports. The brokerage presently has a "buy" rating on the ride-sharing company's stock. Citigroup's target price suggests a potential upside of 77.67% from the company's previous close...

Read Full Story »»»

DiscoverGold

DiscoverGold

$LYFT Driver shortages.. costs going up.. under key 60 area and now fighting to hold the 200D...

By: Options Mike | August 8, 2021

• $LYFT Driver shortages.. costs going up.. under key 60 area and now fighting to hold the 200D...

Read Full Story »»»

DiscoverGold

DiscoverGold

LYFT down $6. lol at these two jokes. UBER and LYFT cannot make money

Lyft posts adjusted profit three months ahead of target as rides rebound

By: Tina Bellon and Akanksha Rana | August 3, 2021

(Reuters) -Lyft Inc on Tuesday posted an adjusted quarterly profit three months ahead of target, as it kept costs down while rides rebounded.

The company made an adjusted profit before interest, taxes, depreciation and amortization for the first time in its nine-year history. For the three months ending in June it posted adjusted earnings of $23.8 million. The adjustments exclude one-time costs, primarily stock-based compensation, which drove a $252 million net loss.

Shares rose 4% in after-hours trading following the announcement. Shares of Uber Technologies (NYSE:UBER) Inc rose more 1%, as the Lyft (NASDAQ:LYFT) results raised expectations for its larger rival, which releases its own quarterly report on Wednesday.

"Our business model has never been more healthy," Lyft President John Zimmer said in an interview with Reuters, citing greater profitability from technology and efficiency improvements the company has made over the last couple of years.

Zimmer said the company would be able to keep costs down even when ridership returns to pre-pandemic levels.

"We expect to remain profitable on an adjusted basis going forward and are hopeful that the country will continue to come back," Zimmer added.

Lyft on Tuesday said its platform had continued to grow in July despite increasing concerns over the more contagious Delta variant of the coronavirus spreading throughout the United States.

Analysts had expected an adjusted EBITDA loss of nearly $50 million, according to Refinitiv data. Lyft originally had said it would achieve the profitability goal by the end of this year, then moved the target ahead to the third quarter.

The earlier-than-expected profitability announcement came as ridership grew by more than 3.6 million from the first three months of the year to more than 17 million riders during the second quarter - a time when U.S. cities lifted pandemic-related restrictions and more Americans returned to the road.

Second-quarter revenue came in at $765 million, above analyst estimates for $697 million.

Lyft was able to take advantage of its leaner cost structure thanks to drastic cost cuts over the last year. The company slashed around $2.5 billion from its expenses in 2020, including through widespread layoffs.

On a yearly basis, Lyft has nearly halved total cost as a share of revenue in the second quarter. Costs as a percentage of revenue were also down significantly compared with the second quarter in 2019.

Lyft and Uber have struggled to ramp up driver supply as consumers return to their platforms, providing large incentives and payment guarantees in an effort to attract drivers.

Zimmer said the company had welcomed 50% more new drivers in the second quarter compared with the first and said driver earnings remain at elevated levels across the country.

Lyft previously said it expects more drivers to return in the third quarter, when enhanced U.S. unemployment pay is phased out in all states.

But driver earnings could remain higher long-term compared with pre-pandemic times, Zimmer said, with more efficient routing software reducing the overall number of drivers and the miles drivers spend cruising around without a passenger in the backseat.

"The idea is that we can be more efficient, we can do more with less, we can help drivers earn more," Zimmer said.

Lyft in July also resumed its shared rides offer, suspended at the start of the pandemic. It allows multiple passengers to split a car traveling in the same direction, but Lyft currently limits shared rides to two passengers, with the middle and front seats remaining empty.

Read Full Story »»»

DiscoverGold

DiscoverGold

Earnings Previews: Lyft,...

By: 24/7 Wall St. | August 2, 2021

Lyft

Ride-hailing provider Lyft Inc. (NASDAQ: LYFT) has posted a share price gain of about 96% over the past 12 months. So far in 2021, the stock is up nearly 17%. The company, and main rival Uber, are seeing rising demand from riders, but are having difficulty filling the demand for drivers.

Surging coronavirus infections may have sliced into second-quarter results, but it will be what the company sees going forward that could determine how well quarterly results are received. Lyft has said that it will be profitable by the third quarter. Guidance must endorse that promise. And lack of guidance will be interpreted as backing away from that promised profitability.

Sentiment on the company tends to be bullish, with 23 of 38 analysts putting Buy or Strong Buy ratings on the stock. Another 13 rate the shares at Hold. At a price of around $57.70, the stock’s implied upside based on a median price target of $72 is about 25%. At the high target of $86, upside potential on the stock is 49%.

Second-quarter revenue is expected to reach $699.3 million, which would be up nearly 15% sequentially and 106% year over year. Lyft is expected to post a per-share loss of $0.25 in the quarter, 10 cents better than the first-quarter loss and $0.61 better than the year-ago loss. For the full year, analysts are forecasting a per-share loss of $0.66 (including a fourth-quarter profit of four cents) and revenue of $3.14 billion, or a third higher year over year.

Lyft stock trades at 100.4 times estimated 2022 earnings and 34.2 times estimated 2023 earnings. The stock’s 52-week range is $21.34 to $68.28. The company does not pay a dividend...

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft (LYFT) May Report Negative Earnings: Know the Trend Ahead of Next Week's Release

By: Zacks Equity Research | July 27, 2021

Wall Street expects a year-over-year increase in earnings on higher revenues when Lyft (LYFT) reports results for the quarter ended June 2021. While this widely-known consensus outlook is important in gauging the company's earnings picture, a powerful factor that could impact its near-term stock price is how the actual results compare to these estimates.

The stock might move higher if these key numbers top expectations in the upcoming earnings report, which is expected to be released on August 3. On the other hand, if they miss, the stock may move lower.

While the sustainability of the immediate price change and future earnings expectations will mostly depend on management's discussion of business conditions on the earnings call, it's worth handicapping the probability of a positive EPS surprise.

Zacks Consensus Estimate

This ride-hailing company is expected to post quarterly loss of $0.23 per share in its upcoming report, which represents a year-over-year change of +73.3%.

Revenues are expected to be $701.24 million, up 106.6% from the year-ago quarter.

Estimate Revisions Trend

The consensus EPS estimate for the quarter has remained unchanged over the last 30 days. This is essentially a reflection of how the covering analysts have collectively reassessed their initial estimates over this period.

Investors should keep in mind that an aggregate change may not always reflect the direction of estimate revisions by each of the covering analysts.

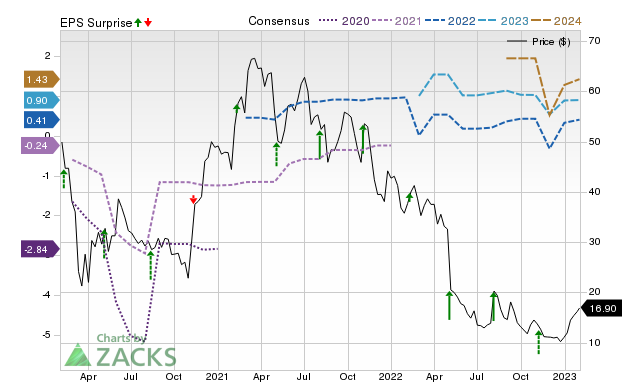

Price, Consensus and EPS Surprise

Earnings Whisper

Estimate revisions ahead of a company's earnings release offer clues to the business conditions for the period whose results are coming out. Our proprietary surprise prediction model -- the Zacks Earnings ESP (Expected Surprise Prediction) -- has this insight at its core.

The Zacks Earnings ESP compares the Most Accurate Estimate to the Zacks Consensus Estimate for the quarter; the Most Accurate Estimate is a more recent version of the Zacks Consensus EPS estimate. The idea here is that analysts revising their estimates right before an earnings release have the latest information, which could potentially be more accurate than what they and others contributing to the consensus had predicted earlier.

Thus, a positive or negative Earnings ESP reading theoretically indicates the likely deviation of the actual earnings from the consensus estimate. However, the model's predictive power is significant for positive ESP readings only.

A positive Earnings ESP is a strong predictor of an earnings beat, particularly when combined with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). Our research shows that stocks with this combination produce a positive surprise nearly 70% of the time, and a solid Zacks Rank actually increases the predictive power of Earnings ESP.

Please note that a negative Earnings ESP reading is not indicative of an earnings miss. Our research shows that it is difficult to predict an earnings beat with any degree of confidence for stocks with negative Earnings ESP readings and/or Zacks Rank of 4 (Sell) or 5 (Strong Sell).

How Have the Numbers Shaped Up for Lyft?

For Lyft, the Most Accurate Estimate is the same as the Zacks Consensus Estimate, suggesting that there are no recent analyst views which differ from what have been considered to derive the consensus estimate. This has resulted in an Earnings ESP of 0%.

On the other hand, the stock currently carries a Zacks Rank of #3.

So, this combination makes it difficult to conclusively predict that Lyft will beat the consensus EPS estimate.

Does Earnings Surprise History Hold Any Clue?

While calculating estimates for a company's future earnings, analysts often consider to what extent it has been able to match past consensus estimates. So, it's worth taking a look at the surprise history for gauging its influence on the upcoming number.

For the last reported quarter, it was expected that Lyft would post a loss of $0.54 per share when it actually produced a loss of $0.36, delivering a surprise of +33.33%.

Over the last four quarters, the company has beaten consensus EPS estimates three times.

Bottom Line

An earnings beat or miss may not be the sole basis for a stock moving higher or lower. Many stocks end up losing ground despite an earnings beat due to other factors that disappoint investors. Similarly, unforeseen catalysts help a number of stocks gain despite an earnings miss.

That said, betting on stocks that are expected to beat earnings expectations does increase the odds of success. This is why it's worth checking a company's Earnings ESP and Zacks Rank ahead of its quarterly release. Make sure to utilize our Earnings ESP Filter to uncover the best stocks to buy or sell before they've reported.

Lyft doesn't appear a compelling earnings-beat candidate. However, investors should pay attention to other factors too for betting on this stock or staying away from it ahead of its earnings release.

Read Full Story »»»

DiscoverGold

DiscoverGold

$LYFT 60 remains a battle then this downtrend... tough action..

By: Options Mike | July 11, 2021

• $LYFT 60 remains a battle then this downtrend... tough action..

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft, Inc. (NASDAQ:LYFT) Receives Consensus Rating of "Buy" from Analysts

By: MarketBeat | July 5, 2021

Shares of Lyft, Inc. (NASDAQ:LYFT) have been assigned a consensus recommendation of "Buy" from the thirty-five ratings firms that are covering the company, Marketbeat Ratings reports. Eight research analysts have rated the stock with a hold rating and twenty have issued a buy rating on the company. The average twelve-month price target among brokers that have updated their coverage on the stock in the last year is $69.68...

Read Full Story »»»

DiscoverGold

DiscoverGold

$LYFT back over 60 is good, I'm worried about $LYFT and $UBER not sure their business model is sustainable..

By: Options Mike | June 26, 2021

• $MSFT ATH's and bit of a pull back now.. watch the 8D if strong it will hold and bounce there..

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft says wait times decrease as U.S. drivers mark gradual return

By: Tina Bellon | June 16, 2021

(Reuters) - Lyft Inc (NASDAQ:LYFT) said on Wednesday the number of drivers on its U.S. ride-hail platform was gradually increasing, resulting in reduced wait times for customers and a modest decrease in surcharge pricing as travel rebounds from pandemic lows.

Lyft said active drivers on its platform had increased 10% since the beginning of May, adding that thousands of new drivers were activated over just the past two weeks.

In data provided to Reuters exclusively, the company said passenger wait times across the United States were down around 15% on average compared with one month ago. Wait times in some major markets, including Austin, Texas; Miami and Philadelphia, were 25% to 30% shorter and down as much as 35% in Las Vegas.

Serving the rebound in travel demand is crucial for Lyft, which has promised investors it will be profitable on an adjusted basis by the end of the third quarter in September. Longer wait times mean a loss of potential customers and lower revenue.

Lyft declined to provide absolute figures for driver numbers and wait times. The company also warned that wait times and prices may continue to fluctuate as the rebound from the pandemic continues.

Lyft and its larger rival Uber Technologies (NYSE:UBER) Inc have been scrambling in recent months to bring back drivers to their platforms to serve a sudden uptick in rider demand as more Americans are vaccinated against COVID-19 and resume pre-pandemic travel.

Uber and Lyft are trying to lure drivers back with additional incentives and the promise of temporarily higher earnings.

The undersupply of drivers has led to a sharp increase in prices and long wait times in many U.S. cities, causing many ride-hail customers to vent their frustrations online.

Lyft said on Wednesday that surcharge fares during peak demand - a measure the company calls Prime Time pricing - had declined 15% during the last week of May compared with the last week of March.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft launches EV rental pilot program for ride-hail drivers in Northern California

By: Tina Bellon | June 15, 2021

(Reuters) - Lyft Inc (NASDAQ:LYFT) said on Tuesday it will launch an electric vehicle rental pilot program for ride-hail drivers in a part of the San Francisco Bay Area in partnership with a local utility.

The EV rental program in San Mateo County south of San Francisco is scheduled to begin this fall. It initially aims to provide roughly 100 EVs for use on the Lyft platform, the ride-hail company and Peninsula Clean Energy said in a statement.

Peninsula Clean Energy, San Mateo County's official energy provider which aims to provide 100% renewable energy by 2025, will provide $500,000 in incentives to ride-hail drivers to ensure the cost of renting an EV is comparable to a gas-powered car.

Lyft said exact rental prices and models were still being determined.

The program is operated by Lyft's Flexdrive unit, which works with local car dealerships to rent out vehicles on a weekly or long-term basis.

Lyft already offers EV rentals in Seattle, Atlanta and Denver, where drivers are able to rent Kia Niro and Chevy Bolt EVs.

Peninsula Clean Energy CEO Jan Pepper in a statement said the San Mateo program might eventually lead to more drivers switching to EVs.

Utilities across the United States are embracing EV sales growth as both a promising new source of revenue and an opportunity to use excess wind and solar power generated when supply exceeds demand.

Lyft and its larger rival Uber Technologies (NYSE:UBER) Inc have promised to convert their U.S. fleets entirely to EVs by 2030. In 2018, less than 1% of all ride-hail miles in California were electric, according to company data provided to the California Air Resources Board.

California regulators last month adopted rules to mandate that nearly all trips on Uber and Lyft's ride-hailing platforms must be in electric vehicles within the next few years.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft, Inc. (LYFT) Given Consensus Recommendation of "Buy" by Brokerages

By: MarketBeat | June 10, 2021

• Lyft, Inc. (NASDAQ:LYFT) has been given an average recommendation of "Buy" by the thirty-five brokerages that are currently covering the company, MarketBeat reports. Eight analysts have rated the stock with a hold recommendation and twenty have issued a buy recommendation on the company. The average 1 year price objective among brokerages that have updated their coverage on the stock in the last year is $69.03...

Read Full Story »»»

DiscoverGold

DiscoverGold

Insider Selling: Lyft, Inc. (LYFT) CEO Sells 36,000 Shares of Stock

By: MarketBeat | June 4, 2021

Lyft, Inc. (NASDAQ:LYFT) CEO Logan Green sold 36,000 shares of the company's stock in a transaction on Tuesday, June 1st. The shares were sold at an average price of $58.19, for a total transaction of $2,094,840.00. The transaction was disclosed in a document filed with the SEC, which is available at this link.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft's first in-house ebike reflects light like a street sign

By: Engadget | June 2, 2021

• Bay Area residents will get to ride it first.

Since 2018 when it bought CitiBike parent company Motivate, Lyft has operated bike-share networks throughout the US. And while its fleet has included both traditional bicycles and those with electric pedal-assist drivetrains, it's now introducing an ebike of its own design.

In development for the better part of three years, the EV features a single gear drivetrain and a more powerful 500-watt electric motor. That should make the bike easy to operate and maintain since there's no front or rear derailleur. Complementing those parts is a battery Lyft claims can go up to 60 miles on a single charge. Lyft built the power cell and the cables that connect all different components into the frame of the bike, which should help protect them from the elements and vandals.

And speaking of the frame, the company went with a new type of paint that is retroreflective. That will make the ebike reflect light at night like a street sign. The front of a bike also features a LED ring light that illuminates the path ahead in Lyft's signature pink tone, while the back wheel includes a hydraulic disc brake for more consistent stopping power. Sensors throughout the frame will make it easier for the company to ensure properly maintained models are out on the road.

And so that more people can try the bike, Lyft has redesigned the seat clamp to accommodate riders of all heights better. A built-in speaker system and LCD screen will guide you through unlocking and parking the bike, as well as other parts of its operation.

The introduction of this new model comes as more and more people in the US and other parts of the world look to different modes of transportation to get around while the pandemic is still a concern. According to Lyft, more than 1.8 million people tried out its bikes and scooters for the first time last year. Its data also shows that people like ebikes in particular, with those models getting two to three times more use than the company's classic pedal bikes.

If you live in the Bay Area, you'll have a chance to try out the new ebike starting next week when it's added to the Bay Wheels fleet. Later in the year, Lyft will begin integrating the bikes into its Divvy program in Chicago.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft, Inc. (LYFT) CAO Lisa Blackwood-Kapral Sells 4,514 Shares

By: MarketBeat | May 28, 2021

Lyft, Inc. (NASDAQ:LYFT) CAO Lisa Blackwood-Kapral sold 4,514 shares of the firm's stock in a transaction on Wednesday, May 26th. The stock was sold at an average price of $53.77, for a total transaction of $242,717.78. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website.

NASDAQ LYFT traded up $1.60 during trading hours on Friday, reaching $57.09. 9,029,342 shares of the company were exchanged, compared to its average volume of 7,494,000. Lyft, Inc. has a 1 year low of $21.34 and a 1 year high of $68.28. The business's 50 day simple moving average is $56.35 and its 200-day simple moving average is $53.06. The company has a quick ratio of 1.16, a current ratio of 1.16 and a debt-to-equity ratio of 0.46. The stock has a market capitalization of $18.80 billion, a P/E ratio of -10.18 and a beta of 2.32.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft Covered Call: One Way To Generate Income Or Protect Recent Gains

By: Tezcan Gecgil/Investing.com | May 26, 2021

San Francisco-based Lyft (NASDAQ:LYFT) is the second largest ride-sharing service provider in the U.S. Founded in 2013, it had its initial public offering in March 2019.

LYFT shares are up by 9% since the beginning of this year and have gained 67% in the last 12 months. On Mar. 18, they hit a record high of $68.28. Now, the stock is hovering at $54.5. The market capitalization stands at $17.7 billion.

LYFT Weekly Chart.

Over the past several weeks, we've discussed how investors could consider writing covered calls on their stock holdings. Today, we look at Lyft and provide an example for a covered call.

Such an option strategy could help investors decrease the volatility of their portfolios and offer shareholders some protection against declines in the share price. Readers who are new to options might want to revisit the initial article in the series before reading this post.

Lyft

Intraday Price: $54.45

52-Week Range: $21.34 - $68.28

Year-to-date Price Change: Up about 9%

Lyft announced Q1 metrics in early May. Revenue came in at $609 million, a decline of 36% from $956 million reached a year ago. COVID-19 meant a substantial decrease in the number of active riders.

Adjusted net loss was $114.1 million, compared with Q1 2020 adjusted net loss of $97.4 million. The company reported $312 million in cash and equivalents at the end of the quarter.

The company expects to reach adjusted EBITDA profitability in the third quarter of 2021 assuming the post-pandemic economic recovery continues.

Given the significant increase in the Lyft share price in the last 12 months, a covered call might be an appropriate strategy for some investors.

Covered Calls On Lyft Stock

For every 100 shares held, the strategy requires the trader to sell one call option with an expiration date at some time in the future.

As we write on Tuesday afternoon, Lyft stock is trading at $54.45. Therefore, for this post, we'll use this price.

A stock option contract on Lyft (or any other stock) is the option to buy (or sell) 100 shares.

Investors who believe there could be some short-term profit-taking soon might use an at-the-money (ATM) or slightly out-of-the-money (OTM) call option. We will use a July 16 expiry 55-strike call option.

This option is OTM, because the strike price ($55) is higher than the current market price of $54.45.

So, the investor would buy (or already own) 100 shares of Lyft stock at $54.45 and, at the same time, sell a Lyft July 16, 2021, 55.0-strike call option. This option is currently offered at a price (or premium) of $3.68.

An option buyer would have to pay $3.68 X 100 (or $368) in premium to the option seller. This call option will stop trading on Friday, July 16, 2021.

This premium amount belongs to the option writer (seller) no matter what happens in the future, for example, on the day of expiry.

Assuming a trader would now enter this covered call trade at $54.45, at expiration, the maximum return would be $423, i.e., $368 + ($55.0 - $54.45) x 100, excluding trading commissions and costs.

Risk/Reward Profile For Unmonitored Covered Call

The intrinsic value of the OTM option at the time of buying is $0. Since the current market price is below the strike price, there is no rationale behind exercising the option. If the stock price moves above the strike price (in our case $55.0), the option then becomes in the money, and it is worth exercising.

Instead, this OTM option has extrinsic value, which is also known as time value. In the case of this covered call, the maximum profit that the trader can realize at expiry is (Strike Price - Stock Entry Price) x 100 + Option Premium Received.

In our example, it would be ($55.0 - 54.45) x 100 + 368 = $423

The trader realizes this gain of $423 as long as the price of Lyft stock at expiration remains above the call option's strike price (i.e.: $55.0).

On expiration day, if the stock closes below the strike price, the option would not get exercised, but would instead expire worthless. Then, the stock owner with the covered call position gets to keep the stock and the money (premium) s/he was paid for selling the option.

At expiration, this trade would break even at a Lyft stock price of $50.77, excluding trading commissions and costs.

Another way to think of this break-even price is to subtract the call option premium ($3.68) from the underlying Lyft stock price when we initiated the covered call (i.e.: $54.45).

On July 16, if Lyft stock closes below $50.77, the trade would start losing money within this covered call setup. Therefore, by selling the covered call, the investor has some protection against a potential loss in the case of a decline in the underlying shares. In theory, a stock's price could drop to $0.

What If Lyft Stock Reaches A New All-Time High?

As we have noted in earlier articles, such a covered call would limit the upside profit potential. For example, if Lyft stock were to reach a new high for 2021 and close at $70 on July 16, the trader's maximum return would still be $423.

In such a case, the option would be deep ITM and would likely be exercised. There might also be brokerage fees if the stock is called away.

As part of the exit strategy, the trader might also consider rolling this deep ITM call option. In that case, the trader would buy back the $55.0 call before expiry on July 16.

Depending on her/his views and objectives regarding the underlying Lyft stock, s/he could consider initiating another covered call position. In other words, the trader could possibly roll out to an Aug. 20 expiry call with an appropriate strike.

Selling Cash-Secured Puts On Lyft

On a final note, a potential investor who does not currently own Lyft stock could also consider selling a cash-secured put option on the stock. We have covered the topic in detail in earlier articles (for example, here).

Such a trade could appeal to investors who want to receive premiums (from put selling) or who want to potentially own Lyft stock for less than its current market price of $54.45 in our example).

So the trader would typically write an OTM Lyft put option and simultaneously set aside enough cash to buy 100 shares of Lyft stock (hence, it is cash-secured).

The Lyft July 16, 2021, 52.50-strike put option is currently offered at a price (or premium) of $2.93.

This premium amount belongs to the option writer (seller) no matter what happens in the future, i.e. until or on the day of expiry.

At expiration on July 16, the maximum return for the seller would be $293, excluding trading commissions and costs. The seller’s maximum gain is this premium amount if Lyft stock closes above the strike price of $52.50. In that case, the option expires worthless.

As our examples show, these options enable investors to put together trades that are not any riskier than owning stocks outright.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft (LYFT) Upgraded to Outperform at Daiwa Capital Markets

By: MarketBeat | May 17, 2021

Lyft (NASDAQ:LYFT) was upgraded by analysts at Daiwa Capital Markets from a "neutral" rating to an "outperform" rating in a research note issued on Monday, Benzinga reports. The brokerage currently has a $56.00 price objective on the ride-sharing company's stock, down from their previous price objective of $59.00. Daiwa Capital Markets' price objective points to a potential upside of 14.24% from the stock's current price...

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft Given New $70.00 Price Target at Morgan Stanley

By: MarketBeat | May 11, 2021

Lyft (NASDAQ:LYFT) had its price objective hoisted by equities research analysts at Morgan Stanley from $65.00 to $70.00 in a research note issued on Tuesday, Benzinga reports. The brokerage currently has an "equal weight" rating on the ride-sharing company's stock. Morgan Stanley's price target indicates a potential upside of 42.39% from the stock's current price.

Several other equities research analysts have also commented on LYFT. Citigroup Inc. 3% Minimum Coupon Principal Protected Based Upon Russell increased their price objective on shares of Lyft from $76.00 to $80.00 in a research note on Thursday, May 6th. Truist Financial increased their price objective on shares of Lyft from $56.00 to $70.00 in a research note on Tuesday, April 27th. Citigroup increased their price objective on shares of Lyft from $76.00 to $80.00 in a research note on Thursday, May 6th. Susquehanna increased their price objective on shares of Lyft from $45.00 to $80.00 and gave the company a "positive" rating in a research note on Wednesday, February 10th. Finally, Truist increased their price objective on shares of Lyft from $44.00 to $66.00 and gave the company a "buy" rating in a research note on Wednesday, February 10th. Eight research analysts have rated the stock with a hold rating and twenty-three have given a buy rating to the stock. Lyft has a consensus rating of "Buy" and a consensus target price of $69.06.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft (LYFT) Shares Gain on Better-Than-Expected Results and Outlook

By: TheStreet | May 5, 2021

• Lyft trades higher after posting a narrower-than-expected first-quarter loss and saying it continues to see a rebound in ridership as the pandemic recovery unfolds.

Lyft (LYFT) shares traded higher Wednesday after the ride-hailing technology company and Uber (UBER) competitor reported a narrower-than-expected first-quarter loss and said it continues to see a rebound in ridership as the pandemic recovery unfolds.

Shares of Lyft were up 6% in premarket trading after the San Francisco-based company posted a per-share loss of 35 cents, 20 cents narrower than the 60-cent loss forecast by analysts polled by FactSet. Revenue came in at $609 million, less than the $677.7 million forecast.

Active riders were 13.49 million vs. 12.8 million expected in a FactSet survey, while revenue per active rider was $45.13 vs. $44.50 expected by FactSet.

Transportation companies in general are beginning to see an increase in activity as COVID vaccinations spur business reopenings following more than 14 months of restrictions and stay-at-home orders - and as people feel more comfortable returning to work and traveling.

Lyft said in mid-March that it expected to post positive weekly ride-hailing growth on a year-over-year basis and every subsequent week through the end of the year, so long as COVID infection rates continued to decline.

The company reaffirmed its expectation that it will reach profitability on an adjusted earnings before interest, taxes, depreciation and amortization basis by the third quarter. Lyft had originally set a goal of reaching that benchmark by the end of the year.

Meantime, Uber will report its own first-quarter results after the close of trading on Wednesday. Analysts polled by FactSet are expecting Uber to post a loss of 56 cents a share on revenue of $3.3 billion.

Shares of Uber were up 3.72% at $54.96 in premarket trading on Wednesday.

Read Full Story »»»

DiscoverGold

DiscoverGold

GOD BLESS U AND BEST OF LUCK 2 U SIR AND HAVE A GREAT WEEK

Analysts Chime In on LYFT After Self-Driving Unit Sale

By: Schaeffer's Investment Research | April 27, 2021

• Lyft is selling its self-driving technology to Toyota for $550 million

• The company move up its profitability timeline by one quarter

Ridesharing platform Lyft Inc (NASDAQ:LYFT) is in the spotlight this morning, after news that the company is selling its self-driving technology unit to Toyota (TM). The $550 million deal, which will close later this year, enabled Lyft to move up its profitability timeline by one quarter. To follow, Needham initiated coverage of the security with a "hold" rating, while BTIG and Truist Securities upped their price targets to $80 and $70, respectively.

At last check, LYFT is up 1.6% to trade at $64.06 -- inching above recent pressure at the $65 level. Furthermore, with long-term support from the 60-day moving average swooping in to catch its recent pullback, today's pop has the stock climbing back up toward its March 18, annual high of $68.28. In the last six months, LYFT has added 182.3%.

On the analyst front, there is still some room for upgrades, though sentiment is mostly bullish. Coming into today, seven of 26 analysts in coverage carried a tepid "hold" rating, while 19 said "buy" or better. Plus, the stock's 12-month target price of $67.60 is a 4.1% premium to current levels.

Meanwhile, short interest represents 9.5% of Lyft stock's available float. In other words, it would take nearly four days to buy back these bearish bets, at the security's average pace of trading.

The options pits also lean firmly in the bullish camp. This is per LYFT's 10-day call/put volume ratio of 5.11 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the 86th percentile of the past 12 months. In other words, long puts are being picked up at a quicker-than-usual clip.

Now looks like a good time to weigh in on the security's next move with options. The stock is seeing attractively priced premiums at the moment, per Lyft stock's Schaeffer's Volatility Index (SVI) of 57%, which sits in just 19th percentile of its annual range.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft (LYFT) Sells Level 5 Unit to Toyota Subsidiary for $550 Million

By: TheStreet | April 26, 2021

• Sale of self-driving unit seen speeding EBITDA profitability at rideshare company.

Lyft, Inc. (LYFT) said Monday after the bell it has agreed to sell its Level 5 self-driving vehicle division to a unit of Toyota Motor Corp. for $550 million.

The ridesharing company said the deal will accelerate its path to profitability, largely by reducing R&D spending.

Level 5 is being sold to Woven Planet Holdings, Inc., a subsidiary of Toyota. Lyft launched its Level 5 unit in 2017 to develop its own self-driving technology. The company said it will now focus on its open platform unit to integrate third-party self-driving technologies with its dispatching network.

"This partnership will help pull in our profitability timeline," Lyft Co-Founder and President John Zimmer said in a statement. "Assuming the transaction closes within the expected timeframe and the COVID recovery continues, we are confident that we can achieve Adjusted EBITDA profitability in the third quarter of this year."

The deal is expected to cut $100 million of Lyft’s non-GAAP operating expenses a year, “primarily from reduced R&D spend,” The statement said.

Lyft will receive $200 million up front, once the transaction closes in the third quarter, with payments of the remaining $350 million spread over five years, according to the statement.

Woven Planet and Lyft have signed commercial agreements for the utilization of Lyft system and fleet data to accelerate the safety and commercialization of the automated-driving vehicles that Woven Planet will develop, according to the statement.

Shares of Lyft rose $1.15, or 1.8%, to $64.21 in after-hours trading. In Toyota ADRs (TM) were little changed in after-hours action.

Lyft and rival Uber UBER have recently been seen as benefiting from economic reopenings as pandemic worries ease in the U.S.

In December, Uber sold its self-driving division to Aurora.

Uber weathered the coronavirus in part because of its Uber Eats food delivery unit, which saw sales surge during lockdowns.

Earlier this month TheStreet's Jim Cramer said he was bullish on Uber following its latest results.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft, Inc. (LYFT) Given Consensus Recommendation of "Buy" by Brokerages

By: MarketBeat | April 21, 2021

Shares of Lyft, Inc. (NASDAQ:LYFT) have received a consensus recommendation of "Buy" from the thirty-seven analysts that are covering the company, Marketbeat reports. Eight analysts have rated the stock with a hold recommendation and twenty-two have assigned a buy recommendation to the company. The average 12-month price objective among brokerages that have issued a report on the stock in the last year is $63.55.

Several brokerages have recently issued reports on LYFT. Morgan Stanley raised their target price on shares of Lyft from $60.00 to $65.00 and gave the company an "equal weight" rating in a research note on Wednesday, March 31st. Barclays lifted their price objective on shares of Lyft from $49.00 to $55.00 and gave the stock an "equal weight" rating in a research note on Wednesday, February 10th. Susquehanna lifted their price objective on shares of Lyft from $45.00 to $80.00 and gave the stock a "positive" rating in a research note on Wednesday, February 10th. Nomura assumed coverage on shares of Lyft in a research note on Tuesday. They set a "neutral" rating on the stock. Finally, Zacks Investment Research raised shares of Lyft from a "sell" rating to a "hold" rating and set a $51.00 price objective on the stock in a research note on Tuesday, January 12th.

Read Full Story »»»

DiscoverGold

DiscoverGold

Lyft lets you request rides directly from your healthcare provider

By: Engadget | April 15, 2021

• The new pass aims to bypass the bureaucracy of booking medical trips.

Ride-hailing services took a beating during the pandemic as stay-in-place restrictions kept business muted. Yet, Lyft is taking some of the lessons learned from the past year to build on its ties with the healthcare sector. Starting today, the company is introducing a feature that lets patients access medical rides directly through the Lyft app. The "Lyft Pass for Healthcare" service is designed to streamline the process of arranging a trip to the doctors via a health plan or social services organization, such as Medicaid and Medicare.

Lyft says patients currently have to trawl through an arduous process to book transportation to their appointment, including phoning a call center up to 72 hours in advance to arrange a ride. By inserting its app into the journey, Lyft is hoping to be the go-to service for recurring trips to check-ups, vaccinations and even prescription pick-ups.

While healthcare providers have been able to offer Lyft journeys in the past, now eligible patients can request covered rides to and from their appointment via the app, which can be redeemed with a Pass (delivered through phone number, code or direct link). Meanwhile, the organization can set a total budget for the transportation program, including the maximum cost for each ride, and monitor usage and spend. Lyft expanded the Pass system to businesses last July as a way for companies to handle rides for workers during the pandemic.

Both Lyft and rival Uber are already offering free or discounted rides for vaccinations as part of their lobbying efforts with the Biden administration to secure jabs for their drivers. Lyft also previously partnered with medical software provider Epic to allow clinicians to schedule a ride for their patients from their health record.

Read Full Story »»»

DiscoverGold

DiscoverGold

Uber, Lyft tout U.S. ride-hail driver pay, incentives amid demand uptick

By: Tina Bellon | April 7, 2021

(Reuters) - Uber Technologies (NYSE:UBER) Inc and Lyft Inc (NASDAQ:LYFT) said U.S. drivers on their ride-hail platforms were earning significantly more than before the pandemic as trip demand outstrips driver supply, prompting the companies to offer extra incentives.

Uber on Wednesday said it would invest an additional $250 million to further boost driver earnings and offer payment guarantees in an effort to incentivize new and existing drivers.

Uber's Vice President of U.S. & Canada Mobility, Dennis Cinelli, in a blog post told drivers to take advantage of higher earnings before pay returns to pre-COVID-19 levels as more drivers return to the platform. https://ubr.to/2Q6pSxN

Uber said drivers spending 20 hours online per week were seeing median hourly earnings of around $31 in Philadelphia and close to $29 in Chicago. Those earnings are after Uber's fee but before expenses, which drivers are responsible for as independent contractors.

Lyft on Tuesday said drivers in the company's top-25 markets were earning an average of $36 per hour compared to $20 per hour pre-pandemic. In Denver, drivers earn as much as $44 per hour on average, the company said. Lyft is also offering additional incentives and promotions in select markets.

The uptick in demand comes as more U.S. states lift lockdown restrictions implemented in response to the COVID-19 pandemic, vaccination rates increase and a growing number of Americans start moving again.

But ride-hail drivers, many of whom stopped driving during the height of the pandemic over safety concerns and amid sluggish demand, have been slow to return to the road.

Uber and Lyft executives have told investors driver supply was a concern going into the second half of the year, when demand is expected to ramp up further. Lyft said investments to boost driver supply will create first-quarter revenue headwind of $10 million to $20 million.

Read Full Story »»»

DiscoverGold

DiscoverGold

$lyft $64.5001 ^ 0.9301 (1.46%)

Volume: 4,384,893 @03/26/21 7:51:29 PM EDT

Lyft, Inc. (LYFT) Given Consensus Recommendation of "Buy" by Brokerages

By: MarketBeat | March 27, 2021

Shares of Lyft, Inc. (NASDAQ:LYFT) have been given an average recommendation of "Buy" by the thirty-six brokerages that are covering the company, Marketbeat Ratings reports. Eight research analysts have rated the stock with a hold recommendation and twenty-two have given a buy recommendation to the company. The average 1 year target price among brokers that have issued ratings on the stock in the last year is $62.76.