Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

mkaiz, did you sell your ILNS for the loss on taxes?

Cerevel Therapeutics will get Alzheimer drugs from PFE. BAPINEUZUMAB and Ponezumab are covered by ILNS patent and licensed to

Pfe.

Michael Jesselson SEC history, ILNS STOCK, ALPHA CAP. MAZA AND HONIG

https://www.nytimes.com/1987/03/12/business/merrill-lynch-official-named-in-4-million-insider-scheme.html

When financier Barry C. Honig was waging a proxy fight for control of the company that became Riot Blockchain Inc. (NASDAQ: RIOT), he demanded that it return excess capital to shareholders through a special dividend.

But once Honig and his allies took over in March 2017, they did exactly the opposite. The Colorado-based company, then known as Bioptix Inc., raised an additional $7 million last spring through two private placements. Honig, his business partners, and other associates bought nearly all of the stock, warrants and convertible notes sold in those deals, which were priced at a 30 percent discount to the market.

By the second week of October, they had turned those securities into 4.7 million common shares. That stock, combined with earlier purchases, gave them nearly two-thirds of the company, on a fully diluted basis.

Only then did Riot Blockchain pay the special dividend, distributing $1 per share or share equivalent, or a little less than $10 million. And in the six weeks that followed, the company’s stock price nearly tripled, as deals with two bitcoin-related businesses in which Honig and his associates had undisclosed stakes attracted investors who were seeking cryptocurrency plays. When Riot Blockchain’s stock hit $24 on the day after Thanksgiving, the shares issued through the April placement were worth more than $100 million.

A Securities and Exchange Commission filing from April shows that Honig sold nearly all of his Riot Blockchain shares in October and November, collecting more than $17 million. He failed to promptly report those sales, as required under SEC rules for non-passive investors who own 5 percent or more of a company’s stock.

Our investigation found that three Honig associates – his brother, Jonathan Honig, and longtime partners Mark E. Groussman and John R. Stetson – likely sold more than $20 million of Riot Blockchain stock from October to January. Its shares peaked at $46.20 in December, then came crashing back to earth. They now trade for less than $4. The company is dangerously low on cash and the SEC is conducting a formal investigation.

riot-blockchain-stock-sales-chart-1024x480.png

Riot Blockchain stock sales chart

As Sharesleuth reported in July, it appears that the group’s activities at Riot Blockchain, PolarityTE Inc. (NASDAQ: PTE), (formerly COOL) and Marathon Patent Group Inc. (NASDAQ: MARA) were part of a broader web of questionable dealings.

On Sept. 7, the SEC brought fraud charges against Barry Honig, Groussman, Stetson and 17 others individuals and entities, including John R. O’Rourke III, another longtime associate who was chairman and chief executive of Riot Blockchain.

The SEC alleged that the defendants participated in so-called “pump and dump” schemes at three other companies:

– BioZone Pharmaceuticals Inc., now Cocrystal Pharma Inc. (NASDAQ: COCP)

– MGT Capital Investments Inc. (OTC: MGTI)

– Mabvax Therapeutics Holdings Inc. (OTC: MBVX)

According to the SEC’s complaint, those schemes generated more than $27 million.

Stetson was, until Sept. 7, executive vice president and chief investment officer of PolarityTE, a Utah-based biotech company whose predecessor was headed by Honig. Our investigation found that the Honig group’s actions at PolarityTE and before that, Majesco Entertainment Inc., mirrored their moves at Riot Blockchain, right down to private placement-and-special dividend maneuver.

The SEC also brought charges against Dr. Phillip Frost, the billionaire chairman and chief executive of Opko Health Inc. (NASDAQ: OPK), and against Opko itself. It alleged that Frost and Opko were part of an undisclosed “control group” at BioZone and Mabvax, and that they either participated in the group’s wrongful activities or aided and abetted them.

Our analysis of SEC filings showed that Honig and Frost sold more than $20 million of their PolarityTE stock between February 2017 and February 2018, with most of those sales coming in the second half of last year.

Once again, Honig failed to promptly report his sales, as required under SEC rules.

honig-pte-sales-analysis-1024x714.png

Honig PTE Sales Analysis

PolarityTE’s stock rose sharply this spring, going from $18.13 a share at the start of April to a high of $41.22 in late June. During that period, the company raised $88 million in new capital through a pair of stock offerings.

At its peak, PolarityTE had a market capitalization of almost $900 million. The company’s stock has since fallen by almost half, closing at $21.12 on Sept. 25.

PolarityTE’s most recent proxy filing shows that Honig, Frost, Groussman, Stetson and another defendant in the SEC case – Michael H. Brauser – controlled as many as 4.95 million shares as of mid-August.

That stock would have had a market value of $126 million at the time. Even with the decline in the company’s share over the past few months, PolarityTE has the potential to be the Honig group’s biggest score – one that was years in the making.

https://m.benzinga.com/article/12472879?utm_referrer=https%3A%2F%2Fwww.google.com%2F

To continue reading Sharesleuth's investigation, click here.

(Editor’s note: Chris Carey, editor of Sharesleuth.com, does not invest in individual stocks and has no position in any of the companies mentioned in this report. Mark Cuban, owners of Sharesleuth

If you have any other stocks that have a gain when you sell them you won’t have to pay taxes on the gain just use you ilns loss to offset the gain so in the end you don’t lose anything

If you have any other stocks that have a gain when you sell them you won’t have to pay taxes on the gain just use you ilns loss to offset the gain so in the end you don’t lose anything

Yes, this will be SEC's priority. You should have sold n bought lunch instead of being stubborn

Where shares traded today . Thought they were suspended?

Every shareholder should contact sec to put pressure on it!

Scammers stole your money!

Nancy Brown is one contact person

BrownN@sec.gov

https://www.sec.gov/news/press-release/2018-182

So what does this mean for us, are we just straight screwed?

About taubiologic

TAU BIO LOGIC

PRECISION IMMUNOTHERAPY TARGETING ALZHEIMER'S DISEASE

WHO WE ARE

Commitment to Innovation

TAU BIO-LOGIC CORP. is a privately held biopharmaceutical company focused on the development of innovative high precision immunotherapies for the treatment of Alzheimer’s disease and related neurodegenerative conditions. The Company was established to accelerate the development of its lead compound, TBL-100 which has been shown in preclinical models to block the toxicity and propagation of tau pathology in nerve cells while avoiding the potential (inherent in other competitive molecules), to further disrupt cellular architecture. TAU BIO-LOGIC is investing in the optimization of TBL-100 to demonstrate safety, efficacy and dosing advantages versus competitors.while advancing the program toward the initiation of clinical trials in Alzheimer's patients. .

Our company is led by Daniel G. Chain, PhD, who is the inventor of the patents underlying TBL-100. Dr. Chain is a seasoned biotechnology executive and scientist entrepreneur dedicated to the development of therapeutics for the treatment of Alzheimer’s and other neurodegenerative diseases. For 20 years, he has established and managed companies in the neurodegeneration field, and his patented innovations helped enable the development of several monoclonal antibodies tested in late stage clinical trials for Alzheimer’s disease and related indications by global pharmaceutical companies. In addition, Dr. Chain spearheaded the development of a metal binding antioxidant clinical-stage compound currently under development for Friedreich’s Ataxia by Intellect Neurosciences, and a first-in-class clinical stage small molecule compound, itanapraced (CSP-1103), being developed for Parkinson’s disease and other indications by CereSpir Incorporated where Dr. Chain is also engaged. Dr. Chain trained as a biochemist and molecular neurobiologist having obtained his PhD from the Weizmann Institute of Sciences in Israel and subsequently trained as a researcher at Columbia College of Physicians and Surgeons in New York.

Alzheimer's Disease

Alzheimer’s disease (AD) is the most common cause of dementia and represents an enormous and growing global public health challenge. It is a uniformly fatal neurodegenerative disorder with no cure or substantially effective treatment. Alzheimer’s Disease International estimated that as of 2013, 44 million people had dementia worldwide, a figure which is expected to increase to 76 million people in 2030 and 136 million in 2050 because of the aging of societies globally (Alzheimer’s Disease International 2013). In the United States, the prevalence of AD in 2015 is estimated at 5 million people, a number which is anticipated to increase to 7 million in 2025 and to 14 million by 2050 (Alzheimer’s Association 2015). AD is a strongly age-associated disorder with onset mainly in later life; the great majority of individuals with the condition are over 65 years of age. Within the older adult population, the prevalence of AD increases dramatically from the sixth through the ninth decade; approximately one-third of individuals with AD currently are 85 years of age or older.

The estimated worldwide cost of dementia was a staggering $604 billion in 2010, with about 70% of the costs being incurred in Western Europe and North America (Alzheimer’s Disease International 2013). In view of the aforementioned epidemiologic trends, massive increases in costs associated with AD are anticipated globally in coming decades if no medical breakthroughs to prevent or cure the disease are developed.

AD is characterized clinically by progressive cognitive impairment, typically beginning as short-term memory impairment, but also notable for executive function deficits, sometimes early behavioral disturbances, and occasionally visuospatial impairment. Over time, the cognitive impairment worsens and affects activities of daily living (ADL). Initially, complex instrumental activities of daily living are impaired, and later, in dementia, basic activities of daily living are lost. The time course is lengthy, with the dementia stage alone often spanning more than a decade. Not only does the disease have a devastating impact on the quality of life for subjects and cause tremendous expense for society, but the protracted course of functional incapacity causes a terrible burden to caregivers, who are also typically elderly, and to other family members and loved ones.

Tau is the major constituent of neurofibrillary tangles, the hallmark pathological lesion that characterizes several diseases collectively referred to as tauopathies including AD which is also characterized by the common occurrence of plaque containing a different protein known as beta amyloid. It is increasingly evident that these two proteins act synergistically to promote pathology. Under disease conditions, tau protein is cleaved by enzymes to yield various fragments. TauC3 is a low abundance but highly noxious, secreted, C-terminally truncated tau fragment ending at aspartate 421. TauC3-induced neurotoxicity has been observed by many scientists with evidence that it may compromise neurons early in the disease and and be responsible for the spread of AD pathologythrough different regions of the brain.

TBL-100

TBL-100 is a very high affinity monoclonal antibody that specifically targets tauC3. Recently published results from cell culture experiments conducted by Harvard University, demonstrate that TBL-100 can block tau uptake and seeding of tau aggregation by brain tissue extracts from Alzheimer’s patients, indicating that it has the potential to prevent propagation of tau. Additionally,experiments conducted by UC Irvine, demonstrate that TBL-100 can engage its target intracellularly and reduce phosphorylation at select epitopes associated with pre-tangle tau pathology compatible with a possible intracellular locus of action of the antibody.

CONTACT US

Send Message

Name

Email*

Message

SEND

TAU BIO-LOGIC CORP.

41 Madison Avenue, 31st Floor, New York, NY 10010

(718) 406-1331

Copyright © 2017 TAU BIO-LOGIC CORP. - All Rights Reserved.

Powered by GoDaddy GoCentral Website Builder

HONIG, MAZA, Jesselson,Chain and Intellect Neurosciences

SEC Orders Hearings On Registration Suspension Or Revocation Against Intellect Neurosciences, Inc. For Failure To Make Required Periodic Filings

Sep 18 18

Securities and Exchange Commission (SEC or the commission) instituted public administrative proceeding to determine whether to revoke or suspend for a period not exceeding twelve months the registration of each class of the securities of Intellect Neurosciences, Inc. for failure to make required periodic filings with the Commission. In this Order, the Division of Enforcement (Division) alleges that the company was delinquent in its required periodic filings with the Commission. In this proceeding, instituted pursuant to Exchange Act Section 12(j), a hearing will be scheduled before an Administrative Law Judge. At the hearing, the judge will hear evidence from the Division and the company to determine whether the allegations of the Division contained in the Order, which the Division alleges constitute failures to comply with Exchange Act Section 13(a) and Rules 13a-1 and 13a-13 there under, are true. The judge in the proceeding will then determine whether the registrations pursuant to Exchange Act Section 12 of each class of the securities of the company should be revoked or suspended for a period not exceeding twelve months. The Commission ordered that the Administrative Law Judge in this proceeding issue an initial decision not later than 120 days from the date of service of the order instituting proceeding.

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=32390485

Dr. CHAIN took tauc3 patent after positiv results

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5439699/

Funding Statement

This work was supported by a sponsored research agreement from Intellect Neurosciences INC (http://www.intellectns.com/). Intellect Neurosciences also provided the anti-TauC3 antibody. Intellect Neurosciences had no role in study design, data collection and analysis, or preparation of the manuscript. They did approve the manuscript to be published. The Massachusetts Alzheimer Disease Research Center Brain Bank provided tissue samples (P50AG005134).

No announcement from ILNS!

TAUC3 patent and Dr. CHAIN private taubiologic corp.

Inventor G Chain Daniel Current Assignee Tau Bio-Logic Corp Original Assignee Intellect Neurosciences Inc

https://patents.google.com/patent/US20160122422

https://taubiologic.com/

Jesselson invested in ILNS and Cerespir

http://google.brand.edgar-online.com/displayfilinginfo.aspx?FilingID=11151859-2047-23224&type=sect&TabIndex=2&companyid=685048&ppu=%252fdefault.aspx%253fsym%253dILNS

https://www.sec.gov/Archives/edgar/data/1683746/000168374616000001/xslFormDX01/primary_doc.xml

Reason?

https://www.sec.gov/Archives/edgar/data/1337905/000114420413027571/v344594_ex99-1.htm

http://google.brand.edgar-online.com/?sym=ILNS

SEC INVESTIGATION

Google: foia ibl intellect neurosciences sec

Dr. CHAIN took tauc3 patent after positiv results

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5439699/

Funding Statement

This work was supported by a sponsored research agreement from Intellect Neurosciences INC (http://www.intellectns.com/). Intellect Neurosciences also provided the anti-TauC3 antibody. Intellect Neurosciences had no role in study design, data collection and analysis, or preparation of the manuscript. They did approve the manuscript to be published. The Massachusetts Alzheimer Disease Research Center Brain Bank provided tissue samples (P50AG005134).

No announcement from ILNS!

TAUC3 patent and Dr. CHAIN private taubiologic corp.

Inventor G Chain Daniel Current Assignee Tau Bio-Logic Corp Original Assignee Intellect Neurosciences Inc

https://patents.google.com/patent/US20160122422

https://taubiologic.com/

Jesselson invested in ILNS and Cerespir

http://google.brand.edgar-online.com/displayfilinginfo.aspx?FilingID=11151859-2047-23224&type=sect&TabIndex=2&companyid=685048&ppu=%252fdefault.aspx%253fsym%253dILNS

https://www.sec.gov/Archives/edgar/data/1683746/000168374616000001/xslFormDX01/primary_doc.xml

Reason?

https://www.sec.gov/Archives/edgar/data/1337905/000114420413027571/v344594_ex99-1.htm

http://google.brand.edgar-online.com/?sym=ILNS

SEC Orders Hearings On Registration Suspension Or Revocation Against Intellect Neurosciences, Inc. For Failure To Make Required Periodic Filings

Sep 18 18

Securities and Exchange Commission (SEC or the commission) instituted public administrative proceeding to determine whether to revoke or suspend for a period not exceeding twelve months the registration of each class of the securities of Intellect Neurosciences, Inc. for failure to make required periodic filings with the Commission. In this Order, the Division of Enforcement (Division) alleges that the company was delinquent in its required periodic filings with the Commission. In this proceeding, instituted pursuant to Exchange Act Section 12(j), a hearing will be scheduled before an Administrative Law Judge. At the hearing, the judge will hear evidence from the Division and the company to determine whether the allegations of the Division contained in the Order, which the Division alleges constitute failures to comply with Exchange Act Section 13(a) and Rules 13a-1 and 13a-13 there under, are true. The judge in the proceeding will then determine whether the registrations pursuant to Exchange Act Section 12 of each class of the securities of the company should be revoked or suspended for a period not exceeding twelve months. The Commission ordered that the Administrative Law Judge in this proceeding issue an initial decision not later than 120 days from the date of service of the order instituting proceeding.

https://www.bloomberg.com/research/stocks/private/snapshot.asp?privcapId=32390485

Frost made 1.1 million off this? The guy must have lost his marbles or be ticked off that he got burned for such a small amount for a guy that’s supposed to be worth a couple bill. It’s going to cost him close to a mill in legal fees.

I wonder how/why Chain was pushed out. Clearly, he was moved out because they wanted control, but it’d be interesting to see the circumstances and now we know why the Pfizer lawsuit was dropped.

Hope no one lost a lot here.

Honig is a real piece of excrement.

https://www.wsj.com/articles/investor-who-rode-pivot-from-biotech-to-bitcoin-sells-big-stake-1517403600

Investors have had nothing but time and a plethora of negative information to unload this stock well in advance of its inevitable demise. For those who weren't sophisticated enough to see the obvious writing on the wall (the company even failing to produce financial filings), well that's too bad, but the fault lies squarely in the lap of those unsophisticated people.

Here is some help moving forward.

There should be an investigation by sec and fbi

The SEC just suspended my stock! Now what?

It happens to almost all penny players. One morning you wake up, grab some coffee, and start checking your stocks, especially that very volatile issue that's been running big. Pre-market Level II is looking good. If all goes well, perhaps today will be the day to take some profit. And then at 9:30, you see something like this:

Level II goes blank. Your heart sinks. If you've had this experience before, you know to go to the SEC website, where your fears are confirmed. Trading has been suspended.

If you're new to the penny arena, you may not have any idea what's going on, so instead you'll go to a message board and try to figure things out. There, you'll probably read conflicting opinions; some will even be reassuring. Pay no attention. Trading suspensions are very bad things. You need to understand what has occurred, and what will occur.

Continued.

http://promotionstocksecrets.com/the-sec-just-suspended-my-stock-now-what/

Now you can load up.

I'm not sure what, if any, legal options investors may have.

We should be able to sue him. Or the company for being deralic of his duttys

The suspension was not a surprise. SEC reporting companies can't just stop reporting. Maza just left shareholders out to dry.

There should be an investigation by sec and fbi

The SEC. A.L.J. can move expeditiously or they can take their sweet time in revoking registrations. For sure though, ILNS will not get off the Grey Market and the company will absolutely have its stock registration(s) revoked.

What time frame are we talking about for the "thereafter" Renee?

but the SEC Admin Law Judge will thereafter revoke Intellect Neurosciences Inc.

Yes, Grey Market first, but the SEC Admin Law Judge will thereafter revoke Intellect Neurosciences Inc. stock registration and the stock will cease trading alltogether.

Thanks Renee- Buh bye ILNS, off to the grey sheet trash heap.

https://www.otcmarkets.com/stock/ILNS/overview

ILNS SEC Suspension for severely delinquent Financials/Filings:

ILNS SEC Suspension for severely delinquent Financials/Filings:

https://www.sec.gov/litigation/suspensions/2018/34-84172.pdf

Order:

https://www.sec.gov/litigation/suspensions/2018/34-84172-o.pdf

Admin. Proceeding:

https://www.sec.gov/litigation/admin/2018/34-84171.pdf

How come I see those 2 and all I think of is 2 goofs who couldn’t get laid in a whorehouse with a fistful of fifties? I guess that’s why they needed to scam, so they could have thousands for the whorehouses. What a bunch of tools. Too dumb to make money legitimately and too dumb to cover their tracks - jackasses.

I checked Maza’s “credentials” awhile back. The scumbag never had a license as an attorney or CPA in any of the States he said he did. And knowing that, there is NO freaking way he worked for “Sullivan & Cromwell” or as a partner at “Ernst & Young.”

They’ll plead it out, claim poverty, and then work on their next scam anyway, while they have the funds buried somewhere. I bet they get no jail time either.

The one thing I’d like to know is what happened with the Pfizer lawsuit, so that they threw in the towel. My guess is that they buried Maza, which if you read the filings, they did reference how insiders were referencing Pfizer despite the NDA. These guys are sociopaths.

Oh well, win some, lose some. Hope nobody here got hammered on it, though.

300 Take (or I am taking) the price down so I can load shares

Great screwed again! Oh I mean screwed some more. Boy I'm getting pretty sore. Scum bags

He should be in prison a long time ago

And Elliot! Now you know why he "left" the other companies. Lol

Barry in the news....SEC Charges Microcap Fraudsters for Roles in Lucrative Market Manipulation Schemes... Google it

It sounds like one man show?? It also seems to be ready for BO ??????

Dr. Maza served as the Chairman of the Board of Directors and Chief Executive Officer of Intellect Neurosciences, Inc. since July 2014 until September 2017 and also serves as it's Chief Financial Officer from May 2006.

https://www.bloomberg.com/research/stocks/people/person.asp?personId=8294489&privcapId=327199821

Conjugated mab and AD

https://labiotech.eu/medical/alzheimers-disease-antibody-f-star/

Our mission, for every European Antibody Congress, is to bring you the very best speakers from big pharma, biotechs, academia and technology innovators to discuss with you the most exciting breakthroughs when it comes to the discovery and development of antibodies. Whether that’s the newest format of a cancer killing ADC, the most advanced screening technology for mAbs, or the clinical development of a bispecific with promises to treat Alzheimer’s disease, we want to give you access to all of this to grow your knowledge, grow your business, and grow your connections.

https://www.terrapinn.com/template/Live/go/9834/0?&utm_source=terrapinn&utm_campaign=listing&utm_medium=link&utm_term=AF

|

Followers

|

166

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

20775

|

|

Created

|

10/14/08

|

Type

|

Free

|

| Moderators | |||

In 2011, we granted an exclusive license to ViroPharma Inc. (now part of Shire plc) covering use of our drug candidate, “OX1” (renamed by Shire as SHP622), and certain of our licensed patents and patent applications related to OX1. Shire is developing SHP622 for the treatment of Friedreich’s Ataxia (“FA”). This drug candidate is a naturally occurring small molecular weight compound (indole-3-propionic acid) that prevents oxidative stress by a combination of hydroxyl radical scavenging activity and metal chelation.

Phase 1 studies in healthy adults were completed in 2010. The drug was found to be generally well tolerated, and the pharmacokinetics revealed that the drug was rapidly absorbed and distributed in the body after oral administration.

Recently, Shire completed a Phase 1b trial to evaluate the safety, tolerability, pharmacokinetics, and pharmacodynamics of SHP622 in 55 adults with FA. SHP622 was generally safe and well tolerated when administered as single and multiple ascending doses. There were no severe treatment emergent adverse events (“TEAEs”) or deaths reported in either the single or multiple dose groups, and the majority of TEAEs were of mild severity. Overall, there were no clinically meaningful differences between SHP622 and placebo or between the single and multiple dose groups. The mean terminal elimination half-life ranged between 7.36 and 10.33 hours across all dose groups. Inter-subject variability appeared to be low to moderate.

Shire has stated that it will continue to analyze the results from the recently completed study and determine an optimal path forward for this program.

| PHASE 1B SAFETY, TOLERABILITY, PK/PD STUDY OF SHP622 IN ADULTS WITH FA | |

|---|---|

| TRIAL DESIGN | Randomized, Double-blind, Placebo-controlled, Multicenter, Single and Multiple Ascending Dose Studies |

| ARM 1 | Experimental: Single dose of SHP622 or placebo

|

| ARM 2 | Experimental: Multiple doses of SHP622 or placebo

|

| ENROLLMENT | 55 |

| COMPLETION | Last patient was enrolled in June 2015; Formal study report completed in April 2016 |

| PRIMARY OBJECTIVE | Evaluate the safety and tolerability of single and multiple oral doses of SHP622 in subjects with FA |

| SECONDARY OBJECTIVE | Characterize the pharmacokinetics of SHP622 by investigation of the plasma concentration-time profile following single and multiple oral doses |

| EXPLORATORY OBJECTIVE | Investigate the pharmacodynamic effects of SHP622 on plasma 8-isoprostane and malondialdehyde and urinary 8-hydroxydeoxyguanosine concentrations following multiple oral doses |

| RESULTS | SHP622 was generally safe and well tolerated when administered as single and multiple PO doses. There were no severe treatment emergent adverse events (“TEAEs”) or deaths reported in either the single or multiple dose groups, and the majority of TEAEs were of mild severity. |

| NEXT STEPS | Shire is determining the optimal path forward for this drug candidate. |

In 2012, we obtained from Northwestern University an exclusive license to worldwide diagnostic and therapeutic applications of a novel monoclonal antibody targeted to caspase cleaved TauC3.

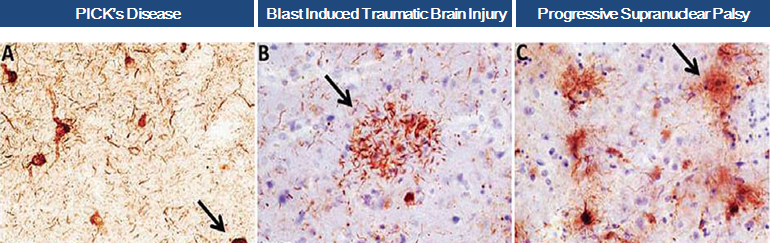

Scientific research and pre-clinical experiments have demonstrated that fragments of Tau protein are present in brains of patients suffering from various neurodegenerative diseases, commonly known as “tauopathies”, and that the truncated form of Tau, known as TauC3, is especially toxic.

We have conducted experiments to demonstrate that caspase cleaved TauC3 is present in models of various tauopathies at a level detectable by our anti-TauC3 antibody and that our anti-TauC3 antibody shows sufficient binding specificity to the target TauC3 protein to indicate that the antibody may be a viable treatment agent.

In 2014, we reported positive top line data from a pre-clinical study conducted on our behalf at UC Irvine showing proof of concept for the antibody in an Alzheimer's disease (AD) mouse model.

In April 2016, we obtained positive data from an in-vitro study conducted on our behalf at Harvard Medical School and the MassGeneral Institute for Neurodegenerative Disease. The experiments demonstrated that our anti-TauC3 antibody significantly blocks TauC3 fragment seeding, aggregation and toxicity, demonstrating that caspase cleaved TauC3 is a potential target for treatment in Progressive Supranuclear Palsy, Traumatic Brain Injury and other tauopathies and that our antibody may be a viable treatment agent.

We are initiating experimental treatment trials of our anti-TauC3 antibody in mouse models of progressive supranuclear palsy (PSP) and traumatic brain injury (TBI). These conditions are rare, “orphan”, neurological diseases of high unmet medical need with no approved therapies.

Scientific evidence has proven that caspase cleaved TauC3 promotes formation of neurofibrillary tangles (NFTs), which are aggregates of hyper-phosphorylated tau found in numerous tauopathies.

Truncation of tau by caspases may occur relatively early in neurodegenerative disease, prior to the key folding steps that lead to the formation of phosphorylated pathological forms of tau. Also, it has been demonstrated that tau truncated at Asp421 (TauC3) aggregates more rapidly and to a greater degree than full-length tau.

Collectively, these studies suggest that the caspase cleavage of tau propagates the formation of NFTs and facilitates filament formation, which are disease- triggering events that are associated with various neurodegenerative conditions, such as Alzheimer’s disease, PSP and TBI.

We are conducting research into the use of antibody drug conjugates (ADCs), as a treatment of amyloidosis and other types of proteinopathies. ADCs chemically combine two different molecules - an antibody and a small molecule - into a single entity. We refer to this approach as “CONJUMAB”.

Our initial ADC candidate, CONJUMAB-A, is designed to combine an amyloid beta monoclonal antibody with a derivative of melatonin, thereby combining the amyloid clearing properties of the antibody with a potent neuroprotectant molecule. The rationale is that the antibody clears the amyloid peptide while the small molecule reduces the neurotoxicity caused by the peptide and provides additional neuroprotective effects to the retina.

CONJUMAB-A is an ideal compound to target amyloid beta in the eye, believed to be the leading cause of Age-Related Macular Degeneration (AMD). CONJUMAB-A would remove this toxic molecule and defend against the presence of free radicals.

We purchased the amyloid beta monoclonal antibody from Immuno-Biological Laboratories Ltd and collaborated with London-based Medical Research Council Technology to create a humanized form, which has the same properties as the original antibody.

CONJUMAB patents are pending worldwide.

The following description of Friedreich’s ataxia (FA) may be found on the website of FARA, the Friedreich’s Ataxia Research Alliance, at wwww.curefa.org.

Friedreich’s ataxia (FA) is a debilitating, life-shortening, degenerative neuro-muscular disorder. Patients suffer progressive degeneration of the central and peripheral nervous systems, which causes impaired motion and gait; diminished vision, hearing and speech; loss of strength and coordination, leading to wheelchair use; increased risk of diabetes; and life-threatening heart complications. About one in 50,000 people in the United States have Friedreich's ataxia.

Most individuals have onset of symptoms of FA between the ages of 5 and 18 years. Adult or late onset FA is less common, <25% of diagnosed individuals, and can occur anytime during adulthood.

FA is an inherited or single gene disorder. Mutations or DNA changes in the FXN gene cause FA.

FA in inherited in an autosomal recessive manner, meaning that individuals with FA have two mutated or abnormal copies of the FXN gene, this means both biological parents must be a carrier of the disease for a child to be affected. It is estimated that 1 in 100 people are carriers, and carriers do not exhibit symptoms of FA. Each such carrier parent has one mutated gene (allele) and one normal gene (allele) in the FXN gene. Because each child gets one of the mother’s genes and one of the father’s genes in this location, there are four possible combinations of the genes passed down to the child or a 25% chance that the child will have FA.

The FA gene mutation limits the production of a protein called frataxin, which is known to be an important protein that functions in the mitochondria (the energy producing factories) of the cell. Frataxin helps to move iron and is involved with the formation of iron-sulfur clusters, which are necessary components in the function of the mitochondria and thus energy production. We also know that specific nerve cells (neurons) degenerate in people with FA, and this is directly manifested in the symptoms of the disease.

Shire is developing SHP622 as a treatment for FA on the basis that SHP622’s radical scavenging activity and metal chelation properties counteract the excess amount of iron in the mitochondria and free radicals in the bodies of FA patients.

There is no FDA approved treatment for FA; at typical orphan drug prices, FA represents a target market with worldwide peak year sales of ~ $1B ($440M-$770M in US and EU alone).

Penetration of the FA market should be rapid because of the significant unmet medical need and lack of competition.

Progressive Supranuclear Palsy (PSP) is a progressive brain disorder that resembles Parkinson’s disease. PSP affects movement, control of walking (gait) and balance, speech, swallowing, vision, mood and behavior, and thinking. Classic signs of the disease are an inability to aim and move the eyes properly and blurring of vision. Symptoms begin on average after age 60 and men are affected more often than women. It is estimated that PSP affects 6 in 100,000 Americans; Incidence 2.8 per 100,000.

The exact cause of PSP is unknown. The symptoms of PSP are caused by a gradual deterioration of brain cells in specific areas in the brain, mainly in the region called the brain stem. The hallmark of the disease, and a possible cause, is the accumulation of abnormal deposits of tau and eventual toxicity in nerve cells in the brain stem. These findings suggest that the use of tau antibody therapeutics, such as such as our anti-TauC3 monoclonal antibody, may be a viable treatment approach.

There is no FDA approved treatment for PSP. No medication is effective in halting the progression of the disease; however, several medications, including dopamine agonists, tricyclic antidepressants, and methysergide, may provide modest symptomatic improvement.

Drugs in development for PSP include: BMS-968168 (Bristol-Myers Squibb) and ABBV-8E12 (AbbVie) both of which are anti-tau antibodies in Phase 1; and several drugs in preclinical stage development.

Traumatic Brain Injury (TBI) is a form of acquired brain injury, which occurs when a sudden trauma causes damage to the brain. Sports-related concussion, which includes chronic traumatic encephalopathy (CTE) is caused by direct impact forces to the head; blast-induced TBI is caused by exposure to blast shock waves.

TBI results from secondary neuronal damage caused by the impact, which leads to progressive neuronal cell death, neural loss, and axonal degeneration in the brain. Symptoms of TBI can be mild, moderate, or severe, depending on the extent of the brain damage. Patients suffer headache, light-headedness, memory loss, confusion, attention deficits, difficulty balancing, aggression, anxiety, depression, etc.

The CDC estimates that TBI affects approximately 1.7 million Americans each year, including approximately 270,000 NFL players and 200,000 war veterans.

There is no FDA approved treatment for TBI; moderately to severely injured patients receive rehabilitation that involves treatment programs in physical therapy, occupational therapy, speech/language therapy, physical medicine, psychology/psychiatry, and social support.

A common feature of TBI related diseases is deposition of the tau protein around cerebral blood vessels in the frontal cortex of the brain. Studies have indicated that military personnel who reported three or more traumatic brain injuries showed high total tau protein concentrations in plasma, in some cases long after the injuries had occurred. These findings are consistent with reports for repetitive head injury in athletes linked to progressive tauopathy, axonal injury and post-concussive disorder symptoms. These findings suggest that the use of tau antibody therapeutics, such as our anti-TauC3 monoclonal antibody, may be a viable treatment approach.

Age-Related Macular Degeneration (AMD) is the leading cause of blindness in elderly people. The global market for AMD is estimated at $4 billion annually.

There are two types of AMD: Wet AMD, characterized by new blood vessel formation; and Dry AMD, with precursor characterized by drusen and atrophic loss of retinal pigment epithelium.

Dry AMD is a large potential market. Approximately 80 percent of patients with AMD have the dry form. Central loss of the macula and underlying retinal pigment epithelium, termed GA, is considered the most severe form of Dry AMD and is responsible for over 20 percent of all cases of legal blindness in North America. There is no approved treatment existing today for Dry AMD.

Evidence from preclinical studies on retinal degeneration demonstrate that combining treatments targeting different components of the amyloid beta formation and aggregation pathway is more effective than monotherapy, indicating that CONJUMAB-A may be an effective treatment agent for Dry AMD.

| Market Value1 | $122,475 | a/o Jul 05, 2016 | |

| Authorized Shares | 2,000,000,000 | a/o Nov 04, 2015 | |

| Outstanding Shares | 5,567,037 | a/o Nov 04, 2015 | |

| -Restricted | Not Available | ||

| -Unrestricted | Not Available | ||

| Held at DTC | Not Available | ||

| Float | 4,717,663 | a/o Nov 04, 2015 | |

| Par Value | Not Available |

Capital Change=shs decreased by 1 for 50 split Pay date=04/12/2011. |

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |