Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Gran Colombia Gold Corp. (TPRFF)(GCM:TSE) Weekly Chart -

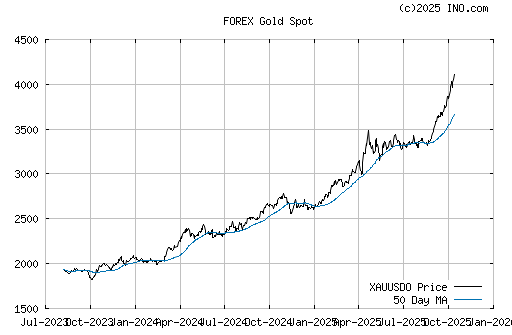

$GOLD - Default Style -

In GOD We Trust -

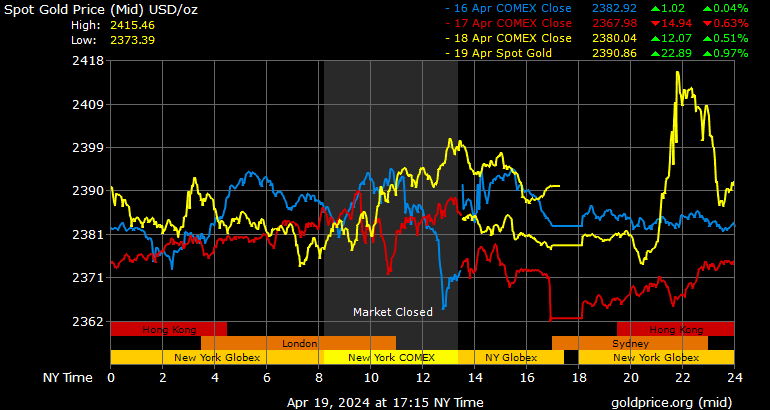

http://www.kitconet.com/images/live/au0001wb.gif

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless America

https://investorshub.advfn.com/Gran-Colombia-Gold-Corp-TPRFF-30138/

Kerr Mines Newsletter has properly arrived for investors and it is about time...

https://us12.campaign-archive.com/home/?u=089745f1fc8715ebd47da6563&id=cc82ff39fb

« ...Claudio Ciavarella

Chief Executive Officer & Director ~ Kerr Mines

Mr. Ciavarella is a Professional Accountant receiving his designation in 1994. He earned his Bachelor of Business Administration from Wilfrid Laurier University’s School of Business and Economics, where he graduated Honours with Distinction.

Mr. Ciavarella is a private business owner with over 25 years experience in the Construction, Real Estate and Manufacturing Industry.... »

http://kerrmines.com

« ...Kerr Mines Strengthens Executive Team with Appointment of VP Projects and Mine General Manager

https://globenewswire.com/news-release/2018/05/30/1513681/0/en/Kerr-Mines-Strengthens-Executive-Team-with-Appointment-of-VP-Projects-and-Mine-General-Manager.html

»...TORONTO, May 30, 2018 (GLOBE NEWSWIRE) -- Kerr Mines Inc. (TSX:KER) (OTC:KERMF) (FRA:7AZ1) (“Kerr” or the “Company”) is pleased to announce the appointment of Mr. David Thomas as Vice President of Projects and Copperstone Mine General Manager. This key addition to the Kerr Mines executive management team is central to the Company’s core strategy of moving into production in 2019.

Mr. Thomas is an Engineer with over 30 years’ experience in the mining industry, specifically in constructing and moving mines into production. He has held key roles in constructing mines such as the Kupol Mine for Bema Gold (now Kinross Gold), Fort Knox and Kubaka mines for Kinross Gold, Kensington and Palmarejo mines for Coeur Mining, Hope Bay for Newmont and Pogo and Red Dog for Cominco (now Teck Resources).

In addition, on May 22 the Company also released and filed its NI 43-101 technical report which can be found on SEDAR and Kerr Mines Investor Information web-page.

“On the heels of the successful 2017 Exploration Program and the positive results of the 2018 Preliminary Feasibility Study, the addition of David to the team provides a catalyst towards the goal of full gold production by the end of 2019,” said Martin Kostuik, President Kerr Mines. “David’s accomplishments in the areas of engineering, procurement and construction management in the mining industry are second to none. David also brings an array of experience to compliment his capital project skills including permitting, financing, mine operations and business development.”

Please see SEDAR and http://kerrmines.com/investors/ for recent filing of Q3 Financial Statements and MD&A for the three and nine months ended March 31, 2018.

About Kerr Mines Inc.

Kerr Mines is a North American gold development and exploration company currently advancing the 100% owned, fully permitted past-producing Copperstone Mine project to production. Copperstone is a high-grade gold project located along a detachment fault mineral belt in mining-friendly Arizona. The project demonstrates significant upside exploration potential within a 4,775 hectare (11,800 acres) land package that includes a production history of over 500,000 ounces of gold.

PDF Version of 43-101 technical report available:

http://kerrmines.com/wp-content/uploads/KerrCopperstone_PFS_43-101.pdf

For further information contact:

Claudio Ciavarella

Chief Executive Officer

cciavarella@kerrmines.com

416-855-9305

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements, including current expectations on the timing of the commencement of production and the rate of production, if commenced. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements. These uncertainties and risks include, but are not limited to, the strength of the Canadian economy; the price of gold; operational, funding, and liquidity risks; the degree to which mineral resource estimates are reflective of actual mineral resources; and the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with underground operations. Risks and uncertainties about Kerr Mines’ business are more fully discussed in the Company's disclosure materials, including its annual information form and MD&A, filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. Kerr Mines assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law.... »

Institutional investors purchased a net $70.9 million shares of EGO during the quarter ended March 2018 and now own 44.36% of the total shares outstanding. This is a greater percentage than is typical for companies in the Precious Metals industry and highlights that the smart money sees this stock as an important holding.

Maurice Mason, VP - Caledonia Mining Corporation (CMCL)

« ...Copperstone Project, La Paz County, Arizona, USA

http://www.investorx.ca/search/00003818/kerr-mines-inc

Large file

Not sure about a gold run. I just try to buy close to 15's silver.

JohnCM - some gold stocks are setting up for nice runs. Take a look at NJMC and NBRI, those are the best of the best!

Thanks, NYBob. NJMC is looking great, I hadn't checked it for a while until I saw your posts. I added it to my watch list and am looking forward to buying some shares asap! Check out NBRI, they are nothing compared to NJMC for now but there are some interesting developments recently.

About New Jersey Mining Company -

New Jersey Mining Company is headquartered in North Idaho, where it is

producing gold at its Golden Chest Mine.

NJMC has established a high-quality, early to advanced-stage asset base

in three historic mining districts of Idaho and Montana, developed with

more than $50-million by NJMC and other companies.

The Company’s objective is to use its considerable in-house skill sets

to build a portfolio of mining and milling operations, with a longer-term vision of becoming a mid-tier producer.

Management is shareholder focused and owns more than 17-percent of NJMC

common stock.

The Company’s common stock trades on the OTC-QB Market under the symbol

“NJMC.”

For more information on New Jersey Mining Company go to www.newjerseymining.com or call:

Monique Hayes, Corporate Secretary/Investor Relations

Email: monique@newjerseymining.com

(208) 625-9001

http://newjerseymining.com/new-jersey-mining-company-sells-its-toboggan-project-to-hecla-mining-company-for-3-million/

God Bless America

Metals Creek Resources (TSXV: MEK) Releases Results From First Four

Drill Holes On The Ogden Gold Project - Timmins Ontario

Toronto, Ontario - May 8, 2018 (Newsfile Corp.) (Investorideas.com

Newswire)

Metals Creek Resources Corp. (TSXV: MEK) (the "company")

is pleased to announce that results have been received from the first

four of a nine hole, 2382m (meters) (see MEK news release February 14,

2018) diamond drill program designed to further test multiple targets

on the Ogden Gold Project.

http://www.investorideas.com/news/2018/mining/05081TSXVMEK.asp

These initial 4 holes were targeting the Thomas Ogden West (TOG West)

and Naybob South mineralization.

Thomas Ogden West

Two holes were drilled in the TOG West area focusing on the continuation of the fold structure west of the Thomas Ogden Zone which previously intercepted in hole TOG17-60 (see news release February 21, 2018) an intercept of 8.0 g/t (grammes per tonne) gold over 2.0m and a second zone of mineralization returning an intercept of 1.21 g/t gold over 24.8m. The TOG West mineralization is interpreted to be an easterly plunging zone parallel to the Thomas Ogden Zone (TOG) and approximately 900m west of the TOG.

Hole TOG18-62, drilled approximately 75m east of hole TOG18-60 returned two zones of mineralization. The first zone of mineralization returned a down hole intercept of 1.42 g/t Au over 6.0m (298.0m to 304.0m) with associated pyrite mineralization and strong silicification and hosted within a felsite unit. A second zone of mineralization was intercepted further down hole returning an intercept (314.0m to 324.14m) of 1.12 g/t gold over 10.14m with associated pyrite and arsenopyrite mineralization with strong albitization. This lower intercept was hosted within altered conglomerates.

Hole TOG18-63, drilled approximately 200m east of OG17-02 which returned a down hole intercept of 4.96 g/t Au over 3.97m (see news release May 03, 2017) and a 75m undercut to hole TOG17-60, targeted the down plunge extension of TOG West mineralization. A down hole intercept of 9.5m (383.0m to 392.5m) grading 1.12 g/t Au was returned with associated pyrite and arsenopyrite mineralization as well as moderate to strong albitization and silicification (Visible gold was noted in this intercept).

Naybob South

Two holes were drilled within the Naybob South stratigraphy testing the

down plunge extent of previously defined mineralized shoots.

These holes are a follow-up to hole OG17-41 which returned multiple

gold intercepts (see news release November 28, 2017)

including 4.16 g/t au over 3.29m.

Hole OG18-42 was drilled within the Naybob South Stratigraphy and was drilled on the western limits of the Naybob South Zone. Hole OG18-42 returned several gold intercepts including a downhole intercept (114.33m to 116.50m) of 1.69 g/t (grammes per tonne) gold over 2.17m (meters) hanging wall to the Naybob South Main Zone. A second zone of mineralization was intersected, returning a downhole intercept (124.0m to 124.4) of 5.54 g/t gold over 0.4m. A third zone of mineralization was intercepted returning a downhole intercept (134.05m to 138.08m) of 0.85 g/t gold over 4.03m. These mineralized units were moderately to strongly albitized with associated pyrite and arsenopyrite mineralization. Hole 42 was a 120m under-cut to hole OG17-41.

Hole OG18-43 was drilled as well within the Naybob South Stratigraphy retuning multiple gold intercepts including mineralization not previously encountered in historic drilling. Hole OG18-43 returned a down hole intercept (105.68m to 106.45m) of 7.12 g/t Au over 0.77m footwall to the main zone. A second zone of mineralization (114.25m to 116.20m) assayed 3.25 g/t Au over 1.95m. A third zone of mineralization (144.55m to 147.55m) assayed 3.19 g/t Au over 3.0m. The Naybob South main zone returned a down hole intercept (175.82m to 178.15m) of 2.14 g/t Au over 2.33m. Mineralization consisted of one to five percent pyrite and arsenopyrite with associated albitization and strong silicification.

Results from first four holes in recent drill program.

Reported drill intercepts are not true widths. At this time there is insufficient data to calculate true orientations.

Results from the remaining 5 Holes are still pending and will be released once they are received and compiled.

The Ogden Property is held under a joint venture in which Metals Creek owns 50%, and Goldcorp Canada Ltd. ("Goldcorp") owns 50% (as manager and on behalf of the Porcupine Joint Venture, a joint venture between Goldcorp Inc. and Goldcorp Canada Ltd.) with MEK being the operator of the project. The Ogden claims cover eight kilometers of strike length of the Porcupine-Destor Fault between Goldcorp's 16 million oz. Dome Mine and Tahoe Resources West Timmins Mine. The vast majority of the Porcupine-Destor Fault on the property is underexplored, compared to other properties in the Timmins Gold camp.

All split core samples were sent to Agat Laboratories. The precious metals were analyzed utilizing a standard fire assay with an atomic absorption finish. As part of the Corporations QAQC protocol, approximately 10% of the samples submitted for assay were also sent for check assays. Standards and blanks were inserted randomly into the sample shipments as part of the sampling protocol. Samples with fire assay results above 1.0 g/t gold are re-analyzed using a gravimetric finish and samples with fire assay results above 5.0 g/t gold or samples showing visible gold are analyzed using the pulp metallic method.

Michael MacIsaac, P.Geo and VP Exploration for the Corporation and a qualified person as defined in National Instrument 43-101, is responsible for this release, and supervised the preparation of the information forming the basis for this release.

About Metals Creek Resources Corp.

Metals Creek Resources Corp. is a junior exploration company incorporated under the laws of the Province of Ontario, is a reporting issuer in Alberta, British Columbia and Ontario, and has its common shares listed for trading on the Exchange under the symbol "MEK". Metals Creek has earned a 50% interest in the Ogden Gold Property, including the former Naybob Gold mine, located 6 km south of Timmins, Ontario and has a 8 km strike length of the prolific Porcupine-Destor Fault (P-DF) that stretches between Timmins, Ontario and Val d'Or, Quebec. Metals Creek also has an option agreement with Quadro Resources on Metals Creeks and Benton Resources Staghorn Gold Project in Newfoundland as well as two option agreements with Anaconda Mining Inc. on Metals Creek's Jacksons Arm and Tilt Cove Properties also in Newfoundland. The company also has an option agreement on its Clarks Brook property with Sokoman Iron Corp. and is engaged in the identification, acquisition, exploration and development of other mineral resource properties, and presently has mining interests in Ontario, Yukon and Newfoundland and Labrador including the recently acquired Great Brehat project on the Great Northern Peninsula of Newfoundland. Additional information concerning the Corporation is contained in documents filed by the Corporation with securities regulators, available under its profile at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Alexander (Sandy) Stares, President and CEO

Metals Creek Resources Corp

telephone: (709)-256-6060

fax: (709)-256-6061

email: astares@metalscreek.com

MetalsCreek.com

Twitter.com/MetalsCreekRes

Facebook.com/MetalsCreek

http://www.investorideas.com/news/2018/mining/05081TSXVMEK.asp

God Bless America

Precious metals blow.

The only play I like is USLV buy in the 9's and sell in the 12's

Rinse and repeat.

« ..."Kerr Mines' Copperstone project is of significantly higher grade than most of the deposits in the western U.S." - Fundamental Research... »

https://www.streetwisereports.com/article/2018/05/01/opportunity-for-gold-right-in-americas-backyard.html

Kerr Mines « 600,000 ounce Copperstone gold project in Arizona is “just the beginning” as it aims for production in 2019.... »

http://www.mining-journal.com/feasibility/news/1335958/kerr-looks-to-restart-copperstone-in-2019

« ...Kerr looks to restart Copperstone in 2019

Junior Kerr Mines (CN:KER) says a positive prefeasibility study for its 600,000 ounce Copperstone gold project in Arizona is “just the beginning” as it aims for production in 2019.

The PFS points to an initial capex of US$22.7 million, thanks to the amount of infrastructure at the past-producing mine, an internal rate of return of 40% and payback within 2.3 years of the flagged 2019 start.

NY-Bob if there is 600,000 au oz, these KERR shares are cheap, cheap, CHEAP imo..... kerrmines.com

« ...Kerr Mines Releases Highlights From Pre-Feasibility Study: 40% IRR, Updated Resource and Production in 2019

https://globenewswire.com/news-release/2018/04/10/1467588/0/en/Kerr-Mines-Releases-Highlights-From-Pre-Feasibility-Study-40-IRR-Updated-Resource-and-Production-in-2019.html

TORONTO, April 10, 2018 (GLOBE NEWSWIRE) -- Kerr Mines Inc. (TSX:KER) (OTC:KERMF) (FRA:7AZ1) (“Kerr” or the “Company”) is pleased to announce the results of the independent Pre-Feasibility study (“PFS”, “Study”) and resource update prepared by Hard Rock Consulting, LLC in accordance with National Instrument 43-101 (“NI 43-101”) for its past producing Copperstone Mine in Arizona, USA. On the momentum of a very successful 2017 Phase I exploration program and this PFS, the Company is pleased to confirm updated gold resources and positive economics at the Company’s Copperstone Mine in Arizona.

Copperstone PFS Highlights (all values US$ unless otherwise noted):

Base case $1,250/oz gold;

Initial capital of $22.7 million which includes a mine equipment capital lease;

Study life operating margin (EBITDA) of $89M, Internal rate of return of 40%;

Payback of initial capital within 2.3 years of 2019 production start;

Recovery of gold averaging 95% using crushing, grinding and whole ore leach;

Average annual sales of 38,347 ounces gold;

Cash Operating Cost of $684 per gold ounce;

All-in Sustaining Cost ("AISC") of $875 per gold ounce;

Measured and Indicated (“M&I”) Mineral Resources of 1,124,800 tonnes averaging 7.63 g/tonne gold;

276,100 ounces contained gold in M&I Resource;

Inferred Mineral Resources of 666,000 tonnes averaging 6.81 g/tonne gold;

145,700 ounces contained gold in Inferred;

Proven and Probable (“P&P”) Mineral Reserves of 802,048 tonnes averaging 6.79 g/tonne gold;

175,093 ounces contained gold in P&P Reserve;

M&I gold resources ounces, which are not part of the P&P reserve ounces, are targeted for potential inclusion in the P&P reserves through recommended future drilling;

Inferred gold resources are open for further expansion and conversion through recommended future drilling in the Copperstone and Footwall zones.

“The results of this PFS display the strong near-term production opportunity for the Copperstone Mine and robust returns for our investors. This is just the beginning," says Martin Kostuik, President. “The impressive exploration upside displayed by the 2017 Phase I program, the historical production of over 500,000 gold ounces and the potential to generate solid positive cash flows by identifying the first four years of gold production, all point toward the opportunity of many more years, beyond the Study timeframe, of profitable production. In fact, there are 100,000 gold ounces of M&I mineral resources that were not included in the P&P mineral resources, part of which are immediately accessible for drilling and potential inclusion.” Kostuik continued, “Our intention is to finance the initial capital through corporate debt. We are currently engaged in discussions focused on non-dilutive financing options with several lending groups to finalize our forthcoming production decision. Furthermore, we shall continue our efforts to enhance shareholder value by pursuing other value-adding activities such as conducting an intense 2018 exploration program which is designed to increase mine life”

Great work Kerr Team... Bravo!

Gold Stocks: The New Safe Haven -

http://news.goldseek.com/GoldSeek/1522767337.php

The increase in the ECI from 2.5% to 10% is expected to amount to additional income of

approximately $5.1 million for the year

http://www.caledoniamining.com/pdfs/Press%20Release%20-%20Increased%20ECI%2004042018.pdf

http://www.caledoniamining.com/pdfs/March%202018%20Investor%20Presentation.pdf

http://www.caledoniamining.com

God Bless America

“4 weeks-left “.At-least One Million-Ounces”-of-gold. Cyber37 wrote!

...so with 1 million oz at $700/oz for gold in the ground & 256 million shares of KER out there....that is $2.73/share. At $0.23/share today, KER is worth looking into.

G37

I concur!

Read more at http://www.stockhouse.com/companies/bullboard?symbol=t.ker&postid=27680737#WjwD8UUIWedPSleV.99

https://mobile.twitter.com/stockhouse/status/970700609706971137/video/1

Cheer$,

GoldenPolarBear

PS Last day to see the Kerr Team at PDAC 2018 in Toronto...

Recent Video Interview with President Martin Kostuik explaining how they confirmed a massive high grade parallel golden zone .... etc...

https://mobile.twitter.com/stockhouse/status/970700609706971137/video/1

Try to find the time to visit the Kerr Mines PDAC booth and ask Martin, Claudio or Brad to explain the gleaming golden rock samples from the Copperstone Mine etc...

John CM, Please... ReVisit the Golden Copperstone Mine in Arizona

The video needed to be slightly changed so...

Time to visit the Copperstone Mine together!

Please join me via this video to visit the Golden Copperstone Mine in Arizona... There is no sound but the visuals are stunning imho

Slightly updated video

My trip to AZ was cancelled.

John-CM Please visit the Golden Copperstone Mine in Arizona

Please join me via this video to visit the Golden Copperstone Mine in Arizona... There is no sound but the visuals are stunning imho

Kerr Mines (TSX: KER; US-OTC: KERMF) is focused on its goal of redeveloping the fully permitted, past-producing Copperstone gold property located along the Walker Lane mineral belt in Arizona.

Copperstone produced over 500,000 oz. gold from an open pit in the past, but left behind was a high-grade measured resource of 934,000 tonnes at 10.4 grams gold per tonne for 311,000 contained oz. gold. Another 335,000 tonnes at 12.2 grams gold lie in the inferred category.

This year, Kerr has planned several milestones, starting with a new resource estimate and prefeasibility study expected in the first quarter and a production decision within the next three months.

Kerr sees the project having upside in several respects, including monetizing by-product copper, expanding the Copperstone and Footwall zones and exploring the property’s regional potential.

Kerr raised $17 million in 2017, and in January 2018 had $9.5 million in debt and $5.6 million in cash.

“...Kerr Mines Inc.: #VRIC2018-Video-Interview Claudio Ciavarella (TSX: $KER)CEOROASTER

Martin Kostuik President & Director, Kerr Mines

Mr. Kostuik (B.Sc., MBA) is a mining engineer and senior executive with 25 years of diversified experience in the mining industry.

Fahad Al Tamimi Chairman, Kerr Mines

Mr. Al Tamimi is a Saudi-based businessman with global investment activities. Previously, he was President and CEO of SaudConsult, the largest engineering firm in Saudi Arabia responsible for many large infrastructure and construction projects in the country.

He was also a 50% partner of Worley Parsons Arabia, which undertook major infrastructure projects in the oil & gas, energy and a mining project worth over $5 billion in Saudi Arabia.

Claudio Ciavarella

Chief Executive Officer & Director

Mr. Ciavarella earned his Bachelor of Business Administration from Wilfrid Laurier University’s School of Business and Economics, where he graduated Honours with Distinction.

Mr. Ciavarella is a private business owner with over 25 years experience in the Construction, Real Estate and Manufacturing Industry. He is currently President of his Forte Group of Companies, a Custom Store Fixture Manufacturer and Chief Financial Officer of the Aqua Tech Group, his construction operations.

He is a Professional Accountant receiving his designation in 1994 and has served on the Board of Kerr Mines for over 7 years.

“...

Rich Fundamentals for High-Grade Gold Project

Jeff Nielson, Stockhouse

The plunge in the price of gold that began in 2011 is now old news to mining investors. The depressed conditions that have persisted in the gold sector for most of the 6+ years since that time have claimed a significant number of corporate casualties – especially among the junior mining companies.

The reality in markets, however, is that what is a disaster for one group of shareholders can spell opportunity for another. Illustrating this point is Kerr Mines Inc. (TSX: KER, OTCQB: KERMF, Forum). The Company’s flagship property is the Copperstone Gold Project, located in western Arizona, close to the Nevada border.

Nevada is world-famous as a gold mining destination, but the same gold-bearing geology also extends into portions of Arizona. Known as the Walker Lane mineral belt, this region in the U.S. has hosted known gold mineralization that already exceeds 40 million ounces.

This particular geology is known as “detachment faults”. While that terminology won’t mean anything to those without a geological background, in the Walker Lane belt such geology is associated with (high grade) gold-bearing mineralization. ...”

JohnCM, it compares strongly-to-Eldorado-imho “...

Kerr Mines 255% increase in mineralized extents of Footwall Zone

TORONTO, ONTARIO--(Marketwired - Jan. 17, 2018) - Kerr Mines Inc. (TSX:KER)(OTCQB:KERMF)(FRANKFURT:7AZ1) ("Kerr" or the "Company") is pleased to announce further results of its Phase I surface drilling program. KER-17S-21 further extends the Footwall Zone by returning a 36.6 meter drill hole interval with 7.5 g/t gold (Au) and 0.26% copper (Cu). Phase I of the program continues to confirm significant gold mineralization and increases the confidence in expanding the resource at the Company's Copperstone Project in Arizona.

”... Highlights

New intervals drilled from the surface through the Footwall Zone include:

3.4 meters @ 7.9 g/t Au and 2.78 % Cu (KER-17S-10)

4.6 meters @ 13.2 g/t Au and 1.28 % Cu (KER-17S-13)

4.3 meters @ 6.8 g/t Au and 0.19 % Cu (KER-17S-17)

36.6 meters @ 7.5 g/t Au and 0.26 % Cu (KER-17S-21)

Increase of 255% of mineralized zone including an increase of 223 meters of strike and 91 meters of dip extents compared to previously announced Footwall Zone.

Discovery of a new and separate Footwall mineralized zone with 105 meters of strike and 240 meters of dip.

Open for further expansion along strike and dip with future drilling.

Martin Kostuik, President, stated, "the significant increase in the size of the Footwall Zone and an addition of a separate mineralized area adjacent to the same Footwall Zone is an amazing step towards increasing Kerr Mines shareholder value. With the surface program complete and underground assay results continuing to be delivered, we are excited to compile all of the 2017 exploration data and form a new Copperstone Project resource by the end of this quarter "

The Copperstone Zone detachment fault system historically produced over 500,000 ounces of gold from an open pit. Continuing below the open pit, the down-dip extension of the Copperstone Zone has an undiluted mineral resource of 313,000 oz Au (311,00 measured + 2,000 indicated) at 10.35 g/t Au (0.302 ounce per ton), estimated in 2010* which is being further enhanced by the Phase I drilling program. The Phase I 8,000 meter surface and underground drilling program is complete with final assays pending. The Phase I program tested along strike and up/down-dip in the D and C portions of the Copperstone Zone and in the newly announced parallel Footwall Zone (see press release dated October 21, 2017).

KER-17S-10 is a vertical core hole drilled in the northwestern portion of the Footwall Zone drilled towards the southwest beneath the Copperstone shear. This hole was designed to extend the Footwall Zone and resulted in a mineralized interval of 7.5 meters @ 3.7 g/t gold and 1.36% copper. Combining gold and gold equivalent copper grades results in a total of 5.9 g/t Au equivalent (g/t AuEq) for the interval. Included in this interval is 3.4 meters @ 7.9 g/t Au and 2.78% Cu for an 12.5 g/t AuEq. Other sub-intervals of this result are in Table 1 below.

KER-17S-11 is an inclined core hole drilled in the northwestern portion of the Footwall Zone drilled towards the southwest. This hole is drilled from the same location as KER-17S-10 and is designed to add up-dip continuity to the KER-17S-10 result. Results are 3 meters @ 3.9 g/t Au and 0.16% Cu for a 4.1 g/t AuEq. This interval is 100 meters up-dip from the interval reported in KER-17S-10.

KER-17S-13 is a vertical reverse circulation (RC) hole collared in the northwestern portion of the Footwall Zone and drilled towards the southwest. KER-17S-13 is designed to upgrade resources, demonstrate continuity and resulted in a mineralized interval of 15.2 meters @ 4.6 g/t Au and 0.48% Cu for a 5.4 g/t AuEq. Included in this interval is 4.6 meters @ 13.2 g/t Au and 1.28% Cu for a 15.3 g/t AuEq. This result is 82 meters down dip of the historic 06CS-17 which contained a 3.0 meter @ 7.0 g/t Au interval. KER-17S-13 is located 125 meters along strike from KER-17S-10.

KER-17S-17 is an inclined core hole drilled in the northwestern portion of the Footwall Zone drilled towards the southwest. KER-17S-17 tests the down dip continuity of the Footwall Zone and intercepts mineralization 100 meters below the historic 06CS-17 interval of 3.0 meters @ 7.0 g/t Au. Results are 9.3 meters @ 3.6 g/t Au and 0.15% Cu for a 3.8 g/t AuEq. This interval includes 4.3 meters @ 6.8 g/t Au and 0.19% Cu for a 7.2 g/t AuEq. KER-17S-17 is located 64 meters along strike from KER-17S-10.

KER-17S-19 is a vertical reverse circulation (RC) hole collared in the northwestern portion of the Footwall Zone and drilled towards the southwest from the same location as KER-17S-04 (see press release dated October 21, 2017). KER-17S-19 tests the down dip potential of the Footwall Zone and contains two mineralized intervals which show the potential to extend the mineralized intervals down dip of KER-17S-04. The first interval is 10.7 meters @ 2.8 g/t Au and contains 3.0 meters @ 4.0 g/t Au. The second interval is 3.0 meters @ 4.6 g/t Au and is 76 meters down dip of KER-17S-04.

KER-17S-21 is an inclined reverse circulation (RC) hole collared in the southeastern extents of the Copperstone pit and drilled towards the southwest. KER-17S-21 tests the down dip continuity of the Footwall Zone and intercepts a 36.6 meter long interval of mineralization. This interval is located 73 meters down dip below the historic 06CS-18 drill hole interval of 3.0 meters @ 3.9 g/t Au. KER-17S-21 contains two mineralized intervals which extend the mineralized zone. The first interval is 3.0 meters @ 6.6 g/t Au and 0.66% Cu for a 7.7 g/t AuEq. The second interval is 36.6 meters @ 7.5 g/t Au and 0.26% Cu for a 7.9 g/t AuEq. Included in this interval are 7.6 meters @ 31.2 g/t Au and 3.0 meters @ 71.9 g/t Au. KER-17S-21 intercepts are located 85 meters from KER-17S-19 intervals.

Table 1. Selected Drill Results

The technical information in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and reviewed and approved by Michael R. Smith, Registered Geologist., who is a "Qualified Person" as defined by NI 43-101 for this project.

About Kerr Mines Inc.

Kerr Mines is a North American gold development and exploration company currently advancing the 100% owned, fully permitted past-producing Copperstone Mine project. Copperstone is a high-grade gold project located along a detachment fault mineral belt in mining-friendly Arizona. The project demonstrates significant upside exploration potential within a 4,775 hectare (11,800 acres) land package that includes a production history of over 500,000 ounces of gold. The Company's current focus is on maximizing Copperstone's potential by defining and expanding current resources and strengthening the mine's economics leading to a production decision.

Quality Assurance and Quality Control Statement

Procedures have been implemented to assure Quality Assurance Quality Control (QAQC) of drill hole assaying being done at American Assay Laboratories (American), which is ISO Accredited. All portions of drill holes are being assayed and samples are securely stored for shipment to American, with chain of custody documentation through delivery. Mineralized commercial reference standards and coarse blank standards are inserted every 20th sample in sequence and results are graphed to assure acceptable results, resulting in high confidence of the drill hole assay results. When laboratory assays are received, the QAQC results are immediately evaluated and graphed to analyze dependability of the drill hole assays. As the Copperstone Project advances, additional QAQC measures will be implemented including 1) selected duplicate assaying being done at a second accredited assay laboratory, 2) duplicate assaying of selected intervals of core (quarter splits) and reverse circulation drilling samples, and 3) metallic screen assays of selected remaining laboratory rejects. All results will be analyzed for consistency.

*Mineral Resource Tabulation - Model capped at 5.0 oz Au/t with a 0.15 oz Au/t cutoff grade, 1,038,000 tons (1,029,000 measured + 9,000 indicated) - NI 43-101 Technical Feasibility Report, Copperstone Project, February 11, 2010. Limited mining of this resource occurred in the period between Q4 2012 and Q3 2013 and updated tons will be tabulated when a new resource is estimated in early 2018....”

Metallurgical test work continues by Resource Development Incorporated of Denver to enhance previously established recoveries for gold and copper.

Gold equivalent values for contained metal were calculated using $US 1,250/ oz Au and $3.00 /lb Cu.

How does this compare to Eldorado?

JohnCM, here are several Kerr Mines’ resources... http://kerrmines.com

”...THE COPPERSTONE MINE

Historically produced over 500,000 oz in the open pit...”

... production history of over 500,000 ounces of gold

BTW NYBOB,

Kerr Mines Announces Closing of Oversubscribed $6,000,000 Private Placement

TORONTO, ONTARIO--(Marketwired - Dec. 14, 2017) - Kerr Mines Inc. (TSX:KER)(OTCQB:KERMF)(FRANKFURT:7AZ1)

("Kerr" or the "Company") is pleased to announce the closing of an oversubscribed non brokered private placement (see press release dated November 29, 2017).

In connection with the placement, the Company will issue 20,371,869 common shares of the Company ("Shares") at a price of $0.30 per Share for total gross proceeds of $6,111,564 (the "Offering"). Proceeds exceeded the originally announced target of $5 million due to high investor interest. The Company will use the net proceeds from the Offering to continue advancing its flagship Copperstone Mine in Arizona to a production restart decision.

"This financing is another positive step forward in achieving our strategic objectives," stated Claudio Ciavarella, Kerr's Chief Executive Officer. "With the success of the first phase of our exploration program we have gained further confidence in our ability to move the project towards the successful completion of our updated resource and Pre-feasibility Study in Q1 2018 and subsequent production decision."

In connection with the Offering the Company paid finder fees totaling $209,387 to certain eligible persons.

The Offering has been conditionally approved by the Toronto Stock Exchange ("TSX") but remains subject to final approval from the TSX. The securities issued pursuant to the Offering are subject to a four month hold period in accordance with applicable securities laws.

About Kerr Mines Inc.

Kerr Mines is a North American gold development and exploration company currently advancing the 100% owned, fully permitted, past-producing Copperstone Mine project. Copperstone is a high-grade gold project located along a detachment fault mineral belt in mining-friendly Arizona. The project demonstrates significant upside exploration potential within a 4,775 hectare (11,800 acres) land package that includes a production history of over 500,000 ounces of gold. The Company's current focus is on maximizing Copperstone's potential by defining and expanding current resources and strengthening the mine's economics leading to a production decision.

Cautionary Note Regarding Forward Looking Statements

This news release contains forward-looking statements, including current expectations on the timing of the commencement of production and the rate of production, if commenced. These forward-looking statements entail various risks and uncertainties that could cause actual results to differ materially from those reflected in these forward-looking statements. Such statements are based on current expectations, are subject to a number of uncertainties and risks, and actual results may differ materially from those contained in such statements. These uncertainties and risks include, but are not limited to, the strength of the Canadian economy; the price of gold; operational, funding, and liquidity risks; the degree to which mineral resource estimates are reflective of actual mineral resources; and the degree to which factors which would make a mineral deposit commercially viable are present; the risks and hazards associated with underground operations. Risks and uncertainties about Kerr Mines' business are more fully discussed in the Company's disclosure materials, including its annual information form and MD&A, filed with the securities regulatory authorities in Canada and available at www.sedar.com and readers are urged to read these materials. Kerr Mines assumes no obligation to update any forward-looking statement or to update the reasons why actual results could differ from such statements unless required by law.

Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release and no stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

CONTACT INFORMATION

Claudio Ciavarella

Chief Executive Officer

416-855-9305

cciavarella@kerrmines.com

Bobby, you beat me to it

There should be all eyes on MXSG

Do some DD and do it soon.

Long MXSG

ALAMOS GOLD ANNOUNCES POSITIVE FEASIBILITY STUDY FOR THE LYNN LAKE PROJECT

12/14/2017

Download this Press Release (PDF 327 KB)

TORONTO, ONTARIO--(Marketwired - Dec. 14, 2017) -

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) ("Alamos" or the "Company") today

reported results from the positive feasibility study conducted on its

Lynn Lake Gold Project ("Lynn Lake"), located in Manitoba, Canada.

All amounts are in United States dollars, unless otherwise stated.

http://www.alamosgold.com/news-and-media/news-releases/news-releases-details/2017/Alamos-Gold-Announces-Positive-Feasibility-Study-for-the-Lynn-Lake-Project/default.aspx

Feasibility Study Highlights

Declared an initial Proven and Probable mineral reserve of 26.8 million tonnes ("Mt") grading 1.89 grams per tonne of gold ("g/t Au"), containing 1.6 million ounces of gold

Average annual gold production of 170,000 ounces over the first six years and 143,000 ounces over the first 10 years with life of mine production of 1.5 million ounces

Life of mine total cash costs of $645 per ounce of gold and attractive mine-site all-in sustaining costs of $745 per ounce

Initial capital estimate of $338 million and total life of mine capital, including sustaining capital and reclamation costs, of $486 million

After-tax net present value ("NPV") of $123 million at a 5% discount rate and an after-tax internal rate of return ("IRR") of 12.5%, representing a 4.6 year payback using base case gold and silver price assumptions of $1,250 and $16.00 per ounce, respectively and a USD/CAD foreign exchange rate of $0.75:1

The Company has also identified a number of opportunities to enhance the

overall economics of the project through an evaluation of a smaller,

higher grade mine plan, employing contract mining, and incorporating

exploration success over the past year which has not be factored into

the feasibility study

"We acquired the Lynn Lake project in 2016 for $20 million and with the

completion of the feasibility study, have outlined solid base case

economics for the project with an

after-tax net present value over $120 million.

As we advance the project through permitting over the next two years, we

see excellent potential to further enhance its overall economics

through a number of avenues, including incorporating recent exploration

success.

We expect stronger economics prior to making a construction decision.

With its location in one of the best mining jurisdictions in the world,

Lynn Lake is an important piece of our longer term growth strategy,"

said John A. McCluskey, President and Chief Executive Officer.

http://www.alamosgold.com/news-and-media/news-releases/news-releases-details/2017/Alamos-Gold-Announces-Positive-Feasibility-Study-for-the-Lynn-Lake-Project/default.aspx

http://www.alamosgold.com/home/default.aspx

http://www.alamosgold.com/investors/Presentations/default.aspx

Alamos-Acquisition-of-Richmont-Presentation_FINAL.pdf -

http://s1.q4cdn.com/556167425/files/doc_downloads/2017/Alamos-Acquisition-of-Richmont-Presentation_FINAL.pdf

ALAMOS GOLD ANNOUNCES COMPLETION OF ACQUISITION OF RICHMONT MINES

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=136621032

ALAMOS GOLD ANNOUNCES COMPLETION OF ACQUISITION OF RICHMONT MINES

11/23/2017

Download this Press Release (PDF 36 KB)

TORONTO, ONTARIO--(Marketwired - Nov. 23, 2017) -

Alamos Gold Inc. ("Alamos") (TSX:AGI) (NYSE:AGI)

is pleased to announce the completion of the previously announced plan of

arrangement (the "Transaction") whereby Alamos acquired all of the

issued and outstanding shares of Richmont Mines Inc. ("Richmont")

(TSX:RIC) (NYSE:RIC).

Under the terms of the Transaction, all Richmont issued and outstanding

common shares were exchanged on the basis of 1.385 Alamos common shares

for each Richmont common share (the "Exchange Ratio").

Upon closing, Alamos has approximately 389,059,503 Class A Shares

outstanding with Alamos and Richmont shareholders owning approximately

77% and 23% of the pro forma company, respectively.

Richmont's common shares will be de-listed from the Toronto Stock

Exchange ("TSX") and the New York Stock Exchange ("NYSE") on November

24, 2017, or shortly thereafter.

"With the completion of the acquisition, we have greatly strengthened

our asset base, cash flow generation and profitability.

Combined with our peer leading growth profile and debt-free balance

sheet, we have solidified our positioning as a leading intermediate gold

producer and are well positioned to deliver long term shareholder

value," said John A. McCluskey, President and Chief Executive Officer of

Alamos.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified

production from four operating mines in North America.

This includes the Young-Davidson and Island Gold mines in northern

Ontario, Canada and the Mulatos and El Chanate mines in Sonora State,

Mexico.

Additionally, the Company has a significant portfolio of development

stage projects in Canada, Mexico, Turkey, and the United States.

Alamos employs more than 1,700 people and is committed to the highest

standards of sustainable development.

The Company's shares are traded on the TSX and NYSE under the symbol

"AGI".

Cautionary Note - Forward Looking Statements

ALAMOS Gold CORPORATE PRESENTATION – NOVEMBER 2017 -

http://www.alamosgold.com/investors/Presentations/default.aspx

Centerra Gold’s acquisition of AuRico Metals -

November 7, 2017 08:00 AM EST

Centerra Gold and AuRico Metals will host a joint conference call on

Tuesday, November 7, 2017 at 8:00 AM Eastern Time for members of the

investment community to discuss the transaction.

The call-in details are as follows:

North American participants should dial the toll-free number: (800) 404-5245

International participants may access the call at: +1 (416) 981-9070

The call will also be webcast live by NASDAQ and can be accessed at:

https://edge.media-server.com/m6/p/o3q7qtwg

A copy of the investor presentation is also available on

the Centerra Gold and AuRico Metals websites at

http://www.centerragold.com and

http://www.auricometals.ca respectively.

4 An audio recording of the call will be available shortly after the call

and will be available until midnight Eastern Time on Friday, December 8, 2017.

The recording can be accessed by calling (416) 626-4100 or

(800) 558-5253 and using the passcode 21862384.

Corporate Presentation & Upcoming Events -

http://www.auricometals.ca/investor-information/events-and-presentations/default.aspx

Good evening mick, good viewing/ $AMI

re;

http://www.mining.com/web/two-overlooked-streaming-stocks-with-huge-upside-potential/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134834404

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134491217

Aurico Metal Inc. (AMI) Latest Corporate Presentation -

http://www.auricometals.ca/investor-information/events-and-presentations/default.aspx

http://www.auricometals.ca

https://investorshub.advfn.com/Aurico-Metal-Inc-AMI-9242/

Aurico Metals Inc TSX:T.AMI

http://www.stockscores.com/charts/charts/?ticker=t.AMI

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134491217

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134223301

I believe AuRico Metals just got up listed -

http://www.marketwatch.com/story/sp-dow-jones-indices-announces-changes-to-the-sptsx-canadian-indices-2017-09-08-17202150

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134223301

In GOD We Trust -

http://www.kitconet.com/images/live/au0001wb.gif

Bitcoin Trading Platform -

https://moneynetwork.usitech-int.com/

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

http://www.biblebelievers.org.au/monie.htm

God Bless

New English and German video with Claudio Ciavarella and ...

New miner coming on line:

Mexus and JV partner MarMar confirm production at Santa Elena mine

By GlobeNewswire, September 11, 2017, 03:01:00 AM EDT

CABORCA, Mexico, Sept. 11, 2017 (GLOBE NEWSWIRE) -- Mexus Gold US (OTCQB:MXSG) ("Mexus" or the "Company") along with its joint venture partner, MarMar Holdings, today announced that they have produced gold in dore form as a result of its ongoing operation at the Santa Elena mine. Mexus CEO Paul Thompson added, "This is a monumental step for Mexus and MarMar as we have met our initial goal which was to get the Santa Elena mine into production. The finances of gold sales will be released in our quarterly reports but we will keep our investors informed as key financial goals are met. The ore we are currently placing on the heap leach pad is averaging 2 grams per ton with an expected recovery rate of 76%. We know now that the high grade near surface material we are mining will result in a lower overall cost of production."

Mr. Marco Martinez, CEO of MarMar Holdings Inc., commented that the recovery of gold will be ongoing now that the recovery system is in full working order. In addition, he stated that the goal is to bring production to 10,000 tons a day by year end.

Mexus Geologist Cesar Lemas added, "During the month of August, the first 3 meter heap leach layer was completed with approximately 30,000 tons of ore being processed. Contained metallics are in the order of 2,000 to 4,000 oz Au and 10,000 to 15,000 oz Ag. Continuous leaching and Merrill Crowe processing will gradually turn the contained values into dore via our recovery system. Mining will also continue with the next 3 meter high heap layer being placed. Solution monitoring by fire assays shows steady recoveries in the order of 1.0 to 2.7 g/m3 Au in 3 to 5 days with an additional 5 up to 43 g/m3 Ag. Continued leaching will concentrate pregnant solution to the optimum values for Merrill Crowe processing. The current flow rate of 50gpm will be gradually increased to 200gpm to achieve maximum processing capacity and overall production. Additional primary filters will improve flow rates and recoveries from the solution. Parallel electrowinning is being installed to trap some of the high grade pregnant solution spots."

Mr. Thompson added, "We are hitting our stride at the right time with the price of gold moving up and the Santa Elena mine beginning to produce gold. These are exciting times for Mexus and its shareholders."

About Mexus Gold US

Mexus Gold US is an American based mining company with holdings in Mexico. Mexus recently joint ventured its flagship property with MarMar holdings of Mexico. The fully owned Santa Elena mine is located 54km NW of Caborca, Mexico. The mine is producing gold. The company is also a partner with MarMar holdings at the San Felix mine in Northern Mexico. This 26,000 + acre property is ready for production which is planned for 2018. Mexus also owns rights to the Ures property located 80km N of Hermosillo, Mexico. This property contains 6900 acres and has both gold and copper on the property. Founded in 2009, Mexus Gold US is committed to protecting the environment, mine safety and employing members of the communities in which it operates.

For more information on Mexus Gold US, visit www.mexusgoldus.com.

Cautionary Statement

Forward looking Statement: Statements in this press release may constitute forward-looking statements and are subject to numerous risks and uncertainties, including the failure to complete successfully the development of new or enhanced products, the Company's future capital needs, the lack of market demand for any new or enhanced products the Company may develop, any actions by the Company's partners that may be adverse to the Company, the success of competitive products, other economic factors affecting the Company and its markets, seasonal changes, and other risks detailed from time to time in the Company's filings with the Securities and Exchange Commission. The actual results may differ materially from those contained in this press release. The Company disclaims any obligation to update any statements in this press release.

CONTACT: Inquiries - Paul Dent, 425-478-4908 pdent@mexusgoldus.com

Blue thank you; RE: $~GCM~ all in sustaining cost $790, cash cost $685 -

Traders optimistic about Gold-D debut -

31 Aug 2017 at 07:00

Gold-D is a gold futures contract, which is a physical settlement

futures contract based on gold bar with 99.99% purity.

Physical delivery is obligated at expiry of the contract.

Only physical gold stored...

"The spot gold price jumped to UScopy,326 (44,023 baht) on Tuesday and

broke the resistance level of copy,300 (43,160 baht) for the third time

this year.

This confirms an upward trend for the remainder of this year,"

said Mr Boonlert.

http://www.bangkokpost.com/business/news/1315991/

Gold Prices Might Explode to $10,000 Because the War Is Coming, Top Expert Warns

Gold prices could be on the cusp of a major breakout.

Daniela Cambone Follow Aug 30, 2017 3:27 PM EDT

https://vid.thestreet.com/p/105/sp/0/playManifest/protocol/https/entryId/0_7rgoto1a/format/url/flavorParamId/35/video.mp4

https://www.thestreet.com/story/14289267/1/gold-prices-might-explode-to-10-000-because-the-war-is-coming-top-expert-warns.html

A Very Good Day for Gold -

http://www.marketoracle.co.uk/Article60076.html

Produced 150,000 ounces of gold with AISC of US$850 per ounce in 2016 -

http://www.grancolombiagold.com/Home/default.aspx

Modernizing high grade Segovia Operations -

http://www.grancolombiagold.com/Home/default.aspx

Marmato: A mountain of gold with 14 million ounces of gold resources -

Corporate Presentation -

http://www.grancolombiagold.com/news-and-investors/events-and-presentations/presentations/default.aspx

Gran Colombia Gold Corp. (TPRFF)(TSE:GCM) -

Very oversold and undervalued -

imo.

http://www.grancolombiagold.com/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134059001

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134065957

https://investorshub.advfn.com/Gran-Colombia-Gold-Corporation--GCM-22090/

https://investorshub.advfn.com/Gran-Colombia-Gold-Corporation--GCM-22090/

Government and miners reached agreement to lift the strike in Segovia and Remedios

RCN Antioquia 7 hours ago

Courtesy Gobernación de Antioquia / Vice Minister Carlos Cante and

Eliober Castañeda, president of the Mining Bureau, reached agreements

to lift the strike in Segovia and Remedios.

42 days had to pass so that the informal miners and the National

Government reached an agreement in the list of petitions that motivated

the cessation of activities in the Northeast of the department.

At the bargaining table, which lasted close to eight hours behind closed

doors at the Antioquia Governor's premises, fifteen points were

discussed that deal with the processes of formalization of ancestral

miners , guarantees to work, schedules to agree on operating contracts

And the recognition of the Mining Bureau as a valid interlocutor for

that extractive activity in Segovia and Remedios.

The Deputy Minister of Mines, Carlos Cante Puentes, celebrated the

agreement between the parties, so he hopes that in the next few hours

the mining strike will be lifted, which has for 41 days paralyzed

trade, transportation and classes in those two locations .

0:00

Elióber Castañeda, president of the Mining Bureau of Segovia and

Remedios, said he will socialize the agreement and its bases with the

protesters.

0:00

So far, the balance of the mining strike is of thousands of families

with food shortages, two people killed in the middle of the

demonstrations and more than 30 people injured between civilians and

members of the Police.

0:00

Categories: Antioquia , Locales

Tags: Antioquia , National Government , Grancolombiagold , Ministry of Mines , mining , Segovia and Remedios

http://www.rcnradio.com/locales/antioquia/gobierno-y-mineros-llegaron-a-acuerdo-para-levantar-el-paro-en-segovia-y-remedios/amp/

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=134065957

God Bless

Core Finance: Caledonia eyes high grade stuff in H2, 2017 -

Mandalay Res. Corp. Presentation June 2017 -

http://www.mandalayresources.com/wp-content/uploads/2013/11/MND_June_Presentation.pdf

http://www.mandalayresources.com/

- God Bless -

Premier Gold Mines Reports 2017 First Quarter Results - First Quarter

Cash & Cash Equivalent Balance Grows to CA$147.3 Million -

May 10th, 2017

https://www.premiergoldmines.com/news/press-releases/premier-gold-mines-reports-2017-first-quarter-results

Unless otherwise stated, all amounts discussed herein are denominated in

Canadian dollars.

Please refer to the Foreign Exchange Assumptions at the end of this

press release for US$ conversions.

PREMIER GOLD MINES LIMITED (TSX:PG)

(“Premier”, “the Company”) is pleased to announce its operational and

financial results for the three months ended March 31, 2017.

The Company previously released its gold production results for the

first quarter of 50,979 ounces of gold (see news release

dated April 18, 2017).

2017 First Quarter Consolidated Highlights

Production of 50,979 ounces of gold and 88,572 ounces of silver

Gold sales of 51,593 ounces at an average realized price(i) of

CA$1,621 (US$1,224) per ounce

Co-product cash costs(i) of US$385 per ounce of gold

Co-product all-in sustaining costs (“AISC”)(i) of US$432 per ounce of gold

Revenue of CA$85.3 million (US$64.4 million)

Operating income of CA$28.4 million (US$21.5 million)

Net income of CA$6.7 million (US$5.1 million)

Quarter end cash balance of CA$147.3 million (US$110.7 million)

Cash flow from operating activities of CA$37.9 million (US$28.6 million) or CA$0.18/share (US$0.14/share)

Free cash flow of CA$27.6 million (US$20.7 million) or CA$0.13/share (US$0.10/share), after investing CA$9.2 million (US$ 7.0 million) in exploration and pre-development programs.

(i) See “Non-IFRS Measures” section. A cautionary note and further information regarding Non-IFRS financial metrics is included in the “Non-IFRS Measures” section of the Q1- 2017 Management’s Discussion and Analysis

Consolidated Financial Highlights - For the three months ended March 31, 2017

Strong operating results for the quarter contributed to an EBITDA of

CA$44.6 million (US$33.7 million) and net income of CA$6.7 million

(US$5.1 million) or CA$0.033/share (US$0.025/share).

Production costs at Mercedes were under budget as a result of cost-

cutting initiatives implemented at the mine.

The Company remains on track to meet production guidance of 125,000-

135,000 ounces of gold in 2017.

These positive results contributed to the Company’s strong financial

position with a CA$27.6 million (US$20.7 million) increase in cash and

equivalents to CA$147.3 million (US$110.7 million) and precious metals

inventories of 22,772 ounces of gold and 55,230 ounces of silver as at

March 31, 2017.

Capital expenditures during the quarter were CA$6.0 million

(US$4.5 million) and exploration, evaluation and pre-development costs

were CA$9.2 million (US$7.0 million). Debt principal and interest paid

during the quarter was CA$4.4 million (US$3.3 million).

https://www.premiergoldmines.com/news/press-releases/premier-gold-mines-reports-2017-first-quarter-results

https://www.premiergoldmines.com/news/press-releases/premier-gold-mines-reports-2017-first-quarter-results

https://www.premiergoldmines.com

Gold & Silver is the only REAL Legal Tender -

by The Founding Fathers for your -

Rights, Liberty and Freedom -

ex....

http://investorshub.advfn.com/boards/read_msg.aspx?message_id=122698944

http://www.kitconet.com/images/live/ag0001wb.gif

http://www.biblebelievers.org.au/monie.htm

- God Bless -

KAT.TO world biggest COBALT MINE skyrocketing! Glencore owns

News ou MXSG in production next month! Dirt cheap PPS at .07 cents!

http://www.irdirect.net/pr/read_release/2074285

|

Followers

|

28

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

558

|

|

Created

|

10/02/06

|

Type

|

Free

|

| Moderators | |||

**********************************************************

MINING REFERENCE LIBRARY

**********************************************************

~*~ Mining Links, Web Publications and Resources ~*~

*~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

|

|

~*~ PRIMARY METALS LIST ~*~

| ALUMINUM | GOLD | PALLADIUM | TELLURIUM |

| ANTIMONY | INDIUM | PLATINUM | TIN |

| BISMUTH | IRIDIUM | RHENIUM | TITANIUM |

| CAMIUM | LEAD | RHODIUM | TUNGSTEN |

| CHROME | MAGNESIUM | RUTHENIUM | URANIUM |

| COBALT | MANGANESE | SELENIUM | VANADIUM |

| COLUMBIUM/NIOBIUM | MERCURY | SILICON | WOLFRAMITE |

| COPPER | MOLYBDENUM | SILVER | ZINC |

| GERMANIUM | NICKEL | TANTALUM |

*~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

~*~ Mining Company Links Directory, Contact Info & News Corner ~*~

*~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~*

REFERENCES:

EXJ = Exploratory Jr. Miner

ProJ = Producing Jr. Miner

NTPro = Near Term Producer Jr. Miner

PMM = Producing Major Miner

A

Abbastar Resources Corp. (ABA.V) EXJ , Uranium www.abbastaruranium.com IR (604-658-2040) info@abbastaruranium

Allana Resources Inc. (AAA.V) (ALLRF), EXJ, Potash, www.allanaresources.com IR (416-861-2267) info@allanaresources.com

Adrianna Resources Inc. (ADI.V) (ANARF) EXJ Iron + Port project www.adrianaresources.com Robert Ferguson IR (877-629-0150) rferguson@adriannaresources.com

American Sierra Gold Corp (AMNP) EXJ, Gold,www.americansierragold.com/ Investor Relations, 1-888-279-3921, ir@americansierragold.com

Anooraq Resources Corporation (TSXV: ARQ; NYSE Amex: ANO) , PROJ, Platinum Group Metals www.anooraqresources.co.za/default.asp Investor Relations info@anooraqresources.co.za

Atlas Mining Company (ALMI) ProJ, Haylocite Clay, www.atlasmining.com Tim Clemensen-IR (212-843-9337) tclemensen@rubensteinir.com

Avalon Ventures Ltd. (AVL) , EXJ, REES, www.avalonraremetals.com Don Bubar Pres. (416-364-4938) dsbubar@avalonraremetals.com

Azteca Gold Corp. (AZG.V) (AZGFF) EXJ Gold, Silver, www.azteca-au.com John Slizza -IR (509-981-2020) info@azteca-au.com

B

B2Gold Corp. (BTO.TO) PMM, Gold www.b2gold.com Ian MacLean IR (604-681-8371) investor@b2gold.com

Baja Mining Corp. (BAJ.TO) (BAJFF) EXJ, Copper, Cobalt, Zinc www.bajamining.com IR (604.685.2323) info@bajamining.com

Banro Corp. (BAA) NTpro, Gold, www.banro.com IR (800-714-7938 ) info@banro.com

Beard Company (BRCO) NTPro, Gold www.beardco.com IR (405-842-2333) info@beardco.com3

Bravo Gold Corp. (BVG.V) (BVGIF) EXJ Gold, Silver www.bravoventuregroup.com IR (888-456-1112) corpdev@mnxltd.com

Brigus Gold Corp. (BRD.TO) (AMEX: BRD) Gold, Silver http://www.brigusgold.com/ IR (866-785-0456) ir@brigusgold.com

Bullion Monarch Mining, Inc.(BULM) PROJ, Gold Silver, Oil Shale, www.bullionmm.com/ R. Don Morris, President, Bullion Monarch Mining (801) 426-8111,info@bullionmm.com

Butler Resources Corp. (BTD/H.V), EXJ, REE www.butlerresource.com IR (866-669-9377)

C

Cadan Resources Corp. (CXD.V) (CADAF) NTPro Gold, Silver, Copper www.cadanresources.com/index.html IR John Andersonl (604 604-218-7400) News www.cadanresources.com/news.html

CanAlaska Uranium LTD. (CVV) (CVVUF), EXJ, Uranium www.canalaska.com Emil Fung-VP Corp. Dev. (604-688-3211 ext. 318) info@canalaska.com

Canada Lithium Corp. (CLQ.TO) EXJ, Lithium www.canadalithium.com IR (416-361-2821) ir@canadalithium.com

Canadian Zinc Corp. (CZN.TO) (CZICF) EXJ, Zinc, Gold, Lead, Silver, www.canadianzinc.com IR (416-362-6686)

Caledonia Mining Corp. (CAL.TO) (CALVF) EXJ, Gold, Copper, Cobalt, www.caledoniamining.com IR (416-

Capital Gold Corp. (CGC) (CGLD), ProJ, Gold, www.capitalgoldcorp.com IR (212- 344-2785) kelly@capitalgoldcorp.com

China Gold International Resources Corp LTD. (CGG.TO) (HKSE: 2099) Pro, Gold Silver http://www.chinagoldintl.com/s/Home.asp IR (604-695-5032)

Coeur D Alene Mines Corp. (CDE) (CDM) PMM, Silver www.coeur.com IR (800-624-2824 )

Commerce Resources Corp. (CCE.V) (CMRZF) EXJ, REE www.commerceresources.com Kevin Bottomley- IR/Shareholder Services (604-484-2700 ext. 226) kevin@commerceresources.com

Comstock Mining Inc. (LODE), EXJ, Gold, Silver, http://www.comstockmining.com IR (775-847-4755)

Constitution Mining Corp. (CMIN) EXJ, Gold , www.constitutionmining.com IR (888-475-0070) info@constitutionmining.com

Conquest Resources Ltd. (CQR.V) (CQRLF), EXJ, Gold www.conquestresources.net Brett Whitelaw- IR (778- 836-5891) info@conquestresources.net

Coronado Resources Ltd. (CDR.V) (CRDAF) ProJ, Gold Silver, Copper, www.coronadoresourcesltd.com. (604-683-6338) jd@coronadoresourcesltd.com

D

Dana Resorces (DANR) EXJ Gold, Silver, Copper www.danaresouces.com (702-952-9629) info@danaresources.com

Diamonds North Resources Ltd. (DDN.V) (DDNFF) EXJ, Diamonds, Gold www.diamondnorthresources.com Nancy Curry - VP Corp, Communications (604-689-2010) info@diamondsnorth.com

DRDGOLD Ltd. (DROOY) PROJ Gold www.drdgold.com/default.asp

Dutch Gold Resources (DGRI) EXJ, Gold, Silver, www.dutchgoldresources.com David Waldman- IR (212-671-1020) info@dutchgoldresources.com

E

ECU Silver Mining Inc. (ECU.TO) (ECUXF) ProJ, Gold, Silver www.ecu.ca IR(858- 456-7300) jm@sdthc.com

Eastern Platinum Ltd. (ELR.TO) PMM, Platinum www.eastplats.com IR (604-685-6851) info@eastplats.com

Ecometals Limited (EC.V)(ECMLF ) EXJ, Gold, Iron, Maganese www.ecometalslimited.com IR (44-207-340-8520)

Eldorado Gold Corp. (ELD.TO) (EGO) PMM, Gold www.eldoradogold.com IR (604-687-4018) info@eldoradogold.com

Endeavour Silver Corp.(EXK) (EDR)PMM, Silver www.edrsilver.com Hugh Clarke IR (877-685-9775)

Evolving Gold (EVG.V) ( EVOGF) EXJ, Gold, www.evolvinggold.com Quinton Hennigh-President (303-678-1207) quinton@evolvinggold.com

F

First Lithium Resources.Inc. (MCI.V) (FLNTF), EXJ, Lithium bearing Pegmatite www.firstlithiumresources.com IR (877-669-0401) info@firstlithiumrresources.com

First Majestic Silver Corp. (FR.TO) (FRMSF) EXJ, Silver www.firstmajestic.com IR (604-688-3033) info@firstmajestic.com

Forum Uranium (FDC.V ) (FDCFF) EXJ http://www.forumuranium.com/s/Home.asp Tel: 604-630-1585 Toll Free: 1-866-689-2599

G

Garibaldi Resources Corp. (GGI.V) EXJ Gold, Silver www.garibaldiresources.com (604- 488 -8851) info@garibaldi.com

Geodex Minerals Ltd. (GXM.V)EXJ, Tin, Molybdenum, Tungsten, Indium, REE www.geodexminerals.com IR Liana Shahinian (604-689-7771) info@geodexminerals.com

Geovic Mining Inc. (GMC.V) (GVCM) EXJ, Cobalt www.geovic.net Andrew C. Hoffman VP (720-350-4130) ahoffman@geovic.net

Gold Coast Mining Corp. (GDSM), EXJ , Gold www.goldcoastmining.com Financial Director (00 233(0)542012011) info@goldcoastmining.com

Gold Crest Mines Inc. (GCMN) EXJ Gold www.goldcrestminesinc.com IR (509-893-0171) info@goldcrestminesinc.com

Goldstone Resources (GRC.TO) (GRSZF) EXJ Phone: 416-628-6626 ext. 6332 http://www.goldstoneresourcesinc.com/

Gold Reserve Inc. (GRZ) EXJ, Gold, Copper, Molybdenum www.goldreserveinc.com Tim Clemensen IR (212-843-9337)

Gold Resource Corp. (GORO), NTPro, Gold, Silver, www.goldresourcecorp.com Jason Reid-VP Corp. Dev. (303-320-7708) jasonreid@goldresourcecorp.com

Grayd Resource Corp (GYD.V ) (GYRSF) EXJ Gold,Silver, Zinc http://www.grayd.com/

Great Basin Gold Ltd. (GBG), NTPro, Gold www.greatbasingold.com Michael Curlook IR (888 633-9332) michaelc@gbgold.co.za

Great Western Mining Group (GWG.V), ProJ, REE, Specialty Alloys, Processing plant www.gwmg.c Ron Malashewski IR Manager (306-659-4500)a info@gwmg.ca

H

Hathor Exploration Ltd. (HAT.V) EXJ, Uranium www.hathor.ca JJ Jennox IR Director (604-684-6707) info@hathor.ca

Hawthorne Gold Corp. (HGC.V) (HWTHF), EXJ, Gold, www.hawthornegold.com Todd Hanas IR (604-484-3668) todd@hawt hornegold.com

Hecla Mining Co. (GSC) (HL), ProJ, Silver, Gold ,Lead, Zinc, www.hecla-mining.com IR (208-769-4128) hmc-info@hecla-mining.com

Houston Lake Mining Co. (HLM.V) (HLKMF), EXJ, Gold, Platinum, REE, www.houstonlakemining.com IR-Linx Partners/Wanda Cutler (416-303-6460) wcutler@linxinc.com

I

IAMGOLD Corp. (IMG) (IAG), ProJ, Gold, Niobium, Diamonds www.iamgold.com Tamara Brown - Director Investor Relations (416-360-4743) info@iamgold.com **LATEST NEWS** www.iamgold.com/news.asp

Indocan Resources Inc. (IDCN), EXJ, Gold, Platinum, Oil www.indocan.com Ken Ash IR (910-300-8189) info@indocan.com **LATEST NEWS** http://www.indocan.com/frontpage.html

International Coal Group Inc. (ICO), PMM, Coal www.intlcoal.com Ira Gamm IR (304- 760 - 2619) igamm@intlcoal.com*LATEST NEWS** http://www.intlcoal.com/pages/news/2009/20090915.pdf

Imperial Metals (III) (IPMLF) PROJ, Copper, Gold, Moly, www.imperialmetals.com/s/Home.asp IR 604-488-2657 info@imperialmetals.com

J

Jaquar Mining Inc. (JAG), PMM, Gold www.jaquarmining.com IR 603-224-4800 ir@jaguarmining.com

K

Klondike Silver Corp. (KS.V), (KLSVF), ProJ, Silver, Gold, Lead, www.klondikesilver.com IR 604-685-222 info@klondikesilver.com

Kobex Minerals Inc. (KXM) EXJ Gold, Silver

Kootenay Gold (KTN.V) (KOOYF) EXJ Gold, Silver 604-601-5650, Toll Free 1-888-601-5650 http://www.kootenaygold.ca/

L

Largo Resources Ltd. (LGO.V) EXJ, Vanadium, Tungsten/molybdenum www.largoresources.com IR (416-861-5895) info@largoresources.com

M

Madison Minerals Inc. (MMRSF) (MMR.V) EXJ, Gold, Silver, Copper www.madisonminerals.com IR (604- 331-8772)

Mag Silver Corp. (MVG) (MAG) EXJ, Silver, Molybdenum www.magsilver.com Gordon Neal IR (604-630-1399) info@magsilver.com

Matamec Exploration Inc. (MAT.V) (MTCEF) EXJ, Gold,Silver,REE www.metamec.com André Gauthier Pres. (514-844-5252) Info@matemec.com

Mega Uranium Mining Ltd. (MGA.TO) EXJ, Uranium www.megauranium.com Richard Patricio EVP (416.643.7630) ir@megauranium.com

Metalline Mining Co (MMG) EXJ Silver, Copper Zinc, Lead http://www.metalin.com/

Minera Andes Corp. (MAI.TO) (MNEAF) ProJ Gold, Copper www.minandes.com Helen Bilhete -Director of IR (647-258-0395) info@minandes.com

N

National Coal Corp. (NCOCF), PMM, Coal www.nationalcoal.com Christine Pietryla IR (865-690-6900 ext. 150) cpietryla@natinalcoal.com

Nevsun Resources Ltd. (NSU) NTP Gold, Copper, Silver, Zinc www.nevsun.com/ IR ir@kincommunications.com

New Gold Inc. (NGD) PROJ, Gold, www.newgold.com/ IR Toll-free: (888)315-9715 info@newgold.com

Northbay Resources Inc. (NBRI), EXJ, Gold, Silver, Platinum, www.northbayresources.com IR (215-661-1100) corp@northbayresources.com

New Pacific Metals Corp. (NUX.V) EXJ, Gold, Silver www.newpacificmetals.com IR (604-633-1368) info@newpacificmetals.com

Northern Shield Resources Inc. (NRN.V) EXJ Platinum, Diamonds www.northern-shield.com IR (613.232.0459) info@nothern-shield.com

Northgate Minerals Corp. (NGX)(NXG), ProJ, Gold, Copper, www.northgateminerals.com IR (416-363-1701) ngx@northgateminerals.com

NovaGold Resources Inc. (NG), EXP, Gold, Copper, www.novaglod.com Greg Johnson IR (866-669-6227) www.novagold.net

O

Oro Gold Resources Ltd. (OGR.V) (OGRSF) EXJ, Gold www.orogoldresources.com Ariel Cobangbang Corp. Communications communications@orogold.com

P

Pacific Gold Corp. (PCFG) NTPro, Gold, Tungsten www.pacificgoldcorp.com IR (416-214-1483) info@pacificgoldcorp.com

Passport Metals Inc. (PPI.V)(PPIMF), EXP, Potash, Gold, Copper www.passportmetals.com

Paramount Gold and Silver Corp. (PZG), EXJ, Gold, Silver www.paramountgold.com (613- 226-9881)

PHI Mining Group Inc. (PHIG) EXJ, Copper, Lead, Zinc, Black Marble www.phimining.com (714-843-5450) infophiglobal.com

Piedmont Mining Co. (PIED) EXJ Gold, Silver www.piedmontmining.com IR Maria Da Silva (877-261-4466)

Polymet Mining Corp. (PLM) (POM) PROJ, Copper, Nickel, Cobalt, Platinum, Palladium, www.polymetming.com Douglas Newby (646-879-5970) dnewby@polymetmining.com

Premier Goldmines Ltd. (PG.TO)(PIRGF), EX, Gold www.premiergoldmines.com IR (807- 346-1390) info@premiergoldmines.com

R

Rare Element Resources Ltd. (RES.V) (RRLMF) EXJ, REE www.rareelementresources.com Donald E Ranta- Pres.CEO don@rareelementresources.com

Roxmark Mining Ltd . Now Goldstone Resources (GRC.TO ~ GRSZF) EXJ http://www.goldstoneresourcesinc.com

Rubicon Minerals Corp. (RMX.TO) (RBY) EXJ, GOLD www.rubiconmetals.com Bill Cavalluzzo -VP (866-365-4706) rubicon@rubiconminerals.com

S

Sangold Corp. (SGR.TO) (SGRCF) ProJ, GOLD www.sangoldcorp.com IR (800-321-8564) info@sangoldcorp.com

Sarissa Resources Inc. (SRSR), EXJ, Niobium, REE www.sarissaresources.com Merle Goetz IR- (604-688-2349) merleg@shaw.ca

Shoshone Silver Mining Co. (SHSH) NTPro, Gold, Silver www.shoshonesilvermining.com IR (208-664-0620 ) lsmith@shoshonesilvermining.com

Sierra Gold Corp. (SGCP) ProJ, Gold, Diamonds, www.sierragoldcorp.com (416-200-6966) Doug Evans - CEO dougevans@sierragoldcorp.com

Silver Falcon Mining Inc. (SFMI), NTPro, Gold, Silver www.silverfalconmining.com Rich Kaiser IR (757-306-6090) yes@yesinternational.com

Silvercorp Metals Inc. (SVMFF) PMM, Silver, Gold, Lead, Zinc, www.silvercorpmetal.com Shirley Zhou IR (604-669-9397) ir@silvercorp.ca

Silver Wheaton Corp. (SLW) PMM, Silver www.silverwheaton.com Brad Kopp IR (604-684-9648) info@silverwheaton.com

Slam Resources Ltd. (SXL.V)(SLMXF), EXJwww.snowfield.com/welcome/index.htmlXPJ, Gold, Copper, Nickel www.slamresources.com IR (866-523-6719) request@slamexploration.com

Snowfield Development Corp. (SNO.V)(SWFCF) EXJ Gold Diamonds, Uranium, www.snowfield.com/welcome/index.html IR (604-681-5720) communications@snowfield.com

Soltera Mining Corp. (SLTA), NTPro, Gold www.solteramining.com IR (888-768-5552) info@solteramining.com

Strathmore Minerals Corp. (STM.TO) (STHJF) PMM, Uranium www.strathmoreminerals.com IR (800-647-3303 ) info@strathmoreminerals.com

T

Tara Gold Resource Corp. (TRGD) EXJ, Gold www.taragoldresources.com (630-462--2079) president@taragoldresources.com

Taseko Mines LTD. (TKO)(TGB) ProJ Copper, Molybdenum, Gold www.tasekomines.com Brian bergot IR (773-373-4545) brianbergot@tasekomines.com

Teck Mining Company (TCK) (TCK/A.TO) PMM, Zinc, Lead, Copper, Molybdenum, Cadmium, Germanium, Indium, Gold, Silver, Coal www.teck.com Catherine Hart - Corp. Communications (604-699-4503)catherine.hart@teck.com

Terrane Metals Corp. (TRX) NTPro, Gold Copper, Moly, Silver, www.terranemetals.com/s/Home.asp

Timberline Resources Corp. (TLR) NTPro, Gold silver zinc, copper, www.timberline-resources.com/home.html IR phone 208.664.4859 info@timberline-resources.com

Timmins Gold (TMM) (TMGOF), PROJ, Gold www.timminsgold.com/s/home.asp IR info@timminsgold.com

TNR Gold Corp. (TNR) EXJ, Gold, copper, Moly, Lithium, and rare earths, www.tnrgoldcorp.com/s/Projects.asp IR 1-800-667-4470, Email, info@tnrgoldcorp.com

Treasury Metals Inc. (TML.TO)(TSRMF) EXJ Gold, Silver, Lead, Zinc IR (416 214-4654) info@treasurymetals.com

Tri Valley Corp. (TIV) EXJ, Gold, Limestone, Oil, Natural Gas, www.tri-valleycorp.com Ted Pompa IR (661-864-0500) info@tri-valleycorp.com

U

Ucore Uranium Inc. (UCU.V) (TIV) EXJ, Uranium www.ucoreuranium.com Scott Koyich IR (403) 619 2200) info@ucoreuranium.com

US Silver Corp. (USA.V)( CYLPF) ProJ, Silver, Copper, Lead, www.us-silver.com Macdougall Consultants LTD.(226-663-3000) macdougall_consult@us-silver.com

V

VIPR Industries (VIPR) EXJ, Gold, Uranium, Diamonds, www.viprindustries.com IR (702-940-0494) info@viprindustries.com

W

Western Sieraa Mining (WSRA) NTPro, Gold, Silver, www.westernsierramining.com IR (928-680-55130 ) info@westernsierramining.com

The super red banksters cults -

Rothschilds World Part 1 "Glen, Rush, Michael...Here's to you boy's"

http://www.youtube.com/watch?v=yhKHwrUA5SM&feature=related

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |