Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

I haven't been following the stock, so I don't know. But yes, GPOR will trade on the NYSE:

NYSE - New Security Notification for Symbol GPOR

05:13 PM, 17 MAY 2021

MARKET: NYSE SERVICE: TRADING

NYSE has determined that the Common Shares issued by Gulfport Energy Corporation is part of a new security offering that will trade under the ticker GPOR with CUSIP 402635502 on May 18, 2021. As this new offering has not previously traded on any listing market and has no prior day's closing price, Regulation SHO Rule 201 will not apply to security GPOR until its second day of trading on NYSE. Further, NYSE Rule 123D(d) will apply and the security will be in a regulatory halt until the NYSE has opened trading.

https://www.nyse.com/trader-update/history#

You may have to do a search to find it.

Note that the stock doesn't seem to be trading yet. Also, by the terms of the bk restructuring, its stock will be a new issuance. The company put out a press release:

https://finance.yahoo.com/news/gulfport-energy-corporation-successfully-emerges-120000595.html?.tsrc=fin-srch

It also filed an 8-K yesterday, in which it explained who gets new stock in the company. I believe common shareholders are Class 8:

-- all Existing Equity Interests (Class 8) in the Predecessor were cancelled on the Effective Date;

But this is the part I don't understand:

On the Effective Date, all of the Existing Equity Interests and all of the Unsecured Notes were cancelled, and, in respect of the cancellation of such indebtedness and pursuant to the Plan and related documentation, (i) 19,726,101 shares of Common Stock representing all of the Common Stock issued and outstanding were issued to the holders of Allowed General Unsecured Claims against the Predecessor and its subsidiaries and Allowed Notes Claims against the Predecessor and its subsidiaries...

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000874499/000121390021027082/ea140991-8k_gulfport.htm

So what shows in your brokerage account today? GPOR did trade, and closed at $71.25 on volume of 3,632 shares.

https://finance.yahoo.com/quote/GPOR?p=GPOR&.tsrc=fin-srch

Yes, but are the commons wiped out? Corporate action notices I got said the shares were moving from OTC to NYSE with a symbol change from $GPORQ to $GPOR and the share exchange would be 1:1

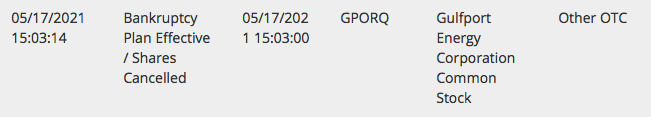

GPORQ's commons were cancelled this afternoon at 3:03:

https://otce.finra.org/otce/dailyList

$gpor $0.0675 v -0.0045 (-6.25%)

Volume: 2,119,200 @03/19/21 3:59:45 PM EDT

Too funny. I had to re read the document twice... it is Mumbai jumbo... lol... but if you read between the lines of the mumbo jumbo... it leaves the door open for GPORQ shareholders? For a possibility that the shares are not cancelled?? Like I said I read it twice...it was confusing at best

Should be spiking up next week. Giving the shareholders voting power is good sign

mystery company-- ecch wrong board ---this company known all to well they going belly up

Its not share cancellation. The word "CANCEL" doesn't exist in any of those pages. So that alone is a great sign. Lets see a nice pop monday!

That's what I got but it means nothing to me ?

I have no idea what their offering or proposing ...

Received offer ? What are they offering ???

Just a bunch of legal mumbo jumbo to me !!!

Kinda looks like the share price is stuck in the .075-.082??? Been like that for these past three trading days

last10k.com/sec-filings/gporq

News Out

Quoted from 10k

Share-based payments to employees, including grants of restricted stock, are recognized as equity or liabilities at the fair value on the date of grant and to be expensed over the applicable vesting period. The vesting periods for restricted shares range between one to three years with annual vesting installments. The Company does not recognize expense based on an estimate of forfeitures, but rather recognizes the impact of forfeitures only as they occur. The Company will continue to account for its share-based payments consistent with prior periods until the Bankruptcy Court takes specific actions to modify or cancel existing awards.

Getting closer? Getting closer to what?

Just look at the stock GameStop. You can see how evil short sellers are. And when things don’t go the short sellers way, then the short sellers ask thevSEC to step in and bail out thevshort sellers. Short sellers are evil

People and the SEC is corrupt and is on the short sellers side. I’ve been in this market for 25 years... the SEC is not on your team. The SEC is corrupt

I stand corrected on the tax code.

Nope read the tax code book on gains/losses on short sales. If a short seller has an open position in a ticker that gets revoked by the SEC. then that short seller does NOT have to report the gains on that short sale. That means the short seller rays zero taxes on the illegal gotton gains. Read the tex laws on short selling. When a companies stock is cancelled the short seller makes100 percent profit and pays zero 0. On the capital gains from

Selling short. The irs is desperately trying to change that law... thebirs ferls short seller SHzozuLD pay taxes on their gains from

A cancelled stock symbol....and the SEC is on the short sellers side. You think the SEC is doing a favor tonthe small retail investor when the SEC revoked a ticket synol? Pppppaaaaallllleeeeeaaaassssseeeee!!!!!!

Nobody is paying the SEC to cancel tickers... geez. Also, you're correct...if the stock gets cancelled shorts never have to cover

However, they would still have to pay tax on the cap gain

Gporq is due to release news... all the bad news is already baked into the cake... the only thing gporq has to fear is that the naked short sellers PAYOFF the SEC and then thevSEC revoked thevstock symbol GPORQ. Thevnaked short sellers of GPORQ are dieting to see that day arrive. Once gporq stock symbol isvrevoked then thevdhort sellersvof gporq never ever havevto cover their short position and all their evil gotton gains is 100 percent tax free capital gains. And you think the SEC is looking out for the little guy?? HUHH. The SEC is on the hedge funds and shorts sellers side... thecSEC is on the payroll of naked short sellers

And there is still a HUGE short position in GPORQ... something might trigger a huge short covering... place your bets on the roulette wheel. This is gambling it’s is a big GAME

Ohhh yesssss. Correction u r. A big ass spike is due to

Happenscwith gporq stock. When it does use it to your reward and benefit and sell your position of GPORQ... cause basically I don’t see gporq shares coming out of bankruptcy alive. But look at hertz car rental. Hertz shares were supposed to be cancelled and the symbol revoked but hertz stock is still trading. But time is ticking. And time is not in favor for gporq stock. I wish I could say other... unless some company wants to

Buynout the existing bond holders. Then that would be a game changer....and the longervthis court case drags out the better for GPORQ shareholders... cause a judge could declare a mis trial or the judge could say gporq should never of filled bankruptcy in the first place

GPORQ will ascened. Can't see it any other way.

Ive had charts that looked like this where the companie's lab blew up (as in exploded/caught fire) and stock price still doubled same day.

This week is best moment for play a lottery or not? no pain no gain.

You should Never make ANY financial decisions based on my suggestions. You should pretty much always do the opposite to what I suggest you should do. I am often wrong. Please do your own DD

$gpor $0.0914 ^ 0.0039 (4.46%)

Volume: 1,160,448 @02/19/21 3:59:54 PM EST

Idk... it looks like gporq is getting some buying action and it looks to be taking down the ship all of resistance at about .095. Then the last wall of resistance looks to be the 10 cent and the 10.2 resistance wall. Half decent volume can take that out rather quickly

Thanks for the clarification. Yeah. Those unusual lots of. 21 shares of GPORQ per trade.. imho. I think all this volumevtoday for GPORQ is market msketsctrading sharesvtonother market makers. I doubt there are any institutional traders buying and selling gporq... same sort of thing happening with the hertz car rental company. That’s basically markets makersctradering amongst other market makers.... and how, still no word from the Houston court of bankruptcy that gporq case is being heard... as far as how many more days gpork will trade before its ticker symbol is revoked is all guessing also... kinda like the hertz car rental company stock. How long do they let the hertz trade symbol keep trading before that is revoked. So yeah... playing gporq is kinda like sitting at a black jack table in a casino

I would think so yes 21 shares per sale, odd, may be some sort mm clean up of sales, I have never seen it before, most likely nothing--

blackjack also a riff on this stock being a crapshoot a spin of the roulette wheel the main chance to loose all

Ok. I’m following u so far... so the 21was the amount of shares traded in a trade? That means some was trading 21 shares per trade...correct?

it looked strange all those 21s in a row there were more than that but not alot

I see all the number 21’s printed to the far right of your screen shots. Is the number 21 mean that was the amount of shares traded at that particular time and at the bid/ask? So someonevis trading 21 shares of GPORQ when they execute an order? If so. That is bizarre why not trade 210 shares per trade or 2,100 shares per trade? 21 shares of GPORQ being executed as a trade a

Ok cablejohn. No see alll the printed number 21,s on the screen shots younprovided.... to the far right they are stamped with the number 21. I know 21 means black jack at the casinos. But what does the 21 mean tonthd screen shot you provided and what does the stamp number 21 havecanything yondobeithbGZpZoRQ. I’m still lost on this one

Hello. Cablejohn. I don’t understand your post... what do you mean blackjack? And then all those different screens you added to your post? I just confused about your last post about gporq

Hello. Cablejohn. I don’t understand your post... what do you mean blackjack? And then all those different screens you added to your post? I just confused about your last post about gporq

Yes. Exactly once again your post is SPOT ON. I remember when gporq was delisted from

The NASDQ stock exchange. But the next day GPORK was trading on the pink sheets... so your last post makes investors of GPORQ, like you and I, feel that and makes us think that the ticker symbol will not be able to trade... who ever compiled that notice should of in the foot males put in a comment such as “although gporq was delisted from NASDAQ ,GPORQ will trade on the pink sheets”. How the media leaves important info that ZgPORQ will trade on the pink sheets makes me wonder is the media puts “SPI on the news to aid and abbet” the evil agenda of short sellers... so the short sellers get even more of their ill gotten gains. Go gporq. I’m waiting for GPORQ to announce they are coming out of bankruptcy... and gporq could spike to 25 cents or 50 cents or even a dollar a share... but I’m a fair minded person.. that “temporary spike isn’t sustainable” because the wheels of motion to tevolevtrading in gporq stock shares will be short lived because it about 95 per cent certain gporq shares and symbol will be revoked and unreadable. I posted several times on the subject on this gporq message board thread about the current situation with gporq.. and the bottom

Likebis you are gambling with this gporq play...it’s likeva roulette wheel at the casino. It’s all a big ass GAME

Yes cablejohn exactly. That’s the recent news release. About GPORQ and the delisting of ticker symbol GPORQ. Because a lot ofboher posters on other message boards besides a IHUB are screaming like chicken

Little. “the sky is falling”

here is the whole thing from AD AM==--__I hold this stock-----

Delisting of Securities of Superconductor Technologies Inc.; Gulfport Energy Corporation; Apex Global Brands Inc.; Pareteum Corporation; and Youngevity International, Inc. from The Nasdaq Stock Market

4:05 pm ET February 1, 2021 (Globe Newswire) Print

The Nasdaq Stock Market announced today that it will delist the common stock, of Superconductor Technologies Inc. Superconductor Technologies Inc.'s common stock was suspended on September 30, 2020 and has not traded on Nasdaq since that time.

Nasdaq also announced today that it will delist the common stock of Gulfport Energy Corporation. Gulfport Energy Corporation's common stock was suspended on November 27, 2020 and has not traded on Nasdaq since that time.

Nasdaq also announced today that it will delist the common stock of Apex Global Brands Inc. Apex Global Brands Inc.'s common stock was suspended on November 5, 2020 and has not traded on Nasdaq since that time.

Nasdaq also announced today that it will delist the common stock of Pareteum Corporation. Pareteum Corporation's common stock was suspended on November 12, 2020 and has not traded on Nasdaq since that time.

Nasdaq also announced today that it will delist the common stock and 9.75% Series D Cumulative Redeemable Perpetual Preferred Stock of Youngevity International, Inc. Youngevity International, Inc.'s common stock and 9.75% Series D Cumulative Redeemable Perpetual Preferred Stock were suspended on November 20, 2020 and has not traded on Nasdaq since that time.

Nasdaq will file a Form 25 with the Securities and Exchange Commission to complete the delistings. The delistings become effective ten days after the Form 25 is filed. For news and additional information about the companies, including the basis for the delisting and whether the companies' securities are trading on another venue, please review the companies' public filings or contact the company directly.

For more information about The Nasdaq Stock Market, visit the Nasdaq Web site at http://www.nasdaq.com. Nasdaq's rules governing the delisting of securities can be found in the Nasdaq Rule 5800 Series, available on the Nasdaq Web site: https://listingcenter.nasdaq.com/rulebook/nasdaq/rules/nasdaq-5800-series

-NDAQO-

https://ml.globenewswire.com/media/a00d1214-f7e8-4665-89e0-dcfda84f5fc8/small/nasdaq-jpg-prdesk-globenewswire-jpg.jpg

https://ml.globenewswire.com/media/a00d1214-f7e8-4665-89e0-dcfda84f5fc8/small/nasdaq-jpg-prdesk-globenewswire-jpg.jpg

You mean they see this?

4:05 pm ET February 1, 2021 (Globe Newswire) Print

The Nasdaq Stock Market announced today that it will delist the common

Nasdaq also announced today that it will delist the common stock of Gulfport Energy Corporation. Gulfport Energy Corporation's common stock was suspended on November 27, 2020 and has not traded on Nasdaq since that time.

Nasdaq will file a Form 25 with the Securities and Exchange Commission to complete the delistings. The delistings become effective ten days after the Form 25 is filed.

RH had to suspend trading to obtain enough funding to meet their margin requirements as a broker. Had they not done so, they'd have faced a margin call in the billions and it would have been game over for them. IDK about you, but I won't deal with a broker who doesn't have sufficient liquidity and reserves. That said, I wouldn't trade with webull either. 5 business days for ACH to clear, and 1-2 business days for wire to clear. What a joke. My broker clears ACH in 3 business days, and wire transfer funds clear the instant they transfer is made.

Yes. I saw on webull that is you type in the search engine GPORQ it says delisted.... that’s because 10 days ago gporq filed form 25-NSE. And yes.... as far as I know it will still trade. ROBINHOOD is a faggot. They bowed down to help the hedge funds fight off stock kitty and his army on the battlefield with GAMESTOP. ROBINHOOD won’t let you buy gporq. Because Robinhood trading platform is run by a bunch of pussies and faggots. The CEO of Robinhood wears green tights to work everyday. Now tdameritrade allows full trading of gporq. Tdameritrade is not afraid of any short hedge fund ... because ameritrade about 15 years ago was under heavy attack by short sellers. Cause the hedge funds didn’t want ameritrade to have a slice of their pie. Hedge funds suck!! They are greedy negative cock suckers

The SEC doesn't determine who gets cancelled and who does not. That determination is made by the bankruptcy court. They determine who gets paid and who does not.

Who said anything about revoked? It was posted that webull lists $GPORQ as delisted, but Robinhood and others allow trading. Trading is still permitted, as it was delisted, not revoked

Yes. I agree. U know I wanna see the shorts get fried.... you know I am member of reddit and stock kitty. Stock kitty is the mastermind behind GAMESTOP. Stock kitty wants to put the hedge funds out of business. But that won’t happen. Because the SEC is on the hedge funds payroll. The SEC is in bed with the hedge funds... so yes,,, you are correct... if the stock symbol gporq is revoked , then the short sellers can rest assured that they never ever have to cover their short position..... so here a question for you to wrestle with..... when the sec revoked the stock symbol gporq, who is the SEC really helping with the revoked stock symbol? Does the revoked stock symbol help you and me who own gporq shares? The answer is NO!!! It does no help or good to common shareholders of GPORQ. EOM

|

Followers

|

27

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

652

|

|

Created

|

06/17/05

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |