Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

If we get a 2x-3x donald bump in November, honestly I may just sell out and end this saga.

We all need to move on with our lives.

Wonderful. You are the true warrior Guido

@realDonaldTrump

— Guido da Costa Pereira (@GuidoPerei) April 27, 2024

Please make getting rid of @FHFA , the most fraudulent government agency in history, a priority in your second term.https://t.co/BT3OkchsXL

The CEO of DJT complained via letter to the big wigs that his stock was being manipulated. Since then, DJT has gained 40%.

Would be nice if Priscilla did the same with FNMA.

Doubt it though.

We wait.

Isn't that what @FHFA was doing? Settling for pennies on the $ as long as donations were made to politically connected nonprofits until stopped by @jeffsessions ?Their conservator swindled hundreds of billions due to Fannie Mae and Freddie Mac through this scheme.

— Guido da Costa Pereira (@GuidoPerei) April 27, 2024

I know that there are a lot of MAGA warriors on this board.. Please see to it that FHFA is on the list of to-be-dismantled.. Put it on your truth social or go to any of his rally and do a slogan, placard and what not..

While i am still 50-50 on Donald doing anything (if its him, which is 50-50 as well), the odds are 100% better than the current admin...

The FHFA heads as well as the GSE heads (indirectly are political appointees) being replaced willbe the first indication of any signs.

And depends on who heads Treasury, who heads FHFA... will tell us a lot..

who wants to put FHFA into his ears on complete dismantlement

https://www.cnn.com/2024/04/27/politics/trump-federal-workers-2nd-term-invs/index.html

It's absolutely insane that this administration will pass the baton to the next one.

Leaving the fate of FnF to the donald.

Well the hit pieces have calmed down since we aren’t close to breaking $2.

It’s a well oiled media machine against the gse’s for years now.

You would think big investors like Ackman would have paid for some news calling out this theft over the years.

With housing being so unaffordable you could get some people listening especially the younger generation that is being screwed these days by all kinds of housing manipulation.

Thanks for the correction

I knew it was something huge like that

Maybe others will understand better

Pagliara is as clueless as we are. Stop idolizing him and you will be fine in a few months

The 30-year fixed-rate mortgage rose to an average 7.17% as of April 25, according to data released by Freddie Mac FMCC on Thursday.

Actually $40 billion a month.

https://www.gata.org/node/6758

Now im really confused, sort of like talking about the weather in Texas and comparing it to ozone gases while sitting in China junkyard. Not a thing of value, for years, towards GSEs.

That was debunked a thousand times.

the Gse’s took $40 billion in toxic MBS on their books at the direction of hank Paulson.

your posts are way too long. Please try to be more concise

Sadly, I’ve been around long enough to remember when the Gse’s took

$40 billion in toxic MBS on their books at the direction of hank Paulson. This allowed the banks to remain solvent when they would have otherwise been sunk, your posts are way too long. Please try to be more concise

I've posted (G) LOSSES. Can't you read?

neither entity met any of the twelve conditions for conservatorship

You are publishing lies!

Hi Mellon,

Great insights and advice!

I certainly appreciate what you have said:

“You should know being humble is lucrative”

Thank you for sharing and being such a positive and inspiring voice of this community.

Michael

So PagLiar admitted to lying?

When will he say Trump Trump Trump?

You and him lie with such a confidence that you make it look like you are some kind of geniuses.

How can anyone say dumb POS Sandra will do 3R and she is working hard?

You guys need to get your head examined.

Glen, I appreciate you taking the time to call out Calabria. Quote: “ So if FHFA is not an independent agency then how does the SPSPA work? The government just signs deals with itself now?”

I encourage you to repent start publishing the truth on your Seeking Alpha. Quit fighting the Common Shareholders. We all know who the real enemy is here. Best Regards

You are publishing lies!

Mr not so much wiseman said Quote: “ The placement in Conservatorship is the only lawful action.” End of Quote

When Paulson met with the directors of Fannie Mae and Freddie Mac to inform them of his intent to take over their companies, neither entity met any of the twelve conditions for conservatorship spelled out in the newly passed HERA legislation. Paulson since has admitted he took the companies over by threat.

HOUSING AND ECONOMIC RECOVERY ACT OF 2008 Page 2734 Twelve Conditions

APPOINTMENT OF THE AGENCY AS CONSERVATOR OR RECEIVER

Link: https://www.congress.gov/110/plaws/publ289/PLAW-110publ289.pdf

The placement in Conservatorship is the only lawful action.

With (G) LOSSES, like to incur (fabricated) losses that deplete their capital. Already commented which ones.

And about the arrangements, all forms part of a SEPARATE ACCOUNT like the FHLBanks in their 1989 bailout by Congress, with assessments sent to a separate account,

.jpeg)

Without realizing that, the FHLBanks had to pay $300 million in interests annually (a 10% rate on a $30B obligation, applying a 0.299% spread over Treasuries. GAO report. It was precisely, Sandra Thompson, who tapped the maximum amount authorized in the law, $30B, just when she arrived at the FDIC in 1990. Not a prudent course. And DeMarco in charge of accounting at GAO, requiring in the report to expel the independent accountant PwC, in order to save recourses. We later knew why: they were just reducing the 40-year interest payments from Funding Corp, where the FHLBanks were Equity holders, that only paid interests, without realizing that their SEPARATE ACCOUNT was for the REDUCTION OF THE PRINCIPAL of the obligation, not just those interests. Then, ST and DeMarco (GAO, UST, FHFA) needed funds to repay the principal. Thank goodness Silicon Valley Bank came across and ST happens to be the FHFA director, authorizing massive leverage in SVB with the advances -loans- from a FHLBank, disregarding the liquidity risk and with an AOCI opt-out election -unrealized losses in Equity- through FDIC regulation. They chose Held-To-Maturity portfolio instead, to evade recording their unrealized losses. Famous Trump's deregulation rhetoric, by removing the safeguards), the rest (on paper) reduces the principal of the RefCorp obligation (initially, a 40-year obligation), but with FnF, the dividend payments are restricted in a provision covered up by all the crooked litigants and the peddlers of the government theft story (the coverup of a material fact is a felony of Making False Statements.)

Therefore, with FnF, the entire assessment was used to repay the principal of the SPS obligation (obligation in respect of Capital Stock), knowing that later on, it will be assessed the true cumulative dividend on SPS the UST is entitled to: like the FHLBanks, it was established a spread over Treasuries, as set forth in the original UST backup of FnF in the Charter Act:

Taking into consideration the Treasury yield as of the end of the month preceding the purchase.

Any FHLBank with a net loss for a quarter, is not required to pay the RefCorp assessment for that quarter.

Fannie Mae - Freddie Mac Commons

Be Bold

Hold for the Gold

June to the moon

Or

Moon in June

Can you guys all just keep to being humble and stop turning this into Reddit?

No one cares who has been posting things firms already read and don't share. No one is a moron or and idiot. No one will get credit for being the most "right" because everyone here is looking at this wrong one way or another.

I'm going to share something as I have had success with listening, and sharing what I can that is goodwill to share given I spend more sweat equity sharing what I don't have to for never getting any return from strangers on a message board.

I usually have some guy tell me he was here longer and I'm wrong and I took all this time just to condense things for you to tie together.

So here's a bit of information from the 336 page PDF report online from the examiner of 'Lehman' (the global parent and its focus on how it consolidated its balance sheet as well as legally did it's infamous accounting "Repo105")... If you think that this isn't all a private and public sector coordinated intentional process playing out to bring new litigation and cross-jurisdictional practices out while the first global "crisis" took place on both paper and the early 80's to 2000's internet connected financial world.... maybe think this whole time the unwinding is being done very carefully but also rolling out at privately coordinated stages as the internet (undersea fiber cables, satellites, software, hardware, data centers etc) in 2024 is more equipped to handle cross-jurisdictional movement of assets, transactions, accounting that works in connected worldwide counterpaties, inter-company cross-jurisdictional entities rolled onto one US based parent balance sheet?

This is something to think about. You are not all wrong, but being convinced you are right enough to call people Reddit level bs back and forth. You should know being humble is lucrative. Being internet "right" will get you nowhere.

Now someone will go ahead and say but mellon that's Lehman! Not Fannie Mae!

You really need to study more if that's how you're going to think of this all.

Repo105 (used to make US Treasuries, Agency Fannie and Freddie securities/bonds 'disappear')

I will leave this for you all to consider a narrow scope of this and calling others idiots for trying to grasp something results from an argument one of you started - Do you want to make money? Or do you want to fight?

If we keep it to sharing insight we can hive mind better results for all investors. No one cares who thinks they are "right"... in the end what a waste of time.

Don't make this Reddit. Work together.

-Mellon

Careful about what you are optimistic about. Sure he can make plans and offer a consent decree but it could be a multi-year process with milestones and achievement requirements and guarantees for affordable housing. Shareholders could still get screwed for many years.

Here’s another example of failure lawsuit with no reference of the Regulator breaking the law.

UNITED STATES COURT OF FEDERAL CLAIMS

Wazee Street Opportunities Fund IV LP,

Filed 04/03/23

Quote: "This lawsuit does not challenge the foregoing arrangement made in

September 2008. While Plaintiffs do not concede that all the measures taken in September 2008 were justified or necessary, they are not here to challenge the placement of Fannie and Freddie into conservatorship at the height of the financial crisis, or the original deal struck by Treasury and FHFA at that time." End of Quote. Page 7

The lawyers are focused on the third amendment net worth sweep. By Public Law the whole contract is illegal, the contract is illegal based on the United States is not permitted to charge a commitment fee to be paid by the enterprises.

Link: https://storage.courtlistener.com/recap/gov.uscourts.uscfc.37252/gov.uscourts.uscfc.37252.30.0.pdf

Pagliara thinks that is the deadline for any Biden action based on what he heard 5 months ago. Since then he seems to be less optimistic of anything happening. I still am optimistic. Capital plans are coming next month

who said fhfa is not an independent agency? fhfa claims so.

why is calabria, the stupid shit is trying to be relevant after what so much damage he did?

Sounds good to me. Make it so Number One.

Going up Monday morning 🌄,🛹🌵🇺🇸

Great comment by Glen. He might be finally reading what Rodney has been saying.

So if FHFA is not an independent agency then how does the SPSPA work? The government just signs deals with itself now?

— Fanniegate Hero (@DoNotLose) April 26, 2024

Do we have clearance to lift off from conservatorship?

Clarence, I appreciate you taking the time to understand our situation.

Below find a link to a letter I sent to

FINANCIAL SERVICES

Committee

Committee Members

118th CONGRESS

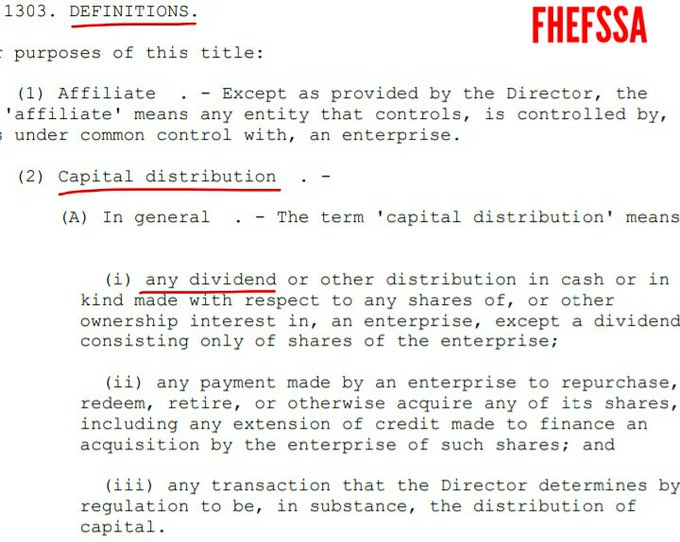

Violations by the Federal Housing Finance Agency (FHFA) violating of the Charter Act, and the Federal Housing Enterprises Financial Safety and Soundness act of 1992 (FHEFSSA); Both as amended by the HOUSING AND ECONOMIC RECOVERY ACT OF 2008, (HERA). The Charter Acts are Fannie Mae and Freddie Mac's enabling statutes. FHEFSSA and HERA are regulatory statutes, governing the companies' regulators. All are laws passed by Congress.

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=172987595

Do we have clearance Clarence ?

Clarence said, Quote: “ “…because FHFA exceeded its statutory conservator authority…”.

That’s the confusion, Conservator AND Regulator are entirely two different positions. The attorney’s DID NOT CHALLENGE the Authority of the Regulator. Justice Breyer told the plaintiffs how to win. The plaintiffs are focused on the contract SPSPA lost dividends and never challenged the FHFA Director as breaking the Law.

Barron4664

09/20/23 9:36 AM

Post #768746 on Fannie Mae (FNMA)

The problem is not with the rulings of the courts. The problem is and always has been that the plaintiffs attorneys have only challenged the “Actions of the Conservator” such as the NWS or other provisions of SPSPA which is a contract. 4617f bars courts from questioning the actions of a conservator. As it should. None of the 15 + years worth of court cases have challenged the action of the FHFA as regulator or Treasury with respect to the statutes that actually matter. The charter act, safety and soundness act, chief financial officer act, etc. To get a takings or an illegal exaction verdict, you have to show that the gov broke the laws. The actions of the conservator cant break a law. But if you go before a judge and say the SPSPA is bad and the gov stole our companies and limiting the argument to the specifics of the SPSPA agreement and the amendments you get 15 years of no results. Had they brought before Lamberth in 2013 any statutory claim involving the actual statutes with regard to the GSEs, then this probably would have ended a long time ago. It almost seems that the plaintiff attorneys have operated as some type of controlled opposition to run the statute of limitations out. A conspiracy. How can 15 years go by and nobody filed a court case based on the charter act. It is like Ray Epps, after 2.5 years, now he gets indicted for 1 count misdemeaner. With GSEs, we get a little victory for Hamish Hume. Look how great the attorneys are, they are fighting hard for us.” End of Quote

THE ATTORNEYS DID NOT CHALLENGE THE CONSERVATORSHIP! THE ATTORNEYS ASKED THE COURTS TO RULE ON THE ILLEGAL CONTRACT, SPSPA: JUSTICE BREYER TOLD THEM HOW TO WIN!

UPMOST IMPORTANT: JUSTICE BREYER: Quote: “Thank you. I think in reading this you could, with trying to simplify as much as possible, do you -- the shareholders' claim as saying we bought into this corporation, it was supposed to be private as well as having a public side, and then the government nationalized it. That's what they did. If you look at their giving the net worth to Treasury, it's nationalizing the company. Now, whatever conservators do and receivers do, they don't nationalize companies. And when they nationalized this company, naturally they paid us nothing and our shares became worthless. And so what do you say?” End of Quote, page 12

The link may not work anymore, the above statement was made and recorded in the transcript.

Link: https://www.supremecourt.gov/oral_arguments/argument_transcripts/2020/19-422_3e04.pdf

June is soon ;)

“…Administrative Procedures Act... None of the litigation made any claims of violation of these acts.”

But the Collins plaintiffs brought at least three different APA claims.

On page 13 of the published Collins v Mnuchin en banc decision, the court explains that Counts I, II, and III were all brought under various parts of the Administrative Procedures Act. Count I survived, and SCOTUS later reviewed it.

On page 13 the court specifies that Count I was brought under the APA, specifically 5 U.S.C. 706(2)(C) et seq., “…because FHFA exceeded its statutory conservator authority…”.

CFPB could just follow what you guys did at FHFA and Net Worth Swindle the equity of the banks they are supposed to regulate.

— Guido da Costa Pereira (@GuidoPerei) April 26, 2024

wasn't scotus case all about apa? i recall reading it a lot. if you are correct in saying that hamish and other plaintiff attorney's were misleading the shareholders and not doing it right and intentionally, they can be sued even if they were not paid by shareholders other than berkowitz: public statements of theirs, filing a class action on other's behalf, it is the same thing that they filed against fhfa : breach of trust. has anyone reached out to hume who may be fume ing if correct that he got caught? of course if you are right. remember hume and his team will make like 300 million in fees from class action if my memory serves it right. not a chump change when shareholders lost everything : $1500 down to $0.40 in last 16 years of their filing frivolous lawsuits and we know in the letter agreement signed it says that all lawsuits must end before end of c ship and hume and his team continues with lawsuits.

You see when I say green then it's green

Yes, the low volume is actually

a good sign for next week, and

for weeks to come

The volume dried up for the past 2 days. Possible sharp up trends next week.

You are about the most ridiculously negative poster to ever haunt

the messageboards...hardly anything you say has credibility, it's like

you're just spouting off printed troll stuff for only one reason, to irritate

others, you never cite any foundation for your opinions, something is

seriously wrong with you outlook

Nothing bad happening here, Fannie and Freddie getting ready

to give us an unusually spectacular week next week

We cannot seem to breakthrough $1.46 Captain Tutt. Do something will ya ?

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

5

|

Posts (Total)

|

802403

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |