Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

#SILJ: WHEN Energy Prices Go Parabolic, Gold and Silver Will Go Parabolic x 3

$AGQ......![]() YES SIR

YES SIR

https://www.silverdoctors.com/gold/gold-news/if-energy-prices-go-parabolic-gold-and-silver-will-go-parabolic-x-3/

#SILJ: ABOUT TO BLOW...![]() GO Lowjack

GO Lowjack

https://youtu.be/U_SVexaSMwk?t=138

#SILJ: PETER SCHIFF TIME ...![]() $12.23 BOTTOM SCRAPING..!

$12.23 BOTTOM SCRAPING..!

SILVER $ 23.00

Frankly speaking, wouldn't AGQ be a safer bet here?

#SILJ: GETTING REAL CLOSE NOW...![]()

Bottoms Up Apes! The funs about to begin!!

"The Sunday open price smash was so clearly criminal that the banks can only pull that trick once a decade or so (remember the 2011 silver bull market weekend assassination)"....![]()

https://new.reddit.com/r/Wallstreetsilver/comments/p49ok3/the_silver_bottom_is_in_now_for_the_fun_part/

Ted Butler wrote a nice article after the Sunday drive by shooting of silver and gold by the Comex criminals.

https://silverseek.com/article/bad-ugly-and-good

After ripping the bankster and CFTC criminals he talked about why he is so bullish moving forward. The biggest reason was that the short position of the 4 and 8 largest traders on the Comex was at multi year lows. He expected that trader commitment report after the Sunday Comex crime spree would result in a major additional reduction in the bankster short position. Strong silver rises are almost always preceded by large reductions in bankster shorts (surprise surprise).

https://www.cftc.gov/dea/futures/other_lf.htm

The CFTC report is out and as predicted they was a large reduction in the short position of especially the top 4 shorts.

The bankster criminals have pushed the silver price down since the silver squeeze began with the intention of reducing their short position by squeezing the leveraged technical funds out. Already at multi year lows the top 4 bankster shorts reduced their short position by a huge 15% in one week.

The relentless price reduction that the banks engineered to reduce their short position was in the face of a massive increase in physical investment demand created by the WSS silver squeeze movement and the most silver bullish macro economic conditions imaginable.

The source of silver to meet the huge increase in physical demand could only come from one place the bankster vaults. The banks have been bleeding silver this whole time since the silver squeeze started. They already proved they lie about their inventory in the LBMA.

The silver smash Friday the 6th resulted in silver backwardation between the London physical price and the September Comex contract. This backwardation lasted all week until the Friday pop in price yesterday.

Backwardation is very unusual indicating serious stress in the market. Strong demand especially in the London physical market after criminal comex price smashes suggests that there is no room for a repeat of the bankster smashing tricks at least anywhere near these prices.

The Sunday open price smash was so clearly criminal that the banks can only pull that trick once a decade or so (remember the 2011 silver bull market weekend assassination) .

Despite the top 4 banksters reducing their open interest by over 7 thousand contracts total open interest went up by almost 8 thousand contracts. On the short side the idiot tech funds opened over 9,000 new short positions. The idiot tech funds will add fuel to the fire as they will be forced to cover as the price of silver rises!

The banks have spent months since the squeeze started reducing their short position on the Comex. Why would they be reducing their short position if silver was plentiful. Why would they slam silver at the least liquid time of the week when there was no one at the trading desks. They know that the price of silver has to rise to stop from bleeding out all their silver. Butler thinks they will be very reluctant to add to their short positions going forward. He even believes they may continue to try to cover, buy, more contracts on the coming price reversal.

After the Tuesday trader commitment report open interest went up by 3 thousand both Wednesday and Thursday. Those we the days that the Bureau of Lying Statistics released their fantasy CPI and PPI numbers. Despite an all time record high PPI on Thursday silver was smashed over .40 cents. The banks have to control the narrative to protect the dollar. Did banks add to shorts those couple of days? Maybe but on Fridays large rise of nearly 3% open interest dropped by almost 3000 contracts.

Normally open interest rises on large up days as the banks sell to cap the price rise. Since technically silver looks pretty ugly it is likely banks were actually the buyers on Friday. This is possibly confirmed by the end of the week long backwardation by Fridays close.

Going forward if the banks aren't willing to add to their Comex short position then the price has nowhere to go but to the moon!! as who else will be selling given the macro conditions and the extreme physical shortfall! Remember GME! The bankster can't possibly come close to covering as long as we keep stacking!

Bottoms Up Apes! The funs about to begin!!

https://preview.redd.it/2rco2mf4tbh71.jpg?width=350&format=pjpg&auto=webp&s=f2148bd3577a85834789d55b4a71cc568bc672df

The markets are flat out rigged. We're no longer a Republic but rather a fascist plutocracy and it's racing toward totalitarianism.

Sure silver is cheap, but supply and demand have no bearing on it--it's what the money masters desire that happens.

#SILJ: Moving On A Fantasy...![]() $13.16

$13.16

$23.50 SILVER

https://www.zerohedge.com/markets/peter-schiff-markets-are-moving-fantasy

https://assets.zerohedge.com/s3fs-public/styles/inline_image_mobile/public/inline-images/unicorn-1024x576.png?itok=-eyD-WD0

Peter Schiff: Markets Are Moving On A Fantasy

Tyler Durden's Photo

BY TYLER DURDEN

MONDAY, AUG 09, 2021 - 02:05 PM

Via SchiffGold.com,

We’ve seen a sharp selloff in both gold and silver. Gold was down over $40 an ounce Friday (and nose-dived in early Sunday trading). Meanwhile, the US dollar saw a sharp increase, along with a rise in long-term Treasury yields. The catalyst for these sharp moves was a better-than-expected jobs report and expectation that it will spark a quick pivot to monetary tightening by the Fed. In his podcast, Peter Schiff said the markets are moving on fantasy, not economic reality.

Peter acknowledged that the employment report was better than expected, but not nearly strong enough to justify the gold and silver selloff and the dollar rally.

If you actually look at the employment number but also look at all the other economic data that came out, not only on the day, but on the week, all of this data continues to support a weak US dollar and a stronger gold price. But the markets are not trading on fundamentals. Fundamentals have nothing to do with this market. This market is based on hype, based on momentum, and it’s based on algorithms.”

Peter said these algorithms are a great example of “garbage in, garbage out.” Whenever they get a good economic number, they trigger gold sales and dollar buys. Or whenever somebody at the Fed talks about the mere possibility of tightening, the computers trigger the same moves. But there is no real rational understanding of what the numbers actually mean and the bigger picture.

In the long run, the fundamentals are the only thing that matter. And that’s why in the long run, we’re going to see a big drop in the dollar and a surge in the price of gold.”

Looking at the employment numbers, Peter said there’s a good explanation for the surge in jobs that has nothing to do with the underlying economy. Many red states cut the extra $300 a week from their unemployment benefits. Nearly 1 million people went back to work in July.

All this does is provide more evidence to what obviously was common sense, that paying people not to work results in people not working. And when you stop paying people not to work, they go back to work.”

But that doesn’t mean we have real strength in the US economy.

Meanwhile, average hourly earnings were up 4% year-on-year in July. That signals more pressure on inflation.

This data means we are ostensibly closer to the conditions that the Fed says need to be met in order to raise interest rates and shrink the quantitative easing program.

It’s this anticipation of the tightening process happening sooner rather than later that is the real reason that you saw the big bid in the dollar and the sell-off in gold — despite the fact that none of this really matters because the Fed is just bluffing about what conditions would be necessary for it to tighten monetary policy because I don’t think the conditions exist that would actually cause the Fed to do that.”

The bottom line is this employment report does not signal some booming economy that will allow the Federal Reserve to remove all of the monetary supports holding up the economy.

In fact, absent those monetary supports, the numbers would not be this good. They would be a lot worse if we didn’t have all the help from the Fed. And the Fed knows if they remove that help then everything is going to implode that’s been built on the foundation of artificially low interest rates and quantitative easing.”

Peter noted the big jump in consumer credit in June. This was supported by the Fed’s ultra-low interest rates. And if consumers couldn’t borrow all this money, they wouldn’t have been able to spend it.

Obviously, if consumers were not able to borrow all this money, then they couldn’t have spent. They couldn’t have bought all this stuff but for their ability to borrow money. And the only reason they can borrow money is because the Fed is supplying it. The Fed is making all this money available. It’s holding interest rates artificially low so that people can pay the interest on all this money that they’re borrowing. And that is what is helping to create a lot of these service sector jobs that would not exist but for the ability of Americans to go deeper into debt.”

Ultimately, the inflation train has left the station and if the Fed tries to turn off the monetary spigots, the economy will end up getting derailed. The bubble economy depends on air supplied by the Fed.

If the Fed stops supplying that air, the whole thing is going to deflate.”

Peter goes on to talk about the trade deficit, the extension of the moratorium on student loan payments, the extension on the eviction moratorium, dumb comments by AOC, and some bitcoin news.

With rampant inflation it's hard to believe silver can be held down like this.

It is what it is.

#SILJ: THE CYCLE GOES ROUND..![]() 13.86

13.86

https://www.lbma.org.uk/prices-and-data/london-vault-holdings-data?_cldee=cm9zcy5hLm5vcm1hbkBtZS5jb20%3d&recipientid=contact-0f46f9024fa4e71180d6005056b11ceb-cba3687549d44f718401d09f4f6d1924&esid=75e6c137-b6f6-eb11-8107-005056b11ceb

Record Stocks of Gold Held in London Vaults

As at end July 2021, the amount of gold held in London vaults hit a record high of 9,634 tonnes of gold (+0.49% on previous month), valued at $565.5 billion, which equates to approximately 770,757 gold bars.

We publish total vault holdings data as part of our continued efforts to improve transparency in the Loco London Precious Metals Market, which also includes reporting weekly LBMA Trade Data. The statistics below include the holdings of the London commercial vaults as well as the Bank of England’s gold holdings (the Bank does not hold any silver).

Record Stocks of Gold Held in London Vaults

As at end July 2021, the amount of gold held in London vaults hit a record high of 9,634 tonnes of gold (+0.49% on previous month), valued at $565.5 billion, which equates to approximately 770,757 gold bars.

There was also 36,589 tonnes of silver (-0.32% on previous month), valued at $30 billion, which equates to approximately 1,219,641 silver bars.

These figures provide an important insight into London’s ability to underpin the physical OTC market.

The publication on the fifth business day of each month of the amount of gold the London vaults were holding at the end of the previous month follows the recent move to publish the equivalent data for silver. It represents a continued move towards greater transparency and timeliness.

#SILJ: The Fed Goes Full Dove...![]()

https://www.silverdoctors.com/gold/gold-news/the-fed-goes-full-dove-rocket-fuel-for-gold-silver-and-mining-stocks/

The Fed Goes Full Dove: Rocket Fuel For Gold, Silver and Mining Stocks

August 1, 2021 1232

The degree to which the policy stance has moved back to 100% “dovish” has been understated…

by Dave Kranzler of Investment Research Dynamics

I ordinarily do not spend time reading the FOMC policy statement after it’s released, saving that brain damage for CNBC. But I read the June release to assess for myself whether or not the Fed had tilted toward a more “hawkish” policy stance and decided that it had not. Because I’m starting to turn bullish on the precious metals sector, I decided to read the July release as well and compared it to the language in the June statement to see if the language had shifted. The degree to which the policy stance has moved back to 100% “dovish” has been understated by the mainstream media.

As an example, the Fed removed the dollar amount of its monthly Treasury and mortgage purchases ($80 billion and $40 billion). In its place it said that it would continue buying these securities “at least at the current pace.” I interpret this language – and the removal of the specific dollar amounts – as opening up the possibility of increasing the amount of monthly QE. In other words, removing the specific dollar amount levels is a subtle way to remove the boundaries on the dollar amount. The Fed also minimized its view of price inflation by referencing “muted inflation pressures.”

I have said all along that the Fed would eventually be forced to print a lot more money and I believe the new language and phraseology of the latest policy statement is setting up this eventuality. This will be rocket fuel for gold and silver. Craig “Turd” Ferguson invited me onto this Thursday Conversation podcast to discuss the Fed and the precious metals sector – click on the graphic below to access the fun:

CLICK HERE FOR PODCAST (HOSTED ON TF METALS REPORT)

#SILJ: WoW "POWELL" & "BIDEN" GAME OVER...!

https://new.reddit.com/r/Wallstreetsilver/comments/otsth4/you_may_have_missed_this_yesterday_this_is/

#SILJ: $GORO...PETER_SCHIFF.TIME..---->>>

Goro is sitting on at least two good Silver deposits in Mexico.

Beam it up to another spin off!

#SILJ: The Silver Bull Is Not “Transitory”...!

https://www.silverdoctors.com/silver/silver-news/the-silver-bull-is-not-transitory/

It’s currently sitting near its 50-year lows. For what it’s worth, silver would have to rise by a factor of 63 times just to match its level at its $50 peak in 1980.

The Silver Bull Is Not “Transitory”

It now may be a great time to be bullish on silver. It’s quite clear that silver tends to…

by Peter Krauth via Streetwise Reports

http://www.streetwisereports.com/article/2021/07/06/the-silver-bull-is-not-transitory.html

Transitory. That’s something we’ve been hearing a lot lately.

At its latest FOMC meeting the Fed naturally decided to keep the fed funds rate target at 0.25%.

It also decided not to mess with the $120 billion monthly bond buying program to help “support the flow of credit to households and businesses.” Par for the course.

Meanwhile inflation numbers of the previous four months have been anything but typical. The Fed’s favored Personal Consumption Expenditures Price Index has soared: in February it was 1.6%, March 2.4%, April 3.6% and in May 3.9%.

But headline CPI recently came in at 5%, reaching a 10-year high.

These recent months of elevated and increasing prices may have been exacerbated by price plunges due to the COVID-19 pandemic. But those were for a few months, and their effects should already have dissipated. And yet, they haven’t.

In fact core inflation, which excludes volatile energy and food prices, recently touched 3.8%, its highest in 30 years.

The Fed is looking increasingly wrong in its assessment that the inflation numbers we’ve been seeing are transitory. That means investors would do well to seek shelter from inflation-protection assets. And as I’ll show, for multiple reasons, chief among them is silver.

Silver is Cheap Vs. Stocks

It’s always informative, and sometimes eye-opening, to look at asset prices in relation to other assets. It usually provides good perspective on relative pricing. In that vein, there’s little more surprising than to see just how cheap silver remains relative to the S&P 500 ratio.

The following chart shows the long-term ratio of silver to the S&P 500.

https://www.silverdoctors.com/wp-content/uploads/2021/07/pk17721.jpg

S&P / RATIO SILVER 0.007

It’s currently sitting near its 50-year lows. For what it’s worth, silver would have to rise by a factor of 63 times just to match its level at its $50 peak in 1980. While this might sound sensational, my point is these conditions have existed in the past. This alone suggests explosive potential upside as the stock market matures and likely corrects, while silver continues to climb.

Physical Silver Demand Remains Elevated

Of course, protection from inflation and uncertainty are great reasons to buy and own silver. And as I described above, inflation appears to be coming back with a vengeance. In any case, many investors are hedging against the risk that it becomes entrenched.

In the past 15 months, prices for physical silver are higher than normal. That’s because demand for physical products has remained elevated, leading to sustained high premiums over the spot price. And that’s if you can even get your hands on them. Many of the most popular coins and bars have been persistently out of stock. Premiums are typically 40% or higher, which is nearly triple normal levels.

What’s more, in its recent World Silver Survey 2021, the Silver Institute is forecasting continued strength this year. It expects physical demand to climb by 26% after a very strong 2020. In fact, it foresees overall demand, from all sectors, to be up by 15%, nearly doubling supply growth of 8%.

One area of note is demand from flexible electronics. The Silver Institute indicates demand for silver in printed and flexible electronics is about 48 million ounces annually. It forecasts demand will rise to about 74 million ounces in 2030, absorbing 615 million ounces of silver in this decade alone.

As technology becomes increasingly commonplace in our daily lives the world over, printed and flexible electronics are likely to play a bigger role. Consider that wearable electronics like smartwatches, appliances, medical devices and a host of internet-connected devices are exploding in use. Sensors for light, motion, temperature, moisture and motion all make use of printed and flexible electronics.

So, it’s natural that the electronics subsector promises to be the fastest growing demand for industrial silver usage.

Silver’s Seasonal Outlook is Bullish

Another indicator that now may be a great time to be bullish on silver is its seasonal trend.

The following is a 45-year chart, from 1975 to 2020, which averages the annual silver price tendency.

https://www.silverdoctors.com/wp-content/uploads/2021/07/pk27721.jpg

From this, it’s quite clear that silver tends to mark a mid-year low right at the end of June. And from that point on, on average, the silver price enjoys a strong third quarter.

How to Play Silver Now

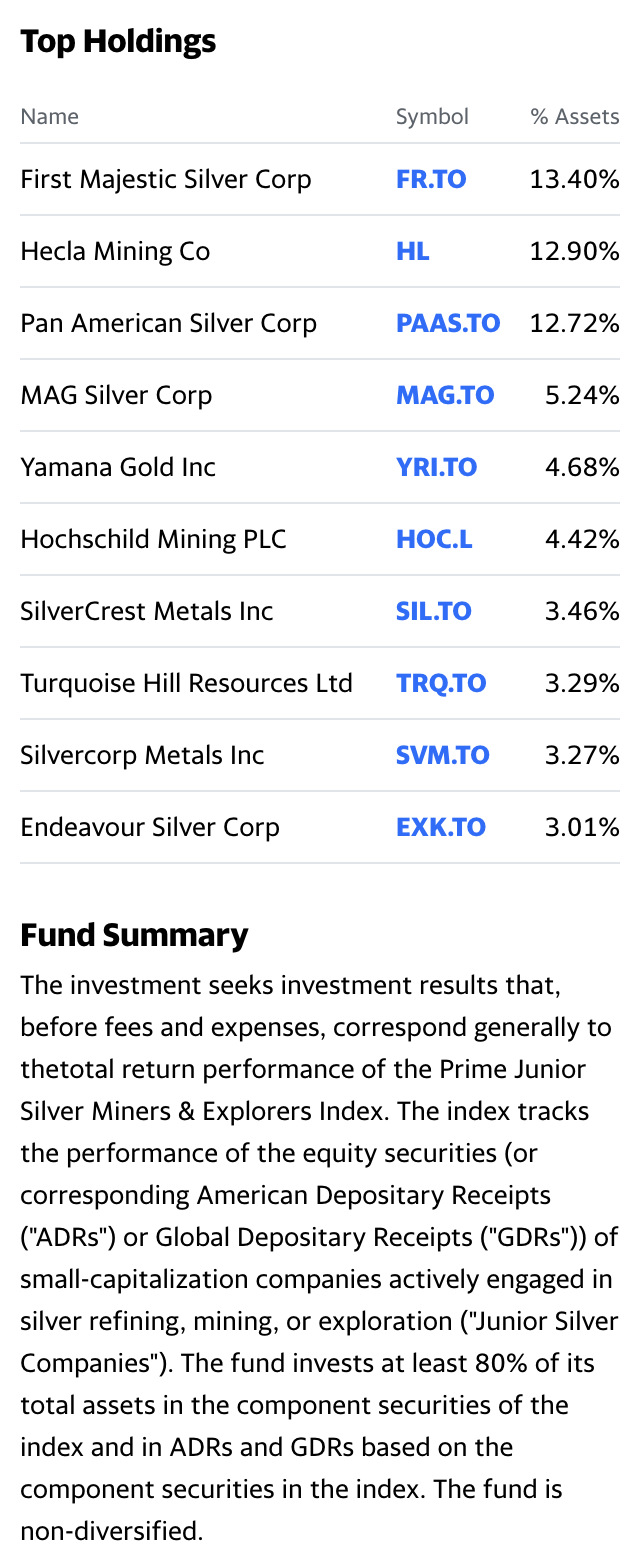

In my view a basket of silver stocks is a great way to approach the high potential of this sector right now. One of my favorite options to accomplish this is the ETFMG Prime Junior Silver Miners ETF (NYSE:SILJ). With over 1 billion in assets and average daily volume over 1.5 million shares, SILJ offer plenty of liquidity to enter and exit at will.

Its top ten holdings represent over 63% of overall assets. And these include Hecla Mining (NYSE:HL), Pan American Silver (TSX:PAAS; Nasdaq:PAAS), First Majestic Silver (TSX:FR; NYSE:AG), MAG Silver (TSX:MAG; NYSE:MAG), Yamana Gold (TSX:YRI; NYSE:AUY), Hochschild Mining (LSE:HOC), SSR Mining (TSX:SSRM; Nasdaq: SSRM), SilverCrest Metals (TSX:SIL; NYSE:SILV), Turquoise Hill (TSX:TRQ; NYSE:TRQ) and Endeavour Silver (TSX:EXK; NYSE:EXK). NYSE:FFMGF

In the end, the Fed is all about managing expectations, not about tell us what we should really expect. Therefore, actively hedging for inflation with a silver miners ETF such as SILJ looks like a great option with a lot of potential upside.

One thing is certain; silver is in the early days of a massive bull market. That’s why in the Silver Stock Investor newsletter I provide my outlook on which silver stocks have the best prospects as this bull market progresses. One stock in the portfolio is up 50%, and several more are up over 30% since the start of 2021 alone. Many offer 5x to 10x return potential in just the next few years, especially as silver heats up.

Remember, silver’s been rising on balance for the last couple of years, and looks primed to rally strongly on the back of multiple drivers.

The key takeaway is that silver’s bull market is anything but transitory.

–Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

Manipulation: I trade futures through TDA and I received a notice saying the close of 1 day does not mean the next open would be in that some trend tip or down (basically paraphrasing). I never did anything much other than day trade 80% of the time. Interesting is how this came out the same day as all grains, metals, stock indices, soft commodities and energies dropped like a rock!!! LOL!!! Buttheads!!!

#SILJ: PEAK PETER SCHIFF...![]() $15.40...SILVER $26.40

$15.40...SILVER $26.40

https://youtu.be/hH-i4rv5zJs?t=430

That is an explosion in the world of finance.

#SILJ: TIME WILL TELL WHAT THE REPO RATE EXPLOSION WAS ALL ABOUT...![]()

https://scontent.fmia1-2.fna.fbcdn.net/v/t1.6435-9/210620176_3006880202964264_8799114802575242054_n.jpg?_nc_cat=100&ccb=1-3&_nc_sid=730e14&_nc_ohc=-d9QhFdo9pUAX_QJt4l&_nc_ht=scontent.fmia1-2.fna&oh=a524c26a1841ed02342c2d1afb5f9647&oe=60E2CC05

#SILJ: THEY ARE TRYING TO SAVE THE $USD....!

91.373...USD INDEX

HANG IN THERE PRO...WON'T LAST VERY LONG...

https://twitter.com/Galactic_Trader/status/1402054573020397572/photo/1

When this #silver thing goes up finally, my prediction is $38, maybe overshoot to $40 briefly, and then we build another base between $34 to $38.

https://pbs.twimg.com/media/E3UY4R5XIAM2RI_?format=png&name=large

It’s on full blast at Costco as ground beef is up 10%

#SILJ: Core Consumer Prices Surge At Fastest Rate Since 1992...!

https://www.zerohedge.com/economics/core-consumer-prices-surge-fastest-rate-1992

Core Consumer Prices Surge At Fastest Rate Since 1992

Tyler Durden's Photo

BY TYLER DURDEN

THURSDAY, JUN 10, 2021 - 08:40 AM

With the world's eyes having moved on from China's rip-roaring PPI (and post-data decision to unleash price controls), this morning's CPI print has been heralded as the arbiter of "is it transitory or not" with some (BofA) even suggesting we are nearing a period of "transitory hyperinflation." The answer for now is - inflation's still accelerating as headline CPI soared 5.0% YoY (hotter than the +4.7% expected). That is the highest level of inflatuion since Aug 2008.

https://assets.zerohedge.com/s3fs-public/styles/inline_image_mobile/public/inline-images/bfmEDCA.jpg?itok=mzHYi7Hy

But it is core CPI that is the huge outlier, soaring 3.8% YoY - the hottest level of inflation since 1992...

https://assets.zerohedge.com/s3fs-public/styles/inline_image_mobile/public/inline-images/bfm1DF9.jpg?itok=OUKs947u

Silver Price Could Explode Higher | Chris Vermeulen • Premiered May 30, 2021

https://youtu.be/VRUP6JvPxnQ

There's a long standing relationship between gold and oil. Now is no different.

http://blog.gorozen.com/blog/the-gold-oil-ratio-revisited

https://www.macrotrends.net/1380/gold-to-oil-ratio-historical-chart

My favorite link:

https://www.visualcapitalist.com/the-gold-oil-ratio-160-years/

Silver is being attacked hard right now.

This guy's a nobody... watch it now... he's fantastic:

https://new.reddit.com/r/Wallstreetsilver/comments/nr5bfb/amc_and_silver_two_fronts_in_the_same_war/

#SILJ: $SILVER ABOUT TO START THE NEXT LEG UP...![]()

https://bullionexchanges.com/customer/account/login

$34 NEXT STOP...!

https://stockcharts.com/c-sc/sc?s=%24SILVER&p=D&b=5&g=0&i=t7964631663c&r=1622110605211

#SILJ: The End Of Paper Gold & Silver Markets...?

The conclusion is that unless the BIS has an ulterior motive to trigger a chaotic financial reset of some sort, it is a case of regulators not understanding the market consequences of their actions.

https://www.zerohedge.com/commodities/end-paper-gold-silver-markets

The End Of Paper Gold & Silver Markets

Tyler Durden's Photo

BY TYLER DURDEN

SATURDAY, MAY 22, 2021 - 09:20 AM

Authored by Alasdair Macleod via GoldMoney.com,

https://www.goldmoney.com/research/goldmoney-insights/the-end-of-paper-gold-and-silver-markets

This article looks at the likely consequences of the Bank for International Settlements’ introduction of the net stable funding requirement (NSFR) for bank balance sheets, insofar as they apply to their positions in gold, silver and other commodity markets.

If they are introduced as proposed, banks will face significant financing penalties for taking trading positions in derivatives. The problem is particularly important for the London gold market, as described in last week’s article on this subject. Therefore they are likely to withdraw from providing derivative liquidity and associated services.

This article delves into the consequences of the NSFR leading to the end of the London forward markets in gold and silver. Replacement demand for physical metal appears bound to rise, and an assessment is therefore made of available gold not tied up in jewellery and industrial uses. An analysis of gold leasing by central banks, leading to double ownership of physical gold, is included.

The conclusion is that unless the BIS has an ulterior motive to trigger a chaotic financial reset of some sort, it is a case of regulators not understanding the market consequences of their actions.

https://assets.zerohedge.com/s3fs-public/styles/inline_image_mobile/public/inline-images/Breather%20%281%29.gif?itok=-Wy5at7a

Introduction

Last week I explained why as they stand the new Basel 3 regulations will make it uneconomic for banks to continue to run bullion trading desks. The introduction of the net stable funding requirement (NSFR) means that mainland European banks, of which ten are LBMA members including the Swiss, will have to comply with the new regulations from the end of June, and all UK banks, in effect the entire banking membership of the London Bullion Market Association (LBMA) will have to comply by the year-end. There are 43 LBMA members listed as banks, and on Comex there are currently 17 with long and 27 with short positions in the Swaps category, which represent bullion bank trading desks in the dominant futures contracts. So being similar, the Comex numbers must broadly replicate those operating in London. It is therefore reasonable to assume that if the LBMA’s banking membership ceases dealings in unallocated bullion, then very few will continue to deal on Comex — the LBMA crowd having ceased taking trading positions.

We are discussing not gold or silver but their derivatives. But there is a problem borne out of the LBMA’s insistence that it involves bullion, albeit unallocated, and not derivatives. The distinction could be important, depending on how the UK regulator applies the NSFR rules. This is because in the calculation of required stable funding, gold consumes 85% of available stable funding while gold liabilities contribute no available stable funding at all. The effect is to impart a negative factor into a bank’s overall net stable funding calculation, making unallocated gold trading hopelessly uneconomic in terms of deployment of total funding capital. The alternative, which does not appear to be under the LBMA’s consideration, is to admit that the whole unallocated gold trading business has nothing to do with gold bullion but is in fact gold derivatives; in which case capital funding penalties under the NSFR would be broadly limited to imbalances between derivative liabilities and derivative assets.

Consequently, it appears that an allocation backstop of 85% of available stable funding (ASF) must be swallowed in the case of gold, which does not appear to be the case if the LBMA confesses to the paper charade.

There are in London, in effect, two markets conflated into one, but they must not be confused. The unallocated market, otherwise known as dealing for forward settlement, is the product of bank credit expansion, not as the LBMA claims, physical metal whose bar origins, weights and fineness are not recorded for convenience’s sake. Perhaps the LBMA would like to let us know where they think it’s all stored; it’s certainly not in LBMA vaults, where after deducting headline figures for custodial gold the float reduces to as little as a few hundred tonnes. Unsurprisingly, the Bank for International Settlements lists these transactions as over-the-counter derivatives for statistical purposes, so we know how they are regarded by the international regulator.

Physical gold held on behalf of customers is never recorded on bank balance sheets. If a bank owns physical gold in its own vault, an independent vault, or allocated to it by another bank acting as custodian with its own vaulting facilities then that appears as an asset on its balance sheet. In that case, it can hedge out the price risk with a matching liability for a zero price-haircut within Basel 3 rules. But this has nothing to do with the NSFR calculation.

Clearly, unless the NSFR calculation is amended at the last moment, following its introduction the character of bullion markets will become markedly different. Gone will be roughly $600bn of paper gold, while presumably some of the paper demand released will migrate to physical metal. There is also the question of how outstanding imbalances will be resolved. This article assesses the consequences.

Unknown motives and politics

It is difficult to understand why the Financial Stability Board, under whose aegis the Basel Committee on Banking Supervision has produced Basel 3, seems intent on destroying derivative markets for gold, silver and also for other commodities. That will be the consequence of the introduction of the NSFR calculation in these markets. As the supreme authority overseeing fiat currencies, the Bank for International Settlements, which oversees the FSB, has no love for gold. One can explain the desire to do away with it: as the riskless form of money, it has been at the centre of monetary affairs for ever and the desire to do away with it must be overwhelming for neo-Keynesian modernists. But if that is the case, then it will be a serious misjudgement, because as this article reveals, the consequence of withdrawing paper supply is likely to drive the gold price significantly higher, along with silver and a host of other important commodity prices. Furthermore, this delayed act, first published in 2014, now comes at a time of rapidly rising commodity prices, reflecting the unprecedented acceleration of global money-printing in 2020, which ironically proves the importance of sound money — gold.

Already, tight, gold silver and commodity markets cannot accommodate a migration out of defunct paper into physical metals and energy without massive price rises to defuse the unsatisfied demand unleashed by this action. Perhaps the regulators at the FSB know this. If they do, then we can only conclude it is a deliberate attempt at a reset of all commodity markets. Bank corruption, particularly in precious metals has been rife: major banks have been regularly fined and continue to manipulate and spoof these markets, fines being seen as little more than a cost of doing business. These are systemic risks a regulator should address. But to assume the FSB is shutting down these paper markets to curb this behaviour exhibits a touching faith in its altruism.

Another popular theory is of an even wider financial reset. The BIS is coordinating research into central bank digital currencies, which if adopted cuts out the commercial banks altogether. In theory, it would allow central banks to more effectively target stimulus and do away with the destabilising cycle of bank credit. The ultimate aim could be to demote and then remove commercial banks from the financial system entirely, in which context the closure of derivative markets by regulatory means makes some sense.

Quantifying gold derivatives

We know from the Bank for International Settlements’ statistics that at the end of the second half of 2020, gold forwards and swaps totalled $530bn, which at the then price of $1898 was the equivalent of 8,685 tonnes of gold in paper form. But other than a triannual survey, the next being due in 2022, according to the BIS this figure is culled from dealers, mainly banks, in only twelve jurisdictions. With respect to commodities and foreign exchanges, these twelve jurisdictions have been found to capture roughly 80% of the total, so grossed up the gold tonnage rises to an equivalent of 10,806.

The LBMA positions are just part of the BIS total. The LBMA only records monthly settlements in London (Loco London) reported by the four clearing members that own and operate London Precious Metals Clearing Limited. They deal solely with LBMA members. The daily average settlement for December 2020 was recorded at 18.9 million ounces, or 588 tonnes. This is only one eighteenth of the BIS figure quoted above. The first thing to note is that daily settlements are not the same thing as outstanding obligations. Furthermore, the BIS statistic includes swaps and forwards not recorded in London nor, for that matter, are they necessarily settled through the LPMCL. But even taking these factors into account the difference between the BIS and LBMA figures still need further explanation.

In an analysis for Hardman & Co published in January 2020, Paul Mylchreest identified two other sources of turnover not included in the LBMA figures: trade between LBMA members and non-members, and central banks dealing in unallocated gold.

Now let us assume that the new Basel regulations have the effect of bringing unallocated bank trading in gold to an end. From the value of outstanding OTC contracts recorded by the BIS adjusted for the trends of its triannual surveys, we can take it to be about 10,800 tonnes. Assuming LBMA members on their own account run relatively minor net positions in the context of this enormous figure, we can assume this outstanding balance is mostly split between central banks, other non-LBMA users of the unallocated market, and OTC trades recorded in other centres.

We have no idea what the central bank position is at any one time, but it would be surprising if they took long positions. Instead, they can be expected to attempt to bolster market confidence in fiat currencies, and in particular the US dollar by selling gold. And by shorting paper gold, they also would seek to encourage physical supply by shaking out weak holders in ETFs. That being the case, not only has the central bank cohort no reason to be long of gold derivatives, but if they have positions, they are almost certainly short. The only likely exception is when a central bank which has leased gold sold into the market might hedge the price risk of not getting it back.

The ending, therefore, of London’s forward settlement market would remove an artificial supply of gold, which we can estimate to be the equivalent of over 10,800 tonnes of gold. To this we should add the net short Swap position on Comex, comprised of bullion bank trading desks, which is currently 486 tonnes. From the main sources of derivative supply, we can therefore see roughly 11,300 tonnes of paper gold supply being withdrawn from the markets if the bullion bank cohort ceases trading in derivative gold. We should now examine the position of central banks further.

Central bank leasing — yet to be resolved

In 2002, Frank Veneroso, a respected analyst, concluded that central banks had leased anything between 10,000—16,000 tonnes of gold at that time — the upper figure being about half of global central bank gold reserves at that time. He gave his reasoning at a speech in Lima on 17 May that year. Central bank leased gold was being sold into the market for dollars, which as part of a carry trade were being reinvested by banks in US Treasury bills and the like, the cost of finance being a gold lease rate of one or two per cent, for a yield of six or seven. Veneroso concluded that much of the gold was repurposed into jewellery and had effectively disappeared from the market.

Between the 1980s and the turn of the millennium, gold had been in a bear market, so the general public, including investing institutions, were either genuine sellers (which was in limited physical quantities) or hedging and speculating on the short side using derivatives. This enabled the bullion banks to hedge out the price risk on gold that would have to be eventually returned to central banks by going long for forward delivery relatively cheaply. But at the time of Veneroso’s speech, gold was $325, having risen from about $255 over the previous fourteen months.

Conditions were changing from a long-established bear market, which favoured gold leasing activity, into the beginning of a new bullish phase. Leasing and even undeclared sales then became a tool for central banks to supply physical liquidity to the gold market, either to rescue bullion banks from being badly squeezed or simply to suppress the price.

The leased gold might not have always left the vaults of central banks in the main gold dealing centres, as Veneroso assumed. However, during the period covered by Veneroso’s analysis, I regularly lunched at The Banker’s Club opposite the Bank of England’s rear entrance in Lothbury. On most days, security vans could be observed entering and leaving the Bank’s premises, transporting physical gold to and from the Bank’s vaults. So perhaps Veneroso was right about physical being sold and delivered into the market, at least to some degree.

In March 2008 gold breached $1,000 for the first time. It would have been impossible for central banks to recover their leased gold by then, because Chinese and Indian demand was beginning to suck physical gold out of Western markets at an alarming rate, in any case significantly faster than any replacement by available mine and scrap supplies. It might appear that leased gold could then have been returned to central banks during the 2012—2015 bear market, but again, Chinese and Indian demand continued to absorb most of the available physical released by any ETF sales and other sources of physical supply.

Alternatively, there would have to have been substantial selling of Western-owned stockpiles, and there is no evidence of that. The best one can say is that in some years, notably 2013, there was some ETF liquidation, but not in the quantities required to resolve the leasing problem. By way of confirmation, in 2014 I was told by one of the large Swiss refiners that they were working double shifts seven days a week turning 400-ounce LBMA bars into 1 kilo 9999 bars, the new Chinese standard. Some of the LBMA bars arrived in a poor condition and obviously had not been touched for decades, scraped out from the darkest recesses in deep-storage vaults. Furthermore, customers from the Middle East were submitting LBMA bars for refining into the new 1 kilo standard and taking them back to be re-vaulted in that form. Not only did this indicate that they were aligning themselves with China’s growing gold presence, but they were definitely not selling. Clearly, the 40% decline in the gold price between September 2011 and December 2015 led to substantial unrecorded increases in physical demand, cleaning out Western vaults. It would not have been possible for central banks to regain their leased gold.

There was, perhaps, further circumstantial evidence of the leasing problem, when Germany decided to withdraw her earmarked gold from the New York Fed’s vaults. The desire to do so was publicly justified on the basis that Germany’s gold no longer needed to be stored abroad, because the threat of a Soviet invasion had been removed by the collapse of communism. But given that the suppression of gold involved leasing and gold swaps in significant quantities in order to maintain the dollar’s credibility, was the true reason nothing to do with Soviet presence but that the Bundesbank suspected its gold was being used for this purpose without its permission?

The Bundesbank’s first action was to request to inspect its gold, a request that was flatly refused. Following that refusal, the decision was taken to begin a process of repatriation. Why it was partial is not entirely clear but could be explained if the Bundesbank suspected it wasn’t actually there. There would be nothing to be gained by demanding the return of all of it, but a partial return might at least enable the New York Fed to find some gold from elsewhere and avoid a public crisis. It turned out that after a series of meetings it was agreed to repatriate only 300 tonnes of Germany’s gold over a period of seven years. In fact, it was returned three years early. The Netherlands also sought, and obtained, 122.5 tonnes of her gold repatriated from New York. Austria arranged for the repatriation of some of its gold from London. While some of these repatriations were in the wake of public demands, they were never important enough to trigger them on their own. But they are consistent with substantial quantities being leased and assessments by the central banks repatriating national gold stocks that they are better secured on their own territory.

Since the days, as Veneroso put it, when central bank gold ended up adorning Asian women, leasing procedures, being targeted at providing liquidity and at supressing the gold price, will have changed. Wherever possible, leased gold need not leave the Bank of England’s or the New York Fed’s vaults. A ledger entry, or book entry transfer confirming it is at the disposal of the lessee is all that’s required, and for the payment for the sale of leased gold to be arranged through the appropriate channels. And from there it can be reassigned by another book entry transfer. We saw this in action when GLD, the gold ETF, ended up with the Bank of England recorded as a sub-custodian holding some 70 tonnes of gold last August precisely in these conditions.

In a leasing contract, ownership remains with the lessor. When arranging gold leasing, we can be sure that in recent times the Bank of England will have comforted lessors that their gold never leaves the Bank of England’s vault, so there’s no need to worry about repossession. This would be an operational justification for continuing leasing activities to offset physical shortages in the market. But the question over how much leased gold that has left the Bank of England and the New York Fed in the past remains unresolved, but it is likely to be in significant quantities with Veneroso’s lower estimate perhaps a bare minimum.

The true quantity of monetary gold

It is commonly stated that the above-ground gold stock is 200,000 tonnes. While that may be a reasonable approximation, most of it is not monetary gold in any sense of the definition and is not therefore its monetary supply.

The statist definition of monetary gold is physical bullion held as part of a central bank’s declared monetary reserves. According to the IMF the current total of all such monetary gold is 35,244 tonnes, though as we have seen from the foregoing paragraphs it is unlikely to be all there or unencumbered. But to this we must add gold bullion hoarded and stored by all other parties on the assumption that it is either a more stable store of monetary value than fiat or an insurance against fiat currencies losing purchasing power. It must be in a form immediately available for monetary purposes, being in bar or coin form. Of an estimated 200,000 tonnes of above ground gold, it is generally assumed that 60% is used for other purposes, mainly jewellery but also some industrial purposes, leaving 80,000 tonnes of monetary gold conforming with our definition. After subtracting official monetary gold from the total, we are left with 44,756 tonnes.

In October 2014 I published an article explaining why China had considerably more gold in storage than her declared reserves, and I estimated that by 2002, when the Chinese government removed the ban on personal ownership and opened the Shanghai Gold Exchange, the state could have acquired up to 25,000 tonnes. Much of this gold would have been leased gold sold into the London market. (Veneroso’s statement about ending up adorning Asian women could not have been true for Chinese women, because they were not permitted to own gold until 2002 and Indian imports were severely restricted for some of the relevant time).

That China had accumulated substantial undeclared bullion stocks was confirmed to me anecdotally by experienced China watchers. If we treat that as part of our estimate of monetary gold, and make an allowance for Russia, of perhaps an unrecorded 5,000 tonnes, monetary gold in the hands of everyone else appears to amount to only 15,000 tonnes.

But this figure will have been bolstered by central bank leasing activity, perhaps even doubled, with leased gold appearing to have two or even more owners, and the actual possession being in undeclared Asian hands. It is in this context that the threat to derivative trading from Basel 3 must be viewed. Not only will paper supply estimated at 11,300 tonnes equivalent in unregulated and regulated markets be threatened with removal, but there is an additional unknown figure of central bank leasing and swaps to be unwound. Obviously, there is significant guesswork involved, but if the numbers outlined herein have the slightest validity, the ending of gold derivative markets, if it is permitted to go ahead, will create a major gold crisis, of which the BIS regulators seem blissfully unaware.

Silver

The mechanics behind dealing in the LBMA silver market are the same as for unallocated gold. The LPMCL settlement system is the same, providing access only to LBMA members. The basis of calculating the net stable funding requirement is the same, so silver derivatives suffer from the same balance sheet disincentives. The principal difference is no silver is vaulted at the Bank of England, nor, so far as we are aware, in the vaults of any other Western central bank.

In terms of demand, it is also primarily an industrial metal, and is mostly consumed. According to the Silver Institute, of a total annual demand of roughly a billion ounces that is forecast in the current year, 253 million ounces is identified as investment demand and a further 150 million ounces as ETF/ETP demand. Bizarrely, the report estimates there will be a fall in ETF demand, when it is already rising. And of the supply, only 18.5% is from recycling.

The BIS figure for outstanding silver OTC derivatives is included in “Other precious metals” at $64bn. The same NSFR treatment for all commodity derivatives, including energy, involves an estimated $858bn’s worth. Not only is the introduction of the NSFR disruptive of precious metal markets, but it also threatens to disrupt wider commodities at a time when their prices are already increasing rapidly as a consequence of falling purchasing powers for fiat currencies.

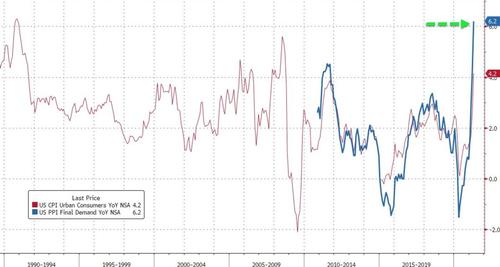

#SILJ: USA Producer Prices Surge Most On Record....!

April 2021 Producer Prices exploded 6.2% YoY

https://www.zerohedge.com/economics/us-producer-prices-surge-most-record

US Producer Prices Surge Most On Record

Tyler Durden's Photo

BY TYLER DURDEN

THURSDAY, MAY 13, 2021 - 08:37 AM

After consumer prices exploded higher yesterday - and were immediately rejected by establishment types as 'transitory', despite the market's obvious disagreement - all eyes were on this morning's producer prices for signs of more pressure. Many were fearful of a repeat of last month's debacle delay (and there were rumors of a softer PPI print leaked earlier today)

The rumors were wrong as April Producer Prices exploded 6.2% YoY (well ahead of the 5.8% expected) which was clearly impacted by the base effect of last year's collapse, but even sequentially, the PPI print was shockingly hot, rising 0.6% MoM (double the +0.3% expected). Excluding food and energy, so-called core PPI advanced even more, or 0.7%.

Source: Bloomberg

That was the biggest YoY jump on record:"There is more inflation coming,” Luca Zaramella, chief financial officer at Mondelez International Inc., said on the food and beverage maker’s April 27 earnings call.“The higher inflation will require some additional pricing and some additional productivities to offset the impact.”

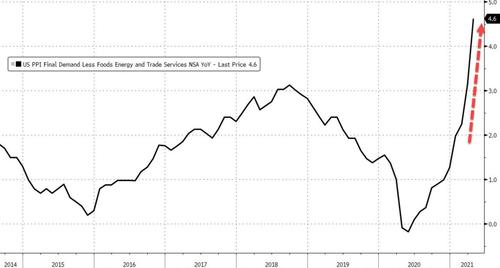

jumped 0.7% from the prior month and increased 4.6% from a year earlier.

Michael Hsu, chief executive officer at consumer-product maker Kimberly-Clark Corp., said in April that the maker of Scott toilet paper and Huggies diapers is “moving rapidly especially with selling price increases to offset commodity headwinds.”

Digging below the surface further, ex-food, energy, and trade, producer prices soared 4.6% YoY, the most on record also.

Source: Bloomberg

Some more details at the final demand level:

Final demand services: Prices for final demand services rose 0.6 percent in April, the fourth consecutive advance. Half of the broad-based increase in April is attributable to the index for final demand services less trade, transportation, and warehousing, which moved up 0.5 percent. Margins for final demand trade services also rose 0.5 percent, and the index for final demand transportation and warehousing services jumped 2.1 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.)

Product detail: Within the index for final demand services in April, prices for portfolio management rose 1.5 percent. The indexes for airline passenger services; food retailing; fuels and lubricants retailing; physician care; and hardware, building materials, and supplies retailing also moved higher. Conversely, margins for machinery and vehicle wholesaling fell 5.6 percent. The indexes for apparel wholesaling and for securities brokerage, dealing, investment advice, and related services also declined.

Final demand goods: Prices for final demand goods climbed 0.6 percent in April, after rising 1.7 percent in March. Leading the April advance, the index for final demand goods less foods and energy increased 1.0 percent. Prices for final demand foods moved up 2.1 percent. In contrast, the index for final demand energy fell 2.4 percent.

Product detail: A major factor in the April increase in prices for final demand goods was the index for steel mill products, which jumped 18.4 percent. Prices for beef and veal, pork, residential natural gas, plastic resins and materials, and dairy products also moved higher. Conversely, the index for gasoline fell 3.4 percent. Prices for chicken eggs and for carbon steel scrap also declined.

Yesterday's data - which showed the strongest monthly gain in the overall consumer price index since 2009 - suggested companies are passing along at least some of the input-price inflation.. and today's PPI surge suggests that push through to CPI is far from over.

Not transitory.

Turning up into the close - for futures, too.

#SILJ: STOP-LOSS TAKE-OUT DAY...![]() $15.50

$15.50

Fantastic video... I look forward to some fireworks by Independence Day.

#SILJ: Basel III Threatens to Break The Gold Derivative Market in June...!

https://goldsilverpros.com/2021/01/22/basel-iii-threatens-to-break-the-gold-derivative-market-in-june/

https://youtu.be/O4DeNbm1BNU?t=21

#SILJ: PETER SCHIFF TIME GOING MAINSTREAM...:-}

https://youtu.be/toGaARDgnjM?t=1400

#SILJ: The most successful juniors could gain 50x or more.

Is Silver Going to $300?

https://www.silverdoctors.com/silver/silver-news/is-silver-going-to-300/

There are some indicators worth examining…

by Peter Krauth via Streetwise Reports

I know this might sound ridiculous to some, but I think silver could reach $300.

No, I haven’t lost my mind. After all, it’s a metal that’s known for massive rallies.

You see, when silver went through its 1970s bull market, it started from a low of $1.31 in October 1971. By the time it reached its peak in 1980, silver had run all the way up to $49. That was a 37x return.

If we consider that silver was priced at $4.20 in late 2001, a 37x return would take it to about $155. However, I think this bull market could be an order of magnitude larger for a number of reasons, the main ones being debt, credit and money printing.

As a result, I think silver’s ultimate peak could be $300, and I won’t rule out possibly even higher.

Bullish Silver Fundamentals

Most developed and many developing nations have been in multi-year or even multi-decade deficit scenarios. This now looks to have become a permanent state, at least until we reach some sort of global financial reset.

The Institute of International Finance explains how the COVID-19 pandemic response added $24 trillion to the global debt mountain last year, to reach a new all-time record high of $281 trillion.

And interest rates being maintained at 5,000-year lows will only encourage more debt. Couple that with many countries borrowing to meet interest payments, and central banks soaking up much of that new sovereign debt, and inflation havens like precious metals gain strong appeal.

Silver in particular has the added benefit of 50% of its demand being industrial. With unprecedented economic stimulus programs, many favoring green energy, silver is uniquely positioned to profit. What’s more, according to Metals Focus, silver supply was down 4% in 2020 by 42 million ounces. According to the Silver Institute, total supply will rise by 8% this year, though total demand will rise nearly twice as much, by 15%, led by industrial, jewelry and physical demand.

So, the fundamental side of silver demand is looking strong, but the technical side is also very bullish.

Bullish Silver Technicals

Let’s consider the gold-silver ratio.

As a quick refresher, the gold-silver ratio is calculated by simply dividing the spot price for one gold ounce by the spot price of one silver ounce. That’s it. Naturally the higher the ratio, the more silver ounces are needed to buy one gold ounce, and vice versa. The most bullish scenario is when the ratio is falling from a high level, ideally from above 80, and the silver price is rising.

Here’s a chart of the gold silver ratio during the 1970s silver bull market.

To me it’s very intriguing to note how recessions, which are the grey vertical bars, tended to mark troughs and/or peaks in the ratio. What’s also interesting is that when silver reached its peak in 1980, the gold-silver ratio ultimately bottomed around the same time at a level near 15, which was below the starting point near 20.

Let’s now move to the current silver bull market that I believe began in 2001. The following chart shows us silver prices since 2000, not adjusted for inflation.

Of course, silver had a tremendous run from $4.20 in 2001 to its 2011 peak at $49. It then corrected until late 2015, then moved sideways until bottoming near $12 last year in March. It had a tremendous move up to $30 within just five months and has been mostly consolidating since.

Now let’s examine the gold-silver ratio action since 2001.

Again we see peaks and troughs tend to occur (though not exclusively) around recessions (gray bars). At silver’s peak in 2011, the ratio bottomed near 33. It then rose almost constantly up to its all-time peak last March at 125, then fell dramatically to its current level around 67, as silver started to significantly outpace gold. Consider that we know from history silver always outperforms gold in precious metals bull markets. So the current action is particularly exciting for silver.

Silver Targets

But what does it all mean for how high the silver price can go? Of course, no one knows for sure. But there are some indicators worth examining for clues and suggestions.

I believe the ratio will ultimately reach a low near 15. And given the inflationary path we’re on, I think gold could peak at $5,000 per ounce. That’s just 2.5 times last August’s peak near $2,000. In fact, I think there’s even a decent chance gold could reach $10,000, which is just five times last August’s peak. But if we stick with $5,000, and an ultimate bottom in the gold-silver ratio of 15, we get ($5,000/15) $333 per ounce of silver.

Let’s look at silver price targets from another angle: inflation.

If we consider inflation-adjusted silver prices going back to 1970, we see that the peak reached in 1980 was actually $120/ounce in today’s dollars, and that’s using government sanctioned inflation statistics, which tend to be well below what we experience in everyday life.

Considering the old way of calculating inflation, which the U.S. abandoned decades ago and I reference below from Shadowstats.com, a realistic inflation rate would have averaged 7%–8% since 1980 (triple official inflation), which would mean an equivalent silver price of $240–$360 dollars at the 1980 peak.

My gold-silver ratio target for silver of $333 is comfortably within the range of $240–$360. If we take the mid-way point between $240 and $360, we get $300. I think that’s as good an estimate as any of where silver can peak in its current bull market.

On this basis, the silver price would need to be up by more than 10x from current levels to reach its ultimate high. Imagine for a moment, if silver were to soar tenfold from here, what the silver producers’ and silver explorers’ share prices would do. It’s not difficult to expect simply spectacular returns. Which is exactly why it’s so attractive to allocate to this space, while being diversified across several stocks, as it’s impossible to know which will do best. Still, odds are very good that if silver goes up by a factor of 10, the average silver stock should easily double that, and be up by a factor of 20, while the most successful juniors could gain 50x or more. That would simply be a repeat of previous bull markets.

Larger silver producers and royalty companies should be seen as core positions to be held for the long term. The more junior explorers should be treated more cautiously as speculations, on which to take profits when they materialize. Selling half of one’s position on a double would be especially sensible.

In any case, I believe it remains early days for silver and silver stocks. I expect to see much higher prices ahead in the metal and the equities. And in my view the current bout of weakness is an opportunity to buy or add to positions in this space. Remember, at $26 silver is still nearly 50% below its all-time nominal high, while gold is just 10% below its all-time nominal high. Silver is clearly the better relative bargain.

In the Silver Stock Investor newsletter, I provide my outlook on which silver stocks have the best prospects as this bull market progresses. Many offer 5x to 10x return potential in just the next few years, especially as silver heats up.

I think silver is currently at or very close to its bottom, but that its ultimate peak could well be in the $300 range.

Either way, silver is headed much, much higher.

–Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

#SILJ: THEY CAN'T CONTROL PM. WHAT THEY CAN DO IS CONTROL THE $US.DOLLAR ....![]() AND THAT IS WHAT THE NWO. IS DOING...! CRASHING THE $USD ... IT'S TIME AS THE PETROL DOLLAR ARE NUMBERED.....

AND THAT IS WHAT THE NWO. IS DOING...! CRASHING THE $USD ... IT'S TIME AS THE PETROL DOLLAR ARE NUMBERED.....![]()

GOLD ..... $6'000

SILVER.....$69...

SEE YOU IN SEPTEMBER....!

|

Followers

|

22

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

212

|

|

Created

|

01/17/14

|

Type

|

Free

|

| Moderators | |||

$SILJ

https://etfmg.com/funds/silj/

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |