Register for free to join our community of investors and share your ideas. You will also get access to streaming quotes, interactive charts, trades, portfolio, live options flow and more tools.

“My small bet got me more shares then I ever held here before being I was able to buy in the low subs before my broker cut me off.”

ROTFLMAO Idiot

That’s too bad you could have “loaded” a bigger loss.

What an idiot

This one really put a hurting on you, didn't it? 🤡 LMAO

"From all the DD I have done on him he is very intelligent. ”

I told you to load right before she exploded from the subs to over 27 cents. You were too stupid to see the amazing setup she had back then and now you can't let it go. 🤡 This ticker has been delisted for years now and you're still harping on it. 🤡 It's sad to see this happen to someone but damm bro just take it as a lesson and move on already. 🤡

“ From all the DD I have done on him he is very intelligent. ”

Any release date? Tia

He is doing a fantastic job!

Is it still “coming”? Tia

Full worldwide lock downs again by the end of the year. That's what my DD is telling me.

"They are gonna try that BS virus scam again, watch and see.

Glad you made money with it."

They are gonna try that BS virus scam again, watch and see.

Glad you made money with it.

My business was closed back then for 6 months due to the BS virus scam they pulled on us. Making the gains I did back then off DIRV saved me from losing everything. The run to 27+ cents from the subs was my biggest win to date trading the OTC. I had all my sell orders set and woke up late that morning and my account was super fat. I was pleasantly shocked being I did not think she would move up that quick. I'm just glad my sell orders we already set being she did not stay up there that long.

"Dog, I think it's fricken hilarious!!!

I made 17k off that cow.

It bought my 2018 Harley."

I underestimated what a ticker with less then 5 million shares in their O/S can do. I knew the gains would come but I never thought they would come that fast and be so huge. DIRV will always be remembered as the ticker that saved me from losing everything in 2020. The 2021 run was just bonus gains for me. My business was back open by then and things were already going good for me by then.

Dog, I think it's fricken hilarious!!!

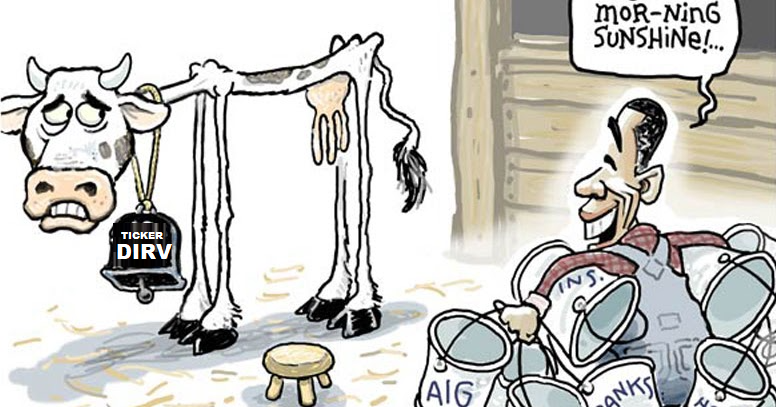

I made 17k off that cow.

It bought my 2018 Harley.

Looks like we have a few of the no proof scam theory promoters back here promoting their nonsense again when we already milked her dry and the ticker has been delisted for a long time already. LMAO

"Sho me da money

Cash Cow"

It's already too late for them to take our huge gains back and they are still working her like despite children as if they have a chance to. LMAO.

.

.

Sho me da money

Cash Cow

Bull Shitbirds of a feather no doubt.

Same ol phony baloney on a different thread.

Smh

Reading comp still kicking that ass I see!

Lolololol

Hey dog, I'm glad I figured out how to trade penny stocks and make bank rather than sit on the sidelines and play police board monitor. Lol

Man, wasn't DirectView a cash cow for a couple of years?

CONdog96 ® I am thankful that I figured this Blatant Fraud out like many others and didn’t fall for the pumpers telling me that it was not.

You can follow me to many more of these Blatant Frauds and doing so can save you from financial ruin.

I can recall among many things how “the new CEO Gary was going to turn this Fraud

around. “

As can be seen, this did Not happen and Once again the pumpers were wrong.

Sorry you missed the big runs here. I tried to help you see they were coming but you were so caught up on the whole scam kick you could not see how good of a setup she had. The regret has to be over whelming. Is that why you are still posting her when this one was delisted a long time ago. Are you using this board as a support group to help cope with all the easy missed gains? LMAO

I told you years ago you would regret missing them before they even came. Was I right? It's ok to answer that truthfully. Everyone here already knows the answer. We are here to support you get through this. We will be here for you for as long as it takes my friend :)

jimr aka trollboy.

Thanks bro! That means a lot. :)

"Bottom line, No one is better than

CONdog96 ®

No one!"

I can't take all the credit though. You helped make me do the DD. Most of the digging I did was just to prove you wrong. I already knew she would POP big when I first found her just because of her micro unrestricted share count combined with her micro market cap.

I could have stayed silent and just made my gains, but I was trying to help you see what I was seeing. At that time, I did not know you were a full-time scam theory promoter. I was just trying to be nice, but it was met with a lot of bitterness and bashing me and my DD. Now I realize it was not because you did not understand my DD and what I was saying. It was because that's what your here to do. (Bash) I don't get why but whatever. If that's your hobby and how you find enjoyment, then all the power to you.

Whatever you say JITTERY the "Born Loser"

Bottom line, No one is better than

CONdog96 ®

No one!

Roger Rolston can’t even match the

CONdog96 ®

He has been so butt hurt he was wrong about DIRV and missed all the huge gains that he has been following me to every ticker I have posted on since then just to tell everyone what a huge scam the ticker is. He is working 5 of the same tickers I'm working on right now. LMAO

It's become an obsession. It's a bit creepy.

"Lol

Police boy rather cry than make money lol"

Lol

Police boy rather cry than make money lol

"I have banked off some of the biggest scam out there. The key is to find them when their share structures & market caps are tiny and load before the hype starts."

"The whole scam kick is costing a lot of big gains to be missed. Don't fall in love with these tickers. Just play them for the scams they are. Understand the setups and the "she is a huge scam" thinking won't matter anymore. The OTC is a wonderful place once it's understood."

EXACTLY!!!!!!!

I would not recommend trading the OTC then. Trading the OTC is not for everyone. It could be nerve racking and cause a lot of stress if it's not understood.

"No Thanks, I don’t trust my money with Frauds."

No Thanks, I don’t trust my money with Frauds.

Once it's learned that most of the penny land CEO's are scammers then more focus can be put towards the technical part of trading which might be a bit too advanced if the thinking is always how these tickers are huge scams.

I have banked off some of the biggest scam out there. The key is to find them when their share structures & market caps are tiny and load before the hype starts.

The reason DIRV was such a cash cow was not because of the company or anything they were doing. It was only because of her micro unrestricted share count combined with her micro market cap. She was geared for big fast moves. When you see setups like that it's a winning combo scam or not. This is the reason she was able to go from the sub pennies to over 27 cents in a few days. Her gearing was amazing for an OTC find.

The whole scam kick is costing a lot of big gains to be missed. Don't fall in love with these tickers. Just play them for the scams they are. Understand the setups and the "she is a huge scam" thinking won't matter anymore. The OTC is a wonderful place once it's understood.

My trading tip of the day ;)

He was the ceo scammer all though your pumping of this Fraud.

Period

Wow!!! 13 years ago.

![]() ))))))))))

))))))))))

That was in 2010. I was like 14 back then. LMAO

I banked off her 2 huge POPs that I tried to tell everyone was coming. The first one was in 2020 and the second one was in 2021. Her setup was amazing for years, and we saw huge gains because of that. It really had nothing to do with the company or the old CEO or the new CEO. It was a share structure play that was easy to see when I found her. Everyone that read my DD back then should have banked if they listened to what I was saying.

I almost want to frame this chart for my office wall being the huge 2 POPs we saw were my biggest gains trading the OTC to date. Follow me for more amazing picks. I have been a micro float king ever since we saw all the action here!! $$$

RALSTON and his co-conspirators sold DirectView stock to the victims based on telemarketers’ false representations and promises that the shares were a no-risk, short-term investment in a debt-free company and that the shares were likely to increase over 100% in value in a short period of time. In contrast to what RALSTON represented to victims, DirectView’s annual report filed with the United States Securities and Exchange Commission for the year ending December 31, 2010, contained dire warnings about the poor fiscal health of DirectView and the risk attendant in purchasing stock, including that the company “may be forced to cease operations” due to losses and cash flow problems, and purchasers “may find it extremely difficult or impossible to resell our shares.”

https://www.justice.gov/usao-sdny/pr/ceo-security-company-sentenced-five-years-prison-international-boiler-room-fraud-scheme

Incorrect and Noted, “ Caused 16 million in losses”

Try again

Damian Williams, the United States Attorney for the Southern District of New York, announced that ROGER RALSTON, the CEO of DirectView Holdings, Inc. (“DirectView”), a Florida-based video surveillance and security company, was sentenced to five years in prison for defrauding elderly victims in connection with an international telemarketing scheme that caused losses of nearly $16 million.

Most that played her are too busy spending their gains to answer silly questions like this when everyone knows that DIRV got delisted a while back for not filling. Do some real DD and see for yourself. LMAO

"Have they made an announcement yet? Tia"

This ticker has been done for a long time now. Should we really still be doing DD on her? LMAO

I have to admit this is one of my favorite boards even though she is not trading anymore. The entertainment we still get here is off the charts.

Have they made an announcement yet? Tia

ROTFLMFAO

“Nonsense, They just filed an 8-K naming the new President. If CEO were to step down it would have been in the same announcement.”

If making “big gains” on others that are involved in a fraud is your thing it is my hope that someone in your life leaves you in the same manner.

Perhaps you may visit the ex ceo.

If you do your DD you will see that my batting average is pretty high. Lmao

When every ticker is claimed to be a scam and that it will be revoked, at some point one of them will get revoked. We are trading the OTC markets so It's to be expected if you understand how the OTC works. It doesn't mean they are not worth trading. Look at all the big gains that were missed the past few years if no shares were held. SMH

“Crying” I am not. I called the Revoked and was told how great the company was.

I am glad that no more victims were taken.

I am also glad that the pumpers had shares when it got revoked

Period pumper"

Before this one got revoked it gave us some huge money-making POP just like I called as soon as I found her. I never expected to get 2 huge POPs out of her when I first found her.

Usually, I take the first POP on these micro floaters and move on. This one had such a good setup I stuck around and was able to double dip. That is not real common be able to bank huge 2 times off the same ticker two years in a row.

Since my luck was so good and her setup still looked amazing, I rolled the dice for a triple dip and had to give back not even 3% of what I made off her. I would do that again for sure. This was not the first ticker I banked off of that got revoked. Experience makes you a better trader to where you can bank even off the ones that get revoked :) RIP - DIRV

More BULLSHIT

|

Followers

|

348

|

Posters

|

|

|

Posts (Today)

|

0

|

Posts (Total)

|

47895

|

|

Created

|

06/22/12

|

Type

|

Free

|

| Moderators | |||

| Volume | |

| Day Range: | |

| Bid Price | |

| Ask Price | |

| Last Trade Time: |