Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Great Panther Silver, Ltd. (G3U), FYI.

thank you all, this is great -

its very few silver mines in EURO -

and the silver investors will find G3U ![]()

when they search for silver mines on IT ![]()

and we will start promo Great Panther in Germany,

London, France forums etc. ![]()

thanks in advance for all your good support ![]()

http://investorshub.advfn.com/boards/board.aspx?board_id=20139

Bloomberg doing it and we got good volume from overseas

and here ![]()

its also some advantage to diversify some investments? - ![]()

for some who trust EURO currency more than US$ ![]()

ex. Germany exchange, is in the process to take over NYSE -

and the investors from overseas will follow ![]()

http://www.bloomberg.com/apps/quote?ticker=G3U:GR

thanks in advance again, for all your good support ![]()

Great Panther too rooaaarrrr over EURO ![]()

God Bless

Gold & SILVER prices "You have not seen anything yet":

says Pastor Lindsey Williams the plan by the global elite

to sabotage the dollar, destroy the economy and America by 2012.

Silver will go to $100/oz: Lindsey Williams

Saturday, March 19, 2011 11:16

http://beforeitsnews.com/story/495/718/Silver_will_go_to_100_oz:Lindsey_Williams.html

Gold & SILVER prices "You have not seen anything yet":

says Pastor Lindsey Williams the plan by the global elite

to sabotage the dollar, destroy the economy and America by 2012.

For the next 10 years silver will be like 2 steps forward 1 step back.

But will probably be more like 5 forward 2 back.

Their may be one big dip & many chickens will flap & sell,

only to regret & see it shoot beyond imagination.

You have to look at the? industrial & technical revolution &

the global economic crisis.

After doing my research I don't give a dam if silver goes down,

as eventual fiat currency is going to 0, it's a possible small

loss or loose everything, whats the fuss.

Silver Bull Run : Lindsey Williams

Great Panther Silver Output Hits Record Levels

Company On Rapid Growth Path to Becoming a Mid-Tier Silver Producer

3.8 Million Ounce Silver Production Target at Two Mexico Mines for 2012

Record 2010 production of silver and base metals by

Great Panther Silver Limited

(TSX: GPR • NYSE Amex: GPL) -- www.greatpanther.com -- bodes well for the company to reach its production goal of 3.8 million ounces of silver by 2012 – an incredible 68% 24-month increase.

“We have had five consecutive quarters of profitability, clearly demonstrating our ability to achieve our goals,” says Great Panther Silver’s President and CEO Robert Archer. “We are one of the fastest growing primary silver producers in Mexico and intend to continue growing while maintaining profitability.”

For investors, the company, which operates two 100%-owned silver mines in mining-friendly Mexico, provides strong leverage to future increases in the price of silver. The fact that the company has gold as a production by-product, providing a comfortable hedge against falling silver prices, is a significant plus. Nor does it hurt that Great Panther Silver is run by a seasoned management team led by Mr. Archer who has previously worked for such major mining companies as Newmont, Placer Dome and Noranda – and is guided by an internationally-recognized board of directors drawn from three continents.

During just the past year, Great Panther Silver invested $17 million from its cash flow to rehabilitate and expand its mines in Mexico, a major accomplishment in itself. The company acquired new equipment, developed new production faces, exceeded plant performance goals, increased resources, defined reserves, and discovered significant new high grade mineralization.

The next two years promise to provide equal accomplishments as Great Panther Silver moves toward its production goals in Mexico and expands its search for advanced silver properties throughout Latin America.

Record Silver, Base Metals Production Posted for 2010

Great Panther Silver achieved record production of 2,255,802 silver equivalent ounces (Ag eq oz) in 2010, a 2% increase over 2009. New records were established as well for the output of individual metals – 1,534,957 ounces silver (up 5%), 7,216 ounces gold (up 1%), 1,092 tonnes lead (up 25%), and 1,358 tonnes zinc (up 29%). In the fourth quarter alone, the company produced 565,660 Ag eq oz.

Production from Guanajuato is expected to increase steadily throughout 2011 to two million ounces of silver equivalent, largely from increased production as the Los Pozos and Santa Margarita areas reach full capacity, Cata production returns to previous levels, and new production develops from the Guanajuatito area.

Plant throughput for 2011 is estimated at 200,000 tonnes at grades of 240 g/t silver and 1.80 g/t gold for metal production of 1.38 million oz silver and 10,400 oz gold.

Output from the Topia Mine is expected to increase as development on existing and new veins and increased plant capacity contribute to production totals. Topia’s 2011 estimated 40,000-tonne plant throughput is expected to produce 0.56 million oz silver, 800 oz gold, 1,170 tonnes lead, and 1,430 tonnes zinc – the equivalent to 0.87 million ounces of silver equivalent.

The company has set a combined 2011 production target from Guanajuato and Topia at 2.87 million ounces of silver equivalent, (1.94 million oz silver, 11,200 oz gold, 1,170 tonnes lead and 1,430 tonnes zinc), based on prices of $1,200/oz Au, $20/oz Ag, $0.85/lb Pb and Zn.

Considering the company’s low operating costs averaging $7 per ounce of silver (net of by-products) – an amount the company expects to soon lower to about $5 per ounce, increased silver production in 2011 and 2012 will significantly boost the company’s bottom line.

“Silver is more than the poor man’s gold. It is the only commodity that has both industrial uses and monetary value,” says Archer. “With increasing demand from recovering economies, we have recently seen the price of silver rising at a significantly faster rate than gold. Because we are a primary silver producer, this gives Great Panther Silver tremendous leverage.”

Historic Silver-Gold Guanajuato Mine Complex on a World-Class Deposit

Great Panther Silver’s Guanajuato Mine Complex is located in Mexico’s second-largest producing silver district of the same name where more than one billion ounces of silver have been produced over the past 400 years.

The Company’s property on this world-class silver-gold deposit has a 4.2 kilometer strike length. The underground mine has 25 shafts, over 100 kilometers of underground tunnels, three ramps, and has produced more than 4.8 million ounces of silver equivalent since the Company restarted production in 2006. The plant has the capacity to double current production rates to about 1,200 tonnes per day. During the final quarter of 2010, the Guanajuato plant achieved record gold recovery and excellent silver recovery of 91.1% and 89.1% respectively. Improvements to plant operations and equipment will continue in 2011.

Production from the Los Pozos area on the 310 and 345 meter levels accounted for more than 50% of the total silver production at the mine during the fourth quarter of 2010, while production at the Cata Clavo and Santa Margarita areas will be increased in 2011. Exploratory core drilling of the Guanajuatito North Zone indicates mineralization continues to depths below the 80 meter level. Most recently, the company discovered deeper mineralized silver-gold zones grading as high as 8.53 g/t gold and 1,300 g/t silver over more than a half meter in width at its Guanajuatito Mine at the northwest end of the Guanajuato Mine Complex. An access ramp will intersect the vein on the 120 meter level here to allow for more detailed exploration in preparation for an additional stoping area.

Underground exploratory core drilling between the Valenciana and Cata mine areas is also underway. Deep drilling under the main Valenciana Mine will begin in the second quarter of 2011 to test structures in the Valenciana area below the 390 level and along a 600 meter strike length.

The NI 43-101 compliant reserves for the historic Guanajuato Mine strongly indicate the project’s long-term viability and, more immediately, an anticipated improved output in 2011 and 2012. Guanajuato contains a measured and indicated mineral resource of 5,450,000 Ag eq oz, with inferred mineral resources estimated at 2,678,000 Ag eq oz. The measured and indicated mineral resources include 4,372,000 Ag eq oz of proven and probable mineral reserves, using a cut-off grade of 185 g/t silver equivalent.

High-Grade Topia Mine Producing Silver, Gold, Lead and Zinc

Great Panther Silver’s historic Topia silver-gold-lead-zinc mine property encompasses 6,500 hectares, dominating this mining district in the Sierra Madre Mountains of Durango State. Mining in the area dates back to 1538.

The deposit is characterized by high-grade, narrow veins. Although currently identified resources will support a 10-year mine life, a pending updated resource estimate is expected to significantly extend the length of economic production at the mine.

The Topia Mine recorded strong production in Q4 2010 of 129,650 oz of silver, 108 oz of gold, 515,305 lbs of lead, and 669,216 lbs of zinc from milling 9,081 tonnes of ore. This equates to 195,598 Ag eq oz, 26% higher than in Q4 2009. Ore grades averaged 458 g/t silver, 0.46 g/t gold, 2.78% lead and 3.64% zinc. New flotation cells for the zinc and lead concentrate circuits will enable a 22% increase in plant throughput in 2011, from 180 to 220 tonnes per day. Q4 metal recoveries at the Topia plant were high: 91.5% for silver, 81.5% for gold, 92.7% for lead and 91.8% for zinc.

Mine development at Topia continued to extend known areas and provide access to new mining areas. Mining of the San Gregorio and El Rosario veins contributed almost 40% of the silver production. Ramp development at Argentina is now fully mechanized, and access to the third level is expected in the Q2 2011.

Great Panther Silver plans to increase production at Topia by 20% per year through 2012. Mineral resource/reserve estimates are pending.

Investment Considerations

Great Panther Silver is well capitalized with $13.5 million in its treasury, and a growing cash flow sufficient to fund production, expanded mine development and exploration. Currently, some 70% of the company’s revenues derive from silver.

Now in its second year of its ambitious three-year plan to reach an annual production rate of 3.8 million ounces of silver equivalent by 2012, Great Panther Silver also has its eye on potential future acquisitions.

“Profitable growth is the key to maximizing long-term shareholder value,” says Archer. “We will grow production and earnings from mining operations, while maintaining a positive cash flow and actively pursuing promising exploration and development opportunities in Mexico and South America.”

If Great Panther Silver’s track record during the past year is any indication, the company could well make good on its promises. For not only did the company set record production numbers in 2010, it conducted successful diamond drilling programs at the Guanajuato Mine, the nearby San Ignacio Project and the Topia Mine that delineated new resources and identified intriguing new mineralized areas. Exploration during the coming year promises more of the same: Great Panther Silver has more than doubled its 2011 drilling program to about 60,000 meters of further exploratory and infill drilling.

For example, the company will spend $2.8 million on further exploration and development at San Ignacio where it is evaluating sites for a portal to an underground ramp. Ore extracted during the development phase will be trucked to the Guanajuato plant for processing. The cash flow generated will offset the cost of exploration and development.

“Our strategy for growth beyond 2012 is to target undercapitalized projects that can be made profitable by introducing new equipment and mining methods,” says Archer.

“This could add millions of ounces to our books and bring

Great Panther Silver to mid-tier status.”

GREAT PANTHER SILVER LIMITED

TSX: GPR • NYSE Amex: GPL

Contact: Erick J. Bertsch,

Vice President of

Corporate Development

2100 - 1177 West Hastings Street

Vancouver, BC

V6E 2K3, Canada

Toll Free: (888) 355-1766

Phone: (604) 608-1766

Fax: (604) 608-1768

E-Mail:

info@greatpanther.com

Web Site:

http://www.greatpanther.com

by The Bull & Bear ![]()

GPL chart TA TI P&F Alert Bullish Price Objective 1st Target

fiat$6.88 per share ![]()

GPL has a long bull hike back UP

the old timers must get their good $$ back ++++

Eric Sprott: The government lied; there is no more silver

http://www.marketoracle.co.uk/financial_markets_analysis_videos_10.htm#vid14

Good news for silver and gold

http://www.pricelessgoldandsilver.com/gregmccoach6.ht

Pension Fund To Get GPL Ag Great Mines LT Safety ![]()

Silver Real Money Peoples LT Long Term Safety ![]()

Great Panther Silver (GPR) funnyfiat$4.23 UP $0.29 +7.36% ![]()

Volume: 2,196,743 @ 10:12:06 AM ET Great Early Strong Demand ![]()

Bid Ask Day's Range

4.22 4.23 4.1 - 4.53

TSE:GPR Detailed Quote

$500 Silver & Imminent Price Explosion! Max Keiser (500 dollar silver ![]()

vs...

Ponzi scheme - Fiat money - made out of nothing -

http://video.google.com/videoplay?docid=-8484911570371055528&q=creature+jeckyll&ei=c8kMSKSjJZPE2AKU2826BA#

FED - Power Center - Created @ NWO -

Ron Paul: "It's criminal."

On the Edge with Dr. Paul Craig Roberts 12.10.10. Max Keiser

http://www.silverbearcafe.com/private/12.10/roberts12-10.html

its only the GPL start ![]()

we have only got the sniff of the

great good monster Ag -

the best to come ![]()

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=60402101

God Bless

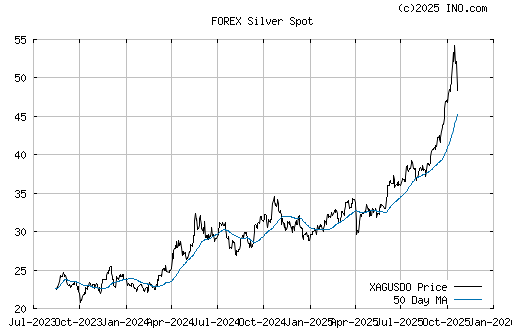

Silver is the new gold: Prices double in a year

Investors flock to the white metal as prices surge to 30-year highs

By Vicky Kapur

February 27, 2011

Silver has more than doubled in the last one year

(GETTY IMAGES)

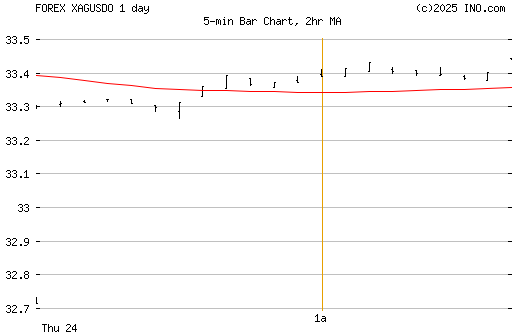

An international buying spree, or flight to safety

by global investors, saw silver prices breach 30-year highs

on Sunday at $33.30 an ounce and in a continuation of

the trend, spot silver prices were up further in early trade

on Monday, making yet another high of $33.44/oz.

Emerging economies of China and India are both heavy consumers

of the metal, which is used in jewellery but also has

its use as a raw material for industrial use.

Silver is now up 16.77 per cent in the past 30 days and according

to traders, has more than doubled in the last one year,

trading as it was at $16.24/oz on February 27, 2010.

Compared with this, gold prices have gone up by less than 6 per cent in the past 30 days and according to data sourced from goldprice.org, the yellow metal is up by just 26 per cent in the last one year.

This is now leading to precious metal analysts to argue that silver will see much more appreciation in the months to come, especially since the extent of global silver reserves are debatable.

“Robust international demand, financial and political instability across the world, and concerns over remaining reserves all harbour well for the price of silver,” said a Mumbai-based wholesale trader of silver. “Silver is the new gold,” he said.

Message

Comments

*

andrew 28 February 2011 08:31

make no mistake, silver will be around 50-60 range by year end... maybe usd going to lose reserve status soon, basket of currencies will be replacing usd interim until china ready to take over...

*

JohnPaul 28 February 2011 07:25

There is a 250M position on the COMEX and they only have 100M physical per their own balance sheet....do the math. Perth mint ran out 100oz bars again last month. Trade as you will ,but better have the physical metal and not be one of those with a receipt for fulfillment as soon as available. Just like the FDIC is 7.5B in the red!...Oh never mind.

*

Fernao de Magalhaes 28 February 2011 04:50

@Ian Hills: You are dead to right. I figured that the silver train had farther to ride than the gold train. Also, I love it that JP Morgan has to take it "in the shorts" every time I buy a silver coin.

*

TheSilverGuild 28 February 2011 04:26

The reason certain familys and Banking Cartels have gained this much influence and control is because they control the monetary system of the world. Money means power! The money system is held in private hands by a handful of elite families and private organisations. These families own all the central banks and commercial banks in the world. The central banks and the commercial banks create money out of thin air whenever they issue a new loan. Money is actually debt!

*

Joey Abie 28 February 2011 02:00

Silver is the new gold! With the price of gold over $1400/oz, the "average Joe" can't afford this type of investment in today's ecomomy, therefore "he" will continue to move into the silver market. This will be especially true in 2012 with the "doomsday" buggers out there!

*

Erv 28 February 2011 00:24

Pop out the champagne SLv hits 40!!!!!!!!!?????!!! Yeah Wow. !!!!!!! Awesome???????

*

Bud 27 February 2011 19:56

Been a silver bug for a while now... physical self held only bullion. With the price around 32. 75 Canadian silver is still a bargain. Ignore the rhetoric from the 'financial experts' who belittle silver ownership and load up now and hold on for the wild ride (up to it's true unmanipulated value as real currency)!

*

Ian Hills 27 February 2011 15:30

Simple to explain - JPMorgan suppresses the price of silver to keep the dollar attractive and India and China buy it on the cheap. Seems like there is almost no silver left at the Comex and this metal will soon be in such short supply that the price will skyrocket to $500 an ounce - all aboard the silver train.

Have your say

Welcome to Great Panther Silver, Ltd. (GPL ![]()

SILVER Verge of a Gigantic Move Higher!

SILVER bull looking strong ![]()

Silver 5-Year Chart

Silver 1-Year Chart ![]()

All charts are courtesy of Stockcharts.com

http://www.greatpanther.com/s/Home.asp ![]()

God Bless

Great Panther Silver NYSE Closing Bell ![]()

25 Feb 2011

Great Panther Silver (GPR) fiat$3.42 UP $0.26 +8.23% ![]()

Volume: 2,310,715 @ 3:59:51 PM ET GREAT DEMAND ![]()

Bid Ask Day's Range

3.42 3.43 3.23 - 3.43

TSE:GPR Detailed Quote

fedz banksterz funnyfiatz$ paperz poncy scheme peanutz -

still can buy it,lol ![]()

Ag Old REAL MONEY ![]()

Interview with Erik Bertsch, Great Panther Silver -

Great Panther Silver (GPL)funfiat$3.3799 UP $0.1899 +5.95% ![]()

Volume: 1,800,260 @ 2:03:27 PM ET Strong Demand ![]()

Bid Ask Day's Range

3.37 3.38 3.25 - 3.43

GPL Detailed Quote

fedz banksterz funfiatz$ paperz peanutz still can buy it,lol ![]()

Ag old REAL MONEY ![]()

Interview with Erik Bertsch, Great Panther Silver -

Great Panther Silver (GPR) fiat$3.16 UP $0.14 +4.64% ![]()

Volume: 2,999,915 @ 3:59:56 PM ET Stong Demand ![]()

Bid Ask Day's Range

3.15 3.17 3.03 - 3.35

TSE:GPR Detailed Quote

Interview with Erik Bertsch, Great Panther Silver -

GPL moved above $3.- and now be margined,lol ![]()

It's going to be hard to not want to sell when this thing

hits 10 bucks but i'm going to hold long lol!

Looks like we are up to 3.12 in after hours...nice!

great buy a lot more Ag babies ![]()

Its only the start- we haven't seen anything yet/ the JET,lol ![]()

history often repeat itself -

was in it before 1975 -

make luv and care for the Au & Ag babies ![]()

wait to it START TO MOVE ![]()

e.g.,

a silver baby dd....

http://www.greatpanther.com/ppt/slide1.htm

God Bless

Great Panther Silver Secures US Listing on NYSE Amex

Feb 07, 2011

Great Panther Silver Secures US Listing on NYSE Amex

GREAT PANTHER SILVER LIMITED (TSX: GPR; NYSE Amex: GPL;

the "Company") is pleased to announce that its common shares

have been authorized for listing on the NYSE Amex stock exchange

in the United States.

The Company expects the shares to begin trading on or about

February 8, 2011 under the trading symbol "GPL".

The Company will retain its listing on the Toronto Stock

Exchange (TSX) in Canada under the trading symbol "GPR".

"With a significant number of US shareholders already in place, the increased exposure anticipated from Great Panther's NYSE Amex listing will further expand the Company's shareholder base and provide US investors, in particular, many of whom have a serious interest in the ownership of silver and silver equities, with a simpler opportunity to trade the common shares of a solid company with strong leverage to silver prices", said Executive Chairman, Kaare Foy.

"We welcome Great Panther Silver to NYSE Amex," said John Casale, Vice President -- NYSE Euronext, "and expect that this listing will benefit the Company by providing greater access to institutional and retail investors."

Robert Archer, President and CEO, commented today: "Great Panther's listing on the NYSE Amex is both a milestone and a logical step in the successful development of the Company. It is also a testament to the talent and dedication of our entire team and something that they should all be proud of. As Great Panther continues to expand its production and resources through mine development, new discoveries and acquisitions, we anticipate that the new listing will facilitate greater trading volumes, visibility and market recognition."

Great Panther Silver Limited is a profitable and rapidly growing primary silver producer operating two 100%-owned mines in Mexico. Its flagship operation, the Guanajuato Mine Complex, forms part of the Guanajuato mining district, historically, the second largest silver producing region in Mexico, having produced more than one billion ounces of silver since the year 1600. Great Panther generates approximately 70% of its revenue from silver and 23% from gold, making it very much a precious metals company. A small amount of lead-zinc is also produced as a by-product at the Company's Topia Mine in Durango State.

For further information, please visit the Company's website at www.greatpanther.com, contact BD Capital at telephone 604 685 6465, call the Company toll free at 1-888-355-1766, or e-mail info@greatpanther.com.

ON BEHALF OF THE BOARD

"Robert A. Archer"

Robert A. Archer, President & CEO

This news release contains forward-looking statements ---- the Company's Annual Report on Form 20-F for the year ended December 31, 2009 and reports on Form 6-K filed with the Securities and Exchange Commission and available at www.sec.gov and Material Change Reports filed with the Canadian Securities Administrators and available at www.sedar.com.

You can view the Previous News Releases item:

Thu Jan 27, 2011,

Great Panther Extends Guanajuatito Silver-Gold Zones To Depth

http://www.greatpanther.com/s/NewsReleases.asp?ReportID=441373&_Type=News-Releases&_Title=Great-Panther-Silver-Secures-US-Listing-on-NYSE-Amex

MWM and all friends, please welcome b4atf and Messiah ![]()

to GPL Mods ![]()

http://investorshub.advfn.com/boards/board.aspx?board_id=20139

is sky the limit ?

hold on to the hat Alice -

to the moon soon ![]()

God Bless

Great Panther Silver Secures US Listing on NYSE Amex

VANCOUVER, BRITISH COLUMBIA -- (MARKETWIRE) -- 02/07/11 --

GREAT PANTHER SILVER LIMITED

(TSX: GPR)(NYSE Amex: GPL) (the "Company") is

pleased to announce that its common shares have been authorized for listing on

the NYSE Amex stock exchange in the United States.

The Company expects the shares to begin trading on or about February 8, 2011 under the trading symbol

" GPL ".

The Company will retain its listing on the Toronto Stock Exchange (TSX)

in Canada under the trading symbol " GPR ".

"With a significant number of US shareholders already in place, the increased

exposure anticipated from Great Panther's NYSE Amex listing will further expand

the Company's shareholder base and provide US investors, in particular, many of

whom have a serious interest in the ownership of silver and silver equities,

with a simpler opportunity to trade the common shares of a solid company with

strong leverage to silver prices," said Executive Chairman, Kaare Foy.

"We welcome Great Panther Silver to NYSE Amex," said John Casale, Vice

President - NYSE Euronext, "and expect that this listing will benefit the

Company by providing greater access to institutional and retail investors."

Robert Archer, President and CEO, commented today: "Great Panther's listing

on the NYSE Amex is both a milestone and a logical step in the successful

development of the Company. It is also a testament to the talent and dedication

of our entire team and something that they should all be proud of. As Great

Panther continues to expand its production and resources through mine

development, new discoveries and acquisitions, we anticipate that the new

listing will facilitate greater trading volumes, visibility and market

recognition."

Great Panther Silver Limited is a profitable and rapidly growing primary

silver producer operating two 100%-owned mines in Mexico. Its flagship

operation, the Guanajuato Mine Complex, forms part of the Guanajuato mining

district, historically, the second largest silver producing region in Mexico,

having produced more than one billion ounces of silver since the year 1600.

Great Panther generates approximately 70% of its revenue from silver and 23%

from gold, making it very much a precious metals company. A small amount of

lead-zinc is also produced as a by-product at the Company's Topia Mine in

Durango State.

For further information, please visit the Company's website at

http://www.greatpanther.com

ON BEHALF OF THE BOARD

Robert A. Archer, President & CEO

This news release contains forward-looking statements within the meaning of

the United States Private Securities Litigation Reform Act of 1995 and

forward-looking information within the meaning of the Securities Act (Ontario)

(together, "forward-looking statements"). Such forward-looking statements may

include but are not limited to the Company's plans for production at its

Guanajuato and Topia Mines in Mexico, exploring its other properties in Mexico,

the overall economic potential of its properties, the availability of adequate

financing and involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements expressed or

implied by such forward-looking statements to be materially different. Such

factors include, among others, risks and uncertainties relating to potential

political risks involving the Company's operations in a foreign jurisdiction,

uncertainty of production and cost estimates and the potential for unexpected

costs and expenses, physical risks inherent in mining operations, currency

fluctuations, fluctuations in the price of silver, gold and base metals,

completion of economic evaluations, changes in project parameters as plans

continue to be refined, the inability or failure to obtain adequate financing

on a timely basis, and other risks and uncertainties, including those described

in the Company's Annual Report on Form 20-F for the year ended December 31,

2009 and reports on Form 6-K filed with the Securities and Exchange Commission

and available at www.sec.gov and Material Change Reports filed with the

Canadian Securities Administrators and available at www.sedar.com.

Contacts:

BD Capital 604-685-6465

Great Panther Silver Limited

1-888-355-1766

info@greatpanther.com

http://www.greatpanther.co

Click here to go to Dow Jones NewsPlus, a web front page of today's most

important business and market news, analysis and commentary:

http://www.djnewsplus.com/nae/al?rnd=9y%2B4QibZzLnG5%2BsTfikoUA%3D%3D

You can

use this link on the day this article is published and the following day.

(END) Dow Jones Newswires

02-07-11 0851ET

08:51 020711

http://investorshub.advfn.com/boards/board.aspx?board_id=20139

Silver Standard for Mexico and Britain -

proposal by Hugo Price:

http://www.plata.com.mx/Mplata/documentos/images/Hugo_Salinas_Price_London_2011.pdf

DEATH OF THE DOLLAR... & BULLION CONFISCATION?

Great Panther Silver, Ltd. (GPR & GPRLF) Ag Show Booth # 430

Vancouver Resource Investment Conference

January 23-24, 2011

Vancouver Convention Centre,

West 1055 Canada Place, Vancouver, BC

http://cambridgehouse.com/conference-details/vancouver-resource-investment-conference-2011/15

Conference Registration | Agenda | Hotel & Travel | Floorplan

Speaker Line Up | Exhibitor List | Map

http://cambridgehouse.com/

http://cambridgehouse.com/conference-details/vancouver-resource-investment-conference-2011/15

Silver set to explode. (up)

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/1/21_James_Turk_-_Silver_in_Backwardation,_Set_to_Explode.html

Nations of sheep will beget 666 governments of khazar wolves. — 888

Start your week with a cheery Ag video:

Sprott fund found it hard to get silver, Embry tells King World News -

Submitted by cpowell on Wed, 2011-01-05 20:38.

Section: Daily Dispatches

3:36p ET Wednesday, January 5, 2011

Dear Friend of GATA and Gold (and Silver):

Interviewed today by Eric King of King World News, Sprott Asset Management's

chief investment strategist, John Embry, made eye-popping

price predictions for gold and silver in 2011 but may have

been more interesting for his remarks about the difficulty

encountered by the Sprott Physical Silver Trust in getting

hold of real metal.

Excerpts from the interview are headlined

"Gold Over $2,000, Silver Above $50 in 2011" and

you can find it at the King World News Internet

site here:

http://tinyurl.com/2424t5h

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

The Valenciana mine - was one of the richest silver

finds in the world history -

In the 18th century this one mine alone accounted for 2/3 of

the world's silver production -

history often repeat itself -

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=58371747

The Valenciana Silver Mine - was one of the richest silver

finds in the world history -

In the 18th century this one mine alone accounted for 2/3 of

the world's silver production -

At the Heart of Mexican Silver – Great Panther -

Precious Metals ...

2010 - Today Great Panther is profitable –

Great Panther's mines are 100% owned and fully paid for. ...

we will be testing the depth extent of the historically

rich Valenciana Mine -

The silver and gold vein systems of

The Veta Madre Mines at Guanajuato

were discovered as early as 1548 -

Today the Guanajuato area and its prolific, high grade

silver Ag / gold Au vein systems -

are still one of the most -

prolific Mother 888-Lode of Silver producing -

regions of the world -

Silver mining required massive capital, technical expertise,

a high level of organization and infrastructure,

and a large labor force -

The Valenciana mine had shafts 2,000 feet deep and 200 feet

in circumference, while it employed 3,000 people -

A shortage of mercury after 1635 led to a sharp downturn in

the production of silver in Mexico -

Still for 250 years, La Valenciana Mine produced >20% of

the world's silver and some year much more Ag -

from our Ag from The Christian Valenciana 888-Mother-Lode -

e.g.,

so "The Peoples New Born Babies" -

would get a drop of Ag-water in the eyes -

to destroy 666-bacteriez -

to give all the Babies a future of a good 888-Vision -

don't ever let the 666-evilz rob you of the Silver -

(then only the 666-babies to get it -

and no 888-babies would get the Ag?) -

A strong mining culture, excellent geology -

political stability and favorable tax and permitting -

structures all combine to create -

major appeal for mining GPR companies -

Non-Mexican companies can maintain 100% ownership of their

properties and reap the full benefits of successful exploration

and project development for their shareholders -

Great Panther Silver -

(TSX – GPR) has two operating mines in Mexico and is on

the prowl for further acquisitions.

GPR is one of the fastest growing primary silver producers

in Mexico with strong leverage to future Ag rises in

the price of silver.

The centerpiece of the company's operations is the world-class

Guanajuato silver-gold mine in the state of Guanajuato.

Silver and profitable junior silver producers as the fortunate -

Great Panther Silver should be on every investor’s radar screen -

Got the Ag bargain play -

Is silver and Great Panther Silver TSX – GPR

on your 888-radar screen?

dd....

if not, maybe for the smart 888-investors they should be -

The beautiful Mexican colonial city of Guanajuato -

and it should not be destroyed by nwo 666-banksterz terrorz gangz

888

God Bless

Great Panther Silver (GPRLF) fiat$2.84 UP $0.0322 +1.15% ![]()

Volume: 311,050 @ 4:00:12 PM ET

Bid Ask Day's Range

2.78 2.86 2.79 - 2.92

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=58235843

Great Panther Silver Chart P&F 1st Target Bull Price Obj. $6.88 per share ~<![]()

Silver spot chart Alert breakout start ~<![]()

Gold & Silver prices "You have seen nothing yet":

Lindsey Williams

Gold & Silver prices "You have seen nothing yet":

Lindsey Williams

Great Panther Silver (GPRLF) fiat$2.5 UP $0.101 +4.21% ![]()

Volume: 144,401 @ 3:54:14 PM ET good demand ![]()

Bid Ask Day's Range

2.43 2.51 2.42 - 2.55

The JP Morgue Whistleblowers Are Back -

http://www.zerohedge.com/article/jp-morgue-whitsleblowers-are-back-cuddly-bears-continue-expose-silver-manipulation-story

Ot. ex. the copycatz 666 terrorz at work -

http://www.bbc.co.uk/news/world-latin-america-11932060

let's pray that it will end soon -

In God We Trust -

http://www.888c.com

God Bless

Any etf'z are the first going to be confiscated by 666gov.'z -

its a NO-NO - BU-BOO -

keep out of it!!! -

Criminal gov. only last to thee goes up in smoke by their

own 666firez - BS alcapoone gov. is short lived -

http://www.deepcapture.com/manipulating-gold-and-silver-a-criminal-naked-short-position-that-could-wreck-the-economy/

#### ####

That's only a small gov. start - wait to the People start to buy ![]()

India, Japan and EURO and the rest of the world will also Wake UP ~<![]()

Gold Imports by China Soar Almost Fivefold as Inflation Spurs Investment

By Bloomberg News - Dec 2, 2010 1:55 AM PT

http://www.bloomberg.com/news/2010-12-02/china-gold-imports-jump-almost-fivefold-as-inflation-outlook-spurs-demand.html#share

e.g.,

http://inflation.us/videos.html

Merry Christmas ~<![]()

!!!

Great Panther Silver (GPR) fiat$2.48 UP $0.25 +11.21% ![]()

Volume: 521,544 @ 9:45:54 AM ET early strong demand ![]()

Bid Ask Day's Range

2.47 2.48 2.27 - 2.49

The Day The Fiat Dollar Die -

- a person / or a nation / be bankrupt -

- about the same for all, will be said -

http://inflation.us/videos.html

it has happen to all fiats before -

e.g. -

not to long ago to USSR, Zimbabwe, Argentina,

Germany etc. btw. -

Gold & Silver have replaced every fiat currency

for the past 3000 years -

http://www.kwaves.com/fiat.htm

well, good to have some Caldera -

survival food on the shelve smile

http://tinyurl.com/2wb832p

Fiat Money Will Die 2011 -

http://www.marketoracle.co.uk/Article22354.html

FED Shell fraud scheme game will end -

Politics comes from the Greek (Poli - Many; Tics - Lies!)

The Great PONZI Scheme (The Fiat-Funny-Money-System)

http://one-simple-idea.com/FederalReserve.htm

rothschild federal reserve fiat currency ponzi scheme -

http://www.dailypaul.com/node/52726

Merry Christmas ~<![]()

Lord, make me an instrument of Thy peace;

where there is hatred, let me sow love;

where there is injury, pardon;

where there is doubt, faith;

where there is despair, hope ![]()

In God We Trust ~<![]()

http://www.888c.com

God Bless

The Day The Fiat Dollar Die -

- a person / or a nation / be bankrupt -

- about the same for all, will be said -

http://inflation.us/videos.html

it has happen to all fiats before -

e.g. -

not to long ago to USSR, Zimbabwe, Argentina,

Germany etc. btw. -

Gold & Silver have replaced every fiat currency

for the past 3000 years -

http://www.kwaves.com/fiat.htm

well, good to have some Caldera -

survival food on the shelve ![]()

http://tinyurl.com/2wb832p

Fiat Money Will Die 2011 -

http://www.marketoracle.co.uk/Article22354.html

FED Shell fraud scheme game will end -

Politics comes from the Greek (Poli - Many; Tics - Lies!)

The Great PONZI Scheme (The Fiat-Funny-Money-System)

http://one-simple-idea.com/FederalReserve.htm

rothschild federal reserve fiat currency ponzi scheme -

http://www.dailypaul.com/node/52726

Great Panther Silver (GPR) fiat$1.88 UP $0.18 +10.59% ![]()

Volume: 1,640,344 @ 3:59:37 PM ET Strong Demand ![]()

Bid Ask Day's Range

1.86 1.88 1.78 - 1.88

Great Panther Silver (GPRLF) fiat$1.82 UP $0.15 +8.98% ![]()

Volume: 316,762 @ 3:57:57 PM ET Strong Demand ![]()

Bid Ask Day's Range

1.81 1.85 1.74 - 1.8215

Full GPRLF Quote

Great Panther Drills 7.70 Metres Of 704g/t Silver And 4.49g/t Gold In Second Hole At San Ignacio Mine Property, Guanajuato

Nov 15, 2010

GREAT PANTHER SILVER LIMITED

(TSX: GPR; the "Company") is pleased to announce that the second surface diamond drill hole at the San Ignacio Mine property, Guanajuato has intersected five zones of silver-gold mineralization below those of the previously reported veins in hole ESI10-01 (see news release of October 28, 2010).

http://www.greatpanther.com/s/NewsReleases.asp?ReportID=428404&_Type=News-Releases&_Title=Great-Panther-Drills-7.70-Metres-Of-704gt-Silver-And-4.49gt-Gold-In-Second-...

Great Panther Drills 7.70 Metres Of 704g/t Silver And 4.49g/t Gold In Second Hole At San Ignacio Mine Property, Guanajuato

Nov 15, 2010

GREAT PANTHER SILVER LIMITED

(TSX: GPR; the "Company") is pleased to announce that the second surface diamond drill hole at the San Ignacio Mine property, Guanajuato has intersected five zones of silver-gold mineralization below those of the previously reported veins in hole ESI10-01 (see news release of October 28, 2010).

http://www.greatpanther.com/s/NewsReleases.asp?ReportID=428404&_Type=News-Releases&_Title=Great-Panther-Drills-7.70-Metres-Of-704gt-Silver-And-4.49gt-Gold-In-Second-...

Drill hole ESI10-02 was collared at the same site as ESI10-01 but at a steeper angle of -60° in order to test the down-dip continuity of the veins intersected in the first hole. In hole ESI10-02, the Melladito vein returned 10.45 metres grading 1.13g/t gold and 98g/t silver, including 7.70 metres grading 1.36g/t gold and 117g/t silver. This correlates well with the 11.45 metres of 1.18g/t gold and 131g/t silver intersected in hole ESI10-01. Similarly, the Nombre de Dios vein returned 7.70 metres grading 4.49g/t gold and 704g/t silver in hole ESI10-02, compared to 3.15 metres of 2.15g/t gold and 157g/t silver in the first hole. The Nombre de Dios intersection in the second hole is at a vertical depth of approximately 330 metres below surface and 145 metres below the intercept in hole ESI10-01, and demonstrates good continuity while also indicating the potential for grades to increase with depth. It is currently unclear as to how the surface sample of 2.3 metres of 3.27g/t gold and 77g/t silver, previously interpreted as the Nombre de Dios vein, correlates with the drill hole intercepts or if it represents a separate vein that has yet to be intersected in drilling.

A deeper footwall stockwork zone in ESI10-02 assayed 1.49g/t gold and 382g/t silver over 3.40 metres. A narrower zone of mineralization in the hangingwall of the Melladito Vein and an intermediate zone between the Melladito and Nombre de Dios veins correlate well between the drill holes and could be of greater significance along strike or down-dip. The most westerly vein system, the Plateros vein, which hosted the former San Ignacio Mine operation, will be drilled later in the program. A plan map showing the location of Great Panther's San Ignacio drill holes, and an interpretative cross section, are posted on the Company web-site at www.greatpanther.com. Based upon the second hole, the veins are now interpreted to be steeply dipping.

"These are very significant results for the San Ignacio Mine property", stated Robert Archer, Great Panther's President & CEO. "The excellent continuity of the veins and the higher grades at depth will make it easier to define a new resource and develop a mine plan. With this early encouragement, we intend to fast-track the delineation and development of San Ignacio."

The initial 2,000 metre core drilling program at San Ignacio will comprise four sections across the three main structures. A substantial program of additional drilling for 2011 is already being prepared and applications for additional drill sites are being filed with the appropriate authorities. Power is being restored to the original San Ignacio Mine area and the shaft and old workings will be pumped out and rehabilitated while further exploration progresses. Underground mapping and drilling will augment the surface work and, once sufficient geological data has been assembled to facilitate a mine plan, development will commence in preparation for mine production.

Highlights of Drill Hole ESI10-02

Zone

Hole ID

FROM m

TO m

Width m

Au g/t

Ag g/t

Melladito hanging wall

ESI10-02

189.25

190.20

0.95

1.39

141

Melladito

ESI10-02

202.45

212.90

10.45

1.13

98

includes

203.60

211.30

7.70

1.36

117

Intermediate

ESI10-02

248.90

250.25

1.35

2.52

74

Nombre de Dios

ESI10-02

379.75

387.45

7.70

4.49

704

Footwall stockwork

ESI10-02

402.70

406.10

3.40

1.49

382

The San Ignacio Mine property covers approximately 4 kilometres of strike length on the La Luz vein system, which is parallel to, and 5 kilometres west of, the principal Veta Madre structure that hosts the main Guanajuato mines (see map on website at http://www.greatpanther.com/i/pdf/SanIgnacio-LocationMap-Sep10.pdf). The La Luz district marks the site of the first discovery of silver in the area, in the year 1548, which led to the discovery of the Veta Madre silver-gold deposits in 1550. It comprises a swarm of generally north-northwest striking, west dipping quartz veins and breccias with associated low sulphidation silver-gold mineralization, along an approximate 8 kilometre long trend.

Robert F. Brown, P. Eng. and Vice President of Exploration for the Company is the Qualified Person for the Guanajuato Mine, under the meaning of NI 43-101. A full QA/QC program is being followed including the regular insertion of splits, blanks, and standards into the core sampling sequence. Analysis of the drill core samples is being conducted at the Guanajuato Mine on-site laboratory, independently operated by SGS.

For further information, please visit the Company's website at www.greatpanther.com, contact B&D Capital at telephone 604 685 6465 begin_of_the_skype_highlighting 604 685 6465 end_of_the_skype_highlighting, fax 604 899 4303 or e-mail info@greatpanther.com.

ON BEHALF OF THE BOARD

"Robert A. Archer"

Robert A. Archer, President & CEO

Oct 18, 2010

Great Panther Hires New Vice-President Corporate Development; Launches New Website

GREAT PANTHER SILVER LIMITED (TSX: GPR; the "Company") is pleased to announce the appointment of Mr. Erick Bertsch to the position of Vice President, Corporate Development. Erick brings more than 16 years experience in the mining industry to Great Panther, beginning his mining career in the field in 1994 before transitioning to investor relations in 2003 with several companies in the Hunter-Dickinson Group. More recently, he has held corporate development positions with Minco Gold and Geodex Minerals. While with Minco, he gained insight into, and contacts within, the silver industry (through Minco's 40% ownership of Minco Silver), which will be valuable in his current role of expanding Great Panther's market presence and corporate growth.

As part of Great Panther's continuing emphasis on improving shareholder relations and increasing market exposure, the Company has updated its website to a new, fresher look with greater functionality and depth of information. The site contains a new section on Corporate Social Responsibility (CSR) in keeping with the Company's commitment to environmental sustainability and community relations. The new site can be accessed through the same address, at www.greatpanther.com.

The Company also announces that it has granted a total of 240,000 stock options to Mr. Bertsch and other new employees, under its stock option plan. The options are exercisable at a price of $1.15 and expire five years from the date of grant.

For further information, please visit the Company's website at www.greatpanther.com, contact B&D Capital at telephone 604 685 6465, fax 604 899 4303 or e-mail info@greatpanther.com.

ON BEHALF OF THE BOARD

"Robert A. Archer"

Robert A. Archer, President & CEO

Great Panther Silver (GPR) fiat$1.17 UP $0.02 +1.74% ![]()

Volume: 895,765 @ 3:59:55 PM ET strong demand ![]()

Bid Ask Day's Range

1.16 1.17 1.1 - 1.17

Full TSE:GPR Quote

Great Panther Silver (GPRLF) fiat$1.16 UP $0.02 UP +1.75% ![]()

Volume: 300,147 @ 3:47:18 PM ET strong demand ![]()

Bid Ask Day's Range

1.13 1.16 1.07 - 1.169

New PR today.

b4

http://www.greatpanther.com/s/NewsReleases.asp?ReportID=423695&_Type=News-Releases&_Title=Great-Panther-Hires-New-Vice-President-Corporate-Development-Launches-New-W...

Share Structure September 21, 2010

Shares Issued: 114,475,912

Warrants: 8,768,750

Finder/Agent Warrants: 963,150

Executive, Consultant and Employee Options: 6,636,100

Fully Diluted: 130,843,912

Great Panther Silver is a silver producer in Mexico -

The Co's flagship is the Guanajuato silver-gold mine,

located in the State of Guanajuato, Mexico.

"In the fourth quarter of 2009, Guanajuato produced

287,101 oz silver

and achieved a record production of 2,367 oz gold,

(470,025 Ag eq oz),

from milling 39,853 tonnes of ore.

The average ore grade at 271g/t Ag, and 2.14g/t Au ..."

Check out the NetTV presentation.

http://www.greatpanther.tv/

Great Panther Silver (GPR)

1.17 ? -0.03 (-2.50%)

Volume: 1,461,789 @ 3:59:52 PM ET

Bid Ask Day's Range

1.17 1.18 1.13 - 1.19

Great Panther Silver (TSE:GPR)(USD) $1.0

Change ? 0.0 (0.00%)

Bid 1.0

Ask 1.01

Volume 296,745

Days Range 0.99 - 1.01

Last Trade 9/21/2010 3:59:52 PM

Detailed GPR Stock Quote

Great Panther Silver (USOTC:GPRLF)(USD)$0.9887 UP $0.0287 +2.99% ![]()

Bid 0.948

Ask 0.99

Volume 88,205

Days Range 0.95 - 0.9921

Last Trade 9/21/2010 3:58:21 PM

Detailed GPRLF Stock Quote

Great Panther Drills 1,681g/T Silver Over 3.15 Metres at Topia Mine

GREAT PANTHER SILVER LIMITED

(TSX: GPR; the "Company") is pleased to report further assays, from the now expanded 7,200 metre (from the initial 6,000 metre) surface drill program on the Topia mine veins. The following core drilling results are from the Cantarranas and San Jorge veins (Hormiguera mine), San Gregorio vein (San Gregorio mine), El Rosario vein (El Rosario mine), Don Benito vein (exploration area) and La Prieta vein (recently purchased La Prieta mine). Highlights are reported on the --Drilling Summary Table-- attached, while plan and longitudinal maps with all of the 2010 surface drilling results reported to date can be found on the Topia Project page --Topia Project--. The program will provide for additional mineral resources to direct mine development and expansion decisions over the next several years and the Company anticipates mineral resource calculations for an additional four to five Topia area mines by September 2010.

more info;

http://www.greatpanther.com/s/NewsReleases.asp?ReportID=409726

Great Panther Silver Ltd (CA;GPR)(GPRLF)

http://www.greatpanther.com/s/StockInfo.asp

Great Panther Silver (TSE:GPR)

Last Price (USD) $0.73

Change ? -0.01 (-1.35%)

Bid 0.73

Ask 0.74

Volume 177,450

Days Range 0.73 - 0.75

Last Trade 8/5/2010 1:39:25 PM

Click for detailed quote page

Great Panther Silver (TSE:GPR)

Last Price (USD) $0.74

Change ? -0.01 (-1.33%)

Bid 0.72

Ask 0.74

Volume 7,600

Days Range 0.72 - 0.74

Last Trade 7/12/2010 10:01:08 AM

Click for detailed quote page

Great Panther Updates Los Pozos and Santa Margarita Development, Plus Rayas Deep Drilling Program at Guanajuato

http://www.greatpanther.com/s/NewsReleases.asp?ReportID=403873

Great Panther Silver (TSE:GPR)

Last Price (USD) $0.8

Change ? 0.0 (0.00%)

Bid 0.8

Ask 0.81

Volume 373,941

Days Range 0.8 - 0.84

Last Trade 6/8/2010 3:57:59 PM

Click for detailed quote page

Great Panther Silver (TSE:GPR)

Last Price (USD) $0.88 ![]()

Change ? 0.02 (2.33%)

Bid 0.86

Ask 0.88

Volume 182,483

Days Range 0.86 - 0.89

Last Trade 5/18/2010 3:56:44 PM

Click for detailed quote page

Great Panther Silver Limited (GPR)

$ 0.84 ?-0.02 (-2.33%)

Volume: 256,070

|

Followers

|

12

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

282

|

|

Created

|

08/04/06

|

Type

|

Free

|

| Moderators | |||

GREAT PANTHER RESOURCES (TSX:GPR)

|

Great Panther Silver Limited, headquartered in Vancouver, Canada, is one of the fastest growing primary silver producers in Mexico with strong leverage to future rises in the price of silver. The Company owns two operating mines in Mexico, and employs almost 800 people. Great Panther Silver Limited, headquartered in Vancouver, Canada, is one of the fastest growing primary silver producers in Mexico with strong leverage to future rises in the price of silver. The Company owns two operating mines in Mexico, and employs almost 800 people.Great Panther's mission is to become a leading primary silver producer by acquiring, developing and profitably mining precious and base metals in Mexico. We are committed to conducting ourselves with fairness and integrity, and managing all business activities in an environmentally responsible and cost-effective manner, while contributing to the well-being of the communities in which we live and work. Our primary goal is that of profitable growth, as we feel this is the key to maximizing long-term shareholder value. Our specific objectives are to grow production and earnings from mining operations and maintain positive cash flow while continuing to actively pursue exploration and development opportunities in Mexico. November 10, 2010: November 10, 2010: |

Nov 24, 2009: News Releases: Great Panther Announces New High Grade Development... (more...) Nov 17, 2009: News Releases: Great Panther Completes $12.3 Million Equity Offer... (more...) Nov 16, 2009: News Releases: Great Panther Reports Third Quarter Revenue Up 104... (more...) |

Enter your email address below to receive periodic updates from Great Panther Resouces Limited |

Great Panther Silver NYSE Closing Bell ![]()

25 Feb 2011

http://www.youtube.com/watch?v=u98FrGvEiug

Members of Great Panther Silver rang the NYSE Closing Bell

on Friday February 25, 2011 to celebrate the company's

listing on NYSE Amex.

http://www.greatpanther.com/s/Home.asp

http://www.greatpanther.com/s/Home.asp

Business Description:

The company has combined highly-experienced international

management and ready access to capital to invest in

silver & gold projects in Mexico.

They recently acquired the Topia Silver Mine in

Durango State & the Santa Fe Silver-Gold Mines

in Guanajuato.

Address:

1177 West Hastings Street, Suite 2100,

Vancouver, BC, CN V6E 2K3

Telephone:

(604) 608-1766

Website:

http://www.greatpanther.com

Facsimile:

(604) 608-1744

Email:

info@greatpanther.com

www.ivarkreuger.com/metalcharts.htm

www.ivarkreuger.com/metalcharts.htm

The super red banksters cults -

Rothschilds World Part 1 "Glen, Rush, Michael...Here's to you boy's"

http://www.youtube.com/watch?v=yhKHwrUA5SM&feature=related

www.greatpanther.com/s/Guanajuato_Photos-Maps.asp

www.greatpanther.com/s/TopiaMine_Photos-Maps.asp

GPR chart TA TI P&F Alert Bullish Price Objective 1st Target

fiat$6.88 per share ![]()

http://www.walkaboutventures.com/

Ponzi scheme - Fiat money - made out of nothing -

http://video.google.com/videoplay?docid=-8484911570371055528&q=creature+jeckyll&ei=c8kMSKSjJZPE2AKU2826BA#

FED - Power Center - Created @ NWO -

Ron Paul: "It's criminal."

http://www.youtube.com/watch?v=Wn8Cuy0F32o&feature=player_embedded

On the Edge with Dr. Paul Craig Roberts 12.10.10. Max Keiser

http://www.silverbearcafe.com/private/12.10/roberts12-10.html

WHY AREN'T THE BANKSTERS IN JAIL? -

IS IT NO LAW OR POLICE IN USA? -

WHY WAS THE HUNT BROTHERS TAKEN TO JAIL? -

AND WHY ISN'T THE BANKSTERS? -

NO EQUAL LAW FOR ALL PEOPLE IN THE USA? -

THE BANKSTERS ALLOWED TO CORNER THE SILVER MARKET? -

DO THE BANKSTERS HAVE MORE RIGHTS THAN THE HUNT BROTHERS? -

TO CORNER THE SILVER MARKET? -

ARE THE MARKET ALLOWED TO BE CORNED ON THE DOWNSIDE? -

BUT NOT ALLOWED TO BE CORNED ON THE UPSIDE? -

ARE THE BANKSTERS THE KINGS AND EMPERORS IN USA WITH SPEC. RIGHTS

TO RIDE WITH SPECIAL BOLSHEVIKS LAWS? -

FIRE ALL POLITICIANS THE PEOPLE DON'T NEED? -

DO THE PEOPLE NEED ANYONE OF THE 666 EVILS?

HAVE THE USA BECOME THE NEXT USSR? - WITH -

SUPER RED BOLSHEVIKS BANKSTERS COMMISSARS -

IS US THE COPYCAT OF USSR? -

IS IT THE PEOPLE WHO WANT THE US TO BE USSR?

btw.

the above Q.s are only a few of the reflexion going on

in my mind when I read the below link -

thanks for the info -

JP Morgan Admits To, Reduces Massive Silver Short Position, Proves Millions Of Conspiracy Theorists Correct

Be sure to read comments at end....Something seems off to me ,or just to good to be true!!

http://www.zerohedge.com/article/jp-morgan-admits-defeat-cuts-silver-short-position-proves-millions-conspiracy-theorists-abso

We need to crash the entire Federal Reserve -

Crash JP Morgan Buy Silver (*)

http://maxkeiser.com/

CUSIP# - importance of it

http://bit.ly/f9qBAo

Zionists or no Zionists...the IRS is an abomination on the American people.

http://www.veteranstoday.com/2010/12/05/jb-campbell-jewish-extortion/

by Montanore thanks for info ~<![]()

Btw. please, pass it along >>>>>>>>>>>>>>>>>

TIA

~<![]()

Gold and silver are higher this morning with the dollar, the British pound and commodity currencies falling in value. It is too early to tell whether the recent margin driven, paper sell off on the COMEX is over but physical supply remains limited while demand remains robust, particularly in China, India and wider Asia.

Knowledgeable experts continue to urge investors to own gold and silver due to the likelihood of much higher prices, currency and inflation risk.

One of the most respected global technical and macro strategists in the world, Robin Griffiths has said that silver and gold could rise to $450 and $12,000 per ounce respectively due to the debasement of paper currencies.

Dow Jones to Gold Ratio - 50 Years (Quarterly)

Griffiths was chief technical strategist with HSBC for over 20 years, has 44 years investment experience and now works for Cazenove Capital, one of the oldest investment houses in the world tracing its origins back to the 17th century. It manages money on behalf of blue blooded clients and is widely believed to manage some of the British Royal family's wealth.

When asked by King World News if his $350 target was a realistic price level for silver Griffiths stated, "That is absolutely not unrealistic. If you adjust the old all-time high for inflation...that gives you $450 for silver. Then you add in the fact that they are printing money, you can take it higher than that without any difficulty at all."

Dow Jones Industrial Average - 50 Years (Quarterly)

Griffiths told King World News that "Bulls (bull markets) are very successful at wobbling people out at the wrong time. "

Griffiths has previously said that not owning gold today is a form of insanity and "may even show unhealthy masochistic tendencies, which might need medical attention." (see here)

He has also critiqued the western media's superficial coverage of gold and their resort to Warren Buffett's ignorant comments on gold despite money printing and international currency debasement on a scale never before seen in history .

Meanwhile perhaps the leading commodity expert of our time, Jim Rogers, has said that silver was not and is not a bubble.

Regarding the recent price correction he said, "I don't know what caused it maybe it was short covering, maybe it was rumors. I have no idea." He continued "silver went down a great deal but if you raise margin requirements 150%-200% you would expect something to collapse," he added.

"I hardly see how silver could be a bubble when, even at its top, it's still below its all-time high. That's not much of a bubble."

If it goes to $150 this year, all other things being equal, then I'd say you better sell your silver. If it goes to $150 in 10 years then I would say that's a normal progression up and that's the way things work. But if the U.S. dollar suddenly turns into confetti then you better hold your silver at $200. So it depends on the circumstances and the timing more than anything else.

Since 2003, GoldCore have said that gold and silver would reach their inflation adjusted highs of $2,400/oz and $130/oz. Our estimates appear increasingly conservative especially given the fact that the official inflation statistics have been debased over the years and are not an accurate reflection of real inflation.

Predicting the future price of any asset class is impossible. Predicting that gold and silver will continue to protect against financial and economic shocks and crashes and global currency debasement is possible.

The current correction should be used as another buying opportunity in order to protect against the continuing extraordinary degree of macroeconomic, monetary and geopolitical risk in the world.

In case you missed it. Watch this! -

INFO VIDEO: Naked Short Selling Part 1

http://www.youtube.com/watch?v=Bfi3Hxasm2s

INFO VIDEO: Naked Short Selling Part 2

http://www.youtube.com/watch?v=RYUU2qZOcM0

INFO VIDEO: Naked Short Selling Part 3

http://www.youtube.com/watch?v=taLhQoTvTLw

http://www.bloomberg.com/avp/avp.htm?clipSRC=mms://media2.bloomberg.com/cache/vIrfhgQPAJ1s.asf

Money Masters: Federal Reserve History part 1 of 3

http://video.google.com/videoplay?docid=8442305921010099392&q=conspiracy

Money Masters: Federal Reserve History part 2 of 3

http://video.google.com/videoplay?docid=5020331178524208549&q=conspiracy

Money Masters: Federal Reserve History part 3 of 3

http://video.google.com/videoplay?docid=6666372716915416357&q=conspiracy

Money, Banking & The Federal Reserve -

http://video.google.ca/videoplay?docid=1349705906064948002&q=gold+money

A must see video clip on the Federal Reserve -

and the current state of the Dollar...

http://www.freedomtofascism.com/blog/2006/12/michael-badnarik-on-federal-reserve.html

A good presentation of market is explaned -

in below link -

http://www.businessjive.com/nss/darkside.html

http://www.ipetitions.com/petition/AFTF_P_1/

To: SEC, U.S. Congress -

Market Reform Petition -

http://www.petitiononline.com/mrktrfrm/petition-sign.html

Whoa! 40 new Sinatures! C'mon everybody -

Spread this around and Lets Get it Off to Congress! -

http://www.petitiononline.com/mrktrfrm/petition.html

by: fish777 - thanks!

TIA!

http://www.goldrush21.com/

http://www.netcastdaily.com/broadcast/fsn2006-1118-1.m3u

http://www.netcastdaily.com/broadcast/fsn2006-1202-2b.m3u

http://www.netcastdaily.com/broadcast/fsn2006-1202-2c.m3u

Those who make peaceful REVOLUTION impossible will

make violent REVOLUTION inevitable.

- John F. Kennedy

Shut Down The Federal Reserve: Save America!

http://www.ipetitions.com/petition/AFTF_P_1/

†With God all things are possible†

by: todd h

ROB-TV in exposing the Gold price suppression scheme -

http://www.youtube.com/watch?v=GbPetrK_6Lc&mode=related&search=

Join GATA -

http://www.GATA.org.

Gold Show -

2007 Vancouver Resource Investment Conference

Vancouver Convention and Exhibition Centre

Sunday and Monday, January 21 and 22, 2007

http://www.cambridgeconferences.com/ch_jan2007.html

The Fiat Money System -

Dr. Bill Veith in studio w/ Alex Jones -

http://tinyurl.com/y3gdzh

Has the 666 destroyed the US$? -

http://globalfire.tv/nj/07en/globalism/us_insolvent.htm

HON. RON PAUL OF TEXAS -

Before the U.S. House of Representatives -

The End of Dollar Hegemony -

http://tinyurl.com/uq9kf

Please pass it along >>>>>>>>>>>>>>>>>>>>>>>>>>>>>

DISCLAIMER

Nothing in the contents transmitted on this board should be construed as an investment advisory, nor should it be used to make investment decisions. There is no express or implied solicitation to buy or sell securities. The author(s) may have positions in the stocks discussed and may trade in the stocks mentioned. Readers are advised to conduct their own due diligence prior to considering buying or selling any stock. All information should be considered for information purposes only. No stock exchange has approved or disapproved of the information

Your opinions are appreciated -

Welcome TIA

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |