Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

Joky you stole my plan. I predicted this on dumb POS Sandra's appointment.

You need to give me credit for that. It has been painful 4 years. Could had been betters if clowns like skateboard/PagLiar did not spread false information or LIES.

I am not going to wait for full release by Trump.

I will sell after Trump's win in Nov. (its going to take atleast 12-18 months for him to do a release, firing dumb POS might take few months, then appointing another will take few more)

Been saying all along these idiots are there just to pass time and collect paychex.

UPMOST IMPORTANT

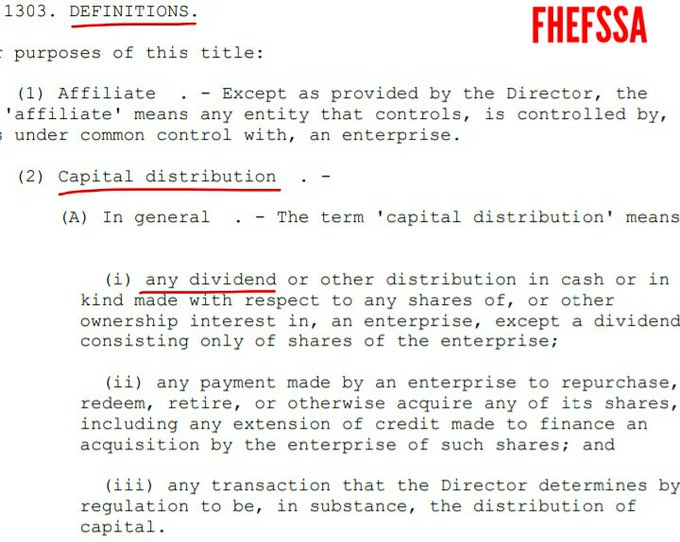

SPSPA which is a contract. 4617f bars courts from questioning the actions of a conservator.

THE PLAINTIFFS BROUGHT THE WRONG LAWSUIT.

Millett and Ginsburg summarized the case and their 70-page opinion as follows:

Quote: “A number of Fannie Mae and Freddie Mac stockholders filed suit alleging that FHFA’s and Treasury’s alteration of the dividend formula through the Third Amendment exceeded their statutory authority under the Recovery Act, and constituted arbitrary and capricious agency action in violation of the Administrative Procedure Act, 5 U.S.C. § 706(2)(A). They also claimed that FHFA, Treasury, and the Companies committed various common-law torts and breaches of contract by restructuring the dividend formula.

We hold that the stockholders’ statutory claims are barred by the Recovery Act’s strict limitation on judicial review. See 12 U.S.C. § 4617(f). We also reject most of the stockholders’ common-law claims. Insofar as we have subject matter jurisdiction over the stockholders’ common-law claims against Treasury, and Congress has waived the agency’s immunity from suit, those claims, too, are barred by the Recovery Act’s limitation on judicial review. Id. As for the claims against FHFA and the Companies, some are barred because FHFA succeeded to all rights, powers, and privileges of the stockholders under the Recovery Act, id. § 4617(b)(2)(A); others fail to state a claim upon which relief can be granted. The remaining claims, which are contract-based claims regarding liquidation preferences and dividend rights, are remanded to the district court for further proceedings.“ End of Quote

Link: https://www.washingtonpost.com/news/volokh-conspiracy/wp/2017/02/21/d-c-circuit-concludes-recovery-act-bars-judicial-review-of-suits-against-fhfa-over-treatment-of-fannie-and-freddie-shareholders/

Barron4664

09/20/23 9:36 AM

Post #768746 on Fannie Mae (FNMA)

The problem is not with the rulings of the courts. The problem is and always has been that the plaintiffs attorneys have only challenged the “Actions of the Conservator” such as the NWS or other provisions of SPSPA which is a contract. 4617f bars courts from questioning the actions of a conservator. As it should. None of the 15 + years worth of court cases have challenged the action of the FHFA as regulator or Treasury with respect to the statutes that actually matter. The charter act, safety and soundness act, chief financial officer act, etc. To get a takings or an illegal exaction verdict, you have to show that the gov broke the laws. The actions of the conservator cant break a law. But if you go before a judge and say the SPSPA is bad and the gov stole our companies and limiting the argument to the specifics of the SPSPA agreement and the amendments you get 15 years of no results.“ End of Quote

With Vergleich he means settlement I guess

I still predict 1st half of 2025 IF Trump wins.

Late 2027 if FJB stays in.

What's next for Lamberth?

He would have to reject the appeal...

Or is there a comparison?

"What are we waiting for? Set the capital reserve to a more realistic level. 4% is too much. 2% is plenty. No more capital needed and exit C-ship."

You know that won't fly. It makes too much sense.

FACT: The authority of UST was about the PURCHASE of securities, and it hasn't purchased even one security.

No one has ever wondered how is this even possible.

It all began with the issuance of $1B worth of SPS free of charge (1 million stocks at $1,000 per stock), with the objective to reduce the Core Capital in the same amount (It carries an offset: it reduced the Additional Paid-In Capital account. Source) and justify the Conservatorship with (G) LOSSES: Likely to incur losses that deplete capital.

Since then, all the SPS LP corresponding to the draws from the UST (1:1) has been increased and that's a Securities Law violation because the securities must be dated at the time the company raises fresh cash, and necessary for the deed of purchase (necessary for the capital gains tax, etc).

Other theme is that, for reporting purposes, they can be unified in one security if they have the same price and characteristics.

The objective was to skip the deadline on the "TEMPORARY" second UST backup of FnF inserted by HERA with unlimited yield SPS, of December 31, 2009, because the deadline refers to the authority on PURCHASES mentioned, and there's been none.

The Warrant is another security that was issued for free on day one, in an attempt to override the prerequisite on PURCHASES by the UST of (iii) to protect the taxpayer (collateral). Once spotted, collateral it is. Collaterals aren't allowed in the original Fee Limitation of the United States ("PROHIBITION...."), this is why Calabria/Pelosi's HERA continues to raise our eyebrows.

This is one of the 7 Securities Law violations that need to be settled and also it serves as Punitive Damages that the Equity holders require to the DOJ. Although the common shareholders waive this claim in the case of "as is" and "takeover" resolution of Fanniegate, not in the case of a Takings at BVPS.

The same with the second round of Punitive Damages due to the Deferred Income accounting, in the case that it's allowed to amortize it into Earnings in one fell swoop without the existing shareholder ($61B Deferred Income together as of end of 2023, is recorded as Debt, not Equity. $42B in Freddie Mac alone)

The third round of Punitive Damages, is against the plotters of the government theft story in formal documents: court briefs, books, articles, etc., for the cover-up of many statutory provisions (Restriction on Capital Distributions; "May" recap is imperative once the capital is generated; etc.) and financial concepts (Dividends, a distribution of Earnings, unavailable with Accumulated Deficit Retained Earnings accounts).

2- SPS LP increased for free since December 2017 and its offset, are missing on the balance sheets (Financial Statement fraud)

3- Fannie Mae posted a charge on the Income Statement, when no SPS LP was required to be increased in the 1Q2020 Earnings report.

4- Stock price manipulation.

5- The value of the Warrant was credited to Additional Paid-In Capital account.

6- Dividends paid out of an Accumulated Deficit Retained Earnings account (for the Separate Account plan).

7- CRTs. Although it's a breach of the Charter Act (Credit Enhancement clause: not among the enumerated ones), it's included here to simplify and because it can also be considered a Securities Law violation. A credit enhancement operation in mortgages where the credit event is the credit loss, is a scam, because it occurs after the company carries out costly foreclosure prevention actions. For instance, Freddie Mac's STACR DNA or HQA notes. Whereas the credit event that triggers the claim of payment in the STACR DN or HQ notes, is serious delinquency. Since 2015, Freddie Mac only issues the former.

They are an excuse to make FnF pay an outstanding annual rate of return on these debt notes, currently between 9%-13% rate (Source: Earnings reports).

The CRTs look more like a continuation of the fraud in early conservatorship, with their 30-year zero coupon callable Medium Term Notes, redeemed at a 5% and 6% annual rate of return soon after they were issued, as a way to extort money from them, commented on Friday showing documentary evidence.

With the CRTs they made a mistake.

$19B in CRT expenses/recoveries is due because it's barred in the Charter Act, no questions asked.

You are working overtime.

You have nothing else to do?

Team work: Guido posts flawed analyses and I call him out.

I don't think it matters if it takes 6 months or 2 years we can keep buying shares that are way to cheap 🛹🌵🇺🇸

(*) With (G) LOSSES: Likely..........

The process will probably take more than a year. Not happening under Biden, like I said over a year ago.

I doubt anything will happen for another 2 years.

Absolutely

He has a better resume than most of us but that doesn't mean anything in this saga unless you have the powers.

Totally true. He's just speculating like the rest of us, not much info to back it up unfortunately. I can't wait for some news or leakage of the actual release plan.

Looking forward to the GSEs being freed- hopefully sooner than later.

Thanks for spreading the info.

Fnma

Thanks. But we're all doing our share. I appreciate you and Baron taking the time to set our detractors right.

You are the best Guido!

It's team work. Thanks for bringing the article to our attention.

What are we waiting for? Set the capital reserve to a more realistic level. 4% is too much. 2% is plenty. No more capital needed and exit C-ship. https://t.co/7s7PvS5OtW

— Robert (@robjunier) April 25, 2024

Pagliara is now only reaching the brain level of this board..

Don't give me a Ruse,

Don't gimme the Blues,

JustGimme some News,

News I can Use !

"Since then he seems to be less optimistic of anything happening..", like a weather man, change tune every week, every month, every year. you know what it is called, manipulation ? fraudster? . don't speak if you don't know, shut the fok up. stop taking his name here, no one cares, zero credibility.

Hi Mellon, This is one of the most thoughtful posts that I have seen. Thanks! The Lehman reference may or may not be relevant but appreciate the discussion and insight. Thank you for taking the time to post these insights.

If we get a 2x-3x donald bump in November, honestly I may just sell out and end this saga.

We all need to move on with our lives.

Wonderful. You are the true warrior Guido

@realDonaldTrump

— Guido da Costa Pereira (@GuidoPerei) April 27, 2024

Please make getting rid of @FHFA , the most fraudulent government agency in history, a priority in your second term.https://t.co/BT3OkchsXL

The CEO of DJT complained via letter to the big wigs that his stock was being manipulated. Since then, DJT has gained 40%.

Would be nice if Priscilla did the same with FNMA.

Doubt it though.

We wait.

Isn't that what @FHFA was doing? Settling for pennies on the $ as long as donations were made to politically connected nonprofits until stopped by @jeffsessions ?Their conservator swindled hundreds of billions due to Fannie Mae and Freddie Mac through this scheme.

— Guido da Costa Pereira (@GuidoPerei) April 27, 2024

I know that there are a lot of MAGA warriors on this board.. Please see to it that FHFA is on the list of to-be-dismantled.. Put it on your truth social or go to any of his rally and do a slogan, placard and what not..

While i am still 50-50 on Donald doing anything (if its him, which is 50-50 as well), the odds are 100% better than the current admin...

The FHFA heads as well as the GSE heads (indirectly are political appointees) being replaced willbe the first indication of any signs.

And depends on who heads Treasury, who heads FHFA... will tell us a lot..

who wants to put FHFA into his ears on complete dismantlement

https://www.cnn.com/2024/04/27/politics/trump-federal-workers-2nd-term-invs/index.html

It's absolutely insane that this administration will pass the baton to the next one.

Leaving the fate of FnF to the donald.

Well the hit pieces have calmed down since we aren’t close to breaking $2.

It’s a well oiled media machine against the gse’s for years now.

You would think big investors like Ackman would have paid for some news calling out this theft over the years.

With housing being so unaffordable you could get some people listening especially the younger generation that is being screwed these days by all kinds of housing manipulation.

Thanks for the correction

I knew it was something huge like that

Maybe others will understand better

Pagliara is as clueless as we are. Stop idolizing him and you will be fine in a few months

The 30-year fixed-rate mortgage rose to an average 7.17% as of April 25, according to data released by Freddie Mac FMCC on Thursday.

Actually $40 billion a month.

https://www.gata.org/node/6758

Now im really confused, sort of like talking about the weather in Texas and comparing it to ozone gases while sitting in China junkyard. Not a thing of value, for years, towards GSEs.

That was debunked a thousand times.

the Gse’s took $40 billion in toxic MBS on their books at the direction of hank Paulson.

your posts are way too long. Please try to be more concise

Sadly, I’ve been around long enough to remember when the Gse’s took

$40 billion in toxic MBS on their books at the direction of hank Paulson. This allowed the banks to remain solvent when they would have otherwise been sunk, your posts are way too long. Please try to be more concise

I've posted (G) LOSSES. Can't you read?

neither entity met any of the twelve conditions for conservatorship

You are publishing lies!

Hi Mellon,

Great insights and advice!

I certainly appreciate what you have said:

“You should know being humble is lucrative”

Thank you for sharing and being such a positive and inspiring voice of this community.

Michael

So PagLiar admitted to lying?

When will he say Trump Trump Trump?

You and him lie with such a confidence that you make it look like you are some kind of geniuses.

How can anyone say dumb POS Sandra will do 3R and she is working hard?

You guys need to get your head examined.

Glen, I appreciate you taking the time to call out Calabria. Quote: “ So if FHFA is not an independent agency then how does the SPSPA work? The government just signs deals with itself now?”

I encourage you to repent start publishing the truth on your Seeking Alpha. Quit fighting the Common Shareholders. We all know who the real enemy is here. Best Regards

You are publishing lies!

Mr not so much wiseman said Quote: “ The placement in Conservatorship is the only lawful action.” End of Quote

When Paulson met with the directors of Fannie Mae and Freddie Mac to inform them of his intent to take over their companies, neither entity met any of the twelve conditions for conservatorship spelled out in the newly passed HERA legislation. Paulson since has admitted he took the companies over by threat.

HOUSING AND ECONOMIC RECOVERY ACT OF 2008 Page 2734 Twelve Conditions

APPOINTMENT OF THE AGENCY AS CONSERVATOR OR RECEIVER

Link: https://www.congress.gov/110/plaws/publ289/PLAW-110publ289.pdf

The placement in Conservatorship is the only lawful action.

With (G) LOSSES, like to incur (fabricated) losses that deplete their capital. Already commented which ones.

And about the arrangements, all forms part of a SEPARATE ACCOUNT like the FHLBanks in their 1989 bailout by Congress, with assessments sent to a separate account,

.jpeg)

Without realizing that, the FHLBanks had to pay $300 million in interests annually (a 10% rate on a $30B obligation, applying a 0.299% spread over Treasuries. GAO report. It was precisely, Sandra Thompson, who tapped the maximum amount authorized in the law, $30B, just when she arrived at the FDIC in 1990. Not a prudent course. And DeMarco in charge of accounting at GAO, requiring in the report to expel the independent accountant PwC, in order to save recourses. We later knew why: they were just reducing the 40-year interest payments from Funding Corp, where the FHLBanks were Equity holders, that only paid interests, without realizing that their SEPARATE ACCOUNT was for the REDUCTION OF THE PRINCIPAL of the obligation, not just those interests. Then, ST and DeMarco (GAO, UST, FHFA) needed funds to repay the principal. Thank goodness Silicon Valley Bank came across and ST happens to be the FHFA director, authorizing massive leverage in SVB with the advances -loans- from a FHLBank, disregarding the liquidity risk and with an AOCI opt-out election -unrealized losses in Equity- through FDIC regulation. They chose Held-To-Maturity portfolio instead, to evade recording their unrealized losses. Famous Trump's deregulation rhetoric, by removing the safeguards), the rest (on paper) reduces the principal of the RefCorp obligation (initially, a 40-year obligation), but with FnF, the dividend payments are restricted in a provision covered up by all the crooked litigants and the peddlers of the government theft story (the coverup of a material fact is a felony of Making False Statements.)

Therefore, with FnF, the entire assessment was used to repay the principal of the SPS obligation (obligation in respect of Capital Stock), knowing that later on, it will be assessed the true cumulative dividend on SPS the UST is entitled to: like the FHLBanks, it was established a spread over Treasuries, as set forth in the original UST backup of FnF in the Charter Act:

Taking into consideration the Treasury yield as of the end of the month preceding the purchase.

Any FHLBank with a net loss for a quarter, is not required to pay the RefCorp assessment for that quarter.

Fannie Mae - Freddie Mac Commons

Be Bold

Hold for the Gold

June to the moon

Or

Moon in June

Can you guys all just keep to being humble and stop turning this into Reddit?

No one cares who has been posting things firms already read and don't share. No one is a moron or and idiot. No one will get credit for being the most "right" because everyone here is looking at this wrong one way or another.

I'm going to share something as I have had success with listening, and sharing what I can that is goodwill to share given I spend more sweat equity sharing what I don't have to for never getting any return from strangers on a message board.

I usually have some guy tell me he was here longer and I'm wrong and I took all this time just to condense things for you to tie together.

So here's a bit of information from the 336 page PDF report online from the examiner of 'Lehman' (the global parent and its focus on how it consolidated its balance sheet as well as legally did it's infamous accounting "Repo105")... If you think that this isn't all a private and public sector coordinated intentional process playing out to bring new litigation and cross-jurisdictional practices out while the first global "crisis" took place on both paper and the early 80's to 2000's internet connected financial world.... maybe think this whole time the unwinding is being done very carefully but also rolling out at privately coordinated stages as the internet (undersea fiber cables, satellites, software, hardware, data centers etc) in 2024 is more equipped to handle cross-jurisdictional movement of assets, transactions, accounting that works in connected worldwide counterpaties, inter-company cross-jurisdictional entities rolled onto one US based parent balance sheet?

This is something to think about. You are not all wrong, but being convinced you are right enough to call people Reddit level bs back and forth. You should know being humble is lucrative. Being internet "right" will get you nowhere.

Now someone will go ahead and say but mellon that's Lehman! Not Fannie Mae!

You really need to study more if that's how you're going to think of this all.

Repo105 (used to make US Treasuries, Agency Fannie and Freddie securities/bonds 'disappear')

I will leave this for you all to consider a narrow scope of this and calling others idiots for trying to grasp something results from an argument one of you started - Do you want to make money? Or do you want to fight?

If we keep it to sharing insight we can hive mind better results for all investors. No one cares who thinks they are "right"... in the end what a waste of time.

Don't make this Reddit. Work together.

-Mellon

Careful about what you are optimistic about. Sure he can make plans and offer a consent decree but it could be a multi-year process with milestones and achievement requirements and guarantees for affordable housing. Shareholders could still get screwed for many years.

|

Followers

|

2331

|

Posters

|

|

|

Posts (Today)

|

26

|

Posts (Total)

|

802424

|

|

Created

|

07/14/08

|

Type

|

Free

|

| Moderators not one red cent ~NORC~ stockprofitter Ace Trader EternalPatience jeddiemack FOFreddie | |||

Fannie Mae (the Federal National Mortgage Association, or FNMA) is a government-sponsored enterprise (GSE) in the U.S. that was established in 1938. Its main purpose is to provide liquidity, stability, and affordability to the U.S. housing market. It does this by purchasing mortgages from lenders (like banks), packaging them into mortgage-backed securities (MBS), and selling those securities to investors. This process ensures that lenders have more capital to issue new home loans, helping more Americans get access to homeownership.

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |