Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

State of delaware is where corporations are put on trial for bankruptcy. the bankruptcy case is closing and this omnibus is pre-trial for a civil case or criminal case. civil case only penalty of found guilty of any wrong doing or fraud is just a fine. whereas in criminal case corporate embezzlement or wire fraud , any conviction is jail in prison with gangsters in prison. hard time. Don't believe the garbage that prisons have tennis courts and recreational activity for inmates.

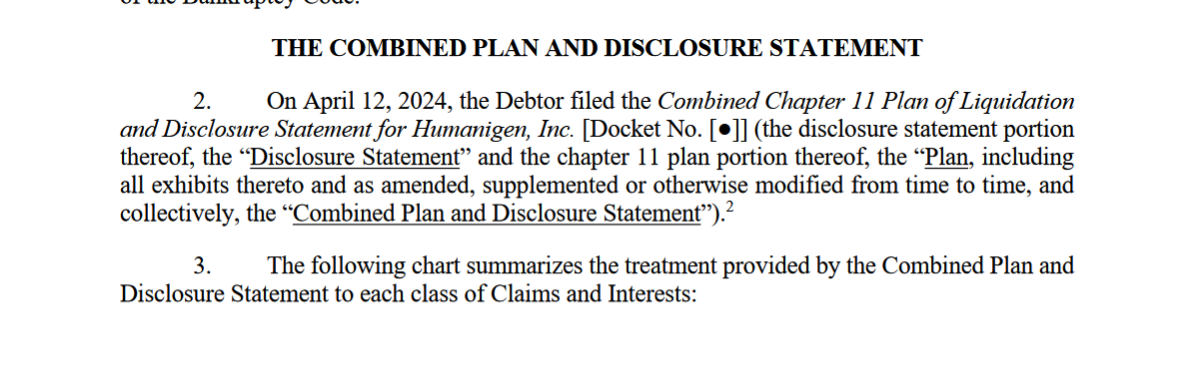

You're very welcome, eb. But my explanation is actually quite sanitized, with an underlying deep and dangerous tale relating to serious criminal activity. I fully understand why management designed our share structure as they did, to mask their accumulation of shares. And I wanted to highlight DJT's experience recalling their loaned shares, to illustrate the importance of excellent news (regulatory approval, restructuring) to add share price momentum to our next recall. I saw some activity that suggests to me that Humanigen could be ready to proceed with executing their game plan. At least, I really hope that's what it means. It could just mean that there is a new normal, which would be fine, if this signals starting our new beginning.

By the way, without the approval of the Emergency Rule Change, the US equity market would have crashed in three days.

Appreciate that explanation, Jay.

why would anyone bid $2 million as stalking bid if the ip patents were worthless. in chapter 7 and chapter 11 in regular business bankruptcy there is no stalking bid. assets are seized by the receiver appointed by the bankruptcy court and auctioned off in an 'OPEN AUCTION' and business is shutdown.

the value of ip or intellectual property is what revenue it can generate. the ip itself has no value if it cannt generate revenue or life of the ip asset. most patents last only 20 years. which is why drugs are so expensive once it's approved. the ip owner has to recoup his cost and expense in developing the 'technology;

as for lenzi it was already making 2.5 million in licensing from just one countrry in australi and was not even approved for commercializiation if the drug was approved for commercialization . global sales can reach 1 billion. so taran got the ip which can possibly generate 1 billion in net cash for nothing.

the entity that owns taran or the controlling shareholder is probably the same entity that owns hgenq or the controlling shareholder of hgenq. which is how taran bough the lenzi ip patents for nothing or free because nobody gives something for nothing 🤑

why is there still 4 employees still on the payroll? in regulator chapter 11 or chapter 7, everybody is fired and an insolvency accounting bankruptcy firm takes control of the company books. and bankruptcy is easily completed. with no objections

Based on what I know, these .047/share settlement was before the chapter 11 petition. and the objections by the equity of the debtors didn't get paid for the .047/share settlement and the law firm probably may not have received the $3 million which was settled. hence the equity debtors. these were probably the equity interest who filed to the get .047/share claim as shareholders. in the lawsuit. but since there is no money after liquidation and dissolution of the hgenq corporation, what is the point of the omnibus hearing.?

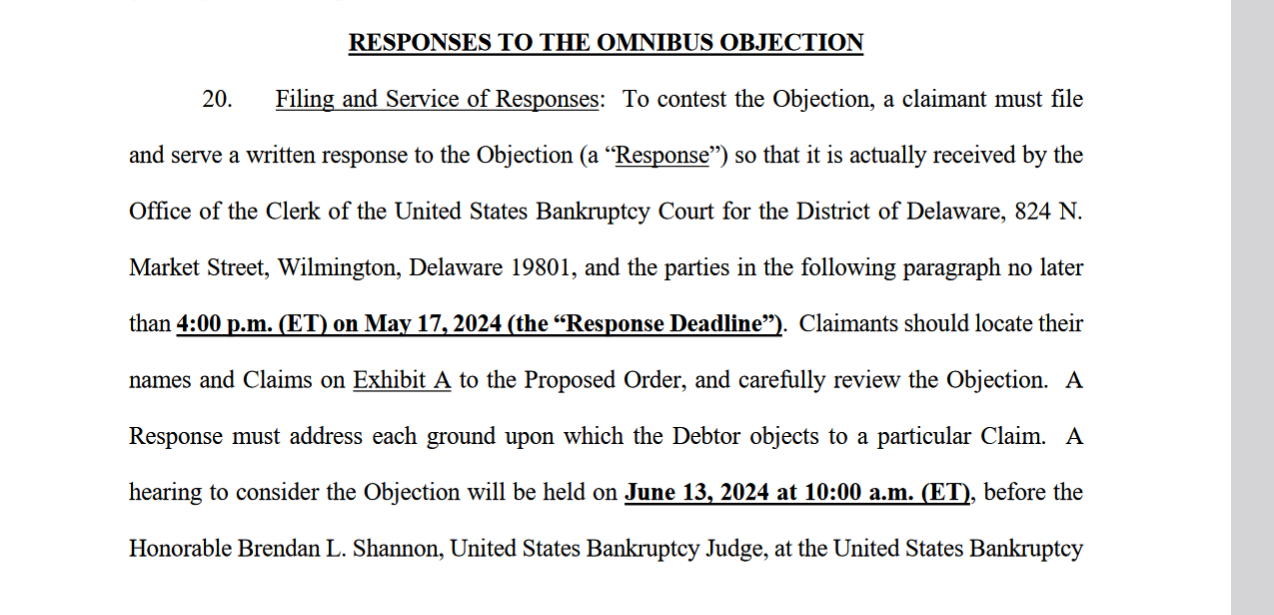

Ominbus hearing on June 13. Omnibus hearing is pre-trial to determine if there is enough evidence for criminal trial. didn't know there were that many small peon shareholders who object to this sham chapter 11 robbery of assets. Most had less than $5000 invested in this stock scam, the biggest and few had over $25,000 and thought it was a legit investment opportunity and invested over $50,000 in this stock fraud operation like the hundreds of other listed stocks. Lenzi is a real asset but the chapter 11 petition was the scheme and the plan. to embezzle assets with fake creditor 'disputed' claims.

Who does Henry work for. he is just an employee. why are the 4 employees not fired and still getting paid $20,000/month for doing nothing.

There is no business to manage. you don't need the board of directors, no ceo nor you need any CFO. the company is done.

One of Sanofi's three new independent Directors is John Sundy. "Between 2014 and 2021, he held several management positions including Senior Vice President at Gilead Sciences..."

https://www.sanofi.com/en/media-room/press-releases/2024/2024-02-22-18-02-50-2833994

Sundy's tenure at Gilead was during the time of our collaboration with them.

"Kite and Humanigen Announce Clinical Collaboration to Evaluate Investigational Combination of Yescarta® (Axicabtagene Ciloleucel) with Lenzilumab in Relapsed/Refractory Diffuse Large B-Cell Lymphoma

-- Phase 1/2 Multi-Center Clinical Trial to Begin Enrolling in Q4 2019 --

The objective of this study is to determine the effect of lenzilumab on the safety of Yescarta. Kite will act as the sponsor of this study and will be responsible for its conduct."

https://www.gilead.com/news-and-press/press-room/press-releases/2019/5/kite-and-humanigen-announce-clinical-collaboration-to-evaluate-investigational-combination-of-yescarta-axicabtagene-ciloleucel-with-lenzilumab-in-r

As I recall, Humanigen refused to sign an exclusivity agreement for Gilead's use of lenz, so Gilead ended up buying Forty Seven for $4.9B, only to have to suspend patient enrollment in a clinical trial due to lack of magrolimab's efficacy.

https://www.gilead.com/news-and-press/press-room/press-releases/2020/3/gilead-to-acquire-forty-seven-for-49-billion

https://www.biospace.com/article/gilead-suspends-patient-enrollment-for-troubled-magrolimab-in-solid-tumor-trials/#:~:text=In%20July%202023%2C%20Gilead%20announced,satisfied%20the%20criteria%20for%20futility.

I could get into Sanofi's agreement with AstraZeneca, who acquired our former board member Kevin Xie's Gracell, but you guys can look into it if you're interested.

Restructurings sure can get complicated.

Some things never change, shajelly. Crucial to our success is Humanigen's plan to recall their loaned shares, which we see that Trump Media (DJT ticker) attempted in a completely amateurish fashion.

The problem comes exactly from my effort to focus on Penson Financial for their role in the SpongeTech market, which led to an Emergency Rule Change the SEC had to approve to transfer Penson's accounts to Apex Clearing.

"I. Self-Regulatory Organization's Statement of the Terms of Substance of the Proposed Rule Change

The Exchange proposes to temporarily suspend the requirements of Exchange Rule 2.6 and related Exchange rules concerning the approval of new Members?[3] of the Exchange in order to approve Apex Clearing Corporation, f/k/a Ridge Clearing and Outsourcing Solutions, Inc. (“Apex Clearing”) as an Exchange Member, subject to Apex Clearing complying with Exchange Rules for a new Member within 30 calendar days of the date that Apex Clearing is provisionally approved as an Exchange Member. The Exchange is also proposing to accept Apex Clearing's assumption of all of the existing clearing agreements and arrangements currently in effect between Penson Financial Services Inc. (“PFSI”) and various other Exchange Members by execution of a global agreement thereto."

https://www.federalregister.gov/documents/2012/06/11/2012-14072/self-regulatory-organizations-bats-exchange-inc-notice-of-filing-and-immediate-effectiveness-of-a

On the plus side for Trump Media, they do have people who understand what is happening, at least to an appreciable extent.

"“I believe quick action is necessary to protect retail shareholders, identify wrongdoers, and determine whether any laws including [Racketeer Influenced and Corrupt Organizations Act] statutes and tax evasion laws have been violated,” wrote CEO Devin Nunes, who on April 24 first asked top House Republicans to probe short selling of Trump Media stock.

Nunes, in a letter dated Wednesday, wrote that the committees should seek documents and testimony from the eight firms that he named: Apex Clearing, Clear Street, Cobra Trading, Cowen and Company, Curvature Securities, StoneX Securities, TradePro and Velocity Clearing."

https://www.cnbc.com/2024/05/02/djt-trump-media-ids-firms-for-house-short-selling-probe.html

My question is, does Nunes know that the House members he is asking for quick action, may be rightfully included as RICO defendants? They empowered Apex Clearing by the Emergency Rule Change they approved.

These are the minefields that Humanigen's management have to contend with. They did so successfully as Kalobios, and they are even better positioned to succeed now.

"Shareholders would have been better off continuing to collect short interest, as DJT dropped 9.6% today."

people who own 50 shares of a company with 200 million shares don't matter. and you don't own the company. the company currently has less than 20 shareholders. and if you have less than 50 shareholders it is a private company. essentially the company is a private company with less than 20 shareholders and one shareholder owning 90% of the shares. waste of money sending mailing to peon shareholders to vote when one guy decides who is the board of directors. in many companies, the board of directors is selected by the ceo who is an employee. like this company, the ceo is also the chairman of t he board, yet on paper he owns less than 200,000 shares but controls and owns the company. something wrong with the corporate structure. in this company, the ceo and three board of directors is just a front for the real owners of hgenq and many companies listed in the exchange. you have one guy who sits on 10 board of directors and has a full time job. how can he do his duties as a board of directors. and gets paid $100,000/year for seat as board of director that only meets 4 times a year

the hgenq 'corporation' is being dissolved which was not part of the initial chapter 11 application. but is always the case. new company emerges with new shares. either your old shares are worthless or traded for new shares that. the controlling shareholder don't need the minority shareholder vote or permissions to dissolve the company

these billings don't need the judge approval either. it's so the lawyers can make money filing the forms. and for documentation only. you don't even need to be a lawyer to be in court and company can represent themselves. the company spent over 5 million in legal fees on their books in the last 3 years. As for the company ,its being liquidated, and dissolved. A new company, with new shares. as how much existing shareholders of the hgenq will get in new company that is the question. nothing. or shares bought out so end any litigation. issues with former investors or shareholders.

the 'loaned shares' what are you talking about on the OTC there is only 38,000 shares short and still not covered which mostly the market maker of this stock, nakes short positions by market makers or the broker/dealer don't have to cover if the shares are worthless unlike retail traders, if retail trader has short position they have to cover and pay borrowing fee. market makers don't pay any borrowing fees in naked shorting. naked shares shorted are not even in the shares shorted info.

"and you need to let the judge know how much you are billing the clients."

Why bother? In your same post, you said, "...hgenq owns no assets." If so, then you're saying the judge is too dumb to convert the case to a CH7, which he should do, if Humanigen is worthless.

But not only do we see the CH11 continued, we see just the opposite of a 'worthless' determination of Humanigen's value. We see additional value recognized.

"The settlement amended the APA to, among other things, significantly expand the events that will trigger the contingent “Milestone Payments” and increase the amount of those payments under the APA."

I think the company owns about 90% of the shares they have issued, and subsequently loaned. And just like shares investors are holding, the price of those shares will spike considerably when Milestone Events are reached, and we advance our restructuring, in conjunction with a recall of our loaned shares.

I have no relationship with the company or insiders, and I don't post for pay. Millions of preventable deaths, and millions more excess deaths, can be avoided when lenz is used as a vaccine enhancement, or as a therapeutic in lieu of 3+ mRNA jabs. The insiders, the judge, and the creditors know more than we do, and they seem to be seeing increased value, as do I.

verbal D - the next thing you hear from durrant will tell you everything you need to know

why keep promoting lenzi, hgenq shareholders no longer own the ip patents for lenzi and even that promissory note is being sold and liquidated. so don't understand why you keep posting about fundamentals about the value of the lenzi molecule. You remind me of guy who's daughter died at age 21 but won't accept she is dead. Accept reality, you've been robbed and entire exchange market supported by the SEC and the gov't to ripoff the public.

The demons don't care about Jesus or God, okay. and have no morals. okay. The only thing that motivates them is money. and don't believe in God and that fake stuff.

A grieving father replicated his dead daughter with AI technology so that he and his wife could keep her “alive” in the “digital world.”

The gov't is here to kill you.

https://petapixel.com/2024/03/19/grieving-father-uses-ai-to-keep-dead-daughter-alive-in-digital-world/

Interesting find, Chaplain, and also coincides with a related study just published in the NIH Library on the subject of atherosclerosis. This could mean that I might be a candidate for a cohort study of lenz.

"Tuesday, April 30, 2024

Scientists find cancer-like features in atherosclerosis, spurring opportunity for new treatment approaches"

https://www.nih.gov/news-events/news-releases/scientists-find-cancer-features-atherosclerosis-spurring-opportunity-new-treatment-approaches

"Atherosclerosis, platelets and thrombosis in acute ischaemic heart disease"

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3760546/#:~:text=In%20advanced%20atheromatous%20plaques%2C%20high,thrombosis%20and%20its%20clinical%20complications.

"AstraZeneca admits for first time in court documents its COVID vaccine can cause TTS (Thrombosis with Thrombocytopenia Syndrome)"

https://www.breezyscroll.com/world/astrazeneca-admits-for-first-time-in-court-documents-its-covid-vaccine-can-cause-tts/amp/

Gov't : We are here to rob you.

Lawyer: I am here to rip you off.

Thank you and have a good day 🤗

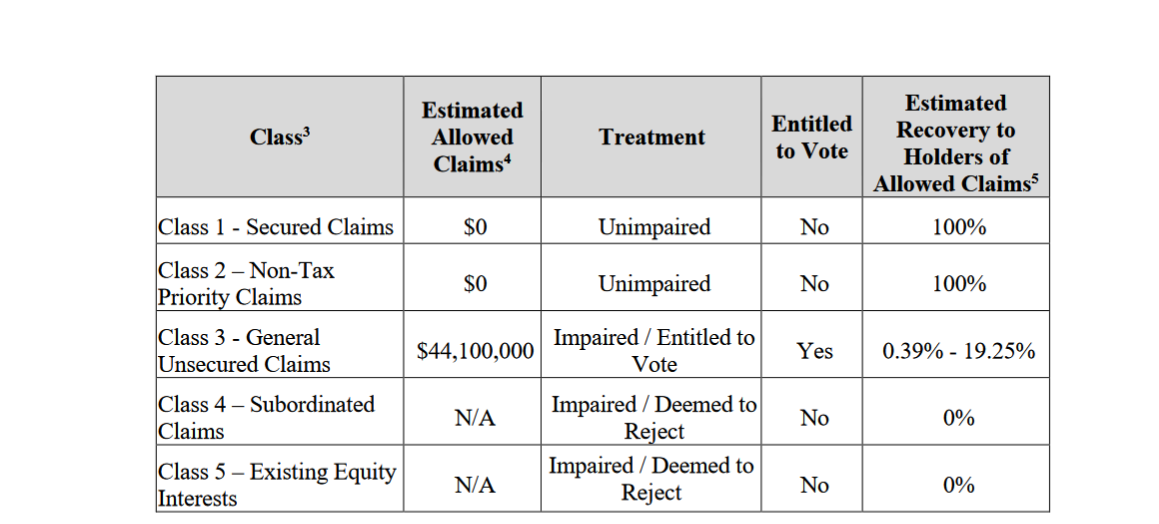

Plan to dissolve HGENQ and liquidate shares of HGENQ. The problem is only secured creditors can vote on the plan. HGENQ has no 'secure' lenders so it's done no need vote. the chair of the bankruptcy committee or the controlling shareholder of hgenq votest to dissolve the hgenq shares and liquidate. and distribute nothing to hgenq shareholders. same as chapter 7. Company is done. shares are worthless.

no need to object, no need to vote and waste the bankrutpcy courts time or anyone else time in this grand theft robbery with help of this bnakruptcy court.

I'm looking forward to how prospective partners may use lenzilumab. For instance, I see that Novavax states they, "Demonstrated our variant strain change capabilities, updating our vaccine to the XBB.1.5 variant for the 2023-2024 vaccination season." Was their ability to accommodate variant strain changes accomplished by enhancing their vaccine with our variant-agnostic lenz?

see pg 4/162 "COVID-19 Clinical and Strain Change"

https://www.sec.gov/Archives/edgar/data/1000694/000100069424000026/novavax2023annualreport-fi.pdf

Also, I'm particularly interested in what role lenz could play in treating or preventing malaria.

"Based on the conclusions reached in the aforementioned studies, we gather that cytokines are important modulators of the immune response in malaria. Dysregulation of the cytokine network in severe malaria is linked to parasite and host factor variations. We have found that many of the cytokines involved in malaria (TNF-a, IFN-?, IL-4, and IL-10) play a double role, as a friend or as an enemy. Proinflammatory cytokines control parasite multiplication and promote parasite clearance. However, elevated levels of proinflammatory cytokines such as TNF-a, IL-6, or IL-8 may be markers of severe malaria. TGF-ß is probably the most important regulatory cytokine that limits the inflammatory process in malaria. Maintaining a balance between proinflammatory and anti-inflammatory cytokines is essential, and disrupting this molecular harmony can lead to unfavorable disease evolution. A better understanding on the cytokine's involvement in malaria pathogenesis could provide the basis for the discovery of novel diagnostic markers and indicators of disease progression and severity, as well as the foundation for the development of new malaria vaccines."

See the Conclusions:

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8592744/#:~:text=Proinflammatory%20cytokines%20control%20parasite%20multiplication,the%20inflammatory%20process%20in%20malaria.

Prospective partner Sanofi's Global Health Unit plans to, "...provide access to a broad portfolio of medicines in 40 countries with the highest unmet medical needs. To that end the GHU created Impact, a unique not-for-profit brand with 30 standard-of-care medicines produced by Sanofi, some of which are considered essential by the World Health Organization (WHO). The Impact medicines cover a wide range of therapeutic areas including diabetes, cardiovascular disease, tuberculosis, malaria and cancer."

See pg 11, "Corporate Social Responsibility update at the end of the Q1 2024"

https://www.sec.gov/Archives/edgar/data/1121404/000112140424000011/pressreleaseq12024english.htm

Sanofi's product pipeline also includes objectives for treating other indications, such as asthma, which could also be an application for lenz.

I think these are exciting times for Humanigen, and I look forward to my open sell order being filled at $200, in the short squeeze we will have when management recalls their loaned shares.

Jay lost his entire "investment" in a pennyscam. Again.

SPNGQ

HGENQ

The company received 2. million in licensing revenue. Taran with their stalking bid bought those 2 2 million dollar receivables and the cash receivables from hgenq so that 2 million they are just buying the cash and accounts receivables for their $2 million dollar bid and get the ip patents for nothing. as the asset put the ip patent as zero value.

Without the fake 37 million in lawsuit claim by pathogen and chime and company spending over 10 million in legal fees in 3 years. this coompany is not bankrupt with only 4 employees, it raised over 100 million in ipo financing assuming that was true and no fake ipo money. The only money the company made could have been shorting shares in ipo to public investors..who how much money was raised in the nasdaq sold to public investors as naked short positions and still not covere>? or shorted that is unknown.

why you need to courts permission for payment or anything? waste of time submitting all the forms need court approval

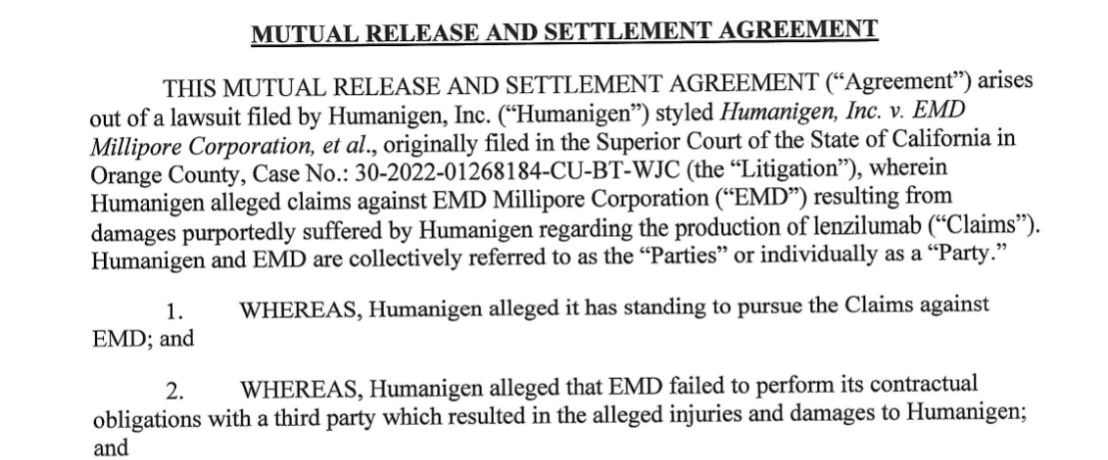

HGENQ gets a $50,000 'settlement' from EMD lawsuit for breach of contract, the same lawsuit by chime and pathogen that was seeking $37 million and the $5 million 'settlement' that cause the company to go bankrupt after FDA rejected the LENZI third stage clinical application.

it was " NOT" the REJECTION by the FDA that caused chapter 11 but the lawsuits afterwards that caused chapter 11 and inability to raise additional capital from new investors and shareholder or the controlling shareholder wanted to go bankrupty to embezzle the patents in sham auction.

nobody would pay more than $50,000 or even $10,000 for cancellation of a contract in business. it was just RFQ to the vendor and no contract s were signed with chime or pathognen and no services were even rendered.

LENZI which was bought for nothing to hgenq shareholders. Now in business, if assets are so below 'fair value' it can be void and buyer knows it's below fair value. I don't know what law that voids transactions. but if an asset was sold to cheap and sold to insiders it considere 'embezzlement' which is why all gov't assets are sold in an OPEN public auction, and anyone with cash can bid on it. In this case of LENZI auction it was NOT an open bid auction. and people were not allowed to bid on it. so it was NOT sold at 'fair price' and seller didn't actively solicit bidders, and based on the conditions, it discouraged any bidder or didn't respond to interested bidders.

In most 'auction's the price of the asset is already known, before the auction is held. and bidders just participate and pay 'fair price'

These drug patents are worth a lot of money if it sells as insurance companies are paying for these treatments 3.5 million/treatment. Who would have that kind of money if they don't have the 3.5 million and no insurance?

these are rare diseases and only a few pay for them.

The treatment will be available by prescription to eligible patients this quarter, a Pfizer spokesperson told CNBC. It has a hefty $3.5 million price tag before insurance and other rebates, the spokesperson added, making it by far one of the most expensive drugs in the U.S.

https://www.cnbc.com/2024/04/26/fda-approves-pfizer-gene-therapy-beqvez-for-treatment-of-hemophilia-b.html

Speaking of Durrant's Amendment to the Milestone Events, Novavax also filed an Amendment to their Articles of Incorporation.

https://www.sec.gov/Archives/edgar/data/1000694/000100069424000013/0001000694-24-000013-index.htm

And Sanofi really seems to be getting things ready for their spinoff.

https://www.sec.gov/Archives/edgar/data/1121404/000112140424000011/pressreleaseq12024english.htm

I think either, or both, of these companies represent potential partnerships for Humanigen.

your were sold hopium and your drank their coolaid.

there was no intention of selling a legitimate investment opportunity or building a real business.

going bankrupcty and stealing investor equity and embezzling corporate assets was the 'evil plan'

As they say, this 'crew' is really good.

you've been creamed by the grand masters of investment fraud.

What don't you understand Cowtownjay, shareholders of hgenq no longer own any asset other than promissory note and that is even being stolen if the hgenq is dissolved. What don't you understand? Accept the facts. there is no hope based on the status quo or information we have now. it's very clear in the chapter 11. they planned this entire fraud operation. like master con artist that is how good they are.

Welcome to the room, and to Ihub, TimelessOasis72. Don't pay any attention to the emojis.

I'm sorry that I can't answer your question. I opted out of the class action. But I would be the first to join a lawsuit against the class action lawyers.

Besides, I think lenz may be demonstrating just how widely it will be accepted into the market, well beyond the covid and oncology indications, where lenz has clinically proven its first-in-class safety and efficacy. I'm glad to see this success being factored into a more rapid and expanded amended version of the Milestone Events. I think that's a truly exciting development, yet it gets absolutely no recognition of its significance by shareholders. I'm sure, though, that investor sentiment will improve sharply, once details of our opportunity are spelled out, letter-by-letter, by management.

Thanks for posting!

phantom trades, phantom of the market.

These trades are NOT HUMAN!! You, you, you are not human!

Some human turned the machines back on this stock

The autobots are still here and back.

It seems the autobots are BACK,,which is good, at totally abandon stock, even autobots are shut down

insurance policy like this buying your wife $10 million dollar life insurance without here knowing about it and a year later your wife died from natural causes and you get the $10 million dollar life insurance and you only bought it one year ago.

The company only agree to pay the $3 million so they can claim the $5 million managmeent liability insurance JACKPOT payout. The company only paid $200,000 in insurance premiums in 2022 and was sued in same year?

could be never because, the lawsuit claim of $3 million was not even on the list of creditor claims in the chapter 11 'petition'. Its a pre petition 'settlement' not a conviction or verdict, so legally its has weight. in law of court.

The law firm Claim #10013

Value $3,000,000.00

Creditor SCOTT GREENBAUM AND JOSHUA MAILEY

Filed Apr 04 2024

and supposedly had the $3 million in insurance money that was paid out the management liability insurance. it was a settlement so it's up to them to pay. a settlement doesn't mean they are guilty or even forced to pay later. both sides agree to 'settle' and can always go to court 'again' if one doesn't honor their word. but the court didn't order the payment.

a settlement is not the same as court order or defendent is guilty of anything. if you they don't pay there is nothing you can do about it and since it's so low you probably don't want to waste months for $200 pay day. 3 million -1.5 mill legal fee. -= 1.5 million in pot/ 1000 claimants it's only $1,500 even 100 people it's only $15,000

How long until you think we’ll actually see the payout on our claims?

The corruption of the FDA is that a drug approval or not approval is about the money and corruption has always been about the money. but the corruption goes too far when people die because of corruption like FDA approving drugs like oxycotin and doctors prescribing it knowing it was bad for drug abuse for profit etc or not approving certain drugs because of competitor don't want it approve or bribed not to approve it. corruption in gov't was taking bribes to approve certain projects and in many countries corruption was expected to get the gov't to do anything to subsidize low wages of gov't workers. and was a gift. or tip. and expected to pay. like SEC approving crypto ETF and exchanges listing obviously fake fraudulent financial instruments.

the FDA or any or when the gov't is corrupt, they no longer have the mandate of heaven and lose authority. that is how gov't and dictators fall, gov't corruption. Gadafffi in Libya embezzled gov't assets to himself and same with Saddam huessien, they stole the state's money for his person account. and lived like Kings were not Kings. but dictators and eventually they were hanged by the people and his personal gaurds who were bribed to kill him.

In North Korea, they perfected state propaganda, Kim is like god or hero to the people. The imperial family in many countries were they were divine family and it's authority was the King was the son of God. or the King was the ultimate shaman. so that is how the King had power and the King's word is law.

“Repeat a lie often enough and it becomes the truth”, is a law of propaganda often attributed to the Nazi Joseph Goebbels. Among psychologists something like this known as the "illusion of truth" effect..--- gov't (FDA) propaganda.

|

Followers

|

326

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

43436

|

|

Created

|

01/31/13

|

Type

|

Free

|

| Moderators cowtown jay | |||

Humanigen, Inc. is a clinical-stage biopharmaceutical company developing its portfolio of next-generation cell and gene therapies for the treatment of cancers via its novel, GM-CSF neutralization and gene-knockout platforms. As a leader in GM-CSF pathway science, we believe that we have the ability to transform CAR-T therapy and a broad range of other T-cell engaging therapies, including both autologous and allogeneic cell transplantation. There is a direct correlation between the efficacy of CAR-T therapy and the incidence of life-threatening toxicities (referred to as the efficacy/toxicity linkage). We believe that our GM-CSF neutralization and gene-editing platform technologies have the potential to reduce the inflammatory cascade associated with serious and potentially life-threatening CAR-T therapy-related side effects while preserving and potentially improving the efficacy of the CAR-T therapy itself, thereby breaking the efficacy/toxicity linkage. Clinical correlative analysis and pre-clinical in vivo evidence points to GM-CSF as the key initiator of the inflammatory cascade resulting in CAR-T therapy’s side-effects. Pre-clinical in vivo data on the neutralization of GM-CSF using antibody or gene KO indicates that it is not required for CAR-T cell activity. Our strategy is to continue to pioneer the use of GM-CSF neutralization and GM-CSF gene knockout technologies to improve efficacy and prevent or significantly reduce the serious side-effects associated with CAR-T therapy.

We believe that our GM-CSF pathway science, assets and expertise create two technology platforms to usher in next-generation CAR-T therapies. Lenzilumab, our proprietary Humaneered® anti-GM-CSF immunotherapy, has the potential to be used in combination with any FDA-approved or development stage CAR-T therapy, as well as in combination with other cell therapies such as HSCT, to make these treatments safer and more effective. In addition, our GM-CSF knockout gene-editing platform has the potential to create next-generation CAR-T therapies that may inherently avoid any efficacy/toxicity linkage, thereby potentially preserving the benefits of the CAR-T therapy while altogether avoiding its serious and potentially life-threatening side-effects.

The company’s immediate focus is combining FDA-approved and development stage CAR-T therapies with lenzilumab, the company’s proprietary Humaneered® anti-human-GM-CSF immunotherapy, which is its lead product candidate. A clinical collaboration with Kite, a Gilead Company, was recently announced to evaluate the use of lenzilumab with Yescarta®, axicabtagene ciloleucel, in a multicenter clinical trial in adults with relapsed or refractory large B-cell lymphoma. The company is also focused on creating next-generation combinatory gene-edited CAR-T therapies using strategies to improve efficacy while employing GM-CSF gene knockout technologies to control toxicity. The company is also developing its own portfolio of proprietary first-in-class EphA3-CAR-T for various solid cancers and EMR1-CAR-T for various eosinophilic disorders. The company is also exploring the effectiveness of its GM-CSF neutralization technologies (either through the use of lenzilumab as a neutralizing antibody or through GM-CSF gene knockout) in combination with other CAR-T, T cell engaging, and immunotherapy treatments to break the efficacy/toxicity linkage including the prevention and/or treatment graft-versus-host disease (GvHD) in patients undergoing allogeneic HSCT. The company has established several partnerships with leading institutions to advance its innovative cell and gene therapy pipeline.

June 15, 2020

Phase 3 Study to Evaluate Efficacy and Safety of Lenzilumab in Hospitalized Patients With COVID-19 Pneumonia

https://clinicaltrials.gov/ct2/show/NCT04351152

Anti-GM-CSF antibodies expected to show better effect in Covid-19 than cytokine-specific targets

July 27, 2020

https://discoverysedge.mayo.edu/2021/06/22/cancer-to-covid-19/

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |