Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

It is a done deal. Lamberth finally certified the jury verdict. We got a five cent pop. That’s about it.

Final Judgement Order - GSEs ( government sponsored enterprises)#FannieMae #FreddieMac pic.twitter.com/6hyQWyihlk

— Nico (@nicosintichakis) August 23, 2024

Are you saying that Lamberth certified the verdict ?

If this isn't concrete evidence than I don't know what is!

The payout is miniscule in comparison to it's domino effect. This case can now be used as a precedent. If Bryndon Fisher succeeds, the SPS is written off and the corporations get a refund of $30 billion, plus interest. If Kelly wins, the corporations get $110 billion back.

The answer would have been different if your son had talked to the Sister of someone... :)

Pretty good summation. It's a paper victory. The ruling that granted only $612MM was the slap in the face. lol

This is a loss disguised as a victory.

what does that mean? We get our 5 cents per FMCC Commons confirmed now? (Minus lawyer fees)

Someone is attempting to post outdated court news with the judge Lamberth's Final Judgment, without pointing out that it's old news dated March 2024 and, secondly, what we are waiting for, is a response of the judge to the FHFA's motion for JMOL (Judgment as a Matter of Law, also known as Judgment notwithstanding the verdict).

Just so everyone knows: the Lamberth Decision on Fannie & Freddie is official.

Final Judgement Order - GSEs ( government sponsored enterprises)#FannieMae #FreddieMac pic.twitter.com/6hyQWyihlk

— Nico (@nicosintichakis) August 23, 2024

Powell speech today might give us a small boost say 5-7 cents which I call condensation. However it would evaporate the next day.

well

they were wrong

No, they're called Hosing Goals, not Housing Goals, HOSING

The annual Housing Goals always lag the market.

Then, a laggard can never be a benchmark by definition.

Once the data is available, the FHFA has to change the "benchmark" or Housing Goals for the next year, as stated by the FHFA at the time of Mel Watt as director.

Therefore, the requirement to do more, is futile because they can't do more than what the market has to offer.

if an Enterprise fails to meet a feasible housing goal, FHFA may require the Enterprise to submit a housing plan describing the steps that it will take to improve its performance.

Differences in the proposed benchmark levels relative to prior housing goals are primarily attributable to changes in projected macroeconomic factors that impact market levels for the different affordable housing segments.

Minority Census Tracts Home Purchase Subgoal.

Fnmas

Volume is pathetic

Just like the vote turnout for kam will be

Absolutely pathetic

New potus is the only hope we have

Same for real crypto companies

Not bs coin names

Go FnF

FIFTH clue that points to the repayment of the SPS fast:

When the dividend payment to UST was switched from 10% dividend to Net Worth increase dividend (NWS dividend), under the Separate Account plan that stipulates that they were assessments sent to Treasury, not actual dividends because it's a capital distribution restricted and unavailable funds for distribution as dividend, out of Accumulated Deficit Retained Earnings accounts.

1989 FHLB-style. The difference is that the FHLBs had to pay an annuity of $300 million in interests, without restrictions. The rest was the assessment sent into a SEPARATE ACCOUNT FOR ZERO COUPON INSTRUMENTS HELD TO ENSURE PAYMENT OF PRINCIPAL.

.jpeg)

With FnF, as dividends are restricted, the full amount was applied towards the reduction of the debenture with the taxpayer "SPS" (A Separate Account plan too). Then, the plotters (the parties in court, justice Alito, former FNMA CEO) began to peddle the idea of "dividend obligation" to turn a dividend into interest payment. That concept doesn't exist in this world.

BOTTOM LINE

A NWS dividend is the fastest speed to that end, as the 10% dividend either increased the losses or was the cause of the losses and subsequent request of funds from the UST (1:1 SPS LP increase), and thus, the outcome is a circular flow: FnF tapped the UST for funds, in order to pay the dividend to UST.

Also known as death spiral, because the outcome is that it was depleting the UST's funding commitment.

It was solved with the NWS dividend, which serves also as the feature captured in the bailout of the FHLBs: they weren't required to send assessments into a Separate Account for the quarter that they reported losses.

Beforehand, FHFA's DeMarco had enacted the July 20, 2011 Final Rule with the surprise at the end of a CFR 1237.12, foreseeing that, with the coming "fast track" NWS dividend, the SPS were going to be redeemed very fast (mainly with the recognition of new Deferred Assets later on), and useful to continue with the Separate Account plan of deception afterwards, now the assessments applied towards the recapitalization of FnF (outside their Balance Sheets), either in the exception 1, 2, 3 or 4 of this "supplemental" restriction on capital distributions.

A plan of deception authorized in the FHFA-C's Incidental Power: "Take any action authorized by this section, in the best interests of .... FHFA".

The "Zing!" power.

PS. Notice that they are the same protagonists in 1989 with the FHLBs and nowadays with FnF, both the institutions FHFA-UST and individuals: DeMarco, Sandra Thompson.

Big bucks no ........

Is the board operating on a 9 to 5 schedule? And everyone disperses, post market close +1 hr?

Wings, I also heard from my brother’s uncle’s brother’s son that Fannie and Freddie are going to the moon!! Wait, that must have been me talking to myself!😂 Go Fannie and Freddie!!!!

My sister today talked with the Son of someone who will be able to make the decision on releasing Fannie and Freddie. He said,” Oh we are on the same page and it will happen.”

Fannie and Freddie's lowball price right now might attract the likes of Mr. Hawkeye Buffett - Remember just a few months ago, Reuters wrote an article that said one of HawkEye's biggest "fumbles," was not loadin' up on Fannie and/or Freddie at one time.

Keep thinking !!

@FHFA & @USTreasury $301 billion swindle of @FannieMae & @FreddieMac equity exposed in US Court of Federal of Claims:https://t.co/CmxaieQoMa

— Guido da Costa Pereira (@GuidoPerei) August 22, 2024

Oh wow. Closed at a new LOD thanks to Sherwin Williams. I’m never shopping at his store again. Everyone should boycott Sherwin Williams. Spread the word.

This dude ran the illegal net worth sweep to steal the money from fannie and freddie. $fnma #fanniegate corruption!!! Fraud!!! https://t.co/gCvgdZWjHr

— Fanniegate Hero (@DoNotLose) August 21, 2024

There's misprint here - It should be HOSING GOALS

No need for 2025-2027 Hosing Goals if we:

Fire Yellen

Fire FHHA Director Thompson

End the Conservatorship

Make Reparations to Fannie and Freddie Shareholders

FNMAS keeps going up while we keep dropping. I’m perplexed. And yes this is a new word for me. I figured I should expand my vocabulary from oh wow.

Oh wow. Enjoying a great lunch at the Costco food court hot dog and drink for $1.50. Sadly the dog costs more than one share of Fannie. Gonna do some shopping afterwards. Anyone need anything ?

FHFA Proposes 2025-2027 Housing Goals for Fannie Mae and Freddie Mac

for immediate release

08/22/2024

Washington, D.C. – The Federal Housing Finance Agency (FHFA) issued a proposed rule today that would establish the housing goals for 2025-2027 that Fannie Mae and Freddie Mac (the Enterprises) would be required to meet on an annual basis. FHFA is requesting comments on all aspects of the proposed rule during the 60-day public comment period.

The housing goals ensure that the Enterprises, through their mortgage purchases, responsibly promote equitable access to affordable housing that reaches low- and moderate-income families, minority communities, and other underserved populations.

“Given persistent challenges in the housing market, FHFA is proposing benchmark levels that reflect these dynamics and continue to ensure that the Enterprises remain focused on supporting key affordable housing segments while operating in a safe and sound manner,” said FHFA Director Sandra L. Thompson. “The goals proposed today offer a meaningful and realistic calibration that takes into account current and forecasted economic factors.”

For the single-family housing goals categories, the Enterprises must meet the benchmark level established in the final rule or meet the actual market level determined retrospectively for the year based on Home Mortgage Disclosure Act (HMDA) data.

The proposed rule would establish a new process for evaluating compliance with the housing goals. Under the current regulation, if an Enterprise fails to meet a feasible housing goal, FHFA may require the Enterprise to submit a housing plan describing the steps that it will take to improve its performance. The proposed rule would provide that FHFA will not require a housing plan if the Enterprise’s performance met the level required by newly-defined Enforcement Factors. These Enforcement Factors address, in part, the uncertainty in forecasting the market several years in advance as well as the time lag in determining the actual market level retrospectively.

For the multifamily housing goals categories, the Enterprises must meet the benchmark level established in the rule. Each Enterprise must purchase mortgages on multifamily properties with the target share of units affordable to families in each goal category, as well as meet a subgoal for low-income families in small (5-50 units) multifamily properties.

Differences in the proposed benchmark levels relative to prior housing goals are primarily attributable to changes in projected macroeconomic factors that impact market levels for the different affordable housing segments.

Oh wow. In order to close green today we desperately need The TightCoil.

Thanks. Will try to use that link more often in my posts.

Oh wow. Sherwin Williams very active today.

Easy come easy go.

One thing you can say about this stock is it is consistent ... what it gives one day it takes back the next ...

Wowzer, I’m predicting a pop today, I’ve been wrong every prediction thus far, wish me luck.

I am a loser !

Why not what? Don't understand your question.

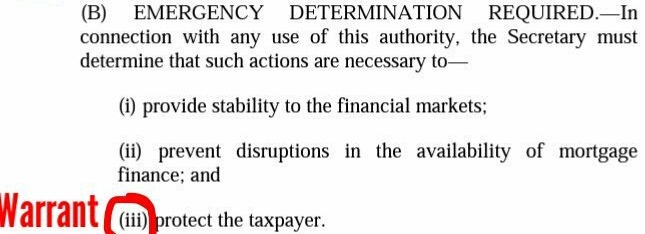

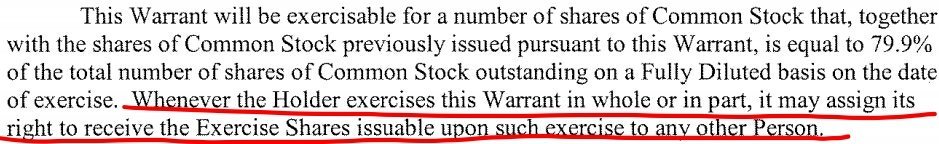

It turns out that that "right to receive shares" that can be assigned (transferred) is the Warrant itself, making it transferable (after exercising it), when in the clause 7 it's claimed that the Warrant is non-transferable. Oops! Two confronting clauses, the one that wrote the prospectus made it void from the beginning, for not knowning what the security Warrant represents.

The initial Fact Sheet states:

"These agreements are the most effective means of averting systemic risk and contain terms and conditions to protect the taxpayer"

These agreements provide significant protections for the taxpayer

We never landed on the moon

Kam kam will not get elected. I coined this nickname.

“Cause he’s bad, bad, Willie brown, badest man in the whole dam town”. lol

Next admin will release the gse’s

End this theft

Go FnF

Instead of speculating how Treasury will use the warrants and what their purpose was, posters should read and understand what the Government Officials actually said and discussed in their own words detailing what the purpose of the warrants were.

Quote: "Mr. Werfel then explained that it is important to understand the government’s intention. The intention was not to eliminate the ownership interests but to prevent current shareholder speculation resulting in speculators taking advantage of government intervention at the expense of others. Driving the stock market value to zero prevents this manipulation from happening. " End of Quote page 24

Link to page 24: https://investorshub.advfn.com/boards/read_msg.aspx?message_id=173695132

I have space in my house, come on over.

Need a nanny? "NWS". "No, caca. It's NWS dividend."

I fear it will be some version of the NWS.

Guido continues to bring up the theme of the Warrant and comparing it with the banks, debunked a thousand times before.

FnF are not ordinary businesses.

The Warrant was a security that UST was authorized to purchase to (iii) protect the taxpayer (collateral of the SPS investment), as expressly stated in the initial Fact Sheet posted by the plaintiff Mr. Pro Se on this board recently.

The exercise price of $0.00001 per share, confirms it, because with this price it looks more like a collateral to protect from losses.

Issued for free, we considered it purchased at $0 cost because the authority of UST was about the purchase of securities.

But the true reason why it was issued, is for the assault on the ownership of FnF by Wall Street and the Community Banks, according to its prospectus clause 2.1: the "right to receive shares" can be "assigned" to any Person: BKT, MS, JPM, Pershing, etc.

It turns out that that "right to receive shares" that can be assigned (transferred) is the Warrant itself, making it transferable (after exercising it), when in the clause 7 it's claimed that the Warrant is non-transferable. Oops! Two confronting clauses, the one that wrote the prospectus made it void from the beginning, for not knowning what the security Warrant represents.

Like the initial $1B SPS LP, issued for free too, and thus, its value was debited from our pockets. The same with today's NWS 2.0 (SPS LP increased for free every quarter) brought to you by the Trump Administration (at the time, debited from the Additional Paid-In Capital account, now depleted. Common Equity too).

Thus, barred in the FHFA-C's Rehab power (Recap with regulatory capital). This initial $1B SPS was called "commitment fee" is some paper, is considered a higher return on the SPS investments it was attached to, as "fees" are barred in the Charter's Fee Limitation of the United States. Anyway, it also bars these "higher returns" on the Treasury's investments in FnF, and the original rate similar to Treasury yields (subsection (c)), prevails.

Well if there's a DJT win in Nov with him assembling his cabinet the question for us shareholders is how fast will we see the wheels start turning for the release and end of conservatorship of Fannie Mae & Freddie Mac?

The lastest rumour was Elon to join the cabinet as a financial adviser ! There's alot to fix with this country in 4 years so for any hope of release and a win for shareholders is they gotta be working on this now planing there move on Jan 6th or we won't see any change in the first year of 2025!!!!.

That's an Awesome post with the link to the emails. That Jim Parrot should be in jail along with the rest of them for conspiring the Gov to illegally take private property !! When will this Kangaroo court end for Fannie Mae & Freddie Mac !!

You and Mr. Michael!!!!

|

Followers

|

2332

|

Posters

|

|

|

Posts (Today)

|

12

|

Posts (Total)

|

802475

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |