Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

It’s all coming - they are turning profitable according to their CEO. Boom!

And the losses are...?

Debt load....?

Full details of Komo's financial position at January 31, 2023 and for the quarterly period ended January 31, 2023 will be published in late March 2023.

I'll wait for the full financial disclosure thanks.

https://www.otcmarkets.com/stock/KOMOD/news/Komo-Plant-Based-Foods-Reports-Impressive-Revenue-Growth-with-a-160-Increase-in-Q2?id=390257

160% revenue increase! Boom! Share price will catch up eventually.

You don’t lose until you sell and there were plenty of opportunities to average down. Thanks for your concern.

Losing 60% looks fine?

Strange reality there.

It looks fine to me but than again, I did my DD.

This stock isn't looking good at all ranger.

Would really like to see more volume down here that mirrors the news, people may be a little bruised to double down or even add any more. They played with the stock price before building the company... it is a growing company and well worth the current share price.

Komo Expands Across Canada with Whole Foods Market

Vancouver, British Columbia--(Newsfile Corp. - February 9, 2023) - Komo Plant Based Foods Inc. (CSE: YUM) (OTCQB: KOMOF) (FSE: 9HB0) (the "Company", "Komo"), a premium plant-based food company, reports planned expansion across Canada with Whole Foods Market.

Komo Plant Based Foods Inc., a fast growing plant-based food products manufacturer, announces today that it will be expanding its presence in Canada through additional distribution at Whole Foods Markets. Komo's line of frozen meals and meal helpers will now be available in all 14 Whole Foods Market locations in Canada, with the newly expanded listings to be on shelves by May of 2023.

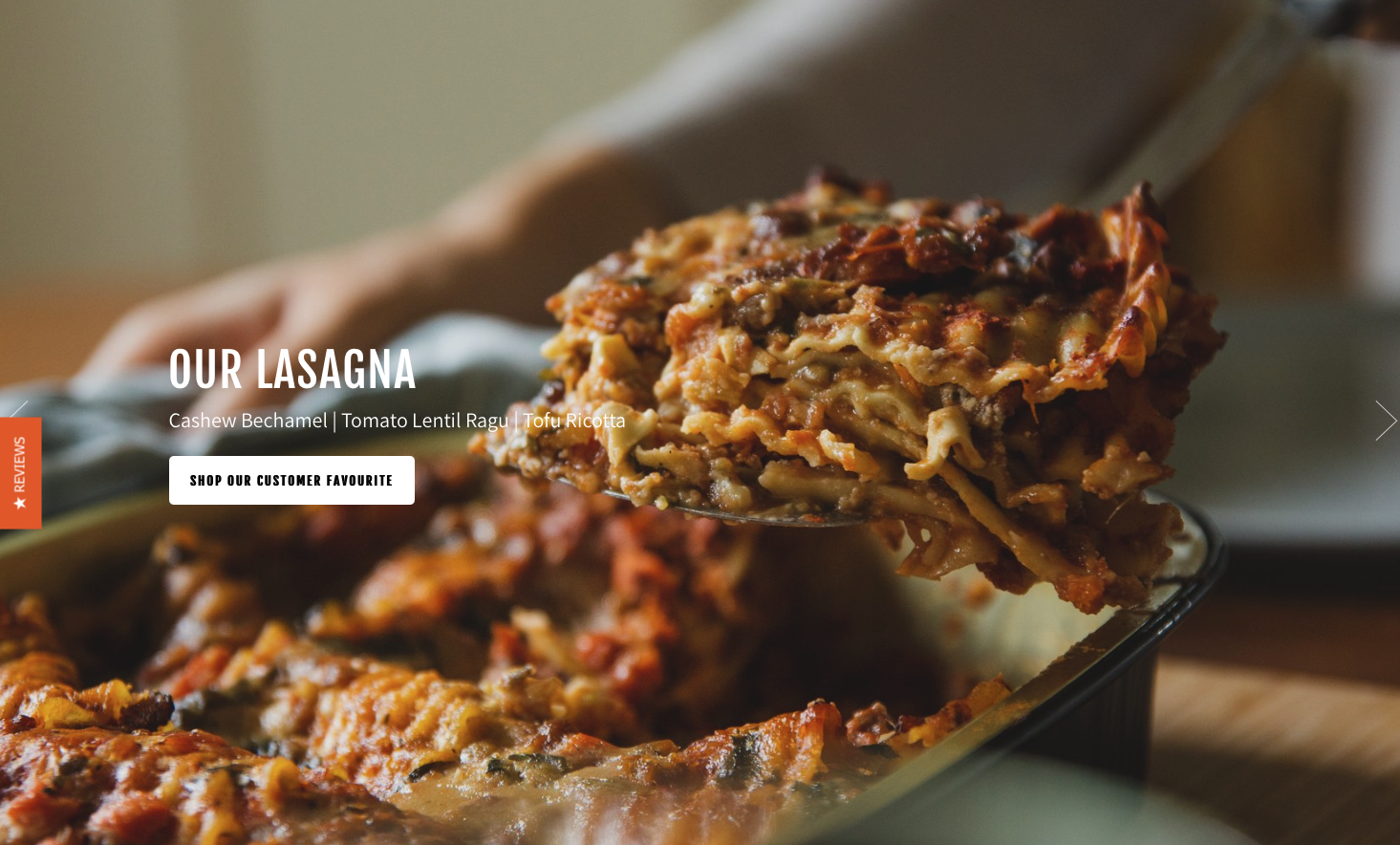

Whole Foods West will be expanding their line of Komo frozen foods from 3 SKUs to 5 SKUs in western Canada and Whole Foods Ontario will be carrying all 5 SKUs, including Komo's 2 serve Lasagna, 2 serve Shepherds Pie, 2 serve Mac & Greens, as well as Komo's line of Meal Helpers: BBQ Mushroom Lentil Taco Filling and Walnut Mushroom Bolognese.

"We're thrilled that Whole Foods Market is adding more Komo products to their selection and continues to support Komo's efforts to bring convenience and high quality plant-based meals to our shared end-consumer," says William White, CEO of Komo. "Our goal has always been to make plant-based eating accessible to everyone, and this expansion into Whole Foods nationally takes us one step closer to achieving that goal"

About Komo

Komo Plant Based Foods is a premium plant-based food company that develops, manufactures and sells a variety of plant-based frozen meals that are always hearty, satisfying and made with wholesome ingredients. Komo's mission is to help make plant-based meals a staple on every dinner table by sharing the company's love for feel-good food that connects the people to the planet. The company believes plant-based eating is the future and that "Change can start with a single bite." The company's experienced plant-based innovation and development team recreates vegan versions of traditionally cheesy and meaty classics, with 100 per cent plants. Komo's 9 products are sold direct-to-consumer through the company's e-commerce website, and a distribution network of on-line and brick and mortar grocery, convenience and natural retailer channels. The company launched in 2021 with the company's flagship products: plant-based lasagna, shepherd's pie and chickenless pot pie, and Komo Plant-Based Meal Helpers -- versatile meal starters to allow the creation of many dishes at home. Komo's newest product is Mac & Greens. All of the company's products are 100-per-cent plant-based, made with wholesome ingredients, free from preservatives and frozen for freshness. Freezing products is a natural and effective way of keeping food products for longer without having to use any preservatives. Komo's meals have an 18-month frozen shelf life. Komo's products are now available in over 840 retail locations across Canada.

Learn more at: www.komocomfortfoods.com and follow on Instagram: @komocomfortfoods For further information, please contact:

William White,

volume sucks.. 1,325 No one cares, and it could be a cult stock some day. Market cap under $ 2 million on a $30 million a year business..

and so we wait.

More good news - expansion is going really well here! I’m curious to see the revenue.

Komo Doubles Retail Distribution to 840 Stores

C.YUM | 1 hour ago

Vancouver, British Columbia--(Newsfile Corp. - February 6, 2023) - Komo Plant Based Foods Inc. (CSE: YUM) (OTCQB:KOMOF) (FSE: 9HB0) (the "Company", "Komo"), a premium plant-based food company, reports significant growth in the number of retail stores carrying Komo products with an increase of over 100% in 3 months.

Komo Plant Based Foods Inc., a fast-growing plant-based food products manufacturer, announces a 100% increase in retail distribution since November of 2022, now available in 840 grocery retail locations across Canada. This impressive growth includes Loblaw's and Loblaws' banner stores and the addition of 50 new retail stores in January 2023, including Georgia Main Group (IGA West and Fresh St. Market), Sobey's West, Safeway and Freson Brothers locations in western Canada, and key natural accounts such as Boites à Grain in Quebec.

"Our focus has always been to provide high-quality, delicious plant-based meals and this growth in distribution demonstrates that more and more people are not only choosing our products as part of their diet but repeat purchases in national accounts such as Loblaw's banners continue to prove that families are welcoming Komo into their lives on weekly, and sometimes daily, basis," says William White, CEO of Komo. "We believe that convenient and wholesome plant-based food is the future of sustainable and healthy eating, and we are committed to making our products more accessible and convenient for consumers. We look forward to continued growth and expanding our reach in the coming months."

The plant-based foods market could make up to 7.7% of the global protein market by 2030, with a value of over $162 billion, up from $29.4 billion in 2020, according to a new report by Bloomberg Intelligence (BI). The report Plant-Based Foods Poised for Explosive Growth identifies growth locations for the plant-based foods market through 2030, as a global animal and dairy protein demand is poised to reach $1.2 trillion by then.

we are decreasing debt and quarterly losses and increasing revenue.

We are hopeful that the roll back will hold its value and bring in new investors as the company continues with its operational successes.

Well yea, the company is going in the right direction.... roll back hold it's value? really?

Sounds good - looking forward to hearing about it.

One thing every trader must remember:::: Never listen to a penny investor that is broke!

The future looks bright but it will take 6 months to find it's footing, in the mean time I still need to have a face to face with this CEO.

I will let you know when it happens, it's just too cold in Vancouver right now but it will happen, the golf course is taking up my time right now.

It is now, yes. The stock is all over the place, which is common after a thinly traded scam undergoes a reverse split.

I see .1875 but you use whatever tools tell you it’s 13 cents lol.

It's thirteen cents now...

We're at $.25, no run for the exits, only 20K on the ask. Those might look like a bargain down the road!

I agree! I’m gonna wait and see what happens.

Yes but the purchase price of our shares just went up 10 fold. If they do not come out with big news it will sink like a stone.

I have faith in the product and the business plan but I have little faith in this punk ass kid that took this to .40 then flushed 1 million shares at us. Next time I am in Vancouver I will look him up, we need some face time.

Still holding my entire position and truthfully I am too far underwater to sell, took it off my watch list until years end.

Anyone that buys in now is getting a steal of a deal.

This share structure is outstanding now, just need some good news and this can run big.

yea that about covers it, reverse splits only work if there is good news behind it, the burn rate is decreasing and revenues are increasing so short term pain for long term gain. Give it a year and it should be on more than solid footing, but it is going to be a long year ahead.

The reverse split was effected at .0146

I emailed investor relations for what it's worth. I think they needed the cash to fuel their expansion. No surprise. If that's indeed what it's being used for I feel like we're going to feel some short term pain for long term gain. If they're successful and they expand into the US and continue growing this stock could absolutely fly down the road with either 9M or 16M shares total once they're profitable. I'm holding my 20,000 shares.

The company is doing great and on track to bring in record revenues. We are targeting profitability by this spring! (But we will need to complete a small capital raise to get there) as you have probably seen from our most recent set of financials released we are decreasing debt and quarterly losses and increasing revenue. We are hopeful that the roll back will hold its value and bring in new investors as the company continues with its operational successes.

KOMOF one for 10 reverse split:

https://otce.finra.org/otce/dailyList?viewType=Symbol%2FName%20Changes

Does not appear that the market is aware of the pending reverse split, yet.

A reverse split Wipeout is the likely result.

There is a Canadian securities ruling that you cannot borrow money if your stock is below .05$ And they probably need to fill the coffers, just hoping they do not have to go with toxic funding ( if that is the case)

If not a share structure under 9 million is sweet, however these things only work if there is very good news on the horizon, and from past experience with this company I don't know if there is

What does this mean for KOMOF stock holders? Are they going to consolidate and then dump more shares? What other reason would there be to do this, uplisting?

KOMO ANNOUNCES 10:1 CONSOLIDATION

Vancouver, B.C. – January 25, 2023: Komo Plant Based Foods Inc. (CSE: YUM)

(OTCQB: KOMOF) (FSE: 9HB0) ( the “Company”, “Komo”), a premium plant-based

food company, announces that, effective at the opening of trading on January 30, 2023 (the

"Effective Date") the common shares of the Company (the "Common Shares") will

commence trading on the Canadian Securities Exchange on a consolidated basis, with one

(1) post-consolidated Common Share outstanding for every ten (10) pre-consolidated

Common Shares (the "Consolidation"). The Company's name and trading symbol will

remain unchanged.

As a result of the Consolidation, on the Effective Date, a total of approximately 9,709,102

Common Shares will be issued and outstanding, subject to adjustments for rounding, with

approximately 7,276,992 Common Shares reserved for issuance. No fractional Common

Shares will be issued, and any post-consolidated fraction of a Common Share will be

rounded to the nearest whole number of Common Shares. The name of the Company has

not been changed, and the trading symbol remains as "YUM". A new CUSIP number has

been issued for the post-consolidated Common Shares, being 50046B205.

The exercise or conversion price and the number of Common Shares issuable under any of

the Company's outstanding convertible instruments will be proportionately adjusted upon

the effectiveness of the Consolidation. In accordance with the Company’s Articles, the

Consolidation does not require shareholder approval.

Shareholders of record as of the Effective Date who hold Common Shares represented by a

DRS (direct registration system) statement will receive an updated DRS statement from the

transfer agent for the Company, Endeavor Trust Corporation, representing Common Shares

on a post-Consolidation basis.

The Consolidation is subject to the acceptance of the Canadian Securities Exchange

Looks like the promotion tempered off.

Well they are headed in the right direction, a couple of things I noticed

1. The decrease in net loss was primarily driven by an increase in sales and gross margin and a decrease in operating expenses.

2. Advertising and promotion expenses were $32,689 in the quarter, as compared to $617,506 in the same quarter of the prior year.

Basically they pumped the living snot out of this thing and handed over almost $1 million to the pumpers, so now the share price is flushed and is way undervalued in a market that does not care any more. OK, so we sit tight, do nothing, and get back to normal by the second quarter of next year, I can live with that although I would like to see a profit on the $50k I put into this thing.

Also, I guess Canadian laws are different, because there is a lot of future promises here that would not go over too well with American SEC requirements.

i.e.; In the next 12 months, Komo plans to continue to strengthen its sales channels and strategy, and onboard new distributors and brokers to expand its presence across Canada and USA. Komo aims to grow its distribution network to reach over 1,000 retail stores in 2023.

Komo plans to increasingly emphasize a wholesale distribution focused business model to speed up its growth in sales, to simplify distribution operations, and to save operating costs.

Bottom line, at this share price we should see a 300% gain to start to get near fair value, My average buy in price is .11 so break even sometime in the next quarter would be expected, anyone getting in now is being give a gift due to the expansion methods of this company.

https://pro.ceo.ca/@newsfile/komo-reports-q1-financial-results

by @newsfile on 29 Dec 2022, 20:42

Komo Reports Q1 Financial Results

Vancouver, British Columbia--(Newsfile Corp. - December 29, 2022) - Komo Plant Based Foods Inc. (CSE: YUM) (OTCQB: KOMOF) (FSE: 9HB0) ( the "Company", "Komo"), a premium plant-based food company, reports financial results for the quarterly period ended October 31, 2022.

FINANCIAL RESULTS

During the quarter ended October 31, 2022, Komo grew its revenue to $178,290, which is an increase of 89% as compared to the same period of the prior year. Revenue growth was driven by greater market presence through wholesales distributions. Wholesale revenue growth was 203% and accounted for 90% of total revenue. Direct to consumer (DTC) sales declined by 57% and accounted for 10% of total revenue.

Komo increased the number of Canadian distributors from 7 to 8 in the quarter. Komo currently has approximately 790 distribution points, defined as the number of retail locations that carry Komo products, representing an increase of 64% as compared to July 31, 2022.

Komo's gross profit margin for the three months ended October 31, 2022 was 39% which is consistent with management expectations, as compared to 35% in the same period of the prior year. The increase in gross margin was primarily driven by increased efficiency with higher production volume.

Komo incurred a net loss of $243,640 for the three months ended October 31, 2022, as compared to $1,778,371 in the same period of the prior year. The decrease in net loss was primarily driven by an increase in sales and gross margin and a decrease in operating expenses. Loss per share, basic and diluted, was nil for the three months ended October 31, 2022 as compared to $0.02 per share of the same period of the prior year.

Advertising and promotion expenses were $32,689 in the quarter, as compared to $617,506 in the same quarter of the prior year.

OUTLOOK

In the next 12 months, Komo plans to continue to strengthen its sales channels and strategy, and onboard new distributors and brokers to expand its presence across Canada and USA. Komo aims to grow its distribution network to reach over 1,000 retail stores in 2023.

Komo plans to increasingly emphasize a wholesale distribution focused business model to speed up its growth in sales, to simplify distribution operations, and to save operating costs.

SUMMARY OF QUARTERLY RESULTS

Komo launched its plant-based foods business in March 2021. The following is a summary of Komo's most recently completed quarterly periods:

October 31,

2022 July 31,

2022 April 30,

2022 January 31,

2022

$ $ $ $

Revenue 178,290 176,536 213,405 166,052

Net loss from continuing operations (243,640) (905,074) (797,486) (1,121,872)

Basic and diluted loss per share from continuing operations (0.00) (0.01) (0.01) (0.01)

October 31,

2021 July 31,

2021 April 30,

2021 January 31,

2021

$ $ $ $

Revenue 94,256 44,940 16,029 -

Net loss from continuing operations (1,778,371) (5,581,069) (376,606) (358,789)

Basic and diluted loss per share from continuing operations (0.02) (0.07) (0.01) (0.01)

LIQUIDITY

The following information relates to Komo for Q1 2023 and fiscal 2022:

October 31,

2022 July 31,

2022

Current ratio(1) 0.7 0.9

Cash $ 46,840 $ 224,344

Working capital deficiency(2) $ (232,997 ) $ (86,047 )

Long Term Debt(3) $ 1,309,161 $ 1,243,256

Shareholders' equity (deficit) $ (1,485,579 ) $ (1,269,190 )

(1) Current ratio is current assets divided by current liabilities.

(2) Working capital is current assets minus current liabilities.

(3) Long Term Debt consists of convertible debentures and Canada Emergency Business Account interest-free loans.

The management's discussion and analysis for the period and the accompanying consolidated financial statements and notes are available under the Company's profile on SEDAR.

About Komo

Komo Plant Based Foods is a premium plant-based food company that develops, manufactures and sells a variety of plant-based frozen meals that are always hearty, satisfying and made with wholesome ingredients. At Komo, the company's mission is to help make plant-based meals a staple on every dinner table by sharing the company's love for feel-good food that connects the people to the planet. The company believes plant-based eating is the future and that "Change can start with a single bite." The company's experienced plant-based innovation and development team recreates vegan versions of traditionally cheesy and meaty classics, with 100 per cent plants. Komo's products are sold direct-to-consumer through the company's e-commerce website, and a distribution network of on-line and brick and mortar grocery, convenience and natural retailer channels. The company's operating subsidiary, Komo Comfort Foods, launched in 2021 with the company's flagship products: plant-based lasagna, shepherd's pie and chickenless pot pie, and Komo Plant-Based Meal Helpers -- versatile meal starters to allow the creation of many dishes at home. Komo's newest product is Mac & Greens. All of the company's products are 100-per-cent plant-based, made with wholesome ingredients, free from preservatives and frozen for freshness. Freezing products is a natural and effective way of keeping food products for longer without having to use any preservatives. Komo's meals have an 18-month frozen shelf life.

Learn more at: www.komocomfortfoods.com and follow on Instagram: @komocomfortfoods For further information, please contact:

William White, President & CEO, Komo Plant Based Foods Inc.

will@komoeats.com

+1 (236) 8000-YUM / (236) 800-0986

I added 200k yesterday and now own half a million shares

Well advertising and promos increased 250% from last year but revenue increased by over 900%! I will take that trade of any day! Takes money to make money - I expect revenue to keep increasing and cost to keep decreasing as they get into more and more stores. They are doing it right and share price should catch up eventually.

* I can’t post anymore today as Ihub has me on 3 post limit across this whole site lol.

Two things I like and one I do not like from this report..

1. Revenue in fiscal 2022 increased 935 percent to $650,249 as compared with $62,835 in

fiscal 2021 primarily driven by an increase of $419,789 in wholesale revenues sales and

$167,625 in direct to consumer revenue due to an expansion of retail distribution points

and continued growth through new and repeat orders

2. Wholesale distribution points increased from 110 locations at July 31, 2021 to 360

locations at July 31, 2022 to 476 distribution points at November 28, 2022 (the number

of retail locations carrying Komo products);

Direct to Consumer sales increased 359 percent to $214,280 in fiscal 2022 compared

with $46,655 in fiscal 2021;

What I DO NOT LIKE

Advertising and promotion expenses were $1,075,538 in fiscal 2022, as compared to

$387,412 in the prior year.

conclusion, they pumped the living snot out of this thing and retail investors took it on the chin:

They had better recover and keep promo expenses in line or there could be retribution.

KOMO REPORTS FISCAL YEAR 2022 FINANCIAL RESULTS

Vancouver, B.C. – November 28, 2022: Komo Plant Based Foods Inc. (CSE: YUM) (OTCQB:

KOMOF) (FSE: 9HB0) (“Komo”), a premium plant-based food company, today reports financial

results for the year ended July 31, 2022.

“We began our fiscal year as a new brand with a mission to make plant-based meals a staple on

every dinner table by sharing our love for feel-good food that connects the people to the planet.

Thanks to the strength of our team and the love of Komo products, we were successful in

achieving sales growth of 935 percent over last year,” says Komo founder and CEO William White.

“The consistently strong retail sales of our products have allowed us to demonstrate to large

retail chains that our products sell well and have repeat customers. We recently completed a

national listing with Loblaws and we are in discussions with several other large national chains.

As a result, we are anticipating continued significant revenue increases in 2023.”

“We achieved many of our objectives in 2022, including expanding the product shelf life of our

frozen products to 18 months, additions to our product line, growth of our customer base and

significant expansion to our distribution network. We plan to continue to follow an asset-light

strategy and focus on developing additional co-packing partnerships to increase our production

capacity.”

Financial highlights:

? Revenue in fiscal 2022 increased 935 percent to $650,249 as compared with $62,835 in

fiscal 2021 primarily driven by an increase of $419,789 in wholesale revenues sales and

$167,625 in direct to consumer revenue due to an expansion of retail distribution points

and continued growth through new and repeat orders

? Increase in number of Canadian distributors from 4 to 7 in fiscal 2022

? Wholesale revenue increased 2,594 per cent to $435,969 in fiscal 2022 compared with

$16,180 in fiscal 2021;

? Wholesale distribution points increased from 110 locations at July 31, 2021 to 360

locations at July 31, 2022 to 476 distribution points at November 28, 2022 (the number

of retail locations carrying Komo products);

? Direct to Consumer sales increased 359 percent to $214,280 in fiscal 2022 compared

with $46,655 in fiscal 2021;

? Gross margin was 34 percent of revenue, and gross profit was $220,093 in fiscal 2022

compared with 44 percent and $27,691 in fiscal 2021;

? Gross profit was $220,093 for the year ended July 31, 2022, presenting an increase of

695% from the prior year.

? Net loss was ($4,602,803) in fiscal 2022 compared with ($6,472,166) in fiscal 2021;

? Advertising and promotion expenses were $1,075,538 in fiscal 2022, as compared to

$387,412 in the prior year.

? General and administrative expenses were $267,319 in fiscal 2022 compared with

$312,474 in fiscal 2021

Use it all you want buddy! I agree with you, I’ll wait. The growth they are showing is incredible, just matter of time before share price catches up.

oh great quote, mind if I use it? Just let common sense took over, 35% profit margin, growing like a weed in a greenhouse, more and more people are too lazy or do not know how to make these meals, great return customer numbers.. yea I can wait

Besides long term investment tax liability 10%, as opposed to short term tax liability of 35 to 39%

I got skinned alive last year and paid $22,500 in income tax because of all the short term gains, this is the year to hold.

I'm quite relaxed thanks.

I don't mess around with these scams so nothing to worry about.

Relax! No one wants it until everyone wants it. I’ll wait.

Looks like a two cent company ranger 7.

expansion is always expensive, that is why a company goes public, many of the biggest companies out there were not profitable for years, even some NASDAQ companies have a negative cash flow. Only the uneducated would see a 25% reduction in losses and call it a red flag, it is always in the posting history what level of market education people achieve in life.

That being said I think some baggy holders will head for the exit on the way up, give this a year and we should see triple digit returns.

They didn’t lose 4.6 million - they used it for operating expanses! Huge difference here! Their revenue increased almost 1,000% to $650k - guess what, it will

Most likely increase another 1,000% going forward which is over $6 million - these guys know what they are doing! Boom!! This is dollar company, end of story.

|

Followers

|

33

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

1583

|

|

Created

|

09/07/21

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |