Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

#AG: USA Producer Prices Surge Most On Record....!

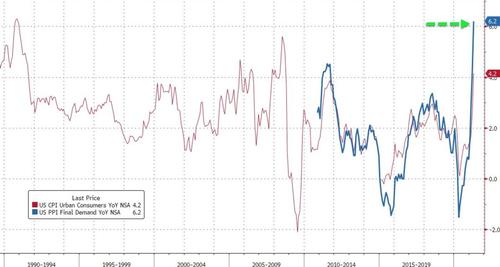

April 2021 Producer Prices exploded 6.2% YoY

https://www.zerohedge.com/economics/us-producer-prices-surge-most-record

US Producer Prices Surge Most On Record

Tyler Durden's Photo

BY TYLER DURDEN

THURSDAY, MAY 13, 2021 - 08:37 AM

After consumer prices exploded higher yesterday - and were immediately rejected by establishment types as 'transitory', despite the market's obvious disagreement - all eyes were on this morning's producer prices for signs of more pressure. Many were fearful of a repeat of last month's debacle delay (and there were rumors of a softer PPI print leaked earlier today)

The rumors were wrong as April Producer Prices exploded 6.2% YoY (well ahead of the 5.8% expected) which was clearly impacted by the base effect of last year's collapse, but even sequentially, the PPI print was shockingly hot, rising 0.6% MoM (double the +0.3% expected). Excluding food and energy, so-called core PPI advanced even more, or 0.7%.

Source: Bloomberg

That was the biggest YoY jump on record:"There is more inflation coming,” Luca Zaramella, chief financial officer at Mondelez International Inc., said on the food and beverage maker’s April 27 earnings call.“The higher inflation will require some additional pricing and some additional productivities to offset the impact.”

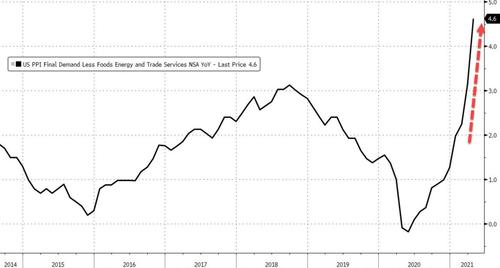

jumped 0.7% from the prior month and increased 4.6% from a year earlier.

Michael Hsu, chief executive officer at consumer-product maker Kimberly-Clark Corp., said in April that the maker of Scott toilet paper and Huggies diapers is “moving rapidly especially with selling price increases to offset commodity headwinds.”

Digging below the surface further, ex-food, energy, and trade, producer prices soared 4.6% YoY, the most on record also.

Source: Bloomberg

Some more details at the final demand level:

Final demand services: Prices for final demand services rose 0.6 percent in April, the fourth consecutive advance. Half of the broad-based increase in April is attributable to the index for final demand services less trade, transportation, and warehousing, which moved up 0.5 percent. Margins for final demand trade services also rose 0.5 percent, and the index for final demand transportation and warehousing services jumped 2.1 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.)

Product detail: Within the index for final demand services in April, prices for portfolio management rose 1.5 percent. The indexes for airline passenger services; food retailing; fuels and lubricants retailing; physician care; and hardware, building materials, and supplies retailing also moved higher. Conversely, margins for machinery and vehicle wholesaling fell 5.6 percent. The indexes for apparel wholesaling and for securities brokerage, dealing, investment advice, and related services also declined.

Final demand goods: Prices for final demand goods climbed 0.6 percent in April, after rising 1.7 percent in March. Leading the April advance, the index for final demand goods less foods and energy increased 1.0 percent. Prices for final demand foods moved up 2.1 percent. In contrast, the index for final demand energy fell 2.4 percent.

Product detail: A major factor in the April increase in prices for final demand goods was the index for steel mill products, which jumped 18.4 percent. Prices for beef and veal, pork, residential natural gas, plastic resins and materials, and dairy products also moved higher. Conversely, the index for gasoline fell 3.4 percent. Prices for chicken eggs and for carbon steel scrap also declined.

Yesterday's data - which showed the strongest monthly gain in the overall consumer price index since 2009 - suggested companies are passing along at least some of the input-price inflation.. and today's PPI surge suggests that push through to CPI is far from over.

Not transitory.

Silver Futures 27.370 up 0.311 5/14/2021 7:49AM

I bet someone still knocks AG down at the open

Not sure, may be correct. See this short report:

AG short shares and short and short covering volume:

https://marketwirenews.com/stock/ag/short/

If the Hedge Fund that is shorting AG is Citadel, they came up with a new way of making money, they don't borrow shares to short, they just sell "air shares" fake share, invoices if you will.

https://cnafinance.com/amc-stock-manipulation-like-youve-never-seen-before/

I understand it's hard to believe, but there's the site and it's an interesting read.

Do you believe this number to be true,

Short Interest

(7.92% of float 04/15/21)

This is what TD Ameritrade is saying

200% Bullshit !!! Lolzzzz

#AG: HIGHER POWERS RUNNING THINGS HERE...![]() $USD... LOSING GROUND AND SILVER GOES PROFIT TAKING...! STAIR STEPPING TO OPEN SKY'S...

$USD... LOSING GROUND AND SILVER GOES PROFIT TAKING...! STAIR STEPPING TO OPEN SKY'S...![]()

Complete Bullshit News! lolzzzzz

Goldman Sachs, jp morgan, BofA, (c/o Fed), and hedgies

Yet, we are down $15.98 0.41 (2.50%)

Bunch of nonsense! Who's shorting AG?

Is this the same Panzer that didn't hold Hill 15 over on AMC. I had fun that day playing Patton. Good to see you here, I love AG.

Someone is playing with AG's share price, we get a nice earnings report and yet, we're down while SLV is up. Good sign to buy more AG!

#AG: Basel III Threatens to Break The Gold Derivative Market in June...!

https://goldsilverpros.com/2021/01/22/basel-iii-threatens-to-break-the-gold-derivative-market-in-june/

https://youtu.be/O4DeNbm1BNU?t=21

Taking profits from battlefields and put it right here man

Dude this CEO knows it ALL IN

Looking to load Massice Panzers here for 5-10+ years

captainscotty my man!!!

#AG: PM GOING MAINSTREAM...:-} $16.43

https://youtu.be/toGaARDgnjM?t=1400

#AG: SILVER GOING TO $300.....!

Is Silver Going to $300?

https://www.silverdoctors.com/silver/silver-news/is-silver-going-to-300/

There are some indicators worth examining…

by Peter Krauth via Streetwise Reports

I know this might sound ridiculous to some, but I think silver could reach $300.

No, I haven’t lost my mind. After all, it’s a metal that’s known for massive rallies.

You see, when silver went through its 1970s bull market, it started from a low of $1.31 in October 1971. By the time it reached its peak in 1980, silver had run all the way up to $49. That was a 37x return.

If we consider that silver was priced at $4.20 in late 2001, a 37x return would take it to about $155. However, I think this bull market could be an order of magnitude larger for a number of reasons, the main ones being debt, credit and money printing.

As a result, I think silver’s ultimate peak could be $300, and I won’t rule out possibly even higher.

Bullish Silver Fundamentals

Most developed and many developing nations have been in multi-year or even multi-decade deficit scenarios. This now looks to have become a permanent state, at least until we reach some sort of global financial reset.

The Institute of International Finance explains how the COVID-19 pandemic response added $24 trillion to the global debt mountain last year, to reach a new all-time record high of $281 trillion.

And interest rates being maintained at 5,000-year lows will only encourage more debt. Couple that with many countries borrowing to meet interest payments, and central banks soaking up much of that new sovereign debt, and inflation havens like precious metals gain strong appeal.

Silver in particular has the added benefit of 50% of its demand being industrial. With unprecedented economic stimulus programs, many favoring green energy, silver is uniquely positioned to profit. What’s more, according to Metals Focus, silver supply was down 4% in 2020 by 42 million ounces. According to the Silver Institute, total supply will rise by 8% this year, though total demand will rise nearly twice as much, by 15%, led by industrial, jewelry and physical demand.

So, the fundamental side of silver demand is looking strong, but the technical side is also very bullish.

Bullish Silver Technicals

Let’s consider the gold-silver ratio.

As a quick refresher, the gold-silver ratio is calculated by simply dividing the spot price for one gold ounce by the spot price of one silver ounce. That’s it. Naturally the higher the ratio, the more silver ounces are needed to buy one gold ounce, and vice versa. The most bullish scenario is when the ratio is falling from a high level, ideally from above 80, and the silver price is rising.

Here’s a chart of the gold silver ratio during the 1970s silver bull market.

To me it’s very intriguing to note how recessions, which are the grey vertical bars, tended to mark troughs and/or peaks in the ratio. What’s also interesting is that when silver reached its peak in 1980, the gold-silver ratio ultimately bottomed around the same time at a level near 15, which was below the starting point near 20.

Let’s now move to the current silver bull market that I believe began in 2001. The following chart shows us silver prices since 2000, not adjusted for inflation.

Of course, silver had a tremendous run from $4.20 in 2001 to its 2011 peak at $49. It then corrected until late 2015, then moved sideways until bottoming near $12 last year in March. It had a tremendous move up to $30 within just five months and has been mostly consolidating since.

Now let’s examine the gold-silver ratio action since 2001.

Again we see peaks and troughs tend to occur (though not exclusively) around recessions (gray bars). At silver’s peak in 2011, the ratio bottomed near 33. It then rose almost constantly up to its all-time peak last March at 125, then fell dramatically to its current level around 67, as silver started to significantly outpace gold. Consider that we know from history silver always outperforms gold in precious metals bull markets. So the current action is particularly exciting for silver.

Silver Targets

But what does it all mean for how high the silver price can go? Of course, no one knows for sure. But there are some indicators worth examining for clues and suggestions.

I believe the ratio will ultimately reach a low near 15. And given the inflationary path we’re on, I think gold could peak at $5,000 per ounce. That’s just 2.5 times last August’s peak near $2,000. In fact, I think there’s even a decent chance gold could reach $10,000, which is just five times last August’s peak. But if we stick with $5,000, and an ultimate bottom in the gold-silver ratio of 15, we get ($5,000/15) $333 per ounce of silver.

Let’s look at silver price targets from another angle: inflation.

If we consider inflation-adjusted silver prices going back to 1970, we see that the peak reached in 1980 was actually $120/ounce in today’s dollars, and that’s using government sanctioned inflation statistics, which tend to be well below what we experience in everyday life.

Considering the old way of calculating inflation, which the U.S. abandoned decades ago and I reference below from Shadowstats.com, a realistic inflation rate would have averaged 7%–8% since 1980 (triple official inflation), which would mean an equivalent silver price of $240–$360 dollars at the 1980 peak.

My gold-silver ratio target for silver of $333 is comfortably within the range of $240–$360. If we take the mid-way point between $240 and $360, we get $300. I think that’s as good an estimate as any of where silver can peak in its current bull market.

On this basis, the silver price would need to be up by more than 10x from current levels to reach its ultimate high. Imagine for a moment, if silver were to soar tenfold from here, what the silver producers’ and silver explorers’ share prices would do. It’s not difficult to expect simply spectacular returns. Which is exactly why it’s so attractive to allocate to this space, while being diversified across several stocks, as it’s impossible to know which will do best. Still, odds are very good that if silver goes up by a factor of 10, the average silver stock should easily double that, and be up by a factor of 20, while the most successful juniors could gain 50x or more. That would simply be a repeat of previous bull markets.

Larger silver producers and royalty companies should be seen as core positions to be held for the long term. The more junior explorers should be treated more cautiously as speculations, on which to take profits when they materialize. Selling half of one’s position on a double would be especially sensible.

In any case, I believe it remains early days for silver and silver stocks. I expect to see much higher prices ahead in the metal and the equities. And in my view the current bout of weakness is an opportunity to buy or add to positions in this space. Remember, at $26 silver is still nearly 50% below its all-time nominal high, while gold is just 10% below its all-time nominal high. Silver is clearly the better relative bargain.

In the Silver Stock Investor newsletter, I provide my outlook on which silver stocks have the best prospects as this bull market progresses. Many offer 5x to 10x return potential in just the next few years, especially as silver heats up.

I think silver is currently at or very close to its bottom, but that its ultimate peak could well be in the $300 range.

Either way, silver is headed much, much higher.

–Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

If only that gap filled, though.

No brainer here, hold and realize solid profits in the future.

#AG: First Majestic Reports First Quarter Financial Results, Inaugural Dividend Payment, and Appointment of VP Operations..:-}

https://www.firstmajestic.com/investors/dividends/

https://seekingalpha.com/pr/18304843-first-majestic-reports-first-quarter-financial-results-inaugural-dividend-payment-and

First Majestic Reports First Quarter Financial Results, Inaugural Dividend Payment, and Appointment of VP Operations

Vancouver, British Columbia--(Newsfile Corp. - May 6, 2021) - First Majestic Silver Corp. (AG) (TSX: FR) (the "Company" or "First Majestic") is pleased to announce the unaudited interim consolidated financial results of the Company for the first quarter ended March 31, 2021. The Company has also adjusted its cost reporting to reflect cash costs and all-in sustaining cost per ounce ("AISC") on a per silver equivalent ounce ("AgEq") basis compared to previous disclosure of only payable silver ounces. The full version of the financial statements and the management discussion and analysis can be viewed on the Company's website at www.firstmajestic.com or on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. All amounts are in U.S. dollars unless stated otherwise.

FIRST QUARTER 2021 HIGHLIGHTS

Revenues totalled $100.5 million, or 17% higher compared to Q1 2020, including a record $4.8 million from silver coins and bullion sales from the Company's online retail store

Realized average silver price of $27.13, a 56% increase compared to Q1 2020

Cash costs increased to $12.61 per AgEq ounce, compared to $8.25 in Q1 2020, primarily due to higher ore development rates and mining contractor costs at Santa Elena to increase future production and higher energy costs at San Dimas

AISC increased to $19.35 per AgEq ounce, compared to $12.23 in Q1 2020

Mine operating earnings of $28.1 million, up 33% compared to Q1 2020

Net earnings of $1.9 million, compared to net earnings of ($32.4) million in Q1 2020

Adjusted EPS of $0.03 after excluding non-cash and non-recurring items

Cash flow per share was $0.14 per share (non-GAAP)

Strong working capital position of $232.8 million and total available liquidity of $297.8 million, including $65.0 million of undrawn revolving credit facility

Declared a cash dividend payment of $0.0045 per common share for the first quarter of 2021 for shareholders of record as of the close of business on May 17, 2021 and will be distributed on or about June 4, 2021

"Strong metal sales, robust silver prices and higher-than-normal premiums for coins and bullion generated healthy revenues, earnings and cash flows during the first quarter," stated Keith Neumeyer, President and CEO. "Due to the high demand for physical coins and bullion, our online retail store generated $4.8 million in silver sales during the quarter, or approximately 5% of our $101 million in total quarterly revenues, representing a new record in its 13-year online history. Furthermore, due to the current demand, the Company is working with numerous mints and refiners to direct as much silver sales as it can through its online store as possible."

Mr. Neumeyer continued, "At the mining units, capital investments are beginning to accelerate at Santa Elena's Ermitaño project as higher development rates are reached in order to prepare the new mine for initial production in early 2022. In addition, Santa Elena is expected to realize significant annualized cost savings of approximately $8 to $10 million starting in the second quarter as a result of its new LNG power plant. At the newly acquired Jerritt Canyon Gold Mine our operations team has begun the integration process and in the coming months ahead we expect to provide our operational plan and market guidance. Finally, I'm pleased to announce that our board of directors has approved the first-ever quarterly dividend payment which will be distributed to shareholders in early June."

OPERATIONAL AND FINANCIAL HIGHLIGHTS

NM - Not meaningful

(1) The Company reports non-GAAP measures which include cash costs per silver equivalent ounce produced, all-in sustaining cost per silver equivalent ounce produced, total production cost per tonne, average realized silver price per ounce sold, working capital, adjusted EPS and cash flow per share. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning and the methods used by the Company to calculate such measures may differ from methods used by other companies with similar descriptions. See "Non-GAAP Measures" on pages 25 to 30 30 of the Company's MD&A for further details of how these metrics are calculated by the Company together with for a reconciliation of non-GAAP to GAAP measures.

Q1 2021 FINANCIAL RESULTS

The Company realized an average silver price of $27.13 per ounce during the first quarter of 2021, representing a 56% increase compared to the first quarter of 2020 and a 9% increase compared to the prior quarter.

Revenues generated in the first quarter totaled $100.5 million compared to $86.1 million in the first quarter of 2020, primarily due to a 56% increase in average realized silver price, partially offset by a 24% decrease in silver equivalent ounces sold. First quarter revenues included a record receipt of $4.8 million from the sale of 146,827 ounces in silver coins and bullion at an average silver price of $32.65 per ounce, or a premium of approximately 24% above the quarterly spot price of $26.25 per ounce. Revenue from the sale of coins and bullion in the first quarter more than doubled over the prior year.

The Company reported mine operating earnings of $28.1 million representing a 33% increase compared to $21.1 million in the first quarter of 2020. The increase in mine operating earnings is primarily attributed to higher metal prices.

The Company reported net earnings of $1.9 million (EPS of $0.01) compared to net earnings of ($32.4) million (EPS of ($0.15)) in the first quarter of 2020. The increase in net earnings was primarily attributed to higher metal prices as well as a $22.7 million loss in the first quarter of 2020 related to mark-to-market adjustments on the Company's foreign currency derivatives.

Adjusted net earnings for the quarter was $7.0 million (Adjusted EPS of $0.03) compared to $8.2 million (Adjusted EPS of $0.04) in the first quarter of 2020, after excluding non-cash and non-recurring items.

Cash flow from operations before movements in working capital and income taxes in the quarter was $31.1 million ($0.14 per share) compared to $23.3 million ($0.11 per share) in the first quarter of 2020.

Cash and cash equivalents at March 31, 2021 was $201.7 million. In addition, the Company had strong working capital of $232.8 million and total available liquidity of $297.8 million, including $65.0 million of undrawn revolving credit facility.

OPERATIONAL HIGHLIGHTS

The table below represents the quarterly operating and cost parameters at each of the Company's three producing silver mines during the quarter.

Total production in the first quarter was 4.5 million silver equivalent ounces, consisting of 2.9 million ounces of silver and 23,873 ounces of gold, representing a decrease of 16% and 9%, respectively, compared to the Company's record setting production in the previous quarter.

COSTS AND CAPITAL EXPENDITURES

Cash cost for the quarter was $12.61 per silver equivalent ounce , compared to $10.21 per ounce in the previous quarter. The increase in cash costs were primarily due to higher ore development and mining contractor costs at Santa Elena in preparation of additional ore faces to increase future production, as well as higher energy costs at San Dimas as a result of lower energy contribution from the hydroelectric dam due to dry season, which forced the mine to rely on the public electricity grid and diesel generators.

AISC in the first quarter was $19.35 per ounce compared to $16.12 per ounce in the previous quarter. The increase in AISC was primarily attributed to the increase in cash costs and sustaining costs being divided by 17% less silver equivalent ounces produced combined with a 14% increase in mine development rates.

Total capital expenditures in the first quarter were $45.1 million, primarily consisting of $14.5 million at San Dimas, $14.3 million at Santa Elena (including $6.7 million towards the Ermitaño project), $2.7 million at La Encantada, $12.6 million for strategic projects and $0.9 million at non-producing properties.

Q1 2021 DIVIDEND ANNOUNCEMENT

The Company is pleased to announce that its Board of Directors has declared a cash dividend payment in the amount of $0.0045 per common share for the first quarter of 2021. Under the Company's dividend policy, the quarterly dividend per common share is targeted to equal approximately 1% of the Company's net quarterly revenues divided by the Company's then outstanding common shares.

The first quarter cash dividend will be paid to holders of record of First Majestic's common shares as of the close of business on May 17, 2021 and will be distributed on or about June 4, 2021.

The amount and distribution dates of future dividends remain at the discretion of the Board of Directors. This dividend qualifies as an 'eligible dividend' for Canadian income tax purposes. Dividends paid to shareholders outside Canada (non-resident investors) will be subject to Canadian non-resident withholding taxes.

APPOINTMENT OF VP OPERATIONS - MEXICO

The Company is pleased to announce the appointment of Colin Bower as Vice President of Operations - Mexico who will be responsible for all operational efforts at the Company's Mexican operations. Mr. Bower will report directly to Steve Holmes, COO, of First Majestic.

Mr. Bower is a seasoned mining professional with over 30 years of successful operational, technical and commercial management experience and is fluent in Spanish. He brings a diverse skillset to First Majestic through his experience with medium and large-scale global surface and underground mining operations where he has focused on value creation through Operational Excellence, Resource Expansion, Cultural Change and ESG all while maintaining a keen focus on safety. Colin's senior management experience includes Executive General Manager at Nevada Gold Mines and Barrick Nevada, General Manager at BHP's Cerro Colorado Mine and KGHM's Robinson Mine, Head of Non-Operated Joint Ventures at BHP Minerals Americas and Vice President Operations at the Sierra Gorda Mine in Chile.

ABOUT THE COMPANY

First Majestic is a publicly traded mining company focused on silver and gold production in Mexico and the United States and is aggressively pursuing the development of its existing mineral property assets. The Company presently owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, the La Encantada Silver Mine and the Jerritt Canyon Gold Mine.

FOR FURTHER INFORMATION contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll-free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

"signed"

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward Looking Statements

This press release contains "forward-looking information" and "forward-looking statements" under applicable Canadian and U.S. securities laws (collectively, "forward-looking statements"). These statements relate to future events or the Company's future performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management made in light of management's experience and perception of historical trends, current conditions and expected future developments. Forward-looking statements include, but are not limited to, statements with respect to: the Company's business strategy; future planning processes; commercial mining operations; cash flow; budgets; mine plans and mine life; costs of production; costs and timing of development at the Company's projects; capital projects and exploration activities and the possible results thereof; commencement of initial production at the Ermitano mine; and payment of dividends. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon guidance and forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur. All statements other than statements of historical fact may be forward-looking statements. Statements concerning proven and probable mineral reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered as and if the property is developed, and in the case of measured and indicated mineral resources or proven and probable mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "forecast", "potential", "target", "intend", "could", "might", "should", "believe" and similar expressions) are not statements of historical fact and may be "forward-looking statements".

Actual results may vary from forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to materially differ from those expressed or implied by such forward-looking statements, including but not limited to: the duration and effects of the coronavirus and COVID-19, and any other pandemics on our operations and workforce, and the effects on global economies and society, risks related to the integration of acquisitions; actual results of exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; commodity prices; variations in ore reserves, grade or recovery rates; actual performance of plant, equipment or processes relative to specifications and expectations; accidents; labour relations; relations with local communities; changes in national or local governments; changes in applicable legislation or application thereof; delays in obtaining approvals or financing or in the completion of development or construction activities; exchange rate fluctuations; requirements for additional capital; government regulation; environmental risks; reclamation expenses; outcomes of pending litigation; limitations on insurance coverage as well as those factors discussed in the section entitled "Description of the Business - Risk Factors" in the Company's most recent Annual Information Form, available on www.sedar.com, and Form 40-F on file with the United States Securities and Exchange Commission in Washington, D.C. Although First Majestic has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended.

The Company believes that the expectations reflected in these forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included herein should not be unduly relied upon. These statements speak only as of the date hereof. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws.

Congrats on great earnings report, Cheers

#AG: LOOKING GOOD...:-} $14 DOUBLE BOTTOM...!

https://stockcharts.com/c-sc/sc?s=AG&p=D&b=5&g=0&i=t8201280465c&r=1620298105118

#AG: THANKS FOR THE HISTORY LESSON...![]() $14

$14

found this https://silverseek.com/article/new-piece-puzzle thought you may like to read it SLV if it's really the case Banks might have to become Miners to replace the PM's they are missing ....?

didn't Corzine former NJ gov totally destroy an investment firm trying stuff like this?

Might even break support. Silver then might go back to $22, even $20.

The price of Silver has become stagnant lately.

Became aware of Keith Neumeyer 6 years ago when I received First Mining shares as part of them taking over a company I owned shares in. Have added to my First Mining shares over the years and it is one of my largest holdings now. Bought some shares in First Majestic 3 years ago and just doubled up on my position last week.

I think the acquisition of Jerritt Canyon is spectacular news. Keith will be growing ounce equivalents by 50% and didn’t spend a dime to do it. I understand that the deal dilutes my original position but keeping $250 million in cash on hand will prove beneficial at this point of the bull cycle. Would love to see another deal(s) that add another 10,000 ounces.

If Keith is half right about his triple digit silver prediction, it will be champagne and cigar time in 2021.

I'm long. Just not a hyper. Do yiu curse on every post you put up, or jyst on this stock?

Calm down a little. They extended the buyback for another year. It had already been ongoing for the past year.

Oh, and shares bought from that same buyback over the past year? ZERO. Not one share. Hopefully they will do better this coming year, but its not a huge announcement or win.

"Under its prior normal course issuer bid, the Company did not repurchase any shares as of March 17, 2021. Under this prior normal course issuer bid, which commenced on March 21, 2020 and expires on March 20, 2021, the Company received approval to purchase up to 10,000,000 common shares."

Strap in folks, so damn glad I’m a shareholder........

https://www.firstmajestic.com/investors/news-releases/first-majestic-renews-share-repurchase-program-20210318

First Majestic buys Nevada gold mine for shares plus warrants

Mar. 12, 2021 7:22 AM ETFirst Majestic Silver Corp. (AG)By: Carl Surran, SA News Editor4 Comments

First Majestic Silver (NYSE:AG) agrees to acquire the Jerritt Canyon gold mine in Elko County, Nevada, from Sprott Mining for $470M in shares plus 5M share purchase warrants.

Also, Sprott Mining president Eric Sprott will complete a $30M private placement investment in First Majestic.

Jerritt Canyon has been in production since 1981 and has produced more than 9.5M oz. of gold over its 40-year production history; in 2020, the mine produced 112.7K oz. of gold at a cash cost of $1,289/oz.

First Majestic says it has identified opportunities to enhance the mine's cost and production profile as well as near-term brownfield potential between the SSX and Smith mines and long-term property wide exploration potential.

While First Majestic will have significant growth in free cash flow for FY 2021, the stock recently traded at more than 35x 2021 free cash flow estimates, Taylor Dart writes in a neutral analysis published on Seeking Alpha.

That is one reason why another company that I was invested in gave up and sold out. I made a decision a while back to keep my investments in the USA and Canada. Way more stable and there are plenty of great PM miners.

Mexico wants 500 million in back tax’s . That’s the problem working with a foreign country. Extortion is a way of life in Mexico. AG has 5000 employees but the government wants their cut .

Ok, What is the bad news today ?

Price not doing so well.

AG SQUEEZE only matter of time. $30 $40 possible next time.

|

Followers

|

145

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

2514

|

|

Created

|

11/12/09

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |