Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

$GS Total Debt (mrq) 522.67B

Goldman Sachs Group (GS) Crushes Earnings Forecast as Investment Banking Revenue Surges

By: TheStreet | July 13, 2021

• Goldman's Investment banking and asset management revenues came in well ahead of Street forecasts as the bank crushed second quarter earnings estimates.

Goldman Sachs Group (GS) posted stronger-than-expected second quarter earnings Tuesday thanks to a surge in asset management and investment banking revenues.

Goldman said earnings for the three months ending in June were pegged at $15.02 per share, nearly 140% higher than last year's tally and firmly ahead of the Street consensus forecast of $10.24 per share. Group revenues, Goldman said, rose 16% to $15.4 billion, the second highest on record that again beat analysts' forecasts of a $12.1 billion total.

Global markets revenues were down 32% from last year to $4.9 billion, Goldman said, while asset management revenues surged 144% to $5.1 billion, nearly double the Street consensus forecast. Investment banking revenues, meanwhile, were up 36% to $3.61 billion.

“Our second quarter performance and record revenues for the first half of the year demonstrate the strength of our client franchise and our continued progress on our strategic priorities," said CEO David Solomon. "While the economic recovery is underway, our clients and communities still face challenges in overcoming the pandemic."

"But, as always, I am proud of the dedication and resilience of our people, who have worked tirelessly to help our clients navigate the ever-changing market environment.”

Goldman Sachs shares were marked 1.25% higher in pre-market trading immediately following the earnings release to indicate an opening bell price of $385.18 each, a move that would extend the stock's year-to-date gain to around 47.2%.

Earlier in the session, Goldman's larger rival, JPMorgan Chase (JPM) - Get Report, posted a 37% increase in investment banking revenues that helped offset an 8% slump in net interest income.

JPMorgan said earnings for the three months ending in June were pegged at $3.78 per share, up 174% from the same period last year and well ahead of the Street consensus forecast of $3.18 per share.

Read Full Story »»»

DiscoverGold

DiscoverGold

christian schittker, he probably used cash from shorting his clients' positions, to run a failed simulation(or did he), predicting England 2020 Euro champions, how pathetic, he can't even predict the weather the next 5 minutes

HA HA HA to the stupid moron at golman SUCKS. gs should stick to shorting their clients' positions, and never PREDICT FOOTBALL

FY2021 EPS Estimates for The Goldman Sachs Group, Inc. Raised by Seaport Res Ptn (GS)

By: MarketBeat | July 8, 2021

FY2021 EPS Estimates for The Goldman Sachs Group, Inc. Raised by Seaport Res Ptn (NYSE:GS) GS 3 Reasons Goldman Sachs (NYSE:GS) Stock is a Buy After Q1 EarningsThe Goldman Sachs Group, Inc. (NYSE:GS) - Equities research analysts at Seaport Res Ptn l...

Read Full Story »»»

DiscoverGold

DiscoverGold

GS BS - interest rates up - GS up $12 and earnings on Tuesday July 13th.. not on a Friday, eh?? :)

By: David Larew | July 10, 2021

• GS BS - interest rates up - GS up $12 and earnings on Tuesday July 13th.. not on a Friday, eh?? :)

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman Sachs Could Scale to Fresh Record High on Upbeat Q2 Earnings; Target Price $414

By: Vivek Kumar | July 8, 2021

• The New York-based leading global investment bank Goldman Sachs is expected to report its second-quarter earnings of $9.52 per share, which represents year-over-year growth of over 52% from $6.26 per share seen in the same quarter a year ago.

The New York-based leading global investment bank Goldman Sachs is expected to report its second-quarter earnings of $9.52 per share, which represents year-over-year growth of over 52% from $6.26 per share seen in the same quarter a year ago.

It is worth noting that in the last two years, the world’s leading investment manager has surpassed market consensus expectations for profit and revenue most of the time.

The better-than-expected number would help the stock hit new all-time highs. The company will report its earnings result on Tuesday, July 13.

According to Zacks, The Goldman Sachs Group will report full-year earnings of $44.81 per share for the current financial year, with EPS estimates ranging from $40.95 to $49.50. For the next financial year, analysts expect that the business will report earnings of $35.81 per share, with EPS estimates ranging from $33.21 to $39.00.

Analyst Comments

“Our 2Q EPS est. increases to $10.05 from $9.53 on positive markets and higher equity investment revs. The equity investment line will likely again be a meaningful rev. swing factor (we model $1.4B vs. $3.1B in 1Q21). Post-DFAST, GS indicated that the dividend will increase to $2.00/qtr. from $1.25/qtr., but did not provide specifics on buybacks. We model 2Q share repurchase of $1.5B (vs. $2.2B cons.) and $2.5B/qtr. (vs.$2.3B/qtr. cons.) for the remainder of this year,” noted Daniel T. Fannon, equity analyst at Jefferies.

Goldman Sachs Stock Price Forecast

Sixteen analysts who offered stock ratings for Goldman Sachs in the last three months forecast the average price in 12 months of $414.50 with a high forecast of $500.00 and a low forecast of $330.00.

The average price target represents 14.44% from the last price of $362.20. From those 16 analysts, 13 rated “Buy”, three rated “Hold” while none rated “Sell”, according to Tipranks.

Morgan Stanley gave the stock price forecast of $165 with a high of $194 under a bull scenario and $104 under the worst-case scenario. The firm gave an “Overweight” rating on the beverage company’s stock.

“As market volatility subsides in the back half of the year and into 2022, we expect total revenues decline 13% y/y in 2022. We are valuing the group on normalized 2023 EPS. We see even more upside elsewhere in the group, particularly in consumer finance stocks which have been under more pressure. This drives our Underweight rating,” noted Betsy Graseck, equity analyst at Morgan Stanley.

“Over time, we expect GS can drive some multiple expansion as management executes on its multi-year strategic shift towards higher recurring revenues.”

Several other analysts have also updated their stock outlook. BMO lowered the target price to $415 from $436. Evercore ISI raised the target price to $410 from $370. Oppenheimer lifted the target price to $493 from $484. UBS upped the target price to $370 from $340.

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman Sachs Group (GS) Stock That is a Safe Play in July

By: Schaeffer's Investment Research | July 7, 2021

• Goldman Sachs stock has seen positive returns in July in nine of the past 10 years

• GS could benefit from a shift in sentiment in the options pits

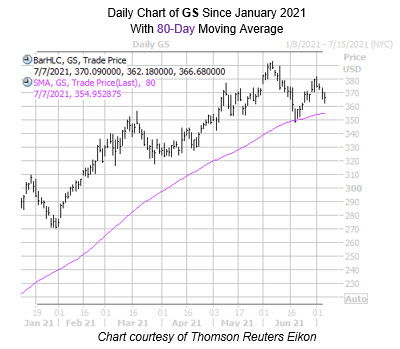

With a stellar first half of the year for Wall Street in the rearview mirror, investors are speculating on potential gains for the latter half -- and things are looking good. Bank stocks have attracted considerable attention of late, as volatile 10-year Treasury yield movements resulted in a recent selloff in the sector. However, this pullback may be the perfect opportunity to jump on Goldman Sachs Group Inc (NYSE:GS). Though the was last seen down 0.7%, trading at $367.22, it boasts a 84.4% year-over-year lead. In addition, GS is just one month removed from a June 7, all-time high of $393.26, and there's reason to believe that level could soon be within reach once again.

Digging deeper, Goldman Sachs stock just made it onto Schaeffer's Senior Quantitative Analyst Rocky White's list of the best performing stocks on the S&P 500 in July, going back 10 years. The security has seen positive monthly returns during this time period nine out of ten times, with a 4% pop on average. This means a move of similar magnitude from its current perch would put GS at nearly $382 -- leaving about 3% between the equity and its aforementioned all-time high.

On the charts, Goldman Sachs stock is pacing for a fourth-straight loss. The last time the equity saw a similar streak of losses, it bounced off the $348 level -- which coincides with the 80-day moving average -- in mid-June, to subsequently climb above $380 by the beginning of July.

A shift in sentiment over in the options pits could create additional tailwinds for Goldman Sachs stock. This is per the security's 50-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the 74th percentile of its annual range. In other words, long puts are being picked up at a faster-than-usual clip.

Echoing this, the equity's Schaeffer's put/call open interest ratio (SOIR) of 1.28, which sits higher than 84% of readings from the past year. This means short-term options traders have been more put-biased than usual.

What's more, GS premiums are a bargain at the moment. The security's Schaeffer's Volatility Index (SVI) of 29% stands higher than 18% of readings in its annual range, suggesting options traders have rarely priced in lower volatility expectations during the past 12 months.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GS 370 area would be key hold, for then you need a break ofr 380..

By: Options Mike | July 5, 2021

• $GS 370 area would be key hold, for then you need a break ofr 380.. no real conviction here for me..

Read Full Story »»»

DiscoverGold

DiscoverGold

GS - if the 10 year treasury yield breaks it's Bearish Descending Triangle

By: David Larew | July 4, 2021

• GS - if the 10 year treasury yield breaks it's Bearish Descending Triangle - the pusher man should go down with the banks - so prime time short for value coming up??? So Goldman said 4300 for the 2021 highs and we are at 4355 - it's not good to dis GS BS :)

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman and EQT AB to Buy Parexel for $8.5 Billion

By: TheStreet | July 2, 2021

• EQT AB and Goldman Sachs Group agree to acquire Parexel International from Pamplona Capital Management.

Swedish private-equity firm EQT AB and Goldman Sachs Group's (GS) investment arm said Friday they will buy clinical research company Parexel International from Pamplona Capital Management for $8.5 billion, including debt.

Parexel had drawn interest from about 10 parties, including

other private-equity firms and drug distributor

AmerisourceBergen (ABC), Bloomberg said.

Founded in 1982, Parexel is headed by Jamie Macdonald, who had previously been a senior adviser to EQT and will remain chief executive.

Pamplona Capital agreed in 2017 to acquire Parexel International for an enterprise value $5 billion and take the company private. Last year, Paraexel made a list of 11 best companies with remote jobs.

"We have followed Parexel closely during the past few years and have been impressed by the company’s development and trajectory," Eric Liu, partner and Global Co-Head of Healthcare at EQT, said in a statement. "We are excited to partner with Goldman Sachs for the next stage of Parexel’s journey, and to back Jamie, who prior to his role at Parexel had been a long-time senior adviser to EQT, as well as the rest of the Parexel team.”

Goldman Sachs Asset Management is the primary investing area within the bank and oversees roughly $2 trillion, according to the Wall Street Journal.

Its other healthcare investments include a manager of optometry services it purchased in 2019 and Datavant, a healthcare data-management company it invested in last month.

"We believe this investment will accelerate Parexel’s growth as it builds on the company’s global footprint, strong operational capabilities and expansive healthcare network," said Jo Natauri, partner and global head of private healthcare investing within Goldman Sachs Asset Management.

EQT oversees 67 billion euros ($79 billion) in assets and its focuses include real estate, technology, infrastructure and healthcare.

In April, Goldman posted stronger-than-expected results for the first quarter, helped by surging investment bank revenue. The bank's shares traded at $374.31, down about 0.2% at last check.

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman Sachs increases quarterly dividend to $2 per share

By: Reuters | June 28, 2021

• (Reuters) - Goldman Sachs Group Inc (NYSE:GS) said on Monday it planned to increase its common stock dividend to $2 per share from $1.25.

Read Full Story »»»

DiscoverGold

DiscoverGold

U.S. Supreme Court tosses class action ruling against Goldman Sachs

By: Andrew Chung | June 21, 2021

(Reuters) -The U.S. Supreme Court on Monday gave Goldman Sachs Group Inc another chance to avoid an investor class action lawsuit accusing the bank of hiding conflicts of interest when creating risky subprime securities before the 2008 financial crisis.

The justices threw out a decision by the Manhattan-based 2nd U.S. Circuit Court of Appeals last year that had allowed Goldman shareholders including the Arkansas Teacher Retirement System to sue as a group under a federal investor protection law. The plaintiffs accused the bank of unlawfully hiding conflicts of interest when creating risky subprime securities.

In directing the 2nd Circuit to reconsider the matter, the justices said the lower court had failed to properly assess whether the bank's statements that the investors had called misleading were too generic to have affected its stock price.

The ruling, authored by Justice Amy Coney Barrett, hands Goldman a victory - for now - in a class action in which the plaintiffs have said they lost more than $13 billion due to the bank's conduct. However, the decision clarified that the burden is still on defendants like Goldman to persuade a court that their alleged misstatements had no impact on the stock price - a finding that conservative Justices Neil Gorsuch, Clarence Thomas and Samuel Alito said they disagreed with in a partial dissent.

In a statement, one of the law firms representing the shareholders, Robbins Geller Rudman & Dowd, welcomed the decision rejecting "Goldman's effort to flip the burden of persuasion" onto plaintiffs.

"Since this case was first filed more than 11 years ago, Goldman Sachs has spared no expense to avoid facing a jury for misleading investors about its role in the financial crisis," the firm said.

Goldman spokesperson Maeve DuVally said the bank was pleased with the decision and "we will continue to vigorously defend ourselves as the case returns to the lower courts."

The Arkansas Teacher Retirement System and other pensions that purchased Goldman shares between February 2007 and June 2010 filed suit, accusing the company and three former executives of violating an anti-fraud provision of the Securities Exchange Act of 1934 and a related SEC regulation. The plaintiffs said that the bank's fraudulent statements kept its stock price artificially high.

The case had been closely followed for clues as to how the Supreme Court, with its 6-3 conservative majority, would view shareholder class actions. Businesses often seek to limit the ability of plaintiffs to collectively sue in order to avoid the higher damages often awarded in such litigation.

The plaintiffs said that when they bought Goldman shares they relied upon the bank's statements about its ethical principles and internal controls against conflicts of interest, and its pledge that its "clients' interests always come first."

Goldman argued that these "aspirational" statements were too vague and general to have had any impact on the stock price.

The case stemmed from Goldman's sale of collateralized debt obligations including Abacus 2007 AC-1, which it assembled with help from hedge fund manager John Paulson.

In 2010, Goldman reached a $550 million settlement with the U.S. Securities and Exchange Commission to resolve charges that it cheated Abacus investors by concealing Paulson's role, including how he made a $1 billion profit by betting that the sale of collateralized debt obligations would fail.

The plaintiffs said that the share price would have been lower if the truth had been known about the company's conflicts of interest.

The 2nd Circuit last year upheld a federal judge's decision to let the plaintiffs sue as a group and rejected one of the company's arguments that generic statements can never impact a stock price.

Justice Sonia Sotomayor issued a partial dissent in the case, saying the 2nd Circuit's decision should have been affirmed.

Read Full Story »»»

DiscoverGold

DiscoverGold

$GS has been the leader and holding in better. 320 is a must hold area should find support between 330-320 for now

By: Options Mike | June 20, 2021

• $GS has been the leader and holding in better. 320 is a must hold area should find support between 330-320 for now

Read Full Story »»»

DiscoverGold

DiscoverGold

JMP Securities Boosts The Goldman Sachs Group (GS) Price Target to $425.00

By: MarketBeat | June 16, 2021

The Goldman Sachs Group (NYSE:GS) had its price target upped by JMP Securities from $400.00 to $425.00 in a report released on Thursday, The Fly reports. The brokerage currently has a "market outperform" rating on the investment management company's stock. JMP Securities' price objective indicates a potential upside of 16.31% from the company's current price...

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman Taps Galaxy Digital as Liquidity Provider for Bitcoin Futures

By: TheStreet | June 18, 2021

• Galaxy Digital will provide liquidity for block Bitcoin trades on the CME, as Goldman Sachs expands its cryptocurrency offerings, the companies said.

Goldman Sachs (GS) is taking on Galaxy Digital Holdings BRPHF, the digital asset management firm founded by ex-Goldman partner Michael Novogratz, as a liquidity provider for Bitcoin futures.

Galaxy will provide the liquidity for block trades on CME, as Goldman expands its cryptocurrency offerings, the companies said.

Goldman is getting back into digital currency trading to help big customers, such as hedge funds, trade Bitcoin futures, Bloomberg reports.

"Our goal is to equip our clients with best execution pricing and secure access to the assets they want to trade," Max Minton, head of digital assets for Goldman Sachs' Asia-Pacific division, said in a statement. "In 2021, this now includes crypto.”

Goldman stock recently traded at $352.23, down 2.6%. It has climbed 45% over the past six months, as the economic recovery has boosted banks. But it has dropped 10% since June 4, as stocks that would benefit from faster economic growth and higher rates have pulled back.

Galaxy recently traded at $18.39, down 0.2%.

Goldman said last month that it’s forming a wealth-management joint venture with state-owned Industrial and Commercial Bank of China. the New York investment bank thus becomes the latest foreign lender to take advantage of a further opening of the country's financial sector to target rising affluence in mainland China.

In April, Goldman posted stronger-than-expected results for the first quarter, helped by surging investment bank revenue.

Profit registered $18.60 a share, nearly six times higher than the year-earlier tally and ahead of the analyst consensus forecast of $10.22 a share.

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman Sachs (GS) Stock Flashes Historically Bullish Signal

By: Schaeffer's Investment Research | June 16, 2021

• The 40-day moving average has acted as a springboard for GS in the past

• The stock is up just over 39% in 2021

The shares of Goldman Sachs Group Inc (NYSE:GS) have been falling since their June 7 all-time high of $393.26. While down 0.4% today, last seen trading at $369.84, the shares sport an impressive 39.5% year-to-date lead. Plus, GS is flashing a historically bullish signal on the charts.

More specifically, the equity just came within one standard deviation of its ascending 40-day moving average, after spending considerable time above it. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, nine similar signals have occurred in the past three years. Goldman Sachs stock enjoyed a positive return one month later in 67% of those cases, averaging a 4.2% gain. From its current perch, a comparable move would put GS above the $385 level and close to its aforementioned record peak.

Puts have been more popular than usual, too, leaving plenty of pessimism to be unwound in the options pits. This is per the security's Schaeffer's put/call open interest ratio (SOIR) of 1.72 sits in the highest percentile of its annual range, meaning short-term options traders have been more bearish than normal.

What's more, GS options can be had for a bargain at the moment. The security's Schaeffer's Volatility Index (SVI) of 26% sits in just the 10th percentile of its annual range, indicating options players are pricing in low volatility expectations right now. What's more, Goldman Sachs stock's Schaeffer's Volatility Scorecard (SVS) ranks at 80 out of 100, which implies the stock usually outperforms these volatility expectations.

Read Full Story »»»

DiscoverGold

DiscoverGold

How much is GS involved in Naked Shorting

Some highlights of House or Cards for full version must open the PDF:

https://pdfhost.io/v/lRQ4HqpG0_House_of_Cards_Atobitt.pdf#page=1

A House of Cards by Austin Tobitt

Parr I Summary: The DTC has been taken over by big money. They transitioned from a manual to a computerized ledger system in the 80s, and it played a significant role in the 1987 market crash. In 2003, several issuers with the DTC wanted to remove their securities from the DTC's deposit account because the DTC's participants were naked short selling their securities. Turns out, they were right. The DTC and it's participants have created a market-sized naked short selling scheme. All of this is made possible by the DTC's enrollee- Cede & Co._____________________________________________________________________________________The events we are living through RIGHT NOW are the 50-year ripple effects of stock market evolution. From the birth of the DTC to the cesspool we currently find ourselves in, this DD will illustrate just how fragile the House of Cards has become.We've been warned so many times... We've made the same mistakes so many times.And we never seem to learn from them._____________________________________________________________________________________In case you've been living under a rock for the past few months, the DTCC has been proposing a boat load of rule changes to help better-monitor their participants' exposure. If you don't already know, the DTCC stands for Depository Trust & Clearing Corporation and is broken into the following (primary) subsidiaries:1.Depository Trust Company (DTC)-centralized clearing agency that makes sure grandma gets her stonks and the broker receives grandma's tendies2.National Securities Clearing Corporation (NSCC)-provides clearing, settlement, risk management, and central counterparty (CCP) services to its members for broker-to-broker trades3.Fixed Income Clearing Corporation (FICC)-provides central counterparty (CCP) services to members that participate in the US government and mortgage-backed securities marketsBriefhistorylesson: I promise it's relevant (thislinkprovides all the info that follows).The DTC was created in 1973. It stemmed from the need for a centralized clearing company. Trading during the 60s went through the roof and resulted in many brokers having to quit before the day was finished so they could manually record their mountain of transactions. All of this was done on paper and each share certificate was physically delivered. This obviously resulted in many failures to deliver (FTD) due to the risk of human error in record keeping. In 1974, the Continuous Net Settlement system was launched to clear and settle trades using a rudimentary internet platform.In 1982, the DTC started using aBook-Entry Only(BEO) system to underwrite bonds. For the first time, there were no physical certificates that actually traded hands. Everything was now performed virtually through computers.

Section 5:Hedgies are f*cked... I’m officially +20 pages deep and there’s still so much I’d like to say. It’s best saved for another time and another post, I suppose. So I guess I’ll wrap all of this up with some of the best news I can possibly provide...It all started with a 73 page PDF that was published in 2005 by a silverback named John D. Finnerty. John was a Professor of Finance at Fordham University when he published“short selling, death spiral convertibles, and the profitability of stock manipulation”. The document is loaded with sh*t that’s incredibly relevant today, especially when it comes to naked short selling. He dives into the exact formula that short sellers use, which is far beyond what my wrinkled brain can interpret, alone...However, when firms are naked shorting a company with the goal of bankrupting them, they leave footprints which are only explained by this event. The proof is in the pudding, so to speak.Any of this sound familiar??“The manipulator can not drive the share price close to zero unless he can naked short an extraordinary number of shares...this form of manipulation would result in... unusually heavy trading volume, and unusually large and persistent fails to deliver at the NSCC”.Anyone else remember the volume in GME during the run-up in January? The total volume traded between 1/31/2021 and 2/5/2021 was 1,508,793,439 shares, or an average daily trade volume of88,752,555 shares. On 1/22/2021, the volume reached 197,157,946... that’s roughly 3x the number of shares that exist..if this doesn’t sound like unusual volume then I’m not sure what is. Furthermore, the FTD report on GameStop was through the roof during this time

Notice the statement where the manipulator will be relieved of its obligation to cover if the firms shares are cancelled in bankruptcy? Did you happen to see footnotes 65 & 66 in the first screenshot of his PDF? It references a company that he used for his analysis...Charter Communications had a whopping 241.8% short float in 2005...The ONLY way the manipulator could have escaped this was by bankrupting the company and relieving the obligation to repurchase those shares...Guess what happened to Charter? They filed forbankruptcy in 2009...same thing hedge funds are trying to do to AMC/GME.

Part III Section 4:Slimy... If you watched the AMA with Wes Christian, he talks about the number of occurrences where the actual short interest is severely understated based on the data his firm obtained for legal proceedings. According to his numbers, in most cases the short interest is 50% - 150%MOREthan what is reported by the SEC(starting at 14:30). The objective isn’t to address the issue: it’s to keep the issue hidden. Firms that underreport their short interest are gaming the system by taking advantage of how the short interest calculation is done. When the SEC relies on reports that broker-dealers provide, and FINRA takes YEARS to reveal the lies within those reports, the broker-dealer can lie without immediately facing the consequences. It allows these firms to operate in a high-risk environment without exposing just HOW big their risk-appetite is.Another example that Wes mentioned wasMerrill Lynch. Merrill was fined$415,000,000(violation 3)in 2016 for using securities held in their customer’s accounts to cover their own trades. Check out this screenshot I took from that case:Remember when we mentionedSEA 15c3-3in the case with Apex? They were asking customers to book short positions to either a cash account or a short margin account.SEA 15c3-3protects those customers from allowing brokers to lend out the securities within their cash accounts...Well Merrill Lynch knocked that one right out of the f*cking park

Merrill made it seem like the required deposit in their customer reserve account was much lower than it truly was. They wouldn’t have been able to use that cash if it reduced the amount below the minimum capital requirement, so they found a way to fudge the numbers. In doing so, they managed to prevent a CODE RED while reaping the benefits of a high-risk ‘opportunity’. Should Merrill have filed bankruptcy during that time, those customers would have been completely blindsided.In the case of short selling, thetrueexposure of short interest is unknown... and I’m not just talking about the short sale indicator. When a firm fails to deliver securities that were sold short, there’s a pretty good indication that they’ve exposed themselves to a bit of a problem.. Now imagine a case where the FTDs start piling up and they STILL continue to short sell that same security.. think I’m joking?Check out theRoyal Bank of Canada:

Again... I was pretty shocked at that one. However, nothing rang-the-bell quite like this one fromGoldman Sachs:Goldman had 68 occasions in 4 months where they didn’t close a failure-to-deliver... In 45 occasions, they CONTINUED to accept customer short sale orders in securities which it had an active failure-to-deliver...When a firm is really starting to sweat, they pull certain tricks out of their ass to quell the situation. Again, this is nothing but smoke and mirrors because that’s all they can really do. Just as Merrill Lynch artificially lowered their customer reserve deposit, other firms make it look like they cover their short positions.One of the ways they do this is by short selling a SH*T load of shares right before a buy-in... Since we’re talking about Goldman Sachs, this seems like a great time to showcase their experience with this..

I promise... It really is as dumb as it sounds...So the perception here is when Goldman’s client has a FTD and they find out a buy-in is coming, the required buy-in would obviously be too extreme for the client to handle.. So they begin to buy those shares while simultaneously shorting AT LEAST the same amount they were required to purchase...Have you ever failed to repay a loan so you went to another bank and got a loan to cover the first one? Well that’s exactly what this is... I know what you’re probably thinking... “didn’t that just kick the can down the road?”. The answer is YES: it didn’t actually solve anything.There’s still one more citation that Goldman received which truly represents the pinnacle ofno-sh\ts-given. After I cover this, I don’t know how anyone could argue the systematic risks that exist within the securities lending business.. Check it out:

For 5 years, Goldman relied on a team of 10-12 individuals to locate shares to be used by its clients for short selling. This group was known as the “demand team”. Naturally, as the number of requests coming in the door started to increase, it became difficult for the team to properly document all of them. The volume peaked at 20,000 requests PER DAY, but the number of individuals that handled this job stayed the same.Obviously, this became too much for them to handle so they opted out of the manual process and found another solution- the F3 key....Yes- the F3 key... This button activated an autofill system which completed98% of Goldman’s orders to locate shares

The problem with Goldman’s autofill system was that it used the number of shares available to borrow at the beginning of that day, which had already been accounted for. After using the auto-locate feature, the demand team didn’t even verify the accuracy of the autofill feature or document which method was used to locate the shares for each order... and this happened for 5 years..Just goes to show how dedicated firms like Goldman Sachs truly are to the smallest of details, you know? Great f*cking work, guys.By the way, I have to show one of Goldman’s short sale indicator violations... It’s too good to pass up

At some point, you just have to laugh at these ass clowns... I mean seriously... one violation for a 4 year period involving over 380,000,000 short interest positions... they have plenty of other short interest violations, I just laughed at how the magnitude of this one was summarized by FINRA with 10 lines and roughly 4 minutes... whoever wrote that one must have been late for lunch.The last thing I’d like to note here is the way in which short sellers use options to “cover” their positions. Wes gave a great overview of this in the AMA(starting at 6:25). Basically, one group will buy puts and another group buys calls. This creates a synthetic share that is only provided if the option is activated. Regardless, short sellers will use that synthetic share to cover their short position and the regulators actually accept it...However, as Wes points out, most of those options expire without being activated which means the share is never delivered. This expiration can be set months down the road and allows the short seller to keep kicking the can.I doubt I need to say this, but we all remember the wild options activity that was happening shortly after GameStop spiked in January.u/HeyItsPixelwas one of the first to point this out. While a lot of that activity was on the retail front, I suspect a lot of it was done by short sellers to cover those positions

However, unlike John’s example where naked short sellers were driving down the price without opposition, GameStop had extremely high demand from retail investors to counter this activity. As I have discussed with Dr. T and Carl Hagberg, the run-up in volume during January and February was largely conducted by naked short sellers in an attempt to suppress the share price. As I have shown in the example with Goldman Sachs, firms will short sell during a buy-in for the same exact reason.

However, unlike John’s example where naked short sellers were driving down the price without opposition, GameStop had extremely high demand from retail investors to counter this activity. As I have discussed with Dr. T and Carl Hagberg, the run-up in volume during January and February was largely conducted by naked short sellers in an attempt to suppress the share price. As I have shown in the example with Goldman Sachs, firms will short sell during a buy-in for the same exact reason. To stabilize the price, you must stabilize supply and demand....

The only conclusion I keep coming back to is that the people with money know what’s going on and are desperately trying to keep it under wraps..So.... In an effort to prove this, I looked for violations that showed their desperation to protect this f*cked up system.Buckle up.27

Part III Section 4:Slimy... If you watched theAMA with Wes Christian, he talks about the number of occurrences where the actual short interest is severely understated based on the data his firm obtained for legal proceedings. According to his numbers, in most cases the short interest is 50% - 150%MOREthan what is reported by the SEC(starting at 14:30). The objective isn’t to address the issue: it’s to keep the issue hidden. Firms that underreport their short interest are gaming the system by taking advantage of how the short interest calculation is done. When the SEC relies on reports that broker-dealers provide, and FINRA takes YEARS to reveal the lies within those reports, the broker-dealer can lie without immediately facing the consequences. It allows these firms to operate in a high-risk environment without exposing just HOW big their risk-appetite is.Another example that Wes mentioned wasMerrill Lynch. Merrill was fined$415,000,000(violation 3)in 2016 for using securities held in their customer’s accounts to cover their own trades. Check out this screenshot I took from that case:Remember when we mentionedSEA 15c3-3in the case with Apex? They were asking customers to book short positions to either a cash account or a short margin account.SEA 15c3-3protects those customers from allowing brokers to lend out the securities within their cash accounts...Well Merrill Lynch knocked that one right out of the f*cking park.28

Merrill made it seem like the required deposit in their customer reserve account was much lower than it truly was. They wouldn’t have been able to use that cash if it reduced the amount below the minimum capital requirement, so they found a way to fudge the numbers. In doing so, they managed to prevent a CODE RED while reaping the benefits of a high-risk ‘opportunity’. Should Merrill have filed bankruptcy during that time, those customers would have been completely blindsided.In the case of short selling, thetrueexposure of short interest is unknown... and I’m not just talking about the short sale indicator. When a firm fails to deliver securities that were sold short, there’s a pretty good indication that they’ve exposed themselves to a bit of a problem.. Now imagine a case where the FTDs start piling up and they STILL continue to short sell that same security.. think I’m joking?Check out theRoyal Bank of Canada:29

Again... I was pretty shocked at that one. However, nothing rang-the-bell quite like this one fromGoldman Sachs:Goldman had 68 occasions in 4 months where they didn’t close a failure-to-deliver... In 45 occasions, they CONTINUED to accept customer short sale orders in securities which it had an active failure-to-deliver...When a firm is really starting to sweat, they pull certain tricks out of their ass to quell the situation. Again, this is nothing but smoke and mirrors because that’s all they can really do. Just as Merrill Lynch artificially lowered their customer reserve deposit, other firms make it look like they cover their short positions.One of the ways they do this is by short selling a SH*T load of shares right before a buy-in... Since we’re talking about Goldman Sachs, this seems like a great time to showcase their experience with this..30

The problem with Goldman’s autofill system was that it used the number of shares available to borrow at the beginning of that day, which had already been accounted for. After using the auto-locate feature, the demand team didn’t even verify the accuracy of the autofill feature or document which method was used to locate the shares for each order... and this happened for 5 years..Just goes to show how dedicated firms like Goldman Sachs truly are to the smallest of details, you know? Great f*cking work, guys.By the way, I have to show one of Goldman’s short sale indicator violations... It’s too good to pass up.

At some point, you just have to laugh at these ass clowns... I mean seriously... one violation for a 4 year period involving over 380,000,000 short interest positions... they have plenty of other short interest violations, I just laughed at how the magnitude of this one was summarized by FINRA with 10 lines and roughly 4 minutes... whoever wrote that one must have been late for lunch.The last thing I’d like to note here is the way in which short sellers use options to “cover” their positions. Wes gave a great overview of this in the AMA(starting at 6:25). Basically, one group will buy puts and another group buys calls. This creates a synthetic share that is only provided if the option is activated. Regardless, short sellers will use that synthetic share to cover their short position and the regulators actually accept it...However, as Wes points out, most of those options expire without being activated which means the share is never delivered. This expiration can be set months down the road and allows the short seller to keep kicking the can.I doubt I need to say this, but we all remember the wild options activity that was happening shortly after GameStop spiked in January.u/HeyItsPixelwas one of the first to point this out. While a lot of that activity was on the retail front, I suspect a lot of it was done by short sellers to cover those positions.

I promise... It really is as dumb as it sounds...So the perception here is when Goldman’s client has a FTD and they find out a buy-in is coming, the required buy-in would obviously be too extreme for the client to handle.. So they begin to buy those shares while simultaneously shorting AT LEAST the same amount they were required to purchase...Have you ever failed to repay a loan so you went to another bank and got a loan to cover the first one? Well that’s exactly what this is... I know what you’re probably thinking... “didn’t that just kick the can down the road?”. The answer is YES: it didn’t actually solve anything.There’s still one more citation that Goldman received which truly represents the pinnacle ofno-sh\ts-given. After I cover this, I don’t know how anyone could argue the systematic risks that exist within the securities lending business.. Check it out:31

For 5 years, Goldman relied on a team of 10-12 individuals to locate shares to be used by its clients for short selling. This group was known as the “demand team”. Naturally, as the number of requests coming in the door started to increase, it became difficult for the team to properly document all of them. The volume peaked at 20,000 requests PER DAY, but the number of individuals that handled this job stayed the same.Obviously, this became too much for them to handle so they opted out of the manual process and found another solution- the F3 key....Yes- the F3 key... This button activated an autofill system which completed98% of Goldman’s orders to locate shares

The problem with Goldman’s autofill system was that it used the number of shares available to borrow at the beginning of that day, which had already been accounted for. After using the auto-locate feature, the demand team didn’t even verify the accuracy of the autofill feature or document which method was used to locate the shares for each order... and this happened for 5 years..Just goes to show how dedicated firms like Goldman Sachs truly are to the smallest of details, you know? Great f*cking work, guys.By the way, I have to show one of Goldman’s short sale indicator violations... It’s too good to pass up.

At some point, you just have to laugh at these ass clowns... I mean seriously... one violation for a 4 year period involving over 380,000,000 short interest positions... they have plenty of other short interest violations, I just laughed at how the magnitude of this one was summarized by FINRA with 10 lines and roughly 4 minutes... whoever wrote that one must have been late for lunch.The last thing I’d like to note here is the way in which short sellers use options to “cover” their positions. Wes gave a great overview of this in the AMA(starting at 6:25). Basically, one group will buy puts and another group buys calls. This creates a synthetic share that is only provided if the option is activated. Regardless, short sellers will use that synthetic share to cover their short position and the regulators actually accept it...However, as Wes points out, most of those options expire without being activated which means the share is never delivered. This expiration can be set months down the road and allows the short seller to keep kicking the can.I doubt I need to say this, but we all remember the wild options activity that was happening shortly after GameStop spiked in January.u/HeyItsPixelwas one of the first to point this out. While a lot of that activity was on the retail front, I suspect a lot of it was done by short sellers to cover those positions.

One year later they adoptedNYSE Rule 387which meant most securities transactions had to be completed using this new BEO computer system. Needless to say, explosive growth took place for the next 5 years. Pretty soon, other securities started utilizing the BEO system. It paved the way for growth in mutual funds and government securities, and even allowed for same-day settlement. At the time, the BEO system was a tremendous achievement. However, we were destined to hit a brick wall after that much growth in such a short time.. By October 1987, that's exactly what happened._____________________________________________________________________________________"A number of explanations have been offered as to the cause of the crash... Among these are computer trading, derivative securities, illiquidity, trade and budget deficits, and overvaluation.."If you're wondering where the birthplace of High Frequency Trading (HFT) came from, look no further. The same machines that automated the exhaustively manual reconciliation process were also to blame for amplifying the fire sale of 1987.The last sentence indicates a much more pervasive issue was at play, here. The fact that we still have trouble explaining the calculus is even more alarming. The effects were so pervasive that it was dubbed the1st global financial crisis.Here's another great summary published by theNY Times: "..to be fair to the computers.. [they were].. programmed by fallible people and trusted by people who did not understand the computer programs' limitations. As computers came in, human judgement went out."Damned if that didn't give me goosiebumps... _______________________________________________________________________________

Notice the last sentence? A major factor behind the crash was a disconnect between the price of stock and their corresponding derivatives. The value of any given stock should determine the derivative value of that stock. It shouldn't be the other way around.This is an important concept to remember as it will be referenced throughout the post.In the off chance that the market DID tank, they hoped they could contain their losses withportfolio insurance.Anotherarticle from the NY timesexplains this in better detail. __________________________________________

Here are a few in favor.All of the comments I checked were participants and classified as market makers and other major financial institutions... go fucking figure.https://www.sec.gov/rules/sro/dtc200302/srdtc200302-82.pdf 8

_____________________________________________________________________________________Twohttps://www.sec.gov/rules/sro/dtc200302/srdtc200302-81.pdf 9

_____________________________________________________________________________________Threehttps://www.sec.gov/rules/sro/dtc200302/rbcdain042303.pdf _____________________________________________________________________________________Here's thefull listif you wanna dig on your own....I realize there are advantages to "paperless" securities transfers... However... It is EXACTLY what Michael Sondow said in his comment letter above..We simply cannot trust the DTC to protect our interests when we don't have physical control of our assets.10

Several other participants, includingEdward Jones, Ameritrade, Citibank, and Prudential overwhelmingly favored this proposal. How can someone NOT acknowledge that the absence of physical shares only makes it easier for these people to manipulate the market?This rule change would allow these 'participants' to continue doing this because it's extremely profitable to sell shares that don't exist, or have not been collateralized. Furthermore, it's a win-win for them because it forces issuers to keep their deposits in the holding account of the DTC...Ever heard of thefractional reserve banking system?? Sounds A LOT like what the stock market has just become.Want proof of market manipulation? Let's fact-check the claims from the opposition letters above.I'm only reporting a few for the time period we discussed (2003ish). This is just to validate their claims that some sketchy shit is going on.1.UBS Securities(formerly UBS Warburg):A.pg 559; SHORT SALE VIOLATION; 3/30/1999B.pg 535; OVER REPORTING OF SHORT INTEREST POSITIONS; 5/1/1999 - 12/31/1999C.PG 533; FAILURE TO REPORT SHORT SALE INDICATORS;INCORRECTLY REPORTING LONG SALE TRANSACTIONS AS SHORT SALES; 7/2/20022.Merrill Lynch(Professional Clearing Corp.):A.pg 158; VIOLATION OF SHORT INTEREST REPORTING; 12/17/20013.RBC(Royal Bank of Canada):A.pg 550; FAILURE TO REPORT SHORT SALE TRANSACTIONS WITH INDICATOR; 9/28/1999B.pg 507; SHORT SALE VIOLATION; 11/21/1999C.pg 426; FAILURE TO REPORT SHORT SALE MODIFIER; 1/21/2003Ironically, I picked these 3 because they were the first going down the line. I'm not sure how to be any more objective about this. Their entire FINRA report is littered with short sale violations. Before anyone asks "how do you know they aren't ALL like that?" The answer is - I checked. If you get caught for a short sale violation, chances are you will ALWAYS get caught for short sale violations. Why? Because it's more profitable to do it and get caught, than it is to fix the problem.Wanna know the 2nd worst part?Several comment letters asked the DTC to investigate the claims of naked shortingBEFOREcoming to a decision on the proposal.. I never saw a document where they followed up on those requests....

https://pdfhost.io/v/lRQ4HqpG0_House_of_Cards_Atobitt.pdf#page=1

Equities Analysts Issue Forecasts for The Goldman Sachs Group, Inc.'s Q2 2021 Earnings (GS)

By: MarketBeat | June 11, 2021

• The Goldman Sachs Group, Inc. (NYSE:GS) - Jefferies Financial Group issued their Q2 2021 earnings per share estimates for The Goldman Sachs Group in a note issued to investors on Wednesday, June 9th. Jefferies Financial Group analyst D. Fannon anticipates that the investment management company will post earnings per share of $9.53 for the quarter. Jefferies Financial Group currently has a "Buy" rating and a $450.00 target price on the stock. Jefferies Financial Group also issued estimates for The Goldman Sachs Group's Q3 2021 earnings at $8.47 EPS, Q4 2021 earnings at $9.21 EPS, FY2021 earnings at $45.80 EPS, Q1 2022 earnings at $9.18 EPS, Q2 2022 earnings at $8.93 EPS, Q3 2022 earnings at $8.86 EPS, Q4 2022 earnings at $9.78 EPS, FY2022 earnings at $36.75 EPS and FY2023 earnings at $41.70 EPS. The Goldman Sachs Group (NYSE:GS) last announced its quarterly earnings results on Tuesday, April 13th. The investment management company reported $18.60 earnings per share (EPS) for the quarter, beating the consensus estimate of $10.22 by $8.38. The Goldman Sachs Group had a net margin of 28.40% and a return on equity of 20.64%. The company had revenue of $17.70 billion during the quarter, compared to the consensus estimate of $11.74 billion. During the same quarter in the previous year, the company posted $3.11 earnings per share. The company's revenue for the quarter was up 102.4% compared to the same quarter last year...

Read Full Story »»»

DiscoverGold

DiscoverGold

Visa (V) Inks Deal With Goldman for Global Corporate Payments

By: TheStreet | June 7, 2021

• Visa will enable Goldman to help its clients 'simplify complexities and costs associated with existing systems,' the companies said.

Visa (V) shares rose Monday as the credit-card giant announced a deal with Goldman Sachs GS that will allow the banking titan’s corporate customers to use Visa to make global payments.

“Through its implementation of Visa B2B Connect and Visa Direct Payouts solutions, Goldman Sachs will help its commercial and corporate banking clients simplify complexities and costs associated with existing systems and inefficient processes,” the companies said in a press release.

“These solutions will enhance Goldman’s cross-border business-to-business (B2B) and business-to-consumer (B2C) payments program for high and low value payments," the release noted. "Goldman Sachs’s corporate clients can move funds quickly and securely, have near real-time visibility into their payment status, obtain necessary reconciliation and compliance data, ultimately helping improve organizations’ cash flow."

Visa traded at $232.66, up 1.11%, in pre-market trading Monday. It has gained 8% over the past six months, compared to 14.4% for the S&P 500. Goldman Sachs shares were up 0.4% to $393 in pre-market trading.

Visa also benefited Monday from an upgrade by Piper Sandler analyst Christopher Donat to overweight from neutral. He boosted his price target to $260 from $234.

Visa has “too wide” a valuation discount to Mastercard (MA), he said, according to Bloomberg.

And Visa will probably benefit more from the vaccine-generated U.S. economic recovery than its rival, Donat said. That’s because prior to the pandemic, Visa received 45% of its revenue in the U.S., compared to 32% for Mastercard.

Last week, Visa reported a 32% increase in U.S. payments volume for May compared to the same month in 2019. Debit payments rose 51% over that time.

In April, Visa reported stronger-than-expected earnings for its latest quarter, helped by an 11% increase in payments volume during the period.

Read Full Story »»»

DiscoverGold

DiscoverGold

The Goldman Sachs Group (GS) Price Target Increased to $420.00 by Analysts at Piper Sandler

By: MarketBeat | June 1, 2021

The Goldman Sachs Group (NYSE:GS) had its price objective boosted by stock analysts at Piper Sandler from $385.00 to $420.00 in a note issued to investors on Tuesday, The Fly reports. The brokerage presently has an "overweight" rating on the investment management company's stock. Piper Sandler's target price would suggest a potential upside of 12.90% from the company's current price. The analysts noted that the move was a valuation call.

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman Sachs Starts The Month With A Breakout

By: Gary S. Morrow | June 1, 2021

Goldman Sachs is breaking out as the new month begins. The stock is trading at new all time highs with the help of today’s 2.5% gain. This powerful move extends the stock’s 2021 gain to 46%. From the March 2020 lows GS is up 110%. Since bottoming last October GS has put in 7 straight monthly gains on 7 straight higher monthly lows. June looks to be the 8th straight.

We expect more upside in the near term for GS. Despite reaching new highs shares are well below overbought levels(daily MACD). Layers of support are now in place. $373-$377 is the initial support zone. On the downside a close back below $361 would violate last week’s lows sending a clear warning sign that the breakout has failed.

No position.

Read Full Story »»»

DiscoverGold

DiscoverGold

$11.01 Billion in Sales Expected for The Goldman Sachs Group (GS) This Quarter

By: MarketBeat | May 30, 2021

Wall Street analysts expect that The Goldman Sachs Group, Inc. (NYSE:GS) will report sales of $11.01 billion for the current quarter, according to Zacks Investment Research. Three analysts have provided estimates for The Goldman Sachs Group's earnings, with the lowest sales estimate coming in at $10.34 billion and the highest estimate coming in at $11.42 billion. The Goldman Sachs Group posted sales of $13.30 billion in the same quarter last year, which would indicate a negative year over year growth rate of 17.2%. The company is expected to announce its next quarterly earnings report on Wednesday, July 21st.

On average, analysts expect that The Goldman Sachs Group will report full year sales of $49.21 billion for the current fiscal year, with estimates ranging from $47.27 billion to $51.73 billion. For the next year, analysts anticipate that the company will post sales of $43.39 billion, with estimates ranging from $42.20 billion to $45.07 billion. Zacks' sales averages are an average based on a survey of research firms that cover The Goldman Sachs Group.

Read Full Story »»»

DiscoverGold

DiscoverGold

The Goldman Sachs Group Target of Unusually High Options Trading (GS)

By: MarketBeat | May 28, 2021

The Goldman Sachs Group, Inc. (NYSE:GS) was the recipient of unusually large options trading activity on Thursday. Traders purchased 134,329 call options on the stock. This represents an increase of approximately 881% compared to the typical volume of 13,695 call options.

Hedge funds have recently bought and sold shares of the business. Price T Rowe Associates Inc. MD grew its holdings in shares of The Goldman Sachs Group by 61.4% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 13,440,527 shares of the investment management company's stock worth $3,544,390,000 after purchasing an additional 5,115,450 shares during the last quarter. Norges Bank bought a new position in shares of The Goldman Sachs Group in the fourth quarter worth approximately $451,166,000. Cibc World Markets Corp grew its holdings in shares of The Goldman Sachs Group by 824.2% in the fourth quarter. Cibc World Markets Corp now owns 1,669,368 shares of the investment management company's stock worth $440,229,000 after purchasing an additional 1,488,745 shares during the last quarter. Jennison Associates LLC grew its holdings in shares of The Goldman Sachs Group by 211.2% in the first quarter. Jennison Associates LLC now owns 2,049,055 shares of the investment management company's stock worth $670,041,000 after purchasing an additional 1,390,627 shares during the last quarter. Finally, Boston Partners boosted its holdings in The Goldman Sachs Group by 148.4% in the fourth quarter. Boston Partners now owns 1,576,561 shares of the investment management company's stock valued at $415,755,000 after acquiring an additional 941,896 shares in the last quarter. 71.29% of the stock is currently owned by hedge funds and other institutional investors.

Read Full Story »»»

DiscoverGold

DiscoverGold

The Goldman Sachs Group, Inc. (GS) Receives Consensus Recommendation of "Buy" from Analysts

By: MarketBeat | May 21, 2021

Shares of The Goldman Sachs Group, Inc. (NYSE:GS) have been assigned an average rating of "Buy" from the twenty-three research firms that are presently covering the company, MarketBeat reports. One equities research analyst has rated the stock with a sell recommendation, six have given a hold recommendation and thirteen have given a buy recommendation to the company. The average 1-year price target among brokers that have updated their coverage on the stock in the last year is $358.59...

Read Full Story »»»

DiscoverGold

DiscoverGold

$GS Goldman Sachs is going to cave fast and hard.

These scam bank rip offs are about to pay the price, dearly and any short positions are going to be what finishes off the banks.

Margin calls will either have to be covered with gold or banks assets.

Bitcoin, crypto's, and Fiat cash will not be accepted to cover short positions.

Black Rock Overseeing the shift and what will be the crash of the Central banking system.

GS - The Pusher Man - didn't like the verbiage of no interest rate hikes until 2022... So Banks and GS sold off...

By: David Larew | May 20, 2021

• Banks - The Pusher Man - didn't like the verbiage of no interest rate hikes until 2022... So Banks and GS sold off...

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman hires Uber executive to run its consumer bank

By: Reuters | May 17, 2021

Goldman Sachs Group Inc (NYSE:GS) hired a top executive from Uber Technologies (NYSE:UBER) Inc to lead its consumer banking business, the bank said in a memo on Monday.

Peeyush Nahar joins Goldman as the global head of its consumer business, which includes its online bank, Marcus. At Uber, he was vice president of technology.

Nahar takes over Goldman's fledgling consumer business at a time of turnover in the division that Chief Executive David Solomon has identified as a key area of growth for the bank.

He is the third global head of consumer banking since last September, when Harit Talwar stepped aside to become division chairman, giving the top job to Omer Ismail. Ismail officially took over in January, but soon left for a position at Walmart (NYSE:WMT) Inc's fintech venture.

A Goldman spokesman confirmed the contents of the memo.

Uber did not immediately respond to a request for comment.

Read Full Story »»»

DiscoverGold

DiscoverGold

Margin calls on steel stocks shorted positions in the mix.

This crooked short seller is about to pay the price, with assets this time around. Black Rock will make sure of it.

New Goldman Crypto Group Reportedly Traded 2 Bitcoin Derivatives

By: TheStreet | May 7, 2021

• Goldman Sachs’s new digital-currency trading group reportedly traded two bitcoin derivatives, a media report says.

A new cryptocurrency desk at Goldman Sachs (GS) has successfully traded two types of bitcoin-linked derivatives, a media report says, quoting an internal memo from the investment firm.

So the cryptocurrency craze appears to have spread to derivatives.

Goldman’s digital-currency-trading group is part of the firm’s currencies and emerging-markets trading division, CNBC reported. It reports to Goldman Partner Rajesh Venkataramani, who wrote the memo, obtained by CNBC..

The New York investment bank wants to “selectively onboard” institutional crypto players to broaden its business, according to the memo.

Goldman stock recently traded at $361.70, down 1.2%. Bank stocks in general fell Friday after a weaker-than-expected jobs report.

Goldman shares have soared 82% amid over the past six months amid its strong financial performance and rising long-term interest rates.

In other cryptocurrency news Friday, Tesla Chief Executive Elon Musk is at it again on cryptocurrencies, tweeting, "Cryptocurrency is promising, but please invest with caution!"

He also tweeted, “I’m looking for a shiba pup!” That refers to the logo of the dogecoin, a digital currency that started as a joke but has now skyrocketed almost 13,000% year to date.

As for Goldman, last month it posted stronger-than-expected first-quarter earnings, thanks in part to surging investment bank revenue.

Goldman said earnings totaled $18.60 a share in the first quarter, nearly six times the year-earlier figure and ahead of the Wall Street consensus forecast of $10.22 a share.

Revenue doubled to $17.7 billion, beating analysts' consensus forecast of $12.4 billion.

After the report, TheStreet.com Founder Jim Cramer discussed why he regrets selling the banking titan’s shares.

Read Full Story »»»

DiscoverGold

DiscoverGold

Bull Of The Day: Goldman Sachs (GS)

By: Zacks Investment Research | April 29, 2021

Goldman Sachs (GS) is a captain of high finance and the banking sector's knight in shining armor. The firm is known for its quick trading action and best-in-class deal-making investment bank. GS has soared 84%, hitting all-time highs, over the past 6 months. The stock illustrated unbelievable quarterly results in its latest quarterly report (what I said needed to happen to confirm the positive price action), which broke company records across the board. On top of that, it looks like these results are sustainable.

Volatility looks like it may be on its way back into the market, and I have no doubt that Goldman's best-in-class trading & sales team are taking full advantage. The $349 per share that GS is trading at today represents a robust purchase price for a long-term investment in the gold standard of high finance.

As you can see from the Trading View chart below, GS has been utilizing its 50-day moving average (blue line) as its support level. Now, after this extraordinary earnings report, GS looks like it's ready to break through its all-time high of $357, on its way up to my Fibonacci retracement (drawn from its peak to trough in March) price targets of $381 (161.8%) and $420 (261.8%) on an even more bullish look.

The economic downturn and proceeding recovery have been an unexpected tailwind for Goldman, driving the business to record profitability the past 2 quarters, with a robust double-digit topline expansion. Due to Goldman's trading and deal-making profit drivers, the bank didn't see the same margin-pinches from the ultra-low interest rates that commercial banks like JP Morgan JPM and Bank of America BAC did.

GS is expected to continue pushing growth and profitability as a slew of big deals and market action extends into 2021. Analysts have been increasingly optimistic about GS following its record earnings on April 14th, pushing its EPS estimates on every time horizon and propelling the stock into a Zacks Rank #1 (Strong Buy).

Recent Earnings

The firm illustrated unbelievable results in the wake of economic uncertainty, taking advantage of new market opportunities. GS reported recorded breaking earnings of $18.60 per share, demonstrating 500% year-over-year growth, and blew Zacks Consensus estimates out of the water by 90%. Its sales were quite strong as well, showing $17.70 billion, up 159% from the same quarter last year, beating estimates by 48%.

Equity trading and its deal-making investment banking (IB) segment were the two largest growth drivers for this best-in-class investment bank. Goldman's investment banking sector was up 73% from the first quarter of 2020, and this segment looks like it's just heating up with Q1 IB earnings up 30% from Q4. Its equities-underwriting portion of IB is booming as a record number of businesses hit the public exchanges.

454 companies IPO'ed in 2020, raising over $167 billion, far surpassing the previous record made in 1999 amid the dot-com mania, and 2021 is on track to break that record. Goldman will continue to be an enormous beneficiary of this push to the public markets.

GS's global markets division was its biggest topline driver over the past quarter as the business strategically navigated the choppy market waters and drove this segment's revenue up 47% from the first quarter of 2020 and up 78% from Q4. Equities sales & trading at Goldman appear to be still riding a tailwind as the stock market surges to seemingly no end.

What's Next For GS?

David Solomon is proving himself at the helm of this remarkable firm. Since Solomon was named CEO and Chairman of Goldman Sachs on October 1st, 2018, GS shares are up 55%. This may not sound like a lot, but GS has navigated the 2018 year-end sell-off and the most significant economic contraction since The Great Depression.

Investors & traders look to be pulling profits from JPM and BAC following their earnings earlier this month, despite sizable beats by both firms (a trend we have seen more and more often following earnings). GS looks like it could be the expectation as its share price jumps. This is a tremendous buying opportunity, with 9 out 13 analysts calling GS a strong buy today.

Price targets have risen across the board following the record quarter results. The most optimistic price target is looking at $500 a share, representing a 43% upside and even the more conservative recent estimates represent sizable double-digit returns. The large upside potential combined with the firm's 1.5% dividend yield makes GS a strong long-term buy and hold today.

I remain a GS buyer despite the run it has already had since the March lows. This company is adaptable and resourceful, and no matter what the economy throws at it, GS comes out on top.

Read Full Story »»»

DiscoverGold

DiscoverGold

$11.01 Billion in Sales Expected for The Goldman Sachs Group, Inc. (GS) This Quarter

By: MarketBeat | April 24, 2021

Equities research analysts expect The Goldman Sachs Group, Inc. (NYSE:GS) to announce sales of $11.01 billion for the current fiscal quarter, Zacks reports. Three analysts have provided estimates for The Goldman Sachs Group's earnings, with estimates ranging from $10.34 billion to $11.42 billion. The Goldman Sachs Group reported sales of $13.30 billion during the same quarter last year, which indicates a negative year over year growth rate of 17.2%. The firm is expected to report its next quarterly earnings results on Wednesday, July 21st.

According to Zacks, analysts expect that The Goldman Sachs Group will report full-year sales of $49.22 billion for the current financial year, with estimates ranging from $47.27 billion to $51.75 billion. For the next year, analysts expect that the business will post sales of $43.39 billion, with estimates ranging from $42.20 billion to $45.10 billion. Zacks' sales calculations are a mean average based on a survey of research analysts that follow The Goldman Sachs Group.

Read Full Story »»»

DiscoverGold

DiscoverGold

Is Goldman Sachs Stock a Smart Investment?

By: StockNews | April 23, 2021

Goldman Sachs Group, Inc. (GS - Get Rating) is known for its top-flight investment banking and asset management services globally. It is the second largest investment bank in the world based on its 2020 revenues. GS is one of the few multinational investment banks that emerged from the Archegos sell-off relatively unscathed.

GS sold approximately $10.50 billion worth Archegos-related shares on March 26, which ultimately triggered the margin call. And thanks to the firm’s first mover advantage, it was able to avoid significant losses in exiting its position. Shares of GS have gained 25.5% year-to-date.

Owing to the firm’s quick decision and trade settlements during one of the largest margin calls in history, GS delivered record revenues and earnings growth at a time when most major investment banks downgraded their fiscal first quarter outlooks. GS’ net revenues increased 102% year-over-year to $17.70 billion in the first quarter ended March 31, 2021. Both its net income and EPS increased 498% from the same period last year to $6.71 billion and $18.60, respectively.

Here’s what we think could shape GS’ performance in 2021:

Robust Profit Margins

GS’ 88.78% trailing-12-month gross profit margin is 61.5% higher than the industry average 54.99%. Its return on sales of 29.33% is 22% higher than the industry average 24.05%, while its capex/sales of 12.27% is significantly higher than the industry average 2.18%.

Also, the company’s ROE and ROA of 17.04% and 1.16%, respectively, compare favorably with industry averages.

Impressive Financial Outlook

A $9.42 consensus EPS estimate for the current quarter ending June 2021, represents a 1,677.4% rise year-over-year. Analysts expect GS’ annual earnings to rise 80.6% from the same period last year to $44.69 per share in its fiscal year 2021. Furthermore, the firm has an impressive earnings surprise history; it beat the Street EPS estimates in three of the trailing four quarters.

GS’ revenue is expected to climb 22.5% from its year-ago value to $11.95 billion in its fiscal second quarter. Its annual revenue in the current year is expected to improve 12.6% year-over-year to $50.16 billion.

Trading at a Discount

In terms of non-GAAP forward P/E, GS is currently trading at 7.45x, which is 38.8% lower than the industry average 12.19x. The company’s 0.50 non-GAAP forward PEG ratio is 61% lower than the industry average 1.27.

Also, GS’ forward price/sales multiple of 2.35 compares favorably with the industry average 3.14.

Consensus Rating and Price Target Indicate Potential Upside

Of 15 Wall Street analysts that rated the stock, nine rated it Buy, five rated it Hold, and one rated it Sell. GS has a $390.07 median 12-month price target, which indicates a potential 15.6% upside. The stock’s price target forecast ranges from a high of $497 to a low of $330.

POWR Ratings Reflect Rosy Prospects

GS has an overall rating of B, which equates to Buy in our proprietary POWR Ratings system. The POWR Ratings are calculated by considering 118 different factors, with each factor weighted to an optimal degree.

GS has a B grade for Value and Sentiment. These grades are justified given the company’s lower-than-industry valuation and favorable analyst sentiment.

Among 24 stocks in the A-rated Investment Brokerage industry, GS is ranked #11. In total, we rate GS on eight different levels. Beyond what we’ve stated above, one can view GS Ratings for Momentum, Quality, Stability, and Growth here.

Bottom Line

Biden’s proposed capital tax hike, announced yesterday, caused major banking stocks and the Dow Jones Industrial Average to decline. However, Wall Street expects the tax hike to be much lower than what was previously anticipated. This reflection caused banking stocks to reverse some of their losses. GS has gained 2.4% since yesterday. Also, with the U.S. Congress expected to pass a scaled-back tax increase with bi-partisan support, GS stock should grow on par with analyst expectations.

Read Full Story »»»

DiscoverGold

DiscoverGold

Bull of the Day: Goldman Sachs (GS)

By: Zacks Investment Research | April 20, 2021

It does not take a rocket scientist to piece together today’s Bull of the Day. Actually, it’s very simple. The market is up at all-time highs. That should make is very easy to choose the winners. In the gold rush, the real fortunes were made not on gold, but on the folks who sold the picks and axes. It is the same with the stock market. The companies that make the most money are going to be the companies that benefit from high equity prices. That’s the stocks involved in the asset management game.

Today’s Bull of the Day is a stock in that game. Not only are they a part of it, arguably, they are the best in that game. I’m talking about the company that every young broker wishes they could be a part of, Goldman Sachs (GS). The Goldman Sachs Group, Inc., a financial institution, provides range of financial services for corporations, financial institutions, governments, and individuals worldwide. It operates through four segments: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management.

The Financial – Investment Bank industry is in the Top 2% of our Zacks Industry Rank. In addition to the favorable rank, the stock has a Zacks Value Style Score of C, Growth of B, and Momentum of A, to help it round off with a VGM Composite Score of A.

The Goldman Sachs Group, Inc. Price and Consensus

The reason for the favorable rank is the series of earnings estimate revisions coming in to the upside from analysts. Over the last 60 days, eight analysts have revised their estimates to the upside for next year while over the last 30 days, eight have done so for the current year. The estimate revisions are nothing short of staggering. For the current year, EPS estimates have swelled from $26.87 to $43 even, while next year’s estimates are up from $30.10 to $34.90. I understand that next year’s number is a contraction, but it’s this year that takes the cake. Year-over-year EPS growth is slated to come in at 73.81%. That is huge for a company with a market cap of over $118 billion.

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman Sachs and JP Morgan have opposing views on the U.S. dollar

By: Kitco | April 19, 2021

New York (Apr 19) Goldman Sachs and JP Morgan have opposing views on the U.S. dollar As we know recently the dollar has been playing havoc on the gold price along with U.S. 10 year yields. Risk sentiment has not been too much of a problem with gold and stocks both moving together on most of the days that the yellow metal rises.

The massive US investment bank JP Morgan has now said they are backing the more upside action in the worlds reserve currency “Citing solid domestic economic data.”. They also noted, “The Federal Reserve should start formally talking about tapering communication in the April minutes.”. That could be one to look forward to.

On the political side, they think the new Presidents fiscal spending plans should aid the greenback as they note “An announcement of Biden's next circa $2 trillion in fiscal spending later this month.”.

Also, the U.S. lagged behind the U.K. on the vaccine front but in terms of some of the other western nations they said the “US vaccination rollout acceleration to help maintain a US gap with the rest of the world.”.

On the specifics, the U.S. bank said it “Recommends remaining long USD vs. currencies where central banks are likely to remain dovish or growth-challenged, including euro, yen, Swiss franc and GBP.”.

Moving on to the other side of the argument, Goldman Sachs are bullish on the euro. The bank said, "The combination of the rising euro-area growth expectations, solid equity returns for the region, initial normalization signals from the ECB, and more stable Fed pricing will extend the recent turn higher in the euro,".

It recommends a trade idea to buy at spot with a 1.2500 target and stop at 1.1750. Their 12-month target is unchanged at 1.2800.

Read Full Story »»»

DiscoverGold

DiscoverGold

The Goldman Sachs Group (GS) PT Raised to $432.00 at BMO Capital Markets

By: MarketBeat | April 15, 2021

• The Goldman Sachs Group (NYSE:GS) had its price target boosted by research analysts at BMO Capital Markets from $409.00 to $432.00 in a research note issued to investors on Friday, The Fly reports. The firm presently has an "outperform" rating on the investment management company's stock. BMO Capital Markets' price objective suggests a potential upside of 27.60% from the company's current price.

GS has been the topic of a number of other research reports. Deutsche Bank Aktiengesellschaft raised their target price on The Goldman Sachs Group from $310.00 to $365.00 and gave the company a "hold" rating in a report on Thursday, April 1st. Citigroup lifted their price objective on The Goldman Sachs Group from $357.00 to $370.00 and gave the stock a "buy" rating in a report on Friday, January 22nd. Daiwa Capital Markets began coverage on The Goldman Sachs Group in a report on Wednesday, January 6th. They set an "outperform" rating and a $300.00 price objective on the stock. Credit Suisse Group lifted their price objective on The Goldman Sachs Group from $395.00 to $400.00 and gave the stock an "outperform" rating in a report on Thursday. Finally, Oppenheimer lifted their price objective on The Goldman Sachs Group from $468.00 to $497.00 and gave the stock an "outperform" rating in a report on Thursday. One investment analyst has rated the stock with a sell rating, five have given a hold rating, fifteen have assigned a buy rating and one has issued a strong buy rating to the company. The Goldman Sachs Group presently has an average rating of "Buy" and an average target price of $345.32.

Read Full Story »»»

DiscoverGold

DiscoverGold

Goldman profit smashes expectations on booming investment banking

By: Reuters | April 14, 2021