As shareholders of Doubleview Gold Corp we would like to share some info about a company that we feel is a hidden gem and hasn’t been discovered by the general market yet. Doubleview Gold Corp is a Canadian resource exploration and development company located in Vancouver British Columbia. It has 3 properties which are all located in BC. BC is a safe mining jurisdiction and one that is in demand by Major Mining companies looking to replenish their depleting assets (last year Rio Tinto announced it is looking for porphyry deposits in BC).

Ticker symbol- DBG (TSX-V)

Outstanding shares (not fully diluted)- 112,530,922 Market Cap- approx. $12.3 million as of 20 May (Cdn)

Company website:

www.doubleview.ca Insider ownership

CEO/President (Farshad Shirvani) owns over 23 million shares (he said his spouse is the 2

nd largest shareholder and the CEO has publicly said his close associates own approx 30% of the shares). The CEO has remortgaged his house multiple times (most recent one was for $500,000) to fund the company. He truly believes in the company, has a lot of skin in the game and is extremely dedicated to the success of this company. We don’t think you will find a more dedicated junior explorer CEO with more dedication and cares as much about the success of his company.

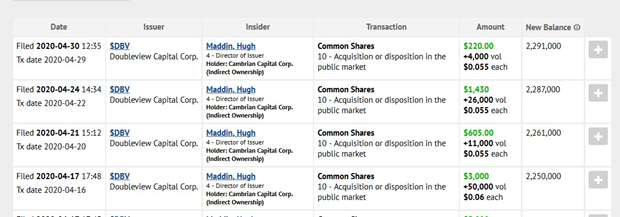

The new recently added director (Hugh Maddin) bought into the last private placement for

$330,000 and it was priced at approx. 50% over the market price during the time period it was announced. He bought into it before becoming a director and since mid April he’s been slowly accumulating on the open market.

Although they have 3 properties, lets just focus on their flagship asset called the HAT Gold Copper property.

They’ve drilled 34 holes so far into this green field project (it had never been drilled before Doubleview acquired it).

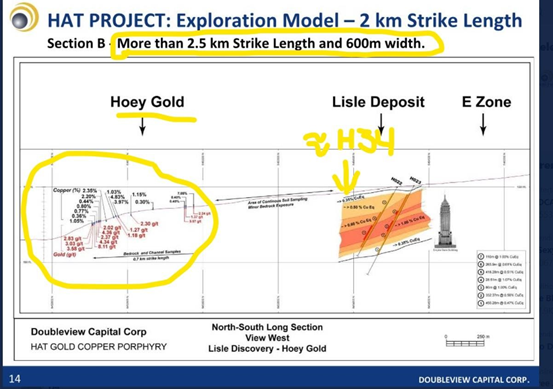

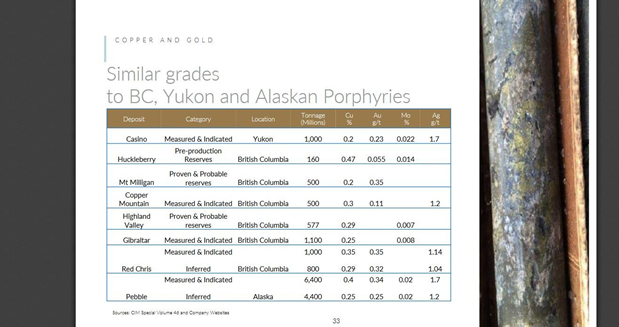

For those that like to do math and do thorough due diligence- current drilled dimensions of the Lisle Zone according to the company is 650m x 920m x depth (unknown yet as it’s open at depth and there are 2 anomalies that go beyond 1.25km). Using 400m which is ULTRA conservative the tonnage is calculated to be approx 600 million tones (used a specific gravity of 3.0). Using an excel spreadsheet the weighted average grade was calculated for all holes drilled. When comparing Doubleview’s current drilled tonnage and weighted average grade against some of BC’s porphyry deposits currently being mined (Gibralter, Mt Milligan, Red Chris, Copper Mountain, Highland Valley, etc) Doubleview currently has more tonnage and better average grades than some deposits in operation! Keep in mind that this is comparing fully defined deposits which include their best grades and Doubleview has only drilled a small fraction of the foot print and hasn’t even explored the remainder of the property yet! What is extremely promising is their 1

st drill campaign with the deep IP in hand (late 2019) they drilled their strongest mineralization so we’re excited about the next drill campaign.

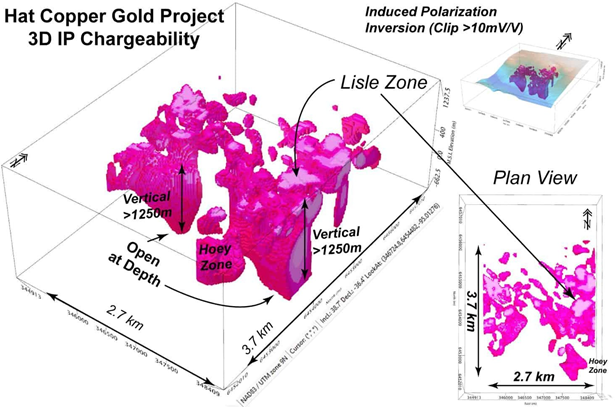

Looking at the deep IP footprint (below) look at what the drilled Lisle Zone of 650m x 920m represents (it’s labelled on the IP pic below) on this enormous foot print (look at the dimensions of the IP foot print 3.7km x 2.7km x depth of over 1.25km in 2 locations). The validity of an IP always needs to be confirmed to ensure it’s valid and Doubleview has tested that it’s valid so this should all be mineralized. If Doubleview has more tonnage so far and higher grades that some deposits currently being mined then this indicates the likely hood the deposit will be wanted by Major mining companies. As they continue to drill the tonnage will increase thus the amount of gold, copper, silver, cobalt and palladium will increase. They have 2 bodies of water immediate by the property (a stream that fills them) and it’s not located in a rugged place so these should not be show stoppers in building an open pit (unfortunately there are great deposits that will never get mined because they’re in bad locations and don’t have the required necessities to operate). Also note that prior to Hudbay Minerals signing a joint venture agreement with Doubleview they would have done extensive due diligence before committing time and money to the project.

| |

| |  |

Major mining companies are on the hunt for large porphyry deposits and they need to replenish their depleting assets. This IP foot print is said to be possibly the biggest in North America! Major mining companies look for large scale projects that have very long mine life to make it worth their while. Unfortunately for these Majors there are not many projects that fit the large scale/long mine life criteria and luckily for Doubleview they have something that has one of the largest IP footprints in North America so you can bet they’re watching closely how this story

unfolds. At what point will a Major make a move is anyone’s guess but with every hole drilled we think it’s getting closer and closer.

What is also important to note is the Deep IP study which was done by Hudbay Minerals was only for the main focus area of the property (Lisle Zone and its surrounds). Following the deep IP, word is they wanted to do the area north of the deep IP surveyed area because they suspected they would find more there too. The footprint they discovered is possibly the biggest in North America so add the fact there might be more mineralization is mind boggling! If you look at the IP foot print the east and west show that there is more of it as it due to it being cut off and not included in the expensive area survey (it is said that this cost Hudbay approx. $1.2 million to do).

If you’re asking about Hudbay and the reason it no longer has a joint venture on the property with such scale and potential it has nothing to do with them not being impressed and walking away. It was assumed that they unwilling had to cater to something else because they really were impressed and excited about the project and was setting it up for years to come (upgraded the camp, worked closely with locale First Nation tribe, was looking to hire people, etc). Their prized deposit in Arizona is going into a big legal battle and all capital and efforts are focused on this:

https://www.azcentral.com/story/news/local/arizona-environment/2019/08/01/hudbay- minerals-appeal-court-decision-blocking-rosemont-mine/1891386001/ See below what was published in the Tahltan Central Government Industry review 2019 about what Hudbay Minerals did in 2018 and had planned for 2019 including to hire people. This shows they didn’t walk away willingly and were setting up to work on the project with longer term views.

Recent assays released 12 May 2020:

Doubleview Drills Strongest Mineralization Discovered so far at Hat Property including 258 meters of 0.31 g/t Gold and 0.47% Copper (1% Cu Eq) in an interval of 450 meters of 0.23 g/t Gold and 0.35% Copper (0.7% Cu Eq)

Doubleview Gold Corp (“Doubleview”, the “Company”) (TSX-V:DBG) is pleased to report that the Company is preparing to re-start diamond drilling at its Hat porphyry discovery in northwest British Columbia after intersecting the strongest mineralization yet encountered at the property. Drill hole H-034 was mineralized from bedrock surface to the total length of 701.2 meter. A 3.6 metre section of core assayed 3.44 g/t Au and 6.61% Cu (10.91% Cu Eq).Nice write up about the last assays in Resource World Magazine (pasted below):

https://resourceworld.com/doubleview-drills-best-intercepts-to-date-at-hat-gold-copper- porphyry/ Doubleview Gold Corp. [DBG-TSXV; DBLVF-OTC; A1W038-Ger], which recently changed its name from Doubleview Capital, is preparing to restart diamond drilling at its Hat porphyry discovery located 50 km northwest of Telegraph Creek, northwestern British Columbia, after intersecting the strongest mineralization yet encountered at the property. Drill hole H-034 was mineralized from bedrock surface to the total length of 701.2 metres. A 3.6-metre section of core assayed 3.44 g/t gold and 6.61% copper for a 10.91% copper equivalent (CuEq). Drill hole H-034, that was directed to a geophysical target area, intersected 689 metres of strong gold-copper mineralization in what appears to be a continuation of the Lisle Zone deposit. H-034 intercepted 88.0 metres of 0.68 g/t gold and 1% copper in a greater interval of 258 metres of 0.31 g/t gold and 0.47% copper (1.87%t CuEq) within a greater interval of 692.3 metres of 0.17 g/t gold and 0.25% copper. Drill hole H-034 was collared 360 metres south-southwest of hole H-022 and 469 metres south-southwest of hole H-023 and expands the dimensions of the Lisle Zone to approximately 920 metres north-south and 650 metres east-west. The indicated vertical dimension is about 620 metres. The Lisle Zone has not been delimited in any direction. Farshad Shirvani, Doubleview’s President and CEO, said: “The large expansion of the Lisle Zone announced today confirms our belief that our Hat Project is rapidly becoming a very significant large deposit and that geophysical data from 2018 surveys are reliable guides to mineralization. Since acquiring the Hat property in 2011, and discovering the Lisle Zone in 2014, we have conducted multiple drill programs and expanded the mineral zone to its present size and we are approaching a situation where our database of analyses will permit resource estimations. Our geologic model is supported by drilling and by geophysical surveys. Several other prospective areas of the property await exploration and we are very confident that not only will we continue to grow the Lisle, but will make new discoveries.” Drilling highlights: HAT-034 demonstrates the potential for higher grades and length not only within but also around the three-dimensional (3-D) IP survey highlighted in previous news releases. The Lisle Zone of the Hat deposit now measures approximately 650 metres by 920 metres and depth has been shown to exceed 600 metres. Most of the 3-D IP footprint and the property remain to be explored. Mineralization remains open in all directions – several large coincident geological, geophysical and geochemical targets close to the Lisle Zone have yet to be drill tested. Recent discoveries have shown the continuity of large-scale gold-rich porphyry-style mineralization and the relevance and reliability of the geophysical database. See company website for complete drill results.Shirvani also stated that the company is actively planning and preparing the next phases of exploring the Hat property but start-up is subject to ensuring the safety of workers operating in a remote location and the company’s ability to finance exploration. End of article

If anyone is interested in Doubleview Gold there is an excellent telegram group for shareholders and we have the CEO in the group. He readily answers shareholder’s questions if he can talk about it so one doesn’t have to all individually call the company to ask questions and we all benefit from the answered questions others ask if he can legally answer it. If interested in joining the group please let your point of contact know and we will give you the link to the private chat. We share due diligence on Doubleview and discuss things related to it. We also have a ex Freeport geologist/geotechnical engineer that worked at the Grasberg Mine that posts in the group. He is a shareholder and has provided us with his comments about the potential of the project and about IP foot print. He is extremely excited about the potential of the property and its future. Grassberg is the largest gold mine and 2nd largest copper mine in the world.

The company has stated they want to resume drilling ASAP. After the last assays on 12 May they received a lot of interest from Major mining companies.

The float (what’s most likely going to be traded) is relatively low and most of the shares are in strong hands that are all believers of a buyout so they’re holding for it to happen. The CEO holds almost 24 million shares, our telegram group hold collectively approx 15 million shares (not including the CEO), Latimer (see below) has been accumulating since summer of 2017 and is constantly on the bid and has been almost buying daily owns approx 10.7 million shares and the CEO’s spouse is the 2

nd biggest shareholder (no idea how many shares). The CEO said that with just a few phone calls he can account for over 50% of the shares so if a low ball offer occurs it can easily be rejected if the major shareholders that are close to the CEO vote against the offer.

To compare Doubleview’s tonnage (approx. 600 million tons based on the drilled Lisle dimension which is just a small fraction of the foot print and using just 400m depth which is way too conservative but it’s better to underestimate than overestimate).

Link to the company presentation:

https://www.doubleview.ca/news-release/powerpoint-presentation/ Drill results:

https://www.doubleview.ca/projects/hat-gold-rich-copper-porphyry/drill-results/ Lawrence Roulston research report on Doubleview from 2017 (20 page report)

https://www.doubleview.ca/wp-content/uploads/2017/02/WestBayreport-Final-1.pdf Based on the current tonnage (drilled Lisle Zone), the grades being similar to other BC porphyry deposits in operation, the foot print being one of the biggest in North America (3.7 km x 2.7 km), the potential of the property (the IP footprint was only done on a part of the property and there could be more mineralization elsewhere), the low tradable float, the company’s goal of aggressively drilling it to take it to a buyout, the location (BC) and the increased interest by Major mining companies we feel this is an extremely undervalued company (stock price as of 20 May is

.11) that holds multiple dollars of upside if it gets bought out. Please do your own due diligence.

Disclosure- This information was not sponsored in any way by Doubleview Gold Corp. This was created anonymously by a shareholder to spread the untold story of Doubleview Gold Corp to their investment contacts and was specifically made for the current shareholders in the Doubleview Telegram chat group (created by shareholders) to use to send to their contacts to get them acquainted with the company because they feel it’s a great investment opportunity. As shareholders we are biased and have done extensive due diligence. We believe Doubleview is a

rare opportunity right now and the timing of this couldn’t be better due to the resource bull market!

If interested please take a look at Doubleview and do your due diligence. If not interested in it right now it’s recommended you keep it on your watch list in case you change you mind after the right news. Also, if interested in the Doubleview private telegram group just ask your point of contact for the link. This is not investment advice and although a lot of facts were taken from reliable sources nobody is responsible for any errors, typos or mistakes in this article. Invest at your own risk and there are no guarantees that Doubleview Gold Corp will succeed in getting bought out by a Major mining company. Please consult investment advice through a certified financial planner.