#2 UPDATE; 12-15-2021

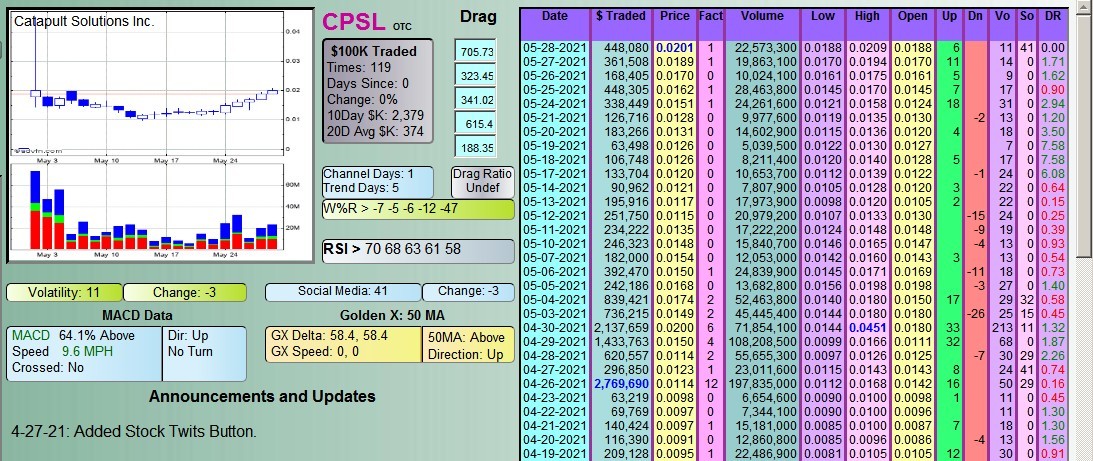

10-q associated wit $dr.foods [Assets As detailed within our balance sheet,

12-15-2021

https://www.otcmarkets.com/filing/html?id=15421361&guid=eKIwk6-ggFhhOth [the above ????? & $DRFS] HMMM !!!!!

the majority of our assets are currently, as of October 31, 2021, Preferred Stock we hold in

Dr. Foods, Inc., formerly known as, “Catapult Solutions, Inc.”

The value of the Preferred stock we hold in Dr. Foods, Inc.

is recorded, as of October 31, 2021, as having a value of $187,500.

Our other assets, as of October 31, 2021 are comprised of cash and

cash equivalents in the amount of $65,887,

‘accounts receivable, other’ of $794 and inventory of $6,089.

The inventory recorded as of October 31, 2021 is comprised of

alternative meat products held by our subsidiary NextMeats France.

UPDATE; 12-15-2021

associated wit NXMH [i wish owner would make some comments fer us'ins]

NEXT MEATS HLDGS INC.

Common Stock

2.78

0.12

4.51%

2.16 / 2.72 (1 x 1)

https://www.otcmarkets.com/stock/NXMH/profile NEXT MEATS HLDGS INC.

3F 1-16-13 EBISU MINAMI

SHIBUYA-KU

TOKYO M0 150-002

Japan

Principal Executive Offices:

2F Shimizu Building

1-34-16 Shinjuku, Shinjuku-ku

Tokyo 1640011

Japan

81-90-6002-4978

info@nextmeats.co.jp

==========================================================

$DRFS

https://www.otcmarkets.com/stock/DRFS/profile c/o Jeffrey DeNunzio

780 Reservoir Avenue

Cranston, RI 02910

Principal Executive Offices:

6-6-20 Minamiaoyama, Minato-ku

6-6-20 Minamiaoyama

Tokyo 107-0062

Japan

(401)-440-9533

ishizuka@nextmeats.co.jp

UPDATE; 11-03-2021 NOW $DRSF DR.FOODS

does dis help some ????? $drsf now was $cpsl

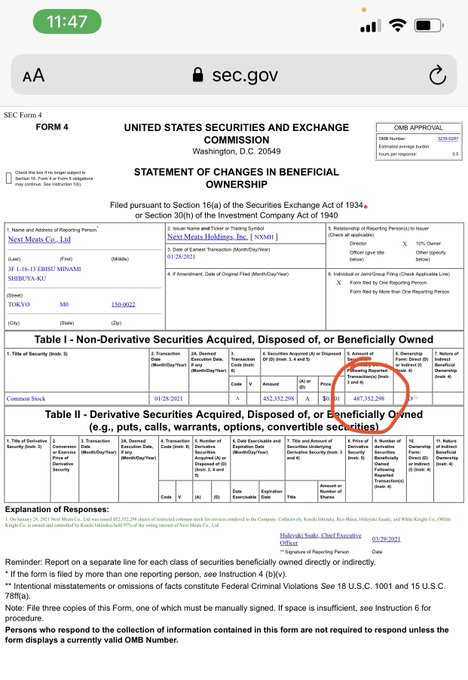

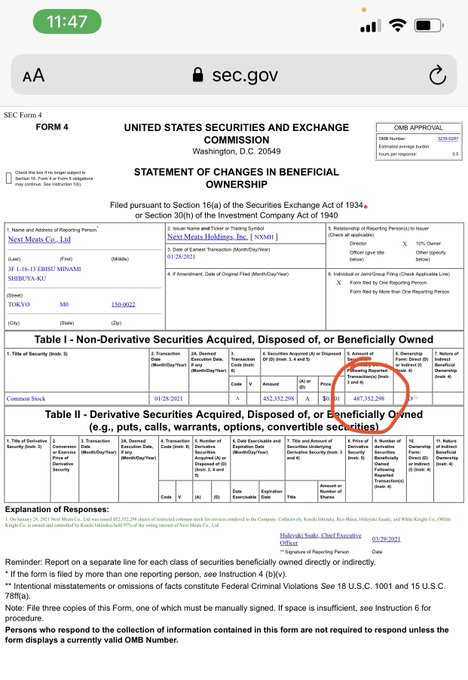

Koichi Ishizuka is the Chief Financial Officer of Next Meats Co., Ltd.

and Next Meats Holdings, Inc.

He is also our sole officer and Director. Koichi Ishizuka also has

control over White Knight Co., Ltd., a Japan Company.

He also serves as sole officer and Director of White Knight Co., Ltd.

Given the pending acquisition of Next Meats Co., Ltd. by Next Meats Holdings, Inc.

is not yet completed (effective),

it should be noted that as of the current date,

majority control of Next Meats Co., Ltd. remains controlled collectively by Ryo Shirai, Hideyuki Sasaki,

and Koichi Ishizuka (personally and via ownership of White Knight Co., Ltd., a Japan Company).

At this time Next Meats Holdings, Inc. is owned and controlled by Next Meats Co., Ltd.

https://sec.report/Document/0001599916-21-000237/ UPDATE; 10-18-2021

$CPSL

https://dr-foods.net/en/ https://dr-foods.net/en/#feature https://dr-foods.net/en/#products https://dr-foods.net/en/#company Microalgae food

Development of plant-based products using microalgae, that support people's health.

09-09-2021

now @ Dr. Foods, Inc. (CPSL) Other OTC - Other OTC Delayed Price. Currency in USD In watchlist Quote Lookup 0.0394-0.0003 (-0.76%) As of 1:13PM EDT. Market open. https://finance.yahoo.com/quote/CPSL?p=CPSL NOW DR. FOODS 08-28-2021

$CPSL

Catapult Solutions Inc.[NO DEBT][SOLAR TECHNOLOGY] (OTCMKTS: CPSL)

Powerful Runner as Blank Check is Acquired by Tokyo, Based Food-Tech Venture Company Next Meats

now DR. FOODS @ yes https://finance.yahoo.com/quote/CPSL?p=CPSL&.tsrc=fin-srch dr.foods

"[AH WOW WOWZER UPDATE MY FRIEND 7 TO SHAREHOLDERS]"

"[Next Meats is currently rapidly expanding its presence to over 9 countries.]"

https://microcapdaily.com/catapult-solutions-inc-otcmkts-cpsl-powerful-runner-as-blank-check-

is-acquired-by-tokyo-based-food-tech-venture-company-next-meats/132442/

[-chart]microcapdaily.com/wp-content/uploads/2014/10/eciggarette.jpg[/chart]

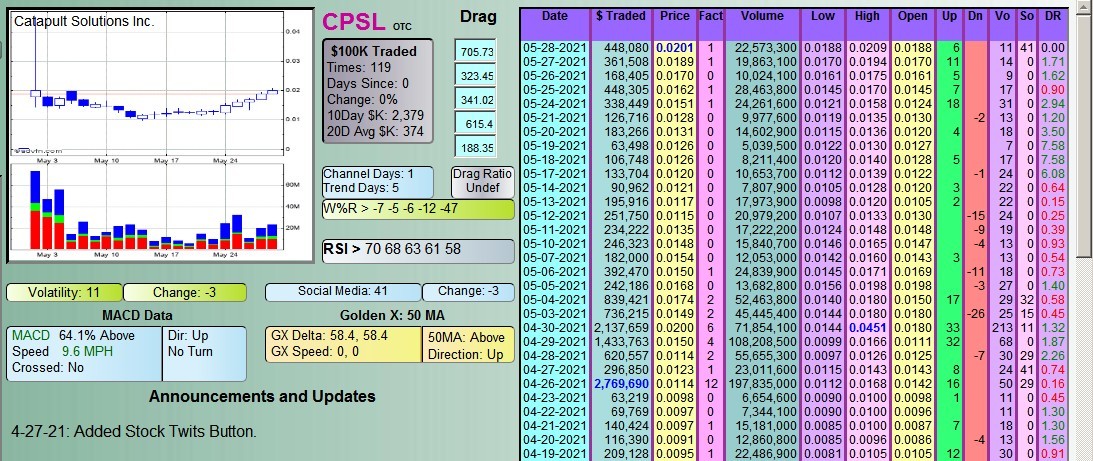

Catapult Solutions Inc. (OTCMKTS: CPSL) is moving northbound with power

as the Company completes the change of control to Next Meats,

a Tokyo, Japan based food-tech venture company trading at $3.80 per share.

Currently under heavy accumulation CPSL has massive liquidity as

legions of new shareholders accumulate emerging as one of the top

most traded stocks in small caps.

The stock is quickly gaining an enormous international following and

is currently on a blue-sky breakout.

On July 28 CPSL filed an 8k reporting the sale of the Company

for $375,000 to NXMH and its controlling shareholder.

Next Meats, a Tokyo, Japan based food-tech venture company trading

at $3.80 per share specializes in the research and development of Japanese-style alternative meat products.

Next Meats is currently rapidly expanding its presence to over 9 countries.

The Company plans to research various types of alternative proteins

in the future and aim to replace all animal meats by 2050.

CPSL is a clean blank check Company with virtually no debt

and will be fully reporting OTC.

Catapult Solutions Inc. (OTCMKTS: CPSL) is a clean blank check company managed by Corporate Revival Services

(https://www.corporaterevivalservices.com), ;

CPSL will be a FULLY REPORTING Company as per the 10-12G filings.

As you will see from the below,

M/D significantly reduced the A/S by 10B

and wiped-out preferred shares meaning no conversions leaving us

with a 2.4B A/S

On July 28 CPSL filed an 8k reporting the sale of the Company

for $375,000 to NXMH and its controlling shareholder.

NXMH is currently trading at $3.80 per share. The 8k states:

“On July 20, 2021, Catapult Solutions, Inc.,

a Nevada Corporation entered into a Share Purchase Agreement by

and among CRS Consulting, LLC, a Wyoming Limited Liability Company.

White Knight Co., Ltd., a Japan Company and Next Meats Holdings, Inc.,

a Nevada Company pursuant to which, on July 23, 2021,

CRS sold 10,000 shares of the Company’s Series Z Preferred Stock,

representing approximately 81.20% voting control of the Company;

5,000 shares of Series Z Preferred Stock were transferred to WKC

and 5,000 shares of Series Z Preferred Stock were transferred to NXMH.

WKC and NXMH paid consideration of three hundred seventy-five thousand dollars ($375,000)

(the “Purchase Price”).

The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company,

with WKC and NXMH, becoming the Company’s largest controlling stockholders.

The sole shareholder of White Knight Co., Ltd., a Japanese Company,

is Koichi Ishizuka.

The majority shareholder of Next Meats Holdings, Inc.,

a Nevada Company, is Next Meats Co., Ltd. Next Meats Holdings, Inc.

is currently an SEC reporting company.

https://twitter.com/JustJessTrading/status/1420374120131272709

https://microcapdaily.com/catapult-solutions-inc-otcmkts-cpsl-powerful-runner-as-blank-check-is-acquired-by-tokyo-based-food-tech-venture-company-next-meats/132442/

========================================================

The new majority shareholder NXMH Based in Tokyo, Next Meats is a food-tech venture company that specializes in the research and development of Japanese-style alternative meat products.

Its journey of product development began in 2017,

and the company was officially established in June of 2020.

In December 2020 they announced their partnership with Toyota-Tsusho Corporation, and was listed on the American OTCBB in January of 2021.

The company is currently rapidly expanding their presence to over 9 countries.

They plan to research various types of alternative proteins in the future and aim to replace all animal meats by 2050.

[-chart]pbs.twimg.com/media/E7inik_VcAM7hVl?format=jpg&name=large[/chart]

Next Meats Co, the alternative meat venture company from Tokyo,

is known for commercializing the world’s first vegan Japanese

barbecue meat analogues—the NEXT Yakiniku series,

as well as the NEXT Gyudon,

which is a vegan simulation of the traditional Japanese beef bowl.

Next Meats has recently gained attention for successfully developing

an alternative egg product,

the NEXT Egg 1.0, and also launching the NEXT Yakiniku in the U.S.

and selling out their first release of products in a day.

Today, Next Meats just revealed their plan to start the construction

of their eco-friendly production facility called the “NEXT Factory”,

in Niigata, Japan, which is the hometown of Ryo Shirai,

one of the two co-founders.

This factory will be a one-stop hub dedicated to alternative protein products

and will include everything from an R&D lab to the production line.

This kind of large-scale facility specifically dedicated to the development of alternative proteins is likely to be the first of its kind in Japan*.

In a press conference announcing the construction of the facility, founders Hideyuki Sasaki

and Ryo Shirai

revealed that the NEXT Factory will incorporate DX systems as well

as solar panels and other sustainable technologies,

and its completion is scheduled for next summer. =========================================================================================================

UPDATE; 08-25-2021

$CPSL

SOME changes with entity, i do see name change to DR. FOODS, INC.

https://www.otcmarkets.com/filing/html?id=15185323&guid=4up1k6FKju8xE3h

reading dis below seems like ah buyout is coming imho.

Our majority shareholders, collectively, Next Meats Holdings Inc.,

and White Knight Co., Ltd.,

and our Board of Directors, comprised solely of Koichi Ishizuka,

executed a resolution to ratify, '

affirm, and

approve a name and

ticker symbol change of the Company.

Pursuant to the aforementioned resolution, the name of the Company was approved to be changed from Catapult Solutions, Inc., to Dr. Foods, Inc.

A Certificate of Amendment to change our name was filed with the Nevada Secretary of State on August 24, 2021 with an effective date of the date of submission.

Effective August 24, 2021:

Article 1 of the certificate of incorporation now states as follows:

1. The name of the Corporation is Dr. Foods, Inc.

The foregoing description of the Amendment to the Company’s Certificate of Incorporation is not complete

and is qualified in its entirety by reference to the full text of the Amendment,

a copy of which is filed as Exhibit 3.1, to this Current Report on

Form 8-K and is incorporated by reference herein.

Item 8.01 Other Events.

Currently, as of the filing date of this report,

the Company is pending a FINRA corporate action to effectuate the aforementioned name change from Catapult Solutions, Inc.

to Dr. Foods, Inc., and to change our ticker symbol.

The legal date of our name change, August 24, 2021,

may differ from the market release date when posted on FINRA’s daily list.

An 8-K will be filed with the Commission after completion of our corporate actions that will detail the new CUSIP number for our

common stock and ticker symbol.

The Company’s current business plan is to explore and evaluate

various business opportunities in,

amongst other industries,

the alternative meats and lab-grown food product sectors including

but not limited to mergers,

acquisitions, or business combination transactions after which

the Company would cease to be a "shell" or "blank check" company.

The Company’s principal business objective for the next 12 months

and beyond such time will be to achieve long-term growth potential through a combination with a business rather than immediate,

short-term earnings.

The Company will not restrict its potential candidate target companies to any specific business

or geographical location and,

thus, may acquire any type of business.

The Company may merge with or acquire another company in which the promoters,

management, or promoters’ or managements’ affiliates or associates, directly or indirectly, have an ownership interest.

(a) Potential for growth, indicated by new technology, anticipated market expansion or new products;

(b) Competitive position as compared to other firms of similar size and experience within the industry segment as well as within the industry as a whole;

(c) Strength and diversity of management, either in place or scheduled for recruitment;

(d) Capital requirements and anticipated availability of required funds, to be provided by the Company or from operations, through the sale of additional securities, through joint ventures or similar arrangements or from other sources;

(e) The cost of participation by the Company as compared to the perceived tangible and intangible values and potentials;

(f) The extent to which the business opportunity can be advanced;

(g) The accessibility of required management expertise, personnel, raw materials, services, professional assistance and other required items; and,

(h) Other relevant factors.

In applying the foregoing criteria,

no one of which will be controlling,

management will attempt to analyze all factors and circumstances

and make a determination based upon reasonable investigative measures and available data. Potentially available business opportunities may occur in many different industries,

and at various stages of development, all of which will make the

task of comparative investigation and analysis of such business opportunities extremely difficult and complex.

Due to the Company's limited capital available for investigation,

the Company may not discover or adequately evaluate adverse facts

about the opportunity to be acquired.

A large number of established and well-financed entities,

including venture capital firms, are active in mergers and

acquisitions of companies which may be a merger or acquisition

candidate for the Company.

Nearly all such entities have significantly greater financial resources,

technical expertise and managerial capabilities than the Company and, consequently,

we will be at a competitive disadvantage in 'identifying possible business opportunities and successfully completing a business combination.'

Moreover, the Company will also compete with numerous other small

public companies in seeking merger or acquisition candidates.

[-chart]content.edgar-online.com/edgar_conv_img/2021/08/25/0001599916-21-000195_IMAGE_005.JPG[/chart]

08-23-2021 filing

$CPSL CURRENT

Catapult Solutions, Inc. 08-23-2021

https://www.otcmarkets.com/filing/html?id=15179575&guid=D6F1kaMsLmwLtth

Notes to Audited Financial Statements

(Unaudited)

Note 1 Organization and Description of Business

Catapult Solutions, Inc. (we, us, our, the "Company" or the "Registrant") was incorporated in the State of Nevada on February 26, 2021.

On February 26, 2021, Jeffrey DeNunzio was appointed Chief Executive Officer, Chief Financial Officer, and Director of Catapult Solutions, Inc.

The Company was created for the sole purpose of participating in a Nevada holding company reorganization pursuant to NRS 92A.180, NRS 92A.200, NRS 92A.230 and NRS 92A.250.

The constituent corporations in the Reorganization were

Ambient Water Corporation (“AWGI” or “Predecessor”),

Catapult Solutions, Inc. (“Successor”), and Catapult Merger Sub, Inc. (“Merger Sub”).

Our director is, and was, the sole director/officer of each constituent corporation in the anticipated Reorganization.

Catapult Solutions, Inc. issued 1,000 common shares of its common

stock to Predecessor and Merger Sub issued 1,000 shares of its

common stock to Catapult Solutions, Inc. immediately prior to the Reorganization.

As such, immediately prior to the merger, Catapult Solutions, Inc. became a wholly owned direct subsidiary of Ambient Water Corporation

and Merger Sub became a wholly owned and direct subsidiary of Catapult Solutions, Inc.

Pursuant to the above, on April 23, 2021, Ambient Water Corporation filed Articles of Merger with the Nevada Secretary of State.

The merger became effective on April 28, 2021, at 4:00 PM EST (“Effective Time”).

At the Effective Time,

Predecessor was merged with and into Merger Sub (the “Merger),

and Predecessor became the surviving corporation.

Each share of Predecessor common stock issued and outstanding immediately prior to the Effective Time was converted into one

validly issued,

fully paid and non-assessable share of Catapult Solutions, Inc.’s

common stock.

At the time of the merger, 10,000 shares of Series Z Preferred Stock were issued to CRS Consulting, LLC,

a Wyoming LLC owned and controlled by Jeffrey DeNunzio,

Thomas DeNunzio and

Paul Moody,

for services rendered to the Company.

Series Z Preferred Stock has no conversion rights to any other class, and every vote of Series Z Preferred Stock has voting rights equal to 1,000,000 votes of Common Stock.

On July 20, 2021, the Company entered into a Share Purchase Agreement (the “Agreement”)

by and among CRS Consulting, LLC,

a Wyoming Limited Liability Company (“CRS”), White Knight Co., Ltd.,

a Japan Company (“WKC”), and Next Meats Holdings, Inc.,

a Nevada Company (“NXMH”), pursuant to which, on July 23, 2021, (“Closing Date”),

CRS sold 10,000 shares of the Company’s Series Z Preferred Stock, representing approximately 81.20% voting control of the Company;

5,000 shares of Series Z Preferred Stock were transferred to WKC

and 5,000 shares of Series Z Preferred Stock were transferred to NXMH.

WKC and NXMH paid consideration of three hundred seventy-five thousand dollars ($375,000) (the “Purchase Price”).

The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company,

with WKC and NXMH, becoming the Company’s largest controlling stockholders.

On the Closing Date, July 23, 2021, Mr. Jeffrey DeNunzio resigned as

the Company’s Chief Executive Officer,

Chief Financial Officer,

President, Secretary, Treasurer.

In addition, Mr. DeNunzio resigned as Director on the Closing Date

and his resignation is effective upon the 10th day after the mailing

of the Company’s information statement on Schedule 14f-1 to the Company’s stockholders.

On the Closing Date, Mr. Koichi Ishizuka was appointed as the

Company’s Chief Executive Officer,

Chief Financial Officer,

President, Secretary,

Treasurer,

and Director.

Mr. Ishizuka’s appointment as Director is to be effective upon the

10th day after the mailing of the Company’s information statement

on Schedule 14f-1 to the Company’s stockholders.

As of June 30, 2021, the Company had not yet commenced any operations.

The Company has elected March 31st as its year end.

Note 2 Summary of Significant Accounting Policies

Basis of Presentation

This summary of significant accounting policies is presented to

assist in understanding the Company's financial statements.

These accounting policies conform to accounting principles,

generally accepted in the United States of America,

and have been consistently applied in the preparation of the

financial statements.

Use of Estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates

and assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. In the opinion

of management, all adjustments necessary to make the financial statements not misleading have been included.

Actual results could differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents.

Cash and cash equivalents on June 30, 2021, and March 31, 2021, were $0 for both periods.

Income Taxes

The Company accounts for income taxes under ASC 740, “Income Taxes.” Under the asset

and liability method of ASC 740, deferred tax assets

and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases.

Deferred tax assets and liabilities are measured using enacted tax

rates expected to apply to taxable income in the years in which

those temporary differences are expected to be recovered or settled.

The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs.

A valuation allowance is provided for certain deferred tax assets if

it is more likely than not that the Company will not realize tax assets through future operations.

No deferred tax assets or liabilities were recognized on June 30, 2021.

Basic Earnings (Loss) Per Share

The Company computes basic and diluted earnings (loss) per share

in accordance with ASC Topic 260, Earnings per Share.

Basic earnings (loss) per share is computed by dividing net income (loss) by the weighted average number of common shares outstanding during the reporting period.

Diluted earnings (loss) per share reflects the potential dilution

that could occur if stock options

and other commitments to issue common stock were exercised or

equity awards vest resulting in the issuance of common stock that

could share in the earnings of the Company.

The Company does not have any potentially dilutive instruments as

of June 30, 2021, and, thus, anti-dilution issues are not applicable.

Fair Value of Financial Instruments

The Company’s balance sheet includes certain financial instruments.

The carrying amounts of current assets and current liabilities approximate their fair value because of the relatively short period

of time between the origination of these instruments and their

expected realization.

ASC 820, Fair Value Measurements and Disclosures,

defines fair value as the exchange price that would be received

for an asset or paid to transfer a liability (an exit price) in the

principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date.

ASC 820 also establishes a fair value hierarchy that distinguishes between

(1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and

(2) an entity’s own assumptions about market participant

assumptions developed based on the best information available in

the circumstances (unobservable inputs).

The fair value hierarchy consists of three broad levels,

which gives the highest priority to unadjusted quoted prices in

active markets for identical assets or liabilities (Level 1)

and the lowest priority to unobservable inputs (Level 3).

The three levels of the fair value hierarchy are described below:

- Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets

or liabilities.

- Level 2 - Inputs other than quoted prices included within Level 1

that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets or liabilities

in active markets;

quoted prices for identical or similar assets or liabilities in markets that are not active;

inputs other than quoted prices that are observable for the asset

or liability (e.g., interest rates); and inputs that are derived principally from or corroborated by observable market data by correlation or other means.

- Level 3 - Inputs that are both significant to the fair value measurement and unobservable.

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of

June 30, 2021.

The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values due to the short-term

nature of these instruments. These financial instruments include

accrued expenses.

F-5 UPDATE; 08-15-2021 $NXMH RELATED TO $CPSL $NXMH WAS SPAC ENTRY @ $11.48 NOW @ $5.90

Pink Current Information https://www.otcmarkets.com/stock/NXMH/profile

$CPSL [-chart]pbs.twimg.com/media/E8NZBDMX0AUm7bu?format=jpg&name=360x360[/chart]

[-chart]pbs.twimg.com/media/E8NZBDOWUAgWhe-?format=jpg&name=small[/chart]

courtesy of Tyler hackworth @Tylerhackworth3

New dd on $cpsl $nxmx

$Cpsl filing stating $nxmh shares Thinking faceParent company, umbrella, Merging together?

Who becomes Next Meats Co. Ltd is the question Thinking face

@JustJessTrading

@AlexDelarge6553

@MosiahWillis

@HDOGTX

@HectorCannabis

@KingShard1

UPDATING; 08-04-2021

COURTESY OF Tyler hackworth @Tylerhackworth3 $CPSL

https://pbs.twimg.com/media/E790I9KXIAA0KU3?format=jpg&name=large [-chart]pbs.twimg.com/media/E790I9KXIAA0KU3?format=jpg&name=large[/chart]

UPDATING; 08-04-2021

@ PINKS NO DISCRIPTION STILL NO CHANGE !!!!!

@ pinks logo & address , low share count $CPSL MKT CAP 121,552,021

08/03/2021

https://backend.otcmarkets.com/otcapi/company/logo/CPSL CPSL SECURITY DETAILS Share Structure

Market Cap Market Cap.121,552,021

08/03/2021

Authorized Shares.....2,400,000,000

08/03/2021

Outstanding Shares...2,315,276,582

08/03/2021

Restricted.....................169,604,806

08/03/2021

Unrestricted...............2,145,671,776

08/03/2021

Held at DTC...............2,032,244,190

08/03/2021

Float............................2,032,244,190

03/31/2021

Par Value.0.001

ADDING 07-31-2021

Courtesy of JESS 'Catapult Solutions Inc. (CPSL)'

$CPSL Remember this $NXMH is just one of the companies that is a

major shareholder in $CPSL Next Meat $NXMH is all over the world

and headed to NASDAQ They didn’t pay $375,000 for $CPSL for nothing!

Big things coming! Mark it! 'Next Meats Holdings Inc. (NXMH)'

RE;

NXMH also signed a research & development agreement with Nagaoka University of Technology to look into epigenetic applications in creating new alternative meat products.

https://t.co/K286yn1bFb?amp=1 [-chart]pbs.twimg.com/media/E7inik_VcAM7hVl?format=jpg&name=large[/chart]

UPDATING 07-31-2021

SEEING IS BELIEVING CATAPULT SOLUTIONS, INC. : Entry into a Material Definitive Agreement, Changes in Control or Registrant, Change in Directors or Principal Officers,

Financial Statements and Exhibits (form 8-K)

07/28/2021 | 09:13am EDT

Item 1.01 Entry into a Material Definitive Agreement.

https://www.marketscreener.com/quote/stock/CHINA-PRECISION-STEEL-IN-16561453/news/CATAPULT-SOLUTIONS-INC-Entry-into-a-Material-Definitive-Agreement-Changes-in-Control-or-Registr-35989965/ 07/28/2021 | 09:13am EDT

share with twitter

share with LinkedIn

share with facebook

Item 1.01 Entry into a Material Definitive Agreement.

On July 20, 2021, Catapult Solutions, Inc., a Nevada Corporation (the "Company"),

entered into a Share Purchase Agreement (the "Agreement")

by and among CRS Consulting, LLC,

a Wyoming Limited Liability Company ("CRS"), White Knight Co., Ltd.,

a Japan Company ("WKC"),

and Next Meats Holdings, Inc., a Nevada Company ("NXMH"), pursuant

to which, on July 23, 2021, ("Closing Date"),

CRS sold 10,000 shares of the Company's Series Z Preferred Stock, representing approximately 81.20% voting control of the Company;

5,000 shares of Series Z Preferred Stock were transferred to WKC

and 5,000 shares of Series Z Preferred Stock were transferred to NXMH.

WKC and NXMH paid consideration of three hundred seventy-five thousand dollars ($375,000) (the "Purchase Price").

The consummation of the transactions contemplated by the Agreement resulted in a change in control of the Company, with WKC and NXMH, becoming the Company's largest controlling stockholders.

The sole shareholder of White Knight Co., Ltd., a Japanese Company,

is Koichi Ishizuka. The majority shareholder of Next Meats Holdings, Inc.,

a Nevada Company, is Next Meats Co., Ltd. Next Meats Holdings, Inc.

is currently an SEC reporting company.

Except as described herein, there were no arrangements or

understandings among former and new control parties with respect

to the election of directors or other matters.

As required to be disclosed by Item 403(c),

there are no arrangements, known to the Company,

including any pledge by any person of securities of the Company,

the operation of which may at a subsequent date result in a change

in control of the Company.

The foregoing description of the Agreement is a summary only and is qualified in its entirety by reference to the complete text of the Agreement filed herewith as Exhibit 10.1.

Item 5.01 Change in Control of Registrant.

The information set forth under Item 1.01 above is incorporated by reference into this Item 5.01.

Pursuant to the information disclosed above, in Item 1.01 White Knight Co., Ltd.,

a Japan Company, and Next Meats Holdings, Inc. are now our largest controlling shareholders.

The sole shareholder of White Knight Co., Ltd., a Japanese Company,

is Koichi Ishizuka.

The majority shareholder of Next Meats Holdings, Inc. is Next Meats Co., Ltd.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain officers;

Compensatory Arrangements of Certain Officers.

On the Closing Date, July 23, 2021,

Mr. Jeffrey DeNunzio resigned as the Company's Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer.

In addition, Mr. DeNunzio resigned as Director on the Closing Date

and his resignation is effective upon the 10th day after the mailing

of the Company's information statement on Schedule 14f-1 to the Company's stockholders.

On the Closing Date, Mr. Koichi Ishizuka was appointed as the Company's Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director.

Mr. Ishizuka's appointment as Director is to be effective upon the

10th day after the mailing of the Company's information statement

on Schedule 14f-1 to the Company's stockholders.

The resignation of Mr. DeNunzio was not the result of any

disagreement with the Company on any matter relating to its operations, policies, or practices.

There is no arrangement or understanding among the newly appointed officers and directors or any other person pursuant to which they

were appointed as a director and officer of the Company.

Mr. Koichi Ishizuka does not have a direct or indirect material

interest in any transaction required to be disclosed pursuant to

Item 404(a) of Regulation S-K.

At this time, the Company does not have any written employment agreements or other formal compensation agreements with our

new officer and director.

Compensation arrangements are the subject of ongoing development

and the Company will disclose any compensatory arrangements entered

into in the future.

The biographical information of Mr. Koichi Ishizuka is below:

Mr. Koichi Ishizuka, age 49,

attended the University of Aoyama Gakuin where he received his MBA

in 2004. Several years later in 2011 he graduated from the Advanced Management Program at Harvard School of Business.

Following Mr. Ishizuka's formal education,

he took a position as the head of marketing with Thomson Reuters,

a mass media and information firm.

Thereafter, he served as the CEO of Xinhua Finance Japan in 2006,

Fate Corporation in 2008, and LCA Holdings., Ltd in 2009.

Currently, Mr. Ishizuka serves as the Chief Executive Officer of

OFF Line Co., Ltd., Photozou Co., Ltd., Photozou Holdings, Inc.,

Photozou Koukoku Co., Ltd., Off Line International, Inc.

and OFF Line Japan Co., Ltd.

He has held the position of CEO with OFF Line Co., Ltd. since 2013, Photozou Co., Ltd since 2016,

Photozou Holdings, Inc since 2017, Photozou Koukoku Co., Ltd. since 2017, Off Line International, Inc. since 2019 and OFF Line Japan Co., Ltd. since 2018.

On November 18, 2020, he was appointed as Chief Financial Officer of Next Meats Holdings, Inc.,

a position he still holds today. On May 7, 2021, Mr. Koichi Ishiukza

was appointed as the Chief Executive Officer, Chief Financial Officer, President, Secretary, Treasurer, and Director of Business Solutions Plus, Inc., which is now known as WB Burgers Asia, Inc.

ITEM 9.01. Financial Statements and Exhibits.

(d) Exhibits

NUMBER EXHIBIT

10.1 Share Purchase Agreement between Catapult Solutions, Inc.,

CRS

Consulting, LLC, White Knight Co., Ltd. and Next Meats Holdings, Inc.

dated July 20, 2021.

17.1 Officer and Director Resignation Letter $CPSL Filing Agent: DeNunzio Jeffrey

pthi.htm 10-12G

07-26-2021

https://sec.report/Document/0001599916-21-000130/ Commission file number: _________

https://sec.report/Document/0001599916-21-000130/ ;

Prime Time Holdings, Inc.

(Name of Small Business Issuer in its charter)

07-21-2021 Now current; [-chart]www.otcmarkets.com/logos/tier/PS.png[/chart]

Pink Current Information

[-chart]www.otcmarkets.com/badges/verified-profile.png[/chart]

Verified Profile 03/2021

[-chart]www.otcmarkets.com/badges/transfer-agent.png[/chart]

Transfer Agent Verified

07-19-2021 UPDATE;

MENTIONED HERE;

Zidars 07/19/2021 Today Monday ~ 40-50 'HOT' PENNY/SUBPENNY STOCKS NEWS~RUMORS/ MERGERS JVs Pink Current https://www.youtube.com/watch?v=sgWOyStIt6w&ab_channel=FrameworkFortune UPDATE; 06-01-2021

THANK YOU, PERFECT SAUCER BREAKOUT READ. $CPSL I LIKE $HPIL LOTS

[-chart]investorshub.advfn.com/uimage/uploads/2021/5/28/yfrhtDDAmandaCPSL.jpg[/chart]

https://www.corporaterevivalservices.com/status-updates Within this subsection of this website page, “The Company,” and or “Ambient Water” refer to Ambient Water Corp., a Nevada Corporation.? AWGI-Court Order-Signed-A-20-823994-P.pd EVENT: ORDER GRANTING APPLICATION FOR THE APPOINTMENT OF JEFFREY DENUNZIO On February 24, 2021, Jeffrey DeNunzio filed Restated Articles of Incorporation. Amongst other changes, the authorized shares of both Common and Preferred stock were changed and a mandatory conversion of any previous shares of Series A and B Preferred Stock issued/ outstanding were converted into shares of Common stock and such classes of Preferred Series A and B cancelled. The mandatory conversion is detailed within the Restated Articles of Inc. The Restated Articles of Inc. also created a new class of Series Z Preferred stock. See below.? On or about February 25, 2021, 10,000 shares of Series Z Preferred Stock were issued to CRS Consulting, LLC for assisting the Custodian with the resurrection of its corporate charter, reinstating good standing with the Company’s transfer agent and providing services to salvage value for the benefit of shareholders. Jeffrey DeNunzio, Paul Moody and Thomas DeNunzio are members of CRS consulting Services, LLC. Jeffrey DeNunzio is also current custodian of Ambient Water Corporation.? Pursuant to a shareholder meeting on March 29, 2021, Jeffrey DeNunzio was appointed to the position of Director, President, Treasurer, and Secretary.? Ambient Water Corporation has consented to participate in a holding company reorganization (“Reorganization”) pursuant to NRS 92A.180, NRS A.200, NRS 92A.230 and NRS 92A.250. The constituent corporations in the Reorganization will be Ambient Water Corporation (“AWGI” or “Predecessor”), Catapult Solutions, Inc. (“Successor”), and Catapult Merger Sub, Inc. (“Merger Sub”). Our director is the sole director/officer of each constituent corporation in the anticipated Reorganization.? Catapult Solutions, Inc. will issue 1,000 common shares of its common stock to Predecessor and Merger Sub will issue 1,000 shares of its common stock to Catapult Solutions, Inc. prior to the Reorganization. Immediately prior to the merger, Catapult Solutions, Inc. will be a wholly owned direct subsidiary of AWGI and Merger Sub will be a wholly owned and direct subsidiary of Catapult Solutions, Inc. The merger shall become effective at such time as the Articles of Merger are filed and stamped by the Nevada Secretary of State (“Effective Time”). At the Effective Time, Predecessor shall be merged with and into Merger Sub (the “Merger), and Predecessor shall be the surviving corporation. Each share of Predecessor common stock issued and outstanding immediately prior to the Effective Time shall be converted into one validly issued, fully paid and non-assessable share of Catapult Solutions, Inc. (“Successor”) common stock. Catapult Solutions, Inc. will ultimately be successor to Ambient Water Corporation as a result of this reorganization.? Pursuant to the above, on April 23, 2021, Ambient Water Corporation filed Articles of Merger with the Nevada Secretary of State. The merger shall become effective on April 28, 2021 at 4:00 PM EST (“Effective Time”). At the Effective Time, Predecessor shall be merged with and into Merger Sub (the “Merger), and Predecessor shall be the surviving corporation. Each share of Predecessor common stock issued and outstanding immediately prior to the Effective Time shall be converted into one validly issued, fully paid and non-assessable share of Catapult Solutions, Inc.’s (“Successors”) common stock. Catapult Solutions, Inc. is a shell company with no material operations. In addition, Ambient Water Corporation is pending a FINRA corporate action to process the foregoing Reorganization. Commensurate with this action is a request to change the Company’s stock ticker symbol. The new ticker symbol, and new CUSIP number will be announced via the FINRA daily list. There are no other material events to report as of the time this section was last updated. If there becomes anything else material to report it will be posted here.? Transfer Agent:?

https://www.corporaterevivalservices.com/status-updates Within this subsection of this website page, “The Company,” and or “Ambient Water” refer to Ambient Water Corp., a Nevada Corporation.? AWGI-Court Order-Signed-A-20-823994-P.pd EVENT: ORDER GRANTING APPLICATION FOR THE APPOINTMENT OF JEFFREY DENUNZIO On February 24, 2021, Jeffrey DeNunzio filed Restated Articles of Incorporation. Amongst other changes, the authorized shares of both Common and Preferred stock were changed and a mandatory conversion of any previous shares of Series A and B Preferred Stock issued/ outstanding were converted into shares of Common stock and such classes of Preferred Series A and B cancelled. The mandatory conversion is detailed within the Restated Articles of Inc. The Restated Articles of Inc. also created a new class of Series Z Preferred stock. See below.? On or about February 25, 2021, 10,000 shares of Series Z Preferred Stock were issued to CRS Consulting, LLC for assisting the Custodian with the resurrection of its corporate charter, reinstating good standing with the Company’s transfer agent and providing services to salvage value for the benefit of shareholders. Jeffrey DeNunzio, Paul Moody and Thomas DeNunzio are members of CRS consulting Services, LLC. Jeffrey DeNunzio is also current custodian of Ambient Water Corporation.? Pursuant to a shareholder meeting on March 29, 2021, Jeffrey DeNunzio was appointed to the position of Director, President, Treasurer, and Secretary.? Ambient Water Corporation has consented to participate in a holding company reorganization (“Reorganization”) pursuant to NRS 92A.180, NRS A.200, NRS 92A.230 and NRS 92A.250. The constituent corporations in the Reorganization will be Ambient Water Corporation (“AWGI” or “Predecessor”), Catapult Solutions, Inc. (“Successor”), and Catapult Merger Sub, Inc. (“Merger Sub”). Our director is the sole director/officer of each constituent corporation in the anticipated Reorganization.? Catapult Solutions, Inc. will issue 1,000 common shares of its common stock to Predecessor and Merger Sub will issue 1,000 shares of its common stock to Catapult Solutions, Inc. prior to the Reorganization. Immediately prior to the merger, Catapult Solutions, Inc. will be a wholly owned direct subsidiary of AWGI and Merger Sub will be a wholly owned and direct subsidiary of Catapult Solutions, Inc. The merger shall become effective at such time as the Articles of Merger are filed and stamped by the Nevada Secretary of State (“Effective Time”). At the Effective Time, Predecessor shall be merged with and into Merger Sub (the “Merger), and Predecessor shall be the surviving corporation. Each share of Predecessor common stock issued and outstanding immediately prior to the Effective Time shall be converted into one validly issued, fully paid and non-assessable share of Catapult Solutions, Inc. (“Successor”) common stock. Catapult Solutions, Inc. will ultimately be successor to Ambient Water Corporation as a result of this reorganization.? Pursuant to the above, on April 23, 2021, Ambient Water Corporation filed Articles of Merger with the Nevada Secretary of State. The merger shall become effective on April 28, 2021 at 4:00 PM EST (“Effective Time”). At the Effective Time, Predecessor shall be merged with and into Merger Sub (the “Merger), and Predecessor shall be the surviving corporation. Each share of Predecessor common stock issued and outstanding immediately prior to the Effective Time shall be converted into one validly issued, fully paid and non-assessable share of Catapult Solutions, Inc.’s (“Successors”) common stock. Catapult Solutions, Inc. is a shell company with no material operations. In addition, Ambient Water Corporation is pending a FINRA corporate action to process the foregoing Reorganization. Commensurate with this action is a request to change the Company’s stock ticker symbol. The new ticker symbol, and new CUSIP number will be announced via the FINRA daily list. There are no other material events to report as of the time this section was last updated. If there becomes anything else material to report it will be posted here.? Transfer Agent:? $CPSL WAS

$AWGI Olde Monmouth Stock Transfer Co.,Inc. MKT CAP 34,844,913

05/24/2021

http://www.oldemonmouth.com/ 200 Memorial Pkwy

Atlantic Highlands, NJ 07716

Office (732) 872-2727

UPDATED 05-25-2021 NO CHANGE

CPSL SECURITY DETAILS.Share Structure

Market Cap Market Cap..34,844,913

Authorized Shares......2,400,000,000

Outstanding Shares....2,315,276,582

Restricted.Not....Available

Unrestricted.Not Available

Held at DTC.Not Available

Float............................2,032,244,190

Par Value.................0.001

Ticker Symbol: AWGI

Common Shares Authorized: 2,400,000,000

Common Shares Outstanding: 2,315,276,582

Preferred Shares Authorized:

20,000,000 of which 10,000 are designated as Series Z Preferred Stock.

Series Z Preferred Stock has no conversion rights to any other class

and every vote of Series Z Preferred Stock shall have voting rights equal to 1,000,000 votes of Common Stock.

Preferred Shares Outstanding: 10,000 Shares of Series Z

UPDATED 04-26-2021

$AWGIffective Date 04-28-2021 Articles of Merger to all.FILING HISTORY Effective Date 04-28-2021

NEW COMPANY INSERTION EFFECTIVE 04-28-2021

Catapult Solutions Inc

Olde Monmouth Stock Transfer Co., Inc.

http://www.oldemonmouth.com/

200 Memorial Pkwy

Atlantic Highlands, NJ 07716

Office (732) 872-2727

Ticker Symbol: AWGI

Common Shares Authorized: 2,400,000,000

Common Shares Outstanding: 2,315,276,582

Preferred Shares Authorized:

20,000,000 of which 10,000 are designated as Series Z Preferred Stock.

Series Z Preferred Stock has no conversion rights to any other class

and every vote of Series Z Preferred Stock shall have voting rights equal to 1,000,000 votes of Common Stock.

Preferred Shares Outstanding: 10,000 Shares of Series Z VERY IMPORTANT ITEM; 04-29-2021

$AWGI AS STATED BELOW SHARE REDUCTION---A/S - Reduced to 2.4B (~10B reduction)

COURTEST OF CPM $AWGI Moody/Denunzio Moving Fast on $AWGI

Latest filing with NVSOS indicates change in share structure

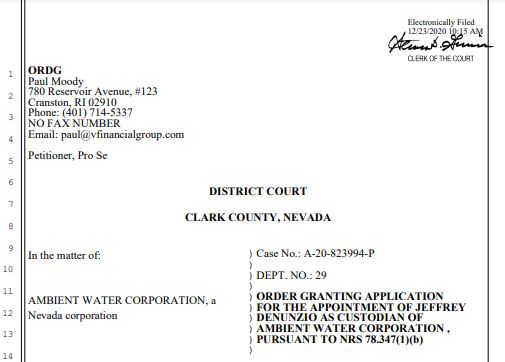

Case No.: A-20-823994-P

New Share Structure

No Preferred Shares - This is huge as there will be no conversions from preferred to commons in the future...no dilution...HUGE

A/S - Reduced to 2.4B (~10B reduction)

What I really like in that reduction is that they are setting up a Share Structure for a really good size company here.

Again, wiping out preferred shareholders is beautiful, NO CONVERSIONS.

IMO, we should see a pretty large company R/M'ing in here. Beautiful reduction, brings more confidence.

$AWGI --> Buy on dips and HOLD.

Onward and upward.

CPM

FILING HISTORY DETAILS

File Date Effective Date Filing Number Document Type Amendment Type Source View

04/22/2021 04/28/2021 20211406011 Articles of Merger Internal Snap Shot

02/24/2021 02/24/2021 20211258321 Amended and Restated Articles Internal Snap Shot

01/22/2021 01/22/2021 20211238498 Certificate of Amendment by Custodian Internal Snap Shot

01/21/2021 01/21/2021 20211181016 Certificate of Reinstatement Internal Snap Shot

12/19/2017 12/19/2017 20170536154-74 Annual List Internal Snap Shot

01/30/2017 01/30/2017 20170041606-57 Amendment Internal Snap Shot

10/26/2016 10/26/2016 20160470482-24 Annual List External Snap Shot

09/13/2016 09/13/2016 20160404062-55 Certificate of Designation Internal Snap Shot

03/07/2016 03/07/2016 20160105143-93 Amendment Internal Snap Shot

01/14/2016 01/14/2016 20160017525-49 Certificate of Designation Internal Snap Shot

< Previous ... 123 ... Next >Page 1 of 3, records 1 to 10 of 28

Go to Page

=================================================

https://www.otcmarkets.com/stock/AWGI/security

$AWGI AWGI SECURITY DETAILS Share Structure mkt cap $22,689,711

04/23/2021

https://www.otcmarkets.com/stock/AWGI/security

Market Cap Market Cap...22,689,711

Authorized Shares......2,400,000,000

Outstanding Shares....2,315,276,582

Restricted............................Available

Unrestricted.................Not Available

Held at DTC..................Not Available

Float.............................2,032,244,190

Par Value....................................0.001

MOODY FILER---01-29-2021

Case No.: A-20-823994-P  http://42c44033-02b0-4164-bb6a-607abcd35ef7.filesusr.com/ugd/5adfcf_ee2ea825ae5948ee8e370170e6929fdc.pdf

http://42c44033-02b0-4164-bb6a-607abcd35ef7.filesusr.com/ugd/5adfcf_ee2ea825ae5948ee8e370170e6929fdc.pdf Jeffrey DeNunzio 3 780 Reservoir Avenue, #123 4 Cranston, RI 02910 Phone 401- 641-0405 5 NO FAX NUMBER 6 Email: teakwood5@cox.net 8 Custodian,

Pro Se DISTRICT COURT CLARK COUNTY, NEVADA 9 10 In the matter of: 11 12 Ambient Water Corporation, a Nevada corporation ________________________________________ ) Case No.: A-20-823994-P ) ) DEPT. NO.: XXIX ) ) QUARTERLY REPORT OF THE ) CUSTODIAN

COMES NOW, Jeffrey DeNunzio, the appointed Custodian of AMBIENT WATER CORPORATION, who hereby submits this Quarterly Report as requested by this Court through its Order dated December 23, 2020.

1. Jeffrey was previously appointed by this Court as Custodian of AMBIENT WATER CORPORATION on December 16, 2020, pursuant to NRS §78.347. 21 2.

On or about October 30, 2020, Petitioner brought this action as a shareholder of the Corporation 22 seeking appointment of Jeffrey DeNunzio as Custodian of the Corporation because ,

among other things, the 23 24 Corporation had allowed its charter with the State of Nevada to lapse by failing to file the required 25 annual reports and to pay the required annual fees. 26 3.

The last known officers and directors reflected in the records of the Nevada Secretary of State (“NVSOS”) 27 did not object to Plaintiff's Petition, nor did any of the last known shareholders. -

1 - QUARTERLY REPORT OF THE CUSTODIAN

4. Following the entry of the Order appointing Jeffrey DeNunzio as Custodian on December 23, 2020,

the Custodian filed a Certificate of Reinstatement and Certificate of Amendment to Articles of Incorporation with NVSOS in excess of the 10 days requirement pursuant to NRS 78.347

(4) because NVSOS was owed $22,685 and the Company had to borrow money from Petitioner to pay NVSOS.

Custodian paid NVSOS in full and reinstated the Company on January 21, 2021 and filed the Amendment on January 22, 2021.

Custodian has located the last known transfer agent for the Company known as Securities Transfer Corp. who agreed to terminate the Company’s transfer agent and registrar agreement

in exchange for $4,922.50 that was owed by the Company to transfer agent.

Custodian had to borrow money from Petitioner to pay transfer agent. Olde Monmouth Stock Transfer Co., Inc. was appointed as the new transfer agent because they have lower corporate action and maintenance fees.

The Company plans to hold an annual or special meeting of shareholders in the coming weeks.

To date, Custodian has not heard from the previous management of the Company. DATED this 29th day of January, 2020 Respectfully Submitted by:

By: /s/ Jeffrey DeNunzio Jeffrey DeNunzio 780 Reservoir Avenue, #123 Cranston, RI 02910 Phone 401- 641-0405 NO FAX NUMBER Email: teakwood5@cox.net Custodian, Pro Se

http://42c44033-02b0-4164-bb6a-607abcd35ef7.filesusr.com/ugd/5adfcf_ee2ea825ae5948ee8e370170e6929fdc.pdf Possible Custodianship

https://www.vfinancialgroup.com/ November 13, 2017 there were 2,242,475,661 shares of the Company’s common stock were issued and outstanding. ==================================================================================================================================================

https://investorshub.advfn.com/Moody-DeNunzio-Custodian-Shells-38686/ Ambient Water Corp Still ah Shell as of 02-07-2021

ARE TEAM https://www.vfinancialgroup.com/our-team.html COURTESY OF Golden_Cross

$AWGI(.0029) Next Undervalued Paul Moody Custodian Plays To Get To Blue Skies

$ILIM(.0023) and $AWGI(.0029) Next Undervalued Paul Moody Custodian Plays To Get To Blue Skies $ILIM IS IN THEIR OWN NOW !!!!!

Completed Moody Mergers Market Cap $KAVL = ~$110,000,000 Million $TKSI = ~$90,500,00 Million Current Custodian Plays Next to Merge Market Caps $ILIM = ~$4,576,015 Million $AWGI = ~$5,384,000 Million $IALS = ~33,750,000 Million $PERT = ~$25,500,000 Million 02-07-2021

DISCLAIMER: ONLY FOR MICK

https://investorshub.advfn.com/boards/profilea.aspx?user=1012

*The Board Monitor and herewithin , are not licensed brokers and assume NO responsibility for actions,

investments,decisions, or messages posted on this forum.

CONTENT ON THIS FORUM SHOULD NOT BE CONSIDERED ADVISORY NOR SOLICITATION

AUTHORS MAY HAVE BUYS OR SELLS WITH THE COMPANIES MENTIONED IN TRADING POSTERS SHOULD DUE DILIGENT BUYING OR SELLING.

ALL POSTING SHOULD BE CONSIDERED FOR INFORMATION ONLY. WE DO NOT RECOMMEND ANYONE BUY OR SELL ANY SECURITIES POSTED HEREWITHIN.

ANY trade entered into risks the possibility of losing the funds invested.

• There are no guarantees when buying or selling any security.Any