Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Recent interview with Jim Rickards. He explains why current inflation actually is transitory, and why the Fed's plans for aggressive tightening will be a major mistake that will likely end in recession.

For gold, he said a falling dollar will be needed to get the gold price moving higher (the dollar has been rising for most of 2021). He said that a weakening US economy could eventually prompt the US administration into a an active policy to lower the dollar.

First however, the Fed overreacts by tightening too aggressively, leading to recession -

>>> Don't fear a 20% stock market plunge: JPMorgan

Yahoo Finance

by Brian Sozzi

December 27, 2021

https://finance.yahoo.com/news/dont-fear-a-20-stock-market-plunge-jp-morgan-180947467.html

Some reassuring words on record-setting markets into the New Year from JPMorgan strategists.

"In particular, outside of the Big 10 stocks in the U.S., equity drawdowns and multiple de-rating have been severe. Russell 3000 was down only -4% and Nasdaq Composite -7% from 12-month highs, however, the average drawdown for constituents in these indices was -28% and -38%, respectively. Some argue this price action is a harbinger of late-cycle dynamics or at least an intra-cycle 10-20% market correction. In our view, conditions for a large sell-off are not in place right now given already low investor positioning, record buybacks, limited systematic amplifiers, and positive January seasonals," said JPMorgan chief macro equity strategist Dubravko Lakos-Bujas in a new research Monday.

Lakos-Bujas doesn't appear to be alone in the bullishness.

The S&P 500 hit an intraday record early on in Monday's session as investors bid up stocks despite rising Omicron-related infections globally. Gains were fueled by upbeat holiday retail sales data out of Mastercard SpendingPulse. If the S&P 500 closes at a record, it will mark the 69th time this year the index has hit a record high. The S&P 500 has notched a record close on nearly 30% of trading days this year, according to Bloomberg.

Meanwhile, 26 out of 30 components of the Dow Jones Industrial Average were in the green, paced by gains in Home Depot, Cisco, and Yahoo Finance Company of the Year Microsoft.

Traders also nibbled at high multiple tech stocks such as Nvidia, which held down the spot as the top trending ticker on the Yahoo Finance platform for most of the session.

With the momentum in the markets persisting despite numerous macroeconomic and health concerns, Lakos-Bujas says investors should stay in risk-on mode.

"We find the current setup very attractive for high beta stocks — emphasizing both sides of the barbell: (1) on the value/cyclical side, in particular, reopening stocks (such as travel, leisure, hospitality, experiences) and energy; (2) on the secular growth side various high beta segments (such as payments, e-commerce, gaming, cybersecurity, biotech) have already seen significant multiple de-rating (i.e., -30% to -70%), yet fundamentals for many of these themes remain intact with continued strong secular growth and large addressable market sizes. Historical analysis (30+ years) shows that the largest outperformance of high beta stocks tends to be in January (i.e., tax-loss harvesting, investor bottom fishing, etc.)," writes Lakos-Bujas.

<<<

>>> 7 Reasons the Stock Market Could Crash in January

Motley Fool

by Sean Williams

12-24-21

https://www.msn.com/en-us/money/markets/7-reasons-the-stock-market-could-crash-in-january/ar-AAS8p8u

In less than a week, we'll officially be ringing in a new year. However, Wall Street might be sad to see 2021 come to a close. The benchmark S&P 500 (SNPINDEX: ^GSPC) has more than doubled up (+24%) its average annual total return of 11% (including dividends) over the past four decades, and it hasn't undergone a steeper correction than 5%. It's been a true running of the bulls.

But as we turn the page on 2021, it's quite possible Wall Street could lose its luster. Below are seven reasons the stock market could crash in January.

1. Omicron supply chain issues (domestic and abroad)

The most obvious obstacle for the S&P 500 is the ongoing spread of coronavirus variants, of which omicron is now the most predominant in the United States. The issue is that there's no unified global approach as to how best to curtail omicron. Whereas some countries are now mandating vaccines, others are imposing few restrictions, if any.

With a wide variance of mitigation measures being deployed, the single greatest risk to Wall Street is continued or brand-new supply chain issues. From tech and consumer goods to industrial companies, most sectors are at risk of operating shortfalls if global logistics continue to be tied into knots by the pandemic.

2. QE winding down

Another fairly obvious high-risk factor for Wall Street is the Federal Reserve going on the offensive against inflation. As a reminder, the Consumer Price Index for all Urban Consumers (CPI-U) rose 6.8% in November, which marked a 39-year high for inflation.

Earlier this month, Federal Reserve Chairman Jerome Powell announced that the nation's central bank would expedite the winding down of its quantitative easing (QE) program. QE is the umbrella program responsible for buying long-term Treasury bonds (buying T-bonds pushes up their price and weighs down long-term yields) and mortgage-backed securities.

Reduced bond buying should equate to higher borrowing rates, which in turn can slow the growth potential of previously fast-paced stocks.

3. Margin calls

Wall Street should also be deeply concerned about rapidly rising levels of margin debt, which is the amount of money that's been borrowed by institutions or investors with interest to purchase or short-sell securities.

Over time, it's perfectly normal for the nominal amount of outstanding margin debt to climb. But since the March 2020 low, the amount of outstanding margin debt has come close to doubling, and now sits at nearly $919 billion, according to November data from the independent Financial Industry Regulatory Authority.

There have only been three instances in the last 26 years where margin debt outstanding rose by at least 60% in a single year. It happened just months before the dot-com bubble burst, almost immediately ahead of the financial crisis, and in 2021. If stocks drift lower to begin the year, a margin-call wave could really accelerate things to the downside.

4. Sector rotation

Sometimes, the stock market dives for purely benign reasons. One such possibility is if we witness sector rotation in January. Sector rotation refers to investors moving money from one sector of the market to another.

On the surface, you'd think a broad-based index like the S&P 500 wouldn't be fazed by sector rotation. But it's no secret that growth stocks in the technology and healthcare sectors have been primarily leading this rally from the March 2020 bear market bottom. Now that we're well past the one-year mark since this bottom, it wouldn't be all that surprising to see investors locking in some profits on companies with valuation premiums and migrating some of their cash to safer/value investments or dividend plays.

If investors do begin to choose value and dividends over growth stocks, there's little question the market-cap-weighted S&P 500 will find itself under pressure.

5. Meme stock reversion

A fifth reason the stock market could crash in January is the potential for a dive in meme stocks, such as AMC Entertainment Holdings and GameStop.

Even though these are grossly overvalued companies that have become detached from their respectively poor operating performances, the Fed noted in its semiannual Financial Stability Report that near- and long-term risks exist with the way young and novice investors have been putting their money to work.

In particular, the report highlights that households invested in these social-media-driven stocks tend to have more-leveraged balance sheets. If common sense prevails and these bubble-like stocks begin to deflate, these leveraged investors may have no choice but to retreat, leading to increased market volatility.

6. Valuation

Even though valuation is rarely ever enough, by itself, to send the S&P 500 screaming lower, historic precedents do suggest Wall Street may be in trouble come January.

As of the closing bell on Dec. 21, the S&P 500's Shiller price-to-earnings (P/E) ratio was 39. The Shiller P/E takes into account inflation-adjusted earnings over the past 10 years. Though the Shiller P/E multiple for the S&P 500 has risen a bit since the advent of the internet in the mid-1990s, the current Shiller P/E is more than double its 151-year average of 16.9.

What's far more worrisome is that the S&P 500 has declined at least 20% in each of the previous four instances when the Shiller P/E surpassed 30. Wall Street simply doesn't have a good track record of supporting extreme valuations for long periods of time.

7. History makes its presence felt

Lastly, investors can look to history as another reason to be concerned about the broader market.

Since 1960, there have been nine bear market declines (20% or more) for the S&P 500. Following each of the previous eight bear market bottoms (i.e., not including the coronavirus crash), the S&P 500 underwent either one or two double-digit percentage declines in the subsequent 36 months. We're now 21 months removed from the March 2020 bear market low and haven't come close to a double-digit correction in the broad-market index.

Keep in mind that if a stock market crash or correction does occur in January, it would represent a fantastic buying opportunity for long-term investors. Just be aware that crashes and corrections are the price of admission to one of the world's greatest wealth creators.

<<<

>>> Diversify your portfolio the right way ?— here are 5 assets with little connection to the stock market’s wild swings

MoneyWise

by Clayton Jarvis

December 19, 2021

https://finance.yahoo.com/news/diversify-portfolio-way-5-assets-140000363.html

Diversify your portfolio the right way ?— here are 5 assets with little connection to the stock market’s wild swings

If your idea of a diversified portfolio is one that only needs growth and value stocks, it’s a good thing you’re reading this.

With prominent investors like Michael Burry, Jeremy Grantham and Charlie Munger expecting a historic correction to hit the stock market, it’s an opportune time to take a long, thoughtful look at your portfolio.

Specifically, you need to make sure it holds the kinds of assets that can help offset any potential losses associated with your stock market exposure.

Let’s look at five assets that can help grow your portfolio, even in the midst of market chaos. We’ll start with three traditional asset classes and then dig into two overlooked examples that show just how interesting — and profitable — alternative investments can be.

1. Bonds

When inflation is making short work of fixed-income returns, bonds can seem even less attractive than usual.

But elevated inflation won’t be around forever, and if the stock market truly is in for a reckoning, the guaranteed income associated with bonds, modest as it is, may be easier to stomach than a historic decline in share values.

In addition to the lower risk, investors also opt for bonds at times of economic uncertainty because decreases in consumer spending can lead to weakening profits and lower share prices.

The bond market is vast, so you should be able to find products that meet your needs as an investor.

U.S. savings bonds, mortgage-backed securities and emerging market bonds are a few examples. And getting exposure is now as easy as purchasing established bond ETFs such as the iShares U.S. Treasury Bond ETF, SPDR Long Term Corporate Bond ETF, and VanEck Investment Grade Floating Rate ETF.

2. Real estate

Real estate is detached from the stock market to such an extent that it provides one of the best hedges against falling share prices.

There hasn’t been a period in recent American history where millions of people weren’t willing to pay for shelter, either by renting or buying properties of their own.

Demand for housing may fluctuate from neighborhood to neighborhood, but its overall ceaselessness should continue to push prices and rent higher, no matter what’s happening on Wall Street.

Purchasing an investment property — a condo, a detached home, a triplex — is the ideal for most investors. Others are happy to keep updating their own residence with an eye toward a future sale.

You can also purchase shares in a real estate investment trust, or REIT, which distributes rental income to shareholders. Names like Realty Income, Digital Realty Trust, and Public Storage should provide a good starting point for investors who'd like to investigate the space.

3. Commodities

Commodities can help shield your portfolio from a declining stock market, but they come with their own unique risks.

When investing in commodities, you’re buying the raw materials used to produce consumer goods and reselling them at (hopefully) a higher price. Cotton, coffee, metals, cattle and petroleum products all qualify as commodities.

Commodity prices are a reflection of supply and demand dynamics in individual markets, so their performance isn’t tied to the stock market. Commodities tend to have a low to negative correlation to both stocks and bonds.

That said, commodities investing is inherently volatile. Unfavorable weather could ruin an investment in chickpeas; new regulations could kill your investment in coal. But if everything falls into place, the returns can be great.

These days, a practical way to invest in commodities is through well-established, broad-based commodity ETFs, such as the Invesco DB Commodity Index Tracking Fund.

If you want to invest in a specific commodity, there are ETFs for that too. For instance, gold bugs have long loved the SPDR Gold Shares ETF for easy access to the market.

Meanwhile, gold mining companies like Barrick Gold and Newmont should also do well if the price of the yellow metal goes up.

4. Fine art

Like commodities, art values depend on supply and demand; it’s just that supply, when it comes to art, means a one-of-a-kind display of genius — something people regularly pay millions for.

In addition to being uncorrelated with the stock market, fine art has the ability to kick off healthy returns.

Between 1995 and 2020, contemporary art has outperformed the S&P 500 by 174% — that’s nearly three times the returns — according to the Citi Global Art Market chart.

Fine art used to be an investment for wealthy aficionados with access to the capital and insight required to make smart purchases.

But new platforms are helping everyday investors get into the fine art market by selling shares in modern masterpieces that could one day be sold for solid gains.

“Those artists tend to appreciate at single-digit to low-double-digit rates, but they're very good stores of value,” says Scott Lyn, CEO of art investing platform Masterworks. “It's very unlikely that you lose money investing in one of those paintings.”

5. Sports cards

In the same investable, collectible vein as fine art lie sports cards, some of which can be worth a fortune.

In October, a rare Michael Jordan Upper Deck card was auctioned off for $2.7 million. Earlier this year, a Tom Brady rookie card was sold for $2.25 million.

Social media and a whole lot of pandemic-related free time spent digging through old collections have helped trigger a new wave of interest in sports cards.

They’re like a meme stock alternative — they don’t always pay off, but when they do, look out.

You can play the sports card game in many ways:

Buy individual cards you think will maintain their value.

Buy boxes of cards and go hunting for one-of-a-kind items that can sell for ridiculous amounts.

Pool your money with other investors to purchase high value cards and resell them at some point in the future.

Find a broker who, for a fee, will help you buy, sell and trade sports cards like stocks.

Just be careful.

The bottom fell out of the sports card market in the mid-90s — too many companies, too many cards. With all the money the space is attracting today, expect more companies to try and get a piece of it.

<<<

>>> As U.S. inflation hits a 39-year high, pros share 7 things to do with your money to help protect yourself from high inflation

Dec. 15, 2021

MarketWatch

By Alisa Wolfson

https://www.marketwatch.com/picks/as-u-s-inflation-hits-a-39-year-high-pros-share-7-things-to-do-with-your-money-to-help-protect-yourself-from-high-inflation-01639577364?siteid=yhoof2

As consumer prices post their biggest yearly gain since 1982, here’s investment advice on TIPS, I bonds, stocks, crypto and more.

U.S. inflation hit a 39-year high in November, according to government data, with consumer prices rising 6.8% in November, as compared to the same month in 2020. This is the fastest rise in consumer prices since 1982, and November was the sixth consecutive month that inflation was over 5%. These changes, no doubt, have many Americans worried about their money — and more specifically, what they can do with their money to help protect against inflation.

“For those that keep their savings in a traditional savings account, it’s unlikely the interest rate they are earning will outpace inflation, and what can happen is inflation can eat into your purchasing power of money as a result,” says Leanna Devinney, certified financial planner and vice president and branch leader of Fidelity Investments. So while you still need an emergency fund (you’ll want at least three months worth of income in there) in savings, investing is going to be key to helping you weather inflation better, pros say. Here’s their advice on where to put your money.

Stocks and diversification are key, says Snigdha Kumar, head of product operations at investment app Digit

Investors should continue to be invested in stocks because they generally hold up better during times of inflation, explains Kumar, who adds that “diversification is our north star.” Suze Orman shared a similar sentiment about stocks recently, noting that: “Bonds and cash struggle to keep pace with inflation; only stocks have a track record of earning more than inflation.”

Consider value stocks in the consumer staples space, says Kumar. “Value stocks that are in the consumer staples space, like food and energy, do well during inflation because demand for staples is inelastic and that gives these companies higher pricing power as they are able to increase their prices with inflation better than other industries,” Kumar says.

Think about TIPS and high-yield bonds, says Devinney

“Consider different types of inflation-resistant fixed income investments such as Treasury Inflation-Protected Securities (TIPS) and high-yield bonds,” says Devinney. Kumar also recommends TIPS. “Since diversification is our north star, one could also acquire some lower risk securities that are inflation linked,” Kumar says. “TIPS securities carry a similar risk as other fixed income investments, but they add an adjusted principal amount if inflation increases.”

Look into I bonds

I bonds are inflation-protected U.S. savings bonds, and I bonds purchased before the end of April offer a 7.12% yield. But, there’s a catch: An individual can only purchase up to $10,000 of I bonds per year electronically or $5,000 in paper. Here’s a guide on I bonds.

Consider crypto, says Michael Wilkerson, executive vice chairman of Helios Fairfax Partners

Wilkerson says Bitcoin and Ethereum provide the most liquid ways to invest in crypto. “This may yet prove to be the most efficient inflation hedge in this environment. Regulatory interference will remain the main risk for the crypto utopia,” says Wilkerson. That said, read this guide on how much of your portfolio to put in crypto.

Consider alternative investments like gold and real estate, says Kumar. In the theme of diversification, Kumar says she always suggests having 5% to 10% of a portfolio in alternatives or hedges, like gold and real estate, during inflation. “The rationale for buying gold is that its asset value isn’t damaged by the eroding value of cash so it’s a good anti-inflationary hedge,” Kumar says. “Real-estate platforms, especially retail real estate, do well during inflation because landlords and property owners see the value of their property increase,” she says, noting that: “We’re already seeing that in the real estate market in the United States right now.” For his part, Warren Buffett has also spoken of real estate as something to consider to hedge against inflation.

Reduce exposure to certain types of investments, says Devinney

“It may also help to reduce exposure to investments that are more sensitive to inflation such as certain Treasury bonds. Treasury bonds typically have lower yields than the equivalent duration investment grade bonds and that is why treasury bonds aren’t as inflation resistant,” says Devinney. You may also want to steer clear or some CDs, savings accounts and more.

And Kumar doesn’t recommend investing too much in growth stocks during times of inflation because those companies expect to earn a bulk of their cash flow in the future. As inflation increases, those future cash flows are worth less and therefore they lose stock value.

And finally, you should do an honest review of your expenses. Kelly LaVigne, vice president of consumer insights at Allianz Life, says most people think they can combat rising costs simply by cutting back on some aspect of their current expenses, but it’s impossible to do this in a logical way without a clear understanding of what you’re currently spending. “You might think you can make an impact by spending less on a few grocery items or limiting daily trips to the coffee shop, but those might be relatively useless endeavors if you are paying significantly more in other places where inflation is taking a bigger chunk of your budget,” says LaVigne.

<<<

>>> The Best And Worst Sectors For Rising Interest Rates

Mar 31, 2021

Seeking Alpha

by Kevin Means

https://seekingalpha.com/article/4416978-best-worst-sectors-etfs-for-rising-interest-rates

Summary

Current monetary and fiscal policies risk an overheated and inflationary economy.

Increased interest rates already begun are a likely result.

Using an objective statistical model, I calibrate the current sensitivity of sectors and industries to rising interest rates.

Sector recommendations are to buy financials (XLF) and energy (XLE) and avoid/sell technology (XLK).

Interest rates are notoriously difficult to forecast. However, if you believe that rates will continue to rise (as I do), it may be helpful to know which market sectors are likely to be most affected, for good or ill.

Four-Factor Risk Model

At Sapient Investments, we use a proprietary risk model to measure the risks of a stock, bond, fund, or portfolio. It is described more fully in an article on our website entitled “How Much Risk is in My Portfolio?” The four risk factors are:

MKT – stock market risk (S&P 500 Index)

LTB – interest rate risk (10-Year Treasury Index)

DLR – currency risk (U.S. Dollar Index)

OIL – commodity risk (West Texas Intermediate Crude Oil Index)

These four major risk factors are the most important in explaining the behavior of most investments. Although the focus of today’s article is LTB risk, to get an accurate measure, it is important to control for the other risk effects at the same time. That is why our risk model uses multiple regression analysis in which we regress monthly returns against monthly changes in all four risk factors simultaneously. That allows us to disentangle the various risk effects from each other and present a more accurate picture of the true risk factor sensitivities.

Also important is the fact that our risk model uses exponentially-weighted regressions, which weight more recent monthly returns more heavily than those further back in time. Specifically, our regressions use the most recent 36 months, with half of the weight on the most recent 12 months.

10 Major Sectors

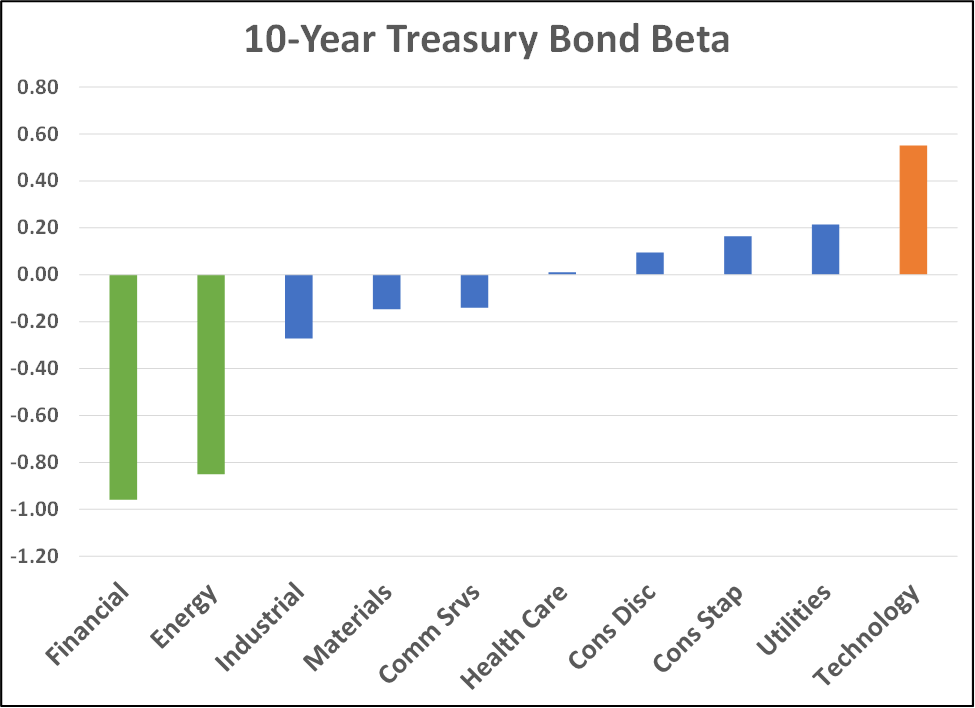

In the graph below, we show the LTB betas of the 10 major economic sectors into which U.S. stocks are generally grouped.

Source: Graph created by author using data from FactSet

Perhaps the most important thing to remember when thinking about the effects of interest rate changes is that bond prices and returns move in the opposite direction of interest rate changes. When interest rates go up, bond prices go down. So, assets that have a positive LTB beta will also go down when rates go up.

In the graphs above and below, we use color as a reminder about this relationship. Assets with the most negative sensitivity to LTB changes are in green—they will go up in price if interest rates rise, the opposite reaction from bonds. Assets with the most positive sensitivity to LTB changes are in orange—they will go down in price if interest rates rise, just like bonds.

When trying to understand the effects of LTB risk on various sectors, it is helpful to understand why interest rates might be changing. The fact that our risk model emphasizes what has been happening recently is particularly helpful. For example, energy stocks have not historically had a strong relationship with the 10-Year Treasury Bond, either positive or negative. However, recently, energy stocks have been exhibiting a decidedly more negative relationship to bonds than has been typical in the past because of the extremely depressed levels from which energy stocks have been rebounding as hopes for an economic recovery have been emerging. Rising interest rates are often associated with a strengthening economy, which is good for all economically-sensitive stocks. Energy stocks have been behaving with very heightened sensitivity to the outlook for a post-pandemic recovery.

Financial stocks have historically had a slightly negative relationship to the 10-Year Treasury Bond, but they have recently exhibited a much stronger inverse relationship, probably because interest rates have been so low and the yield curve so flat that it has been difficult for financial institutions, particularly banks, to earn normal profits using their traditional model of “borrowing short and lending long.” Rising long-term bond yields help financial stocks to earn a positive spread on their assets.

Technology has not traditionally been known for a high level of sensitivity to changes in interest rates. However, interest rates are so low that mathematically speaking, even relatively small changes in interest rates can have a dramatic effect on the current value of high growth stocks.

All financial assets are valued by discounting future cash flows. This relationship is easier to calculate for bonds because all of their cash flows are known in advance—the coupon interest payments and the return of principal are contractual. Bonds with longer maturities have more of their cash flows in the distant future. A bond’s “duration” measures its sensitivity to changes in interest rates, which is exactly what LTB beta measures. The difference is that duration can be calculated exactly ahead of time, but stock LTB beta is estimated using time-series regression analysis. But the underlying rationale is the same. High growth stocks with little or no present earnings are expected to have the bulk of their cash flows occur in the distant future, making their present values much more sensitive to changes in interest rates. They are, in effect, “high duration stocks.”

Industries Most Affected

The graph below shows some of the industries that have unusually extreme LTB betas, either positive or negative.

Source: Graph created by author using data from FactSet

Those on the left side could be described as economic recovery industries. They typically suffered poor returns in 2020 and are only recently seeing their stock prices recover. They are also most often considered value industries as opposed to growth industries.

The industries on the right side are a varied lot. Some are clearly associated with the “winners” in 2020, especially software, medical equipment, and solar. These are all growth industries in which a large portion of the expected cash flows are many years down the road. Consequently, they have been hurt by rising rates through the mechanism of the increased discount rate.

Other industries on the right side are sensitive to changes in interest rates through the economics of how their businesses operate. For example, the demand for real estate and home construction is strongly influenced by mortgage interest rates—when rates move up, demand falls. Similarly, gold miners are affected by the price of gold, which in turn is affected by interest rates because gold does not provide any interest or dividend income, and when interest rates rise, the opportunity cost of owning gold increases, making it a less attractive store of value.

Will Rates Keep Rising?

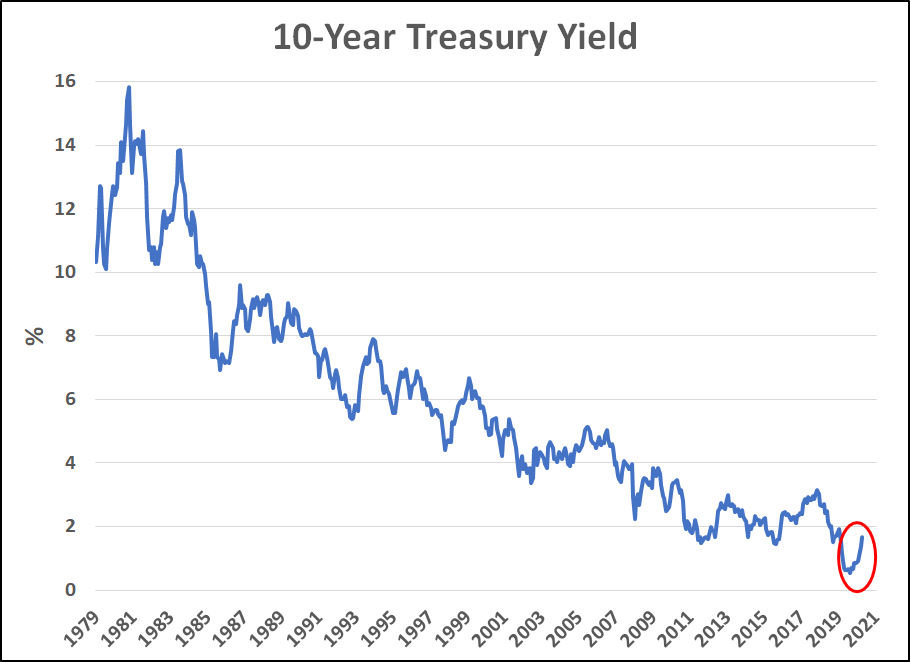

The graph below depicts the history of the 10-Year Treasury Bond Yield since 1979. It had been on a downtrend since 1981 when it peaked at 15.8%. Last summer, the yield hit an all-time low of .5%. Since then, the yield has increased over 1% to 1.7%.

Source: Graph created by author using data from FactSet

Two observations can be made from this graph. One is that the short-term trend has clearly been up. The other is that if there is a tendency for long-term reversion to the mean, it will be an upward gravitational pull.

What has caused the 10-Year Treasury Yield to move up? Certainly not Fed tightening. The Fed has maintained its unprecedentedly easy money approach, holding short-term rates close to zero and buying huge amounts of longer-term bonds to try to push rates lower all along the yield curve. It appears that the “bond market vigilantes” are back. If bond market participants fear that inflation will devalue their investments, they will naturally sell. They may not wait for the Fed to tighten to stave off inflation or trust that it will, and in fact, given the mindset of the current Fed, the central bank appears much more willing to tolerate much more inflation than would have been the case even a few years ago, in the interest of fostering “full employment.”

With the change in control of both houses of Congress as well as the executive branch, another potentially inflationary element has been added to the policy mix—aggressively expansionary fiscal policy. Blowout deficit spending now looks like it will be the new normal. Historically, when governments have overspent, rather than raise taxes, the easier route has been to weaken the value of the currency through inflation, making repayment of government borrowing easier. Add a propensity towards anti-business, pro-union, and environmental tax and regulatory changes, which are likely to dampen productivity and economic growth, and the mix looks a lot like the policies that led to the “stagflation” conditions of the 1970s.

Inflation has not shown up in the CPI yet, but the bond market is clearly worried about it, and rightly so. The present trends seem unlikely to go away any time soon, and if anything, they seem likely to intensify.

Prepare your portfolio for higher interest rates.

<<<

>>> Wholesale inflation jumps record 9.6% over past 12 months

Yahoo Finance

MARTIN CRUTSINGER

December 14, 2021

https://finance.yahoo.com/news/wholesale-inflation-jumps-record-9-134429918.html

WASHINGTON (AP) — Prices at the wholesale level surged by a record 9.6% in November from a year earlier, an indication of on-going inflation pressures.

The Labor Department said Tuesday that its producer price index, which measures inflation before it reaches consumers, rose 0.8% in November after a 0.6% monthly gain in October. It was the highest monthly reading in four months.

Food prices, which had fallen 0.3% in October, jumped 1.2% in November. Energy prices rose 2.6% after a 5.3% percent rise October.

The 12-month increase in wholesale inflation set a new record, surpassing the old records for 12-month increases of 8.6% set in both September and October. The records on wholesale prices go back to 2010.

Core inflation at the wholesale level, which excludes volatile food and energy, rose 0.8% in November with core prices were up 9.5% over the past 12 months.

The increase in wholesale prices was widespread, led by a 1.2% increase in the cost of goods and a 0.7% rise in the price of services.

In the goods category, the price of iron and steel scrap rose 10.7% while the price for gasoline, jet fuel and industrial chemicals all moved higher. In the food category, the price of fresh fruits and vegetables rose while the price of chickens fell.

The surge in wholesale prices followed news Friday that consumer prices shot up 6.8% for the 12 months ending in November, the biggest increase in 39 years, as the price of energy, food and many other items shot up.

The Federal Reserve, holding its last meeting of the year this week, is expected to announce Wednesday that it will accelerate the pace at which it reduces its monthly bond purchases, preparing the way to begin raising its key benchmark interest rate, possibly by mid-2022 as it seeks to demonstrate its resolve to bring inflation under control.

<<<

>>> Twenty Central Banks Hold Meetings as Inflation Forces Split

Bloomberg

By Enda Curran, Jana Randow, Rich Miller, and Philip Aldrick

December 11, 2021

https://www.bloomberg.com/news/articles/2021-12-11/twenty-central-banks-hold-meetings-as-inflation-forces-split?srnd=premium

Fed is expected to taper support while others are still easing

Bank of England’s hiking hints undermined by omicron

The world’s top central banks are diverging, as some turn to tackling surging inflation while others keep stoking demand, a split that looks set to widen in 2022.

The differences will be on full display this week with the final decisions for 2021 due at the U.S. Federal Reserve, European Central Bank, Bank of Japan and Bank of England, which are together responsible for monetary policy in almost half of the world economy. They won’t be alone -- about 16 counterparts also meet this week, including those in Switzerland, Norway, Mexico and Russia.

Central Bank Decisions This Week

The latest wild-card is the omicron coronavirus variant -- how severe its impact proves to be on growth and inflation will be a crucial consideration for officials into the new year. The worry is that a strain more resistant to vaccines would force governments to impose new restrictions on business and keep consumers at home.

A shift in policy always carries risks. Tightening and then discovering the inflation threat was temporary all along -- as many central bankers have said all along -- could derail recoveries; waiting and finding that price pressures are persistent could require more aggressive tightening than otherwise.

“The likelihood of policy slip-ups is now much much greater,” said Freya Beamish, head of macro research at TS Lombard. The inflation outlook is confused by “the presence of an endemic virus,” she said.

Fed Chair Jerome Powell is tipped to confirm on Wednesday that he’ll deliver a quicker withdrawal of stimulus than planned just a month ago. He may even hint at being open to raising interest rates sooner than expected in 2022 if inflation persists near its highest in four decades.

The outlook for his central banking peers is less clear, marking an end of two years in which they largely synchronized their efforts to tackle the coronavirus recession, only to find inflation surging back stronger than anticipated in many key economies.

Stimulus at Fed, ECB, BOJ has vastly increased their balance sheets

Although she’s likely to end emergency stimulus, ECB President Christine Lagarde will stick to an expansionary policy stance on Thursday as she insists soaring prices are due to factors that won’t endure, such as energy costs, supply snags and statistical quirks. Lagarde has indicated she doesn’t expect to raise rates in 2023.

Subdued price pressures in Japan are also allowing BOJ Governor Haruhiko Kuroda to hold onto a doggedly dovish stance, even as the government rolls out another round of record spending. Japanese policy makers convene Friday.

Perhaps most strikingly, Governor Andrew Bailey’s Bank of England is now cooling on the need to hike rates, having not long ago flirted with a shift. In contrast, Norway’s central bank may hike again.

Elsewhere, while the People’s Bank of China has started to ease policy as a property-market downturn threatens to hamper growth, other emerging economies such as Brazil and Russia are aggressively tightening.

Russia may do so again this week, as may Mexico, Chile, Colombia and Hungary. Still, Turkey is set to cut again at the urging of President Recip Tayyip Erdogan.

“We are set for increasing monetary policy divergence,” said Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis SA.

What Bloomberg Economics Says...

“Rising global inflation, higher commodity prices and weaker currencies likely synchronized rate movements in emerging markets this year. Tighter U.S. monetary policy will probably provide another global force for more rate hikes next year.”

-- Ziad Daoud, chief emerging markets economist

Even if the path of rates differs, a wide-scale slowing of bond-buying programs will reduce support for economies. BofA Global Research strategists predict liquidity will peak in the first quarter of 2022, and that the Fed, ECB and BOE are on course to shrink their balance sheets to $18 trillion by the end of next year from above $20 trillion at the start of the year.

The implications for divisions in global policy could also include a rising dollar against a weakening euro and yuan, potentially stoking currency tensions as China’s exports get another lift. A stronger greenback would also lure money away from emerging markets, undermining their own fragile recoveries.

“The increase in the Fed fund rates next year and a stronger U.S. dollar will be a testing time for emerging markets,” said Jerome Jean Haegeli, chief economist at Swiss Re AG in Zurich, and previously of the International Monetary Fund. “The fault lines opened up by Covid-19 are looking more persistent.”

At the Fed, a widely-anticipated decision to wind up its bond-buying more quickly could leave it in a position to raise rates as early as March, should it deem that necessary to stem surging inflation.

U.S. consumer prices rose the fastest in almost four decades, government data showed Friday.

Fed watchers expect the central bank’s new economic forecasts to show for the first time that a majority of policy makers project at least one rate increase in 2022.

ECB’s Stimulus Exit Path Emerges With Inflation at Record Pace

Inflation Near 40-Year High Shocks Americans, Spooks Washington

Fed Seen on Track to Quicken Taper After Latest Inflation Print

The Bank of England Needs One Million Missing Workers to Return

In the U.K., traders convinced of a liftoff this year pared bets after the emergence of omicron, and they’ll likely be proved right if comments from the BOE’s most hawkish official serve as a guide. Michael Saunders recently highlighted the benefits of waiting before raising rates from 0.1% to assess the economic impact of the variant.

The U.K.’s tight labor market is nevertheless driving up wage growth, and officials are concerned that high inflation, expected to hit a decade high of 5% next year, is seeping into expectations. Unlike the Fed, the BOE’s mandate keeps it focused on prices.

At the ECB, Lagarde is also sticking to the narrative that record-high inflation will eventually subside -- even though officials acknowledge that persistent supply bottlenecks mean it may take longer than initially thought, and some policy makers are getting uncomfortable just standing by.

With the European economy close to pre-crisis levels, the institution is set to confirm that bond-buying under its signature 1.85 trillion-euro ($2.1 trillion) pandemic program will end in March as planned. Regular asset purchases will continue. Rate hikes, economists surveyed by Bloomberg agree, won’t be on the agenda until 2023.

Ultimately, the severity of omicron will play a huge role in the monetary policy story next year. Two weeks after the variant’s discovery, there are plenty of unknowns.

“If the variant dampens demand more than it exacerbates supply-chain disruptions, it could prove disinflationary,” said economist Sian Fenner of Oxford Economics. “But the reverse is equally true.”

<<<

>>> It’s not just Elon Musk: Corporate insiders sell stocks at historic levels as market soars

Wall Street Journal

Dec. 11, 2021

By Tripp Mickle , Theo Francis

https://www.marketwatch.com/story/its-not-just-elon-musk-corporate-insiders-sell-stocks-at-historic-levels-as-market-soars-11639091560

So far this year, 48 top executives have collected more than $200 million each from stock sales

Microsoft CEO Satya Narayana Nadella sold about half of his Microsoft shares in late November, yielding about $285 million.

Company founders and leaders are unloading their stock at historic levels, with some selling shares in their businesses for the first time in years, amid soaring market valuations and ahead of possible changes in U.S. and some state tax laws.

So far this year, 48 top executives have collected more than $200 million each from stock sales, nearly four times the average number of insiders from 2016 through 2020, according to a Wall Street Journal analysis of data from the research firm InsiderScore.

The wave has included super sellers such as cosmetics billionaire Ronald Lauder and Google GOOGL, +0.25% co-founders Larry Page and Sergey Brin, who have sold shares for the first time in four years or more as the economic recovery fueled strong growth in sales and profit. Other high-profile insiders—including the Walton family, heirs to the Walmart Inc. WMT, +1.83% fortune, and Mark Zuckerberg, chief executive of Facebook parent Meta Platforms Inc. FB, -0.02% —have accelerated sales and are on track to break recent records for the number of shares they have sold.

Read: Elon Musk exercises more options, sells another $1 billion of Tesla stock

Across the S&P 500, insiders have sold a record $63.5 billion in shares through November, a 50% increase from all of 2020, driven both by stock-market gains and an increase in sales by some big holders. The technology sector has led with $41 billion in sales across the entire market, up by more than a third, with a smaller amount but an even bigger increase in financial services.

Read: CEO Satya Nadella sells about half of his Microsoft shares

“What you’re seeing is unprecedented” in recent years, said Daniel Taylor, an accounting professor at the University of Pennsylvania’s Wharton School who studies trading by executives and directors. He said 2021 marks the most sales he can recall by insiders in a decade, resembling waves of sales during the twilight of the early 2000s dot-com boom.

<<<

>>> Warren Buffett is holding these stocks for the huge free cash flow — with inflation at a 31-year high, you should too

MoneyWise

by Brian Pacampara, CFA

December 7, 2021

https://finance.yahoo.com/news/warren-buffett-holding-stocks-huge-175400129.html

Warren Buffett is holding these stocks for the huge free cash flow — with inflation at a 31-year high, you should too

Wall Street pays a ton of attention to company earnings.

But reported earnings are often manipulated through aggressive or even fraudulent accounting methods.

That’s why risk-averse investors need to focus on companies that generate gobs of free cash flow.

Cold, hard cash is real, and can be used by shareholder-friendly management teams to:

Pay inflation-fighting dividends.

Repurchase shares.

Grow the business organically.

Investing legend and Berkshire Hathaway CEO Warren Buffett is famous for his love of cash flow-producing businesses.

Let’s take a look at three stocks in Berkshire’s portfolio that boast double-digit free cash flow margins (free cash flow as a percentage of sales).

Chevron (CVX)

Leading off our list is oil and gas giant Chevron, which has generated $13.9 billion in free cash flow over the past 12 months and consistently posts free cash flow margins in the ballpark of 10%.

The shares have been hot in recent months on the strong rebound in energy prices, but with inflation continuing to heat up, there might be plenty of room left to run.

Management’s recent initiatives to cut costs and improve efficiency are starting to take hold and should be able to fuel shareholder-friendly actions for the foreseeable future.

Just last week, Chevron announced that it would boost its buyback program to as much as $5 billion a year, about 60% higher than previous guidance.

The stock still offers an attractive dividend yield of 4.7%, which investors can pounce on using some extra cash.

Moody’s (MCO)

With whopping free cash flow margins above 30%, credit ratings leader Moody’s is next up on our list.

Moody’s shares held up incredibly well during the height of the pandemic and are up nearly 290% over the past five years, suggesting that it’s a recession-proof business worth betting on.

Specifically, the company’s well-entrenched leadership position in credit ratings, which leads to outsized cash flow and returns on capital, should continue to limit Moody’s long-term downside

Moody’s has generated about $2.4 billion in trailing twelve-month free cash flow. And over the first nine months of 2021, the company has returned $975 million to shareholders through share repurchases and dividends.

Moody’s has a dividend yield of 0.6%.

Coca-Cola (KO)

Rounding out our list is beverage giant Coca-Cola, which has produced $8.1 billion in trailing twelve-month free cash flow and habitually delivers free cash flow margins above 20%.

The stock has had plenty of ups and downs in recent months, but patient investors should look to take advantage of the short-term uncertainty. Coca-Cola’s long-term investment case continues to be backed by an unrivaled brand presence, massive scale efficiencies, and still-attractive geographic growth tailwinds.

And the company is back to operating at pre-pandemic levels.

In the most recent quarter, Coca-Cola posted revenue of $10 billion, up 16% from the year-ago period, driven largely by a 6% increase in unit case volume.

Coca-Cola shares offer a dividend yield of 3.1%.

Generate income outside of the shaky stock market

Even if you don't like these specific stock picks, you should still look to implement Buffett's time-tested strategy of investing in real assets that produce cold, hard cash.

And you don't have to limit yourself to the stock market.

For instance, some popular investing services make it possible to lock in a passive income stream by investing in a wide variety of alternative assets — including fine art, commercial real estate, and even luxury vehicle finance.

You’ll gain diversified exposure to alternative asset classes that big-time investment moguls usually have access to, and you’ll receive regular payouts in the form of monthly or quarterly dividend distributions.

<<<

>>> Bill Gates is using these dividend stocks to generate a giant inflation-fighting income stream ?— you might want to do the same

MoneyWise

by Clayton Jarvis

December 8, 2021

https://finance.yahoo.com/news/bill-gates-using-dividend-stocks-194300892.html

With elite investors like Michael Burry and Jeremy Grantham predicting a reckoning for today’s overheated stock market, it might be time to look at dividend stocks.

Dividend stocks are a way to diversify a portfolio that may be chasing growth a little too obsessively. They generate income in good times, bad times and, particularly important today, times of high inflation.

They also tend to outdo the S&P 500 over the long run.

One prominent portfolio that’s heavy on dividend stocks belongs to The Bill & Melinda Gates Foundation Trust. With the trust being used to pay for so many initiatives, income needs to keep flowing into it.

Dividend stocks help make this happen.

Here are three dividend stocks that occupy significant space in the foundation’s holdings. You may even be able to follow in its footsteps with some of your spare change.

Waste Management (WM)

Waste Management Inc, is an American waste management & environmental services company. It’s not the most glamorous of industries, but waste management is an essential one.

No matter what happens with the economy, municipalities have little choice but to pay companies to get rid of our mountains of garbage, even if those costs increase.

As one of the biggest players in the space, Waste Management remains in an entrenched position.

The shares have more than doubled over the past five years and are up about 42% year to date. Management is projecting 15% revenue growth this year.

Currently offering a yield of 1.4%, Waste Management’s dividend has increased 18 years in a row.

The company has paid out almost $1 billion in dividends over the last year, and its roughly $2.5 billion in free cash flow for 2021 means investors shouldn’t have to worry about receiving their checks.

Caterpillar (CAT)

As a company whose fortunes typically follow that of the larger economy — that’ll happen when your equipment is a fixture on building sites the world over — Caterpillar is in an intriguing post-pandemic position.

The company’s revenues are feeling the effects of a paralyzed global supply chain, but still-historically low interest rates and President Joe Biden’s recently passed $1.2 trillion infrastructure bill mean there could be an awful lot of building going on in the U.S. in the near future.

Caterpillar’s mining and energy businesses also provide exposure to commodities, which tend to do well during times of high inflation.

The company’s stock has ridden higher raw material and petroleum prices to an almost 15% increase this year.

After announcing an 8% increase in June, Caterpillar’s quarterly dividend is currently at $1.11 per share and offers a yield of 2.2%. The company has increased its annual dividend 27 years straight.

Walmart (WMT)

With grocery stores deemed essential businesses, Walmart was able to keep its more than 1,700 stores in the U.S. open throughout the pandemic.

Not only has the company increased both profits and market share since COVID coughed its way across the planet, but its reputation as a low-cost haven makes Walmart many consumers’ go-to retailer when prices are rising.

Walmart has steadily increased its dividends over the past 45 years. Its annual payout is currently $2.20 per share, translating into a dividend yield of 1.6%.

After trending slightly downward over the past month, Walmart currently trades at roughly $136 per share. If that's still too steep, you can get a smaller piece of the company using a popular app that lets you to buy fractions of shares with as much money as you are willing to spend.

Look beyond the stock market

Aerial side view head of cargo ship carrying container and running near international sea port for export.

At the end of the day, stocks are inherently volatile — even those that provide dividends. And not everyone feels comfortable holding assets that swing wildly every week.

If you want to invest in something that has little correlation with the ups and downs of the stock market, take a look at some unique alternative assets.

Traditionally, investing in fine art or commercial real estate or even marine finance have only been options for the ultra rich, like Gates.

But with the help of new platforms, these kinds of opportunities are now available to retail investors, too.

<<<

>>> Billionaire George Soros Loads Up on These 3 “Strong Buy” Stocks

TipRanks

November 29, 2021

https://finance.yahoo.com/news/billionaire-george-soros-loads-3-144712924.html

Wall Street has known its share of legends, but few of them have made as big a splash as “the Man Who Broke the Bank of England.” That nickname belongs to George Soros who earned the tag after famously betting against the British Pound in 1992; following the Black Wednesday crash, the hedge fund manager pocketed $1 billion in a single day. This is the stuff that Wall Street legends are made of.

By then Soros was already incredibly successful and in the midst of steering his Quantum Fund to decades-long average annual returns of 30%.

Today, Soros remains the chair of Soros Fund Management and is thought to be worth over $8 billion, a figure which would have been far greater but for the billionaire’s extensive philanthropic work.

So, when Soros takes out new positions for his stock portfolio, it is only natural for investors to sit up and take notice. With this in mind, we decided to take a look at three stocks his fund has recently loaded up on. Soros is not the only one showing confidence in these names; according to the TipRanks database, Wall Street’s analysts rate all three as Strong Buys and see plenty of upside on the horizon too.

EQT Corporation (EQT)

We’ll start with the largest natural gas producer in the US. EQT is an $8 billion industry giant, operating in the gas-rich Appalachian states of Pennsylvania, West Virginia, and Ohio. With 1 million acres of land holdings in the Marcellus and Utica shale deposits, and 19 trillion cubic feet of proven natural gas reserves, the company is well-positioned to gain from the current regime of rising gas prices, even as the Biden Administration pushes an anti-fossil fuel strategy.

One clear sign of EQT’s strong position: the stock is up 65% year-to-date, even after some late-summer volatility. In the most recent quarterly report, for Q3, the company’s revenue came in at $1.79 billion, reversing the year-ago quarter’s $255 million revenue loss, while the EPS of 12 cents was up from a year-ago loss of 15 cents per share. Looking forward, management has boosted this year’s guidance on free cash flow upward by $200 million.

From Soros’ position, it’s clear that he sees profit potential in natural gas. His fund pulled the trigger on 534,475 shares, giving it a new position in EQT. At current prices these shares are now worth over $11.4 million.

Soros isn’t the only one giving this resource stock some love. Wall Street analyst Vincent Lovaglio, writing from Mizuho Securities, points out several strong points from 3Q21.

“Gas realizations were better than expected, low end of full year capex guidance is down slightly, full year operating cash flow guide is higher on the commodity rally and in line with our full-year forecast, and the company optimized firm-transport agreements expected to lower unit gathering while improving realizations.”

In addition, Lovaglio isn’t shy in setting forth his opinion that the company will start returning cash to shareholders, sooner rather than later, believing EQT is “positioned to announce a cash return framework early next year.”

In line with these comments, Lovaglio rates EQT stock a Buy and his $35 price target points toward 68% upside in the next 12 months. (To watch Lovaglio’s track record, click here)

Overall, the Strong Buy consensus rating on this stock is supported by 11 recent reviews, which include 9 Buys against just 2 Holds. The shares are selling for $21.35 and the $29.64 average price target suggests an upside of 42%. (See EQT stock analysis on TipRanks)

Fisker (FSR)

The next stock we’ll look at is Fisker, an electric vehicle (EV) maker based in LA, California. Fisker is preparing to jump full-on into the consumer automotive segment, and unveiled its Ocean fully electric SUV earlier this month at the 2021 Los Angeles Auto Show. The company has already been taking pre-orders on the vehicle; with the unveiling, Fisker is now putting its money where its mouth is. The Ocean, with – among other features – a solar-panel roof capable of generating battery charging power, is scheduled to start its regular production run in November of next year.

In recent weeks, Fisker has met some other important milestones for investors to consider. First, on November 2, the company announced an agreement with the European battery maker Contemporary Amperex Technology to receive two separate battery supply options for the Ocean, with a total of 5 gigawatt-hours annual battery capacity over the years 2023 to 2025. And one day later, Fisker noted that its prototype Body Shop at the Austria Fisker Ocean assembly plant, is now fully operational and that production has begun on the Ocean’s prototype run, allowing the vehicle to enter the next phase of testing.

Constant progress toward a deliverable product is a clear positive marker for a pre-production auto maker, and Soros clearly agrees; he picked up 317,300 shares of Fisker, opening his position in the company with a holding now worth $6.26 million.

Giving Fisker an Outperform (i.e. Buy) rating, with a $32 target price indicating room for ~57% one-year upside, Credit Suisse analyst Dan Levy is also clearly bullish, and he bases his conclusion on the recent unveil.

Backing his stance, Levy writes, “FSR’s unveil of the production version of the Ocean at the LA Auto Show last week reinforces our bull thesis on FSR – with EV uptake sharply inflecting and the market lacking sufficient model options, FSR offers a compelling value proposition – sleek product at a high-volume price point, and with a de-risked path to market.”

Going on, Levy lays out the key point: “Reaching start-of-production for Ocean next year, even if the vehicle isn’t profitable initially, may be enough to drive significant upside for the stock.” (To watch Levy’s track record click here)

Wall Street appears to be in broad agreement with Levy, as FSR shares maintain a Strong Buy rating from the analyst consensus. There have been 8 recent reviews, including 6 Buys and 2 Holds. Meanwhile, the stock’s $26 average implies 27% upside potential from the $20.44 trading price. (See FSR stock analysis on TipRanks)

SoFi Technologies (SOFI)

Last on our list is SoFi, short for Social Finance, a San Francisco-based personal finance company. The company uses social media modes to connect its members with loan funding sources. SoFi offers a full range of loan products, from student loans to home financing, and maintains a solid commitment to its ‘no fee’ policy; the only cost to borrowers is the interest on the loan. And with SoFi’s non-traditional underwriting approach, it is able to offer borrowers lower rates than are available with banks.

Founded 10 years ago, SoFi only entered the public trading markets this year. Like many firms in recent years, the company took advantage of the rising market environment to enter a SPAC transaction, merging with Social Capital Hedosophia V in the early summer and putting the SOFI ticker on the NASDAQ on June 1.

Earlier this month, SoFi published its 3Q21 financial data, showing strong growth, especially in membership numbers. The company recorded year-over-year member growth of 96%, reaching a total of 2.9 million. Of that growth, 377,000 new members were added in Q3, making the quarter the company’s second-best ever for member increase. For the quarter, adjusted net revenue came in at $277 million, beating the company’s previously published guidance high end of $255 million by 9%. Management is predicting further acceleration of revenue growth in Q4, and is guiding toward $272 million to $282 million in net revenue. Achieving this would bring 49% to 55% yoy revenue growth. For the full year, the company expects revenues in the range of $1.002 billion to $1.012 billion.

Also looking ahead, the company has applied for a national bank charter, a move that will take it into the traditional banking industry. The move would bring the lender under the auspices of the Federal Deposit Insurance Corporation, a plus for account holders. SoFi management has indicated that its charter application is in line with regulatory expectations.

A finance company with sound underwriting and bright prospects, working in an environment flush with cash, is sure to attract investors – and Soros bought in heavily. He opened his position at 177,500 shares, valued at $3.22 million given current prices.

Wall Street, like Soros, sees plenty to appreciate here. Rosenblatt analyst Sean Horgan says, “We continue to be buyers on SOFI here." His Buy rating is backed by a $30 price target indicating his confidence in a one-year upside of 65%. (To watch Horgan’s track record, click here)

Looking at the company's latest earnings, the analyst highlights several positive developments: "1) Digital influencer partnerships led to 400mn impressions and 775k engagements with SOFI content, and SOFI's TikTok campaign drove more than 8bn views and more than 1mn uses of SOFI's branded hashtag #SoFiMoneyMoves; 2) 18% of member growth (up from 3% in 2Q) was driven by the successful launch of SOFI's new and enhanced referral programs, including 'Refer the App'; 3) 73% of cross buying was driven by money/invest members (85% including relay); 4) Galileo accounts totaled 88.9mn (80%y/y) vs. consensus of 85.1mn; 5) the lending segment adj. revenue hit a record of $215mn,which was driven by growth in SOFI's personal loan business originations (+167% y/y to$1.6bn); 6) total members grew 96% y/y to 2.9mn in 3Q21."

Once again, we’re looking at a Strong Buy stock, with the Buys outweighing the Holds by a 5 to 1 margin. The shares have a current trading price of $18.11 and an average price target of $26.33, indicative of a ~46% one-year upside. (See SOFI stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

<<<

>>> Never Mind Tesla CEO Elon Musk’s Stock Sales. Look What Microsoft’s CEO Just Did.

Barron's

By Al Root

Nov. 30, 2021

https://www.barrons.com/articles/microsoft-ceo-stock-sale-tesla-elon-musk-51638284642

A lot has been made of Tesla CEO Elon Musk’s stock sales, but Microsoft CEO Satya Nadella recently sold a chunk of stock that is a much larger portion of his total holdings.

Nadella sold about half his stake in Microsoft (ticker: MSFT), according to recent filings with the Securities and Exchange Commission. The CEO unloaded 838,584 shares on Nov. 22 and 23, netting him about $285 million. He has about 831,000 Microsoft shares left, worth roughly $280 million.

“Satya sold approximately 840,000 shares of his holdings of Microsoft stock for personal financial planning and diversification reasons,” a Microsoft spokesperson told Barron’s in an emailed statement. “He is committed to the continued success of the company and his holdings significantly exceed the holding requirements set by the Microsoft Board of Directors.”

Nadella is required to hold stock worth 15 times his base salary. That amounts to about $38 million. Nadella’s salary is $2.5 million. That’s cash compensation.

Planning and diversification are two reasons. Still, investors are left to debate why he might choose to diversify now, or if state or federal capital-gains taxes changes weighed in Nadell’a decision.

Regardless of the details, the sale is significant. It represents a large portion of his total pay and holdings. Nadella’s total reported compensation over the past three years amounts to about $137 million, including more than $93 million worth of stock.

Microsoft doesn’t award stock options any longer. The company has shifted to performance stock awards that are earned when certain time or performance milestones are hit.

He has been CEO since early 2014. Microsoft stock has returned about 35% a year on average since then, while the S&P 500 and Dow Jones Industrial Average have returned about 16% and 14% a year on average, respectively, over the same span.

The Nadella sales take the CEO pay-and-taxation spotlight away from Musk for the moment. Musk started selling Tesla stock after asking Twitter (TWTR) followers if he should sell 10% of his holdings to accelerate paying taxes on unrealized capital gains. Twitter voted yes and the sales commenced.

Musk has sold about 8.6 million shares worth $9.2 billion in recent weeks. He appears to be about half way through the 10% sale his Twitter followers voted for. It’s hard to say exactly, however. Some sales have been stock received as Musk has exercised stock options, while other sales have been from his existing holdings.

Most of Musk’s pay comes in the form of management stock options. Musk, excluding his options, owns about 17% of Tesla stock. Nadella owns about 0.01% of Microsoft stock outstanding.

Microsoft shares aren’t doing much in response to the news. Shares were 1.4% lower in late trading Tuesday, while the S&P 500 and Dow were down about 1.3% and 1.4%, respectively.

<<<

>>> Investor Ackman says U.S. facing 'classic bubble' fueled by Fed's easy money policy

Reuters

November 18, 2021

By Svea Herbst-Bayliss

https://finance.yahoo.com/news/investor-ackman-says-u-facing-173150771.html

(Reuters) - Investor William Ackman, whose views are widely watched on Wall Street, said on Thursday that the U.S. central bank's ultra-easy monetary policy has created a "classic bubble" and that he thinks the Federal Reserve will need to tighten rates more quickly to fight inflation.

"We are in a classic bubble which has been driven by the Fed," Ackman, who runs hedge fund Pershing Square Capital Management, said at a conference sponsored by S&P Global Ratings.

Ackman was speaking days after the government announced that U.S. consumer prices in October surged 6.2% over the last 12 months, outpacing many economists' forecasts.

"Every indicator is flashing red," Ackman said, citing surging prices in real estate, the art market and the stock market.

He called inflation the biggest risk for his hedge fund this year and said he expects the central bank will have to raise rates soon, echoing warnings he made on Twitter several weeks ago.

"I think the Fed will be forced to tighten much more quickly," Ackman said, adding that he does not see much reason to keep interest rates at their current low levels, arguing that easy monetary policy was not bringing people back into the workforce.

He also said higher prices are being fueled by structural changes and that recent increases may not be transitory, as some policy makers, economists and many corporations have said.

ESG initiatives, including a switch to cleaner energy and demands for higher wages, are here to stay and are costly, Ackman said, noting they will fuel higher prices for some time.

Ackman said on Twitter last month that he had been invited to give a presentation to the Federal Reserve Bank of New York to share his views on inflation and that he said policy makers should "taper immediately and begin raising rates as soon as possible."

He said again on Thursday that he has hedged his portfolio, fearing higher rates could negatively impact the hedge fund's long-only equity portfolio. Ackman's Pershing Square Holdings Fund has returned 26.1% since January after a 70.2% gain last year.

<<<

>>> Gladstone Land Corporation (LAND) Q3 2021 Earnings Call Transcript

LAND earnings call for the period ending September 30, 2021.

Motley Fool

Gladstone Land Corporation (NASDAQ:LAND)

Q3 2021 Earnings Call

Nov 10, 2021, 8:30 a.m. ET

https://www.fool.com/earnings/call-transcripts/2021/11/10/gladstone-land-corporation-land-q3-2021-earnings-c/?source=eptyholnk0000202&utm_source=yahoo-host&utm_medium=feed&utm_campaign=article

Contents:

Prepared Remarks

Questions and Answers

Call Participants

Prepared Remarks:

Operator

Greetings, and welcome to Gladstone Land Third Quarter Earnings Call. [Operator Instructions]. A question-and-answer session will follow the formal presentation. [Operator Instructions].

I would now like to turn the conference over to your host, David Gladstone, Chief Executive Officer and President. Thank you. You may begin.

David J. Gladstone -- Chairman, Chief Executive Officer and President

Well, thank you for that nice introduction. This is David Gladstone, and welcome to the quarterly conference call for Gladstone Land. And again, thank you all for calling in today. We appreciate you take time out of your day to listen to our presentation. We're first going to start with Erich. Erich Hellmold is in the office today for Michael LiCalsi. Erich is our Deputy General Counsel, and he is also the -- one of the big guns in administration side of our business and that's the administrator for all the Gladstone funds. Erich, why don't you start?

Erich Hellmold -- Deputy General Counsel

Thanks, David, and good morning. Today's report may include forward-looking statements under the Securities Act of 1933 and the Securities Exchange Act of 1934, including those regarding our future performance. These forward-looking statements involve certain risks and uncertainties that are based upon our current plans, which we believe to be reasonable.

Many factors may cause our actual results to be materially different from any future results expressed or implied by these forward-looking statements, including all risk factors in our Forms 10-K and other documents we file with the SEC. Those can be found on our website, www.gladstoneland.com, specifically the Investor's page or on the SEC's website at www.sec.gov. We undertake no obligation to publicly update or revise any of these forward-looking statements whether as a result of new information, future events or otherwise, except as required by law.

Today we will discuss FFO, which is Funds From Operations. FFO is a non-GAAP accounting term defined as net income excluding the gains or losses from the sale of real estate and any impairment losses from property, plus depreciation and amortization of real estate assets. We will also discuss core FFO, which we generally define as FFO adjusted for certain non-recurring revenues and expenses, and adjusted FFO which further adjusts core FFO for certain non-cash items, such as converting GAAP rents to normalized cash rents. We believe these are better indications of our operating results and allow better comparability of our period-over-period performance.

Please take the opportunity to visit our website, www.gladstoneland.com, and sign up for our email notification service, so you can stay up to date on the Company. You can also find us on Facebook, keyword-The Gladstone Companies, and we have our own Twitter handle @GladstoneComps.

Today's call is an overview of our results, so we ask you to review our press release and Form 10-Q, both issued yesterday for more detailed information. Again, those can be found on the Investors page of our website.

Now, I'll turn the presentation back to David Gladstone.

David J. Gladstone -- Chairman, Chief Executive Officer and President

All right. Thank you, Erich. I always start with a brief recap of the current farmland holdings. We currently own about 108,000 acres on 160 farms and about 45,000 acre-feet of banked water. All those together total about $1.4 billion in assets that we own. Our farms are located in 14 different states, and more importantly in 28 different growing regions, and our farms continue to be 100% occupied and are leased to 82 different tenant farmers, all of whom are unrelated to us. And the tenants on these farms are growing over 60 different types of crops.

Given the number of different growing regions, tenants, types of crops, our farms -- on our farms, we think this is sufficient diversification to provide for safety and security of the cash flows coming from the rents. And we believe this diversification helps protect the dividends that we're paying to our preferred as well as our common shareholders. There are no guarantees in this world, anything can happen in this life. But right now, we're feeling pretty good about getting the money in from rents and paying it out as dividends.

We had another strong quarter from the acquisition standpoint and we continued to see a decent number of buying opportunities come our way. And in the fourth quarter, we've gotten off to a nice start. We still have a few farms that we're working on to close before the end of the year. Hopefully, we'll get them all done. It has been kind of a slow year in terms of the pandemic has kept people out of the office and that always slows things down.

We continue to be able to renew all the expiring leases without incurring any downtime on any of our farms and notable increase in these renewals reflects the positive trends in all the rental rates that we're currently seeing in many regions.

Overall operations on our farms remained strong and demand for products that are grown in most of our farms remains relatively strong. And these are products like berries and vegetables and nuts. And as anybody who goes to the grocery store these days, tell you, there are many of these types of food that continue to increase in price and that's good for our farmers and good for us long-term.

During the third quarter, the team acquired five farms, 5,000 acre-feet of banked water for total price of about $62 million. In addition, right after the quarter-end, we acquired two more farms, approximately 2,000 more acre-feet of banked water or total about $46 million. So we have new investments of about $108,000 -- $108 million from last time.

Overall, initial net cash yield to us on these are about 5.5%. In addition, all the leases on these farms contain certain provisions such as participation rents or annual escalations that should push that figure higher as we go forward in the future. As a reminder, this banked water is water that we own, but is stored in a local water district. We can use the water that's in these districts on the farmland located in Kern County that sub-basin where the water is, where we have several farms and we can sell it to a third-party, or we can use it on our farms.

Our plan is to hold the water to keep as a safeguard for our own assets in the region. Currently, we are not using any of it. We're using the water that we have from the wells that we have on the farms in the past. They say they have not used any of it, they kept buying a little bit. So when it came time to sell, they wanted to sell us the same insurance for water that we have in these wells. All of our farms currently have enough water, but we like the security of having extra water.

On the leasing front, since the beginning of the third quarter, we executed ten lease renewals on properties located in California, Colorado, Florida and Michigan.

Overall, these lease renewals are expected to result in an increase in annual net operating income of about $227,000 or about 8% over the prior leases that we had. Looking ahead, we only have three leases scheduled to expire in the next six months that make up less than 2% of our total annualized lease revenue. We are in discussion with the existing tenants on these farms, as well as some potential new tenants and we aren't expecting any downturn -- downtime on these farms.

Overall, we continue to expect the new leases on these farms to be relatively flat from where they are today. There are few other items I'd like to touch on before we move on. The first one is going -- the ongoing drought in the West, despite some recent record-breaking rainfall parts of California. Certainly in Oregon and Washington, they've gotten a good amount of water down on the farms, but they also have gotten many feet of snow in the mountains, and when that snow melts, it feeds all the farms in the valley. However, all our properties continued to be in a position where there is currently ample water to complete both the current crop and next year's crop. Where we have farms located in water districts, those districts have stored water or other supplemental sources that cover our farms for the short-term.

Almost all of the farms out West have well sites and most of them rely on groundwater as their main source of the irrigation. For these properties, we are seeing a typical seasonal dropping of the water table levels, and we haven't had any, of course, that have gone dry. And all of our farms currently have pumping capacity to cover their crop needs.

One thing you should know is that wet and dry weather cycles are the norm out West. Those of you here in the Midwest or in the South, this is something that you would know how to handle most likely, but it's very difficult in the West, especially California. Throughout any long-term investment, we know that we're going to have both drought periods and wet periods. So when we underwrite a potential investment out West, we look for properties with multiple sources of water, we build in drought scenarios in our projections, and we also take into account potential government regulations because sometimes they just come in and say we'd like you to pump 25% less water out of the ground. We've done that and we've done a good job keeping the government happy with our water.