Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Gold Reserve Provides Update (2/06/17)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V: GRZ) (OTCQB: GDRZF) (“Gold Reserve” or the “Company”) today reported that it has been in discussions with the Government of the Bolivarian Republic of Venezuela ("Venezuela") regarding payments that were due under the terms of the previously announced amended settlement agreement (the “Settlement Agreement”).

Gold Reserve’s executive committee members, James Coleman, Rockne Timm and Douglas Belanger, have been meeting in Caracas with senior Venezuelan officials. These officials indicated that the payment to Gold Reserve has been delayed due to certain procedures and processes which have slowed the completion of the related financing.

The parties previously agreed to temporarily refrain from enforcing the ICSID Award and from seeking the decision on the annulment of the Award. Notwithstanding Venezuela’s assurances to comply with the Settlement Agreement, the parties have agreed to have the Paris Court of Appeal issue its decision on Venezuela's motion for annulment on February 7, 2017. The Gold Reserve legal team believes that the motion should be denied and Gold Reserve’s arbitration award will be confirmed.

The Minister of the People’s Power for Ecological Mining Development, Roberto Mirabal and the Attorney General, Reinaldo Muñoz, also stated, “Venezuela expects to be in a condition to satisfy its obligations under the Settlement Agreement.” Mr. Mirabal further stated, “The Republic looks forward to continuing to move the gold copper silver Siembra Minera Project (Brisas Cristinas) forward, which will create many positive benefits for the region and the Republic."

James Coleman of Gold Reserve stated, “The settlement process has been long and at times difficult with our shareholders patiently waiting for completion. Although, the Company remains optimistic, it is well aware of the views of its stakeholders and is diligently working to complete the transaction as previously outlined in prior news releases. Accordingly, based on the Caracas meetings and the assurances set out herein, the Company believes that the Settlement Agreement will be respected and the terms satisfied.”

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov, and www.sedar.com.

http://www.businesswire.com/news/home/20170206006158/en/Gold-Reserve-Update

Gold Reserve Announces Resignation of Board Member to Take Position with Trump Administration (1/24/17)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (“Gold Reserve” or the “Company”) today announced that Kenneth I. Juster has resigned, effective immediately, from the Board of Directors of the Company to take a position with the Donald J. Trump Administration as Deputy Assistant to the President for International Economic Affairs. Mr. Juster’s resignation from the Board is required as a result of his new position.

On behalf of the Board of Directors, management and shareholders, we want to thank Mr. Juster for his excellent counsel and contributions to the Company during a very important period in the Company’s history. We wish him great success in his new position at the White House.

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov, and www.sedar.com.

http://www.businesswire.com/news/home/20170124006620/en/Gold-Reserve-Announces-Resignation-Board-Member-Position

Gold Reserve Reports on Pending Settlement Payment from Venezuela (12/16/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (“Gold Reserve” or the “Company”) today reported that the government of the Bolivarian Republic of Venezuela has informed the Company that the payment of US$300 million that was due December 15, 2016 under the terms of the previously announced amended settlement agreement with the government is expected to be deposited in the Company’s bank accounts in the next few days. The Company will provide more information as it becomes available.

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov, and www.sedar.com.

http://www.businesswire.com/news/home/20161216005309/en/Gold-Reserve-Reports-Pending-Settlement-Payment-Venezuela

Red/Black bet on 12/15. Let's see if the pps gets skiddish just before that day. Anything can happen in Venezuela between now and then

Venezuela to Pay Gold Reserve by December 15, 2016 and Mining Update (12/02/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V: GRZ) (OTCQB: GDRZF) (“Gold Reserve” or the “Company”) today reported that it has agreed to further modify the settlement agreement (the “Settlement Agreement”) previously entered into with the Bolivarian Republic of Venezuela (“Venezuela”) (see Press Release dated November 4, 2016). The first payment of US$ 300,000,000, originally scheduled for November 30, 2016, is now rescheduled to take place on or before December 15, 2016.

The balance for future payments remains the same as previously described, namely that the second payment of US$ 469,681,823 be made on or before January 3, 2017, a third payment of US$ 50,000,000 on or before January 31, 2017, a fourth payment of US$ 100,000,000 on or before February 28, 2017, and a final payment of US$ 90,000,000 on or before June 30, 2017. The aggregate payments to be made by Venezuela have not changed.

Gold Reserve executives, who are in Caracas, have been assured by Roberto Mirabal, Minister of the People’s Power for Ecological Mining Development, that the funds are in place and that Venezuela is just completing certain administrative actions to have the funds transferred to Gold Reserve.

Minister Mirabal stated, “We have worked closely with Gold Reserve executives and we have now finalized the arrangements for the initial payment to Gold Reserve, which shall take place by December 15, 2016. In addition, we have had several board of directors meetings of the Mixed Company and the project at long last is moving forward, which is a historic milestone for Venezuela, for the Mining Arch and the people in the Las Claritas community. In order to promote early gold production, the intention is to initiate small-scale mining at several sites while construction of the main large-scale mineral processing plant is proceeding, in order to maximize local employment opportunities.”

James H. Coleman, Chairman of Gold Reserve, stated, “Our meetings here in Caracas have gone well, the funding is now in place and Gold Reserve, based on Minister Mirabal’s assurances, will be in receipt of the initial payment by December 15, 2016. This is an important event not only for Gold Reserve, but for Venezuela as it confirms to the mining and investment communities that you can do business in Venezuela and that it is indeed open for international business.”

The Mixed Company, of which Gold Reserve owns 45% and Venezuela owns 55%, and which holds the Brisas/Cristinas gold deposit, will initiate the development plan of the mining activities needed to commence construction as soon as possible.

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov, and www.sedar.com.

http://www.businesswire.com/news/home/20161202005382/en/Venezuela-Pay-Gold-Reserve-December-15-2016

IIROC Trading Halt - GRZ

Dec 1, 2016

VANCOUVER, Dec. 1, 2016 /CNW/ - The following issues have been halted by IIROC:

Company: Gold Reserve Inc.

TSX-Venture Symbol: GRZ

Reason: At the Request of the Company Pending News

Halt Time (ET): 10:24 AM

IIROC can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly market. IIROC is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada.

SOURCE Investment Industry Regulatory Organization of Canada (IIROC) - Halts/Resumptions

For further information: IIROC Inquiries 1-877-442-4322 (Option 2) - Please note that IIROC is not able to provide any additional information regarding a specific trading halt. Information is limited to general enquiries only.

http://iiroc.mediaroom.com/index.php?s=2429&item=148243

Venezuela is paying a price for its delays.

The aggregate payments to be made by Venezuela have not changed and the payments will be completed seven months earlier than originally contemplated.

Are they going to pay this time or just another delay

Gold Reserve Enters into Amendment to Settlement Agreement with Venezuela, Establishes Mixed Company to Develop Brisas-Cristinas Project (11/04/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V: GRZ) (OTCQB: GDRZF) (“Gold Reserve” or the “Company”) today reported that it has entered into an amendment to the settlement agreement (the “Settlement Agreement”) previously entered into with the Bolivarian Republic of Venezuela (“Venezuela”) and has together with Venezuela taken steps to establish the mixed (joint venture) company Empresa Mixta Ecosocialista Siembra Minera, S.A. that will develop the Brisas-Cristinas gold copper project in Southeastern Venezuela.

Under the terms of the original Settlement Agreement, Venezuela was to pay Gold Reserve US$600,000,000 on or before October 31, 2016 and US$169,681,823 on or before December 31, 2016 to satisfy of the arbitral award granted in favor of the Company by the International Centre for Settlement of Investment Disputes and Venezuela also agreed to pay the Company an aggregate of US$240,000,000 for its technical mining data related to the Brisas property in instalments, with the last instalment to be paid on or before October 31, 2017.

The parties have agreed to a revised payment schedule under which Venezuela will make a first payment of US$300,000,000 on or before November 30, 2016, a second payment of US$469,681,823 on or before January 3, 2017, a third payment of US$50,000,000 on or before January 31, 2017, a fourth payment of US$100,000,000 on or before February 28, 2017 and a final payment of $90,000,000 on or before June 30, 2017. The aggregate payments to be made by Venezuela have not changed and the payments will be completed seven months earlier than originally contemplated.

On October 28, 2016 Gold Reserve and representatives of Venezuela also convened the first meeting of the Board of Directors of the mixed company, of which Gold Reserve owns 45% and Venezuela owns 55%, to immediately initiate the development plan of the mine activities needed to commence construction as soon as possible.

The Company’s executive team, led by Rockne Timm, Douglas Belanger and James H. Coleman, has been in Caracas working with their counterparts in the Venezuela government to conclude an agreement that was a “win” for both parties. Mr. Timm said, “The many days and months of meetings have resulted in an agreement that positions the parties to move forward and build a major class gold property that will benefit both Gold Reserve shareholders and the people of Venezuela. I am proud to have been part of this historic transaction.”

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov, and www.sedar.com.

http://www.businesswire.com/news/home/20161104005904/en/Gold-Reserve-Enters-Amendment-Settlement-Agreement-Venezuela

lol j/k. have a good night.

Prospectus relates to a private placement completed in May 2016.

My only connection to the company is being a shareholder.

how many shares are they selling? Is that why you have a job?

How to own a gold mine for free:

1. Buy today.

2. Receive $7.50 in settlement distributions over the next year.

GDRZF (8/09/16)

GOLD RESERVE INC (GDRZF)

Last Trade [tick] 5.2934[+]

Volume 46,608

Net Change 0.2434

Net Change % 4.82%

52 Week High 5.9000 on 03/01/2016

52 Week Low 2.1900 on 01/14/2016

Day High 5.4000

Day Low 5.1000

GDRZF (8/08/16)

GOLD RESERVE INC (GDRZF)

Last Trade [tick] 5.0500 [-]

Volume 730,810

Net Change 0.7500

Net Change % 17.44%

52 Week High 5.9000 on 03/01/2016

52 Week Low 2.1900 on 01/14/2016

Day High 5.5434

Day Low 4.2000

Bolivarian Republic of Venezuela Agrees to Pay Gold Reserve Arbitral Award and Acquire Mining Data and Executes an Agreement to Jointly Develop the Brisas Cristinas Gold Copper Mining Project (8/08/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V: GRZ) (OTCQB: GDRZF) (“Gold Reserve” or the “Company”) announces that it has executed a settlement agreement ("Settlement Agreement") with the Bolivarian Republic of Venezuela ("Venezuela") which includes payment of the arbitral award (the "Award") granted in favor of the Company by the International Centre for Settlement of Investment Disputes in respect of the Brisas project. In addition, Venezuela has agreed to acquire the Company's mining data for $240 million and the parties have entered into an agreement ("Mixed Company Agreement") for the formation of a jointly owned company ("Mixed Company"). The Mixed Company will have the gold, copper, and silver rights to 18,000 hectares, including the Brisas Cristinas deposit.

The Settlement Agreement includes, among other terms:

• Venezuela will pay the Company the Award, which amounts to US$769,681,823, including accrued interest up to February 24, 2016, in two installments, US$600,000,000 which is expected on or before October 31, 2016 and the remaining US$169,681,823 on or before December 31, 2016. This payment shall be made to Gold Reserve using resources from the financing to be obtained by Venezuela for such purposes. The Company has agreed to a temporary suspension of the legal enforcement of the Award until final payment of the Award is made by Venezuela. Upon the final payment of the Award, the Company will cease all legal activities related to the collection of the Award.

• Venezuela will acquire the Company’s technical mining data for US$240 million in four quarterly installments of US$50 million beginning October 31, 2016, with a fifth and final installment of US$40 million due on or before October 31, 2017. After the final payment, the Company’s technical mining data will be transferred to the Venezuelan National Mining Database.

• Venezuela will use the proceeds from any financing it closes after the execution of this agreement to pay Gold Reserve the amounts owed under this agreement in preference to any other creditor.

• Gold Reserve may terminate the Settlement Agreement by written notice, without requiring any decision from any judicial authority if the two installments with respect to the payment of the Award are not received by Gold Reserve within the periods provided in the Settlement Agreement.

The terms of the Mixed Company Agreement include:

• The Mixed Company will be beneficially owned 55% by Venezuela and 45% by a wholly-owned subsidiary of Gold Reserve. The mining project term is 40 years (20 years with two 10 year extensions).

• Venezuela will contribute to the Mixed Company, the rights to the gold, copper, silver and other strategic minerals contained within 18,000 hectares located in southeast Bolivar State which includes the Brisas Cristinas project. Gold Reserve, under a Technical Services Agreement, will provide engineering, procurement and construction services to the Mixed Company. Gold Reserve will receive a fee of 5% of all costs of construction and development of the project. After commencement of commercial production, the Company will be paid a fee of five percent (5%) for its technical assistance during operations.

• Venezuela and the Company will work together to complete financing(s) to fund the contemplated US$2.1 billion anticipated capital costs of the Brisas Cristinas project.

• Presidential Decrees have been or will be issued within the legal framework of the "Orinoco Mining Arc,” with the following tax and fiscal incentives for Mixed Companies operating in that area: ? Exemption from value added tax, stamp tax, municipal taxes and any taxes arising from the contribution of tangible or intangible assets, if any, to the Mixed Companies by the parties.

- The Mixed Companies will incur the same cost of electricity, diesel and gasoline as that incurred by the government or related entities.

• Venezuela and Gold Reserve will participate in the net profits of the Mixed Company, in accordance with an agreed upon formula resulting in specified respective percentages based on the sales price of gold per ounce. For sales up to $1600 per ounce, net profits will be allocated 55% to Venezuela and 45% to Gold Reserve. For sales greater than $1600 per ounce, the incremental amount will be allocated 70% to Venezuela and 30% to Gold Reserve. For example, with sales at $1600 and $3500 per ounce, net profits will be allocated 55%/45% and 60.5%/39.5% respectively.

• The Mixed Company will pay a net smelter return royalty (NSR) to Venezuela on the sale of gold, copper, silver and any other strategic minerals of 5% for the first ten years of commercial production, 6% for the next ten years and 7% thereafter.

• The Mixed Company will be authorized to maintain funds associated with future capital cost financings in US dollar accounts.

• The Mixed Company will be authorized to export and sell its concentrate and doré containing gold, copper, silver and other strategic minerals outside of Venezuela and maintain proceeds from such sales in an offshore US dollar account.

• The sales proceeds will be converted into local currency at the most favorable exchange rate offered by Venezuela to other entities to pay, as required, Venezuela income taxes and annual operating and capital costs for the Brisas Cristinas project. In addition, dividends and profit distributions, if any, will be directly paid to the Mixed Company shareholders.

• If Venezuela enters into an agreement with a third party for the incorporation of a mixed company to perform similar activities with terms and conditions that are more favorable than the above tax and fiscal incentives, Venezuela agrees to use its best efforts to grant to the Mixed Company similar terms that will apply to the Brisas Cristinas project.

• Venezuela will indemnify Gold Reserve and affiliates against any future legal actions associated with the Brisas Cristinas project.

• The Mixed Company Board of Directors will be comprised of seven individuals, of which four will be appointed by Venezuela and three by Gold Reserve.

The combined Brisas Cristinas project, a gold-copper deposit located in the Kilometer 88 Mining District of Bolivar State in southeast Venezuela, when constructed, is anticipated to be the largest gold mine in South America and one of the largest in the world.

Doug Belanger, President of Gold Reserve, stated, “On behalf of the shareholders and stakeholders we are very pleased to settle our dispute with Venezuela. This settlement allows us to proceed with the tremendous opportunity for the Company and Venezuela to jointly develop the Brisas Cristinas gold, copper deposit while providing Venezuela a great opportunity to attract new foreign direct investments due to the set of policies and regulations approved by the administration for the mining industry. This will be transformed into solid economic growth in Venezuela and the expansion of a new industry complementary to the Republic's existing oil industry. After receipt of the award and settlement of all of the Company's financial obligations, a substantial majority of the net proceeds of the payments related to the Award and sale of the technical mining data is planned to be distributed to our shareholders.”

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov, and www.sedar.com.

http://www.businesswire.com/news/home/20160808005663/en/

Gold Reserve Provides Update on Discussions with Venezuelan Government (8/02/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (the “Company” or “Gold Reserve”) is hereby providing an update on the previously announced settlement and mixed company (joint venture) agreements covered under the Memorandum of Understanding with the Bolivarian Republic of Venezuela. Gold Reserve hopes to be in a position to announce the execution of all of the agreements in the near term and will provide further updates as and when circumstances warrant.

Due to the potential for uneven disclosure, the stock will remain halted until this has occurred so that there is no uneven or premature disclosure of the details to the marketplace. Gold Reserve also wishes to thank its shareholders for their patience.

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov, and www.sedar.com.

http://www.businesswire.com/news/financialpost/20160801006365/en/Gold-Reserve-Update-Discussions-Venezuelan-Government

Gold Reserve Updates on Status of Agreements with Venezuela (6/23/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (the “Company” or “Gold Reserve”) announces a further extension of the previously announced Memorandum of Understanding (“MOU”) with the Bolivarian Republic of Venezuela to July 15, 2016. The execution of the previously announced settlement and mixed company (joint venture) agreements have been delayed due to recent positive events in Venezuela, such as the formation of the new “Ministry of Ecological Mining Development” and the appointment of a new Minister allowing the government to pursue the development of its mineral resources independent of the energy sector. In addition, the government, as part of the approval process for the mixed company, has recently completed an extensive technical and economic due diligence review of the Brisas-Cristinas business plan proposed by the Company.

The Attorney General of Venezuela, Reinaldo Munoz stated, “We have agreed to extend the MOU to allow additional time to finalize both agreements.”

Doug Belanger, President of Gold Reserve stated, “We believe that all the documentation related to the settlement and mixed company agreements are now substantially completed and that the signing of these agreements should take place in the very near future.”

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov and www.sedar.com.

http://www.businesswire.com/news/home/20160623006373/en/Gold-Reserve-Updates-Status-Agreements-Venezuela

IIROC Trade Halt - Gold Reserve Inc.(6/21/16)

Vancouver, British Columbia--(Newsfile Corp. - June 21, 2016) - The following issues have been halted by IIROC:

Company:

Gold Reserve Inc.

TSX-V Symbol:

GRZ

Reason:

At the Request of the Company Pending News

Halt Time (ET)

09:47

IIROC can make a decision to impose a temporary suspension of trading in a security of a publicly listed company, usually in anticipation of a material news announcement by the company. Trading halts are issued based on the principle that all investors should have the same timely access to important company information. IIROC is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada.

- 30 -

For further information: IIROC Inquiries 1-877-442-4322 (Option 3) - Please note that IIROC is not able to provide any additional information regarding a specific trading halt. Information is limited to general enquiries only.

http://www.stockhouse.com/news/press-releases/2016/06/21/iiroc-trade-halt-gold-reserve-inc

Gold Reserve Provides Update on Agreements with Venezuela (6/08/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (the “Company” or “Gold Reserve”) reported today that its senior executives continue to meet in Caracas with Venezuelan government officials to finalize the settlement and mixed company agreements, as well as related documents from various Venezuelan government entities.

“We have made significant progress and believe we are in the final stage of completing these agreements and the recent approval of the new Ministry and the announcement by President Maduro appear to be a confirmation of these efforts.”

On June 7, 2016, President Nicolas Maduro Moros, in an address on national television, announced the creation of a new Ministry exclusively dedicated to mining activities, named the Ministry for Ecological Mining Development. President Maduro also announced that six agreements would be executed in the near term, which the Company understands includes the agreement between Gold Reserve and Venezuela.

Doug Belanger, President, stated that, “We have made significant progress and believe we are in the final stage of completing these agreements and the recent approval of the new Ministry and the announcement by President Maduro appear to be a confirmation of these efforts.”

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov and www.sedar.com.

http://www.businesswire.com/news/home/20160608006587/en/Gold-Reserve-Update-Agreements-Venezuela

Venezuela's Maduro creates mining ministry (6/07/16)

Venezuelan President Nicolas Maduro announced on Tuesday the creation of a ministry devoted just to mining, as the OPEC nation pushes to develop untapped mineral resources to diversify away from the oil industry, which provides nearly all its foreign exchange.

Maduro's government is seeking international partnerships with foreign investors to boost gold production. This year, Venezuela inked an agreement with Canadian mining company Gold Reserve to develop the Las Brisas and Las Cristinas mines as a way of resolving a long-running arbitration dispute.

"I announce the creation of the new ministry of popular power for ecological mining development," Maduro said in his weekly program on state television, appointing Roberto Mirabal to the lead the ministry.

State-run mining firms Minerven and the Venezuelan Mining Corporation will be under the supervision of the new ministry.

Mining activities had been overseen by the Ministry of Petroleum and Mining.

Mirabal will be in charge of leading negotiations with Gold Reserve, which won a $750 million award through the World Bank's International Center for Settlement of Investment Disputes following a conflict over the 2009 termination of a mining concession.

Gold Reserve agreed this year to participate in a new joint venture with Venezuela's government as a way of resolving the dispute.

Venezuela is suffering a severe recession and the world's highest inflation because of a combination of low oil prices and a decaying state-led socialist economic model. Maduro blames the problems on an "economic war" carried out by political rivals and business leaders.

http://www.reuters.com/article/us-venezuela-mining-idUSKCN0YU070

A short case was recently presented on Seeking Alpha Pro.

Seeking Alpha is a very good source of information. However, I do not subscribe to pro-level research.

GDRZF is indicated at $4.05/$4.10 pre-market.

Enterprising Investor, what are your thought here, i use to be a shareholder many years ago, and was just looking at it yesterday, always a fighting battle in venezuela, but that creates oppurtunities, thanks.

Gold Reserve Announces Extension of Memorandum of Understanding with Venezuela (5/28/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (the “Company”) announced today that, by mutual agreement, the Company and the Bolivarian Republic of Venezuela have extended the previously announced February 24, 2016 Memorandum of Understanding (the “MOU”) from May 27, 2016 to June 21, 2016.

The MOU contemplates settlement, including payment and resolution, of the arbitral award granted in favor of the Company by the International Centre for Settlement of Investment Disputes in respect of the Brisas Project and the payment for the transfer of the related technical mining data previously compiled by the Company. In addition, a new joint venture will be established for the development of the Brisas and the adjacent Cristinas gold-copper projects by the Company and Venezuela.

Gold Reserve’s senior executives are in Caracas and had made significant progress towards completing the agreements. However, due to their complexity and the fact that this will be the first transaction pursuant to the new Venezuelan mining initiative announced earlier this year by President Nicolas Maduro Moros, the parties were unable to complete the agreements by May 27, 2016. Gold Reserve is working with senior officials of the Venezuela government to close the transactions contemplated in the MOU by June 21, 2016.

Attorney General of Venezuela, Reinaldo Muñoz today stated, “We are working with the executives of Gold Reserve to finalize this transaction and move the project forward together.”

Doug Belanger, President of Gold Reserve stated, “We continue to advance the settlement and joint venture agreements and have made significant progress towards a successful conclusion. The importance of this project to Venezuela as well as to Gold Reserve requires that we establish a solid legal foundation to take this project to its logical conclusion. In regards to the trading in the Company’s shares on May 27, 2016 and based on the progress being made on the settlement and the joint venture agreements, we know of no reason to explain the drop in the stock price.”

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov and www.sedar.com.

http://www.businesswire.com/news/home/20160528005007/en/Gold-Reserve-Announces-Extension-Memorandum-Understanding-Venezuela

Why was it halted??

Why did it tank so much?

In regards to the trading in the Company’s shares on May 27, 2016 and based on the progress being made on the settlement and the joint venture agreements, we know of no reason to explain the drop in the stock price.”

https://finance.yahoo.com/news/gold-announces-extension-memorandum-understanding-143200405.html

Come Invest In Sunny Venezuela (5/22/16)

Summary

• The idea of socialism is popular in the US

• How is the reality of socialism working out?

• A Venezuelan investment idea to consider

Many Americans love the idea of socialism

What is the appeal? There is much one might love - you can get paid to not work, you can legally take other people's stuff, and you can get credit for generosity with other people's money. It takes the powerful feeling of envy and backs it with force. While capitalism leads to inequality by rewarding good behavior (supplying goods and services that customers want) and punishing bad (you own the consequences of your actions for better and for worse), socialism enforces equality by doing the opposite.

Who wants free stuff? Quite a lot of people. According to current survey data, socialism is especially popular among millennials, the fastest growing minorities, the lower income brackets, and Democrats. While Americans are currently more supportive of capitalism than socialism overall, the fastest growing groups are the most enthusiastic about socialism. White respondents prefer capitalism by 29%, black respondents by 11%, and Hispanics prefer it by 10%. As income falls, support for socialism rises - upper income earners prefer capitalism by 47%, middle income earners prefer it by 36%, and lower income earners prefer it by 8%. People under 30 years old are 11% more favorable towards socialism.

Most Republicans identify as capitalists. Across the aisle, Democrats are twice as likely to identify as socialists than they are to identify as capitalists. Most Democratic primary voters believe socialism has a "positive impact on society". Such Democratic voters view socialism favorably across every age group, race, and gender. They prefer it to capitalism by a 15% margin. Those 45 years old and younger prefer it by a 27% margin. Most agree that the government should take control of certain industries.

How is socialism working in practice?

One place where the ideas of socialism have recently been put into practice is Venezuela. Many socialists in the US have gushed over Venezuelan socialism (see Hugo Chavez's economic miracle, which specifically fawns over Venezuelan crime and poverty statistics). Before I get into the specifics of my long idea in Venezuela, it is worth a look at the empirical evidence of how Venezuelan socialism is working out in practice. As with other country markets that I have invested in including Russia, this is more of a practical than a philosophical question. So, in that spirit, how are things going for socialism in Venezuela?

Venezuela economy shrank by 6% last year and is on track to shrink another 8% this year. Annual inflation is running at over 700%.

The currency has collapsed to the point where the company responsible for running its printing press is refusing to do business with the Venezuelan government. Whereas capitalism uses the price system to connect the supply of good with demand for those goods, socialism uses queuing. In Venezuela, queuing is a big part of daily life.

Queuing has advantages and disadvantages. One advantage is that socialists can describe things as "free". Disadvantages have recently included scarcity of basic staples and violent riots. In the first quarter, the official government statistics indicate 4,696 murders in Venezuela; however, unofficial estimates from human rights monitors are about 55% higher. The capital city of Caracas is now the most violent city in the world with over 120 homicides per 100,000 inhabitants. Morgues cannot keep up on busy nights, so fresh corpses are stacked outside.

Socialism is famous for free healthcare, but hospitals are often without antibiotics, IV solution, and food. Doctors have to contend with power outages that shut down respirators. The president responded by discouraging Venezuelans from using hair dryers,

“

I always think a woman looks better when she just runs her fingers through her hair and lets it dry naturally. It's just an idea I have.

- Nicolas Maduro in response to widespread power outages

In total, the Misery Index, calculated by adding the unemployment rate, lending rate, and the inflation rate, minus the annual percent change in real GDP per capita, indicates that Venezuela is the most miserable place on earth.

Investing in Venezuela

Having reviewed socialism in theory and practice, I would like to make the case for investing in Venezuela. The investment in question is Gold Reserve (OTCQB:GDRZF). I first disclosed this investment in 2014, writing that,

“

Gold Reserve (GDRZF in the US; GRZ in Canada) has a market cap of $248 million and a $740 million award against Venezuela from the World Bank's International Centre for Settlement of Investment Disputes/ICSID. Venezuela is just about the last country you want to owe you money, but this judgment is enforceable abroad including in the US. Venezuela relies on imports and exports and it has some assets such as Citgo that could be vulnerable.

GDRZF equity trades at a deeper discount than does Venezuela credit, despite the fact that ICSID awards survive sovereign default. While it has become prohibitively expensive, in the past one could hedge out a lot of the Venezuelan risk via the purchase of Venezuelan credit default swaps (CDSs).

What is next for GDRZF? On Monday December 15, 2014, the ICSID tribunal reaffirmed the $714 million award. With interest, Venezuela currently owes GDRZF about $744 million. This amount increases by $1.5 million each month. GDRZF is pursuing their award through both French and American courts.

The original thesis was that we would be able to collect the ICSID award. If necessary, we could seize assets in the US. Perhaps we could sell the project data to Venezuela for something. The price was around $3.50 (in Canada); the value was $6-7. Since then, the price has gone to $5.80, but the value is clearer. Venezuela settled, signing a memorandum of understanding regarding both the award and the joint development of the Brisas and Las Cristinas projects. We get an award with interest. We also get a 45% interest in a JV to develop the Brisas and Cristinas properties using Gold Reserve's technical mining data. I had not known exactly what CEO Doug Belanger was up to. Typically I favor simple plans (liquidate and send me my money) but he came up with something much better.

Hedge

I don't think that this investment requires a hedge on either Venezuela (too expensive) or gold. However, there are pricier gold miners such as Coeur (NYSE:CDE) that can be shorted against it. Coeur will keep digging up gold, but they will also keep diluting equity holders towards $0.00 over time.

Conclusion

Socialism is an idea that attracts enthusiasm within large and growing segments of the US. It is also being put into practice in Venezuela with measurable results. Despite problems that include an estimated 100,000 illegal miners, many of whom are members of armed gangs, there could be an opportunity in Venezuelan gold mining via Gold Reserve. While the Venezuelan government is the majority JV partner, this opportunity is not about politics, just business.

What exactly is Gold Reserve worth? Well its JV's locale is certainly deserving of some discount. For political stability and convenience, I would prefer all of my natural resource investments to be located between Gstaad and Lake Geneva in Switzerland. However, I have to go wherever 4.54 billion years of geological history plopped them. But even applying a draconian discount, this idea will probably end up being a double from its original disclosure and a substantial upside from today.

Disclosure: I am/we are long GDRZF.

Additional disclosure: Chris DeMuth Jr and Andrew Walker are portfolio managers at Rangeley Capital. We invest with a margin of safety by buying securities at discounts to their intrinsic value and unlocking that value through corporate events. To maximize returns for our investors, we reserve the right to make investment decisions regarding any security without notification except where notification is required by law. We manage diversified portfolios with a multi-year time horizon. Positions disclosed in articles may vary in sizing, hedges, and place within the capital structure. Disclosed ideas are related to a specific price, value, and time. If any of these attributes change, then the position might change (and probably will).

Stocks: GDRZF, CDE

http://seekingalpha.com/instablog/957061-chris-demuth-jr/4884349-come-invest-sunny-venezuela

Gold Reserve Announces Closing of Private Placement and Extension of Memorandum of Understanding with Venezuela (5/17/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (the “Company” or “Gold Reserve”) is pleased to announce the closing of its previously announced non-brokered private placement (the “Private Placement”). Including the issuance of 5,210,000 Class A Common Shares of the Company (“Shares”) previously announced by the Company, the Company has issued an aggregate of 8,562,500 Shares under the Private Placement at a price of US $4.00 per share for proceeds in the amount of US $34,250,000. The proceeds will be used by the Company for general working capital purposes.

No commission or finder’s fee was paid in connection with the Shares issued pursuant to the Private Placement. Such Shares were offered pursuant to exemptions from the prospectus requirements of applicable securities legislation and will be subject to a hold period in Canada of four months and a day from their respective dates of issuance.

The Company also announced today that, by mutual agreement, the Company and the Bolivarian Republic of Venezuela have extended the previously announced February 24, 2016 Memorandum of Understanding (the “MOU”) from May 12, 2016 to May 27, 2016.

The MOU contemplates settlement, including payment and resolution, of the arbitral award granted in favor of the Company by the International Centre for Settlement of Investment Disputes in respect of the Brisas Project and the payment for the transfer of the related technical mining data previously compiled by the Company, as well as the development of the Brisas and the adjacent Cristinas gold-copper project by the Company and Venezuela.

The parties are working diligently to complete the necessary documentation to finalize the agreements contemplated by the MOU.

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov and www.sedar.com.

http://www.businesswire.com/news/home/20160517006625/en/Gold-Reserve-Announces-Closing-Private-Placement-Extension

Gold Reserve Closes First Tranche of Private Placement (5/04/16)

Gold Reserve Inc. closed the first tranche of its previously announced non-brokered private placement. To date, 5,210,000 Class A Common Shares have been issued at a price of US $4.00 per share for proceeds in the amount of US $20,840,000. The Company has received conditional approval from the TSX Venture Exchange for the issuance of up to an aggregate of 9,500,000 Shares and has been granted an extension until 5/15/16 to complete the sale of the remaining shares pursuant to the Private Placement. Proceeds will be used for general working capital purposes.

http://www.sec.gov/Archives/edgar/data/1072725/000107272516000085/gdrzfform6kexhibit991050516.htm

Gold Reserve Inc. Announces Extension of Memorandum of Understanding with the Venezuelan Government (4/25/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V:GRZ) (OTCQB:GDRZF) (the “Company”) announced today that, by mutual agreement, the Company and the Bolivarian Republic of Venezuela have extended the previously announced February 24, 2016 Memorandum of Understanding (the “MOU”) from April 24, 2016 to May 12, 2016.

The MOU contemplates settlement, including payment and resolution, of the arbitral award granted in favor of the Company by the International Centre for Settlement of Investment Disputes in respect of the Brisas Project, the transfer of the related technical mining data previously compiled by the Company, as well as the development of the Brisas and the adjacent Cristinas gold-copper project, which would be combined into one project by the Company and Venezuela.

The parties are working diligently to prepare the necessary documentation to complete the transactions and require more time to accomplish this.

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov and www.sedar.com.

http://www.businesswire.com/news/home/20160425006302/en/Gold-Reserve-Announces-Extension-Memorandum-Understanding-Venezuelan

Gold Reserve Says Venezuela Must Post Bond During Appeal

By Christine Powell

Law360, New York (March 21, 2016, 7:03 PM ET) -- Gold Reserve Inc. asked the D.C. Circuit on Monday to refuse Venezuela’s argument that it shouldn't have to post a bond while appealing a November decision enforcing a more than $713 million arbitral award issued to the Canadian mining company in a dispute over canceled mining permits, saying such “extraordinary relief” was unwarranted.

On March 7, Venezuela told the appeals court that, while parties are automatically entitled to a stay of a money judgment during an appeal after a bond is posted, the court can, and should, exercise its discretion in this case to stay enforcement of the award without requiring a bond during the country’s appeal of U.S. District Judge James E. Boasberg's order.

Judge Boasberg shot down Venezuela's bid to stay his judgment without posting a bond late last month. But in doing so, he failed to recognize that foreign sovereigns should not be required to post security to obtain a stay absent extenuating circumstances, the country told the appeals court. Here, Venezuela argued, being forced to post a supersedeas bond would impose a substantial strain on its financial resources.

But on Monday, Gold Reserve blasted the country’s request, saying the relief was reserved for “unusual circumstances.” Further, Venezuela has not met the "onerous burden" of demonstrating that such a stay wouldn’t endanger the company’s interest in ultimate recovery, it said.

“As the district court found, Venezuela has not demonstrated a willingness to pay the judgment and has failed to show how posting a bond is impracticable,” Gold Reserve’s opposition to the motion said. “In this circumstance, a bond is required.”

The award was issued in September 2014 by an International Centre for Settlement of Investment Disputes tribunal, which found that Venezuela had breached its international obligations by abruptly curtailing certain mining concessions granted to Gold Reserve. According to Judge Boasberg's November confirmation order, the award is worth more than $713 million plus $22.2 million in pre-award interest, $5 million in legal fees and costs, and post-award interest.

In denying the South American nation’s original request for a stay of enforcement without posting the bond, Judge Boasberg noted that while the court may exercise its discretion to authorize unsecured stays in cases it considers appropriate, such a bond is typically required in normal cases.

In this case, he said that Venezuela never acknowledged that it would willingly pay the money if its appeal is unsuccessful. Nor did it explain how it would be impracticable to post the bond while the appeal is ongoing, he noted.

Gold Reserve had told the district court that Venezuela's argument that putting up the bond would place a strain on its budget implied that the country wouldn't be able to eventually pay the award, or that it would be unwilling to pay, but the country told the D.C. Circuit that its argument meant no such thing.

"There is no inconsistency, as Gold Reserve suggested below, in the fact that a sovereign can have sufficient means to pay a judgment while also recognizing that it would impose an unwarranted hardship for those same funds to be redirected from public services to an appeal bond," the country said in its motion.

On Monday, Gold Reserve shot back at the appellate level, saying that “foreign sovereigns are subject to the same standard as all other judgment debtors.”

Additionally, the company said Venezuela had not shown it was entitled to a stay under “stringent standards” the D.C. Circuit laid out in a 1977 ruling, nor had it shown it was likely to succeed on the merits of its arguments that the lower court had incorrectly confirmed the arbitral award.

In separate proceedings, Venezuela is currently asking the Paris Court of Appeal to annul the award based on the tribunal's alleged breaches of French arbitration law, including the exercise of jurisdiction beyond the scope of Venezuela’s consent to the arbitration and due process violations. Venezuela also claims that the tribunal acted in contravention of important public policy concerns.

Concurrently, Venezuela and Gold Reserve announced earlier this month that they are mulling a deal that would settle the dispute, which would include the payment and resolution of the award, as well as a potential $2 billion capital investment from Venezuela for future mining projects.

Representatives for Gold Reserve declined to comment on Monday, while Venezuela’s representatives did not respond immediately to requests for comment.

Gold Reserve is represented by Jonathan S. Franklin, Matthew H. Kirtland and Caroline M. Mew of Norton Rose Fulbright US LLP.

The Bolivarian Republic of Venezuela is represented by Janis H. Brennan and Michael J. Licker of Foley Hoag LLP.

The case is Gold Reserve Inc v. Bolivarian Republic of Venezuela, case number 1:14-cv-02014, in the U.S. District Court for the District of Columbia.

--Additional reporting by Caroline Simson. Editing by Kelly Duncan.

http://www.law360.com/articles/774365/gold-reserve-says-venezuela-must-post-bond-during-appeal

Venezuela Says No Bond Needed During Gold Reserve Appeal (3/08/16)

By Caroline Simson

Law360, New York (March 8, 2016, 6:57 PM ET) -- Venezuela told the D.C. Circuit on Monday that as a foreign sovereign, it shouldn't have to post a bond while it appeals a November decision enforcing a more than $713 million arbitral award issued to Canadian mining company Gold Reserve Inc. in a dispute over canceled mining permits.

While parties are automatically entitled to a stay of a money judgment during an appeal after a bond is posted, the court can, and should, exercise its discretion in this case to stay enforcement of the award without requiring a bond during Venezuela's appeal of U.S. District Judge James E. Boasberg's order, the South American nation told the appeals court.

Judge Boasberg shot down Venezuela's bid to stay his judgment without posting a bond late last month. But in doing so, he failed to recognize that foreign sovereigns should not be required to post security to obtain a stay absent extenuating circumstances, the country told the appeals court. Here, Venezuela argued, being forced to post a supersedeas bond would impose a substantial strain on its financial resources.

"While Venezuela’s national budget establishes its ability to pay the judgment, requiring the posting of a bond large enough to cover a judgment of over $700 million would force Venezuela to divert resources that are needed to provide essential public services, a point left unaddressed by the district court," the country said.

The award was issued in September 2014 by an International Centre for Settlement of Investment Disputes tribunal, which found that Venezuela had breached its international obligations by abruptly curtailing certain mining concessions granted to Gold Reserve. According to Judge Boasberg's November confirmation order, the award is worth more than $713 million plus $22.2 million in pre-award interest, $5 million in legal fees and costs, and post-award interest.

Gold Reserve had told the district court last month that Venezuela's argument that putting up the bond would place a strain on its budget implied that the country wouldn't be able to eventually pay the award, or that it would be unwilling to pay. But Venezuela told the D.C. Circuit that its argument meant no such thing.

"There is no inconsistency, as Gold Reserve suggested below, in the fact that a sovereign can have sufficient means to pay a judgment while also recognizing that it would impose an unwarranted hardship for those same funds to be redirected from public services to an appeal bond," the country said.

In denying the South American nation’s original request for a stay of enforcement without posting the bond, Judge Boasberg noted that while the court may exercise its discretion to authorize unsecured stays in cases it considers appropriate, such a bond is typically required in normal cases.

In this case, he said that Venezuela never acknowledged that it would willingly pay the money if its appeal is unsuccessful. Nor did it explain how it would be impracticable to post the bond while the appeal is ongoing, he noted.

In separate proceedings, Venezuela is currently asking the Paris Court of Appeal to annul the award based on the tribunal's alleged breaches of French arbitration law, including the exercise of jurisdiction beyond the scope of Venezuela’s consent to the arbitration and due process violations. Venezuela also claims that the tribunal acted in contravention of important public policy concerns.

Concurrently, Venezuela and Gold Reserve announced last week that they are mulling a deal that would settle the dispute, which would include the payment and resolution of the award, as well as a potential $2 billion capital investment from Venezuela for future mining projects.

Attorneys for Gold Reserve declined comment on Tuesday, and Venezuela's attorneys weren't immediately available for comment.

Gold Reserve is represented by Jonathan S. Franklin, Matthew H. Kirtland and Caroline M. Mew of Norton Rose Fulbright US LLP.

The Bolivarian Republic of Venezuela is represented by Janis H. Brennan and Michael J. Licker of Foley Hoag LLP.

The case is Gold Reserve Inc v. Bolivarian Republic of Venezuela, case number 1:14-cv-02014, in the U.S. District Court for the District of Columbia.

--Editing by Rebecca Flanagan.

http://www.law360.com/articles/768682/venezuela-says-no-bond-needed-during-gold-reserve-appeal

$GDRZF recent news/filings

bullish 4.49

http://www.goldreserveinc.com/

$GDRZF charts

basic chart ## source: stockcharts.com

basic chart ## source: stockscores.com

big daily chart ## source: stockcharts.com

big weekly chart ## source: stockcharts.com

$GDRZF company information

## source: otcmarkets.com

Link: http://www.otcmarkets.com/stock/GDRZF/company-info

Ticker: $GDRZF

$GDRZF extra dd links

## STOCK DETAILS ##

After Hours Quote (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/after-hours

Option Chain (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/option-chain

Historical Prices (yahoo.com): http://finance.yahoo.com/q/hp?s=GDRZF+Historical+Prices

Company Profile (yahoo.com): http://finance.yahoo.com/q/pr?s=GDRZF+Profile

Industry (yahoo.com): http://finance.yahoo.com/q/in?s=GDRZF+Industry

## COMPANY NEWS ##

Market Stream (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/stream

Latest news (otcmarkets.com): http://www.otcmarkets.com/stock/GDRZF/news - http://finance.yahoo.com/q/h?s=GDRZF+Headlines

## STOCK ANALYSIS ##

Analyst Research (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/analyst-research

Guru Analysis (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/guru-analysis

Stock Report (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/stock-report

Competitors (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/competitors

Stock Consultant (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/stock-consultant

Stock Comparison (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/stock-comparison

Investopedia (investopedia.com): http://www.investopedia.com/markets/stocks/GDRZF/?wa=0

Research Reports (otcmarkets.com): http://www.otcmarkets.com/stock/GDRZF/research

Basic Tech. Analysis (yahoo.com): http://finance.yahoo.com/q/ta?s=GDRZF+Basic+Tech.+Analysis

Barchart (barchart.com): http://www.barchart.com/quotes/stocks/GDRZF

## FUNDAMENTALS ##

Call Transcripts (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/call-transcripts

Annual Report (companyspotlight.com): http://www.companyspotlight.com/library/companies/keyword/GDRZF

Income Statement (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/financials?query=income-statement

Revenue/EPS (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/revenue-eps

SEC Filings (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/sec-filings

Latest filings (otcmarkets.com): http://www.otcmarkets.com/stock/GDRZF/filings

Latest financials (otcmarkets.com): http://www.otcmarkets.com/stock/GDRZF/financials

Short Interest (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/short-interest

Dividend History (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/dividend-history

RegSho (regsho.com): http://www.regsho.com/tools/symbol_stats.php?sym=GDRZF&search=search

OTC Short Report (otcshortreport.com): http://otcshortreport.com/index.php?index=GDRZF

Short Sales (otcmarkets.com): http://www.otcmarkets.com/stock/GDRZF/short-sales

Key Statistics (yahoo.com): http://finance.yahoo.com/q/ks?s=GDRZF+Key+Statistics

Insider Roster (yahoo.com): http://finance.yahoo.com/q/ir?s=GDRZF+Insider+Roster

Income Statement (yahoo.com): http://finance.yahoo.com/q/is?s=GDRZF

Balance Sheet (yahoo.com): http://finance.yahoo.com/q/bs?s=GDRZF

Cash Flow (yahoo.com): http://finance.yahoo.com/q/cf?s=GDRZF+Cash+Flow&annual

## HOLDINGS ##

Major holdings (cnbc.com): http://data.cnbc.com/quotes/GDRZF/tab/8.1

Insider transactions (yahoo.com): http://finance.yahoo.com/q/it?s=GDRZF+Insider+Transactions

Insider transactions (secform4.com): http://www.secform4.com/insider-trading/GDRZF.GDRZF

Insider transactions (insidercrow.com): http://www.insidercow.com/history/company.jsp?company=GDRZF

Ownership Summary (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/ownership-summary

Institutional Holdings (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/institutional-holdings

Insiders (SEC Form 4) (nasdaq.com): http://www.nasdaq.com/symbol/GDRZF/insider-trades

Insider Disclosure (otcmarkets.com): http://www.otcmarkets.com/stock/GDRZF/insider-transactions

## SOCIAL MEDIA AND OTHER VARIOUS SOURCES ##

PST (pennystocktweets.com): http://www.pennystocktweets.com/stocks/profile/GDRZF

Market Watch (marketwatch.com): http://www.marketwatch.com/investing/stock/GDRZF

Bloomberg (bloomberg.com): http://www.bloomberg.com/quote/GDRZF:US

Morningstar (morningstar.com): http://quotes.morningstar.com/stock/s?t=GDRZF

Bussinessweek (businessweek.com): http://investing.businessweek.com/research/stocks/snapshot/snapshot_article.asp?ticker=GDRZF

Announcement of capital raise fails to spook investors.

Gold Reserve Inc. Announces Proposed Private Placement (3/09/16)

Gold Reserve Inc. announces that it plans a private placement to raise gross proceeds of up to US $38,000,000 by issuing 9,500,000 Class A common shares at a price of US $4.00 per Share. The proceeds will be used by the Company for general working capital purposes. No commission or finder's fee will be paid.

http://www.sec.gov/Archives/edgar/data/1072725/000107272516000075/gdrzfform6kexhibit991030916.htm

Gold Reserve deal with Venezuela a potential turning point for Canadian miners with arbitration wins (3/01/16)

Canadian mining companies are putting together a pretty good winning streak in international arbitration cases against foreign governments.

But their record of collecting on those awards is a lot more mixed.

Late last week, a tiny firm called Gold Reserve Inc. shocked many onlookers by reaching a potentially favourable settlement with the Venezuelan government, which it has been battling in court for more than six years. On the other hand, Khan Resources Inc. and Stans Energy Corp. have won high-profile decisions against Mongolia and Kyrgyzstan and have yet to see any benefit from their efforts.

Gold Reserve spent much of the 1990s and early 2000s developing the Brisas project in Venezuela, while a separate Canadian firm called Crystallex International Corp. worked on an adjoining gold deposit called Las Cristinas. Each company invested hundreds of millions of dollars in Venezuela before Hugo Chavez’s government expropriated them both in 2008.

Both firms filed international arbitration suits. And in September 2014, Gold Reserve won an award worth more than US$740 million. (The Crystallex case is still ongoing.)

That is a major bill for Venezuela, where the economy is reeling due to weak oil prices and runaway inflation. But if the government refused to pay, Gold Reserve could potentially seize sovereign assets located outside the country. A refusal could also have a negative impact on Venezuela’s credit reputation.

Venezuela decided to settle. The government said it formed a joint venture with Gold Reserve to develop both the Brisas and Las Cristinas projects. Gold Reserve said Venezuela also agreed to pay an arbitration award, though it did not specify the amount.

“We’re not commenting on the dollars,” chief executive Doug Belanger said, though he added that Venezuela “recognizes the award.”

At this point, the two sides have only signed a memorandum of understanding. If the settlement agreement falls through, Belanger said Gold Reserve would continue to try to claim its full arbitration award.

Meanwhile, Toronto-based Khan has failed in its efforts to get Mongolia to pay up or settle. The company won a US$100 million award early last year after the state seized its Dornod uranium project.

“It’s been a year now,” Khan chief executive Grant Edey said. “We’ve asked them to pay and they’re reticent. They don’t respect Canadian companies or the rule of law.”

Mongolian officials will be in Toronto next week, trying to solicit investment in the country’s mining sector at the Prospectors and Developers Association of Canada (PDAC) conference. It will be a tough sell as long as the state refuses to pay out Khan.

Edey will be meeting with the Mongolians ahead of the conference and hopes the two sides can finally reach a settlement. But for now, Mongolia is trying to annul the arbitration award with a legal challenge in France.

In the case of Stans Energy, the company won a US$118 million award against Kyrgyzstan in 2014 that got annulled by Moscow courts the following year. Regardless, the company is trying to get the award recognized by the Ontario Court of Justice.

Legal experts said that when countries have no choice but to pay out arbitration awards, they usually do agree to pay or settle. Argentina, for example, recently settled arbitration cases and ended a long-running dispute with creditors.

On the other hand, Russia has shown no willingness to pay a US$50 billion award to the former shareholders of Moscow-based Yukos Oil Company, a company that during the past decade was allegedly bankrupted by the state and later had its assets nationalized.

“Most cases wind up seeing some form of settlement at the end of the day, because these awards are enforceable and have some kind of bite,” said Robert Wisner, co-head of the international arbitration practice at McMillan LLP.

http://business.financialpost.com/news/mining/gold-reserve-deal-with-venezuela-a-potential-turning-point-for-canadian-miners-with-arbitration-wins

GDRZF hits new 52-week high (3/01/16)

GOLD RESERVE INC (GDRZF)

Last Trade [tick] 4.7450 [-]

Volume 874,066

Net Change 0.2650

Net Change % 5.92%

52 Week High 5.9000 on 03/01/2016

52 Week Low 2.1900 on 01/14/2016

Open 5.0000

Day High 5.9000

Day Low 4.3600

IIROC Trade Resumption - Gold Reserve Inc.

Vancouver, British Columbia--(Newsfile Corp. - February 29, 2016) - Trading resumes in:

Company:

Gold Reserve Inc.

TSX-V Symbol:

GRZ

Resumption Time (ET):

08:00 March 1, 2016

http://www.stockhouse.com/news/press-releases/2016/02/29/iiroc-trade-resumption-gold-reserve-inc

And the winners are...

“This is a tremendous opportunity for the Company and Venezuela to jointly develop the Brisas-Cristinas Project while providing economic growth in the region and the creation of a new industry complementary to the Republic's existing oil industry. After settlement of all of the Company's obligations, substantially all of the net proceeds of the payment related to the Award and technical mining data is expected to be distributed to our shareholders.”

Gold Reserve Enters into Memorandum of Understanding with the Government of Venezuela to Settle Gold Reserve’s Arbitration Award and Jointly Develop the Brisas and Las Cristinas Projects (2/29/16)

SPOKANE, Wash.--(BUSINESS WIRE)--Gold Reserve Inc. (TSX.V: GRZ) (OTCQB: GDRZF) (“Gold Reserve” or the “Company”) announces that it has entered into a Memorandum of Understanding (the “MOU”) with the Bolivarian Republic of Venezuela (“Venezuela”) that contemplates settlement, including payment and resolution, of the arbitral award (the “Award”) granted in favor of the Company by the International Centre for Settlement of Investment Disputes in respect of the Brisas Project, the transfer of the related technical mining data previously compiled by the Company, as well as the development of the Brisas and the adjacent Cristinas gold-copper project, which will be combined into one project (the "Brisas-Cristinas Project") by the Company and Venezuela.

Under the terms proposed by the MOU, Venezuela would proceed with payment of the Award including accrued interest and enter transactional (settlement) and mixed company ("joint venture") agreements, which are expected to be executed in approximately 60 days, subject to various conditions, including without limitation receipt of all necessary regulatory and corporate approvals and the successful negotiation and execution of definitive agreements. In addition, Venezuela would pay an amount to be agreed upon for the Company's contribution of its technical mining data to the Brisas-Cristinas Project.

Following completion of the definitive agreements, it is anticipated that Venezuela, with the Company's assistance, would work to complete the financing to fund the contemplated payments to the Company pursuant to the Award and for its mining data and $2 billion towards the anticipated capital costs of the Brisas-Cristinas Project. Upon payment, the Company will cease all legal activities related to the collection of the Award.

The Brisas and Cristinas properties, together with the technical data with respect to the Brisas project owned by Gold Reserve, would be transferred to a Venezuelan mixed company, which is expected to be beneficially owned 55% by Venezuela and 45% by Gold Reserve. The Company is also expected to be engaged under a technical assistance agreement to provide procurement, engineering and construction services for the project. The parties would also seek, subject to the approval of the National Executive Branch of the Venezuelan government, the creation of a Special Economic Zone providing the establishment of a special customs framework for the mixed company and other tax and economic benefits.

The combined Brisas-Cristinas Project, a gold-copper deposit located in the Kilometer 88 mining district of Bolivar State in south eastern Venezuela, when constructed, is anticipated to be the largest gold mine in South America and one of the largest in the world.

Doug Belanger, President of Gold Reserve, stated, “This is a tremendous opportunity for the Company and Venezuela to jointly develop the Brisas-Cristinas Project while providing economic growth in the region and the creation of a new industry complementary to the Republic's existing oil industry. After settlement of all of the Company's obligations, substantially all of the net proceeds of the payment related to the Award and technical mining data is expected to be distributed to our shareholders.”

Further information regarding the Company can be located at www.goldreserveinc.com, www.sec.gov and www.sedar.com.

http://www.businesswire.com/news/home/20160229006802/en/Gold-Reserve-Enters-Memorandum-Understanding-Government-Venezuela

Although no specific names have been mentioned, Codelco is the leading producer of copper and Barrick Gold (ABX) for gold.

Freeport McMoRan (FCX) and Newmont Mining (NEM) come in second in copper and gold, respectively.

http://investingnews.com/daily/resource-investing/base-metals-investing/copper-investing/top-10-copper-producing-companies-2/

http://investingnews.com/daily/resource-investing/precious-metals-investing/gold-investing/barrick-newmont-anglogold-goldcorp-kinross-newcrest/

Venezuela Sees Savior in Gold as Country Fights to Avoid Default (2/26/16)

By Nathan Crooks and Noris Soto

Central bank head says Gold Reserve JV to bring in $5 billion

Country close to getting $5 billion loan, Merentes says

Venezuela is planning to move fast with a new mining joint venture announced this week with Spokane, Washington-based Gold Reserve Inc. and will start extracting the precious metal within six months, according to central bank President Nelson Merentes.

The government will have a 55 percent to 60 percent stake in the new venture, while Gold Reserve and partners from the U.S., Germany and Canada will control 40 percent to 45 percent, Merentes said Friday in an interview in his office in Caracas, adding that the consortium will be incorporated within a month.

“The venture involves the largest gold producer in the world and the largest copper producer,” Merentes said, declining to name the companies that will join the project with Gold Reserve. “There are already global banks, investment funds and people with capital who want to invest. This agreement will bring liquidity to help the state meet its commitments.”

The joint venture resolves an arbitration dispute with Gold Reserve and will bring funds totaling $5 billion into the country that will help shore up international reserves that have declined with the price of oil, Merentes said. The investment and new gold production will diversify the country’s sources of foreign currency earnings and allow it to continue making payments on international debt, he added.

“We’re on the way toward getting a $5 billion loan, of which $2 billion will go to develop the project and another $3 billion will go to the central bank or state, depending on what the investor is most comfortable with,” Merentes said. “If we get more, it would even be better.

The amount that goes directly to the government will be repaid from its share of production from the project, he said.

A World Bank arbitration court ruled in 2014 that Venezuela must pay $740 million to Gold Reserve for taking over its Brisas gold and copper project in 2008. Gold Reserve said it acquired and began developing the Brisas mine, which it considers one of the world’s largest undeveloped gold and copper deposits, in 1992, according to its website.

Gold Reserve did not immediately reply to an e-mail sent late Friday seeking comment.

No Default

Venezuela is seeking to develop sectors beyond petroleum as it endures its deepest recession in a decade after oil prices slumped amid a global supply glut. Seeking to increase government revenues, Maduro last week raised gasoline prices for the first time in almost two decades and devalued the nation’s currency to get more bolivars for its petrodollars.

The country will continue to make debt payments and will not default, Merentes said. The country is buying back debt in market operations when it can, he added.

Venezuela’s international reserves fell $1.5 billion to $13.5 billion on Feb. 25, the lowest level since March, 2003, as the country paid back bonds that matured Friday. The country’s bonds rallied as the payment bolstered investor confidence and as oil, the country’s main export, headed for its biggest weekly increase since August.

“Venezuela always has paid its debt, and we won’t stop doing so,” Merentes said. “It’s always a good move to buy back debt when the price is low and we do so when we can.”

Trade Minister Jesus Faria said this week that the government will honor all of its obligations this year, yet swaps traders see a 63 percent chance that the country will default sometime over the next year, the highest rate in the world.

While the country shipped $1.3 billion of gold to Switzerland in January, most of the country’s reserves of the precious metal remain in Venezuela, Merentes said, adding the the movements were a normal part of liquidity management.

Merentes declined to comment on reports that Venezuela had asked China to modify repayment terms for loans it has from the country and deferred questions on the matter to state oil company Petroleos de Venezuela SA.

Currency Market

The central bank is finishing up regulations for a revamped alternative currency market known as Simadi and expects to make announcements next week, Merentes said.

“It will start around the rate where it is right now and then float,” Merentes said. “When it floats, it will float. Last year, Simadi did not float, but this time it will truly float. The conditions for the new system are different. The central bank may intervene from time to time, but we hope that it’s private actors who will act with a greater force.”

Maduro announced the changes to the currency market last week when he devalued the official rate to 10 bolivars per dollar from 6.3 and scrapped an intermediate rate that traded around 13 bolivars per dollar. The Simadi market last sold dollars for about 205 bolivars, according to the central bank.

http://www.bloomberg.com/news/articles/2016-02-27/venezuela-sees-savior-in-gold-as-country-fights-to-avoid-default

Venezuela’s $5 Billion Gold Deal: Progress On Default? (2/25/16)

By Dimitra DeFotis

Venezuela’s government announced late Wednesday that it settled with Canadian mining company Gold Reserve (GDRZF), and will have a controlling stake in a new $5 billion joint venture.

Gold Reserves wanted $750 million including interest for the expropriation of its assets under the Hugo Chavez administration in 2008. The government is fighting a handful of related cases, via the International Center for Settlement of Investment Disputes (ICSID), that seek $3.2 billion in restitution with interest. The government’s bond covenants require that it pay arbitrated awards of $100 million or more within 30 days to avoid triggering defaults.

Eurasia Group analysts Risa Grais-Targow and Agata Ciesielska write that “while the deal demonstrates Venezuela’s willingness to pay its debt, liquidity constraints will still lead to a default in the fourth quarter of the year.” They add:

The Nicolas Maduro administration announced last night that it had reached an agreement with Canadian mining company Gold Reserve that resolves their ongoing international arbitration dispute. The government announced a $5 billion deal that creates a new joint venture (55% state, 45% Gold Reserve) to develop the Las Brisas (Gold Reserve’s former concession) and Las Cristinas properties (a separate ICSID case brought by Crystallex over this concession is still pending at ICSID). According to the government, the deal includes a $2 billion investment and a $2 billion loan. Statements by Gold Reserve suggest that the government intends to use the properties as collateral to obtain additional financing instead of a loan commitment from Gold Reserve itself. While the precise details of the deal are unclear, it seems unlikely that the government can use this asset to generate new liquidity in the near-term.”

Aside from Gold Reserve, the other most advanced cases are Exxon Mobil (XOM) for its Cerro Negro project, and Highbury International, both of which could see their annulment cases conclude later this year. Even after this option has been exhausted, we would expect the government to appeal any enforcement orders. Several other annulment proceedings are underway, but will likely be decided in 2017 or 2018.”

Starting to wish I still had some of this? Idk hard to tell with maduro.

Gold Reserve had 76,142,647 shares outstanding at 9/30/15.

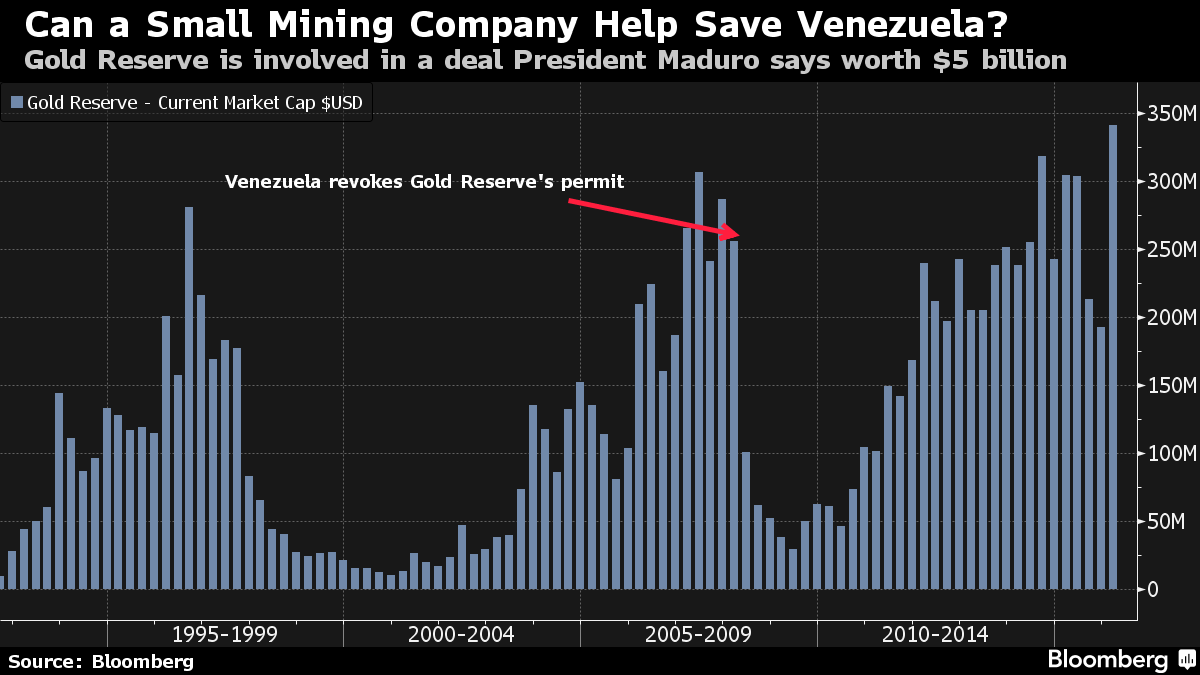

Can a Small Mining Company Help Save Venezuela? (2/25/16)

by Nathan Crooks

Venezuela’s plan to get a $2 billion loan and a $2 billion investment in a mining joint venture involves a company whose market value has never exceeded $350 million. The government said on Wednesday that it resolved a longstanding dispute with Gold Reserve Inc., whose principal asset was an arbitration judgment against the South American country. A World Bank court ruled in 2014 that cash-strapped Venezuela had to pay $740 million to Gold Reserve for taking over its gold assets in the country. Now, President Nicolas Maduro says all is good, and his government will work to develop a project with the company in what he said was a $5 billion deal.

http://www.bloomberg.com/news/articles/2016-02-25/can-a-small-mining-company-help-save-venezuela-chart

IIROC Trade Halt - Gold Reserve Inc.

Vancouver, British Columbia--(Newsfile Corp. - February 25, 2016) - The following issues have been halted by IIROC:

Company:

Gold Reserve Inc.

TSX-V Symbol:

GRZ

Reason:

At the Request of the Company Pending News

Halt Time (ET)

08:38

10

Very interesting chart pattern.

Somebody's Ouija Board began working overtime about a week ago predicting this outcome.

|

Followers

|

14

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

255

|

|

Created

|

12/11/08

|

Type

|

Free

|

| Moderators | |||

Gold Reserve Inc. has a history in mining dating back to 1956 and was formed for the purpose of acquiring, exploring, and developing mining properties and placing them into production. The Company is incorporated under the laws of the Province of Alberta, Canada and is listed on the TSX Venture Exchange and the OTCQB Markets Exchange.

In 1992, the Company acquired and began developing what is now known as the Brisas gold and copper project, located in the historic Km 88 mining district of the State of Bolivar in southeastern Venezuela (the "Brisas Project"). The Brisas deposit, which is one of the largest undeveloped gold/copper deposits in the world, contains ore reserves of 10.2 million ounces of gold and 1.4 billion pounds of copper. From 1992 to 2009, the Company invested close to US $300 million in acquisition, land exploration, development, equipment, and engineering costs, which the Company believed developed the Brisas Project into a world class mining project.