Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

So I'm not a silk expert but is 25 tons a lot?

Anyone have an example of say prima silk tonnage per year production?

What can be done with 25 tons?

Lol. Dude, the evidence is what the company is doing. You are opposed to that, so, anything anyone says in relation to the company is considered a "baseless opinion" to you. Totally contradicts everything that's really going on here! Which, of course, is the naysaying MO. And that of those not really invested in the company.

Unfortunately you don’t actually make any cogent statements here. Simply enfolding my comments in harsh language doesn’t make them wrong. Just something you don’t happen to like.

If you disagree with me, offer evidence instead of heaping on baseless opinions.

KBLB has stated their current priority is ramping up production of more worms. That requires more eggs to get more worms, to create more eggs to get more worms, and so on. That gets us to creating much more product faster. It's the smartest thing to do instead of attempting to please the unappeasable by splitting the production into some silk and some worms. Pretty simple to comprehend for most.

Do you want to get to more product, faster, or just complain about everything no matter what? It's obvious.

KBLB is making what no others can.

Beyond Kong and Very Strong!

MCA

So, what you just showed is the ratio to selling and buying is decreasing to a balance now. Nice. Seems like the MM's are running out of shares to sell. I'll be adding to the Buy column this week.

Remember how much it went up on the single photo of 55-65lbs of KBLB silk?

Hang on for images of tonnage! It's going to blow the doors off the share price. KBLB is clearly under valued, but it's not going stay this price for long. We are ahead of schedule for tonnage. We have a much larger facility with much more production capacity and plans to add even more. And military or medical contracts to follow will make some big $$$. They want this product, no doubt.

Or, are the goo makers still the way to go? I'm not seeing the bashers push it much these days. Odd?

KBLB is making what no others can...and they know it.

MCA

<< KBLB reported 320 pounds of cocoons >>

KBLB never publicly stated that those cocoons were ever processed. So that is 0 kilos of spider silk at this time.

<< The quantity of silk shown in the December photo certainly looks closer to 20 kilos than 5. >>

IR stated that is was only 5+ kilos.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=174618443

Another convoluted 'analysis' to make sure no one can follow your line of thinking. Let’s break it down, shall we? First, your obsession with semantics—'support production at a level of 25 metric tons per year'—is just a desperate attempt to make progress sound like it’s not happening. We get it, you’re stuck on parsing words instead of acknowledging the larger picture: KBLB is ramping up production capacity, and the facility is already in motion.

Now, you weave in the whole instar silkworm speculation from an old video, followed by 'conjecture based on the language in past PRs.' Translation? You don’t have any solid facts here, so you're just filling in blanks with guesses to pad your post and make it seem like you’re delivering some deep insight. Spoiler alert: you’re not.

Then, you dive into an unnecessary math breakdown, talking about egg yields and cross-breeding in such excruciating detail that it sounds like you're auditioning for a role in a biology documentary. All this to distract from the core issue: KBLB is scaling up, and it’s happening faster than your doomsday rhetoric can handle.

Finally, your grand conclusion—'as I keep reminding a skeptical audience'—is the cherry on top. The only skepticism is about whether you’ll ever acknowledge that this company is actually delivering. Your long-winded, overly technical posts are just a smokescreen, designed to look authoritative while avoiding the fact that KBLB is moving forward and you’re left spinning in circles.

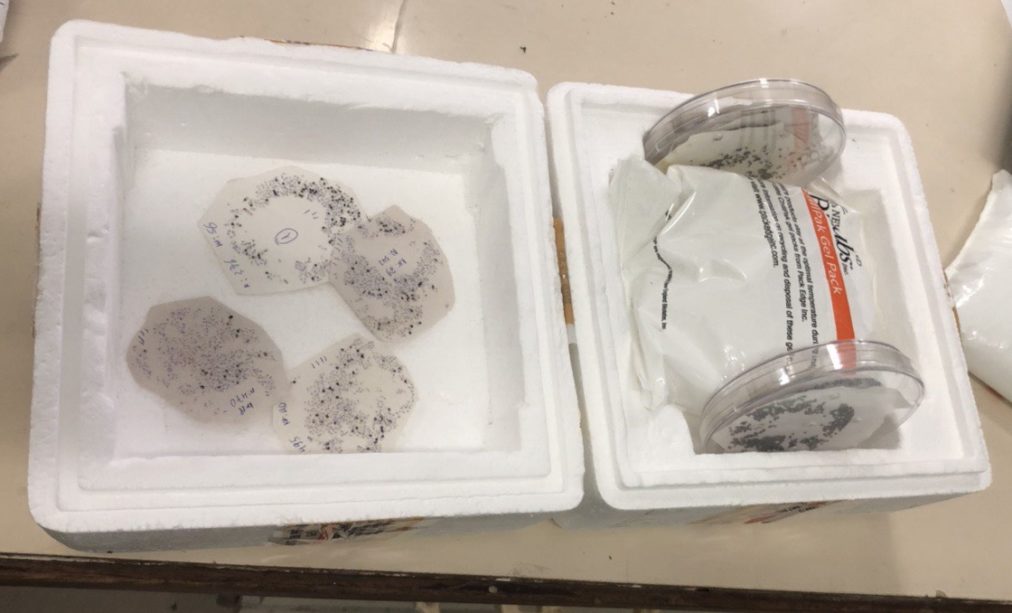

KBLB reported 320 pounds of cocoons in a PR. Using average estimates for the weight of silk compared to the weight of the cocoon, that generates about 20 kilos of silk.

That is certainly greater than 5 kilos, which may have been an amount Ben mentioned in private.

The quantity of silk shown in the December photo certainly looks closer to 20 kilos than 5. A kilo hank of silk can easily be held in one hand. I suspect I could hold two in each hand without great difficulty.

I’m sticking with my estimate of 20 kilos until further evidence clarifies the weight.

<< largest production cycle reported (~20 pounds of kilos) >>

KBLB IR reported that it was only 5+ kilos.

No. The facility has the capacity to SUPPORT production at a level of 25 metric tons per year.

KBLB evidently intends to produce eggs or first instar silkworms in the facility, distribute them to growers, and collect the cocoons.

From a video posted a while back of a silkworm farm, the farm did not pick up eggs from the factory but instead young silkworms, probably in their first instar.

This means the silkworm farmers don’t have to transport and hatch eggs. They can focus on feeding and growing silkworms, not hatching eggs. Makes sense.

KBLB has not explicitly said they would provide baby silkworms (or eggs) to silkworm farms. This is partly conjecture based on the language in past PRs.

But the newly enlarged facility does not have the capacity to raise 2 metric tons of silkworms per cycle. Most of us appreciate producing 110,000,000+ eggs of sufficient quality per month (not counting the eggs needed to sustain the breeding pool) is a challenge for a company whose largest production cycle reported (~20 pounds of kilos) entailed producing a little over a hundred thousand eggs.

The hybrid model requires that parents of two separate lines be bred and hatched within a day or two of each other. Assuming 200 eggs per pair (a very high level of egg yield), KBLB will need to hatch 550,000 males and 550,000 females each month. The males and females from each parent line will be isolated from one another and cross-bred with a member of the alternate parent line. First, though, we have to pick out any of the silkworms that don’t meet the quality standards KBLB sets.

Breeding silkworms is a labor-intensive practice. KBLB will have to scale up their production ability and expand their breeding pool. These both take time…

As I keep reminding a skeptical audience.

even though your delicate sensibilities are wounded by my cautious posts, no one is forcing you or anyone else on this board to read them.

More like a bent fruit told you!!😂

Web, just looked back the past three months on every weekly PR Thompson put out. What happened to the share price at the end of the day?

It went down every single time..

Every time he opens his mouth shareholders, lose money. I’ll say it over and over. This is nothing but a game to him and he’s gonna drag this out for years and years and the share price will roam around from $.03 cents-$.10.. .. truth be told he has no customers he’s operating on Hype

Man you work hard to create negative sentiment here, and have done the EXACT SAME THING FOR OVER 7 YEARS STRAIGHT.

I wonder why that might be?

Hmmmm…..

![]()

Looking for an entry point? Don't wait. Jump right in! 😁

Since the share price was pumped to its peak of about 16 cents, the stock has consistently sold off on a weekly basis.

Week of 24 Jun - 1.9 million buys, 3.9 MILLION SELLS

Week of 1 Jul - 1.3 million buys, 2.7 MILLION SELLS

Week of 8 Jul - 650K buys, 943K SELLS

Week of 15 Jul - 707K buys, 2.6 MILLION SELLS

Week of 22 Jul - 800K buys, 2.8 MILLION SELLS

Week of 29 Jul - 660K buys, 2.1 MILLION SELLS

Week of 5 Aug - 1.3 million buys, 2.5 MILLION SELLS

Week of 12 Aug - 1.2 million buys, 1.5 MILLION SELLS

Week of 19 Aug - 278K buys, 1.5 MILLION SELLS

Week of 26 Aug - 629K buys, 1 MILLION SELLS

Week of 2 Sep - 853K buys, 1.6 MILLION SELLS

Week of 9 Sep - 901K buys, 1.4 MILLION SELLS

Week of 16 Sep - 970K buys, 984K SELLS

In other words, some shareholders have been dumping their holdings....

. 12 cents by Friday close?

Bolt will probably get there before KBLB. 🤣

COVID didn't affect anything that KBLB was doing, because KBLB wasn't doing anything.

<< Do you remember 2020? Not a good year for most of the world. >>

That is the same old BS lies that we keep hearing over and over.

COVID didn't affect anything that KBLB was doing, because KBLB wasn't doing anything.

Your obsession with diminishing everything KBLB reeks of desperation. The Letter to Shareholders not being a public PR doesn’t make the content any less valid—unless of course, one is grasping for excuses to smear KBLB. It’s laughable that you act like you’re an expert on what goes on behind closed doors when all you do is sit on the sidelines and throw rocks.

The 'never started anything' claim? Let’s talk about what’s actually happening: eightfold increase in production capacity, successful scale-ups, and real product being produced. Meanwhile, you’re still stuck on a website that didn’t go live. Lol. Newsflash—this company isn’t in the business of making websites, it’s in the business of creating breakthrough, Holy Grail technology, which is exactly what they’re doing.

Calling it Kool-Aid won’t change the reality of KBLB’s advancements. It's gotta really suck for those drinking the KBLB "Haterade" to never see the ultimate failures they're hoping for because KBLB keeps hitting milestone after milestone. Oh well. Can't say the hints to "move on" weren't on constant display. LOL.

2020? Do you remember 2020? Not a good year for most of the world.

Living in the past much? Many companies are just recovering. Some have not. Many have gone under. Such as the ones the "concerned" bashers try to promote on here.

Looking forward to seeing what metric tonnes of KBLB Spider Silk looks like.

Looking forward to the wash, rinse, repeat of metric tonnes of KBLB spider silk production.

It's odd when anyone spends so much time on a message board when they are not looking forward to great things. Why stay around? $$$

KBLB is making what no other company can.

Beyond Kong and Very Strong.

MCA

Today’s news is very good , as it has been all year long, regardless of current stock price. It amazes me how short sighted some choose to be. I see a company steadily building out its infrastructure so it can provide its customers a reliable high quality product that they can produce consistently and in large volume. That takes time. I hope to see a partnership or a sale announced before year end but it’s quite alright if it doesn’t happen by then as I’m playing the long game. So is the company. The company has made it clear and has all but spelled out for us the customer demand is there. I believe they have at least one client ready to sign once the company demonstrates it can produce tonnage in a high quality consistent manner. The company’s approach is the right one. The CEO was right when he said they have maybe just one shot to get it right when they do launch a product. All you have to do is look at the goo companies who launched “limited” products prematurely and lost some credibility. When Kraig Labs builds it out , customers will come and the stock price will react accordingly. And a reminder , the stock is up about 3x the price around this time last year. Up 3x in 12 months is a pretty good investment in my book.

<< This new facility has the capacity for 25 metric tonnes of production per year! >>

That is just another empty forward-looking statement that means nothing.

They previously had a facility with a capacity of 40 metric tons per year in 2020. How much did they produce? ZERO

They have had a production contract for $40 million for the past 4 years. How much did they produce? ZERO

This is just another carrot on a stick....

Wash, rinse, repeat.....

Ah , you see Patrik that is where it comes from becomes really shady and sneaky with Thompson. He has a proven track record over 10+ years of hiding, these sort of things from his shareholders. I can assure you you’ll never see any pictures, nothing …he uses a lot of wordplay.. I mean, just think how bad his reputation is right now with potential investors. I’m telling you the man has no conscience at all.

“These PRs do nothing for new investors”

Guess that will depend on the investor. Some might see today’s PR as a culmination of what they have been building towards all year. Prove the production model works and build out the larger facility to carry them through 2025. Check and check.

Many will continue to wait for deliveries and sales. No problem. They will likely pay more per share if they choose to wait for more confirmation.

It’s all about risk tolerance. Some will be ready to get in before launch. Many will want to wait. IMO, waiting for confirmation on deliveries and sales means you will pay more for shares.

To each their own.

For now, I’ll take the continued progress.

While we wait for large scale production, what else might we hear about? Previous production runs being sold/delivered? New partnerships? Revised Kings agreement? Other?

Q4 has always been the expected timeframe for meaningful, market moving news. Still on track, if not a bit ahead of schedule.

W2R

<< Kim stated this in Letter to Shareholders >>

First, it was a "Letter to Shareholders", which means it wasn't posted publicly (via a PR).

Second, the Kings / MtheMovement contract was signed in Nov 2020. That "letter" was written in May 2023, over 3 years later.

Third, "slowed down" is a blatant lie, since they never started anything to begin with. There was never any marketing, since there was never any product. Even though a website was promised in "the coming weeks", nothing every appeared.

It is ridiculous to even try to defend stuff like this. But I understand that it is meant for the drinkers of the Kool-Aid. LOL.

All that will matter for this stock and company is all that has ever mattered -- which is what they have yet to accomplish in any meaningful way:

production and sales.

The market goes "Meh" and shrugs its collective shoulders at each of these so-called PRs. When the broader market recognizes that there is something to be excited about, that's when things will move.

Production and sales.

Outstanding news to get after returning from taking my family to the beach for a week.

This new facility has the capacity for 25 metric tonnes of production per year! So, since it has 8 times the capacity of the other facility, that means the other facility was capable of producing over 3 metric tonnes per year. And they are already looking at expanding for additional production capacity in 2025 for even more production NEEDS and DEMANDS.

KBLB is about to be huge!

The uses for KBLB's Spider Silk are almost endless. Clothing, military, medical.

Very exciting times folks.

Looking forward to many more vacations soon. :)

KBLB is making what no others can.

Beyond Kong and Very Strong!

MCA

I think one of Buffett's investment tenets is "when you don't understand your investment, just hold and bash until you do."🤪

Only buys today till now....Imagine a stock full of potential, the holy grail in the fibre industry, hold down by mms manipulating the pps......Once a big buy comes in, many investors just looking at the chart will jump in this stock, till now, mms still have the control, but we longs know what we have here, a GAME CHANGER FOR THE TEXTILE INDUSTRY.......

These PRs do nothing for new investors as I believe we will see little change in

trading and the continuing low volume. All Kim has to say “we have xxx amount

in inventory”and we are on pace to achieve metric ton production by years end

and volume and pps rise would follow upwards but he can’t even do that. Pathetic.

I guess it must be “top secret”

Patrik

Not being a jersey but...i believe it said that the additional facility ALONE has the annual capacity to 25 metric tons correct?

Correct me if I am wrong.

A buyout..OMG ! You have to be kidding me. All I’ve ever heard for years is wait till productions is announced , it’s going to go thru the roof…. Well, they announced production., have you seen the share price today?… down she went… have you people not caught on yet every time Thompson opens his mouth down, she goes … nobody trust this man it’s apparent….games, people… games

That’s what Thompson is good at, and he’s very good at it

I heard the buyout price was just a bit higher: $20 TRILLION.

A little spider told me…

When you post a reply to one of my posts, you have some obligation to read and understand what I say.

For example, in spite of your declaration, I did NOT say that KBLB would be unable to produce at metric ton levels this year. I said they would struggle to meet those goals. That is to say, meeting such a goal would be difficult for KBLB, not a walk in the park.

Reading today’s PRs, KBLB now has the facilities that “when fully utilized, has the capacity to support the production of 25 metric tons of spider silk per year.”

That’s about 2 metric tons per month, right?

So KBLB is working hard to reach metric ton levels of production and will then continue the difficult challenge of ramping production up to two metric tons per month.

I get the impression you think Thompson has a magic wand that he will wave around and POOF tons upon tons of DS.

I think it will be a slog to build up their breeding pool while maintaining the quality of both the breeding pool and the resulting silk. It’s not going to happen overnight. KBLB will not be producing 2 metric tons per month in January.

The poster I was responding to claimed that KBLB would shortly be announcing production facilities in several different countries. Do you see that happening? Or do you see KBLB engaged in a challenging build-up of capacity, hiring and training new people, ensuring that all of the quality control checks are in place and being followed adequately, ensuring their food supply is not contaminated, and so on.

Rome wasn’t built in a day. KBLB will take time to scale up, especially since they haven’t answered the question: who is going to buy their silk?

Finally, be assured that I am not going to take investment advice from you and I will remind you that, even though your delicate sensibilities are wounded by my cautious posts, no one is forcing you or anyone else on this board to read them.

I have to agree with banana I think a buyout is looming ever closer. I ask this....Is a company going to want to buy us out at this price or are they going to wait until we're a few dollars per share? We are becoming more and more ripe for the picking.Our product is a game changer and ripe for BO.

Go KBLB!!! Tick tock BAM!!!!

Kong wanna be.

Kim stated this in Letter to Shareholders:

We have taken the detailed technical analysis from the spinning of the first yarn and revamped our staple fiber processing with the guidance and advice of top experts here in the U.S. We believe that perfecting the processing of the fibers and yarns which will, in turn, create fabrics and garments of the highest quality is critical for the launch of our joint venture apparel brand, SpydaSilkTM. Kraig Labs and our partner Kings Group have intentionally slowed down the marketing and launch of the SpydaSilk, the website, and its social media presence, to align with the future release of the brand’s first products.

8/24/23-Things evidently aren't working out the way they were designed to.

A certain amount of money was slated for Kings to commit each year to the "cause."

They've committed NOTHING.

===========

Setting up a business, without either product or knowing if you will be able to provide any in the foreseeable future, isn't the wisest of moves.

It possesses the earmarks of OTC shenanigans.

Not saying it's a scam but certainly some of the moves are definitely "scam-adjacent."

In this particular trading arena, not a good look for KBLB.

===========

WEBSLINGER STATED:

<< Did KBLB provide Kings Group with shares? >>

KBLB stated the following:

"as consideration for its ownership position in the SpydaSilk brand and Joint Venture, KBLB shall issue 1,000,000 share of KBLB stock to MK."

It looks like the Scumbag CEO never followed through and scammed them.

Again check your understanding of the wording!!

This PR comes from a situation of strength in current existing production. The technology is now perfected and proven highly successful. They produced 325 lbs of cocoons many months ago, then 10x and 10x and whatever it is, but it’s major expansive!

So they say this can produce 8x current production, but this facility can produce 20tons…..think about it for a minute….they obviously only say the basics.

Imo I think some groups want a LOT?

Amen, Beach. I caught that myself. Could it be Kim giving us a hint that the great reveal IS coming? He is very cryptic sometimes in his wording. It is one of the things I love about him. As we know, KBLB's share price is a joke. We should be trading at .25 right now. Sooner or later the blind will see, and those lacking common sense will actually finally get some. GO KBLB! ![]()

No it quite clearly is not. It is reporting progress from the September 9th PR, stating the facility is NOW COMPLETE and “proudly announces the initiation of its first production cycle for the BAM-1 parental strains at its newly established production center.”

And “when fully utilized, has the capacity to support the production of 25 metric tons of spider silk per year.”

This is happening, whether you like it (I do) or not (you don’t, for whatever reason(s)).

Sorry to disappoint…

Might be time to start looking for a new gig..

![]()

Calling today’s PR a 'rehash' of the September 9th one is nothing more than a lazy attempt to downplay actual progress. If you bothered to read beyond the headlines, you’d notice some key differences: the September 9th PR focused on the completion and preparation of the facility, while today’s PR announced the launch of full-scale production. That's a major leap forward—something you conveniently gloss over to fit your 'wash, rinse, repeat' narrative.

I get it, though, it’s easier to pretend nothing's changed when the facts don’t support a doom-and-gloom agenda. The truth is, KBLB has transitioned from prepping the facility to actually producing spider silk at a capacity that can scale to meet market demands. Which is actually what they will wash, rinse, and repeat!

There are several things that stand out in the following excerpt.

"This new facility boasts a footprint eight times larger than its previous facility and, when fully utilized, has the capacity to support the production of 25 metric tons of spider silk per year. This transition to a larger facility marks a pivotal moment in the Company’s growth and its commitment to transforming the textile industry."

Wrong. It announced PRODUCTION HAS BEGUN in the facility.

The key is production. Saying that a facility is capable of producing X metric tons doesn’t mean anything. They actually have to produce silk. Remember when they put this out in 2020?

The difference between 2020 and 2024 is that in 2020 the worms weren’t ready for prime time and COVID was killing not just people but KBLB’s progress and innovation. Now in 2024, KBLB has a successful BAM1 silkworm strain which, if everything goes well, will lead to metric ton production and SALES!!! ![]() Prepare for the harvest!!!

Prepare for the harvest!!!

THIS NEWS COULDN'T BE MORE BULLISH!!!!!!!

I like this panic from one of the daily naysayers about today's pr, and i can understand all his efforts filled with lies and bs to talk today's great news down.......feels so good!

Today's PR is basically a rehash of the PR on 9 Sep:

https://www.kraiglabs.com/kraig-biocraft-laboratories-completes-new-production-center-expands-capacity-more-than-eightfold/

Wash, rinse, repeat....

|

Followers

|

641

|

Posters

|

|

|

Posts (Today)

|

62

|

Posts (Total)

|

281388

|

|

Created

|

05/04/08

|

Type

|

Free

|

| Moderators MU_Redskin1 gimmegimmeminemine TRUISM WebSlinger | |||

Email: corporate@KraigLabs.com

KRAIG LABS WEBSITE FOR INVESTORS

Quarterly and Annual Reporting to the SEC is available on the Company's Website and EDGAR.

* Financial Statements * SEC Filings *

Outstanding Shares as of January 12, 2023

For issues or questions relating to share certificates or the transfer of securities please contact the company's transfer agent:

Olde Monmouth Stock Transfer Co., Inc.

200 Memorial Pkwy.

Atlantic Highlands, New Jersey 07716

Phone: (732) 872-2727

(since August 14, 2013)

Kraig Biocraft Laboratories, Inc. (KBLB) is the first company with a commercially feasible spidersilk to be mass produced.

Kraig Labs is a biotechnology company focused on the development of commercially significant high performance polymers and technical fibers. Kraig Lab's focus has been on the production of a transgenic silkworm incorporating specific gene sequences from the golden orb weaving spider. These specific gene sequences inserted are to enable the silkworm to spin a new recombinant fiber which incorporates spider silk proteins. With the scientific breakthrough announced on September 29, 2010, Kraig Labs is now working to commercialize the transgenic silkworms to compete in the garment industry silk market. The value for the chinese raw silk market alone is 3-5 billion per annum. With the creation of 20 seperate transgenic silkworms, all with unique properties, Kraig Labs is now working at an accelerated pace to build upon their first generation transgenic organisms to develop their second generation of transgenic silkworm incorporating spider silk proteins. The scientists nearly doubled the strength of the silkworm with these specific spider gene insertions. Their second generation of transgenics are expected to be complete in 2011. These second generation organisms are to be compared with the strength, flexibility and resiliency of the native spider in which the gene sequences are derived from. These fibers which will match the strength of spider silk are expected to compete in the technical textiles market valued in excess of 120 billion per annum. The 3rd generation organisms are currently in the planning phase. These organisms are expected to spin fibers exceeding the strength of native spiders and may incorporate gene sequences that release an antibiotic, or to help reduce scarring with use in bandages.

Kraig Biocraft Laboratories has a sponsored research and development program with the University of Notre Dame, and the University of Wyoming. The genetic work is occurring at the University of Notre Dame, headed by Dr Malcolm Fraser, Phd. The gene sequences are derived from Dr. Randy Lewis's(University of Wyoming) patented gene sequences of the golden orb weaving spider. Kraig labs is paying for all expenses incurred for this research and development program, and thus Kraig Labs has exclusive global commercialization rights with the technologies developed, including methods, organisms, and fibers produced.

MANAGEMENT

Kim Thompson, Founder and CEO

As the CEO of the company, Mr. Thompson is the only member of the scientific advisory board who is also

a part of the corporation's management. His formal education lies in the fields of economics and law.

He received his B.A. in Applied Economics from James Madison College at Michigan State University.

He received his Juris Doctorate from the University of Michigan Law School in 1994.

Mr. Thompson founded Kraig Biocraft Laboratories in his pursuit of the development of new biotechnologies

with industrial applications. As chairman of the scientific advisory board, he brings a unique perspective,and

acts as the primary liaison between the advisory board and the corporation.

Mr. Thompson brings a wealth of experience in business management and consultation to Kraig. Following

the completion of his undergraduate degree, Mr. Thompson joined California Craftsman, Inc. as a

Vice-President with primary responsibility for both marketing and human resources.

Kim Thompson was the director of business development at Franchise Venture Partners, LLC. He subsequently

joined the firm of Shearson, Lehman, Hutton where he specialized in equity trading and research of small cap

companies. Mr. Thompson received the highest series seven score for all Shearson brokers in his class nationwide.

His experience in those small cap equity markets has proven to be invaluable both in his legal and business successes.

Prior to becoming a public company CEO, Mr. Thompson was the founder and senior litigation partner in a California

commercial law firm where he worked as corporate and litigation counsel to privately held and public companies.

His many accomplishments in corporate law include winning and collecting in full what his firm believes to have been

the largest award of lost profits in a California commercial arbitration up to that time. An important part of his work was

winning victories on behalf of corporate clients in disputes over intellectual property and distribution rights. He has

represented business clients ranging from small start ups and micro caps to Fortune 100 companies.

With a background in business leadership and in advising public and private corporations, Kim Thompson continues

to bring a unique perspective to the successful management of business. His extensive business and legal background

enables him to create practical solutions to business problems and seize opportunities for growth.

Mr. Thompson is a member of the Triple Nine Society for persons with documented genius level IQs (having tested above

the 99.9th percentile). He is also active in the realm of science and invention where he has to his credit a number of

provisional patent applications including innovations in the areas of biotechnology, organic polymers, genetic engineering

and magnetic field manipulation, among others.

Mr. Rice has over 13 years’ experience growing development stage businesses with a focus on technology development, commercialization, and go to market strategies. Mr. Rice holds a B.S. in Chemical engineering from Michigan Technological University.

Prior to joining Kraig Biocraft Laboratories Mr. Rice was the Director of Advanced Technologies for Ultra Electronics, AMI. In this role, Mr. Rice was responsible for the identification, capture, and execution of new technology programs. During his tenure with AMI, Rice secured more than twenty five million dollars in funded development programs from the US Department of Defense which his team successfully leveraged into commercially viable spinoff products. Mr. Rice was also responsible for technical sales, marketing, and promotion of AMI’s products and capabilities. Rice joined AMI as the third full time employee and helped to lead the organization through its rapid growth and ultimate acquisition by Ultra Electronics in 2011.

Earlier in his career Mr. Rice developed unique advanced manufacturing techniques, established and trained a production staff, led engineering development, authored numerous technical papers, and is a recognized subject matter expert. Mr. Rice holds 5 issued patents and numerous provisional patents.

Mr. Rice brings a history of transforming revolutionary ideas into viable commercial products.

Mr. Rice is currently completing his Masters of Business Administration through the Executive Program at the Eli Broad College of Business: Michigan State University.

Credit Randy Stewart

Credit Randy StewartDespite the huge potential of genetically modified animals outside of laboratory research, commercialisation of these animals has been extremely limited. Numerous factors, including negative consumer perception, regulatory hurdles, and limitations inherent to classical GM technologies, have kept the majority of GM animal applications within the realm of academic research. However genome editing using zinc finger nucleases could help develop new markets for the future commercialisation of GM animals.

Genetic modification is commonplace throughout the life sciences sector, from fundamental research to pharmaceutical testing. GM cellular and animal models are valuable tools for the study of many chronic diseases, the testing of pharmaceutical compounds and the development of new therapeutic strategies. Genetic modification also offers great benefits in vaccine and biopharmaceutical manufacturing, which rely heavily on the use of GM organisms for biomolecule design and production. Modifying the genome of an organism or cell line allows the incorporation of target biomolecules in specific biological contexts, as well as the transfer of a gene product from a low-producing organism to one that can produce on a commercial scale. These applications have been widely accepted for many years, with countless GM organisms approved for medical manufacturing applications by drug regulators in all major countries. Despite this widespread success within the research and pharmaceutical sectors, the use of GM organisms outside of these markets has been limited.

Despite the lack of broad acceptance for most commercial applications of GM animal products, this technology has been able to gain traction in a few market sectors. The most obvious application has been the commercialisation of transgenic animals for the production of biomolecules for therapeutic use. Cattle, sheep and goats have been used for large-scale production of antibodies, steroids and hormones - most notably insulin - for many years. In 2009, GTC Biotherapeutics received US FDA approval for bioproduction of a recombinant human antithrombin. This product - ATryn - is extracted from the milk of transgenic goats, and is the first approved biopharmaceutical to be produced using genetically engineered animals. Although this is a significant breakthrough for the commercialisation of GM animals, it is still within the pharmaceutical industry, and is a natural progression of existing cell-based technologies. Of potentially greater commercial interest is the extension of genetic engineering outside of this sector, into areas such as food production, textiles and even companion animals.

GM crops have been available in many countries since the early 1990s, and numerous cash crops - including sugar beet, soybean, corn and tomatoes - have been modified to improve resistance to disease, increase the rate of growth or enhance nutritional value. However, cultivation of these transgenic crops is generally tightly regulated, particularly within the European Union, and this, together with negative public opinion, has limited the more widespread development of GM technologies.

Similar to GM crops, many of the animals currently under development are intended to confer disease resistance, an application particularly suited to the use of zinc finger nuclease (ZFN) technology. Many diseases can be treated by the targeted deletion or modification of a host gene. With ZFNs, these targets can be modified with no footprint of genetic engineering. Due to the high costs of raising livestock, another area of focus in developing commercial GM animals has been increasing the rate of growth or size of animals. Among the first GM animals likely to be launched is a fast growing salmon from AquaBounty. The AquAdvantage Salmon is designed to reach market size in half the time of a wild type salmon, reducing costs for fish farmers and limiting the environmental impact of salmon farming by avoiding the need for ocean pens.

Although genetic engineering of animals for food is primarily driven by economic pressures, GM technologies have also been used in the companion animals market. In this sector, genetic modification can be used for practical purposes - such as the creation of hypoallergenic animals or the correction of heritable congenital defects which have arisen though inbreeding - or for purely cosmetic purposes, such as GloFish. The first example of a GM pet, GloFish are fluorescent zebrafish (Danio rerio) that have had genes encoding naturally fluorescent proteins (GFP, YFP, RFP) inserted into their genome. Developed by a group at the National University of Singapore, GloFish were originally created to develop live detection systems for water pollution. They were introduced as pets in the United States in 2003 following over two years of extensive environmental research and consultation. In Europe however, the sale and possession of GloFish is prohibited by rigorous legislation concerning the use of GM technologies.

By allowing precisely targeted insertion of spider genes and concomitant removal of endogenous silkworm silk genes at the same locus, ZFN technology offers the potential for development of transgenic silkworms which will produce native spider silk at commercially viable levels

Perhaps even more interesting from a commercial perspective is the use of GM animals in the manufacture of textiles. Silkworms - actually the larval form of the silkmoth Bombyx mori - have been used for the production of silk for thousands of years, with natural silk still produced by the cultivation of silkworms today. Silkworm cocoons are unwound to create linear silk threads, then re-spun into textiles in much the same way as cotton. Although the applications of silkworm silk are numerous, due to their unique physical and chemical properties, there is also widespread interest in the silks of several other insects.

Spider silk, in particular, offers numerous possibilities within the technical textiles industry, due to its incredible tensile strength and elasticity; characteristics which have not yet been replicated in synthetic materials. Like all insect silks, spider silk fibres consist of repetitive units of protein crystals separated by less structured protein chains. The exact properties and composition of each spider silk vary with its intended function. Major Ampullate or dragline silk, for example, is relatively hydrophobic with very high tensile strength and toughness, as it is used to form the outer rim and spokes of a web. In contrast, hydrophilic capture spiral silks, which form the inner structures of the web, are sticky and highly elastic to effectively entrap prey. This high degree of variability offers enormous potential for the textiles industry, raising the possibility of tailoring the properties of silk to create advanced technical fabrics, for applications such as bulletproof vests, parachute canopies and automobile airbags; biomedical applications, including sutures and tendon and ligament repair; new fabrics, for sportswear and clothing; and even microelectronics.

Although the use of spider silks for microsutures has recently been reported, more widespread application of spider silk technologies is currently limited by the difficulty in producing silks on a commercially viable scale. This is due to the difficulties of rearing spiders in large numbers, due to their highly territorial and cannibalistic nature. As a result, the harvesting of spider silk fibres is extremely time consuming and labour intensive, with production of the only known spider silk garment - an 11 foot by 4 foot shawl made from golden orb spider silk - taking 150 people over five years to produce and costing in excess of £300,000!

.

To overcome these limitations, and allow future development of spider silk technologies, an alternative strategy for spider silk production is required. This makes spider silk production an obvious candidate for genetic modification, inserting spider silk genes into the genome

of other silk-making insects for bioproduction. For example, random insertion of orb spider silk genes into silkworms has allowed production of hybrid spider/silkworm silk using traditional silkworm farming strategies. The resulting hybrid silk contains approximately 10% spider silk

and has greater strength and durability than native silkworm silk, raising the possibility of using transgenic silkworms to produce pure spider silks.

Though straightforward in principle, the exchange of native silkworm genes for spider silk genes, alongside more widespread exploitation of genetic engineering, has been limited by the inherent restrictions of conventional GM technologies.

The generalised process of modifying an organism requires several capabilities, including:

While many different techniques exist for accomplishing each of these steps, most GM technologies offer a compromise between the efficiency of the technique and the ability to accurately and precisely target the locus of interest. Viral genomic delivery technologies effectively deliver nucleic acids to cells and organisms, but fall short on ability to target specific regions of the genome, generally only allowing random insertion of genetic material. In comparison, transposase technologies allow a greater degree of targeting, but leave unwanted traces of exogenous DNA in their wake. Other methods involve the introduction of naked DNA into the cell, which results in insertion into the genome at very low frequencies, usually at random, limiting this approach to organisms that can be economically cultivated at high densities and screened in large numbers. Simply put, most techniques for genetic manipulation are random, inefficient and leave a 'footprint' of foreign DNA. While this is usually tolerated in basic research, it is not acceptable for most commercial applications, and has been a major hurdle for GM animal technologies to date.

The advent of zinc finger nuclease (ZFN) technology represents a significant breakthrough for commercialisation of GM animal products, offering precisely targeted, efficient genome editing for the first time. Commercially available through Sigma Life Science under the CompoZr brand, this technique can be used to create permanent and heritable changes to an organism of interest.

This high degree of variability offers enormous potential for the textiles industry, raising the possibility of tailoring the properties of silk to create advanced technical fabrics

ZFNs are a class of engineered DNA binding proteins that facilitate targeted editing of the genome by creating double-strand breaks at user-specified locations. These breaks stimulate the cell's natural DNA repair mechanisms - homologous recombination (HR) and non-homologous end joining (NHEJ) - which can be exploited to achieve rapid and permanent site-specific modification of the desired genes. While HR can be used to insert foreign DNA sequences, NHEJ allows the cell's natural processes to create precisely targeted mimics of natural mutations which leave no traces of foreign DNA. Unlike previous techniques, ZFNs offer excellent sequence specificity, binding 24 to 36 base pair target sequences to virtually eliminate off target effects, and are able to achieve modification rates exceeding 20 %, well above rates for most other technologies.

The technique is already being used to create transgenic silkworms for spider silk production. By allowing precisely targeted insertion of spider genes and concomitant removal of endogenous silkworm silk genes at the same locus, ZFN technology offers the potential for development of transgenic silkworms which will produce native spider silk at commercially viable levels.

GM technologies have revolutionised the research world and have great potential in a variety of commercial applications, but have been limited by the inherent restrictions associated with historical GM technologies. The main drawback of these technologies is their inability to accurately and efficiently target genes of interest, instead relying on random insertion of genetic material into host genomes. These limitations result in the need for extensive and costly screening to identify animals with correct transgene expression (without compromising the viability of the animal), and also result in the co-expression of both the transgene and native homologues already present.

The advent of ZFN technology signifies the beginning of an exciting new chapter in the world of genetic modification, allowing precise, targeted and efficient genome editing for the first time. Production of native spider silk using transgenic silkworms is just one example of the potential commercial applications of this innovative technology, taking us one step closer to the reality of industrial scale biomanufacturing and paving the way for an entirely new spectrum of environmentally friendly materials.

Authors:

Joseph Bedell and Brian Buntaine

Commercial Animal Technologies Group, Sigma Advanced Genetic Engineering (SAGE) Labs, Sigma Life Science

HEADLINES FOR KRAIG BIOCRAFT LABORATORIES / (KBLB):

PHOTOS FROM VIETNAM POSTED JULY 6, 2018

ANN ARBOR, Mich., – January 7, 2019 –Kraig Biocraft Laboratories, Inc. (OTCQB: KBLB) (“Company”), the leading developer of spider silk based fibers, announces today that it has successfully delivered the first two shipments of its highly specialized silkworms, which produce a silk with the physical characteristics of spider silk, to Vietnam.

Today’s announcement is the culmination of more than 5 years of work, and challenging negotiation, with the government of Vietnam. The silkworms from these first two shipments have already hatched and are now enjoying a fresh mulberry diet, so, for the first time in history, the global demand for spider silk materials has a viable, cost effective, and scalable solution.

“The dream of commercializing our powerful technology is now materializing. This marks a dramatic leap forward in Kraig Labs’ business plan for commercial production and mass marketing of cost effective recombinant spider silk, and becomes the foundation for an entirely new industry,” said, COO, Jon Rice. “To our long-term shareholders, who have taken this journey with us, as well as our team in the US and Vietnam, who have worked tirelessly to make this dream a reality, I cannot thank you enough. As we start the New Year, full of new opportunity, we truly have something incredible to celebrate.”

The Company has been working with leading sericulture experts, biotechnology institutions, and governmental agencies, in Vietnam, to further boost the silk industry with our revolutionary technology. Kraig Labs is currently finalizing renovation plans for a ~46,000 square foot production factory in Quang Nam Province, Vietnam.

“Our plan has always been to bring our technology to the silk producing regions of the world for rapid scale-up,” said, CEO and Founder, Kim Thompson. “Today we see the fruits of that effort. With its massive silk infrastructure and production capacity, Vietnam is an ideal location to launch our technology scale-up. Congratulations to our team and shareholders, as we prepare for the realization of large scale production.”

\

\

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |